Abstract

This paper examined the nexus between economic growth, energy consumption, urbanization, population growth, and carbon emissions in the BRICS economies from 1990 to 2019. In order to yield valid and reliable outcomes, modern econometric techniques that are vigorous to cross-sectional dependence and slope heterogeneity were employed. From the findings, the studied panel was heterogeneous and cross-sectionally dependent. Also, all the series were first differenced stationary and co-integrated in the long run. The Augmented Mean Group (AMG) and the Common Correlated Effects Mean Group (CCEMG) estimators were employed to estimate the elastic effects of the predictors on the explained variable, and from the output of both estimators, energy consumption worsened environmental quality via high carbon emissions. Also, the AMG estimator affirmed economic growth to be a significantly positive determinant of carbon emissions. However, both estimators confirmed urbanization and population growth as trivial predictors of the emissivities of carbon. On the causal connections amidst the series, there was bidirectional causality between economic growth and carbon emissions, between energy consumption and economic growth, between economic growth and population growth, between energy consumption and urbanization, and between economic growth and urbanization. Lastly, a causation from urbanization to carbon emissions was unfolded. Policy implications are further discussed.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Global attention has always been drawn to environmental protection issues. Carbon dioxide (CO2) emission prevention is one of the most effective steps in environmental sustainability. Since the Industrial Revolution, the combustion of fossil fuels has generated a rapid increase in global CO2 emissions, leading to global warming (Musah et al. 2021d). With the depletion of resources and the disadvantages of conventional energy usage continuing to emerge, logical and efficient energy use has become a vital aspect of a nation’s sustainable development (Musah et al. 2021a). Literature has shown that energy use increases as economic activities increase (Hongxing et al. 2021). As a result, the environment depletes due to the emissions of CO2 from these economic activities (Musah et al. 2021c). According to Raghutla and Chittedi (2020), increased economic growth necessitates more output, while energy consuming activities must fulfill the greatest number of human desires, resulting in more pollution and waste while putting a strain on environmental and natural resources. Greater economic activities necessitate more energy supply; in 2010, emerging economies consumed 16% more energy than developed economies, and emerging economies are expected to consume 88% more energy than developed economies by 2040 (Paramati et al. 2016). The World Bank reports that world economic growth grew from 37.88 trillion US dollars to 84.85 trillion US dollars from 1990 to 2019. From 1990 to 2014, universal energy consumption increased from 1662.93 to 1922.5 kg per capita equivalent to oil. This increased consumption of energy has generated several environmental problems, according to Musah et al. (2020). The world economy will have huge expansion by 2050, as quoted in Mardani et al. (2018). Similarly, worldwide energy demand is expected to grow by 80%, with greenhouse gas emissions estimated to spread by 50% during the same period (Li et al. 2021a). The following forecasts are in line with the ones made by Li et al. (2021a) and Erdogan et al. (2020), who have argued that more economically developing nations are consuming a great deal of energy and are causing greater environmental damage. Therefore, studies of energy consumption characteristics of major nations allow us to discover their experiences of green development and offer vital lessons for energy conservation and reducing of emissions among the BRICS (Brazil, Russia, India, China, and South Africa) countries and the globe as a whole.

The BRICS have grown in popularity in the general media and academics (Zakarya et al. 2015). BRICS nations have important features with other developing nations, such as a big population, an undeveloped economy with fast development, and a readiness to join the global market (Liu et al. 2020). The BRICS are undergoing severe economic transformation and structural upheaval (Xiang et al. 2021). In the research conducted by Goldman (2003), the BRICS could play an ever more significant role in the international economy in under 40 years than the G6 (US, Japan, Germany, France, Italy, and the UK), and by 2025 the magnitude of the BRICS economies can represent more than half of G6. Pao and Tsai (2010) postulated that by the year 2050, the economic growth of BRICS nations is anticipated to surpass that of the G6 countries. More specifically, the nominal economic growth of the BRICS nations was $18.6 trillion in 2018, representing more than 23% of world output (Zhang et al. 2019). Its significance to global economic prosperity should not be overlooked. With BRICS nations experiencing fast economic expansion, the link amid economic growth and environmental degradation is heavily contested. Furthermore, the economic growth and industrialization levels of the BRICS nations depend significantly on high energy consumption industries such as building, mining, and manufacturing (Cowan et al. 2014), which leads to a dramatic increase in CO2 emanations in the BRICS nations. As stated in World Bank figures in 2014, the BRICS nations’ annual CO2 releases are as follows starting from the highest to the lowest: China 10,291,926.88 kt (28.48%), India 2,238,377.14 kt (6.19%), Russia 1,736,984.56 kt (4.81%), Brazil 529,808.16 kt (1.47%), and South Africa 489,771.85 kt (1.36%). Collectively, the five countries accounted for 42.31% of global CO2 emissions. The BRICS nations are among the largest CO2 emitters in the world (Ganda 2019). BRICS economies are now situated below the global value chain, with huge environmental costs (Zhang et al. 2019), and sacrificing environmental quality to preserve economic advancement is unsustainable (Wang and Zhang 2020). The changes in their energy framework and economic growth level are immense and influential, making them excellent samples for empirical research.

Whereas the connection amid CO2 emissions and energy usage has piqued the interest of academics in recent years, there seems to be no broad agreement among researchers. According to one body of study, energy usage has a detrimental influence on CO2 emissions (Ehigiamusoe and Lean 2019; Mensah et al. 2021; Murshed et al. 2021; Musah et al. 2021c). They discovered that energy consumption positively impacts CO2 emissions, implying that as energy consumption increases, so do CO2 emissions. Furthermore, an advanced degree of economic expansion can be accomplished with larger levels of energy use, which intensifies CO2 emissions. However, if the proportion of clean renewable energy in the energy mix is high, increased energy use may not worsen CO2 emissions (Hossain 2011). Sun et al. (2021) discovered an inverse linkage between energy use and CO2 emissions, signifying that increasing energy use reduces CO2 emissions. Differences in time, place, and variable selection might be the basis of these contradictory results, suggesting an ongoing debate on the relationship between the above factors and the need for more studies. Another body of research argued that there is a link amid CO2 emissions and economic development. They proposed that CO2 emissions surge during the initial phases of economic advancement, but fall after a specific level of economic progress is reached (Arouri et al. 2012; Chen et al. 2016; Xu et al. 2020). Furthermore, Musah et al. (2021c) assert that economic advancement helped shape people’s living standards in the countries, allowing them to switch their buying habits from low emission products to high emission products such as automobiles and air conditioners, among others, thereby increasing the level of emissions in the nations. Nevertheless, in 18 EU member nations, Kasperowicz (2015) discovered an inverse relationship amid economic growth and CO2 secretions. This means that economic growth and CO2 secretions go in opposing directions since a boost in one does not cause a rise in the other. Similarly, Ozcan (2013) discovered that CO2 emissions decline when real economic growth per capita rises. The grounds for incorporating economic growth in this study are the uneven impacts of reducing and rising economic growth on CO2 emissions.

Urbanization, linked to abiotic deterioration of the environment, including air, soil, sea, and forest quality, is another driver of CO2 emissions (Li et al. 2021b; Musah et al. 2021a). Musah et al. (2021a) posited that as the population goes up, society puts strain on finite resources for existence. Nevertheless, the influence on the climate via urbanization is conflicting. Mahmood et al. (2020) suggested that urbanization might limit environmental deterioration through resource efficiency and environmental quality enhancement. A research carried out showed an adverse correlation between urbanization and environmental degradation (Dadon 2019). The world’s urban population is estimated to reach 4.6 billion by 2030 (Mensah et al. 2021). As a result, it is normal to anticipate that urbanized areas would be stimulated by strong economic trend sources such as construction, production, and transportation, fueled mostly by fossil fuels, resulting in environmental deterioration. As a result, incorporating urbanization into this study is critical. Another factor influencing CO2 emissions is population increase. Some studies have demonstrated the influence of population expansion on CO2 emissions. A positive linkage amid population increase and CO2 emissions have been established by some studies (Li et al. 2021b; Mahmood and Chaudhary 2012; Wang et al. 2013). Li et al. (2021b) contend that population increase does not provide energy efficiency initiatives to reduce the nation’s CO2 emissions. The BRICS nations account for roughly 26.656% of the earth’s surface and 41.53% of the earth’s population, according to UN estimates (2019). High population increase may have positive and negative economic and environmental repercussions, necessitating its inclusion as a predictor of CO2 emissions.

