Abstract

Motivated by investment-based asset pricing, we show that two firm fundamentals, investment and profitability, have substantial predictive power for REIT returns. The return predictability of investment and profitability is not subsumed by conventional models and can be useful for understanding the cross section of expected REIT returns. To illustrate, we construct an investment-based factor model for REITs that consists of a market factor, an investment factor, and a profitability factor. The investment-based model outperforms conventional models in capturing well-known cross-sectional patterns in REIT returns. Our findings suggest that incorporating investment-based asset pricing can be a promising direction for future real estate finance research.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

A growing investment-based asset pricing literature shows that variations in asset returns can be understood from the perspective of corporate investment decisions (e.g., Cochrane 1991, Berk et al. 1999, and Zhang 2005a, b). The key insight is straightforward: Investment decisions reflect corporate managers’ expectation about the riskiness of future cash flows. Therefore, we can extract information about the unobservable riskiness of future cash flows from the observable corporate investment decisions. This insight is supported by extensive empirical evidence (e.g., Cochrane 1996, Liu et al. 2009, and Hou et al. 2015a, b). For example, Hou et al. (2015a) show that their investment-based q-factor model provides a better fit for the cross section of common stock returns than leading conventional models.

We propose incorporating the investment-based asset pricing into real estate finance research. In particular, we apply it to understand the expected returns of real estate investment trusts (REITs). The investment-based model suggests that two firm fundamentals, investment and profitability, provide useful information about discount rates (expected returns).Footnote 1 The basic idea follows the principle of capital budgeting: Firms will invest more when profitability is high and the discount rate is low. Controlling for profitability, high investment implys low discount rates. Controlling for investment, high profitability signals high discount rates.

We show that investment and profitability have substantial predictive power for REIT returns. From 1994 to 2013, REITs with the highest 20 % investment rates underperform REITs with the lowest 20 % investments by 0.36 % per month (t = −1.98), while REITs with the highest 20 % profitability beat REITs with the lowest 20 % profitability by 0.70 % per month (t = 2.90). The predictive power of investment and profitability cannot be subsumed by conventional models widely used in the REIT literature. For example, the model-adjusted return spread related to profitability increases to 0.90 % per month (t = 4.77) for the Fama-French three-factor model and 0.80 % per month (t = 4.16) for the Carhart four-factor model.

We then show that the return predictability of investment and profitability can be useful for understanding the cross section of expected REIT returns. To illustrate, we construct an investment-based three-factor model for REITs that consists of a market factor, an investment factor, and a profitability factor. Compared with the conventional models, the investment-based model does a better job in matching return variations associated with price momentum, earnings surprise, idiosyncratic volatility, and share turnover. For example, the investment-based model produces a high-minus-low pricing error of 0.26 % per month (t = 1.56) across quintile portfolios sorted on earning surprise. In contrast, the high-minus-low error is 0.70 % per month (t = 3.82) for the Fama-French model and 0.52 % per month (t = 2.94) for the Carhart model. Our findings suggest that incorporating investment-based asset pricing into real estate finance research is a promising direction.

Our study contributes to real estate finance by introducing new economic insights from asset pricing research. The documented return predictability of investment and profitability adds to the existing literature on the cross section of expected REIT returns (e.g., Chui et al. 2003a, b, Hung and Glascock 2010, and Price et al. 2012). Moreover, given its good empirical performance, the new investment-based model can serve as a useful tool for empirical research and applications, such as assessing real estate fund manager performance. Finally, by linking returns to the fundamentals of REITs, our results suggest that well-known patterns in REIT returns may not necessarily be attributed to market inefficiency (e.g., Price et al. 2012). Identifying the exact economic forces behind the investment and profitability effects is an important question for future research.

Our study also adds to the asset pricing literature that studies the interaction between asset prices and corporate investments. Cochrane (1991, 1996) first applies an investment model to study stock returns. Berk et al. (1999) construct real option models to explain stock return anomalies. More recently, Liu et al. (2009) show that an investment-based model can explain stock returns related to earnings surprise, book-to-market, and corporate investment. Hou et al. (2015a) construct an investment-based factor model that outperforms conventional models in pricing a wide range of stock return anomalies. Our study differs by applying the investment-based model to the real estate market. Given the economic importance of the real estate market, our study serves as a valuable extension. In addition, the real estate market may provide certain empirical advantages for testing the investment model. For example, non-real estate companies often invest in a wider range of tangible and intangible assets. In contrast, asset and investment decisions are more homogeneous for real estate companies.

