Abstract

This is the first study to examine the post-earnings-announcement drift anomaly in a Real Estate Investment Trust (REIT) context. The efficient markets hypothesis suggests that unexpected earnings should be fully incorporated into asset prices soon after being publicly announced. We hypothesize that publicly announced earnings signals may be more certain for REITs due to the presence of a parallel (private) asset market, suggesting less drift for REIT stocks. However, we find a large REIT drift component that is both statistically and economically significant. Furthermore, while the initial earnings surprise response is more muted for REITs, we find that the magnitude of the drift is significantly larger for REITs than for ordinary common stocks (NonREITs). Thus, information does not appear to move between the private and public asset markets in such a way as to render REIT earnings signals more certain than NonREIT earnings signals.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The post-earnings-announcement drift (PEAD) Footnote 1 is the phenomenon where stock returns continue to drift in the same direction as the surprise portion of an earnings announcement. That is, positive earnings surprises tend to be followed by abnormal returns that continue to drift up and negative earnings surprises tend to be followed by abnormal returns that continue to drift down. While semi-strong form market efficiency suggests that information should be fully incorporated into stock prices soon after the information becomes publicly known, the information in earnings announcements seems to be incorporated slowly into asset prices over a period of several months after the announcements are made (Ball and Brown 1968; Foster et al. 1984; Bernard and Thomas 1989, 1990).

Few anomalies to market efficiency have stood the test of time. Fama (1998) argues that most of them are the statistical byproducts of flawed empirical methods. However, he also acknowledges that two anomalies legitimately remain “above suspicion”, PEAD and the short-term continuation of returns (momentum).Footnote 2 While momentum in the returns of Real Estate Investment Trusts (REITs) has been the subject of recent study (Chui et al. 2003; Hung and Glascock 2008, 2010) PEAD in a REIT setting has yet to receive attention. This apparent gap in the literature is curious, given that returns momentum has been shown to be related to PEAD (Chan et al. 1996; Chordia and Shivakumar 2006).

This is the first study of which we are aware to examine REIT PEAD. We do so in the context of recent literature which contends that uncertainty may be the underlying cause of the drift (Lewellen and Shanken 2002; Brav and Heaton 2002; Liang 2003; Francis et al. 2007).Footnote 3 The efficiency with which markets fully incorporate information into asset prices is called into question when firms earn abnormally high (low) returns following positive (negative) earnings announcements. The uncertainty theory suggests that the initial signal sent by an earnings announcement is only partially incorporated into a stock’s price due to investor uncertainty regarding the full meaning of the signal. Then, as time passes and the information slowly becomes more certain, the signal becomes more fully incorporated into the stock price, resulting in the drift.

The REIT market provides a natural setting in which to examine the relation between information uncertainty and PEAD. Capozza and Lee (1994) suggest that REIT assets may be valued with much greater precision than the assets of typical corporations (NonREITs) because real estate assets also trade individually as properties. When securitized, commercial real estate assets are indirectly held and traded as REIT shares in the public markets. However, commercial real estate assets are also traded in the directly held private market as well.Footnote 4 Private market participants competing with REITs for larger high-quality commercial property assets are primarily sophisticated institutional investors that collectively generate substantial commercial real estate data. As a result, the parallel asset market may provide a greater level of industry and asset performance information than can be found for typical firms. Essentially, investors might be able to effectively pierce through to the performance of the underlying asset base for REITs with much greater clarity than for NonREITs. This, in turn, should enable REIT investors to more fully understand, and quickly incorporate, the signal in the earnings announcement. Accordingly, we would expect to find less PEAD among REITs when compared to NonREITs due to the greater certainty that stems from the rich commercial real estate performance information environment.

We document a statistically and economically significant drift for REITs over the 1982–2008 sample period of approximately 5%. This translates into annualized returns to a zero investment portfolio long in high earnings surprise REITs and short in low earnings surprise REITs of just under 20%, on average. In contrast, NonREIT PEAD over the same period is markedly less at 3% (12% annualized). This difference either provides evidence against the uncertainty theory or suggests that the parallel asset market does not render REIT earnings signals more certain than NonREIT signals. At 4% (just under 17% annualized) small stock (Small NonREIT) PEAD is noted to be less pronounced than REIT PEAD, but the difference is not statistically significant.

We also find that REITs have a more muted response to the information contained in the earnings surprise compared to both ordinary common stocks and small stocks. With abnormal announcement period returns of 1% for REITs, the magnitude of the initial earnings surprise response is less than half of the magnitude we observe for NonREITs and less than one third of the initial response for Small NonREITs. These differences are highly significant.

We further examine the uncertainty theory on an intra-industry basis by comparing PEAD differences within the REIT industry over time. REIT evolution has been defined by rule changes which have significantly altered the industry. Ling and Ryngaert (1997) contend that REIT valuation is more uncertain post-1990 than pre-1990 on account of greater ownership structure complexity. They posit that active management and the introduction of the umbrella partnership REIT (UPREIT) structure inject greater subjectivity in REIT valuation when compared to the earlier, simpler pass-through arrangement.

Overall, this paper makes the following contributions to the literature. First, we document PEAD in a REIT context. Second, we find that REIT PEAD is significantly greater in overall magnitude than that which we observe in ordinary common stocks, and similar in magnitude to small stocks. Third, we show that the initial incorporation of earnings information into stock prices is more muted for REITs than for both typical equities and small stocks. Additionally, our results suggest that despite the rich information environment created by the parallel asset market, information does not appear to flow from the private to the public market in such a way that it renders REIT earnings signals more certain than NonREIT earnings signals. Finally, comparisons within the REIT industry are consistent with both Chui et al. (2003) and the uncertainty explanation for PEAD.

This study is developed in the following sections. In the next section we review the literature and develop our hypotheses. The third section describes our sample. In the fourth section we present our analysis and discuss the results. The fifth section concludes.

Literature Review and Hypothesis Development

First documented by Ball and Brown (1968), PEAD continues to be an actively researched topic which has yet to be explained. The finance and accounting literature is replete with potential explanations for the incomplete market reaction to earnings announcements.Footnote 5 Many attribute the anomaly to human behavioral shortcomings such as investor irrationality or bias. Some contend that investor bias results in initial under-reaction to earnings news (Bernard and Thomas 1989, 1990; Freeman and Tse 1989; Mendenhall 1991; Wiggins 1991, among others) while others assert that the cause is investor over-reaction (DeBondt and Thaler 1985, 1987). Regardless of the direction of the reaction, investor biases are likely to be more pronounced in cases of greater information uncertainty (Daniel et al. 1998, 2001; Hirshleifer 2001; Zhang 2006).

A recent vein of literature has explored the combination of rational learning and information uncertainty as a potential cause of the drift. Lewellen and Shanken (2002) show that predictability arises from the learning process. They argue that in cases of information uncertainty, where investors must learn about expected cash flows, empirical tests can find patterns in the data which may depart from what we would expect in a world of perfect information. Parameter uncertainty “drives a wedge” between the empirical distributions estimated by econometricians and the distributions as perceived by rational investors.

