Abstract

This research formulates a theoretical framework to investigate the impacts of trade on consumption-based carbon emissions (CCO2) and also takes into account the influence of financial development and renewable energy use utilizing panel data for Mexico, Indonesia, Nigeria, and Turkey (MINT) nations between 1990 and 2017. The study utilizes a series of second-generation techniques such as Westerlund cointegration, cross-sectional augmented autoregressive distributed lag (CS-ARDL), and augmented mean group (AMG) tests to capture the linkage between CCO2 emissions and the independent variables. The study aims to answer the following questions: (a) can exports and imports determine CCO2 emissions in the MINT nations? (b) Is there a long-run association among the variables under investigation? The results of the Westerlund cointegration reveal a long-run association among the variables. The CS-ARDL outcomes indicate that imports and economic growth increase CCO2 emissions, while renewable energy use and exports decrease CCO2 emissions. Moreover, the outcomes of the AMG test also give credence to the CS-ARDL results. Our key policy recommendations are that initiatives, rules, and regulatory mechanisms should be implemented that promote the transformation toward renewable energy.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

For decades, the global environment has been threatened by global warming and climate change (Adebayo 2020; Sarkodie et al. 2020). According to environmental experts, carbon dioxide (CO2) levels have risen dramatically as a result of unregulated human competition for energy, which they claim is a significant cause of global warming (Bekun et al. 2020; Adebayo and Kirikkaleli 2021; He et al. 2018; Zhao et al. 2020). CO2 emissions levels seem to have reached a high-risk point according to recent trends (Khan et al. 2020a). Nevertheless, addressing growing CO2 emissions without obstructing growth has proven to be a difficult task (Rjoub et al. 2021). Nevertheless, there is a widespread agreement that a significant decrease in CO2 emissions in the modern era should be a key component of environmental policy (Intergovernmental Panel on Climate Change [IPCC 2018).

The extent of international trade has been rising for many years; however, between 2005 and 2015, the volume of international trade rose significantly by nearly 62%. The ratio of international trade to overall gross domestic product (GDP) has also risen to a new high, from 23% in 1960 to 58% in 2017 (World Bank 2020). The single most significant factor linking international trade to rising carbon emissions is the growth of international trade. On a larger scale, although trade is thought to improve global efficiency, some critics see international trade as a tool used by rich countries to reduce their carbon emissions. Such decreases in pollution, on the other hand, are likely to be compensated by an increase in pollution in the region(s) where services and goods are exchanged, a phenomenon identified as carbon leakage (Khan et al. 2020b; Bekun et al. 2021; Ali et al. 2020).

Alternatively, the “Pollution Haven Hypothesis” claims that international trade pushes highly polluting sectors to low-income countries with less strict pollution legislation (Cole, 2004). While pollutants emitted beyond a nation’s territorial boundaries, i.e., production- or territory-based emissions, continue to receive publicity, consumption-based carbon emissions, which are adjusted for international trade, receive less attention (He et al. 2021; Hasanov et al. 2021; Khan et al. 2020b; Kirikkaleli and Adebayo 2021). Nonetheless, it is claimed that previous carbon dioxide measures are inaccurate. For example, they ignore the reality that developed economies concentrate on services and knowledge-based industries, which emit less CO2 than industrial- and agriculture-based economies (Jiborn et al. 2018; Khan et al. 2020a; Khan et al. b). Likewise, emerging nations manufacture products that are used by wealthier countries, but the carbon emissions associated with this production are traced to the emerging nations (Peters and Hertwich 2008).

As a result, industrialized countries seem to be reducing their carbon emissions, as reported by the widely contested inverted U-shaped environmental Kuznets curve (Stern et al. 1996). Nonetheless, they do satisfy the growing demand from emerging nations (Sarkodie et al. 2020; Usman et al. 2020). Since such pollution (consumption-based emissions) cannot be distinguished from increasing levels of income, which facilitates the trade volume and intensity of emissions across the world, the truth of the argument that with a certain point of income, the emissions level falls, is called into question. As a result, a consumption-based strategy is potentially more suitable for covering the whole pollution chain, creating carbon stock responsibility, and understanding the feasibility of global attempts to reduce increasing emission levels (Knight and Schor 2014). Furthermore, comparative research indicates that trade has a substantial influence on consumption-based emissions, while no effect is observed regarding territory-based emissions (He et al. 2021; Hasanov et al. 2021; Khan et al. 2020b).

Previous research on trade and carbon emissions has mostly concentrated on production-based emissions, overlooking consumption-based emissions. Furthermore, recent research has focused on the fundamental connection in aggregated trade contexts, ignoring the disaggregated impact of trade or how imports and exports influence carbon emissions independently. However, CCO2 emissions and exports are negatively related, while CCO2 emissions and imports are positively connected (e.g., Hasanov et al. 2021; He et al. 2021; Kirikkaleli and Adebayo 2021; Liddle 2018). Consequently, existing trade and carbon emissions analyses have taken into account a variety of panels of nations, including the oil-exporting nations (Hasanov et al. 2021); Mexico, Indonesia, Nigeria, and Turkey (MINT) nations (Awosusi et al. 2021); and a combination of emerging and advanced nations (Pata and Caglar 2021; Rahman et al. 2020; Dauda et al. 2021; Hdom and Fuinhas 2020). Nevertheless, in the case of the MINT countries, scholars have neglected the trade–carbon emissions connection. To the best of our understanding, no prior studies have investigated these connections utilizing the MINT countries as a case study.

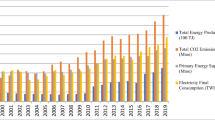

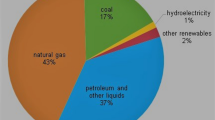

The “MINT” nations (Mexico, Indonesia, Nigeria, and Turkey) were recognized in 2013 as new emerging markets that would act as a focal point for an economic community that would play a major role in global economic relations (Durotoye 2014). The MINT nations share common features, as revealed in Fig. 1, including a young and growing population along with their advantageous geographic location, which places them close to advanced markets. For example, Indonesia and China are near neighbors, Turkey is on the European Union’s frontier, Mexico has a land border with the United States, and Nigeria serves as Africa’s economic rallying point (Asongu et al. 2018). As shown in Fig. 2, the GDP per capita values of Mexico, Indonesia, Nigeria, and Turkey were US$10385, US$4284.685825, US$2383, and US$15190, respectively, in 2019 (World Bank 2020). Furthermore, out of the four MINT nations, only Nigeria is not yet a part of the G20 community, which includes both emerging and developed nations. Nigeria, on the other hand, has a competitive edge due to its ample natural resources, particularly crude oil. Despite the abundance of resources in the MINT nations, the economic development of the four countries has been impacted by various obstacles, such as an increase in energy demand and emissions.

