Abstract

This article proposes a new auction design for the efficient allocation of pollution permits. We show that if the auctioneer restricts the bidding rule of the uniform-price auction—coupled with a simple ex-post supply adjustment rule—then truthful bidding is obtained. Consequently, the uniform-price auction is more allocatively efficient than conventional formats that are currently observed in pollution markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Auctions are now a common method to allocate pollution permits. The very nature of pollution permits means that they are normally allocated in multiple units, which increases the complexity of designing an efficient allocation mechanism (Alvarez et al. 2019). Although multi-unit uniform-price auctions are a natural process to allocate these resources (and preferred by governments), there are significant concerns regarding the efficiency of these mechanisms (Wilson 1979; Ausubel et al. 2014). Furthermore, previous attempts to improve auction efficiency—for example, by designing Vickrey-Clarke-Groves (VCG) mechanisms—have never been used in large-scale practical applications due to complex payment rules that limit the adoption of these mechanisms. Thus it is currently unknown how to design a uniform-price auction that is both allocatively efficient and implementable in the vast array of environmental applications.

This article proposes a new auction design that can lead to the efficient allocation of permits. A new set of rules is introduced where the auctioneer restricts buyers’ bids and allows the supply of rights to be reduced once bids have been submitted. We show that integrating these new bidding rules and marginal ex-post supply adjustment can result in truthful bidding and potential revenue improvement.

The ideal outcome of a uniform-price auction is to achieve the Walrasian equilibrium. If buyers submit their bids truthfully, then the clearing price associated with the Walrasian equilibrium can be obtained by using the pricing rule for the uniform-price auction. This is especially important in environmental auctions as the price associated with the Walrasian equilibrium may result in the correct valuation of the resource, which has important consequences for firms’ emissions choices, activity on secondary markets, and investment decisions.Footnote 1 Yet uniform-price auctions usually fail to achieve the desirable Walrasian equilibrium. This is because there exists ‘demand reduction’ by buyers, which is the underreporting of their actual demand (Wilson 1979; Back and Zender 1993). In a uniform-price auction each buyer’s bid could potentially determine the price paid for all units. Unsurprisingly, then, buyers will manipulate their bids (reduce demand) in order to reduce the clearing price. Thus to achieve the ideal outcome in a uniform-price auction, it is important to design rules so that the incentives for demand reduction are eliminated.

This article considers a situation where buyers have private values for pollution rights with asymmetric demand capacities. The basic model studies a case where buyers have constant values with flat demands, however this is later extended to a case with diminishing marginal values and downward sloping demands. Under the assumption of constant values, we propose two major changes to the original uniform-price auction: (i) we limit the number of bids each buyer can submit to one and (ii) we allow the auctioneer to adjust the ex-post supply of rights. By restricting the number of bids that buyers submit, we eliminate their potential to manipulate demand using a schedule of bids. As a result, the winners’ bids do not have an impact on the clearing price.Footnote 2 Using (ii), the auctioneer has the potential to reduce the supply of auctioned rights after the bids have been submitted. The rationale behind using this supply adjustment is that if buyers could win a proportion of their total capacity, then they would have incentives to manipulate their bids at the margin in order to win a proportion of their total demand at a lower price. To eliminate this incentive the supply can be reduced to ensure winning bidders obtain only their full capacity and all other bidders receive zero allocation. The proposed auction design in this article mitigates buyers’ incentives for demand reduction and results in truthful bidding. Thus, if a regulator implements this auction design to allocate pollution permits, then buyers with the highest realized valuations receive those rights, whenever the regulator decides to sell them.

Truthful bidding also occurs when the model is extended to include buyers that have diminishing marginal values for the pollution rights. In this setup, buyers’ values for the rights continually diminish throughout their capacity demands. The auction rules are similar to the constant value case but with some minor differences: buyers are only allowed to submit linear demands up to their capacities. This essentially becomes a case where buyers report their maximum willingness to pay. There is again an ex-post supply adjustment, where the auctioneer adjusts the supply based on the slope of the aggregate demand. However, as we show later, the supply adjustment will not take place in equilibrium and it therefore mainly acts as an instrument of deterrence. Thus for a range of potentially realistic scenarios, the auction design ensures truthful bidding and potential revenue improvements from existing uniform-price auctions.

This proposed auction design may be applicable to existing pollution permit auctions (Lopomo et al. 2011). Within most cap-and-trade markets, quarterly uniform-price auctions are the predominant method of initial permit allocation. For example, the Regional Greenhouse Gas Initiative (RGGI), the European Union Emissions Trading Scheme (EU-ETS), and the California Cap-and-Trade Program run uniform-price auctions. The revenue raised from these auctions is significant. For example total cumulative auction proceeds from RGGI in 2017 totaled just over US$198m while Member States of the EU-ETS generated EUR11.8 bn in the period 2013-2015 (Commission 2017).Footnote 3 While differences do exist in each of these auctions—such as the inclusion of Cost Containment Reserves (Khezr and MacKenzie 2018b) in RGGI and the process of consignment in California (Khezr and MacKenzie 2018a)—the basic uniform-price rules continue to apply, which may mean the existence of inefficiencies and the loss of auction revenue. The proposed auction design within this article shows that, in many circumstances, these schemes could be simplified and improved.