The rest of the paper is organized as follows. We briefly review the related literature in the next section. We then discuss our methodology in the third section and data and measurement in the fourth section. In the fifth section, we document the empirical evidence that support the predictions from investment-based asset pricing. The last section concludes and discusses future directions.

Literature

Despite the extensive work on the cross section of stock returns, there are a more limited set of papers on this topic in the real estate literature. Because of the unique regulatory structure of REITs, along with many other types of financial stocks, REITs are typically excluded from asset pricing studies of stock returns. However, there are reasons to believe that REITs may yield useful insights into both asset pricing theory and the nature of the underlying asset class. In particular, REITs are financial claims associated with portfolios of investment-grade real estate assets. Such assets trade in reasonably well-developed markets with a high degree of informational transparency. This parallel asset market idea has been exploited by many other REIT studies and is postulated to reduce the information uncertainty associated with REITs (at least to a larger degree than most other common stocks, see for instance, Hartzell et al. 2010). Furthermore, REITs are required to hold 75 % of their assets in real estate (or related assets) and the long-term relationships between REIT returns and the performance of the underlying assets is now well established (see Bond and Chang 2013 for a recent review of this literature).

The prior literature in this area has identified two dominant features of the determinants of the cross section of REIT returns: price momentum and earnings drift. The importance of price momentum was identified by Chui et al. (2003a, b), and later confirmed by Hung and Glascock (2008, 2010), Derwall et al. (2009), and Goebel et al. (2013). The price momentum effect in the real estate market is pervasive and economically larger than found in common stocks (Chui et al. 2003b, and Derwall et al. 2009).

Another feature of REIT returns that warrants additional investigation is the finding of a significant post earnings announcement drift (Price et al. 2012). The finding is inconsistent with the perceived high information transparency for REITs. Furthermore, the magnitude of this effect is stronger for REITs than common stocks. The connection between price momentum and earnings drift has been investigated by Feng et al. (2014). The authors find that the two effects are negatively correlated and a trading strategy based on earnings drift dominates a price momentum strategy.

The paper most related to ours is Glascock, and Lu-Andrews (2014) who investigate a profitability premium in REITs. They use a variety of profitability measures, including FFO, but find gross profitability and return on equity measures to be preferred. They also find that profitability dominates the size and book-to-market in cross-sectional regressions. Their study focuses on the cross-sectional predictability of profitability and does not consider the construction of common risk factors based on these measures or the role of investment.

Methodology

Investment-based asset pricing model (e.g., Hou et al. 2015a) suggest that two firm fundamentals, investment and profitability, provide useful information about discount rates (expected returns). The intuition is straightforward: Firms will invest more when profitability is high and discount rates are low. Controlling for profitability, high investments are associated with low discount rates and thus should negatively predict future returns. Controlling for investments, high profitability signals high discount rates and should positively predict future returns. To test these theoretical predictions, we first form REIT portfolios based on investment and profitability and see whether this generates a significant spread in future returns. In addition, we test if any return predictive power of investment and profitability can be subsumed by conventional models.

We then follow the methodology of Hou et al. (2015a) and construct an investment-based factor model for REITs that consists of a REIT market factor (r MKT ), an investment (investment-to-assets, I/A) factor (r I/A ), and a profitability (return on equity, ROE) factor (r ROE ):

in which E[r] is the expected return of a REIT, r f is the risk-free rate, β MKT , β I/A and β ROE are the factor loadings, and E[r MKT ] , E[r I/A ] and E[r ROE ] are the corresponding expected factor premiums. The REIT market factor is defined as the excess return on the FTSE NAREIT All Equity REIT Index over the one-month Treasury bill rate. The investment factor is defined as the difference in average returns between low-investment REITs and high-investment REITs, while the profitability factor is defined as the difference in average returns between high-profitability REITs and low-profitability REITs.

The new model can be tested using the standard time-series factor regressions:

in which r t − r f , t is the realized excess REIT return in period t, a is the intercept or pricing error, b, i, and r are the slopes or estimated factor loadings on the market factor, the investment factor, and the profitability factor, and e t is the residual. To evaluate the model, we form testing portfolios based on well-known REIT return predictors and examine the model’s ability to capture the resulting dispersions in future returns. If the model performs well, then the pricing error a should be both economically and statistically close to zero.

For comparison, we also examine the performance of three leadings conventional models in the literature: The Capital Asset Pricing Model (CAPM), the Fama-French three-factor model (Fama and French 1993, 1996), and the Carhart four-factor model (Carhart 1997):

in which β MKT , β SMB , β HML and β UMD are the factor loadings on the market factor (r MKT ), the size factor (r SMB ), the book-to-market (B/M) factor (r HML ) and the momentum factor (r UMD ), and E[r MKT ], E[r SMB ] , E[r HML ] and E[r UMD ] are the corresponding expected factor premiums.

