Abstract

We examine the relation of time-varying idiosyncratic risk and momentum returns in REITs using a GARCH-in-mean model and incorporate liquidity risk in the asset pricing model. This is important because illiquidity may be more severe for REITs due to the nature of their underlying assets. We find that momentum returns display asymmetric volatility, i.e., momentum returns are higher when volatility is higher. Additionally, we find evidence that REITs with lowest past returns (losers) have higher idiosyncratic risks than those with highest past returns (winners) and that investors require a lower risk premium for holding losers’ idiosyncratic risks. Therefore, although losers have higher levels of idiosyncratic risks, their low risk premia cause low returns, which contribute to momentum. Lastly, we find a positive relation between REITs’ momentum return and turnover.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In a momentum trading strategy, one buys stocks with the highest past returns (winners) and sells stocks with the lowest past returns (losers) and holds the portfolio for 6 months to 12 months. Jegadeesh and Titman (1993) document that the U.S. stock market yields 12% annual return over the past 30 years using momentum trading strategy. Additionally, the authors suggest that these momentum returns are not a result of systematic risk of the securities. Chui, Titman and Wei (2003) also find significant momentum returns in Real Estate Investment Trusts (REITs) from 1982 to 2000 and Hung and Glascock (2008) find that REIT momentum returns are higher in up markets and REIT winner portfolios have higher dividend to price ratios. However, there is no conclusive explanation for momentum returns. As existing asset-pricing models cannot explain momentum returns, such returns are ‘abnormal’ in the sense that investors can achieve profits without net investment. Abnormal returns generated from momentum trading strategies provide strong evidence against the efficient market hypothesis. Some researchers attribute momentum to investors’ overreaction or underreaction to firm-specific news,Footnote 1 while others use rational risk-return theories to interpret momentum. Some recent studies on risk-based explanations on momentum returns include Connolly and Stivers (2003), Grundy and Martin (2001), Chordia and Shivakumar (2002), Johnson (2002), Ahn et al. (2003), and Moskowitz (2003).Footnote 2 Nevertheless, these studies do not reach a conclusive explanation. The momentum phenomenon leads to one interesting question: what risk measures can be used to explain and predict momentum returns?

This research provides evidence about momentum by looking into (a) idiosyncratic risk, and (b) asymmetric risk associated with momentum returns in Real Estate Investment Trusts (REITs). Our work controls for traditional systematic risks such as market return, size, book-to-market ratio, and most importantly, liquidity.

Many recent studies have reported that idiosyncratic risk plays a significant role in explaining asset returns, contrary to the traditional Capital Asset Pricing Model (CAPM). For example, Ooi et al. (2009) examine the relationship between idiosyncratic risks and REIT returns. The authors find that idiosyncratic risks and REIT returns are positively related, meaning that REITs with higher firm-specific risks exhibit higher returns. Fu (2007) estimates idiosyncratic risk of industry firms using an EGARCH model to account for the time-varying nature of idiosyncratic risk. The author reports a positive relation between idiosyncratic risk and stock returns. On the contrary, Ang et al. (2006) and Guo and Savickas (2006) both show a negative relation between idiosyncratic risks and expected returns for industry firms. However, Bali and Cakici (2008) by appling different weighting methods, data frequency, and breakpoints to sort stock suggest that there is no relation between idiosyncratic volatility and expected stock returns.

The implication of above studies is that traditional asset pricing models used in momentum studies may be improved by incorporating idiosyncratic risk measures. Thus, we analyze momentum returns with respect to idiosyncratic risks. Specifically, if stocks with higher past returns (winners) have higher magnitudes of idiosyncratic risks than those with low past returns (losers), this extra source of risk on top of systematic risks may contribute to momentum profitability. Moreover, we investigate whether winners and losers exhibit different sensitivities to idiosyncratic volatilities.

Additionally, we analyze asymmetric volatility as an explanation of momentum returns. Asymmetric risk is a phenomenon in which stock returns and their volatilities are negatively related. In other words, negative returns increase volatility and positive returns decrease volatility [see Engle and Ng (1993), Bekaert and Wu (2000), Wu and Xiao (2002)]. Two popular theories about asymmetric volatility are leverage effects and volatility feedback effects. The leverage effect theory suggests that negative returns on stocks increase financial leverage, which increases their volatilities [see Black (1976) and Christie (1982)]. The authors argue that a fall in stock price causes an increase in debt-equity ratio (financial leverage) of the firm, and the volatility associated with the firm increases subsequently.Footnote 3 On the other hand, the volatility feedback hypothesis suggests that good news such as positive stock returns decreases volatility and bad news such as negative stock returns increases volatility [see Bekaert and Wu (2000), Wu (2001), and Dennis et al. (2006)]. An anticipated volatility increase (decrease) raises (decreases) the required return on equity for losers (winners), which leads to an immediate decrease (increase) of current stock price.Footnote 4 We analyze momentum returns using the volatility feedback theory. Our logic is as follows. We consider good past returns (winners) as good news. According to the volatility feedback theory, the news will decrease future volatilities of winners, and therefore decrease their required rate of returns, causing an increase in immediate stock prices. On the other hand, if we believe poor past returns (losers) signals bad news, such news will increase future volatility of losers, and therefore increase required rate of return, causing a decrease in current stock price. As a result, trends on stock prices are magnified by volatilities. Accordingly, stocks with good (bad) past performance will continue to perform well (poorly), resulting in a momentum outcome.

REITs provide a good opportunity to study the idiosyncratic risk and asymmetric risk effect in momentum returns for the following reasons. First, REITs show cyclical volatility in the past due to economic fluctuations and major structural changes. Therefore, the effect of cyclical volatility in momentum returns may be more significant in REITs. Ooi et al. (2009) finds that idiosyncratic volatilities in REITs follow a cycle in the past two decades. Firm-specific risks in REITs rose in the early-1990s, reached a peak in 1993, drifted down from 1994-1998, then peaked again in late 1990s. In addition, the authors find asymmetric risk patterns in REITs: idiosyncratic risk increased significantly in bear markets, but only reduced marginally in bull markets. Secondly, REITs are considered to exhibit higher asymmetric information than industry firms. Due to the specific knowledge required to understand the underlying assets of REITs in localized markets, managers of REITs are believed to have superior information about the firms than public investors and stock analysts. As a result, firm-specific risks may have more explanatory power in asset returns than systematic risks in the real estate sector. Thirdly, REITs have relatively illiquid underlying assets compared to industry firms. Traditional asset pricing models such as capital asset pricing model or Fama and French three-factor model do not include any liquidity factor. As a result, momentum returns in REITs may be partly caused by liquidity risk, which has not been incorporated in past momentum studies. We study this potential effects by adding a liquidity measure into our asset pricing models to elaborate momentum returns in REITs.

Our evidence suggests four main findings. First, using a GARCH-in-mean model, we discover that momentum returns display asymmetric volatility. Momentum returns in REITs are higher when volatility is higher. However, this result becomes insignificant when we apply 10% breakpoint to select winners/losers. Secondly, losers have a higher level of idiosyncratic risk than winners. Although the result contradicts with traditional risk-return tradeoff theory, it is consistent with the negative relation between stock returns and idiosyncratic risks found in Ang et al. (2006) and Guo and Savickas (2006). Moreover, we find that the difference in losers’ and winners’ idiosyncratic risks is positively associated with momentum returns. We interprete this outcome as providing evidence that idiosyncratic risk is an important factor in explaining momentum returns. Thirdly, we find strong evidence that losers’ returns are negatively related to their idiosyncratic risks, and find some evidence that winners’ returns are positively related to their idiosyncratic risks. The result indicates that for losers, higher idiosyncratic risk volatility is penalized with lower required rate of return. It also implies that although losers have higher idiosyncratic risk, investors do not require a higher risk premium for holding losers’ idiosyncratic risks. Lastly, we find a positive relation between momentum returns and liquidy. It implies that liquidity risk is priced in REITs’ momentum returns. Moreover, liquidity risk premia for winners are higher than those for losers, consistent with rational risk-return theory.

The remainder of the paper is organized as follows. Section II presents literature review. Section III states our hypotheses and methodologies. Section IV describes the data. Section V reports results and discussions. Finally, Section VI concludes.