1.1 Related literature

The proposed auction design has two distinct features: a restriction on buyers’ bids and a supply rule that may reduce the number of total rights after bids have been submitted. Supply adjustment rules have previously been proposed to eliminate or reduce demand reduction in uniform-price auctions (Back and Zender 2001; LiCalzi and Pavan 2005; McAdams 2007; Damianov and Becker 2010). In Back and Zender (2001) the seller maximizes revenue by adjusting supply downward from a predefined maximum supply. Whereas in LiCalzi and Pavan (2005) a predefined increasing supply function is used and in McAdams (2007) and Damianov and Becker (2010) the seller selects auction supply after bids have been submitted. Our approach complements this literature by designing an alternative ex-post supply adjustment process in a more general setting. Previous studies have shown the efficiency-enhancing properties of supply adjustments in a relatively restrictive environment; namely, all previous studies assume buyers have a common value for the auctioned goods. In this article we analyze new auction rules in an environment where buyers have their own private value for the goods, which can be either constant or diminishing in their (asymmetric) capacity demand.

The auction design presented in this article has some similarities to the well-known Vickrey auction (Vickrey 1961). For instance, in both cases it is a weakly dominant strategy for bidders to bid truthfully. However, the auction proposed in this article has simpler rules and may be easier to implement in reality compared to a Vickrey auction (which has not been widely adopted (Ausubel and Milgrom 2004)).

A key focus of this article is to outline an efficiency-enhancing auction design for pollution rights. Related to environmental policy, a substantive literature exists on investigating optimal (truthful inducing) regulatory design (e.g., Kwerel 1977; Dasgupta et al. 1980; Duggan and Roberts 2002; Montero 2008; Shrestha 2017). In this literature the goal of the regulator is to choose a regulatory design that maximizes social welfare. Most of these studies assume that the regulator is certain about the damage function that is associated with the environmental policy but is uncertain about firms’ private costs (i.e., uncertain about the demand for pollution). In order to obtain the efficient level of pollution, schemes have been devised that allow firms to report the pollution of rivals (Duggan and Roberts 2002), obtain rebates with adjustable permit supply (Montero 2008), and choose from a menu of price and quantity contracts (Shrestha 2017). These regulations, therefore, are designed to induce firms to act truthfully by submitting correct cost functions. In particular, a key component of Montero (2008) is that firm-specific rebates are generated by the regulator, which induce truth telling (based on the damage caused), whereas Shrestha (2017) shows that if the menu schedule (i.e., supply) is more elastic than the firm’s residual marginal damage function then this offsets the firm’s incentive to underbid. In our alternative approach we do not require rebates to occur (as in Montero (2008)) and we allow each firm to submit a single price/quantity demand (rather than choose from a regulator-determined set of contracts as in Shrestha (2017)). Underbidding/non-truth-telling usually occurs because firms have multiple bids to strategically manipulate prices (i.e., so-called demand reduction). In our approach we obtain truthful bidding because we restrict firms to a single bid (by way of an auction rule)—thus they are constrained in their bid manipulation—while also ensuring that the supply can be ex post reduced. Our focus is to model an auction in a second-best scenario where the policy target is (quite realistically) set by a political process. Our objective, then, is somewhat different to this literature as we focus on how to design an efficient auction for a given policy level: one that can incite truthful bidding and potentially increase revenue.Footnote 4

Our contribution, then, provides the architecture for a pollution permit auction that incites truthful bids. This has potential benefits to regulators and policymakers as the design rules we outline could be operationalized within existing regulatory frameworks. For example, the regulator is required to design two new auction rules. Requiring single bids from firms is simply an administrative matter and the use of variable supply within auctions is now becoming commonplace in existing permit markets; auction supply now varies within the Regional Greenhouse Gas Initiative (RGGI), albeit in a very different manner to what is proposed in this article.

The remainder of this article is organized as follows. Section 2 introduces the model and presents the results related to the single-bid uniform-price auction. Section 3 extends the model to allow for diminishing marginal values. Section 4 discusses unknown capacity demand. Finally, Section 5 concludes the paper. All proofs are relegated to the appendix.

2 The basic model

Consider a regulator that sells up to \(\bar{Q}\) pollution permits in an auction. A set of potential buyers \(\Theta =\{1,\ldots , n\}\), with \(n>2\), exists where buyer \(i\in \Theta \) has a marginal value \(v_i\) for all units up to a capacity \(\lambda _i\).Footnote 5 Buyers’ individual capacities are their maximum demand for permits, which can be interpreted as their unconstrained (unregulated) emissions and we focus on non-trivial cases where \(\lambda \equiv \sum _1^n \lambda _i > \bar{Q}\).Footnote 6 Buyers’ values are private information but their unregulated emission levels are public information. This assumption reflects pollution permit markets, for example, as although firms may have individual private values for permits—which reflect their private costs of abatement—their unregulated emissions may be accurately known because the regulator has monitored and verified the emissions prior to the commencement of the regulation. Indeed the regulator controls the registry that tracks firms’ held permits, emissions, and transactions. Note also that this information from the registry is public knowledge and firms can only bid for permits in an auction by using their designated registry accounts, which thus provides the auctioneer with immediate access to estimates of capacity information about bidders.Footnote 7 We allow marginal values to be independently and identically distributed according to some known distribution function F(.) on \([\underline{v}, \bar{v}]\) with density \(f<\infty \), but the results are robust for a situation with interdependent values.Footnote 8 Also suppose the seller’s reservation value for the units is normalized to zero.

