Abstract

This empirical study aims to test the validity of the environmental Kuznets curve (EKC) hypothesis for China within the framework of (Narayan and Narayan Energy Policy 38(1):661–666, 2010) approach. To this end, the study employs a recently developed Fourier ARDL procedure and time-varying causality test over the period 1965–2016 to analyze the short- and long-term relationships between economic growth, economic complexity index, energy consumption, and ecological footprint. The findings of the Fourier ARDL procedure confirm the existence of cointegration among the series. Moreover, the results of this study demonstrate that energy consumption and ecological complexity increase ecological footprint in both the short- and long term. However, the short-term elasticity of economic growth is smaller than the long-term elasticity, implying that the EKC hypothesis is not valid for China. This finding is robust as it is confirmed by the time-varying causality test. The overall results illustrate that economic complexity has an increasing impact on ecological footprint, and economic growth is not effective to solve environmental problems in China. Therefore, the Chinese government should encourage a more environmentally friendly production process and cleaner technologies in exports to reduce environmental pollution.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Today, air, water, and soil pollution pose a great danger for both human health and national economies. Despite the improving efficiency level, the increase in the level of pollution continues due to the human demand for natural resources. Air pollution in particular increased significantly over the last half-century. Considered as one of the most important air pollution indicators, carbon dioxide (CO2) emissions increased worldwide by 172% from 1967 (12,068 million tons) to 2016 (32,913 million tons; BP 2019). However, CO2 emissions are only an indication of air pollution. Wackernagel and Rees (1996) have developed a more comprehensive environmental pollution indicator by including water and soil pollution as well as air pollution. This indicator, called an ecological footprint (EF), measures human pressure on the environment as a global hectare area (gha) and reflects complex environmental issues (Wang et al. 2018).

Additionally, the EF represents human natural resource demand, while biocapacity represents the natural resource supply. By comparing the EF with biocapacity, the biologically productive area required for human consumption can be measured. If the demand for natural resources exceeds supply, then ecological deficit occurs. Meanwhile, the EF indicates the degree of human resource consumption that exceeds environmental limits (Yilanci and Pata 2020). For the first time, the world’s EF was higher than biocapacity in 1970, therefore illustrating that people live beyond the earth’s capacity (Hubacek et al. 2009). The problem, defined as the “ecological deficit,” continues to increase year by year. In connection, the worldwide EF increased by 133% from 1967 to 2016. Similarly, the carbon footprint, which is an indicator of air pollution within the EF, increased by 191% in the same period (Global Footprint Network 2019). When both CO2 emissions and EF are examined, it is evident that worldwide environmental conditions are worsening. Therefore, determining the factors affecting environmental pollution and thus taking various measures is essential for a better future.

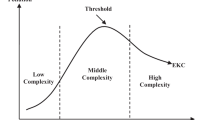

Fossil fuel-based energy consumption (EC) and economic development are the most important macroeconomic indicators that affect environmental degradation. On the one hand, many studies have proven that an increase in fossil fuel use reduces environmental quality (Saboori and Sulaiman 2013; Bölük and Mert 2014). On the other hand, Grossman and Krueger (1991) determine that there is an inverted U-shaped quadratic relationship between economic development and environmental pollution indicators such as dark matter, sulfur dioxide (SO2), and suspended particles. This relationship, which is described by Panayotou (1993) as the environmental Kuznets curve (EKC), implies that as the income level increases in the early stages of economic development, environmental pollution increases at first but then declines after attaining a certain threshold level of income. This theoretical proposition states that the environment deteriorates because the environmental pressure is higher in the early stages of economic growth (Narayan and Narayan 2010). Despite this, at high-income levels, economic development positively affects the environmental quality (Stern 2017).

In short, the EKC hypothesis claims that a better environment and sustainable growth will be accompanied by economic development. Nevertheless, income and square of income can be highly correlated. When testing the EKC hypothesis, using cubic or quadratic models can cause collinearity or multicollinearity problems. To overcome this problem, Narayan and Narayan (2010) propose testing the EKC hypothesis by comparing the short- and long-term income elasticity of linear models. They state that if short-term income elasticity is found to be higher than the elasticity in the long-term, then this indicates that environmental pollution will decrease over time, and the EKC hypothesis is valid. Brown and McDonough (2016) state that short- and long-term coefficients would not demonstrate the EKC shape and thus criticize Narayan and Narayan’s (2010) work. The validity of this criticism has not yet been proven, and the test of the EKC hypothesis by Narayan and Narayan’s approach continues in current studies (see, e.g., Dong et al. 2018a).

In the studies testing the validity of the EKC hypothesis, CO2 emissions are widely used as the dependent variable (Danish et al. 2017; Pata 2018a, b, 2019; Chen et al. 2019a; Munir et al. 2020). However, in recent studies, EF is also used to test the EKC hypothesis as an indicator of environmental pollution (Liu et al. 2018; Yilanci and Ozgur 2019). Furthermore, researchers investigate the validity of the EKC hypothesis by including different explanatory variables such as economic complexity, globalization, and democratization as well as income and EC (Can and Gozgor 2017; Usman et al. 2019; Bilgili et al. 2020). The economic complexity developed by Hidalgo and Hausmann (2009) is, briefly, a combination of a country’s productive output. In other words, it is a measure of a country’s ability to produce high value-added products and its productivity (Hausmann et al. 2014). In a society with advanced inputs, the level of productive output increases. Inputs include the level of knowledge and skills such as technology, human capital, institution, and legal system (Lee and Vu 2019). Therefore, economic complexity defines a country’s skill-based and knowledge-based efficient production capacity (Can and Gozgor 2017). Countries with higher economic complexity can produce more productivity products. Since the economic complexity index (ECI) is calculated only with the trade data of the United Nations, productivity products are based only on exports. The high ECI indicates that both high-complexity products and a wide variety of products are produced in a country. Differences in the complexity of the economy explain the diversity and sophistication of the products exported by countries. The ECI is calculated in terms of ubiquity and diversity of highly complex products. In complex economies, individuals and companies produce more diverse products with large networks and comprehensive knowledge and skills. On the contrary, simpler economies produce fewer and simpler products in a narrow space. In this context, economic complexity is an indicator of a country’s economic development level.

