Abstract

This paper summarizes five 2007–2008 resource commodity committee reports prepared by the Energy Minerals Division (EMD) of the American Association of Petroleum Geologists. Current United States and global research and development activities related to gas hydrates, gas shales, geothermal resources, oil sands, and uranium resources are included in this review. These commodity reports were written to advise EMD leadership and membership of the current status of research and development of unconventional energy resources. Unconventional energy resources are defined as those resources other than conventional oil and natural gas that typically occur in sandstone and carbonate rocks. Gas hydrate resources are potentially enormous; however, production technologies are still under development. Gas shale, geothermal, oil sand, and uranium resources are now increasing targets of exploration and development, and are rapidly becoming important energy resources that will continue to be developed in the future.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Peter D. Warwick Footnote 1

Footnote 2

The increasing demand for and continuing depletion of accessible oil and gas resources are causing greater dependence on energy minerals such as coal, uranium, and unconventional sources of oil and natural gas. The Energy Minerals Division (EMD) of the American Association of Petroleum Geologists (AAPG) is a membership-based, technical interest group having the primary goal of advancing the science of geology, especially as it relates to exploration, discovery, and production of mineral resources and for energy-related purposes. Contained in this paper are five summaries derived from 2007 to 2008 committee reports presented to the EMD leadership. The complete set of committee reports is available to EMD members at http://emd.aapg.org/members_only/. This paper updates the 2006 EMD review published in this journal (American Association of Petroleum Geologists, Energy Minerals Division, 2007) and is presented here as a service to the general geologic community.

Included in this paper are reviews of current United States and global research activities related to gas hydrates, gas shales, geothermal resources, oil sands, and uranium resources. The field of gas hydrates research is rapidly expanding and is currently focused on identifying areas with resource potential and on production technology. Research and development of gas shales, geothermal resources, oil sands, and uranium resources are continuing and new interest in these resources has driven exploration efforts into frontier basins. New production technologies have significantly contributed to the advanced development of these unconventional resources and have allowed them to become important contributors to the current energy mix. Please contact the individual authors for additional information about the topics covered in this report. The following website provides more information about all unconventional resources and the Energy Minerals Division: http://emd.aapg.org.

Gas Hydrates

R. W. Lankston Footnote 3 and A. H. Johnson Footnote 4

Gas hydrate is a naturally occurring “ice-like” combination of natural gas and water that has potential as an immense resource of natural gas. Gas hydrate is widespread in permafrost regions and in sediments along outer continental margins. The world’s commercial resource potential for gas hydrate is not known at present. Previous abundance estimates have not considered the variability of the host sediment and thus have not segregated the potentially commercial deposits of concentrated hydrate in porous, permeable sands from the significantly larger volumes occurring in shales that are not recoverable. Even so, the commercial resource potential is on the order of many thousands of Tcf (trillion cubic feet; or tens to hundreds of trillion cubic meters, m3).

The U.S. Minerals Management Service published a gas hydrate resource estimate for the Gulf of Mexico in 2008 with a mean estimate of 6,717 Tcf (190 trillion m3) in place in sandstone reservoirs. Also in 2008, the U.S. Geological Survey published a gas hydrate resource estimate for the North Slope of Alaska with a mean estimate of 85.4 Tcf (2.4 trillion m3) technically recoverable gas resources (Collett and others, 2008). Estimates of the gas hydrate resource potential for the U.S. Atlantic and Pacific margins are in progress. Global estimation of gas hydrate resource potential is hindered by the lack of subsurface data through the hydrate stability zone along most continental margins and polar regions. The “Global Energy Assessment” being conducted through the International Institute for Applied Systems Analysis (IIASA) is currently integrating existing data and geological models to determine estimates of theoretically recoverable, technically recoverable, and economically recoverable gas from hydrate. Due to the limitations of data, the estimates are expected to span several orders of magnitude with the largest resource occurring in the marine environment. Results of the assessment are scheduled for release in 2011.

The U.S. Department of Energy (DOE) National Energy Technology Laboratory (NETL) has a broad spectrum of hydrate studies that includes research aspects that relate to climate impacts of hydrate dissociation, sea floor and facilities safety, as well as energy resource. The NETL is supporting three resource-focused programs. The first one of these is a consortium of agencies, universities, and petroleum industry contractors coordinated by BP Exploration (Alaska) Inc. to map and test gas hydrate occurrences on the North Slope of Alaska. In early 2007, the program drilled a stratigraphic test to a depth of approximately 1,000 m (3,280 ft) and cored two sands predicted to be hydrate-bearing in pre-drill analyses of seismic and log data. Pre-drill predictions of sand thicknesses and hydrate concentration were generally accurate. Schlumberger’s Modular Formation Dynamics Tester (MDT) sampling was conducted, and gas from hydrate dissociation under simple pressure drawdown was collected.

Post-drill work continues to refine the methodologies for seismic prediction of hydrate concentration and to analyze the core from the two hydrate-bearing sands. The two sands totaled about 30 m (98 ft) in thickness and had hydrate concentrations in the pore space of approximately 65%.

The consortium conducted a workshop in March 2008 to define a strategy for developing a production testing facility in the Eileen trend of the North Slope. The conceptual target for beginning work at the test facility is in 2009.

The second NETL program is a joint industry project (JIP) coordinated by Chevron Corporation. This program began with a focus on the safety of sea floor facilities and safely drilling through hydrate-prone sections in the deep water Gulf of Mexico. Since the successful 2005 drilling program of the JIP, the focus of the project has evolved to include energy resource considerations. The planned 2009 program will conduct drilling with logging-while-drilling (LWD) technology. No coring is planned for 2009. The JIP has included a large effort to quantify hydrate concentrations from seismic data. The 2005 drilling program tested the pre-drill predictions in generally fine-grained sediments. The 2009 drilling will test seismic predictions in sandy sections, including locations in the Alaminos Canyon Area, where a hydrate-bearing sand was previously logged during the drilling of a conventional prospect.

The BP Alaska and the Chevron consortia are conducting traditional seismic and well log analyses, and designing drilling programs. The third NETL supported program is being conducted in the vicinity of Barrow, Alaska, and involves a detailed analysis of historical gas production from three fields. Production from these fields may have included a component of gas from hydrate dissociation from layers above the producing horizons. Results of this analysis should be available soon.

Gas hydrate mapping, drilling, and production testing programs are underway in several countries, particularly in those with little or no access to conventional hydrocarbon resources within their boundaries. India, Japan, and Korea are notable examples. China has also begun a hydrate program. With China having access to considerable conventional resources, the Chinese motivation for researching gas hydrate would seem to stem from a growing need for hydrocarbon resources in general.

Japan has a two-year program of testing at the Mallik site on the Mackenzie Delta of northern Canada. In the winter season of 2006–2007, wells from the 2002 international program at Mallik, during which gas was produced through depressurization, were re-entered and prepared for another phase of production testing. The production testing was completed during the 2007–2008 season. This Japanese project and the United States project on the North Slope have similar economic philosophies, i.e., testing the relatively shallow hydrate-bearing horizons in the Arctic is generally less expensive than comparable operations in deep water.

In 2006, India sponsored a major drilling program to sample inferred gas hydrate occurrences in its territorial waters off both its west and east coasts. The program demonstrated the viability of relatively rapid drilling with LWD logging, and that success in being leveraged by the Chevron JIP for the 2008 drilling cruise. Two DVDs of the data from the 2006 India program were released in March 2008 and can be obtained through the chief scientist of the program, Timothy Collett of the U.S. Geological Survey.