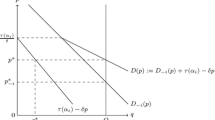

The selling method is a modified version of a sealed-bid uniform-price auction. In particular, the auctioneer only allows bidders to submit a single sealed-bid for all units they demand. The auctioneer sorts the submitted bids from the highest to the lowest value, which generates the aggregate demand as a step function. The allocation rule is defined as follows. At the beginning of the game the auctioneer announces \(\bar{Q}\) as the maximum quantity available for sale. However, the auctioneer determines the exact amount of supply after the bids are submitted. The final quantity supplied by the seller is equal to the largest amount less than or equal to \(\bar{Q}\) such that the whole capacity of successful buyers is satisfied.Footnote 9 That is, if the lowest-valued (successful) buyer cannot obtain their full capacity then the auctioneer reduces supply until the next lowest-valued buyers can satisfy their full capacity (we assume ties in bids are broken randomly). To observe this consider Fig. 1. In Fig. 1 (a) the aggregate demand is not flat at \(\bar{Q}\), therefore all buyers to the left of \(\bar{Q}\) receive quantities equal to their capacities: \(\bar{Q}\) is the determined auction supply. In Figure 1 (b), however, the aggregate demand is flat at \(\bar{Q}\), meaning that the lowest successful buyer(s) cannot satisfy their full capacity. The auctioneer then reduces supply to \(Q^{**}\) such that all buyers to the left of \(Q^{**}\) obtain the permits, and other buyers receive nothing. In this case the final quantity supplied by the seller \(Q^{**}\), is less than \(\bar{Q}\).

To specify the payment rule, denote \(b_i\) as the bid submitted by bidder i, which determines the maximum willingness to pay for \(\lambda _i\) permits. The aggregate demand is therefore the sum of individual bids, and can be represented by the following step function D(p), where p is the price per permit:

The auction clearing price, which is the price for all quantities won, is set by the highest losing bid. The formal expression of the auction clearing price is,

The first expression of (2) is equivalent to the highest losing bid when the aggregate demand is not flat at \(\bar{Q}\) (Figure 1 (a)). The second expression is for the case where the aggregate demand is flat at \(\bar{Q}\). In this instance, the price is set as in Figure 1 (b).Footnote 10

2.1 Results

We now show how the auction design performs with respect to truthful bidding and allocative efficiency as well as how this design compares to conventional uniform-price auctions. To begin let us formally define allocative efficiency.

Definition 1

Allocative efficiency:

-

Weak allocative efficiency. An allocation of \(Q< \bar{Q}\) permits has weak allocative efficiency if and only if all Q permits are allocated to those buyers with highest values for them.

-

Strong allocative efficiency. An allocation of \(\bar{Q}\) permits has strong allocative efficiency if and only if all \(\bar{Q}\) permits are allocated to those buyers with highest values for them.

Note that, following Armstrong (2000), we make a distinction between ‘weak’ and ‘strong’ allocative efficiency: the difference being that, in the former, the seller can withhold rights and the efficiency focus is solely on the rights that are sold whereas, in the latter, all potential gains from trade between auctioneer and bidder need to be realized. Given the auction design and the setting, the next proposition shows that bidders would bid truthfully.

Proposition 1

It is a weakly dominant strategy for bidders to bid truthfully, that is to bid equal to their marginal value.

An essential point in the result of Proposition 1 is that all winning buyers’ bids are independent of the price they pay.Footnote 11 This is the result of both the payment rule and the supply adjustment. The payment rule guarantees that bidders never pay a price equal to their own bid. Also, as a result of the supply adjustment, bidders cannot manipulate their bid to win a proportion of the total capacity at a lower price. Recall that without the supply adjustment truthful bidding may not be the optimal outcome. When there is no ex-post supply adjustment, bidders could win some of their capacities at the flat section of the demand schedule. In that case, there are clear incentives for demand reduction in order to reduce the final price for a proportion of the total capacity.

Given we know bidders have a (weakly) dominant strategy to bid truthfully, we now consider the performance of the proposed auction design.

Corollary 1

The uniform-price auction with single bids generates weak allocative efficiency.

