Abstract

The budgetary implications of an aging population in the OECD are often considered dire. This study argues that this need not be the case provided that older educated workers are more innovative than their younger counterparts and that the workers with tertiary education stay in the labor force until their 60s. In using a panel of 21 OECD countries over the period 1870–2009, this paper estimates the productivity growth effects of education for different age groups, through the channels of innovation and imitation. The results show that educated workers are highly innovative and that the propensity to innovate increases sharply with age.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

OECD countries are aging fast. The consensus view is that this is likely to act as a constraint on future per capita income growth in industrialized countries (OECD 2006a; Garibaldi et al. 2011; Prettner 2013). An aging population increases the age dependency ratio, which, in turn, reduces the tax base and increases government expenditures on pensions and health (OECD 2006a). Furthermore, it is widely perceived that individuals tend to be more productive at a younger age, as shown by Haltiwanger et al. (1999), among others. Coupled with high resistance toward increasing the pension age, the aging population is considered to be a big threat to the welfare state of the old industrialized countries.

However, as discussed in detail in the next section, aging need not be a drag on productivity growth for the following three reasons. First, since it has become more difficult to innovate after the Second Industrial Revolution, education is increasingly becoming an asset that facilitates innovations. Second, cognitive abilities of sufficiently educated people, which are crucial for innovative activity, peak in the later stages of their working life and stabilize thereafter compared to their uneducated counterparts. Third, older workers have some advantages over younger workers due to greater knowledge, based on experience. Thus, provided that older educated workers stay in the labor force, aging need not be a drag on the economy.

Despite the potential large welfare effects of an aging society, very little research, if any, has been undertaken to examine the growth effects of aging for different educational groups at the macroeconomic level. Thus far, the discussion has predominantly been centered on the government’s balance sheet rather than on innovative activity. However, changes to the government’s budget balance will have only one-off effects on income, whereas variations in innovative activity will have permanent growth effects if growth is proportional to the level of educational attainment. Since growth rates in the long run override the levels effects, the welfare effects of aging may actually be positive. This depends on the effects of aging on innovative activity, the resources spent on education, and whether the pension age is kept constant or is increased along with higher life expectancy.

The objective of this paper is to examine the productivity growth effects of educational attainment among different age groups and educational categories. Previous studies on the relationship between human capital-based absorptive capacity and productivity growth have not considered the productivity effects of different age cohorts and educational groups (see, e.g., Kneller and Stevens 2006; Vandenbussche et al. 2006). We examine whether the oldest educated age cohort in the labor force contributes more to productivity growth than its younger counterpart and, therefore, whether raising the pension age among educated workers can counterbalance the income drag of increasing old-age dependency. Using data for 21 OECD countries over the period 1870–2009 and based on the framework of Nelson and Phelps (1966) and Vandenbussche et al. (2006), we test whether the growth effects of human capital through the channels of innovation and imitation differ across age and education.

This paper proceeds as follows. Section 2 discusses the research on cognitive ability and aging. Section 3 presents the baseline empirical estimates. Robustness checks are performed in Section 4. Section 5 discusses the microeconomic evidence and its relation to our results, and the last section concludes.

2 Cognitive ability, experience, and aging

The productivity growth effects of aging depend on two counteracting forces. New technology and work organization render some skills obsolete and, therefore, lead to a depreciation of human capital at older ages. However, this may be counterbalanced by the skills and experience required to adapt to the new technology and incorporate it into new products and production processes. Recent studies show that it is becoming increasingly hard to innovate, suggesting that more years of training are required to understand existing technology and to develop new technologies based on previous knowledge (Aghion and Howitt 1998; Jones 2009, 2010). While inventors before the Second Industrial Revolution during the mid-nineteenth century were often without formal tertiary education, innovative activity has increasingly been undertaken by a highly specialized and educated labor force (Mokyr 2005; Jones 2010).

Since productivity growth is driven by technological progress along the balanced growth path, the ability of workers to continue innovating as they age becomes an important issue for the productivity effects of aging and the potential productivity effects of increasing the pension age. The ability to innovate varies with age which, in turn, depends on how fluid and crystallized intelligence develop with aging. Fluid intelligence is the speed at which operations can function, whereas crystallized intelligence consists of knowledge acquired over a lifetime due to education and on-the-job training. Medical and psychological research suggests that fluid intelligence peaks at 30–40 years of age and declines thereafter, while crystallized intelligence declines at a much slower rate and may even increase with age (Salthouse 1985). Salthouse (1985) argues that crystallized intelligence, such as numeracy, among educated workers shows little evidence of decline at .

Experience on the job also tends to improve older compared to younger workers’ productivity since the former use more efficient strategies developed through prior learning and experience (Salthouse and Maurer 1996). Moreover, an older educated workforce is likely to contribute disproportionately to productivity growth through facilitating organizational development. Experienced and knowledgeable workers can provide guidance on how to ameliorate conflict within institutions and improve intergroup relations, thereby resulting in higher productivity growth, which may counterbalance, decreasing productivity on other fronts (Salthouse and Maurer 1996).

Research finds that the ability to innovate peaks at around the age of 50 and then plateaus. In particular, Hoisl (2007) finds that the quality of inventions among German inventors peaks between the ages of 45–54 and is fairly stable thereafter. A survey of 9,017 European patented inventions in 2003–2004 reveals that more than one third of the inventors in the sample were older than 50 (Giuri et al. 2007). Furthermore, Feyrer (2007) shows that an increase in the size of the working population aged 40 to 50 years tends to increase productivity growth. He argues that about one quarter of income differences between rich and poor nations are attributable to their different demographic structures and that poor countries tend to have low productivity because their workforces are too young. Notwithstanding their findings, these statistics may still understate the role of age and vintage as inventors who have been promoted into senior positions are no longer directly involved in innovative production, although they may still provide input indirectly. Older workers’ contribution to productivity growth may also be underestimated due to the time spent on coaching younger workers.

