Abstract

This paper examines the dynamic short- and long-term relationship between per capita GDP, per capita energy consumption, financial development, urbanization, industrialization, and per capita carbon dioxide (CO2) emissions within the framework of the environmental Kuznets curve (EKC) hypothesis for Turkey covering the period from 1974 to 2013. According to the results of the autoregressive distributed lag bounds testing approach, an increase in per capita GDP, per capita energy consumption, financial development, urbanization, and industrialization has a positive effect on per capita CO2 emissions in the long term, and also the variables other than urbanization increase per capita CO2 emissions in the short term. In addition, the findings support the validity of the EKC hypothesis for Turkey in the short and long term. However, the turning points obtained from long-term regressions lie outside the sample period. Therefore, as the per capita GDP increases in Turkey, per capita CO2 emissions continue to increase.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In today’s world, environmental pollution is one of the biggest barriers to sustainable economic growth. Increased economic development through rapid industrialization and urbanization causes increased environmental pollution. Urbanization enables the transfer of labor from agricultural production to urban production, thus leading to economic transformation in several countries (Henderson 2003). However, an increased urban population, together with better living standards and job opportunities, leads to increased CO2 emissions. Cities around the world account for more than two thirds of global energy use, leading to 70% of energy-related carbon dioxide emissions (IRENA 2016).

Industrialization is another important factor increasing CO2 emissions due to increased energy consumption. Economists calculate the growth levels of countries using GDP per capita, and there is a close relationship between economic growth, the share of the industrial sector in the GDP, and the structure of the industrial sector (Panayotou 1993). The economies with low agriculture-based per capita GDP at the beginning gradually began to produce light-industry products. Having achieved medium income levels or having become industrialized through the years, these countries have proceeded to the point of manufacturing heavy-industry products. It is not possible for a middle-income country to achieve economic growth without urbanization and industrialization, or for a high-income country to achieve economic growth without big developed cities (World Bank 2009). During the manufacturing of heavy-industry products, the increased use of natural resources in the urban-industrial centers leads to environmental pollution, especially in countries with an economic growth rate over 5% (Munasinghe 1999).

As the income per capita and the welfare level of a country increases, environmentalist policies are developed, and reduction of CO2 emissions becomes one of the goals. In some countries, the level of technology increases as the income level increases. In countries that transform from the industrial sector to the service sector as a result of increased technology, the intensity of raw material usage and CO2 emissions leading to environmental pollution is reduced. As countries’ income per capita increases to the top level, their environmental awareness increases, and they develop better finance systems. Additionally, these countries’ abilities to afford to meet the costs of reducing environmental pollution increase. Thus, economic growth turns from an enemy of the environment into a friend when a certain level of income per capita is reached (Panayotou 1993).

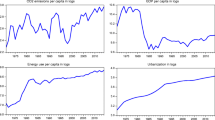

Energy is an important and indispensable production factor for economic growth that used directly production process (Stern 1997; Stern 2004). Although energy has advantages for an economy by providing production and transportation activities, it also has disadvantages because it increases the environmental pollution (Anatasia 2015). The most important reason for the increase in CO2 emissions is seen as energy consumption, especially from fossil fuels such as oil, gas, and coal (Saboori and Sulaiman 2013). Especially in developing countries, CO2 emissions have increased due to the consumption of oil and fossil fuels during the process of achieving high growth rates through industrialization. In Turkey, a developing country, these emissions have continued to increase over the years. According to the World Development Indicators (World Bank 2016), Turkey emitted 59,486 kt CO2 in 1973. This amount increased by 481% in 2013, corresponding to 345,981 kt. In the same period, the Turkish economy grew by 4.48% on average, and Turkey’s total energy consumption also increased from 19,863 to 85,520 ktoe, 88.2% of which derived from fossil fuel consumption. Fossil fuel consumption has increased in Turkey as energy demand and consumption have increased.

Reducing CO2 emissions is extremely important to achieving sustainable development in Turkey, a candidate country for addition to the European Union, which aims to be among the top 10 biggest economies in the world.