A variety of factors have slowed the commercial development of gas hydrate. Chief among these in the United States are competition from other natural gas resources (particularly gas shale), the availability and rates for drilling rigs capable of drilling in areas with hydrate potential, and the lack of an industry-scale production test that verifies the recovery rates needed for commercial viability. A successful production test with sustained high flow rates should escalate the pace of development.

Most of the resource-related research programs that are funded by national governments have targets around 2015–2016 to demonstrate the viability of gas hydrate as an energy resource or to actually have production facilities on-stream.

Gas Shale

B. J. Cardott, Footnote 5 K. L. Avary, Footnote 6 K. A. Bowker, Footnote 7 T. C. Chidsey, Jr., Footnote 8 W. B. Harrison, III, Footnote 9 J. N. McCracken, Footnote 10 C. D. Morgan, Footnote 11 D. E. Tabet Footnote 12

Shale gas production and reserves in the United States were 1.2 and 21.5 Tcf (34 billion and 906 billion m3), respectively, during 2007, accounting for 9% of the U.S. total gas reserves (Energy Information Administration, 2009). More than 40 formations containing black shale hydrocarbon source rocks across the United States and Canada are currently being evaluated as gas shales. Below are a few highlights.

Fort Worth Basin, Texas: Barnett Shale (Mississippian)

The Barnett Shale is the most active current gas-shale play in the United States. According to the Texas Railroad Commission, as of January 8, 2009, there were a total of 10,146 Barnett Shale gas wells and 5,177 permitted locations in the Newark East Field (discovery date, October 15, 1981) of the Fort Worth Basin. During calendar year 2007, 1,054 billion cubic feet (Bcf; 21.7 billion m3) of gas was produced from the field, accounting for 20% of Texas gas production. There are a total of 222 operators in the Newark East (Barnett Shale) Field.

Technological discoveries made in the development of the Barnett Shale play (such as the application of microseismic mapping, slick-water fracs, and horizontal drilling) have contributed to the advancement of all gas-shale plays. Recent reports indicate that simultaneously fractured wells (termed simo-frac) have higher gas production than wells fractured individually.

Arkoma Basin, Arkansas: Fayetteville Shale (Mississippian)

According to the Arkansas Oil and Gas Commission (AOGC), there are a total of 742 completed Fayetteville Shale wells (as of March 21, 2008). A map of Fayetteville Shale wells is available at the AOGC web site. Additional information is available at the Arkansas Geological Survey web site: http://www.geology.ar.gov/home/index.htm. Fayetteville Shale gas production during calendar year 2007 was 89 Bcf. The thickness of producing zones is 50–550 ft (15–168 m) at vertical depths of 1,500 to 6,500 ft (457–1,981 m).

Arkoma Basin, Oklahoma: Woodford Shale (Late Devonian-Early Mississippian)

According to the Oklahoma Geological Survey, as of March 21, 2008, there were a total of 381 Woodford Shale gas-well completions since 2004 (first application of advanced completion technology), primarily in the western part of the Arkoma Basin in eastern Oklahoma. Of the 271 horizontal Woodford Shale gas wells completed during 2005–2007, initial potential gas rates ranged from 3 to 12,000 thousand cubic feet of gas per day (Mcfg/day; 85–339,800 m3/day). Excluding 23 old well workover completions, cumulative production from 279 Woodford Shale-only wells drilled from 2004 to 2007 is 63,752,439 Mcf (1.8 billion m3) gas and 63,752,439 barrels (BBLs; 10.1 million m3) oil/condensate. There were a total of 30 operators active in Oklahoma gas shales during calendar year 2007.

Michigan Basin, Michigan: Antrim Shale (Devonian)

The Michigan Basin Antrim Shale play is a little over 20 years old, having begun the modern phase of development in 1987. The total number of producing wells drilled in the play through 2007 is approximately 9,600 with about 9,400 still online.

Cumulative gas production exceeded 2.5 Tcf (70.8 billion m3) through 2007. Michigan Antrim production is reported by project rather than by individual well or lease. Projects may be only a few wells or more than 70 wells. There were 719 separate projects at the end of 2007. Cumulative production for 2007 was 136,104,267 Mcf (3.8 billion m3) of gas. That was a 3% decline from 2006.

There were 32 operators with production and 9,382 wells were online at the end of 2007. In addition, 340 new wells were drilled in 2007, which is a 4% increase in wells from 2006. Most of the production comes from a few operators. The top 10 operators produced 78% of the total Antrim gas in 2007.

Although some wells initially produce as much as 500 Mcf/day (14.2 thousand m3/day), most wells produce less than 100 Mcf/day (2.8 thousand m3/day). Play-wide average production at the end of 2007 was 39 Mcf/day (1.1 thousand m3/day) per well. Many Michigan Antrim wells begin with high water production and begin to increase gas production as the water is pumped off. Water production generally continues throughout the project life, although it usually declines through time. Play-wide gas-to-water production ratio reached almost 3 Mcf/BBL (2.3 thousand m3/BBL) in 1998; the 2007 ratio is 1.45 Mcf/BBL (1.31 thousand m3/BBL).

CO2 is also an issue in the produced Antrim gas which is mostly of biogenic origin. Most wells begin with very low amounts of CO2 in the produced gas; however, the percentage of CO2 increases through time. Some projects that have a long production history now exceed 30% CO2 in the produced gas. The play-wide average was just over 14% CO2 in 2007.

Wells produce from depths as shallow as 350 ft (107 m) to just over 3,000 ft (914 m), although the majority of well completion depths are from 1,000 to 2,500 ft (305–762 m). Wells are typically drilled with water and an attempt is made to keep the well in balance or slightly under-balanced. Wells are hydrofractured with water and sand. Some wells are stimulated using nitrogen or foam.

Appalachian Basin, Multi-State: Marcellus Shale (Devonian)

The Marcellus Shale has attracted a great deal of attention in New York, Pennsylvania, and West Virginia since Range Resources announced a significant gas discovery in the Marcellus in southwestern Pennsylvania in 2003. The Marcellus has long been thought of as a source for much of the gas produced from many other reservoirs throughout the Appalachian Basin and it has been penetrated by thousands of wells being drilled to deeper Lower Devonian, Silurian, Ordovician, and Cambrian targets. However, the technology for drilling horizontally and massive “Barnett style” hydro fracturing has only recently caused the Marcellus to be viewed in a different way. The Marcellus varies in thickness across the basin, with a maximum thickness of over 250 ft (76 m) in northeastern Pennsylvania. Drilling depth varies from as little as 2,000 ft (610 m) in New York to more than 9,000 ft (2,743 m) in central Pennsylvania.

Developing the Marcellus is not without its challenges, among them lack of infrastructure, complex leasing issues, availability of water for completion, disposal of produced water and frac water, and public availability of production data, especially in Pennsylvania. In the eastern counties where the Marcellus is the thickest, there has been little or no drilling historically so pipelines are often not nearby. Also, landowners in the eastern part of the play are often unfamiliar with mineral extractive industries and activities, and there is less likelihood that the oil and gas rights have been severed from the surface rights. In contrast, in the areas where there has been production from other reservoirs, it is often challenging to find acreage available for lease and not held by existing production.

Several hundred Marcellus wells have been permitted in New York, Pennsylvania, and West Virginia in the last 5 years. Many have been completed. Limited production data are available. In Pennsylvania, individual well production data are confidential for 5 years.

