Abstract

The effect of demographic change on the labor force and on fiscal revenues is topical in light of potential pension shortfalls. This paper evaluates the effect of demographic changes between 2010 and 2030 on labor force participation and government budgets in the EU-27. Our analysis involves the incorporation of population projections, and an explicit modeling of the supply and demand side of the labor market. Our approach overcomes key shortcomings of most existing studies that focus only on labor supply when assessing the effects of policy reforms. Ignoring wage reactions greatly understates the increase in fiscal revenues, suggesting that fiscal strain from demographic change might be less severe than currently perceived. Beyond, our micro-based approach captures the impact on fiscal revenues more accurately than previous studies. Finally, as a policy response to demographic change and worsening fiscal budgets, we simulate the increase in the statutory retirement age. Our policy simulations confirm that raising the statutory retirement age can balance fiscal budgets in the long run.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Ongoing long-term demographic changes are widely considered a risk to fiscal sustainability in developed countries. A shrinking labor force, combined with a growing old age dependency ratio, is expected to negatively affect tax revenues and raise pension expenditures. This may threaten governments’ capacities to fund social welfare systems and the provision of other public goods. As a consequence, pension systems in virtually all industrialized countries have been subject to recent reforms (OECD 2013). While the expectations of growing pension expenditures have been supported by a number of studies, the case is less clear-cut for the evolution of fiscal revenues. The interlinkages between demographic transitions and labor market outcomes deserve special attention in this context. If, for example, a shrinking labor force is becoming better educated at the same time (as is projected), average wages will increase. Additionally, if there is a scarcity of labor, neoclassical economic theory predicts that wages should increase in order to stimulate labor supply. Future tax revenues may therefore increase despite population shrinkage. Hence, it is crucial to account for reactions on both sides of the labor market when assessing the effects of demographic changes on future fiscal balances. Most studies, however, do not systematically account for labor supply and demand responses. We study fiscal sustainability in the EU, combining population projections for 2030 with micro-based elasticities of labor supply and demand, allowing us to overcome this limitation.

Specifically, this paper outlines the extent of the challenges for public budgets from demographic changes in a four-step analysis. First, we incorporate two scenarios of projected demographic changes via a reweighting procedure into micro-datasets for the EU-27 countries. In a second step, the implied wage effects are analyzed by modeling the demand and supply side of the labor market. Supply elasticities are differentiated by skill, gender and household type for each EU-27 country. On the demand side, we differentiate own-wage elasticities of demand by country and skill group, drawing on a meta-analysis approach. Next, the consequences for fiscal budgets are investigated with a tax-benefit simulation. We capture personal taxes, social insurance contributions, social transfers, public pensions, and main demography-related public expenditures. Finally, we analyze the impact of an increase in the statutory retirement age, which is an obvious and widely discussed policy response to demographic change.

Our approach is micro-driven and accounts for the full heterogeneity in populations and tax-benefit rules, required to model essential interactions between demographics, labor market behavior and fiscal systems. Unlike computable general equilibrium (CGE) approaches, the only assumptions we impose concern the elasticities of labor supply and demand or stem from the demographic projections.

Our findings contribute to a broad academic debate on the consequences of demographic change. The impact of demographic aging and decreasing population size on long-term economic growth has been treated in a number of endogenous growth models (Prettner and Prskawetz 2010). In these models, the association between population size and economic growth is ambiguous and subject to the modeling framework. This literature regularly predicts positive growth effects from population aging, as households seek to save more during their working life. This triggers investments and hence growth. Incorporating social security, however, may reverse this result, as rising payroll taxes crowd out private savings (Kotlikoff et al. 2007). Notable studies investigating the fiscal implications of population aging in an overlapping generations setting are Fehr (2000) and Börsch-Supan et al. (2014). This literature pays particular attention to the pension system when dependency ratios rise, while treating the tax system in a rather simplistic manner. Börsch-Supan et al. (2014) argued that while sticking to a pay-as-you-go system, living standards in Europe can be maintained in spite of population aging if total employment can be moderately increased. A similar point is made by Ang and Madsen (2015), who show empirically, using a long-term country panel, that an aging work force is usually more productive. This suggests that the contribution of older workers with tertiary education to national production can outweigh higher pension and health costs. Finally, Kudrna et al. (2016) explored the welfare effects from cutting pensions versus raising taxes.

Concerning the fiscal implications of demographic changes, there are a number of studies on the sustainability of pension systems. Comprehensive projections can be found in Dekkers et al. (2010), European Commission (2012) and OECD (2013). There is, however, little work dealing with the impact of population aging on public revenues. The complexity of existing tax-benefit system calls for micro-based approaches rather than representative agent models. Decoster et al. (2014) applied age profiles of taxes and expenditures to a demographic projection for Belgium. Aaberge et al. (2007) allowed for labor supply responses within a micro-macro-CGE model of the Norwegian economy. Finally, de Blander et al. (2013) brought a demographic projection for Flanders to a micro-dataset through a reweighting procedure. The present paper shares methodological aspects with each of these studies, but is more ambitious in allowing for behavioral responses on both sides of the labor markets for a multitude of countries.

Our approach is further able to capture heterogeneous developments between population subgroups. Our treatment of the tax and contribution systems contains far more detail than macro-models generally can. This comes at the cost of ignoring potential general equilibrium effects—we return to this limitation in the next section.

Our paper further extends the literature by exploring the scope of effective policy responses. Surprisingly, despite the relevance of the topic, there are only very few ex ante studies investigating the effects of reforms to pension systems.Footnote 1 Leombruni and Richiardi (2006) set up an agent-based micro-simulation model of labor supply to analyze the evolution of the Italian labor force, taking into account demographic projections. Explicitly modeling retirement rules as well as behavior, they simulate the effects of an Italian retirement reform from the 2000s on the labor market. Mara and Narazani (2011) simulated the effects on employment and retirement behavior of a reduction in pension benefits in combination with targeted income support in Austria. They show that such a reform increases social welfare as well as the employment of middle-income males (aged 55–60). Another simulation study by Fehr et al. (2012) investigates the recent increase in the German statutory retirement age from 65 to 67 years. They show that this rise will postpone effective retirement by about one year and redistribute toward future cohorts. Yet, the reform is found to be not sufficient to offset the projected future increase in old age poverty. None of the studies above deals with reforms of the pension system in a comparative European perspective, taking into account different country-specific fertility profiles and pension systems. Comparing the effects of pension system reforms across Europe helps to shed light on the role that systemic elements of pension policies play in shaping the fiscal budget effects.