This study, consisting of five sections, tests the validity of the EKC hypothesis for Turkey by incorporating the effects of financial development, industrialization, urbanization, total energy consumption, and primary energy consumption into the analysis. Following the introduction, the study presents literature review, describes the data set and model, introduces the empirical methods, presents the findings obtained using the empirical methods, and finally sets out conclusions and suggestions to policy makers.

Literature review

Grossman and Krueger (1991) performed the first empirical analysis to test environmental degradation and per capita GDP nexus. Their findings indicated that there was an inverted U-shaped relation between per capita GDP and sulfur dioxide and dark-matter concentrations, which turns from positive to negative. Shafik and Bandyopadhyay (1992) reached same conclusions for 149 countries covering the period of 1960–1990. Panayotou (1993) coined the term environmental Kuznets curve (EKC) to define this relationship.

It is important to eliminate the problem of the omitted variable while examining the validity of the EKC hypothesis. Because income level is not the only factor affecting CO2 emissions, studies have begun to incorporate other variables, such as energy consumption, energy price, financial development, urbanization, industrialization, trade openness, and foreign direct investments into the analysis while testing the EKC hypothesis.

There are various studies on this issue in the literature, and there is no consensus on whether the EKC hypothesis is valid or not. However, there are a small number of studies that include industrialization and urbanization in the analysis of the EKC hypothesis, and these studies are quite new. Cole (2004) in OECD and non-OECD countries, Farhani et al. (2014) in ten MENA countries, and Apergis and Ozturk (2015) in Asian countries tested the validity of the EKC hypothesis and found that industrialization increased CO2 emissions.

On the other hand, Shahbaz et al. (2013a) in South Africa, Shafiei and Salim (2014) in 29 OECD countries, Shahbaz et al. (2014) in United Arab Emirates, Farhani and Ozturk (2015) in Tunisia, Jebli and Youssef (2015) in Tunisia, Kasman and Duman (2015) in EU member and candidate countries, Ozturk and Al-Mulali (2015) in Cambodia, Shahbaz et al. (2015) in Portugal, Al-Mulali et al. (2016) in Kenya, Dogan and Turkekul (2016) in the USA, Katircioğlu and Katircioğlu (2017) in Turkey, and Ozatac et al. (2017) in Turkey reported that urbanization increased CO2 emissions.

