Abstract

Auctions have become popular as means of allocating emissions permits in the emissions trading schemes developed around the world. Mostly, only a subset of the regulated polluters participate in these auctions along with speculators, creating a market with relatively few participants and, thus, incentive for strategic bidding. I characterize the bidding behavior of the polluters and the speculators, examining the effect of the latter on the profits of the former and on the auction outcome. It turns out that in addition to bidding for compliance, polluters also bid for speculation in the aftermarket. While the presence of the speculators forces the polluters to bid closer to their true valuations, it also creates a trade-off between increasing the revenue accrued to the regulator and reducing the profits of the auction-participating polluters. Nevertheless, the profits of the latter increase in the speculators’ risk aversion.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Emissions trading schemes (ETS) are favored as market-based instruments for controlling pollution because they offer compliance flexibility through trade. Their major appeal is that, assuming competitive emissions markets, they direct the emissions reductions towards the most cost-effective emitters, minimizing the social cost of compliance. These considerations have been recognized by several jurisdictions around the world. First, the European Commission (EC) established the European Union Emission Trading Scheme (EU ETS), which is currently the biggest cap-and-trade program in the world. Its operation commenced in 2005, with the purpose of helping the Member States (MS) to comply with the Kyoto Protocol commitments. The first two phases of the scheme (2005–2007 and 2008–2012, respectively) were characterized by the discretionary nature entailed by the free permits allocation method, also called grandfathering. However, in 2013 auctioning was introduced as the default method of distributing permits, being the most important design change implemented in Phase 3 (2013–2020). While co-existing with free allocation, auctioning will become progressively the sole method of initial distribution by the end of the trading phase. Moreover, while in Phases 1 and 2 of the scheme permits were distributed only to the regulated installations, in Phase 3 non-regulated entities,Footnote 1 such as authorized individuals, investment banks or credit institutions, can also purchase permits directly from the EC through the periodic auctions.Footnote 2 These entities seek to make profits by engaging in speculative activity in the emissions permits markets.

Second, the Air Resources Board (ARB) established the California ETS, which has been in place since 2013. Although some industrial facilities receive permits free of charge, the ARB implemented auctioning as a rule for allocating permits beginning with the first compliance period. This is in contrast with the EU ETS in which MS had the option but not the obligation to auction a certain proportion of permits in Phases 1 and 2.Footnote 3 However, similar to the EU auctions, non-regulated firms can also submit bids to the ARB auctions, which are held every quarter. Third, the Regional Greenhouse Gas Initiative (RGGI) is an ETS which regulates emissions in the power sector of nine American states.Footnote 4 The scheme runs in three-year long compliance periods, as of January 2009. Unlike the EU and California ETSs, which are currently using a hybrid between auctioning and grandfathering as the allocation method, the RGGI sells virtually all the emissions permits through auctions. The RGGI auctions are organized at quarterly intervals in a sealed-bid uniform price format and, as in the EU and California, entities without compliance obligations can submit bids along with the regulated firms.

This paper is motivated by the emergence of auctioning as a popular method of allocating emissions permits in the ETSs around the world, and by the permission of the non-regulated entities to bid in these auctions. The inclusion of the non-regulated entities brings into attention the secondary market which is often disregarded by the ETS policy literature (Demailly and Quirion 2006; Hepburn et al. 2006; Neuhoff 2007; Benz et al. 2010) or even the economics literature (Subramanian et al. 2007). Despite the extensive theoretical literature which derives important results regarding bidders’ strategies in an auction with a resale market (Haile 2000, 2003; Garratt and Troger 2006; Pagnozzi 2007; Bikhchandani and Huang 1989) bidders’ behavior and auction outcome in the context of an ETS has been scarcely considered. Indeed, several experimental studies investigate polluters behavior in ETS auctions with resale (Goeree et al. 2010; Burtraw et al. 2009) but, to the best of my knowledge, only Haita (2014) studies theoretically polluters compliance behavior in an ETS with an auction and a resale market. However, the author fails to incorporate uncertainty, firms’ heterogeneity or the non-regulated entities.

The aim of this paper is to characterize the bidding behavior of two fundamentally different types of bidders, the polluters (regulated firms) and the speculators (non-regulated firms), in an ETS with heterogeneous firms and uncertainty. Using numerical examples, I conduct comparative statics to discuss the influence of the speculators on the outcome of the emissions permits markets and polluters’ profits. To this end I build a two-stage game in which a subset Footnote 5 of the polluters together with the speculators firstly bid in an auction for the distribution of emissions permits. While the speculators gamble on the secondary market price, the rationale for the polluters’ participation in the auction is their increasing marginal abatement cost (see Sect. 2). In the second stage all firms decide on the secondary market trade, which determines polluters’ abatement (emissions reductions) levels. The auction is modeled as a uniform price sealed-bid auctionFootnote 6 of a perfectly divisible asset, whereby bidders submit demand schedules and receive permits according to their bids, at the price where the aggregated demand equates the supply. In this model the supply of permits is perfectly inelastic and exogenously given.Footnote 7 Finally, the secondary market is modeled as a Walrasian exchange, in which the price is found by setting the excess demand to zero.

The underlying assumption of the model is that firms face uncertainty at the auctioning stage. The uncertainty is captured by a common shock to polluters’ emissions needs,Footnote 8 to which they respond idiosyncratically. This response can be either positive or negative, hence defining either a pro-cyclical or a counter-cyclical polluter. The resolution of uncertainty occurs after the initial allocation of permits is completed but before the secondary market trade and abatement decisions take place. In the model, both the polluters and the speculators are assumed to be risk averse. This assumption is supported, for instance, by the theory of the firm literature which argues that risk aversion rather than risk neutrality characterizes firms’ decisions under uncertainty (Sandmo 1971; Leland 1972). In the ETS context, risk-averse polluters and speculators are present also in Colla et al. (2012), Aatola et al. (2013), Baldursson and von der Fehr (2004). Moreover, the empirical evidence suggests that the emissions markets participants are indeed risk averse (Chevallier et al. 2009). Finally, the auction with resale literature supports the risk aversion assumption for the speculators in my model (Kyle 1989; Vargas 2003; Keloharju et al. 2005). In this literature, a perfectly divisible risky asset is auctioned off before its liquidation value is realized, as is the case with the emissions permits in the current model.

The main results of the paper can be summarized as follows. First, in addition to compliance motives, a polluter also bids according to a speculative componentin her valuation function, which depends on the resale value of the permit and her risk preference. A speculator, on the other hand, values the first permit exactly at its expected secondary market price. Second, numerical simulations show that the participation of the speculators in the permits markets has an adverse effect on the profits of those polluters that participate in the auction. This is due to the fact that the presence of the speculators, on the one hand enhances truthful bidding by the polluters and, on the other hand, decreases polluters’ purchases in the auction. The latter effect may have a positive impact on the auction-participating polluters insuring them in the case of a negative shock, by reducing their speculative purchases. However, the former effect generally hurts their profits because it increases the auction clearing price. The net effect depends on the relative change in prices and permits earned. Hence, the presence of the speculators creates a trade-off between polluters’ welfare and a higher auction revenue.

Related literature My paper relates to two studies that model either auctions or speculators in markets for emissions permits. First, in Subramanian et al. (2007) permits are distributed in a uniform price auction, but the secondary market is omitted. Although firms do not bid truthfully in their model, the authors argue for an auction equilibrium which allocates the permits efficiently. However, as my model shows, the possibility for resale considerably affects polluters’ bidding behavior and, thus, it cannot be neglected. While also assuming complete information, their model does not incorporate uncertainty or speculators. Subramanian et al. (2007) find that dirtier firms invest less in abatement than cleaner firms and the abatement level increases in permits availability. Both results follow from the fact that, in their model, permits and abatement are strategic complements. By contrast, in my model abatement and permits are strategic substitutes and, therefore, the level of abatement decreases in the emissions cap. Finally, in their two-firm asymmetric auction game, Subramanian et al. (2007) claim a linear equilibrium in which they impose symmetric intercepts. By contrast, I derive the asymmetric unique linear equilibrium for an auction game with more than two firms, without imposing restrictions on the parameters of the bid functions.