Brav and Heaton (2002) further develop this argument in their comparison of behavioral and rational structural uncertainty theories as explanations for financial anomalies. Behavioral explanations relax the assumption of rational information processing. In this framework, cognitive biases prevent investors from fully and accurately processing news, which can give rise to less-than-efficient financial markets. Alternatively, if the assumption of complete information is relaxed, it is possible to see the same anomalies manifest in the data based on rational investor learning. Under such models, the anomalies are the result of either mistakes or risk premiums attributable to incomplete information.

Liang (2003) and Francis et al. (2007) provide initial empirical support relating PEAD and uncertainty when considering investors’ non-Baysian and rational behaviors. As of yet there is no universally accepted authoritative measure of information uncertainty. Liang uses the change in expected squared error of average analysts’ forecastsand requires firms to have at least two 1-quarter-ahead quarterly forecasts in addition to two 1-year-ahead annual forecast revisions. Francis et al. use the volatility of unexplained accruals, an accounting based measure derived from earnings that requires 7 years of data to estimate. Shivakumar (2007) points out that such approaches bias their samples towards large firms, raising questions regarding the generalizability of their results. This criticism is particularly important since it is well established that PEAD is most pronounced in small stocks.

The question of uncertainty measurement may be best addressed by analyzing specific industries where the information diffusion process is more unambiguous than in the stock market as a whole. Hou (2007) finds that industries are the primary channel for news dissemination in the equity markets. Kovacs (2007) analyzes intra-industry PEAD and finds that a firm’s post-earnings returns depend on subsequently arriving industry earnings news. Specifically, PEAD is observed when there is uncertainty about subsequent industry earnings news.

The REIT market provides a unique setting in which to examine the relation between information uncertainty and PEAD. REITs have at least three unique characteristics which are relevant to the examination of information uncertainty and asset pricing anomalies. First, REITs operate in tandem with a parallel asset market which may provide an additional layer of information beyond the already relatively transparent nature of commercial real estate assets. Second, REITs are required to disgorge most of the cash generated by the operation of their underlying assets in order to maintain their pass-through tax status. Third, it has been argued that REITs have undergone changes in their level of uncertainty due to regulatory refinements which have significantly altered their structure (Ling and Ryngaert 1997).

When securitized, commercial real estate assets are indirectly held and traded as REIT shares in the public markets. However, many of these same assets are traded in the directly held commercial real estate asset market as well.Footnote 6 The private market is much larger than the publicly traded REIT market and is dominated by sophisticated, institutional investors who generate volumes of information.Footnote 7 For example, a group of investment managers established the National Council of Real Estate Investment Fiduciaries (NCREIF) as a non-partisan collector and disseminator of real estate performance information.Footnote 8 Other organizations provide extensive commercial real estate performance data and benchmarks as well.

While both REITs and typical industrial firms are required to file quarterly and annual statements with the SEC, the existence of this parallel commercial real estate asset market should enable investors to effectively see through to the underlying performance of REIT assets much more clearly than for typical industrial firms. Overall, the parallel asset market may potentially provide a greater level of industry and asset (e.g. retail, office, industrial, apartment) performance information for REITs than can be found for NonREITs.Footnote 9

Additionally, regulations stipulate that REITs must payout at least 90% of their taxable earnings in the form of dividends.Footnote 10 Unable to retain substantial levels of earnings, REITs must constantly turn to the capital markets in order to capitalize on growth opportunities. By subjecting REITs to the scrutiny and due diligence that accompany securities offerings, frequent trips to the capital markets provide an unusual incentive for REITs to remain transparent (Danielsen et al. 2009). Thus, signals sent by REIT earnings announcements should be characterized as being much more certain than earnings announcements for typical equities due to the unique REIT information environment. This leads to the following two hypotheses:

-

Hypothesis 1

REIT PEAD should be less pronounced than NonREIT PEAD.

-

Hypothesis 2

The initial reaction to earnings signals should be more complete for REITs compared to NonREITs.

The REIT market also provides an ideal intra-industry setting in which to examine PEAD due to industry changes which have been argued to cause REIT valuation to become comparatively more uncertain after 1990 (Ling and Ryngaert 1997). Ling and Ryngaert assert that the introduction of active management and the creation of the UPREIT structure around this time caused REIT valuation to become more uncertain. Specifically, increased organizational complexity infused greater subjectivity into the valuation process. Chui et al. (2003) examine momentum profits before and after 1990 and find that momentum profits increase in the latter, more uncertain time period. Similarly, we expect a greater manifestation of REIT PEAD in the more uncertain time period when compared to the earlier, more certain era. This leads to the additional hypothesis:

-

Hypothesis 3

PEAD within the REIT industry should increase over time as the REIT structure becomes more uncertain.

Data

Our sample period runs from 1982 through 2008. Prior to this time quarterly Compustat data is less reliable and the number of publicly traded REITs is prohibitively small. Furthermore, starting the sample at 1982 provides for direct comparability with Chui et al. (2003). Following Chui et al. (2003) and Hung and Glascock (2008, 2010) we include all types of REITS (Equity, Mortgage, and Hybrid) in order to obtain a sufficient sample size in the pre-1990 period.Footnote 11 Daily returns data for firms listed on NYSE, AMEX, and NasdaqFootnote 12 are obtained from CRSP for share codes 10, 11, and 12 for ordinary common stocks (NonREITs), and share code 18 for REITs. We exclude financials (sic 6000–6999)Footnote 13 and utilities (sic 4600–4699). Earnings announcement dates and quarterly earnings come from Compustat. Firms must be listed on CRSP/Compustat for at least 2 years for inclusion in our sample, consistent with Fama and French (1992) and Chui et al. (2003). We end up with 212,455 firm-quarter observations over the 1982–2008 period. 203,971 of these are attributable to NonREITs and 8,484 are REIT observations.Footnote 14

Table 1 provides descriptive statistics for all firms in our sample broken out into REIT, NonREIT, and Small NonREIT portfolios, where Small NonREITs are the subset of NonREITs that fall within the lowest market capitalization quintile based on NYSE size breakpoints. We look at Small NonREITs separately because REIT returns behavior has historically been most highly correlated with small stocks (Goldstein and Nelling 1999) although the correlation has reduced over time (Ghosh et al. 1996). Panel A shows the distributional characteristics based on firm size for each portfolio. Firm size is measured by market capitalization, calculated as the stock price times the number of shares outstanding as of 45 days prior to the earnings announcement date. As expected, NonREITs are much larger than REITs, with average market capitalizations of $2.8 billion and $846 million, respectively. However, the mean NonREIT size figure is lowered by the inclusion of Nasdaq firms which predominantly fall within the smallest NYSE size quintile. The Small NonREIT subsample mean size is only $121 million.