Our results show the magnitude of fiscal strain expected from demographic change, revealing a negative outlook for the majority of countries. Taking into account labor market effects substantially improves the balance. Increasing the retirement age, as implemented in many countries, further improves fiscal outcomes, leading to mostly positive outcomes. This is comparable to previous findings on the country level. For Norway, Aaberge et al. (2007) found a smoothening fiscal impact when accounting for labor supply adjustments. Decoster et al. (2014) did not model behavioral responses, but demonstrated a moderate, positive impact of higher elderly employment rates on fiscal sustainability. Employing a modest economic growth scenario, de Blander et al. (2013) also found that increased pension claims can be financed through higher tax revenue as a consequence from increasing real wages.

The paper is structured as follows. Section 2 describes our approach of modeling demographic change and the labor market in more detail. Section 3 describes our implementation of the retirement age reform. Section 4 presents results on labor market and fiscal outcomes. Section 5 contains results on the intergenerational distribution of funding public finances. Section 6 concludes.

2 Data and methodology

Micro-simulation models (MSM) have become a standard tool for the ex ante evaluation of tax-benefit reforms (Bourguignon and Spadaro 2006). The basic idea of MSM is to apply different sets of tax rules to the same sample of households and compare the outcomes across various dimensions such as inequality and employment. It offers a suitable framework to deal with the questions we pose due to its ability to account for the full heterogeneity within a given population. This is in contrast to approaches relying on representative agents, including CGE models. Moreover, the MSM results can be aggregated to the macro-level, while this can be problematic for representative agent models due to potential biases. In the context of divergent demographic trends across EU countries, a micro-based approach is particularly useful, as we can account for the fact that the age composition, educational attainment and household composition are affected differently by demographic change across countries. In this paper, we make two main advances in MSM that may be valuable for other research and policy analyses in the future. First, past MSM studies have been focused on modeling labor supply behavior while being relatively agnostic as far as labor demand feedback effects were concerned. By introducing a novel labor supply and labor demand link (explained in Sect. 2.2), we overcome this shortfall and add a more realistic (partial) equilibrium notion to MSM. Second, demographic changes are accounted for by reweighting the micro-data, which allows us to not only study labor market adjustments to policy reforms in current years but also in the relatively distant future (see Sect. 2.1). Our chosen framework proposes, therefore, a middle ground between micro- and macro-approaches by making MSM outcomes more plausible when accounting for labor market effects. At the same time, the method is parsimonious, straightforward to implement and does not rest on too many assumptions, avoiding a black box.

The main parameters we employ, apart from assumptions underlying the demographic projections, are the elasticities of labor supply and demand. Throughout the analysis, we keep these elasticities constant, even though it is unlikely to be the case in practice. Time-persistent elasticities imply that responses of supply and demand to relative scarcities in the labor market are not changing over time. While the mechanics of the labor market might change over time, it is a priori not clear in which direction they might change and how much variation there could be. For that reason, it seems more reasonable to proceed with the assumption that there are no substantial changes to labor supply or demand elasticities in this time period.

2.1 Population projections

We draw on Huisman et al. (2013) population projections for EU-27 in 2030, which are differentiated along the dimensions of age, gender, household type and education, separately for each country. The projections start from assumptions underlying the Eurostat projections, EUROPOP2010, but allow for additional variation, captured with two scenarios—the tough and the friendly scenario. The scenarios make different assumptions about international and internal migration, educational attainment, life expectancy, fertility and GDP growth. Broadly speaking, the tough scenario implies more severe challenges for European policy makers than the friendly scenario as it assumes lower fertility, lower educational attainment, less international migration and a higher life expectancy.Footnote 2 The latter scenario is assumed to cause a strong increase in the old age dependency ratio. In contrast, the friendly scenario assumes higher net international immigration to Europe which has a positive impact on the working-age population as well as increasing the level of educational attainment.Footnote 3

We incorporate these projections into our micro-data—European Union Statistics on Income and Living Conditions (EU-SILC) survey—by a reweighting procedure. The EU-SILC data are representative for the population in each country and contain rich information about socio-demographic characteristics and incomes of households, serving as input for the tax-benefit calculator (explained further below). Essentially, we adjust the respective sample weights for each observation proportionally to meet the target size in a given stratum.Footnote 4 By means of reweighting, we are able to analyze how the European labor force will change over the course of two decades. Using the implied changes in the skill and age composition, we get a projection for the future labor force and aggregate labor supply before wage adjustments. Tables 3 and 4 detail by country how the population and the labor force can be expected to change in each European country by 2030. Figure 1 contrasts country-wise changes in labor force, defined as the population between age 15 and 64, and population for both scenarios. With few exceptions, the labor force is expected to shrink across countries in both the tough and friendly scenario—on average by 9.2 and 1.0%, respectively. The most drastic decreases are expected for Bulgaria, Romania, the Baltic countries and Germany. Although fertility rates are kept constant at the 2010 levels in the tough scenario, this assumption cannot be the main driver for the stark differences in headcounts between the two scenarios, as most newborn children will not be in the labor force in 2030. From all the different assumptions between both scenarios, migration has the most direct impact on the size of the labor force. As Table 5 shows, net migration flows are projected to be negative for the whole EU in the tough scenario. On the other hand, the friendly scenario implies a substantial overall annual inflow of 2.7 million migrants in 2030.

Apart from an overall decrease in size, the European labor force will undergo two major transitions, namely a shift toward older and higher-skill workers. The share of older workers is projected to rise in nearly all countries, most notably in the Southern European countries. This development is accompanied by increasing educational attainment, resulting in significant increases in the share of high skilled workers in every country. This holds for both demographic scenarios and is particularly pronounced in the friendly scenario. In the tough (friendly) scenario, the share of high skilled rises by only 0.9 ppt (8.0 ppt) in Germany, while other countries exhibit stronger increases, e. g., 10.7 and 15.8 ppt, respectively, in Poland. The developments along both dimensions are visualized in Fig. 2.

2.2 Labor market effects

In most countries, the total number of hours worked, before accounting for wage adjustments, is projected to decrease as a result of demographic changes, ceteris paribus (Table 7, columns labeled D). It is unlikely that major transitions in the number of hours worked, as implied by our projections, would leave the behavior of labor market participants unaffected. In a neoclassical model of the labor market, greater scarcity of the production factor (labor) is expected to induce a wage increase which, in turn, may cause workers to supply more hours of work as potential disposable income rises. We model these wage adjustments by taking into account labor supply and demand elasticities as explained below.