There are also various studies on this issue for Turkey in the national literature. Lise (2006) used OLS method for the period between 1980 and 2003 and found that the EKC hypothesis was invalid, and as the per capita GDP increases, per capita CO2 emissions continue to increase. Lise and Van Montfort (2007) performed Engle-Granger cointegration and error correction model (ECM) covering the period of 1970–2003 and found that the EKC hypothesis was invalid. Akbostancı et al. (2009) utilized panel data analysis for the period of 1992–2001 and time series analysis for the period of 1968–2003. They concluded that the EKC hypothesis was invalid and there was an N-shaped relationship between per capita GDP, per capita particulate matter, and SO2 and CO2 emissions. Halicioglu (2009) performed the autoregressive distributed lag (ARDL) bounds testing, Johansen-Juselius cointegration, and ECM covering the period 1960–2005. He found that the EKC hypothesis was invalid and trade openness and per capita energy consumption had a positive impact on per capita CO2 emissions in the long term. Ozturk and Acaravci (2010) used the ARDL bounds testing and ECM for the period of 1968–2005 and found that the EKC hypothesis was valid. Ozturk and Acaravci (2013) employed the ARDL bounds testing and vector error correction model (VECM) from the period 1960 to 2007. They decided that the EKC hypothesis was valid and trade openness and per capita energy consumption had a positive impact on per capita CO2 emissions in the long term. Shahbaz et al. (2013b) utilized the ARDL bounds testing, Johansen-Juselius and Gregory-Hansen cointegration tests, and VECM from 1970 to 2010. They found that the EKC hypothesis was valid and energy density and globalization had a negative effect on per capita CO2 emissions in the long term. Çil Yavuz (2014) employed Johansen-Juselius and Gregory-Hansen cointegration tests and fully modified ordinary least squares (FMOLS) and dynamic ordinary least square (DOLS) estimators for the periods of 1960–1978 and 1979–2007. She concluded that the EKC hypothesis was valid in the long term for the both periods. Bölük and Mert (2015) used the ARDL bounds testing for 1961–2010 and confirmed the validity of the EKC hypothesis for Turkey. Besides, they found that per capita electricity production from renewable energy sources reduced per capita CO2 emissions. De Vita et al. (2015) employed Maki cointegration test, the ARDL estimator, and VECM from 1960 to 2009. They concluded that EKC hypothesis was valid and per capita energy consumption and tourism development had a positive impact on per capita CO2 emissions. Seker et al. (2015) performed the ARDL bounds testing and Hatemi-J cointegration test from 1974 to 2010. They found that per capita energy consumption and foreign direct investment had a positive effect on per capita CO2 emissions, and the EKC hypothesis was valid both in the short and long term. Tutulmaz (2015) utilized Engle-Granger and Johansen-Juselius cointegration tests from 1968 to 2007. He found that the EKC hypothesis was valid. Gozgor and Can (2016) employed Maki cointegration test, DOLS estimator, and ECM covering the period 1971–2010. They found that EKC hypothesis was valid and per capita energy consumption had a positive impact on per capita CO2 emissions. Çetin and Ecevit (2017) utilized the ARDL bounds testing and VECM from 1960 to 2011. They decided that the EKC hypothesis was valid and financial development, trade openness, and per capita energy consumption had a positive effect on per capita CO2 emissions. Gökmenoğlu and Taspinar (2016) performed the ARDL bounds testing and Toda-Yamamoto causality test for the period of 1974–2010. They concluded that the EKC hypothesis was valid and per capita energy consumption and FDI had a positive impact on per capita CO2 emissions. Katircioglu (2017) used Maki cointegration test, DOLS and the ARDL estimators, and ECM for the period of 1960–2010. She found that the EKC hypothesis was valid and oil prices had a negative impact on per capita CO2 emissions. Katircioğlu and Katircioğlu (2017) utilized Maki cointegration test and the ARDL estimator for the period of 1960–2010. They decided that the EKC hypothesis was valid and urbanization and per capita energy consumption had a positive impact on per capita CO2 emissions. Katircioğlu and Taşpinar (2017) used Maki cointegration test and DOLS estimator for the period of 1960–2010. They concluded that the EKC hypothesis was valid and financial development had a negative effect on per capita CO2 emissions. Koçak and Şarkgüneşi (2017) also used Maki cointegration test, DOLS estimator, and Hacker-Hatemi-J bootstrap causality test for the period 1974–2013. They found that the EKC hypothesis was valid and per capita energy consumption and financial development had a positive impact on per capita CO2 emissions. Ozatac et al. (2017) employed the ARDL bounds testing and ECM from the period of 1960 to 2013. They found that the EKC hypothesis was valid and per capita energy consumption, trade openness, and urbanization had a positive impact on per capita CO2 emissions.

Among these studies, those only conducted by Katircioğlu and Katircioğlu (2017) and Ozatac et al. (2017) included urbanization in the analysis for Turkey. As far as the author knows, no existing study examined the validity of the EKC hypothesis for Turkey by incorporating the effects of both urbanization and industrialization into the analysis. Therefore, this is the first study investigated EKC hypothesis for this country with the multivariate framework by incorporating urbanization, industrialization, energy consumption, financial development, and economic growth that aims to contribute to the literature.

Data and model

In this empirical study, the author examined the EKC hypothesis for Turkey from the period of 1974 to 2013. The basic model in Eq. (1) is used to examine the relationship between environmental pollution and economic growth within the framework of the EKC hypothesis.

In the equation, EP denotes the environmental pollutants such as per capita sulfur dioxide, nitrogen oxides, particulate matter, and CO2 emissions; Y and Y2 denote GDP per capita and its square, respectively; Z denotes the other explanatory variables that affect environmental pollution such as per capita energy consumption, trade openness, financial development, urbanization, globalization, and industrialization. Equation (2) shows the log-linear quadratic model used in this study.