Black Warrior Basin, Alabama and Mississippi: Floyd/Neal Shale (Mississippian)

Over the past year, there has been continued activity in the Floyd/Neal Shale (hereafter referred to as the Floyd) play in the Black Warrior Basin of Alabama and Mississippi. The only producing Floyd well produces about 100 Mcf/day (2,832 m3/day). Two additional horizontal wells (there were five previously) were drilled in the Floyd in 2007. Carrizo Oil and Gas drilled a horizontal well in Clay County, Mississippi, and Jim Walter Resources Inc. drilled a horizontal well in Tuscaloosa County, Alabama. Both of these wells were fracture stimulated, but with poor results.

Many companies have either sold their acreage positions (e.g., Murphy Oil Corporation sold 200,000 acres (80,940 hectares) to Vantage Energy, LLC) or have placed their positions on the market (e.g., David H. Arrington Oil and Gas Inc.). However, Cabot Oil and Gas Corporation and others have announced that they plan to drill additional wells in the play in 2008. Various companies active in the play, including Cabot, have presented material to their investors regarding their activities in the play.

In November 2007, the Geological Survey of Alabama (http://www.gsa.state.al.us/documents/misc_ogb/Floyd%20Shale.pdf) published an overview of Floyd Shale drilling activity in the state by Sexton and Powell (State Oil and Gas Board of Alabama). In the basin, the Neal Shale (the black shale within the Floyd interval) ranges from 50 to 150 ft (15–46 m) thick and is found at a depth range of 4,500–7,800 ft (1,272–2,377 m).

Illinois Basin, Indiana: New Albany Shale (Devonian)

According to the Indiana Geological Survey, there are a total of 553 New Albany Shale gas wells completed since 1885 (as of March 21, 2008). Most of the wells, drilled since the mid-1990s, are in Harrison County at depths of 500–1,100 ft (152–335 m). Production rates range from 20 to 450 Mcfg/day (566–12,740 m3/day). Recent exploration is in Daviess County. Gas production is thermogenic and mixed thermogenic/biogenic primarily from the organic-rich Clegg Creek Member.

Utah Shale Gas Activity

Uinta Basin Mancos Shale Play (Numerous Operators Tested and Produced Gas from the Mancos Shale in 2007–2008)

The Mancos is reported to be an overpressured, silty shale section up to 3,500 ft (1,067 m) thick, with 2–5% porosity and 1.4% + total organic carbon (TOC). Estimated in-place gas is reportedly between 280 and 350 Bcf per square mile (3–3.8 billion m3/km2), with a projected estimated ultimate recovery (EUR) of 5–15% of in-place gas. Initial flow rates range from 1,000 to 2,000 Mcf/day (28,320–56,630 m3/day). The exact extent of the play has not been defined.

In 2007 at River Bend field in the southwestern Uinta Basin, GASCO Energy Inc. completed three wells at depths from 12,000 to 16,000 ft (3,658–4,877 m) testing Mancos Shale gas potential. Five new GASCO wells were planned for 2008. In 2008 at Monument Butte field of the Uinta Basin, Newfield Exploration Company, in partnership with GASCO, planned to drill two Mancos Shale reservoir tests below the currently oil productive Green River Formation.

In 2008 at the West Tavaputs field of the southwestern Uinta Basin, Bill Barrett Corporation planned to complete one deep Upper Cretaceous Mancos Shale gas test well.

In 2007 and 2008, Petro-Canada received permits to drill more than a dozen deep wells on the West Tavaputs Plateau in the southwestern Uinta Basin. These wells are designed to test the Mancos Shale and shallower formations.

At the Natural Buttes field in the eastern Uinta Basin, Questar Gas is evaluating deep, tight gas sand/shale gas play potential. They completed 17 Mancos Shale/Dakota Formation wells in 2007; more than 30 similar wells are planned for 2008. Questar is also targeting Mancos Shale targets at Flat Rock field in the southern Uinta Basin. XTO Energy Inc. planned to test the Mancos Shale potential of their Natural Buttes acreage in 2008.

In 2007, Royale Energy Inc. and Retamco Operating Inc. staked deep tests targeting the Mancos and other formations in the southeastern part of the Uinta Basin along the Uncompahgre Uplift.

Central Utah Paleozoic Shale Gas Play: Two Companies Tested Paleozoic Shale Gas Reservoirs in Central Utah

In late 2007, Bill Barrett Corporation sold a 50% working interest in 29,531 net acres (11,950 hectares) of the shale gas prospect named Hook in the southwestern Uinta Basin to ConocoPhillips. In 2008, the partners planned to continue to acquire leasehold acreage and drill one or two Mississippian Manning Canyon exploration tests in this prospect. The shale horizon is expected to be 600–700 ft (183–213 m) thick. At the nearby Woodside prospect, Barrett completed the Woodside #1 well and reportedly is conducting a Pennsylvanian shale gas test.

In central Utah, Shell Western Exploration and Production, Inc. has drilled one well and staked a second rumored test of Paleozoic shale gas reservoirs in Emery and Carbon Counties, respectively. No resource estimates are available for this frontier play with unknown extent.

Paradox Basin Pennsylvanian Shale Gas Play: Several Companies are Testing or Trying to Expand Shale Gas Production from the Pennsylvanian Paradox Formation

CrownQuest Operating, LLC recently conducted workovers on the Gothic and Chimney Rock shale zones of the Pennsylvanian Paradox Formation. In 2008, they planned an ambitious exploration program with at least nine wells staked. Baytex Energy Trust, Fidelity Exploration and Production Company, Babcock and Brown, and Bill Barrett Corporation have staked new wells that are designed to test Paradox Formation shale reservoirs. Bill Barrett has defined 80–150 ft (24–46 m) thick Paradox Formation shale plays for the Gothic (1,850 sq. mi., or 4,791 km2 area in Colorado) and Hovenweep (1,300 sq. mi., or 3,367 km2 area in Utah and Colorado) intervals. Barrett established Gothic production from three wells in Colorado in 2008, and plans to test the Hovenweep in Utah in 2009. These shale intervals tend to be slightly thinner in the Utah portion of the Paradox Basin.

In the northwestern part of the basin near Delta’s Greentown discovery, Delta Petroleum Corporation and Petro-Canada have staked additional wells to evaluate clastic Paradox Formation zones, which most likely include shales. In late 2007, Delta’s Greentown Federal 28–11 discovery well was approved by the Bureau of Land Management (BLM) to connect up to pipeline for production. The well is currently producing over 1.5 million cubic feet/day (MMcf/day) (42,480 m3/day) from the “O” clastic interval (undisclosed thickness) within the Paradox Formation salt section. Delta estimates that the initial six-month production trend demonstrates that the well will recover approximately 2.0 Bcf (56.6 million m3).

Wasatch Plateau Tununk Shale Member of Mancos Shale (Cretaceous)

On the Wasatch Plateau in central Utah, XTO Energy Inc. is drilling, completing or has staked three wells targeting the Tununk Shale Member of the Mancos Shale. XTO took over the prospects from Dominion Exploration and Production Inc. The extent and resource potential of this frontier play are unknown.

Canada

The shale gas potential for Canada has been recognized and summarized in a number of reports for the Western Canada Sedimentary Basin (WCSB) and for the rest of the country. The gas production from the increasingly important shale gas plays in the continental United States has provided the inspiration and geological analogies to the Canadian counterparts.

Faraj and others (2002, 2004) summarized the following formations: Upper Cretaceous Wilrich and equivalents, Jurassic Nordegg/Fernie, Triassic Doig/Doig Phosphate/Montney, Devonian/Mississippian Exshaw/Bakken, and the Devonian Ireton/Duvernay. Their published cumulative resource volume for just the Wilrich, Duvernay, Montney, Doig, and Doig Phosphate formations was 86 Tcf (2.4 trillion m3). This study concentrated on shales with a predominantly thermogenic gas source.

