Abstract

This review presents six summaries for energy resource commodities including coal and unconventional resources, and an analysis of energy economics and technology for the different commodities, as prepared by the Energy Minerals Division of the American Association of Petroleum Geologists. Unconventional energy resources, as defined in this report, are those energy resources that do not occur in discrete oil or gas reservoirs held within stratigraphic and/or structural traps of sedimentary basins. As defined, such energy resources include coal, coalbed methane (CBM), tight gas and liquids, bitumen and heavy oil, uranium (U), thorium (Th), and associated rare earth elements of interest to industry, and geothermal. Current North American and global research and development activities are summarized for each of the unconventional energy resource commodities in separate topical sections of this report.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The Energy Minerals Division (EMD) of the American Association of Petroleum Geologists (AAPG), founded in 1977, is primarily a membership-based technical interest group. EMD’s main goals are to advance the geology, exploration, discovery, development, and production of unconventional energy resources. Research on unconventional energy resources is rapidly changing, and exploration and development efforts for these resources are constantly growing. The AAPG-EMD facilitates as an international forum for those people working on energy resources, other than conventional oil and gas.

Six summaries derived from 2017 committee reports presented at the EMD Annual Meeting in Houston, TX, in June 2017, are in this review. A complete set of EMD committee reports is available to AAPG members at http://www.aapg.org/about/aapg/overview/committees/emd-committees. This report updates the 2006, 2007–2008, 2011, 2013, and 2015 EMD unconventional energy reviews published in this journal (American Association of Petroleum Geologists, Energy Minerals Division 2006, 2007, 2009, 2011, 2014a, 2015a, b).

Included here are overviews of research, development and exploration activities in North America and other regions of the world, related to coal, coalbed methane (CBM), tight gas and liquids, bitumen and heavy oil, U and Th deposits and associated rare earth elements (REE) of industrial interest, and geothermal. An analysis of energy economics and technology as related to these unconventional resources is also included. For further information about the subjects covered in each topical section of this report, please contact the individual authors for each section. The following website provides more information about all unconventional resources and the AAPG-EMD: http://emd.aapg.org.

Coal

World Overview and Future Technology Issues

Coal is the second-largest energy commodity worldwide in terms of energy use, exceeded only by oil. Production from the top-ten coal-producing countries in 2016 was 8012.2 million short tons (MMst) or 7268.6 million metric tons (MMt). These countries account for ~ 90% of the world’s total coal production, with China being the top coal-producing and consuming country. The world’s top-ten coal-producing countries, in terms of decreasing production according to the Energy Information Administration (EIA), are: (1) China, (2) India, (3) USA, (4) Australia, (5) Indonesia, (6) Russia, (7) South Africa, (8) Germany, (9) Poland, and (10) Kazakhstan.

Worldwide coal consumption, projected to the year 2040, will only slightly rise with respect to 2015 levels. China will continue to be the largest consumer of coal (~ 73 quadrillion Btu [British Thermal Units]), although its coal consumption is expected to decline. In contrast, coal consumption in India is projected to increase by almost 3% per year, surpassing coal consumption in the USA.

Although natural gas continues to compete with coal as a source for electricity generation, coal still has a powerful influence on electricity prices worldwide, and coal plants are likely to remain price-setting power units for many countries. Consequently, future security of coal supply will be necessary to maintain stability in wholesale electricity prices. Metallurgical coal prices are also reduced in the global markets. Recent declines in US coal exports are related to a decrease in world coal demand, depressed international coal prices, and greater coal production in other coal-exporting countries. Decreased US coal production has resulted from competition from lower natural gas prices, increasingly strict federal regulations, and coal plant retirements because of implementation of new air quality and emission standards. US coal production in 2016 was 740.5 MMst (671.8 MMt).

This represents a 21.5% reduction from 2014. In addition, there was a decline of the productive capacity of US coal mines by 8.6% from the years 2015 to 2016, with a concomitant decline in coal consumption by 8.4%. However, US coal production in the first two quarters of 2017 was greater than that in the first two quarters of 2016, with Wyoming as the leading coal-producing state.

Leading Coal-Producing Countries in 2016

China, India, and the USA were the top-three leading countries for coal production in 2016 (Table 1). Together, they account for two-thirds of the world’s coal production, although India and China also depend on imported coal to meet total demand. China’s increased demand is driven by electricity generation, as well as by increased manufacturing and infrastructure development. All three of these countries began to increase coal production in the first half of 2017 (The Energy Advocate 2017). By the end of May, production had increased by 6%, compared to the same period in 2016. This was the result of several factors that include India’s continued efforts to augment existing electrification, shifting energy markets in the USA, and energy policy changes in China. Clean coal, defined as coal combustion with greenhouse gas capture, continues to be an important component of China, India, and the US’ plans for future energy.

Future Worldwide Coal Production and Consumption

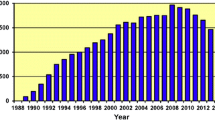

Global coal production, projected to the year 2040, is expected to change only slightly, increasing by only 3% (Fig. 1). China, which designates almost all of its coal production for use within its own country, is projected to decrease coal production by 15% from 2015 to 2040, concurrent with decreased demand. However, India is projected to offset this trend in China by increasing its annual coal production as demand rises.

World coal production projected to 2040. Values are in billion short tons (Bst). From Energy Information Administration (EIA 2017a)

Worldwide coal consumption is projected to the year 2040 as only slightly rising with respect to 2015 levels (Fig. 2). China will continue to be the largest consumer of coal in 2040 (about 73 quadrillion Btu), although its coal consumption is expected to decline. In contrast, coal consumption in India is projected to increase by almost 3% per year, surpassing the USA.

World coal consumption projected to 2040. Values are in quadrillion Btu (British Thermal Units). From Energy Information Administration (EIA 2017a)

Asia will remain the world’s largest importer of coal (Fig. 3), whereas Australia and Indonesia are expected to be the largest exporters (Fig. 4). By 2040, Australia will provide 37% of the world’s coal exports, followed by Indonesia at 28%. Coal consumption in OECD (Organization for Economic Cooperation and Development) countries is anticipated to decline by 0.6% per year because of increased reliance on natural gas and renewables, coupled with moderate electricity demand. Trade in metallurgical coal for steel production will gradually increase overall, reflecting increased industrial consumption in India.

World coal imports projected to 2040. Values are in billion short tons (Bst). From Energy Information Administration (EIA 2017a)

World coal exports projected to 2040. Values are in billion short tons (Bst). From Energy Information Administration (EIA 2017a)

China

China continues to lead the world in coal production, with 2016 production at 3574.2 MMst (3242.5 MMt) (Table 1). Of the 28 provinces in China that produce coal, Shanxi, Inner Mongolia, Shaanxi, and Xinjiang contain most of China’s coal resources (Meng et al. 2009). China continued to be the largest energy consumer globally, representing 23% of the world’s energy consumption. More than 90% of coal produced by China is from underground mines (Meng et al. 2009). Shenhua Group and China National Coal Group, China’s largest state-owned coal companies, produce ~ 50% of the coal in China. Local state-owned companies account for ~ 20%, with small mines producing 30%. Because of new government regulations and decreasing prices, many of the ~ 10,000 inefficient and small mines in the country are closing, with the result of large state-owned companies having a greater share in China’s overall coal production. China is also welcoming foreign investment to modernize existing large-scale coal mines and to apply new technologies. In addition to coal, China is also becoming more open to foreign investment in coal-to-liquids (CTL), coalbed methane (CBM), coal-to-gas (CTG), and slurry pipeline transportation projects.

Of the top-ten coal-producing countries in 2016, China accounted for ~ 45% of the world’s coal production. However, China’s coal production in 2016 declined 7.9% and coal consumption also fell by 1.6% in 2016. At the same time, natural gas production in China rose by 1.4% (British Petroleum 2017a). However, coal is still China’s main source of fuel, accounting for 62% of the nation’s energy use.

A recent monthly decline in China’s coal production in August 2017 was linked to a landslide in Shanxi Province (Reuters 2017a). August coal production levels (320.8 MMst [291 MMt]) were the lowest since October 2016. In addition, coke production for steel manufacture fell 5.3% in August to approximately 40.7 MMst (37 MMt).

Coal consumption in China is expected to fall from approximately 84 quadrillion Btu (British Thermal Units) in 2015 to approximately 73 quadrillion Btu (Fig. 5). Electric power and industrial use will continue to dominate China’s coal consumption. Coal imports are also expected to decline (Fig. 6). China will import only about 3% of its coal for consumption through 2040 because of its policy to be self-sufficient (Energy Information Administration (EIA) 2017a).

