Abstract

Generally, most of the inventory costs are not always fixed due to uncertainty of competitive market. In the existing literature, it is found that several researchers have worked on uncertainty considering inventory parameters as fuzzy valued. In this work, we have represented the inventory parameters as interval. Using this concept, we have developed a two-warehouse inventory model with advanced payment, partial backlogged shortages. Due to uncertainty, this problem cannot be solved by existing direct/indirect optimization technique. For this purpose, different variants of particle swarm optimization techniques (viz. PSO-CO, WQPSO and GQPSO) have been developed to solve the problem of the proposed inventory model by using interval arithmetic and interval order relations. Finally, to illustrate and also to validate the proposed model, a numerical example has been solved and the best found solutions (which is either optimal solution or near optimal solution) obtained from different variants of PSO have been compared. Then, a sensitivity analysis has been performed to study the effect of changes of different parameters of the model on the optimal policy.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

1.1 Literature Review

It is well known that there are several crucial factors involved in the inventory management. Here, we have discussed some of the major factors which directly or indirectly affect the business of an organization. Deterioration in inventory is a major issue for every business organization. It means degradation, spoiling, decay, damage, etc. In this area, Liao and Huang (2010) have formulated a deterministic inventory model for deteriorating items with trade credit financing and capacity constraints. Similarly, Hung (2011) has developed an inventory model taking with generalized-type demand and deterioration. Widyadana and Wee (2012) discussed the economic production quantity model for deteriorating items in their model. Later on, Shah et al. (2013) have built an inventory model with non-instantaneous deteriorating items with generalized-type deterioration. Then, Taleizadeh and Nematollahi (2014) have presented an inventory control problem for deteriorating items with backordering and financial consideration. Again, Taleizadeh et al. (2015) have formulated a vendor-managed inventory model in supply chain system for deteriorating item and solved by Stackelberg approach. Tsao (2016) has made an inventory model which helps for a decision to find joint location, inventory and preservation facility under delay in payments condition. Shaikh et al. (2019) have proposed an economic order quantity model for deteriorating item with preservation technology investment. Shaikh et al. (2017a) have again explored another inventory model with non-instantaneous deterioration inventory model with price- and stock-dependent demand for fully backlogged shortages under inflation. Subsequently, Pal et al. (2017) have discussed a stochastic production inventory model for deteriorating item with finite life cycle. Except the earlier-mentioned work, many other researchers have also developed the inventory model considering deterioration as a factor. Here, we have cited few of them in Table 1.

Another factor in inventory management is availability of physical space to store the goods for smooth running of the business. In this regard, two-warehouse facility is in the eye of business organization. In a two-warehouse system, there are two warehouses; first one is owned warehouse (OW) and second one is rented warehouse (RW). Sometimes business organization wants to keep more goods beyond their capacity, for different reasons such as (1) to avoid stock-out situations, (2) to store large quantity of seasonal products, (3) To avail the discount facility, (4) to meet up the high demand of the product and so on. They keep the excess amount beyond the capacity of owned warehouse in a rented warehouse. In this area, a lot of works have been reported in the existing literature. Recently, Liang and Zhou (2011) have formulated a two-warehouse inventory model for deteriorating item with delay in payments. Sett et al. (2012) have developed a two-warehouse inventory model with increasing demand and time-varying deterioration. Again, Liao et al. (2013) has proposed a deterministic inventory model with two-warehouse system considering trade credit financing. Bhunia et al. (2013) have also discussed a two-warehouse deterministic inventory model by using elitist real-coded genetic algorithm. Subsequently, Das et al. (2014) have presented a two-warehouse production inventory model with time-varying demand using genetic algorithm with varying population size approach. Similarly, Bhunia et al. (2015) have introduced particle swarm optimization in their two-warehouse inventory model. Palanivel and Uthayakumar (2016) have formulated a two-warehouse inventory model with optimal credit period and partial backlogging under inflation. Jaggi et al. (2017) have proposed a two-warehouse inventory model with deteriorating item having imperfect quality under delay in payments. Then, Shaikh (2017) has introduced alternative trade credit policy in his two-warehouse inventory model.

Over the last few years, researchers have successfully used meta-heuristic methods to solve optimization problems in different fields of Science and Engineering disciplines. Some of these algorithms are genetic algorithm, particle swarm optimization, ant colony optimization, differential evolution, among others. Among these algorithms, the mostly used efficient algorithms are genetic algorithm (GA) and particle swarm optimization (PSO). In this research work, we have used the particle swarm optimization (PSO). In this connection, the recent works of Bhunia et al. (2014, 2017), Bhunia and Shaikh (2016), Tiwari et al. (2017), Shaikh et al. (2017b) are worth mentioning.

Nowadays, advance payment or prepayment scheme is very much popular among the business people. Advance payment means that the retailers make payment a part of total amount which is to be paid in advance for supplying of goods and the balance amount is included in the invoice only with the delivery. This means that retailers/suppliers can buy the whole products by prepaying a part of the total amount and can run the business and later pay the balance on instalments. Some of the researchers have worked on advance payment and developed some inventory models. Maiti et al. (2009) have developed an inventory model with stochastic lead time and price-dependent demand introducing advance payment. Thangam (2011) has proposed a model on dominants retailers optimal policy in a supply chain under advance payment scheme and trade credit, then subsequently again Thangam (2012) has extended the model with optimal price discounting and lot-sizing policies under advance payment scheme and two-echelon trade credit. Similarly, Taleizadeh et al. (2013) have presented an economic order quantity model with multiple partial prepayment and partial backordering, and then Taleizadeh (2014a) developed an inventory model for an evaporating item with partial backordering and advance payments. Teng et al. (2016) have built lot-size policies for deteriorating items with expiration date and advance payments. Recently, Tavakoli and Taleizadeh (2017) have developed an EOQ model by introducing conditional discount for decaying items with full advance payment.