Data and Measurements

Our analysis focuses on the universe of equity REITs as identified by the National Association of Real Estate Investment Trusts (NAREIT). The sample includes 356 unique equity REITs traded on NSYE, Amex, and Nasdaq from 1994 to 2013. Monthly return data are from CRSP and annual and quarterly accounting data are from Compustat. The common stock-based conventional factors are from Ken French’s website. Following the REIT literature, we also construct the REIT-based version of the conventional factors.Footnote 2

We measure investment as investment-to-assets (I/A), which is defined as the annual growth rate in non-cash assets (Compustat item AT minus item CHE).Footnote 3 Growth in non-cash assets is a comprehensive measure of investments in different productive assets (e.g., fixed assets and working capital).Footnote 4 We measure profitability as quarterly return on equity (ROE), defined as quarterly income before extraordinary items (item IBQ) divided by one-quarter-lagged book equity.Footnote 5 Book equity is shareholders’ equity, plus balance sheet deferred taxes and investment tax credit (item TXDITCQ) if available, minus the book value of preferred stock (item PSTKQ). Depending on availability, we use stockholders’ equity (item SEQQ), or common equity (item CEQQ) plus the book value of preferred stock, or total assets (item ATQ) minus total liabilities (item LTQ) in that order as shareholders’ equity. Annual investment rate is considered known four months after the corresponding fiscal year end. Quarterly ROE becomes known on the earnings announcement date (item RDQ).

Table 1 presents the summary statistics for the NAREIT equity REIT sample. The unique number of REITs ranges from 105 in 2009 to 195 in 1998, while their average market capitalization grows steadily from 223 million dollars in 1994 to 4.28 billion dollars in 2013. The median REIT in our sample has an annual investment rate of 10.44 % and a quarterly ROE of 1.70 %. Both investment and profitability vary substantially across REITs. For example, the top 5 % REITs expand their assets by 95.76 % while the bottom 5 % REITs shrink their assets by 9.61 %. Investment and profitability have a positive rank correlation of 0.17, as more profitable REITs tend to invest more. High-investment REITs tend to have somewhat lower B/M and lower recent past returns than low-investment REITs.Footnote 6 Meanwhile, high-profitability REITs tend to be growth firms with good recent returns, positive earnings surprise, low idiosyncratic risk, and low share turnover.

Results

We first show that investment and profitability can predict future returns of REITs and such predictability cannot be subsumed by the conventional models. We then construct return factors based on investment and profitability, and show that an investment-based three-factor model can match the cross section of expected REIT returns better than the conventional models.

Return Predictability Tests

Sorting on Investment and Profitability Separately

At the beginning of each month, we rank REITs into five portfolios based on their annual investment rates or profitability. We calculate the value-weighted portfolio returns and rebalance the portfolios monthly. Consistent with theory, Panel A of Table 2 shows that high investments are associated with low average future returns. As investment increases, portfolio excess return decreases almost monotonically from 1.05 % per month to 0.70 % per month. The spread of −0.36 % per month is economically meaningful and statistically significant at the 5 % level. In addition, both the CAPM and the Fama-French model have trouble capturing this spread.Footnote 7 The high-minus-low error is −0.44 % per month (t = −2.33) for the CAPM and −0.39 % per month (t = −2.14) for the Fama-French model. The Carhart model produces a more moderate high-minus-low error of −0.25 % per month (t = −1.38).

In Panel B of Table 2, more profitable REITs earn higher future returns than less profitable REITs. As profitability increases, portfolio excess return rises monotonically from 0.33 % per month to 1.03 % per month. The large spread of 0.70 % per month (t = 2.90) widens even further after benchmark adjustment. For example, high-profitability REITs “beat” low-profitability REITs by 0.80 % per month (t = 4.16) according to the Carhart model. All three conventional models produce average pricing errors of around 0.20 % for the quintile portfolios and are rejected by the GRS test, which indicates their inability to subsume the return predictive power of profitability.

Sorting on Investment and Profitability Jointly

Theoretically, the relation between investment (profitability) and expected return is conditional on holding profitability (investment) constant. Meanwhile, investment and profitability tend to be positively correlated in the data. Hence, the predictive power of investment and profitability can offset each other in separate unconditional sorts. To better examine their power, we sort on investment and profitability jointly. At the beginning of each month, we sort REITs into three groups based on their annual investment rates and independently into three groups based on their profitability.Footnote 8 The two-way sort produces nine portfolios, which are value-weighted and rebalanced monthly. For comparison, we also form three portfolios based on either investment or profitability.