As previously mentioned, the primary goal of this research is to investigate the effect of trade on CCO2 pollution in the MINT countries. Mexico, Indonesia, Nigeria, and Turkey are among the countries represented on our panel. For a variety of factors, this study examines the effect of trade on carbon emissions in MINT nations. The first is that, to the best of the researchers’ knowledge, no previous research has assessed consumption-based carbon emissions in the MINT countries. The MINT nations are a relatively young community of emerging market economies that has gained little recognition thus far. Second, MINT nations are characterized as prime investment destinations and the second wave of fast-growing emerging nations (Odugbesan and Rjoub 2020; Khan et al. 2020b). With a population of about 700 million people, including a substantial number of young workers, the nations have the capacity for strong economic growth, a geographic advantage that allows access to large markets, and policies that promote the private sector. Third, these nations have a bad track record when it comes to emissions. Based on these factors, the MINT nations are an excellent sample for studying the effect of trade on CCO2 emissions.

The remainder of this research is compiled as follows: the empirical and theoretical frameworks are depicted in “Empirical review” and “Theoretical framework,” respectively. The data and methodology are illustrated in “Data, model, and methodology.” The data analysis and discussion are portrayed in “Methodology,” and the conclusion is presented in the “Conclusion” section.

Empirical review

In this segment, we examine three types of studies: those that assessed carbon emissions (CO2) in MINT nations, those that investigated carbon emissions (CO2) around the world, and those that explored consumption-based carbon emissions (CCO2).

Synopsis of studies on the determinants of CO2 emissions in the MINT countries

Recently, several studies (e.g., Aziz et al. 2021; Odugbesan and Rjoub 2020; Dogan et al.2019; Scherer et al. 2019; Öztürk and YILDIRIM 2015) have been conducted regarding the determinants of carbon emissions (CO2) in the MINT nations (Mexico, Indonesia, Nigeria, and Turkey). Nonetheless, their findings are mixed. For instance, Aziz et al. (2021) assessed the dynamics among real growth, utilization of energy, urban population, and CO2 emissions in the MINT countries between 1993 and 2017. The authors utilized the autoregressive distributed lag (ARDL) and Granger causality approaches to explore these interconnections, and their outcomes revealed a long-run association between the variables of interest. Furthermore, they found proof of a feedback causal linkage between real growth and energy usage in Mexico and Turkey. Moreover, in Nigeria and Indonesia, the energy-induced growth hypothesis was supported. The study of Shao et al. (2019) assessed the pollution haven and pollution halo hypotheses in the MINT nations from 1982 to 2014 using the panel vector error correction model approach. The empirical outcomes from this study revealed that foreign direct investment (FDI) inflows lead to an upsurge in environmental degradation, which illustrates that the pollution haven hypothesis does not hold. Furthermore, they identified a feedback causality from FDI inflows to CO2 emissions in the MINT nations. Likewise, using the Granger causality and ARDL bound test, the study of Odugbesan and Rjoub (2020) explored the dynamics among CO2 emissions, real output, urbanization, and energy use in the MINT nations from 1993 to 2017. The outcome from this study indicated that in Nigeria and Indonesia, the energy-growth hypothesis was validated, while they found proof of a feedback causal linkage between energy use and economic growth in Mexico and Turkey. Furthermore, in all the countries (Mexico, Indonesia, Nigeria, and Turkey), there was evidence of a unidirectional causal linkage from CO2 emissions to energy use. Using the fully modified ordinary least square (FMOLS) and dynamic ordinary least square (DOLS) in the MINT nations, the study of Balsalobre-Lorente et al. (2019) examined the pollution haven hypothesis (PHH) for the period between 1990 and 2013, and their outcomes showed an inverted U relationship between FDI and environmental degradation. Moreover, the study validated the environmental Kuznets curve (EKC) hypothesis in the MINT nations. In order to verify the EKC hypothesis in the MINT nations, Öztürk and Yildirim (2015) used a dataset stretching from 1960 to 2010, and their outcomes validated the EKC hypothesis in the studied nations. The study of Dogan et al. (2019) on the association among real growth, CO2, and energy usage between 1971 and 2013 revealed that exports, energy use, and real GDP are the major causes of environmental deterioration in the MINT countries.

Synopsis of studies on determinants of CO2 emissions

Using seven OECD countries, Ahmad et al. (2021) assessed the linkage between CO2 emissions and GDP. The investigators applied pooled mean group (PMG)-ARDL and Dumitrescu and Hurlin (DH) causality to examine this association, and the findings indicated that economic growth exerts a positive impact on CO2 emissions, which implies that an economic expansion leads to a decrease in environmental sustainability. The DH causality test also showed a one-way causal linkage from GDP to CO2. The research of Zhang et al. (2021) in Malaysia using the novel wavelet and gradual shift causality found that energy use, gross capital formation, and GDP growth exert a positive impact influence on CO2 emissions, which infers that an upsurge in GDP, energy use, and gross capital formation will lead to a decrease in environmental sustainability in Malaysia. Likewise, the study of Kirikkaleli and Adebayo (2021) on the interconnection among real GDP, renewable energy use, and CO2 emissions in India using data from the period 1992 to 2015 determined that an upsurge in GDP and energy use leads to a decrease in environmental sustainability, while an upsurge in renewable energy increases environmental sustainability. Furthermore, they found evidence of one-way causality from GDP, energy use, and renewable energy to CO2 emissions, which implies that GDP, renewable energy use, and energy use can predict significant variations in environmental sustainability in India. Moreover, the study of Adams et al. (2021) in countries with high geopolitical risk identified that real growth and energy use decrease environmental sustainability, while the DH causality test results showed a feedback causality between GDP and CO2 emissions. The study of Adedoyin et al. (2020) in Brazil, Russia, India, China, and South Africa (BRICS) nations also revealed a positive association between CO2 emissions and economic expansion, while they found evidence of a negative linkage between CO2 emissions and renewable energy use. Using six regions, Al-mulali and Sheau-Ting 2014) explored the association among exports, imports, and CO2 pollution from 1990–2011. The investigators applied panel econometric techniques, and their findings showed that real growth, exports, and imports increase the degradation of the environment. The study of Liu (2020) on the determinants of CO2 emissions in China between 1965 and 2016 revealed that real GDP and energy usage lead to an upsurge in degradation of the environment, while an upsurge in renewable energy consumption leads to a decrease in environmental degradation. Jebli et al. (2019) assessed the linkage among renewable energy usage, GDP growth, tourism, and FDI inflows between 1995 and 2010 in 22 Central and South American nations. The outcomes disclosed that renewable energy usage and FDI inflows decrease environmental degradation, while an upsurge in GDP growth leads to a decrease in CO2 pollution.

