Abstract

This article aims to approach the research related to the environmental Kuznets curve from a new and more holistic perspective. Therefore, while testing the validity of the environmental Kuznets curve, the ecological footprint as the indicator of environmental degradation will be used as the dependent variable within the model, while the economic complexity index used together with the per capita income and the trade-to-GDP ratio will be used as the independent variables. The analysis confirms the validity of the environmental Kuznets curve for the top nine industrialized countries in terms of the value-added by industry as a percentage of the GDP between 1970 and 2017. In addition, the study shows that economic complexity decreases an economy’s ecological footprint. According to the results of the causality test, there is a causal relationship from all the independent variables to the ecological footprint variable.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The purpose of the study is to prove the existence of an inverted U-shaped relationship between environmental degradation and per capita income. Global economies are faced with an increased demand for goods and services brought about by efforts to generate economic growth as industries and economies have rapidly transformed since the industrial revolution (Boleti et al., 2021). New technologies have radically changed sectors/industries and have emphasized the importance of the economic structures of a country in order to develop and modernize their production. At the same time, structural transformation has directly impacted the environment. As economies have evolved from agricultural-based production to more sophisticated industries and services, it has encouraged the rapid growth of fossil fuel consumption (Boleti et al., 2021). In the twentieth century, this process has not just increased but accelerated. These accelerated efforts to generate economic growth that come with rising demand and increased production naturally increase the need for energy (Gozgor & Can, 2017). While industrial production triggers intense energy consumption, many problems inevitably arise. One of these problems is that the increase in the amount of carbon dioxide causes the greenhouse gas effect and this effect creates some significant environmental problems (Lapatinas et al., 2021; Haggar, 2012; Nordhaus, 2019). One of the most important and difficult challenges facing humanity is understanding the mechanisms that affect the environment while also maintaining high economic growth rates (Hervieux & Darne, 2015). Recently, academic circles and policymakers have given more importance to understanding the relationships between economic growth and the environment and discussing them with a focus toward sustainability (Kang et al., 2019; Saboori & Sulaiman, 2013). Therefore, this article attempts to analyze the relationship between environmental degradation and economic growth using a multidisciplinary approach that examines this chain of relations.

The concept of the environmental Kuznet’s curve (EKC) was developed and popularized by Grossman and Krueger (1991) from a theory originally proposed by Simon Kuznets (1955). The concept hypothetically shows an inverted U-shaped relationship between economic growth and environmental quality. In explaining the rationale for the shape of the EKC, Grossman and Krueger (1991) state that economic growth affects environmental quality through three important channels: the scale effect, the composition effect, and the technique effect. Some studies show that economic growth positively affects environmental quality (Kilic & Balan, 2018; Mosconi et al., 2020; Shahbaz & Sinha, 2019). At the initial stage of economic development, economies create less environmental pollution, since the production structures of an economy depend largely on agriculture. In the later stages of economic development, this changes due to specialization and the increase in product diversity, and at this stage, the curve indicates there is an increase in environmental degradation unless an economy quickly transitions to a level of high economic complexity. With the increase in economic development, some policymakers are looking more closely at cleaner technology and environmentally friendly structures of production. In this way, the dangers of environmental degradation can be reduced. When countries become fully developed, technical advancement tends to make countries more able and willing to spend resources on research and innovation for green energy and technologies to further improve environmental quality. That is, as economies grow, environmental degradation initially increases but eventually reaches a turning point that continues with a downward trend (Pata, 2021). Pata (2021) describes the connection between these relationships in the following figure (Fig. 1).

The relationship between environmental pollution and economic complexity (from Pata, 2021)

The first part of the process to be discussed is the dynamics of environmental degradation. A possible source of environmental degradation is anthropogenic carbon dioxide (CO2) emissions (Ritchie & Roser, 2017). It is also well known that there is a close relationship between CO2 and economic activities (Batjes, 2014). Although CO2 emissions are used as a specific indicator of environmental degradation, the ecological footprint is a measurement of environmental degradation from a much broader perspective and will be used as the dependent variable for the model in this article. The ecological footprint is accepted in the field as an appropriate indicator of environmental degradation (Al-Mulali & Öztürk, 2015; Galli et al., 2012; Mrabet & Alsamara, 2017). The ecological footprint was originally designed by Mathis Wackernagel and William Rees at the University of British Columbia in 1990. Similar to the concept of the carbon footprint, it is a broad measurement method that is now frequently used by scientists, governments, businesses, and institutions that work to understand the ecological conditions (https://www.footprintnetwork.org).

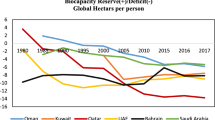

The other part of the process is discussing the economic dynamics. Although per capita income is used as an indicator of economic development, it only thinly reflects the structural transformations of an economy. For example, commodity-dependent countries such as Saudi Arabia, the United Arab Emirates, and Qatar or some Latin American economies have a relatively high GDP per capita compared to other national economies, but it is not necessarily reflective of robust economic transformation in their economies. Their economies are heavily dependent on one commodity or on producing products with a low level of economic complexity. Therefore, in order to better understand the actual production structure of a country, a more effective measurement tool is economic complexity. Economic complexity can be explained by differences in economic performance as well as being highly correlated with income (Ferrarini & Scaramozzino, 2013). Economic complexity provides a broad perspective on the structure, scale, and technological changes of an economy (Dogan et al., 2019; Neagu & Teodoru, 2019). Naturally, these changes have effects on the environmental quality according to their energy consumption choices (Chu, 2021). In other words, economic complexity reflects the productive nature of a country (Hausman & Hidalgo, 2011), which leads to a particular pattern of energy consumption and thus an impact on its environmental quality. Other researchers such as Can and Gozgor (2017) have also used the economic complexity index as an explanatory variable to test the validity of the environmental Kuznets curve. Therefore, in this approach, the economic complexity index will be used together with per capita income and trade-to-GDP ratio as the independent variable of the model. Different results were obtained in studies that tested the validity of the EKC with the variable of economic growth. In studies that examine the EKC from a holistic perspective and analyze data related to economic complexity rather than economic growth, the findings obtained do not have uniform results. But it should be noted that this literature is quite limited. These studies are detailed below.

The first contribution of this study is to draw attention to the relationship between environmental degradation and economic complexity and to examine the relationship with a more original and holistic approach. Many countries depend on this type of important data and specifically data that integrates economic complexity, not merely economic growth. In addition, the second major contribution to the field is to make proposals about the environmental effects that come from the empirical findings of this model. These proposals must also be in line with a growth model that requires qualified transformation and is consistent with empirical results. The introduction of this study includes a summary of the hypothesis that shapes the research and the unique features of this study. In the second part, the literature review will be covered under two sub-titles: economic growth and environmental degradation, economic complexity, and environmental degradation. The third section explains the research design and methodology, while the fourth section outlines the empirical results. The final part of the study includes policy proposals and a concluding discussion.

Literature Review

In the study, the validity of the environmental Kuznets curve for the top nine industrialized countries in terms of the value added by industry as a percentage of GDP is tested. As a result of this focus, the literature review consists of two subsections. The first set of studies are those that investigate the relationship between economic growth and environmental degradation (whether the environmental Kuznets curve is valid or not). The second set of studies analyzes the relationship between economic complexity and environmental degradation.

Economic Growth and Environmental Degradation

The literature that analyzes the relationship between economic growth and environmental degradation shows that there are various and conflicting results. Some studies obtained findings that confirmed that the EKC was valid (Shahbaz et al., 2013; Al-Mulali et al., 2015; Dogan & Seker, 2016; Kilic & Balan, 2018; Aslan et al., 2018; Danish & Ulucak, 2021; Ntim-Amo et al., 2022; Zhang &Yan, 2022; Htike et al., 2022; Jahanger et al., 2022; Wang et al., 2022; Acevedo-Ramos et al., 2023). However, in other studies, findings were obtained that challenged the validity of the EKC (Bagliani et al., 2008; Caviglia-Harris et al., 2009; Dietz et al., 2012; Ozcan et al., 2018; Bese & Kalayci, 2019; Ozcan et al., 2020; Laverde-Rojaset et al., 2021 and Zhang, 2021). In additional studies that used a large sample size, divergent results were obtained with respect to different countries (Ozcan, 2013; Ozturk et al., 2016; Mrabet & Alsamara, 2017 and Ozcan et al., 2019).