Literature Review

Liquidity Risks

Past literature suggests that liquidity risk may contribute to asset returns. In other words, researchers find that illiquid stocks have higher returns, and thus, liquidity risk is compensated for in asset pricing [see Brennan and Subrahmanyam (1996), Brennan et al. (1998), Datar et al. (1998)]. Amihud (2002) reports a positive relationship between expected liquidity and stock return, suggesting that liquidity risks compensate for cross-sectional stock returns. Moreover, liquidity effect is stronger for small firms. Chordia et al. (2002) report a positive relation between stock returns and variability of liquidity. That is, stocks with more volatile liquidity have lower expected returns. In contrast to other studies that examine the level of firm-specific liquidity and return, Pastor and Stambaugh (2003) estimate an aggregate liquidity state variable and examine the relation between market-wide liquidity risk and stock returns. They find evidence that returns on stocks with high sensitivities to aggregate liquidity exceeds that for stocks with low sensitivities. Furthermore, liquidity risk accounts for half of the momentum profits.

In momentum literature, Lee and Swaminathan (2000) find empirical evidence that volume can explain momentum profits. The authors also report that a trading strategy that buys past high-volume winners and selling past high-volume losers outperforms a similar strategy based solely on past price information. Sadka (2006) examines the relation between firm-specific liquidity and stock return. The author decomposes firm-specific liquidity risk into variable and fixed components and finds that it is the variable component rather than the fixed component that is priced in momentum returns. It suggests that a substantial part of momentum returns can be viewed as compensation for unexpected variations in the aggregate ratio of informed traders to noise traders.

Idiosyncratic Risks

Traditional asset pricing model such as the capital asset pricing model asserts that systemic market risks compensate for stock returns. Under the modern portfolio theory by Markowitz (1959), diversified portfolios eliminate all idiosyncratic risks associated with individual stocks in portfolios. As a result, idiosyncratic risks do not matter in asset pricing. However, recent studies have shown that idiosyncratic risks actually contribute to asset returns. Interestingly, there are contrasting results on the relation between idiosyncratic risks and asset returns. Some studies report a positive relation, while other studies find a negative relation. For example, Malkiel and Xu (1997) show that portfolios with higher idiosyncratic risk have higher mean returns. Malkiel and Xu (2008) further provide evidence that idiosyncratic volatility is positively associated with stock returns at the firm level. Goyal and Santa-Clara (2003) report a positive relation between idiosyncratic volatility and stock returns. Fu (2007) estimates idiosyncratic volatility with a time-varying EGARCH model, and finds a positive relation between idiosyncratic volatility and stock return. In the real estate sector, Ooi et al. (2009) find that idiosyncratic risks and REIT returns are positively related, meaning that REITs with higher firm-specific risks exhibit higher returns. On the contrary, other researchers find idiosyncratic risks and asset returns to be negatively related. For example, Ang et al. (2006) report a negative relation between firm-specific risks and stock returns, where idiosyncratic volatility is defined as the error term in the standard Fama and French (1993) model. The authors find a strongly significant difference of −1.06% per month between the average returns of the quintile portfolio with the highest idiosyncratic volatility stocks and the quintile portfolio with the lowest idiosyncratic volatility stocks. Guo and Savickas (2006) also find that idiosyncratic volatility is negatively related to future stock market returns. Bali and Cakici (2008) further suggest that the significant relation (positive or negative) between idiosyncratic risk and return found in previous studies are caused by different data frequency, weighting mechanism, or breakpoint used to sort stocks applied in previous studies.

Asymmetric Risks

Asymmetric volatility effect refers to the negative relation between stock returns and their volatilities. Engle and Ng (1993) is the first study to observe that negative returns increase volatility and positive returns decrease volatility. There are two theories to explain the asymmetric volatility effect—leverage theory and volatility feedback theory. The first theory uses leverages, the financial risks of firms, to account for the negative relation between risk and return. Black (1976) and Christie (1982) suggest that negative returns on stocks increase financial leverage, which increases their volatilities. These studies argue that a fall in stock price causes an increase in debt-equity ratio (financial leverage) of the firm, and the volatility associated with the firm increases subsequently. On one hand, a rise in stock price due to positive past returns (winners) will decrease leverage of firms, and thus decrease volatility. On the other hand, a drop in stock price due to negative past returns (losers) will increase leverage of firms, and therefore increase volatility. As a result, the negative relation between volatilities and returns can be explained by leverages of firms. In contrast, the volatility feedback hypothesis suggests that good news such as positive stock returns decreases volatility and bad news such as negative stock returns increases volatility. For example, Bekaert and Wu (2000) examine the leverage effect and time-varying risk premium and suggest that asymmetric volatility is caused by the variance dynamics at the firm level, not by changes in leverage, and thus volatility feedback effect is the dominant cause. Wu (2001) examines both the leverage effect and volatility feedback effect and finds that the volatility feedback is significant both statistically and economically. Dennis, Mayhew, and Stivers (2006) find that market-level systematic volatility is the major factor that causes asymmetric volatility in individual stock returns, and thus support the volatility feedback hypothesis.

Several asymmetric risk models have been studied to explain stock returns. Asymmetric risk models allow conditional variance to be time-variant and are able to better estimate asset returns. For example, Nelson (1991), Glosten et al. (1993), Laux and Ng (1993) develop asymmetric ARCH models to examine asset returns. Campbell and Hentschel (1992) present a quadratic GARCH (QGARCH) model to study volatility process of stock dividends. The model is able to explain the negative skewness and excess kurtosis of the data. Bekaert and Wu (2000) use a conditional CAPM model with a GARCH-in-mean parameterization to study asymmetric volatility in Japanese stock market, and show that volatility feedback hypothesis better explains asymmetric risk effect than leverage hypothesis does. Black and McMillan (2006) apply a GARCH-in-mean model and show that value stocks have higher asymmetric risk than growth stocks, therefore explaining the value premium (value stocks with high book-to-market ratio have higher returns than growth stocks with low book-to-market ratio). In the real estate sector, Jirasakuldech et al. (2009) estimate the conditional volatility of equity REITs in a GARCH model, and compare the conditional volatility for two sub-periods: pre-1993 and post-1993. The authors find a positive relationship between conditional volatility and expected return during the pre-1993 period, but find no evidence of any significant relationship during the post-1993 period.

Hypotheses and Methodologies

This paper examines the relation of time-varying idiosyncratic risk and momentum returns in REITs with a GARCH-in-mean model. It also incorporates liquidity risk in the asset pricing model, since illiquidity risk might be more severe for REITs due to the nature of their underlying assets. We posit the following research questions:

-

1

Is momentum return time-varying?

-

H1

We hypothesize that momentum return is time-varying and can be estimated with a GARCH-in-mean model. In other words, we hypothesize that momentum returns are higher during periods of high volatilities.

-

2

Is idiosyncratic risk priced in REITs’ momentum returns?

In order to answer the above question, we examine both the level and the sensitivity of winners and losers to their idiosyncratic risks, respectively. Therefore, we posit the following two sub-questions and hypotheses.

-

2a

Do winners and losers have different levels of idiosyncratic risks?

-

H2a

We hypothesize winners to exhibit higher levels of idiosyncratic risks than losers. If the hypothesis is true, we show that idiosyncratic risks are compensated for, and winners have higher returns because their idiosyncratic risks are higher.

-

2b

Do winners and losers have different sensitivities to idiosyncratic risks?

-

H2b

We hypothesize winners to exhibit higher sensitivities to idiosyncratic risks than losers. If the statement is true, we provide evidence that risk premia for winners are higher than that for losers. In other words, investors require a higher risk premium for holding winners (assumed to be riskier based on our second hypothesis) than losers.

-

3

Is liquidity risk priced in momentum returns?

-

H3

We hypothesize that liquidity is priced in momentum returns, under the assumption that market is efficient. In other words, winners should exhibit higher risk premium to liquidity risks than losers.

The following section provides detailed discussions our three hypotheses.

Time-Series Analysis

The capital asset pricing model (CAPM) and the Fama-French three factor modelFootnote 5 provide two theoretical foundations for a trade-off relationship between risk and excess return. In theory, risk is to be measured by the conditional covariance of returns with the market. However, in practice, risks vary over time. Prior research has found that asset returns exhibit negative skewness and excess kurtosis. Thus, application of the GARCH-in-mean (GARCH-M) model to traditional asset pricing models improves model performance by permitting risk to be time-variant. More specifically, negative shocks typically increase volatility greater than positive shocks of equal magnitude. In other words, negative returns cause an upward revision of the conditional volatility, whereas positive returns cause a smaller upward or even a downward revision of the conditional volatility.Footnote 6 In this research, we extend the Fama-French three factor model with a GARCH(1,1)-in-mean model to study asymmetric volatility in REITs’ momentum returns. The model used for estimating Capital-Asset-Pricing Model with a GARCH-M model is as follows:

Where Rt is the return of momentum portfolio, and Rm,t is the market return. SMB is the small-minus-big size factor, and HML is the high-minus-low book-to-market ratio factor. Liquidity is measured by volume and turnover. Since momentum portfolio is a long-short strategy, we define liquidity as the difference between winners’ and losers’ liquidity measures, volume and turnover. Volatility of portfolio returns is measured by conditional variance ht, which is defined as a function of squared values of the past residuals, presenting the ARCH factor, and an auto regressive term (ht−1) presenting the GARCH factor. The parameters β 0, β 1, β 2, β 3 , β 4 , γ, α0, α1, α2 are estimated.