Hamblin (2006) described 46 shale gas plays from western Canada, Ontario, Quebec, Atlantic Canada, Northwest Territories, and Nunavut. The report concluded that seven regions had the best potential based on geological/geochemical properties and geographic locations with proximity to infrastructure and production. These plays are: Upper Ordovician of the Appalachian Basin, Upper Devonian of the Appalachian/Michigan Basin, Upper Devonian of the northwestern WCSB, Jurassic of western WCSB, Middle to Upper Cretaceous of WCSB Plains, and Middle Devonian of Mackenzie Corridor.

Since these reports came out and as a result of successful announcements of shale gas discoveries and production in the United States, the Canadian industry has quietly had teams working on shale plays and building up land positions. Through 2007, there were no announcements of economic potential for these Canadian shales. The following discussion summarizes each area of importance.

Northeast British Columbia

Horn River Basin—Devonian Muskwa Shale: In February 2008, EOG Resources announced that the Devonian Muskwa Shale in the northeast British Columbia Horn River Basin has substantial natural gas potential. Three horizontal wells tested at 3.5, 4.2, and 5 MMcf/day (99,110, 118,900, and 141,600 m3/day). This play is still in the early stages of delineation but based on the technical data gathered on their 14,000-acre (5,666-hectare) position they may have potential net reserves of approximately 6 Tcf (170 billion m3). Production was expected to start in June 2008 with significant volumes coming in 2010 and beyond. The press has made positive comparisons with the Barnett Shale, but this semi-remote northeast British Columbia location will reduce the project’s rate of return. Nexen Inc. has also announced a land position in this important play, and Apache Corporation, EnCana Corporation, and Devon Energy have been mentioned as land holders.

Triassic Montney: Arc Energy Trust has had success in the Montney with horizontal wells that produce 10 MMcf/day (283,200 m3/day). The British Columbia government has reported that total production increased from 18 wells and 350 MMcf/month (9.9 million m3/month) in June 2002, to 140 wells and 2,730 MMcf/month (77.3 million m3/month) by May 2007. The Arc Energy’s Dawson and EnCana’s Swan fields are the largest producers.

Alberta

Stealth Ventures Ltd. announced commercial shale gas production from the Colorado Group in the Wildmere region of eastern Alberta. The Alberta Energy Resource Conservation Board (ERCB) recognizes their operations as shale gas exploitation. Thirty-nine wells have been drilled in this play. A number of other operators are targeting Colorado Group shales.

Saskatchewan

PanTerra Resource Corporation and other companies continue shale gas exploration in Saskatchewan. Thirty-six wells have been drilled to date.

Quebec—St. Lawrence Lowlands

On April 1, 2008, Forest Oil Corporation announced a significant gas discovery in the Ordovician Utica Shale in Quebec. Two vertical wells reported posted production rates as great as 1 MMcf/day (28,320 m3). The play is in its early stage, but the players are encouraged because of shallowness, the rock properties, pipeline infrastructure, and proximity to Eastern markets. Junex Inc. and Questerre Energy Corporation are partners in the project.

New Brunswick—Moncton Basin

Corridor Resources Inc. has reported that their most recent well encountered 3,806 ft (1,160 m) of fractured, Lower Mississippian Frederick Brook Shale with encouraging natural gas shows. This play is very much in its infancy with a horizontal well planned for late 2008.

Nova Scotia—Kennetcook Basin

Triangle Petroleum Corporation announced that two wells drilled into the Upper Devonian/Lower Mississippian Horton Bluff Formation have been traced. One of the wells is beginning to recover small amounts of gas. The company is encouraged and intends to drill 6–8 more wells, including horizontals. They have 516,000 gross acres (208,800 hectares) in this block.

Geothermal

J. L. Renner Footnote 13

Summary

Electrical generation capacity utilizing geothermal energy continues to increase in the United States. The completion of plants at Raft River field near Malta, Idaho and the Bottle Rock plant at The Geysers, California are two recent additions. In September 2008, Rocky Mountain Oilfield Testing Center (RMOTC) and Ormat Technologies began operating an experimental 250 KWe geothermal plant utilizing 88°C water from the Tensleep Formation at the Teapot Dome Oilfied (see http://www.rmotc.doe.gov/newsevents/ormat.html). Several web sites offer periodic information related to the geothermal industry and legislation and regulation affecting geothermal development. The Geothermal Energy Association (GEA) publishes the GEA Update periodically. It is available at http://www.geo-energy.org or http://www.geo-energy.org/publications/updates.asp. They also released publications updating United States and World geothermal production. As of March 2009, the GEQA reported that the installed capacity in the United States was 3040 MWe and that 14,885 GWh were generated in 2007. GEA also provides summaries of existing and planned geothermal development projects in the United States (http://www.geo-energy.org/information/developing.asp). GEA published a two-part report concerning the state of geothermal development. The two volumes discuss the technology requirements and environmental effects of exploration and drilling (Part I) and power generation (Part II). Both volumes are available on the GEA website. In addition, the Nevada Division of Minerals periodically publishes the Nevada Geothermal Update at http://minerals.state.nv.us/ or http://minerals.state.nv.us/formspubs.htm.

The Future of Geothermal Energy

A team of geothermal experts led by Dr. Jefferson Tester of the Massachusetts Institute of Technology released a seminal report, “The Future of Geothermal Energy” in late 2006 (Tester and others, 2006). The report provides an in-depth review of the potential to produce geothermal energy in the United States using stimulation technologies similar to those used by the petroleum industry. The key finding of the report is that 100,000 MWe could be on line in the United States by about 2050. The report is available electronically at: http://geothermal.inl.gov/.

United States Geothermal Activity

U.S. Geothermal brought on line a 13 MWe geothermal plant near Malta, Idaho, in December 2007. The plant is the first unit to be placed online in Idaho since an Idaho National Laboratory experimental plant was closed in 1982.

Bottle Rock geothermal plant, which had been closed, resumed generation during 2007. The plant is at the northeast edge of The Geysers geothermal field, the world’s largest operating geothermal field.

Ormat Technologies, Inc. placed online additional capacity at several of its Nevada Plants.

The U.S. Bureau of Land Management conducted geothermal lease sales in California, Idaho, Nevada, and Utah during 2007 and 2008. These were the first lease sales conducted under the provisions of the Energy Policy Act of 2005, which modified leasing provisions and royalty rates for both geothermal electrical production and direct use. Results from the lease sales are reported in Table 1. Notable changes include a legislative mandate that all geothermal leases be awarded competitively and changes in royalty rates. The new law parallels existing oil and gas leasing provisions. The Bureau also initiated a programmatic environmental impact statement to speed leasing of high priority geothermal tracts when environmentally acceptable.

Southern Methodist University’s Geothermal Laboratory hosted its second and third “Geothermal Energy Generation in Oil and Gas Settings Conference” during June 2007 and 2008. About 200 people from Asia, Australia, Europe, and North America attended the each event. The conference goal is to stimulate the development of geothermal energy in new areas utilizing existing oil and gas infrastructure. The conference presentations are available at: http://www.smu.edu/geothermal/Oil&Gas/Oil&GasPresentations.htm.

Oil Sands

F. J. Hein Footnote 14

Bitumen is extra-heavy oil that requires the addition of energy or solvents for mobility and production through wells. Oil sands consist of bitumen and the surrounding host sediment and exclude any associated natural gas. In the United States, oil sands are commonly called tar sands.