Supply side elasticities Our estimates of labor supply elasticities stem from the analysis of Bargain et al. (2014). While the empirical literature on own-wage labor supply elasticities is vast, Bargain et al. (2014) were the first to carry out estimations for a multitude of countries relying on a uniform methodological framework. They apply a flexible discrete choice model where couples are assumed to maximize a joint utility function over a discrete set of working hour choices. The utility function is specified to account for fixed costs of work, labor market restrictions within countries or even states, preference heterogeneity with respect to age, the presence and number of children as well as unobserved heterogeneity components. We draw on their elasticity estimates, distinguished by sex, marital status and skill level.Footnote 5 As the study covers only 17 EU countries, we use the respective country group mean (see Table 2) if a particular country is not covered.Footnote 6

Demand side elasticities To capture reactions on the demand side of the labor market, we use skill-specific demand elasticities from the meta-analysis in Lichter et al. (2015), shown at the bottom of Table 2. On the basis of empirical findings from 105 studies covering 30 years, the authors run a meta-regression of the estimated own-wage elasticity of labor demand. This allows them to obtain mean estimates for a given country, controlling for characteristics of the study, such as the time period or the estimation methods. We estimate a regression model on their dataset which follows their main specification (Lichter et al. 2015, p. 101,) but adds an interaction term between skill level and country group. We then use our specification to predict conditional mean values, setting the time trend to 2030. Due to lack of available empirical studies, the demand elasticities can only be differentiated by skill level (low skilled vs others) and country group. The latter may not be too problematic given the convergence processes among countries in the same geographic region. The meta-study reveals negative own-wage elasticities of demand which are larger than the supply side elasticities.

Linking labor supply and demand. The graph illustrates the implied supply and demand shifts with overall decreasing labor supply and demand. While this is projected to happen in 15 countries in the tough scenario, the opposite may also occur (see Fig. 1)

Labor market equilibrium Figure 3 visualizes our approach to combine both market sides to obtain the new labor market equilibrium. A formal representation is provided in the Appendix. We build on the approach of linking labor supply and demand in structural labor supply models by Peichl and Siegloch (2012).Footnote 7 In line with them, we differentiate supply side responses by marital status, gender and skill level, leading to twelve distinct labor markets. This ensures a flexible adjustment process as it incorporates the main sources of heterogeneous labor market behavior. As we project a shrinking labor force for 18 out of 27 EU countries, even for the optimistic scenario (Fig. 1), starting from the initial equilibrium A, the labor supply curve shifts to the left due to a shrinking labor force in the future.Footnote 8 Under constant wages, employment would change by the magnitude of the labor supply shock (Point B). This is the pure demographic effect. Negative elasticities on the demand side, however, imply higher wages due to greater scarcity of labor. We additionally take into account the demand shift that can be expected. As the total population is projected to decrease in the majority of countries, the aggregate demand for goods and services can be expected to decrease as well leading to a lower demand for labor. This is represented by a proportional shift of the demand curve, reflecting the relative population change in the respective country. A lower overall population hence manifests in a leftward shift of the LD curve. The new labor market equilibrium is hence defined by the intersection of \(\hbox {LS}_{2030}\) and \(\hbox {LD}_{2030}\) (Point C), featuring (in this example) higher employment and wages than in Point B.

Figure 4 displays the resulting average wage changes across the EU-27 for both scenarios. On average, we project wages to grow by 11.5% (12.4%) in the tough (friendly) scenario. It is crucial to note that, despite an average increase, there are many workers experiencing lower wages. With a few exceptions, average wage changes in a given country are very similar across demographic scenarios.Footnote 9 The starkest changes are projected for Germany and Austria. The smallest average wage increases are projected for Hungary, Latvia and Slovakia.

Our simulated wage changes are moderate given the time horizon of 20 years. Assuming a value of 1% for the annual productivity growth of labor over the period under consideration, one would end up with a total increase in labor productivity of 22% from 2010 to 2030.Footnote 10 Such productivity effects would add to the implied wage changes. Our labor market model does not explicitly address changing skill premiums due to technological change. The educational trends in the population projections are arguably driven to some extent by an anticipated rise in skill premiums, but they are taken to be exogenous in our model.

2.3 Tax-benefit calculator

Any analysis of the fiscal effects of demographic change necessarily needs to address the full heterogeneity of the population of a country, as tax-transfer rules are highly complex and the individual burden of taxation (or eligibility for transfers) depends on personal and household circumstances. The requirements for such ex ante analysis are well met by fiscal micro-simulation models (see, for example, O’Donoghue 2014), which are commonly used in the analysis of public policies (Figari et al. 2015). Given our cross-national focus and the EU-wide scope of analysis, a natural choice is to use EUROMOD, which is the only tax-benefit micro-simulation model covering all EU-27 countries (Sutherland and Figari 2013).Footnote 11 EUROMOD enables us to conduct a comparative analysis of tax and benefit systems consistently in a common framework. It would be interesting to extend the scope of analysis to further countries facing demographic challenges (e. g., Japan or China). Unfortunately, there are no harmonized datasets and micro-simulation tools available, preventing the production of comparable results.

EUROMOD calculates household disposable income, based on household characteristics, their market incomes and a given set of tax-benefit rules. The model covers social insurance contributions from employees, employers and self-employed, income taxes, other direct taxes as well as cash benefits. While pension system rules are not replicated in EUROMOD, individual receipts of private and public pensions, as well as their interactions with tax and benefit rules, are covered by the data. EUROMOD is mainly based on nationally representative micro-data from the EU-SILC released by Eurostat, or its national counterparts where available and when they provide more detailed information. We use version F6.0 of EUROMOD with input datasets based primarily on the SILC 2008 wave.Footnote 12 The sample size for each country varies from about 10 thousand individuals for Luxembourg and Cyprus to more than 50 thousand individuals for Italy and the UK.

We define a concept of Fiscal Balance (FB) as our outcome of interest. FB encompasses the sum of all personal taxes and social insurance contributions (SIC) paid less cash benefits received that are either simulated in EUROMOD or contained in the SILC data. We further subtract public expenditures that are closely linked to the population structure, i.e., expenditures for health care, old age care, child care and education. As these are not provided by EUROMOD, we rely on Eurostat (2013) that provides respective per capita expenditures by age group and country. This allows us to impute these expenditures on the personal level.Footnote 13 This definition of fiscal balance is partial as it ignores other government expenditure items such as infrastructure or defense, and non-household or indirect taxes (corporate income tax, VAT). However, it is still an informative indicator to broadly measure changes in public finances collected or spent in the labor market in this context as it captures the main revenue items (income taxes, SIC) and expenditures (public pensions, health and education) affected by changes in the population structure and by retirement age policies. For the year 2010, our fiscal concept covers on average around 50% of total government revenues and 61% of total expenditures.

In order to facilitate the comparison between governments of different size, the total balance is normalized and shown as the share of total household disposable income in 2010.Footnote 14 Note that we assume an unchanged institutional environment. Our setting does not incorporate a commodity market; hence, there are no price effects. All fiscal results can therefore be understood in constant prices. Equivalently, one could think of policy parameters that are uprated according to the inflation rate.

3 Modeling retirement age reform

Our policy scenario raises the gender-specific retirement age in each country by 5 years, which roughly corresponds to the average forecasted increase in the life expectancy in the friendly scenario (see Huisman et al. 2013, Table 3) .Footnote 15 The statutory retirement age varied notably in 2008 (which is the reference period for our sample), from 60 in France to 68 for males in Finland—see Table 6 in the Appendix. Between 2008 and 2015, 21 out of 27 EU countries have implemented a raise in the statutory retirement age, mostly in the range of two to three years (European Commission 2015, pp. 182ff). Our policy scenario hence anticipates some of the measures already undertaken.

