Abstract

This report contains nine unconventional energy resource commodity summaries and an analysis of energy economics prepared by committees of the Energy Minerals Division of the American Association of Petroleum Geologists. Unconventional energy resources, as used in this report, are those energy resources that do not occur in discrete oil or gas reservoirs held in structural or stratigraphic traps in sedimentary basins. These resources include coal, coalbed methane, gas hydrates, tight-gas sands, gas shale and shale oil, geothermal resources, oil sands, oil shale, and U and Th resources and associated rare earth elements of industrial interest. Current U.S. and global research and development activities are summarized for each unconventional energy commodity in the topical sections of this report.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Peter D. Warwick, Footnote 1 Paul C. Hackley 1

The Energy Minerals Division (EMD) of the American Association of Petroleum Geologists (AAPG) is a membership-based, technical interest group having the primary goal of advancing the science of geology, especially as it relates to exploration, discovery, and production of unconventional energy resources. Current research on unconventional energy resources is rapidly changing and exploration and development efforts for these resources are constantly expanding. Nine summaries derived from 2013 committee reports presented at the EMD Annual Meeting in Pittsburgh, Pennsylvania in April, 2013, are contained in this review. The complete set of committee reports is available to AAPG members at http://emd.aapg.org/members_only/annual2011/index.cfm. This report updates the 2006, 2009, and 2011 EMD unconventional energy review published in this journal (American Association of Petroleum Geologists, Energy Minerals Division 2007, 2009, 2011).

Reviews of research activities in the U.S., Canada, and other regions of the world, that are related to coal, coalbed methane, gas hydrates, tight-gas sands, gas shale and shale oil, geothermal resources, oil sands, oil shale, and U and Th resources and associated rare earth elements (REEs) of industrial interest, are included in this report. An analysis of energy economics is also included. Exploration and development of all unconventional resources has expanded in recent years and is summarized in this report. Please contact the individual authors for additional information about the topics covered in this report for each section. The following website provides more information about all unconventional resources and the EMD: http://emd.aapg.org.

Coal

William A. Ambrose Footnote 2

World Coal Production and Consumption

Coal continues to be a significant component of the world’s energy production and consumption, with total world coal production slightly exceeding 8 billion short tons (bst), or ~7.2 billion metric tonnes in 2010 (U.S. Energy Information Administration 2011a). Coal has represented the world’s largest source for electricity generation over the past century, and is second only to oil as the world’s top energy source. More than 1,400,000 megawatts (MW), or >1,400 gigawatts (GW) of electricity could be supplied from the ~1,200 newly proposed coal-fired power plants worldwide (MIT Technology Review 2011).

China produced 45% of the world’s coal in 2010, more than three times than the U.S., and more than the U.S., India, Australia, and Indonesia combined (Fig. 1). Relative ranking among the top coal-producing countries has been nearly consistent since 2000, with Indonesia having its coal production increasing by 368% from 2000 to 2010, thereby displacing Russia as the fifth largest producer. China’s coal production has grown by 188%, whereas U.S. coal production has increased by only 1% from 2000 to 2010 (Fig. 2).

Relative world coal production in 2010 from China, the United States, India, Australia, Indonesia, and the rest of the world. From U.S. Energy Information Administration (2011a)

Chart displaying world coal production from the leading coal-producing countries and the rest of the world from 2000 to 2010. From U.S. Energy Information Administration (2011a). Billion short tons or 0.9 billion metric tonnes

China also consumed 3.8 bst (3.45 billion metric tonnes) of coal in 2011, nearly half the world’s total consumption (Sweet 2013). This increased consumption is partly driven by more than a threefold increase in electricity generation in China since 2000. Global demand for coal has grown by about 2.9 bst (2.6 billion metric tonnes) since 2000, with 82% of the total demand in China.

U.S. Coal Production and Consumption

U.S. coal production in 2011, spurred by a rise in exports, increased to ~1.1 bst (1.0 billion metric tonnes), up from 2010 levels (U.S. Energy Information Administration 2012a). Capacity utilization increased ~2.8 to ~79% at underground mines, whereas utilization at surface mines was unchanged at 83.3%. Although U.S. coal production for exports continues to be strong, the share of coal to the country’s overall energy production is declining, mainly owing to expanded natural gas production (Humphries and Sherlock 2013). Lower demand for coal in U.S. markets is projected from a combination of factors that include increasingly strict federal regulations, lower natural gas prices, and coal plant retirements. Celebi et al. (2012) and Reuters (2012), based on data from NERC (2011), estimated that market conditions and environmental regulations will contribute to 59–77 GW of coal plant retirements by 2016 (Fig. 3). The greatest loss of coal-fired electricity generation is projected to be in the southeastern U.S., with 27–30 GW of plant retirements, followed by the northeastern U.S. (18–26 GW).

Announced and projected coal coal-fired power plant capacity retirements in the U.S. by North American Electric Reliability Corporation (NERC). From Celebi et al. (2012) and from data in NERC (2011). Abbreviations used are for Florida Reliability Coordinating Council (FRCC), Midwest Reliability Organization (MRO), Northeast Power Coordinating Council (NPCC), ReliabilityFirst Corporation (RFC), SERC Reliability Corporation (SERC), Southwest Power Pool, RE (SPP), Texas Reliability Entity (TRE), and Western Electricity Coordinating Council (WECC)

Coal production in the western U.S., dominated by Wyoming, was 587.6 million short tons (mst) (~529,000 metric tonnes) in 2011, representing a decrease of 0.7% from the previous year (U.S. Energy Information Administration 2012a). Factors causing this decrease in western U.S. coal production included limited access to foreign markets and flooding in Montana. Coal production in the Appalachian region, driven by exports of bituminous coal, increased by 0.2% to 336.0 mst (~302,000 metric tonnes). Texas, Illinois, and Indiana saw production increases of 12.0, 13.6, and 7.1%, respectively. Export demands were responsible for increases in coal production in Illinois and Indiana, whereas increased production in Texas was also the result of demand from new domestic power plants.

U.S. Coal Regulatory Issues and Clean Coal

The U.S. Environmental Protection Agency (EPA) has issued greenhouse gas regulations that have impaired the construction of new coal-fired power plants in the U.S. that do not employ clean coal technology that involves carbon capture and storage (CCS). EPA is expected to also apply these regulations to existing power plants. However, coal will still account for up to 35% of U.S. electricity generation for another 30 years (U.S. Energy Information Administration 2011b). Currently, the U.S. maintains 316,000 MW of coal-fired generation, representing ~30% of the nation’s total electricity generation fleet.

Clean coal is coal that is gasified and burned in high-oxygen mixtures, resulting in removal of hazardous substances such as arsenic, lead, cadmium, mercury, and nitrogen and sulfur dioxides, as well as capture of CO2 and hydrogen. Factors that impact costs and the selection of optimal areas for new clean coal sites include (1) proximity of sites to mine mouths, (2) distance of CO2 transport via pipelines to carbon sinks, and (3) transmission losses between new power-generating facilities and user load (Mohan et al. 2008; Cohen et al. 2009; Dooley et al. 2009; Hamilton et al. 2009). Newcomer and Apt (2008) concluded that optimal sites for new clean coal facilities should be near the user electric load, owing to transmission losses exceeding costs of installing new CO2 pipelines and fuel transport. However, economic incentives that support new clean coal facilities should also be considered, such as EOR (enhanced oil recovery) with generated CO2 (Holtz et al. 2005; Advanced Resources International 2006; Ambrose et al. 2011, 2012).

Clean coal activity in North America is led by the Dakota Gasification Company where ~95 million cubic feet per day of CO2, generated by gasification of North Dakota lignite, is transported via a 205-mile (328-km) pipeline to Weyburn oil field in Saskatchewan for EOR (Chandel and Williams 2009). Weyburn field has become the largest land-based CO2 storage project in the world, having sequestered >12 million metric tonnes (Preston et al. 2009).