In Eq. (2), CO2 denotes per capita carbon emissions (metric tons per capita); URB denotes urbanization (ratio of urban population to total population); FD denotes financial development (domestic credit to private sector percentage of the GDP); MVA denotes industrialization (manufacturing value-added percentage of GDP); PEC denotes primary energy consumption per capita (million tons oil equivalent); TEC denotes total energy consumption per capita (kiloton of oil equivalent); and Y and Y2 denote GDP per capita and its square, respectively (with constant 2010 US$). In the model, there is an inverted U-shaped relation between economic growth and CO2 emissions when δ1 is positive and δ2 is negative, as assumed by the EKC hypothesis. When δ1 > 0, CO2 emissions increase with increasing GDP per capita, and after a turning point, δ2 < 0 indicates reduced emissions. The turning point after which CO2 emissions reduce is Y* = − δ1/2δ2, and exp(Y*) yields the monetary value representing this point. Dinda (2004) asserted that developing countries have not reached this turning point yet. The turning point is expected to be outside of the sample period in the developing countries and to be inside of the sample period in the developed countries (Iwata et al. 2010). δ6 is expected to be positive, while δ3 and δ4 may be either positive or negative, depending on the level of economic development.

The data on PEC was obtained from the British Petroleum Statistical Review of Energy (BP 2016); TEC was obtained from the International Energy Agency (IEA 2016), and the other variables were obtained from the World Development Indicators (World Bank 2016).

Methodology

Stationary tests

In the ARDL approach, the dependent variable included in the analysis must be I(1), while the independent variables may be either I(0) or I(1). Before using the ARDL bounds testing, variables should be tested using unit root tests to determine whether they are I(2) or not. The augmented Dickey–Fuller (ADF) (Dickey and Fuller 1981), a conventional unit root test developed by Dickey and Fuller, includes lagged values of the variables in the intercept and intercept-trend models to eliminate the potential problem of autocorrelation in error terms. Conventional unit root tests that do not allow for structural breaks in the model may yield misleading results. The Zivot–Andrews (Z–A) unit root test (Zivot and Andrews 1992) developed by Zivot and Andrews, based on the ADF test, allows for one endogenous break in the model A (in the intercept) and model B (in the trend). In both unit root tests, the null hypothesis assumes that the series has a unit root. The alternative hypothesis assumes that the series is stationary in the ADF unit root test or stationary with an endogenous structural break in the Z–A unit root test.

ARDL bounds testing approach

In the autoregressive distributed lag (ARDL) bounds testing developed by Pesaran et al. (2001), series appear in the analysis at different orders of integration, either I(0) or I(1). Consisting of three steps, this testing approach yields effective results in the studies with small sample sizes. Equation (3) shows the unrestricted error correction model (UECM) formulated at the first step to estimate cointegration:

In Eq. (3), ∆ denotes the difference operator; ψ0 denotes the constant term; ut is the white noise error term; and ψ1, 2, 3, 4, 5, 6 and ϑ0, 1, 2, 3, 4, 5, 6 represent coefficients. Optimal lag lengths j, k, l, m, n, o, and p can be determined differently by using the Akaike (AIC) or Schwarz-Bayesian (SBC) information criteria. The null hypothesis (H0 : ψ0 = ϑ0 = ϑ1 = ϑ2 = ϑ3 = ϑ4 = ϑ5 = ϑ6 = 0), assuming no cointegration between the variables is tested against the alternative hypothesis (H1 : ψ0 ≠ ϑ0 ≠ ϑ1 ≠ ϑ2 ≠ ϑ3 ≠ ϑ4 ≠ ϑ5 ≠ ϑ6 ≠ 0), which assumes the existence of cointegration between the variables. There is a cointegration, if the null hypothesis is rejected when the F-statistics obtained from the bounds testing are greater than the upper I(0) critical values tabulated by Narayan (2005)’s table for samples 30–80 observations. The null hypothesis is accepted, and cointegration is not exist when the F-statistic is smaller than the lower I(0) critical values.

At the second step, long-term coefficients are estimated. Finally, at the third step, short-term coefficients and the coefficient of the error correction term are estimated using the ARDL-based ECM given in Eq. (4).