Shahbaz et al. (2013) investigated the relationship between CO2 emissions, energy intensity, economic growth, and globalization in Turkey using data between 1970 and 2010. The study concluded that the environmental Kuznets curve is valid for Turkey. Al-Mulali et al. (2015) also investigated the validity of the environmental Kuznets curve using the ecological footprint variable in 93 countries. According to the results obtained by using a generalized method of moments (GMM) and a fixed effects method, the inverted U-shaped relationship between GDP growth and the ecological footprint variable was confirmed. This situation suggests that the EKC is valid in upper-middle and high-income countries, but not in countries that have low and low-middle range of income. Dogan and Seker (2016) tested the validity of the environmental Kuznets curve for the European Union using data from 1980 to 2012, with the help of panel estimation techniques that are resistant to cross-sectional dependence. The study found that non-renewable energy increases CO2 emissions, while trade and renewable energy reduce carbon emissions. It also obtained results that supported the validity of the EKC. Kilic and Balan (2018) tested the validity of the EKC in 151 countries with the panel data method by using data from 1996 to 2010. The findings of the study confirm the validity of the EKC hypothesis. In the USA, Aslan et al. (2018) also investigated the validity of the EKC under the framework of the bootstrap rolling-window approach, using data between 1966 and 2013. This study also concluded that the EKC is valid in this case. Danish and Ulucak (2021) analyzed the relationship between nuclear energy consumption and CO2 emissions using data between 1971 and 2018. Their analysis used the dynamic auto-regressive distribution lag (DARDL) method within the framework of IPAT and the environmental Kuznets curve. According to the findings of the study, it was observed that an increase in the use of nuclear energy tends to reduce environmental pollution.

In addition, Bagliani et al. (2008) investigated the validity of the environmental Kuznets curve for 141 countries by using the ecological footprint as the dependent variable. However, in their study, it was observed that there was no inverted U-shaped relationship between environmental pollution and economic growth. Caviglia-Harris et al. (2009) analyzed the validity of the EKC using the ecological footprint (EF) variable. In the study, no empirical evidence was found that linked economic development and EF. Dietz et al. (2012) used a panel data method to examine the relationship between GDP per capita and a measurement called ecological intensity of human well-being (EIWB). The results of the study, which looked at data from 58 countries, showed that the relationship between EIWB and GDP per capita was actually U shaped, which is the inverse of the environmental Kuznets curve. Ozcan et al. (2018) used a bootstrap time-varying causality approach to investigate the validity of the EKC in the Turkish economy for data between 1961 and 2013. This study found that the EKC is not valid in this case. Bese and Kalayci (2019) investigated the same hypothesis with respect to three developing countries (Egypt, Kenya, and Turkey) by using data from 1971 to 2014. The study concluded that the EKC is not valid for Egypt, Kenya, and Turkey, but the growth hypothesis is valid for Egypt and Kenya. The neutrality hypothesis for Turkey was also confirmed in this study. Ozcan et al. (2020) analyzed the relationship between energy consumption, economic growth, and CO2 emissions in 35 OECD countries using data from 2000 to 2014. The analysis uses a panel vector autoregressive regression (PVAR) approach within a generalized method of moments (GMM) framework. The findings of this study show that GDP and energy consumption have a positive effect on all environmental quality indicators. Furthermore, Laverde-Rojas et al. (2021) investigated the validity of the EKC with the vector error correction model (VECM) by using data in Colombia from 1971 to 2014. The findings of this study demonstrated that the EKC is not valid in Colombia. Zhang (2021) analyzed the existence of the peripheral environmental Kuznets curve in China with the autoregressive distributed lag (ARDL) model and boundary testing. The study concluded that there is an N-shaped relationship instead of an inverted U-shaped curve in the long run.

Ozcan (2013) tested the validity of the environmental Kuznets curve in 12 Middle Eastern countries using a panel data analysis for data between 1990 and 2008. In the study, a U-shaped curve was detected for 5 Middle Eastern countries, and an inverted U-shaped curve was detected for 3 Middle Eastern countries, while no causal link was found for the other 4 countries. Ozturk et al. (2016) also tested the validity of the environmental Kuznets curve in 144 countries using a GMM time series and a system GMM panel analysis for data between 1988 and 2008. The study revealed that the EKC more accurately characterizes upper-middle and high-income countries than other countries. Mrabet and Alsamara (2017) used an autoregressive distributed lag (ARDL) model to test the EKC in Qatar for data between 1980 and 2011 by using variables such as carbon dioxide emissions (CO2) and the ecological footprint (EF). This study found that the inverted U-shaped hypothesis is not valid in Qatar with respect to the CO2 emissions variable, but is valid with respect to the EF variable. Similarly, Ozcan et al. (2019) examined the relationship between energy consumption, economic growth, and environmental degradation in 33 OECD countries using data from 2000 to 2013. According to the curve causality approach, the existence of the EKC was found in 23 countries in relation to the environmental performance index and found in 25 countries in relation to the ecological footprint. More recent studies on this subject are given below.

Ntim-Amo et al. (2022) conducted an annual time series analysis for data in Ghana from 1980 to 2014. The results of the study confirm the validity of the EKC in the agricultural sector both in the short and long term. Zhang and Yan (2022) examined the EKC using the SDM model in 274 cities from different regions of China between 2007 and 2017. The results show a consistent inverted U-shaped relationship between income and SO2 emissions in all three major regions. Also, using CO2 emissions as an indicator of pollution, the study found that the EKC is valid only in the eastern and central cities of China. Htike et al. (2022) confirmed the validity of the EKC with respect to three different sectors of 86 developing and developed countries. The data was analyzed between 1990 and 2015, and the specific sectors that confirmed the EKC were the electricity and heating sector, the commercial and public services sector, and the other industries connected to energy production. However, while emissions in the manufacturing and construction sector, housing sector and agriculture, forestry, and fisheries sectors decreased, emissions in these sectors increased with the development of the transport sector. Liu et al. (2022) retested the EKC by applying a new regression kink model for G7 countries from 1890 to 2015. The results showed no inverse U-shaped curve for the USA, Germany, Italy, Canada, and Japan. Saqib et al. (2022) studied the E7 countries (Brazil, China, India, Indonesia, Russia, Mexico, and Turkey) between 1995 and 2019 using a cross-sectional enhanced autoregressive distribution lag method (CS-ARDL), an augmented mean group estimator (AMG), and the Dumitrescu-Hurlin causality test. This study confirmed the validity of the EKC in this case. Jahanger et al. (2022) researched the impact of economic growth, hydroelectric energy production, and urbanization on Malaysia’s CO2 emissions. The study confirms the existence of the EKC between 1965 and 2018 by using a quantile autoregressive distributed lag model (QARDL) and the Granger causality analysis. Wang et al. (2022) tested the same curve using carbon emissions data that is connected with trade openness, human capital, renewable energy, and natural resources rents in 208 countries from 1990 to 2018. This study confirmed the validity of the EKC using the generalized method of moments method and the fully modified ordinary least squares estimator. Acevedo-Ramos et al. (2023) examined the validity of the EKC for data related to Colombia. The study discussed carbon dioxide emissions, methane emissions, and other variables such as the ecological footprint, urbanization, foreign direct investment, energy usage, and the added value of the agriculture and industry sectors. These variables were dynamically analyzed with 12 simulations and the empirical findings support the validity of an inverted U-shaped relationship.