Moreover, studies have consistently found that the risk of dementia in old age is a significant declining function of education (Le Carret et al. 2003). Friedland (1993) suggests that education increases synaptic density and promotes intellectual and creative activity patterns, resulting in a lifelong neural activity that could be physiologically beneficial. Education may be an early cognitive stimulation having a positive influence on cerebral (part of central nervous system) growth and cognition and, therefore, able to provide some resilience to cerebral lesions. Numerous experiential studies suggest that an enriched environment may promote brain development (Le Carret et al. 2003). Importantly, if workers are expected to stay in the labor force for more years, their jobs will be more demanding, thus increasing the demand for job training courses. Experiments with rats suggest that stimulating mental activities during post-educational years enhances the effects of education and helps to form a cognitive reserve (Le Carret et al. 2003). Furthermore, Hertzog et al. (1999) have shown that intellectually engaging activities in later life act as a buffer against cognitive decline. In a similar vein, Le Carret et al. (2003) find that education is associated with controlled processes and conceptualization abilities.

Finally, there are twice as many successful founders aged over 50 as there are under 25 years old and twice as many over 60 as under 20, while the highest rate of entrepreneurial activity is among people aged between 55 and 64, and the lowest rate is among the 20- to 34-year-old generations. Colonel Harland Sanders was in his 60s when he started the Kentucky Fried Chicken chain, and Ray Kroc started building the McDonald’s franchise system in his 50s (The Economist 2012). The late Steve Jobs was as creative in his 50s as he was in his 20s when he started Apple. If these examples and findings can be traced out at the macrolevel, the prospects for an aging society may not be bleak.

3 Empirical estimates

3.1 Model specification

Endogenous growth theory proposes that growth is driven by the use of better quality technology and more efficient use of resources. Letting productivity growth be a positive function of human capital, technology proximity, and age dependency yields the following regression model:

where A is the total factor productivity (TFP), labor productivity, or per capita GDP; \(\frac {A_{i,t-1}}{A_{t-1}^{\max } }\) is the proximity to the technology frontier and is measured as the relative productivity gap between country i and the technology leader at time t, where the leader is chosen as the country having the highest TFP among all countries in the sample at time t; H is the vector of human capital decomposed into different educational and age groups; YAG and OAG are the ratios of young- (0–14) and old-age (65+) dependency, respectively; X is the vector of control variables, including trade openness, domestic innovative activity, and international knowledge spillovers; d t is the time-specific effect, capturing common shocks and world productivity growth or the unobservable individual-invariant time effects; and ε i t is the stochastic error term. The panel is regressed in 5-year differences in order to filter out the business cycle influences. Human capital, proximity to the frontier, and all control variables are measured as the average within the period that is covered by the differences. The growth equation is estimated for a panel of 21 OECD countries covering the period 1870–2009. The data sources are provided in the Appendix (only available online).

Age dependency rates are only included in the per capita income growth regressions because age dependency does not directly affect TFP and labor productivities as these estimates are based on hours worked and not on the size of the population. An increase in age dependency rates should lower per capita income because the population outside the workforce does not contribute to production. Although accounting identities predict that age dependency rates are equally a drag on per capita income, they are subdivided into old- and young-age dependency rates since the focus of this paper is on the productivity growth effects of aging.

The productivity growth effects of education are divided into three educational groups (primary, secondary, and tertiary) and three age groups (20–34, 35–49, and 50–64). The coefficients of these groups reflect their social returns and their relative sizes. Human capital is assumed to influence productivity growth by increasing the efficiency of production, innovative activity, and the ability to adapt technologies that are developed elsewhere (Nelson and Phelps 1966; Vandenbussche et al. 2006). In the model developed by Vandenbussche et al. (2006), workers with primary or secondary education facilitate imitation or diffusion of existing technology, whereas workers with tertiary education promote the innovation of new technology. Their theoretical model proposes that tertiary education should become increasingly important for productivity growth as a country moves closer to the technology frontier, whereas primary and secondary education becomes less important. These effects are captured by the level of human capital and the interaction between human capital and proximity to the frontier.

In particular, the model of Vandenbussche et al. (2006) predicts that the coefficient of the interaction between human capital and proximity to the frontier depends on whether the workers are highly skilled (tertiary education) or lowly skilled (primary and secondary education). For highly skilled workers, the coefficient is predicted to be positive because they innovate, but for lowly skilled workers, negative because the growth effects of imitation decrease as the economy approaches the technology frontier. Thus, the growth-enhancing impact of skilled labor increases with a country’s proximity to the frontier. Conversely, the growth-enhancing impact of unskilled workers decreases as a country catches up with the technology frontier. Growth is assumed to be negatively related to proximity to the frontier because the effective costs of adaption and imitation of new technologies are inversely related to the technological distance (Dowrick and Nguyen 1989). Its theoretical mechanism has been shown by Barro and Sala-I-Martin (2004).

However, the effects of the interaction terms may not follow the predictions of the model of Vandenbussche et al. (2006). The seminal model of Nelson and Phelps (1966) lumps all groups of educational attainment together and predicts that the impact of the interaction between the average years of schooling among the working age populations and proximity to the technology frontier is negative, under the assumption that education facilitates the adaptation of technologies developed at the world frontier.Footnote 1 Thus, the Nelson-Phelps model predicts the coefficients of the interaction terms to be the same for all groups of educational achievement. Which model is the best description of the OECD experience is an empirical question addressed in this paper.

Trade openness and international knowledge spillovers through the channel of imports are included as control variables. Growth is assumed to be positively related to openness because increased openness to international trade implies lower tariff and other trade barriers, greater specialization, and a greater potential to acquire knowledge embedded in imported goods (Madsen 2009). International knowledge spillovers are assumed to enhance productivity due to the improved quality and product variety of imported intermediate products (Keller 2004; Madsen 2007; Ang and Madsen 2013).