The result of Corollary 1 shows that the single-bid uniform-price auction is allocatively efficient. When the seller allocates these permits, they will be allocated to the buyers with the highest value. This is denoted “weak efficiency” as the auctioneer may decide to retain some permits even if there were bidders with a positive value for them.Footnote 12

In terms of the expected revenue that can be generated, it is ambiguous whether the proposed mechanism is revenue superior to a standard-uniform price auction. It is difficult to analyze because the equilibrium permits sold at each auction might be different between both mechanisms: either \(\bar{Q}\) in the standard auction and \(Q^{**} \le \bar{Q}\) in the single-bid uniform-price auction. If we were to hold the number of permits constant across both mechanisms then it can be shown that the single-bid uniform-price auction is revenue superior to a standard-uniform price auction. However, note that a standard-uniform price auction that sells \(\bar{Q}\) permits could result in higher revenue compared to a single-bid uniform-price auction that supplied \(Q^{**}<\bar{Q}\) permits.

Throughout this part of the analysis we allowed buyers to have a constant marginal value for a given capacity (we provide the case of diminishing marginal values in Section 3). Constant values are realistic within the majority of environmental contexts, including pollution markets (e.g., Khezr and MacKenzie 2018a). As pollution rights are tradable, the marginal valuation can be interpreted as firms’ (differing) estimates of the expected future price on the secondary market that they could obtain for selling a right.

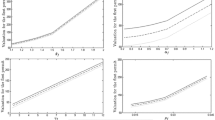

2.2 Social welfare implications

Throughout the analysis our focus has been on auction efficiency: to allocate auctioned permits to those with the highest value. Thus our context is within a second-best world where the maximum externality target \(\bar{Q}\) is not chosen to maximize social welfare but simply (and realistically) a political decision. Yet, even in this environment, implications for social welfare can be obtained. Consider a welfare maximizing level of Q denoted by \(Q^*\), where the marginal damage of the environmental rights is equal to the true demand for rights (marginal cost) in Figure 2. It is likely that any real-world policy target \(\bar{Q}\) is larger than the level required within a first-best world (given the nature of negative externalities) . For example, this is the case in most current cap-and-trade markets. In this framework the auctioneer has the ability to reduce the level of permits and—simply assuming increasing marginal damages over Q—will result in improvements in social welfare due to a reduction in the policy target away from \(\bar{Q}\) (see, for example, Shrestha 1998). From Figure 2, the social welfare gain from this auction is the hatched area under the marginal damage function (MD) and above the demand schedule. In the event that \(\bar{Q}<Q^*\) then it is clear that social welfare may decrease using this auction design.

We can also compare the proposed auction design to a conventional uniform-price auction. Figure 3 is similar to Figure 2 but now we have introduced the aggregate demand from a conventional uniform-price auction denoted by the thick dashed red line. It is clear that under a conventional uniform-price auction demand reduction occurs and a lower clearing price is established at \(\hat{p}\). Note that in terms of social welfare each unit is now being bought below the clearing price derived in this new auction design, \(p'\). Thus relative to a conventional uniform-price auction, the proposed auction design can generate social welfare improvements.

3 Diminishing marginal values

In this section we extend the original model to a case where buyers have diminishing marginal values for units. Similar to the above analysis, suppose buyer i’s maximum willingness to pay for a unit is \(v_i\), where \(v_i\) is private information. We now suppose that buyers’ values diminish at a rate equal to \(\rho \), which is common for all buyers.Footnote 13

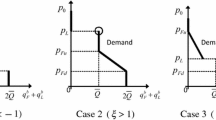

The new auction rules for the diminishing marginal values setting are as follows. Each buyer i submits a linear demand schedule \(d_i(v_i, q_i)\), where \(q_i\) is the amount of demand at each price. The auctioneer sorts these demands from the highest to the lowest and calculates the aggregate demand schedule. The auctioneer then allocates the permits based on the aggregate demand function from the highest price to the lowest until \(\bar{Q}\) is reached. Let us first discuss the shape of the aggregate demand. The aggregate demand starts from the highest submitted value, and diminishes at a rate equal to \(\rho \) until it reaches the second highest submitted value. At this point, there exists a kink in the aggregate demand where it diminishes at a rate equal to \(\frac{\rho }{2}\) until the next kink, which is the third highest submitted value, and so on. A typical example is presented in Fig. 4.

The supply adjustment is as follows. Bidders to the left of \(\bar{Q}\) receive their demand as long as the aggregate demand diminishes at a rate equal to \(\frac{\rho }{k}\) after kink k. Otherwise, the supply reduces to the first kink \(k'\) that satisfies the right diminishing rate, that is, \(\frac{\rho }{k'}\).

Proposition 2

It is a weakly dominant strategy for bidders to submit their true demand.

The intuition behind Proposition 2 is that being untruthful results in a punishment by the supply adjustment. A buyer may influence the price that other buyers pay by submitting an untruthful demand, but cannot reduce the price they pay for their own permits by reducing their own demand schedule. The weakly dominant strategy provides several more desirable features for the proposed mechanism, which are presented in the next proposition.

Proposition 3

The mechanism has a dominant strategy equilibrium that generates strong allocative efficiency.