Second, Colla et al. (2012) build a model with two rounds of permits trade and risk-averse polluters and speculators, assumed to be atomistic. In their model permits are fully grandfathered rather than being auctioned and, thus, only the polluters are endowed with permits, initially. Therefore, in the first trading round the speculators buy the permits from the polluters and unwind their positions in the second round. The trading rounds are separated by the realization of a common productivity shock, which affects all the polluting firms identically. Polluters are assumed to be homogeneous and therefore, the equilibrium is symmetric. Instead, my model allows for heterogeneity in several dimensions, including different levels of risk aversion and idiosyncratic responses to the common shock. In their modeling approach, capital investment (abatement) increases the productivity of the permits and, therefore, similarly to Subramanian et al. (2007), the authors find that the level of capital investment increases in the emissions cap. The authors show that the price of the first round of trade increases in the number of speculators if and only if they are less risk averse than the polluters. By contrast, since in my model the first market (the auction) is a unilateral market, its price increases with the number of speculators regardless of their risk preference relative to that of the polluters.

The paper proceeds as follows. The next section develops the model and the assumptions employed. The model is solved and the analytical results are discussed in Sect.3. Section 4 includes numerical comparative statics and Sect.5 concludes.

2 The model

2.1 Timing and players

Assume an ETS with \(N>2\) regulated polluters indexed by f. Each polluter has stochastic emissions needs \(e_f \) given by the following equation:

where \(\epsilon \) is a shock common to all polluters, normally distributed with mean zero and variance one,Footnote 9 while \(\gamma _f \) is the level of unconditional expected emissions needs. Apart from providing tractability, the assumption of a common shock also has realistic grounds. Indeed, it is natural that firms acting in the same industry are affected by common uncertainties to which they might react differently. Therefore, parameter \(\alpha _f \) captures the idiosyncrasy of this shock and it can be positive or negative, depending on whether the firm is pro-cyclical or counter-cyclical.

Note that the emissions needs can be interpreted in terms of demand for the polluter’s final output. Hence, while polluters may act in different output markets, the same variation in the macroeconomic or industry conditions leads to different changes in their actual production due to, for example, different production cost functions. However, I abstract from the production decisions and I focus on the emissions needs resulted from the polluter’s optimization problem. In fact, assuming exogenous emissions needs is equivalent to assuming that firms are price takers on their respective output markets.Footnote 10 Hence, \(e_f \) can be regarded as the emissions needs generated by firm’s production decisions, net of any (potentially) freely-distributed permits. Therefore, the model presented below can also accommodate the case of an ETS in which a share of the total emissions permits is grandfathered. However, in order to keep the exposition simple and focus on the bidding behavior, in what follows I assume zero grandfathering.Footnote 11

In order for negative \(e_f \) to occur with negligible probability, I maintain the following assumption:

Assumption 1

For each polluter \(f=1,\ldots ,N\) we have \(\Phi \left( {\frac{\gamma _f }{\alpha _f }} \right) \approx 1\) if \(\alpha _f >0\) and \(\Phi \left( {\frac{\gamma _f }{\alpha _f }} \right) \approx 0\) if \(\alpha _f <0,\) where \(\Phi \) denotes the cumulative distribution function of the standard normal distribution

A suffcient condition for Assumption 1 to be satisfied is that \(\gamma _f \) is sufficiently larger than \(\alpha _f \), i.e. \(\gamma _f \gg \alpha _f \) for all f.

The timing of the game is the following. First, the perfectly inelastic supply of permits \(\bar{{E}}\) is auctioned off in a sealed-bid uniform price auction.Footnote 12 At this point polluters face uncertainty about their emissions needs, as described by Eq. (1). In this model, both the emissions cap and the decision to participate in the auction are exogenous.Footnote 13 After the uncertainty is resolved, the polluters engage in abatement (emissions reduction) activity at a quadratic cost given by \(\theta _f r_f^2 \), where \(r_f \) denotes the amount of abatement. Finally, the secondary-market trade is a degenerate stage in the sense that the trade is determined by the emissions compliance constraint and the outcome of the previous stages.

In this paper abatement is modeled as end-of-pipe emissions reduction (e.g. CO2 capture and storage facilities or scrubbers) or investment in green projects generating certificates that can be used against the discharged emissions. This approach to modeling abatement is also present in Maeda (2003), Montero (2009) and Wirl (2009). Note that I model the abatement decisions after the uncertainty is resolved, in which case the abatement investment cycle is relatively fast and firms have the possibility to adapt their investment after the permits markets’ outcomes are realized. Alternatively, one could model abatement decisions under uncertainty and before the auction is conducted. This would reflect the long term abatement decisions at a lower frequency than the auction. This approach is, in fact, closer to the reality of an ETS in which several auctions are conducted during one calendar year. However, since in this paper the abatement decision cannot be separated from the trading decision, modeling abatement before uncertainty would also require a round of secondary-market trade. Moreover, adjustments through trade (and abatement) would still be needed after the resolution of the uncertainty.

In addition to the polluting firms, \(M\ge 1\) speculators, indexed by s, participate in the markets for permits with the sole purpose of gaining profits from the difference between the auction price and the secondary market price.

2.2 The markets

2.2.1 Primary market

The primary market is modeled as a sealed-bid uniform price auction, whereby a bidder\(j\in \{f,s\}\) submits a demand schedule \(D_j (\nu )\) representing the number of permits she wants to purchase at any price\(\nu \). The regulator aggregates the individual demands and computes the clearing price \(\nu ^{*}\)as the point where the aggregate demand equates the fixed supply\(\bar{{E}}\). Each bidder is then awarded permits according to her bidding schedule and the auction clearing price.Footnote 14

I make two important assumptions concerning this market. First, I assume that only a subset \(N_a <N\) of the polluters bid in the auction, along with the M speculators. This assumption is supported by evidence from existing ETSs. For example, during the first three years of the EU ETS Phase III auctions, the number of bidders was never larger than 26,Footnote 15 while the scheme covers around 12,000 installations. Similarly, in the first three quarterly auctions organized by the ARB for California ETS, there were, on average, 85 participants out of the total of around 600 installations. This low participation is somewhat justified in the case of the EU and California because a proportion of the permits is distributed gratis. However, evidence from the RGGI, in which virtually all permits are allocated in a sealed-bid uniform price auction (Sopher et al. 2014), provides stronger support for the assumption that only a subset of the regulated polluters participate in the auction. During the first 14 auctions the average participation by polluters was 34 out of the 211 regulated emitters, while during the first 11 auctions of the second compliance period on average only 31 out of the 168 regulated emitters submitted bids (RGGI Inc 2014). The low auction participation can be attributed to participation costs such and firms’ ability to meet the auction qualification requirements. For example, an auction participant has to register as a member of the auction platform and has to make a liability proof in the form of a bid guarantee. Cash constraints, informational and bureaucratic costs or transaction fees also count as reasons for non-participation. From these considerations, I take firms’ participation in the auction as exogenously given and I do not model the decision to enter the action.

Second, I model the auction as a strategic market. It has been established both theoretically and empirically that uniform-price auctions create incentives for demand reduction, even if the number of bidders is large. For instance, Milgrom (2004, p. 262) argues that even when the bidders are small relative to the market, there can be equilibria in which prices settle far below the competitive price. This result has been firstly pointed out by Wilson (1979) who showed that the uniform price auction can have equilibria which result in significant reduction of the revenue to the auctioneer, regardless of the number of bidders or their attitude towards risk. Moreover, Ausubel et al. (2014) emphasize that when bidder’s marginal utility is decreasing, the seller will not be able to extract the whole surplus, even when the number of bidders approaches infinity. Finally, evidence of demand reduction in uniform-price auctions is also present in experimental studies (Ausubel et al. 2014; Burtraw et al. 2009). Therefore, my model accounts for demand-reduction incentives, which, in fact, ensures the generality of the equilibrium, as one can always recover the competitive equilibrium by letting the number of bidders grow large. It is, thus, clear from the outset that the differential demand reductions stemming from bidders asymmetries will lead to inefficient allocations in the auction.