As this indicator is a part of economic development, it also relates to environmental pollution. Simple economies generally focus on the production of agricultural products and raw minerals and thus cause limited environmental degradation. However, more developed and industrialized economies, which have become more complex with the diversification in production, cause excessive environmental degradation (Swart and Brinkmann 2020). Finally, at high levels of economic complexity, economies become more environmentally friendly as they develop their levels of technology and knowledge. At such a stage, countries can reduce environmental pollution by producing more complex products with clean production technologies.

For the reasons mentioned above, economic complexity index, economic growth, and fossil fuel-based EC can affect environmental pressure. In this context, the main scope of this study is to investigate the EKC hypothesis, including the effect of Chinese economic complexity and EC in the analysis. The study contributes to the existing literature in two respects: (i) To the best of our knowledge, this is the first attempt to test the impact of the ECI on EF in China. (ii) The study for the first time investigates the EKC hypothesis using newly developed Fourier ARDL approach and a time-varying causality for China within the framework of Narayan and Narayan (2010). For these two reasons, we expect the study to enrich the existing literature.

The remainder of the study is designed as follows. The next section provides brief information about the economic and environmental situation in China. The following section describes the EKC literature, first summarizing studies on the EKC hypothesis for China, then investigating the studies based on Narayan and Narayan’s (2010) approach, and, finally, examining the literature on economic complexity and environmental pollution nexus. The following section presents the data and econometric methodology used in this work. This is followed by empirical results and discussion. Finally, the last section concludes the study and suggests specific environmental policy implications for China.

The economic and environmental situation in China

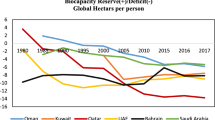

China’s ability to reduce environmental pollution is an important issue not only for the country but also for the whole world. China has the world’s second-largest economy, with current USD 13.608 trillion (constant USD 10.797 trillion) income in 2018 (World Bank 2020). In addition, China is the largest exporting country in the world. China ranked 33 out of 129 countries in terms of economic complexity in 2017 (OEC 2020). Economic complexity has increased in the country, especially since the 2000s. China’s large economy, high exports, and mid-upper economic complexity are based on an open economy model. After the 1978 economic reform, China experienced an extraordinary average growth rate of 9% between 1978 and 2012 (Li et al. 2016). This rapid growth caused the natural resource base to deplete and overload (Chen et al. 2007). Moreover, the concurrent, exponential increase in fossil fuel consumption has caused destructive and disruptive effects on the environment (Chen et al. 2019a); China has been the largest coal consumer on the Asian continent for a significant period of time. Since the 2008 global crisis, China has had an average annual growth rate of 6%. Although this has decreased compared to the past, environmental pollution has not decreased in the same proportion. In terms of environmental performance index, China ranks 120th among 180 countries, indicating that the country has poor environmental quality (Wendling et al. 2018). Though China is rich in natural resources, it lacks per capita resources and efficient technology (Hubacek et al. 2009). In 2016, China continued to have the world’s largest total EF, at 5.195 billion gha (Global Footprint Network 2019). However, in the last 4 years, both the total and per capita EF in China have started to decrease slightly. The per capita EF of China, which was 3.72 gha in 2013, dropped to 3.62 gha in 2016. Nevertheless, compared to the 1970s, human pressure on the environment has increased by over three times in the country. China has had an ecological deficit since 1969, and the biocapacity increase has been limited and thus not met the EF requirement. Figure 1 illustrates the ecological balance of the analysis period in China.

Figure 1 indicates that the ecological balance was achieved in China between 1965 and 1968. Per capita, EF first exceeded by a small amount in 1966, and this deterioration has increased since 1969. The ecological deficit continued to increase and reached 2.7 gha in 2013. This demonstrates that environmental conditions are not sustainable in China. Therefore, determining the factors affecting environmental problems in China is an important issue for both the country and the world as a whole.

Literature review

In the “Introduction” section, we mentioned various studies that investigate the validity of the EKC hypothesis using CO2 emissions and the EF as a dependent variable. The number of studies testing the EKC hypothesis is constantly increasing. Since there are numerous studies examining the EKC hypothesis, we focused only on specific literature. In our study, we divided the literature section into two parts: (a) studies testing the EKC hypothesis for China, and (b) studies testing the EKC hypothesis by including the ECI in the analysis.