The first complication for implementing the reform arises from the fact that average effective retirement age is usually lower than the statutory retirement age. There are substantial fractions of the population that retire before they reach the statutory retirement age, for instance due to health-related concerns and/or country-specific regulations that facilitate early retirement. This is true for current retirement ages across Europe and with all likelihood will also be the case after raising the legal retirement age. As a result, employment rates tend to decrease relatively smoothly around the statutory retirement age rather than exhibiting a very clear and sharp drop. This means that we need to predict employment rates under the new policy regime not only for the group of people affected by the increase in retirement age directly, i.e., those above the current age threshold and below the new one, but for a wider group of people. In the absence of a structural model determining the retirement decision (see, for example, Manoli et al. 2015), we base the employment rate of the target group on a 5-year younger cohort (taking the three-year moving average to obtain smoother patterns).Footnote 16 We apply this approach to four separate groups of people, distinguished by gender and singles/couples to obtain new employment rates for all age groups older than 40, which is where employment rates peak in most countries, though the largest changes occur naturally for age groups around the current statutory retirement age.Footnote 17

Figure 5 demonstrates our approach, taking male workers in Germany as an example: the solid lines are observed employment rates by age in the status quo (2010) under the current statutory retirement age of 65 (indicated by the first dashed vertical line). We basically assume that an increase in the statutory retirement age from 65 to 70 (under the first reform) shifts the employment curve to the right (by five years as well), shown with the dashed lines. For example, as the (smoothed) employment rate of single men at the retirement age of 65 was 0.19, we assume it will also be 0.19 at a new retirement age of 70. The area between the solid and the dashed line reflects the total increase in employment.

After deriving target employment rates, we assign a corresponding number of retirees from the affected age groups back to work. As the exit into retirement before reaching the statutory age is likely to be non-random, we need to identify individuals with the highest probability to be in employment under the new retirement rules. We estimate the probability of being in work for all individuals i between 45 and 75 years using the following probit model:Footnote 18

The probability of being employed is a function of individual characteristics \(X_i\) such as age (a cubic polynomial), the number of children, disability status, dummies for educational attainment, capital income, region, marital status as well as employment status and income of the partner.Footnote 19 Partner’s status is crucial in couples, as the motivation to continue work might be low in the presence of a high-earning spouse. We estimate the model for each country separately for male and female workers (see Table 14 and 15 in the Appendix with the estimation results).

Having obtained the vector of coefficients \(\beta \), we are able to predict the probability of being employed for those currently out of work. We then order these potential workers by the employment probability and, starting with the individuals with the highest probability, assign current retirees back to work until we meet the projected target employment rate by gender for each cohort. For those assigned into work, we assume individual labor supply to be equal to the cell-specific (defined by age, sex and education) mean value in weekly hours. The individual gross hourly wage is obtained from a regression that relates wages to observable individual characteristics and uses the standard Heckman (1979) technique to control for the unobservable factors that influence the selection into work.Footnote 20

Once we have adjusted relevant labor market characteristics and imputed gross wage for individuals assigned back to employment, we use EUROMOD to calculate new tax liabilities and benefit entitlements. Note that we are not able to account for increased old age pension claims from longer employment trajectories as public pensions are not simulated in the model, but taken from observed micro-data.Footnote 21 The relation between additional time in employment and the individual pension claim depends on the country-specific pension system. As an example, countries differ in the number of years in employment on which the pension amount is calculated and how earnings from various points in time are weighted (OECD 2013, pp. 124f). Accounting for altered pension claims would require a dynamic modeling of individual earnings profiles, combined with the full set of institutional rules of the respective pension system, ideally also capturing interactions with private and occupational pension schemes. The European Commission (2015, p. 218) demonstrates the heterogeneity in pension claims if careers become slightly longer. For working two additional years, the change in the replacement rate (i. e., the ratio of pension entitlements to previous earnings) ranges from 0 to 20 percentage points across EU countries. A similar caveat applies to the treatment of private pensions, as this would require an explicit modeling of future savings behavior of the labor force.

The above description of deriving the market equilibrium abstracted from any policy reaction to the projected demographic transitions. Yet, the logic of our supply–demand link can be easily extended to any additional policy reform. To see how an increase in the retirement age interacts with our labor market model, return to Fig. 3. Starting from the equilibrium with no policy reform, i.e., point C, an increase in the retirement age will increase labor supply and thus lead to an additional shift of the labor supply curve to the right. The new equilibrium point yields higher employment and lower wages compared to C.

4 Labor market and fiscal results

In this section, we present our main simulation results. We focus on two outcomes (i) changes in hours worked and (ii) the effect of the fiscal balance. For both outcomes, we estimate effects at three different stages: (a) only taking into account demographic change (stage D), which isolates the external shock to labor supply for given wages; (b) after the demographic change and wage adjustments effects (stage DW), which captures interactions between labor demand and supply following the initial supply shock; and (c) after the demographic change and the counterfactual policy reform of a 5-year increase in the retirement age (stage DRW), taking into account wage reactions. Results for the three different stages are shown estimated for both the tough and the friendly demographic scenario and for all countries. For clarity, we report the results by country group, roughly reflecting welfare regimes (Esping-Andersen 1990; Ferrera 1996). Detailed results by country are reported in Tables 7, 8, 9, 10, 11, 12 and 13 in the Appendix.

The upper panel of Table 1 shows changes in total hours worked. The pure demographic effect (D) is \(-7.0\% (+3.0\%)\) in the tough (friendly) scenario for the EU-27. This represents the total labor market effect, capturing both intensive and extensive reactions. Isolating the extensive margin, i. e., the change in total employment, reveals similar effects of \(-7.4\) and \(+2.5\%\), respectively (see Table 8 in the Appendix). Eastern and Continental Europe are projected to face the largest declines, while total hours actually rise in both scenarios in the Nordic and Anglo-Saxon countries. Comparing changes in hours to changes in the labor force size (\(-9.2\) and \(-1.0\%\) for the tough and friendly scenarios, respectively) suggests that focusing on headcount overestimates the reduction in effective labor and ignores differential labor supply behavior across socio-demographic groups. The change in hours partly compensates for the reduction in labor force. This suggests that demographic changes will increase the share of people with a stronger preference for working.

Wage reactions to initial shocks in labor supply, and accounting for demand side adjustments at the same time (columns labeled DW of Table 1) lead to additional negative effects on aggregate hours on top of what is induced by the demographic changes only. The wage adjustments to the demographic change do not, therefore, have a stabilizing effect on aggregate employment.Footnote 22 The additional decrease in aggregate hours due to wage adjustment is particularly felt in southern European countries. Nevertheless, it should be stressed that the aggregate difference is a sum of positive and negative trends for the 12 distinct labor market simulations we employ.