The current study investigates predictors of CO2 emissions based on the above highlights. By including covariates such as economic growth, energy consumption, urbanization, population, and CO2 emissions in the BRICS, this study adds to the body of evidence already available. This study contributes to the extant literature in the following ways: First, cross-sectional independence and homogeneity assumptions are anticipated to result in erroneous estimating outcomes if the data panel is heterogeneous and cross-sectionally dependent. As a result, we investigated whether the panel data utilized in this work is homogenous and cross-sectionally independent and found that cross-sectional dependency and heterogeneity concerns are present, allowing us to employ econometric panel techniques that are resilient to such difficulties. Second, the econometric techniques employed in this study differ significantly from those employed in prior studies. The study used the Common Correlated Effects Mean Group (CCEMG) and Augmented Mean Group (AMG) estimators to explore the elastic effect of the explanatory factors on the response variable. They were used because of their robustness to sectional dependency, slope heterogeneity, and exogenous or endogenous regressive agents. Pao and Tsai (2010), Ummalla and Goyari (2021), Yıldırım et al. (2019), Ummalla et al. (2019), Aneja et al. (2017), and among others (see Table 1) also conducted their studies in the BRICS countries but did not apply these robust second-generation econometric techniques. Based on the AMG and CCEMG estimators, our study affirmed that energy consumption escalates CO2 emissions, opposing those of Ummalla and Goyari (2021) and Ummalla et al. (2019), who revealed that energy consumption reduces CO2 emissions in the BRICS countries. Also, both estimators confirmed urbanization as an insignificant determinant of CO2 emissions, contradicting that of Raghutla and Chittedi (2020) and Wang et al. (2016), who affirmed urbanization as a significant predictor of CO2 emanations in the BRICS countries.

The remainder of the report is organized as follows: The literature review section investigates the current literature that supports the topic under investigation. The materials and methods section explores the techniques used to conduct the analysis. The empirical result section accounts for the empirical discoveries of this research, while the last section discusses the results, conclusions, and policy recommendations of the research.

Literature review

Energy consumption, economic growth, and carbon emission nexus

The relationships amid biomass consumption, economic development, and CO2 secretions in West Africa between 1980 to 2010 were examined by Adewuyi and Awodumi (2017). This connection examined the integration of pollutant production and energy demand function with an increased indigenous growth model. The three-phase minimum-square (3SLS) regression estimator demonstrated a highly substantial interaction feedback connection with GDP, biomass energy usage, and CO2 emissions in Nigeria, Burkina Faso, Mali, Gambia, and Togo. In the other Western African countries, there was also a partially significant connection between the factors. This study is essential but was solely limited to the usage of energy from biomass. Consequently, the results of this research cannot be widespread for all energy sources employed in the countries worldwide. Işık et al. (2019) evaluated the EKC assumption at the developed national level for ten selected US states with the largest CO2 emissions levels. The research used panel estimation approaches robust to cross-sectional reliance in its investigation. Only five states, New York, Florida, Michigan, Illinois, and Ohio, were subject to the EKC hypothesis which is inverted U-shaped. Intriguingly, the negative consequences of fossil fuel consumption on the emissions of CO2 in Texas were not statistically discovered, even though this state is the country’s largest oil producer. In addition, concerning the other states, the beneficial impact of renewable energy usage in Florida was significantly low. Although the study was carried out in countries with similar economic characteristics, the findings were contradictory. These conflicting results show that the discussion on energy growth emissions is endless and justifiable for investigation, in line with our study. The effect of banking growth in the country on CO2 emissions has been tested by Samour et al. (2019). According to ARDL estimations, the rise of the banking industry has improved the nation’s energy consumption and has resulted in higher CO2 emissions. Although this result is significant, it must be interpreted carefully since the research was limited to the banking sector of Turkey only. The likelihood that the results could be varied if the other economic areas have been included in the assessment is high. The results must be taken with care as the study was carried out at the company level. If the survey was carried out at the national level, the findings might not remain the same. Also, from 1974 to 2014, Pata and Kahveci (2018) carried out a study in Turkey. Economic development was significantly linked to CO2 emissions from the results. However, there was no association of renewable energy with national CO2 emissions. This finding is quite insightful, yet it must be carefully interpreted since the research was confined only to Turkey. The findings may vary if the investigation considers other nations beyond Turkey. Waheed et al. (2019) examined the connection amid GDP, energy usage, and CO2 emissions in a single nation and multi-nation studies. The survey focused on country coverage, modeling methodology, research periods, and empirical findings. The outcome postulated that CO2 emissions in industrialized nations have not been associated in the disclosures with economic development. Increased energy usage in wealthy nations has also been identified as a key factor of excessive CO2 emissions. These results are very important to the academic community, but they should be regarded with prudence since this investigation has not included all advanced countries in the world. There may also be alternative models that were not considered by the studies. If the investigation had been carried out using other various modeling methods and nations, the results could be otherwise. Balcilar et al. (2019) studied the historical links between G7 nations’ CO2 emissions and energy consumption. The study employed the historical estimation technique in its evaluation based on time variations and business cycles. The result required sacrificing economic expansion by Canada, Italy, Japan, and partially the USA to reduce CO2 pollution by limiting fossil fuel consumption. Since the early 1990s, this condition has been invalid in France, for Germany during the analytical time, and for the UK with few exclusions. Research findings were also available for Canada, Germany, Japan, UK, and the USA as proof of opposite to the EKC’s theory. For France and Italy, the study found N-shaped BC curves. GDP had no harmful influence on the environmental quality, while the EKC’s hypothesis for Germany and the UK was invalid and this effect also looked cyclical in the USA. While the study was carried out on the G-7 members, the results were conflicting. These contrasting results highlighted the way our research was conducted. We explored the connection amid energy usage, economic growth, and CO2 secretions among the BRICS nations.

Urbanization, population growth, and carbon emission nexus

Abbasi et al. (2020) investigated the nexus amid urbanization, energy usage, and CO2 emissions for a group of eight Asian nations (Bangladesh, China, India, Indonesia, Malaysia, Nepal, Pakistan, and Sri Lanka) from 1982 to 2017. Panel co-integration and Granger causality approaches were used in the analysis. Panel co-integration results showed a long-run link amid urbanization and CO2 emissions. Moreover, the findings showed that urbanization has a positive and considerable effect on CO2 secretions, implying that urban expansion is a barrier to long-term environmental quality improvement. These findings are extremely important to the academic world; yet, they should be interpreted cautiously since not all Asian countries were covered in the analysis. There might be additional modeling approaches that the research may have missed out. The results might have been different if alternative modeling approaches and countries had been included in the research. From 1970 to 2015, Ali et al. (2017a, b) empirically evaluated the effect of urbanization on CO2 emissions in Singapore. The study employed the autoregressive distributed lags (ARDL) technique to investigate the effect connection between the variables. The primary result demonstrated that urbanization has an adverse and substantial influence on CO2 emissions in Singapore, implying that urban growth in Singapore is not a barrier to environmental quality enhancement. Thus, in the sample nation, urbanization improves environmental quality by lowering CO2 emissions. This discovery is probably important; nevertheless, it should be interpreted cautiously due to the study’s geographic restriction to Singapore. The findings may vary if the investigation considers other nations beyond Singapore. Wang et al. (2020) conducted research on the connection amid urbanization and CO2 emissions. Panel data analysis model was utilized to study the link amid urbanization and CO2 emanations for 166 Chinese cities from 2005 to 2015. The conclusion validated an inverted U-shaped curve amid urbanization and CO2 pollution; large urbanization expansion aids to decrease CO2 secretions. However, despite the importance of the findings to academic community, the study was limited to a narrow time span (2005 to 2015). As a result, the findings cannot be applied to other nations globally, as the outcomes may alter if more nations or locations and historical periods were included. Khan and Su (2021) studied the influence of urbanization on CO2 emanations in newly industrialized nations from 1991 to 2019. The research explored an ideal level of urbanization at which newly industrialized nations may cut CO2 emissions. The findings indicated that urbanization has a positive impact when it is less than the threshold value. In contrast, urbanization has an adverse influence on CO2 emissions when it exceeds the threshold. These results are very important to the academic community, but they should be regarded with prudence since this investigation has not included all industrialized countries in the world. There may also be alternative models that were not considered by the studies. If the investigation had been carried out using other various modeling methods and nations, the results could be otherwise. Asumadu-Sarkodie and Owusu (2016) evaluated the interaction amid CO2 emanations, GDP, energy usage, and population increase in Ghana from 1971 to 2013. The vector error correction model (VECM) and the ARDL model were used in the analytical method. Long-run elasticities indicated that an expansion in population would increase CO2 emissions in Ghana. This study is essential; however, it was confined to only Ghana, and the results may differ if all West African nations were studied. As a result, the findings of this study cannot be generalized to other nations throughout the world. Wu et al. (2021) used the fixed-effect model of panel econometric regression to empirically study the effects of population flow and other associated elements on China’s CO2 emanations from 2005 to 2018. The findings suggest that China’s population flow has the potential to lower the rise of CO2 emissions in the long and short term. Also, regional population aging and improved knowledge structure as a consequence of population movement are both advantageous to lowering CO2 secretions; however, regional urbanization as a result of population flow is not substantially associated to the rise of household miniaturization on CO2 emanations. Furthermore, in the northwest area of the Hu Huanyong Line (Hu Line), population flow encourages a rise in CO2 emissions, but the converse is true in the southeast area of the Hu Line. These contradictory results indicate that the debate amid urbanization, population increase, and CO2 secretions is ongoing and that an investigation of this type is necessary.