Environmental pollution and growth nexus studies for China

Many researchers have investigated the validity of the EKC hypothesis for China using quadratic and cubic models. Some of the researchers found that the EKC hypothesis is valid for China. For instance, Shen (2006) performed a simultaneous equation model from 1993 to 2002, concluding that the EKC hypothesis is valid for chemical oxygen demand, arsenic, and cadmium emissions. The study also indicates a U-shaped curve for SO2 and no relationship between dust fall and economic growth. Jalil and Mahmud (2009) utilized the ARDL approach from 1975 to 2005 to confirm the validity of the EKC for CO2 emissions. Yin et al. (2015) used panel data from 2000 to 2012 to demonstrate that the EKC hypothesis is valid for CO2 emissions. Aslan and Gozbasi (2016) employed a fully modified ordinary least squares (FMOLS) and Granger causality test during the period between 1997 and 2013. They illustrated that the EKC hypothesis is valid for CO2 emissions from transportation, solid, liquid, and gaseous fuel consumption but that there is no inverted U-shaped relationship between income level and CO2 emissions from residential buildings and commercial and public services, manufacturing industries and construction, electricity and heat production, and aggregate emissions. Hao et al. (2016) used a spatial Durbin model for 29 Chinese provinces over the period 1995–2012 and concluded that the EKC hypothesis is valid for CO2 emissions. Li et al. (2016) employed panel data from 1996 to 2012 and verified the validity of the EKC hypothesis in 28 Chinese provinces for CO2, industrial wastewater, and industrial waste solid emissions. Wang et al. (2016) applied stochastic impacts by regression on population, affluence, and technology (STIRPAT) model over the period 1990–2012 and provided evidence in support of the EKC hypothesis for SO2 emissions. Cheng et al. (2017) performed a dynamic spatial panel model in 30 Chinese provinces for the period of 1997–2004 and detected an inverted U-shaped relationship between income level and CO2 emissions. Dong et al. (2017) utilized the Pedroni cointegration test, FMOLS, and dynamic least square (DOLS) estimators from 1995 to 2014 and demonstrated that an inverted U-shaped relationship exists between income and CO2 emissions. Wang et al. (2016) applied stochastic impacts by regression on population, affluence, and technology (STIRPAT) model over the period 1990–2012 and provided evidence in support of the EKC hypothesis for SO2 emissions. Cheng et al. (2017) performed a dynamic spatial panel model in 30 Chinese provinces for the period of 1997–2004 and detected an inverted U-shaped relationship between income level and CO2 emissions. Dong et al. (2017) utilized the Pedroni cointegration test, FMOLS, and dynamic least square (DOLS) estimators from 1995 to 2014 and demonstrated that an inverted U-shaped relationship exists between income and CO2 emissions. Riti et al. (2017) used the ARDL approach, impulse response, and variance decomposition analyses from 1970 to 2015 and verified the EKC hypothesis for CO2 emissions. Dong et al. (2018b) conducted the Bayer-Hanck cointegration test, ARDL approach, and vector error correction model (VECM) over the period 1993–2016. They stated that the EKC hypothesis is valid and that economic growth will begin to decrease CO2 emissions by approximately 2028. Zhang and Zhang (2018) employed the ARDL bounds test over the period 1982–2016 and verified the validity of the EKC for CO2 emissions. Chen et al. (2019a) performed the ARDL approach and VECM from 1980 to 2014. The authors included renewable energy production as an independent variable in the analysis and found that the EKC hypothesis is valid for CO2 emissions. Gokmenoglu et al. (2019) utilized the ARDL bounds test and VECM from 1971 to 2014 to conclude that the EKC hypothesis is valid for CO2 emissions. Zhao et al. (2020) utilized the generalized method of moments for 30 Chinese provinces from 2005 to 2015 and concluded that the EKC hypothesis is valid for CO2 emissions.

Contrary to these studies, the following research studies reach the opposite outcome. Wang et al. (2011) utilized a panel cointegration test and error correction model, covering the period of 1995–2007 for 28 provinces in China. They found a U-shaped relationship between CO2 emissions and income level. Pao et al. (2012) used an improved grey model from 1980 to 2009, finding that the estimated results cannot support the EKC hypothesis for CO2 emissions. Yang et al. (2015) used extreme bound analysis to investigate the relationship between seven pollution indicators (CO2, SO2, industrial SO2, industrial wastewater, industrial smoke, industrial gas, and industrial gas discharge), trade, foreign direct investment, population density, abatement expenditure, and income level in 29 Chinese provinces over the period 1995–2010. The authors determined that the EKC hypothesis is not valid and that there is an increasing monotonic relationship between economic growth and pollutants, such as CO2 emissions and industrial gas. He et al. (2017) conducted the STIRPAT regression model over the period 1995–2013 in 29 provinces of China and concluded that the obtained results do not confirm the EKC relationship between income level and CO2 emissions. Liu et al. (2018) examined the relationship between export diversification, income, and EF over the period 1990–2013. They concluded that though the EKC hypothesis is valid in Korea and Japan, it is not in China. Xu et al. (2018) used a panel cointegration test and VECM for 29 Chinese provinces, covering the period of 1985–2015, finding that the EKC is not valid for SO2 emissions. Chen et al. (2019b) used the Pedroni cointegration test and panel Granger causality test over the period 1995–2012. They indicated that the EKC is not supported in the western and central regions for CO2 emissions, while confirming the validity of the curve in the eastern region. Gui et al. (2019) applied a spatial panel model for 285 Chinese cities covering the period of 2006–2015 and determined that the EKC hypothesis is not valid for municipal solid waste generation. The authors also found that economic growth deteriorates environmental quality.

Given the above literature, 15 studies determined that the EKC hypothesis is valid, while the other eight were unable to confirm it. For China, only Liu et al. (2018) tested the EKC hypothesis using EF. In many studies, findings differ according to the environmental pollution indicator used. Although there are several studies in the literature testing the EKC hypothesis for China, no consensus has been reached (Xu 2018). To our knowledge, only two studies examined the EKC hypothesis using linear models for China. In the first study, Narayan and Narayan (2010) used the panel Pedroni cointegration test for the Middle East, South Asia, Latin America, East Asia, and Africa regions covering the period of 1980–2004. They demonstrated that the EKC hypothesis is not valid in China and approximately 65% of the sample for CO2 emissions. In the second, Dong et al. (2018a) performed the ARDL approach and VECM for China over the period 1965–2016. They verify the EKC hypothesis for CO2 emissions. The findings of these two studies hence differ from each other.