As expected, the hours effects from raising the statutory retirement age by 5 years are substantial (columns labeled DRW in Table 1) with the change in aggregate hours going from \(-8.5\% (1.9\%)\) to \(-5.5\% (16.7\%)\). The largest improvement in hours of work is seen in Continental and Southern European countries. This suggests that undertaking this reform can counterbalance the decrease in hours worked from demographic changes even in the tough scenario. There are, however, a few countries (Bulgaria, Estonia, Latvia) where the decline in total hours still exceeds 10% (Table 7).

Decomposed balance changes by country, tough scenario. Note The figure depicts the percentage change in the components of the normalized fiscal balance (Eq. 2) for each step, relative to 2010. TAX: personal taxes, SIC: social insurance contributions, BEN: benefit and pension payments, EXP: demography-related expenditures

Panel B of Table 1 shows how the changes in total hours translate into fiscal outcomes. The figures refer to relative differences in the fiscal balance, normalized by the total disposable income in 2010:

We first quantify the scale of fiscal stress which the demographic change is likely to lead to. Under constant wages (columns labeled D in Table 1), public fiscal balances would decrease by around 6% of household disposable income in both scenarios. The negative budgetary effect in the friendly scenario occurs despite hours increasing 3% on average. This suggests a predominant effect from wage losses for highly qualified workers compared to positive revenue effects from higher wages and hours worked for other groups of employees. Figures 6 and 7 decompose the change in fiscal balances for the tough and friendly scenarios. The components include income tax, social security contributions, cash benefits and government expenditure (including health, old age care, child care and educational expenditures as explained in Sect. 2.3). From these figures, we can see that the negative fiscal balance estimated before accounting for wage changes or introducing the retirement reform (bars labeled D in Figs. 6 and 7) is driven by increased spending on (old age) cash benefits, partly counterbalanced by increased taxes and social insurance contributions though not always. The fiscal outlook is similar across countries, a few exceptions include those which are expected to face significant population growth (e.g., Sweden) or have a greater reliance on private pension schemes, such as Ireland or the UK. Another interesting finding is a positive contribution of expenditures in some Eastern European countries and Germany (tough scenario), which can be explained by large decreases in the total population.

Decomposed balance changes by country, friendly scenario. Note The figure depicts the percentage change in the components of the normalized fiscal balance (Eq. 2) for each step, relative to 2010. TAX: personal taxes, SIC: social insurance contributions, BEN: benefit and pension payments, EXP: demography-related expenditures

With wage adjustments, the fiscal outlook is less bleak. The average change in fiscal balance is still negative but reduced to \(-3\% (-1\%)\) in the tough (friendly) scenario (columns labeled DW in Table 1). The net budget change in the Nordic and Anglo-Saxon countries becomes even positive, on average. The Continental countries also improve their position substantially, while improvements are less drastic for the Southern and Eastern countries. As can be seen in Figs. 6 and 7, improvements in the fiscal balance from the wage change are mainly due to higher tax revenues (bars labeled DW compared to D). Revenues from contributions and spending on benefits vary relatively little. While the friendly scenario shows fiscal balances in nearly all EU countries close to or above zero after the wage reactions, a couple of countries perform poorly in the tough demographic scenario: Hungary, Latvia, Romania and Slovakia end up with deficits above 5% of total household disposable income. A couple of reasons may serve as intuition for these results. Latvia, Romania and Hungary belong to the countries with the strongest projected decline in labor force and working hours. In the next simulation step, wage increases are not translated into higher tax revenues. This is presumably due to the flat tax regimes present in these countries.Footnote 23

The retirement age reform brings EU average fiscal balance close to break even in both scenarios. Compared with the outcome after the demographic and wage changes (columns labeled DRW compared to DW in Table 1), fiscal balances improve most in Southern and Eastern Europe, while we project stagnating or even falling balances for the other country groups. This is explained by the fact that there are two developments following the retirement age increase. Mechanically, cash benefits decrease and revenues increase with higher employment among the older cohorts. Additionally, there is a wage decrease due to higher labor supply, working against the positive revenue effect. The additional budget change from the retirement age reform is marked by a clear decrease in benefit payments (bars labeled DRW compared to DW in Figs. 6 and 7). This positive effect on balances is offset by decreases in tax revenues, in some cases even dropping below the level with pure demographic changes (D). A main reason for such a drop can be found by investigating the employment-age profiles as in Fig. 5.Footnote 24 The four countries identified above share low employment rates well below the statutory retirement age. As a consequence, the policy scenario induces little additional employment, thus also limiting fiscal improvements. This is in contrast to Bulgaria, for which strong demographic shifts are projected as well. The retirement policy, however, substantially improves the fiscal position for Bulgaria, as employment rates are much higher for workers just below the statutory retirement age than in those countries with little differences between the scenarios DW and DRW.

5 Intergenerational distributional impact

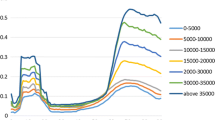

The previous section demonstrated fiscal strains for most countries from the expected demographic change. A related question is how the financing of public goods is going to be distributed across the population in the future. We therefore investigate the consequences of the demographic change on the intergenerational distribution of financial burden. Governments are financed to a large extent by the working-age population: the share of total taxes and contributions paid by people aged 15–64 amounts to 91% on average for the base year. Our demographic scenarios show that the share of working-age population, on average, decreases from 67.9 to 63.4% (tough) and 62.3% (friendly), respectively. Figure 8 plots the change in the share of the working-age population between 2010 and 2030 on the horizontal axis, and the change in the share of the taxes and social security paid by the working-age population on the vertical axis (in the absence of a retirement age reform). Most of the countries (in both demographic scenarios) appear to the left of the 45-degree line. This means that while the share of working-age people in the population is projected to decrease from 68% on average in 2010 to around 63% in 2030, the fiscal burden for this group does not decrease by the same magnitude. In other words, the working-age population pays a larger share of total tax and social security in 2030 than in 2010, relative to its share in population. The fiscal burden accrues more toward the working-age population than the non-working-age population. This result is intuitive on two grounds. First, it is mainly the working-age population profiting from higher average wages. Second, most income tax and contribution systems treat pension incomes preferentially (OECD 2013).

6 Conclusion

It is widely believed that aging populations in European countries will put pressure on public finances through higher spending on old age benefits and lower tax revenues. The issue has gained even more relevance in the aftermath of the Great Recession which has weakened governments’ fiscal positions ahead of demographic developments. This paper assesses to what extent these concerns are justified and explores a raise in the statutory retirement age as one likely policy response.