Coal consumption in China to 2040. Values are in quadrillion Btu (British Thermal Units). From Energy Information Administration (EIA 2017a)

Coal imports to China to 2040. Values are in million short tons (MMst). From Energy Information Administration (EIA 2017a)

Chinese companies are constructing or planning to develop more than 700 new coal-fired plants in China and around the world (Tabuchi 2017). Approximately 20% of these new plants, to be located outside of China, would increase the world’s coal-fired electricity output by > 40%. Electricity generation in China is operated by state-owned holding companies, although limited private and foreign investments have recently been made in the electricity sector. Improvements to power grids are also being made to deal with power shortages. China has expanded the construction of natural gas-fired and renewable power plants to introduce power to remote population centers. The relative contribution of coal for generation of electricity is projected to decline from 72 to 47% by 2040, with increasing contributions from other fuels (Fig. 7). Coal will continue to be an important feedstock for electricity generation in China, reaching a high value of approximately 4400 billion kilowatt hours by 2030. Already 150 gigawatts (GW) of new coal-fired capacity has been canceled or delayed until at least 2020, in view of China’s plans for stricter emission controls and retirements of old, inefficient power plants that account for up to 20 GW of power.

Annual electricity generation in China in 2015, projected to 2040. The relative contribution from coal is expected to fall from 72 to 47% by 2040. Values are in trillion kilowatt hours. From Energy Information Administration (EIA 2017b)

India

Most of India’s coal reserves occur in the eastern part of the country. Jharkhand, Chhattisgarh, and Odisha states together comprise 64% of the country’s coal reserves. Other significant coal-producing states include West Bengal, Andhra Pradesh, Madhya Pradesh, and Maharashtra (EIA 2016a). Coal India Limited (CIL) is India’s largest and the world’s largest coal producer, having produced > 80% of the country’s coal in the last 5 years (Reuters 2016).

India’s primary energy consumption increased by 5.4% in 2016, remaining the third-largest consumer of world energy (British Petroleum 2017b). Coal is India’s primary source of energy. India ranks second in coal production in the world (Table 1). Coal production in India grew by 2.4% in 2016, and India’s share of world coal consumption is 11% (British Petroleum 2017b).

Most of India’s coal consumption is from electric power (Fig. 8). Coal demand in India is expected to increase significantly by 90% to 2040 because of industrial growth and continued rural electrification (EIA 2017a). Coal is expected to keep pace with other sources of energy for electricity generation (Fig. 9). Coal India Ltd. has been in contact with private power utilities, requesting that they consume more domestic coal. However, some power companies who operate plants in coastal areas in southern India favor imported coal, which for them is more economical where land haulage is not involved.

India’s coal consumption by sector, projected to 2040. Values are in quadrillion Btu (British Thermal Units). From Energy Information Administration (EIA 2017a)

Projected sources of electricity generation in India to the year 2040. Values are in billion kilowatt hours. From Energy Information Administration (EIA 2017a)

Even though coal is the greatest provider of electricity generation in India, accounting for approximately 60% of installed power capacity, coal shortages continue to cause shortfalls in electricity generation, resulting in frequent blackouts. Approximately 90% of the country’s coal mines are opencast mines, which although being cost-effective, cause environmental damage. India lacks advanced technology for large-scale, underground mining operations with the result that overall productivity levels in the country are low. Low levels of competition in the coal sector inhibit private and foreign investment and state regulations continue to cause delays for mining companies in receiving mining permits. Additional delays are caused by limited railway capacity, delays in new railroad projects, and high transport costs. However, India has recently completed three major rail transportation projects for increased shipments of coal from major producing regions in northeastern India to other parts of the country.

USA

Future Trends, Production, and Exports

Natural gas continues to take a larger share of the US energy base relative to coal. By 2020, natural gas will overtake coal as the dominant fuel (British Petroleum 2017c). According to the April–June 2017 Quarterly Coal Report (EIA 2017c), released in October 2017, US coal production from January to June was 384,115 thousand short tons (~ 384 MMst) [~ 348 MMt]), representing a 15% increase relative to a comparable period in 2016 (Table 2). However, January to June 2017 production was less than that of the third and fourth quarters of 2016. Production of steam coal, dedicated to electric power generation, continues to far exceed production of metallurgical coal in the USA (Fig. 10).

Quarterly US coal production from 2015 to the first half of 2017. Values are in million short tons (MMst). From Energy Information Administration (EIA 2017d)

Wyoming continues to be the leading coal-producing state, having produced 152,535 Mst (152.5 MMst [138.3 MMt]) in the first half of 2017, a 21.9% increase relative to a comparable period in 2016 (Table 3). States experiencing sharp declines in coal production include Ohio (− 35%) and Tennessee (− 21.9%). The Powder River Basin was maintained as the number one major supply region for the USA, with first half of 2017 coal production of almost 160,000 Mst ([160 MMst [145.1 MMt]) (Table 3 and Fig. 11). Monthly exports of coal and coke in the first half of 2017 have remained either steady or have slightly increased (Figs. 12 and 13, respectively).

Quarterly US coal production from by major supply region from 2015 from the first half of 2017. Values are in million short tons (MMst). From Energy Information Administration (EIA 2017d)

Monthly US coal exports from September 2016 to August 2017. Values are in short tons (st). From Energy Information Administration (EIA 2017d)

Monthly US coke exports from September 2016 to August 2017. Values are in short tons (st). From Energy Information Administration (EIA 2017d)

Coal Data Sources

The Energy Information Administration has an interactive, online Coal Data Browser that provides detailed information on US coal. Accessible at http://www.eia.gov/beta/coal/data/browser/, this data site integrates comprehensive information, statistics, and visualizations for US coal, including electricity generation. The browser also allows users to access data from the Mine Safety and Health Administration and coal trade information from the U.S. Census Bureau.

The Coal Data Browser allows the user to:

-

Map coal imports and exports by country and by US ports handling coal;

-

Map where mines send coal and where power plants obtain coal;

-

Analyze coal receipts by sulfur, ash, and heat content, as well as per mine;

-

Observe changes in coal prices;

-

Cross-link mine-level data pages with EIA’s U.S. Energy Mapping System to discover data on all active coal mines; and

-

Observe changes in coal worker employment in specific states.

The Energy Information Administration also provides an energy mapping system for a variety of energy sources that include coal, coal mines, and location and identity of coal-fired electricity installations in the USA.

Information on coal can be accessed at: https://www.eia.gov/state/maps.cfm?v=Coal. The general site can be reached via: https://www.eia.gov/state/maps.cfm?v=Fossil%20Fuel%20Resources.

The annual coal distribution report for 2016, released on November 21, 2017, by the Energy Information Administration (EIA 2017h), consists of an archive of coal distribution by state, destination by state, consumer category, method of transportation, as well as foreign coal distribution by major coal-exporting state. It can be accessed at https://www.eia.gov/coal/distribution/annual/archive.php.

In addition, the annual coal report, released on November 15, 2017, by the Energy Information Administration (EIA 2017i), provides annual data on US coal production, number of mines, productive capacity, recoverable reserves, employment, productivity, consumption, stocks, and prices. Highlights for the year 2016 include a decline of the productive capacity of US coal mines by 8.6% from the years 2015–2016, with a concomitant decline in coal consumption by 8.4%.

Australia

Australia is the top-ranked coal-exporting nation. By 2040, Australia will provide 37% of the world’s coal exports (Fig. 4). Metallurgical coal is Australia’s second-largest export commodity, exceeded only by iron ore on a weight basis. Australia exported approximately US $28 billion of both metallurgical and steam coal in FY 2015 (EIA 2017e). Most of the Australia’s coal, which is typically low in ash content, occurs in Queensland and New South Wales (Sydney and Bowen basins, respectively). These basins accounted for most of Australia’s black coal production in 2015. The Gippsland Basin in Victoria was associated with 96% of brown coal production in the same year.

Coal production in Australia has grown by 42% in the last 10 years. Coal accounts for 32% of all energy consumption (Fig. 14) and 63% of electric generation in Australia (Fig. 15). Most of Australia’s coal is exported, with domestic use being < 25% of total production (Fig. 16). Coal consumption in Australia had been declining because of fuel switching to natural gas and increased reliance on renewables. However, after repeal of the carbon tax in 2014, coal consumption has increased slightly since 2015 (Energy Information Administration, EIA 2017e). In addition, resurgence in coal mining in Australia is related to the country eclipsing Indonesia as the top-ranked, coal-exporting nation, with markets in China, India, Japan, South Korea, and other countries in southeastern Asia. Coal exports are supported by nine major coal ports and export terminals in Queensland and New South Wales. These terminals have a combined capacity of > 510 MMst (> 462.7 MMt) per year. New port projects are being developed and were projected to add > 50 MMst (> 45.4 MMt) to annual coal loading capacity into 2017 (Energy Information Administration, EIA 2017f). Australia has ~ 120 privately owned coal mines (EIA 2017f). Most of Australia’s coal production is from open pit operations. BHP Billiton, Anglo American (UK), Xstrata (Switzerland), and Rio Tinto (Australia–UK) are major players in Australia’s coal industry. Australia has invested $11.2 billion in advanced infrastructure projects to add nearly 80 MMst (72.6 MMt) to production capacity by 2017.