Texas has several examples of new and planned clean coal projects that illustrate how clean coal technology can be applied to EOR. Texas, which produced 45.9 mst (~41,300 metric tonnes) of coal and lignite in 2011 (U.S. Energy Information Administration 2012a), contains a wide variety of areas suitable for clean coal technologies. These areas are delineated by mapping spatial linkages between coal- and lignite-bearing formations, groundwater and surface water resources, and CO2 sinks in brine formations for long-term CO2 storage or in mature oil fields with EOR potential. Primary regions in Texas where favorably co-located CO2 source–sink factors related to coal and lignite trends include the Gulf Coast, the Eastern Shelf of the Permian Basin, and the Fort Worth Basin. However, areas outside coal and lignite basins also have clean coal potential because of existing CO2 pipelines and proximity to EOR fields that can economically sustain new clean coal facilities.

The Texas, Louisiana, Mississippi, and Alabama part of the Gulf Coast contains an additional 4.5 billion barrels (BBls; 715 million m3) of oil that could be technically produced by using miscible CO2 flooding (Holtz et al. 2005). For example, the Texas part of the Permian Basin has the potential for technical recovery of 5.6 BBls (890 million m3) and economic recovery of ~0.7 BBls (111 million m3) of oil from 127 reservoirs (Advanced Resources International 2006). Although the CO2 pipeline infrastructure is well developed in the Permian Basin, the Texas Gulf Coast also has great potential for clean coal development, owing to co-located CO2 sources and sinks such as mine-mouth electric power plants and abundant lignite resources, as well as CO2 storage potential in EOR fields, deep, unmined low-rank coal seams (McVay et al. 2009), and thick brine formations.

Three clean coal projects and facilities are being developed in Texas, including (1) the NRG Parish Plant near Houston (NRG 2013), (2) the Tenaska Plant near Sweetwater (Tenaska 2013), and (3) the TCEP Summit Plant near Odessa (TCEP 2013). The NRG Parish Plant contains four main units, with up to 2,650 MW of coal-fired and 1,200 MW of gas-fired generation capacity. Its advanced burners can achieve 50–60% reductions in NOx and it has a flue-gas slipstream that can capture 90% of the CO2. Up to 1.65 metric tonnes (1.8 mst) of CO2 will be sequestered annually. EOR opportunities exist in the Frio Formation (Oligocene) in nearby oil fields, including West Ranch field in Jackson County (Galloway and Cheng 1985; Galloway 1986).

The Tenaska Plant near Sweetwater, Texas is to be a 2,400-acre (970 ha) facility to be completed in 2014. The plant is designed for supercritical steam generation, using dry-cooling technology. It will have a 600 MW net capacity and coal will be supplied from the Powder River Basin. The plant will capture 85–90% CO2 for EOR and additional production of 10 million BBls/year in the Permian Basin. Prominent nearby oil fields include the SACROC Unit (Scurry Area Canyon Reef Operators Committee), from which oil has been produced from miscible-CO2 floods since 1971 (Brummett et al. 1976).

Operations for construction of the Summit Plant near Odessa, Texas are to begin in 2014–2015. The total project cost is projected to be ~$2.4 billion USD, with a $450 million contribution from the U.S. Department of Energy (DOE). The Summit Plant is designed as a 400 MW IGCC (integrated gasification combined cycle) plant with feedstock from the Powder River Basin. The plant will capture up to 90% of the CO2, representing 3 metric tonnes (3.3 mst) per year for Permian Basin EOR.

Other uses of coal and associated carbon materials are discussed by Campbell in this Review, in context with the nuclear power industry and the emerging carbon industry.

Coalbed Methane

Jack C. Pashin Footnote 3

EMD Activities

The 2012 AAPG Annual Convention and Exposition in Long Beach featured presentations on environmental impacts, coal seam CO2 storage, and seismic characterization of coalbed methane (CBM) reservoirs. The 2013 program in Pittsburgh featured an oral presentation on produced water and poster presentations covering topics from resource evaluation to stable isotopes in CBM reservoirs.

One goal of the EMD Coalbed Methane Committee is to monitor international CBM activities more closely. Sources of international production and reserves data are being examined and are important for characterizing expansion of the CBM industry in Australia and Asia. The chairmanship of the Coalbed Methane Committee remains open, and the search for a new chair continues.

Industry Activity, Production, and Reserves

The U.S. remains the world leader in CBM exploration, booked reserves, and production. Currently, there is commercial coalbed gas production or exploration in approximately 12 U.S. basins and several basins in Canada. However, activity has slowed substantially in response to low gas prices. The major producing areas are the Powder River, San Juan, Black Warrior, Central Appalachian, Raton, and Uinta basins. Other U.S. areas with significant exploration or production are the Cherokee, Arkoma, Illinois, Hanna, Gulf Coast, and Greater Green River basins. Development continues in all major U.S. basins, and the principal environmental issue confronting the industry is water disposal. Production operations are maturing, and the U.S. DOE has sponsored a series of studies on produced water management and CO2-enhanced coalbed methane recovery. Of major interest is a new pilot program that is being led by Virginia Tech in the Appalachian Basin of Virginia, which is scheduled to begin injection of up to 20,000 short tons (18,144 metric tonnes) of CO2 into multiple coal seams to determine the viability of enhanced recovery and geologic storage.

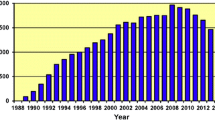

The U.S. Energy Information Administration (EIA) has released CBM production and reserve numbers through the end of 2010. CBM production in 2010 was 1,886 billion cubic feet (Bcf) (53.4 billion m3), decreasing by 1.5% from 2009 (Fig. 4; Table 1) (U.S. Energy Information Administration 2012c). Booked reserves decreased from 18,578 Bcf (526 billion m3) in 2009 to 17,508 Bcf (496 billion m3) in 2010 representing a decrease of 1,070 Bcf (30 billion m3) (5.7%) (Fig. 5; Table 2). CBM represented 8.5% of 2010 dry gas production and 5.7% of proved dry gas reserves in the U.S. Interestingly, CBM production is declining only slightly as a proportion of U.S. gas production but is declining significantly in terms of proved dry gas reserves. This decline is related to the booking of major shale gas reserves, which is significantly changing U.S. gas markets (Fig. 6).

Historic U.S. CBM production 1990–2010. Data from the U.S. Energy Information Administration (2012c). 1 Billion cubic feet (Bcf) = 28.3 million m3

Historic U.S. CBM reserve trends from 1990 to 2010. Data from U.S. Energy Information Administration (2012c). 1 Billion cubic feet (Bcf) = 28.3 million m3

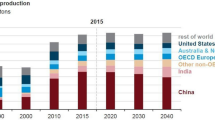

Sources of U.S. Natural gas production (trillion cubic feet) showing projected steady coalbed methane supply concurrent with major increase of shale gas supply. Note that shale gas production becomes significant by 2010, and is projected to dominate by 2040 (Source: U.S. Energy Information Administration, 2012b). 1 Trillion cubic feet (Tcf) = 28.3 billion m3

Most CBM activity in the eastern U.S. is focused on the Appalachian Basin of southwestern Virginia and the Black Warrior Basin of Alabama, with several companies actively developing joint CBM and coal-mine methane (CMM) projects. In southwestern Virginia, production has decreased substantially from 111 Bcf (3.1 billion m3) in 2009 to 97 Bcf (2.7 billion m3) in 2010 (Table 1). West Virginia production declined from 31 to 17 Bcf (0.9 to 0.5 billion m3) over the same time period. Pennsylvania production decreased from 16 to 3 Bcf. In Alabama, production decline was less pronounced, with 105 Bcf (2.97 billion m3) being produced in 2009 and 102 Bcf (2.89 billion m3) being produced in 2010.

The Midcontinent region consists of the Cherokee, Forest City, Arkoma, and Illinois Basins. Horizontal drilling has been an effective development strategy, although major increases of production in recent years are now being offset by slowed development. Kansas production decreased modestly from 43 Bcf (1.21 billion m3) in 2009 to 41 Bcf (1.16 billion m3) in 2010, whereas Oklahoma decreased from 55 Bcf (1.56 billion m3) in 2009 to 45 Bcf (1.27 billion m3) in 2010, continuing a steep decline trend that began in 2007. The principal issue affecting CBM development in the eastern and midcontinental U.S. is competition with shale gas, which has introduced significant price pressure. Although production operations persist, few wells are being drilled, and reserves are not being replaced.