According to the Schumpeterian growth theory, domestic innovative activity is captured by research intensity, which is measured as the ratio of the number of patent applications by domestic residents to employment. Innovative (patenting) activity is divided by product variety (employment), given that the effectiveness of R&D is diluted as the number of products proliferates following an expansion in the economy. Employment is used as a measure of product variety because the number of products is growing at the same rate as population in steady state in the Schumpeterian growth models (see Aghion and Howitt 1998, Chap. 12; Ha and Howitt 2007). Furthermore, empirical models have found employment to be a good measure of product varieties (see, e.g., Griffith et al. 2004; Ha and Howitt 2007; Madsen 2008; Madsen et al. 2010a, b; Ang and Madsen 2011). Madsen (2008), in particular, finds that the significance of research intensity is insensitive to whether product variety is measured using employment or the stock of trademarks.

3.2 Data

As mentioned above, productivity is measured as TFP, labor productivity, and output per capita. Two measures of TFP are used in the regressions: a conventional measure with Hicks-neutral technological progress (in the robustness section) and one with embodied technological progress (default regressions). The former is measured as economy-wide TFP data and is based on the two-factor homogenous Cobb-Douglas production technology with Hicks-neutral technical change as follows: \(Y_{it} =A_{it} K_{it}^{\alpha } L_{it}^{1-\alpha } \), where Y i t is the real output for country i at time t, A i t is the TFP, K i t is the total capital stock, L i t is the number of hours worked, and α is the capital’s income share. Thus, TFP is computed as

where (1−α) is computed as the unweighted average of labor’s income share in country i and the USA. Labor’s income share for each country is, in turn, estimated as the average during the period for which data are available (for details, see Madsen 2010). Labor is measured by economy-wide employment multiplied by annual hours worked.

The second TFP measure allows for embodied technological progress following the seminal contribution of Solow (1960), which is extended by Greenwood et al. (1997) (see also Hercowitz 1998). According to the embodiment hypothesis, new technology is predominantly embodied in new, more efficient types of fixed capital, particularly equipment and machinery (Greenwood et al. 1997). Consequently, the embodiment and disembodiment effects can be distinguished by considering an efficiency capital as an additional factor in the Cobb-Douglas production function with Hicks-neutral technological progress as follows:

where \(A_{it}^E \) is the disembodied technological progress, \(\Tilde {{K}}_{it}^{\text {eq}} \) is the capital stock of equipment in efficiency units, and \(K_{it}^{\text {st}} \) is the capital stock of structures.

Relative prices of consumer and investment goods are used to capture embodied technological progress following the approach of Greenwood et al. (1997). They argue that technological progress makes new equipment less expensive than old equipment in efficiency units, ceteris paribus. Computers are examples of equipment that has become substantially cheaper in efficiency units over time, and they have increased the efficiency of production due to embodied technological progress. Since significant quality improvements do not occur in most of the consumer good-producing sectors, embodied technological progress increases the relative prices of consumption goods, assuming that costs have changed by the same proportion in the two sectors. Accordingly, embodied technological progress, proxied by relative prices, is incorporated into the efficiency capital stock using the inventory perpetual method as follows:

where δ is the depreciation rate, \(I_{i,t}^{\text {eq}} \) is the gross investment in equipment and machinery, \(P_{i,t}^{\text {cpi}} \) is the consumer price index, and \(P_{i,t}^{\text {meq}} \) is the price deflator for machinery and equipment. Thus, disembodied TFP is computed as

Although this adjustment appears to be straightforward, it is incredibly difficult to obtain price deflator data for equipment and machinery investment back to 1870, and the effect of embodied technological progress may not have been sufficiently accounted for in historical investment deflators. In particular, hedonic pricing is usually required to capture the quality improvements of investment in equipment and machinery (see Greenwood et al. 1997). National statistical agencies have increasingly improved investment deflators in the post-World War II (WWII) period, and this is reflected in a significant increase in consumer prices relative to prices of equipment and machinery. However, information about the construction of investment deflators before WWII is rarely available, and the prices of consumer goods relative to the prices of machinery and equipment have not shown the consistent increases that we would expect. Furthermore, there are large measurement errors that have to be adjusted for during periods of high inflation and hyperinflation. These considerations suggest that the estimates of investment-induced technological progress are not as reliable as we would like them to be.

Another problem associated with the measurement of embodied technological progress through relative prices is that consumer prices include prices of pharmaceutical products, which are, in turn, influenced by technological progress in the pharmaceutical sector. This is a highly innovative sector, as characterized by a very high level of R&D intensity (see, e.g., Lichtenberg and Virabhak 2007; Lichtenberg 2010, 2012a, b). For the country sample used in this paper, R&D in the pharmaceutical sector alone accounted for approximately 10 % of total R&D in 2009, suggesting that the pharmaceutical industry is a highly innovative sector (source: OECD STAT 2013). The implication here is that the investment-induced technological progress, proxied by (P cpi/P meq), may potentially underestimate the embodied technological progress. This is because P cpi would otherwise be higher if pharmaceutical products are excluded in the calculation of the consumer price index. Note that pharmaceutical prices should not be included in the calculation of P meq since technological progress within the pharmaceutical sector is not investment-specific and, as such, does not directly enhance the productivity of other sectors in the economy.

A natural way to deal with technological progress within the pharmaceutical sector is to remove pharmaceutical products from the consumer price index. This approach, however, is complicated by the fact that data on consumer prices for pharmaceutical products are not available very far back in time. Yet, the available data give mixed signals about technological progress within the pharmaceutical sector. For example, while consumer prices of pharmaceuticals relative to the overall consumer price index decreased in six OECD countries (Finland, Greece, Ireland, the Netherlands, Spain, and Switzerland), they increased in ten OECD countries (Austria, Belgium, Denmark, France, Germany, Italy, Norway, Portugal, Sweden, and the UK) over the period from 1999 to 2011 (source: Eurostat 2013). These conflicting trends are likely to reflect the fact that price changes of pharmaceuticals are incredibly difficult to measure since new products constantly enter the market, and the improvement of these products relative to their older counterparts cannot always be assessed.

