Abstract

This study examines the impact of energy consumption, urbanization, and globalization on environmental degradation proxied by carbon emissions (CO2) in the South Asian Association for Regional Cooperation (SAARC) countries, namely Sri Lanka, Pakistan, Maldives, Nepal, Bhutan, Bangladesh, and India using data over the period 1990–2018. The cross-sectional autoregressive distributed lag (CS-ARDL), pooled mean group (PMG), and Dumitrescu and Hurlin (D-H) Granger causality techniques are employed for the empirical analysis. First and second-generation panel unit root tests are used to determine the stationary level of all data series which reveals mixed order of integration. The empirical findings show that urbanization, gross domestic product (GDP) per capita income, energy consumption, industrial growth, globalization, and financial development cause CO2 emissions, while the other variables, namely arable land and innovation, put negative effects on CO2 emissions. Moreover, the D-H heterogeneous test results exhibit that bi-directional relationship exists between CO2 and arable land, urbanization, industrial growth, and financial development, while a unidirectional causality exists between CO2 emissions and GDP per head income. These findings suggest that planned urbanization, investment in renewable energy sources, and effective strategies regarding the economic and financial integration with the global economies are required for a clean and green environment.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Climate change is one of the most significant environmental pressures affecting the sustainable economic growth of almost all countries around the world. Govindaraju and Tang’s (2013) study reveals that countries’ objectives to achieve faster growth and development are causing massive environmental deterioration and resources depletion. CO2 emissions, which are considered one of the basic indicators of pollution, come from cement manufacturing, consumption of gas flaring, burning of fossil fuels, coal, solid, gas fuels as well as liquid materials. The literature shows two main sources of CO2 emissions. The first one is the natural source of CO2 emissions, such as respiration ocean release, and decomposition. Because of human actions, the atmospheric absorption of CO2 emissions has risen to dangerous levels, which was further triggered by the industrial revolution. The second source of CO2 emissions is the human activities such as the burning of fuels like natural gas, coal, oil, cements production, and deforestation (Chen & Huang, 2013). Variation in weather conditions, intense droughts of food production, increasing sea levels, and shortage in supply of freshwater threaten the livelihood of humans and other living organisms. CO2, an odorless, colorless, and nonpoisonous gas mostly emitted by the burning of carbon, other human action, and the respiration of living organisms, is the main greenhouse gas (GHG) responsible for global warming (Abdul-Wahab et al. 2015).

Globalization, which is caused by transformations, international competition, and technological developments of the economies, results in increased production of goods and services. However, globalization along with industrialization and urbanization may lead to negative externalities and the deterioration of the environment quality. Globalization affects CO2 emissions through income effect, scale effect, and composition effect channels (Antweileret et al., 2001). The income effect hypothesis states that globalization produces emissions as a consequence of increased foreign trade and foreign investment and vice versa. The scale effect shows that growing economic and financial integration at the international levels leads to higher competitiveness and product diversification, resulting in increased CO2 emissions. Similarly, the composite effect of globalization postulates that with changes in the scale and structure of the economy, pollution may increase because of the more carbon-intensive consumption (Salahuddin et al., 2019).

Similarly, it is evident from the literature that countries that experienced unplanned urbanization led to increased use of natural resources and consumption of energy (Destek & Ozsoy, 2015). The theoretical link between urbanization and the environment can be explained based on three theories including ecological modernization theory, urban environmental transition theory, and compact city theory (Poumanyvong & Kaneko, 2010). The basic theme of the ecological modernization theory is that with the expansion of the economy, the risk of environmental damage increases and for minimizing its adverse effects, strategies for planned urbanization could be effective in this regard. The theory also suggested that to control the greater risks of environmental damage, the countries shall be transformed from more dependent on the manufacturing sector to service-based economies.

Similarly, the urban environmental transition theory sheds light on the fact that urban cities are generally characterized by significant industrialization that causes a high level of emissions. However, the theory also proposed that as urban people are comparatively rich against the people living in rural areas, they are usually concerned more regarding the promotion of environmental quality and may undertake several initiatives for bringing reduction in the pollution. Finally, the compact city theory states that urbanization damages the environment through public infrastructure such as water supply, health facilities, education, and transport, etc.

Based on the above theories, a series of studies are available in the literature showing different channels through which urbanization affects environmental quality. Firstly, urbanization brings an increase in the anthropogenic activities, fuel consumption, and transportation, which results in the generation of greater air pollution (Ahmad et al. 2019). Secondly, the rapid increase in urbanization triggers the need for better infrastructure, which causes deforestation and CO2 emissions (Sadorsky, 2014). Thirdly, urbanization distorts the natural habitats and produces new habitats for some species such as sparrows, eradiate for native species, flies, and sparrows (Uttara et al; 2012). Fourthly, urbanization leads to serious environmental challenges such as the development of slums, industrial dumps, contamination dispersal, municipal wastes, and traffic congestion. Fifthly, urbanization increases the industrial production which results in greater levels of air pollution (Samreen & Majeed, 2020).

Furthermore, high levels of energy consumption can also worsen the environment, because it produces greenhouse gases (GHGs) into the atmosphere. The use of traditional energy sources is the key source of economic growth and environmental degradation. By the way, numerous researchers worked on the nexus among energy used, CO2 emissions, and macroeconomics variables. Fossil fuels are the backbone of global energy. IEA (2018) reported that in all forms of primary energies, approximately 81% share is of the fossil fuels, oil share is 31.9%, coal contribution is 27.1%, and 22.1% is natural gas contribution. The high energy consumption increased pollutant emission and their effects on global environmental quality, resulting in decreasing the bio-capacity, unpredictable weather conditions, rising altered habitats, ecosystem, and global temperature (Usman, 2021). These costs have raised the energy supply and demand and also affect the future policies. Therefore, traditional energy used rises the CO2 emissions (Yang et al. 2021).

The dilemma for a human is to choose environmental protection and economic growth. Ecology is changed by global warming. Numerous studies showed that CO2 emissions is produced by human activities and global warming is closely related to CO2 emissions (Lee & Lee, 2009; Jaunky, 2011; Al-mulali, 2012; Liddle, 2012). Furthermore, a good stock of research work on ecological economics pointed out the connection between economic growth and CO2 emissions (Coondoo & Dinda, 2002; Soytasetal, 2007). Jaunky (2011) found that pollution and income are having monotonically increasing nexus, while economic growth harms environmental quality. According to Bojanic (2012), increased energy use leads to increase CO2 emissions. IEA (2007) reported that the 5.3% is the annual growth rate of CO2 emissions in Asia. Moreover, Lee (2006) worked on eleven countries to analyze the connection between energy use and GDP. The findings revealed that income level and energy use are neutral to each other for selected economies. Niu et al. (2011) worked for the eight Asia Pacific countries, to check the association between GDP per capita, CO2, and energy use. The findings of the study reveal a long-run association between CO2, GDP per capita, and energy use.

In the extant literature, large number of studies explored the determinants of carbon emissions by focusing on both the developed and developing countries. These studies have often looked into the effects of national income, energy consumption, population growth, foreign direct investment, and trade openness on CO2 emissions. Overall, the outcomes of these investigations revealed that some factors are very critical for environmental degradation, while others are less environmentally harmful or even improve the environmental quality. This all may be depending on the region, culture, data structure, and socio-economic context of the countries. Consequently, consensus on climate change causes is difficult to achieve due to differences in economic structure between countries. Moreover, the findings of a study cannot be generalized to the other countries because of the unique socio-economic characteristics of the countries. Thus, the issue of CO2 emissions requires careful analysis in light of the countries’ economic structure. The aim of the present study is to investigate the impact of globalization, urbanization, and energy consumption on carbon emissions in the six countries from SAARC, namely Sri Lanka, Pakistan, Maldives, Nepal, Bhutan, Bangladesh, and India. Keeping in view all that the present study contributes to the literature in threefold: First, unlike the previous studies, this study simultaneously investigates the effects of globalization, urbanization, and energy consumption on CO2 in SAARC countries with a broader aim to achieve sustainable development goals. The relationship of these variables with CO2 needs to be explored specifically in for SAARC which is important for implementing effective strategies to protect the environment and accomplishment of sustainable development. Second, other key variables including industrial growth and innovation are also incorporated for providing a more in-depth insight to the causes of CO2. Third, the determinants of CO2 have been explored in the framework of extended version of STIRPAT model. Finally, the study applied recent econometric techniques, i.e., CS-ARDL along with PMG and D-H panel Granger causality test for estimation which provide robust results seems more plausible for policy formulation and implementation.