In Table 3, portfolio excess returns decrease with investment but increase with profitability, consistent with our earlier findings. For example, when holding profitability low, low-investment REITs outperform high-investment REITs by 0.61 % per month (t = 2.70). All three models have trouble matching this spread: The low-minus-high error ranges from 0.46 % (t = 1.96) for the Carhart model to 0.68 % (t = 3.15) for the CAPM. The low-minus-high return spread related to investment is on average 0.37 % per month across the three profitability groups. In contrast, the spread is only 0.26 % per month when we do not control for profitability.

The high-minus-low return spread related to profitability is 0.67 % per month (t = 2.91) for high-investment REITs, 0.29 % (t = 1.25) for medium-investment REITs, and 0.46 % (t = 1.69) for low-investment REITs. The conventional models cannot capture the spreads in both the high- and low-investment groups. For example, the Carhart model produces high-minus-low errors of 0.63 % (t = 2.29) and 0.54 % (t = 2.33) respectively. The average conditional spread related to profitability is 0.47 % per month across the three investment groups, which is close to the unconditional spread of 0.48 %.

Combining both investment and profitability produces the strongest spread in future REIT returns. The average excess return is 1.22 % per month for REITs with low investment and high profitability, but only 0.15 % per month for REITs with high investment and low profitability. The spread of 1.06 % per month (t = 3.85) is highly significant and cannot be explained by any of the conventional models. The pricing error is 1.36 % (t = 5.29) for the CAPM, 1.40 % (t = 5.35) for the Fama-French model, and 1.00 % (t = 4.22) for the Carhart model.

Overall, our results confirm the theoretical predictions that Investment and profitability provide useful information about the expected returns of REITs. Since such information is not captured by the conventional models, incorporating investments and profitability to a benchmark model could be beneficial for modeling the expected returns of REITs.

An Investment-Based Three-Factor Model

Following Hou et al. (2015a), we construct new factors using a two-way independent sort on investment and profitability.Footnote 9 Specifically, at the beginning of each month we sort REITs into three groups based on their investment and independently into three groups based on their profitability. The two-way sort produces nine portfolios, which are value-weighted and rebalanced monthly. The investment factor (r I/A ) is computed as the difference (low-minus-high) between the simple average of the returns on the three low-investment portfolios and the simple average of the returns on the three high-investment portfolios. The profitability factor (r ROE ) is computed as the difference (high-minus-low) between the simple average of the returns on the three high-profitability portfolios and the simple average of the returns on the three low-profitability portfolios.

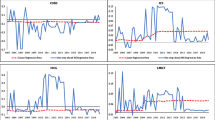

Table 4 summarizes the properties of the new factors. In Panel A, the investment factor has an average return of 0.37 % per month (t = 2.45), which is statistically significant at the 5 % level. The conventional models cannot subsume the investment factor’s power. For example, the Fama-French model explains only 8 % of its variations and its model-adjusted mean is 0.42 % per month (t = 2.63). The investment factor has moderate correlations with the conventional factors, ranging from −0.24 to 0.23. Therefore, the investment factor seems to capture a new dimension of REIT returns.

Similarly, the profitability factor also captures return variations unaccounted for by the conventional models. The profitability factor has a mean of 0.47 % per month (t = 2.67), which increases further to more than 0.50 % after controlling for the exposures to the conventional factors. The profitability factor is correlated with the momentum factor (0.48) and the value factor (−0.52), but even the Carhart four-factor model can explain only 37 % of its variations. Finally, the correlation between the two new factors is only 0.04. Hence, they appear to capture independent variations in REIT returns.

In Panel B of Table 4, the conventional (non-market) factors have much weaker return predictive power, compared with the new factors. The average monthly premium is only 0.19 % (t = 1.45) for the size factor and 0.10 % (t = 0.60) for the B/M factor. The insignificant size and value premiums after 1990 are consistent with earlier evidence (e.g., Chui et al. 2003a, b). The monthly premium of the momentum factor is somewhat higher at 0.30 % (t = 0.94), but is statistically insignificant and drops to only 0.08 % after controlling for the exposures to the new factors.Footnote 10

Testing the Investment-Based Model

We form testing portfolios of REITs based on well-known return predictors and examine the model’s ability to capture the dispersions in future returns. Specifically, we form monthly value-weighted quintile portfolios based on price momentum, earnings surprise, idiosyncratic volatility, and share turnover.Footnote 11 Chui et al. (2003a, b) show that price momentum and to a lesser extent share turnover are important predictors of REIT returns. More recently, Price et al. (2012) and Feng et al. (2014) document a strong earnings surprise effect. DeLisle et al. (2013) show that idiosyncratic volatility risk is priced in the cross section of REIT returns.