Proposition 3 indicates that, in the case of diminishing marginal values, the proposed mechanism with supply adjustment would allocate all the \(\bar{Q}\) permits to those with the highest value. Therefore, it results in ‘strong’ efficiency. This result is noteworthy because almost all of the existing literature suggests that variants of the uniform-price auction are inefficient. Also note that when buyers have diminishing marginal values, it is usually more difficult for the regulator to identify demand reduction. In the current mechanism this is not a problem as the simple supply adjustment acts to prevent buyers from demand reduction. Further, in equilibrium, the mechanism achieves strong allocative efficiency, where the supply adjustment process is not used.

3.1 Comparison with a standard uniform-price auction

As shown above, the proposed mechanism has some desirable equilibrium properties. What remains is the revenue comparison between the proposed mechanism and the standard uniform-price auction. We first need to analyze bidding behavior within a standard uniform-price auction. In a uniform-price auction, bidders submit demand schedules and the auctioneer allocates all the objects based on the aggregate demand without any supply adjustments. The expected payoff bidder i receives from winning a quantity \(q_i\) is

where p is the auction clearing price. The expected payoff of each firm is the area under the individual demand function and above the clearing price. The equilibrium quantity allocation of bidder i is the residual supply determined by other bidders’ demand at the equilibrium price. So one can rewrite Equation (3) as follows

The next step is to show that buyers would reduce their demands in a uniform-price auction. The following proposition shows that truthful bidding cannot be an equilibrium of a standard-uniform price and, in fact, if there exists an equilibrium with undominated strategies, it must include demand reduction.

Proposition 4

In every undominated equilibrium of the uniform-price auction, at least some buyers submit demand schedules below their actual demand.

The result of Proposition 4 is intuitive. When bidders can affect the price they pay for the permits they win, and the supply is fixed, there are clear incentives for demand reduction. Thus Proposition 4 shows that every undominated equilibrium of a standard uniform-price auction is allocatively inefficient. Note that even if all buyers underbid proportionally, we would still have an inefficient allocation of units. To see this, begin with the the highest value buyer that reduces demand at a rate higher than \(\rho \). Once we get to the second highest buyer and allocate units the allocation becomes inefficient because the highest buyer still has demand for larger values. Further, the aggregate demand represented in an equilibrium of a uniform-price auction is strictly below the actual aggregate demand. Thus the following proposition is immediate.

Proposition 5

The current mechanism is revenue superior to the standard uniform-price auction.

The intuition behind revenue superiority is straightforward. In equilibrium all firms bid truthfully because any demand reduction will be punished by supply reduction. Unlike the case with constant marginal values, here in equilibrium the allocated supply will always be equal to \(\bar{Q}\). Thus revenue superiority is guaranteed.

The diminishing marginal value setup extends the previous results of this article to address situations where buyers have downward sloping demands rather than flat demands. Although there are reasonable grounds to assume that buyers in environmental markets may have constant marginal values for a single auction (as discussed in the previous section), the extension to the case of diminishing marginal values helps to highlight the robustness of this auction design and the potential applicability of this framework to other areas of interest.

4 Unknown capacities

Up to this point we have assumed that firms’ capacities are known by the regulator. This is a reasonable condition as the capacities are in the form of unregulated emissions determined prior to the auction or verified emissions in a previous compliance period. In this section, we consider two relaxations of this assumption, where firms’ capacities are unknown. In particular, suppose (i) the regulator monitors and determines the unregulated emissions, but there is a level of uncertainty as to the accuracy of the findings and (ii) firms’ capacities are privately known and are chosen by firms. For the first case, suppose the regulator privately receives a signal \(s_i\) for the actual capacity of firm i from a known distribution. The regulator upon observing signal \(s_i\) chooses \(\hat{\lambda }_i(s_i)\) as the capacity of firm i before the auction starts.Footnote 14 It is straightforward that unless the signals are perfect—which only happens in the full information case—the regulator would not be able to estimate the correct capacity of each firm. However, given that the distribution is known, there are bounds that limit these estimates. Note that irrespective of underestimation or overestimation by the regulator, as long as inaccurate estimations exist, the allocative efficiency of the auction is reduced. This is because at least some permits are no longer allocated to firms that value them the most. Yet it can also be shown that the truthful dominant strategy equilibrium will still exist in the case where the regulator estimates the capacities: it is still a weakly dominant strategy for each firm to bid their true values, irrespective of the choice of the capacity by the regulator.

The second case exists where capacities are privately known and chosen by firms. In particular, suppose each firm’s capacity is independently distributed according to a known distribution function. Only firm i knows their exact capacity while the distribution function and the limits are public information. In such a case, with a similar argument as the one in Proposition 1, it is possible to show firms would still submit their bid prices truthfully. Note that when firms can choose their capacities, they can essentially adjust their demand. Therefore they may have incentives to reduce their demand in order to increase their overall payoff by paying less for the winning units. This is similar to the classic demand reduction discussed in the literature (e.g., Wilson 1979; Back and Zender 1993). In this case the auction could become vulnerable to demand reduction and result in a reduction in allocative efficiency.

Thus when capacities are unknown there are two main conclusions: firms continue to submit their bid prices truthfully and the allocative efficiency of the auction may reduce.