Infill drilling of Fruitland CBM wells in the San Juan Basin (Colorado and New Mexico) decreased markedly in 2009 due to recession, but activity is starting to accelerate. Colorado and New Mexico continue to dominate CBM production and reserves (Tables 1, 2). Cumulative production for Colorado and New Mexico represents 50% of total U.S. CBM production. In 2010, CBM production in Colorado increased from 498 to 533 Bcf (14.1 to 15.1 billion m3), and production in New Mexico declined slightly from 432 to 402 Bcf (12.2 to 11.4 billion m3). Also, activity is rebounding in the Powder River Basin of Wyoming, and production increased in 2010 from 535 to 566 Bcf (15.1 to 16 billion m3), accounting for 30% of U.S. CBM production.

International activity has been on the rise, and operations in the Qinshui Basin of China remain active, thus proving the CBM potential of intensely fractured semi-anthracite and anthracite. As in the U.S., depressed natural gas prices are slowing Canadian development. Development is intensifying in the Bowen, Surat, and Sydney Basins of Australia, as well as the Karoo Basin of South Africa. CBM in eastern Australia is being produced from high-permeability coal seams that can contain large quantities of oil-prone organic matter, and the produced gas is being considered for export into Asian liquefied natural gas (LNG) markets. A number of LNG plants (up to 5 or 6) are being considered in Australia. Hence, companies are striving to book reserves to support the expenditure for LNG plant development as quickly as possible. Significant potential exists in the Gondwanan coal basins of India, and some fields have been developed.

Potential also exists in the coal basins of Europe and the Russian platform, and development in these areas is focusing mainly on CMM. Exploration programs have been initiated in recent years to explore for CBM in the structurally complex European coal basins of western Europe, including Germany. Russia continues to promote CBM exploration and development but defining a market for the gas and predicting gas prices are problematic for future development. However, the coal basins in Russia may contain the largest CBM resources in the world. Once a market for this gas is identified, then CBM exploration in Russia should increase significantly.

Gas Hydrate

Art H. Johnson Footnote 4

Japanese Gas Hydrate Production Test

On March 12, 2013 the Japanese Ministry of Economy, Trade and Industry announced the commencement of the first offshore gas hydrate production test. The test was conducted in the Nankai Area off the coasts of Atsumi and Shima peninsulas in water depths of approximately 1,000 m (3280.8 ft).

Production was initiated through depressurization of hydrate-bearing turbidite sands located 300 m (984.3 ft) beneath the seafloor. Sustained natural gas production was established with a drillstem test at a rate of 0.7 million cubic feet per day (MMcfd; 19.8 thousand m3/day). The test continued until March 18, 2013, at which point there was both a malfunction of the pump used for depressurization and a simultaneous increase in sand production. A total of 4 million cubic feet (113 thousand m3) of gas was recovered in total, an amount higher than had been predicted. Initial analysis of the test indicates that the dissociation front reached the monitoring wells located 20 m (65.6 ft) from the test well.

Abandonment of the site will be completed by August 31, 2013. The brief test was not designed to yield commercial production rates; however, the results will be used to implement the next phase of the MH21 program, which will include commercial development. That phase is scheduled for fiscal years 2016–2018.

The Nankai test was conducted with the deep sea drillship “Chikyu.” The produced gas was either vented or flared, depending on flow rates and weather conditions. In preparation for the production test, a part of the production well (AT1-P) and two temperature-monitoring boreholes (AT1-MC/MT1) were drilled in February and March, 2012. During drilling operations, intensive geophysical logging was conducted. In addition, a dedicated borehole in the same area was drilled to recover pressure cores. This was undertaken to obtain detailed data regarding the geology, geomechanics, geochemistry, microbiology, and petrophysics of the hydrate-bearing sediments.

United States Gas Hydrate Program

The U.S. DOE’s Methane Hydrate Program continues to pursue several important areas of gas hydrate research and characterization despite severe budget constraints. The selected projects are designed to increase the understanding of gas hydrates in the context of future energy supply and changing climates. U.S. Geological Survey (USGS) personnel continue their involvement in resource evaluation, including consultation with assessment programs being conducted outside of the U.S.

Ignik Sikumi Gas Hydrate Exchange Trial

The results of the Ignik Sikumi Gas Hydrate Exchange Trial were released in late 2012, including a presentation at the Arctic Technology Conference. The test was carried out from February 15 to April 10, 2012 in Prudhoe Bay Field, Alaska. The project team injected a mixture of carbon dioxide (CO2) and nitrogen into hydrate-bearing sand, and demonstrated that this mixture could promote the production of natural gas. This test was the first ever field trial of a methane hydrate production methodology whereby CO2 was exchanged in situ with the methane molecules resulting in methane gas and CO2 hydrate.

After measurement and compositional analysis, gas from the Ignik Sikumi test was flared. During the test, 210 thousand cubic feet (5.9 thousand m3) of a N2/CO2 gas mixture was pumped into the methane hydrate-bearing formation. The injected gas was 23% N2 and 77% CO2. The recovered gas was 2% CO2, 16% N2, and 82% CH4, demonstrating that significant exchange had taken place within the reservoir of carbon dioxide for methane. Although not a technology for near-term production of methane from hydrate deposits, the test provides a path for carbon sequestration in the future. All data developed in the test were released in March, 2013. The Prudhoe Bay production test, delayed by a number of issues, remains under review by the partners. The Gulf of Mexico Joint Industry Project (JIP) has concluded. The pressure core system and laboratory equipment developed for the JIP was used for the Japanese program.

Gas Hydrate in India

A planned LWD (logging-while-drilling) drilling program is under review for offshore India in 2014, with site selection finalized in April, 2013. This program is focused on reservoir delineation and resource assessment, and is targeting hydrate-bearing sands. Two legs are planned, with the first dedicated to LWD logging. The previous gas hydrate field program (2006) targeted seismic BSRs (bottom simulating reflectors) and recovered significant amounts of gas hydrate, but in fine-grained sediments having low permeability.

Gas Hydrate in China

China commenced exploratory gas hydrate drilling and coring in Spring, 2013. Results and other details of the program have not yet been released.

Gas Hydrate in South Korea

After two successful drilling programs (2006 and 2010), South Korea is planning a gas hydrate production test for 2014.

Tight-Gas Sands

Fran Hein Footnote 5 and Dean Rokosh Footnote 6

Tight gas is in low-permeability (mD to μD)/low-porosity reservoirs, and gas cannot be extracted economically without expending much technological effort (i.e., fracturing and/or acidizing) (King 2012). Most tight-gas sand production/exploration activities take place in North America, China, Australia, Poland, and the Ukraine (Jenkins 2010, 2011; Hein and Jenkins 2011; and Hart’s Unconventional Gas Center, www.ugcenter.com). The following play descriptions show the variability of tight-gas sands.

The United States

-

1.

The Dew–Mimms Creek Field, East Texas Basin (Fig. 7), hosted by the Bossier Formation, yields ~1% of East Texas gas production. During early Bossier time, small alluvial fan-deltas developed along NW ancestral Gulf of Mexico, resulting in highly lenticular reservoirs, with little connectivity. Commingled production from multiple sandstones in each wellbore facilitates recovery from marginal sandstones that would otherwise not be produced. This has resulted in field consolidations, with commingling of the Cotton Valley Sand, the Bossier Sand, and the deeper Cotton Valley limestone. Estimated ultimate recoveries (EURs) per well range from 28.3 to 113.2 million m3 (1,000–3,998 million cubic feet, MMcf).

Figure 7 Basins in North America with long-term tight-gas sandstone production (red) and more prospective areas (yellow). Tight-gas sandstone plays discussed are in the East Texas, Green River, Piceance basins of the U.S.A. and the Western Canada Sedimentary Basin (WCSB) of Alberta, Canada. Modified from Meckel and Thomasson (2008)

-

2.

The Jonah Field, Green River Basin (Fig. 7), has large net-pay thickness of low-permeability sandstones over a very large area, with conventional trapping mechanisms. Primary production is from basin-centered accumulations (Fig. 8) of the fluvial Lance Formation. The field has converging faults along flanks of a major anticline, with updip trapping against boundary faults. Tight-gas production is from a zone where permeability is enhanced due to faulting. In the Jonah field there are currently 1,876 gas wells, 73 dry holes (or suspended), and 112 permitted locations or actively/completing wells. Cumulative production reported to date for 1,818 wells are: 3,860 billion cubic feet (Bcf; 109 billion m3) gas, 36.4 million barrels (MMBBLs; 5.8 million m3) oil, 39.6 MMBBLs (5.8 million m3) water, and water to gas ratio (WGR) 10.3 BBLs/MMcf.