Price Momentum and Earnings Surprise

In Panel A of Table 5, past winners outperform past losers by 0.34 % per month (t = 0.83). Neither the CAPM nor the Fama-French model can explain the momentum effect. The model-adjusted return spread is 0.82 % per month (t = 2.55) for the CAPM and 1.05 % per month (t = 3.62) for the Fama-French model. In contrast, the investment-based model performs as well as the Carhart model, reducing the high-minus-low spread to only −0.05 % per month (t = −0.13). The new model’s success is consistent with the variations in investment and profitability. Past winners are significantly more profitable than past losers: Quarterly ROE increases monotonically from 1.55 % to 2.78 %. Consistently, the profitability factor loading increases by 1.00 across the portfolios. Meanwhile, investment rates are largely flat across the momentum portfolios. Therefore, the high average returns of past winners can be inferred from their conservative investments relative to high profitability.

In Panel B of Table 5, earnings surprise is positively related to future returns, with a high-minus-low spread of 0.46 % per month (t = 2.36). Consistent with the findings of Price et al. (2012) and Feng et al. (2014), none of the conventional models can capture the earnings surprise effect. The high-minus-low pricing error ranges from 0.52 % per month (t = 2.94) for the Carhart model to 0.70 % per month (t = 3.82) for the Fama-French model. All three conventional models are strongly rejected by the GRS test. In contrast, the investment-based model produces a much smaller error of 0.26 % per month (t = 1.56), as well as the lowest average pricing error of 0.12 % per month across the portfolios. The new model’s performance can be explained by the patterns in investment and profitability. Relative to REITs with low earnings surprise, REITs with high earnings surprise have substantially higher profitability but similar investment rates, indicating their higher discount rates (expected returns).

Idiosyncratic Volatility and Share Turnover

In Panel A of Table 6, REITs with high idiosyncratic volatility earn lower future returns than REITs with low idiosyncratic volatility. The raw return spread is −0.65 % per month (t = −1.64), which widens after controlling for exposure to the conventional factors. The investment-based model produces a statistically insignificant spread of −0.43 % per month (t = −1.02), compared with −1.29 % per month (t = −5.13) for the Fama-French model and −0.80 % per month (t = −2.48) for the Carhart model. All three conventional models produce large average pricing errors and are rejected by the GRS test. Again, the return variations associated with the idiosyncratic volatility risk are consistent with the variations in investment and profitability. As IVOL increases, the annual investment rate increases from 22.23 % to 27.32 %, while quarterly ROE decreases from 2.71 % to 1.36 %. Therefore, High-IVOL firms are “expected” to have lower future returns because they invest more relative to their lower profitability.

Panel B of Table 6 shows that measured by share turnover, more liquid REITs earn lower average returns than less liquid REITs. The high-minus-low return spread is −0.39 % per month (t = −1.47), which increases to −0.71 % per month (t = −3.99) for the CAPM, −0.71 % per month (t = −4.19) for the Fama-French model, and −0.46 % per month (t = −2.80 %) for the Carhart model. The new model produces both the smallest high-minus-low pricing error of −0.32 % (t = −2.05) and the smallest average pricing error of 0.10 % per month. The negative liquidity premium is largely consistent with fundamentals: More liquid REITs invest more despite lower profitability.

In sum, the investment-based model outperforms the conventional models in explaining well-known patterns in the cross section of REIT returns. Moreover, the variations in REIT returns are consistent with the variations in investment and profitability. Thus, the model’s good performance is also consistent with its economic motivation.

Comparing with the Investment and Profitability Effects in Common Stocks

Hou et al. (2015a) show that investment and profitability help capture a large number of return patterns in the cross section of (nonfinancial) common stocks. Since the underlying economic forces that affect the discount rates of common stocks may also affect REITs, one question is whether the pricing information in investment and profitability differs between common stocks and REITs. In this section, we test whether the common stock-based model from Hou et al. (2015a) can capture the investment and profitability effects in REITs. Specifically, Hou et al. construct a four-factor model (called the q-factor model) as the following:

in which β * MKT , β * ME , β * I/A and β * ROE are the factor loadings on the market factor (r SMB ), the size factor (r ME ), the investment factor (r I/A ) and the profitability factor (r ROE ), and E[r * MKT ], E[r * ME ] , E[r * I/A ] and E[r * ROE ] are the corresponding expected factor premiums. Since the REIT-based investment model does not include the size factor, we also apply their q-factor model without their size factor.