Economic Complexity and Environmental Degradation

More broadly, studies on the relationship between economic complexity and environmental degradation in the literature are showing that economic complexity increases environmental pollution (Neagu & Teodoru, 2019; Yılancı & Pata, 2021; Moleiro Martins et al., 2021; Rafique et al., 2021; Algan et al., 2021; Abbasi et al., 2021; Shahzad et al., 2021 and Lee et al., 2022; Hassan et al., 2023; Majeed et al., 2022; Arnaut & Dada, 2022). However, other studies show that economic complexity actually reduces environmental pollution (Romero & Gramkow, 2020; Mealy & Teytelboym, 2020; Boleti et al., 2021). In some of the studies, an inverted U-shaped relationship was found between economic complexity and environmental pollution (Can & Gozgor, 2017; Azizi et al., 2019; Chu, 2021 and Pata, 2021), while the findings of other studies vary depending on the country (Dogan et al., 2019; Adedoyin et al., 2021; Adedoyin et al., 2021; Aluko et al., 2022).

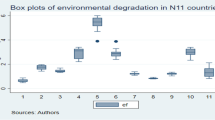

Neagu and Teodoru (2019) analyzed the relationship between economic complexity, greenhouse gas emissions, and energy consumption in the context of European economies. The study applied the fully modified least squares (FMOLS) estimator and the dynamic ordinary least squares (DOLS), method and it concluded that an increase in economic complexity and non-renewable energy consumption also increases environmental pollution. Yilanci and Pata (2020) analyzed the validity of the EKC for China between 1965 and 2016 within the framework of the Narayan and Narayan Energy Policy 2010 approach (Narayan & Narayan, 2010). Accordingly, the relationships between the economic complexity index, energy consumption, economic growth, and the ecological footprint were investigated by using the Fourier ARDL procedure and a time-varying causality test. The study concluded that economic complexity and energy consumption increase the ecological footprint. Moleiro Martins et al. (2021) examined the relationship between CO2 emissions and economic complexity in the top seven countries with the highest level of economic complexity by using data from 1993 to 2018. The findings of the study revealed that economic complexity and economic growth in these countries increase CO2 emissions, while globalization and renewable energy consumption reduce CO2 emissions. Rafique et al. (2021) tried to estimate with a panel data analysis the determinants of the ecological footprint for the top 10 economies with the highest level of economic complexity. The study, which examined data between 1980 and 2014, concluded that in the long run, economic complexity, export quality, urbanization, and economic growth increase the ecological footprint, while renewable energy production reduces the ecological footprint. Algan et al. (2021) examined the relationship between economic complexity and environmental degradation for N11 countries (Vietnam, Egypt, Nigeria, Pakistan, Indonesia, Philippines, Bangladesh, South Korea, Mexico, Iran, and Turkey), using data from 1990 to 2014. According to the results of their panel ARDL/PMG analysis, increases in the level of economic complexity and total population in these countries increase carbon emissions and non-renewable energy use. Abbasi et al. (2021) analyzed the relationship between the economic complexity index (ECI), per capita gross domestic product (GPC), gross domestic product (GDP), tourism (TR), energy price indices (EPI), and CO2 levels with a second-generation cointegration and cross-sectionally increased autoregressive distributed lag (CS-ARDL) method for data between 1990 and 2019. The study found a positive relationship between ECI, GDP, and CO2 in the long run and short run. Shahzad et al. (2021) analyzed the relationship between economic complexity, the ecological footprint, and fossil fuel energy in the USA with the help of the quantile autoregressive distributed lag (QARDL) model, the newly developed quantile unit root test, and the quantile Granger causality test using data from 1965 to 2017. The results of the analysis show that fossil fuel energy consumption and economic complexity greatly increase the ecological footprint in the USA. Lee et al. (2022) investigated the validity of the EKC for 99 countries using data from 2006 to 2017. Their study found that improvements in tourism increase environmental degradation, economic complexity reduces environmental quality, and interestingly, they found that the increase in the level of national security limits the negative effects of tourism and economic complexity on the environment. Romero and Gramkow (2020) examined the relationship between economic complexity and greenhouse gas emissions for 67 countries between 1976 and 2012. This study found that economic complexity reduces greenhouse gas emissions. In their study, Mealy and Teytelboy (2020) examined the ability to export complex green products competitively using the sequencing method. It was concluded that top-ranked countries are more likely to have high environmental patent rates, stricter environmental policies, and low levels of CO2 emissions. Boleti et al. (2021) examined the relationship between economic complexity and environmental performance for 88 developed and developing countries, using data from 2002 to 2012. The study concluded that an increase in economic complexity leads to better environmental performance.

Can and Gozgor (2017) tested the determinants of CO2 emissions in France using a unit root test, which included two structural breaks and a dynamic ordinary least squares estimation. The study concluded that the environmental Kuznets curve is valid in France and that a higher level of economic complexity increases the level of CO2 emissions. Azizi et al. (2019) analyzed the relationship between economic complexity and environmental pollution for 99 countries using data from 1992 to 2017. The study also analyzed this relationship in the context of the EKC, by using the dynamic ordinary least squares (DOLS) method. The study found the EKC to be valid in this case and that economic complexity decrease environmental pollution. Chu (2021) also examined the environmental Kuznets curve in the context of economic complexity. The findings indicate the existence of an inverted U-shaped relationship between CO2 emissions and economic complexity. Similarly, Pata (2021) analyzed the effects of globalization, economic complexity, and renewable and non-renewable energy consumption on the ecological footprint and CO2 emissions. The study used a combined cointegration test and three different estimation methods using data from the USA between 1980 and 2016. The study found that the EKC is valid with respect to this data.

Dogan et al. (2019) analyzed the relationship between economic complexity and CO2 emissions for 55 countries and whether it confirms the validity of the EKC. Employing a panel quantile regression for data between 1971 and 2014, the study found that while economic complexity increased environmental degradation in low- and middle-income countries, it was able to control CO2 emissions and not increase environmental degradation in high-income countries. Adedoyin et al. (2021) analyzed the relationship between economic complexity and carbon emissions using the system GMM method with data from 1995 to 2016. The study observed that economic complexity greatly reduced carbon emissions in upper-middle and high-income groups, while it increased carbon emissions in low-income groups. Integrating the groups together, the findings confirmed the validity of the EKC. More recent studies on this subject are given below.

Aluko et al. (2022) investigated the effect of economic complexity on environmental degradation by applying the method of moments quantitative regression for 35 OECD countries between 1998 and 2017. The results of the study showed that increasing economic complexity at higher income levels reduces environmental degradation. Majeed et al. (2022) used economic panel cointegration tests, cross-section dependency tests, error correction model (ECM), fully modified ordinary least squares (FMOLS), and a quantile regression (FE-QR) analysis to explore the relationship between economic complexity and environmental degradation for OECD countries between 1971 and 2018. As a result of these analyses, economic complexity was shown to have a positive relationship with carbon emissions in the long run. The FE-QR results in particular suggest that the impact of economic complexity on emissions is higher in economies where carbon emissions are already low. Thus, this study also confirms the validity of the EKC. Arnaut and Dada (2022) analyze quarterly data between 1995 and 2017 by applying unit root tests (with and without structural breaks), an autoregressive distributed lag (ARDL) bounds test, and a dynamic ordinary least square estimation. The relationship between economic complexity and environmental degradation in this study is analyzed by using the least square method. The findings show that economic complexity, non-renewable energy, and economic growth both increase the ecological footprint in the short and long term and therefore negatively affect the environment. However, renewable energy and urbanization were found to reduce the ecological footprint over two periods and thus improve environmental quality. Hassan (2022) examined the effects of the ecological footprint for OECD countries between 1990 and 2019. The study used a certain type of analysis to make predictions that are more resistant to inter-country dependencies and heterogeneity such as the cross-sectional augmented autoregressive distributed lag, the common correlated effects estimator, and augmented mean group estimator. The findings show that high scores in the economic complexity index increase the ecological footprints of the OECD countries.