In the existing literature, a lot of research works have been done by considering the fixed inventory costs. However, in real-life situations, the inventory costs are not always fixed due to uncertainty of competitive marketing situations. In this work, we have considered the inventory parameters as interval valued due to uncertainty. We have applied this concept in a two-warehouse inventory model with advanced payment, partial backlogged shortage. Due to representation of interval cost, we cannot solve this problem by existing optimization technique. In this reason, we have developed a soft computing technique (particle swarm optimization) to solve our proposed inventory model by using interval arithmetic and interval order relations. Also, we have compared the obtained optimal solution obtained from different variants of PSO (viz. PSO-CO, WQPSO and GQPSO). Finally, we have supplied a numerical example to validate our proposed inventory model and performed a sensitivity analysis to study the effect of changes of different parameters.

1.2 Research gap and our contribution

In the existing literature, it is observed that a lot of research works have been done by considering the inventory parameters as fuzzy valued. Initially, they have considered the inventory parameters as fuzzy valued and formulate fuzzy mathematical model. Then, in solution procedure, they have used defuzzification technique to solve the developed problem. In this work, we have considered the inventory parameters as interval valued. This is another kind of uncertainty representation. Here, we do not use any uncertainty removal technique. We have solved the proposed problem by soft computing technique with the help of interval arithmetic and interval order relations. The final results of the proposed problem are in interval form. Very few research works have been done by taking interval-valued inventory costs. We have solved this problem by using different variants of PSO. In this work, our contributions are as follows:

-

(1)

We have updated the solution technique by using interval arithmetic and interval order relation.

-

(2)

Compared the solution by different variants of PSO.

-

(3)

Advance payment and partial backlogging have been considered.

-

(4)

Interval-valued inventory parameters have been considered.

-

(5)

Advance payment has also mentioned in the contribution no. 3. and price-dependent demand have been considered.

2 Assumptions and notations

The following assumptions and notations have been considered in the entire paper.

2.1 Assumptions

-

1.

Inventory system contains single item.

-

2.

The demand of the item is linearly dependent on price i.e. D(p) = a − bp where \( a > bp\,\;{\text{and}}\;\;a,b > 0. \)

-

3.

The deterioration rates for both warehouses (owned and rented) are constants and known. Also for better preservation facility, the deterioration rate in RW is less than the same in OW.

-

4.

There is no repair or replacement facility for deteriorated units.

-

5.

Inventory planning horizon is infinite.

-

6.

Inventory costs, like, ordering cost, inventory holding cost/carrying cost, purchasing cost, shortage cost and opportunity cost are interval valued.

-

7.

The retailer pays a fraction k of the total purchasing cost with n equally multiple instalments within the lead time M and receives the lot by paying the remaining purchasing cost.

-

8.

The holding cost per unit of rented warehouse (RW) is greater than that in OW due to better preservation facilities in RW.

-

9.

Shortages are allowed and during the stock-out period, a fraction η(< 1)of the demand will be backordered.

Notation

Notations | Units | Description |

|---|---|---|

A = [AL, AU] | $/order | Interval-valued ordering cost |

a | Constant | Location parameter of demand |

b | Constant | Shape parameter of demand |

p | $/unit | Selling price per unit |

cl = [clL, clU] | $/unit | Interval-valued opportunity cost per unit |

cs = [csL, csU] | $/unit | Interval-valued shortage cost per unit |

α | Constant | Deterioration rate in OW |

β | Constant | Deterioration rate in RW |

cho = [choL, choU] | $/unit | Interval-valued holding cost per unit in OW |

chr = [chrL, chrU] | $/unit | Holding cost per unit in RW |

W 1 | Units | Inventory level at RW |

R | Units | Backlogged units |

S | Units | Highest inventory level after fulfilling backlogged quantity |

cp = [cpL, cpU] | Units | Interval-valued purchasing cost per unit |

η | Units | Partial backlogging factor (0 < η < 1) |

M | Years | Length of the lead time during which the enterprise will pay the prepayments |

n | Constant | Number of equally spaced prepayments during the lead time |

k | Constant | Fraction of the purchasing cost that must be paid with multiple prepayments (0 < k < 1) |

cd = [cdL, cdU] | $/unit | Deterioration cost per unit |

TC = [TCL, TCU] | Total cost of the entire circle | |

Decision variable | ||

t 1 | Year | Time at which the stock reaches to zero |

T | Year | The length of the replenishment cycle |

3 Problem definition

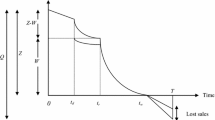

Let us suppose that an enterprise orders (S + R) units of product for business purpose by prepaying a k fraction of the purchasing cost by n equal instalments at equal intervals within the lead time M and receives the lot by paying the remaining purchasing cost at time t = 0. Shortly after, R units are utilized to fulfil the partially backlogged demand and consequently, the on-hand inventory level becomes \( S \). Out of which \( W_{1} \) units are stored in OW and the remaining part \( (S - W_{1} ) \) units are stored in RW. Since the RW offers better facilities apparently, the holding cost in RW is greater than that in OW and as such the products in RW will be consumed first. During the time interval \( [0,t_{1} ] \), the inventory level in RW depletes due to meet up the customers’ demand \( D(p) \) as well as constant deterioration rate \( \beta \), and at time \( t = t_{1} , \) it becomes zero. However, in OW, the inventory level depletes due to constant deterioration rate \( \alpha \) only up to the time \( t = t_{1} \). After that, the inventory in OW is depleted due to the customers’ demand \( D(p) \) and deterioration simultaneously during the time interval \( [t_{1} ,t_{2} ] \). At time \( t = t_{2} \), it also becomes zero. Thereafter, shortages occur and accumulate with a constant rate \( \eta \) fraction of demand during the time interval \( [t_{2} ,T] \). The pictorial representation of the mentioned two-warehouse inventory system is depicted in Fig. 1.