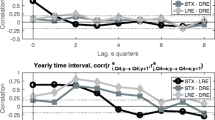

Table 7 shows that the common stock-based factors have little power for REIT portfolios sorted on investment or profitability. In Panel A, the loadings on common stock-based factors are largely flat across the investment portfolios, and the high-minus-low spread barely changes after model adjustment. For example, in the benchmark q-factor model (with the size factor), the spread in the investment factor loading is only −0.10 and the model-adjusted return spread even increases slightly to −0.39 % per month (t = −1.67). In Panel B, the spread in the profitability factor loading is more than 0.30 between high- and low-profitability REITs, consistent with the positive return spread. However, the spreads in other factor loadings are negative. As a result, the spread in model-adjusted returns stays above 0.70 % per month.

In Table 8, we directly compare the REIT-based investment and profitability factors with their common stock-based version. Consistent with earlier findings, the common stock-based factors cannot subsume the REIT-based factors. The model-adjusted return is above 0.40 % per month for the REIT-based investment factor and above 0.50 % for the REIT-based profitability factor. Moreover, the correlation is only 0.03 between the two investment factors, while the two profitability factors have a more meaningful correlation of 0.31. Overall, the investment and profitability effects in REITs seem to differ from those in common stocks. This finding suggests that the cross-sectional return variations in the REIT market might be driven by different economic forces.

Conclusion

Motivated by investment-based asset pricing, we show that investment and profitability have substantial predictive power for future REIT returns, and such predictability is not captured by conventional models. We construct an investment-based three-factor model for REITs and show that it outperforms conventional models in matching several well-known patterns in the cross section of REIT returns. Based on our findings, we see several interesting future directions. First, the investment-based model provides a useful expected return benchmark for empirical research and applications in real estate finance. For example, the model may be used to evaluate the performance of real estate portfolios. Alternatively, the model may be used to investigate market reaction to corporate events in the real estate market. Second, our results show that well-known predictors of REIT returns can be linked to investment and profitability, which are firm fundamentals. Therefore, these previous findings may not necessarily imply market inefficiency. Pinning down the precise economic forces behind the investment and profitability effects may provide better understandings of the pricing efficiency of REITs and thus is an important question for future research.

Notes

In the context of REITs, a good example of investment is property acquisition, while profitability is determined by property income and price appreciation.

The construction of the REIT-based conventional factors is described in Appendix B.

Including cash holdings in total assets produces similar results. We exclude the cash holding component because it does not represent investments in productive assets. For example, Cooper et al. (2008) show that the cash holding component of asset growth does not carry much information about the future returns of common stocks.

We found similar results using the annual growth rate in net real estate investment or net property investment from SNL financial.

The REIT industry often promotes the use of (adjusted) funds from operation (FFO) as profitability measure. However, Vincent (1999) show that the GAAP net income provides (marginally) the most information about REIT performance among alternative measures of profitability. Using quarterly FFO data from SNL financial produces similar results.

Detailed definitions for the conventional characteristics are documented in Appendix A.

For brevity, our discussion focuses on results using the REIT-based conventional factors. Using the common stock-based conventional factors produces similar or stronger results in favor of our conclusions (results are available upon request).

Due to the limited sample size, we sort REITs into only three groups, instead of five, to make sure that the portfolios are reasonably diversified.

Hou et al. (2015a) construct a four-factor model that consists of a market factor, a size factor, an investment factor, and a profitability factor. To construct their factors, they form 18 portfolios using a two by three by three independent sort on size, investment, and profitability. Due to the limited sample size of REITs, we do not sort on size and thus do not include the size factor in our test.

The relatively low momentum factor premium from 1994 to 2013 is consistent with the finding of Feng et al. (2014) and can be partly attributed to the poor momentum return after the 2008 financial crisis.

Other conventional characteristics such as B/M have much weaker predictive power of REIT returns after 1990 (e.g., Chui, et al. 2003). Hence, we do not include them for brevity.

References

Ang, A., Hodrick, R. J., Xing, Y., & Zhang, X. (2006). The cross-section of volatility and expected returns. Journal of Finance, 61, 259–299.

Berk, J. B., Green, R. C., & Naik, V. (1999). Optimal investment, growth options, and security returns. Journal of Finance, 54, 1553–1607.

Bond, S. A., & Chang, Q. (2013). REITs and the private real estate market. In H. K. Baker & G. Filbeck (Eds.), Alternative investments – balancing opportunity and risk. Hoboken, NJ: Wiley.

Carhart, M. M. (1997). On persistence in mutual fund performance. Journal of Finance, 52, 57–82.