Modified from Energy Information Administration (EIA 2017e)

Relative percentage of energy consumption in Australia in 2015 according to fuel type.

Modified from Energy Information Administration (EIA 2017e)

Relative percentage of energy sources for electricity generation in Australia in 2015 according to fuel type.

Modified from Energy Information Administration (EIA 2017e)

Coal production and consumption in Australia from 1992 to 2015. Values are in million short tons (MMst)

Indonesia

The three largest coal resource regions in Indonesia are South Sumatra, South Kalimantan, and East Kalimantan (Fig. 17). Indonesia currently ranks ninth in coal reserves worldwide, containing slightly more than 2% of total global coal reserves (Indonesia-Investments 2017). Approximately 60% of these reserves are composed of subbituminous coal.

From Indonesia-Investments (2017)

The three major coal resource regions in Indonesia. Regions are (1) South Sumatra, (2) South Kalimantan, and (3) East Kalimantan.

Production, export, and consumption of coal in Indonesia have all increased substantially since 2007 (Table 4). Indonesia exports almost 80% of its produced coal (EIA 2015a). Indonesia has recently become important as a source for Chinese coal imports. Indonesia’s coal exports are primarily destined for Asian markets, with 85% of total coal exports going to China, Japan, South Korea, India, and Taiwan.

Indonesia’s energy mix, projected to the year 2025, includes increased reliance on coal, although renewable energy is expected to rise at a higher rate than that for coal (Table 5). Indonesia is projected to increase annual coal production by an average of 3% to 2020 (Jardine Lloyd Thompson Group 2017). One of the main reasons for this projected increase is because the Government of Indonesia plans to invest in power infrastructure in the near future, hoping to reach a level of 99.7% electrification by 2025. This plan calls for coal to compose 60% of the overall national fuel mix to achieve a total power capacity of 90.5 GW by the end of 2019. PT Bumi Resources Tbk is Indonesia’s largest mining company and coal producer, with 88 MMst (79.8 MMt) produced in 2013. PT Bumi plans have been to increase production of power station coal in 2017, in expectation of stable coal prices that reflect recent rises in Chinese thermal coal futures (Jensen 2016). PT Adaro is the second-largest coal producer in Indonesia, accounting for almost 60 MMst (54.4 MMt) of coal in 2013. Other major producers include PT Kideco Jaya, PT Indotambang Raya Megah, and PT Berau. The top five producers in Indonesia have recently accounted for more than 45% of coal production (Indonesia-Investments 2017).

Russia

Approximately 80% of Russia’s coal production is thermal (steam) coal, and 20% is metallurgical (coking) coal. Russia’s coal reserves account for almost 18% of the world’s total coal reserves, although Russia’s share of coal production has recently been < 5% (Fig. 18) (Slivyak 2015). More than half of Russia’s coal exports, which have risen significantly since 2002, go to Europe. China accounts for 16% of Asian exports, whereas the UK receives 10% (Fig. 18).

The majority of Russia’s coal production and reserves are located in the Kansk-Achinskiy and Kuznetskiy basins in central Russia (Fig. 19). Coal in these regions requires long-distance transport to reach markets, placing Russian coal at an economic disadvantage with respect to other competing sources. However, some economists believe that the weaker ruble, resulting from sanctions and low oil prices, should make Russian coal exports more price competitive. Russia has plans to expand its port capacity for increased Asian exports.

Coal production in Russia has risen in the last 3 years, having increased by 3% by the end of 2017 and reaching a value of 438.4 MMst (397.7 MMt) (Reuters 2017b). Thermal coal exports will exceed 168.7 MMst (153 MMt) in 2017, up from 164.2 MMst (149 MMt) in 2016. Metallurgical coal exports will have risen from 23.9 MMst (21.7 MMt) to between 25.4 and 26.5 MMst (23 and 24 MMt).

Russian thermal coal exports to Europe are expected to diminish in the next decades as Europe develops more green energy systems, coupled with greater competition from exports from Colombia and the USA (IHS Markit 2017). Russian export markets are anticipated to shift to southeast Asia, with Russia exporting 57.3 MMst (52 MMt) to southeast Asia and the Pacific Rim by 2020.

South Africa

South Africa contains 95% of Africa’s total coal reserves (EIA 2016b), and relies heavily on its large-scale, coal-mining industry. The country also has a well-developed synthetic fuels (synfuels) industry, manufacturing gasoline and diesel fuel from the Secunda CTL plant and Mossel Bay GTL plant. The synfuels industry represents nearly all of South Africa’s oil, as its domestic production is small. More than 37 MMst (> 33.6 MMt) of coal are processed yearly and converted into liquid fuels and a range of chemical feedstock at the Sasol synfuels plant in Secunda. The plant has a capacity of 160,000 barrels per day (bbl/d) of oil equivalent. Sasol has plans for expanding Secunda’s capacity by 30,000 bbl/d.

Coal accounts for 72% of the country’s total primary energy consumption (Fig. 20). The electricity sector accounts for > 50% of the coal consumed in South Africa, with lesser amounts represented by petrochemical and metallurgical industries followed by domestic heating and cooking.

From Chamber of Mines of South Africa (2016)

Principal coal mines and companies in South Africa.

Most of South Africa’s coal production is from the northeastern part of the country (Fig. 20). South Africa exports have recently accounted for approximately 25% of its coal production. However, development of global alternative energy sources has affected South African coal-exporting markets (Olalde 2017). In addition, there has been a trend of an increasing number of smaller coal-mining companies in South Africa, formerly dominated by large companies such as Eskom. Six companies in 2007 accounted for 90% of South Africa’s production, with eight mines producing more than 60% of the country’s coal. The number of coal mines in 2007 was 93, but increased to 148 mines by 2016. However, total coal production rose by only 10% in the same period.

Despite shrinking coal-exporting markets, domestic coal mining in South Africa remains a vital part of the economy, having employed more than 77,500 people in 2016, representing 17% of the total employment in the South African mining sector (Chamber of Mines of South Africa 2017). Total coal sales were approximately R 112 billion, with coal-exporting earnings averaging 12% of all merchandise exports.

Germany

Coal is Germany’s most abundant indigenous energy resource, and it accounted for about 25% of Germany’s total primary energy consumption in 2014 (EIA 2016c). Power and industrial sectors consume most of the coal in Germany, with lignite-fired generation providing ~ 44% of total electric generation in 2014. Although Germany has large reserves of lignite and hard coal, only 22.0 MMst (~ 20 MMt) are planned for development because of Germany’s decision to curtail subsidized hard coal production in 2018 (Euracoal 2017a) and to reduce greenhouse gas emissions by 40% (from 1990 levels) by 2020 (Destatis 2015). However, lignite’s future in Germany is better, with an estimated 5510 MMst (~ 5000 MMt) of mineable reserves in existing and approved surface mines.

Hard coal and lignite accounted for approximately 13 and 12% of Germany’s main energy production, respectively, in 2015 (Euracoal 2017a). However, 90% of Germany’s hard coal was imported, mainly from Russia, Colombia, the USA, Australia, Poland, and South Africa. Lignite production in Germany in 2015 was 196.2 MMst (~ 178 MMt). This production came from four main areas that include: (1) the Rhenish mining district encompassing Cologne, Aachen, and Mönchengladbach; (2) the Lusatian mining district in southeastern Brandenburg and northeastern Saxony; (3) the Central German mining district in southeastern Saxony-Anhalt; and (4) and in northwestern Saxony as well as the Helmstedt mining area in Lower Saxony (Euracoal 2017a). Almost 90% of the lignite was employed for power generation. Slightly more than 42% of electric power generation in Germany in 2015 came from hard coal and lignite. Coal-fired power plants in Germany are still required to compensate for nuclear power, which Germany is foregoing in the wake of the Fukushima incident. Germany’s current energy mix reflects long-term plans to eventually phase out coal, while renewable energy sources are developed (Fig. 21).

From Euracoal (2017a)

Germany’s projected energy mix from 2015 to 2030. Values are in gigawatts (GW).

Poland

Poland is the second-largest coal producer in Europe, with Germany in first rank (Energy Information Administration, EIA 2016d). Coal accounted for 55% of energy consumption, with oil representing 26%, natural gas being 15%, and renewable energy sources comprising 4%. Poland consumes virtually all its domestic coal production, with minor coal exports to the Czech Republic, Germany, and Ukraine (S&P Global Platts 2015). Poland’s coal-fired power plants represent > 75% of installed electric generating capacity.