5 Conclusions

This article proposes an auction that results in truthful bidding for pollution permits. The proposed auction design has two distinct features (i) the auctioneer restricts buyers’ bids for their full demand of permits and (ii) allows a simple ex-post supply adjustment rule, where the aggregate supply of rights can be reduced after bids have been submitted. Using these two features we show truthful bidding occurs. This proposed mechanism is administratively simple and requires no knowledge of firms’ marginal costs or marginal damages to incite truthful bidding. Thus this mechanism is able to efficiently allocate permits. Similar to the Vickrey auction, we show it is a weakly dominant strategy for each firm to bid their true values. Despite the similarities between this and the Vickrey auction, our main contribution is to propose a design that has advantages over the Vickrey auction: a simple and applicable design for an environmental context.

A natural application of this auction is to tradable permit auctions. In all current permit auctions, the uniform-price design is chosen to generate a single equilibrium price that can assist the development of the secondary market. Yet current auction designs come at a cost: these uniform-price auctions are known to be inefficient as bidders normally shade their bids with a resulting lower equilibrium auction price (Khezr and MacKenzie 2018a). This newly proposed auction could, under a number of potential settings, generate an allocatively efficient permit auction that will generate the Walrasian equilibrium. Although tradable permit auctions are a potential application, this auction design can be further applied to other environmental (multi-unit) resources (such as rights for water, conservation, and so on) as well as non-environmental rights such as treasury bills.

Notes

We focus on the efficiency of the initial allocation of permits and abstract from the secondary market. As (Krishna 2009) states, resale cannot guarantee efficiency, due to, for example, transaction costs or thin markets, therefore a regulator should aim for the most efficient initial allocation mechanism.

The independence of a winning firm’s bid and the price paid is the result of the single-bid rule. Thus if buyer i’s bid is above the clearing price, then the clearing price is set by the bid of another buyer, which is independent of buyer i’s bid.

The California Cap-and-Trade Program has over US$3bn of revenue generated per annum (CARB, 2018) yet the process of consignment requires a proportion of this revenue to be rebated back to auction participants (Khezr and MacKenzie 2018a). For RGGI results see https://www.rggi.org/Auctions/Auction-Results/Prices-Volumes

Later in the article we provide a comparison between the proposed auction design and a conventional uniform-price auction to show the possibility of social welfare improvements as well as discussing potential limitations of using this new approach.

In Section 3 we extend the model to allow for diminishing marginal values. We initially focus on constant values as there exists a number of justifications within an environmental setting. In the short run—when technologies are fixed—bidders’ values of the auction units can be interpreted as their expected value of selling the right on a secondary market or their marginal cost of using their abatement technology, which would be constant for the short-run capacity limits within this auction. As in existing permit auctions, we focus on scenarios where there are a relatively large number of bidders from similar industries (thus firm heterogeneity is not excessive).

This can also be interpreted as the verified emissions of each firm in the previous compliance period as long as the aggregate emissions are decreasing over time.

Within the Regional Greenhouse Gas Initiative (RGGI) the COATS tracking platform not only gives the auctioneer immediate access to estimates of bidders’ capacities but also provides public reports of emissions and allowance activity https://www.rggi.org/allowance-tracking/rggi-coats. The same is also true within the European Union Emissions Trading Scheme (EU-ETS) with their Union Registry https://ec.europa.eu/clima/policies/ets/registry_en and also the (publicly available) European Union Transaction Log (EUTL) http://ec.europa.eu/environment/ets/transaction.do?languageCode=en. The California Cap-and-Trade Program also has their Compliance Instrument Tracking System Service (CITSS) that reports emissions data and transactions similar to the other schemes.

While we abstract from the explicit modeling of a secondary market, note that inclusion of the market would not alter our results. As the secondary market occurs after the auction has finished, firms within the auction would use backward induction and their marginal values in the auction \(v_i\) would represent their expected marginal value of a permit on the secondary market.

We thus assume the process of quantity adjustment is costless.

Note that despite the single-bid property of the auction proposed, the outcomes can vary from the Vickrey auction. In fact, given that firms have multi-unit demands with heterogeneous capacities, these two mechanisms could result in very different outcomes. For instance, denote \(\lambda _l\) as the capacity of the firm who submitted the highest losing bid. If, at least, one winning bidder has a larger capacity than \(\lambda _l\), the Vickrey auction results in lower prices equal to the second highest losing bid for at least some units. However, the single-bid auction results in a uniform price equal to the highest losing bid for all units independent of the capacities.

Note that when the number of bidders is low and each bidder’s capacity is a significant proportion of the total units, the supply adjustment could potentially result in not allocating a significant amount of units. For instance, suppose there are only two bidders, one with a large capacity and one with a small capacity. If the bidder with a smaller capacity has the higher value and the total supply intersects the aggregate demand at a flat, then the auction could end up allocating zero units to the larger firm. However, note that given the application we noted for the current mechanism, we are unlikely to have such a scenario: the number of firms in a permit auction is relatively large (above 50 in some cases) and the capacity of firms are relatively small compared to the total number of permits available.