The rest of the paper is organized as follows. The study’s section-2 deals with the literature review, the methodology and data are given in section-3. Section-4 presents results and the discussion and conclusion are given in section-5.

Literature review

Theoretical review

There are three main theories such as environment transition theory (ETT), ecological modernization theory (EMT), and compact city theory (CCT) (Pouman & Kaneko, 2010). The ETT is developed by Gordon McGranahan and his colleagues during the early 1990s. The research investigated a link between urbanization and environment and growing affluence and challenges (Collatz et al. 1990; Li & Lee, 1994; McGranahan et al. 1996). It focuses on environmental burdens such as industrial contamination due to cities growth and income level rises. The environmental challenges become more, delayed, and dispersed. Emerging and developing newly industrialized economies are facing several obstacles in tackling several challenges like provision of better facilities for the urban population, enhancement in energy efficiency, and improvement of environmental quality. The focus of most economies is on rising income level while overlooking the environmental quality (Bekhet & Othman, 2018). Therefore, the connection of urbanization with energy intensity and emission has grown a dynamic concern. Several studies have looked at the relationship between the amount of energy used by the urbanized population, urbanization, and associated emissions. Environmental quality should be attained, because it represents a very high level of development for any country and a move towards sustainable development (Sadorsky, 2014).

The ecological modernization theory (EMT) has been developed in the early 1980s. EMT stated that the connection between innovation in technology and economic activity, and the involvements of civil society and nation-state are needed to attain the best environmental outcomes. Huber (1991) investigated the role of the state in environmental quality and suggested that regulation by authorities is vital to delivering stability factor crucial to innovate for business decision-making processes. He argued that the state can play an active role in promoting environmental quality. EMT is used in the formulation of effective environmental policies, and it discussed the role of society in a sustainable and clean environment (Howe et al. 2010).

The compact city theory aims that how the urban area developed with time (Miao, 2017). The debate on the urbanization and environment relationship is specifically becomes important when the Commission of European Communities (CEC) published its “Green Paper on the Urban Environment” (1990). The commission revealed that urban development is one of the most important factors for sustainable development. Their vision for the future was centered on the “compact city” which would be modeled on “the old traditional life of the European City, stressing density, multiple-use, social and cultural diversity” (Sakurai et al., 1990). The CCT also responds to the concern that development affects the environment and society. The compact city can be characterized by dense and mixed clustering of jobs, amenities, social services, shops, and housing within an integrated system supporting efficient use of energy and land. It also focused on green belts as boundaries for development, and protection of the agriculture sector and environment (Westerink et al., 2013).

Empirical studies

Energy and CO 2 emissions

High energy use worsens the environmental quality because the conformist source of energy creates GHGs in the atmosphere. In the case of MENA countries, Omri (2013) analyzed the link among the economic growth, energy use, and environmental degradation by using the panel econometrics technique from 1990 to 2011. The finding indicated that energy policies and the environment are responsible factors for affecting the connection between energy use and economic growth in the case of MENA region. Dogan and Turkekul (2016) conducted a research on real output, urbanization energy use, and CO2 emissions for the USA economy from 1960 to 2010 by using ARDL approach. The study found that there is a bi-directional causality between GDP and CO2, energy use and CO2, urbanization, and GDP. While, CO2 emissions has no causality with the trade openness. Kahouli (2017) investigated the long- and short-run nexus among energy use, financial development, and economic growth for selected countries. They estimated Cobb–Douglas production using data for the years 1995–2015. The findings revealed that there is long-run co-integration between all the variables. Tariq et al. (2018) conducted a study for four developing countries and explored the relationship between economic growth and energy use over the period 1981–2015. Anser (2019) worked on human activities and energy consumption and its effects on CO2 emission in Pakistan by using ARDL from 1972 to 2014. They found that urbanization, population growth, and the use of fossil fuels have an impact on CO2 emissions.

The study of Khan et al. (2019) examined the economic factors, energy use, globalization, and CO2 in Pakistan from 1971 to 2016. They found that political globalization, economic globalization, FDI, energy use, and financial development have a positive effect on CO2 in Pakistan. Siddique et al. (2020a, b) worked on the impact of energy use and urbanization on CO2 in South Asia from 1983 to 2013. They used panel Granger causality and co-integration. The author revealed that there is long-run nexus between economic growth and energy use. Moreover, the author also revealed that there is bidirectional causality between CO2 and energy use. Panigrahi et al. (2020) found that there is a positive effect of energy use and FDI on CO2 in the UAE and Oman. They worked on the FDI, economic growth, and energy consumption on CO2 by using the cointegration test.

Economic growth and CO 2 emissions

According to the environmental Kuznets curve (EKC) hypothesis, the nexus between CO2 emissions and GDP is inverted U-shaped and nonlinear. It suggested that GDP is linked with CO2 emissions and reduced if the economy is growing (Shahbaz et al. 2013). Balsalobre-Lorente et al. (2018) analyzed how natural resources, electricity, and economic growth affect CO2 emissions in a case study of five European Union countries (i.e., the UK, Germany, Italy, and France). They used the period from 1985 to 2016. The results revealed that there is a relation between renewable electricity and economic growth. Moreover, the need for renewable energy regulation is connected to energy innovation and rising renewable sources, therefore it reduces the effect of fossil energy on CO2. Obradović and Lojanica (2017) worked on Bulgaria and Greece to examine the nexus among energy use, economic growth, and CO2. They concluded that there is a long-run causal relationship between energy use and economic growth with CO2. While there is no causality existed between the above-mentioned variables and CO2 emissions in the short run. Kais and Ben (2017) observed a unidirectional causality from GDP to carbon emissions for three selected North African countries during 1980–2012. Lee and Yoo (2016) estimated the Granger causality test among the economic growth, energy use, and carbon emissions. The author found that there is a unidirectional causality from carbon emission to economic growth from 1971 to 2008. Ahmed et al. (2016) found a long-term association between energy use, economic growth, and carbon emissions for Sri Lanka during 1971–2006.

Urbanization and CO 2 emissions

Jones (1991) worked on the nexus among urbanization, energy use, and CO2 emission by using the cross-sectional data. They found that there existed correlation between energy per capita and urbanization. Moreover, urbanization increased energy usage and transport energy. In the context of EKC, Ehrhardt-Martinez et al. (2002) analyzed the correlation between deforestation and urbanization. The study revealed that at the initial stages of growth urbanization lead to an increase in deforestation rate, while run down when urbanization spreaded. In the context of the STIRPAT model used by York et al. (2003), they found that urbanization has a positive effect on energy use and CO2. The findings of a study by Poumanyvong and Kaneko (2010), which used the STIRPAT model to examine the relationship between renewable energy and growth, revealed that urbanization has improved the usage of energy. Chen et al. (2008) observed the nexus between energy use and urban density. They found that there was a negative association existed between them. In the context of time series analysis for the period of 1978–2011, Zhang et al. (2014) worked on the association between economic growth, industrial, and urbanization on CO2 in China by using the ARDL modeling approach. The results of the study showed that a long-term connection existed between urbanization and energy emission. Mishra et al. (2009) revealed that there was a positive nexus between CO2 and urbanization in Tonga, French, and Polynesia, but a negative relationship in Samoa.

Globalization and CO 2 emissions

Dreher (2006) examined the effects of globalization on CO2 emissions for both the developing and developed countries. The finding revealed that globalization inspired the developed economies to undertake green technology projects around the world. Feridun et al. (2006) found that globalization accelerated the emerging countries’ growth rate, but it adversely affected their environmental quality. Jorgenson and Jorgenson & Givens (2014) and Li et al. (2015) analyzed the link between globalization and CO2. They used trade openness as a proxy for globalization. They found that globalization has negatively related to CO2 emissions. By using the time series data from 1984 to 2011, Doytch and Uctum (2016) found that financial development and globalization increased investment but had adverse effects on CO2 emission. You and Lv (2018) reported that globalization and CO2 are positively linked. Another study was done by Saint-Akadiri et al. (2019) that looked at the connection between globalization and the environment for fifteen countries from 1995 to 2014. They showed that energy use and globalization have a positive effect on CO2. Zaidi et al. (2019) analyzed the link of globalization with CO2 in eighty-seven counties. Their results demonstrated that globalization would reduce CO2 in middle-income and high-income economies in the future, whereas it will bring an increase in CO2 emissions in low-income countries.