Compared with other countries in the European Union, Poland has large reserves of hard coal and lignite that are devoted to electricity generation (Euracoal 2017b). Hard coal reserves in Poland amount to 23.3 billion short tons (Bst) (21.1 Bt), most of which are located in the Upper Silesian and Lublin coal basins. Lignite reserves in the country are 1.54 Bst (1.4 Bt). In addition, 24.4 Bst (22.1 Bt) of lignite resources exist in Poland. Upper Silesia accounts for ~ approximately 79% of Poland’s reserves of hard coal, with approximately half of these seams being economically workable. These hard coal reserves, almost all of which are mines with long-wall systems, are mined at an average depth of ~ 1970 ft (600 m). Steam coal represented 82% of hard coal mined in 2015 (Euracoal 2017b).

Lignite reserves in Poland are mined at the surface. Two mines are in central Poland, whereas a third is in the southwestern part of the country. Production of lignite in 2015 was 69.6 MMst (63.1 MMt). Virtually of this lignite is devoted to mine-mouth power plants (Euracoal 2017b). Approximately 80% of Poland’s electrical generation capacity is from hard coal and lignite. Abundant coal in Poland is seen as a means of lessening dependence on Russian natural gas, with climate objectives as being secondary (Bauerova 2015). Poland has the lowest reliance on natural gas among the European Union’s 10 largest economies. Polish industry spent 23% less for power than German industry in 2012, as well as having provided jobs for > 100,000 people.

Kazakhstan

Coal accounts for > 60% of Kazakhstan’s total energy consumption (Fig. 22) (EIA 2016e). Despite Kazakhstan being ranked among the top-ten coal-producing countries (Table 1), it contributes comparatively little to global coal volumes (< 4%) (World Energy Council 2017). Kazakhstan exports ~ 25% of its own coal production (virtually all steam coal), with most exports bound for Russia (EIA 2017g). Kazakhstan plans to offset export losses to Russia with new markets in Finland, Greece Italy, Kyrgyzstan, the UK, and China, despite recent reductions in coal production in China.

From Energy Information Administration (EIA 2016e)

Relative percentage of energy consumption by fuel type in Kazakhstan in 2013.

Kazakhstan contains > 400 coal deposits. Approximately one-third are composed of lignite. Most coal production is sourced from the Karaganda Basin, a source of underground coking coal, and the Ekibastuz Basin that supplies coal for electric power generation (World Energy Council 2017). Kazakhstan also produces minor volumes of metallurgical coal for domestic consumption. Coal provides most of Kazakhstan’s power generation, with most coal-fired plants being located in the north part of the country. Kazakhstan’s total installed generating capacity is ~ 18 GW, of which 87% comes from fossil fuels.

Coalbed Methane

Introduction

Coalbed methane (CBM; also known as coalbed methane, coalbed natural gas, coal seam gas) is a type of unconventional natural gas generated and stored in coal beds. Sorbed gas is released and produced from coal following the reduction of hydrostatic pressure with the removal of water from coal cleats and other fractures during drilling. Coal mine methane (CMM), on the other hand, is gas produced in association with coal-mining operations.

Production and reserves of natural gas from coal beds in the USA continued to decline in 2016. CBM is still an important resource globally. Research on CBM remains active, however, as indicated by > 50 technical papers published in 2017.

Summaries of CBM Production for Selected Countries

The USA. The Energy Information Administration (EIA 2009a) shows a map of US lower 48 states CBM fields (as of April 2009). US annual CBM production peaked at 1.966 trillion cubic feet (Tcf; 55.67 billion m3) in 2008 (EIA 2009b, 2010, 2018a). CBM production declined to 1.020 Tcf (28.88 billion m3) in 2016 (EIA 2018a), the lowest level since 1997, representing 3.8% of the US total natural gas production of 26.7 Tcf (756.1 billion m3; EIA 2018b; Fig. 23). Note that US CBM production in the Energy Information Administration (EIA 2018a, their Table 15) is different than US CBM gross withdrawals in the Energy Information Administration (EIA 2017j, their Table 1). According to the Energy Information Administration (EIA 2018a, their Table 15), the top 7 CBM-producing US states during 2016 (production in billion cubic feet, Bcf; or million m3) were Colorado (352; 9.97), New Mexico (253; 7.16), Wyoming (143; 4.05), Virginia (102; 2.89), Alabama (45; 1.27), Oklahoma (43; 1.22), and Utah (39; 1.10). Annual CBM production decreased for each state over the previous year (EIA 2018a, c; Fig. 24). Cumulative US CBM production from 1989 through 2016 was 35.7 Tcf (1.01 trillion m3).

US CBM production (1989–2016 compiled from EIA 2018a)

According to the Energy Information Administration (EIA 2018c), annual peak CBM production in the top 7 CBM-producing US states during 2016 occurred in the following years: Colorado (2010), New Mexico (1997), Wyoming (2008), Virginia (2009), Alabama (1998), Oklahoma (2007), and Utah (2002) (Fig. 24). Bleizeffer (2015) provides a history of Wyoming CBM production. The U.S. Geological Survey (2014) includes hyperlinks to the U.S. Geological Survey CBM assessment publications and web pages.

According to the Potential Gas Committee Press Release (2017), the USA has 158.7 Tcf (4.5 trillion m3) CBM resources (15.0 Tcf, 0.4 trillion m3 probable resources [current fields], 48.0 Tcf, 1.4 trillion m3 possible resources [new fields], and 95.7 Tcf, 2.7 trillion m3 speculative resources [frontier]) for 2016, an increase of 0.6 Tcf (17.0 billion m3) CBM resources since 2014. By region, 152.3 Tcf (4.3 trillion m3) “most likely” CBM resources are distributed as follows: 57.0 Tcf (1.6 trillion m3) Alaska; 52.6 Tcf (1.5 trillion m3) Rocky Mountain; 17.3 Tcf (489.9 billion m3) Atlantic; 11.6 Tcf (328 billion m3) North Central; 7.8 Tcf (221 billion m3) Midcontinent; 3.4 Tcf (96 billion m3) Gulf Coast; and 2.6 Tcf (74 billion m3) Pacific. US annual CBM-proved reserves peaked at 21.87 Tcf (619 billion m3) in 2007 (EIA 2009b, 2010, 2018d) and declined to 10.585 Tcf (300 billion m3) in 2016 (EIA 2018d) representing 3.3% of the US total natural gas reserves of 322 Tcf (9.1 trillion m3; EIA 2018e; Fig. 25). Annual CBM-proved reserves by US state (through 2016) are available from the Energy Information Administration (EIA 2018d).

The Environmental Protection Agency (EPA) Coalbed Methane Outreach Program (https://www.epa.gov/cmop) has information on US coal mine methane, including a map of coal mine methane (CMM) recovery at active and abandoned US coal mines.

Australia. Stark and Smith (2017) indicated the Walloon CBM play in the Bowen-Surat Basin (discovered in 2009) has gas resources of 503 million barrels of oil equivalent (MMBOE), while the Walloon CBM play in the Kumbarilla Ridge Basin (discovered in 2001) has gas resources of 535 MMBOE.

Information on Australian coal seam gas is available on the Australian Government Geoscience Australia web sites (http://www.ga.gov.au/scientific-topics/energy/resources/petroleum-resources/coal-seam-gas; http://www.ga.gov.au/data-pubs/data-and-publications-search/publications/oil–gas-resources-australia/2005/coalbed-methane). According to the Energy Information Administration (EIA 2017f, p. 8, 11; updated March 7, 2017), “Geoscience Australia estimated total proved plus probable commercial reserves at 114 Tcf (62% conventional natural gas, 38% coal bed methane (CBM), and less than 1% tight gas) as of 2014. … CBM resources, equivalent to about 43 Tcf, are primarily located in the northeastern Queensland Province in the Bowen Basin and Surat Basin. Geoscience Australia anticipates the resource distribution of natural gas will shift from the offshore traditional gas production to CBM or other sources in the next few decades because key CBM developers are aggressively exploring and drilling in several areas. … Commercial production from CBM, which began in 1996, rose to 424 Bcf in 2015, 50% higher than in 2014. This production increase corresponds with the commencement of the country’s first CBM-to-LNG export terminals in Queensland over the past 2 years.”

Towler et al. (2016, p. 254) provided “An overview of the coal seam gas developments in Queensland,” in which they reported “In the 2014/2015 fiscal year Queensland produced 469 Bcf of gas, of which 430 Bcf was CSG” (coal seam gas) from the Bowen and Surat basins. The most recent Queensland Government petroleum and coal seam gas report is available at https://publications.qld.gov.au/ dataset/queensland-petroleum-and-coal-seam-gas (accessed February 16, 2018).