Ausubel et al. (2014), is one of the few papers that study diminishing marginal values, where buyers have identical utility functions. Unlike their model, we assume buyers have asymmetric demand functions.

Note that the accuracy of the signal has a close relationship with the level of efficiency. In particular, one expects a less accurate ex-ante signal results in, on average, less accurate prediction of capacities and lower level of efficiency. In this context, the accuracy of signals could be translated to both the probability of estimating the correct capacity and the dispersion of the distribution. However, due to the probabilistic nature of signals, the ex-post efficiency of a particular auction may not monotonically decrease if the uncertainty regarding the signal increases.

References

Alvarez F, Mazón C, André FJ (2019) Assigning pollution permits: are uniform auctions efficient? Econ. Theory 67:211–248

Armstrong M (2000) Optimal multi-object auctions. Rev Econ Stud 67:455–481

Ausubel LM, Cramton P, Pycia M, Rostek M, Weretka M (2014) Demand reduction and inefficiency in multi-unit auctions. Rev Econ Stud 81:1366–1400

Ausubel LM, Milgrom P (2004) ‘The lovely but lonely Vickrey auction’, Discussion Papers 03-036, Stanford Institute for Economic Policy Research

Back K, Zender JF (1993) Auctions of divisible goods: on the rationale for the treasury experiment. Rev Financ Stud 6:733–764

Back K, Zender JF (2001) Auctions of divisible goods with endogenous supply. Econ Lett 73:29–34

CARB (2018) ‘California Cap-and-trade Program summary of auction settlement prices and results’, http://www.arb.ca.gov/cc/capandtrade/auction/results_summary.pdf, California Air Resources Board

Damianov DS, Becker JG (2010) Auctions with variable supply: uniform price versus discriminatory. Europ Econ Rev 54:571–593

Dasgupta P, Hammond P, Maskin E (1980) On imperfect information and optimal pollution control. Rev Econ Stud 47:857–860

Duggan J, Roberts J (2002) Implementing the efficient allocation of pollution. Am Econ Rev 92:1070–1078

European Commission (2017) Analysis of the use of auction revenues by the member states. Technical report. European Commission, Brussels

Khezr P, MacKenzie IA (2018a) Consignment auctions. J Environ Econ Manag 87:42–51

Khezr P, MacKenzie IA (2018b) Permit market auctions with allowance reserves. Int J Ind Organiz 61:283–306

Krishna V (2009) Auction Theory. Academic Press, San Diego

Kwerel E (1977) To tell the truth: imperfect information and optimal pollution control. Rev Econ Stud 44:595–601

LiCalzi M, Pavan A (2005) Tilting the supply schedule to enhance competition in uniform-price auctions. Europ Econ Rev 49:227–250

Lopomo G, Marx LM, McAdams D, Murray B (2011) Carbon allowance auction design: an assessment of options for the United States. Rev Environ Econ Policy 5:25–43

McAdams D (2007) Adjustable supply in uniform price auctions: non-commitment as a strategic tool. Econ Lett 95:48–53

Montero J-P (2008) A simple auction mechanism for the optimal allocation of the commons. Am Econ Rev 98:496–518

Shrestha RK (1998) Uncertainty and the choice of policy instruments: a note on Baumol and Oates propositions. Environ Res Econ 12:497–505

Shrestha RK (2017) Menus of price-quantity contracts for inducing the truth in environmental regulation. J Environ Econ Manage 83:1–7

Vickrey W (1961) Counterspeculation, auctions, and competitive sealed tenders. J Financ 16:8–37

Wilson R (1979) Auctions of shares. Quart J Econ 93:675–689

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We would like to thank the Co-Editor, Timo Goeschl, and three anonymous referees whose comments helped us improve the paper. The usual disclaimer applies.

Appendix

Appendix

Proof of Proposition 1

Suppose bidder i with value \(v_i\) submits a bid \(b_i<v_i\) and the price at which all permits are sold is p. We claim that bidding \(b_i=v_i\) weakly dominates \(b_i<v_i\). If \(p>v_i\) in both situations the payoffs are zero. If \(p<v_i\), then bidding \(b_i<v_i\) either results in a zero payoff or results in a payoff equal to \(v_i-p\). However, bidding equal to \(v_i\) would always result in a positive payoff equal to \(v_i-p\). Therefore, bidding \(b_i=v_i\) weakly dominates bidding \(b_i<v_i\).