Synopsis of studies on determinants of consumption-based carbon emissions

This sub-\section presents a summary of studies that have explored consumption-based carbon emissions (CCO2). Kirikkaleli and Adebayo (2021) examined the determinants of CCO2 emissions in India utilizing data from 1992 Q1 and 2016 Q4. The outcomes from the FMOLS and DOLS revealed that GDP growth triggers degradation of the environment, while it is improved by technological innovation and renewable energy usage. Furthermore, the frequency domain causality test revealed that real output, technological innovation, and GDP growth can predict CCO2 emissions. In Mexico, He et al. (2021) assessed the dynamics among CCO2 emissions, financial development, growth, and energy usage between 1990 and 2017. The investigators utilized the dual approach technique, and the outcomes revealed a long-run connection between all the variables. Moreover, the ARDL outcomes illustrated that an upsurge in GDP and energy usage leads to an upsurge in CCO2 emissions, while the frequency domain causality test revealed that financial development, energy usage, and GDP can predict CCO2 emissions. Adebayo et al. (2021) assessed the linkage among renewable energy usage, CCO2 emissions, and technological innovation in Chile between 1990 and 2018. The investigators utilized the novel NARDL to explore this interconnection, and the findings revealed that an increase and decrease in GDP growth lead to an upsurge in CCO2 emissions. In addition, an increase in renewable energy usage decreases CCO2 emissions in Chile. Using data from the period between 1990 and 2018 for nine oil-exporting nations, the study of Khan et al. (2020a) revealed that an upsurge in imports and GDP growth leads to an upsurge in CCO2 emissions, while an upsurge in exports leads to an upsurge in CCO2 emissions. The study of Khan et al. (2020b) on the determinants of CCO2 emissions in G7 nations between 1990 and 2017 disclosed that exports, renewable energy usage, and environmental innovation decrease CCO2 emissions, while imports and GDP growth increase CCO2 emissions in the G7 nations. In the E-7 nations, Safi et al. (2021) investigated the dynamics among CCO2 emissions, GDP, imports, and exports; and their empirical outcomes showed that imports and economic growth lead to an upsurge in CCO2 emissions, while exports and financial instability lead to a decrease in CCO2 emissions.

Theoretical framework

This section explains the theoretical framework by which imports and exports and GDP influence CCO2 emissions. Consumption-based carbon emissions (CCO2) include all government and household final domestic consumption demand, inventory adjustments, gross fixed capital formation, and purchases made overseas by citizens (Hasanov et al. 2021). This calculation is trade-adjusted, spanning the whole carbon chain, and aids in identifying the generation of carbon dioxide in one nation and its use in others (Hasanov et al. 2021; Peters et al., 2012; Khan et al. 2020a). As a result, the impact of foreign trade in this analysis is calculated by separating imports and exports. According to the theory, an increase in exports provides more products and services for destination nations to use while leaving fewer for domestic use. Exports include products and services produced in the country of origin and used in the recipient state. As a result, CO2 emissions from exports must be emitted in the receiving nation. Imports, on the other hand, cover products and services foreign nations produced and domestically utilized by recipient nations which lead to the emission of CO2 in the recipient nation.

It is anticipated that rising exports will decrease CCO2 emissions in the host nation, while an increase in imports will raise CCO2 emissions in the recipient nation. Aside from imports and exports, CO2 emissions from the manufacturing sector are retained in the host nation (He et al. 2021; Adebayo et al. 2021; Hasanov et al. 2021; Kirikkaleli and Adebayo 2021). From a theoretical standpoint, an increase in the level of imports of services and goods is associated with increased consumption since it is regarded as one of the main components of any country’s overall consumption level, which is particularly valid in the case of the MINT nations. The MINT nations are mainly emerging nations, and their imports provide a significant portion of the final and intermediate goods and services consumed by the host nations. Hasanov et al. (2021) and Khan et al. (2020b) directly identified this phenomenon. Likewise, gross domestic product (GDP) is an indicator of the economy’s well-being, which includes various elements such as government expenditure, consumption, investment, and net exports. Since consumption accounts for the majority of GDP, increasing consumption is highly associated with CCO2 emissions (Hasanov et al. 2021; Omri and Kahouli 2014; Kirikkaleli and Adebayo 2021). Furthermore, when income levels rise in the MINT nations, which are emerging nations, there is a chance that not only the nation but also households and businesses will consume more with a strong marginal tendency to consume, thus increasing CO2 emissions (Adebayo et al. 2020; Khan et al. 2020b).

Data, model, and methodology

Data and model

The present research assesses the connection between consumption-based emissions (CCO2) and trade (import [IMP] and export [EXP]) while taking into account the effect of financial development (FD), income (GDP), and renewable energy consumption (REC) in the MINT nations (Mexico, Indonesia, Nigeria, and Turkey). This study utilizes data covering the period between 1990 and 2018. Table 1 presents information on the variables utilized. The analysis flow is presented in Fig. 3. The present research follows the studies of Khan et al., 2020c, d) and Hasanov et al. 2021) by incorporating financial development into the model. The research function and model are presented in Eqs. 1 and 2:

In Eq. 2, CCO2, EXP, IMP, REC, and FD signify consumption-based carbon emissions, exports, imports, renewable energy use, and financial development, respectively. The time period is depicted by t, such as between 1990 and 2018; the parameters are θ1, θ2, θ3, θ4, and θ5; and the error term is illustrated by ε. The cross sections are illustrated via i, i.e., Mexico, Indonesia, Nigeria, and Turkey. In this empirical research, all the variables of interest are converted to their logarithm form. In the empirical literature, various different studies have been conducted to assess this connection(e.g., Joshua et al. 2020; Oluwajana et al. 2021; Sarkodie et al. 2020; Kirikkaleli and Adebayo, 2020; Bekun et al. 2020; Rjoub et al. 2021; Adebayo et al. 2021; Khan et al. 2021; Wang et al. 2021; Adebayo and Kirikkaleli 2021; Ozturk et al. 2021). However, few studies have considered CCO2 emissions as a proxy of environmental degradation.