2.2.2 Secondary market

The secondary market has the role of correcting the misallocations from the first stage in which the actual needs for permits are unknown. Let \(\lambda \) be the price of the secondary market and \(t_j (\lambda )\) the supply (demand) on this market. In order to ensure negligible probability of the secondary market price being negative, I employ the following assumption:

Assumption 2

where \(\Phi \) denotes the cumulative distribution function of the standard normal distribution.

A suffcient condition for Assumption 2 to hold is that, in expectations, the environmental constraint is tight enough, i.e. \(\sum \nolimits ^N_{f=1} {\gamma _f } \gg \bar{{E}}\).

Unlike the auction, the secondary market is large and it comprises all N polluters and the M speculators. The speculators are net sellers in this market because they only need to unwind their positions. Hence, this market is thicker than the primary market and it is, therefore, modeled as being competitive. The argument for this is that firms’ constraints in engaging in permits’ exchanges are lower than in the case of the auction: the ETS operators can access the secondary market via many routes, such as over-the-counter trade or through intermediaries like banks and specialized traders. Therefore, I model this market as a Walrasian exchange which clears at price \(\lambda ^{*}\), such that the excess demand is zero.

While they are both Walrasian markets, the essential difference between the primary and the secondary markets in this model is that in the primary market the demand schedules may be submitted strategically. Such strategies are successful not only due to the thinness of this market, but also because all players are buyers and the auctioneer does not act to reduce their strategic incentives. This is not the case in the secondary market, in which players are split into buyers and sellers and in which the size of the market does not allow for effective influence over the price.Footnote 16

In this model permits are not bankable. Therefore, a polluter closes her position by trading the surplus or deficit of permits in the secondary market, accounting for the abatement decisions, such that to comply with the regulations. Hence, her net supply (demand) in the secondary market is given by the environmental constraintFootnote 17:

as the actual emissions needs net of the amount of permits purchased in the auction and her level of abatement. Thus, \(t_f >0\) indicates a net buyer, while \(t_f <0\) indicates a net seller. Additionally, the firm cannot sell more permits than it holds, i.e. \(t_f \ge -D_f ,\forall f\).

2.3 The utilities

I assume that both the polluters and the speculators are risk averse with constant absolute risk aversion (CARA) utility functions of profits. A polluter derives profit from the revenue (expenses) of selling (purchasing) permits in the secondary market, net of the abatement cost and the expenses on purchasing permits in the auction:

Let \(\rho _f >0\) be the CARA coeffcient. Then each polluterfmaximizes the following utility function of profit:

Next, recall that the speculators engage in the markets for permits in order to make profits from the price spread between the auction and the secondary market. Hence, the profit (loss) of speculator s is given by the revenue from selling the permits in the secondary market minus the expenses of buying them in the auction:

Similarly to the polluters, each speculator s maximizes a CARA utility function of profit,

where \(\rho _s >0\) is her coeffcient of risk aversion.

3 Solving the model

The model is solved under the common knowledge assumption. Each polluter aims at finding the optimal combination of abatement and permits holdings to achieve environmental compliance. Speculators, on the other hand, only need to decide on their bids in the auction. I assume that permits and abatement are perfectly divisible and, therefore, the utility functions are differentiable with respect to each variable. This allows me to only consider continuous strategies. I solve the model by backward induction.

3.1 Abatement and secondary-market trade

At this stage the uncertainty is resolved. Hence, polluter f decides on the abatement level \(r_f ,\) given her initial allocation, such that to maximize her profit function given by (3) under the constraint \(0\le r_f \le e_f \). This constraint ensures that the abatement is not negative and it is not larger than the actual emissions needs. The Kuhn-Tucker conditions provide the following optimal level of abatement:

and \(r_f =e_f \) if \(2\theta _f e_f \le \lambda \). For simplicity I focus on the interior solution (7) and, therefore, only consider the values of \(r_f <e_f \), i.e. polluters operate in the region where the marginal abatement cost at the actual emissions needs is above the secondary market price, for any realization of \(\epsilon \).

The abatement decisions also determine the secondary-market trading position. Taking \(D_f \) as given and substituting (7) in (2), the demand (supply) of polluter f reads:

Note that for \(D_f =0,\) equation (8) gives the demand function for the \(N-N_a \) firms that do not participate in the action, as well as for the unsuccessful bidders.

Since at the end of the game any permit held has zero value, the speculators close their positions by selling all permits earned in the auction:

The following proposition gives the market equilibrium price.

Proposition 1

If the entire supply of permits is distributed in the auction, then

clears the secondary market, i.e. \(\sum \nolimits _{f=1}^N {t_f } (\lambda ^{*})+\sum \nolimits _{s=1}^M {t_s } (\lambda ^{*})=0\).

By Assumption 2, the probability of negative \(\lambda ^{*}\) is negligible. Note that the secondary market price is not affected by the characteristics of the speculators. This is intuitive since speculators do not need permits for production and the secondary market is competitive. However, as expected, \(\lambda ^{*}\) is increasing in the abatement cost and decreasing in the total supply of permits. Consequently, the amount of abatement decreases in the number of available permits (see Eq. (7)). This is in contrast with both Subramanian et al. (2007) and Colla et al. (2012), who find that the abatement investment increases in the supply of permits. The explanation stands in the fact that in both papers permits and abatement are strategic complements. Thus, a larger supply of permits represents an expansion of firms’ production capacities and abatement becomes more attractive. By contrast, in my model permits and abatement are strategic substitutes.

Accounting for (1), the secondary market price given by (10) can be decomposed into a deterministic and a stochastic component, respectively:

where \(\bar{{\lambda }}^{*}=2\left( \sum \nolimits ^N_{f=1} {\gamma _f } -\bar{{E}}\right) /\left( \sum \nolimits ^N_{f=1} {\theta _f ^{-1}} \right) \) is the expected secondary market price, which is positive by Assumption 2, and \(\Omega =2\left( \sum \nolimits ^N_{f=1} {\alpha _f } \right) /\left( \sum \nolimits ^N_{f=1} {\theta _f ^{-1}} \right) \) is the sensitivity of the secondary market price to the common uncertainty \(\epsilon \). In essence, this sensitivity represents polluters’ aggregate response to uncertainty. Note that \(\Omega \) is positive if \(\sum \nolimits _{f=1}^N {\alpha _f } >0\) and negative otherwise. Therefore, if most firms are pro-cyclical \((\Omega >0)\) a positive shock to the economy \((\epsilon >0)\) increases their actual emissions. Consequently, the demand for permits increases, resulting in a higher secondary market price. Conversely, if most firms are counter-cyclical \((\Omega <0)\), the polluters sell the available permits, thus increasing the supply in the secondary market and depressing the permits’ price. However, the latter case is less realistic as most regulated industries are pro-cyclical.

3.2 Auction

At this stage firms face uncertainty. The auction participants simultaneously submit bids to the regulator, by forming expectations about the actual emissions needs and the prevailing secondary market price. Therefore, \(\lambda ^{*}\) can be interpreted as the liquidation value of a permit. Without any loss of generality, let the auction-participating polluters be indexed from 1 to \(N_a \). In order to decide their bids, the polluters maximize the expected utility functions of profits (4). Following Marin and Rahi (1999), maximizing the expected value of (4) is equivalent to maximizing the following mean-variance utility function:

for \(f=1,\ldots ,N_a \) where,Footnote 18

Equation (12) is a mean-variance utility function in which \(\kappa _f \) captures polluter’s disutility from bearing uncertainty at this stage of the game. Note that the higher the risk aversion, the larger the disutility: \(\partial \kappa _f /\partial \rho _f >0\). The following assumption ensures that the ex-ante utility function given by (4) is well-defined ( Marin and Rahi 1999):

Assumption 3

For any polluter f, the following holds: \(1+2\rho _f A_f >0\).

Substituting \(A_f\) from (13), the condition from Assumption 3 becomes \(\Omega \alpha _f <(2\rho _f )^{-1}+\Omega ^{2}(4\theta _f )^{-1}\). Therefore, if most firms are pro-cyclical \((\Omega >0)\), this assumption implies an upper positive bound on polluter’s sensitivity \(\alpha _f \). If, instead, \(\Omega <0\), then polluter’s sensitivity has a lower negative bound. This is to say that the polluters can be neither too pro-cyclical nor too counter-cyclical. Assumption 3 also ensures that \(\kappa _f\) is positive.