Economic complexity and environmental pollution studies for various countries

Some studies in the literature examine the impact of economic complexity on environmental pollution. In the first of these studies, Can and Gozgor (2017) used DOLS covering the period of 1964–2014. They proposed that EC increases CO2 emissions, while economic complexity suppresses environmental pollution. The findings of this study confirmed the validity of the EKC hypothesis for France. Moreover, Dogan et al. (2019) applied a panel quantile regression approach for 55 countries over the period 1971–2014. They indicated that the EKC hypothesis is valid in high-income countries, while there is a U-shaped relationship between CO2 emissions and economic growth in higher-middle-income and lower-middle-income countries. They also concluded that economic complexity stimulates environmental degradation in lower- and higher-middle-income countries, while it mitigates CO2 emissions in high-income countries. Lapatinas et al. (2019) performed fixed-effects two-stage least squares from 2002 to 2012. They concluded that economic complexity declines overall environmental pollution while stimulating particular air quality indicators such as CO2 emissions and fine particular matter. Their results also indicated that the EKC hypothesis is valid for 88 developing and developed countries. Neagu (2019) used cointegrating polynomial regression, panel FMOLS, and DOLS estimators for 25 selected European Union (EU) countries from 1995 to 2017, discovering an inverted U-shaped relationship between economic complexity and CO2 emissions for the whole panel and Belgium, France, Finland, Italy, Sweden, and the UK. Neagu and Teodoru (2019) utilized the Pedroni cointegration test, FMOLS, and DOLS estimators for 25 EU countries over the period 1995–2016. According to the study’s results, the increase in economic complexity raises greenhouse gas emissions in EU countries with both low and high economic complexity. Swart and Brinkmann (2020) used the first differences and fixed effect estimators from 2002 to 2014, demonstrating that economic complexity increases forest fires while decreasing waste generation. They also claimed that economic complexity has no impact on deforestation and air pollution in Brazil. The results of this study support the validity of the EKC hypothesis for waste generation and deforestation.

The impact of the ECI on environmental degradation can vary depending on the country or country groups studied and pollution indicators examined. None of the above studies have analyzed the effects of the ECI on environmental pollution in China. In addition, none investigate the impact of economic complexity on the EF. Hence, this study aims to fill these gaps in the current literature using the newly developed Fourier ARDL procedure.

Data and econometric methodology

In this study, in order to test the EKC hypothesis for China over the period 1965–2016, we used the following model:

where EF, GDP, EC, and ECI indicate per capita EF (gha), per capita GDP (constant 2010 USD), per capita EC (gigajoule), and ECI respectively. We compiled the data from four different sources. The EF data are obtained from the Global Footprint Network (2019); the GDP data are derived from World Development Indicators (World Bank 2020); the EC data are extracted from British Petroleum Statistical Review of World Energy (BP 2019); and the ECI data are collected from OEC (2020). Because China is a developing country, we expect the coefficient of ECI (β3) to be positive. Using the logarithmic form of the variables, we aimed to calculate elasticity and reduce heteroskedasticity problem.

Figure 2 presents the level values of the logarithmic variables on the right vertical axis and the first differenced values of these variables on the left vertical axis. The levels of per capita EF, per capita real GDP, and per capita EC have significantly increased over time. Moreover, it is also evident that the ECI increased from 1994 to 2014, while it decreased sharply from 2014 to 2015. While the level values of the variables have an increasing or decreasing trend, the first differenced values of the variables are almost horizontal with constant variance.

After examining the distribution of the variables, we tested the relationship in Eq. (1) using a bootstrap ARDL bounds test with a fractional Fourier frequency (FARDL) developed by Yilanci et al. (2020). The FARDL cointegration test has several attractive properties. Firstly, the regressors can be either I(0) or I(1); secondly, the test allows endogenous structural breaks; thirdly, the FARDL procedure can also provide effective and reliable results in small samples.

We can rewrite Eq. (1) in an unrestricted error correction representation, as in Eq. (2), to apply the FARDL test:

where Δ and p are the first difference operator and lag length respectively. d(t) is a deterministic term that can be defined as

where π = 3.1416, k is a particular frequency that is employed for approximating structural breaks, and t and T show the trend term and sample size respectively. We used a Fourier approximation as the function can capture an unknown number of breaks of both gradual and sharp structural changes. We determined optimal lag lengths and value of k that is in the interval k = [0.1, …, 5], employing Akaike Information Criteria (AIC). According to Christopoulos and Leon-Ledesma (2011), integer frequencies are useful for temporary breaks, while fractional frequencies imply permanent breaks.

Following Pesaran et al. (2001) and McNown et al. (2018), we tested the null hypothesis of no cointegration relationship using F test (FA), t test (t), and F test (FB), as in Eq. (3).

Testing results of FA, FB, and t produced four different cases:

-

Case 1: Cointegration occurs when FA, FB, and t are significant.

-

Case 2: No cointegration occurs when FA,FB, and t are insignificant.

-

Case 3: Degenerate case #1 occurs when FA and FB are significant but t is not significant.

-

Case 4: Degenerate case #2 occurs when FA and t are significant but FB is not significant.

All cases except case 1 imply that there is no cointegration among the variables. Since the critical values are computed using bootstrap simulations, they are based on the specific integration properties of the empirical data; thus, the possibility of inconclusion about the hypotheses using traditional ARDL bounds test is eliminated. In contrast, the performance of the bootstrap test is better in terms of power and size than the asymptotic test (e.g., the ARDL bounds test), as described by McNown et al. (2018).

Empirical results and discussion

The FARDL bounds testing procedure cannot be used when any of the variables included in the analysis are stationary at the second difference (i.e., I[2]). On the other hand, the time-varying causality test is sensitive to the optimal lag length, which varies according to the order of integration of the variables. Therefore, the first step of our analysis was to determine the integration levels of the variables using several unit root tests and tabulate the test results in Table 3 (see Appendix). The results of the unit root test provided the stationarity condition of the FARDL bounds test. We then tested the long-term relationship between the variables using the FARDL test and presented the results in Table 1.