So the inventory level \( I_{r} (t) \) in RW at any instant \( t \) can be described by the following differential equation

subject to the conditions

The solution of Eq. (1), with the condition \( I_{r} (t) = 0\,\,\,{\text{at}}\,\,t = t_{1} \), is given by

Using \( I_{r} (0) = S - W_{1} \) in Eq. (3), one can write

Again, the inventory level \( I_{o} (t) \) in OW at any instant \( t \) can be described by the following differential equations:

subject to the conditions

Again, \( I_{o} (t) \) is continuous at \( t = t_{1} \) and \( t = t_{2} \).

The solutions of the differential Eqs. (5)–(7), with the help of conditions (8), can be written as

By considering the continuity at \( t = t_{1} \) and \( t = t_{2} \), we can write

and

The different inventory costs for the proposed model are as follows:

-

(a)

$$ {\text{Ordering}}\;{\text{cost}} = A $$

-

(b)

$$ {\text{Purchase}}\;{\text{cost}} = c_{p} (S + R) = \left[ {c_{pL} (S + R),c_{pU} (S + R)} \right] $$

-

(c)

$$ \begin{aligned} {\text{Holding}}\;{\text{cost}} & = \left[ {c_{hrL} \int\limits_{0}^{{t_{1} }} {I_{r} (t)} \;{\text{d}}t + c_{hoL} \int\limits_{0}^{{t_{1} }} {I_{o} (t)} \;{\text{d}}t + c_{hoL} \int\limits_{{t_{1} }}^{{t_{2} }} {I_{o} (t)} \,{\text{d}}t,c_{hrU} \int\limits_{0}^{{t_{1} }} {I_{r} (t)} \,{\text{d}}t + c_{hoU} \int\limits_{0}^{{t_{1} }} {I_{o} (t)} \,{\text{d}}t + c_{hoU} \int\limits_{{t_{1} }}^{{t_{2} }} {I_{o} (t)} \,{\text{d}}t} \right] \\ & = \left[ {\frac{{c_{hrL} (a - bp)}}{{\beta^{2} }}\left( {e^{{\beta t_{1} }} - \beta t_{1} - 1} \right) + \frac{{c_{hoL} W_{1} }}{\alpha }\left( {1 - e^{{ - \alpha t_{1} }} } \right) + \frac{{c_{hoL} (a - bp)}}{{\alpha^{2} }}\left( {e^{{\alpha (t_{2} - t_{1} )}} - \alpha (t_{2} - t_{1} ) - 1} \right),} \right. \\ & \quad \left. {\frac{{c_{hrU} (a - bp)}}{{\beta^{2} }}\left( {e^{{\beta t_{1} }} - \beta t_{1} - 1} \right) + \frac{{c_{hoU} W_{1} }}{\alpha }\left( {1 - e^{{ - \alpha t_{1} }} } \right) + \frac{{c_{hoU} (a - bp)}}{{\alpha^{2} }}\left( {e^{{\alpha (t_{2} - t_{1} )}} - \alpha (t_{2} - t_{1} ) - 1} \right)} \right] \\ \end{aligned} $$

-

(d)

$$ \begin{aligned} {\text{Deterioration}}\;{\text{cost}} & = \left[ {c_{dL} \beta \int\limits_{0}^{{t_{1} }} {I_{r} (t)} \;{\text{d}}t + c_{{{\text{d}}L}} \alpha \int\limits_{0}^{{t_{1} }} {I_{o} (t)} \,{\text{d}}t + c_{{{\text{d}}L}} \alpha \int\limits_{{t_{1} }}^{{t_{2} }} {I_{o} (t)} \,{\text{d}}t,\left. {c_{{{\text{d}}U}} \beta \int\limits_{0}^{{t_{1} }} {I_{r} (t)} \,{\text{d}}t + c_{{{\text{d}}U}} \alpha \int\limits_{0}^{{t_{1} }} {I_{o} (t)} \,{\text{d}}t + c_{{{\text{d}}U}} \alpha \int\limits_{{t_{1} }}^{{t_{2} }} {I_{o} (t)} \,{\text{d}}t} \right]} \right. \\ & = \left[ {\frac{{c_{{{\text{d}}L}} (a - bp)}}{\beta }\left( {e^{{\beta t_{1} }} - \beta t_{1} - 1} \right) + c_{{{\text{d}}L}} W_{1} \left( {1 - e^{{ - \alpha t_{1} }} } \right) + \frac{{c_{{{\text{d}}L}} (a - bp)}}{\alpha }\left( {e^{{\alpha (t_{2} - t_{1} )}} - \alpha (t_{2} - t_{1} ) - 1} \right),} \right. \\ & \quad \left. {\frac{{c_{{{\text{d}}U}} (a - bp)}}{\beta }\left( {e^{{\beta t_{1} }} - \beta t_{1} - 1} \right) + c_{{{\text{d}}U}} W_{1} \left( {1 - e^{{ - \alpha t_{1} }} } \right) + \frac{{c_{{{\text{d}}U}} (a - bp)}}{\alpha }\left( {e^{{\alpha (t_{2} - t_{1} )}} - \alpha (t_{2} - t_{1} ) - 1} \right)} \right] \\ \end{aligned} $$

-

(e)

$$ \begin{aligned} {\text{Shortage}}\;{\text{cost}} & = \left[ {c_{sL} \int\limits_{{t_{2} }}^{T} {\left\{ { - I_{o} (t)} \right\}{\text{d}}t,c_{sU} \int\limits_{{t_{2} }}^{T} {\left\{ { - I_{o} (t)} \right\}{\text{d}}t} } } \right] \\ & = \left[ {\frac{1}{2}c_{sL} \eta (a - bp)(T - t_{2} )^{2} ,\frac{1}{2}c_{sU} \eta (a - bp)(T - t_{2} )^{2} } \right] \\ \end{aligned} $$

-

(f)

$$ \begin{aligned} {\text{Opportunity}}\;{\text{cost}} & = \left[ {c_{lL} (1 - \eta )\int\limits_{{t_{2} }}^{T} {D\,dt,c_{lU} (1 - \eta )\int\limits_{{t_{2} }}^{T} {D\,dt} } } \right] \\ & = \left[ {c_{lL} (1 - \eta )(a - bp)(T - t_{2} ),c_{lU} (1 - \eta )(a - bp)(T - t_{2} )} \right] \\ \end{aligned} $$