Linking EU-27 demographic projections for 2030 with rich household-level data and employing micro-simulation methods, we simulate the fiscal effects of demographic change, accounting for substantial population heterogeneity and the complexity of tax-benefit systems. Using the EU tax-benefit model EUROMOD, our analysis covers 27 EU countries in a consistent way in a common framework. This is complemented by a partial equilibrium model of the labor market, relying on recent micro-based empirical evidence.

We quantify the scale of fiscal stress which the demographic change is likely to incur. Assuming constant real wages, public fiscal balances would decrease by around 6% of household disposable income on average—less than the drastic fiscal adjustments carried out in European countries following the recent crisis but of a comparable magnitude.Footnote 25 This is driven by increased spending on (old age) cash benefits, in most countries partly counterbalanced by increased taxes and social insurance contributions due to the older and better educated labor force. The fiscal outlook is broadly similar across countries, a few exceptions include those which are expected to face more favorable demographic developments and have a greater reliance on private pension schemes. Overall, the results are not particularly sensitive to the underlying demographic scenarios. Under flexible wage conditions, however, labor scarcity leads to a strong wage growth and small employment increases (compared to the situation with fixed wages) which, together, notably reduce the worsening in fiscal balances though are not sufficient to withstand it entirely.

We also consider a retirement age reform which increases the current (gender specific) statutory retirement age by 5 years—roughly corresponding to the projected increase in life expectancy. We model effective retirement ages by extrapolating current employment profiles. Our results demonstrate that such reforms could more than offset the impact of demographic processes on fiscal balances. This is due to increased taxes as there is a strong correlation between the increase in the number of people in work and improvement in the fiscal balance, though the reduction in the welfare bill also matters. These effects are, however, moderated and sometimes even reversed, by lower wages due to higher labor supply. As a result, the likely wage reaction to the demographic change coupled with a retirement age reform is sufficient to avoid worsening in fiscal balances in nearly all countries. An analysis of the change in the fiscal burden reveals that under the existing tax-benefit systems, the working-age population will assume even a greater role in financing the government. Their share of payments relative to the population share is projected to rise. Overall, our results paint a less worrying outlook on the fiscal implications of the demographic change. This is in line with previous findings on the country level.

We conclude that wage dynamics are highly relevant for the analysis as dramatic demographic shifts may engender important wage adjustments. This highlights the importance of taking interactions between the demand and supply sides of the labor market into account when evaluating retirement reforms—looking at static effects only can be highly misleading. Nevertheless, our results should be considered in light of some limitations. Extensions to our work could address broader general equilibrium effects by considering the role of technological change and associated changes in labor productivity and returns to education. A more comprehensive concept of fiscal balance, taking for example indirect taxes into account, could be useful. Applying our setting to a dynamic micro-simulation model could improve accuracy with respect to the change in individual pension entitlements in particular. Further work can also explore alternative policy options available such as reducing public pensions and increasing the tax burden for those currently employed. Another option to counterbalance a decreasing labor force is pursuing policies which encourage higher migration. Even though migrants are likely to be net fiscal contributors (see, for example, Dustmann et al. 2010), this topic remains politically highly sensitive.

Notes

Huisman et al. (2013) used a cohort component model to project the age and sex distribution, while education projections are based on KC et al. (2010). Comparing their population projections by skill level to those of the European Centre for the Development of Vocational Training (CEDEFOP), which provides an EU-wide population projection for 2020, shows that the two are well aligned in terms of headcounts (CEDEFOP 2012).

The recent influx of asylum seekers could not be incorporated. This is partly due to lack of reliable information on composition and size of the refugee influx. Moreover, there is huge uncertainty with regard to the length of stay in the host country. According to Hatton (2013), the rate of accepted asylum seekers dropped sharply in the course of the 1990s refugee inflow in the OECD due to tighter asylum policies. The effects on labor force composition in the medium to long run are hence far from certain.

For a similar application of sample reweighting in the context of tax-benefit micro-simulation for Australia, see Cai et al. (2006).

See Appendix for more details.

The country groups are defined as follows. Continental: AT, BE, DE, FR, LU, NL; Nordic: DK, FI, SE; Southern: CY, EL, ES, IT, MT, PT; Eastern: BG, CZ, EE, HU, LT, LV, PL, RO, SI, SK. Anglo-Saxon: UK, IE.

The key difference from Peichl and Siegloch (2012) is the absence of a labor supply shock on the individual level. In our setting, the initial labor supply shock arises from demographic change. Our approach is more restrictive as it requires constant elasticities on both sides of the labor market. This way, the new equilibrium can be obtained analytically and does not require the iterative procedure of Peichl and Siegloch (2012).

Under the assumption of constant elasticities, any supply–demand curve can be fully characterized by the elasticity and a single observation of hours. This assumption is crucial for this framework. While behavioral responses might be quite stable over time, this may not hold under substantial wage changes. Specifying supply–demand curves with non-constant elasticities is of course possible, but the empirical foundation for this assumption would be weak.

For an intuition of the wage effects, see Eq. 6 in the Appendix. The wage change depends on the changes in total population and supplied hours, as well as on the elasticities on labor supply and demand.

For France, the 2007 wave is used; for Malta, the 2009 wave; and for the UK, the Family Resources Survey 2008/2009. We uprate all data to the base year 2010 to minimize inconsistencies between datasets.

Eurostat (2013) did not provide numbers for RO, BG, CY, MT, LV and LT. Similarly to the behavioral parameters, we assume in those cases the average age-related pattern of public expenditures as found in the respective country group. Although expenditure effects for these countries should be treated with caution, this facilitates cross-country comparability.

A numerical example for Austria (AT) illustrates this. Here, the baseline fiscal balance amounts to €–11.2 bn and decreases to €–23.4 bn in the friendly scenario, considering demographic change only. This difference divided by the total household income in 2010 (€ 124.3 bn) is hence –9.82%, which is reported in Table 13.

It also addresses the Barcelona target of raising the retirement age gradually by 5 years (European Council 2002). We additionally ran a second reform scenario that introduces a universal retirement age of 70. The main conclusions are not fundamentally different, and the results are available upon request.

We also rule out decreases in the employment rate by setting the minimum level equal to what is observed currently for a given cohort.

The age variable for Malta is grouped in 5-year intervals; hence, our retirement age-related adjustments are also inevitably cruder in this case.

A similar approach has been used, for example, by Brewer et al. (2011).

Some occupations or industries might bear higher health risks, implying that workers retire earlier. In order to take this into account, we would need information on pensioners’ previous occupation or industry. Unfortunately, this information is not available.

The estimation results are available upon request.

Pension claims might also change due to changed individual earnings (Sect. 2.2).

Considering the transition in and out of employment only gives a similar, albeit slightly more positive picture. Average changes amount to \(-7\) and \(+3.8\%\), respectively.

Slovakia reintroduced a progressive income tax in 2012.

The figures are available upon request.

Replicating our fiscal balance concept with revenue statistics, EU-27 balances worsened during the Great Recession, on average, by 7.4% of disposable income.