An interactive map of coal seam gas wells in New South Wales is available at http://www.resources andenergy.nsw.gov.au/landholders-and-community/coal-seam-gas/facts-maps-links/map-of-csg-wells. Relatively few wells are producing gas, while most of the wells are either “permanently sealed” or “not producing gas.”

China. Stark and Smith (2017) indicated the Taiyuan CBM play in the Qinshui Basin (discovered in 2007) has gas resources of 717 MMBOE.

By the end of August 2017, the CBM production in China was 4.46 billion m3 with a growth of 3.3%, of which the production in August alone was 0.59 billion m3 with a growth of 7.2%, as reported by the China Coal Bed Methane Industry Market Research Report (http://www.china5e.com/news/news-1004285-1.html). Shanxi Province has the most CBM production of 2.92 billion m3 in the 8 months of 2017, of which in August 2017 the CBM production was 0.41 billion m3, accounting for 70% of the total production in the whole country.

According to the news from the Shanxi Province Land and Resources Department of August 23, 2017, the Yushe-wuxiang coalbed methane resource survey project made breakthrough progress with a new discovery of CBM and shale gas resources of 181.2 billion m3 in an area of 388.51 km3. Ignition tests show that daily production is up to 1000 m3. Burial depth of the coal bed in this area is more than 1300 m. The project shows a great innovation in production technology of deeply buried CBM (http://www.inengyuan.com/2017/nynews_0825/3338.html). By the end of August 2017, North China Petroleum Company drilled 107 CBM wells and is planning to drill 157 more wells. By 2020, annual CBM production in North China Petroleum Company is estimated to be 20 billion m3.

Information about coal mine methane (CMM) in China is available from the Environmental Protection Agency (EPA 2018). The China country analysis brief is available from the Energy Information Administration (EIA 2015b).

Canada. Canada contains diverse CBM resources, which are concentrated chiefly in the: Carboniferous strata in rift basins of the eastern Canadian Maritime Provinces; Mesozoic-Cenozoic strata in intermontane basins of British Columbia; and in Cretaceous strata of the Western Canada Sedimentary Basin of the Cordilleran foreland in Alberta. The vast majority of the resource and reserve base are in Alberta, where the Alberta Geological Survey estimates original gas in place (OGIP) on the order of 500 Tcf. The bulk of the production comes from the Upper Cretaceous Horseshoe Canyon play and development is active in a variety of other Cretaceous coal-bearing formations. Early production operations focused on vertical wells completed in multiple coal seams, and expansion of the industry between 2005 and 2007 was buoyed by the advent of lateral and multilateral drilling in single seams.

Remaining reserves in Alberta are estimated to be about 2 Tcf according to the Alberta Energy Regulator, indicating that although development is widespread, potential exists for a major expansion of the industry given a favorable economic climate. Development activity, however, has decreased significantly in recent years in response to low natural gas prices. According to the International Energy Agency (IEA), Canadian CBM production peaked at 8.9 Bcm (315 Bcf) in 2010. Production was 7.2 Bcm (254 Bcf) in 2014, and the annual rate of decline has increased from 3.7% in 2011 to 6.8% in 2014 (Fig. 26). Accordingly, the current economic climate remains challenging for the development of new CBM reserves in Canada.

General information on CBM in Alberta is available from the Alberta Energy Regulator (2015), Alberta Energy (2018), and Alberta Geological Survey (2018).

India. Bhattacharya (2016, p. 51) reported that “India contains 60.6 billion tonnes of coal…could contain up to 4.6 trillion m3 of gas.” Of 33 CBM exploration blocks awarded since 2001, only three blocks are producing gas. “The lack of commercial production stems from factors including the lack of detailed reservoir characterization, the lack of professional training for domestic companies, and the lack of equipment and advanced CBM technology in the most productive basins” (Bhattacharya 2016, p. 51).

Russia. Information on prospects for CBM production in Russia is at http://www.gazprom.com/about/production/extraction/metan/ (website accessed February 16, 2018).

Tight Gas and Liquids Reservoirs

Introduction

Within the last few years shale gas and liquids have evolved to stacked reservoirs including tight carbonates and tight sandstones.

As of 2016, The Energy Information Agency (EIA) of the USA no longer carries a definition for tight gas; hence production is not itemized in their latest annual reports. It appears that tight gas is now rolled into conventional natural gas statistics. The EIA has definitions for shale gas and tight oil, the latter of which includes the Eagle Ford and Bakken. This report therefore not only includes the summary of activities in shale gas and liquid plays but also tight carbonate and sandstone plays in North America and internationally.

Shale Gas and Liquids

Shale gas and liquids have been the focus of extensive drilling for the past 12 + years owing to enhanced engineering, recovery and abundance of reservoir. Although there is international interest in exploiting hydrocarbons from these unconventional reservoirs, with active exploration projects on most continents, much of the successful exploitation from shales continues to be in North America (Fig. 27), particularly in the USA but increasingly so in Canada and South America. Production from these reservoirs has been instrumental in a recent ranking of the USA as the World’s leading nation in production of petroleum and other liquids (EIA 2016f). Steep increases in shale gas and tight oil production in the USA since 2007 have been realized (EIA 2016f) (Figs. 28 and 29); and overall, seven tight liquids and shale plays (e.g., Eagle Ford Formation, Bakken Formation, Niobrara Formation, Anadarko Basin, various rocks in the Permian Basin, Haynesville Shale, and the Marcellus Shale) are collectively responsible for almost 90% of the growth in US oil and gas production (EIA 2016f). Forecast projections indicate that shale gas and tight liquids production will increase into the coming decades (Fig. 30) (EIA 2016f); although, for the past 3 years, production from tight oil and shale gas formations declined in the USA due to low oil and gas prices. However, some areas experienced a revival (e.g., Haynesville and Marcellus Shale) due to LNG facilities being built along the East Coast of the USA. Despite the downturn, US shale gas production has increased to 49,000 MCF/D by end of 2017 (Fig. 28). Natural gas production also increased slightly in the Marcellus and Permian basins.

Shale tight gas and liquids plays in the USA (from Energy Information Administration, EIA 2016f)

Monthly dry gas production in the USA with the most important contributing shale gas plays (Energy Information Administration, EIA 2018f)

Monthly tight oil production listing the most important tight oil producing formations in the USA (from Energy Information Administration, EIA 2017k)

(a) Forecast of US tight oil production through 2040. (b) Forecast of US shale gas production through 2040 (Energy Information Administration, EIA 2016f)

New plays in shale liquids contributed to a reversal in oil production after a general decline over the last 20 years. The Permian Basin now contributes close to 50% of oil production in the USA. Although shale oil production remains strong at approximately 9 million B/D due to improvements in drilling techniques, with rising oil and gas prices; drilling and production has been increasing in all basins in 2018 (EIA 2018f).

Overall, Europe remains relatively unexplored owing to regulations and limited producibility as compared to North America and many parts of Asia remain relatively unexplored for unconventional shale gas and oil, but interest in these plays is certainly high.

South America’s potential as unconventional shale gas and oil province is currently being developed in the Neuquen Basin of Argentina, with major companies cutting out big stakes in the estimated technically recoverable 308 Tcf of gas and 16 billion barrels of oil and condensate from the Vaca Muerta shale gas and liquids play (EIA 2015c). In addition, the Los Molles Formation of the Neuquen Basin adds an estimated 275 Tcf of shale gas and 3.7 billion barrels of shale oil and condensate (EIA 2015c). China has been aggressively pursuing shale gas production in the past years, becoming the third-largest shale producer in the world in 2017 resulting in an increase of 76.3% from 2015 (Slav 2018).

The following summary provides the reader with information about many shale systems in North America that are actively being exploited for contained hydrocarbons as well as an overview of activities in many other continents. Please see the EMD website for full reports on all the major shale gas and tight oil plays (http://www.aapg.org/divisions/emd/resources).

North American Shale Plays

USA

The majority of US shale plays are producing oil, gas, and condensate. Tight oil production makes up 54% of total US oil production in 2017 (EIA 2018b). Since the 2015–2016 downturn production in most shale plays have slowly been increasing since mid-year 2016 (Fig. 29). Notably, the Bakken production has been outpacing Eagle Ford oil production with the Bakken now producing 1.2 million barrels/day (Fig. 31, EIA 2018g). Most of the contribution (36%) from tight oil formations comes from the Permian Basin, which has prolific tight, stacked reservoirs such as the Wolfcamp, Spraberry, and Bonespring formations. Increases in proppant intensity, lateral lengths, and changes to slick water completions are among the factors that have allowed the Permian Basin to remain one of the most economic regions for oil production despite the current low-oil-price environment.