The results of the FARDL test show that the optimal frequency is 3.5, which is evidence of a permanent break in the cointegration relationship. Moreover, all the test statistics are larger than the bootstrap critical values at the traditional levels, so we conclude that there is a long-term relationship among the variables. We present the long- and short-term estimation results in Table 2.

The long-term coefficients indicate that a 1% increase in GDP also creates a 0.06% increase in environmental pollution. Concurrently, EC and ECI have a positive effect on EF. A 1% increase in EC and ECI increases EF by 0.47% and 0.15% respectively. The EC is the most important factor that increases EF. The outcome of the positive impact of EC on pollution in China is in line with the findings of Jalil and Mahmud (2009), Wang et al. (2011), Pao et al. (2012), Li et al. (2016), Riti et al. (2017), and Gokmenoglu et al. (2019). Although China is the world’s largest renewable energy consumer, coal consumption in the country is quite high. In addition, China’s energy efficiency is very low (Feng et al. 2018). For these reasons, China’s primary EC continues to increase environmental pressure. To reduce the negative effects of EC on the environment, the Chinese government needs to implement a more comprehensive and environmentally friendly energy policy than the current one.

The result that economic complexity increases environmental degradation is consistent with the findings of Dogan et al. (2019) for CO2 emissions in lower- and higher-middle-income countries, Lapatinas et al. (2019) for CO2 emissions and fine particular matter in 88 countries, Neagu and Teodoru (2019) for greenhouse gas emissions in European countries with both low and high economic complexity, and Swart and Brinkmann (2020) for forest fires in Brazil. This finding shows that China produces and exports products that cause environmental pollution. The country has not yet used pollution-reducing technologies adequately in the production of export goods that require high levels of knowledge and skills. At the same time, China has become a pollution haven for many developed countries. Developed countries realize the production process of many consumer goods in China due to cheap labor. In the production process of advanced and complex products, excessive use of natural resources takes place, and thus EF increases. Because of all these reasons, China should consider economic complexity as a criterion while creating environmental policies.

After investigating the long-term findings, we estimated the error correction model that is based on the FARDL procedure to obtain short-term coefficients. The results show that while GDP has a decreasing effect on the short term, EC and ECI have a positive effect on the EF. The coefficient of error correction term (ECT) is found as statistically significant and has a negative value that indicates a deviation from the long-term equilibrium will be corrected. The results demonstrate that the short-term coefficient of GDP is smaller than the long-term. This indicates that the EKC hypothesis is not valid for China, because economic growth increases the environmental quality in the short-term while it stimulates the EF in the long-term. These findings do not support the results of Can and Gozgor (2017), who examine the relationship between the ECI and environmental pollution for the first time. The authors state that the economic complexity mitigates CO2 emissions in France. However, it is important to acknowledge that the environmental pollution indicator and country examined by the authors are different from our study. Therefore, the differences in findings are not surprising. Our results also differ from the findings of Dong et al. (2018a), who argue that the short-term coefficient of GDP in China is higher than the long-term coefficient. Moreover, Narayan and Narayan (2010) illustrate that the EKC hypothesis is invalid for China. However, the authors determined that the GDP coefficient is positive in both periods. In our findings, although the EKC hypothesis is not valid, the short-term coefficient of GDP is negative and therefore differs from the results of Narayan and Narayan (2010).

Finally, we applied the bootstrap causality test of Hacker and Hatemi (2006) in a time-varying form to see instabilities in the causality relationship over time. There are two main advantages to using this test over the alternatives: it is not necessary to take differences of the variables if they have a unit root, and the test does not necessitate to test the cointegration relationship prior to the causality testing. By employing this test in a time-varying manner, we can reveal dates in which causality relationship exists. In the following figures, the solid line that is drawn parallel to the bottom axis shows the threshold line. The values that are above this line indicate the non-rejection of the null hypothesis of no causality exists.

We tested the causality relationship between the EF and the GDP, and Fig. 3 provides the results. The dashed line indicates the test statistics that are used for testing the null hypothesis that causality runs from the GDP to the EF. The solid line (i.e., black with squares) illustrates the statistics that are computed for testing the null hypothesis that no causality exists from the EF to the EC. The results reveal that there exists a causality relationship from GDP to EF in 1997–1999 and 2004–2005, while reverse causality exists from EF to GDP in 1981 and 2014. Moreover, Fig. 3 demonstrates that the causality relationship from EF to GDP has increased twice and peaked and then decreased. Since this causality relationship has reached the top point twice and then decreased, there is no threshold income level. It has been proven that, for China, there is no inverted U-shaped relationship between EF and GDP. Therefore, the findings of the causality test also imply that the EKC hypothesis is not valid in China.

We next tested the causality relationship between EF and EC; the results of which are provided in Fig. 4.

These results display that there exists causality from EC to EF in 1979, 1984, 1991, 1999–2009, and 2016, while the reverse causality relationship is valid for the periods 1992–1996, 2002–2005, and 2015–2016. The causality relationship from EF to EC is limited. Meanwhile, the causality relationship from EC to EF is found in approximately 30% of the sample period. This demonstrates that China’s primary EC has caused significant environmental degradation. Moreover, the bidirectional causality relationship between EF and EC in 2016 indicates that human pressures on the environment have an impact on EC decisions and that EC has caused environmental degradation in recent years. The following figure consists of the test statistics for the causality relationship between EF and ECI.

Figure 5 illustrates that causality runs from ECI to EF in 1981–1987, 2006, and 2008–2011, while a causality exists from EF to ECI in 1982–1983, 1985, 1999, and 2001. These findings reveal that the ECI is effective in the increase of EF.