Further, maximizing the ex-ante utility of a speculator defined by (6) is equivalent to maximizing the following objective function:

The marginal valuation function for permits of an auction-participating polluter can be derived from (12) by taking the first derivative with respect to \(D_f \) Footnote 19:

where \(v_f =\bar{{\lambda }}^{*}\left( {1+\kappa _f \Omega \alpha _f } \right) +\kappa _f \Omega ^{2}\left( {\gamma _f -\frac{\bar{{\lambda }}^{*}}{2\theta _f }} \right) \) represents polluter’s valuation for the first permit, in which \(B_f \) was substituted from (13). Function \(V_f (D_f )\) characterizes firm’ bidding aggressiveness in the auction which decreases in the number of permits at a rate that depends on the uncertainty parameters \(\kappa _f \) and \(\Omega \). Two components can be distinguished in \(v_f \), as follows:

Result 1

A polluter’s valuation for the first permit has a speculative component given by \(\bar{{\lambda }}^{*}\left( {1+\kappa _f \Omega \alpha _f } \right) \) , which depends on the expected secondary market price, and a use component given by \(\kappa _f \Omega ^{2}\left( {\gamma _f -\frac{\bar{{\lambda }}^{*}}{2\theta _f }} \right) \), that reflects the role of the permit as a compliance instrument.

The speculative component is the sum of a purely speculative part, given by the expected secondary market price and a cautionary demand for permits, which depends on the risk attitude parameters and the sensitivity to uncertainty. Consistent with the intuition, the use value increases in the abatement cost and the expected emissions needs.

In turn, the marginal valuation for permits of a speculator is given by:

Again, the constant term in (16) represents the speculator’s true valuation for the first permit. As in the case of the polluters, the slope of the marginal valuation function is affected by the uncertainty parameters \(\rho _s \) and \(\Omega \). Note that if the speculators were risk neutral, i.e. \(\rho _s =0\), the valuations would be flat functions at the level of the expected secondary market price \(\bar{{\lambda }}^{*}.\)

Result 2

A speculator’s true valuation for the first permit exactly equals the expected resale value of the permit, \(\bar{{\lambda }}^{*}.\)

Results 1 and 2 reveal the difference between an emissions permit and other financial instruments, such as bills and securities. It is clear that the speculators treat an emissions permit as a financial security, valuing the first permit at its expected liquidation value, independent of the risk aversion. By contrast, from the polluter’s point of view a permit is not only a speculation asset, but also a factor of production. Moreover, the speculative value a polluter attaches to the first permit does not depend only on the final liquidation value, but also on the uncertainty parameters. For instance, if all polluters are pro-cyclical, then each polluter overvalues the first permit relative to its expected liquidation value. On the other hand, the valuation for the first permit stemming from the use component equates the expected permits needs (expected emissions needs net of expected abatement), adjusted with the uncertainty factor \(\kappa _f \Omega ^{2}.\) This reflects the fact that uncertainty affects the polluter’s directly through the output market, and not only through the secondary-market price.

Equilibrium Bids Bidders form their bidding strategies based on the endogenously derived marginal valuations (15) and (16). The equilibrium concept is Supply Function Equilibria (SFE). Finding the general SFE involves solving a system of differential equations such as (22) in Appendix 1, which is not only intractable but also poses the problem of multiplicity of equilibria for the case of asymmetric bidders. This motivates the focus on linear bidding strategies like in Green (1996, 1999).Footnote 20 In addition, I assume that all polluters participating in the auction have positive valuations for the first permit:

Assumption 4

For all auction-participating polluters the following holds

In fact, all firms being pro-cyclical is a suffcient condition for Assumption 4 to be fulfilled. If some polluters had negative valuations, they would not participate in the auction and, given the common knowledge assumption of this model, they would be disregarded by all the other participants at this stage. Note, in addition, that all speculators have positive valuations.

Assuming continuous bid functions for prices below the marginal valuation for the first permit, in Appendix 1 it is shown that they are affine function of \(\nu \), with a kink at the point where the price equals bidder’s true valuation for the first permit.Footnote 21 The bid function of a polluter reads:

And that of a speculator is:

The slopes \(y_f \) and \(y_s \) represent the demand-reduction factors. These are implicitly defined by the system of equations given by (24) in Appendix 1, which cannot be solved analytically. However, Rudkevich (2005) shows that this system of equations has a unique positive solution. Hence, the auction has a unique linear equilibrium given by (17) and (18). Note that if the auction participants act as price takers in the auction, then \(y_f \) and \(y_s \) correspond to truthful bidding. Specifically, from the valuations functions (15) and (16), the slopes of the competitive bids can be determined as \(y_f =(\kappa _f \Omega ^{2})^{-1}\), for a polluter and \(y_s =(\rho _s \Omega ^{2})^{-1}\), for a speculator.

It can be argued that financial traders, i.e. the speculators in the current model, are risk neutral rather than risk averse. Therefore, let us consider the case of risk neutral speculators. This amounts to \(\rho _s =0\) in the above equations. As noted above, such a speculator has a constant marginal valuation at the level of the expected secondary market price. If all participants bid competitively, the risk neutral speculator demands infinity for a price equal to the expected secondary market price. However, with strategic bidding by the other auction participants, speculators’ demand is bounded by the upward sloping residual supply schedule (Kyle 1989) and the slopes of speculators’ bidding schedules are still given by the system of equations (24), by making \(\rho _s =0.\) In Appendix B I show that, maintaining the focus on linear strategies, the case of risk neutral speculators is nested in the main model. However, while not improving the analytical tractability of the model, this simplification also leads to uninteresting results.Footnote 22 Precisely, with \(\rho _s =0\) and \(M\ge 2\), the only non-negative solution of (24) is zero. This means that all bidders submit empty bids and the auction cancels. While this outcome might be a shortcoming of the linear strategies, the intuition for it is the following. First, note that the marginal valuation functions of risk-neutral speculators are constant. Second, the SFE has bidders competing in quantities and, since for any unit demanded the valuation is the same, a strategic bidder reduces her demand the same at any price. Thus, the existence of at least two such bidders creates a race to the bottom that results in demand-reductions to the extreme.Footnote 23

In Sect. 4 I consider numerically the effect of the speculators on the outcome of the two permits markets. In particular, in Sect. 4.5 I illustrate the case of one risk-neutral speculator acting in the permits markets, as well as how speculators’ risk aversion affects the equilibrium variables, including values of \(\rho _s \) arbitrarily close to zero.

Clearing Price the individual demands by horizontal summation of (17) and (18), which results in a piecewise aggregate demand function. The auction clearing price is given by the point where the aggregate demand equates the fixed supply of permits. This is the highest price for which the aggregate excess demand is non-negative:

Definition 1

Let \(\nu ^{*}\) be the price at which the auction clears. Then, \(\nu ^{*}\) is defined as:

and zero otherwise.

Let \(n\le N_a \) and \(m\le M\) be the number of successful bidders, i.e. their maximum willingness to pay for the first permit is above \(\nu ^{*}\) (see Eqs. (17) and (18)). Without any loss of generality, let these bidders be indexed by \(f=1,\ldots ,n\) and \(s=1,\ldots ,m\). Thus, without a price floor condition, the auction clearing price reads:

Then, the initial permits allocation of an auction participant is given by \(D_f^*=\max \left\{ {0, D_f (\nu ^{*})} \right\} \) and \(D_s^*=\max \left\{ {0, D_s (\nu ^{*})} \right\} ,\) respectively. Equation (20) allows to establish the following proposition:

Proposition 2

In an ETS with auctioning, risk averse market participants, limited auction participation and strategic bidding, there exists a spread between the auction clearing price and the expected secondary market price of permits given by the second term on the right-hand side of (20).

The sign of the spread is ambiguous, but it only depends on the characteristics of the polluters who are successful in the auction, on the aggregate shock sensitivity of all polluters and on the number of permits issued by the regulator. However, the speculators can influence its sign indirectly, through their affect on the polluters’ demand-reduction factors, \(y_f \)’s. Nevertheless, as the denominator on the right-hand side of (20) shows, they can directly influence the size of this spread through their own demand-reduction factors \(y_s \).