Following the theoretical foundation, the reason for incorporating the variables of interest is illustrated here. The massive growth in global output presents a significant threat to the atmosphere, and billions of human lives are resultantly at significant risk. Constant economic output expansion has culminated in a rise in GDP, which contributes to increased energy demand and therefore CO2 emissions (Zhang et al. 2021; Kirikkaleli et al. 2020; Orhan et al. 2021; Udemba et al. 2021; Bekun et al. 2020; Baloch et al. 2021; Deng et al. 2021; Yuan et al. 2021). Furthermore, increased productivity is linked with a country’s ecological footprint owing to the continued exploitation of natural resources. As a result, industrial value added is projected, and GDP is anticipated to impact CO2 emissions positively \( \left({\theta}_1=\frac{\beta {CCO}_2}{\beta GDP}>0\right) \). Furthermore, exports are expected to impact CO2 emissions positively. The reason for this linkage is that CO2 emissions from exports are emitted in the receiving nation. As a result, based on these arguments, exports are expected to decrease CCO2 emissions \( \left({\theta}_1=\frac{\beta {CCO}_2}{\beta EXP}<0\right) \). On the other hand, CO2 emissions and imports are positively connected because imports of energy-intensive goods boost the consumption of energy, resulting in higher consumption-based emissions (Khan et al., 2020c, d; Sadorsky 2012; Hasanov et al. 2021). Thus, based on the theoretical argument, imports are expected to increase CCO2 emissions \( \left({\theta}_3=\frac{\beta {CCO}_2}{\beta IMP}>0\right) \). Furthermore, the use of renewable energy plays an important role in lowering CO2 emissions. The theoretical basis for the negative association between CO2 pollution and renewable energy use is that green energy production uses safer and clean energy sources that are sustainable and meet existing and potential future requirements (Adedoyin et al. 2020; Sarkodie et al. 2020). As a result of the previous arguments, renewable energy use is predicted to have a detrimental effect on CCO2 emissions \( \left({\theta}_4=\frac{\beta {CCO}_2}{\beta REC}<0\right) \). Some studies (e.g., Shahbaz et al. 2018; Mishkin 2009) have claimed that financial development raises CO2 emissions because it decreases credit limitations in the nation and raises GDP, thus causingCO2 emissions to rise. As Oluwajana et al. (2021) explained, financial development reduces the costs of finance and enhances the liquidity of firms, allowing them to raise productivity, thereby stimulating CO2 emissions and the utilization of energy. Contrarily, some studies (e.g., He et al. 2021; Sadorsky 2012) have claimed that financial development reduces CO2 emissions because it stimulates investments in cutting-edge technologies that can minimize carbon emissions. Hence, based on the arguments, it is predicted that financial development will trigger CCO2 emissions if it is not eco-friendly \( \left({\theta}_5=\frac{\beta {CCO}_2}{\beta FD}>0\right) \), otherwise \( \left({\theta}_5=\frac{\beta {CCO}_2}{\beta FD}<0\right) \) if it is eco-friendly.

Methodology

Cross-sectional dependence and slope heterogeneity tests

Cross-sectional dependence in panel data analysis is more likely to arise in the current era, with rising international globalization and lower trade restriction. Disregarding the problem of cross-sectional dependence and assuming independence between cross sections can lead to inaccurate, biased, and unreliable estimates (Wang et al. 2021; Grossman and Krueger 1995). In this study, the Pesaran (2015) test is utilized to test for cross-sectional dependence. Likewise, assuming a homogeneous slope coefficient without testing for a heterogeneous slope coefficient would provide deceptive estimator outcomes (Adedoyin et al. 2020; Wang et al. 2021). As a result, Pesaran and Yamagata (2008) designed an adjusted variant of Swamy’s (1970) test to assess cross-sectional slope heterogeneity. Prior to capturing the stationarity features of panel data, it is important to firstly verify the existence of cross-sectional dependence and slope homogeneity. The slope homogeneity test equations are depicted as follows:

where adjusted delta tilde and delta tilde are depicted by \( {\overset{\sim }{\Delta }}_{ASH} \) and \( {\overset{\sim }{\Delta }}_{SH}, \) respectively.

Panel unit root tests

The study proceeds by utilizing the cross-sectional augmented Im–Pesaran–Shin (CIPS) test. In addition, the paper relies on the cross-sectional augmented IPS and augmented Dickey–Fuller (ADF) tests initiated by Pesaran (2007), which are also recognized as the CADF and CIPS tests. The CADF test equation is depicted as follows:

where \( {\overline{Y}}_{t-1} \) and \( \Delta \overline{Y_{t-l}} \) denote the lagged and first differences averages, respectively. Further, Eq. 6 shows the CIPS test statistic obtained by taking the average of each CADF.

where the CIPS in Eq. 6 is obtained from Eq. 5. These second-generation unit root tests have been used recently since the first-generation unit root tests produce unreliable outcomes, specifically if there is an existence of cross-sectional dependence in the data.

Panel cointegration test

If there is evidence of breaks in the series and a cross-sectional heterogeneous slope coefficient, the conventional panel cointegration tests such as Pedroni (2004) and McCoskey and Kao (1998) tests will present spurious outcomes. Therefore, this research employs the Westerlund (2007) cointegration technique to assess the linkages among consumption-based carbon emissions (CCO2), economic growth, renewable energy, financial development, exports, and imports in the MINT nations. As stated by Kapetanios et al. (2011), this test is more reliable and stable when the error terms are cross-sectionally dependent. The test is depicted as follows:

where \( {\delta}_{1i}={\beta}_i(1){\hat{\vartheta}}_{21}-{\beta}_i{\lambda}_{1i}+{\beta}_i\hat{\vartheta}{2}_i\ \mathrm{and}\ y{2}_i=-{\beta}_i\lambda {2}_i \)

The test statistics of the Westerlund cointegration are given as follows:

where Eqs. 7 and 8 portray the group means statistics, including Ga and Gt. Equations 9 and 10 stand for panel statistics including Pa and Pt. It has both null and alternative hypotheses of “no cointegration” and “cointegration,” respectively.