Bitumen (extra-heavy) and heavy oil deposits have been reported from over 70 countries worldwide, with the largest deposits located in Canada and Venezuela (Meyer, Attanasi, and Freeman, 2007; Dusseault and others, 2008; Hein and Marsh, 2008; Hernandez, Bauza, and Cadena, 2008; Marsh and Hein, 2008; Villarroel, 2008). The U.S. Geological Survey recently released a report concerning the worldwide distribution of heavy oil and natural bitumen resources, with a classification of their occurrence in different geological basins (Meyer and others, 2007). The largest accumulation of oil sands in the world is located in Alberta, Canada, with current estimates of 270 billion m3 (or about 1,698 billion barrels) of in-place bitumen resource being currently identified (Marsh and Hein, 2008). Of this huge resource, it is estimated that 27.5 billion m3 (or about 173 billion barrels) is considered to be recoverable from the currently mined and drilled areas using current commercial technologies (Alberta Energy Resources Conservation Board, 2008). A regional geologic overview of the Canadian oil sands is given in several papers (Hein, 2006; Hein, Marsh, and Boddy, 2007; Hein and others, 2007; Hein and Marsh, 2008; Marsh and Hein, 2008). On a world-wide basis, in addition to the vast oil sands of Canada, extra-heavy oil in Venezuela and oil sands of the western United States, China, and Russia are of interest.

The only active commercial oil sands production in North America is in the Western Canada Sedimentary Basin, in northeastern Alberta, Canada (Hein and Marsh, 2008). Other areas most likely for future oil sands growth include northwestern Saskatchewan, in the Western Canada Sedimentary Basin; the Colorado Plateau, Uinta Basin and Paradox Basins of Utah; the North Slope of Alaska; the Black Warrior Basin, Alabama; the Maverick Basin, southwest Texas; the Borderland Basins of California; the Eastern Interior Basin and Appalachian Basin areas of Kentucky and Illinois; and the Tri-State, Mid-Continent region of Kansas, Missouri, and Oklahoma. Two asphalt quarries are operating in the Uvalde area of southwest Texas, which had (in 1981) an excess of 1 million tons (907,200 tonnes) of production per year, and which has been surface-mined for road-paving (Ewing, 2004). At present no bitumen accumulations are currently being commercially produced for hydrocarbon resources in the United States, although these occurrences are estimated to have 6.1 billion barrels (1 billion m3) of recoverable bitumen (Meyer and others, 2007). At present, Canada is considered to be an important strategic source of bitumen and synthetic crude oil (obtained by upgrading bitumen). If the United States wants to become more energy independent, its existing oil sand deposits should start to be commercially produced, either by surface mining or in situ extraction, and be included as part of its commercial daily oil production.

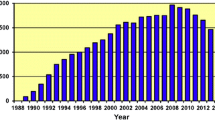

In 2007, Alberta’s crude bitumen production totaled 482.5 million barrels (76.7 million m3). This total production is equivalent to 1.32 million barrels per day (210,000 m3/day). Of this total, bitumen production, 59% (284.7 million barrels or 5,260,000 m3) came from surface mining and 41% (197.8 million barrels or 31,450,000 m3) came from in situ production (Alberta Energy and Utilities Board, 2007). The bitumen that was produced by surface mining was upgraded to synthetic crude oil (SCO). In situ bitumen production was marketed as non-upgraded crude bitumen. Alberta’s production of bitumen has more than doubled in the last decade or so, and it is expected to increase to greater than 3 million barrels per day (>0.48 106 m3) over the next decade. In 2006, the production of raw bitumen and SCO accounted for 62% of Alberta’s total crude oil and raw bitumen production, with an expected increase to 86% by 2016 (Fig. 1) (Alberta Energy Resources Conservation Board, 2008).

Alberta supply of crude oil and equivalent (from Alberta Energy and Utilities Board, 2007). SCO refers to synthetic crude oil produced from bitumen

In Alberta, as of December 2006, the bitumen reserves under active development (mainly by surface mining) accounted for only 12% of the remaining established reserves at 21 billion barrels (3.3 billion m3). To unlock the huge potential of the remaining bitumen resource, other in situ technologies will have to be improved. The most commonly used in situ technologies are Steam Assisted Gravity Drainage (SAGD) and Cyclic Steam Stimulation (CSS). Both SAGD and CSS have high demands for both energy and water to produce steam, the need for good permeability (both vertical and horizontal), relatively thick pay zones (>10 m or 32.8 ft), an absence of barriers (cemented zones, thick, laterally continuous shales), and an lack of significant top/gas or bottom water thief zones.

There are critical technology needs for more environmentally friendly methods of extraction, production, and upgrading of oil sands. For surface mining operations, this involves tailings and consolidated tailings reclamation and re-vegetation of open pit mine sites. Most of the bitumen resources are extracted by in situ technologies, mainly thermal, such as SAGD and CSS. Because there is significant production of GHGs (greenhouse gases) with bitumen production and upgrading, critical technology needs involve research into: (1) alternative sources of heat for steam generation (i.e., geothermal, nuclear, burning of slag); (2) use of other methods to reduce the viscosity of the bitumen so it will flow to the well bore or through pipelines more easily (i.e., diluents, catalysts, microbial and nanotechnology); (3) underground in situ extraction, refining and upgrading; and (4) co-sequestration of greenhouse gases by injection into abandoned reservoirs or other geologic media.

Critical environmental issues relate to the balance between greenhouse gas emissions and water/energy usage and the recovery, production and upgrading of bitumen. Specifically, the critical environmental issues are how to extract, produce, and upgrade the bitumen in an environmentally friendly way such that: (1) the use of energy to heat the water to steam is reduced; (2) the greenhouse gas emissions are reduced or compensated for by carbon trading or CO2 sequestration; and (3) the extraction, production, and upgrading of the bitumen and done by efficient and economic means. Some areas that are being worked on include: land reclamation in surface mining; tailings and consolidated tailings disposal and reclamation; co-production of other products from tailings and bitumen upgrading (such as vanadium, nickel, sulfur, etc.); in situ recovery; and underground refining. In Canada, oil sand developers are working to reduce CO2 emissions by 45% per barrel by 2010, compared to 1990. Also, in Canada, developers are legislated to restore oil sand mining sites to at least the equivalent of their previous biological productivity. For example, at the Syncrude mine site near Fort McMurray, Alberta, the Fort MacKay Indian band has reclaimed much of the previous tailings pond areas into grasslands that support a modest bison herd (~500–700 head).

Some of the focus of recent in situ technology and advances includes:

-

integration of future oil sands with emerging oil shale co-production in the western United States;

-

new technologies for in situ recovery and underground refining of oil sands in western Canada, including underground combustion and refining;

-

use of Cold Heavy Oil Production with Sand (CHOPS) as a specialized primary type of production where progressive cavity pumps assist in lifting bitumen and sand to surface, and utilizing sand to produce wormholes in the reservoir to increase permeability;

-

search for alternative sources of energy for steam production, including the development of nuclear industries in conjunction with oil sands in situ production plants (Peace River, Alberta); and

-

further development and use of technologies, including Vapour Extraction (VAPEX), Toe-to-Heel-Air-Injection (THAI), Supercritical Partial Oxidation (SUPOX), and various hybrid developments, including CO2 flooding.

The results of a recent American Association of Petroleum Geologists (AAPG) Hedberg Conference held in Banff, Alberta (October 2007) (Hein, Marsh, and Boddy, 2007a; Suter, Leckie, and Larter, 2007), will be published as an AAPG Memoir. At the upcoming 2009 AAPG Annual Meeting in Denver, a poster session (and possible oral session) is planned on oil (tar) sands, as part of the unconventional resource sessions.