Figure 8 Schematic diagram of the different types of onshore natural gas plays. Conventional resources are buoyancy-driven hydrocarbon accumulations, with secondary migration and structural and/or stratigraphic closures. Unconventional, continuous gas accumulations, in basin centers and transition zones, are controlled by expulsion-driven secondary migration and capillary seal (from U.S. Departments of the Interior, Agriculture, and Energy 2008, p. 46)

-

3.

The Mamm Creek Field, Piceance Basin (Fig. 7), ~ 20% of gas production in the Piceance Basin (Fig. 7), has most of its production from tight basin-centered accumulations (Fig. 8) of the fluvial Williams Fork Formation. The complexity of this fluvial-marginal marine system resulted in very heterogeneous connectivity between reservoirs. In the Mamm Creek field there are currently 2,649 gas wells, 42 dry or suspended, and 463 permitted locations or actively/completing wells. Cumulative production reported to date for 3,780 wells are: 1,222 Bcf (34.6 billion m3) gas, 10.5 MMBBLs (1.7 million m3) oil, 69.9 MMBBLs (11.1 million m3) water, and WGR 57.2 BBLs/MMcf.

-

4.

Wamsutter Development Area, greater Green River Basin (Fig. 7) has ~1.42 trillion m3 (50.1 trillion cf) of original gas in place (OGIP). Unconventional reservoirs are in the Almond Formation. The main producer is the Upper Almond—an amalgamated shoreface deposit, with tidal channels. The greater Wamsutter area consists of >15 federal units and companies define the area differently. Taking the deep basin gas as “Wamsutter,” there are currently >4,000 wells in the area, consisting of >3,600 gas wells, ~100 dry or suspended, and 365 permitted locations or actively/completing wells. Cumulative production reported to date for 3,730 wells are: 3,385 Bcf (95.8 billion m3) gas, 52.7 MMBBLs (8.4 million m3) oil, 53.6 MMBBLs (8.5 million m3) water, and WGR 15.8 BBLs/MMcf.

Canada

In Alberta (Fig. 7) recent advances in drilling/completion technologies have opened up unconventional, low-permeability zones for economic production. At present, most of the wells being drilled in Alberta are horizontal (Fig. 9), focused on the Cardium and Montney formations, with <10% on other tight-gas plays (i.e., Nikanassin, Fig. 10).

Drilling statistics related to total rig count, number of vertical and horizontal wells completed on a quarterly basis from 2009 to 2012 in the Alberta portion of the Western Canada Sedimentary Basin (Alberta Energy Regulator 2013, http://www.aer.ca/)

Drilling statistics for non-confidential wells related to total rig count, for the Montney, Cardium, and Nikanassin, completed on a quarterly basis from 2009 to 2012 in the Alberta portion of the Western Canada Sedimentary Basin (Alberta Energy Regulator 2013, http://www.aer.ca/)

-

5.

The Cardium Formation, Alberta, Canada (Fig. 7), with >10 billion barrels (1.6 billion m3) of oil-in-place, has had only ~17% of its hydrocarbons recovered using conventional technologies. Cardium conventional reservoirs are incised estuarine valley-fills, progradational shorefaces, or transgressive sheets. Surrounding these conventional reservoirs are “halos” of the largely tight (permeabilities < 0.5 mD), thin-bedded, mixed lithologies of very fine sandstone to shale. This example is one in which there is a clear continuum of fluids, reservoir, and development strategies between the older (but now renewed) conventional fields, and the emerging fringe tight-gas and liquids-rich gas accumulations in the distal edges of the conventional fields.

-

6.

The Nikanassin Formation, British Columbia and Alberta, Canada (Fig. 7) has thinner (5–15 m) fluvial channel and thicker (>50–500 m; >164–1,640 ft) incised-valley-fill reservoir sandstones, with porosities of 6–10%, and permeabilities of 0.01–1 μD. Reservoir sandstones are quartz-rich, highly cemented, brittle, and, where productive, extensively fractured. The Nikanassin is a structural play where thrust-belt tectonics has fractured the brittle sandstones to enhance porosity/permeability. Gas was generated in the associated coals with regional conventional trapping. Nikanassin development fairways are along the leading edges of the NW–SE—trending thrust faults. Early returns show production up to 3.2 Bcf (90,000,000 m3) per well (Oil and Gas Inquirer 2012).

-

7.

The Montney Formation, British Columbia and Alberta, Canada (Fig. 7), commonly called a “shale gas,” is a thin-bedded succession of mixed-bed lithologies, including siltstone and very fine sandstone that overlies organic-rich shale. Since 2003, the upper and lower Montney tight-gas sandstones/siltstones have been developed using multi-stage hydraulically fractured horizontal wells. The upper and lower Montney is stacked distal shoreface/delta fringe, shelf sandstone/siltstone, and turbidites with gross thicknesses to 156 m (512 ft) in the lower Montney of British Columbia and about 250 m thick in the upper Montney of Alberta; porosities typically <3–10%, with <mD permeabilities. Most recent drilling in the Montney has focused on liquid-rich gas or oil-prone areas.

China

-

8.

The Shuixigou Group, Hami Basin, China (Fig. 11) consists of three stacked successions of tight-gas sandstones from lacustrine-braided delta-front settings, with thick associated coals (Feng et al. 2011). Reservoirs have porosity of 4–8.4% and permeability of 0.077–3.61 mD; individual reservoirs range from 18 to 55 m (59 to 180 ft) net thickness, with a gross thickness of 105–280 m (344–919 ft). Gas traps are combined stratigraphic-structural traps. The most favorable production is from faulted anticlines with high densities of fractures and thick (20–30 m; 65–98 ft) top coal measures. In China, other tight-gas sandstones, with proved reserves >3,000 billion m3 (105.9 trillion cf), are widely distributed and are undergoing extensive exploration and development (Fig. 11; Table 3).

Figure 11 Table 3 Characteristics of main tight-gas sandstone reservoirs in China (Yukai et al. 2011)

There is a “blending” of the conventional versus unconventional resources in these technology-driven plays. The more “distal” unconventional tight-gas sands (“hybrid shales”) have high sandy silt/siltstone content, relatively low clay content, but with self-sourced organics. These include halos around conventional fields and basin-centered accumulations. As technology continues to evolve there will be a continuum from fringe conventional plays to tight-gas sandstones/siltstones, and the present distinctions between these commodities will become less clear.

Gas Shale and Liquids

Gas Shale and Liquids Committee of the Energy Mineral Division

Worldwide, organic-rich “shales,”Footnote 7 whether siliciclastic- or carbonate-dominated, are increasingly targets for exploration and production of oil, condensate, and natural gas. These organic-rich rocks were always considered an important component of petroleum systems insofar as they were the organic-rich source rocks from which petroleum was generated. However, in addition to being the source rocks for conventional reservoirs, sufficient hydrocarbons remained locked in the organic-rich mudrocks such that they are now the focus of exploration and production as “unconventional” reservoirs. Although there is an international interest in exploiting hydrocarbons from these unconventional reservoirs, with active exploration projects on most continents (U.S. Energy Information Administration 2013d), much of the successful exploitations from mudrocks continue to be in North America, particularly in the U.S. but increasingly so in Canada (Fig. 12). Hydrocarbons are produced from unconventional shale reservoirs that range in age from Ordovician to Tertiary.

Locations of shale plays in North America. (U.S. Energy Information Administration, http://www.eia.gov/pub/oil_gas/natural_gas/analysis_publications/maps/maps.htm#shaleplay, accessed July 17, 2013)

Interestingly, natural gas has been produced from shales in the U.S. for more than 200 years. The first documented production of natural gas from shales was that from Devonian rocks in New York in 1821 (Hill et al. 2008), and the gas was used to light street lamps in at least one town (Roen 1993). Although this early production proved that gas could be successfully exploited from shales, shale gas production remained low and even in 1990, gas from shales accounted for less than 1% of all the natural gas produced in the U.S. (based on production figures from U.S. Energy Information Administration 2013a). Nevertheless, by 2010, approximately 23% of gas produced in the U.S. was from shales (U.S. Energy Information Administration 2013a) and current projections are that by 2040, about 50% of domestic gas production will be from shales (Fig. 6).