In Eq. (4), α0 represents the constant term; ∆ represents the difference operator; α1, 2, 3, 4, 5, 6, 7 denote short-term coefficients; δ denotes the error correction term; ut represents the white noise error term; and r, s, t, u, v, y, and z denote optimal lag lengths using the information criteria as in Eqs. (3) and (4). The δ coefficient represents the adjustment speed of the short-term deviations to the long-term equilibrium.

Empirical results

First, the ADF and Z–A unit root tests were utilized to define the variable level of stationarity. The maximum lag length was calculated using l12 = int{12(T/100)1/4} as recommended by Schwert (1989) and determined as kmax = 12x(39/100)0.25 = 9. As proposed by Elliott et al. (1996), optimal lag lengths were determined using the SBC in these two unit root tests. Table 1 shows the results of the ADF and Z–A unit root tests. According to the results of the ADF unit root tests, TEC was stationary at level, and all five variables other than URB were stationary at first difference. The results of the Z–A unit root test show that URB, TEC, and MVA were stationary at level I(0), while the other four variables were stationary at first difference I(1).

After the variables were found not to be stationary at second difference I(2) by unit root tests, we performed the bounds testing to examine the cointegration relationship. According to the results of the bounds testing given in Table 2, there is cointegration between the variables in both models at the significance level of 5%.

Table 3 shows the long-term coefficients estimated at the second step after examining the cointegration relationship. The results show that, for model 1, a 1% increase in the per capita primary energy consumption and urbanization in the long-term increased per capita CO2 emissions by 0.283 and 0.277%, respectively. A 1% increase in industrialization and financial development increased CO2 emissions by 0.105 and 0.087%, respectively. Similarly, for model 2, a 1% increase in per capita total energy consumption and urbanization increased CO2 emissions by 0.505 and 0.405%, respectively. Conversely, a 1% increase in industrialization and financial development increased CO2 emissions by 0.126 and 0.092%, respectively. In both models, the coefficients obtained for GDP per capita show that the EKC hypothesis is valid in the long term. The turning points for model 1 and model 2 were found to be $16,485 and $12,205, respectively. Both model turning points were outside of the sample period. They show that CO2 emissions have increased with increasing GDP per capita in Turkey, which is a developing country. After the income level, the other most important factors leading to CO2 emissions are energy consumption, urbanization, and industrialization. The estimated ARDL models were subject to the BG-LM autocorrelation, the Breusch-Pagan-Godfrey (BGP), the White test, and the ARCH test. The results of the tests did not show a presence of autocorrelation and heteroscedasticity. The Jarque-Bera test showed that the error terms were normally distributed. The Ramsey-Reset test statistics also revealed that the model had a proper functional form.

Following the estimation of long-term coefficients, the error correction model (ECM) based on the ARDL model was formed to estimate the short-term coefficients as part of the third step. In Table 4, all variables other than urbanization increased per capita CO2 emissions in the short term. The coefficient of the error correction term, found to be statistically significant at 1% and close to − 1, indicates that potential shocks could be eliminated within a year. The EKC hypothesis is valid for Turkey in the short term, too.

CUSUM and CUSUMSQ tests developed by Brown et al. (1975) and respectively applied to consecutive error terms and squares of consecutive error terms were performed to test whether the short- and long-term coefficients obtained from the ARDL models were stable or not. The null hypothesis of both tests showed that no structural change occurred in the estimated coefficients and that the coefficients were stable. In Table 5, the results of these two tests show that the null hypothesis is accepted and finding the coefficients to be stable.

Conclusion

This empirical analysis examined the validity of the EKC hypothesis for Turkey from 1974 to 2013 using the ARDL bounds testing. The findings obtained from the bounds testing confirmed the presence of cointegration between CO2 emissions, per capita energy consumption, financial development, industrialization, urbanization, and GDP per capita. After GDP per capita, the most important factors leading to CO2 emissions were, respectively, energy consumption, urbanization, and industrialization in the long term. In the short term, urbanization had no impact on per capita CO2 emissions. Other variables increased CO2 emissions in the short term, too. Financial development increased CO2 emissions to a minimum extent in both the short and long term.