CO 2 emission, economic growth, and innovation

In their study, Asongu et al. (2016) worked on testing the relationship between energy consumption, CO2, and economic growth for 24 African countries using a panel ARDL approach. The study found a long-run relationship between energy consumption, CO2, and GDP. Toumi and Toumi (2019) used non-linear ARDL model of asymmetric causation between renewable energy usage, CO2, and economic development in KSA from 1990 to 2014. The non-linear asymmetric causality test results showed that negative shocks in carbon dioxide emissions had only positive impacts on real GDP in the long-term, but these effects are unobservable in the short-term. Fan and Hossain (2018) worked on technological innovation, trade openness, CO2, and economic growth in China and India from 1974 to 2016 by using utilized the ARDL bounds test methodology and Toda-Yamamoto Granger causality test. The obtained results revealed that technological innovation, trade openness, and CO2 emissions had a significant and positive impact on economic growth in the long-run but showed mixed results in the short-run for China. Trade openness has a substantial influence on India’s economic growth, while CO2 showed a negative impact in the short run. In the long-term, technological innovation is insignificant, and in the short run, both technological innovation and trade openness are insignificant for India’s economic growth.

According to Jayanthakumaran et al. (2012), energy consumption, per capita income, and structural changes all influenced CO2 in China. For India, on the other hand, the similar link cannot be established. The reason for this is that India’s informal economy is greater than China. India has a good number of microenterprises which consume low energy. Carbon costs are greater in China than in India, according to Pradhan et al. (2017), due to variations in emission intensity and the rate of deployment of new technology. Broadband penetration has favorable influence on economic development in 22 OECD nations (Koutroumpis 2009). The impact of mobile telecommunications on GDP was demonstrated by Gruber and Koutroumpis (2011). The influence of ICT on economic growth for ASEAN5 + 3 nations was explored by Ahmed and Ridzuan (2013), who discovered that capital, labor, and telecommunications investment all had positive associations with GDP.

Li et al. (2021) reported that technological innovation could play a vital role in alleviating environmental challenges. For example, technical advancements can directly improve environmental quality by producing environmental-related technologies, which can be understood as environmental rules that prevent the garbage from being disposed of into the ecosystem (Nathaniel et al. 2021). A study by Sohag et al. (2015) examined the impact of technological innovation on energy usage in Malaysia. They found that rising GDP per capita and trade openness causes technological innovation to have a rebound effect on energy use.

Empirical methodology and data

Model specification

This study employs the extended version of STIRPAT model to investigate the effects of globalization, urbanization, energy consumption, and economic growth on environmental degradation (i.e., CO2 emissions) in the case of SAARC countries. The STIRPAT model is proposed by Dietz and Rosa (1994) which is an extension and mathematical generalization of IPAT model. In IPAT model, the authors at first time introduced the idea in equation form that environmental impact is the product of three components, namely population, affluence, and technology (see Ehrlich & Holdren, 1971). The IPAT model is basically an accounting equation and can be written as given:

However, since its introduction, the main criticism against the IPAT model given in Eq. 1 is that it is based on fixed proportionality across the regressors and is not useful for hypothesis testing (York et al; 2003).

Dietz and Rosa (1994) introduced an extended version of IPAT to overcome the shortcoming in the initial IPAT model, which is known as STIRPAT model. The general form of the STIRPAT model is given in Eq. (2). Where I, P, A, T, and U are the environment quality, population, affluence, technology, and residual term, and β1 β2 and β3 are the coefficient of population, affluence, and technology respectively.

According to Haseeb et al. (2017), Anser (2019), and Anser et al. (2021), the advantages of using the STIRPAT model are that it allows us to add additional regressors based on the study’s objective. Consequently, in this research, Eq. 2 has been extended by adding another variable, i.e., globalization (G). Thus, the extended version of STIRPAT model is as given in Eq. (3).

Many studies transformed Eq. 3 into log form to postulate its linear form. Thus, Eq. 3 in the form of logarithm can be written as follows:

In the literature of environmental economics, the total carbon emission is used as a measure of environmental degradation (I). On the right side of the STIRPAT model, P is measured through arable land and urbanization, T is measured through energy use and industrialization, and A is measured by the GDP per capita. The extended STIRPAT model has been extensively used for investigating the impact of arable land, energy use, and urbanization on environmental quality proxied by carbon emissions (Agboola & Bekun, 2019; Qiao et al., 2019; Chandio et al., 2020; Siddique et al., 2020a, b). It is also recognized that moving towards industrialization in order to increase economic growth degrades the environment (Samreen & Majeed, 2020). Similarly, the financial development and technological innovations are considered mitigating factors of CO2 emissions (Islam et al., 2017; Saidi and Mbarek, 2017; Fan & Hossain, 2018).

Therefore, to investigate the impact of different socio-economic indicators on CO2 emissions in context of SAARC countries, the specific STIRPAT model is given as follows:

In Eq. (5), all variables are in natural log where \(ln\) stand for natural logarithm. In the subscript, t stands for year and i is used for cross-section. The term CO2 represents carbon dioxide emissions, and AL and UB stand for arable land and urbanization. GDPPC is GDP per capita. The EC, IG, FD, INO and GLO represent energy consumption, industrial growth, financial development, innovations, and globalization, respectively. Furthermore, \({\beta }_{0}\) is the intercept and \({\beta }_{1} to {\beta }_{8}\) are the related coefficients. The specified variables were chosen from a wider dataset for the following reasons: (a) the panel dataset is available for all years and cross-sectional, (b) this research aims to clearly describe the effects of urbanization, globalization, energy, and financial development on CO2 emissions, simultaneously.

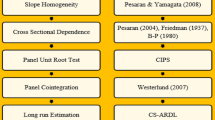

Estimation procedure

For the estimation of results, panel unit root tests, pooled mean group (PMG), and cross-sectional autoregressive distributed lag model (CS-ARDL) techniques are used. Granger causality test has also been utilized for investigating the causal association among variables. To test unit root in the data, first and second generation panel unit root tests, namely LLC test proposed by Levin et al. (2002), IPS test proposed by Im and Pesaran (2003), and CIPS test developed by Pesaran (2007), are used. The CIPS test overcomes the shortcoming of cross-sectional dependence in the first-generation unit root tests, i.e., LLC and IPS tests in our case. The Bruesch-Pagan LM test and Pesaran CD test are also used to check for cross-sectional dependence in the model’s error component. Checking cross-sectional dependency serves as a guide for choosing the best unit root tests and most relevant mean estimator strategy for the linear relationship between the model’s variables in empirical research (Menash, et al., 2019).

Next to the unit root analysis and cross-sectional dependence check, this work uses the pooled mean group (PMG) method, which is proposed by Pesaran et al. (1999). The PMG considered a lower degree of heterogeneity, as it imposes homogeneity in the long-run estimates and heterogeneity in the short-run estimates. More interestingly, the PMG is even applicable in cases where some of the variables are stationary at level and other are stationary at first difference (Hongxing et al., 2021). For the empirical testing, the following equation of PMG is used.

Equation (6) is the general form of the panel ARDL. Where in our case, \({y}_{i,t}\) denotes carbon dioxide emissions (CO2) which is the dependent variable. The term \({y}_{ i, t-j}\) denotes lagged of the dependent variable, \({X}_{i, t-j}\) is the vector of explanatory variables, i.e., arable land, urbanization, GDP per capita, energy consumption, industrial growth, financial development, innovation, and globalization. In the subscripts, \(i\) and t stand for countries (1, 2,…., N) and time periods (1990 to 2018), respectively. Furthermore, the term \({\omega }_{i}\) shows the fixed effects; \({\delta }_{ij}\) represents the coefficient of the lagged regress and variable; \({\Omega }_{ij}\) are m × 1 coefficient vectors (lagged regressors); and \({\mu }_{it}\) is an error term.