The models described above are to test whether γ equals to zero. If γ equals to zero, there is no relationship between volatility and return. γ is interpreted as the coefficient of relative risk aversion of investors by Merton (1980), Engle et al. (1987), Campbell and Hentschel (1992), and Campbell (1993). These authors point out that γ is a time-varying risk premium and the sign and magnitude of γ depend on utility functions of investors. As a result, γ can be positive, negative or zero. A positive γ indicates a higher risk premium required by investors when volatility is high. On the other hand, a negative γ means a lower risk premium required by investors when volatility is high. There are no conclusions about the signs of γ. For example, Campbell and Hentschel (1992) find the relation between volatility and expected return to be positive, while Nelson (1991), Glosten, Jagannathan, and Runkle (1993) find the relation to be negative.

We apply an GARCH-in-mean model to momentum returns. Our first hypothesis (H1) predicts that momentum returns display asymmetric volatility, e.g., momentum returns are higher when the volatility is higher (γ coefficient is positive). If rational risk-return theory is correct, we should find γ positive for momentum returns. On the other hand, if γ is negative, it contradicts risk-return trade-off theory.

Cross-Sectional Analysis

In this section, we are interested in whether winner and loser stocks have different levels of idiosyncratic risk or display different sensitivities to idiosyncratic risk and market risk. In other words, we study both the levels and sensitivities to idiosyncratic risk and market risk cross-sectionally to see if they contribute to asset returns after other systematic factors are controlled for. In addition, we examine whether liquidity risk is priced in momentum by adding a liquidity factor to the Fama and French three-factor model.

After obtaining each stock’s idiosyncratic risk from Eq. (1) to (3), we form monthly momentum portfolios by entering a long/short position on winners/losers. We then run a time-series regression on Eq. (4) to investigate whether idiosyncratic risks cause momentum returns.

In Eq. (4), momentum return is the dependent variable. MSE measures the difference between winners’ and losers’ idiosyncratic risks. Rm is the market return. SMB is the small-minus-big size factor, and HML is the high-minus-low book-to-market ratio factor. Turnover measures the difference between winners’ and losers’ turnover rates. Our second hypothesis (H2a) predicts β MSE to be positive, i.e., idiosyncratic risk is positively correlated with momentum returns. Furthermore, our third hypothesis (H3) predicts β Turnover to be positive. That is, liquidity risk is priced in momentum.

Next, we study the sensitivities of stock returns to idiosyncratic risk and market risk, after other market factors are controlled for. Every month t, we run a time-series regression in Eq. (1)–(3) for each REITs using observations from month t-12 to month t+24 to obtain each stock’s risk sensitivities to each risk factor. Note that momentum strategy is a short-term trading strategy which relies on past returns to predict future returns. The calibration period usually ranges from past 6 months to 12 months, whereas the holding period usually ranges from 6 months to 24 months. Numerous studies [see Jegadeesh and Titman (2001) and Lee and Swaminathan (2000), among the others] have shown that momentum returns become insignificant or even reversed if the momentum portfolio is held longer than 24 months. As a result, we choose month t-12 to month t+24 as the testing period in our analysis in order to obtain as many observations as possible. In other words, we assume that if a stock is identified as a winner (loser) on month t, it should yield higher (lower) returns from month t-12 to month t+24.

Next, we employ series of cross-sectional regressions to two groups, winners and losers, respectively, to study the risk sensitivities of winners and losers to each risk loading.

Where R i is the monthly mean returns of a winner or a loser REIT identified on month t over the period t-12 to t+24. MSE is the mean square errors of residuals from the factor model in Eq. (1)–(3). β M measures systematic risk to the market. β SMB measures sensitivity to small-minus-big size factor, and β HML measures sensitivity to high-minus-low book-to-market factor. β Turnover measures sensitivity to liquidity risk. A statistically significant \(\gamma _{MSE} \) coefficient is evidence that idiosyncratic risk is priced in stock returns, whereas a statistically significant \(\gamma _{Turnover} \) is evidence that liquidity risk is priced in stock returns. Furthermore, a positive \(\gamma _{MSE} \) or \(\gamma _{Turnover} \) implies that risk is compensated, whereas a negative coefficient implies that risk is penalized. We run multiple regressions using one or more risk factors in Eq. (5) as explanatory variables. According to risk-return trade-off hypothesis, risks should be compensated for with returns. Precisely, our second hypothesis (H2b) predicts that coefficient γMSE in Eq. (5) is expected to be positive. Moreover, winners should have a higher γMSE coefficient than losers, given the fact that winners exhibit higher returns than losers. In contrast, if coefficient γMSE is negative, it contradicts the rational risk-return theory, but is consistent with previous findings by other researchers.Footnote 7

Data

Our data sample comprises publicly traded between 1983 and 2006.Footnote 8 REITs are first identified by the data on National Association of Real Estate Investment Trusts (NAREIT). We select the REITs that have return data available in the Center for Research in Security Prices (CRSP) over the sample period. Specifically, we select security characteristic line (SCL) 18 to identify REITs in CRSP. Monthly stock returns for REITs and market index returns over the sample period are obtained from the CRSP. The REIT sample therefore includes all the REITs (including equity, mortgage, and hybrid) listed on the NYSE, AMEX, and NASDAQ. We further filter the sample by selecting REITs with more than 3 years of observations.

This study follows the procedure of forming momentum portfolios of Jegadeesh and Titiman (1993). As suggested by Bali and Cakici (2008), different weighting mechanisms, breakpoints to sort stocks, or data frequency might affect the significance of relation between idiosyncratic risks and mean returns. Therefore, we perform our tests using (i) value- and equally-weighted mechanisms, (ii) 10% and 30% as breakpoints to sort stocks into decile portfolios,Footnote 9 and (iii) CAPM, Fama and French 3-factor model, and a four-factor model (Fama-French model plus a liquidity factor) in our study.

The winner and loser are formed monthly based on 6-month lagged returns and held for 6 months. Winner and loser portfolios are equally and value-weighted monthly, and their respective returns are measured 1-month after the portfolio formation (a 6-month/1-month/6-month strategy). Note that momentum strategy is a short-term trading strategy which relies on past returns to predict future returns. The calibration period usually ranges from past 6 months to 12 months, whereas the holding period usually ranges from 6 months to 24 months. We adopt a 6/1/6 strategy by following the convention in momentum studies. Monthly returns calculated using arithmetic average method. The securities in the bottom 10% or 30% in the ranking are assigned to a loser portfolio, while those in the top 10% or 30% are assigned to a winner portfolio. Next, we form monthly zero-cost momentum portfolios by entering a long position in winner portfolios and a short position in loser portfolios, and hold the momentum portfolios for 6 months. Momentum portfolios are zero-cost because a momentum trading strategy uses the profits of short-selling losers to purchase winners. These momentum portfolios are overlapping. For example, the momentum return on December 2006 is the average monthly momentum returns of six momentum portfolios formed on July, August, September, October, November, and December 2006.

Exhibit 1 presents descriptive statistics of our sample. We have 193 REITs in the sample. However, the number of REITs in our sample is not static overtime. As shown in the first column of Exhibit 1, the total number of REITs in our sample grew from 33 to 193, over the 1983 to 2006 period. REITs in our testing period yield an average 1.05% monthly return, and a 9.48% monthly standard deviation. The average market capitalization of the sample REITs is 0.58 millions of dollars. In addition, the average trading volume of our sample is 20,206 shares, whereas the average turnover is 0.58. A comparison of the firm characteristics of winners and losers suggests that their returns, market capitalizations, and turnover rates are statistically different. Panel A in Exhibit 1 identifies winners/losers as top/bottom 10% in the ranking of all REITs in a month, whereas Panel B identifies winners/losers as top/bottom 30%. Panel A shows that, when we use 10% as breakpoint, the number of REITs in a winner portfolio ranges from 3 to 10, and it ranges from 4 to 20 for a loser portfolio. The mean returns of winners and losers are 7.1% and −5.5%, respectively. The difference between winners’ and losers’ returns is 12.6%. In addition, winners have higher average market capitalization than losers. The average market capitalization of winners is 0.45 millions of dollars, while losers on average have a 0.26 millions of dollars market capitalization. The difference in market capitalization is statistically significant at 1%. With respect to the liquidities of winners and losers, we find that these two groups have similar trading volumes, but winners have higher turnover than losers. The data shows the trading volumes of winners and losers are not statistically different. However, winners’ turnover is 0.79, higher than losers’ turnover, 0.72. The difference (0.07) is statistically significant at 5%. Panel B reports summary statistics for winners and losers using 30% as breakpoint to identify winners/losers. We find similar results as panel A. Panel B suggests that the numbers of winners and losers portfolios are higher. The number of REITs in a winner portfolio ranges from 9 to 58, and it ranges from 10 to 57 in a loser portfolio. In addition, the difference between winners’ and losers’ returns is 7%, statistically significant at 1%. The average market capitalization of winners is 0.21 millions of dollars higher than that of losers, and the average turnover of winners is 0.05 greater than that of losers, both statistically significant at 1% level.