Now suppose bidder i submits a bid equal to \(b'_i>v_i\). We show this is also weakly dominated by a bid equal to her value. If \(v_i<b'_i<p\), then both cases would result in zero payoff. If \(v_i<p<b'_i\), then \(b'_i\) wins but results in a negative payoff, since \(v_i<p\). In this case bidding equal to \(v_i\) results in zero payoff. Finally, if \(p<v_i<b'_i\) both bids would result in similar payoffs. \(\square \)

Proof of Corollary 1

Efficiency is a straightforward result of truthful bidding. Since the mechanism allocates the objects to those with the highest values, then it is efficient. However, since there are instances that the seller may sell less than \(\bar{Q}\), then it is weakly efficient. \(\square \)

Proof of Proposition 2

To show that bidding truthfully is a weakly dominant strategy we start by a representative buyer and show that this buyer cannot benefit from demand reduction if all other buyers act truthfully. Suppose buyer i bids its true demand schedule, that is, \(p=v_i -\frac{v_i}{\lambda _i} q_i\). First, calculate the aggregate demand without the consideration of buyer i. Note that each buyer by submitting a demand schedule, creates a kink on the aggregate demand at their reported value. Define \(c_{-i}\) as the value of the buyer who sets the last kink before \(\bar{Q}\) when excluding buyer i in the aggregate demand. In other words \(c_{-i}\) is the lowest reported value that can win some permits, excluding i. There are two possible scenarios with respect to the relation of \(c_{-i}\) and buyer i’s value \(v_i\).

S1: If \(v_i > c_{-i}\), then buyer i wins some permits, say \(q_i\), and pays a price \(p<v_i\). Thus, the payoff for buyer i is,

S2: If \(v_i < c_{-i}\), then two outcomes are possible. The kink at \(v_i\) on the aggregate demand could be either to the left of \(\bar{Q}\) or to the right and the last one before \(\bar{Q}\).

S2.1: When the kink is at the left of \(\bar{Q}\), but lower than \(c_{-i}\), they win \(q'_i\) permits and pay a price equal to \(p'\) with a positive payoff equal to,

S2.2: When the kink is at the right of \(\bar{Q}\), buyer i receives zero payoff.

Now, suppose buyer i submits a value \(z_i <v_i\) in its demand schedule then in scenario S2.2 they obviously receive zero payoff again. But now in scenario S1 and S2.1 they would also receive a zero payoff due to the supply adjustment. To see this, suppose the kink at \(z_i\) is the kth highest kink. The slope of the aggregate demand after this kink is,

where \(\rho '<\rho \) is the slope of the buyer i’s demand function with \(z_i\). The above slope is less than \(\frac{\rho }{k}\) because,

The last inequality is true because \(\rho '<\rho \). According to the supply adjustment, when the slope of aggregate demand is less than \(\frac{\rho }{k}\) after kink k, the supply would reduce to kink k and buyer i receives zero permits.

Thus it is a weakly dominant strategy for buyers to bid their true demand. \(\square \)

Proof of Proposition 3

Given the result of Proposition 2, if all buyers except buyer i play their weakly dominant strategy, then there is no incentive for buyer i to deviate from this strategy. So submitting the true value is a dominant strategy equilibrium of this game. The efficiency part is straightforward because the mechanism allocates the objects to those with the highest values, since in equilibrium the aggregate demand represents the true demand of each buyer. Also, since the supply adjustment does not take place in equilibrium, all quantities available would be allocated to buyers. Thus the mechanism is fully efficient. \(\square \)

Proof of Proposition 4

Suppose all buyers except buyer i submit their true demands. We want to show it is not optimal for buyer i to follow the same strategy. First, rewrite Equation (4) as follows,

The first-order condition is

Given the market-clearing price condition, \(q^*_i =\bar{Q} - \sum _{j\ne i} (\lambda _j - \frac{\lambda _j}{v_j}p)\), one can rewrite the first-order condition as follows

Define \(\psi _j = \sum _{j\ne i} \frac{\lambda _j}{v_j} \), then the equilibrium demand schedule of bidder i becomes,

Since \(\frac{1}{\psi _j} < \rho \) for \(n>2\), the best response of player i is to submit a demand function with a strictly lower slope than their actual demand. Thus there exist no equilibrium with truthful demands.

What remains to show is that bidding above the actual demand is not an optimal decision for buyers. To see this, suppose bidder i submits a demand schedule that is above their actual demand function. The only situation that matters is the one where buyer i is pivotal and wins some permits. When the submitted demand is higher than the actual demand, buyer i wins more permits but pays a higher price. Let us focus on the margin and a case where buyer i is only marginally above their true demand. For any extra unit buyer i wins, there will be an extra loss to the surplus at the same price. Now given that price will also go up, the loss in the surplus will be even higher. Therefore, submitting the true demand dominates submitting any demand above the true demand. \(\square \)

Proof of Proposition 5

Given the result in Proposition 4, in any undominated equilibrium of the standard uniform-price at least some buyers reduce their demands. Therefore, any equilibrium aggregate demand of the standard uniform-price auction is strictly lower than the actual demand. Since we show that in the proposed mechanism the aggregate demand is the same as the sum of the true demands, then the auction clearing price for the proposed mechanism is strictly larger than the clearing price of a standard uniform-price auction. Thus, the revenue of the proposed auction, which is \(p\bar{Q}\), is also strictly higher than the revenue of a standard uniform-price auction. \(\square \)

Rights and permissions

About this article

Cite this article

Khezr, P., MacKenzie, I.A. An allocatively efficient auction for pollution permits. Environ Resource Econ 78, 571–585 (2021). https://doi.org/10.1007/s10640-021-00543-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-021-00543-3