Normally, it is convenient to work with the re-parameterization form of an Eq. 6 to estimate for the long-run and short-run parameter estimates simultaneously. Therefore, reparametrized version of the panel PMG is utilized and specified as follows:

where, \({{\Delta CO}_{2}}_{i,t}= {CO}_{2,it}-{CO}_{2, it-1},{\theta }_{i}=-\left(1-\sum_{j=1}^{p}{\delta }_{i,j}\right),{\alpha }_{i} =\sum_{j=0}^{q}{\Omega }_{ij}{\delta }_{i,j}= -\sum_{k=j+1}^{p}{\delta }_{ik}, j=\mathrm{1,2},\dots ., p-1,{\Omega }_{ij}=-\sum_{k=j+1}^{q}{\Omega }_{ik}, j=\mathrm{1,2},\dots ., q-1,\)

In Eq. 7, \({\theta }_{i}\) represents the “speed of adjustment of the CO2 emissions towards the long run equilibrium,” and the coefficient represents the long-run relationship between the dependent and independent variables. Furthermore, the coefficients \({\delta }_{i,j}\) and \({\Omega }_{ij}\) capture the short-run effects between variables.

Regarding the PMG estimation method, as stated above, that PMG estimators are consistent under the assumption of long-run slope homogeneity in the model. In case, the data set exhibit cross-sectional dependency and slope heterogeneity, the results based on ARDL, or PMG would be biased. The approach of ARDL also assume the cross-sectional independence in the residuals of the regression specification. Reportedly, the problem of biased results can be observed in the presence of cross-sectional dependence in the residuals (Phillips & Sul, 2003). As a result, in addition to the PMG analysis, this study employed Chudik and Pesaran’s (2015) recommended model, namely the cross-sectionally autoregressive distributed lag model (CS-ARDL), to examine the relationship between the series (see also Chudik & Pesaran, 2013). The CS-ARDL corrects for CD and heterogeneity issue in the data and generates trustworthy outcomes, as opposed to the mean group (MG), pooled mean group (PMG), and augmented mean group (AMG) estimators (Wang et al., 2021; Adebayo & Rjoub, 2021). The superiority of the present study empirical methodology over other is the traditional estimating techniques such as fixed-effects estimator, fully modified OLS and dynamic OLS do not take into account the CD, and slope heterogeneity issues (An et al., 2021). The CS-generation of ARDL approach, which adds additional lags to the ARDL specification in Eq. 6, is used to account for heterogeneity and cross-sectional dependencies. Therefore, an additional method is used for estimation, which is known as cross-sectionally autoregressive distributed lag model (CS-ARDL) (see Mehmood, 2022). The CS-ARDL approach avoids the problem, which according to Chudik and Pesaran (2013) augment the specification for ARDL in Eq. (6) with additional lags of cross-sectional averages of the regressors. The modified version of the equation with the additions of cross-sectional lag term is presented as follows:

where, \({\overline{Z} }_{t-1}=({\overline{CO} }_{2, i,t-j},{\overline{X} }_{ i,t-j})\) are the averages of regressand and regressor, p, q, indicate lags for each variable and r is the number of lags of the cross-sectional averages to be included. \(\overline{Z }\) basically represents cross-section averages and avoids the cross-section dependence (Hasanov et al. 2018). The long-run coefficient estimates in the CS-ARDL approach can be calculated as follows:

Furthermore, Eq. 9 can be presented into error correction form as given below:

where \({\Delta }_{I}=t-(t-1)\).

In addition, we also analyzed the causal relationship between the model’s variables. For this, we utilize the panel causality test (the DH test) developed by Dumitrescu and Hurlin (2012). The test account for cross-sectional dependence using the critical values based on a bootstrap procedure. The following sets of equations (from 10 to 17th) represent the basic specification of DH test for causality check between two stationary variables of the model:

where, \({\varnothing }_{j}\) represents individuals’ effects which are fixed in time dimension, \({\varnothing }_{11i}, {\varnothing }_{12i}\), \({\varnothing }_{21i}, {and \varnothing }_{22i}\) are parameters that may vary across group but constant in time. \({\cup }_{it}\) is a column vector of the white noise error term. Using Eqs. (10–17), the DH test assumes the null and alternative hypothesis as given:

Null hypothesis: \({H}_{0}: {\varnothing }_{12ik}=0\) or \({H}_{0}: {\varnothing }_{21ik}=0\), which corresponds to the absence of causality for all individual countries in the panel.

Alternative hypothesis: \({H}_{1}: {\varnothing }_{12ik}\ne 0\) or \({H}_{1}: {\varnothing }_{21ik}\ne 0\) shows the presence of causality for the individual countries in the panel.

Data sources and variables description

This study utilized data for the panel of SAARC countries during 1990–2018. The countries’ panel included Bangladesh, Bhutan, India, Maldives, Nepal, Pakistan, and Sri Lanka. Table 1 presents variables’ description, their symbol, unit of measurement, and data sources. CO2 is carbon dioxide emissions and measured as metric tons per capita, land area (LA) is measured as percentage of land area, and economic growth is measured through GDP per capita (constant 2010 US$). Urban population growth is used as a proxy for urbanization and the annual percentage (%) growth of industry value added is used as a proxy for industrial growth. Moreover, the data on financial development and globalization variables are in indexes form. Trademark application is used as a proxy of innovations. Data for all variables are retrieved from the World Development Indicators (2021), World Bank and are transformed into natural log for purpose of analysis.

Empirical results

This section presents the results for the empirical models of the study. The details are given as under:

Descriptive statistics and correlation matrix

Table 2 showed the mean value and their respective standard errors as well as minimum and maximum values of the variables used. The mean value basically indicates the average value of the variable and standard deviation shows the extent of deviation from its mean value. The mean and standard deviation for CO2 emissions are 0.309 and 0.139, respectively. For GDP per capita, the mean and standard deviations are equal to 6.452 and 0.316, respectively. The average values of energy consumption and innovations are 13.41 and 8.73 respectively, which are relatively greater than the average value of other variables. The standard deviations of financial development and arable lands are relatively low. Furthermore, the results for correlation matrix of the respective variables are also shown in the Table 2. The range of correlation coefficient is from − 1 to + 1, where the value of correlation matrix indicates that some of the variables are exhibit positive correlation, while other negative. Such it is evident from the first row of the table that urbanization, GDP per capita, industrial growth and globalization are having positive association with the CO2 emissions, while other variables revealed a negative correlation with the CO2 emissions.

Results of panel unit root tests and cross-sectional dependency

In our study, we employed Levin et al. (2002) the LLC test, Im, Pesaran and Shin (2003) the IPS test, and Pesaran et al. (2007) the CIPS test to study the stationary properties of the variables of interest. Table 3 shows the first two tests’ results at level and at first difference. Where, the results of LLC test show that urbanization, energy consumption, industrial growth, and globalization are stationary at level. While, CO2 emissions, arable land, GDP per capita, and financial development all are stationary after first difference. The IPS test results rejected the null hypothesis in case of industrial growth, financial development, and globalization, whereas, accepted it in case of other variables. Therefore, it is obvious that in both cases, the variables showed a mixed order of integration. Some variables are stationary at level, while other are stationary at first order.

It is found that the model’s variables showed a mixed order of integration, i.e., I (0) and I (1) stationary levels. In this case, the most appropriate technique for the analysis of the data is PMG. However, before the application of PMG, the specified model is also tested for the cross-sectional dependency. Basically, in panel data, the cross-sectional dependency (CD) indicates spillover impacts of a shock from one country to another. Reportedly, if the model concern has an issue of CD and if it is ignored, the results will lead to biased estimates (Pesaran, 2015). Therefore, the presence of cross-sectional dependence in the error terms of the regression in Eq. 6 has been observed using Breusch-Pagan LM test, Pesaran CD test, and Pesaran-scaled LM test, respectively. The results of all the respective tests are given in Table 4. The results show that null hypothesis of “cross-sectional independence” is strongly rejected. Results demonstrated that estimates of the LM tests are significant at 1% level of significance and estimated CD test is significant at 5% level of significance. These results depicted that the usual mean group estimator, which ignores cross-sectional dependence, is no more reliable.

Note here that the first-generation tests are based on the “cross-sectional independence hypothesis.” In response to the need for panel unit root tests that allows for cross-sectional dependency, we also tested CIPS unit root test proposed by Pesaran (2007). The CIPS test is categorized as a second-generation panel unit root test. The null hypothesis of the test is that all panel series are non-stationary, while the alternative hypothesis is that it is stationary. The results of CIPS test are described in Table 5. The findings demonstrated that urbanization and industrial growth are level stationary, while CO2 emissions, arable land, GDP per capita, energy consumption, financial development, innovation, and globalization are stationary at first difference. Consequently, it is necessary to conduct panel ARDL for the possible existence of a long-run relationship between variables used in the empirical model.