The analysis results confirmed the validity of the EKC hypothesis for Turkey, both in the short and long term. However, the turning points found in the analysis were outside the sample period. Hence, CO2 emissions continued increasing with increasing GDP per capita in Turkey. Different from the finding of Koçak and Şarkgüneşi (2017), the findings of this study support the studies of Bölük and Mert (2015) and Tutulmaz (2015), which found the turning point for Turkey to be outside of the sample period.

It is important to reduce CO2 emissions and achieve sustainable development for a country aiming to be a member of the European Union, such as Turkey. The use of old technologies, which cause environmental pollution, during the processes of energy consumption, urbanization, and industrialization should be replaced with the use of environmentally friendly technologies. In Turkey, fossil fuels provide 88.2% of the total energy consumption. Turning to alternative energy resources should reduce the share of fossil fuels (the burning of which leads to environmental pollution) in total energy consumption. Environmental taxes should be imposed to minimize the impact of industrialization and urbanization on the environment. Unplanned urbanization is an important problem in Turkey. Regulations to increase the quality of the environment should be part of any designs for urban transformation.

Finally, if the per capita income is expressed in the purchasing power parity, the results can be based on more robust basis. In this respect, sufficient data were not available in Turkey for time series analysis. As the sufficient data available in the following years, the analysis can be repeated with this direction. In addition, disaggregated energy consumption can be included in the analysis along with industrialization and urbanization in the future research for this country.

References

Akbostancı E, Türüt-Aşık S, Tunç GI (2009) The relationship between income and environment in Turkey: is there an environmental Kuznets curve? Energy Policy 37(3):861–867. https://doi.org/10.1016/j.enpol.2008.09.088

Al-Mulali U, Solarin SA, Ozturk I (2016) Investigating the presence of the environmental Kuznets curve (EKC) hypothesis in Kenya: an autoregressive distributed lag (ARDL) approach. Nat Hazards 80(3):1729–1747. https://doi.org/10.1007/s11069-015-2050-x

Anatasia V (2015) The causal relationship between GDP, exports, energy consumption, and CO2 in Thailand and Malaysia. Int J Econ Perspect 9(4):37–48

Apergis N, Ozturk I (2015) Testing environmental Kuznets curve hypothesis in Asian countries. Ecol Indic 52:16–22. https://doi.org/10.1016/j.ecolind.2014.11.026

Bölük G, Mert M (2015) The renewable energy, growth and environmental Kuznets curve in Turkey: an ARDL approach. Renew Sust Energ Rev 52:587–595. https://doi.org/10.1016/j.rser.2015.07.138

BP (2016) British petroleum statistical review of world energy. Accessed on 2th March, 2017 through the link https://www.bp.com/content/dam/bp/en/corporate/excel/energy-economics/statistical-review-2017/bp-statistical-review-of-world-energy-2017-underpinning-data.xlsx

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relationships over time. J R Stat Soc Ser B Methodol 37(2):149–192

Cole MA (2004) Trade, the pollution haven hypothesis and the environmental Kuznets curve: examining the linkages. Ecol Econ 48(1):71–81. https://doi.org/10.1016/j.ecolecon.2003.09.007

Çetin M, Ecevit E (2017) The impact of financial development on carbon emissions under the structural breaks: empirical evidence from Turkish economy. Int J Econ Perspect 11(1):64–78

Çil Yavuz N (2014) CO2 emission, energy consumption, and economic growth for Turkey: evidence from a cointegration test with a structural break. Energy Sources Part B 9(3):229–235. https://doi.org/10.1080/15567249.2011.567222

De Vita G, Katircioglu S, Altinay L, Fethi S, Mercan M (2015) Revisiting the environmental Kuznets curve hypothesis in a tourism development context. Environ Sci Pollut Res 22(21):16652–16663. https://doi.org/10.1007/s11356-015-4861-4

Dickey DA, Fuller WA (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49(4):1057–1072. https://doi.org/10.2307/1912517

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49(4):431–455. https://doi.org/10.1016/j.ecolecon.2004.02.011

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213. https://doi.org/10.1007/s11356-015-5323-8