Uranium

M. D. Campbell Footnote 15

Production of uranium concentrate in the United States was 1,058,386 pounds (480,076 kg) U3O8 in 2008, up 8% from the previous quarter, but down 10% from the fourth quarter 2007. During the fourth quarter, 2008, in United States, uranium oxide (U3O8) was produced at: One Mill: White Mesa Mill, and six In Situ-Leach Plants: Alta Mesa Project, Crow Butte Operation, Kingsville Dome, Rosita, Smith Ranch-Highland Operation, and Vasquez.

Production of uranium concentrate in the United States totaled 3,922,823 pounds (1,779,363 kg) U3O8 in 2008. This amount was 13% lower than the 4,533,578 pounds (2,056,396 kg) produced in 2007. Uranium mines in the United States produced 4.5 million pounds (2,041,166 kg) of uranium oxide (U3O8) in 2007, 3% less than in 2006 (Fig. 2, Table 2). Six underground mines produced uranium during 2007, one more than in 2006. Six in situ-leach mining operations produced uranium in the United States in 2008, up one from 2007. Overall, there were 12 mines in the United States that produced uranium during part or all of 2008.

Total employment in the U.S. uranium production industry was 1,231 person-years for 2007, an increase of 63% from the 2006 total (Fig. 3). Mining employment increased the most (213%) and exploration employment showed the second largest increase (100%), and is expected to increase further in 2008. Uranium milling and processing employment rose 11%, while reclamation employment did not change from 2006 to 2007 but is expected to have risen in 2008.

In Situ Uranium Recovery

In situ recovery of uranium continued to expand in Wyoming and especially in Texas and elsewhere in the United States and overseas. However, recent economic issues (4th Quarter, 2008) have cooled expansion, but recovery is anticipated in 2009. The total U.S. production capacity is summarized in Table 3.

Socio-Economic Issues

Socio-economic issues have become an integral part of uranium recovery projects today. Uranium occurs naturally in aquifers and this is the reason for background groundwater studies before mining is undertaken. Community support for in situ uranium recovery continues to improve in many parts of the United States, but is often hampered by anti-uranium activist groups. State regulatory and Federal agencies have tightened regulations of the 1970s to meet today’s concerns for appropriate environmental controls, and the uranium industry is changing to meet the new regulations. At present, the uranium recovery industry has an outstanding record in Texas, for example, for remediating past in situ operations. Texas has never recorded an incident of affected groundwater drinking water outside of known areas containing natural uranium and its associated radiogenic products, 226Radium, 222Radon, and others and the associated remediation projects conducted to date (Table 4).

While the aquifer may contain suitable drinking-water quality over an extensive area, the area of the aquifer containing uranium mineralization has been naturally contaminated and was contaminated long before humans drilled water wells. The fact that the aquifer contains uranium mineralization has been misunderstood by landowners, which has resulted in numerous protests and added costs that uranium companies must spend to respond to this misunderstanding, even on frivolous lawsuits. The state now understands and has enacted regulations to prohibit the use of ground water as a source of drinking water in the aquifer(s) containing uranium mineralization. Therefore, establishing baseline environmental conditions are essential for providing clear and reasonable mine closure guidelines that lease owners and surrounding landowners will understand and support. Surveys and meteorological studies are conducted to determine seasonal variations well before uranium recovery begins.

To a large extent, in situ recovery of uranium is both a natural resource development project and a natural contaminant remediation project. Although uranium ore is a natural energy resource, it is also a bacterial-waste product that was formed within the bio-geochemical cell under the influence of reductants, either hydrogen sulfide or methane, present within the roll-front within the aquifer(s) (Fig. 4).

Bio-geochemical cell forming Uranium (after Rackley, 1975)

Uranium ore is a by-product of anaerobic and aerobic bacterial respiration that forms within the bio-geochemical cell. Both rely heavily on, and are driven by, geological and hydrogeological processes including: the hydraulic conductivity of the sands involved either within the ore zone or in the monitored sands above and below the ore zone; the hydraulic gradient of each of the sands; and the porosity of the sands involved and of the ore-zone. To this, the hydrochemistry of ore zone fluids and injection fluids must be added (both within the ore zone and at proximal and distal parts of the aquifer designated by the state as a uranium production zone and not to be used as a source of drinking water).

Exploration for new uranium deposits is not only needed to fuel nuclear reactors, but also to locate naturally contaminated deposits in aquifers that unaware rural residents may have been using for drinking water. This condition easily can be identified by the rural landowner thorough testing of groundwater supplies. Yearly sampling of the water supply should be undertaken as a regular activity of rural well maintenance. Water should be tested for normal constituents including pH, iron, and manganese. Rural residences may become alarmed when their water turns a muddy red with flakes of biomass in the water, indicating that iron bacteria and the often associated sulfate-reducing bacteria have infected the well. This can be remediated by the local water well contractor, usually by chlorinating and cleaning out the well. It is the responsibility of the well owner to maintain the water quality and the man-made devices designed to extract the ground water; that is, the pump and the water well. Iron bacteria have nothing to do with uranium drilling or development as claimed by some media reporters and believed by a few well-meaning but vociferous landowners (Fig. 5).

Pit wall of uranium roll-front (geochemical cell) (after Dickinson and Duval, 1977)

With the general public becoming more environmentally conscious, it is imperative that an ISR uranium company be prepared to respond to all spills and releases immediately and inform concerned persons of the conditions. This may not eliminate problems and misunderstandings, but a community approach should minimize most of the associated problems. Lingering problems involve local media reporting uranium company activities making statements that have no basis in fact or appropriate reference, or combining and confusing subjects in the article to encourage the reader to draw certain conclusions that the general public might not otherwise make. There are also problems with paid activists who are credentialed in one academic field but who claim knowledge in another and attempt to influence others on subjects about which they know very little, even to the point of practicing geology and engineering without a state license which was intended to protect the public from just such misleading information.

World Uranium Reserves

While uranium exploration has picked up in the United States, activity around the world has been expanding substantially over the past few years. Recently, the International Atomic Energy Association (IAEA) announced reserves numbers for 2007. Canada, Australia, and Kazakhstan still control nearly 60% of the known reverses (Fig. 6), although new discoveries are expected from other parts of the world that will increase the reserves, especially in Africa, Canada, and South America.

World Uranium reserves (Source: International Atomic Energy Agency, http://www.iaea.org/)

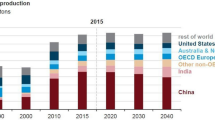

The need for viable energy fuel will become critical by mid-century. All conventional energy sources are predicted to peak during this period and alternative resources are anticipated to fill the gap (Fig. 7). However, nuclear power utilities and associated uranium exploration industry have sufficient identified reserves to last well past the year 2074. Even with the anticipated nuclear power expansion from 439 to 788 reactors over the next 30 years, present reserves will likely meet the demand; reserves typically increase as the fuel price rises and as demand stimulates exploration.

Uranium in present economic concentrations occurs on Earth ranging in rocks of the Precambrian to the sediments of Tertiary age. It also is available as by-products from nuclear devices, from processing phosphate deposits, and from other sources. An alternative future energy scenario that phases out coal, fuel oil, and dams for electrical generation, combined with expanding the use of nuclear and natural gas, while postponing the use of alternative methods of electrical generation, is illustrated in Fig. 7. This “alternate universe” scenario includes nuclear power providing most of the electricity with natural gas providing fuel for transportation. Less-developed countries may use the remaining carbon-based fuels.