Examples of how shales have contributed to overall increases in production in some states can be seen in Figure 13. For example, in Texas, exploitation from the Mississippian Barnett Shale resulted in the statewide increase in gas production starting in 2004, although Barnett production started more than 10 years earlier. In addition, the statewide increase observed in 2011 for Texas is due to exploitation from the Cretaceous Eagle Ford Formation as well as the Jurassic Haynesville Shale (U.S. Energy Information Administration 2012d). The Haynesville is also responsible for the statewide increase in gas production in Louisiana, whereas production from the Mississippian Fayetteville Shale (Fig. 13) resulted in the statewide increase for Arkansas. The Devonian Marcellus Shale is responsible for increase in gas production in Pennsylvania and West Virginia. Shale gas development, although in its infancy, is also underway from the Devonian Horn River Formation and the Triassic Montney Formation in western Canada (Jock McCracken, Egret Consulting, written communication, 2013).

Shale gas production for various shales in the U.S. from 2000 to the present. ND North Dakota, TX Texas, PA Pennsylvania, WV West Virginia, LA Louisiana, OK Oklahoma, AR Arkansas, MI Michigan, IN Indiana, OH Ohio. (U.S. Energy Information Administration, http://www.eia.gov/energy_in_brief/article/about_shale_gas.cfm, accessed 7/17/2013.) 1 billion cubic feet = 28.3 million m3

Production of oil from mudrocks—commonly referred to as “tight oil”—is also occurring in the U.S. and the increase in domestic exploitation has contributed to the observed reversal in oil production after a general decline over the last 20 years (U.S. Energy Information Administration 2012d). The increase in production of tight oil is most apparent in North Dakota, due to exploitation of the Late Devonian-Early Mississippian Bakken Formation; oil and condensate production from the Eagle Ford Formation in Texas (Fig. 14) also has contributed significantly to an overall increase in domestic production in the U.S. The Bakken Formation in Manitoba and Saskatchewan is also producing oil (Jock McCracken, Egret Consulting, written communication, 2013). Oil produced from the Late Devonian-Early Mississippian Woodford Shale has helped to keep production level from Oklahoma over the past decade (Fig. 14).

Shale oil production for various states in the United States for the time period 2000–2011. The increase in production in Texas in 2011 is due to exploitation of the Eagle Ford Formation. The increase in oil production in North Dakota since 2005 is largely due to exploitation of the Bakken Formation. (U.S. Energy Information Administration, http://www.eia.gov/todayinenergy/detail.cfm?id=5390#, accessed July 17, 2013.) 1 Barrel (oil) = 0.159 m3

Although there is active exploration elsewhere in the world for unconventional gas and oil, successful exploitation is limited. Overall, Europe remains relatively unexplored as compared to North America, with Paleozoic and Mesozoic organic-rich rocks as potential exploration targets. Nevertheless, recent decisions to scale back exploration efforts have made it difficult to evaluate what the future holds for European shale gas and oil exploitation (Ken Chew, Independent Analyst, written communication, 2013). As with Europe, many parts of Asia remain relatively unexplored for unconventional shale gas and oil, but interest in these plays is certainly high. Australia, China, New Zealand, India, and Japan have all experienced interest in exploration for shale gas and oil (Shu Jiang, University of Utah, Energy Geosciences Institute, and Jeff Aldridge, Dart Energy, Ltd., Singapore, written communication, 2013). Mesozoic organic-rich rocks in South America also have potential as unconventional shale gas and oil reservoirs, but exploration and exploitation of these reservoirs is not as mature as that in North America.

The Shale Gas and Liquids Committee of the EMD of the AAPG continues to monitor exploration activities related to shale gas and oil that are occurring throughout the World. Two reports a year are produced by members of the committee, with emphasis on individual shales in North America, but sections of these reports are also devoted to exploration activities in Europe, China, and elsewhere in Asia. The complete set of committee reports is available to AAPG members at http://emd.aapg.org/members_only/annual2011/index.cfm. As interest in unconventional shale resources continues to increase, it is expected that the committee reports will expand to incorporate information to keep AAPG members abreast of the ever-changing environment of unconventional shale gas and oil.

Geothermal

Richard J. Erdlac, Jr. Footnote 8

Introduction

The focus of this review presents highlights of two significant geothermal scientific conferences that were held in 2012 and 2013. The two conferences are the Geothermal Resources Council Annual Meeting, held in Reno, Nevada, September 30 to October 3, 2012, and the Southern Methodist University (SMU) Geothermal Conference, held March 13–14, 2013, in Dallas, Texas. However, prior to this review, a brief discussion of U.S. geothermal is appropriate.

Geothermal power production is the only renewable energy resource that shares many of the same geoscience, reservoir analysis, drilling, completion, and other qualities found in the production of oil and gas. In the case of geothermal, the goal is to produce hot water…the hotter the better…for the conversion of heat to electrical power. The Geothermal Energy Association (http://www.geo-energy.org/) reports that most of the geothermal energy produced in the United States (3,187 MW capacity) has been in the western states, with California and Nevada leading the nation with 2,615 and 469 MW, respectively. Other states such as Hawaii (43 MW), Utah (42 MW), Idaho (16 MW), Alaska (0.73 MW), Oregon (0.28 MW), and Wyoming (0.25 MW) produce the remaining amount of geothermal electric power.

Historically, most early geothermal power generation in the U.S. came from dry steam produced from wells drilled in areas of high heat flow and at relatively shallow depths (Fig. 15). Dry steam power plants account for around 1585 MW (nearly 50%) of installed geothermal capacity, all of which are located in California. This type of production is from high-temperature resources where live steam is found in the subsurface. But it is also limited in aerial distribution, requiring specific geologic criteria to be met for this type of resource. Hence, dry steam production became flat by 1985. Fortunately, new technology was developed to capture additional heat through flash-steam processes, allowing somewhat lower temperature water under pressure to “flash” to steam during a pressure reduction process. The flash-steam process generated an additional 900 MW of power, mostly from California, between 1985 and 1990, after which further production through 2012 occurred at a much slower rate. The development of binary turbine technology has opened the industry even more, allowing much lower temperature fluids to be used for power generation along with a move of the geographic footprint beyond California, especially in the last decade. It is the binary technology that has allowed various demonstration projects for heat capture from produced hot water in conjunction with oil and gas production that has the potential to drastically expand geothermal power production into sedimentary basins in the U.S. and worldwide.

Total U.S. geothermal installed capacity by technology type from 1975 to 2012. Output is in megawatts (MW) of power. Source from Geothermal Energy Association Annual Geothermal Power Production and Development Report: April 2012 (http://www.geo-energy.org/)

Numerous projects are underway regarding geothermal production in areas generally perceived as oil and gas regimes, and are part of this discussion below. Additionally, a major project at data gathering throughout the country is underway through the various State geologic surveys (discussed below) that will make larger amounts of data…especially from oil and gas well temperature data…available for subsurface map generation. Some of these data have been used to generate an interactive map hosted by Google Earth that allows for a very regional picture of potential temperatures existing at various depths in the subsurface (Fig. 16). The data can be queried for different depth ranges of temperature, surface heat flow, along with other parameters. For Figure 16 a depth of 5.5 km was chosen due to this depth being in the range of deeper gas fields in many parts of the country. The yellow dots located in each state represent the potential for geothermal energy production within each state. Clicking on any state initiates a drop-down window that shows the production potential within that state. Figure 17 is an example from Texas. The depth range for energy recovery is 3–7 km. Temperatures are listed for the various depths, along with the estimates of the amount of recovery in megawatts of power. Low, median, and high potential recovery factors are listed and are calculated over a 30-year project life.

Example of geothermal potential within Texas for a 3–7-km-depth range. Source: www.google.org/egs

The importance of these data, along with the following discussion, is to demonstrate that geothermal energy is no longer confined to areas worldwide where active or recently active volcanic activity is dominant. Geologically quiescent areas such as sedimentary basins appear to hold a vast heat energy source that has yet to be fully explored. Because of the drilling and data available through the oil and gas industry, this industry is sitting on a huge untapped potential for energy production that is renewable, has good upsider public relations potential, and can provide jobs for geoscientists, petroleum engineers, drillers, and many other support services for decades to centuries to come.