The CS-ARDL and PMG estimates

The panel unit root tests result show that variables of the empirical model are stationary at different integration order. Therefore, the panel ARDL method can be employed to estimate the long run relationship among the series. Two methods are used in this study: pooled mean group (PMG) and cross-sectional ARLD (CS-ARDL). We estimated the PMG estimators given in Eq. (7) and the CS-ARDL estimators given in Eq. (9). The estimates of CS-ARDL and PMG are presented in columns 2 and 3 of Table 6, respectively. The upper part of the Table 6 shows the long-run parameter estimates and lower panel of the table shows short-run parameter estimates. Under the method of CS-ARDL, the estimates showed the negative association of arable land with the CO2 emissions. The level of significance is at 1% and the coefficient value is 0.65, indicating that a 1% rise in the arable land leads to reduce CO2 emissions by 0.65%. Given its importance, many scholars have inspected the significance of the agriculture sector with the sources of renewable energy use on carbon emission, for instance, Tyner (2012), Bayrakc and Koçar (2012), Qiao et al. (2019), Chandio et al. (2020), and Yu and Wu (2018). These studies employed the various panel data approaches and the outcomes explored that the agriculture sector is the main cause to degrade the environment in different regions. Furthermore, a significant feedback hypothesis exists between the agriculture sector and environmental degradation. Agboola and Bekun (2019) examined the impact of agricultural value-added, FDI, energy utilization, and trade openness on carbon emission in the EKC framework. The results explored that agricultural value-added, energy utilization, and trade openness increase environmental pollution.

The estimated coefficients of innovation and globalization are also negatively associated with the CO2 emissions; however, among the two variables, only innovation turned statistically significant. These negative effects of innovation and globalization are similar to the findings of the previous studies, including Feridun et al. (2006), Li et al. (2015), Jordaan et al. (2017), Khan et al. (2018), and Saint et al. (2019). It is believed that globalization can influence the environment through scale, technical, and composition effects. In view of this argument, Yang et al. (2020) proposed that globalization can be used as an instrument to minimize carbon emission and promote environmental quality for 97 countries from 1990 to 2016. Saud et al. (2020) used ARDL method, to investigate the impact of globalization and financial development on the ecological footprint in the One Belt One Road (OBOR) countries. According to their findings, globalization and financial development have worsened the environment. Wang et al. (2019a, b) argued that globalization could degrade the environmental quality in the case of 137 countries through ecological modernization theory. On contrary, wen et al. (2021) revealed evidence of globalization and CO2 emissions being positively related. Furthermore, Xiaoman et al. (2021) concluded that economic globalization mitigates CO2 emissions levels in the case of the Middle East and North Africa (MENA) countries. Shen et al. (2021) tested the impact of globalization on CO2 emissions and found globalization to be a cause of environmental degradation in the case of BRICS countries.

Additionally, the long-run coefficient estimates of the remaining variables are positively significant, except the financial development. Among all the variables, the urbanization effects are greater on CO2 emissions, followed by the effects of energy consumption. However, energy consumption effects are highly significant. A 1% changes in urbanization and energy consumption have changed CO2 emissions by 1.53% and 0.40%, respectively. This is consistent with Liu and Bae (2018a, b), Majeed and Luni (2019), Azam (2020), Azam and Abdullah (2021), Aljadani et al. (2021), Azam et al. (2022), and Aljadani (2022), among others. Siddique et al. (2020a, b) examined the impact of urbanization and energy consumption on CO2 emissions in South Asia and observed that the energy consumption and urbanization are the main drivers which positively influences carbon dioxide emissions. In a study by Tamazian et al. (2009), it concluded that a developed financial structure could overcome ecological deprivation in the case of BRICS. Similarly, Tamazian and Rao (2010) explored that financial liberalization can escort to worsening carbon emissions and consequently enhances environmental performance in 24 selected transition countries. Adedoyin et al. (2020) found similar findings for renewable energy consumption and production by considering the structural breaks in carbon emissions variables for 41 countries. Ahmad et al. (2019) studied the heterogeneous impact of intensity of non-renewable energy consumption, urban concentration, and economic growth on CO2 emissions of 31 Chinese provinces from 2004 to 2017. The findings supported that economic growth and urbanization increase environmental deterioration in the long-term. Increase in GDP per capita in SAARC countries have also contributed positively to the CO2 emissions in the long run; however, their effects are nominal, i.e., 0.039%. Nathaniel and Iheonu (2019) argued that variations in the association between economic growth and environmental pollution are not in the exogenous procedures; however, it could be prejudiced by some other factors and their related economic and financial policies. Baloch et al. (2021) investigated the dynamic linkage between financial development, energy innovation, economic growth, and carbon emission during 1990–2017 for selected OECD countries. The results estimated from the PMG-ARDL approach suggested that financial development endorses energy innovation and protects ecological excellence.

The coefficient values of the industrial growth and financial development are 0.006% and 0.022% respectively, where industrial growth is significant and financial development is statistically insignificant. In the empirical studies, Bayar and Maxim (2020) used the dynamic seemingly unrelated cointegration regressions (DSURs) estimator to observe the nexus between financial development and environment in 11 post-transition European economies and the result demonstrated that financial development and energy utilization worsen the environmental quality. Similarly, Khan et al. (2020a, b) examined financial development and globalization with environment sustainability represented by CO2 emissions. Interestingly, the results explored that financial development and globalization are positively correlated with environmental degradation indicating that the financial sector is not offering a significant opportunity to green energy technologies in sample countries. Wang et al. (2011) found that the heavy industry of China significantly contributed to carbon emissions. Al-Mulali and Ozturk (2015) provided similar results for MENA countries. Similar empirical findings also found by Liu & Bae (2018a, 2018b) for China, by Pata (2018) for Turkey, Hong et al. (2019) for South Korea, and Samreen & Majeed (2020) for a panel of 89 countries. On contrary, Zhou et al. (2013) reported the environmental conservation impact of industrialization for Chinese economy owing to upgrading and optimization of industrial structure. Congregado et al. (2016) concluded favorable environmental effects of industrialization for the USA because of replacing fossil fuels consumption by renewable energy sources. In the short-run results, again, urbanization and energy consumption greatly contribute to the CO2 and are highly significant. The coefficient estimates of industrial output and financial development are significant also with positive signs and significant. These results are consistent with the finding of Awan and Azam (2021) and Awan et al. (2020).

In addition to the CS-ARDL results, Table 6 also provides the estimation of PMG, which do not account for the cross-sectional dependencies in their panel estimates. These results again reflect the negative signs for arable land and innovation, while positive signs for urbanization, GDP per capita, industrial growth, energy consumption, and financial development. It is also found that an increase in the GDP per capita greatly contributed to the CO2 emissions, followed by an increase in urbanization and energy consumption respectively. Under this estimation, in the short run, urbanization and financial development exert high significant positive effects on CO2 emissions in the SAARC countries implying that in the short run, growing urbanization and financial development increase CO2 emissions. The results of PMG estimates showed that with the CS-ARDL estimations, the results are consistent in their estimates with almost similar coefficients and signs, except for the GDP per capita and urbanization coefficients which were different in their magnitude. However, the cross-sectional dependence test results are highlighted in last row of the Table 6. The related cross-sectional dependence test results are significant in the case of PMG results, while insignificant in the case CS-ARDL approach. These results indicate that the outcome of CS-ARDL is unbiased and more reliable estimation as compared to the PMG estimates.

Dumitrescu Hurlin (D-H) panel Granger causality estimates

Finally, the D–H Granger causality test is employed, and the results are given in Table 7. In the table, the variables of interest are shown in first row and column. The respective results in row-second shows that the null hypothesis that AL, UB, IG, and FD “do not granger cause CO2 emissions” is rejected. This implies that AL, UB, IG, and FD granger cause CO2 in the SAARC countries. Looking at the remaining results, it largely confirms that there is bi-directional causality between CO2 and AL, between CO2 emissions and UR, CO2 and IG, and CO2 emissions and FD. However, there is an unidirectional causality between CO2 and GDP per capita. Bidirectional causality is also observed for the combinations of AL and UR, EC and GDP per capita, FD and EC, FD and GDP per capita, UR and EC, IG and UR, FD and UR, INV and UR, and AL and UR. Moreover, no causality is observed for the CO2 emissions and EC, CO2 and innovations.