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica 64(4):813–836. https://doi.org/10.2307/2171846

Farhani S, Mrizak S, Chaibi A, Rault C (2014) The environmental Kuznets curve and sustainability: a panel data analysis. Energy Policy 71:189–198. https://doi.org/10.1016/j.enpol.2014.04.030

Farhani S, Ozturk I (2015) Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22(20):15663–15676. https://doi.org/10.1007/s11356-015-4767-1

Gozgor G, Can M (2016) Export product diversification and the environmental Kuznets curve: evidence from Turkey. Environ Sci Pollut Res 23(21):21594–21603. https://doi.org/10.1007/s11356-016-7403-9

Gökmenoğlu K, Taspinar N (2016) The relationship between CO2 emissions, energy consumption, economic growth and FDI: the case of Turkey. J Int Trade Econ Dev 25(5):706–723. https://doi.org/10.1080/09638199.2015.1119876

Grossman GM, Krueger AB (1991) Environmental impacts of a north American free trade agreement. NBER working papers, 3914. National Bureau of economic research, Inc

Halicioglu F (2009) An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 37(3):1156–1164. https://doi.org/10.1016/j.enpol.2008.11.012

Henderson V (2003) The urbanization process and economic growth: the so-what question. J Econ Growth 8(1):47–71. https://doi.org/10.1023/A:1022860800744

Jebli MB, Youssef SB (2015) The environmental Kuznets curve, economic growth, renewable and non-renewable energy, and trade in Tunisia. Renew Sust Energ Rev 47:173–185. https://doi.org/10.1016/j.rser.2015.02.049

Kasman A, Duman YS (2015) CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: a panel data analysis. Econ Model 44:97–103. https://doi.org/10.1016/j.econmod.2014.10.022

Katircioglu S (2017) Investigating the role of oil prices in the conventional EKC model: evidence from Turkey. Asian Econ Financ Rev 7(5):498–508. https://doi.org/10.18488/journal.aefr/2017.7.5/102.5.498.508

Katircioğlu S, Katircioğlu S (2017) Testing the role of urban development in the conventional environmental Kuznets curve: evidence from Turkey. Appl Econ Lett. https://doi.org/10.1080/13504851.2017.1361004

Katircioğlu ST, Taşpinar N (2017) Testing the moderating role of financial development in an environmental Kuznets curve: empirical evidence from Turkey. Renew Sust Energ Rev 68(1):572–586. https://doi.org/10.1016/j.rser.2016.09.127

Koçak E, Şarkgüneşi A (2017) The impact of foreign direct investment on CO2 emissions in Turkey: new evidence from cointegration and bootstrap causality analysis. Environ Sci Pollut Res accessed on 5th November, 2017 through the link https://doi.org/10.1007/s11356-017-0468-2

Lise W (2006) Decomposition of CO2 emissions over 1980–2003 in Turkey. Energy Policy 34(14):1841–1852. https://doi.org/10.1016/j.enpol.2004.12.021

Lise W, Van Montfort K (2007) Energy consumption and GDP in Turkey: is there a co-integration relationship? Energy Econ 29(6):1166–1178. https://doi.org/10.1016/j.eneco.2006.08.010

Munasinghe M (1999) Is environmental degradation an inevitable consequence of economic growth: tunneling through the environmental Kuznets curve. Ecol Econ 29(1):89–109. https://doi.org/10.1016/S0921-8009(98)00062-7

Narayan PK (2005) The saving and investment nexus for China: evidence from cointegration tests. Appl Econ 37(17):1979–1990. https://doi.org/10.1080/00036840500278103

IEA (2016) Accessed on 17th April, 2017 through the link https://www.iea.org/media/statistics/IEA_Headline EnergyData _2016.xlsx

IRENA (2016) Renewable energy in cities. IRENA, Abu Dhabi

Iwata H, Okada K, Samreth S (2010) Empirical study on the environmental Kuznets curve for CO2 in France: the role of nuclear energy. Energy Policy 38(8):4057–4063. https://doi.org/10.1016/j.enpol.2010.03.031