To overcome the measurement problems associated with prices of pharmaceutical products, we will also use the consumer prices of food in addition to general consumer prices in the robustness checks. The benefit of using the consumer food price index is that it excludes pharmaceuticals, but the shortcoming is that food prices reflect only a fraction of consumables. However, given the length of our data sample, we are constrained by how much disaggregated data on consumer prices can be found.

Human capital is measured as the fraction of the working age population for the age groups 20–34, 35–49, and 50–64 having primary (PRI), secondary (SEC), and tertiary (TER) education. It is estimated using the gross enrolment rate (GER), which is defined as the fraction of the population in a certain age cohort that is enrolled at a certain educational level. The GER for primary, secondary, and tertiary education is estimated for each age cohort. School enrolment data are available on primary (6–11 years of age), secondary (12–17 years of age), and tertiary (18–22 years of age) levels since the nineteenth century for the countries considered in this study. For some countries, the data are extrapolated backward to ensure that primary school enrolment is available from 1812. In 1870, for example, the oldest cohort in the labor force (64 years of age) did their first year of primary schooling in 1812, while the youngest cohort (15 years of age) did their first year of primary schooling in 1861. The data are adjusted for the length of the school year and school attendance rates.

International knowledge spillovers through the channel of imports (IKS) are measured following the formula suggested by Lichtenberg and van Pottelsberghe de la Potterie (1998) and extended by Madsen (2007) as follows:

where m i j t is the country i’s imports from the exporting country j at time t; y j t is the exporter j’s GDP at time t; \(PI_{jt}^d \) is the exporter j’s patent intensity (the number of patent applications over employment) at time t, that is, it is the patent intensity of the 21 OECD countries considered in this study; m f and m s are the “flow” and “stock” of nominal imports, respectively; and y f and y s are the flow and stock of nominal GDP, respectively. The initial values of m s and y s are estimated, respectively, as \(m_{i,1870}^s =m_{i,1870}^f /(g_i^m +\delta )\) and \(y_{i,1870}^s =y_{i,1870}^f /(g_i^y +\delta )\), where g m and g y are the average annual growth rates of m f and y f for each country over the period 1870–2009. Unlike Lichtenberg and van Pottelsberghe de la Potterie (1998), the stock rather than the flow measure is used here since it is less subject to temporary shocks in import penetration. A cyclical reduction in imports will dramatically reduce the values of international knowledge spillovers, although this does not necessarily imply that international knowledge has been lost in the process, given that imported high-tech equipment is not a short-lived physical asset. The stock measure overcomes this deficiency (Madsen 2007).

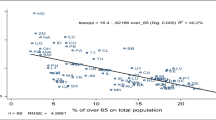

Trade openness is measured as the ratio of imports to GDP. Age dependency is captured by two measures: the young-age dependency ratio (the number of people under 15 as a proportion of the total population) and the old-age dependency ratio (the number of people over 64 as a proportion of the total population).

The summary statistics for the key variables are presented in Table 1. The average educational attainment is lower for the older than the younger-age cohort because educational attainment has been increasing during the sample period. The TFP, labor productivity, and per capita GDP growth rates appear high because they are measured in 5-year periods. On an annual basis, they are only 1.5, 2.6, and 2.2 %, respectively. The labor productivity growth rates are higher than the TFP growth rates because TFP-induced capital accumulation increases labor productivity growth rates. Finally, the labor productivity rates exceed the per capita growth rates because of a significant reduction in annual hours worked during the period 1870–2009, while the labor force participation rates, on average, have only increased modestly over the sample period.

3.3 Estimation method

The model is estimated using the system generalized method of moments (GMM) estimator. Under certain assumptions and moment conditions, Arellano and Bover (1995) and Blundell and Bond (1998) propose the use of a system GMM estimator that combines the regression in first differences with an additional regression in levels using suitable instruments to produce more consistent and efficient estimates. Accordingly, past levels of the regressors are used as instruments for current differences in the first-differenced regression, whereas past changes of the regressors are used as instruments for future levels in the regression involving level variables. These are internal instruments which are generated based on some transformation of the existing variables that may not be truly exogenous. However, it would be a very challenging task to find suitable external instruments for different levels of educational attainment going as far back as 1870. Furthermore, the feedback effects from growth to educational attainment is likely to be minuscule since educational attainment is determined from schooling decisions from up to 58 years before. Potential endogeneity is, therefore, dealt with using the system GMM estimator of Arellano and Bover (1995) and Blundell and Bond (1998) without incorporating any additional external instruments. This estimator is shown to be the preferred approach for estimation of empirical growth models due to its superior ability in exploiting stationarity restrictions (see Bond et al. 2001).

Two identification tests are presented to check the validity of the instruments, as suggested by Arellano and Bond (1991), Arellano and Bover (1995), and Blundell and Bond (1998). The first is Sargan’s test of overidentifying restrictions, which tests the overall validity of the instruments. The second test checks for second-order serial correlation (i.e., AR(2)) in the first-differenced error term. Support for the use of this approach is found since the null hypotheses could not be rejected in any of the regression models below.

3.4 Core results

Table 2 presents the results for the dynamic panel growth regressions. The coefficients of the time dummies are not reported in the table to conserve space. The estimates show that neither primary nor secondary education has a direct positive growth effect, whereas almost all the coefficients of tertiary education are significantly positive. This is consistent with the results of Luca et al. (2009) that the age profile of cognitive skills is heavily influenced by the level of education. Thus, these findings suggest that to get into a permanent growth path through education, a country has to invest in tertiary education. This, however, may not hold for the poorest countries whose poor quality of education may prevent investment in education from delivering its desired growth effects.