Conclusion and policy implications

This study examined the effects of globalization, urbanization, and energy consumption along with other control variables innovation, financial development, arable land, GDP per capita, and industrial growth on CO2 emissions in six SAARC countries over the period 1990–2018. To achieve the objectives, we first tested the data for unit root through “first generation” and “second generation” panel unit root tests. The panel unit root test analysis shows that the series are in mixed order of integration. Therefore, we employ panel ARDL/PMG and CS-ARDL techniques for estimation of long-run parameter estimates. In addition, the D–H panel Granger causality test has been used for exploring the direction of causal relationship between variables of the model.

The empirical findings of CS-ARDL and PMG estimators reveal negative association of globalization with the CO2 emissions. This adverse effect of globalization suggests that the income, scale, and composition effects seem to be ineffective in SAARC because of the socio-economic conditions of these economies. Globalization in the case of SAARC countries can rather be helpful in tackling the CO2 emissions. In contrast, urbanization and energy consumption depict positive influence on CO2, indicating that the positive effect of urbanization can be due to as SAARC countries experiencing the rapid and unplanned urbanization results in higher level of carbon emissions. Similarly, the energy consumption for household usage and firms’ production in these countries is also very high and uncontrollable. This heavy use of energy also contributed significantly towards the CO2 emissions and thereby contributing into the environmental destruction. The empirical result of the present study also shows that among other variables, namely arable land and innovations, remained negatively significant. While GDP per capita, industrial growth and financial development contributed positively to the carbon emissions highlighting that these factors expanding carbon emissions in the region. The short-run estimates are also consistent with the long-run estimates showing that globalization reduces CO2 emissions, and urbanization and energy consumption positively affected the carbon emissions. Whereas arable land and innovations became negatively significant, and other variables, namely GDP per head income, industrial growth and financial development became positively significant. The ECM value is − 0.29 shown by the CS-ARDL results showing that the short-run disequilibrium will be corrected with a speed of − 0.29% in the long run. Furthermore, results of the D–H panel causality test indicated a bidirectional causal link of arable land, urbanization, industrial growth, and financial sector development with the CO2 emissions. There was a unidirectional relationship between CO2 emissions and GDP per capita, while no causality is found between CO2 emissions and innovations. Overall, these findings showed that the use of arable land, urbanization, and use of energy consumption contributed to the CO2 emissions in the SAARC region.

The empirical findings recommend several policy implications in terms of essential initiatives to regulate carbon emissions and regional integration to mitigate environmental degradation in the SAARC countries. First, suitable measures are required regarding the globalization of these economies which can further helps these countries to control further deterioration of environmental quality. Second, the government shall take appropriate initiatives for the planned urbanization which could play an effective role in controlling the CO2 emissions, i.e., pollution and reducing its harmful effects on the environment and human health. Third, the governments of SAARC countries shall spend more on the research and innovation to promote clean and green energy which results in less CO2 emissions. Moreover, strengthening financial sector and providing conducive environment to foreign investors can also safeguard the environmental quality and sustainable economic growth in SAARC. Finally, the existing arable land shall be better utilized to improve the environmental quality.

Data availability

The data used in this study is openly available. Source of dataset is provided in Table 1.

References

Abdul-Wahab SA, Charabi Y, Al-Maamari R, Al-Rawas GA, Gastli A, Chan K (2015) CO2 greenhouse emissions in Oman over the last forty-two years. Renew Sustain Energy Rev 52:1702–1712

Adedoyin F, Ozturk I, Abubakar I, Kumeka T, Folarin O, Bekun FV (2020) Structural breaks in CO2 emissions: are they caused by climate change protests or other factors? J Environ Manage 266:110628

Adebayo TS, Rjoub H (2021) Assessment of the role of trade and renewable energy consumption on consumption-based carbon emissions: evidence from the MINT economies. Environ Sci Pollut Res 28(41):58271–58283

Agboola MO, Bekun FV (2019) Does agricultural value added induce environmental degradation? Empirical evidence from an agrarian country. Environ Sci Pollut Res 26(27):27660–27676

Ahmad M, Zhao ZY, Li H (2019) Revealing stylized empirical interactions among construction sector, urbanization, energy consumption, economic growth and CO2 emissions in China. Sci Total Environ 657:1085–1098

Ahmed A, Uddin GS, Sohag K (2016) Biomass energy, technological progress and the environmental Kuznets curve: evidence from selected European countries. Biomass Bioenerg 90:202–208

Ahmed EM, Ridzuan R (2013) The impact of ICT on East Asian economic growth: panel estimation approach. J Knowl Econ 4(4):540–555

Aljadani A (2022) Assessment of financial development on environmental degradation in KSA: how technology effect? Environ Sci Pollut Res 29:4736–4747. https://doi.org/10.1007/s11356-021-15795-1

Aljadani A, Toumi H, Toumi S, Hsini M, Jallali B (2021) Investigation of the N-shaped environmental Kuznets curve for COVID-19 mitigation in the KSA. Environ Sci Pollut Res 28:29681–29700. https://doi.org/10.1007/s11356-021-12713-3

Al-Mulali U (2012) Factors affecting CO2 emission in the Middle East: a panel data analysis. Energy 44(1):564–569

Al-Mulali U, Ozturk I, Lean HH (2015) The influence of economic growth, urbanization, trade openness, financial development, and renewable energy on pollution in Europe. Nat Hazards 79(1):621–644

Anser MK (2019) Impact of energy consumption and human activities on carbon emissions in Pakistan: application of STIRPAT model. Environ Sci Pollut Res 26(13):13453–13463

An H, Razzaq A, Haseeb M, Mihardjo LW (2021) The role of technology innovation and people’s connectivity in testing environmental Kuznets curve and pollution heaven hypotheses across the Belt and Road host countries: new evidence from Method of Moments Quantile Regression. Environ Sci Pollut Res 28(5):5254–5270

Anser, MK., Syed, QR., Apergis, N. (2021). Does geopolitical risk escalate CO2 emissions? Evidence from the BRICS countries. Environmental Science and Pollution Research, 1–11.

Antweiler W, Copeland BR, Taylor MS (2001) Is free trade good for the environment? American Economic Review 91:877–908

Apergis N, Payne JE, Menyah K, Wolde-Rufael Y (2010) On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol Econ 69(11):2255–2260

Asongu S, El Montasser G, Toumi H (2016) Testing the relationships between energy consumption, CO2 emissions, and economic growth in 24 African countries: a panel ARDL approach. Environ Sci Pollut Res 23(7):6563–6573

Awan AM, Azam M, Saeed IU, Bakhtyar B (2020) Does globalization and financial sector development affect environmental quality? A panel data investigation for MENA countries. Environ Sci Pollut Res 27:45405–45418

Awan AM, Azam M (2021) Evaluating the impact of GDP per capita on environmental degradation for G-20 economies: does N-shaped environmental Kuznets curve exist? Environ Dev Sustain. https://doi.org/10.1007/s10668-021-01899-8

Azam, M., Abdullah, H., (2021). Dynamic links among tourism, energy consumption and economic growth: empirical evidences from top tourist destination countries in Asia. Journal of Public Affairs. https://doi.org/10.1002/pa.2629

Azam M (2020) Energy and economic growth in developing Asian economies. Journal of the Asia Pacific Economy 25(3):447–471

Azam, M., Rehman, ZU. Ibrahim, Y., (2022). Causal nexus in industrialization, urbanization, trade openness, and carbon emissions: empirical evidence from OPEC economies. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-021-02019-2

Baloch MA, Ozturk I, Bekun FV, Khan D (2021) Modeling the dynamic linkage between financial development, energy innovation, and environmental quality: does globalization matter? Bus Strateg Environ 30(1):176–184

Balsalobre-Lorente D, Shahbaz M, Roubaud D, Farhani S (2018) How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 113:356–367

Bayar Y, Maxim A (2020) Financial development and CO2 emissions in post-transition European Union countries. Sustainability 12(7):2640

Bayrakcı AG, Kocar G (2012) Utilization of renewable energies in Turkey’s agriculture. Renew Sustain Energy Rev 16(1):618–633

Bekhet HA, Othman NS (2018) The role of renewable energy to validate dynamic interaction between CO2 emissions and GDP toward sustainable development in Malaysia. Energy Economics 72:47–61

Bojanic AN (2012) The impact of financial development and trade on the economic growth of Bolivia. J Appl Econ 15(1):51–70

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41

Chandio AA, Akram W, Ahmad F, Ahmad M (2020) Dynamic relationship among agriculture-energy-forestry and carbon dioxide (CO2) emissions: empirical evidence from China. Environ Sci Pollut Res 27(27):34078–34089

Chandio AA, Jiang Y, Akram W, Adeel S, Irfan M, Jan I (2021) Addressing the effect of climate change in the framework of financial and technological development on cereal production in Pakistan. J Clean Prod 288:125637

Chen JH, Huang YF (2013) The study of the relationship between carbon dioxide (CO2) emission and economic growth. Journal of International and Global Economic Studies 6(2):45–61

Chen S, Li N, Guan J, Xie Y, Sun F, Ni J (2008) A statistical method to investigate national energy consumption in the residential building sector of China. Energy and Buildings 40(4):654–665

Chiou-Wei SZ, Chen CF, Zhu Z (2008) Economic growth and energy consumption revisited—evidence from linear and nonlinear Granger causality. Energy Economics 30(6):3063–3076

Chudik, A., Pesaran, MH. (2013). Large panel data models with cross-sectional dependence: a survey. CAFE Research Paper, (13.15).