When the literature review is evaluated in general, it is seen that the effects of economic growth and economic complexity on environmental pollution do not have consistent or uniform results. In other words, the results of some studies show that the environmental Kuznets curve is valid, while an inverted U-shaped relationship wasn’t found in other studies. Furthermore, some of the studies found both positive and negative relationships between economic complexity and environmental degradation.

Research Design and Methodology

Empirical Model

The empirical model used in this study examines the validity of the EKC for the most industrialized nine countries in the world (China, the USA, Japan, Germany, the UK, South Korea, France, Italy, and Mexico) who are the global leaders in the value-added of industry as a percentage of national GDP. Although we initially focused on the top nine countries, Canada had to be excluded due to a lack of available data. The study of Yilanci and Pata (2020) inspired this research as the authors brought new insights to this type of study. Specifically, they introduced ways of using the ecological footprint as a dependent variable and the economic complexity index as an explanatory variable in order to test the validity of the EKC. As a result, the empirical model we constructed is as follows:

The analysis covers the period from 1970 to 2017. The analysis does not include data up to the present day because there is a lack of available data on the ecological footprint. Some detailed information and the descriptive statistics of the variables that are used in the model are presented in Table 1.

In this model, the ecological footprint variable is used to indicate the level of environmental degradation. The EKC is understood to hold when the coefficient of GDP per capita is significantly positive (\({\beta }_{1}>0\)) and the coefficient of the square of GDP per capita is significantly negative (\({\beta }_{2}<0\)). These two coefficients together indicate the validity of the EKC, which is an inverted U-shaped quadratic relationship between the ecological footprint and per capita income (Ansari et al., 2020). When it comes to the theoretical expectations for the other explanatory variables, we expect the \({\beta }_{3}\) coefficient to be negative since the knowledge content of production and export is expected to decrease environmental degradation. Furthermore, \({\beta }_{4}\) is expected to be positive since trade increases environmental degradation via logistic activities. It should also be noted that all variables in the model are used in logarithmic form, meaning that the coefficients correspond to long-run elasticities.

Econometric Methodology

To test the EKC and estimate the long-term coefficients, these were the steps that were followed: First, the stationarity of the variables was examined by employing the first-generation Hadri unit root test and the second-generation cross-sectionally augmented ADF (CADF) test. Afterward, depending on the results, Kao and Pedroni cointegration tests were applied. After detecting the presence of cointegrated relationships between the variables, FMOLS and DOLS estimators were used to estimate the long-term coefficients. The Dumitrescu-Hurlin causality test was also applied to analyze the causal relationship between the dependent variable and the independent variables.

Panel Unit Root Tests

The stationarity of the variables in the econometric analysis is crucial for the results to be reliable. Analyzing non-stationary variables may cause spurious regression. The tests that are employed to examine the unit root are classified as first-generation and second-generation unit root tests. The first one assumes there is no cross-section dependence (correlation between cross-section units), while the second assumes the opposite (Brooks, 2014).

Hadri (2000) developed a unit root test in which the null hypothesis is stationarity. He claimed that the way in which classic hypothesis testing is done ensures that the null hypothesis of the unit root is accepted as long as there is no strong evidence to the contrary. Hadri developed this test by expanding on a previous test suggested by Kwiatkowski et al. (Hadri, 2000). The test statistics of this test (LM statistics) are detailed below (2) (Hadri, 2000):

where \({S}_{it}=\sum_{j=1}^{t}{\hat{\epsilon }}_{ij}\) is the partial sum of the residuals and \({\hat{\sigma }}_{\epsilon }^{2}=\frac{1}{NT}\sum_{i=1}^{N}\sum_{t=1}^{T}{\hat{\epsilon }}_{it}^{2}\) is a consistent estimator of \({\sigma }_{\epsilon }^{2}\). These test statistics are tested under the null hypothesis of stationarity against the alternative hypothesis of the unit root.

As for the second-generation unit root test, we implemented the cross-sectionally augmented Dickey-Fuller (CADF) test. The CADF test can be used in the case of both T > N and N > T (Pesaran, 2007). Pesaran (2007) showed based on Monte Carlo simulations that the CADF test gives robust results even for small values of N and T (Pesaran, 2007).

Using the assumption that \({y}_{it}\) is built based on the dynamic linear heterogeneous panel data model, Pesaran (2007) followed the model in Eq. (3) (Pesaran, 2007):

In Eq. (3), \({y}_{i0}\) has a density function with a finite mean and variance, and the error term \({u}_{it}\) has a structure with a single factor:

In Eq. (4), \({f}_{t}\) denotes an unobserved common effect, and \({\varepsilon }_{it}\) denotes an error term specific to the cross-section. When we combine Eqs. (3) and (4), the result is Eq. (5):

where \({\alpha }_{i}=(1-{\varnothing }_{i}){\mu }_{i}\), \({\beta }_{i}=-(1-{\varnothing }_{i})\) and \(\Delta {y}_{it}={y}_{it}-{y}_{i,t-1}\)

H0 shows that all cross-sections have unit roots \({(H}_{0}:{\beta }_{i}=0)\), while H1 represents stationarity \({(H}_{1}:{\beta }_{i}<0)\). The CADF test reveals test statistics for both the cross-sections and the overall panel. The test statistics for the overall panel (CIPS) are obtained by averaging the test statistics of the cross-sections (Pesaran, 2007):

Panel Cointegration Tests

Based on the results of the cross-section dependency test for the residuals, we decided to implement a first-generation cointegration test. Hence, the Kao (1999) and Pedroni (2004) cointegration tests are implemented in this study. These tests are extended forms of the Engle-Granger cointegration test that involves panel data.

Supposing that \({y}_{it}\) and \({x}_{it}\) are incorrectly estimated by the least squares method for all i, Kao (1999) used the following least square dummy variable (LSDV) in the regression model (Kao, 1999):

In this equation, \(i=1\dots .,N\) refers to the cross-section units and \(t=1,\dots ,T\) refers to the residual-based period. Then, Kao (1999) derives the limiting distribution of the residual based cointegration tests by applying DF and ADF to the model above. The DF test is applied to the residuals using \({\hat{e}}_{it}=\rho {\hat{e}}_{it-1}+{v}_{it}\) and \(\hat{\rho }\), in which the OLS estimation of \(\rho\) is obtained. The null hypothesis is \(\rho =1\), meaning the residuals have unit roots (Kao, 1999). The ADF test is applied to the regression which includes the lag values:

where p is chosen to prevent the residuals \({v}_{it}\) from being serially correlated. Then, Kao (1999) defines the ADF statistics which do not depend on the nuisance parameters, so that it converges to N(0,1) asymptotically (Kao, 1999):

The Pedroni cointegration test proposes several tests that allow for heterogeneous intercepts and trend coefficients across units. Pedroni (2004) follows the regression in Eq. (10):

where \(i=1\dots .,N\) represents members, \(t=1,\dots ,T\) represents the time period, \({X}_{it}\) is an m-dimensional column vector for each member i, and \({\beta }_{i}\) is an m-dimensional row vector for each member i. The variables \({y}_{it}\) and \({X}_{it}\) are assumed to be I(1) for each i of the panel, and under the null hypothesis of no cointegration \({e}_{it}\), the residuals, will also be I(1). \({\alpha }_{i} \mathrm{and} {\delta }_{i}\) coefficients allow for the possibility of member-specific fixed effects and a deterministic trend, and the \({\beta }_{i}\) slope coefficients are also allowed to vary across cross-section units. All this means that the cointegration vectors may be heterogeneous across the members. Based on this, the null hypothesis is: “H0: all of the individuals of the panel are not cointegrated.” The alternative hypothesis is: “H1: a significant portion of the individuals are cointegrated” (Pedroni, 2004).