Panel B of Table 1 shows the distributional characteristics for each portfolio based on book-to-market (BM) ratios. Book-to-market equity is calculated as the two-quarter lagged book value of equity divided by firm market capitalization as defined above. With a median value of 0.71, REITs have higher book-to-market ratios than both NonREITs (0.49) and Small NonREITs (0.60). That is, REITs are primarily value oriented given the income oriented nature of their underlying assets and the requirement to pay out at least 90% of their annual book earnings in the form of dividends.

Returns volatilities for the three portfolios are shown in Table 1, Panel C. Volatility is calculated as the standard deviation of daily returns for firm j in month m. All monthly observations are then averaged. REIT volatility of 2.15% over the entire sample period is significantly less than 3.63% for NonREITs and 4.39% for Small NonREITs, lending support to the idea that REITs are relatively more certain than their ordinary common stock counterparts.Footnote 15 However, consistent with Ling and Ryngaert (1997) and Chui et al. (2003), we find that REITs become relatively more uncertain following industry structural changes as volatility increases from the 1982–1989 sub-period to the 1990–1999 sub-period.Footnote 16 While volatility is somewhat less during the 2000–2008 sub-period, is does not revert back to the same levels we see in 1982–1989.

Analysis and Results

We follow the standard methodology for PEAD calculation (Ball and Brown 1968; Foster et al. 1984; Bernard and Thomas 1989) and sort stocks into earnings surprise deciles based on the magnitude of the earnings surprise and cumulate size adjusted returns for each of the portfolios. Earnings surprises, SURP j , are calculated using the seasonal random walk model where the difference between earnings-per-share and earnings-per-share lagged four quarters is scaled by the stock price 45 days prior to the earnings announcement dateFootnote 17:

We use the seasonal random walk model for several reasons. First, it avoids the biases that stem from analyst forecasts. Johnson (2004) notes that analysts’ forecasts can be biased by conflicts of interests, incentives, and career concerns. Further bias can be introduced since analysts are more likely to cover larger firms. Since one of our primary concerns is documenting the extent of PEAD for REITs relative to both NonREITs and Small NonREITs, size bias and forecast availability are issues of particular concern. Bradshaw et al. (2009) find that simple random walk models are more accurate than analysts’ forecasts for firms that are smaller, younger, or have limited analyst following. We also use the seasonal random walk model because the data are available for our entire sample period and are judged to be more reliable than analyst forecast data. First Call data only dates back to 1989 and the I/B/E/S data has repeatedly been shown to be unreliable, particularly prior to the 1990s. Barron and Stuerke (1998) indicate that I/B/E/S forecast recording processes improved in the 1990s, but were fraught with issues in the 1980s. Ljungqvist et al. (2009) find that identical I/B/E/S downloads taken at different times reveal problems such as alterations of recommendations, the addition and deletion of records, and the removal of analyst names. Hence, analyst forecast data sources remain suspect. Lastly, survey evidence shows that managers place greater weight on earnings in the same quarter of the prior year as their earnings benchmark. Graham et al. (2005) find that 85.1% of CFO’s consider four quarter lagged earnings to be the most important earnings benchmark, followed secondly by analyst consensus estimates.Footnote 18

Abnormal returns are estimated using size adjusted returns calculated as the difference between the raw return for stock j on day t and the mean return of a portfolio of all firms in the same size decile:

where ARj,t is the abnormal return for firm j on day t, Rj,t is the total return for firm j on day t, and Rp,t is the mean return on day t for all firms in the same size decile as firm j.Footnote 19

Graphical Analysis

To determine whether PEAD exists in our sample we cumulate abnormal returns over the 121 day window surrounding earnings announcement dates and plot the mean for each SURP decile. The cumulative abnormal returns (CARs) are the sum of the individual abnormal returns calculated as:

where CAR(−60,60)j represents the cumulative abnormal return for stock j from day t = −60 to day t = 60. The earnings announcement date is set to t = 0.

Figure 1 shows the mean of all CAR(−60,60)j for all REITs sorted into SURP deciles on a quarterly basis for the entire sample period. We can see that the decile portfolios start to spread even prior to the earnings announcements. Campbell et al. (2009) describe the spreading seen on the left side of the figure as the tendency for returns to anticipate earnings surprises. This is followed by a clear jump immediately surrounding the earnings announcements. If the earnings announcement signals were immediately and fully incorporated into stock prices we would expect the right side of the figure to be flat. However, we observe a continued spreading of the decile portfolios over the following 60 days, with the decile portfolios lining up monotonically from positive (Decile 10) to negative (Decile 1). Thus, PEAD is manifest in the REIT subsample and firms with the most extreme positive earnings surprises (Decile 10) continue to earn abnormally high returns, while REITs with the lowest earnings surprises (Decile 1) continue to earn abnormally low returns.

Cumulative Abnormal Returns for all REITs by SURP deciles for the 1982–2008 sample period. Abnormal returns are estimated using size adjusted returns calculated as \( \left\{ {{\hbox{A}}{{\hbox{R}}_{\rm{jt}}} = {{\hbox{R}}_{\rm{jt}}} - {{\hbox{R}}_{\rm{pt}}}} \right\} \) where ARjt is the abnormal return for firm j, day t; Rjt is the raw return for firm j, day t; and Rpt is the equally weighted mean return on day t for all firms in the same size decile as firm j. Size is the market capitalization of firm j as of day t = −45 and size deciles are based on NYSE size breakpoints. Abnormal returns are cumulated over a 121 day period starting 60 days prior to the earnings announcement through 60 days after the announcement. Day zero is the date of the earnings announcement. SURP is the earnings surprise calculated as \( \left\{ {\left[ {{\hbox{EPS}}\left( {\hbox{qtr}} \right)-{\hbox{EPS}}\left( {{\hbox{qtr}} - {4}} \right)} \right]/{\hbox{Stock}}\,{\hbox{Price}}\left( {{\hbox{day}}\,t = - {45}} \right)} \right\} \). Firms are sorted into SURP deciles each quarter. REITs are defined as stocks with CRSP share code 18

Figure 2 shows the mean of all CAR(−60,60)j for all NonREITs sorted into SURP deciles on a quarterly basis for the entire sample period. The same patterns we see with REITs can be seen with NonREITs, with a few notable differences. The ability of NonREIT returns to anticipate the direction and relative magnitude of the earnings surprise is much more pronounced than with REITs. This, in turn, causes the drift (spread between Decile 10 and Decile 1) cumulated over the entire 121 day window to be of greater magnitude for NonREITs than that which we observe for REITs. Visual inspection shows the NonREIT spread to approximately double the REIT spread. However, if we focus on the PEAD window (days t = 1 through t = 60) it is difficult to determine if the divergence of the extreme SURP deciles for the REITs and NonREITs is substantially different. This is contrary to our hypothesis that less drift should be manifest in REITs when compared to their common stock counterparts. This suggests that either the uncertainty explanation for PEAD does not hold, or that REITs are actually more uncertain than NonREITs over our sample period.