Regarding the age-specific educational growth effects, older workers with tertiary education are markedly more productive than their younger counterparts. The coefficients of tertiary education are nearly twice as large as for the oldest compared to the youngest-age cohort. This effect is amplified by a factor of approximately 3 if it is taken into account that educational attainment among the younger-age cohorts is, on average, almost three times as large as the older-age cohort in the sample period (see Table ). Increasing the fraction of the working age population in the age group of 50–64 with tertiary education by 10 % points would increase the TFP growth rates by 0.31 × 0.464 = 0.14 % points annually, provided that the productivity effects from the interaction between education and the distance to the frontier are held constant. This number seems minuscule. However, assuming that the real interest rate is 2 % higher than the TFP growth rate, the present value of TFP would increase by 376 %, which is a significant gain.Footnote 2

Turning to the interaction terms, the interaction between secondary education and proximity to the frontier is significantly negative in most cases, while the interaction term for primary education is significantly negative in only a third of the cases, and the absolute values of the coefficients are substantially smaller than the former. These results make an intuitive sense in that workers with secondary education have better skills to adapt the technologies developed at the frontier compared to individuals with only primary education. Furthermore, there is also some evidence to suggest that this relationship strengthens with age, suggesting that the older-age cohorts in the work force with a secondary education are better at adopting frontier technologies than their younger counterparts.

The coefficients of the interaction between tertiary education and proximity to the frontier, however, are found to have a larger significant positive impact on growth in nearly all cases. The absolute magnitude of the coefficients on the tertiary interaction term increases steeply with age, signifying the increasing importance of seniority forinnovation as the country moves toward the frontier. Coupled with the finding of a significant direct positive effect of tertiary education, this provides strong evidence in support of the hypothesis that skilled human capital facilitates innovative invention and technological improvements as countries move closer to the technological leader. Given that such an effect is found to be strongest among older workers, it appears that more experienced, educated, and technically trained older workers contribute disproportionately to growth in economies close to the frontier. Thus, older workers are not only better at imitating but also more capable of innovating.

The findings that the coefficient of the interaction terms are positive for tertiary education but negative for primary and secondary education are consistent with the model of Vandenbussche et al. (2006), but inconsistent with the predictions of the Nelson and Phelps (1966) model in which the interaction between education at all levels and proximity (distance) to the frontier are expected to have negative (positive) effects on growth. They are also in line with the empirical results of Vandenbussche et al. (2006) and Ang et al. (2011), but incompatible with Bartel and Lichtenberg (1987) who find that highly educated workers have a comparative advantage with respect to learning and implementing new technologies developed elsewhere. This evidence is in favor of their hypothesis based on derived labor demand functions using data for 61 US manufacturing industries. The conflicting results may reflect the fact that cross-country data are used in this paper and in the estimates of Vandenbussche et al. (2006) and Ang et al. (2011), whereas Bartel and Lichtenberg (1987) base their evidence on industrial data.

The coefficients of proximity to the frontier are negative and highly significant in all nine cases, which is consistent with the findings of Dowrick and Nguyen (1989), and the predication that the smaller the effective costs of imitation, the further away is the country from the frontier (Gerschenkron 1952; Barro and Sala-I-Martin 2004, Chap. 8). Trade openness is mainly found to have negative growth effects, whereas there is some positive effect of international knowledge transmission via the import channels. The finding of a negative growth effect of trade openness seems to be counterintuitive but is consistent with the previous studies using long historical data (see, e.g., Vamvakidis 2002).

Finally, the coefficients of old-age as well as young-age dependency rates are negative and are mostly significant, which is consistent with the fact that income is spread over more people as the age dependency rates increase. The negative effect on growth is found to be significantly larger for old-age dependency.

While our results suggest that old-age dependents in the economy act as a drag on income growth, this negative impact is more than offset by the growth effects of older well-educated workers who remain in the workforce. Our estimates in the column 3c of Table imply that the average old-age dependency ratio would have to be increased by at least 45 %, holding other effects constant, for this positive growth effect of an older educated workforce to be counterbalanced. Although continued increases in human longevity imply that the number of elderly dependents as a share of those of working age will rise steeply in the OECD over the next few decades, this estimate is based on the simplifying assumptions that the ratio of the working age population for the 50–64 age group having tertiary education and the labor force participation rates among elderly workers remain constant in the future.

4 Robustness checks

Five robustness checks are undertaken in this subsection: (1) providing estimates for the post-WWII sample period, (2) regressing the model using innovative activity as the dependent variable instead of productivity growth, (3) estimating the full model which encompasses all age group-specific human capital variables, (4) providing estimates in which time dummies are excluded from the regressions, and (5) separating the embodied and disembodied technological progress in the regression models.

4.1 Post-WWII regressions

The post-WWII estimates will reveal whether the growth effects of aging and schooling have changed relative to the period before 1946. Furthermore, the post-WWII data of educational attainment and embodied technological progress are of better quality than the earlier data because school enrolment data going as far back as 1812 were not available for all countries. The regression results of the post-WWII estimates are displayed in Table 3. Due to a much smaller sample, the coefficients are slightly less significant than those reported in Table . However, the key results still prevail. Tertiary education still has significant positive direct and indirect growth effects and the strength of the relationship increases even more sharply with age than the results described above, using the full sample period. This result is consistent with the finding in the literature that the complexity of innovation has been increasing over time (Aghion and Howitt 1998; The Economist 2012), therefore giving an advantage to educated workers in the older-age cohort.