Even with a positive price spread, the speculators’ potential for making profits depends on whether they are able to purchase permits in the auction, which in turn depends on the relative bidding power between polluters and speculators. For tractability, let us restrict attention to the case of competitive bidding and symmetric bidders. Proposition 3 gives the auction outcome for this special case.

Proposition 3

Assume that all bidders are symmetric, i.e. \(\alpha _f =\alpha ,\theta _f =\theta ,\gamma _f =\gamma ,\rho _f =\rho ^{F},\forall f \quad \) and \( \rho _s =\rho ^{S},\forall s\) and that they bid competitively.

-

(i)

If \(\gamma <\bar{{E}}/N_a \) , then the auction outcome is given by:

$$\begin{aligned} \nu ^{*}= & {} \bar{{\lambda }}^{*}+\frac{4\rho ^{F}\rho ^{S}\alpha ^{2}\theta ^{2}(N_a \gamma -\bar{{E}})}{M\rho ^{F}+N_a (1-2\theta \alpha ^{2}\rho ^{F})\rho ^{S}}<\bar{{\lambda }}^{*}; \\ D^{f}= & {} \frac{M\gamma \rho ^{F}+\rho ^{S}\bar{{E}}(1-2\theta \alpha ^{2}\rho ^{F})}{M\rho ^{F}+N_a (1-2\theta \alpha ^{2}\rho ^{F})\rho ^{S}}\hbox {, }\forall f\hbox { and }\\ D^{s}= & {} \frac{\rho ^{F}(\bar{{E}}-N_a \gamma )}{M\rho ^{F}+N_a (1-2\theta \alpha ^{2}\rho ^{F})\rho ^{S}}>0, \forall s. \\ \end{aligned}$$ -

(ii)

If \(\gamma \ge \bar{{E}}/N_a ,\) then the auction outcome is given by:

$$\begin{aligned} \nu ^{*}=\bar{{\lambda }}^{*}+\frac{4\rho ^{F}\alpha ^{2}\theta ^{2}(N_a \gamma -\bar{{E}})}{N_a (1-2\theta \alpha ^{2}\rho ^{F})}>\bar{{\lambda }}^{*};D^{f}=\frac{\bar{{E}}}{N_a }, \quad \forall f\hbox { and } \quad D^{S}=0, \quad \forall s. \end{aligned}$$

Proof

The proof is straightforward after substituting the competitive slopes \(y_f =\frac{1-2\theta \alpha ^{2}\rho ^{F}}{4\alpha ^{2}\theta ^{2}\rho ^{F}},\forall f\) and \(y_s =\frac{1}{4\alpha ^{2}\theta ^{2}\rho ^{S}},\forall s\) in (17) and (18), respectively. Moreover, polluters’ symmetry implies \(n=N_a\). Similarly, as all speculators have the same risk aversion we have \(m=M\) in (20) for \(\gamma <\bar{{E}}/N_a \). \(\square \)

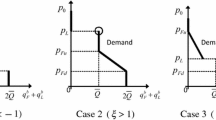

While the assumptions in Proposition 3 are unlikely to be met in practice, they offer the necessary tractability to establish a benchmark for the conditions under which the speculators can influence the auction outcome. As it turns out, this crucially depends on the tightness of the environmental constraint relative to polluters’ expected emissions needs. If the environmental constraint is sufficiently loose (condition (i) in Proposition 3), competitive bidding in the auction results in speculators earning a positive number of permits. Moreover, they expect positive profits from re-selling these permits, i.e. the expected secondary market price is above the auction clearing price. By contrast, a tight environmental constraint (condition (ii) in Proposition 3), increases polluter’s bidding aggressiveness which results in an auction clearing price above the expected secondary market price. Therefore, the speculators submit empty bids (see Eq. (18)).

An important conclusion from this proposition, albeit its restrictive assumptions, is that the speculators do not have the ability to drive the polluters out of the auction, while the opposite case may be true. Note that the conditions under which this happens are independent of the risk aversion coefficients of the two types of players or of the relation between the two. This independence is, however, driven by the assumption of competitive bidding employed in Proposition 3, which means that the two types of bidders do not interact. However, with strategic interaction in the auction, the demand-reduction factors \(y_f \) and \(y_s \) will not depend only on own risk aversion coefficient, but also on the risk aversion coefficients of the opponents (see Eq. (24)). In this case a combination of the relative tightness of the environmental constraint and the relative risk aversion between polluters and speculators will determine the success of the speculators in the auction. This is illustrated numerically in the next section.

4 Numerical comparative statics

The asymmetries of the players do not allow for an analytical solution of the demand-reduction factors (see the system of equations (24)). Therefore, in this section I use numerical examples in order to conduct comparative statics and assess the predictions of the model. The values of the parameters are appropriately chosen such that Assumptions 1–4 are fulfilled.

4.1 Individual valuations

Figure 1 shows the true valuation for the first permit of an individual polluter, as a function of her fundamentals, for different values of \(\bar{{E}}\), with the parameters set to \(\gamma _f =20, \alpha _f =2, \rho _f =0.05\hbox { and }\theta _f =2.\) In each panel of this figure I vary one of the above parameters, keeping the others constant. The upper-left panel of the figure shows that the higher the slope of the marginal abatement cost (parameter \(\theta _f )\), the more value the polluter attaches to the first permit at the auctioning stage. This is intuitive since in this model permits and emissions reductions are substitutes. Moreover, the valuation is convex, implying that the willingness to pay increases faster for higher marginal abatement costs. The upper-right panel shows that the firm is willing to pay more for the first permit if she is more sensitive to the common shock (parameter \(\alpha _f )\) because higher pro-cyclicality amplifies her permits needs in case of a positive shock.

Next, the lower-left panel of Fig. 1 illustrates the linear relationship between the valuation and the expected emissions needs (parameter \(\gamma _f )\). Finally, the lower-right panel shows that a polluter’s valuation for the first permit increases in the risk aversion (parameter \(\rho _f )\), at a higher rate for higher levels of risk aversion. Consistent with the intuition, the individual valuations are shifted downwards as the environmental constraint is relaxed. This shift is the largest when the polluters differ with respect to \(\alpha _f \).

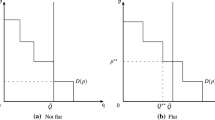

4.2 Demand reduction

The left panel of Fig. 2 shows the speculators’ effect on a polluter’s demand-reduction strategy. The solid line depicts the true demand function, i.e. the demand the polluters would submit if they acted competitively. Any demand schedule below this line incorporates strategic demand reduction. The polluters reduce their bids more as the number of the speculators decreases and they approach truthful bidding as more speculators enter the market. Next, consistent with the multi-unit auction theory, the polluters increasingly reduce their bids with the number of units bid—note the larger divergence of the demand schedules as the quantity demanded increases. The right panel in the figure shows how the speculators affect the expected price spread. Since the bids approach the true demands as the speculators enter the market, the auction clearing price increases and it approaches the expected secondary market price, which, in this model, is unaffected by the presence of the speculators. Hence, the larger the number of the speculators in the market, the less profitable the permit speculation activity.

4.3 Heterogeneity

Figures 3, 4 and 5 illustrate the equilibrium of the ETS game, allowing for polluters asymmetries. In terms of the notations of the model, we have \(N=50,N_a =10\) and \(M=5\). In all these figures I consider two environmental regimes, a tight one (\(\bar{{E}}=100)\) and a relaxed one (\(\bar{{E}}=200)\). In all figures, the upper-left panels show polluters’ and speculators’ valuations for the first permit, the upper-right panels depict the permits allocation in the auction, while the lower-right panels show the expected profits. Finally, the lower-left panels represent the expected trading positions in the secondary market, with positive values denoting net purchases and negative values indicating net sales. On the horizontal axes firms are ordered as follows. Indices from 1 to 10 represent the auction-participating polluters, indices from 11 to 50 are the polluters who do not participate in the auction and indices from 51 to 55 denote the speculators. The horizontal lines in the figures represent the auction clearing prices for the two environmental regimes considered. In all cases, speculators’ valuations for the first permit coincide to the expected secondary market price.