Geothermal Resources Council Annual Meeting—September 30–October 3, 2012

A total of 214 presentations were made at the Geothermal Resources Council annual meeting in Reno, Nevada. At least 20 articles related to geothermal energy in sedimentary environments were identified through the table of contents by title and recognition of various authors involved with this type of geothermal energy production. When presented, the papers are arranged within session topics. Although there may be additional presentations that fall within low-temperature geothermal production or geothermal energy from sedimentary rock, these were the presentations that stood out from the others. A brief description of these presentations is presented here.

Case Studies

While previous geothermal studies involving Mississippi have focused in the southern part of the state and the Mississippi River flood plain, a study presented by Lindsey (2012) has looked at the eastern, north-central Mississippi area in Oktibbeha County. Using well data from the Mississippi Oil and Gas Board website, wells with online log images were downloaded with the bottom-hole temperature (BHT) data recorded for the county. During the data analysis stage, temperature correction values were applied to the data that improved the expected temperature found at depth, thereby improving upon past mapping of the region and increasing the likelihood that geothermal energy could be produced over a larger area than previously thought. By contrast, the Denbury Resources well that demonstrated coproduced geothermal power production using the ElectraTherm Green Machine was farther south in the Summerland Field of Covington and Jones Counties.

Jumping to Germany, Lentsch et al. (2012) presented a discussion on overcoming drilling challenges with rotary steerable systems in deep geothermal wells in the Molasse Basin of southern Germany. These wells have been drilled to between 8,200 and 14,700 ft (2499 and 4,480 m), with horizontal displacement of up to 9,800 ft (2,987 m). The wells are drilled into karstified dolomites and limestones of the upper Jurassic that form the most productive thermal aquifer of the basin. Depending on temperature and production rates, the thermal energy is used for power generation coupled with heating, or for heating alone in the case of lower temperatures. Temperatures between 176 and 284°F (80 and 140°C) and water production rates over 44,000 BBLs per day (6,995 m3) are common.

Another presentation by Borozdina et al. (2012) focused on thermochemical modeling of cooled brine injection into low-enthalpy sedimentary reservoirs for district heating projects. The concept discussed is that of a doublet well system—an injector—producer combination—and the chemistry consequences that can result and which must be managed. Two case studies were modeled for this study, the Dogger limestones of the Paris Basin and the Rijswijk sandstones in the southern Netherlands. The practical outcomes of the studies were that although porosity changes caused by temperature-induced precipitation or dissolution of mineral species (carbonate, anhydrite, and silicates) do occur, their magnitude neither alter porosity, permeability, nor subsequent reservoir performance significantly.

Coproduction

Not to be outdone by coproduced geothermal demonstration projects in the U.S., the LB reservoir in the Huabei oil field has been studied and used in China for geothermal power production. Xin et al. (2012) reported that pilot tests were conducted in oil wells with produced water temperatures in the 230–250°F (110–121°C) range. The field is 93 miles (150 km) south of Beijing with an oil reservoir area of around 11,000 acres (4,452 ha), with the oil layer located in Mesoproterozoic Jixian System Dolomite at a depth of over 10,500 ft (3,200 m). Rock porosity was reported at 6.0% with permeability around 158 mD. There is a dense micro-fracture network at 1–2 fractures/cm2. The rock is dominated by small vugs and the fractures are the main channel for fluid flow. Prior to this project, there were 6 producing wells out of a field total of 27, with a 97.8% water cut. The project appeared to be an attempt to not only increase the amount of oil being produced but also, with the increase in hot water production, capture the heat and generate electrical power. To test this concept, a 400-kW screw expander manufactured by Jiujiang Power was used with a water flow of over 18,000 BBls (2,862 m2) per day from 8 producing wells. Gross output was 360 kW with net at 310 kW, for a total energy generated of 310,000 kWh of electricity over a several months period. When fully operational, the power plant can generate 2,700,000 kWh of electricity per year, with an increase in oil production.

Returning to the U.S., Augustine and Falkenstern (2012) of the National Renewable Energy Laboratory (NREL) provided an estimate of the near-term electricity generation potential from coproduced water from active oil and gas wells. Previous studies have estimated that 15–25 billion barrels (2.4–4 billion m3) of water are coproduced annually. These studies suggested that total electricity generation potential could be in the tens of gigawatts. Augustine and Falkenstern (2012) focused on the near-term market potential of the coproduced resource by developing a 2.5 million well database from information derived from 24 state oil and gas commissions, of which 500,000 were identified as active wells. Cut-off temperature for electricity production was chosen to be 176°F (80°C). As an electronic database for well temperatures was not readily available, the authors assumed a BHT from comparing the location and depth of the wells to previous U.S.-wide geothermal and temperature maps derived from the SMU Geothermal Laboratory and the older AAPG BHT database. With these assumptions in place, the authors concluded that a near-term electricity production potential of 300 MW existed. Various practical operational factors such as minimum power plant size, available cooling water or transmission, project economics, etc., could further limit the number of sites that could be developed. Interestingly, roughly two-thirds of the near-term potential was found to exist in Texas.

Focusing into specific basin level geothermal, Crowell et al. (2012) investigated various BHT correction methods within the Denver Basin of Colorado and Nebraska. When oil and gas wells are drilled the act of drilling alters the temperature profile of a well to some generally unknown distance into the surrounding rock. Since most wells are not allowed to sit to allow for a return to temperature equilibrium between the well bore and the formation, correction factors are the attempt to calculate what the actual BHT in the well would be if equilibrium was reached. Crowell et al. (2012) investigated three existing schemes: the Forster, the Harrison, and the Kehle corrections. Each of these correction equations were generated with a specific region or dataset in mind, making the application of these corrections to other basins inappropriate, since different lithologies and thermal histories will be present in different areas. Several wells that were in the Nebraska part of the basin were in temperature equilibrium, and these wells were used to generate a correction factor specific to the Denver Basin.

Moving into Wyoming, Nordquist and Johnson (2012) presented a discussion of data collected on a 3.5-year operation of an Ormat 250 kW power generation plant operating on the RMOTC facility at the Teapot Dome oil field north of Casper. During this time the power plant has produced over 2,120,000 kWh (enough for 120 homes each year) and utilized over 11,140,000 barrels (1,771,118 m3) of water, at a temperature between 195 and 210°F (91 and 99°C). Production is from the Tensleep Battery that has up to 60,000 BBLs (9,539 m3) water per day available from multiple wells. This project was started as a demonstration to determine the feasibility of coproduced geothermal energy and has been successful in showing the potential for future development. Further information can be found at www.rmotc.doe.gov.

Knowing and determining the reliability of data is important when using that data to make decisions regarding energy production, be it geothermal or oil and gas operations. Various standards of quality codes have been used since the 1970s for conventional geothermal analysis that include equilibrium temperature logs, thermal conductivity measurements, and appropriate data corrections. However, the increased use of BHT data from oil and gas wells has required a re-evaluation, and new standards that cover this preponderance of new data are being made available through the National Geothermal Data System. Richards et al. (2012) from SMU have proposed a revised reliability code that incorporated the past systems with increased parameter definition to cover both the traditional and BHT sites. A method encompassing weighted values for each primary parameter used to determine heat flow is linked in a series to rank the site reliability. Thus, heat flows from different data types and calculation methods can be compared to determine data reliability.

Enhanced Geothermal Systems (EGS)

EGS represents an approach whereby a geothermal potential exists at a location but that the deliverable water/heat from that formation will occur only if the formation or rock units are enhanced through some induced process—i.e., fracking. In the first of these two papers, Bruno et al. (2012) from Terralog, USA, stated that the recent advance in drilling, completion, and production technology within the oil and gas industry has the potential to be applied in the geothermal industry to unlock geothermal resources in areas where geothermal has not been produced. Working in conjunction with the University of California, Irvine, this group is investigating advanced design concepts for paired horizontal well recirculation systems that would be optimally configured for geothermal energy recovery in permeable sedimentary and crystalline formations. In this example, horizontal well pairs would exist as an injector and producer to establish a relatively closed-loop recirculation system, thus allowing more efficient and controlled flow and heat transfer, and reduced wastewater management requirements.