Cross-sectional augmented autoregressive distributed lag (CS-ARDL) test

For the long and short-run estimations, this study employs the CS-ARDL test proposed by Chudik and Pesaran (2016). Compared to other techniques such as mean group (MG), pooled mean group (PMG), common correlated effect mean group (CCMG), and augmented mean group (AMG), this test is more robust and performs more efficiently (Wang et al. 2021). This method addresses the issues of heterogeneous slope coefficients, cross-sectional dependence, unobserved common factors and nonstationarity (mixed integration order), and endogeneity. This is because overlooking unobserved common factors will cause inaccurate estimation outcomes (Khan et al. 2020b). The CS-ARDL general equation is represented as follows:

In the previous equation, \( {X}_{t-1}^{-}=\left({Y}_{t-1}^{-},{Z}_{t-{1}^{\iota}}^{-}\right)\iota \). The average cross sections are depicted by \( \overline{Y_t} \) and \( \overline{Z_t} \), respectively. In addition, \( {X}_{t-1}^{-} \) represents the averages of both independent and dependent variables. Equations 19 and 20 represent the long-run and mean group coefficients, which are depicted as follows:

This research further employs the augmented mean group (AMG) developed by Eberhardt (2012) as a robustness check for the CS-ARDL long-run estimation.

Findings and Discussion

The findings of the econometric estimations and testing are presented in this section. The study commenced by presenting the slope heterogeneity and cross-sectional dependence (CSD) tests. The outcomes of both cross-sectional dependence and slope heterogeneity tests are depicted in Table 2. The cross-sectional dependence outcomes reject the null hypothesis of no cross-sectional dependence in units, indicating that our indicators are not independent of one another across sections, i.e., nations. Furthermore, the null hypothesis of homogeneity, which illustrates that slope coefficients for each cross section are heterogeneous, is rejected as revealed by the Pesaran and Yamagata (2008) test. The present study proceeds by investigating the panel data stationarity features. This is done by employing the Pesaran (2007) unit root test, the results of which are presented in Table 3. The outcomes of the Pesaran (2007) unit root test reveal that all the indicators are non-stationary at level i.eI(0), with the exemption of renewable energy consumption, which is stationary at a level I(0) at a significance level of 1%. However, after the series’ first difference was taken, all the indicators are found to be stationary.

In order to assess the cointegration among the series, the present study employs both first- and second-generation cointegration tests. The study utilizes the Westerlund cointegration tests proposed by Westerlund (2007). If there is evidence of structural breaks and cross-sectional heterogeneous slope coefficient, the conventional panel cointegration tests such as Pedroni (2004) and McCoskey and Kao (1998) tests will yield misleading outcomes. Thus, the study employs the Westerlund cointegration test to overcome these problems. The outcomes of the Westerlund cointegration test, which are presented in Table 4, reject the null hypothesis of “no cointegration.” Thus, there is cointegration among the variables of interest. As a robustness check, the study employs first-generation tests (Kao and Pedroni cointegration). The outcomes of the Kao and Pedroni cointegration tests presented in Table 5 reject the null hypothesis of “no cointegration among the series.” This implies that there is evidence of cointegration among the variables of interest. Therefore, the present study concludes that there is a long-run association among CCO2 emissions and imports, exports, economic growth, renewable energy, and financial development.

Table 6 provides the outcomes of the CS-ARDL. The outcomes show a positive interconnection between GDP growth and CCO2 emissions as revealed by the positive coefficient of 1.1499 which illustrates that an upsurge of 1% in GDP leads to a 1.149% increase in CCO2 emissions in the MINT nations. Likewise, GDP is an indicator of an economy’s well-being that includes consumption, government spending, investment, and net exports, among other things. Consumption accounts for the majority of GDP, and rising consumption is favorably correlated with consumption-based carbon emissions (Bekun et al. 2020; Soylu et al. 2021; Alola et al. 2020; Tufail et al. 2021; Dogan et al. 2019). Furthermore, as income levels rise in MINT countries, it is possible that not only the country but also businesses and families, will consume more, therefore increasing carbon emissions (He et al. 2021; Khan et al. 2020b). This outcome corroborates the findings of Adebayo et al. (2021) for Chile, Khan et al. (2021) for oil-exporting nations, and Hasanov et al. (2021) for the BRICS nations, who established a positive linkage between CCO2 emissions and GDP. Likewise, imports positively influence CCO2 emissions as illustrated by the positive coefficient of 1.1499, which illustrates that an upsurge of 1% in imports leads to a 1.149% increase in CCO2 emissions in the MINT nations. From a theoretical standpoint, an increase in the imports of goods and services is linked to rising consumption since they are one of the most important elements of every nation’s overall consumption volume, which is particularly valid in the case of the MINT nations. The MINT nations consume a large volume of intermediate and final goods and services because they are emerging nations. Increased imports imply increased domestic demand and, as a result, increased CO2 emissions. Imports contribute to the national consumption level considerably. For instance, the imports of Mexico, Indonesia, Nigeria, and Turkey were US$484 billion, US$259 billion, US$62 billion, and US$259 billion, respectively, in 2019 (World Bank, 2021). This outcome is consistent with the findings of Khan et al. (2021) for oil-exporting nations and Hasanov et al. (2021) for the BRICS nations who established a positive linkage between CCO2 emissions and imports.

On the other hand, exports negatively affect consumption-based carbon emissions, as revealed by the negative coefficient of 0.3062, which illustrates that an upsurge of 1% in exports leads to a 0.306% decrease in CCO2 emissions in the MINT nations. From a theoretical perspective, export growth provides more services and goods for the recipient nations to consume and leaves less for domestic consumption. Our findings comply with the studies of Khan et al. (2021) for oil-exporting nations, Hasanov et al. (2021) for the BRICS, and Fernández-Amador et al. (2017) for a global panel of developed and developing countries. Likewise, renewable energy usage affects consumption-based carbon emissions, as revealed by the negative coefficient of 0.4072, which illustrates that an upsurge of 1% in renewable energy use leads to a 0.4072% decrease in CCO2 emissions in the MINT nations. This outcome concurs with the findings of Kirikkaleli and Adebayo (2021) for India and Khan et al. (202b) for the G7 countries. Renewable energy technology is a means of reducing consumption-based emissions since it uses pure and safer forms of energy that are affordable and meet existing and potential demands. Finally, there is no significant linkage between CCO2 emissions and financial development in the MINT nations. The probable reason for this insignificant connection is that financial development does not increase environmental quality in developing countries like the MINT nations (Mexico, Indonesia, Nigeria, and Turkey), where the structural transformation of the financial sector is still in its early stages.