FMOLS and DOLS Estimators

Based on the cross-section dependency test results for the residuals of the model, we implemented FMOLS and DOLS estimators after detecting the presence of cointegration. Kao and Chiang (2000) provided a comparison for the finite sample properties of the OLS (ordinary least squares), fully modified OLS (FMOLS), and dynamic OLS (DOLS) estimators in panel data models. The Monte Carlo simulation results revealed that the OLS estimator is a biased estimator for finite samples (Kao & Chiang, 2000). Chen et al. (1999) followed the regression in Eq. (11):

The OLS estimator of β is first given in Eq. (12) below (Chen et al., 1999):

After detecting biased results of the OLS estimator, Chen et al. (1999) developed a bias-corrected OLS estimator. However, they revealed through the Monte Carlo experiments that the corrected estimator has poor performance and does not always exhibit less bias (Chen et al., 1999). Afterwards, the FMOLS estimator was developed by making some corrections for endogeneity and serial correlation problems on the OLS estimator in Eq. (12) (Kao & Chiang, 2000):

where \({\hat{\Delta }}_{\varepsilon u}\) is the kernel estimates of \({\Delta }_{\varepsilon u}\).

Kao and Cheng (2000) then used the DOLS estimates of β, \({\hat{\beta }}_{D}\), by running the regression in Eq. (14) below:

Finally, Kao and Chiang (2000) concluded that the FMOLS estimator is not more successful than the OLS estimator in general. The authors also indicate that the DOLS estimator performs very well in all cases of homogeneous and heterogeneous panels. Hence, the DOLS estimator was shown to be more promising than the OLS and FMOLS estimators in order to estimate cointegrated panel regressions (Kao & Chiang, 2000).

Dumitrescu-Hurlin Panel Causality Test

The Dumitrescu-Hurlin panel causality test, which is a type of Granger causality test developed for heterogeneous panel data models by Dumitrescu and Hurlin (2012), is based on the linear model in Eq. (15):

It assumes that x and y are stationary variables, lag length (k) is specific to the cross-section unit, and the panel is balanced. \({\gamma }_{i}^{(k)}\) represents the autoregressive parameter, and \({\beta }_{i}^{(k)}\) represents the slope of regression coefficients that remain stable over time. However, they are allowed to vary among the cross-section units. The null hypothesis of this test represents homogeneous non-causality and is indicated as follows (Dumitrescu & Hurlin, 2012):

The alternative hypothesis in the Dumitrescu-Hurlin causality test is heterogeneous compared to the standard Granger causality test. In other words, the null hypothesis refers to the non-existence of a causal relationship, while the alternative hypothesis refers to the existence of causality from X to Y for some cross-section units. The alternative hypothesis is indicated in Eq. (16) (Dumitrescu & Hurlin, 2012):

First, the Wald statistic (\({W}_{i,T}\)) is estimated, which corresponds to the \({H}_{0}:{\beta }_{i}=0\) hypothesis for each cross-section unit. Afterwards, \({W}_{N,T}^{HNC}=(\frac{1}{N}){\sum }_{i=1}^{N}{W}_{i,T}\), which is the Wald statistic for the overall panel, is obtained by calculating the arithmetic average of these Wald statistics (Saracoglu & Songur, 2017). Two test statistics are estimated in the Dumitrescu-Hurlin causality test (Zeren and Ari, 2013): \({Z}_{N,T}^{HNC}\) standardized test statistic for \(T,N\to \infty ,\) and \({\widetilde{Z}}_{N}^{HNC}\) standardized test statistic for the fixed T sample. The formulations of these test statistics are given in Eq. (17) and Eq. (18), respectively (Dumitrescu & Hurlin, 2012):

Dumitrescu and Hurlin (2012) suggest using asymptotically-distributed \({Z}_{N,T}^{Hnc}\) test statistics when T > N, and suggest using semi-asymptotically-distributed \({\widetilde{Z}}_{N}^{Hnc}\) test statistics when T < N.

Empirical Results

The present study examined the dynamic relationships between GDP per capita, ecological footprint, the economic complexity index, and the trade-to-GDP ratio for the top nine leading countries in terms of value-added in industry as a percent of GDP. In line with the aim of the study, the validity of the EKC was tested by employing cointegration tests. The first step in this case is to test the stationarity of the variables. However, before applying unit root tests, we applied a cross-section dependency test to each variable. The results of this test are given in Appendix 1. p values lower than 0.05 indicate that the null hypothesis of no cross-section dependence is rejected. The results in Appendix 1 show that all variables except LogEF have cross-section dependence. In light of these results, we employed the Hadri test for LogEF as a first-generation unit root test, and we applied the CADF test for all other variables as a second-generation test (Table 2).

The results of the Hadri unit root test determined that the LogEF variable has unit root at level and it becomes stationary at the first difference. The CADF test also indicates the same result for all other variables. It is concluded that the integration level of all variables is I(1). Since all variables are I(1), we further examined if there is a cointegrated relationship for the model in Eq. (1) (Table 3).

In the Pedroni test, at least five of the within-dimension test statistics are expected to be insignificant to reject the null hypothesis of no cointegration. In the Kao test, we reject the null hypothesis of cointegration if the p value of the ADF statistics is higher than 0.05. Both of the results reveal that there is a cointegrated relationship among these variables.

The next step is to estimate the long-run coefficients. However, it is necessary to check if there is a multicollinearity problem between the explanatory variables. Therefore, we presented the VIF values in Appendix 2. In the literature, it is accepted that if the VIF values are less than five, then there is no multicollinearity problem (Leitão et al., 2021). Accordingly, Appendix 2 shows that all VIF values are lower than five. Therefore, based on these results, the next step was taken to estimate the long-run coefficients.

As mentioned above, the coefficient of per capita GDP is required to be significantly positive, and the coefficient of the square of per capita GDP is expected to be significantly negative in order for the EKC to be valid in this case. Examining Table 4, the coefficient of per capita GDP is seen to be significantly positive, and the coefficient of the square of per capita GDP is significantly negative for both the FMOLS and DOLS estimates. Therefore, these results confirm the validity of the EKC in these nine countries for the data used between 1970 and 2017. Also, LogECI was found to have a significantly negative effect on the LogEF variable which is in accordance with theoretical expectations. The coefficient of the LogTrade variable is not significant in both the FMOLS and DOLS estimates. (Table 5)

Finally, the Dumitrescu-Hurlin panel causality test was used to examine the existence of a causal relationship from the independent variables to the dependent variable. Moreover, we employed a cross-section dependence test (LMadj) to detect whether there is cross-section dependence in the residuals of the equations that correspond to the causal relationships. The residuals of the models that correspond to the causal relationships were found to have cross-section dependence, except the one model representing causality from LogGDP to LogEF. Accordingly, we applied a first-generation causality test for this causal relationship, while we applied second-generation causality tests for the others. We also presented \({Z}_{N,T}^{Hnc}\) test statistics since T > N in this sample. According to the results of the causality tests, there is a causal relationship from all independent variables (namely, LogECI, LogGDP, and LogTrade) to the LogEF variable.

The results of the model analysis show that as economic growth in these nine countries increases the level of environmental destruction increases up to a certain stage. This process reverses after reaching a certain level. This result is consistent with other related studies (Shahbaz et al., 2013; Al-Mulali et al., 2015; Dogan & Seker, 2016; Kilic & Balan, 2018; Aslan et al., 2018; Danish & Ulucak, 2021). In addition to the empirical results obtained from the model, economic complexity was found to have a significant negative effect on the ecological footprint variable in this period. That is, as economic complexity increases, the ecological footprint decreases. These results are also consistent with theoretical expectations and previous studies (Romero & Gramkow, 2020; Mealy & Teytelboym, 2020; Boleti et al., 2021).

Conclusion and Discussion

The main hypothesis of the study is to demonstrate the validity of an inverted U-shaped relationship between environmental degradation and per capita income. Therefore, this study examined the dynamic relationships between the economic complexity index, ecological footprint, GDP per capita, and the trade-to-GDP ratio for the top nine industrialized countries between 1970 and 2017. Looking at the results of the model, the findings confirm the validity of the EKC for these countries. In addition, according to the results of the causality tests, there is a causal relationship from all the independent variables analyzed. There are a number of policy recommendations that can be made in line with the empirical results of the article. These recommendations are listed below.