Cumulative Abnormal Returns (CARs) for all NonREITs by SURP deciles for the 1982–2008 sample period. Abnormal returns are estimated using size adjusted returns calculated as \( \left\{ {{\hbox{A}}{{\hbox{R}}_{\rm{jt}}} = {{\hbox{R}}_{\rm{jt}}} - {{\hbox{R}}_{\rm{pt}}}} \right\} \) where ARjt is the abnormal return for firm j, day t; Rjt is the raw return for firm j, day t; and Rpt is the equally weighted mean return on day t for all firms in the same size decile as firm j. Size is the market capitalization of firm j as of day t = −45 and size deciles are based on NYSE size breakpoints. Abnormal returns are cumulated over a 121 day period starting 60 days prior to the earnings announcement through 60 days after the announcement. Day zero is the date of the earnings announcement. SURP is the earnings surprise calculated as \( \left\{ {\left[ {{\hbox{EPS}}\left( {\hbox{qtr}} \right)-{\hbox{EPS}}\left( {{\hbox{qtr}} - {4}} \right)} \right]/{\hbox{Stock}}\,{\hbox{Price}}\left( {{\hbox{day}}\,t = - {45}} \right)} \right\} \). Firms are sorted into SURP deciles each quarter. NonREITs include all stocks traded on NYSE, AMEX, and NASDAQ with CRSP share codes 10, 11, and 12 (excluding financials and utilities)

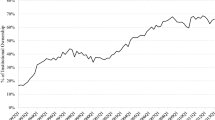

To check this on a more continuous basis we plot the drift quintile spread by year over the 1982–2008 period similar to Bernard and Thomas (1989).Footnote 20 Figure 3 illustrates the spread, which is the 121 day CAR for the highest SURP quintile minus the 121 day CAR for the lowest SURP quintile for REITs, NonREITs, and Small NonREITs. We see that Small NonREITs have the largest overall spread, on average, followed by NonREITs. When looking at the 121 day CAR, which includes the anticipation, initial reaction, and PEAD windows, REITs have the lowest average spread.Footnote 21

Drift spread for REITs, NonREITs, and Small NonREITs over the 121 day period around earnings announcements, by year. The drift spread is calculated as the mean 121 day Cumulative Abnormal Return (CAR) for firms in the high SURP quintile minus the mean 121 day CAR for firms in the low SURP quintile. Firms are sorted into SURP quintiles each quarter. Abnormal returns are estimated using size adjusted returns calculated as \( \left\{ {{\hbox{A}}{{\hbox{R}}_{\rm{jt}}} = {{\hbox{R}}_{\rm{jt}}} - {{\hbox{R}}_{\rm{pt}}}} \right\} \) where ARjt is the abnormal return for firm j, day t; Rjt is the raw return for firm j, day t; and Rpt is the equally weighted mean return on day t for all firms in the same size decile as firm j. Size is the market capitalization of firm j as of day t = −45 and size deciles are based on NYSE size breakpoints. Abnormal returns are cumulated over a 121 day period starting 60 days prior to the earnings announcement through 60 days after the announcement. Day zero is the date of the earnings announcement. SURP is the earnings surprise calculated as \( \left\{ {\left[ {{\hbox{EPS}}\left( {\hbox{qtr}} \right)--{\hbox{EPS}}\left( {{\hbox{qtr}} - {4}} \right)} \right]/{\hbox{Stock}}\,{\hbox{Price}}\left( {{\hbox{day}}\,t = - {45}} \right)} \right\} \). REITs are defined as stocks with CRSP share code 18. NonREITs include all stocks traded on NYSE, AMEX, and NASDAQ (excluding financials and utilities) with CRSP share codes 10, 11, and 12. Small NonREITs are the subset of NonREITs that fall within the lowest size quintile based on NYSE size breakpoints

To isolate PEAD we cumulate abnormal returns for the post announcement window, days t = 1 through t = 60, following Liang (2003):

Figure 4 shows the drift spread of the high SURP quintile minus the low SURP quintile for the 60 day post earnings announcement CARs. The plot illustrates that REITs tend to have a greater manifestation of PEAD than both NonREITs, and the Small NonREIT subsample. Although there is some variation from year to year, this suggests that, in contrast to our initial hypothesis, earnings information is more slowly incorporated into REIT prices than the prices of both ordinary common stocks and small stocks.Footnote 22 If this is the case, then we should find a more muted initial reaction to the earnings announcement for REITs.

Post-earnings-announcement drift spread for REITs, NonREITs, and Small NonREITs over the 60 day post earnings announcement period, by year. The drift spread is calculated as the mean 60 day Cumulative Abnormal Return (CAR) for firms in the high SURP quintile minus the mean 60 day CAR for firms in the low SURP quintile. Firms are sorted into SURP quintiles each quarter. Abnormal returns are estimated using size adjusted returns calculated as \( \left\{ {{\hbox{A}}{{\hbox{R}}_{\rm{jt}}} = {{\hbox{R}}_{\rm{jt}}} - {{\hbox{R}}_{\rm{pt}}}} \right\} \) where ARjt is the abnormal return for firm j, day t; Rjt is the raw return for firm j, day t; and Rpt is the equally weighted mean return on day t for all firms in the same size decile as firm j. Size is the market capitalization of firm j as of day t = −45 and size deciles are based on NYSE size breakpoints. Abnormal returns are cumulated over a 60 day period starting 1 day after the earnings announcement through 60 days after the announcement. Day zero is the date of the earnings announcement. SURP is the earnings surprise calculated as \( \left\{ {\left[ {{\hbox{EPS}}\left( {\hbox{qtr}} \right)--{\hbox{EPS}}\left( {{\hbox{qtr}} - {4}} \right)} \right]/{\hbox{Stock}}\,{\hbox{Price}}\left( {{\hbox{day}}\,t = - {45}} \right)} \right\} \). REITs are defined as stocks with CRSP share code 18. NonREITs include all stocks traded on NYSE, AMEX, and NASDAQ (excluding financials and utilities) with CRSP share codes 10, 11, and 12. Small NonREITs are the subset of NonREITs that fall within the lowest size quintile based on NYSE size breakpoints

Firm-Level Analysis

The initial reaction is captured in the manner of Francis et al. (2007) by summing abnormal returns for the day immediately prior to the earnings announcement date and the abnormal return on the earnings announcement date itself. Including the day prior to the announcement helps account for any substantial information leakage. For each stock associated with earnings announcement j:

We check the relation between REITs and CARs at the firm level by regressing CARs for the post-earnings-announcement drift period (1,60), for the initial reaction period (−1,0), and the full 121 day window (−60,60) on SURPj and an indicator variable set equal to 1 if firm j is a REIT, and 0 otherwise. To eliminate extreme outliers we winsorize SURPj at the 0.25th percentile in each tail. We also check for interaction between REITj and SURPj in addition to adding controls for firm characteristics using size, SIZEj, and book-to-market equity, BMj.

where CARw,j indicates the CARs for a particular window [CAR(1,60), CAR(−1,60), CAR(−60,60)] for each firm j. Standard errors are corrected for potential heteroscedasticity (White 1980), dependence within observations of a firm across time, and dependence within a quarter across firms, following the methodology outlined in Petersen (2009).