Chui, A. C. W., Titman, S., & John Wei, K. C. (2003a). The cross section of expected REIT returns. Real Estate Economics, 31, 451–479.

Chui, A. C. W., Titman, S., & John Wei, K. C. (2003b). Intra-industry momentum: the case of REITs. Journal of Financial Markets, 6, 363–387.

Cochrane, J. H. (1991). Production-based asset pricing and the link between stock returns and economic fluctuations. Journal of Finance, 46, 209–237.

Cochrane, J. H. (1996). A cross-sectional test of an investment-based asset pricing model. Journal of Political Economy, 104, 572–621.

Cochrane, J. H. (2011). Presidential address: discount rates. Journal of Finance, 66, 1047–1108.

Cooper, M. J., Gulen, H., & Schill, M. J. (2008). Asset growth and the cross-section of stock returns. Journal of Finance, 63, 1609–1651.

Davis, J. L., Fama, E. F., & French, K. R. (2000). Characteristics, covariances, and average returns: 1929 to 1997. Journal of Finance, 55, 389–406.

DeLisle, J. R., Price, M. K. S., & Sirmans, C. F. (2013). Pricing of volatility risk in REITs. Journal of Real Estate Research, 35, 223–248.

Derwall, J., Huij, J., Brounen, D., & Marquering, W. (2009). REIT momentum and the performance of real estate mutual funds. Financial Analysts Journal, 65, 24–34.

Fama, E. F., & French, K. R. (1992). The cross-section of expected stock returns. Journal of Finance, 47, 427–465.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33, 3–56.

Fama, E. F., & French, K. R. (1996). Multifactor explanation of asset pricing anomalies. Journal of Finance, 51, 55–84.

Feng, Z., McKay Price, S., & Sirmans, C. F. (2014). The relationship between momentum and drift: industry-level evidence from equity real estate investment trusts (REITs). Journal of Real Estate Research, 36, 383–407.

Gao, X., & Ritter, J. R. (2010). The marketing of seasoned equity offerings. Journal of Financial Economics, 97, 33–52.

Gibbons, M. R., Ross, S. A., & Shanken, J. (1989). A test of the efficiency of a given portfolio. Econometrica, 57, 1121–1152.

Glascock, J., & Lu-Andrews, R. (2014). “The Profitability Premium in Real Estate Investment Trusts”, Available at SSRN: http://ssrn.com/abstract=2375431.

Goebel, P. R., Harrison, D. M., Mercer, J. M., & Whitby, R. J. (2013). REIT momentum and characteristic-related REIT returns. Journal of Real Estate Finance and Economics, 47, 564–581.

Hartzell, J., Muhlhofer, T., & Titman, S. (2010). Alternative benchmarks for evaluating mutual fund performance. Real Estate Economics, 38, 121–154.

Hou, K., Xue, C., & Lu, Z. (2015a). Digesting anomalies: an investment approach. Review of Financial Studies, 28, 650–705.

Hou, K., Xue, C., Lu, Z. (2015b). A comparison of new factor models, NBER Working Paper No. 20682.

Hung, S.-Y. K., & Glascock, J. (2008). Momentum profitability and market trend: evidence from REITs. Journal of Real Estate Finance and Economics, 37, 51–69.

Hung, S.-Y. K., & Glascock, J. (2010). Volatilities and momentum returns in real estate investment Trusts. Journal of Real Estate Finance and Economics, 41, 126–149.

Liu, L. X., Whited, T. M., & Lu, Z. (2009). Investment-based expected stock returns. Journal of Political Economy, 117, 1105–1139.

Price, M. K. S., Gatzlaff, D. H., & Sirmans, C. F. (2012). Information uncertainty and the post-earnings-announcement drift anomaly: insights from REITs. Journal of Real Estate Finance and Economics, 44, 250–274.

Vincent, L. (1999). The information content of funds from operations (FFO) for real estate investment trusts (REITs). Journal of Accounting and Economics, 26, 69–104.

Zhang, L. (2005a). The value premium. Journal of Finance, 60, 67–103.

Zhang, L. (2005b). Anomalies, NBER working paper 11322.

Acknowledgments

We gratefully acknowledge the financial support of the Real Estate Research Institute (RERI) in completing this research. We thank Qing Bai, David Geltner, Jung-Eun Kim, Doug Poutasse, Stuart Rosenthal, Jim Shilling, and Eva Steiner for helpful comments and participants at the RERI annual conference, the AREUEA national conference, the AREUEA International meeting, the RECAPNET annual conference, and the Asian Real Estate Society meeting. We also thank Calvin Schnure for assistance with the NAREIT equity REIT data.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendices

A. Variable Definitions

Market Equity (ME), or size, is share price (item PRC) times the number of shares outstanding (item SHROUT) from CRSP.