At this stage, the total labor supply elasticities are used.

References

Aaberge, R., Colombino, U., Holmøy, E., Strøm, B., & Wennemo, T. (2007). Population ageing and fiscal sustainability: Integrating detailed labour supply models with CGE models. In A. Harding & A. Gupta (Eds.), Modelling our future: Social security and taxation (Vol. I, pp. 259–290). Amsterdam: Elsevier.

Ang, J. B., & Madsen, J. B. (2015). Imitation versus innovation in an aging society: international evidence since 1870. Journal of Population Economics, 28(2), 299–327.

Bargain, O., Dolls, M., Fuest, C., Neumann, D., Peichl, A., Pestel, N., et al. (2013). Fiscal union in Europe? Redistributive and stabilizing effects of a European tax-benefit system and fiscal equalization mechanism. Economic Policy, 28(75), 375–422.

Bargain, O., Orsini, K., & Peichl, A. (2014). Comparing labor supply elasticities in Europe and the US: New results. Journal of Human Resources, 49(3), 723–838.

Börsch-Supan, A., Härtel, K., & Ludwig, A. (2014). Aging in Europe: Reforms, international diversification and behavioral reactions. American Economic Review: Papers and Proceedings, 104(5), 224–229.

Bourguignon, F., & Spadaro, A. (2006). Microsimulation as a tool for evaluating redistribution policies. Journal of Economic Inequality, 4(1), 77–106.

Brewer, M., Browne, J., Joyce, R., & Payne, J. (2011). Child and working-age poverty from 2010 to 2020. London: Institute for Fiscal Studies.

Cai, L., Creedy, J., & Kalb, G. (2006). Accounting for population ageing in tax microsimulation modelling by survey reweighting. Australian Economic Papers, 45(1), 18–37.

CEDEFOP. (2012). Future skills supply and demand in Europe: Forecast 2012. European Centre for the Development of Vocational Training Research Paper No. 26.

Cribb, J., Emmerson, C., & Tetlow, G. (2013). Incentives, shocks or signals: Labour supply effects of increasing the female state pension age in the UK. IFS Working Paper.

de Blander, R., Schockaert, I., Decoster, A., & Deboosre, P. (2013). The impact of demographic change on policy indicators and reforms. FLEMOSI Discussion Paper No. 25.

Decoster, A., Flawinne, X., & Vanleenhove, P. (2014). Generational accounts for Belgium: Fiscal sustainability at a glance. Empirica, 14, 663–686.

Dekkers, G., Buslei, H., Cozzolino, M., Desmet, R., Geyer, J., Hofmann, D., et al. (2010). The flip side of the coin: The consequences of the European budgetary projections on the adequacy of social security pensions. European Journal of Social Security, 12(1), 94–120.

Dolls, M., Fuest, C., & Peichl, A. (2012). Automatic stabilizers and economic crisis: US vs Europe. Journal of Public Economics, 96(3–4), 279–294.

Dustmann, C., Frattini, T., & Halls, C. (2010). Assessing the fiscal costs and benefits of A8 migration to the UK. Fiscal Studies, 31(1), 1–41.

Esping-Andersen, G. (1990). The three worlds of welfare capitalism. Princeton: Princeton University Press.

European Commission. (2012). The 2012 ageing report: Economic and budgetary projections for the 27 EU member states (2010–2060). Brussels: European Union.

European Commission. (2015). The 2015 pension adequacy report: Current and future income Adequacy in old age in the EU. Directorate-General for Employment, Social Affairs and Inclusion.

European Council. (2002). Barcelona European council: Presidency conclusions. 15 and 16 March.

Eurostat. (2013). The distributional impact of public services in European countries. Eurostat Methodologies and Working Papers.

Fehr, H. (2000). Pension reform during the demographic transition. Scandinavian Journal of Economics, 102(3), 419–443.

Fehr, H., Kallweit, M., & Kindermann, F. (2012). Pension reform with variable retirement age: A simulation analysis for Germany. Journal of Pension Economics and Finance, 11, 389–417.

Ferrera, M. (1996). The ’Southern Model’ of welfare in social Europe. Journal of European Social Policy, 6(1), 17–37.

Figari, F., Paulus, A., & Sutherland, H. (2015). Microsimulation and policy analysis. In A. B. Atkinson, & F. Bourguignon (Eds.), Handbook of income distribution (Vol. 2, Chapter 25, pp. 2141–2221). North Holland: Elsevier.

Hatton, T. J. (2013). Refugee and asylum migration: A short overview. In A. Constant & K. F. Zimmermann (Eds.), International handbook on the economics of migration. Cheltenham: Edward Elgar.

Heckman, J. (1979). Sample selection bias as a specification error. Econometrica, 47(1), 153–161.

Huisman, C., de Beer, J., van der Erf, R., van der Gaag, N., & Kupiszewska, D. (2013). Demographic scenarios 2010–2030. NEUJOBS Working Paper D 10.1. http://www.neujobs.eu/publications/working-papers/demographic-scenarios-2010-2030.

Immervoll, H., Kleven, H. J., Kreiner, C. T., & Saez, E. (2007). Welfare reform in European countries: A microsimulation analysis. The Economic Journal, 117(516), 1–44.

Kc, S., Barakat, B., Goujon, A., Skirbekk, V., Sanderson, W., & Lutz, W. (2010). Projection of populations by level of educational attainment, age, and sex for 120 countries for 2005–2050. Demographic Research, 22, 383–472.

Kotlikoff, L. J., Smetters, K., & Walliser, J. (2007). Mitigating America’s demographic dilemma by pre-funding social security. Journal of Monetary Economics, 54(2), 247–266.

Kudrna, G., Tran, C., & Woodland, A. (2016). Facing demographic challenges: Pension cuts or tax hikes. Cesifo Working Paper No. 5644.

Leombruni, R., & Richiardi, M. (2006). Laborsim: An agent-based microsimulation of labour supply. An application to Italy. Computational Economics, 27, 63–88.

Lichter, A., Peichl, A., & Siegloch, S. (2015). The own-wage elasticity of labor demand: A meta-regression analysis. European Economic Review, 80, 94–119.

Manoli, D., Mullen, K. J., & Wagner, M. (2015). Policy variation, labor supply elasticities, and a structural model of retirement. Economic Inquiry, 53(4), 1702–1717.

Manoli, D., & Weber, A. (2012). Labor market effects of the early retirement age. New York City: Mimeo.

Mara, I., & Narazani, E. (2011). Labour-incentive reforms at preretirement age in Austria. Empirica, 38, 481–510.

O’Donoghue, C. (Ed.). (2014). Handbook of microsimulation modelling. Bingley: Emerald.

OECD. (2013). Pensions at a glance 2013. Paris: OECD.

Peichl, A., & Siegloch, S. (2012). Accounting for labor demand effects in structural labor supply models. Labour Economics, 19(1), 129–138.