Specifically, the coefficients of the interaction between tertiary education and proximity to the technology frontier are significantly positive in five of the nine cases, which is consistent with the regressions in Table . Although there is some weak effect of primary education, secondary education still has no positive direct growth effects. The coefficients of the interaction between secondary education and proximity to the frontier are negative and statistically significant in five of the cases, thus reinforcing the finding above that individuals with secondary education adapt the technologies that are developed at the frontier. Finally, the old-age as well as the young-age dependency ratio has a negative effect on per capita income. Overall, the results are broadly consistent with those reported in Table .

4.2 Innovations

Table 4 reports estimates of Eq. (1) using innovative activity as the dependent variable, where innovative activity is measured as patent applications divided by the stock of patents, which, in turn, is constructed based on the inventory perpetual method. The coefficients of secondary education are either insignificant or significantly negative at the 10 % level, whereas the coefficients of primary education are positive and significant only for the old-age cohort. Consistent with the above findings, coefficients of the interaction between secondary education and proximity to the frontier are significant and negative, and this relationship strengthens with age.

Turning to tertiary education, the coefficients of tertiary education are positive and statistically significant in five of the six cases and again increase steeply with age. In line with our baseline results, the coefficients of the interaction between tertiary education and proximity to the frontier are significant in four cases, and their magnitude also steeply increases with age. Thus, these results suggest that production of ideas is an important channel through which the older educated cohorts in the labor force influence productivity growth.

4.3 Encompassing model regressions

Table 5 displays the estimates in which all human capital variables and their interaction with proximity to the frontier are entered simultaneously in the regressions. By doing so, this exercise sheds some light into the relative contributions of each age group-specific variable to growth. Although the direct effect of tertiary education loses significance, probably due to the excessive number of explanatory variables, its indirect effect on growth remains to be, remarkably, statistically significant for the older-age group. The coefficients of the interaction between the age group 50–64 with tertiary education and proximity to the frontier are very precisely estimated at the 1 % level, corroborating the conclusions above.

4.4 Excluding time dummies

Time dummies have been included in all the regressions above. Therefore, these estimates may have been affected by the interaction between the time dummies and the included regressors or may have captured time effects from variables that show the same cross-country time profile. However, excluding time dummies from the regressions, as reported in Table 6, does not alter the principal results. The coefficients of tertiary education remain mostly significant and continue to rise steeply with age. The interaction terms also maintain their signs and significance; secondary schooling is important for imitation of products and processes developed at the frontier, while the tertiary educated labor force is innovating. Furthermore, growth remains to be significantly positively related to distance to the frontier. The only major difference between the results in Table 6 compared to the results above is that age dependency rates are no longer significantly negative, suggesting that they may not have as strong as a negative effect on per capita income as predicted by accounting identities or that their variations may not have been sufficiently large for identifying any systematic effect.

4.5 Separating embodied and disembodied technological progress

The TFP regressions have thus far been based on TFP estimates in which embodied technological progress has been incorporated into the TFP estimates. The dependent variable in the regressions in columns 1a to 1c in Table 7 is based on the conventional TFP growth rates in which no adjustment for embodied technological progress has been made. The results are remarkably consistent with those found previously; the coefficients of tertiary education as well as its interaction with proximity to the frontier are all significant and increasing with age.

Embodied technological progress, measured as TFP minus TFP adjusted for embodied technological progress, is included as an additional regressor in columns 2a–3c in Table . The dependent variable is TFP growth adjusted for embodied technological progress. Embodied technical progress is based on the ratio of consumer prices to prices of machinery and equipment investment in the regressions in columns 2a–2c, while it is based on the ratio of food prices and prices of machinery and equipment investment in the regressions in columns 3a–3c. The coefficients of the educational variables and their interactions with proximity to the frontier are largely consistent with the previous estimates. The coefficients of embodied technological progress are found to be statistically insignificant in all cases. However, this does not mean that embodied technological progress has been an unimportant driver for technological progress, but rather, it highlights some measurement issues. As discussed previously, efficiency gains are unlikely to have been properly incorporated into the investment deflator for machinery and equipment during most of the estimation period, which may have rendered the estimates of embodied technological progress inaccurate. Finally, the results are, again, consistent with those found previously; the coefficients of tertiary education as well as its interaction with proximity to the frontier are all significant and increasing with age.

5 Comparison of results with microevidence on earnings profiles

An important question is whether the findings above square well with microeconomic evidence and the extent to which microeconomic results can be translated into the macrolevel. First, consider the microeconomic evidence. Data on median annual earnings by age and educational attainment from the US Census Bureau’s 2006–2008 American Community Survey show an inverted U-shaped wage profile for graduates with bachelor and masters degrees. However, the wage profile increases with age for graduates with doctoral degrees, which is important in the context of the present study because these are the educational groups that are more likely to innovate and enhance the efficiency of production than graduates at lower levels. Since persistent growth is ultimately a result of new innovations, it is likely that the university graduates with the longest graduate degrees are the most innovative. Until recently, it was probably the graduates with masters degrees or, further back in time, graduates with bachelor degrees that were the most innovative and were paid to do the most innovative jobs. Thus, historically, the earnings curve may well have increased with age for all university graduates in, at least, the first half of the sample period covered in our estimates. Unfortunately, no historical evidence of earnings profiles over the working life is available for the USA or other OECD countries.

Not all OECD countries have inverse U-shaped wage profiles. Among the 12 countries surveyed by the OECD (2011), only five have an inverted U-shaped earnings profile with age (Canada, Czech Republic, Japan, the UK, and the USA). Note that all skill groups are included in these OECD data, which is important since the wage profile is more curved for workers at the lower end of the education scale.

The literature on productivity over the working age gives mixed evidence. While most studies find that productivity over the working age is inversely U-shaped, there are also exceptions, such as Hellerstein and Neumark (1995) and Hellerstein et al. (1999), who find that productivity increases over the life span (see Skirbekk 2003 for a survey). Using macrodata, Lindh and Malmberg (1999) and Malmberg and Lindh (2002) find that the proportion of the 50–64 years old in the work force is positively related to income growth in the next 5 years, but such an effect is not found for the younger-age groups. This suggests that productivity peaks late in the working life.