Chudik A, Pesaran MH (2015) Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. Journal of Econometrics 188(2):393–420

Collatz GJ, Berry JA, Farquhar GD, Pierce J (1990) The relationship between the Rubisco reaction mechanism and models of photosynthesis. Plant, Cell Environ 13(3):219–225

Commission of the European Communities. (1990). Green paper on the urban environment (Vol. 12902). Office for Official Publications of the European Communities.

Congregado E, Feria-Gallardo J, Golpe AA, Iglesias J (2016) The environmental Kuznets curve and CO2 emissions in the USA. Environ Sci Pollut Res 23(18):18407–18420

Coondoo D, Dinda S (2002) Causality between income and emission: a country group-specific econometric analysis. Ecol Econ 40(3):351–367

Destek MA, Ozsoy FN (2015) Relationships between economic growth, energy consumption, globalization, urbanization and environmental degradation in Turkey. Int J Energy Statistics 3(04):1550017

Dietz T, Rosa EA (1994) Rethinking the environmental impacts of population, affluence and technology. Hum Ecol Rev 1(2):277–300

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213

Doytch N, Uctum M (2016) Globalization and the environmental impact of sectoral FDI. Econ Syst 40(4):582–594

Dreher A (2006) Does globalization affect growth? Evidence from a new index of globalization. Appl Econ 38(10):1091–1110

Dumitrescu EI, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29(4):1450–1460

Ehrhardt-Martinez K, Crenshaw EM, Jenkins JC (2002) Deforestation and the environmental Kuznets curve: a cross-national investigation of intervening mechanisms. Soc Sci Q 83(1):226–243

Ehrlich PR, Holdren JP (1971) Impact of population growth. Science 171(3977):1212–1217

Erülgen A, Rjoub H, Adalıer A (2020) Bank characteristics effect on capital structure: evidence from PMG and CS-ARDL. J Risk Financial Manag 13(12):310

Fan H, Hossain MI (2018) Technological innovation, trade openness, CO2 emission and economic growth: comparative analysis between China and India. Int J Energy Econ Policy 8(6):240

Feridun M, Ayadi FS, Balouga J (2006) Impact of trade liberalization on the environment in developing countries: the case of Nigeria. J Dev Soc 22(1):39–56

Govindaraju VC, Tang CF (2013) The dynamic links between CO2 emissions, economic growth and coal consumption in China and India. Appl Energy 104:310–318

Gruber H, Koutroumpis P (2011) Mobile telecommunications and the impact on economic development. Econ Policy 26(67):387–426

Hasanov FJ, Liddle B, Mikayilov JI (2018) The impact of international trade on CO2 emissions in oil exporting countries: territory vs consumption emissions accounting. Energy Econ 74:343–350

Haseeb M, Hassan S, Azam M (2017) Rural-urban transformation, energy consumption, economic growth and CO2 emissions: using STRIPAT model for BRICS countries. Environ Prog Sustain Energy 36(2):523–531

Hong JH, Kim J, Son W, Shin H, Kim N, Lee WK, Kim J (2019) Long-term energy strategy scenarios for South Korea: transition to a sustainable energy system. Energy Policy 127:425–437

Hongxing Y, Abban OJ, Boadi AD, Ankomah-Asare ET (2021) Exploring the relationship between economic growth, energy consumption, urbanization, trade, and CO2 emissions: a PMG-ARDL panel data analysis on regional classification along 81 BRI economies. Environ Sci Pollut Res 28(46):66366–66388

Howe GW, Beach SR, Brody GH (2010) Microtrial methods for translating gene-environment dynamics into preventive interventions. Prev Sci 11(4):343–354

Huber, J. (1991). Fortschritt und Entfremdung. In Industrialismus und Ökoromantik (pp. 19–42). Deutscher Universitätsverlag.

IEA, (2007). International energy agency Unites States (US). Global Energy and CO2 Status Report. OECD/IEA 2007

IEA, (2018). International energy agency Unites States (US). Global Energy and CO2 Status Report. OECD/IEA 2018

Im, KS., Pesaran, MH. (2003). On the panel unit root tests using nonlinear instrumental variables. Available at SSRN 482463.

Islam MZ, Ahmed Z, Saifullah MK, Huda SN, Al-Islam SM (2017) CO 2 emission, energy consumption and economic development: a case of Bangladesh. J Asian Finance, Econ Business 4(4):61–66

Jaunky VC (2011) The CO2 emissions-income nexus: evidence from rich countries. Energy Policy 39(3):1228–1240

Jayanthakumaran K, Verma R, Liu Y (2012) CO2 emissions, energy consumption, trade and income: a comparative analysis of China and India. Energy Policy 42:450–460

Jones DW (1991) How urbanization affects energy-use in developing countries. Energy Policy 19(7):621–630

Jordaan SM, Romo-Rabago E, McLeary R, Reidy L, Nazari J, Herremans IM (2017) The role of energy technology innovation in reducing greenhouse gas emissions: a case study of Canada. Renew Sustain Energy Rev 78:1397–1409

Jorgenson AK, Givens JE (2014) Economic globalization and environmental concern: a multilevel analysis of individuals within 37 nations. Environ Behav 46(7):848–871

Kahouli B (2017) The short and long run causality relationship among economic growth, energy consumption and financial development: evidence from South Mediterranean Countries (SMCs). Energy Econ 68:19–30

Kais S, Ben Mbarek M (2017) Dynamic relationship between CO2 emissions, energy consumption and economic growth in three North African countries. Int J Sustain Energ 36(9):840–854

Khan HUR, Ali M, Olya HG, Zulqarnain M, Khan ZR (2018) Transformational leadership, corporate social responsibility, organizational innovation, and organizational performance: symmetrical and asymmetrical analytical approaches. Corp Soc Responsib Environ Manag 25(6):1270–1283

Khan MK, Teng J-Z, Khan MI, Khan MO (2019) Impact of globalization, economic factors and energy consumption on CO2 emissions in Pakistan. Sci Total Environ 688:424–436

Khan Z, Ali S, Umar M, Kirikkaleli D, Jiao Z (2020) Consumption-based carbon emissions and international trade in G7 countries: the role of environmental innovation and renewable energy. Sci Total Environ 730:138945

Khan Z, Hussain M, Shahbaz M, Yang S, Jiao Z (2020) Natural resource abundance, technological innovation, and human capital nexus with financial development: a case study of China. Resour Policy 65:101585

Koutroumpis P (2009) The economic impact of broadband on growth: a simultaneous approach. Telecommunications Policy 33(9):471–485

Lee C-C (2006) The causality relationship between energy consumption and GDP in G-11 countries revisited. Energy Policy 34(9):1086–1093

Lee C-C, Lee J-D (2009) Income and CO2 emissions: evidence from panel unit root and cointegration tests. Energy Policy 37(2):413–423

Lee C-C, Chang C-P, Chen P-F (2008) Energy-income causality in OECD countries revisited: the key role of capital stock. Energy Economics 30(5):2359–2373

Lee SJ, Yoo SH (2016) Energy consumption, CO2 emission, and economic growth: evidence from Mexico. Energy Sources Part B 11(8):711–717

Levin A, Lin C-F, Chu C-SJ (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econometrics 108(1):1–24

Li J, Zhang X, Ali S, Khan Z (2020) Eco-innovation and energy productivity: new determinants of renewable energy consumption. J Environ Manage 271:111028