Shale oil production from the Bakken Region and associated gas showing an increase in 2018 (from Energy Information Administration, EIA 2018f)

Many more tight plays have been discovered and exploited since the original shale gas plays of the Barnett, Haynesville, Eagle Ford and Marcellus. Two of the new and upcoming plays are Oklahoma’s SCOOP (South Central Oklahoma Oil Province) and STACK (Sooner Trend Anadarko Basin Canadian and Kingfisher Counties) plays mainly in Mississippian Meramec and Woodford formations in the Anadarko Basin (Fig. 32). Since 2013, more effective completion designs and core area development have yielded a ~ 70% increase in initial production (IP) rates, which are now competitive with rates for the Permian and Eagle Ford (Kallanish Energy 2017). Another play gaining importance in the USA has been the Niobrara–Codell region of Colorado and Wyoming (Fig. 33a, b). Since 2015, tight oil production has increased to 579,000 barrels/day and surpassing the Eagle Ford in tight gas production (Fig. 34).

Producing areas in Oklahoma (Kallanish Energy 2017)

US crude oil production and forecast 2016–2018 (from Energy Information Administration, EIA 2017k)

According to the Energy Information Administration’s Drilling Productivity Report, natural gas production in the Appalachia region—namely the Marcellus and Utica shale plays—has increased by more than 14 billion cubic feet per day (Bcf/d) since 2012. Overall Appalachian natural gas production grew from 7.8 Bcf/d in 2012 to 22.1 Bcf/d in 2016 and was 23.8 Bcf/d in 2017, based on data through October 2017 (Fig. 35) (Energy Information Administration, EIA 2017k).

Average monthly new well shale gas production per rig 2012–2017 showing the dominance of Appalachian shale gas production (from Energy Information Administration, EIA 2017k)

Canada

Canadian shales have been successfully contributing 15% of shale gas to the North American gas production largely coming from the Montney and Duvernay formations (Fig. 36) and producing 335,000 b/d (Reuters 2018). In addition, the Bakken and Exshaw formations add oil reserves to Canada’s production.

European Shales

Europe continues to be relatively unexplored for shale gas and, especially, shale liquids. Shale gas drilling has taken place in six countries and shale liquids drilling in three countries. In total some 137 exploration and appraisal wells with a shale gas exploration component have been drilled, including horizontal legs from vertical wells. Thirty-nine of these wells are shallow-gas tests drilled in Sweden, largely using mineral exploration equipment. Eleven wells have been drilled to target shale liquids and hybrid continuous tight oil deposits.

Significant shale gas exploration activity since April 2016 has been limited to England where two horizontal wells, which will be hydraulically fractured in the Bowland Shale, are under way. Approval has also been granted for two shale gas exploratory wells in the Gainsborough Trough of the English East Midlands and these should be drilled in early 2018. Three wells (one a sidetrack) have been drilled to investigate the potential of naturally fractured limestone and shale within the Kimmeridge Clay of the Weald Basin of southern England. More wells are planned to test this hybrid continuous tight oil play.

Opposition to hydraulic fracturing and shale oil and gas exploration at a grassroots level in general remains strong. Public pressure has resulted in moratoria being placed on some or all aspects of shale gas exploration and production in Bulgaria, Czech Republic, France, Germany, Ireland and Netherlands, plus certain administrative regions in Spain, Switzerland and the UK (Scotland; Wales; Northern Ireland). Proposed new environmental legislation led OMV Group (based in Vienna) to abandon its plans for shale gas exploration in Austria.

A complete historic review of all European activity through October 2017 can be found and downloaded here at: https://www.academia.edu/35008291/Shale_Gas_and_Shale_Liquids_Plays_in_Europe_October_2017.

Global Tight Gas Activity

Tight gas is an unconventional hydrocarbon resource contained in low-permeability (millidarcy to microdarcy range) and low-porosity reservoirs. In the past only sandstone or siltstone was considered as “tight”; however, increasingly low-permeability/low-porosity carbonate reservoirs are also included as tight reservoirs. Tight gas reservoirs are historically a dry gas resource; but, low gas prices have compelled companies toward resources containing more liquids (oil or natural gas liquids).

Exploration and development of tight reservoirs in much of the world is declining, especially dry gas, particularly since the shale resource boom has accelerated. However, in places such as China and Argentina where gas resources are in short supply exploration and development is continuing for new resources.

As of 2016, the Energy Information Agency (EIA) of the USA no longer carries a definition for tight gas; hence, production is not itemized in their latest annual reports. It appears that tight gas is now rolled into conventional natural gas statistics. The EIA has definitions for shale gas and tight oil, the latter of which includes the Eagle Ford and Bakken.

This report summarizes tight gas mainly sand play characteristics and activity, where possible, in the USA, Australia, Canada, China, Argentina, Algeria, and Oman; the latter three countries being added this past year to the present EMD overview.

USA

The Energy Information Administration estimated in a report that as of January 1, 2015, 291.0 trillion cubic feet (Tcf) of Total Technically Recoverable Resources (TTRR) of dry tight gas exists within the contiguous USA, with 63.3 Tcf Proved Reserves and 227.8 Unproved Reserves (EIA 2017k). This represents about 12% of the total TTRR of dry gas onshore and offshore (including Alaska).

A map, table and short report of tight gas resources in the USA was published in 2014 by the U.S. Geological Survey (USGS). All of the data, maps and report are available digitally from the USGS and are not reproduced here, since their online map contains more detail than can be revealed at the scale of this page.

The U.S. Geological Survey (2014) evaluated tight -gas and tight oil resources in the following areas (arranged alphabetically): Appalachian Basin; Arkoma Basin; Big Horn Basin; Denver Basin; Piedmont, Blue Ridge Thrust Belt, Atlantic Coastal Plain and New England; Eastern Oregon and Washington; North Central Montana; Powder River Basin; San Juan Basin; Southern Alaska Basin; Southwestern Wyoming Basin; Uinta–Piceance Basin; and Wind River Basin. In some cases, partial or whole revisions to the basin/area assessment have been made and are also available; e.g., Appalachian Basin Energy Resources: A New Look at an Old Basin (Ruppert and Ryder 2014).

Production is not itemized in the latest EMD annual reports (2016 forward), due to the EIA no longer carrying a definition for tight gas. According to the EIA, “With the full deregulation of wellhead natural gas prices and the repeal of the associated Federal Energy Regulatory Commission (FERC) regulations (EIA 2009c), tight natural gas no longer had a specifically defined meaning, but generically still refers to natural gas produced from low-permeability sandstone and carbonate reservoirs.”

As assessed by the EIA, notable tight natural gas formations include (but are not confined) to:

-

Clinton, Medina, and Tuscarora formations in Appalachia;

-

Berea sandstone in Michigan;

-

Bossier, Cotton Valley, Olmos, Vicksburg, and Wilcox Lobo along the Gulf Coast;

-

Granite Wash and Atoka formations in the Midcontinent;

-

Canyon Formation in the Permian Basin;

-

Mesaverde and Niobrara formations in multiple Rocky Mountain basins.

See the following reference: (https://www.eia.gov/energyexplained/index.cfm?page=natural_gas_where).

A few historical tight gas discoveries, not on the above EIA list include the Dew–Mimms Creek field, East Texas Basin; the Jonah field, Green River Basin, Wyoming; the Mamm Creek field, Piceance Basin, Colorado; and the Wamsutter Development Area, Green River Basin, Wyoming (American Association of Petroleum Geologists, Energy Minerals Division 2009, 2011, 2014a, 2015a). In some cases drilling has occurred into these fields over the past few years.

International Tight Gas

According to McGlade et al. (2012), tight gas may be developed in many areas of the world other than the USA, but estimates have been difficult to gather, in some cases, because tight gas is included in conventional gas estimates. Nonetheless, McGlade et al. (2012) present “an overview of the current estimates” of 54.5 trillion cubic meters (E12 m3) (1914 Tcf) of technically recoverable tight gas from 14 regions or countries in the world.

Below we summarize some of the more notable tight gas and tight oil plays in other countries from a variety of sources.

Argentina. Although oil production has often received most of the attention, Wood Mackenzie Ltd. suggest a shift to tight gas production is being driven by lower cost and pricing incentives ($7.50MM/BTU) relative to shale. Tight production in Argentina “almost tripled” over a 2-year period to 565 MMcf/d during the first quarter of 2017 (Oil & Gas Journal 2017). Six formations were studied in their report with top-quartile wells having flow rates five times higher than bottom-quartile wells. For example, of the 6 wells studied the 90-day initial production (IP) rate from the median well was about 2 MMcf/d. The hydraulically fractured Mulichinco Formation reservoirs, which were produced from horizontal wells, had the highest Estimated Ultimate Recovery (EUR) of 5 Bcf. Flow rates in other strata such as within the Lajas Formation were more variable; while production from the Punta Rosada reservoirs is expected to be best achieved using vertical wells. Such variability in flow rates indicates that a “statistical approach” to field development may be expected for these complex reservoirs.