Table 6 presents the outcomes of the short-run CS-ARDL test. The empirical outcomes reveal that both imports and GDP growth trigger CCO2 emissions in the MINT nations. Furthermore, both renewable energy usage and exports impact CCO2 emissions negatively, while there is no proof of a significant interconnection between CCO2 emissions and financial development. The speed of adjustment represented by ECM (−1) is −0.77, showing that the adjustment toward equilibrium is 77% for the CS-ARDL model. The long-run coefficients are larger than the short-run coefficients because these surveyed nations are emerging nations that are still expanding, certainly in terms of economic expansion, which has a positive impact on CO2 emissions.

To verify the consistency of the CS-ARDL, the present study employs the AMG test as a robustness check. The outcomes of the AMG are depicted in Table 7. The outcomes show that both economic expansion and imports exert a positive impact on CCO2 emissions. This outcome complies with the CS-ARDL outcomes. Furthermore, both renewable energy use and exports mitigate CCO2 emissions, which complies with the CS-ARDL outcomes. Lastly, there is no proof of a linkage between CCO2 emissions and financial development. This outcome also corroborates the CS-ARDL long-run outcomes.

Conclusion

This research explores the impact of trade on consumption-based CO2 and also takes into account the influence of renewable energy use, financial development, and economic growth for MINT nations, utilizing data covering the period between 1990 and 2018. We established a theoretical basis for this study in contrast to other researchers who have used variables in their CO2 analysis in an ad-hoc manner. In the estimations, we have also taken into consideration the panel data’s integration, cointegration, heterogeneity, and cross-country interdependence. As a consequence, our findings are reliable, and our policy recommendations are robust. The study found that the previous variables are crucial determinants of consumption-based CO2 in the MINT nations in both the long and short run. The current study found that the use of renewable energy and exports reduces CCO2 emissions, whereas increasing economic activity and imports increases CCO2 emissions.

The results of this study will be helpful for policymakers when formulating clean energy policies, financial development policies, and trade policies to reduce CO2 emissions. It is widely known that using green energies is good for the environment. As a result, MINT policymakers can maintain their enthusiasm for the expansion of renewable energy use. Our observational findings revealed that using green energy in the MINT countries would substantially reduce CO2 emissions. As a result, decision makers are recommended to regard renewable energy usage as a critical component of their countries’ clean energy transformations. Furthermore, the researchers discovered that when income or economic activity rises, emissions rise accordingly. Therefore, decision makers are encouraged to implement certain steps and regulations to prepare for this. Carbon pricing (CP) is one of the most important pollution control strategies in this respect since it offers many benefits over other options. As a result, global organizations including the International Energy Agency, United Nations, and the World Bank (WB) advise governments around the world to take this move.

Consequently, in terms of foreign trade-related emission policies for the MINT countries, policy initiatives that promote the exports of more CO2-containing goods and services and discourage imports can be recommended. Again, policy interventions can be implemented and aimed at raising exports of products and services that contain CO2 emissions. These can be viewed as important environmental emission reduction initiatives in the MINT countries. However, since environmental pollution is a worldwide problem, these interventions will not be productive because they lead to increased CO2 emissions in consuming nations and, as a result, increased global emissions. Furthermore, such interventions do not seem to be effective in the coming years, as nations may increasingly introduce CO2 border adjustment initiatives in their international trade policies. As a result, the enforcement of initiatives, rules, and the development of regulatory mechanisms that facilitate the shift to sustainable energy through technical advancements will be our key policy suggestions.

Finally, the current study has two research shortcomings that can lead to further research opportunities. Due to the unavailability of data beyond the period of study, the research ended in 2018. Therefore, future analysis should take into account more recent data. Second, other studies can use various groups or areas as case studies to investigate other determinants of CCO2 emissions.

References

Adams S, Anser QR, Syed T (2021) Energy consumption, finance, and climate change: Does policy uncertainty matter?. Econc Anal Policy 70:490–501

Adebayo TS (2020) Revisiting the EKC hypothesis in an emerging market: an application of ARDL-based bounds and wavelet coherence approaches. SN Applied Sciences 2(12):1–15

Adebayo TS, Akinsola GD, Odugbesan JA, Olanrewaju VO (2020) Determinants of Environmental Degradation in Thailand: Empirical Evidence from ARDL and Wavelet Coherence Approaches. Pollution 7(1):181-196. https://doi.org/10.22059/poll.2020.309083.885

Adebayo TS, Kirikkaleli D (2021) Impact of renewable energy consumption, globalization, and technological innovation on environmental degradation in Japan: application of wavelet tools. Environ Dev Sustain:1–26

Adebayo TS, Udemba EN, Ahmed Z, Kirikkaleli D (2021) Determinants of consumption-based carbon emissions in Chile: an application of non-linear ARDL. Environ Sci Pollut Res:1–15

Adedoyin FF, Gumede MI, Bekun FV, Etokakpan MU, Balsalobre-Lorente D (2020) Modeling coal rent, economic growth and CO2 emissions: does regulatory quality matter in BRICS economies? Sci Total Environ 710:136284

Ahmad M, Khan Z, Rahman ZU, Khattak SI, Khan ZU (2021) Can innovation shocks determine CO2 emissions (CO2e) in the OECD economies? A new perspective. Econ Innov New Technol 30(1):89–109

Ali HS, Nathaniel SP, Uzuner G, Bekun FV, Sarkodie SA (2020) Trivariate modelling of the nexus between electricity consumption, urbanization and economic growth in Nigeria: fresh insights from Maki cointegration and causality tests. Heliyon 6(2):e03400

Al-mulali U, Sheau-Ting L (2014) Econometric analysis of trade, exports, imports, energy consumption and CO2 emissions in six regions. Renew Sust Energ Rev 33:484–498

Alola AA, Adedoyin FF, Bekun FV (2020) Growth impact of transition from non-renewable to renewable energy in the EU: the role of research and development expenditure. Renewable Energy 159:1139–1145.