In Fig. 3 polluters differ only with respect to the marginal abatement costs, according to \(\theta _f =2-f/50\), such that a low index corresponds to a high abatement cost. Consistent with the views expressed in the literature (e.g. Betz et al. 2010) I assume that the high-abatement-cost polluters are the auction participants. Indeed, high-abatement-cost firms value the first permit more than the low-abatement cost firms,Footnote 24 and their valuations decrease with the loosening of the environmental constraint. This is also true for the speculators, since a looser environmental constraint is reflected into a lower expected liquidation value of the permit. A relaxed environmental constraint also decreases the auction clearing price, and most of the additional permits end up in the hands of the speculators. For this reason, most of the trade now takes place between the speculators and the polluters who do not participate in the auction. These polluter’s buying positions increase with the loosening of the environmental constraint, since the cheaper permits substitute abatement. This is an example of a situation in which the speculators act as a cushion for those polluters which may be cash constrained at the time of the auction. Finally, in expectations, both the polluters and the speculators gain from the increase in the permits’ supply.

Figure 4 illustrates heterogeneity with respect to polluters’ sensitivities to uncertainty, such that a lower index corresponds to higher sensitivity: \(\alpha _f =2-f/50.\) Footnote 25 While permits’ valuations increase in the sensitivity to uncertainty, they decrease with the relaxation of the environmental constraint. The equilibrium outcome of the game is largely similar to the one from Fig. 3. However, it appears that polluters’ expected profits are more sensitive to the change in the permits supply when they are heterogeneous with respect to the shock sensitivity instead of the abatement cost.

Finally, Fig. 5 depicts polluters’ heterogeneity with respect to the expected emissions needs, with low-indexed polluters being high emitters: \(\gamma _f =12-f/13\). Note from (24) that the demand-reduction factors are independent of the expected emissions needs. For this reason, the slopes of the allocation profiles from the upper-right picture of the figure preserve the slopes of the valuations profiles shown in the upper-left picture. Also, the expected trading positions of the auction-participating polluters are the same, since the speculative components in their bidding functions are equal to each other. Note that under a tight environmental regime the speculators are unable to purchase permits in the auction, as their valuations (expected secondary market price) are too low compared to those of the polluters. Consequently, the auction clearing price settles above the expected secondary market price.

4.4 Auction participation

Figure 6 shows the auction clearing price (left picture) and the expected profit of a polluter (right panel) as a function of \(N_a \), assuming that the polluters are symmetric in all of their characteristics. The solid lines correspond to the case in which speculators are banned from the auction (\(M=0)\), while the dashed lines correspond to the case in which \(M=10\) speculators bid in the auction. Consistent with the theory of multi-unit uniform price auctions (e.g. Keloharju et al. 2005), the auction clearing price increases when more polluters participate in the auction, albeit at a decreasing rate. This price increases further when the speculators enter the auction, for any number of auction-participating polluters. Consequently, the expected profits of an auction-participating polluter decrease in M. Moreover, these profits are U-shaped in the total number of polluters who bid in the auction. This is due to two facts resulting from an increase in \(N_a \): (i) due to the inelastic supply of permits, each polluter is allocated fewer permits in the auction and (ii) the auction clearing price increases. Specifically, for low values of \(N_a \) the auction clearing price increases faster than the decrease in the allocations such that the total permits expenditures increase and profits decrease. Conversely, for large values of \(N_a \) the auction clearing price increases at a lower rate than the decrease in the allocations, resulting in lower total permits expenditures and higher profits.

The profit of a non-participating polluter is represented by the horizontal dotted line in the right panel of Fig. 6. Hence, the number of the auction-participating polluters does not affect the expected profits of those polluters who do not participated in the auction. This is because their profits only depend on the expected secondary market price, which, in turn does not depend on the auction participation. Note that, one can derive polluter’s incentive to participate in the auction by comparing the horizontal dotted line with the dashed and the solid lines in the picture. For the case depicted in Fig. 6 with \(M=0\), the cut-off point is \(N_a =13\), i.e. it pays off to participate in the auction only if the number of participants is below 13 as the auction-participating polluters make higher profits than the polluters who only buy their permits in the secondary market. However, as speculators enter the auction, the cut-off point drops and fewer polluters benefit from entering the auction (the dotted line is above the dashed line at a lower \(N_a )\). This is primarily due to speculators driving up the auction clearing price, for any \(N_a .\)

In conclusion, when speculators are absent from the market there is a higher incentive for the polluters to participate in the auction. However, this reduces the regulator’s revenue as compared to a situation with speculators. Therefore, the regulator’s weighting between auction revenue and polluters’ compliance cost saving may turn out to be crucial for policy adoption.

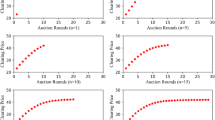

Figure 7 repeats the exercise from Fig. 6 for varying M, for two different levels of speculators’ risk aversion. As M increases, the polluters change their demand-reduction factors, which in turn lifts the auction clearing price. At the same time, some permits are allocated to the speculators, thus decreasing the polluters’ initial allocations. Hence, with a constant number of auction-participating polluters, the speculators have two effects. On the one hand they lower the permits inventories of the auction-participating polluters and, on the other hand they reduce the expected price spread between the secondary market and the auction. The combination of the two effects leads to foregone revenue from resale in the secondary market by the auction-participating polluters. However, as the number of the speculators increases, their marginal effect on polluters’ profits vanishes. Moreover, when the speculators’ risk aversion increases, their negative effect on polluter’s profits decreases. The reason is that with higher risk aversion, the speculators reduce their bids more, thus depressing the auction clearing price which directly benefits the polluters. This effect is further explored below.

4.5 Speculators’ risk preference

The most important rationale for the permission of the speculators to participate in the auction of emissions permits is their risk tolerance which can provide insurance for the risk averse polluters. Figure 8 illustrates the outcome of the game for the extreme case of one risk neutral speculator,Footnote 26 varying in turn the three dimensions of polluters’ heterogeneity. As expected from the theoretical model, due to their strategic demand reductions the auction-participating polluters win permits in the auction despite the risk neutrality of the speculator. The picture also confirms that the speculator is driven out of the market if the polluters’ expected emissions are sufficiently high (the speculator earns zero permits when the polluters differ in \(\gamma _f )\).

Finally, Fig. 9 considers the effect of the speculators’ risk aversion on the auction-participating polluters. The upper-left panel of the figure shows that the auction price is decreasing and convex in speculators’ risk aversion. The intuition is the following. As equation (16) shows, risk aversion reduces speculators valuations for any additional permit. Therefore, risk aversion decreases speculators’ bidding aggressiveness which, in turn, depressed the auction price. Next, the upper-right panel of the figure shows that the permits’ allocations in the auction are non-monotonic in speculators’ risk aversion. To understand this, let us consider the case of the speculators. Everything else constant, for low levels of risk aversion the auction price decreases faster than the risk aversion increases. Therefore, the speculators are awarded more permits due to the lower auction clearing price. For higher levels of risk aversion, the opposite is true, such that the decrease in the auction price cannot outweigh the timid bidding behavior triggered by the higher risk aversion. As the speculators earn more permits, the polluters earn less and vice-versa, which is reflected in the polluters’ expected trading position (the lower-left panel). Nevertheless, polluters’ profits increase (lower-right panel) because the secondary market revenue loss is outweighed by the lower price they pay for purchasing the permits in the auction, as the speculators become more risk averse.

5 Conclusions

This paper developed a static complete information model of an ETS in which the regulator allocates the permits in a uniform-price auction followed by a secondary market trade. The twist is that the emissions needs of the polluters are uncertain before the auction is conducted and are only realized before the secondary market trade takes place. The flexibility of the model allows to capture asymmetries among firms with respect to their attitudes to risk, their levels of demand, and their sensitivities to a common demand shock. The main result is that the presence of the speculators has an adverse effect on polluters’ profits. The reason for this is that speculators participation in the auction increases its clearing price, which, however, benefits the revenue accrued to the regulator. Moreover, since polluters are not committed to abatement investment before the resolution of the uncertainty, the speculators have no influence over the expected secondary market price, which only depends on the fundamentals of the polluters. Consequently, polluters’ abatement decisions are unaffected by the presence of the speculators.