Methods and material

Data source and descriptive statistics

The research was done with a panel of five countries in the BRICS, i.e., India, China, Brazil, Russia, and South Africa. Their geographical area and political and economic institutions are extremely heterogeneous. Therefore, the researchers were able to undertake a thorough analysis of the explanatory series because of their variability. All of the data was acquired from the World Development Indicators (WDI). Table 2 contains additional information about the series used for the study:

The descriptive statistics of the variables under investigation are summarized in Table 3. lnGDP had the greatest average value of 5993.815, followed by lnEC, lnCO2, lnUR, and lnPP with a mean value of 2092.642, 5.783403, 2.089132, and 1.015292, respectively. The lnCO2 has a range of 23.6893492 with maximum and minimum values of 24.68935 and 0.7090008, correspondingly. lnGDP has an upper limit value of 12,011.53 and a lower limit value of 575.5015, which resulted in a range of 11,436.0285. Also, lnEC has an upper limit value of 5941.586 and a lower limit value of 350.0757, which resulted in a range of 5591.5103. The lnUR has a range of 5.068526 with an upper limit of 4.601685 and a minimum figure of −0.466841. Last, lnPP has a range of 2.9569143 with an upper limit of 2.49689 and a lower limit of −0.4600243. A variable is uniformly dispersed if it has a skewness of zero and kurtosis of 3, agreeing to Sharma and Bhandari (2013) and Westfall (2014). The skewed findings presented in Table 3 revealed a negatively skewed dispersion of lnGDP, lnUR, and lnPP, whereas lnCO2 and lnEC distribution were skewed positively. Furthermore, the tails of the lnCO2 dispersion were fatter with positive excess kurtosis (K>3). In contrast, the tails of the lnGDP, lnEC, lnUR, and lnPP distribution were narrower with adverse excess kurtosis (K<3). The investigators further employed the Jarque–Bera test to determine if the sampled data had the skewness and kurtosis of a normal distribution. Our findings refuted the null assumption that the factors were normally distributed.

Table 3 also denotes the correlation between the study variables. From the outcome, there was a positive and significant correlation amid lnGDP and lnCO2 emissions at a 1% significant level (r=0.466; p<0.01). This indicates that an upsurge in lnGDP leads to a rise in lnCO2 emissions, and also, a fall in lnGDP results in a fall in lnCO2 emissions and the other way round. Also, there was a positive and material affiliation amid lnEC and lnCO2 emissions (r=0.946; p=0.01). This infers that a decrease or rise in lnEC leads to a decrease or rise of BRICS countries’ lnCO2 emissions, and the reverse is true. Moreover, there was an adverse and significant connection amid lnUR and lnCO2 emissions (r=−0.572; p<0.01). This implies that an upsurge in lnUR leads to a drop in lnCO2 emissions, and likewise, a fall in lnUR accounts for an escalation in lnCO2 emissions and the other way round. Last, there was also an adverse and material effect between lnPP and lnCO2 emissions (r=−0.547; p=0.01). This means that an upsurge in lnPP leads to a drop in lnCO2 emissions, and likewise, a decline in lnPP results in an escalation in lnCO2 emissions and conversely.

The researchers intended to see if the independent variables were tightly connected or not since multi-collinearity might lead to excessive assurance intervals and lower trustworthy probability figures, resulting in distorted or misleading implications (Gokmen et al. 2020). Multi-collinearity was found using the Variance Inflation Factor (VIF) or the degree of tolerance (1/VIF) after conducting the OLS regression with lnCO2 emissions as the response variable and lnGDP, lnEC, lnUR, and lnPP as the explanatory variables. A variable with a VIF of more than 5 (VIF>5) or a degree of tolerance less than 0.2 (1/VIF<0.2) was determined to be significantly collinear with all other independent variables. The VIFs of lnGDP, lnEC, lnUR, and lnPP in Table 4 with their degrees of tolerance (1/VIF) suggested unrelated components. This indicates that all of the elements are capable of being employed in conjunction in this research.

Model formulation

In the present study, carbon dioxide emission (CO2) is used as a response variable. In contrast, the vector of explanatory factors includes energy consumption (EC), economic growth (GDP), urbanization (UR), and population (PP). The econometric model incorporating the aforestated series was specified as

where \({\beta }_{1}\), \({\beta }_{2}\), \({\beta }_{3}\), and \({\beta }_{4}\) are the coefficients of EC, GDP, UR, and PP, respectively, while \({\mu }_{it}\) is the presumed error term with an average of zero and variation of \({\sigma }^{2}\). Also, \(i\) \(\left(i=1, 2, 3...,N\right)\) stands for the investigated nations, while \(t\) \((t= 1, 2, 3...,T)\) epitomizes the time frame. Finally, \({\boldsymbol{\alpha }}_{{\varvec{i}}}\) represents the constant term. In order to minimize heteroscedasticity and data fluctuation issues, all the series in Eq. (1) were log-transformed resulting in the following relation:

where \({\beta }_{1}\), \({\beta }_{2}\), \({\beta }_{3}\), and \({\beta }_{4}\) are the coefficients of lnEC, lnGDP, lnUR, and lnPP, correspondingly. All other items in Eq. (2) were as defined in Eq. (1). Expectedly, \({\beta }_{1}\) and \({\beta }_{2}\) were to have positive effects on CO2 emissions. However, \({\beta }_{3}\) and \({\beta }_{4}\) could either have a positive or a negative influence on the emanation of CO2.

Econometric approaches

All data analysis from the time-dependent panel drives through numerous phases before the desired targets can be achieved. As a result, the empirical interpretation of the research followed the following econometric methods.

Cross-sectional dependence tests

Due to the economic bond amidst BRICS economies, there is the possibility that there will be correlations in the panel understudy. According to Musah et al. (2021a), the negligence of cross-sectional dependence could lead to biased estimates that could lead to wrong inferences. Therefore, as a first step, the authors tested for the presence of dependencies or otherwise in the residual terms via the Pesaran (2004) scaled LM test, Pesaran (2015) CD test, Breusch and Pagan (1980) LM test, and the Friedman (1937) test. First, by using the Pesaran (2004) scaled LM test, Pesaran (2015) CD test, LM test Breusch and Pagan (1980), and the Friedman (1937) test, investigators verified the existence and absence of dependencies in the panel. Take the standard model data panel into account:

where \((i=1, 2, 3...,N)\) and \((t= 1, 2, 3...,T)\), \({\beta }_{i,t}\) is a \(K \times 1\) transmitter of invariable to be computed; \({X}_{i,t}\) signifies a \(K \times 1\) transmitter of input variables; \({\alpha }_{i}\) signpost a time-invariant computation; and \({\mu }_{i,t}\) means the error term, which is presumed to be separately and indistinguishably dispersed. The test of zero sectional dependency assumption compared with the alternate assumption of cross-sectional interconnection is expressed in the following terms:

where \({\rho }_{ij} or {\rho }_{ji}\) is the coefficient of correlation derived from and by the error conditions of the model:

For the test of cross-sectional dependence in heterogeneous panels, the Breusch and Pagan (1980) LM test can be applied in a fixed case and as \(T\to \infty\). The test is calculated by the phrase:

proposed a scaled version of the \({LM}_{BP}\) test given by

Pesaran et al. (2004) show that \({CD}_{LM}\) is asymptotically distributed as N (0, 1), under the null, with \(T\to \infty\) first, and then \(n\to \infty\).

Pesaran (2015) recommended the following CD test statistic:

where \({\widehat{\rho }}_{ij}\) is the coefficient of correlation. More officially, if the error term for component \(i\) in the period \(t\) is \({\mu }_{it}\), then the assumption of this trial is expressed as

A test grounded on the Spearman ranking coefficient of correlation was suggested by Friedman (1937). The correlation coefficient of the Spearman is equal to

The test of Friedman is carried out based on the average Spearman correlation:

where \({\widehat{r}}_{ij}\) is the model estimation of the residual grade connection coefficient. Large \({R}_{AVE}\) values mean the presence of non-zero cross-sectional relationships. Friedman stated that \(FR= [\left(T-1\right)\left(\left(N-1\right){R}_{AVE}+1\right)]\) is distributed asymptotically with \(T-1\) degrades of freedom, as N becomes big for fixed T.