Book-to-Market Equity (B/M) is book equity divided by market equity. Following Davis et al. (2000), we measure book equity as stockholders’ book equity, plus balance sheet deferred taxes and investment tax credit (item TXDITC) if available, minus the book value of preferred stock. Stockholders’ equity is the value reported by Compustat (item SEQ), if it is available. If not, we measure stockholders’ equity as the book value of common equity (item CEQ) plus the par value of preferred stock (item PSTK), or the book value of assets (item AT) minus total liabilities (item LT). Depending on availability, we use redemption (item PSTKRV), liquidating (item PSTKL), or par value (item PSTK) for the book value of preferred stock. Market equity is from Compustat (item PRCC_F times item CSHO) or CRSP at the fiscal year end. B/M is considered known four months after fiscal year end.

Momentum (MOM) for month t is measured as the cumulative stock return from month t-12 to month t-2 (skipping month t-1).

Investment (I/A) is measured as the annual growth rate in total non-cash assets (Compustat item AT minus item CHE). Annual investment rate is considered known four months after fiscal year end.

Profitability (ROE) is measured as quarterly return on equity (ROE), defined as income before extraordinary items (Compustat item IBQ) divided by one-quarter-lagged book equity. Book equity is shareholders’ equity, plus balance sheet deferred taxes and investment tax credit (item TXDITCQ) if available, minus the book value of preferred stock (item PSTKQ). Depending on availability, we use stockholders’ equity (item SEQQ), or common equity (item CEQQ) plus the book value of preferred stock, or total assets (item ATQ) minus total liabilities (item LTQ) in that order as shareholders’ equity. Quarterly ROE is deemed as known on the earnings announcement date (item RDQ).

Earnings Surprise (SUE) is measured as the standardized unexpected earnings (SUE). We calculate SUE as the change in the most recently announced quarterly earnings per share (Compustat item EPSPXQ) from its value announced four quarters ago divided by the standard deviation of this change in quarterly earnings over the prior eight quarters. We require a minimum of six quarterly observations of earnings change in calculating SUE. Earnings surprise is deemed as known on the earnings announcement date (item RDQ).

Idiosyncratic Volatility (IVOL): Following Ang et al. (2006), we measure a stock’s idiosyncratic volatility as the standard deviation of the residuals from regressing the stock’s returns on the Fama-French three factors. We require a minimum of 15 daily returns in calculating idiosyncratic volatility.

Share Turnover (TO) is the average daily share turnover during the past 6 months. Daily share turnover is the number of shares traded (CRSP item VOL) on a given day divided by the number of shares outstanding (item SHROUT) on the same day. Following Gao and Ritter (2010), we adjust the trading volume for REITs traded on NASDAQ before 2004. Specifically, we divide NASDAQ volume by 2 prior to February 2001, by 1.8 between February 2001 and December 2001, and by 1.6 between 2002 and 2003.

B. Construction of the REIT-Based Conventional Factors

The REIT-based market factor (r MKT ), is defined as the return on the FTSE NAREIT All Equity REIT Index minus the one-month Treasury bill rate. The construction of other conventional factors largely follows the standard Fama and French approach. At the beginning of each month, we sort all REITs into two portfolios based on their market equity. Independently, we sort REITs into three portfolio based on their B/M. The two-way sort on size and B/M produces six portfolios, which are value-weighted and rebalanced monthly. We define the size factor (r SMB ) as the return spread between the simple average of the three small-cap portfolios (small-growth, small-neutral, small-value) and the simple average of the three big-cap portfolios (big-growth, big-neutral, big-value). The B/M factor (r HML ) is defined as the return spread between the simple average of the small-value and big-value portfolios and the simple average of the small-growth and big-growth portfolios. Independently, we also sort REITs into three portfolios based on their return momentum. The two-way sort on size and momentum produces six portfolios, which are value-weighted and rebalanced monthly. The momentum factor (r UMD ) is the return spread between the simple average of the small-winner and big-winner portfolios and the simple average of the small-loser and big-loser portfolios. Summary statistics for the REIT-based conventional factors are presented in Table 9.

Rights and permissions

About this article

Cite this article

Bond, S., Xue, C. The Cross Section of Expected Real Estate Returns: Insights from Investment-Based Asset Pricing. J Real Estate Finan Econ 54, 403–428 (2017). https://doi.org/10.1007/s11146-016-9573-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-016-9573-0