The paper also shows the role of the secondary market on players’ bidding strategies. In particular, the derived endogenous marginal valuations for permits reveals that a polluter’s valuation for the first permit consists of a speculative component, which depends on the secondary market price, and a use component, which depends on her expected permits needs. Therefore, a polluter may attach a higher value to the first permit than its expected secondary market value. By contrast, a speculator does not value the first permit more than its expected secondary market price. Moreover, their success in the auction and, thus, the speculative profits depend on the relationship between this price and the auction clearing price which is, however, ambiguous. The difference between the two prices depends directly on polluters’ characteristics and indirectly on the bidding strategies of the speculators.

The downside of model’s flexibility is that the auction equilibrium cannot be derived analytically. Therefore, comparative statics of the equilibrium variables were conducted numerically. The analysis showed that, consistent with the theory of multi-unit auctions, the presence of the speculators increases the auction clearing price and it provides incentive for the polluters to bid closer to their valuations. Next, the speculators have a negative effect on the profits of the auction-participating polluters, though these profits increase in speculators’ risk aversion. The latter is due to the fact that the higher their risk aversion, the more the speculators reduce their bids, depressing the auction clearing price.

In conclusion, under the assumptions of these model in which the secondary market for permits is competitive and speculators do not affect the abatement decisions, their presence in the auction creates a trade-off between the regulator’s revenue and the profits of the auction-participating polluters. This result suggests the need for alternative ways of increasing competition in the auction and, consequently, the auction revenue accrued to the regulator. This could be achieved, for example, by lessening the polluters’ access to the auction platform, i.e. implementing policies that can increase\(N_a \).The increased auction participation by the polluters may increase the auction revenue without increasing the total compliance cost for the regulated entities. Additionally, one can reduce the rationale for speculators participation in the auction by organizing frequent auctions which would encourage the participation of the cash-constrained polluters, unable to bear the risk of holding permits for long periods of time. This measure has been recognized by the EU ETS in which the spot auctions take place as often as several times per week, but this is not the case for the California ETS or the RGGI, in which the auctions take place only every quarter

Notes

For details see Article 18 in the Commission’s Regulation (EU) No 1031/2010 of 12 November 2010.

The EC has designated the EEX platform in Leipzig, Germany as the transitional common auction platform.

The auction limit was set to 5 and 10 % in the two phases, respectively.

The RGGI States are: Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New York, Rhode Island and Vermont. At the start of the scheme, New Jersey was also part of the program, but the state withdrew effective January 1, 2012.

The experience from both the EU ETS and the California ETS shows that not all regulated firms participate in the initial auction. Details on this are provided in Sect. 2.

This is the auction format used by the EU, California, RGGI and Quebec.

In reality the emissions cap is established based on meteorological targets. For example, the EU ETS cap for 2013 was just slightly below 2.04 billion permits and it decreases until 2020, such that ”[...] the overall global annual mean surface temperature increase should not exceed 2 degrees Celsius above preindustrial levels” (Directive 2009/29/EC of the European Parliament).

These are the emissions the firm would release if there were no environmental regulations.

Setting the variance of the shock to one does not reduce the generality of the problem. Variances other than one can be thought of as being absorbed in \(\alpha _f ,\forall f\).

It could be argued that some of the largest polluters, i.e. the electricity producers, are acting in monopoly rather than in competitive markets. However, as these are typically natural monopolies, their prices are regulated and, therefore, they can be considered price takers. The price-taking assumption means that I can focus on the permits market.

Modeling grandfathered permits explicitly would only affect the secondary market price by a constant.

In cases in which some grandfathering exists, \(\bar{{E}}\) denotes the supply of permits net of grandfathered permits.

In practice, the emissions cap is decided based on geological and meteorological forecasts related to the global temperature. A polluter’s participation in the auction may depend on participation costs, cash constraints or the acceptance as a member of the auction platform or other participation costs.

It is worth noting that the theoretical literature does not give any clear revenue ranking or equivalence result for the multi-unit, multi-demand auctions (Klemperer 1999; Ausubel et al. 2014). In fact, Maskin and Riley (1989) conclude that for the multi-demand case, the standard auctions are not optimal and, instead, a nonlinear pricing scheme is the optimal selling procedure. This indicates that, indeed, the uniform-price auction format is not optimal in the revenue-maximization sense. There are, nevertheless, other considerations that make it popular for distributing emissions permits: it has a price mechanism that is easy to understand and perceived as fair, since everyone pays the same price, it encourages more participation than the discriminatory auction (Ausubel et al. 2014), it provides a good price discovery and protection against disruptions of the output market (for details see Holt et al. 2007).

Based on EEX Exchange market data: www.eex.com.

In fact, even if the secondary market was thin, thus creating a bilateral oligopoly market, Malueg and Yates (2009), Haita (2014) show that, as long as firms do not differ in the slopes of their marginal abatement costs, the strategies of the buyers and sellers cancel out, leaving the price unchanged relative to the competitive one. This is, however, only a special case in the current model, which leaves the thickness of the market as the main argument for price-taking behavior in the secondary market.

Penalties for non-compliance are excluded from the model. Most ETSs have prohibitively high penalties such that non-compliance is deterred.

For brevity, constant terms have been discarded.

Note that although bidders have heterogeneous valuations, in a uniform price auction each bidder pays the same price.

Although linear strategies may appear restrictive, they can be interpreted as linear approximations of demand around the equilibrium price. Moreover, it can be shown that if the \(n-1\) firms other than i plays a linear strategy, then the best response of firm i is also linear.

One could also generalize to an equilibrium in discontinuous piecewise linear functions in which each firm would take into account the active firms in the market for each price range, according to the marginal valuations for the first permit. This approach is illustrated in Baldick et al. (2004) for the case of two firms bidding for electricity supply (see also Rudkevich 2005). However, such a procedure would complicate the analysis and shift the focus of the paper. Therefore, it is worth thinking of (17) and (18) as smooth approximations of piecewise linear functions.

The case of all bidders being risk neutral and submitting competitive bids would amount to all bidders submitting bid functions equal to the expected secondary market price. For the case of strategic bidding with risk neutrality and no speculators, see Haita (2014).

Decreasing marginal valuation functions are crucial for obtaining meaningful SFE in linear strategies.

For convenience, I represent the valuations of the auction non-participating polluters (indexed from 11 to 50) as being equal to zero.

For illustrative convenience I assume that the most sensitive polluters participate in the auction.

Recall that with more than two risk neutral speculators the auction cancels.

References

Aatola, P., Ollikainen, M., & Toppinen, A. (2013). Price determination in the EU ETS market: Theory and econometric analysis with market fundamentals. Energy Economics, 36(1), 380–395.

Ausubel, L. M., Cramton, P., Pycia, M., Rostek, M., & Weretka, M. (2014). Demand Reduction and Ineffciency in multi-unit auctions. Review of Economic Studies, 81(4), 1366–1400.

Baldick, R., Grant, R., & Kahn, E. (2004). Theory and application of linear supply function equilibrium in electricity markets. Journal of Regulatory Economics, 25(2), 143–167.

Baldursson, F. M., & von der Fehr, N.-H. M. (2004). Price volatility and risk exposure: On market-based environmental policy instruments. Journal of Environmental Economics and Management, 48(1), 682–704.

Benz, E., Loschel, A., & Sturm, B. (2010). Auctioning of CO\(_{2}\) emission allowances in phase 3 of the EU emissions trading scheme. Climate Policy, 10, 705–718.

Betz, R., Seifert, S., Cramton, P., & Kerr, S. (2010). Auctioning greenhouse gas emissions permits in Australia. Australian Journal of Agricultural and Resource Economics, 54(2), 219–238.

Bikhchandani, S., & Huang, C. (1989). Auctions with resale markets: An exploratory model of Treasury bill markets. The Review of Financial Studies, 2(3), 311–339.

Burtraw, D., Goeree, J., Holt, C. A., Myers, E., Palmer, K., & Shobe, W. (2009). Collusion in auctions for emissions permits: An experimental analysis. Journal of Policy Analysis and Management, 28(4), 672–691.