Slope heterogeneity test

Since ignorance of slope heterogeneity might prejudice regression analysis leading to wrong tests of hypothesis, the researchers tested for heterogeneity or homogeneity in the slope coefficients via the Pesaran and Yamagata (2008) test. This test can be computed through the relation

In cases where \(\tilde{S }\) and \(\stackrel{\sim }{\Delta }\) are the statistics for testing, \({\widehat{\beta }}_{i}\) is the pooled OLS coefficient, \({\stackrel{\sim }{\beta }}_{WFE}\) is a pooled weighted fixed effect estimator, \({x}_{i}\) is the matrix of the input series, \({M}_{T}\) is the identity matrix, \({\stackrel{\sim }{\sigma }}_{i}^{2}\) is the estimate of \({\sigma }_{i}^{2}\), and \(K\) is the predictor number. The test version is partially amended in the following terms:

Unit root tests

At the third stage of the analysis, the integration order of the series was assessed via the cross-sectionally augmented Dickey–Fuller (CADF) and cross-sectional Im, Pesaran, and Shin (CIPS) unit root tests. These tests were engaged because they are robust to cross-sectional correlations and slope heterogeneity. The CADF relation is expressed as

where \({\overline{y} }_{t-1}\) and \(\Delta {\overline{y} }_{i-j}\) show the cross-sectional requirements of the lagging aims and the first differences in different series, respectively. The CIPS statistics can be determined as since both tests are related:

where \({CADF}_{I}\) is the \(t\) figures in the CADF.

Panel co-integration tests

Fourth, we checked the existence or nonexistence of co-integration amidst the series through the Westerlund and Edgerton (2007) co-integration test and the Durbin–Hausman test. It should be noted that the Durbin–Hausman test was employed to check the robustness of the Westerlund and Edgerton (2007) co-integration test. These tests were employed due to their ability to control for residual cross-sectional correlations and slope heterogeneity. The Westerlund and Edgerton (2007) test is grounded on the relation

There are two bodies in the Westerlund and Edgerton (2007) test. The collective figures (Ga and Gt) evaluate the co-integration with one component or more. The panel data (Pα and Pt) examine the co-integration into all cross-sectional components. This test regarded the error correction model calculated as

Panel model estimation

The long-lasting equilibrium connections between the series were investigated at stage five of the analysis using Common Correlated Effects Mean Group (CCEMG) and Augmented Mean Group (AMG) regression estimators. The CCEMG estimators are beneficial in the strong cross-sectional reliance and slope heterogeneity (Chudik and Pesaran 2013; Pesaran 2006). Assume that heterogeneous coefficients have the following equation:

In Eq. (24), αi is the heterogeneous loading factor; Xit and Yit are independent and dependency-dependent variables; βi means each slope of each unit; αi refers to each unit’s heterogeneous fixed effects and ̄ a reference to the error. Averaging each unit’s pitches is used to calculate the CCEMG estimator AMG:

where \(\widehat{\beta }\) i is the coefficient of Eq. (25) for the cross-section, and the regression of OLS is being applied. The highly resilient AMG estimator is another way of establishing CDs (Eberhardt and Bond 2009). The AMG estimator employs a two-step measurement approach. The first step is to apply time to the unknown common factor, as stated in the OLS equation:

where ∆ represents the operation differential, and the time coefficients are ρ. The second step assesses each unit’s slopes (i.e., βi at Eq. (26)). Mathematically, this is expressed as

Where βi in Eq. (27) is computed, although the CCEMG and AMG estimators are strong to CD and provide heterogeneous pitches, the AMG estimator is impartial and effective for various intersections in time-dimensional combinations (Bond and Eberhardt 2013).

Causality test

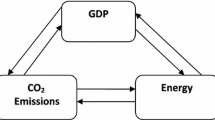

According to Qin et al. (2021), regression outputs fail to comment on the causal directions amidst series. Therefore, as a final step, the Dumitrescu and Hurlin (2012) causality test was engaged to explore the causations between the variables (Fig. 1). This test was used because it offers consistent and reliable outcomes in the presence of cross-sectional dependence and slope heterogeneity. This test is calculated through the expressions

where \({W}_{N, T}^{\mathrm{Hnc}}\) is the mean value of each Wald statistics. The mean statistics coincide in sequence with the equation beneath, according to Dumitrescu and Hurlin (2012) as T and N start to approach infinity, suggesting that the separate residues are autonomously spread over all the CS, and their covariance is equal to zero:

where \({Z}_{N, T}^{\mathrm{Hnc}}\) are Z-stats, N is the CS number, and K is the optimal lag time. Furthermore, Dumitrescu and Hurlin (2012) claim that if T intends to be infinite, each forest status would be autonomously distributed in the same way as the average forest statistics are equivalent to K, and the variation is equal to 2K. A standardized Z-stat is then computed approximately for the average HNC null statistics as follows:

The null assertion and alternate assumption are outlined as follows for the panel statistics measured:

Empirical results

The real analytical process began by evaluating the occurrence or lack of cross-sectional reliability in the panel. The null assumption implies cross-sectional independence within the series, whereas the alternative hypothesis presupposes cross-sectional dependency. The denial of the null assumption and acceptance of the alternative assertion that there is a cross-sectional dependency within the data series was necessarily grounded on the findings of the cross-sectional reliance check. In simple terms, there were dependencies in the panel understudy as shown in Table 5, aligning those of Musah et al. (2021a), Musah et al. (2021b), and Phale et al. (2021).

Next, the investigators performed a Pesaran–Yamagata homogeneity check to see if the path coefficients were heterogeneous or homogeneous. From the results shown in Table 6, the null assumption of homogeneity in the slope coefficients was denied supporting that of Musah et al. (2021d). Based on this finding, econometric techniques that are resilient to slope heterogeneity were employed for the analysis.

At the third phase, the integration order of the series was assessed via the CADF and the CIPS unit root tests, which are resilient to cross-sectional reliance and slope heterogeneity. From the results illustrated in Table 7, all the series became stationary after their first difference, collaborating those of Musah et al. (2021a) and Li et al. (2021a). The series being integrated of order I(1) signpost, they could be co-integrated in the long run; therefore, the Westerlund and Edgerton co-integrated test and the Durbin–Hausman test displayed in Tables 8 and 9 were conducted to examine the variables’ co-integration attributes. From the revelations, the null hypothesis of no co-integration amidst the series was rejected supporting those of Li et al. (2021b) and Musah et al. (2021f). Centering on this outcome, the researchers proceeded to analyze the long-run relationship between the variable via the CCEMG and AMG regression estimators.

Based on the findings in Table 10, the long-term balanced liaison amid the series was determined by the AMG and CCEMG estimators. Table 11 provides the summary of both AMG and CCEMG estimators in terms of signs and significance. From the AMG estimates, lnGDP positively influenced lnCO2 emissions in the BRICS nations (β=0.0001926; p<0.05). This denotes that an upsurge or fall in lnGDP will result in an upsurge or drop in lnCO2 emanations in the countries and the other way around. It was discovered that the lnEC predicted lnCO2 emanations in the BRICS nations positively and substantially (β=0.0035163; p<0.01). The positive influence of lnEC on lnCO2 emanations means that an upsurge or decrease of lnEC will account for an upsurge or decline in lnCO2 emanations and vice versa. The significant effect of lnEC on lnCO2 emissions infers that lnEC has a material effect on lnCO2 emissions in the BRICS nations. Further, it was revealed that lnUR has a positive and insignificant association with lnCO2 emissions in the BRICS nations (β=1.920611; p>0.1). The positive influence of lnUR on lnCO2 emanations means that an upsurge or decrease of lnUR will result in an upsurge or decline in lnCO2 emissions and the other way around. However, the insignificant influence of lnUR on lnCO2 emissions implies that lnUR has no material influence on BRICS nations’ lnCO2 emissions. Also, there was an adverse and insignificant interaction between lnPP and lnCO2 emissions (β=−0.312332; p>0.1). The negative interaction implies that an upsurge in lnPP will decrease lnCO2 emissions in the BRICS nations and the other way around. The insignificant effect reveals immaterial effects amid lnPP and lnCO2 emissions. Consequently, at a 1% significance level, Wald χ2 value is 72.92, suggesting that the series dispersion accurately reflects the model. The RMSE value reveals that the model has high predictive relevance, which is in line with the work of Pham (2019).

The CCEMG results in Table 10 reveal that lnGDP had no substantial impact on lnCO2 emissions in the BRICS (β=0.0002299; p>0.1). The immaterial influence of lnGDP on lnCO2 emissions infers that an upsurge in lnGDP did not yield any substantial influence on the lnCO2 emissions of BRICS nations. Also, lnEC had a substantial positive effect on lnCO2 secretions in the BRICS (β=0.0031094; p<0.01). The positive influence of lnEC on lnCO2 emissions means that an upsurge or decrease of lnEC will lead to an upsurge or fall in lnCO2 emanations, and the reverse is true. The significant impact of lnEC on lnCO2 emissions implies that lnEC has a material influence on lnCO2 emanations in the BRICS countries. Further, lnUR had a negative and insignificant influence on lnCO2 emissions (β=−0.4398151; p>0.1). The negative interaction implies that an increase in lnUR will decrease lnCO2 emanations in the BRICS nations and vice versa. The insignificant effect reveals immaterial effects amid lnUR and lnCO2 emissions. Last, it was revealed that lnPP has a positive and insignificant linkage with lnCO2 emanations in the BRICS nations (β=0.6589383; p>0.1). The positive influence of lnPP on lnCO2 emanations means that an upsurge or decrease of lnPP will result in an upsurge or decline in lnCO2 emissions and the other way around. However, the insignificant impact of lnPP on lnCO2 emissions implies that lnPP has no material impact on lnCO2 emanations in the BRICS nations. Last, the hypothesized lnCO2 model had a strong specification and robust enough to produce an efficient predictive estimate, as evidenced by the substantial and statistically significant value of Wald χ2 (β=388.94; p<0.01). The RMSE value reveals that the model has a high predictive relevance.