Due to economic growth and the increasing demands for consumption, often there is a lack of efficiency in resource allocation, and as a result, resources tend to be wasted. Furthermore, non-renewable resources available in the environment are limited. It is also argued that even if some resources can be renewed, the accelerating economic growth will irreversibly affect the environmental destruction process. For these reasons, focusing on economic growth approaches that can minimize damage to the environment should be high priorities for every country. In addition, sustainable growth goals will also force countries to act competitively. This competition will also bring with it a production structure that requires a more efficient distribution of resources. This process can create economies that produce more complex, high-tech products which, in turn, promotes innovative technologies and efficiency. Therefore, the first policy proposal is about the necessity of transforming the production structure in developing countries in a way that promotes economic complexity. A type of production structure that is economically complex will create benefits to the economy in a way that increases the income of the country and a production chain that is more sensitive to the environment. For this reason, national policies for the growth of underdeveloped and developing economies should be sensitive to the importance of producing high-tech products as they consider economic and structural transformations. Policymakers should evaluate their export and import structure and determine helpful strategies that improve and facilitate the development of foreign trade with neighboring countries under these principles.

The results of the study show that although there are increasing environmental challenges in the early stages of economic development, economic complexity contributes positively to an economy’s ecological footprint when resources are used with efficient technologies. Technological production, which requires specialized knowledge, is possible with human capital that is well-equipped. The second policy proposal is related to the education structure of an economy. Arranging the education system and various course programs in such a way that there is a strong investment in specialized training and technical know-how increases economic growth within a structure that is economically complex. More than that, this type of economic growth is shown to reduce damage caused to the environment. As an additional policy proposal, we recommend using green or environmentally friendly technologies to reduce damage to the environment during the economic development process. Structural changes that encourage or require cleaner and renewable energy sources help reduce emissions and support a complex economic growth model that is also mindful of the environment.

The final policy recommendation draws attention to the need for government support for companies and specific sectors that stand out in producing complex products that reduce their ecological footprint. Investment resources should be provided to these sectors or companies with incentives such as selective loan options and various tax advantages. These incentives will both stimulate environmentally-friendly production and encourage already established companies to look toward green alternatives. These recommendations based on the findings of this study preserve sustainable production structures that help countries achieve their economic goals and preserve an important level of environmental awareness.

Data availability

All data generated or analyzed during this study are included in the supplementary material of this article.

References

Abbasi, K. R., Lv, K., Radulescu, M., & Shaikh, P. A. (2021). Economic complexity, tourism, energy prices, and environmental degradation in the top economic complexity countries: Fresh panel evidence. Environmental Science and Pollution Research, 28(48), 68717–68731. https://doi.org/10.1007/s11356-021-15312-4

Acevedo-Ramos, J. A., Valencia, C. F., & Valencia, C. D. (2023). The Environmental Kuznets Curve Hypothesis for Colombia: Impact of Economic Development on Greenhouse Gas Emissions and Ecological Footprint. Sustainability, 15, 3738. https://doi.org/10.3390/su15043738

Adedoyin, F. F., Nwulu, N., & Bekun, F. V. (2021). Environmental degradation, energy consumption, and sustainable development: Accounting for the role of economic complexities with evidence from World Bank income clusters. Business Strategy and the Environment, 30(5), 2727–2740. https://doi.org/10.1002/bse.2774

Algan, N., Bal, H., & Manga, M. (2021). N-11 Ülkelerinde Ekonomik Karmaşıklık ve Çevresel Bozulma İlişkisine Yönelik Ampirik Analiz. International Conference on Eurasian Economies, 2021, 324–329.

Al-Mulali, U., & Ozturk, I. (2015). The effect of energy consumption, urbanization, trade openness, industrial output, and the political stability on the environmental degradation in the MENA (Middle East and North African) region. Energy, 84, 382–389. https://doi.org/10.1016/j.energy.2015.03.004

Al-Mulali, U., Weng-Wai, C., Sheau-Ting, L., & Mohammed, A. H. (2015). Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecological Indicators, 48, 315–323. https://doi.org/10.1016/j.ecolind.2014.08.029

Aluko O. A., Opoku E. E. O., & Acheampong A.O. (2022), Economic complexity and environmental degradation: Evidence from OECD countries. Business Strategy and Environmentment, 1–22. https://doi.org/10.1002/bse.3269

Ansari, M. A., Ahmad, M. R., Siddique, S., & Mansoor, K. (2021). An environment Kuznets curve for ecological footprint: Evidence from GCC countries. Carbon Management, 11(4), 355–368. https://doi.org/10.1080/17583004.2020.1790242

Arnaut, M., & Dada, J. T. (2022). Exploring the nexus between economic complexity, energy consumption and ecological footprint: New insights from the United Arab Emirates. International Journal of Energy Sector Management. https://doi.org/10.1108/IJESM-06-2022-0015

Aslan, A., Destek, M. A., & Okumus, I. (2018). Bootstrap rolling window estimation approach to the analysis of the environment Kuznets curve hypothesis: Evidence from the USA. Environmental Science and Pollution Research, 25(3), 2402–2408. https://doi.org/10.1007/s11356-017-0548-3

Azizi, Z., Daraei, F., & Boroujeni, A. (2019). The impact of economic complexity on environmental pollution. Economic Development Policy, 7(2), 201–219.

Bagliani, M., Bravo, G., & Dalmazzone, S. (2008). A consumption-based approach to environmental Kuznets curves using the ecological footprint indicator. Ecological Economics, 65(3), 650–661. https://doi.org/10.1016/j.ecolecon.2008.01.010

Batjes, N. H. (2014). Total carbon and nitrogen in the soils of the world. European Journal of Soil Science, 65(1), 10–21. https://doi.org/10.1111/ejss.12115

Bese, E., & Kalayci, S. (2019). Testing the environmental Kuznets curve hypothesis: Evidence from Egypt, Kenya, and Turkey. International Journal of Energy Economics and Policy, 9(6), 479–491. https://doi.org/10.1111/ejss.12115

Boleti E., Garas A., Kyriakou A., & Lapatinas A. (2021). Economic complexity and environmental performance: evidence from a world sample, Environmental Modeling And Assessment. ISSN 1420–2026, 26(3), JRC121608, 251–270. https://doi.org/10.1007/s10666-021-09750-0

Brooks, C. (2014). Introductory econometrics for finance (3rd ed.). Cambridge University Press.

Can, M., & Gozgor, G. (2017). The impact of economic complexity on carbon emissions: Evidence from France. Environmental Science and Pollution Research, 24(19), 16364–16370. https://doi.org/10.1007/s11356-017-9219-7

Caviglia-Harris, J. L., Chambers, D., & Kahn, J. R. (2009). Taking the “U” out of Kuznets: A comprehensive analysis of the EKC and environmental degradation. Ecological Economic, s, 68(4), 1149–1159. https://doi.org/10.1016/j.ecolecon.2008.08.006

Chen, B., McCoskey, S. K., & Ka, C. (1999). Estimation and inference of a cointegrated regression in panel data: A Monte-Carlo study. American Journal of Mathematical and Management Sciences, 19(1–2), 75–114. https://doi.org/10.1080/01966324.1999.10737475

Chu, L. K. (2021). Economic structure and environmental Kuznets curve hypothesis: New evidence from economic complexity. Applied Economics Letters, 28(7), 612–616. https://doi.org/10.1080/13504851.2020.1767280

Danish, O. B., & Ulucak, R. (2021). An empirical investigation of nuclear energy consumption and carbon dioxide (CO2) emission in India: Bridging IPAT and EKC hypotheses. Nuclear Engineering and Technology, 53(6), 2056–2065. https://doi.org/10.1016/j.net.2020.12.008