Exhibit 1:

Summary Statistics for the Sample from 1983 to 2006

This table presents the summary statistics of REITs during the 1983 to 2006 period. Winners and losers are identified using techniques in Jegadeesh and Titman (1993). Panel A reports statistics using top/bottom 10% to identify winners/losers, whereas panel B reports statistics using top/bottom 30%. Mean Return is the average monthly return of REITs in the sample. S.D. of Return is the average monthly standard deviation of returns of REITs. Market capitalization is the average monthly market capitalization of REITs. Volume is the average monthly number of shares traded. Turnover is the average monthly turnover (defined as volume divided by number of outstanding shares). The last column reports significance of difference between winners and losers.

Panel A: 10% breakpoint | Entire Sample | Winners | Losers | Difference (winners - losers) |

No. of REITs | 33-193 | 3-19 | 4-20 | |

Mean Return | 1.05% | 7.1% | -5.5% | 12.6%b |

S.D. of Return | 9.48% | 13.9% | 14.3% | |

Market capitalization | 0.58m | 0.45m | 0.26m | 0.18mb |

Volume | 20206 | 22474 | 22664 | 2190 |

Turnover | 0.58 | 0.79 | 0.72 | 0.07a |

Panel B: | ||||

30% breakpoint | ||||

No. of REITs | 33-193 | 9-58 | 10-57 | |

Mean Return | 1.05% | 4.5% | -2.5% | 7%b |

S.D. of Return | 9.48% | 10.1% | 10.7% | |

Market capitalization | 0.58m | 0.63m | 0.42m | 0.21mb |

Volume | 20206 | 21239 | 20864 | 375 |

Turnover | 0.58 | 0.65 | 0.60 | 0.05b |

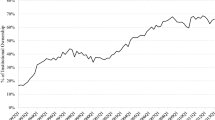

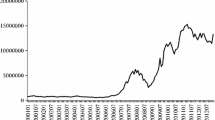

Exhibit 2 presents number of REITs and average market capitalization of our sample over time. One can see that the number of REITs in our sample increased dramatically in the early 1990s, reached its peak (193 REITs) in 1995, and then gradually settled at 140 in 2006. On the other hand, we find that market capitalization of REITs in our sample increased significantly in the testing period. The average market capitalization of the 33 REITs in 1983 is $108,303. However, in 2006, the average market capitalization of the 140 REITs in our sample is $2,248,363. Exhibit 3 reports mean returns, market capitalizations, volumes, and turnovers of REITs across 10 deciles sorted by past 6-month average returns. The data shows that the average returns of larger deciles are consistently higher than those of smaller deciles. In addition, the average market capitalizations of large deciles are higher than those of small deciles. The only exception to this increasing trend of market capitalization is the 10th decile. However, the 10th decile still has greater market capitalization than the first decile. In regards to liquidities, we find that winners and losers (no matter defined as the top/bottom 10% or 30%) have higher liquidities than other deciles. Exhibit 3 shows that both volume and turnover have a U-shape curve, implying that top and bottom deciles are more frequently traded compared to those deciles in the middle. This U-shape pattern is more substantial for turnover than for volume.

Exhibit 2:

Statistics of returns of winner, loser, and momentum portfolios from July 1983 to December 2006

Momentum portfolios are formed using techniques of Jegadeesh and Titman (1993). The winner and loser portfolios are formed monthly based on six-month lagged arithmetic returns and held for six months. Both and value-weighted and equally-weighted portfolios are reported. Winners/losers are identified as top/bottom 30% in Panel A, and are identified as top/bottom 10% in Panel B. Momentum returns are measured one-month after the portfolio formation (a 6-month/1-month/6-month strategy). These momentum portfolios are overlapping. For example, the momentum return on December 2006 is the average monthly momentum returns of six momentum portfolios formed on July, August, September, October, November, and December 2006.

Value-Weighted | Equal-Weighted | |||||

Panel A: 30% Breakpoint | Winner Portfolio | Loser Portfolio | Momentum Portfolio | Winner Portfolio | Loser Portfolio | Momentum Portfolio |

No. of observations | 282 | 282 | 282 | 282 | 282 | 282 |

Mean | 1.78%b | -0.19% | 1.98%b | 1.71%b | 0.00% | 1.60%b |

S.D. | 1.93% | 2.19% | 2.27% | 1.54% | 1.92% | 1.54% |

Skewness | -0.09 | -1.41 | 1.21 | -0.17 | -0.62 | 0.77 |

Kurtosis | 0.12 | 4.13 | 3.44 | -0.25 | 1.27 | 1.69 |

Maximum | 6.91% | 5.44% | 13.36% | 6.11% | 6.04% | 7.98% |

Minimum | -4.38% | -11.5% | -3.22% | -2.46% | -6.71% | -2.37% |

Panel B: 10% Breakpoint | ||||||

No. of observations | 282 | 282 | 282 | 282 | 282 | 282 |

Mean | 2.1%b | -1.97% | 4.03%b | 2.06%b | -0.01%b | 2.98%b |

S.D. | 3.74% | 3.99% | 5.33% | 2.88% | 2.81% | 3.48% |

Skewness | -0.03 | -0.42 | 0.19 | -0.14 | -0.29 | -0.02 |

Kurtosis | 0.12 | 0.24 | 0.42 | 0.74 | -0.20 | -0.22 |

Maximum | 12.85% | 7.34% | 19.84% | 11.24% | 6.66% | 13.52% |

Minimum | -9.54% | -15.48% | -10.55% | -6.79% | -8.75% | -6.42% |

Exhibit 3:

Test asymmetric volatility in momentum returns with the four-factor and GARCH-in-mean model. Winners/losers are identified as top/bottom 30%.

Where Rt is the return of a momentum portfolio, and Rm,t is the market return. SMB is the small-minus-big factor in the Fama-French three factor model, and HML is the high-minus-low book/market ratio factor. Volume and turnover are used to measure liquidity. Liquidity is measured by the average difference between winners’ and losers’ volumes in model 3 and 7, and is measured by the average difference between winners’ and losers’ turnover rates in model 4 and 8. Model 1 to 4 report results for value-weighted momentum returns, whereas model 5 to 8 report results for equal-weighted momentum returns. Volatility of portfolio returns is measured by conditional variance ht, which is defined as a function of squared values of the past residuals, presenting the ARCH factor, and an auto regressive term (ht-1) presenting the GARCH factor. t-values are reported in parentheses.