Ozatac N, Gokmenoglu KK, Taspinar N (2017) Testing the EKC hypothesis by considering trade openness, urbanization, and financial development: the case of Turkey. Environ Sci Pollut Res 24(20):16690–16701. https://doi.org/10.1007/s11356-017-9317-6

Ozturk I, Acaravci A (2010) CO2 emissions, energy consumption and economic growth in Turkey. Renew Sust Energ Rev 14(9):3220–3225. https://doi.org/10.1016/j.rser.2010.07.005

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267. https://doi.org/10.1016/j.eneco.2012.08.025

Ozturk I, Al-Mulali U (2015) Investigating the validity of the environmental Kuznets curve hypothesis in Cambodia. Ecol Indic 57:324–330. https://doi.org/10.1016/j.ecolind.2015.05.018

Panayotou T (1993) Empirical tests and policy analysis of environmental degradation at different stages of economic development (No.292778). International Labour Organization

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326. https://doi.org/10.1002/jae.616

Saboori B, Sulaiman J (2013) Environmental degradation, economic growth and energy consumption: evidence of the environmental Kuznets curve in Malaysia. Energy Policy 60:892–905. https://doi.org/10.1016/j.enpol.2013.05.099

Schwert GW (1989) Tests for unit roots: a Monte Carlo investigation. J Bus Econ Stat 20(1):147–159. https://doi.org/10.1198/073500102753410354

Seker F, Ertugrul HM, Cetin M (2015) The impact of foreign direct investment on environmental quality: a bounds testing and causality analysis for Turkey. Renew Sust Energ Rev 52:347–356. https://doi.org/10.1016/j.rser.2015.07.118

Shafik N, Bandyopadhyay S (1992) Economic growth and environmental quality: time-series and cross-country evidence. World Bank Publications 904:1–50

Shafiei S, Salim RA (2014) Non-renewable and renewable energy consumption and CO2 emissions in OECD countries: a comparative analysis. Energy Policy 66:547–556. https://doi.org/10.1016/j.enpol.2013.10.064

Shahbaz M, Tiwari AK, Nasir M (2013a) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61:1452–1459. https://doi.org/10.1016/j.enpol.2013.07.006

Shahbaz M, Ozturk I, Afza T, Ali A (2013b) Revisiting the environmental Kuznets curve in a global economy. Renew Sust Energ Rev 25:494–502. https://doi.org/10.1016/j.rser.2013.05.021

Shahbaz M, Sbia R, Hamdi H, Ozturk I (2014) Economic growth, electricity consumption, urbanization and environmental degradation relationship in United Arab Emirates. Ecol Indic 45:622–631. https://doi.org/10.1016/j.ecolind.2014.05.022

Shahbaz M, Dube S, Ozturk I, Jalil A (2015) Testing the environmental Kuznets curve hypothesis in Portugal. Int J Energy Econ Policy 5(2):475–481

Stern DI (1997) Limits to substitution and irreversibility in production and consumption: a neoclassical interpretation of ecological economics. Ecol Econ 21(3):197–215. https://doi.org/10.1016/S0921-8009(96)00103-6

Stern DI (2004) Economic growth and energy. Encyclopedia of Energy 2(00147):35–51. https://pdfs.semanticscholar.org/9e64/598980900ca14e41b0863b4da818c2596031.pdf

Tutulmaz O (2015) Environmental Kuznets curve time series application for Turkey: why controversial results exist for similar models? Renew Sust Energ Rev 50:73–81. https://doi.org/10.1016/j.rser.2015.04.184

World Bank (2009) The world development report 2009: reshaping economic geography. World Bank, Washington DC

World Bank (2016) World development indicators Accessed on 17th April, 2017 through the link http://data.worldbank.org/data-catalog/world-development-indicators

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 10(3):25–44. https://doi.org/10.1198/073500102753410372

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Philippe Garrigues

Rights and permissions

About this article

Cite this article

Pata, U.K. The effect of urbanization and industrialization on carbon emissions in Turkey: evidence from ARDL bounds testing procedure. Environ Sci Pollut Res 25, 7740–7747 (2018). https://doi.org/10.1007/s11356-017-1088-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-017-1088-6