Chevallier, J., Ielpo, F., & Mercier, L. (2009). Risk aversion and institutional information disclosure on the European carbon market: A case-study of the 2006 compliance event. Energy Policy, 37(1), 15–28.

Colla, P., Germain, M., & van Steenberghe, V. (2012). Environmental policy and speculation on markets for emission permits. Economica, 79, 152–182.

Demailly, D., & Quirion, P. (2006). CO2 abatement, competitiveness and leakage in the European cement industry under the EU ETS: Grandfathering vs. output-based allocation. Climate Policy, 6(1), 93–113.

Garratt, R., & Troger, T. (2006). Speculation in standard auctions with resale. Econometrica, 74(3), 753–769.

Goeree, J. K., Palmer, K., Holt, C. A., Shobe, W., & Burtraw, D. (2010). An experimental study of auctions versus grandfathering to assign pollution permits. Journal of the European Economic Association, 8(2–3), 514–525.

Green, R. (1996). Increasing competition in the British electricity spot market. The Journal of Industrial Economics, 44(2), 205–216.

Green, R. (1999). The electricity contract market in England and Wales. The Journal of Industrial Economics, 47(1), 107–124.

Haile, P. A. (2000). Partial pooling at the reserve price in auctions with resale opportunities. Games and Economic Behavior, 33, 231–248.

Haile, P. A. (2003). Auctions with private uncertainty and resale opportunities. Journal of Economic Theory, 108, 72–110.

Haita, C. (2014). Endogenous market power in an emissions trading scheme with auctioning. Resource and Energy Economics, 34, 253–278.

Hepburn, C., Grubb, M., Neuhoff, K., Matthes, F., & Tse, M. (2006). Auctioning of EU ETS phase II allowances: How and why? Climate Policy, 6(1), 137–160.

Holt, C., Shobe, W., Burtraw, D., Palmer, K., Goeree, J. (2007). ‘Auction design for selling CO2 emission allowances under the regional greenhouse gas initiative’, Final Report, http://www.rff.org/research/publications/.

Keloharju, M., Nyborg, K. G., & Rydqvist, K. (2005). Strategic behavior and underpricing in uniform price auctions: Evidence from Finnish treasury auctions. The Journal of Finance, 60(4), 1865–1902.

Klemperer, P. (1999). Auction theory: A guide to the literature. Journal of Economic Surveys, 13(3), 227–286.

Klemperer, P. D., & Meyer, M. A. (1989). Supply function equilibria in oligopoly under uncertainty. Econometrica, 57(6), 1243–1277.

Kyle, A. (1989). Informed speculation with imperfect competition. The Review of Economic Studies, 56(3), 317–355.

Leland, E. H. (1972). Theory of the firm facing uncertain demand. The American Economic Review, 62(3), 278–291.

Maeda, A. (2003). The emergence of market power in emission rights markets: The role of initial permit distribution. Journal of Regulatory Economics, 24(3), 293–314.

Malueg, D. A., & Yates, A. J. (2009). Bilateral oligopoly, private information, and pollution permit markets. Environmental and Resource Economics, 43(4), 553–572.

Marin, J. M., & Rahi, R. (1999). Speculative securities. Economic Theory, 14(3), 653–668.

Maskin, E., & Riley, J. (1989). Optimal multi-unit auctions. In F. Hahn (Ed.), The economics of missing markets: Information and games (pp. 312–335). Oxford: oxford University Press.

Milgrom, P. (2004). Putting auction theory to work. Cambridge, UK: Cambridge University Press.

Montero, J.-P. (2009). Market power in pollution permit markets. The Energy Journal, 30, Special Issue #2.

Neuhoff, K. (2007). Auctions for CO2 allowances: A straw man proposal. Electricity Policy Research Group: Climate Strategies. University of Cambridge.

Pagnozzi, M. (2007). Bidding to lose? Auctions with resale. RAND Journal of Economics, 38(4), 1090–1112.

RGGI Inc. (2014). CO2 Auctions, Tracking and Offsets. http://www.rggi.org/market/co2auctions/results.

Rudkevich, A. (2005). On the supply function equilibrium and its applications in the electricity markets. Decision Support Systems, 40, 409–425.

Sandmo, A. (1971). On the theory of competitive firm underprice uncertainty. The American Economic Review, 61(1), 65–73.

Sopher, P., Mansell, A. & Munnings, C. (2014). Regional greenhouse gas initiative. The worlds carbon markets: A case study guide to emissions trading. Environmental Defense Fund and International Emissions Trading Association.

Subramanian, R., Gupta, S., & Talbot, B. (2007). Compliance strategies under permits for emissions. Production and Operations Management, 16(6), 763–779.

Vargas, J. S. (2003). Bidder behavior in uniform price auction: Evidence from Argentina. Universidad Nacional de La Plata, mimeo.

Wilson, R. (1979). Auctions of shares. The Quarterly Journal of Economics, 93(4), 675–689.

Wirl, F. (2009). Oligopoly meets oligopsony: The case of permits. Journal of Environmental Economics and Management, 58, 329–337.

Acknowledgments

I would like to thank the Editor, Michael A. Crew, and two anonymous referees for their helpful comments, suggestions and time dedicated to this paper. I am indebted to Andrzej Baniak and Adam Szeidl for valuable suggestions in early stages of developing the model. I am grateful to Andrea Canidio, Peter Kondor, Nenad Kos and Andreas Lange for fruitful discussions. All errors are mine. This research was partially supported by the European Research Council Starting Grant for Project 636746 (HUCO).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Derivation of the bidding schedules

Each bidder \(j\in \{f,s\}\) chooses her bidding strategy maximizing the utility in (12) if she is a polluter or in (14) if she is a speculator, acting as a monopsonist on the residual supply of permits \(\bar{{E}}-D_{-j} (\nu )\), where \(D_{-j} (\nu )=\sum \nolimits _i {D_i } (\nu ),i=1,\ldots ,j-1,j+1,\ldots ,N_a +M\). The equilibrium concept is the supply function equilibria (Klemperer and Meyer 1989). A strategy for bidder j is a non-increasing schedule \(D_j (\nu )\) which specifies the quantity demanded for every price \(\nu \).

Thus, each bidder solves the following problem:

The first order conditions read:

Focusing on linear strategies, let the demand schedules have the form:

Substituting (23) in (22), grouping around \(\nu \) and identifying the coeffcients yields:

and

Appendix 2: The case of risk-neutral speculators

Instead of maximizing the CARA utility function of profits, a risk-neutral speculator maximizes the expected profit: \(\max _\nu E[\Pi _s ]=E[(\lambda ^{*}-\nu )D_s (\nu )]=(\bar{{\lambda }}^{*}-\nu )D_s (\nu )\) on the residual supply \(D_s (\nu )=\bar{{E}}-D_{-s} (\nu ),\) where \(-s\) represents bidders \(1,\ldots ,N_a \) (i.e. the polluters) plus the \(M-1\) speculators except for s. The FOC reads:

Assuming linear strategies of the form \(D_s (\nu )=x_s -y_s \nu \) and identifying the coefficients in (B.1) it obtains: \(D_s (\nu )=y_s (\bar{{\lambda }}^{*}-\nu ),\) where \(y_s =\sum \nolimits _{j=1,j\ne s}^{N_a +M} {y_j } ,\) which is exactly the counterpart of the second type of equations in (24), for \(\rho _s =0\). The slopes of the polluters will continue to be given by the first type of equations in (24). Note, however, that in this case the system of equations (24) does not have a positive solution for\(M\ge 2\). In fact, the only non-negative solution is \(y_f =y_s =0\) and this amounts to all firms submitting empty bids. The only non-degenerated equilibrium in linear strategies is obtained for \(M=1\). In this case we have \(y_s =\sum \nolimits _{f=1}^{N_a } {y_f } ,\) with \(y_f \) defined by \(y_f =(1-\Omega ^{2}\kappa _f y_f )(y_f +2y_{-f} ),\) where \(y_{-f} =\sum \nolimits _{i=1,i\ne f}^{Na} {y_i } \).

Rights and permissions

About this article

Cite this article

Haita-Falah, C. Uncertainty and speculators in an auction for emissions permits. J Regul Econ 49, 315–343 (2016). https://doi.org/10.1007/s11149-016-9299-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-016-9299-1