Asongu S, Akpan US, Isihak SR (2018) Determinants of foreign direct investment in fast-growing economies: evidence from the BRICS and MINT countries. Financial Innovation 4(1):1–17

Awosusi AA, Adebayo TS, Kirikkaleli D, Akinsola GD, Mwamba MN (2021) Can CO2 emissions and energy consumption determine the economic performance of South Korea? A time series analysis. Environ Sci Pollut Res:1–16

Aziz N, Sharif A, Raza A, Jermsittiparsert K (2021) The role of natural resources, globalization, and renewable energy in testing the EKC hypothesis in MINT countries: new evidence from method of moments quantile regression approach. Environ Sci Pollut Res 28(11):13454–13468

Baloch MA, Ozturk I, Bekun FV, Khan D (2021) Modeling the dynamic linkage between financial development, energy innovation, and environmental quality: does globalization matter? Bus Strateg Environ 30(1):176–184

Balsalobre-Lorente D, Gokmenoglu KK, Taspinar N, Cantos-Cantos JM (2019) An approach to the pollution haven and pollution halo hypotheses in MINT countries. Environ Sci Pollut Res 26(22):23010–23026

Bekun FV, Adedoyin FF, Alola AA (2020) An assessment of environmental sustainability corridor: the role of economic expansion and research and development in EU countries. Sci Total Environ 713:136726

Bekun FV, Adebayo TS, Akinsola GD, Kirikkaleli D, Umarbeyli S, Osemeahon OS (2021) Economic performance of Indonesia amidst CO 2 emissions and agriculture: a time series analysis. Environ Sci Pollut Res 1–15

Chudik A, Pesaran MH (2016) Theory and practice of GVAR modelling. J Econ Surv 30(1):165–197

Dauda L, Long X, Mensah CN, Salman M, Boamah KB, Ampon-Wireko S, Dogbe CSK (2021) Innovation, trade openness and CO2 emissions in selected countries in Africa. J Clean Prod 281:125143

Deng R, Li M, Linghu S (2021) Research on calculation method of steam absorption in steam injection thermal recovery technology. Fresenius Environ Bull 30:5362–5369

Dogan E, Taspinar N, Gokmenoglu KK (2019) Determinants of ecological footprint in MINT countries. Energy & Environment 30(6):1065–1086

Durotoye A (2014) The MINT countries as emerging economic power bloc: Prospects and challenges. Developing Country Studies 4(5):1–9

Eberhardt M (2012) Estimating panel time-series models with heterogeneous slopes. Stata J 12(1):61–71

Fernández-Amador O, Francois JF, Oberdabernig DA, Tomberger P (2017) Carbon dioxide emissions and economic growth: an assessment based on production and consumption emission inventories. Ecol Econ 135:269–279

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110(2):353–377

Hasanov, F. J., Khan, Z., Hussain, M., & Tufail, M. (2021). Theoretical framework for the carbon emissions effects of technological progress and renewable energy consumption. Sustainable Development.

Hdom HA, Fuinhas JA (2020) Energy production and trade openness: assessing economic growth, CO2 emissions and the applicability of the cointegration analysis. Energy Strategy Reviews 30:100488

He L, Shen J, Zhang Y (2018) Ecological vulnerability assessment for ecological conservation and environmental management. J Environ Manage 206:1115–1125. https://doi.org/10.1016/j.jenvman.2017.11.059

He X, Adebayo TS, Kirikkaleli D, Umar M (2021) Consumption-based carbon emissions in Mexico: an analysis using the dual adjustment approach. Sustainable Production and Consumption 27:947–957

IPCC. (2018). Intergovernmental Panel on Climate Change. Global Warming of 1.5 °C .

Jebli MB, Youssef SB, Apergis N (2019) The dynamic linkage between renewable energy, tourism, CO2 emissions, economic growth, foreign direct investment, and trade. Latin American Economic Review 28(1):1–19

Jiborn M, Kander A, Kulionis V, Nielsen H, Moran DD (2018) Decoupling or delusion? Measuring emissions displacement in foreign trade. Glob Environ Chang 49:27–34

Joshua U, Bekun FV, Sarkodie SA (2020) New insight into the causal linkage between economic expansion, FDI, coal consumption, pollutant emissions and urbanization in South Africa. Environ Sci Pollut Res:1–12

Kapetanios G, Pesaran MH, Yamagata T (2011) Panels with non-stationary multifactor error structures. J Econ 160(2):326–348

Khan I, Hou F, Zakari A, Tawiah VK (2021) The dynamic links among energy transitions, energy consumption, and sustainable economic growth: A novel framework for IEA countries. Energy 222:11993

Khan Z, Ali M, Jinyu L, Shahbaz M, Siqun Y (2020a) Consumption-based carbon emissions and trade nexus: evidence from nine oil exporting countries. Energy Econ 89:104806

Khan Z, Ali S, Umar M, Kirikkaleli D, Jiao Z (2020b) Consumption-based carbon emissions and international trade in G7 countries: the role of environmental innovation and renewable energy. Sci Total Environ 730:138945

Kirikkaleli D, Adebayo TS (2020) Do renewable energy consumption and financial development matter for environmental sustainability? New global evidence. Sustain Dev 5(4):4-23. https://doi.org/10.1002/sd.2159

Kirikkaleli D, Adebayo TS (2021) Do public-private partnerships in energy and renewable energy consumption matter for consumption-based carbon dioxide emissions in India? Environ Sci Pollut Res:1–14

Kirikkaleli D, Adebayo TS, Khan Z, Ali S (2020) Does globalization matter for ecological footprint in Turkey? Evidence from dual adjustment approach. Environ Sci Pollut Res 28(11):14009–14017

Knight KW, Schor JB (2014) Economic growth and climate change: a cross-national analysis of territorial and consumption-based carbon emissions in high-income countries. Sustainability 6(6):3722–3731

Liddle B (2018) Consumption-based accounting and the trade-carbon emissions nexus. Energy Econ 69:71–78

Liu X (2020) The impact of renewable energy, trade, economic growth on CO2 emissions in China. Int J Environ Stud:1–20

McCoskey S, Kao C (1998) A residual-based test of the null of cointegration in panel data. Econ Rev 17(1):57–84

Mishkin FS (2009) Is monetary policy effective during financial crises? Am Econ Rev 99(2):573–577