Discussion of the results

The AMG and CCEMG estimators determined the long-term balanced connection between the series. According to the AMG estimator, lnGDP substantially influenced lnCO2 emanations in the BRICS nations. lnGDP’s significant positive influence on lnCO2 emissions suggests that a 1% growth in lnGDP will result in lnCO2 emissions increased by 0.01926%. This study has significant conclusions; higher rates of growth can lead to CO2 emissions. However, the result differs in the CCEMG estimator, where lnGDP positively influenced lnCO2 emanation but was statistically irrelevant. The result in the AMG estimator indicates that an upsurge in GDP resulted in an upsurge in performance of the principal factors of production in the country, including labor, capital, and land. The operations of these economic undertakings rely heavily on the use of large volumes of pollutant energy that increases CO2 emissions. The findings collaborate with past research of Islam et al. (2021), Muhammad (2019), and Nosheen et al. (2021) that found GDP as a driver of CO2 emissions. The result opposes Sheraz et al. (2021), Bosah et al. (2021), and Shoaib et al. (2020), who postulated GDP as a material opposing driver of CO2 emanations in the long run.

lnEC has a material positive impact on lnCO2 emissions; therefore, a unit upsurge in lnEC will escalate lnCO2 emissions by 0.3516% and 0.31094%, correspondingly, based on AMG and CCEMG estimators. This result is not surprising, as most BRICS countries are enclosed with many businesses that largely rely on high polluting energy sources to promote their activities. This conclusion shows that economic activity in BRICS countries, in general, is linked to the use of huge quantities of unfavorable energy sources, mainly fossil fuels, coal, natural gas, etc. These sources of energy increase the country’s emission rate. In short, a rise in the processing of goods and services is linked with the consumption of large quantities of fossil fuels which increases the degree of secretions of CO2 in the countries. The finding is congruent with Ali et al. (2016), Musah et al. (2021e), and Musah et al. (2021b), who found EC as a significant driver of CO2 emissions. However, our outcome contradicts Zafar et al. (2019), who revealed that EC does not influence CO2 emissions, and Sun et al. (2021) discovered an inverse linkage between EC and CO2 emissions, signifying that increasing energy consumption reduces CO2 emissions.

According to both AMG and CCEMG, lnUR had an immaterial influence on lnCO2 emissions in BRICS nations. The irrelevant outcome of lnUR on lnCO2 indicates that an upsurge in lnUR has no major influence on BRICS countries’ lnCO2 emissions. This finding shows that people moving to cities, which leads to increased industrialization, development of companies, and the construction of roads, bridges, hospitals, and marketplaces, among other things, does not influence CO2 emissions. Our finding supported Hafeez et al. (2019), Ali et al. (2016), and Martínez-Zarzoso and Maruotti (2011), who discovered UR as an insignificant driver of CO2 emissions. This study estimate conflicts with Islam et al. (2021), Musah et al. (2021e), and Joshua et al. (2020), who revealed UR as a substantial predictor of CO2 emissions.

lnPP has an irrelevant influence on lnCO2 emissions in BRICS countries conferring to AMG and CCEMG assessment. This outcome designates that an upsurge or reduction in lnPP rate did not influence lnCO2 emissions in the nations. Our discoveries are supported by Toth and Szigeti (2016) and Musah et al. (2021d), who discovered no link amid PP and CO2 emissions. The findings disagree with Khan et al. (2021), Namahoro et al. (2021), and de Souza Mendonca et al. (2020), who found PP as a major predictor of CO2 emissions.

The AMG and CCEMG estimators can only investigate long-run equilibrium relations amid the factors since they cannot investigate causal relations between variables. Regarding this constraint, Dumitrescu and Hurlin (2012) causality test investigated the causal connections amid the studied series. Table 12 indicates the test results for the causality outcome. Figure 2 illustrates the directions between the variables. There are two-way causes between lnGDP and lnCO2, according to the findings. These results posit that an upsurge or decline in lnGDP produced an upsurge or decline in lnCO2 secretions and the other way around. This study shows that GDP is accountable for the nation’s carbon pollutants. This study outcome is in conjunction with the result from Abban and Hongxing (2021), Musah et al. (2021e), and Mirza and Kanwal (2017), who revealed a two-headed link amid GDP and emanations of CO2. The finding contrasted with the finding made by Ali et al. (2017a, b) and Shahbaz et al. (2016). A causal link from lnCO2 to lnEC was established. This outcome suggests that the rise or decline in lnCO2 caused an upsurge or decline in lnEC, however not the other way around. In other words, the EC level of the countries depended on CO2 emissions. Our estimates are in agreement with Sun et al. (2018) and Saudi (2019); the findings are nonetheless conflicting with Cetin et al. (2018) and Musah et al. (2021b). A one-way causal link has also been revealed from lnUR to lnCO2 emissions. This result means the country’s CO2 emissions depend heavily on how quickly people relocate to metropolitan areas to pursue jobs and other livelihoods. Any effort to reduce the UR pace would drop the country’s CO2 emission rate. This result confirms Mesagan and Nwachukwu (2018) and Lin and Zhu (2018) but is contrary to Murshed et al. (2021) and Abban and Hongxing (2021).

Moreover, there was a unidirectional causality from lnCO2 emissions to lnPP. This means PP growth is not the cause of high CO2 pollutions in BRICS countries, but CO2 emissions increase the country’s PP rate. This discovery verifies the findings of Musah et al. (2020), whose analysis identified CO2 emission causality to PP. It also contradicts Shuai et al. (2017), who found that PP is a major driving force of CO2 emissions in 125 economies. In addition, lnGDP and lnPP have two-way causalities. This finding indicates that the two variables are mutually reliant. Economic undertakings are therefore dependent on the PP rate in the nations, and the PP rate also depends on the degree of economic activity in the countries. The outcome did not deviate from Musah et al. (2020) and York (2007), who established a double-headed relationship between GDP and PP. The finding deviates from Musah et al. (2021d), who detected no causal link amid the two variables. The study further established feedback causation amid lnGDP and lnUR. This finding implies that UR has created more jobs by setting up new enterprises, industrialization, establishing schools, marketplaces and hospitals, and other social amenities to help promote economic growth in the BRICS nations. GDP also allowed BRICS nations to transform their municipalities into urban centers. GDP has thus aided the speed-up of BRICS’s UR process. This outcome is connected with Musah et al. (2021a), whose research found that UR and GDP have a feedback connection. However, Musah et al. (2021e) detected a one-headed link from GDP to UR.

Causal feedback was found in this investigation with lnGDP and lnEC. This indicates that lnGDP depends on the lnEC; in the BRICS nations, lnEC depends on lnGDP. Any fluctuations in lnGDP will therefore have a significant influence on lnEC in the nations and conversely. The findings also suggest that as the BRICS economies grow, they will be compelled to utilize more energy, enhancing their energy competence and economic capability. The findings back up Esen and Bayrak (2017) and Doan and Mckie (2018), who postulated a strong linkage amid GDP and EC. The findings contradict Zerbo (2017) and Ozturk and Acaravci (2010), who found no link amid EC and GDP. There was also a feedback causality between lnEC and lnUR in the countries. The findings show that lnEC relies on lnUR and that lnUR relies on lnEC (both are mutually exclusive). This research backs up Shahzad et al.’s (2017) findings in Pakistan, demonstrating a crucial relationship between UR and EC. In contrast, Naqvi et al. (2020) and Nosheen et al. (2021) observed EC to UR causality. Furthermore, bidirectional causation between lnEC and lnPP was discovered in these countries. The discovery specifies that an upsurge or drop in lnEC leads to an upsurge or decline in lnPP and the other way around. This means that the transition from traditional agro-based undertakings to manufacturing or industrial undertakings, as a result of the country’s increased PP, results in an increment in EC, and also a shift from small- and medium-scale production to large-scale production results in a significant rise in EC and subsequent CO2 emissions. This research backs up the findings of York (2007) and Liu (2009), which found a critical relationship between EC and PP. Furthermore, in the BRICS economies, lnPP and lnUR had a bidirectional causality. This suggests that an upsurge or fall in lnPP caused an upsurge or drop in lnUR, and the opposite is true. This research implies that as PP has increased in most BRICS countries, more individuals have moved to cities in quest of better opportunities. This movement produces results not just for the migrants but also for their economies since the lawful activities they participate in contribute to overall economic development. Increased PP also necessitates additional developmental activities such as roads, factories, transportation, hospitals, and the spread of power to villages, towns, and cities, among other things, to satisfy the PP’s needs. All of these activities contribute to the growth of the economy. The findings back up Musah et al. (2020), who revealed a two-headed causal link between PP and UR. The findings further align with York’s (2007) findings, which demonstrated a strong link between PP and UR in 14 EU nations.