Model | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.01b | 0.00 | |

β0 | (1.13) | (1.17) | (0.85) | (1.19) | (1.82) | (1.69) | (2.65) | (1.66) |

0.01 | 0.01 | 0.01 | 0.01 | -0.00 | 0.01 | 0.01 | 0.01 | |

β1 | (0.62) | (0.48) | (0.30) | (0.65) | (-0.07) | (0.47) | (0.41) | (0.64) |

-0.01 | -0.01 | -0.01 | 0.01 | 0.01 | 0.00 | |||

β2 | (-0.37) | (-0.25) | (-0.34) | (0.19) | (0.23) | (0.18) | ||

-0.01 | -0.01 | -0.01 | 0.03 | 0.03 | 0.03 | |||

β3 | (-0.27) | (-0.20) | (-0.26) | (0.99) | (1.13) | (0.96) | ||

-0.00 | -0.00 | 0.00 | -0.00 | |||||

β4 | (-1.17) | (-0.28) | (-1.71) | (-0.00) | ||||

0.00b | 0.00b | 0.00b | 0.00b | 0.00b | 0.00 | 0.00 | 0.00 | |

α0 | (2.60) | (2.61) | (2.56) | (2.62) | (1.88) | (1.75) | (1.86) | (1.75) |

0.46b | 0.46b | 0.48b | 0.47b | 0.37b | 0.35b | 0.42b | 0.35b | |

α1 | (4.21) | (4.24) | (4.34) | (4.25) | (3.39) | (3.30) | (3.49) | (3.29) |

0.46b | 0.47b | 0.46b | 0.46b | 0.53b | 0.56b | 0.50b | 0.56b | |

α2 | (6.34) | (6.42) | (5.78) | (6.43) | (4.67) | (4.81) | (4.36) | (4.77) |

Γ | 0.63b | 0.63b | 0.48b | 0.62b | 0.63b | 0.63b | 0.52b | 0.63b |

(3.31) | (3.30) | (2.60) | (3.28) | (2.75) | (2.65) | (2.55) | (2.58) |

Exhibit 4 shows statistics of returns of the winner, loser, and momentum portfolios formed on July 1983 to December 2006. Panel A reports results using 30% breakpoint to identify winners/losers. It suggests that the winner portfolio has a monthly average return of 1.78%, whereas the loser portfolio has a monthly average return of −0.19%. The average monthly momentum return is 1.98%, statistically significant at 1%. Equal-weighted portfolios result in a slightly lower average momentum return, 1.60%. Panel B presents results for the top/bottom deciles. The data shows that using 10% as breakpoint yields even higher momentum returns. The average value-weighted momentum return is 4.03%, and average equal-weighted momentum return is 2.98%. Both figures are almost doubled compared to those using 30% as breakpoint.

Results and Discussion

Time-Series Analysis

Empirical results based on the four-factor and GARCH-in-mean model in Eq. (1) to (3) are reported in Exhibit 3 and 4. Exhibit 3 presents results using 30% breakpoint to identify winners and losers, whereas Exhibit 4 presents results using 10% breakpoint. Volume and turnover are used to measure liquidity. Liquidity is measured by the average difference between winners’ and losers’ volumes in model 3 and 7, and is measured by the average difference between winners’ and losers’ turnover rates in model 4 and 8. Model 1 to 4 report results for value-weighted momentum returns, whereas model 5 to 8 report results for equal-weighted momentum returns. Exhibit 3 suggests that all coefficients in the GARCH model are significant across all models. In particular, a positive γ suggests that momentum returns are higher when volatility is higher, which supports our first hypothesis. Equal-weighted momentum returns exhibit similar results to value-weighted returns. Exhibit 4, which reports results using 10% breakpoint, suggests that a GARCH-in-mean model does not fit momentum returns well. The γ coefficient is not significant for all models. Overall, our time-series analysis suggests that momentum returns are higher when volatility is higher, confirming our first hypothesis (H1). However, the result is insignificant when we use the top/bottom deciles to form momentum returns.

Exhibit 4:

Test asymmetric volatility in momentum returns with the four-factor and GARCH-in-mean model. Winners/losers are identified as top/bottom 10%.

Where Rt is the return of a momentum portfolio, and Rm,t is the market return. SMB is the small-minus-big factor in the Fama-French three factor model, and HML is the high-minus-low book/market ratio factor. Liquidity is measured by the average volume difference between winners and lossers in model 3 and 7, and is measured by average turnover difference between winners and losers in model 4 and 8. Model 1 to 4 report results for value-weighted momentum returns, whereas model 5 to 8 report results for equal-weighted momentum returns. Volatility of portfolio returns is measured by conditional variance ht, which is defined as a function of squared values of the past residuals, presenting the ARCH factor, and an auto regressive term (ht-1) presenting the GARCH factor. t-values are reported in parentheses.

Model | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

0.02a | 0.02a | 0.02a | 0.02a | 0.03b | 0.03b | 0.03b | 0.03b | |

β0 | (2.25) | (2.32) | (2.05) | (2.30) | (3.10) | (3.42) | (3.44) | (3.13) |

-0.08 | -0.04 | -0.05 | -0.04 | -0.09a | -0.09 | -0.08 | -0.08 | |

β1 | (-1.63) | (-0.66) | (-0.74) | (-0.66) | (-2.15) | (-1.64) | (-1.55) | (-1.48) |

0.01 | 0.01 | 0.01 | 0.05 | 0.06 | 0.06 | |||

β2 | (0.10) | (0.12) | (0.10) | (0.82) | (0.97) | (0.97) | ||

0.11 | 0.10 | 0.11 | 0.03 | 0.04 | 0.04 | |||

β3 | (0.97) | (0.95) | (0.97) | (0.40) | (0.49) | (0.54) | ||

-0.00 | -0.00 | 0.00 | 0.00 | |||||

β4 | (-1.53) | (-0.03) | (-0.82) | (-1.53) | ||||

0.00a | 0.00a | 0.00a | 0.00a | 0.00 | 0.00 | 0.00 | 0.00 | |

α0 | (2.13) | (2.18) | (2.07) | (2.17) | (1.07) | (1.10) | (1.07) | (1.09) |

0.31b | 0.33b | 0.32b | 0.33b | 0.07 | 0.14 | 0.14 | 0.14 | |

α1 | (3.14) | (3.23) | (3.15) | (3.21) | (1.82) | (1.91) | (1.92) | (1.98) |

0.60b | 0.57b | 0.59b | 0.57b | 0.82b | 0.81b | 0.82b | 0.82b | |

α2 | (5.70) | (5.18) | (5.49) | (5.18) | (9.13) | (9.24) | (9.46) | (9.89) |

0.31 | 0.29 | 0.34 | 0.29 | 0.03 | -0.02 | -0.02 | 0.11 | |

Γ | (1.40) | (1.41) | (1.62) | (1.41) | (0.09) | (-0.08) | (-0.06) | (0.40) |

Cross-Sectional Analysis

In this section, we are interested in whether winners and losers have different magnitudes of idiosyncratic risks and different sensitivities to idiosyncratic volatility. We first analyze the levels of conditional idiosyncratic risks for winners and losers. Idiosyncratic risks are measured as variance of residuals h t in Eq. (1)–(3). Exhibit 5 shows that losers have higher idiosyncratic risks than winners. Panel A shows that when winners are defined as the top 30% of all REITs, the average value-weighted monthly idiosyncratic risk is 0.41%, while losers’ average value-weighted monthly idiosyncratic risk is 0.55%, both statistically significant. An equality test further confirms that the difference in winners’ and losers’ idiosyncratic risks is significant. There is a negative 0.15% difference in winners’ and losers’ average value-weighted idiosyncratic risks. The result is at odds with our second hypothesis (H2a) and contradicts with rational risk-return tradeoff theory. However, it is consistent with Ang et al. (2006) and Guo and Savickas (2006), who report an idiosyncratic volatility puzzle that firms with high idiosyncratic volatility have lower expected returns. The third column reports equal-weighted idiosyncratic risks. The data suggests that equal-weighted idiosyncratic risks are larger than value-weighted ones, and the difference in losers’ and winners’ idiosyncratic risks is −0.23%. Panel B reports idiosyncratic risks of winners and losers using 10% as breakpoint, and it suggests that losers again have higher levels of idiosyncratic risks. Both the value- and equal-weighted differences in idiosyncratic risks between winners and losers are doubled compared to the figures in Panel A. (Figs. 1 and 2)

Exhibit 5:

Summary statistics of idiosyncratic risks of winners and losers

Idiosyncratic risk is defined as the mean square errors of residuals from the four-factor model and a GARCH-in-mean model.

Where R i is the monthly mean return of a winner or a loser REIT identified on month t over the period t-12 to t+24. Rm,t is the market return. SMB is the small-minus-big factor in the Fama-French three factor model, and HML is the high-minus-low book/market ratio factor. Liquidity is defined as the turnover of each stock.