Canada. Tight gas in the Western Canada Sedimentary Basin has been studied and tested at least since the late 1970s (Masters 1979). Masters indicated that tight gas in the deep basin of Alberta and British Columbia is trapped down-dip of free water with no impermeable barrier between them. After this initial work, it was found that this down-dip trap model may be spurious; and was likely a result of miscorrelation of units (D. Cant, pers. comm. 2018). Subsequent work extended the plays outside of the deep basin into the foothills and, thus, the tight gas plays were determined to be more regional in extent (Hayes 2003, 2009).

The National Energy Board of Canada (NEB) recently released published an energy market assessment on natural gas production in Canada entitled, “Canada’s Energy Future 2017 Supplement” (Fig. 37), see (https://www.neb-one.gc.ca/nrg/ntgrtd/ftr/2017ntrlgs/index-eng.html).

Graph of tight gas production in Western Canada to November 2017 with a projection to 2020 (NEB 2018). The NEB report projected production to 2050 but the data has been cutoff at 2020 for this report. The NEB definition of tight gas includes low-permeability sandstone, siltstone, limestone or dolostone reservoirs. Shale gas and conventional gas production was not included in this figure

Most of the tight gas production comes from the western Canadian provinces. Peak production of tight gas in Alberta has been significantly reduced by about 4 Billion cubic feet per year (Bcf/year) from 2004 to the present. British Columbia production has stayed flat or has risen slightly over an equivalent period, while Saskatchewan tight gas from the southwestern portion of the province has decreased significantly.

China. Tight gas sandstone exploration started during the 1970s in China (Dai et al. 2012, 2015). Tight gas sandstones are widely distributed in a number of basins including the Ordos, Hami (including the Taibei Depression, located in the Tu-Ha Basin, also called the “Turpan-Hami” Basin), Sichuan, Songliao, Tarim, and deeper parts of the Junggar Basin (Fig. 38), with the favorable prospective areas exceeding 300,000 km2. In early 2012, tight gas sands were considered one of the most promising unconventional resources in China. This is largely due to three factors: (1) the confirmed assessments of tight gas sands resources in China; (2) the advanced state of technological development for tight gas sands production; and (3) the distribution of tight gas sands in many areas previously developed for conventional gas plays, with existing infrastructure in place.

Distribution of large, tight gas Fields in China (Hao et al. 2007)

“Natural gas now accounts for 6 percent of China’s energy demand, double the market share in 2007. In 2016, China’s consumption of natural gas grew by 6.4 percent, reaching 224 billion cubic meters. China’s domestic gas production in 2016 was 150 billion cubic meters, up by 2.2%, and China’s gas imports increased 22 percent to reach 75 billion cubic meters. As China moves forward with its plan to replace coal with cleaner and more efficient natural gas in power generation, the demand for gas will increase steadily in the long-run. The Chinese government expects gas to provide 10 percent of the country’s energy by the end of the 13th Five-year Plan period (2016–2020).” See the following weblink: (https://www.export.gov/article?id=China-Oil-and-Gas).

Australia. Tight petroleum exploration activities remained low during the year 2017 due to a combination of factors including a moratorium on hydraulic fracturing in Western Australia, Northern Territory, and Victoria; and a downturn in petroleum industry activity related to lower-commodity prices. However, studies related to tight petroleum assessment continue in Australia, with over $2.3 million (AUD) spent on tight petroleum research.

The moratorium, which is expected to last for 12 months, has prevented many companies including Buru Energy and AWE Ltd., as well as Japanese giant Mitsubishi Corp., from exploring for onshore gas in Western Australia, which contains some of the nation’s biggest untapped resources.

The Northern Territory government will wait until next year to decide on lifting its moratorium on hydraulic fracturing, preventing further drilling and assessment programs within the McArthur, Beetaloo, and Georgina basins, which contain some of the world’s oldest (Precambrian and Cambro-Ordovician) intact deposits.

Estimated tight petroleum resources of Australia include: technically recoverable 437 Tcf of gas and 17.5 billion barrel oil (Kuuskraa et al. 2013), and up to 1000 Tcf of gas (Cook et al. 2013). Geographically, these resources are within the organic-rich shale and tight sand reservoirs of Queensland, South Australia, Northern Territory, and Western Australia. Stratigraphically, these resources are within the: Precambrian Velkerri and Kyalla shales of Beetaloo Basin; Cambrian Arthur Shale of Georgina Basin; Ordovician Goldwyer Formation of Canning Basin; Permian Roseneath–Epsilon–Murteree (REM) formations of Cooper Basin; Permian Carynginia Formation of Perth Basin; Triassic Kockatea Shale of Perth Basin; and Cretaceous Goodwood/Cherwell Mudstone of Maryborough Basin (Fig. 39).

Geological assessment and regulations to develop these resources are underway and will continue for several years. At this stage, mostly vertical wells with only a few fractured intervals have been completed, as opposed to thousands of horizontal wells with many fractured intervals as in the USA. Challenges to developing these resources include a very small Australian market, a lack of existing infrastructure, remote locations, and a social license to operate.

Oman. The Khazzan natural gas field, located in northern Oman, was discovered in 2000 by British Petroleum Ltd. (BP), and began production in 2017 (BP 60%, Oman Oil Company 40%). The field is termed a “tight gas giant,” with an estimated 10.5 trillion cubic feet of recoverable gas resources, 7 TCF of recoverable reserves. The first phase of development is expected to yield about 1 bcf/d natural gas and about 25,000 barrels per day of gas condensate from 200 wells with production climbing to 1.5 bcf/d after phase two, from a total of about 300 wells. A variety of fracturing technologies have been attempted in these tight reservoirs, including million lb. cross-linked gel fracs and 50,000 bbl slick water fracs.

Production comes from the Cambrian Barik sandstone at depths between ~ 14,000 feet to exceeding 16,000 feet (from ~ 4.27 km to 4.88 + km). The sediments are interpreted to have been deposited within a transition zone from continental, fluvial braid plain/shoreface settings to offshore marine basinal environments. Reservoirs are within a combined stratigraphic-structural trap (Millison et al. 2008).

A complex network of largely secondary porosity may control productivity. The sandstone is largely quartz cemented; however, feldspathic-rich intervals seem to have better overall reservoir quality. The presence of bitumen suggests that early hydrocarbon charging may have preserved reservoir-quality rock. Helium porosity measurements range up to 24% in select fluvial facies; however, the arithmetic mean ranges from ~ 9% in fluvial sediments to ~ 4% in the more distal offshore facies. The geometric mean of horizontal permeability ranges from 0.l56 md in fluvial facies to 0.06 md in distal offshore facies.

Algeria. The In Salah gas projects are located in the Ahnet–Timimoun Basins of Algeria and contain seven gas fields, three of which in the north have been on production since 2003, and four new fields in the south, which were brought on production in 2016. The northern fields include the Teguentour field that Hirst et al. (2001) describe as primarily a tight gas reservoir.

In the Teguentour field, conventional sandstones are interbedded with volumetrically dominant tight reservoirs (< 1mD). The tight gas intervals are from Devonian and Carboniferous rocks with quartz cementation being relatively pervasive and the main cause of lower porosity and permeability, “often in the microdarcy range” (Hirst et al. 2001). Sandstone porosity in the tight zones is up to about 9%. Initial gas production of the three northern fields was at about 317–353 Bcf/year (9–10 × 109 m3/year) (Oil and Gas Journal, Online July 7, 2004; http://www.ogj.com/articles/2004/07/algerias-in-salah-gas-fields-now-producing.html).

Acknowledgments

The authors Ursula Hammes and Dean Rokosh extend thanks to Michael Vanden Berg, Kent Bowker, Brian Cardott, Ken Chew, Thomas Chidsey, Jr., Catherine Enomoto, Ameed Ghori, Peng Li, Jock MacCracken, Craig Morgan, and Richard Nyahay, who all contributed to this paper.

Bitumen and Heavy Oil

The topic of bitumen and heavy oil has been covered extensively in previous AAPG-EMD biennial updates (American Association of Petroleum Geologists, Energy Minerals Division 2009, 2011, 2014a, b, 2015a, b); along with an AAPG Studies in Geology, published in 2013 (Hein et al. 2013). Because of these recent publications only a brief executive summary is given here of these commodities. The exceptions are those deposits in Nigeria and Russia, which have not had comprehensive discussion in these prior publications, and are discussed more fully here.