Conclusion and policy recommendations

From 1990 through 2019, this study looked at the relationship between BRICS countries’ GDP, EC, PP, UR, and CO2 emissions. For the analysis, more sophisticated panel estimate approaches were applied to uncover reliable and valid results. A preliminary check was performed to see if the variables could be utilized together. The test revealed that the study model had no issues with multi-collinearity. According to the heterogeneity and cross-sectional tests findings, the study’s panels were heterogeneous and cross-sectionally based. Also, all of the series achieved stationarity at the first distinction. Furthermore, Westerlund and Edgerton’s panel co-integration test discovered that the covariates under consideration were co-integrated in the long run. The AMG and CCEMG estimators were utilized to evaluate the long-run balanced connection between the series. According to the AMG estimator, lnGDP and lnEC substantially and positively influenced lnCO2 emissions. Furthermore, the AMG estimator showed that lnUR and lnPP are insignificant predictors of lnCO2 emissions in BRICS nations. According to the CCEMG estimate, lnEC forecasted lnCO2 emissions in the BRICS nations positively and significantly. However, lnGDP, lnUR, and lnPP did not influence lnCO2 emissions. Last, the Dumitrescu–Hurlin test was used to assess the causative linkages in the series, and the outcomes demonstrated a double-headed causality in the panel among lnGDP and lnCO2, lnGDP and lnEC, lnGDP and lnUR, lnGDP and lnPP, lnEC and lnUR, lnEC and lnPP, and lnUR and lnPP. There was one-way causation from lnCO2 emanations to lnEC in the panel. There was also a one-way link from lnUR to lnCO2 emissions. Finally, one-way causation was established from lnCO2 emissions to lnPP. The methods used in this study show that the results are accurate in drafting some policy recommendations. As a result, these subsequent suggestions were made:

-

1.

Authorities must establish policies that promote both sustainability of the environment and economic growth in their respective nations. This objective can be achieved by modifying energy policy to reduce reliance on non-renewable energy sources such as fossil fuels, coal, and natural gas while encouraging renewable energy sources like solar, wind, biogas, biomass, and hydropower. These sustainable energy sources will not only reduce CO2 emissions but will also help countries prosper economically.

-

2.

Furthermore, policies that relate to the environment should be adequately planned, structured, and employed following the country’s macroeconomic goals. Once this is realized, energy conservation programs aimed at reducing CO2 emissions will help nations flourish economically.

-

3.

Because urbanization contributes to CO2 emissions, authorities must strive to create jobs and raising rural people’s living conditions. Individuals will move from rural to urban zones at a slower rate as a result of this. Furthermore, giving social facilities to rural areas will aid in reducing the rate of urbanization, hence lowering emissions in the country.

-

4.

Authorities and other stakeholders should strengthen energy policies and laws that protect and regulate CO2 emissions in three key areas of the economy: agricultural, industrial, and service sectors. Because these sectors are the main drivers of development in every economy, their activities must be regulated to ensure low emissions of CO2.

-

5.

Governments and authorities should support hydropower energy usage to reduce CO2 emissions and boost economic growth. They should increase the use of this energy source by lowering its installation costs.

-

6.

Lastly, authorities should evaluate the relationship between CO2, EC, UR, PP, and GDP when developing and implementing economic policies. Policies that promote environmental conservation while also increasing economic growth should be aspired with zeal.

Limitations of the study

This research had two significant flaws that must be addressed. To begin, the investigators intended to use a much-prolonged time than what was actually used. Because of data limitations, the study period was confined to 1990 to 2019. When such data is completely available, the researchers urge subsequent studies to report periods longer than the study term. Furthermore, the findings of this study cannot apply to the entire world because BRICS states differ in terms of geographical area, histories, system of government, and financial systems. As a result, projecting findings from solely the BRICS nations may lead to incorrect inferences. Despite the difficulties mentioned above, the research was successful in its objectives.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Change history

28 March 2024

This article has been retracted. Please see the Retraction Notice for more detail: https://doi.org/10.1007/s11356-024-33122-2

Abbreviations

- EC:

-

Energy consumption

- GDP:

-

Economic growth

- UR:

-

Urbanization

- PP:

-

Population

- CO2 :

-

Carbon dioxide

- BRICS:

-

Brazil, Russia, India, China, South Africa

- CCEMG:

-

Common Correlated Effects Mean Group

- AMG:

-

Augmented Mean Group

- WDI:

-

World Development Indicators

- UN:

-

United Nations

- EKC:

-

Environmental Kuznets curve

- ARDL:

-

Autoregressive distributed lag

- FMOLS:

-

Fully modified ordinary least squares

- DOLS:

-

Dynamic ordinary least squares

- ECM:

-

Error correction model

- MRIO:

-

Multi-regional input–output

- VECM:

-

Vector error correction model

- NMVGM:

-

Novel multi-variable grey model

- 3SLS:

-

Three-stage least square method

- OLS:

-

Ordinary least square

- CADF:

-

Cross-sectionally augmented Dickey–Fuller

- CIPS:

-

Cross-sectional Im, Pesaran, and Shin

- VIF:

-

Variance inflation factor

- EU:

-

European Union

References

Abban OJ & Hongxing Y (2021). What initiates carbon dioxide emissions along the Belt and Road Initiative? An insight from a dynamic heterogeneous panel data analysis based on incarnated carbon panel. Environ Sci Pollut Res 28(45):64516–64535. https://doi.org/10.1007/s11356-021-14779-5

Abbasi MA, Parveen S, Khan S, Kamal MA (2020) Urbanization and energy consumption effects on carbon dioxide emissions: evidence from Asian-8 countries using panel data analysis. Environ Sci Pollut Res 27(15):18029–18043. https://doi.org/10.1007/s11356-020-08262-w

Adewuyi AO, Awodumi OB (2017) Biomass energy consumption, economic growth and carbon emissions: fresh evidence from West Africa using a simultaneous equation model. Energy 119:453–471

Ali G, Ashraf A, Bashir MK, Cui S (2017) Exploring environmental Kuznets curve (EKC) in relation to green revolution: a case study of Pakistan. Environ Sci Policy 77:166–171

Ali HS, Abdul-Rahim AS, Ribadu MB (2017) Urbanization and carbon dioxide emissions in Singapore: evidence from the ARDL approach. Environ Sci Pollut Res 24(2):1967–1974. https://doi.org/10.1007/s11356-016-7935-z

Ali HS, Law SH, Zannah TI (2016) Dynamic impact of urbanization, economic growth, energy consumption, and trade openness on CO2 emissions in Nigeria. Environ Sci Pollut Res 23(12):12435–12443

Aneja R, Banday UJ, Hasnat T, Koçoglu M (2017) Renewable and non-renewable energy consumption and economic growth: empirical evidence from panel error correction model. Jindal J Bus Res 6(1):76–85

Arouri MEH, Youssef AB, M’henni H, Rault C (2012) Energy consumption, economic growth and CO2 emissions in Middle East and North African countries. Energy Policy 45:342–349

Asumadu-Sarkodie S, Owusu PA (2016) Carbon dioxide emissions, GDP, energy use, and population growth: a multivariate and causality analysis for Ghana, 1971–2013. Environ Sci Pollut Res 23(13):13508–13520. https://doi.org/10.1007/s11356-016-6511-x

Balcilar M, Ozdemir ZA, Tunçsiper B, Ozdemir H, & Shahbaz M (2019) On the nexus among carbon dioxide emissions, energy consumption and economic growth in G-7 countries: new insights from the historical decomposition approach. Environ Dev Sustain 22(8):8097–8134. https://doi.org/10.1007/s10668-019-00563-6

Balsalobre-Lorente D, Driha OM, Bekun FV, Osundina OA (2019) Do agricultural activities induce carbon emissions? The BRICS experience. Environ Sci Pollut Res 26(24):25218–25234

Banday UJ, & Aneja R (2020) Renewable and non-renewable energy consumption, economic growth and carbon emission in BRICS. Int J Energy Sec Manag 14(1):48–260. https://doi.org/10.1108/IJESM-02-2019-0007

Bond SR, & Eberhardt M (2013) Accounting for unobserved heterogeneity in panel time series models. Working Paper, Nuffield College, University of Oxford, Mimeo.