-

(g)

Interval-valued capital cost: The capital cost from Fig. 1 or Taleizadeh (2014a, b) is

$$ \begin{aligned} & \left[ {\left\{ {I_{c} \left[ {\frac{{kc_{pL} (S + R)}}{n} \cdot \frac{M}{n}(1 + 2 + 3 + \cdots + n)} \right]} \right\},\left\{ {I_{c} \left[ {\frac{{kc_{pU} (S + R)}}{n} \cdot \frac{M}{n}(1 + 2 + 3 + \cdots + n)} \right]} \right\}} \right] \\ & \quad = \left[ {\left\{ {\frac{n + 1}{2n}I_{c} Mkc_{pL} \left[ {W_{1} + \frac{a - bp}{\beta }\left( {e^{{\beta t_{1} }} - 1} \right) + \eta (a - bp)(T - t_{2} )} \right]} \right\},} \right. \\ & \quad \quad \left. {\left\{ {\frac{n + 1}{2n}I_{c} Mkc_{pU} \left[ {W_{1} + \frac{a - bp}{\beta }\left( {e^{{\beta t_{1} }} - 1} \right) + \eta (a - bp)(T - t_{2} )} \right]} \right\}} \right] \\ \end{aligned} $$

Therefore, the total cost per unit time (i.e. average cost) is

i.e.

where

and

4 Solution procedure

In this work, we have considered the value of inventory parameters as interval valued (i.e. the value of each parameter lies between an interval). Due to this interval representation of inventory cost, the total costs per unit time are converted into interval valued. So, we cannot be able to solve this problem by usual direct/indirect optimization technique. In this paper, we have solved our proposed problem by using interval order relations and particle swarm optimization. The details about interval mathematics including interval order relations and particle swarm optimization technique have been described in “Appendices A and B”.

5 Special cases

In this section, we have discussed some special cases of our proposed model. If we consider the interval-valued costs as fixed, i.e. \( A = A_{L} = A_{U} \), \( c_{l} = c_{lL} = c_{lU} \), \( c_{s} = c_{sL} = c_{sU} \), \( c_{ho} = c_{hoL} = c_{hoU} \), \( c_{hr} = c_{hrL} = c_{hrU} \), \( c_{p} = c_{pL} = c_{pU} \), \( c_{d} = c_{dL} = c_{dU} \), then the total cost is reduced to \( TC\left( {t_{1} ,T} \right) = TC_{L} \left( {t_{1} ,T} \right) = TC_{U} \left( {t_{1} ,T} \right) \). So, the model is converted to crisp model.

-

(a)

Model with complete backlogging \( \left( {{\text{i}} . {\text{e}} .\eta = 1} \right) \)

If \( \eta = 1 \), then the total cost per unit time is given by

-

(b)

Model without Shortage

If \( T \approx t_{2} \), i.e. \( R = 0 \), then the total cost per unit time becomes

Using continuity at \( t = t_{1} \), we can get

-

(c)

Model without advance payment (i.e. M = 0)

If \( M = 0 \) i.e. the purchasing cost will be paid at the receiving time of the lot, then the total cost function per unit time, \( TC(t_{1} ,T) \), is given by

-

(d)

If \( S - W_{1} = 0 \), \( t_{1} = 0 \),\( \eta = 1 \) and \( D \) is constant, then the proposed model is reduced to a single warehouse model and similar to Taleizadeh (2014a).

-

(e)

If \( S - W_{1} = 0 \), \( t_{1} = 0 \) and \( D \) is constant, then the proposed model is reduced to a single warehouse model and similar to Taleizadeh (2014b).

6 Numerical illustration

In order to demonstrate the proposed model, a numerical example has been considered with the following values of different parameters.

AL = $495/order, AR = $500/order, a = 250 units/year, b = 0.5, p = $15/unit, \( c_{pL} = \) $9/unit, \( c_{pR} = \) $10/unit, \( c_{hrL} = \) $3.5/unit/year, \( c_{hrR} = \) $3.5/unit/year, \( c_{hoL} = \) $0.5/unit/year, \( c_{hoR} = \) $1/unit/year, \( c_{sL} = \) $13/unit/year, \( c_{sR} = \) $14/unit/year, \( c_{lL} = \) $16/unit/year, \( c_{lR} = \) $17/unit/year,\( c_{dL} = \) $9/unit/year, \( c_{dR} = \) $10/unit/year,\( M = \) 15*12/30 year, \( I_{c} = \) $0.25/year, \( W_{1} = \) 100 units, \( \alpha = 0.1 \), \( \beta = 0.08 \), \( n = 15 \), \( k = 0.4 \) and \( \eta = 0.8 \).

These values have been considered from a hypothetical two-warehouse inventory system, not from any case study. With the help of the above-mentioned example, we have solved the problem by different variants of PSO and the results are given in Table 2.

Also, we have performed statistical analysis of different variants of PSO which are shown in Table 3, 4 and 5.

7 Sensitivity analysis

From the earlier-mentioned numerical example, sensitivity analysis has been done to investigate the effect of changes (under or over estimation) of different inventory parameters on the optimal solutions and the average cost. This analysis has been performed by changing (increasing and decreasing) the parameters from − 20 to + 20%, taking one or more parameters at a time making the other parameters at their original values. The numerical results of this analysis have been shown in Table 6.

From Table 6, the following observations can be made:

-

1.

The centre value of the average cost of the system \( TC \) is highly sensible with respect to the parameters \( a, \) less sensitive with respect to the parameters \( c_{hrL} ,c_{hrU} ,c_{hoL} ,c_{hoU} ,W,\alpha \,{\text{and}}\,\beta \), whereas moderately sensitive with respect to the rest of the parameters.

-

2.

Cycle length (T) is less sensitive with respect to the parameters p and moderately sensitive with respect to the rest of the parameters.

-

3.