Panel A: 30% breakpoint | Value-weighted idiosyncratic risk | Equal-weighted idiosyncratic risk |

Winners | 0.41%b | 0.62%b |

Losers | 0.55%b | 0.85%b |

Difference (winners-losers) | -0.15%b | -0.23%b |

Panel B: 10% breakpoint | ||

Winners | 0.65%b | 0.92%b |

Losers | 1.04%b | 1.38%b |

Difference (winners-losers) | -0.39%b | -0.46%b |

We then investigate whether idiosyncratic risks contribute to momentum returns in a four-factor model. Since some REITs suffer from illiquidity problem, our model adds liquidity to the Fama-French three-factor model. In other words, our four-factor model controls for market return, size, B/M ratio, and liquidity. Because the summary statistics in Exhibit 1 suggests no difference between winners’ and losers’ volumes, we define liquidity as turnover in Eq. (4). Exhibit 6 presents our results. Models 1 through 12 provide clear evidence that conditional idiosyncratic risk, MSE, is a powerful explanatory variable in momentum returns. As shown in Exhibit 6, coefficients for idiosyncratic risk, MSE, are negative and highly significant regardless of the other explanatory variables included in the regression. Note that winners have lower idiosyncratic risks than losers, as reported in Exhibit 6. As a result, the MSE variable, defined as winners’ idiosyncratic risk minus losers’ idiosyncratic risk, is negative. Therefore, a negative coefficient to the MSE variable in our results simply suggests that the difference in winners’ and losers’ idiosyncratic risks contribute to momentum returns. As a robustness check, we run the regression using different weighting methods and breakpoints. Panel A presents results for value-weighted portfolios using 30% breakpoint. Model 1 shows that β MSE is −0.74 (t-value = −6.39) in a capital asset pricing model. Model 2 controls for size and book-to-market and shows a similar result. β MSE in model 2 is −0.74 (t-value = −6.26). Model 3 adds turnover to the Fama-French three-factor model, and shows consistent result. β MSE in model 3 is −0.85 (t-value = −6.69). The result provides evidence the effect of idiosyncratic risk on momentum is not subdued by liquidity effects. With regards to liquidity risk, we find that liquidity also plays an important role in momentum. The turnover coefficient is 0.004 (t-value = 2.24) in model 3, meaning that the difference in winners’ and losers’ turnovers is positively associated with momentum returns. Panel B to D report results using different weighting methods and breakpoints to sort stocks. They are all statistically consistent with results in Panel A.

Exhibit 6:

Momentum return and the difference in winners’ and losers’ idiosyncratic risks

Where momentum return is the dependent variable. MSE measures the difference between winners’ and losers’ idiosyncratic risks. Rm is the market return. SMB is the small-minus-big size factor, and HML is the high-minus-low book-to-market ratio factor. Turnover measures the difference between winners’ and losers’ turnover rates. After obtaining each stock’s idiosyncratic risk from equation (1) to (3), we form monthly momentum portfolios by entering a long/short position on winners/losers. We then run a time-series regression on equation (4) to investigate whether idiosyncratic risks justify momentum returns. t-values are reported in parentheses.

Model | Intercept | MSE | Rm,t | SMB | HML | Turnover |

Panel A: Value-weighted portfolios with 30% breakpoint | ||||||

1 | 0.01b | -0.74b | -0.00 | |||

(22.05) | (-6.39) | (-0.45) | ||||

2 | 0.01b | -0.74b | -0.01 | 0.01 | -0.01 | |

(20.96) | (-6.26) | (-0.80) | (0.90) | (-0.49) | ||

3 | 0.01b | -0.85b | -0.01 | 0.01 | -0.01 | 0.004a |

(20.17) | (-6.69) | (-0.89) | (0.42) | (-0.67) | (2.24) | |

Panel B: Equal-weighted portfolios with 30% breakpoint | ||||||

7 | 0.01b | -0.75b | -0.01 | |||

(26.72) | (-8.70) | (-1.57) | ||||

8 | 0.01b | -0.76b | -0.02 | 0.01 | -0.01 | |

(25.56) | (-8.59) | (-1.92) | (0.85) | (-0.79) | ||

9 | 0.01b | -0.84b | -0.02a | 0.01 | -0.02 | 0.01b |

(23.77) | (-9.35) | (-2.06) | (0.55) | (-1.19) | V | |

Panel C: Value-weighted portfolios with 10% breakpoint | ||||||

4 | 0.02b | -0.74b | -0.03 | |||

(19.84) | (-8.61) | (-1.66) | ||||

5 | 0.02b | -0.73b | -0.05a | 0.01 | -0.05 | |

(19.25) | (-8.37) | (-2.24) | (0.04) | (-1.36) | ||

6 | 0.02b | -0.79b | -0.05a | 0.00 | -0.05 | 0.003a |

(18.29) | (-8.62) | (-2.14) | (0.07) | (-1.41) | (2.03) | |

Panel D: Equal-weighted portfolios with 10% breakpoint | ||||||

10 | 0.02b | -0.66b | -0.04a | |||

(23.27) | (-8.08) | (-2.38) | ||||

11 | 0.012a | -0.67b | -0.04a | 0.03 | 0.01 | |

(21.99) | (-8.09) | (-2.11) | (1.26) | (0.28) | ||

12 | 0.02b | -0.70b | -0.04a | 0.03 | -0.00 | 0.004a |

(21.04) | (-8.44) | (-2.29) | (1.13) | (-0.05) | (2.25) | |

Our next goal is to study whether winners and losers display different sensitivities to risk factors. Every month t, we run a time-series regression in Eq. (1)–(3) for each REIT using observations from month t-12 to month t+24 to obtain each stock’s risk sensitivities to risk factors in the Fama-French three-factor model. We then run a cross-sectional regression in Eq. (5) to winners and losers respectively, using the beta coefficients and MSEs estimated from Eq. (1)–(3). Exhibit 7 presents our results. Panel A reports results using 30% breakpoint to identify winners/losers, whereas Panel B reports results using 10% breakpoint. Model 1 and 2 in Panel A study sensitivities of asset returns to idiosyncratic risks. We find that returns of winners have an insignificant coefficient to their idiosyncratic risks, while losers have a significantly negative coefficient (γMSE = −0.56). A positive (negative) coefficient implies that investors require a higher (lower) risk premium for bearing higher idiosyncratic risk. Our results suggest that losers’ idiosyncratic risks are penalized with lower returns. It also implies that although losers have a higher level of idiosyncratic risk as shown in Exhibit 5, investors do not require a higher risk premium for holding losers’ idiosyncratic risk. Model 3 and 4 study the relation of stock returns and sensitivities to idiosyncratic volatilities, after controlling for market return. Losers’ γMSE coefficient is −0.55 (t-value = −33.54), but winners’ γMSE is again insignificant. Model 5 and 6 examine the relation between idiosyncratic risk and asset return, after controlling for market return, size, and book-to-market. Results are similar to our previous findings. Winners have an insignificant coefficient, whereas losers have a negative γMSE coefficient −0.55 (t-value = −33.34). Model 7 and 8 include a liquidity factor, and have similar results as previous models. It is worthy to note that the winners’ liquidity coefficient is higher than that of losers. In model 7, winners’ liquidity coefficient is 0.01 (t-value = 24.63). On the other hand, model 8 shows that losers’ liquidity coefficient is 0.007 (t-value = 9.74). The result suggests that liquidity risk premia for winners are higher than those for losers. In other words, although winners have lower liquidity risk (as measured by higher turnover) than losers, investors require a higher liquidity risk premium for winners.

In Panel B, we present results using 10% breakpoint to sort stocks. We demonstrate that winners have positive coefficients to idiosyncratic risks, and losers have negative coefficients to idiosyncratic risks. Specifically, model 9 shows that winners’ γMSE coefficient is 0.15 (t-value = 3.78), and losers’ γMSE coefficient is −0.41 (t-value = −15.10). It implies that winners’ idiosyncratic risks are compensated with higher returns, and that losers’ idiosyncratic risks are penalized with lower returns. This finding does not change regardless of the other explanatory variables included in the regression, as shown in model 11 through 16. In sum, result presented in Exhibit 7 confirm our second hypothesis (H2b) that winners (losers) have higher (lower) risk premia to idiosyncratic risk, causing momentum returns. It also confirms our third hypothesis (H3) that winners (losers) have higher (lower) risk premia to liquidity risk.

Exhibit 7:

Risk premiums to different risk factors in the four-factor model

First, we run a time-series GARCH-in-Mean model to each REIT:

Every month t, we run a time-series regression in equation (1)-(3) for each stock using observations from month t-12 to month t+24 to obtain each stock’s risk sensitivities to risk factors. Rt is individual stock return, and Rm,t is the market return. SMB is the small-minus-big size factor, and the HML is high-minus-low book-to-market ratio factor from the Fama-French three factor model. Turnover is the turnover of each stock.

Next, we run a cross-sectional regression in equation (5) to REITs identified as winners and losers, respectively.

Where R i is the monthly average return of a winner or a loser REIT identified on month t over the period t-12 to t+24. MSE is the mean square errors of residuals from the factor model in equation (1)-(3). β M measures an asset return’s systematic risk to the market. β SMB measures return sensitivity to the small-minus-big size factor, and β HML measures return sensitivity to the high-minus-low book-to-market factor. β Turnover measures return sensitivity to turnover factor. t-values are reported in parentheses.