Regardless of the nature of the relation between REITs, uncertainty, and the drift, we expect a positive significant coefficient on SURPj. If REITs are more certain than NonREITs and the uncertainty explanation for the drift is correct, then we expect a negative significant coefficient for γ2 when the dependent variable is CAR(1,60) since REITs should experience less drift when compared to stocks with greater informational uncertainty. However, based on the graphical evidence from Figs. 1, 2, 3, and 4, which suggest that either REITs are less certain than NonREITs or that the uncertainty theory is invalid, we expect a positive significant coefficient for γ2 when the dependent variable is CAR(1,60).

Our original expectations lead us to anticipate a more muted initial reaction for NonREITs compared to REITs. Thus, when the dependent variable is CAR(−1,0) we expect the coefficient on REITj to be positive. On the other hand, Figs. 1, 2, 3, and 4 lead us to the opposite expectation, where the initial reaction to earnings surprise information is less complete for REITs compared to NonREITs.

Table 2 presents the firm-level regression results. As expected, SURPj is positive and significant at the 1% level in all specifications. The coefficients on REITj and the interaction between REITj and SURPj are highly significant as well. SIZEj is always significant, but the magnitude is small since we control for size differences on the left hand side of the equation by using size adjusted returns. Book-to-market equity is significant in the initial reaction period and full 121 day window, but is insignificant in the PEAD window.

PEAD results are shown in Table 2, Panel A, where the dependent variable is CAR(1,60). The estimated coefficient on REITj indicates the average magnitude of the drift to REITs relative to NonREITs, while the REIT*SURPj interaction term allows the response to vary relative to the size of the surprise. In the PEAD window the magnitude of the average difference in the REIT response is small, but statistically significant. However, the coefficient on REIT*SURPj, which captures the marginal difference in the cumulative abnormal returns for REITs, suggests the response is almost twice that of NonREITs. This holds both with and without including SIZE and BM control variables. Thus, consistent with the graphical results presented above, the evidence suggests the drift is more pronounced in REIT stocks.Footnote 23

The regressions results for the initial reaction window are shown in Table 2, Panel B, where the dependent variable is CAR(−1,0). The coefficient on REITj provides the average magnitude of the initial earnings surprise response for REITs relative to NonREITs. While the magnitude is small, it is negative and significant, suggesting a more muted initial response to the unexpected earnings signal for REITs compared to NonREITs. The coefficient on REIT*SURPj shows the level of the initial response conditional on the size of the earnings surprise. The magnitude of the negative and significant interaction coefficient suggests that the immediate REIT response is roughly half of what we observe for the initial surprise. All together, firm-level regression results show that REITs have a more muted initial response to earnings news and subsequently show a greater emergence of the drift.Footnote 24

Portfolio-Level Analysis

Since firm-level analysis includes all firms across the full range of earnings surprises, we examine the magnitude of the drift at the portfolio level in order to isolate the extreme surprise quintile portfolios. Portfolio-level comparisons approximate a potential trading strategy using zero-investment portfolios long in high earnings surprise firms and short low earnings surprise firms. We sort firms into SURP quintiles for REITs, NonREITs, and the Small NonREIT subsample. Differences in CARs between the High and Low SURP quintile portfolios are reported in Table 3. On the portfolio level, REITs, NonREITs, and Small NonREITs all exhibit statistically significant abnormal returns for the three cumulative abnormal returns windows considered. For the post announcement window, CAR(1,60), REITs have the highest PEAD at a mean of 4.88% compared to 2.97% for NonREITs and 4.22% for Small NonREITs.Footnote 25 With a quarterly difference of nearly 2% (8% annualized), the drift magnitude for REITs is significantly higher than we see for NonREITs. However, the magnitude of the drift in the post announcement window for REITs and Small NonREITs are not significantly different from one another. For the initial reaction window, CAR(−1,0), the REIT response is clearly the lowest with a portfolio mean difference of 1.04% compared to 2.38% for NonREITs and 3.29% for Small NonREITs. All three reactions are significantly different from one another, at the 1% level. When the pre-earnings announcement anticipation window, the announcement window, and the post announcement window are considered together, CAR(−60,60), we again see evidence suggesting that REIT returns do not anticipate earnings surprises as well as ordinary common stocks with significant mean differences of 9.73% for REITs, 13.33% for NonREITs, and 17.92% for Small NonREITs.

Intra-Industry Analysis

Taken together, the results of the graphical, firm-level, and portfolio-level analyses can be interpreted as either evidence against the uncertainty theory or evidence that suggests the parallel asset market does not render REIT earnings signals more certain than earnings signals for NonREITs. For clarification, we test the uncertainty theory on an intra-industry basis given the documented changes within the REIT industry over time (Ling and Ryngaert 1997). Following Chui et al. (2003) we compare the magnitude of the anomaly before and after 1990. Based on the uncertainty hypothesis, we expect the magnitude of the drift to be greater in the latter sub-period (1990–1999), where REITs have been argued to have become more uncertain, relative to the earlier period (1982–1989). For completeness, we include a third sub-period (2000–2008) as well since the data are now available.Footnote 26

Table 4 shows the PEAD magnitude comparisons by sub-period. For REITs, zero-investment portfolios long in stocks in the high surprise quintile and short in stocks within the low surprise quintile earn higher cumulative abnormal returns after 1990 than before 1990. The magnitude increases from a statistically insignificant 2.20% in the 1982–1989 sub-period to a highly significant 4.37% and 5.70% in the 1990–1999 and 2000–2008 sub-periods, respectively. However, while the magnitude increases over the whole sample period, we are unable to pick up significant differences when comparing the 1982–1989 and 1990–1999 sub-periods. We do find a statistically significant increase in the drift when comparing the 1982–1989 and 2000–2008 sub-periods.Footnote 27 These results are consistent with Chui et al. (2003), who document increases in the momentum anomaly following REIT industry structural changes, and lend support for the uncertainty hypothesis in an intra-industry context.Footnote 28

Strong statistical significance for PEAD raises the question of economic significance. To profit from the drift using zero-investment portfolios the rewards for doing so must exceed the round trip transactions costs. On the high end, Bernard and Thomas (1989) argue that round trip transactions costs for large (small) stocks are approximately 3% (6%) per quarter when defined to include both bid-ask spreads and commissions. To arrive at these cost estimates the authors rely on Stoll and Whaley (1983). Other studies estimate much lower transactions costs. Berkowitz et al. (1988) find round trip transactions costs for a large institutional investor to be roughly 0.5%. Chan and Lakonishok (1995) provide evidence that round trip transactions costs for a broad cross section of firms that is weighted somewhat more heavily by larger stocks to be just under 1%. Chan and Lakonishok (1997) show that institutional investors incur round trip transactions costs of slightly over 2% when trading small stocks. Ling et al. (2000) argue that REIT transactions costs fall somewhere between those we see for large and small firms. Based on the aforementioned literature Ling et al. (2000) apply round trip transactions costs of 0.48% for large stocks, 1% for REITs, and 2% for small stocks. However, even if the costs applied by Ling et al. (2000) were doubled, a PEAD investment strategy would be profitable given the magnitudes we observe in Tables 3 and 4, particularly for REITs.Footnote 29

Shivakumar (2007) notes that while this anomaly violates semi-strong form market efficiency, the strategy remains profitable. Campbell et al. (2009) find that institutional investors do, in fact, trade on PEAD. They show that institutional trading anticipates both earnings surprises and PEAD. In other words, institutions buy (sell) stocks prior to positive (negative) earnings surprises and the stocks they buy (sell) tend to drift up (down).