Highest stock level (S) is moderately sensitive with respect to the parameters \( c_{pU} ,c_{hrU} ,c_{hoU} \,{\text{and}}\,a \), whereas highly sensitive with respect to the rest of the parameters.

-

4.

Maximum shortage level (R) is moderately sensitive with respect to \( A_{U} ,c_{hrL} ,c_{hrU} ,c_{hoL} \,{\text{and}}\,c_{hoU} \). Also, the maximum shortage level is highly sensitive with respect to the parameter \( \eta \).

8 Conclusion

In this work, a two-warehouse inventory system has been investigated by considering advance payment and partial backlogging with interval-valued inventory costs. In this model, the corresponding optimization problem with interval objective has been formulated and solved with the help of different variants of particle swarm optimization (PSO) technique and interval order relations. Due to interval-valued inventory cost, the different variants of PSO algorithm have been developed by using interval arithmetic and interval order relations. Then, the obtained best found solutions (which is either optimal or nearer to optimal) from different variants of PSO have been compared, and it is observed that all the variants of PSO have produced the exactly same solution. To the best of our knowledge, for the first time, we have proposed this advanced payment in two-warehouse system. In the existing literature, very few research works have been done in advance payment in inventory system. These were developed only for single warehouse system and also some special cases have been reported.

The proposed inventory model can be extended by considering several realistic features such as non-instantaneous deterioration effect of commodity, fully backlogged shortages and without ending inventory polices, all unit discount facility, price discount due to advance payment. Also, one may extend this model by taking nonlinear demand with nonlinear holding cost. Again, anyone can introduce another realistic feature such as trade credit (single level, two level or partial) and fuzzy-valued inventory costs to extend this model.

References

Bhunia AK, Samanta SS (2014) A study of interval metric and its application in Multi-objective optimization with interval objective. Comput Ind Eng 74:169–178

Bhunia AK, Shaikh AA (2015) An application of PSO in a two warehouse inventory model for deteriorating item under permissible delay in payment with different inventory policies. Appl Math Comput 256:831–850

Bhunia AK, Shaikh AA (2016) Investigation of two-warehouse inventory problems in interval environment under inflation via particle swarm optimization. Math Comput Model Dyn Syst 22(2):160–179

Bhunia AK, Shaikh AA, Maiti AK, Maiti M (2013) A two warehouse deterministic inventory model for deteriorating items with a linear trend in time dependent demand over finite time horizon by Elitist Real-Coded Genetic Algorithm. Int J Ind Eng Comput 4(2):241–258

Bhunia AK, Mahato SK, Shaikh AA, Jaggi CK (2014) A deteriorating inventory model with displayed stock-level-dependent demand and partially backlogged shortages with all unit discount facilities via particle swarm optimization. Int J Syst Sci Oper Logist 1(3):164–180

Bhunia AK, Shaikh AA, Gupta RK (2015) A study on two-warehouse partially backlogged deteriorating inventory models under inflation via particle swarm optimization. Int J Syst Sci 46(6):1036–1050

Bhunia AK, Shaikh AA, Barron LEC (2017) A partially integrated production-inventory model with interval valued inventory costs, variable demand and flexible reliability. Appl Soft Comput 55:491–502

Clerc M (1999) The swarm and queen: towards a deterministic and adaptive particle swarm optimization. In: Proceedings of IEEE Congress on evolutionary computation, Washington, DC, USA, 1951–1957

Clerc M, Kennedy JF (2002) The particle swarm: explosion, stability, and convergence in a multi-dimensional complex space. IEEE Trans Evol Comput 6:58–73

Coelho LS (2010) Gaussian quantum-behaved particle swarm optimization approaches for constrained engineering design problems. Expert Syst Appl 37:1676–1683

Das D, Kar MB, Roy A, Kar S (2014) Two-warehouse production inventory model for a deteriorating item with time-varying demand and shortages: a genetic algorithm with varying population size approach. Optim Eng 15(4):889–907

Diabat A, Taleizadeh AA, Lashgari M (2017) A lot sizing model with partial downstream delayed payment, partial upstream advance payment, and partial backordering for deteriorating items. J Manuf Syst 45:322–342

Hansen E, Walster GW (2004) Global optimization using interval analysis. Marcel Dekher Inc., New York

Hung KC (2011) An inventory model with generalized type demand, deterioration and backorder rates. Eur J Oper Res 208(3):239–242

Jaggi CK, Barron LEC, Tiwari S, Shafi AA (2017) Two-warehouse inventory model for deteriorating items with imperfect quality under the conditions of permissible delay in payments. Sci Iran 24(1):390–412

Karmakar S, Mahato SK, Bhunia AK (2009) Interval oriented multi-section techniques of global optimization. J Comput Appl Math 224:476–491

Lashgari M, Taleizadeh AA, Ahmadi A (2016a) Partial up-stream advanced payment and partial down-stream delayed payment in a three-level supply chain. Ann Oper Res 238(1–2):329–354

Lashgari M, Taleizadeh AA, Sana SS (2016b) An inventory control problem for deteriorating items with back-ordering and financial considerations under two levels of trade credit linked to order quantity. J Ind Manag Optim 12(3):1091–1119

Lashgari M, Taleizadeh AA, Sadjadi SJ (2018) Ordering policies for non-instantaneous deteriorating items under hybrid partial prepayment, partial trade credit and partial backordering. J Oper Res Soc 69(8):1167–1196

Liang Y, Zhou F (2011) A two ware house inventory model for deteriorating items under conditionally permissible delay in payment. Appl Math Model 35(5):2221–2231

Liao JJ, Huang KN (2010) Deterministic inventory model for deteriorating items with trade credit financing and capacity constraints. Comput Ind Eng 59(4):611–618

Liao JJ, Chung KJ, Huang KN (2013) A deterministic inventory model for deteriorating items with two warehouses and trade credit in a supply chain system. Int J Prod Econ 146(2):557–565

Maiti AK, Maiti MK, Maiti M (2009) Inventory model with stochastic lead time and price dependent demand incorporating advance payment. Appl Math Model 33(5):2433–2443