A crucial finding of our paper is that educational attainment relates to income growth and not to the level of income, as in microeconomic studies discussed above. Coupled with the presence of scale effects in ideas production, this paper finds that older graduates increase the stock of knowledge, and this generates permanent growth effects. If the growth-enhancing benefits of innovations by educated workers accrue to the firm that employs them, wages of these workers would increase by the present value of the additional profits arising from the innovation in perfect foresight models. However, as stressed by Romer (1990), an innovating firm cannot prevent other firms from using its invention for further innovations; otherwise, there will not be scale effects in ideas production. Furthermore, since innovations are unpredictable due to the random nature of success, significant innovations are unlikely to be reflected in the wages of the innovators.

6 Conclusion

The estimates in this paper showed that the productivity growth effects of older workers with tertiary education are substantially higher than those of their younger counterparts. Furthermore, secondary schooling was found to be a significant determinant of imitation of products and processes developed at the frontier countries, and the strength of the adaption of frontier technology sharply increases with the age of the labor force. The results were robust to an inclusion of control variables, consideration of a more recent sample period, whether time dummies are included in the regressions, and whether the dependent variable is measured by growth in total factor productivity, labor productivity, per capita income, or the rate of patenting. Thus, although individuals pull per capita income down when they retire, workers with tertiary education will compensate more for the health and pension expenses during their later years in the labor force.

Although workers in most European countries are trying to defend their “right” to retire early, there are signs that labor force participation rates among older workers are rising. An increasing trend in labor force participation rates among older workers has been observed in a number of OECD countries over the period 1984–2004 (OECD 2006b). This trend has continued even during the recent global financial crisis, where employment growth for workers over the age of 54 has increased by nearly 2 % in OECD countries (OECD 2010). The fact that workers over the age of 50 with a tertiary education contribute substantially to productivity growth suggests that an increase in the pension age among workers with tertiary education can potentially have a large positive productivity effect. Thus, society can actually gain from aging, provided that workers with tertiary education stay in the labor force just a little bit longer than they currently do. Since life expectancy at birth has almost doubled over the last century while the retirement age has remained almost unaltered, it seems reasonable to ask for a few more years of contribution to the economy.

Notes

Related to that Cohen and Levinthal (1989) argue that in addition to pursuing new process and product innovation, firms invest in R&D to exploit externally available information. Since the focus of the model of Vandenbussche et al. (2006) is on human capital, the empirical implications of their model may well be different from those of Cohen and Levinthal (1989) in that human capital creates techniques and processes that are quite different from those of technological progress created by R&D. R&D is directed toward the creation of new processes, better technology, and higher-quality products, while investment in human capital is channeled toward increasing the knowledge of a particular field.

The present value of TFP is given by \(PV=A_0 \int _0^{\infty } {e^{\left ( {g-r} \right )t}dt} =\frac {A_0 }{r-g}\), where A 0 is the initial TFP, ris the real interest rate, and g is the TFP growth rate. If the latter is increased permanently by 0.14 % points, then the present value would be \(PV_1 =\frac {A_0 }{r-(g+0.0014)}\), and the gain would be \(PV_1 -PV_0 =\frac {A_0 }{r-\left ( {g+0.0014} \right )}-\frac {A_0 }{r-g}=A_0 \times \frac {0.0014}{\left ( {r-g-0.0014} \right )(r-g)}\).

References

Aghion P, Howitt P (1998) Endogenous growth theory. MIT Press, Cambridge

Ang J B, Madsen J B (2011) Can second-generation endogenous growth models explain productivity trends and knowledge production in the Asian miracle economies? Rev Econ Stat 93:1360–1373

Ang J B, Madsen J (2013) International R&D spillovers and productivity trends in the Asian miracle economies. Econ Inq 51:1523–1541

Ang J B, Madsen J B, Rabiul Islam M (2011) The effects of human capital composition on technological convergence. J Macroecon 33:465–476

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econom 68:29–51

Barro R, Sala-I-Martin X (2004) Economic growth. The MIT Press, Cambridge

Bartel A P, Lichtenberg F R (1987) The comparative advantage of educated workers in implementing new technology. Rev Econ Stat 69:1–11

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87:115–143

Bond S R, Hoeffler A, Temple J (2001) GMM estimation of empirical growth models. Centre for Economic Policy Research discussion paper no. 3048

Cohen W M, Levinthal D A (1989) Innovation and learning: the two faces of R&D. Econ J 99:569–596

Dowrick S, Nguyen D-T (1989) OECD comparative economic growth 1950–85: catch-up and convergence. Am Econ Rev 79: 1010–1030

The Economist (2012) Enterprising oldies. The Economist Feb 25th: 66

Feyrer J (2007) Demographics and productivity. Rev Econ Stat 89:100–109

Friedland R (1993) Epidemiology, education, ecology of Alzheimer’s disease. Neurology 43:246–249

Garibaldi P, Oliveira-Martins J, Ours Jv (2011) Ageing, health and productivity: the economics of increased life expectancy. Oxford University Press, Oxford

Gerschenkron A (1952) Economic backwardness in historical perspective. In: Hoselitz B (ed) The progress of underdeveloped areas. University of Chicago Press, Chicago, pp 3–29

Giuri P, Mariani M, Brusoni S, et al (2007) Inventors and invention processes in Europe: results from the PatVal-EU survey. Res Policy 36:1107–1127

Greenwood J, Hercowitz Z, Krusell P (1997) Long-run implications of investment-specific technological change. Am Econ Rev 87:342–362