Conclusion

Given the transparent nature of commercial real estate assets and the presence of a parallel market in which these assets trade, we hypothesized that REITs would exhibit considerably less post-earnings-announcement drift than ordinary common stocks. The greater ability for investors to pierce through to the performance of the underlying REIT assets should render REIT earnings signals relatively more certain than the earnings signals of their NonREIT counterparts. According to the uncertainty argument, less uncertainty should translate into less drift since investors should be able to quickly and fully incorporate the new information into asset prices.

As the first study to analyze the post-earnings-announcement drift in a REIT context, we document a strong manifestation of the anomaly during the 1982–2008 period. Graphical, firm-level regression, and portfolio-level comparison evidence indicate that REIT PEAD is both large and significant. The economically significant drift of nearly 20% on an annualized basis is significantly larger than that which we observe for NonREITs (12% on an annual basis). REIT drift also appears to be somewhat larger than the drift we find in the Small NonREIT sub-sample (roughly 17% annualized), however, the difference is not significant.

We find strong differences between REITs, NonREITs, and Small NonREITs when comparing the initial reaction to the earnings surprises. Earnings announcement window REIT returns are significantly more muted than their NonREIT and Small NonREIT counterparts. REIT abnormal announcement window returns are less than half of what we find for NonREITs and less than one third of what we find for Small NonREITs.

Taken together, the muted initial response and large subsequent drift either provides evidence against the uncertainty hypothesis or suggests that the parallel asset market does not render REIT earnings signals relatively more certain than their NonREIT counterparts. The latter explanation is consistent with Barkham and Geltner (1995) and Chiang (2009) who contend that information and price discovery originate in the publicly traded real estate market and flow to the private market.

For additional comparison, we also analyze REIT PEAD on an intra-industry basis. Within REIT industry comparisons provide weak support for both the uncertainty hypothesis and findings of earlier studies (Ling and Ryngaert 1997; Chui et al. 2003) that argue that the REIT industry has become relatively more uncertain over time. The corresponding returns to zero investment portfolios long in high earnings surprise REITs and short in low earnings surprise REITs increase from a statistically insignificant 2.2% in the 1982–1989 sub-period, to a highly significant 4.4% in the 1990–1999 sub-period, and a highly significant 5.7% in the 2000–2008 sub-period.

While the results are robust to variations in methodology and sample composition, we note a few questions that are raised. First, why do REITs show greater drift than ordinary common stocks and small stocks when their returns volatility is not nearly as high? Assuming returns volatility can be used as a measure to proxy for uncertainty (Chui et al. 2003; Zhang 2006), we would expect much less drift for REITs compared to NonREITs and Small NonREITs. However, we do not find this to be the case. Second, why do investors appear to be able to anticipate earnings surprises to a greater extent for NonREITs and Small Nonreits compared to REITs? This result suggests that the overall information environment for REITs is not as rich as the information environments of NonREITs and Small NonREITs. Third, how long does REIT PEAD last and is there a reversion, or convergence with NonREIT returns behavior, at longer horizons? The finance literature provides mixed evidence regarding the duration of the PEAD anomaly among NonREITs due to the shortcomings of long term abnormal performance estimation. We leave a complete exploration of these findings to future study.

Notes

Also referred to in this paper as simply “the drift”.

First documented by Jegadeesh and Titman (1993), momentum is the phenomenon where stocks that have performed well (poorly) in recent months tend to continue to perform well (poorly).

The literature is replete with unsuccessful attempts to explain the drift. Researchers have not been able to attribute PEAD to various risk adjustments, poor research design, market frictions such as transactions costs and liquidity constraints, or the psychological biases of market participants.

Mahoney et al. (1996) show that while there are some differences in terms of geographic concentration and proportionate allocation to various property types (retail, multi-family, office/industrial, etc.) in the asset bases of publicly (NAREIT) and privately (NCREIF) held commercial real estate, there is nontrivial overlap as well. The overall location correlation is 0.79 and both NAREIT and NCREIF have roughly 85% of their holdings in the top 100 MSAs. For example, 1995 REIT allocations include 35% to retail, 24% to apartments, 12% to industrial/office, and 28% to ‘other’. 1995 NCREIF allocations are 36% in retail, 14% in apartments, 44% in industrial/office, and 6% to ‘other’.

See Bernard (1992) for a detailed review of possible explanations for the PEAD anomaly.

Pagliari et al. (2005) and Riddiough et al. (2005) both show that returns between the two parallel markets are not significantly different from one another after adjusting for characteristics such as leverage, liquidity, management structure, property type, and taxes. MacKinnon and Al Zaman (2009) provide additional evidence of linkages between the publicly and privately held commercial real estate markets.

The private market can only be considered to be “much larger” than the public market if property not tracked by NCREIF is taken into consideration in addition to NCREIF property. Otherwise, the two markets are close in size. NCREIF tracks just over 6,000 properties with an estimated combined market value of $238 billion as of the end of 2009. According to NAREIT, publicly traded REIT market capitalization as of the end of 2009 is roughly $248 billion.

With respect to the price discovery processes, the direction of information flow is the subject of debate in the literature. Some contend that information flows from the private to the public real estate sector (Tuluca et al. 2000). Others argue that information flows from the public market to the private market (Barkham and Geltner 1995; Chiang 2009).

Internal Revenue Code §857(a)(1).

Equity REITs comprise the largest proportion of total publicly traded REITs and this proportion has increased over time. According to data available on the NAREIT website, Equity REITs made up 46%, 74%, and 81% of the total number of REITs in the 1982–1989, 1990–1999, and 2000–2008 time periods, respectively. Consequently, Mortgage (35%, 17%, 15%) and Hybrid (20%, 10%, 4%) REITs decreased as a percentage of total REITs during the same time periods. Although untabulated, the relative proportions based on market capitalization are even more pronounced in favor of Equity REITs.

Some of the PEAD literature, such as Bernard and Thomas (1989, 1990), restricts their samples to NYSE and AMEX firms. However, recent literature that investigates market anomalies in a REIT setting includes Nasdaq firms as well (Chui et al. 2003; Hung and Glascock 2008, 2010). In unreported analyses we find that our results are not sensitive to the inclusion of Nasdaq firms.