Another paper of this session by Allis et al. (2012) looked at stratigraphic reservoirs in the Great Basin of the western U.S. They indicated that deep basins in this high heat flow region of the western U.S. may have stratigraphic reservoirs deeper than 9,800 ft (2987 m) with temperatures over 300°F (149°C). These reservoirs are sub-horizontal and may be larger in area and geothermal power potential than the traditional fault-hosted hydrothermal reservoirs that have been previously developed. They looked in some detail at two such basins, the Black Rock Desert in Utah and the north Steptoe Valley in Nevada, identifying high temperatures and sufficient signs of stratigraphic permeability to warrant more intensive investigation of their geothermal power potential.

Exploration

Exploration is the first step in any subsurface energy (or mineral) production; the resource needs to be located. Allison et al. (2012), at the Arizona Geological Survey, have been the portal of data collection for the National Geothermal Data System (GDS) which was begun with financial support from the U.S. DOE for the purpose of fostering geothermal energy exploration and development. The data are being provided by all 50 states (www.stategeothermaldata.org), federal agencies, national labs, and academic centers. An increasing set of over 30 geoscience data content models is in use or under development to define standardized interchange formats for aqueous chemistry, borehole temperature data, drill stem tests (DSTs), seismic event hypocenter, geologic unit features, well header features, heat flow/temperature gradients, and permeability to name just a few of the data assets being made available. As of May 2012 there were nearly 37,000 records registered in the system catalog, and 550,075 data resources online, along with hundreds of Web services to deliver integrated data to the desktop from free downloading or online use. The GDS is under simultaneous design, population, and deployment with completion of the initial phases due mid-to-late 2013.

Other groups actively involved in establishing this database are the DOE-Energy Efficiency and Renewable Energy (EERE) Geothermal Technologies Program, Boise State University, and the National Renewable Energy Laboratory (NREL). Anderson et al. (2012) presented information on the basic structure of the National Geothermal Data System (NGDS) as envisioned by the DOE. They discussed the planned functionality of the site for data retrieval, usage, and submission of information. DOE foresees a NGDS that will allow users to search, analyze, and download high-quality geothermal datasets and relevant geothermal information. Once the system is fully operational, the future of the NGDS lies in basic activities of data capture, data curation, and data analysis. An example of data analytical integration would be the use of an ESRI ArcGIS application to pull in Google temperature and depth maps as well as SMU 2004 heatflow maps. The success of the program depends upon geothermal scientists and data scientists working to answer key questions pertinent to putting clean, base-load geothermal energy online.

While the U.S. is actively placing geothermal-related data in a format for anyone to use, Canada is also moving forward in ways for developing its geothermal resources. Richter et al. (2012) provided an update on development within Canada involving resource potential, geothermal projects currently being developed, and a description of the current geothermal energy market and its players, along with the activities of the Canadian Geothermal Energy Association (CanGEA) that works to foster geothermal development in Canada. Various studies have indicated that a significant resource potential exists, but that the market for geothermal power and direct use of heat has remained stagnant. CanGEA has been working to create a favorable legal framework and support scheme on both the federal and provincial/territorial level. Additionally, CanGEA is developing a National Geothermal Database, provincial/territorial geothermal favorability maps, commencing work on a Geothermal Power and Direct Use of Heat Technology Roadmap and Implementation Framework, and continuing its efforts to bring geothermal to the oil and gas sector of Canada.

Returning to the U.S., Gosnold et al. (2012) have been investigating the thermostratigraphy of the Williston Basin, important not only for geothermal energy but also for better understanding the history of oil and gas generation. They developed an approach for determining temperatures of strata in a sedimentary basin using heat flow, formation lithology, thickness, and thermal conductivity of rock. They calibrated the method on five sites in the basin where temperature versus depth profiles allowed an iterative analysis of temperature gradient, thermal conductivity, and heat flow. Comparison of the temperature projections to BHT provided insight on determining a reliable correction for BHT data. Large-scale application of the method using stacked structure contours can provide a complete and accurate assessment of geothermal resources in a basin.

Geophysics

Reflection seismic data have generally not been used extensively in the geothermal industry while magnetic surveys have been more important in industry development. Ardakani and Schmitt (2012) presented a discussion on the integration of both survey types for geothermal exploration in northeast Alberta, Canada. The “Athabasca region” holds a significant amount of Alberta’s bitumen resources contained in both oil sands and carbonates. The area has not been developed due to its relative isolation from existing infrastructure and uncertainties associated with in situ production from the carbonates. More recent interest in the region has opened possibilities for either EGS or conventional geothermal system development. Over 50 2D seismic lines and high-resolution aeromagnetic data, along with well log data from 511 wells, were obtained for integration and interpretation in construction of a regional geological/geophysical model for this area of relatively thin layers of sediments overlying the Precambrian metamorphic rocks of the Canadian Shield. Motivation for the study is the need to find sustainable and lower greenhouse gas emission solution for production of bitumen from these oil sands, using geothermal heat as part of the production process.

Regulatory Environmental Issues

Energy and environmental analyses have been important in working to develop a robust set of geothermal technologies that meet future demand. Previous work summarized what is currently known about the life cycle freshwater requirements of hydrothermal and EGS-generating systems. Clark and Harto (2012) of Argonne National Laboratory presented an assessment of the use of freshwater in low-temperature geopressured geothermal power (GPP) generation systems as part of a larger effort to compare the life cycle impacts of geothermal electricity generation with other power generation technologies. Argonne carried out this life cycle analysis (LCA) to quantify energy, water, and environmental impacts of GPP plants to understand the potential environmental impacts of future geothermal industry growth. The LCA boundaries include all on-site activities for the construction and operation of a geothermal facility over a 30-year operational lifetime. The LCA focused on a GPP scenario that produced 3.6 MW of electric power from the geothermal contribution and 17.3 MW of thermal power from the natural gas contribution. Parameters used were based on industry experts and well field characteristics at Pleasant Bayou (Texas) and other geopressured geothermal test wells. Clark and Harto (2012) found that on a per-well basis and a per-kWh lifetime energy output basis, geopressured geothermal systems appear to consume less water than other geothermal technologies. Overall water requirements across the lifetime are low because maintaining reservoir pressure is not a long-term goal of geopressured systems. The spent geofluid is typically sent to a disposal well, also the opportunities for reuse of the geofluid could be explored.

Turning from freshwater usage in geothermal production, Morgan (2012) presented information on geothermal regulations in Colorado, with land ownership being a key issue. Colorado geothermal resources are separately classified as water on private land and as mineral on state and federally administered lands. Additionally, where classified as mineral, only the heat is classified as mineral, regardless of the land administration. Any water used to extract the heat is administered by the Colorado State Engineer through the Division of Water Resources. Rules and regulation for permitting geothermal exploration and development are better understood if considered separately for private, state-administered, and federally administered lands. Many geothermal resources cover more than one of these types of land, but the permitting processes are not synchronized. Sovereign Native American lands were not included in his discussion as they represent a special category of land. As a result, multiple agencies may be involved at any given time with geothermal activities, with each agency or group operating on different time schedules.

Reservoir Management

Every geologist knows that geothermal energy is a vast resource, based solely on the makeup of our planet. The difficulty is in retrieving it for use and support of our technical infrastructure. Much of the geothermal production has historically occurred in the western states, with EGS technology opening areas where low-temperature geothermal reservoirs can be used for various purposes. Bedre and Anderson (2012) from West Virginia University presented a paper discussing sensitivity analysis of low-T reservoirs and the direct use of geothermal energy. While they indicated that the eastern U.S. has lower temperature gradients than many of the western states, West Virginia has a higher gradient compared to other eastern states. Of course, knowledge of this fact has been the direct result of much greater drilling in places such as the Appalachian Basin for oil and reservoirs. For example, these data have resulted in identifying a hot spot in the eastern part of West Virginia where temperatures reach 300°F (149°C) at a depth of around 14,700–16,400 ft (4,481–4,999 m). Bedre and Anderson (2012) performed a sensitivity analysis of a reservoir at this temperature at a depth of 16,400 ft (4,999 m), using seven natural and human controlled parameters within a geothermal reservoir: reservoir temperature, injection fluid temperature, injection flow rate, porosity, rock thermal conductivity, water loss (%), and well spacing. A 30-year timeframe of operation was used to run the reservoir simulation. Their results indicated that reservoir temperature was the most important parameter affecting production. Variations in porosity and rock thermal conductivity did not affect the reservoir performance significantly. Other factors had varying levels of impact, with reservoir temperature or injection flow rate having the greatest impact.