Odugbesan JA, Rjoub H (2020) Relationship among economic growth, energy consumption, CO2 emission, and urbanization: evidence from MINT countries. SAGE Open 10(2):2158244020914648

Oluwajana D, Adebayo TS, Kirikkaleli D, Adeshola I, Akinsola GD, Osemeahon OS (2021) Coal consumption and environmental sustainability in South Africa: the role of financial development and globalization. International Journal of Renewable Energy Development 10(3):527–536

Omri A, Kahouli B (2014) Causal relationships between energy consumption, foreign direct investment and economic growth: fresh evidence from dynamic simultaneous-equations models. Energy Policy 67:913–922

Orhan A, Adebayo TS, Genç SY, Kirikkaleli D (2021) Investigating the Linkage between Economic Growth and Environmental Sustainability in India: Do Agriculture and Trade Openness Matter?. Sustainability 13(9):4753

Öztürk Z, YILDIRIM E (2015) Environmental Kuznets curve in the MINT countries: evidence of long-run panel causality test. International Journal of Economic & Social Research 11(1)

Ozturk I, Agboola MO, Adedoyin FF, Agboola PO, Bekun FV (2021) The implications of renewable and non-renewable energy generating in Sub-Saharan Africa: the role of economic policy uncertainties. Energy Policy 150:112115

Pata UK, Caglar AE (2021) Investigating the EKC hypothesis with renewable energy consumption, human capital, globalization and trade openness for China: evidence from augmented ARDL approach with a structural break. Energy 216:119220

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometric theory:597–625

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22(2):265–312

Pesaran MH (2015) Time series and panel data econometrics. Oxford University Press

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econ 142(1):50–93

Peters, G. P., & Hertwich, E. G. (2008). CO2 embodied in international trade with implications for global climate policy.

Rahman MM, Saidi K, Mbarek MB (2020) Economic growth in South Asia: the role of CO2 emissions, population density and trade openness. Heliyon 6(5):e03903

Rjoub H, Adebayo TS, Awosusi AA, Odugbesan JA, Akinsola GD, Wong W-K (2021) Sustainability of energy-induced growth nexus in Brazil: do carbon emissions and urbanization matter? Sustainability 13:4371. https://doi.org/10.3390/su13084371

Sadorsky P (2012) Energy consumption, output and trade in South America. Energy Econ 34(2):476–488

Safi A, Chen Y, Wahab S, Ali S, Yi X, Imran M (2021) Financial instability and consumption-based carbon emission in E-7 countries: the role of trade and economic growth. Sustainable Production and Consumption 27:383–391

Sarkodie SA, Adams S, Owusu PA, Leirvik T, Ozturk I (2020) Mitigating degradation and emissions in China: the role of environmental sustainability, human capital and renewable energy. Sci Total Environ 719:137530

Scherer L, de Koning A, Tukker A (2019) BRIC and MINT countries’ environmental impacts rising despite alleviative consumption patterns. Sci Total Environ 665:52–60

Shahbaz M, Zakaria M, Shahzad SJH, Mahalik MK (2018) The energy consumption and economic growth nexus in top ten energy-consuming countries: fresh evidence from using the quantile-on-quantile approach. Energy Econ 71:282–301

Shao Q, Wang X, Zhou Q, Balogh L (2019) Pollution haven hypothesis revisited: a comparison of the BRICS and MINT countries based on VECM approach. J Clean Prod 227:724–738

Soylu ÖB, Adebayo TS, Kirikkaleli D (2021) The Imperativeness of Environmental Quality in China Amidst Renewable Energy Consumption and Trade Openness. Sustainability 13(9):5054

Stern DI, Common MS, Barbier EB (1996) Economic growth and environmental degradation: the environmental Kuznets curve and sustainable development. World Dev 24(7):1151–1160

Swamy PA (1970) Efficient inference in a random coefficient regression model. Econometrica: Journal of the Econometric Society:311–323

Tufail M, Song L, Adebayo TS, Kirikkaleli D, Khan S (2021) Do fiscal decentralization and natural resources rent curb carbon emissions? Evidence from developed countries. Environ Sci Pollut Res 1–12

Udemba EN, Güngör H, Bekun FV, Kirikkaleli D (2021) Economic performance of India amidst high CO2 emissions. Sustainable Production and Consumption 27:52–60

Usman O, Akadiri SS, Adeshola I (2020) Role of renewable energy and globalization on ecological footprint in the USA: implications for environmental sustainability. Environ Sci Pollut Res 27:30681–30693

Wang KH, Liu L, Adebayo TS, Lobon OR, Claudia MN (2021) Fiscal decentralization, political stability and resources curse hypothesis: a case of fiscal decentralized economies. Res Policy 72:102071

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69(6):709–748

World Bank (2020) World development indicators. http://data.worldbank.org/. Retrieved 25 Apr 2021

Yuan H, Wang Z, Shi Y, Hao J (2021) A dissipative structure theory-based investigation of a construction and demolition waste minimization system in China. J Environ Plan Manag 1–27. https://doi.org/10.1080/09640568.2021.1889484

Zhang L, Li Z, Kirikkaleli D, Adebayo TS, Adeshola I, Akinsola GD (2021) Modeling CO2 emissions in Malaysia: an application of Maki cointegration and wavelet coherence tests. Environ Sci Pollut Res:1–15

Zhao X, Gu B, Gao F, Chen S (2020) Matching Model of Energy Supply and Demand of the Integrated Energy System in Coastal Areas. J Coast Res 103:983–989. https://doi.org/10.2112/SI103-205.1

Availability of data and materials

Data is readily available at https://data.worldbank.org.

Author information

Authors and Affiliations

Contributions

Tomiwa Sunday Adebayo designed the experiment and collected the dataset. The introduction and literature review sections were written by Husam Rjoub, and Tomiwa Sunday Adebayo constructed the methodology section and empirical outcomes in the study. Husam Rjoub contributed to the interpretation of the outcomes. All the authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethical approval

This study follows all ethical practices during writing.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Philippe Garrigues

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Adebayo, T.S., Rjoub, H. Assessment of the role of trade and renewable energy consumption on consumption-based carbon emissions: evidence from the MINT economies. Environ Sci Pollut Res 28, 58271–58283 (2021). https://doi.org/10.1007/s11356-021-14754-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-14754-0