Bosah CP, Li S, Ampofo GKM, & Liu K (2021) Dynamic nexus between energy consumption, economic growth, and urbanization with carbon emission: evidence from panel PMG-ARDL estimation. Environ Sci Pollut Res 28(43):61201–61212. https://doi.org/10.1007/s11356-021-14943-x

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239–253

Cetin M, Ecevit E, Yucel AG (2018) The impact of economic growth, energy consumption, trade openness, and financial development on carbon emissions: empirical evidence from Turkey. Environ Sci Pollut Res 25(36):36589–36603

Chen P-Y, Chen S-T, Hsu C-S, Chen C-C (2016) Modeling the global relationships among economic growth, energy consumption and CO2 emissions. Renew Sustain Energy Rev 65:420–431

Chudik A, & and Pesaran M Hashem (2013) Large Panel Data Models with Cross Sectional Dependence: CAFE Research Paper No. 13.15, Available at SSRN: https://ssrn.com/abstract=2316333 or http://doi.org/10.2139/ssrn.2316333

Cowan WN, Chang T, Inglesi-Lotz R, Gupta R (2014) The nexus of electricity consumption, economic growth and CO2 emissions in the BRICS countries. Energy Policy 66:359–368

Dadon I (2019) Planning the second generation of smart cities: technology to handle the pressures of urbanization. IEEE Electrification Mag 7(3):6–15

de Souza Mendonca AK, Barni GdAC, Moro MF, Bornia AC, Kupek E, Fernandes L (2020) Hierarchical modeling of the 50 largest economies to verify the impact of GDP, population and renewable energy generation in CO2 emissions. Sustain Prod Consum 22:58–67

Doan MA, & Mckie D (2018) Chapter Four Crowdfunding: From Global Financial Crisis To Global Financial Communication. Expanding financial communication: Investor relations, crowdfunding, and democracy in the time of fintech, 89–109

Dumitrescu E-I, Hurlin C (2012) Testing for Granger non-causality in heterogeneous panels. Econ Model 29(4):1450–1460

Eberhardt M, Bond S (2009) Cross-section dependence in nonstationary panel models: a novel estimator. MPRA Paper 17692, University Library of Munich, Germany

Ehigiamusoe KU, Lean HH (2019) Effects of energy consumption, economic growth, and financial development on carbon emissions: evidence from heterogeneous income groups. Environ Sci Pollut Res 26(22):22611–22624

Erdogan S, Okumus I, Guzel AE (2020) Revisiting the Environmental Kuznets Curve hypothesis in OECD countries: the role of renewable, non-renewable energy, and oil prices. Environ Sci Pollut Res 27(19):23655–23663

Esen Ö, & Bayrak M (2017) Does more energy consumption support economic growth in net energy-importing countries? J Econ Finance Adm Sci 22(42):75–98. https://doi.org/10.1108/JEFAS-01-2017-0015

Friedman M (1937) The use of ranks to avoid the assumption of normality implicit in the analysis of variance. J Am Stat Assoc 32(200):675–701

Ganda F (2019) The impact of industrial practice on carbon emissions in the BRICS: a panel quantile regression analysis. Prog Ind Ecol 13(1):84–107

Gokmen S, Dagalp R, & Kilickaplan S (2020) Multicollinearity in measurement error models. Communications in Statistics - Theory and Methods, 1–12. https://doi.org/10.1080/03610926.2020.1750654

Goldman S (2003) Dreaming with BRICS. The path to 2050. Global economics paper no: 99, October.

Hafeez M, Yuan C, Shahzad K, Aziz B, Iqbal K, Raza S (2019) An empirical evaluation of financial development-carbon footprint nexus in One Belt and Road region. Environ Sci Pollut Res 26(24):25026–25036

Hongxing Y, Abban OJ, Boadi AD, & Ankomah-Asare ET (2021) Exploring the relationship between economic growth, energy consumption, urbanization, trade, and CO2 emissions: a PMG-ARDL panel data analysis on regional classification along 81 BRI economies. Environ Sc Pollut Res 28(46):66366–66388. https://doi.org/10.1007/s11356-021-15660-1

Hossain MS (2011) Panel estimation for CO2 emissions, energy consumption, economic growth, trade openness and urbanization of newly industrialized countries. Energy Policy 39(11):6991–6999

Işık C, Ongan S, Özdemir D (2019) Testing the EKC hypothesis for ten US states: an application of heterogeneous panel estimation method. Environ Sci Pollut Res 26(11):10846–10853

Islam MM, Khan MK, Tareque M, Jehan N, & Dagar V (2021) Impact of globalization, foreign direct investment, and energy consumption on CO2 emissions in Bangladesh: Does institutional quality matter? Environ Sci Pollution Res 28(35):48851–48871. https://doi.org/10.1007/s11356-021-13441-4

Joshua U, Bekun FV, & Sarkodie SA (2020) New insight into the causal linkage between economic expansion, FDI, coal consumption, pollutant emissions and urbanization in South Africa. AGDI Working Paper, No. WP/20/011, African Governance and Development Institute (AGDI), Yaoundé.

Kasperowicz R (2015) Economic growth and CO2 emissions: the ECM analysis. J Int Stud 8(3):91–98

Khan I, Hou F, Le HP (2021) The impact of natural resources, energy consumption, and population growth on environmental quality: fresh evidence from the United States of America. Sci Total Environ 754:142222

Khan K, Su C-W (2021) Urbanization and carbon emissions: a panel threshold analysis. Environ Sci Pollut Res 28(20):26073–26081. https://doi.org/10.1007/s11356-021-12443-6

Li K, Hu E, Xu C, Musah M, Kong Y, Mensah IA, … Su Y (2021a) A heterogeneous analysis of the nexus between energy consumption, economic growth and carbon emissions: evidence from the group of twenty (G20) countries. Energy Explor Exploitation 39(3):815–837

Li K, Zu J, Musah M, Mensah IA, Kong Y, Owusu-Akomeah M, … Agyemang JK (2021b) The link between urbanization, energy consumption, foreign direct investments and CO2 emanations: an empirical evidence from the emerging seven (E7) countries. Energy Explor Exploitation 01445987211023854

Lin B, Zhu J (2018) Changes in urban air quality during urbanization in China. J Clean Prod 188:312–321

Liu J-L, Ma C-Q, Ren Y-S, Zhao X-W (2020) Do real output and renewable energy consumption affect CO2 emissions? Evidence for selected BRICS countries. Energies 13(4):960

Liu Y (2009) Exploring the relationship between urbanization and energy consumption in China using ARDL (autoregressive distributed lag) and FDM (factor decomposition model). Energy 34(11):1846–1854

Mahmood H, Alkhateeb TTY, Al-Qahtani MMZ, Allam Z, Nawaz A, Furqan M (2020) Urbanization, oil price and pollution in Saudi Arabia. Int J Energy Econ Policy 10(2):477

Mahmood H, Chaudhary A (2012) FDI, population density and carbon dioxide emissions: a case study of Pakistan. Iran J Energy Environ 3(4):354–360

Mardani A, Streimikiene D, Nilashi M, Arias Aranda D, Loganathan N, Jusoh A (2018) Energy consumption, economic growth, and CO2 emissions in G20 countries: application of adaptive neuro-fuzzy inference system. Energies 11(10):2771

Martínez-Zarzoso I, Maruotti A (2011) The impact of urbanization on CO2 emissions: evidence from developing countries. Ecol Econ 70(7):1344–1353

Meher S (2021) Impact of economic growth and electricity consumption on CO2 emissions in BRICS countries: A panel data analysis. Nabakrushna Choudhury Centre for Development Studies, Working Paper No.81

Mensah IA, Sun M, Omari-Sasu AY, Gao C, Obobisa ES, & Osinubi TT (2021) Potential economic indicators and environmental quality in African economies: new insight from cross-sectional autoregressive distributed lag approach. Environ Sci Pollut Res 28(40):56865–56891. https://doi.org/10.1007/s11356-021-14598-8

Mesagan EP, Nwachukwu MI (2018) Determinants of environmental quality in Nigeria: assessing the role of financial development. Econ Res Financ 3(1):55–78

Mirza FM, Kanwal A (2017) Energy consumption, carbon emissions and economic growth in Pakistan: dynamic causality analysis. Renew Sustain Energy Rev 72:1233–1240

Muhammad B (2019) Energy consumption, CO2 emissions and economic growth in developed, emerging and Middle East and North Africa countries. Energy 179:232–245

Murshed M, Ahmed Z, Alam MS, Mahmood H, Rehman A, & Dagar V (2021) Reinvigorating the role of clean energy transition for achieving a low-carbon economy: evidence from Bangladesh. Environ Sci Pollut Res 28(47):67689–67710. https://doi.org/10.1007/s11356-021-15352-w

Musah M, Kong Y, Mensah IA, Antwi SK, & Donkor M (2020) The link between carbon emissions, renewable energy consumption, and economic growth: a heterogeneous panel evidence from West Africa. Environ Sci Pollut Res 27(23):28867–28889. https://doi.org/10.1007/s11356-020-08488-8