Moore RE (1979) Methods and applications of interval analysis. SIAM, Philadelphia

Pal B, Sana SS, Chaudhuri K (2017) A stochastic production inventory model for deteriorating items with products finite life-cycle. RAIRO-Oper Res 51(3):669–684

Palanivel M, Uthayakumar R (2016) Two-warehouse inventory model for non–instantaneous deteriorating items with optimal credit period and partial backlogging under inflation. J Control Decis 3(2):132–150

Sett BK, Sarkar B, Goswami A (2012) A two-warehouse inventory model with increasing demand and time varying deterioration. Sci Iran 19(6):1969–1977

Shah NH, Soni HN, Patel KA (2013) Optimizing inventory and marketing policy for non-instantaneous deteriorating items with generalized type deterioration and holding cost rates. Omega 41(2):421–430

Shaikh AA (2017) A two warehouse inventory model for deteriorating items with variable demand under alternative trade credit policy. Int J Logist Syst Manag 27(1):40–61

Shaikh AA, Mashud AHM, Uddin MS, Khan MAA (2017a) Non-instantaneous deterioration inventory model with price and stock dependent demand for fully backlogged shortages under inflation. Int J Bus Forecast Market Intell 3(2):152–164

Shaikh AA, Barron LEC, Tiwari S (2017b) A two-warehouse inventory model for non-instantaneous deteriorating items with interval-valued inventory costs and stock-dependent demand under inflationary conditions. Neural Comput Appl 1–18

Shaikh AA, Panda GC, Sahu S, Das AK (2019) Economic order quantity model for deteriorating item with preservation technology in time dependent demand with partial backlogging and trade credit. Int J Logist Syst Manag 32(1):1–24

Sun J, Feng B, Xu WB (2004) Particle swarm optimization with particles having quantum behavior. In: IEEE Proceedings of Congress on evolutionary computation, pp 325–331

Sun J, Feng B, Xu WB (2004) A global search strategy of quantum-behaved particle swarm optimization. In: Proceedings of the 2004 IEEE conference on cybernetics and intelligent systems, pp 111–116

Taleizadeh AA (2014a) An EOQ model with partial backordering and advance payments for an evaporating item. Int J Prod Econ 155:185–193

Taleizadeh AA (2014b) An economic order quantity model for deteriorating item in a purchasing system with multiple prepayments. Appl Math Model 38(23):5357–5366

Taleizadeh AA (2017) Lot-sizing model with advance payment pricing and disruption in supply under planned partial backordering. Int Trans Oper Res 24(4):783–800

Taleizadeh AA, Nematollahi M (2014) An inventory control problem for deteriorating items with back-ordering and financial considerations. Appl Math Model 38(1):93–109

Taleizadeh AA, Niaki STA, Shafii N, Ghavamizadeh MR, Jabbarzadeh A (2010) A particle swarm optimization approach for constraint joint single buyer single vendor inventory problem with changeable lead-time and (r, Q) policy in supply chain. Int J Adv Manuf Technol 51:1209–1223

Taleizadeh AA, Pentico DW, Jabalamali MS, Aryanezhad M (2013) An economic order quantity model with multiple partial prepayment and partial back ordering. Math Comput Model 57(3–4):311–323

Taleizadeh AA, Noori-daryan M, Barron LEC (2015) Joint optimization of price, replenishment frequency, replenishment cycle and production rate in vendor managed inventory system with deteriorating items. Int J Prod Econ 159:285–295

Taleizadeh AA, Jolai F, Wee HM (2017) Multi objective supply chain problem using a novel hybrid method of meta goal programming and firefly algorithm. Asia Pac J Oper Res 34(4):1750021

Tavakoli S, Taleizadeh AA (2017) An EOQ model for decaying items with full advance payment and conditional discount. Ann Oper Res 259:415–436

Teng JT, Barron LEC, Chang HJ, Wu J, Hu Y (2016) Inventory lot size policies for deteriorating items with expiration date and advance payments. Appl Math Model 40(19–20):8605–8616

Thangam A (2011) Dominants retailers optimal policy in a supply chain under advance payment scheme and trade credit. Int J Math Oper Res 3(6):658–679

Thangam A (2012) Optimal price discounting and lot-sizing policies for perishable items in a supply chain under advance payment scheme and two-echolon trade credits. Int J Prod Eng 139(2):459–472

Tiwari S, Jaggi CK, Bhunia AK, Shaikh AA, Goh M (2017) Two-warehouse inventory model for non-instantaneous deteriorating items with stock-dependent demand and inflation using particle swarm optimization. Ann Oper Res 254(1–2):401–423

Tsao YC (2016) Joint location, inventory, and preservation decisions for non-instantaneous deterioration items under delay in payments. Int J Syst Sci 47(3):572–585

Widyadana GA, Wee HM (2012) An economic production quantity model for deteriorating items with multiple production setups and rework. Int J Prod Econ 138(1):62–67

Zia NP, Taleizadeh AA (2015) A lot-sizing model with backordering under hybrid linked-to-order multiple advance payments and delayed payment. Transp Res Part E Logist Transp Rev 82:19–37

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors declare that they have no conflict interest.

Additional information

Communicated by V. Loia.

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Interval mathematics

An interval number is denoted by \( A = \left[ {a_{L} ,a_{U} } \right] \) and defined by \( A = \left[ {a_{L} ,a_{U} } \right] = \left\{ {x:a_{L} \le x \le a_{U} ,x \in R} \right\}. \), where \( a_{L} \) and \( a_{U} \) are lower and upper bounds, respectively. Any real number \( x \in R \) can be expressed as an interval number [x, x] as degenerate with zero width. Also, interval number can be expressed in terms of centre and radius form as \( A = \left[ {a_{c} ,a_{w} } \right] = \left\{ {x:a_{c} - a_{w} \le x \le a_{c} + a_{w} ,x \in R} \right\} \), where aC = (aL + aU)/2 is the centre of the interval number and aW = (aU − aL)/2, the radius of the interval number. The basic definitions of interval arithmetic are given Moore (Moore 1979) and which are given below:

Definition A.1

Let us consider A = [aL, aU] and B = [bL, bU] be any two interval numbers. Then, arithmetical operations such as addition, subtraction, multiplication of scalar number, multiplication and division of interval numbers are given below:

-

1.