Resource Assessment

There has been a renewed interest in recovering the geothermal energy stored in sedimentary basins for electricity production. With exploration for oil and gas resources and well logs, temperatures at depth, and reservoir properties such as depth to basement and formation thickness are better known than in many conventional geothermal areas. The availability of these data reduces exploration risk and allows development of exploration models for each basin. Porro et al. (2012) of NREL presented estimates in the magnitude of recoverable geothermal energy from 15 major U.S. sedimentary basins and ranked these basins relative to their potential. Total available thermal resource per basin was estimated using the volumetric heat-in-place method, and a qualitative recovery factor was determined for each basin based on data on flow volume, hydrothermal recharge, and vertical and horizontal permeability. A more in-depth study is necessary to better determine recovery factors for each basin. [Of interest is that onshore Gulf of Mexico was not included in this study, where past efforts produced viable geothermal energy.]

Turning from the regional U.S. basin study to a specific basin, Bohlen (2012) presented a preliminary geothermal resource assessment for the Raton Basin in Colorado. While Colorado has substantial thermal resources, slow geothermal progress has generally been due to geological complexities, rugged terrains, and “not in my back yard” attitudes that have prevented serious development. A number of rock samples have been taken from the outcrop of Raton Basin rocks to determine thermal conductivity in the laboratory. Surface and BHT data were available from 1,172 active gas wells in the Raton Basin from an operating producer. Total depths ranged from just over 650 to over 7,200 ft (198–2,195 m). The majority (999 wells) are less than 3,200 ft (975 m) and go no deeper than the Pierre Shale. Using the well data and conductivity values, thermal gradients and heat flow were calculated for 3,200; 6,500; and 9,800 ft (975; 1,981; and 2,987 m) depths, indicating higher temperatures at depth than previously thought. All of the analyses resulted in a picture of the Raton Basin being a far better candidate for geothermal power production than previously thought.

SMU Geothermal Conference—March 13–14, 2013

No geothermal conference was held at SMU in 2012 as there was conflict with other geothermal meetings around the country and the fact that the SMU personnel were busy in participation in these conferences, such as at the AAPG Annual meeting. However, an SMU Geothermal Laboratory Conference on Geothermal Energy and Waste Heat to Power: Utilizing Oil and Gas Plays was held in March, 2013 with 171 attendees, 24 oral presentations, and 10 poster presentations. The AAPG-EMD geothermal committee was represented by David Blackwell and Paul Morgan. Notes recorded about the conference taken by Denise Gatlin and Maria Richards, along with student Stefano Benato, assisted in the writing of this article.

For the past 7 years there has been a new focus for the geothermal industry to use the data from oil and gas fields to develop coproduction of all fluids and in turn extract the heat to generate power. Since the first SMU Geothermal Energy Utilization Conference in 2006, numerous improvements in technology, resource evaluation, and associated economics have occurred. The paradigm shift from high temperature, hydrothermal system geothermal development in the western U.S., to today’s focus including low temperature, coproduction from sedimentary basins, represents the broader interest in pushing the envelope for producing electricity. The expectation of early adoption by the oil and gas community has fallen short, yet interest and expectation that someday it will happen is generally accepted. For the first time, this event combined the surface waste heat to power (WHP) equipment with geothermal energy projects, realizing the need for the oil and gas industry to be able to “kick the tires” on equipment and in the process immediately be able to take advantage of the heat and pressure currently created by their surface equipment. This is of special interest as indicated by Texas Railroad Commissioner David Porter hosting a workshop on using excess natural gas for power on drilling leases, along with discussion of other options for on-site power generation such as waste heat energy capture in December of 2012.

Oral Presentations

Opening remarks by the Maguire Energy Institute’s Bud Weinstein stating “Heat is a terrible thing to waste!” grabbed the attention of attendees and set the ground work for covering all aspects of electrical production from heat sources in oil and gas fields. The source could be from surface equipment, referred to as “waste-heat,” or geothermal heat brought to the surface with oil/gas/water from the reservoir.

Federal Energy Regulatory Commission (FERC) Chairman Jon Wellinghoff (2013) impressed the attendees during his keynote address with his in-depth knowledge of the geothermal and waste heat resources and applicable technologies. Wellinghoff emphasized FERC’s focus to open the generation market to small, independent producers as a method to improve U.S. electrical security, consistency, and ability to deal with natural hazards. Use of geothermal resources, in all forms from home loop systems to direct use to electrical production along with the vast applications for waste heat power are seen by Wellinghoff as part of the necessary energy mix for the U.S. to meet the projected electricity generation needs for the future.

The conference structure took attendees through all aspects of oil and gas field development, representing the vast applications for both geothermal and waste heat to apply to improved field operations. The Environmentally Friendly Drilling Systems Program (EFD) presenter, David Burnett (2013) explained how society’s acceptance of environmental issues either slows or speeds up changes from innovative technology improvements. Texas A&M University has been the coordinator of the EFD program working with the U.S. DOE, Houston Advanced Research Center, Research Partnership to Secure Energy for America, oil/gas companies, universities, national labs, and environmental organizations to develop and implement improved hydraulic fracturing use of water, and air emissions from drilling. An EFD scorecard was developed to see how any site ranks within the defined criteria. Although geothermal is a smaller industry, as developers move into sedimentary basins for coproduced geothermal or larger scale projects using enhanced geothermal systems, Burnett emphasized the need to engage all stakeholders, public and private, for successful project completion. [Just as hydraulic fracturing has resulted in public and private push-back in the oil and gas industry, the geothermal sector is not immune to similar events, such as push-back occurring in Hawaii regarding geothermal development – Erdlac comment from Geothermal Energy Association news announcement.]

Lukawski (2013), a PhD candidate at Cornell University, compared geothermal drilling to oil and gas drilling costs. Flow rates in geothermal wells can only be dreamt about in most oil and gas environments as they start for geothermal typically in the 10,000 BBLs (1,590 m3) per day range. Well drilling and completion contribute 20–75% of the capital investment in geothermal power plants, with enhanced geothermal systems requiring the most costly upfront expenditures because of the deeper depths. One difference from oil and gas completions is the cementing of the full annulus because of the pressure and flow rates. Yet the study showed that while the cost of drilling has increased for oil and gas wells, geothermal well costs have leveled off because of improvements in drilling techniques for deeper depths, and at shallow depths (<6,000 ft; 1,829 m) geothermal is similar to slightly less in cost. Lukawski (2013) concluded that the geothermal community should not use the oil and gas cost indices to normalize the cost of geothermal wells.

Once the reservoir is drilled, testing is needed; Randy Normann (2013) of Perma Works discussed how the Hydro-Fracturing Monitoring Tool is able to “run barefoot” (no heat shield) up to 570°F (299°C) under high pressure and stay in the reservoir for weeks to years without removing the logging tool. This allows for long-term monitoring of changes in the well and reservoir such as testing changes in injection or production, well connectivity, shut-in testing, reservoir pull down test, and power plant maintenance. This capability will change our understanding of the life of a reservoir system, pressure fluxes, and how to improve stimulation. Tools capable of these harsh conditions make high-temperature EGS projects more viable.

A key factor driving the rapid improvement in equipment is the ability of manufacturers to meet the needs of both the geothermal and waste heat to power communities with the same technology. Highlighting the small-scale (<100 kW) environments, Fox (2013) of ElectraTherm discussed improvements in their Green Machine after a demo at an oil well in Mississippi and how the same technology is being deployed rapidly into the European market to meet the demand for waste heat applications. With fluid temperatures in the 190–240°F (88–116°C) temperature range, a number of oil and gas operations become viable for waste heat energy capture including coproduced hot fluids, compressor stations, natural gas well head flaring, and amine sweetening plants.

Ronzello (2013) of Pratt and Whitney Power Systems discussed the expected outcome from the acquisition by Mitsubishi Heavy Industries of the PWPS/Turboden ORC equipment line, which ranges from small to medium sized (1–10 MW). Ronzello’s graphic on efficiency as a function of resource and surface temperature clearly explained the benefit of utilizing the highest heat sources. In his example, similar equipment efficiency can range between 7.5% and 25%, depending upon the source temperature variations, i.e., 195°F and 590°F (91 and 310°C), respectively. This emphasized the importance of the temperature rather than industry or source of the temperature: such as biomass, geothermal, waste heat, CHP, etc.