The economic and social fabric of America depends on how rapidly the United States can develop and implement a viable energy plan (see Kucewicz, 2007). With the declining oil and gas resources, and with coal becoming an unacceptable energy source on the basis of its socio-economic limitations extending over the next 30 years, nuclear power appears to be the only viable source of energy to generate the large quantities of electrical power that will be required. Also, as uranium reserves are consumed in the early twenty-second century, there is no reason to conclude that additional resources will not be discovered. Also, recycling of uranium (and plutonium) almost certainly will be re-instated for development (Leventhal and Dolley, 1994; Campbell, Wise, and Evensen, 2005; U.S. Department of Energy, 2007; Campbell, Wise, and Rackley, 2007; Campbell and others, 2008; Campbell, Wise, and King, 2008). The use of thorium as a fuel to generate electricity also will play an increasing role (Sorensen, 2006; and older, but still relevant information in U.S. Atomic Energy Commission, 1969). Over the past 10 years, helium-3 (aka 3He) has received considerable attention for its potential to produce significant fusion energy. 3He, a gas, is apparently present in substantial concentrations trapped within certain minerals present in the lunar regolith having accumulated after billions of years of bombardment by the solar wind (Campbell and others, in prep).

Lastly, it is not unreasonable to assume that economic uranium (thorium and helium-3) deposits will be discovered elsewhere in the solar system, i.e., on other planets, moons, or asteroids. The environmental processes that form the younger types of uranium mineralization (of Tertiary age) require the presence of water, bacteria and associated enzymes, and may not be present on many of these distant bodies. However, water may be more pervasive than originally assumed. Geologically older types of uranium mineralization associated with igneous and metamorphic rocks similar to deposits that occur in Proterozoic gneiss and amphibolites (Christopher, 2007) and to the younger rocks in the United States (Armbrustmacher and others, 1995), as well as the well-known, developed uranium deposits in Canada and northern Australia and those under development in Africa, would be analogues for the types of deposits that would be expected to occur elsewhere in the solar system. Some early speculations about uranium, thorium, and associated geochemistry have already begun (Surkov and others, 1980; Zolotov, Krot, and Moroz, 1993). With the number of unmanned missions planned in the next few years, additional information should be available to begin looking actively for resources in our solar system, hopefully within the next 20–30 years and beyond, supported by both solar and nuclear power (Campbell and others, in prep).

Notes

U.S. Geological Survey, 956 National Center, 12201 Sunrise Valley Drive, REston, VA 20192, USA,

To whom correspondence should be addressed; e-mail: pwarwick@usgs.gov

Geoscience Integrations, Missoula, MT 59806, USA.

Hydrate Energy International, Kenner, LA 70065, USA.

Oklahoma Geological Survey, Norman, OK 73019, USA.

West Virginia Geological and Economic Survey, Morgantown, WV 26508, USA.

Bowker Petroleum LLC, The Woodlands, TX 77393, USA.

Geological Survey of Utah, Salt Lake City, UT 84114, USA.

Western Michigan University, Kalamazoo, MI 49008, USA.

Petro-Canada, Calgary, AB T2P 3E3, Canada.

Geological Survey of Utah, Salt Lake City, UT 84114, USA.

Geological Survey of Utah, Salt Lake City, UT 84114, USA.

Geothermal consultant, Inver Grove Heights, MN 55076, USA.

Energy Resources Conservation Board, Calgary, AB T2P 3G4, Canada.

M.D. Campbell and Associates, L.P., Houston, TX 77019, USA.

References

Armbrustmacher, T. J., Modreski, P. J., Hoover, D. B., and Klein, D. P., 1995, Thorium-rare earth element vein deposits, U.S. Geological Survey Open File Report 831 (Chapter 7), p. 50–53, Accessed the Internet on August 15, 2008: http://pubs.usgs.gov/of/1995/ofr-95-0831/CHAP7.pdf, last accessed September 2008.

Alberta Energy and Utilities Board, 2007, Alberta’s Energy Reserves 2006 and Supply/Demand Outlook 2007–2016, Alberta Energy and Utilities Board, Statistical Series, ST98-2007, p. 1–1 to 9–14, 4 Appendices.

Alberta Energy Resources Conservation Board, 2008, Alberta’s Energy Reserves 2007 and Supply/Demand Outlook 2008–2017, Alberta Energy and Utilities Board, Statistical Series, ST98-2008, variously paginated: http://www.ercb.ca/docs/products/STs/st98_current.pdf, last accessed September 2008.

American Association of Petroleum Geologists, Energy Minerals Division, 2007, Unconventional energy resources and geospatial information-2006 review. Natural Resources Research, 16(3), 243–261.

Campbell, M. D., King, J. D., Wise, H. D., Handley, B., and Campbell, M. D., II, in prep., The role of nuclear power in space exploration and the associated environmental safeguards: an overview, 2009 Report of the Uranium Committee: Energy Minerals Division, American Association of Petroleum Geologists. To be released at the AAPG Convention, June 21, Denver, CO.

Campbell, M. D., King, J. D., Wise, H. M., Rackley, R. I., and Handley, B. N., 2008, The Nature and extent of uranium reserves and resources and their Environmental development in the U.S. and overseas: American Association of Petroleum Geologists 2008 Annual Convention Program, 17, 27.

Campbell, M. D., Wise, H. M., and King, J. D., 2008, Nuclear fuel exploration, in situ recovery, and environmental issues in context with the national energy needs through year 2040, in Proceedings of the Texas Commission on Environmental Quality Conference and Trade Fair, April 30, Austin, Texas, CD-ROM.

Campbell, M. D., Wise, H. M., and Rackley, R. I., 2007, Uranium in situ leach (recovery) development and associated environmental issues: Gulf Coast Assoc. Geol. Soc. Trans., v. 91, 18 p: http://www.mdcampbell.com/CampbellWiseRackleyGCAGS2007.pdf, last accessed September 2008.

Campbell, M. D., Wise, H. M., and Evensen, D., 2005, Recent uranium industry developments, exploration, mining and environmental programs in the U.S. and Overseas: Report of the Uranium Committee, Energy Minerals Division, AAPG, March 25: (http://www.mdcampbell.com/2005EMDuraniumReport.pdf, last accessed February 15, 2009.

Christopher, P. A., 2007, Technical report on the Coles Hill uranium property, Pittsylvania County, Virginia (North and South Deposits), for Virginia Uranium, Inc., Chatham, Virginia, November 6 (A 43-101 Report), 49 p: http://www.mdcampbell.com/ColesHill UraniumVirginia.pdf, last accessed February 15, 2009.

Collett, T. S., Agena, W. F., Lee, M. W., Zyrianova, M. V., Bird, K. J., Charpentier, T. C., Houseknect, D. W., Klett, T. R., Pollastro, R. M., and Schenk, C. J., 2008, Assessment of gas hydrate resources on the North Slope, Alaska, 2008: U.S. Geological Survey Fact Sheet 2008–3073, 4 p: http://pubs.usgs.gov/fs/2008/3073/, last accessed March 16, 2009.

Dickinson, K. A., and Duval, J. S., 1977, Trend areas and exploration techniques—South-Texas uranium: Geologic controls, exploration techniques, and potential, in Geology [and Environmental Considerations] of Alternate Energy Resources, Uranium, Lignite, and Geothermal Energy in the South Central States, pp. 45–66 (Fig. 4D—p. 51): The Houston Geological Society, 364 p, http://www.ela-iet.com/ie08000B.htm, accessed April 1, 2007.

Dusseault, M. B., Zambrano, A., Barrios, J. R., and Guerra, C., 2008, Estimating technically recoverable reserves in the Faja Petrolifera del Orinoco—FPO, in Proceedings World Heavy Oil Congress, Edmonton 10–12 March, 2008, paper 2008–437, 6 p.