Li L, Lee YS (1994) Pricing and delivery-time performance in a competitive environment. Manage Sci 40(5):633–646

Li ZZ, Li RYM, Malik MY, Murshed M, Khan Z, Umar M (2021) Determinants of carbon emission in China: how good is green investment? Sustain Prod Consumption 27:392–401

Li Z, Xu N, Yuan J (2015) New evidence on trade-environment linkage via air visibility. Econ Lett 128:72–74

Liddle B (2012) The importance of energy quality in energy intensive manufacturing: evidence from panel cointegration and panel FMOLS. Energy Econ 34(6):1819–1825

Liu X, Bae J (2018) Urbanization and industrialization impact of CO2 emissions in China. J Clean Prod 172:178–186

Majeed MT, Luni T (2019) Renewable energy, water, and environmental degradation: a global panel data approach. Pak J Commer Soc Sci 13(3):749–778

Majeed MT, Samreen I, Tauqir A, Mazhar M (2020) The asymmetric relationship between financial development and CO 2 emissions: the case of Pakistan. SN Appl Sci 2(5):1–11

McGranahan, G., Songsore, J., & Kjellén, M. (1996). Sustainability, poverty and urban environmental transitions. Sustainability, the environment and urbanization, 103–133.

Mehmood U (2022) Renewable energy and foreign direct investment: does the governance matter for CO2 emissions? Application of CS-ARDL. Environ Sci Pollut Res 29:19816–19822. https://doi.org/10.1007/s11356-021-17222-x

Mensah IA, Sun M, Gao C, Omari-Sasu AY, Zhu D, Ampimah BC, Quarcoo A (2019) Analysis on the nexus of economic growth, fossil fuel energy consumption, CO2 emissions and oil price in Africa based on a PMG panel ARDL approach. J Clean Prod 228:161–174

Miao L (2017) Examining the impact factors of urban residential energy consumption and CO2 emissions in China–evidence from city-level data. Ecol Ind 73:29–37

Miao X, Yan X, Qu D, Li D, Tao FF, Sun Z (2017) Red emissive sulfur, nitrogen codoped carbon dots and their application in ion detection and theraonostics. ACS Appl Mater Interfaces 9(22):18549–18556

Mishra V, Smyth R, Sharma S (2009) The energy-GDP nexus: evidence from a panel of Pacific Island countries. Resource Energy Econ 31(3):210–220

Nathaniel SP (2021) Economic complexity versus ecological footprint in the era of globalization: evidence from ASEAN countries. Environ Sci Pollut Res 28(45):64871–64881

Nathaniel SP, Iheonu CO (2019) Carbon dioxide abatement in Africa: the role of renewable and non-renewable energy consumption. Sci Total Environ 679:337–345

Niu S, Ding Y, Niu Y, Li Y, Luo G (2011) Economic growth, energy conservation and emissions reduction: a comparative analysis based on panel data for 8 Asian-Pacific countries. Energy Policy 39(4):2121–2131

Obradović S, Lojanica N (2017) Energy use, CO2 emissions and economic growth–causality on a sample of SEE countries. Econ Res-Ekonomska Istraživanja 30(1):511–526

Omri A (2013) CO2 emissions, energy consumption and economic growth nexus in MENA countries: evidence from simultaneous equations models. Energy Econ 40:657–664

Panigrahi SK, Azizan NAB, Kumaraswamy S (2020) Investigating dynamic effect of energy consumption, foreign direct investments and economic growth on CO2 emissions between Oman and United Arab Emirates: evidence from Co integration and causality tests. Int J Energy Econ Policy 10(6):288

Pata UK (2018) Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J Clean Prod 187:770–779

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Economet 22(2):265–312

Pesaran MH (2015) Testing weak cross-sectional dependence in large panels. Economet Rev 34(6–10):1089–1117

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc 94(446):621–634

Phillips PC, Sul D (2003) Dynamic panel estimation and homogeneity testing under cross section dependence. Economet J 6(1):217–259

Poumanyvong P, Kaneko S (2010) Does urbanization lead to less energy use and lower CO2 emissions? A Cross-Country Anal Ecol Econ 70(2):434–444

Pradhan BK, Ghosh J, Yao YF, Liang QM (2017) Carbon pricing and terms of trade effects for China and India: a general equilibrium analysis. Econ Model 63:60–74

Qiao Y, Martin F, He X, Zhen H, Pan X (2019) The changing role of local government in organic agriculture development in Wanzai County, China. Canadian J Development Studies/revue Canadienne D’études Du Développement 40(1):64–77

Sadorsky P (2011) Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 39(2):999–1006

Sadorsky P (2014) The effect of urbanization on CO2 emissions in emerging economies. Energy Econ 41:147–153

Saidi K, Mbarek MB (2017) The impact of income, trade, urbanization, and financial development on CO2 emissions in 19 emerging economies. Environ Sci Pollut Res 24(14):12748–12757

Saint Akadiri S, Lasisi TT, Uzuner G, Akadiri AC (2019) Examining the impact of globalization in the environmental Kuznets curve hypothesis: the case of tourist destination states. Environ Sci Pollut Res 26(12):12605–12615

Sakurai K, Teshima A, Kyuma K (1990) Changes in zero point of charge (ZPC), specific surface area (SSA), and cation exchange capacity (CEC) of kaolinite and montmorillonite, and strongly weathered soils caused by Fe and Al coatings. Soil Sci Plant Nutr 36(1):73–81

Salahuddin M, Gow J, Ali MI, Hossain MR, Al-Azami KS, Akbar D, Gedikli A (2019) Urbanization-globalization-CO2 emissions nexus revisited: empirical evidence from South Africa. Heliyon 5(6):e01974

Samreen I, Majeed MT (2020) Spatial econometric model of the spillover effects of financial development on carbon emissions: a global analysis. Pak J Commer Soc Sci 14(2):569–602

Saud S, Chen S, Haseeb A (2020) The role of financial development and globalization in the environment: accounting ecological footprint indicators for selected one-belt-one-road initiative countries. J Clean Prod 250:119518

Shahbaz M, Shahzad SJH, Ahmad N, Alam S (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364

Shahbaz M, Solarin SA, Mahmood H, Arouri M (2013) Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ Model 35:145–152

Shen Y, Li X, Hasnaoui A (2021) BRICS carbon neutrality target: measuring the impact of electricity production from renewable energy sources and globalization. J Environ Manage 298:113460

Siddique HMA, Majeed DMT, Ahmad DHK (2020) The impact of urbanization and energy consumption on CO2 emissions in South Asia. South Asian Studies 31(2):745–757

Siddique HMA, Majeed DMT, Ahmad DHK (2020) The impact of urbanization and energy consumption on CO2 emissions in South Asia. South Asian Studies 31:2

Sohag K, Begum RA, Abdullah SMS, Jaafar M (2015) Dynamics of energy use, technological innovation, economic growth and trade openness in Malaysia. Energy 90:1497–1507

Soytas U, Sari R, Ewing BT (2007) Energy consumption, income, and carbon emissions in the United States. Ecol Econ 62(3–4):482–489

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence Trans Econ Energy Econ 32(1):137–145

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37(1):246–253

Tariq G, Huaping S, Haris M, Yusheng K (2018) Energy consumption and economic growth: evidence from four developing countries. American J Multidisciplinary Res 7:1

Toumi S, Toumi H (2019) Asymmetric causality among renewable energy consumption, CO2 emissions, and economic growth in KSA: evidence from a non-linear ARDL model. Environ Sci Pollut Res 26(16):16145–16156

Tyner WE (2012) Biofuels and agriculture: a past perspective and uncertain future. Int J Sust Dev World 19(5):389–394

Usman, M., Jahanger, A. (2021) Heterogeneous effects of remittances and institutional quality in reducing environmental deficit in the presence of EKC hypothesis: a global study with the application of panel quantile regression. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-021-13216-x

Uttara S, Bhuvandas N, Aggarwal V (2012) Impacts of urbanization on environment. Int J Res Eng Appl Sci 2(2):1637–1645

Wang J, Ryan D, Anthony EJ, Wildgust N, Aiken T (2011) Effects of impurities on CO2 transport, injection and storage. Energy Procedia 4:3071–3078

Wang J, Zhou W, Pickett ST, Yu W, Li W (2019) A multiscale analysis of urbanization effects on ecosystem services supply in an urban mega region. Sci Total Environ 662:824–833