Conclusions and policy recommendations

In this empirical study, the relationships between per capita EF, per capita real GDP, per capita EC, and ECI in China are investigated by recent time series methods, including FARDL bounds testing procedure and time-varying causality test. The FARDL test outcomes demonstrate that all independent variables have a long-term relationship with EF in China. The negative and statistically significant coefficient of the ECT also confirms the cointegration relationship. The long-term coefficients indicate that economic complexity, EC, and economic growth impede environmental quality. Moreover, the short-term coefficients illustrate that increasing economic complexity and EC increases EF, whereas economic growth has a reducing effect on environmental pressure. According to the results of the FARDL model, the per capita real income elasticity has risen from − 0.142 in the short term to 0.060 in the long term. The positive long-term income elasticity and negative short-term income elasticity do not support the validity of the EKC hypothesis. These findings prove that as economic growth increases in China, environmental pollution continues to increase in the long-term, and, therefore, economic development is not a solution for environmental problems. This empirical evidence also indicates that natural resources are used excessively and inefficiently in the process of economic growth. Overconsumption and inefficient use of natural resources is a sign that China’s economic development model is not sustainable. China thus must take various measures to protect natural resources and provide a cleaner environment alongside its economic growth. For instance, the Chinese government could provide tax exemptions and low-interest credits to companies that use natural resources effectively. In addition, policymakers could expand the share of research and development of clean technologies in national income and give innovative subsidies to environmental firms.

Regarding other independent variables, the long-term estimates indicate that EC and economic complexity increase EF. Moreover, the results of the time-varying causality test demonstrate that EC and economic complexity cause environmental pollution in certain periods. As a result, these two variables stimulate increasing human-environmental pressure. According to the World Bank (2020) data, fossil fuels made up 84.4% of China’s total EC in 2014. Renewable EC in China is low compared to fossil fuels. Since fossil fuel use significantly increases environmental pollution, the Chinese government needs to implement policies that increase energy efficiency and encourage the use of cleaner energy sources. Energy efficiency can be increased by using new energy-saving technologies. Moreover, the share of fossil fuel-based EC within total EC could be reduced by decreasing energy intensity and providing renewable energy substitutions. To improve environmental quality, policymakers should implement energy conservation policies in China. In addition, environmental awareness-raising programs carried out by various organizations should be financially supported to reduce human pressure on the environment. In regard to economic complexity, it is evident that China’s heavy industry production increases environmental pollution. As a developing country, China consumes more natural resources and increases environmental pollution when it produces more complex and informed products. Economic growth and greater exports take precedence over environmental concerns for China. Environmental laws applied to export companies in China are more flexible than in developed countries. Although China has high growth rates, its economic complexity lags behind many high-income countries. It can thus be said that the current economic complexity in China does not encourage environmentally friendly technologies. Hence, economic complexity increases China’s EF. In order to reduce the EF, the export process should be carried out with more environmentally friendly and technological methods. Additionally, the Chinese government should increase investments and expenses on pollution abatement programs to reduce China’s EF.

Finally, this study provides two main research opportunities. In future research, the validity of the EKC hypothesis can be tested for more economically complex countries using the FARDL approach. In addition, the effects of the economic complexity on environmental pollution can be investigated for Chinese provinces.

References

Aslan A, Gozbasi O (2016) Environmental Kuznets curve hypothesis for sub-elements of the carbon emissions in China. Nat Hazards 82(2):1327–1340. https://doi.org/10.1007/s11069-016-2246-8

Bilgili F, Ulucak R, Koçak E, İlkay SÇ (2020) Does globalization matter for environmental sustainability? Empirical investigation for Turkey by Markov regime switching models. Environ Sci Pollut Res 27(1):1087–1100. https://doi.org/10.1007/s11356-019-06996-w

Bölük G, Mert M (2014) Fossil & renewable energy consumption, GHGs (greenhouse gases) and economic growth: Evidence from a panel of EU (European Union) countries. Energy 74:439–446. https://doi.org/10.1016/j.energy.2014.07.008

BP (2019) British petroleum statistical review of world energy. https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/xlsx/energy-economics/statistical-review/bp-stats-review-2019-all-data.xlsx Accessed 12 February 2020

Brown SP, McDonough IK (2016) Using the environmental Kuznets curve to evaluate energy policy: some practical considerations. Energy Policy 98:453–458. https://doi.org/10.1016/j.enpol.2016.09.020

Can M, Gozgor G (2017) The impact of economic complexity on carbon emissions: evidence from France. Environ Sci Pollut Res 24(19):16364–16370. https://doi.org/10.1007/s11356-017-9219-7

Chen B, Chen GQ, Yang ZF, Jiang MM (2007) Ecological footprint accounting for energy and resource in China. Energy Policy 35(3):1599–1609. https://doi.org/10.1016/j.enpol.2006.04.019

Chen Y, Wang Z, Zhong Z (2019a) CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renew Energy 131:208–216. https://doi.org/10.1016/j.renene.2018.07.047

Chen Y, Zhao J, Lai Z, Wang Z, Xia H (2019b) Exploring the effects of economic growth, and renewable and non-renewable energy consumption on China’s CO2 emissions: evidence from a regional panel analysis. Renew Energy 140:341–353. https://doi.org/10.1016/j.renene.2019.03.058

Cheng Z, Li L, Liu J (2017) The emissions reduction effect and technical progress effect of environmental regulation policy tools. J Clean Prod 149:191–205. https://doi.org/10.1016/j.jclepro.2017.02.105

Christopoulos DK, Leon-Ledesma MA (2011) International output convergence, breaks, and asymmetric adjustment. Stud Nonlin Dynam Economet 15(3):1558–3708. https://doi.org/10.2202/1558-3708.1823

Danish ZB, Wang B, Wang Z (2017) Role of renewable energy and non-renewable energy consumption on EKC: evidence from Pakistan. J Clean Prod 156:855–864. https://doi.org/10.1016/j.jclepro.2017.03.203

Dogan B, Saboori B, Can M (2019) Does economic complexity matter for environmental degradation? An empirical analysis for different stages of development. Environ Sci Pollut Res 26(31):31900–31912. https://doi.org/10.1007/s11356-019-06333-1