Griffith R, Redding S, Reenen Jv (2004) Mapping the two faces of R&D: productivity growth in a panel of OECD industries. Rev Econ Stat 86:883–895

Ha J, Howitt P (2007) Accounting for trends in productivity and R&D: a Schumpeterian critique of semi-endogenous growth theory. J Money Credit Bank 39:733–774

Haltiwanger J C, Lane J I, Spletzer J R (1999) Productivity differences across employers: the roles of employer size, age, and human capital. Am Econ Rev 89:94–98

Hellerstein J K, Neumark D (1995) Are earnings profiles steeper than productivity profiles? Evidence from Israeli firm-level data. J Human Resour 30:89–112

Hellerstein J K, Neumark D, Troske K R (1999) Wages, productivity, and worker characteristics: evidence from plant-level production functions and wage equations. J Labor Econ 17:409–446

Hercowitz Z (1998) The ‘embodiment’ controversy: a review essay. J Monet Econ 41:217–224

Hertzog C, Hultsch D F, Dixon R A (1999) On the problem of detecting effects of lifestyle on cognitive change in adulthood. Psychol Aging 14:528–534

Hoisl K (2007) A closer look at inventive output—the role of age and career paths. Munich School of Management discussion paper no. 2007 no. 12

Jones B F (2009) The burden of knowledge and the death of the Renaissance Man: is innovation getting harder?Rev Econ Stud 76:283–317

Jones B F (2010) Age and great invention. Rev Econ Stat 92:1–14

Keller W (2004) International technology diffusion. J Econ Lit 42:752–782

Kneller R, Stevens P A (2006) Frontier technology and absorptive capacity: evidence from OECD manufacturing industries. Oxford Bull Econ Stat 68:1–21

Le Carret N, Lafont S, Letenneur L, et al (2003) The effect of education on cognitive performances and its implication for the constitution of the cognitive reserve. Dev Neuropsychol 23:317–337

Lichtenberg F (2010) The contribution of pharmaceutical innovation to longevity growth in Germany and France. CESifo working paper series 3095

Lichtenberg F R (2012a) Contribution of pharmaceutical innovation to longevity growth in Germany and France, 2001–7. PharmacoEconomics 30:197–211

Lichtenberg F R (2012b) Pharmaceutical innovation and longevity growth in 30 developing and high-income countries, 2000–2009. NBER working papers no. 18235

Lichtenberg F R, van Pottelsberghe de la Potterie B (1998) International R&D spillovers: a comment. Eur Econ Rev 42:1483–1491

Lichtenberg F R, Virabhak S (2007) Pharmaceutical-embodied technical progress, longevity, and quality of life: drugs as ‘equipment for your health’. Manag Decis Econ 28:371–392

Lindh T, Malmberg B (1999) Age structure effects and growth in the OECD, 1950–1990. J Popul Econ 12:431–449

Luca G D, Mazzonna F, Peracchi F (2009) Aging, cognitive abilities and education in Europe, Paper presented at the 2009 AEA conference

Madsen J B (2007) Technology spillover through trade and TFP convergence: 135 years of evidence for the OECD countries. J Int Econ 72:464–480

Madsen J B (2008) Semi-endogenous versus Schumpeterian growth models: testing the knowledge production function using international data. J Econ Growth 13:1–26

Madsen J B (2009) Trade barriers, openness, and economic growth. South Econ J 76:397–418

Madsen J B (2010) The anatomy of growth in the OECD since 1870. J Monet Econ 57:753–767

Madsen J B, Ang J B, Banerjee R (2010a) Four centuries of British economic growth: the roles of technology and population. J Econ Growth 15:263–290

Madsen J B, Saxena S, Ang J B (2010b) The Indian growth miracle and endogenous growth. J Dev Econ 93:37–48

Malmberg B, Lindh T (2002) Population change and economic growth in the Western world, 1850–1990. Paper presented at workshop in Rostock

Mokyr J (2005) Long-term economic growth and the history of technology. In: Aghion P, Durlauf S (eds) Handbook of economic growth. North-Holland, Amsterdam, pp 1113–1180

Nelson R R, Phelps E S (1966) Investment in humans, technological diffusion, and economic growth. Am Econ Rev 56:69–75

OECD (2006a) Live longer, work longer. OECD observer no. 254

OECD (2006b) OECD employment outlook 2006. OECD, Paris

OECD (2010) OECD employment outlook moving beyond the jobs crisis. OECD, Paris

Prettner K (2013) Population aging and endogenous economic growth. J Popul Econ 26:811–834

Romer P M (1990) Endogenous technological change. J Polit Econ 98:S71–102

Salthouse T A (1985) A theory of cognitive aging. North-Holland, Amsterdam

Salthouse T A, Maurer T J (1996) Aging, job performance, and career development. In: Birren J E, Schaie K W (eds) Handbook of the psychology of aging, 4th edn. Academic Press, San Diego

Skirbekk V (2003) Age and individual productivity: a literature survey. MPIDR working papers with number WP-2003-028

Solow R M (1960) Investment and technical progress. In: Arrow K J, Karlin S, Suppes P (eds) Mathematical methods in the social sciences. Stanford University Press, Palo Alto

Vamvakidis A (2002) How robust is the growth-openness connection? Historical evidence. J Econ Growth 7:57–80

Vandenbussche J, Aghion P, Meghir C (2006) Growth, distance to frontier and composition of human capital. J Econ Growth 11:97–127

Acknowledgments

Helpful comments and suggestions from two referees are gratefully acknowledged as is financial support from the Australian Research Council (James Ang & Jakob Madsen: DP120103026; Jakob Madsen: DP110101871).

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Junsen Zhang

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Ang, J.B., Madsen, J.B. Imitation versus innovation in an aging society: international evidence since 1870. J Popul Econ 28, 299–327 (2015). https://doi.org/10.1007/s00148-014-0513-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-014-0513-0