Summary

Bitumen and heavy oil deposits occur in more than 70 countries across the world. The global in-place resources of bitumen and heavy oil are estimated to be 5.9 trillion barrels (938 billion m3), with more than 80% of these resources found in Canada, Venezuela and the USA. Globally there is just over one trillion barrels of technically recoverable unconventional oils: 434.3 billion barrels of heavy oil, including extra-heavy crude, and 650.7 billion barrels of bitumen. These bitumen and heavy oil deposits are commonly interpreted as degraded conventional oils (Head et al. 2003; Bata et al. 2015, 2016; Bata 2016; Hein 2016). The two most important processes that act on light oil to produce bitumen and/or heavy oil are biodegradation (hydrocarbon oxidation process involving the microbial metabolism of various classes of compounds, which alters the oil’s fluid properties and economic value) and water washing (the removal of the more water-soluble components of petroleum, especially low molecular weight aromatic hydrocarbons such as benzene, toluene, ethylbenzene, and xylenes) (Palmer 1984). The common by-products of anaerobic biodegradation are significant amounts of various biogenic gases (Head et al. 2003, 2010). These secondary biogenic gases may accumulate within bitumen and heavy oil reservoirs (Fustic et al. 2013). Virtually all of the bitumen being commercially produced in North America is from Alberta, Canada, making it a source of bitumen and of the synthetic crude oil obtained by upgrading bitumen. Estimated remaining established reserves of in situ and mineable crude bitumen is 165 billion bbls (26.3 billion m3). To date, about 5% of Canada’s initial established crude bitumen has been recovered since commercial production began in 1967. In situ production overtook mined production for the first time in 2012 and has since continued to exceed mined production in 2013 (Alberta Energy Regulator 2015). The Faja Petrolifera del Orinoco (Orinoco Heavy Oil Belt) in eastern Venezuela is the world’s single largest heavy oil accumulation. The total estimated oil in place is 1.2 trillion barrels (190 billion m3) of which 310 billion barrels (49.3 billion m3) is considered technically recoverable. Currently, the USA is producing commercial quantities of heavy oil from sand deposits in two principal areas, the San Joaquin Basin of central California and the North Slope of Alaska.

California has the second-largest heavy oil accumulations in the world, second only to Venezuela. California’s oil fields, of which 52 each have reserves exceeding 100 million bbls (15.9 million m3), are located in the central and southern parts of the state. As of 2014, the proved reserves were 2854 million barrels (453.7 million m3), nearly 65% of which is heavy oil in the southern San Joaquin Basin. In addition to the heavy oil accumulations that are being produced, California has numerous undeveloped shallow bitumen deposits and seeps, a resource is estimated to be as large as 4.7 billion bbls (0.74 billion m3). Alaska’s heavy oil and bitumen deposits on the North Slope are very large (24 to 33 billion bbls, or 3.8 to 5.2 billion m3) and they hold promise for commercially successful development. Heavy oil constitutes approximately 13.1% of the total Russian oil reserves, which official estimates place at 22.5 billion m3 or 141.8 billion bbls. Recoverable heavy oil occurs in three principal petroleum provinces, the Volga-Ural, Timan–Pechora and the West Siberian Basin. In all regions of sustained production, the industry is steadily improving in situ recovery methods and reducing environmental impacts of surface mining of bitumen and heavy oil.

The bitumen and heavy oil commodity commonly consists of bitumen and heavy oil principally in unlithified sand. However, heavy oil reservoirs can also include porous sandstone and carbonates. Oil sands petroleum includes those hydrocarbons in the spectrum from viscous heavy oil to near-solid bitumen, although these accumulations also can contain some lighter hydrocarbons, including natural gas. The hydrocarbons within the bitumen and heavy oil accumulations are denser than conventional crude oil and considerably more viscous (Fig. 40), making them more difficult to recover, transport and refine. Heavy oil is just slightly less dense than water, with specific gravity in the 1.000 to 0.920 g/cc range, equivalent to API gravity of 10° to 22.3°. Bitumen and extra-heavy oil are denser than water, with API gravity less than 10°. Extra-heavy oil is generally mobile in the reservoir, whereas bitumen is not. At ambient reservoir conditions, heavy and extra-heavy oils have viscosities greater than 100 centipoise (cP), the consistency of maple syrup.

Bitumen has a gas-free viscosity greater than 10,000 cP (Danyluk et al. 1987; Cornelius 1987), equivalent to molasses. Many bitumens and extra-heavy oils have in-reservoir viscosities many orders of magnitude larger than conventional crudes. There are a variety of factors that govern the viscosity of these high-density hydrocarbons, such as their organic chemistry, the presence of dissolved natural gas, and the reservoir temperature and pressure. The viscosity of a heavy oil or bitumen is only approximated by its density.

Some heavy oils are the direct product of immature (early) oil maturation. However, bitumen and most heavy oils are the products of in-reservoir alteration of conventional oils by water washing, evaporation (selective fractionation) or, at reservoir temperatures below 80 °C, biodegradation (Blanc and Connan 1994), all of which reduce the fraction of low molecular weight components of the oil. These light-end distillates are what add commercial value to oil. Thus, in addition to being more difficult and costly to recover and transport than conventional oil, heavy oil and bitumen have lower economic value.

Upgrading to a marketable syncrude (also called synthetic crude or “synoil”) requires the addition of hydrogen to the crude to increase the H/C ratio to values near those of conventional crudes. Heavy oil and bitumen normally contain high concentrations of NSO compounds (nitrogen, sulfur, oxygen) and heavy metals, the removal of which during upgrading and refining further discounts the value of the resource. Some bitumen and heavy/extra-heavy oils can be extracted in situ by injection of steam or super-hot water, CO2, or viscosity-reducing solvents, such as naphtha. At shallow overburden depths, bitumen normally is recovered by surface mining and processed with hot water and/or solvents. In areas with thicker overburden (generally > 70 m), bitumen is recovered by in situ technologies, most commonly steam-assisted gravity drainage (SAGD) or cyclic steam stimulation (CSS).

The International Energy Agency (IEA) estimates the total world oil resources are between 9 and 13 trillion barrels, of which just 30% is conventional crude oil. The remaining 70% of unconventional crude is divided 30% oil sands and bitumen, 25% extra-heavy oil, and 15% heavy oil.

Bitumen and heavy oil deposits occur in more than 70 countries across the world. The global in-place resources of bitumen and heavy oil are estimated to be 5.9 trillion barrels (938 billion m3), with more than 80% of these resources found in Canada, Venezuela and the USA (Meyer and Attanasi 2003; Hein 2013). However, these unconventional oils are not uniformly distributed (Table 6). Meyer et al. (2007) note that heavy oils are found in 192 sedimentary basins and bitumen accumulations occur in 89 basins. The largest oil sand deposits in the world, having a combined in-place resource of 5.3 trillion barrels (842 billion m3), are along the shallow up-dip margins of the Western Canada Sedimentary Basin and the Orinoco foreland basin, eastern Venezuela. Western Canada has several separate accumulations of bitumen and heavy oil that together comprise 1.7 trillion barrels (270 billion m3). The Orinoco Heavy Oil Belt is a single extensive deposit containing 1.2 trillion barrels (190 billion m3) of extra-heavy oil.

Both the Western Canada Sedimentary Basin and the Orinoco Foreland Basin have extensive world-class source rocks and host substantial conventional oil pools in addition to the considerably larger resources within shallow oil sands. Globally there is just over one trillion barrels (159.0 billion m3) of technically recoverable unconventional oils (Table 6), 434.3 billion barrels (69.1 billion m3) of heavy oil, including extra-heavy crude, and 650.7 billion barrels (103.5 billion m3) of bitumen (Meyer and Attanasi 2003). South America, principally Venezuela, has 61.2% of the heavy oil reserves and North America, mainly western Canada, has 81.6% of the bitumen reserves.

Nigeria. Extensive oil sands occur in Nigeria along an east–west belt, stretching over an area of 120 km x 6 km, across Lagos, Ogun, Ondo, and Edo states in southwestern Nigeria (Fasasi et al. 2003; Obaje 2009). These oil sands, which are mostly associated with the Cretaceous Afowo Formation, are under-exploited, at present; but, it is a potential source of future revenue for Nigeria. Bata et al. (2015) also reported the occurrence of a Cretaceous oil sand (the Bima oil sand deposit) in the Nigerian sector of the Chad Basin. The Bima oil sand deposit extends into the Gongola Arm of the Upper Benue Trough and is similar to other Cretaceous oil sands, predominantly occurring at shallow depths on basin flanks and generally lacking a seal cover, making the oil susceptible to biodegradation. The Bima oil sand is another potential source of revenue for Nigeria.