Except REITs, most of which are classified as SIC 6798.

This essentially represents the population of REITs and NonREITs during the 1982–2008 sample period for which sufficient data are available, consistent with prior drift studies (Foster et al. 1984; Bernard and Thomas 1989, 1990). However, in unreported analysis we also check our results using a size matched sample, a book-to-market equity matched sample, a volatility matched sample, and a random sample and find consistent results.

Although not shown, all volatility measurements are statistically different from one another at the 1% level.

We choose the stock price as of day t = −45 as the SURP scalar following Liang (2003). However, we find that our results are not sensitive to the choice of SURP scalar.

For comparability between REITs and NonREITs we follow the literature and use EPS as the earnings measure in the surprise calculation. The question remains regarding the most appropriate earnings surprise calculation in a REIT setting given the widespread use of Funds From Operation (FFO) as an industry specific earnings measure. However, we leave a complete exploration of this issue to further study.

Bernard and Thomas (1989) find that PEAD is not a result of risk mismeasurement and, thus, is unaffected by risk adjustment.

See Fig. 5 in Bernard and Thomas (1989)

There are large differences in the amount of total drift (pre- and post-earnings announcement) for REITs, NonREITs, and Small NonREITs as shown in Figs. 1, 2, and 3. Upon closer visual inspection of Figs. 1 and 2, it appears that much of this is attributable to differences in decile spreading during the anticipation window. While the primary focus of this study is on stock returns behavior during the post-announcement window, with a secondary focus on stock returns during the initial reaction window, we acknowledge the related nature of the anticipation window returns as well. As such, later analysis includes tabulated results for the total drift period [CAR(−60,60)], although we do not attempt to render a detailed interpretation. We conclude that REIT returns are less able to anticipate future earnings surprises than NonREITs (Bernard and Thomas 1989; Campbell et al. 2009). However, there is little literature to build upon in deciphering the exact meaning of the anticipation window differences and we leave a more in depth look at this component to future study.

We also observe that PEAD, as plotted in Fig. 4, seems to be counter-cyclical, particularly for REITs relative to NonREITs. Lending support to the idea that the drift is related to uncertainty, REIT PEAD increases dramatically in times of general economic uncertainty such as the recessions in the early 1990s, early 2000s, and late 2000s.

We also use alternative drift windows of 30 [CAR(1,30)] and 45 [CAR(1,45)] days and find consistent results (unreported). However, the focus of our analysis is on the sixty day [CAR(1,60)] post-earnings-announcement drift window, consistent with the literature (Foster et al. 1984; Bernard and Thomas 1989; Liang 2003; Campbell et al. 2009). Additionally, following the suggestion of a referee, we also winsorize cumulative abnormal returns to check for potential outlier effects and our inferences remain unchanged (unreported).

We find the regression results to be robust to alternative regression methods which are much less powerful. We run Fama and MacBeth (1973) cross sectional regressions where the first stage consists of 109 quarterly cross sectional regressions and the second stage effectively evaluates the results of the cross sectional regressions using the time series standard errors. The resulting coefficient estimates are highly significant with signs of the same direction and magnitudes that are nearly identical to those in Table 2.

At the suggestion of a referee we check for outlier effects by winsorizing the cumulative abnormal returns and find results that are not materially different (unreported).

In unreported results we also regress CAR(1,60) and CAR(−1,0) on an operating partnership indicator variable in a manner similar to Eqs. 6, 7, and 8, only we limit the sample to all REIT observations and drop the variables that differentiate between REIT and NonREIT observations. The regression results are consistent with those in Table 2, Panels A and B, and suggest that the greater potential uncertainty associated with the complex operating partnership ownership structure is related to greater PEAD.

We acknowledge that the increased proportion of Equity REITs may be driving this result. As a percentage of total REIT market capitalization, Equity REITs made up 46% in 1982–1989, 74% in 1990–1999, and 81% in 2000–2008. However, most of the increase can be seen when comparing the first two sub-periods. Thus, if the increase in Equity REITs is driving the result, it would seem likely that we would also find significant differences between the 1982–1989 and 1990–1999 sub-periods as well. However, when the 1990s are included by arbitrarily cutting the sample in the middle of the decade, the differences become more difficult to detect. In this scenario (not reported), the earlier and latter sub-periods are not significantly different from one another.

Neither NonREITs nor Small NonREITs show this same upward trajectory across the three sub-periods. We find all NonREIT and Small NonREIT differences to be statistically insignificant.

We thank a reviewer for suggesting that potential profitability may be tempered by short side implementation issues. Over the full sample period, roughly half of the REIT long-short zero investment portfolio returns can be attributed to the short position.

References

Ball, R., & Brown, P. (1968). An empirical evaluation of accounting income numbers. Journal of Accounting Research, 6, 159–178.

Barkham, R., & Geltner, D. M. (1995). Price discovery in American and British property markets. Real Estate Economics, 23, 21–44.

Barron, O., & Stuerke, P. (1998). Dispersion in analysts’ earnings forecasts as a measure of uncertainty. Journal of Accounting, Auditing and Finance, 13, 243–268.

Berkowitz, S. A., Logue, D. E., & Noser, E. A. (1988). The total cost of transactions on the NYSE. Journal of Finance, 43(1), 97–112.

Bernard, V. (1992). Stock price reactions to earnings announcements: A summary of recent anomalous evidence and possible explanations. In R. Thaler (Ed.), Advances in behavioral finance. New York: Russell Sage.

Bernard, V., & Thomas, J. (1989). Post-earnings-announcement drift: delayed price response or risk premium? Journal of Accounting Research, 27, 1–36.

Bernard, V., & Thomas, J. (1990). Evidence that stock prices do not fully reflect the implications of current earnings for future earnings. Journal of Accounting and Economics, 13, 305–340.

Bradshaw, M. T., Drake, M. S., Myers, J. N., & Myers, L. A. (2009). A re-examination of analysts’ superiority over time-series forecasts. Working Paper, Boston College.

Brav, A., & Heaton, J. B. (2002). Competing theories of financial anomalies. Review of Financial Studies, 15(2), 575–606.

Campbell, J. Y., Ramadorai, T., & Schwartz, A. (2009). Caught on tape: institutional trading, stock returns, and earnings announcements. Journal of Financial Economics, 92, 66–91.

Capozza, D. R., & Lee, S. (1994). The equity REIT universe 1985–1992: The role of property type and size. Working Paper, University of Michigan.

Chan, L., & Lakonishok, J. (1995). The behavior of stock prices around institutional trades. Journal of Finance, 50(4), 1147–1174.

Chan, L., & Lakonishok, J. (1997). Institutional equity trading costs: NYSE versus Nasdaq. Journal of Finance, 52(2), 713–735.

Chan, L., Jegadeesh, N., & Lakonishok, J. (1996). Momentum strategies. Journal of Finance, 51(5), 1681–1713.