Model | Intercept | MSE | βM | βSMB | βHML | βTurnover | |

Panel A: 30% breakpoint | |||||||

Winners | 1 | 0.02b | -0.04 | ||||

(72.90) | (-1.66) | ||||||

Losers | 2 | 0.01b | -0.56b | ||||

(33.51) | (-33.53) | ||||||

Winners | 3 | 0.02b | -0.03 | 0.03b | |||

(71.85) | (-1.66) | (7.94) | |||||

Losers | 4 | 0.01b | -0.55b | 0.02b | |||

(32.59) | (-33.34) | (5.03) | |||||

Winners | 5 | 0.02b | -0.04 | 0.04b | 0.02b | 0.01a | |

(69.94) | (-1.81) | (7.33) | (4.09) | (2.03) | |||

Losers | 6 | 0.01b | -0.55b | 0.01b | 0.01a | -0.02a | |

(32.61) | (-33.34) | (2.72) | (2.26) | (-2.18) | |||

Winners | 7 | 0.01b | -0.06b | 0.04b | 0.02b | 0.01a | 0.01b |

(51.24) | (-3.17) | (7.48) | (3.35) | (1.94) | (24.63) | ||

Losers | 8 | 0.01b | -0.55b | 0.01b | 0.01a | -0.02a | 0.007b |

(22.83) | (-33.30) | (2.68) | (2.04) | (-2.46) | (9.74) | ||

Panel B: 10% breakpoint | |||||||

Winners | 9 | 0.02b | 0.15b | ||||

(34.12) | (3.78) | ||||||

Losers | 10 | 0.004b | -0.41b | ||||

(6.51) | (-15.10) | ||||||

Winners | 11 | 0.02b | 0.14b | 0.05b | |||

(33.67) | (4.76) | (4.76) | |||||

Losers | 12 | 0.003b | -0.41b | 0.04b | |||

(5.94) | (-14.96) | (3.89) | |||||

Winners | 13 | 0.02b | 0.14b | 0.05b | 0.03a | 0.03 | |

(32.77) | (3.61) | (4.71) | (2.20) | (1.67) | |||

Losers | 14 | 0.003b | -0.41b | 0.03a | 0.02 | -0.02 | |

(6.25) | (-14.92) | (2.30) | (1.38) | (-1.40) | |||

Winners | 15 | 0.01b | 0.10b | 0.05b | 0.02 | 0.02 | 0.01b |

(25.03) | (2.72) | (4.68) | (1.48) | (1.64) | (17.97) | ||

Losers | 16 | 0.003b | -0.41b | 0.03a | 0.02 | -0.03a | 0.002b |

(4.21) | (-14.90) | (2.17) | (1.30) | (-1.61) | (3.81) | ||

To conclude, our cross-sectional results can be summarized as follows.

-

Losers have higher idiosyncratic risks than winners. More importantly, the significant difference in winners’ and losers’ idiosyncratic risks contributes to momentum returns, after controlling for other market variables including liquidity.

-

Losers’ returns have a negative sensitivity to their idiosyncratic risks, and winners’ returns have a positive sensitivity to their idiosyncratic risks. It implies that although losers have higher idiosyncratic risk, investors do not require a higher risk premium for holding losers’ idiosyncratic risks. Instead, losers’ idiosyncratic risks are penalized with lower returns. In other words, although losers have higher levels of idiosyncratic risks, their low risk premia contribute to low returns, which explain momentum.

-

The difference in winners’ and losers’ turnovers is positively associated with momentum returns. Moreover, winners have higher risk premia to liquidity risk than losers.

Conclusion

This research investigates whether or not idiosyncratic volatility, asymmetric volatility, and liquidity can explain momentum returns in REITs. We apply a GARCH-in-mean model to capital-asset-pricing model and the Fama-French three factor model to test asymmetric volatility effect in momentum returns in REITs. Furthermore, we study whether or not cross-sectional idiosyncratic volatility explains momentum returns. Precisely, we study whether winners and losers have different magnitudes or sensitivities to idiosyncratic volatility. We also investigate whether liquidity is a significant factor in REITs’ momentum returns, since REITs have relatively illiquid underlying assets compared to industry firms. We have four key findings. First, using a GARCH-in-mean model, we discover that momentum returns display asymmetric volatility. Momentum returns in REITs are higher when volatility is higher. However, this result becomes insignificant when we apply 10% breakpoint to select winners/losers. Second, losers have a higher level of idiosyncratic risk than winners. The difference in losers’ and winners’ idiosyncratic risks is economical significant and contribute to momentum. Third, we find strong evidence that losers’ returns are negatively related to their idiosyncratic risks, and find some evidence that winners’ returns are positively related to their idiosyncratic risks. The result indicates that for losers, higher idiosyncratic risk volatility is penalized with lower required rate of return. This also implies that although losers have higher idiosyncratic risk, investors do not require a higher risk premium for holding losers’ idiosyncratic risks. As consequence, although losers have higher levels of idiosyncratic risks, their low risk premia help explain their low returns. Lastly, we find a positive relation between momentum returns and liquidity, as measured by turnover. It implies that liquidity risk is priced in REITs’ momentum returns. Moreover, liquidity risk premia for winners are higher than those for losers, consistent with rational risk-return tradeoff hypothesis.

We can further investigate sources of idiosyncratic risk in future research. According to the leverage effect theory by Christie (1982), a drop in stock price increases the leverage of firms, causing a higher volatility. As a result, higher idiosyncratic risks may be caused by higher leverages.

Notes

Jegadeesh and Titman (2001) suggest that momentum returns cannot be explained by cross-sectional dispersion in returns. Behavioral explanations on momentum returns include investors’ underreaction to firm-specific news (Barberis et al. 1998 and Grinblatt and Han 2005) or overreaction to firm-specific news (Daniel et al. 1998, 2001, Hong and Stein 1999, and Barberis et al. 2003).

Lee and Swaminathan (2000) and Connolly and Stivers (2003) suggest that industry past volume predicts future returns. Grundy and Martin (2001) and Jegadeesh and Titman (2001) find that cross-sectional differences in expected returns is not the dominant cause of momentum. Chordia and Shivakumar (2002) show that most momentum can be explained by lagged treasury-bill yield, market dividend yield, term spread, and default spread. Johnson (2002) suggests that a cross-sectional dividend growth rate should be responsible for momentum. Ahn et al. (2003), Moskowitz (2003) provide a stochastic discount factor to measure risk premium in momentum, and report that when correct risk factor is used, momentum disappears.

A rise in stock price due to positive past returns (winners) will decrease leverage of firms, and thus decrease volatility. On the other hand, a drop in stock price due to negative past returns (losers) will increase leverage of firms, and therefore increase volatility. As a result, the negative relation between volatilities and returns can be explained by leverages of firms.

Bekaert and Wu (2000) examine the leverage effect and time-varying risk premium and suggest that asymmetric volatility is caused by the variance dynamics at the firm level, not by changes in leverage, and thus volatility feedback effect is the dominant cause. Wu (2001) examines both the leverage effect and volatility feedback effect and finds that the volatility feedback is significant both statistically and economically. Dennis et al. (2006) find that market-level systematic volatility is the major factor that causes asymmetric volatility in individual stock returns, and thus support the volatility feedback hypothesis.

See Fama and French (1993).

See Bollerslev, Chou and Kroner (1992) for a review of ARCH modeling.

Ang et al. (2006) find that firms with high idiosyncratic volatility have lower expected return.

We select this sample period because before 1983 there are only a few number of REITs to form momentum portfolios.

10% is the conventional breakpoint used in momentum studies, whereas 30% is the breakpoint used in most REIT momentum studies due to REITs’ smaller sample size.

References

Ahn, D., Conrad, J., & Dittmar, R. F. (2003). Risk adjustment and trading strategies. Review of Financial Studies, 16(2), 459–485. doi:10.1093/rfs/hhg001.

Amihud, Y. (2002). Illiquidity and stock returns: cross-section and time-series effects. Journal of Financial Markets, 5, 31–56. doi:10.1016/S1386-4181(01)00024-6.

Ang, A., Hodrick, R., Xing, Y., & Zhang, X. (2006). The cross-section of volatility and expected returns. Journal of Finance, 51, 259–299. doi:10.1111/j.1540-6261.2006.00836.x.

Bali, T. G., & Cakici, N. (2008). Idiosyncratic volatility and the cross-section of expected returns. Journal of Financial and Quantitative Analysis, 48(1), 29–58.

Barberis, N., Shleifer, A., & Vishny, R. (1998). A model of investor sentiment. Journal of Financial Economics, 49(3), 307–343. doi:10.1016/S0304-405X(98)00027-0.