Dong K, Sun R, Hochman G, Zeng X, Li H, Jiang H (2017) Impact of natural gas consumption on CO2 emissions: panel data evidence from China’s provinces. J Clean Prod 162:400–410. https://doi.org/10.1016/j.jclepro.2017.06.100

Dong K, Sun R, Dong X (2018a) CO2 emissions, natural gas and renewables, economic growth: assessing the evidence from China. Sci Total Environ 640:293–302. https://doi.org/10.1016/j.scitotenv.2018.05.322

Dong K, Sun R, Jiang H, Zeng X (2018b) CO2 emissions, economic growth, and the environmental Kuznets curve in China: what roles can nuclear energy and renewable energy play? J Clean Prod 196:51–63. https://doi.org/10.1016/j.jclepro.2018.05.271

Feng C, Wang M, Zhang Y, Liu GC (2018) Decomposition of energy efficiency and energy-saving potential in China: a three-hierarchy meta-frontier approach. J Clean Prod 176:1054–1064. https://doi.org/10.1016/j.jclepro.2017.11.231

Global Footprint Network (2019) National footprint accounts. http://data.footprintnetwork.org/#/countryTrends?cn=351&type=BCpc,EFCpc Accessed 17 February 2020

Gokmenoglu KK, Taspinar N, Kaakeh M (2019) Agriculture-induced environmental Kuznets curve: the case of China. Environ Sci Pollut Res 26:37137–37151. https://doi.org/10.1007/s11356-019-06685-8

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement. (NBER Working Paper No. 3914). Retrieved from National Bureau of Economic Research website: http://www.nber.org/papers/w3914

Gui S, Zhao L, Zhang Z (2019) Does municipal solid waste generation in China support the Environmental Kuznets Curve? New evidence from spatial linkage analysis. Waste Manag 84:310–319. https://doi.org/10.1016/j.wasman.2018.12.006

Hacker RS, Hatemi JA (2006) Tests for causality between integrated variables using asymptotic and bootstrap distributions: theory and application. Appl Econ 38(13):1489–1500. https://doi.org/10.1080/00036840500405763

Hao Y, Liu Y, Weng JH, Gao Y (2016) Does the Environmental Kuznets Curve for coal consumption in China exist? New evidence from spatial econometric analysis. Energy 114:1214–1223. https://doi.org/10.1016/j.energy.2016.08.075

Hausmann R, Hidalgo CA, Bustos S, Coscia M, Simoes A, Yildirim MA (2014) The atlas of economic complexity: mapping paths to prosperity. MIT Press, Cambridge

He Z, Xu S, Shen W, Long R, Chen H (2017) Impact of urbanization on energy related CO2 emission at different development levels: regional difference in China based on panel estimation. J Clean Prod 140:1719–1730. https://doi.org/10.1016/j.jclepro.2016.08.155

Hidalgo CA, Hausmann R (2009) The building blocks of economic complexity. Proc Natl Acad Sci 106(26):10570–10575. https://doi.org/10.1073/pnas.0900943106

Hubacek K, Guan D, Barrett J, Wiedmann T (2009) Environmental implications of urbanization and lifestyle change in China: ecological and water footprints. J Clean Prod 17(14):1241–1248. https://doi.org/10.1016/j.jclepro.2009.03.011

Jalil A, Mahmud SF (2009) Environment Kuznets curve for CO2 emissions: a cointegration analysis for China. Energy Policy 37(12):5167–5172. https://doi.org/10.1016/j.enpol.2009.07.044

Lapatinas A, Garas, A, Boleti E, Kyriakou A (2019) Economic complexity and environmental performance: evidence from a world sample. MPRA Paper No. 92833.

Lee KK, Vu TV (2019) Economic complexity, human capital and income inequality: a cross-country analysis. Jpn Econ Rev. https://doi.org/10.1007/s42973-019-00026-7

Li T, Wang Y, Zhao D (2016) Environmental Kuznets curve in China: new evidence from dynamic panel analysis. Energy Policy 91:138–147. https://doi.org/10.1016/j.enpol.2016.01.002

Liu H, Kim H, Liang S, Kwon OS (2018) Export diversification and ecological footprint: a comparative study on EKC theory among Korea, Japan, and China. Sustainability 10(10):3657. https://doi.org/10.3390/su10103657

McNown R, Sam CY, Goh SK (2018) Bootstrapping the autoregressive distributed lag test for cointegration. Appl Econ 50(13):1509–1521. https://doi.org/10.1080/00036846.2017.1366643

Munir Q, Lean HH, Smyth R (2020) CO2 emissions, energy consumption and economic growth in the ASEAN-5 countries: a cross-sectional dependence approach. Energy Econ 85:104571. https://doi.org/10.1016/j.eneco.2019.104571

Narayan PK, Narayan S (2010) Carbon dioxide emissions and economic growth: panel data evidence from developing countries. Energy Policy 38(1):661–666. https://doi.org/10.1016/j.enpol.2009.09.005

Neagu O (2019) The link between economic complexity and carbon emissions in the European Union countries: a model based on the environmental Kuznets curve (EKC) approach. Sustainability 11(17):4753. https://doi.org/10.3390/su11174753

Neagu O, Teodoru MC (2019) The relationship between economic complexity, energy consumption structure and greenhouse gas emission: heterogeneous panel evidence from the EU countries. Sustainability 11(2):497. https://doi.org/10.3390/su11020497

OEC (2020) Economic complexity rankings. https://oec.world/en/rankings/country/neci/ Accessed 17 February 2020

Panayotou T (1993) Empirical tests and policy analysis of environmental degradation at different stages of economic development. Working Paper, Technology and Employment Programme, International Labour Office, Geneva, WP238.