Chiang, K. C. H. (2009). Discovering REIT price discovery: a new data setting. Journal of Real Estate Finance and Economics, 39, 74–91.

Chordia, T., & Shivakumar, L. (2006). Earnings and price momentum. Journal of Financial Economics, 80, 627–656.

Chui, A. C. W., Titman, S., & Wei, K. C. (2003). Intra-industry momentum: the case of REITs. Journal of Financial Markets, 6, 363–387.

Daniel, K. D., Hirshleifer, D., & Subrahmanyam, A. (1998). Investor psychology and security market over-and under-reactions. Journal of Finance, 53(6), 1839–1886.

Daniel, K. D., Hirshleifer, D., & Subrahmanyam, A. (2001). Overconfidence, arbitrage, and equilibrium asset pricing. Journal of Finance, 56(3), 921–965.

Danielsen, B. R., Harrison, D. M., & Van Ness, R. A. (2009). REIT auditor fees and financial market transparency. Real Estate Economics, 37, 515–557.

DeBondt, W. F. M., & Thaler, R. H. (1985). Does the stock market overreact? Journal of Finance, 40(3), 793–805.

DeBondt, W. F. M., & Thaler, R. H. (1987). Further evidence on investor overreaction and stock market seasonality. Journal of Finance, 42(3), 557–581.

Fama, E. F. (1998). Market efficiency, long-term returns, and behavioral finance. Journal of Financial Economics, 49, 283–306.

Fama, E. F., & French, K. R. (1992). The cross-section of expected stock returns. Journal of Finance, 47(2), 427–465.

Fama, E. F., & MacBeth, J. (1973). Risk, return, and equilibrium: empirical tests. Journal of Political Economy, 81(3), 607–636.

Foster, G., Olsen, C., & Shevlin, T. (1984). Earnings releases, anomalies, and the behavior of security returns. The Accounting Review, 59, 574–603.

Francis, J., Lafond, R., Olsson, P., & Schipper, K. (2007). In formation uncertainty and post-earnings-announcement-drift. Journal of Business Finance & Accounting, 34(3 & 4), 403–433.

Freeman, R., & Tse, S. (1989). The multi-period information content of earnings announcements: rational delayed reactions to earnings news. Journal of Accounting Research, 27, 49–79.

Ghosh, C., Miles, M., & Sirmans, C. F. (1996). Are REITs stocks? Real Estate Finance, 13, 46–53.

Goldstein, M., & Nelling, E. (1999). REIT Return Behavior in Advancing and Declining Markets. Real Estate Finance, 15(4), 68–77.

Graham, J. R., Harvey, C. R., & Rajgopal, S. (2005). The economic implications of corporate financial reporting. Journal of Accounting and Economics, 40, 3–73.

Hirshleifer, D. (2001). Investor psychology and asset pricing. Journal of Finance, 56(4), 1533–1596.

Hou, K. (2007). Industry information diffusion and the lead-lag effect in stock returns. Review of Financial Studies, 20(4), 1113–1138.

Hung, K., & Glascock, J. L. (2008). Momentum profitability and market trend: evidence from REITs. Journal of Real Estate Finance and Economics, 37(1), 51–70.

Hung, K., & Glascock, J. L. (2010). Volatilities and momentum returns in real estate investment trusts. Journal of Real Estate Finance and Economics, 41(2), 126–149.

Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: implications for stock market efficiency. Journal of Finance, 48, 65–91.

Johnson, T. C. (2004). Forecast dispersion and the cross section of expected returns. Journal of Finance, 59(5), 1957–1978.

Kovacs, T. (2007). Is the post-earnings announcement drift rational or behavioral? Evidence from intra-industry information transfers. Working Paper, Northeastern University.

Lewellen, J., & Shanken, J. (2002). Learning, asset-pricing tests, and market efficiency. Journal of Finance, 57(3), 1113–1145.

Liang, L. (2003). Post-earnings announcement drift and market participants’ information processing biases. Review of Accounting Studies, 8, 321–345.

Ling, D. C., & Ryngaert, M. D. (1997). Valuation uncertainty, institutional involvement, and the underpricing of IPOs: the case of REITs. Journal of Financial Economics, 43, 433–456.

Ling, D. C., Naranjo, A., & Ryngaert, M. D. (2000). The predictability of equity REIT returns: Time variation and economic significance. Journal of Real Estate Finance and Economics, 20(2), 117–136.

Ljungqvist, A., Malloy, C., & Marston, F. (2009). Rewriting history. Journal of Finance, 64, 1935–1960.

MacKinnon, G. H., & Al Zaman, A. (2009). Real estate for the long term: the effect of return predictability on long-horizon allocations. Real Estate Economics, 37(1), 117–153.

Mahoney, J., McCarron, S., Miles, M., & Sirmans, C. F. (1996). Location differences in private and public real estate investment. Real Estate Finance, 13(2), 52–64.

Mendenhall, R. (1991). Evidence of possible underweighting of earnings-related information. Journal of Accounting Research, 29, 170–180.

Pagliari, J. L., Scherer, K. A., & Monopoli, R. T. (2005). Public versus private real estate equities: a more refined long-term comparison. Real Estate Economics, 33(1), 147–187.

Petersen, M. A. (2009). Estimating standard errors in finance panel data sets: comparing approaches. Review of Financial Studies, 22(1), 435–480.

Riddiough, T. J., Moriarty, M., & Yeatman, P. J. (2005). Privately versus publicly held asset investment performance. Real Estate Economics, 33(1), 121–46.

Shivakumar, L. (2007). Discussion of information uncertainty and post-earnings-announcement-drift. Journal of Business Finance & Accounting, 34(3 & 4), 434–438.

Stoll, H. R., & Whaley, R. E. (1983). Transactions costs and the small firm effect. Journal of Financial Economics, 12, 57–79.

Tuluca, S. A., Myer, F. C. N., & Webb, J. R. (2000). Dynamics of private and public real estate markets. Journal of Real Estate Finance and Economics, 21(3), 279–296.

White, H. (1980). A heteroskedasticity-consistent covariance matrix estimator and a direct test of heteroskedasticity. Econometrica, 48, 817–838.

Wiggins, J. B. (1991). Do misperceptions about the earnings process contribute to post-announcement drift? Working Paper. Cornell University.

Zhang, X. F. (2006). Information uncertainty and stock returns. Journal of Finance, 61(1), 105–136.

Acknowledgements

The authors acknowledge the helpful comments and suggestions of James Doran, David Peterson, Andy Naranjo, Milena Petrova, Stacy Sirmans and participants at the 2010 FSU Critical Issues in Real Estate Symposium. All remaining errors are our own.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Price, S.M., Gatzlaff, D.H. & Sirmans, C.F. Information Uncertainty and the Post-Earnings-Announcement Drift Anomaly: Insights from REITs. J Real Estate Finan Econ 44, 250–274 (2012). https://doi.org/10.1007/s11146-010-9275-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-010-9275-y