Musah M, Kong Y, Mensah IA, Antwi SK, Donkor M (2021) The connection between urbanization and carbon emissions: a panel evidence from West Africa. Environ Dev Sustain 23(8):11525–11552

Musah M, Kong Y, Mensah IA, Antwi SK, Osei AA, Donkor M (2021) Modelling the connection between energy consumption and carbon emissions in North Africa: evidence from panel models robust to cross-sectional dependence and slope heterogeneity. Environ Dev Sustain 23(10):15225–15239. https://doi.org/10.1007/s10668-021-01294-3

Musah M, Kong Y, Mensah IA, LiK, Vo XV, Bawuah J, . . . Donkor M (2021c) Trade openness and CO2 emanations: a heterogeneous analysis on the developing eight (D8) countries. Environ Sci Pollut Res 28(32):44200–44215. https://doi.org/10.1007/s11356-021-13816-7

Musah M, Kong Y, Vo XV (2021) Predictors of carbon emissions: an empirical evidence from NAFTA countries. Environ Sci Pollut Res 28(9):11205–11223

Musah M, Owusu-Akomeah M, Boateng F, Iddris F, Mensah IA, Antwi SK, Agyemang JK (2021) Long-run equilibrium relationship between energy consumption and CO2 emissions: a dynamic heterogeneous analysis on North Africa. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16360-6

Musah M, Owusu-Akomeah M, Nyeadi JD, Alfred M, Mensah IA (2021) Financial development and environmental sustainability in West Africa: evidence from heterogeneous and cross-sectionally correlated models. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16512-8

Namahoro JP, Wu Q, Xiao H, Zhou N (2021) The impact of renewable energy, economic and population growth on CO2 emissions in the East African region: evidence from common correlated effect means group and asymmetric analysis. Energies 14(2):312

Naqvi SAA, Shah SAR, Abbas N (2020) Nexus between urbanization, emission, openness, and energy intensity: panel study across income groups. Environ Sci Pollut Res 27(19):24253–24271

Nosheen M, Iqbal J, Khan HU (2021) Analyzing the linkage among CO2 emissions, economic growth, tourism, and energy consumption in the Asian economies. Environ Sci Pollut Res 28(13):16707–16719

Ozcan B (2013) The nexus between carbon emissions, energy consumption and economic growth in Middle East countries: a panel data analysis. Energy Policy 62:1138–1147

Ozturk I, Acaravci A (2010) CO2 emissions, energy consumption and economic growth in Turkey. Renew Sustain Energy Rev 14(9):3220–3225

Pao H-T, Tsai C-M (2010) CO2 emissions, energy consumption and economic growth in BRIC countries. Energy Policy 38(12):7850–7860

Paramati SR, Ummalla M, Apergis N (2016) The effect of foreign direct investment and stock market growth on clean energy use across a panel of emerging market economies. Energy Econ 56:29–41

Pata UK, Kahveci S (2018) A multivariate causality analysis between electricity consumption and economic growth in Turkey. Environ Dev Sustain 20(6):2857–2870

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. Cambridge Working Papers in Economics; Faculty of Economics. https://doi.org/10.17863/CAM.5113

Pesaran MH (2006) Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74(4):967–1012

Pesaran MH (2015) Testing weak cross-sectional dependence in large panels. Econ Rev 34(6–10):1089–1117

Pesaran MH, Schuermann T, Weiner SM (2004) Modeling regional interdependencies using a global error-correcting macroeconometric model. J Bus Econ Stat 22(2):129–162

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econ 142(1):50–93

Phale K, Li F, Adjei Mensah I, Omari-Sasu AY, Musah M (2021) Knowledge-based economy capacity building for developing countries: a panel analysis in Southern African Development Community. Sustainability 13(5):2890

Pham H (2019) A New Criterion for Model Selection. Mathematics, 7(12). https://doi.org/10.3390/math7121215

Qin L, Raheem S, Murshed M, Miao X, Khan Z, & Kirikkaleli D (2021) Does financial inclusion limit carbon dioxide emissions? Analyzing the role of globalization and renewable electricity output. Sustainable Development, 1–17. https://doi.org/10.1002/sd.2208

Raghutla C, & Chittedi KR (2021) Financial development, energy consumption, technology, urbanization, economic output and carbon emissions nexus in BRICS countries: an empirical analysis. Manag Environ Qual Int J 32(2):290–307. https://doi.org/10.1108/MEQ-02-2020-0035

Samour A, Isiksal A, Resatoglu N (2019) testing the impact of banking sector development on Turkey’s CO2 emissions. Appl Ecol Environ Res 17(3):6497–6513

Saudi MHM (2019) The role of renewable, non-renewable energy consumption and technology innovation in testing environmental Kuznets curve in Malaysia. Int J Energy Econ 9(1):299–307. https://doi.org/10.32479/ijeep.7327

Shahbaz M, Rasool G, Ahmed K, Mahalik MK (2016) Considering the effect of biomass energy consumption on economic growth: fresh evidence from BRICS region. Renew Sustain Energy Rev 60:1442–1450

Shahzad SJH, Kumar RR, Zakaria M, Hurr M (2017) Carbon emission, energy consumption, trade openness and financial development in Pakistan: a revisit. Renew Sustain Energy Rev 70:185–192

Sharma R, & Bhandari R (2013) Skewness, kurtosis and Newton’s inequality, Rocky Mountain Math. Rocky Mountain journal of mathematics, Vol. 45, pp. 1639–1643

Sheraz M, Deyi X, Ahmed J, Ullah S, & Ullah A (2021) Moderating the effect of globalization on financial development, energy consumption, human capital, and carbon emissions: evidence from G20 countries. Environ Sci Pollut Res 28(26):35126–35144. https://doi.org/10.1007/s11356-021-13116-0

Shoaib HM, Rafique MZ, Nadeem AM, Huang S (2020) Impact of financial development on CO2 emissions: a comparative analysis of developing countries (D 8) and developed countries (G 8). Environ Sci Pollut Res 27(11):12461–12475

Shuai C, Shen L, Jiao L, Wu Y, Tan Y (2017) Identifying key impact factors on carbon emission: evidences from panel and time-series data of 125 countries from 1990 to 2011. Appl Energy 187:310–325

Sun D-Q, Yi B-W, Xu J-H, Zhao W-Z, Zhang G-S, Lu Y-F (2018) Assessment of CO2 emission reduction potentials in the Chinese oil and gas extraction industry: from a technical and cost-effective perspective. J Clean Prod 201:1101–1110

Sun Y, Li M, Zhang M, Khan HSUD, Li J, Li, Z, … Anaba OA (2021) A study on China’s economic growth, green energy technology, and carbon emissions based on the Kuznets curve (EKC). Environ Sci Pollut Res 28(6):7200–7211

Tian X, Sarkis J, Geng Y, Bleischwitz R, Qian Y, Xu L, Wu R (2020) Examining the role of BRICS countries at the global economic and environmental resources nexus. J Environ Manag 262:110330

Toth G, Szigeti C (2016) The historical ecological footprint: from over-population to over-consumption. Ecol Indic 60:283–291

Ummalla M, Goyari P (2021) The impact of clean energy consumption on economic growth and CO2 emissions in BRICS countries: does the environmental Kuznets curve exist? J Public Aff 21(1):e2126

Ummalla M, Samal A, Goyari P (2019) Nexus among the hydropower energy consumption, economic growth, and CO2 emissions: evidence from BRICS countries. Environ Sci Pollut Res 26(34):35010–35022

Waheed R, Sarwar S, Wei C (2019) The survey of economic growth, energy consumption and carbon emission. Energy Rep 5:1103–1115

Wang F, Fan W, Liu J, Wang G, Chai W (2020) The effect of urbanization and spatial agglomeration on carbon emissions in urban agglomeration. Environ Sci Pollut Res 27(19):24329–24341. https://doi.org/10.1007/s11356-020-08597-4

Wang P, Wu W, Zhu B, Wei Y (2013) Examining the impact factors of energy-related CO2 emissions using the STIRPAT model in Guangdong Province, China. Appl Energy 106:65–71

Wang Q, Zhang F (2020) Does increasing investment in research and development promote economic growth decoupling from carbon emission growth? An empirical analysis of BRICS countries. J Clean Prod 252:119853

Wang Y, Li L, Kubota J, Han R, Zhu X, Lu G (2016) Does urbanization lead to more carbon emission? Evidence from a panel of BRICS countries. Appl Energy 168:375–380

Westerlund J, Edgerton DL (2007) A panel bootstrap cointegration test. Econ Lett 97(3):185–190

Westfall PH (2014) Kurtosis as peakedness, 1905–2014. RIP. Am Stat 68(3):191–195

Wu L, Jia X, Gao L, Zhou Y (2021) Effects of population flow on regional carbon emissions: evidence from China. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-15131-7