Energy Information Administration, 2009, U.S. crude oil, natural gas, and natural gas liquids reserves, 2007 annual report: Energy Information Administration, DOE/EIA-0216(2007), 145 p.

Ewing, T. E., 2004, Volcanoes, asphalt, tectonics and groundwater, Field trip guidebook, Gulf Coast Association of Geological Societies, 54th Convention, San Antonio, TX, South Texas Geological Society, Guidebook 2004–01, 92 p.

Faraj, B., Williams, H., Addison, G., McKinstry, B., Donaleshen, R., Sloan, G., Lee, J., Anderson, T., Leal, R., Anderson, C., Lafleur, C., and Ahlstrom, J., 2002, Gas shale potential of selected Upper Cretaceous, Jurassic, Triassic and Devonian shale formations in the WCSB of western Canada: implications for shale gas production: Des Plaines, Illinois, Gas Technology Institute, GRI-02/0233, compact disc, 285 p.

Faraj, B., Williams, H., Addison, G., and McKinstry, B., 2004, Gas potential of selected shale formations in the western Canadian sedimentary basin. GasTIPS, 10(1), 21–25.

Hamblin, A. P., 2006, The “shale gas” concept in Canada: a preliminary inventory of possibilities: Geological Survey of Canada, Open File 5384, 108 p.

Hein, F. J., 2006, Heavy oil and oil (tar) sands in North American: An overview and summary of contributions: Nat. Resour. Res., v. 15, no. 2, p. 67–84.

Hein, F. J., and Marsh, R. A., 2008, Regional geologic framework, depositional models and resource estimates of the oil sands of Alberta, Canada, in Proceedings World Heavy Oil Congress, Edmonton 10–12 March, 2008, paper 2008-320, 9 p.

Hein, F. J., Marsh, R. A., and Boddy, M. J., 2007, Overview of the oil sands and carbonate bitumen of Alberta: Regional geologic framework and influence of salt-dissolution effects, in Proceedings and Abstracts, American Association of Petroleum Geologists Hedberg Conference, Heavy Oil and Bitumen in Foreland Basins—From Processes to Products, September 30–October 3, 2007, Banff and Calgary, AB, Canada, extended digital abstract, modified and posted March 24, 2008, Search and Discovery Article #10145, 3 p. with 2 figures and one table: http://www.searchanddiscovery.net/documents/2008/08017hein/index.htm, last accessed September 2008.

Hein, F. J., Leckie, D., Suter, J., and Larter, S., 2007, Heavy oil and bitumen in foreland basins—From processes to products, in Core Conference, Program with Abstracts, American Association of Petroleum Geologists Hedberg Research Conference, Calgary, Alberta, 37 p.

Hernandez, E., Bauza, L., and Cadena, A., 2008, Integrated reservoir characterization and oil in place estimation for Ayacucho area, Orinoco oil belt Venezuela, in Proceedings World Heavy Oil Congress, Edmonton 10–12 March, 2008, paper 2008–426, 14 p.

Kucewicz, W. P., 2007, Electricity prices and the fuel function: An empirical and global analysis: Econ. Public Policy Rep., v. VIII, no. 1, 64 p: http://mdcampbell.com/ElectricityPricesReport2007.pdf, last accessed September 2008.

Leventhal, P., and Dolley, S., 1994, A Japanese strategic uranium reserve: A safe and economic alternative to plutonium: Sci. Global Security, v. 5, p. 1–31: http://www.mdcampbell.com/5_1leventhal.pdf, last accessed September 2008.

Marsh, R. A., and Hein, F. J., 2008, Canada’s extra-heavy (bitumen) and heavy oil resources, reserves and development. Journal of Canadian Petroleum Technology, 47 (5), 1–5. (May).

Meyer, R. F., Attanasi, E. D., and Freeman, P. A., 2007, Heavy oil and natural bitumen resources in geological basins of the world: U.S. Geological Survey Open-File Report 2007–1084, 36 p: http://pubs.usgs.gov/of/2007/1084/OF2007-1084v1.pdf, last accessed September 2008.

Pelizza, M. S., 2007, Modern in situ uranium recovery technology assures no adverse impact on adjacent aquifer uses: Gulf Coast Assoc. Geol. Soc. Trans., 91, 1, CD-ROM.

Rackley, R. I., 1975, Environment of Wyoming Tertiary uranium deposits. American Association of Petroleum Geologists Bulletin, 56(4), 755–774.

Sorensen, K., 2006, Energy from Thorium, A WebLog devoted to the discussion of thorium as a future energy resource, and the machine to extract that energy: http://thoriumenergy.blogspot.com/2006/04/welcome-and-introduction.html, last accessed August 2008.

Surkov, Y. A., Moskalyova, L. P., Manvelyan, O. S., Basilevsky, A. T., and Kharyukova, V. P., 1980, Geochemical interpretation of the results of measuring gamma-radiation of Mars, in Proceedings of the Lunar and Planetary Science 11th Conference, p. 669–676, Accessed on the Internet August 15, 2008: http://mdcampbell.com/RussianViewofMartianRadioactivityData.pdf, last accessed September 2008.

Suter, J., Leckie, D., and Larter, S., 2007, Heavy oil and bitumen in foreland basins—From processes to products, in Program with Abstracts, American Association of Petroleum Geologists Hedberg Research Conference, Banff, Alberta, 120 p.

Tester, J. W., Anderson, B. J., Batchelor, A. S., Blackwell, D. B., DiPippo, Ronald, Drake, E. L., Garnish, J., Livesay, B., Moore, M. C., Nichols, K., Petty, S., Toksöz, M. N., and Veatch, R. W., Jr., 2006, The future of geothermal energy: Idaho National Laboratory External Report INL/EXT-06-11746, Idaho Falls, ID 396 p: http://www.inl.gov/technicalpublications/Documents/3589644.pdf, last accessed April 2009.

U.S. Atomic Energy Commission, 1969, The use of thorium in nuclear power reactors, Civil Nuclear Power (Wash-UC-80), by Brookhaven National Laboratory and others, Accessed on the Internet: August 15, 2008: http://www.energyfromthorium.com/pdf/WASH-1097.pdf, last accessed September 2008.

U.S. Department of Energy, 2007, Global nuclear energy partnership strategic plan, Office of Nuclear Energy and Office of Fuel Cycle Management, GNEP-167312, Rev. 0, January, 9 p: http://www.gnep.energy.gov/pdfs/gnepStrategicPlanJanuary2007.pdf, last accessed September 2008.

Villarroel, T., 2008, New developments in Orinoco oil belt projects reflect a positive effect on the areas reserves, in Proceedings World Heavy Oil Congress, Edmonton 10–12 March, 2008, paper 2008–412, 8 p.

Zolotov, M. Y., Krot, T. V., and Moroz, L. V., 1993, K, U, and Th behavior in Martian environmental conditions, in Proceedings of the Lunar and Planetary Science 24th Conference, p. 1585–1586: http://mdcampbell.com/RussianKUThMars.pdf, last accessed September 2008.

Acknowledgments

The authors wish to thank two anonymous reviewers. Their comments greatly improved the quality of the paper.

Author information

Authors and Affiliations

Consortia

Rights and permissions

About this article

Cite this article

American Association of Petroleum Geologists, Energy Minerals Division. Unconventional Energy Resources: 2007–2008 Review. Nat Resour Res 18, 65–83 (2009). https://doi.org/10.1007/s11053-009-9094-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11053-009-9094-0