Barberis, N., Shleifer, A., & Vishny, R. (2003). Style investing. Journal of Financial Economics, 68(2), 161–199. doi:10.1016/S0304-405X(03)00064-3.

Bekaert, G., & Wu, G. (2000). Asymmetric volatility and risk in equity markets. Review of Financial Studies, 13(1), 1–42. doi:10.1093/rfs/13.1.1.

Black, F. (1976). Studies of stock price volatility changes, Proceeding of the 1976 meetings of American Statistical Association, Business and Economic Statistics Section, 177–181.

Black, A. J., & McMillan, D. G. (2006). Asymmetric risk premium in value and growth stocks. International Review of Financial Analysis, 15, 237–246. doi:10.1016/j.irfa.2004.12.001.

Bollerslev, T. R., Chou, Y., & Kroner, K. F. (1992). ARCH modeling in Finance: a review of the theory and empirical evidence. Journal of Econometrics, 52, 5–59. doi:10.1016/0304-4076(92)90064-X.

Brennan, M. J., & Subrahmanyam, A. (1996). Market microstructure and asset pricing: on the compensation for illiquidity in stock returns. Journal of Financial Economics, 41, 441–464. doi:10.1016/0304-405X(95)00870-K.

Brennan, M. J., Chordia, T., & Subrahmanyam, A. (1998). Alternative factor specifications, security characteristics, and the cross-section of expected stock returns. Journal of Financial Economics, 49, 345–373. doi:10.1016/S0304-405X(98)00028-2.

Campbell, J. Y. (1993). Intertemporal asset pricing without consumption data. American Economic Review, 83, 487–512.

Campbell, J. Y., & Hentschel, L. (1992). No news is good news: an asymmetric model of changing volatility in stock returns. Journal of Financial Economics, 31, 281–318. doi:10.1016/0304-405X(92)90037-X.

Christie, A. A. (1982). The stochastic behavior of common stock variances. Journal of Financial Economics, 10, 407–432. doi:10.1016/0304-405X(82)90018-6.

Chordia, T., & Shivakumar, L. (2002). Momentum, business cycle and time-varying expected returns. Journal of Finance, 57, 985–1019. doi:10.1111/1540-6261.00449.

Chui, A. C. W., Titman, S., & Wei, K. C. J. (2003). Intra-industry momentum: the case of REITs. Journal of Financial Markets, 6, 363–387. doi:10.1016/S1386-4181(03)00002-8.

Connolly, R., & Stivers, C. (2003). Momentum and reversals in equity-index returns during periods of abnormal turnover and return dispersion. Journal of Finance, 58, 1521–1555. doi:10.1111/1540-6261.00576.

Daniel, K., Hirshleifer, D., & Subrahmanyam, A. (1998). Investor psychology and secu-rity market under- and overreaction. Journal of Finance, 53(6), 1839–1885. doi:10.1111/0022-1082.00077.

Daniel, K., Hirshleifer, D., & Subrahmanyam, A. (2001). Overconfidence, arbitrage, and equilibrium asset pricing. Journal of Finance, 56(3), 921–965. doi:10.1111/0022-1082.00350.

Datar, V. T., Naik, N., & Radcliffe, R. (1998). Liquidity and stock returns: an alternative test. Journal of Financial Markets, 1, 203–219. doi:10.1016/S1386-4181(97)00004-9.

Dennis, P., Mayhew, S., & Stivers, C. (2006). Stock returns, implied volatility innovations, and the asymmetric volatility phenomenon. Journal of Financial and Quantitative Analysis, 41(2), 381–406.

Engle, R. F., & Ng, V. K. (1993). Measuring and testing the impact of news on volatility. Journal of Finance, 48, 1749–1778. doi:10.2307/2329066.

Engle, R. F., Lilien, D. M., & Robins, R. P. (1987). Estimating time-varying risk premia in the term structure: The ARCH-M model. Econometrica, 55, 391–407. doi:10.2307/1913242.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33, 3–56. doi:10.1016/0304-405X(93)90023-5.

Fu, F. (2007). Idiosyncratic risk and the cross-section of expected stock returns, working paper.

Glosten, R. G., Jagannathan, R., Runkle, D. E. (1993). On the relation between the expected value and the volatility of the nominal excess return on stocks. Journal of Finance, 48(5), 1779–1801. doi:10.2307/2329067.

Grinblatt, M., & Han, B. (2005). Prospect theory, mental accounting, and momentum. Journal of Financial Economics, 78(2), 311–339. doi:10.1016/j.jfineco.2004.10.006.

Goyal, A., & Santa-Clara, P. (2003). Idiosyncratic risk matters!. Journal of Finance, 58(3), 975–1007. doi:10.1111/1540-6261.00555.

Grundy, B. D., & Martin, J. S. (2001). Understanding the nature of the risks and the source of the rewards to momentum investing. Review of Financial Studies, 4(1), 29–78. doi:10.1093/rfs/14.1.29.

Guo, H., & Savickas, R. (2006). Idiosyncratic volatility, stock market volatility, and expected stock returns. Journal of Business and Economic Statistics, 24, 43–56. doi:10.1198/073500105000000180.

Hong, H., & Stein, J. C. (1999). A unified theory of underreaction, momentum trading and overreaction in asset markets. Journal of Finance, 54, 2143–2184. doi:10.1111/0022-1082.00184.

Hung, K., & Glascock, J. (2008). Momentum profitability and market trend: evidence from REITs. Journal of Real Estate Finance and Economics, 37(1), 51–70. doi:10.1007/s11146-007-9056-4.

Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: implications for stocks market efficiency. Journal of Finance, 48, 65–91. doi:10.2307/2328882.

Jegadeesh, N., & Titman, S. (2001). Profitability of momentum strategies: an evaluation of alternative explanations. Journal of Finance, 56, 699–720. doi:10.1111/0022-1082.00342.

Jirasakuldech, B., Campbell, R. D., & Emekter, R. (2009). Conditional volatility of equity real estate investment trust returns: a Pre- and Post-1993 comparison. The Journal of Real state Finance and Economics, 38(2), 137–154. doi:10.1007/s11146-007-9079-x.

Johnson, T. C. (2002). Rational momentum effects. Journal of Finance, 57(2), 585–608. doi:10.1111/1540-6261.00435.

Laux, P. A., & Ng, L. K. (1993). The sources of GARCH: empirical evidence from an intraday returns model incorporating systematic and unique risk. Journal of International Money and Finance, 12, 543–560. doi:10.1016/0261-5606(93)90039-E.

Lee, C. M. C., & Swaminathan, B. (2000). Price momentum and trading volume. Journal of Finance, 55, 2017–2069. doi:10.1111/0022-1082.00280.

Malkiel, B. G., & Xu, Y. (1997). Risk and return revisited. Journal of Portfolio Management, 23, 9–14.

Malkiel, B. G., & Xu, Y. (2008). Idiosyncratic risk and security returns, working paper.

Merton, R. (1980). On estimating the expected return on the market: an exploratory investigation. Journal of Financial Economics, 8, 326–361. doi:10.1016/0304-405X(80)90007-0.

Moskowitz, T. J. (2003). An analysis of covariance risk and pricing anomalies. Review of Financial Studies, 16, 417–457. doi:10.1093/rfs/hhg007.

Nelson, D. B. (1991). Conditional heteroskedasticity in asset returns: a new approach. Econometrica, 59, 347–370. doi:10.2307/2938260.

Ooi, J. T. L., Wang, J., & Webb, J. R. (2009). Idiosyncratic Risk and REIT Returns. Journal of Real Estate Finance and Economics, 38(4). doi:10.1007/s11146-007-9091-1.

Pastor, L., & Stambaugh, R. F. (2003). Liquidity risk and expected stock returns. Journal of Political Economy, 111(3), 642–685. doi:10.1086/374184.

Sadka, R. (2006). Momentum and post-earnings-announcement drift anomalies: the role of liquidity risk. Journal of Financial Economics, 80(2), 309–349. doi:10.1016/j.jfineco.2005.04.005.

Wu, G. (2001). The determinants of asymmetric volatility. Review of Financial Studies, 14, 837–859. doi:10.1093/rfs/14.3.837.

Wu, G., & Xiao, Z. (2002). A generalized partially linear model of asymmetric volatility. Journal of Empirical Finance, 9, 287–319. doi:10.1016/S0927-5398(01)00057-3.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hung, SY.K., Glascock, J.L. Volatilities and Momentum Returns in Real Estate Investment Trusts. J Real Estate Finan Econ 41, 126–149 (2010). https://doi.org/10.1007/s11146-008-9165-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-008-9165-8