Addition:

$$ A + B = \left[ {a_{L} ,a_{U} } \right] + \left[ {b_{L} ,b_{U} } \right] = \left[ {a_{L} + b_{L} ,a_{U} + b_{U} } \right]. $$ -

2.

Subtraction:

$$ A - B = \left[ {a_{L} ,a_{U} } \right] - \left[ {b_{L} ,b_{U} } \right] = \left[ {a_{L} ,a_{U} } \right] + \left[ { - b_{U} , - b_{L} } \right] = \left[ {a_{L} {-}b_{U} ,a_{U} - b_{L} } \right]. $$ -

3.

Scalar multiplication:

$$ \lambda A = \lambda \left[ {a_{L} , \, a_{U} } \right] = \left\{ \begin{aligned} &\left[ {\lambda a_{L} , \, \lambda a_{U} } \right] \quad {\rm if} \, \lambda \ge 0 \hfill \\ &\left[ {\lambda a_{U} , \, \lambda a_{L} } \right] \quad {\rm if} \, \lambda < 0, \hfill \\ \end{aligned} \right.\quad {\text{for}}\;{\text{any}}\;{\text{real}}\;{\text{number}}\;{\mathbb{R}}. $$ -

4.

Multiplication:

$$ A \times B = \left[ {\hbox{min} \left( {a_{L} b_{L} ,a_{L} b_{U} ,a_{U} b_{L} ,a_{U} b_{U} } \right),\hbox{max} \left( {a_{L} b_{L} ,a_{L} b_{U} ,a_{U} b_{L} ,a_{U} b_{U} } \right)} \right] $$Specially, \( A \times B = [a_{L} b_{L} ,a_{U} b_{U} ]{\text{ for }}a_{L} ,b_{L} \ge 0 \)

-

5.

Division:

$$ \frac{A}{B} = A \times \left( {\frac{1}{B}} \right) = \left[ {a_{L} , \, a_{U} } \right] \times \left[ {\frac{1}{{b_{U} }}, \, \frac{1}{{b_{L} }}} \right],\quad {\text{provided}}\;0 \in \left[ {b_{L} ,b_{U} } \right] $$

Definition A.2

Integral power of an interval According to Hansen and Walster (2004), the definition of positive integral power of an interval \( A = [a_{L} ,a_{U} ] \) is given by

Definition A.3

\( n \)-th root of an interval According to Karmakar et al. (2009), the \( n \)-th root of an interval \( A = [a_{L} ,a_{U} ] \) is given by

where \( \phi \) being the empty interval.

1.1 Order relations of interval numbers

Let us consider two interval numbers \( A = [a_{L} ,a_{U} ] \) and \( B = [b_{L} ,b_{U} ] \). Then, these two intervals may follow any one of the following three types:

-

Type-1: Two intervals are disjoint, i.e. either \( a_{L} < a_{U} \le b_{L} < b_{U} \) or \( b_{L} < b_{U} \le a_{L} < a_{U} \)

-

Type-2: Two intervals are partially overlapping, i.e. either \( a_{L} \le b_{L} \le a_{U} \le b_{U} \) or \( b_{L} \le a_{L} \le b_{U} \le a_{U} \)

-

Type-3: One of the intervals contains the other one, i.e. either \( a_{L} \le b_{L} < b_{U} \le a_{U} \) or \( b_{L} \le a_{L} < a_{U} \le b_{U} \)

The definitions of interval order relations between two interval numbers have been proposed by several researchers. Recently, Bhunia and Samanta (2014) modified the drawbacks of existing definitions and proposed the modified definitions. The definitions of Bhunia and Samanta (2014) are as follows:

Definition A.4

The interval order relation \( \ge^{\hbox{max} } \) between two intervals \( A = [a_{L} ,a_{U} ] = \left\langle {a_{c} ,a_{w} } \right\rangle \) and \( B = [b_{L} ,b_{U} ] = \left\langle {b_{c} ,b_{w} } \right\rangle \), for maximization problems is as follows:

and \( A >^{\hbox{max} } B \Leftrightarrow A \ge^{\hbox{max} } B{\text{ and }}A \ne B \).

Definition A.5

The interval order relation \( \le^{\hbox{min} } \) between two intervals \( A = [a_{L} ,a_{U} ] = \left\langle {a_{c} ,a_{w} } \right\rangle \) and \( B = [b_{L} ,b_{U} ] = \left\langle {b_{c} ,b_{w} } \right\rangle \), for minimization problems is as follows:

and \( A <^{\hbox{min} } B \Leftrightarrow A \le^{\hbox{min} } B{\text{ and }}A \ne B \).

1.2 Mean, standard deviation and coefficient of variation of Interval Numbers

According to the Bhunia and Samanta (2014), the mean, variance, standard deviation and coefficient of variation of n interval numbers can be defined as follows:

Let \( x_{i} = [x_{iL} ,x_{iU} ] \), \( i = 1,2, \ldots ,n \), be the i-th observation of an interval number. Then, mean \( (\bar{x}) \) and standard deviation \( \left( {\sigma_{x} } \right) \) of the intervals \( x_{1} ,x_{2} , \ldots ,x_{n} \) are given as follows:

and

Coefficient of variation (C.O.V.) of the interval numbers \( x_{1} ,x_{2} , \ldots ,x_{n} \) is given as follows:

Appendix B: Particle swarm optimization (PSO)