Dietz, T., Rosa, E. A., & York, R. (2012). Environmentally efficient well-being: Is there a Kuznets curve? Applied Geography, 32(1), 21–28. https://doi.org/10.1016/j.apgeog.2010.10.011

Dogan, B., Saboori, B., & Can & M. (2019). Does economic complexity matter for environmental degradation? An empirical analysis for different stages of development. Environmental Science and Pollution Research, 26(31), 31900–31912. https://doi.org/10.1007/s11356-019-06333-1

Dogan, E., & Seker, F. (2016). Determinants of CO2 emissions in the European Union: The role of renewable and non-renewable energy. Renewable Energy, 94, 429–439. https://doi.org/10.1016/j.renene.2016.03.078

Dumitrescu, E. I., & Hurlin, C. (2012). Testing for Granger non-causality in heterogeneous panels. Economic Modelling, 29, 1450–1460. https://doi.org/10.1016/j.econmod.2012.02.014

Ferrarini B., & Scaramozzino P. (2013). Asian Development Bank. Complexity, Specialisation and Growth. Working Paper No 344. Retrieved October 5, 2021, from http://hdl.handle.net/11540/2329

Galli, A., Kitzes, J., Niccolucci, V., Wackernagel, M., Wada, Y., & Marchettini, N. (2012). Assessing the global environmental consequences of economic growth through the ecological footprint: A focus on China and India. Ecological Indicators, 17, 99–107. https://doi.org/10.1016/j.ecolind.2011.04.022

Gozgor, G., & Can, M. (2017). Does export quality matter for CO2 emissions? Evidence from China. Environmental Science and Pollution Research, 24(3), 2866–2875. https://doi.org/10.1007/s11356-016-8070-6

Grossman G., & Krueger A. (1991). Environmental impacts of a North American free trade agreement. Working Paper 3914, National Bureau of Economics Research, November. http://www.nber.org/papers/w3914.pdf. https://doi.org/10.3386/w3914

Hadri, K. (2000). Testing for stationary in heterogeneous panel data. Econometrics Journal, 3, 148–161. https://doi.org/10.1111/1368-423X.00043

Haggar, M. H. (2012). Greenhouse gas emissions, energy consumption and economic growth: A panel cointegration analysis from Canadian industrial sector per- spective. Energy Economics, 34, 358–364. https://doi.org/10.1016/j.eneco.2011.06.005

Hausmann, R., & Hidalgo, C. A. (2011). The network structure of economic output. Journal of Economic Growth, 16(4), 309–342. https://doi.org/10.1007/s10887-011-9071-4

Hervieux, M. S., & Darne, O. (2015). Environmental Kuznets curve and ecological footprint: A time series analysis. Economic Bulletin, 35(1), 814–826.

Htike M. M., Shrestha A., & Kakinaka M. (2022). Investigating whether the environmental Kuznets curve hypothesis holds for sectoral CO2 emissions: Evidence from developed and developing countries. Environment Development and Sustainability, 24, 12712–12739.https://doi.org/10.1007/s10668-021-01961-5

Jahanger A., Yu Y., Awan A., Chishti M. Z., Radulescu M., & Balsalobre-Lorente D. (2022). The impact of hydropower energy in Malaysia under the EKC hypothesis: Evidence from quantile ARDL approach. SAGE Open, 12(3). https://doi.org/10.1177/21582440221109580

Kang S. H., Islam, F., Kumar, T., & Aviraral. (2019). The dynamic relationships among CO2 emissions, renewable and non-renewable energy sources, and economic growth in India: Evidence from time-varying Bayesian VAR model, Structural Change and Economic Dynamics. Elsevier, 50(C), 90–101. https://doi.org/10.1016/j.strueco.2019.05.006

Kao, C. (1999). Spurious regression and residual-based tests for cointegration in panel data. Journal of Econometrics, 90(1999), 1–44. https://doi.org/10.1016/S0304-4076(98)00023-2

Kao, C., & Chiang, M. (2000). On the estimation and inference of a cointegrated regression in panel data. Nonstationary Panels, Panel Cointegration and Dynamic Panels, 15, 179–222. https://doi.org/10.1016/S0731-9053(00)15007-8

Kilic, C., & Balan, F. (2018). Is there an environmental Kuznets inverted-U shaped curve? Panoeconomicus, 65(1), 79–94. https://doi.org/10.2298/PAN150215006K

Kuznets, S. (1955). Economic growth and income inequality. The American Economic Review, 45(1), 1–28. http://www.jstor.org/stable/1811581

Lapatinas, A., Garas, A., Kyriakou, A., & Boleti, E. (2021). Economic complexity and environmental performance: Evidence from a world sample. Environmental Modeling & Assessment MPRA, Paper No, 92833, 1–46.

Laverde-Rojas H., Guevara-Fletcher D. A., & Camacho-Murillo A. (2021). Economic growth, economic complexity, and carbon dioxide emissions: The case of Colombia. Heliyon, 7(6), e07188. https://doi.org/10.1016/j.heliyon.2021.e07188

Lee C. C., Chen M. P., & Wu W. (2022). The criticality of tourism development, economic complexity, and country security on ecological footprint. Environmental Science and Pollution Research, 1–37. https://doi.org/10.1007/s11356-022-18499-2

Leitão, N. C., Balsalobre-Lorente, D., & Cantos-Cantos, J. M. (2021). The impact of renewable energy and economic complexity on carbon emissions in BRICS countries under the EKC scheme. Energies, 14(4908), 1–15. https://doi.org/10.3390/en14164908

Liu, P.-Z., Narayan, S., Ren, Y.-S., Jiang, Y., Baltas, K., & Sharp, B. (2022). Re-examining the income–CO2 emissions nexus using the new kink regression model: Does the Kuznets curve exist in g7 countries? Sustainability, 14(7), 3955. https://doi.org/10.3390/su14073955

Majeed, M. T., Mazhar, M., Samreen, I., & Tauqir, A. (2022). Economic complexities and environmental degradation: Evidence from OECD countries. Environment, Development and Sustainability, 24, 5846–5866. https://doi.org/10.1007/s10668-021-01687-4

Mealy, P., & Teytelboy, A. (2020). Economic complexity and the green economy. Research Policy, 103948. https://doi.org/10.1016/j.respol.2020.103948

Moleiro Martins, J., Adebay, T. S., Mata, M. N., Oladipupo, S. D., Adeshola, I., Ahmed, Z., & Correira, A. B. (2021). Modeling the relationship between economic complexity and environmental degradation: Evidence from top seven economic complexity countries. Frontiers in Environmental Science, 9, 1–12. https://doi.org/10.3389/fenvs.2021.744781

Mosconi, E. M., Colantoni, A., Gambella, F., Cudlinová, E., Salvati, L., & Rodrigo-Comino, J. (2020). Revisiting the Environmental Kuznets Curve: THe Spatial Interaction between Economy and Territory Economies, 8(3), 1–20. https://doi.org/10.3390/economies8030074

Mrabet, Z., & Alsamara, M. (2017). Testing the Kuznets curve hypothesis for Qatar: A comparison between carbon dioxide and ecological footprint. Renewable and Sustainable Energy Reviews, 70, 1366–1375. https://doi.org/10.1016/j.rser.2016.12.039

Narayan, P. K., & Narayan, S. (2010). Carbon dioxide emissions and economic growth: Panel data evidence from developing countries. Energy Policy, 38(1), 661–666. https://doi.org/10.1016/j.enpol.2009.09.005

Neagu, O., & Teodoru, M. C. (2019). The relationship between economic complexity, energy consumption structure, and greenhouse gas emission: Heterogeneous panel evidence from the EU countries. Sustainability, 11(2), 497. https://doi.org/10.3390/su11020497