Prettner, K., & Prskawetz, A. (2010). Demographic change in models of endogenous economic growth. A survey. Central European Journal of Operations Research, 18(4), 593–608.

Staubli, S., & Zweimüller, J. (2013). Does raising the early retirement age increase employment of older workers? Journal of Public Economics, 108, 17–32.

Sutherland, H., & Figari, F. (2013). EUROMOD: the European Union tax-benefit microsimulation model. International Journal of Microsimulation, 6(1), 4–26.

Vestad, O. L. (2013). Labour supply effects of early retirement provision. Labour Economics, 25, 98–108.

Acknowledgements

We thank Alfons Weichenrieder and one anonymous referee, as well as seminar and conference participants in Segovia (APPAM International Conference), Esch-sur-Alzette (IMA Congress) and Lake Tahoe (IIPF Congress) for valuable comments and suggestions. The paper is funded by the EU FP7 project “NEUJOBS” (under grant agreement 266833). The process of extending and updating EUROMOD is financially supported by the European Commission [Progress grant No. VS/2011/0445]. The results presented here are based on EUROMOD version F6.0. EUROMOD is maintained, developed and managed by the Institute for Social and Economic Research (ISER) at the University of Essex in collaboration with national teams from the EU member states. We are indebted to the many people who have contributed to the development of EUROMOD and to the European Commission for providing financial support for it. The results and their interpretation are the authors’ responsibility. We use micro-data from the EU Statistics on Incomes and Living Conditions (EU-SILC) made available by Eurostat under contract EU-SILC/2011/55 and the Family Resources Survey data (for the UK) made available by the Department of Work and Pensions via the UK Data Archive. The authors alone are responsible for the analysis and interpretation of the data reported here.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Labor supply elasticities

The total supply elasticity for subgroup \(g \in [1,\ldots ,12]\) in country c is defined as a percentage change in total hours in relation to the percentage change in wages: \(\varepsilon ^S_\mathrm{gc} = \frac{\partial H_\mathrm{gc}}{\partial w_\mathrm{gc}}\frac{w_\mathrm{gc}}{H_\mathrm{gc}}\). The intensive elasticity is this ratio conditional on working at least one hour. The extensive elasticity is defined as the relative change of the employment rate \(E_\mathrm{gc}\): \(\varepsilon ^{S,\mathrm{ext}}_\mathrm{gc} = \frac{\partial E_\mathrm{gc}}{\partial w} \frac{w}{E_\mathrm{gc}}\). This corresponds to the extensive margin (participation) in the result tables of Bargain et al. (2014).

Looking first at single females in Table 2, we see that the labor supply elasticity of low-skilled single females ranges from 0.1 in the Eastern European countries to just over 0.3 in the British Isles. In the medium-skilled category, it is the Southern European countries which display the highest labor supply elasticity for single females (at around 0.3), while the same figure for the British Isles is almost unchanged compared to the low-skilled category. The Nordic and Continental countries show a similarly low labor supply elasticity for this group of medium-skilled single women. The labor supply elasticities of high-skilled single women are much higher than those of low or medium skilled, ranging from 0.25 in Eastern Europe to 0.5 in the Southern European countries and in the UK and Ireland.

In general, women in couples display higher labor supply elasticities than their single counterparts (except for the high-skilled category). Once again, there are discrepancies by country groups although the labor supply elasticity of women in couples displays less variability by skill group than that of single women. Eastern European women in couples have the lowest labor supply elasticity, regardless of skill type, at around 0.1. Non-single southern European women have the largest labor supply elasticities which range from 0.35 among the high skilled to 0.5 among the medium skilled. The labor supply elasticity of continental European women is fairly constant across skill groups at around 0.3, while the Nordic countries and the British Isles also have stable elasticities of around 0.2 across skill groups.

Among single men, the highest labor supply elasticities are to be found among the high and low skilled with the group of medium-skilled single men displaying reasonably stable labor supply elasticities across countries of between 0.1 (in the Continental countries) and 0.2 (in the Nordic countries). Among the low-skilled single men, the British Isles have the largest labor supply elasticity of around 0.45. The smallest, of 0.15, are to be found in the Continental and Eastern European countries. Meanwhile, the Nordic and Southern European low-skilled single men have labor supply elasticities of around 0.25. Similar cross-country grouping patterns are found for the high skilled with the highest elasticities found in the British Isles (0.65), followed by the Nordic (0.35) and Southern European (0.3) countries.

Finally, we observe very low labor supply elasticities for men in couples, regardless of their skill level. These range from 0.06 to 0.14 with the largest values observed for high-skilled men, followed by low-skilled and then medium-skilled men. The Nordic countries display the largest elasticities across country groups for men in couples, regardless of the skill group (Table 2).

1.2 Analytical derivation of new labor market equilibrium

Denoting total hours worked with H and the average wage w, the labor demand elasticity \(\eta \) with respect to wage is defined by \( \eta = \frac{\partial H}{\partial w} \frac{w}{H} = H'(w) \frac{w}{H} \). We assume an iso-elastic demand curve of the form \(H_{D}(w) = cw^{\eta }\), where c is derived from the observed combination of hours and (average) wages.

Assuming an equilibrium state initially, both the supply and the demand curve go through this point. Defining the wage elasticity of labor supply \(\varepsilon \) analogously,Footnote 26 the analytical labor supply curve looks as

Now suppose a labor supply shock due to demographic change, i. e., \(H_1^S = \lambda H_0\). This shifts the labor supply curve (4) by manipulating \(c_0\), i. e., \(c_1 = \lambda \frac{H_0}{w_0^{\varepsilon }}\).

At the same time, we mimic general equilibrium effects from demographic change on the labor demand side by scaling \(c_0^{\mathrm{LD}}\) in Eq. 3 in proportion to the population change \(\pi \). The new labor market equilibrium is found at the intersection of both equations

This yields the new equilibrium wage

The relative wage effect \(\frac{w^{*}}{w_0} = \left( \frac{\lambda }{\pi } \right) ^{\frac{1}{\eta - \varepsilon }} \) for the respective population subgroup can then be fed into the tax-benefit calculator to compute labor market reactions on the individual level and, finally, fiscal effects. Note that measurement error in the individual wage does not constitute a problem here, as \(\frac{w^{*}}{w_0}\) is independent of \(w_0\). We distinguish individual reactions by extensive and intensive labor supply elasticities. First, people in work adjust their number of hours according to the intensive elasticity. In a next step, the number of people in work is adjusted such that the employment rate changes according to the extensive elasticity.

Rights and permissions

About this article

Cite this article

Dolls, M., Doorley, K., Paulus, A. et al. Fiscal sustainability and demographic change: a micro-approach for 27 EU countries. Int Tax Public Finance 24, 575–615 (2017). https://doi.org/10.1007/s10797-017-9462-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-017-9462-3