Pao HT, Fu HC, Tseng CL (2012) Forecasting of CO2 emissions, energy consumption and economic growth in China using an improved grey model. Energy 40(1):400–409. https://doi.org/10.1016/j.energy.2012.01.037

Pata UK (2018a) The effect of urbanization and industrialization on carbon emissions in Turkey: evidence from ARDL bounds testing procedure. Environ Sci Pollut Res 25(8):7740–7747. https://doi.org/10.1007/s11356-017-1088-6

Pata UK (2018b) The influence of coal and noncarbohydrate energy consumption on CO2 emissions: revisiting the environmental Kuznets curve hypothesis for Turkey. Energy 160:1115–1123. https://doi.org/10.1016/j.energy.2018.07.095

Pata UK (2019) Environmental Kuznets curve and trade openness in Turkey: bootstrap ARDL approach with a structural break. Environ Sci Pollut Res 26(20):20264–20276. https://doi.org/10.1007/s11356-019-05266-z

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326. https://doi.org/10.1002/jae.616

Riti JS, Song D, Shu Y, Kamah M (2017) Decoupling CO2 emission and economic growth in China: Is there consistency in estimation results in analyzing environmental Kuznets curve? J Clean Prod 166:1448–1461. https://doi.org/10.1016/j.jclepro.2017.08.117

Saboori B, Sulaiman J (2013) Environmental degradation, economic growth and energy consumption: Evidence of the environmental Kuznets curve in Malaysia. Energy Policy 60:892–905. https://doi.org/10.1016/j.enpol.2013.05.099

Shen J (2006) A simultaneous estimation of environmental Kuznets curve: evidence from China. China Econ Rev 17(4):383–394. https://doi.org/10.1016/j.chieco.2006.03.002

Stern DI (2017) The environmental Kuznets curve after 25 years. J Bioecon 19(1):7–28. https://doi.org/10.1007/s10818-017-9243-1

Swart J, Brinkmann L (2020) Economic complexity and the environment: evidence from Brazil. In: Universities and sustainable communities: meeting the goals of the agenda 2030. Springer, Cham, pp 3–45. https://doi.org/10.1007/978-3-030-30306-8_1

Usman O, Iorember PT, Olanipekun IO (2019) Revisiting the environmental Kuznets curve (EKC) hypothesis in India: the effects of energy consumption and democracy. Environ Sci Pollut Res 26(13):13390–13400

Wackernagel M, Rees W (1996) Our ecological footprint: reducing human impact on the earth. New Society Publishers, The New Catalyst Bioregional Series

Wang SS, Zhou DQ, Zhou P, Wang QW (2011) CO2 emissions, energy consumption and economic growth in China: a panel data analysis. Energy Policy 39(9):4870–4875. https://doi.org/10.1016/j.enpol.2011.06.032

Wang Y, Han R, Kubota J (2016) Is there an environmental Kuznets curve for SO2 emissions? A semi-parametric panel data analysis for China. Renew Sust Energ Rev 54:1182–1188. https://doi.org/10.1016/j.rser.2015.10.143

Wang Z, Yang L, Yin J, Zhang B (2018) Assessment and prediction of environmental sustainability in China based on a modified ecological footprint model. Resour Conserv Recycl 132:301–313. https://doi.org/10.1016/j.resconrec.2017.05.003

Wendling ZA, Emerson JW, Esty DC, Levy MA, de Sherbinin A (2018) 2018 environmental performance index. Yale Center for Environmental Law & Policy, New Haven

World Bank (2020) World development indicators online database. https://databank.worldbank.org/source/world-development-indicators. Accessed 17 February 2020

Xu T (2018) Investigating environmental Kuznets curve in China–aggregation bias and policy implications. Energy Policy 114:315–322. https://doi.org/10.1016/j.enpol.2017.12.027

Yang H, He J, Chen S (2015) The fragility of the Environmental Kuznets Curve: revisiting the hypothesis with Chinese data via an “Extreme Bound Analysis”. Ecol Econ 109:41–58. https://doi.org/10.1016/j.ecolecon.2014.10.023

Yilanci V, Ozgur O (2019) Testing the environmental Kuznets curve for G7 countries: evidence from a bootstrap panel causality test in rolling windows. Environ Sci Pollut Res 26(24):24795–24805. https://doi.org/10.1007/s11356-019-05745-3

Yilanci V, Pata UK (2020) Convergence of per capita ecological footprint among the ASEAN-5 countries: evidence from a non-linear panel unit root test. Ecol Indic 113:106178. https://doi.org/10.1016/j.ecolind.2020.106178

Yilanci V, Bozoklu S, Gorus MS (2020) Are BRICS countries pollution havens? Evidence from a Bootstrap ARDL Bounds testing approach with a Fourier function. Sustain Cities Soc 55:102035. https://doi.org/10.1016/j.scs.2020.102035

Yin J, Zheng M, Chen J (2015) The effects of environmental regulation and technical progress on CO2 Kuznets curve: an evidence from China. Energy Policy 77:97–108. https://doi.org/10.1016/j.enpol.2014.11.008

Zhang Y, Zhang S (2018) The impacts of GDP, trade structure, exchange rate and FDI inflows on China’s carbon emissions. Energy Policy 120:347–353. https://doi.org/10.1016/j.enpol.2018.05.056

Zhao J, Jiang Q, Dong X, Dong K (2020) Would environmental regulation improve the greenhouse gas benefits of natural gas use? A Chinese case study. Energy Econ 87:104712. https://doi.org/10.1016/j.eneco.2020.104712

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there is no conflict of interest.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Yilanci, V., Pata, U.K. Investigating the EKC hypothesis for China: the role of economic complexity on ecological footprint. Environ Sci Pollut Res 27, 32683–32694 (2020). https://doi.org/10.1007/s11356-020-09434-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-09434-4