Ntim-Amo, G., Qi, Y., Ankrah-Kwarko, E., Ankrah, T. M., Ansah, S., Boateng, K. L., & Ruiping, R. (2022). Investigating the validity of the agricultural-induced environmental Kuznets curve (EKC) hypothesis for Ghana: Evidence from an autoregressive distributed lag (ARDL) approach with a structural break. Management of Environmental Quality, 33(2), 494–526. https://doi.org/10.1108/MEQ-05-2021-0109

Nordhaus, W. (2019). Climate change: The ultimate challenge for economics. American Economic Review, 109(6), 1991–2014. https://doi.org/10.1257/aer.109.6.1991

Ozcan, B. (2013). The nexus between carbon emissions, energy consumption and economic growth in Middle East countries: A panel data analysis. Energy Policy, 62, 1138–1147. https://doi.org/10.1016/j.enpol.2013.07.016

Ozcan, B., Apergis, N., & Shahbaz, M. (2018). A revisit of the environmental Kuznets curve hypothesis for Turkey: New evidence from bootstrap rolling window causality. Environmental Science and Pollution Research, 25(32), 32381–32394. https://doi.org/10.1007/s11356-018-3165-x

Ozcan, B., Tzeremes, P., & Dogan, E. (2019). Re-estimating the interconnectedness between the demand of energy consumption, income, and sustainability indices. Environmental Science and Pollution Research, 26(26), 26500–26516. https://doi.org/10.1007/s11356-019-05767-x

Ozcan, B., Tzeremes, P. G., & Tzeremes, N. G. (2020). Energy consumption, economic growth, and environmental degradation in OECD countries. Economic Modelling, 84, 203–213. https://doi.org/10.1016/j.econmod.2019.04.010

Ozturk, I., Al-Mulali, U., & Saboori, B. (2016). Investigating the environmental Kuznets curve hypothesis: The role of tourism and ecological footprint. Environmental Science and Pollution Research, 23(2), 1916–1928. https://doi.org/10.1007/s11356-015-5447-x

Pata, U. K. (2021). Renewable and non-renewable energy consumption, economic complexity, CO2 emissions, and ecological footprint in the USA: Testing the EKC hypothesis with a structural break. Environmental Science and Pollution Research, 28(1), 846–861. https://doi.org/10.1007/s11356-020-10446-3

Pedroni, P. (2004). Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the ppp hypothesis. Econometric Theory, 20, 597–625. https://doi.org/10.1017/S0266466604203073

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. Journal of Applied Econometrics, 22, 265–312. https://doi.org/10.1002/jae.951

Rafique, M. Z., Nadeem, A. M., Xia, W., Ikram, M., Shoaib, H. M., & Shahzad U. (2021). Does economic complexity matter for environmental sustainability? Using ecological footprint as an indicator. Environment, Development, and Sustainability, 1–18. https://doi.org/10.1007/s10668-021-01625-4

Ritchie, H., & Roser, M. (2017). Co2 and greenhouse gas emissions. Our World in Data. Robalino-López, A., Mena-Nieto, A., García-Ramos, J.E., 2014. System dynamics modeling for renewable energy and CO2 emissions: A case study of Ecuador. Energy for Sustainable Development, 20, 11–20.

Romero, J. P., & Gramkow, C. (2020). Economic complexity and greenhouse gas emission intensity. Cambridge Centre for Economic and Public Policy, Department of Land Economy, CCEPP WPO3, University of Cambridge: Cambridge, MA, USA. https://doi.org/10.1016/j.worlddev.2020.105317

Saboori, B., & Sulaiman, J. (2013). CO2 emissions, energy consumption and economic growth in Association of Southeast Asian Nations (ASEAN) countries: A cointegration approach. Energy, 55, 813–822. https://doi.org/10.1016/j.energy.2013.04.038

Saqib, N., Usman, M., Radulescu, M., Sinisi, C. I., Secara C. G., & Tolea C. (2022). Revisiting EKC hypothesis in context of renewable energy, human development and moderating role of technological innovations in E-7 countries?. Frontier Environment and Science, 10:1077658. https://doi.org/10.3389/fenvs.2022.107765

Saraçoğlu, S., & Songur, M. (2017). Sağlık Harcamaları ve Ekonomik Büyüme İlişkisi: Avrasya Ülkeleri Örneği. Kafkas Üniversitesi İktisadi Ve İdari Bilimler Fakültesi Dergisi, 8(16), 353–372.

Shahzad, U., Fareed, Z., Shahzad, F., & Shahzad, K. (2021). Investigating the nexus between economic complexity, energy consumption and ecological footprint for the United States: New insights from quantile methods. Journal of Cleaner Production, 279, 123806. https://doi.org/10.1016/j.jclepro.2020.123806

Shahbaz, M., Ozturk, I., Afza, T., & Ali, A. (2013). Revisiting the environmental Kuznets curve in a global economy. Renewable and Sustainable Energy Reviews, 25, 494–502. https://doi.org/10.1016/j.rser.2013.05.021

Shahbaz, M., & Sinha, A. (2019). Environmental Kuznets curve for CO2 emissions: A literature survey. Journal of Economic Studies, Emerald Group Publishing, 46(1), 106–168. https://doi.org/10.1108/JES-09-2017-0249

Wang, Q., Zhang, F. Y., & Li R. R. (2022). Revisiting the environmental Kuznets curve hypothesis in 208 counties: The roles of trade openness, human capital, renewable energy and natural resource rent. Environmental Research, 216(3), 114637 https://doi.org/10.1016/j.envres.2022.114637

Yilanci, V., & Pata, U. K. (2020). Investigating the EKC hypothesis for China: The role of economic complexity on ecological footprint. Environmental Science and Pollution Research, 27(26), 32683–32694. https://doi.org/10.1007/s11356-020-09434-4

Zeren, F., & Arı, A. (2013). Trade openness and economic growth. International Journal of Business and Social Sciences, 4(9), 317–324.

Zhang, J. (2021). Environmental Kuznets curve hypothesis on CO2 emissions: Evidence for China. Journal of Risk and Financial Management, 14(3), 93. https://doi.org/10.3390/jrfm14030093

Zhang, Z., & Yan, M. (2022). Reexamining the environmental Kuznets curve in Chinese cities: Does intergovernmental competition matter?. International Journal of Environmental Research and Public Health, 19(22), 14989. https://doi.org/10.3390/ijerph192214989.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethical approval

This research does not include any studies on animals that were performed by any of the authors.

Consent to participate

All authors participated in the research work underlying the content of the manuscript.

Consent for publication

All authors have read and approved the final manuscript for submission.

Competing interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article is part of the Topical Collection on Digital Transformation and Disruption

Supplementary Information

Below is the link to the electronic supplementary material.

Appendices

Appendix 1. Cross-section dependency test results

Test | Log EF | Log GDP | Log GDP 2 | Log ECI | Log Trade |

|---|---|---|---|---|---|

CDLM1 | 37.01065 | 1601.403*** | 1589.38*** | 571.278*** | 1033.399*** |

(0.4221) | (0.000) | (0.000) | (0.000) | (0.000) | |

CDLM2 | −0.941554 | 183.424*** | 182.007*** | 62.022*** | 116.484*** |

(0.3464) | (0.000) | (0.000) | (0.000) | (0.000) | |

LMadj | −1.037299 | 183.33*** | 181.911*** | 61.9267*** | 116.39*** |

(0.2996) | (0.000) | (0.000) | (0.000) | (0.000) |

Appendix 2. Variance inflation factor

Variable | Variance inflation factor (VIF) | 1/VIF |

|---|---|---|

LogGDP | 4.24 | 0.2359 |

LogECI | 3.93 | 0.2543 |

LogTrade | 1.16 | 0.8632 |

Mean VIF = 3.11 | ||

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kılıç, C., Soyyiğit, S. & Bayrakdar, S. Economic Complexity, Ecological Footprint, and the Environmental Kuznets Curve: Findings from Selected Industrialized Countries. J Knowl Econ 15, 7402–7427 (2024). https://doi.org/10.1007/s13132-023-01411-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-023-01411-9