In PSO, the following notations have been used:

p_size | the population size or swarm size |

m_gen | the maximum number of generation |

χ | the constriction factor |

c1( > 0) | the cognitive learning rate |

c2( > 0) | the social learning rate |

r1, r2 | the uniformly distributed random numbers lying in the interval [0, 1]. |

v ( k) i | the velocity of i-th particle at k-th generation/iteration |

x ( k) i | the position of i-th particle of population at k-th generation |

p ( k) i | the best previous position of i-th particle at k-th generation |

p ( k) g | the position of the best particle among all the particles in the population |

PSO is a population-based derivative-free soft computing optimization technique based on the individual experience and social interaction. It is very useful and popular continuous optimization technique. In PSO, the potential solutions are called particles. These particles fly through the search space of the problem by following the current optimum particles. Generally, PSO begins with random particles positions (solutions) and then searches the optimum solutions from generation to generation in the search space. So, each particle is updated with two best positions (solutions) in the search space. The first one is called the best position (solution) and this best position is named by personal best position. It is denoted by \( p_{i}^{(k)} \). The second one is called the current best position (solution). It is found so far by any particle in the population. This best value is called as global best and denoted by \( p_{g}^{(k)} \).

In generation to generation, the velocity and position of i-th \( \left( {i = 1,2, \ldots ,p\_{\text{size}}} \right) \) particle are updated in the following way:

and

where w is the inertia weight; \( k\left( { = 1,2, \ldots ,m{\text{ - gen}}} \right) \) denotes the iteration (generation). The constants \( c_{1} \left( { > 0} \right) \) and \( c_{2} \left( { > 0} \right) \) are called the cognitive learning and social learning rates, respectively. These are the acceleration constants. These two constants have important role for varying the velocity of the particle converge to \( p_{i}^{(k)} \) and \( p_{g}^{(k)} \), respectively.

From Eq. (B1), it is observed that the updated rule of the velocity of i-th particle is followed by three factors: (1) past velocity of the particle, (2) the distance between the particle’s best past one and current one and (3) the distance between swarm’s best experience (the position of the best particle in the swarm) and the current position of the particle. The velocity of the particle in (B1) is also restricted by \( \left[ { - v_{\hbox{max} } ,\,\,v_{\hbox{max} } } \right] \) where \( v_{\hbox{max} } \) is called the maximum velocity. Selecting a too small value for \( v_{\hbox{max} } \) causes very small updating of velocities and positions of particles in every iteration. Therefore, the algorithm may take a long time to converge and face the problem of be trapped at local minima. In order to overcome these situations, Clerc (1999), Clerc and Kennedy (2002) have developed improved velocity update rules simply considering a constriction factor \( \chi \). According to them, the updated velocity is given by

Here, the constriction factor \( \chi \) is expressed as

where \( \phi = c_{1} + c_{2} ,\,\,\phi > 4 \) and \( \chi \) is a function of \( c_{1} \) and \( c_{2} \). Usually, \( c_{1} \) and \( c_{2} \) are both set to be 2.05. Thus, \( \phi \) is set to 4.1, and therefore, the constriction coefficient \( \chi \) is 0.729. This PSO is also known as PSO-CO i.e. constriction coefficient-based PSO.

According to classical mechanics, position and velocity of the particle are determined by the trajectory of the particle which indicates that a particle moves along a determined trajectory along the search space. It is not true in quantum mechanics. In quantum mechanics, the position and velocity of a particle cannot be determined together, due to uncertainty principle. Trajectory of a particle is meaningless in quantum mechanics. According to quantum mechanics, if a particle has quantum nature in PSO, then PSO algorithm is bound to work in a different way. Using this nature, Sun et al. (2004a, b) have proposed a new concept in PSO algorithm which is known as quantum PSO (QPSO) and solved some problems. In their proposed PSO algorithm (QPSO), particles’ state equations are structured by wave function. The state of every particle is described by its local attracter p, and the mean optimal position (MP) is determined by the characteristic length L of \( \delta \)-trap. Here, MP enhances the cooperation between particles and particles’ waiting with each other; QPSO can prevent particles trapping into local minima. According to Sun et al. (2004a, b), the iterative equation for the position of the particle in QPSO is as follows:

where \( u_{j} \) is a random number which uniformly distributed in (0, 1). The parameter \( \beta^{\prime} \) is called the contraction–expansion coefficient. It controls the convergence rate of the QPSO algorithm which decreases linearly from 1.0 to 0.5. The global point is called mean best \( m^{(k)} \) of the population at k-th iteration and is defined as the mean of the pbest positions of all particles. That is

Taleizadeh et al. (2010) have solved a supply chain problem by using weighted PSO. Bhunia and Shaikh (2015) applied PSO-CO technique for solving a two-warehouse inventory problem with trade credit policy. Taleizadeh et al. (2017) have solved a multi-objective optimization problem by using meta-goal programming and firefly algorithm. Here, we have used PSC-CO, WQPSO and GQPSO for solving the interval-valued inventory problem with advance payment and partial backlogged shortage.

In WQPSO, the mean best position of QPSO is replaced by weighted mean best position and particles are ranked in increasing order (in case of minimization problem) according to their fitness values. Then, a weighted coefficient \( \alpha_{i} \) is assigned linearly increasing with the particle’s rank. The mean best position \( m^{(k)} \), therefore, is calculated as follows:

where \( \alpha_{i} \) is the weighted coefficient and \( \alpha_{id} \) is the dimension coefficient of every particle. In this work, the weighted coefficient for each particle decreases linearly from 1.5 to 0.5.

On the other hand, according to Coelho (2010) in GQPSO, \( \tilde{p}_{ij}^{(k)} \) is calculated as follows:

where G and g be the random numbers which are generated using the absolute value of the Gaussian probability distribution with zero mean and unit variance.

and the iterative equation for the position of the particle is given by

where \( \beta^{\prime} \) decreases linearly from 1.0 to 0.5

Rights and permissions

About this article

Cite this article

Shaikh, A.A., Das, S.C., Bhunia, A.K. et al. A two-warehouse EOQ model with interval-valued inventory cost and advance payment for deteriorating item under particle swarm optimization. Soft Comput 23, 13531–13546 (2019). https://doi.org/10.1007/s00500-019-03890-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-019-03890-y