Abstract

Efficient inventory management is an important component of enterprises’ green growth model. By reducing the inventory levels and inventory costs and lessening resource waste, enterprises can efficiently achieve green growth. To realize green transformation, enterprises need to form a closed-loop system from product design to resource recovery and utilization and then implement the coordination of “green” and “growth”. Therefore, inventory management and control in a closed-loop system plays an important role in the green growth model and value chain reconstruction. Demand information mutation or the bullwhip effect of the supply chain is one of the important reasons for a high inventory level. It refers to the transmission of the market demand information from the downstream retailer to the upstream supplier throughout the value chain in the course of the fluctuation and variation. The bullwhip effect will cause higher inventory levels and inventory costs for the supplier. And the demand information distortion increases the risk of production and inventory management for upstream suppliers in the value chain and even can lead to the disruption of production and supply. To efficiently achieve the green growth of enterprises through efficient inventory management, this chapter focuses on the impact of the product return, remanufacturing, and different value chain structures on the bullwhip effect and inventory costs based on statistical theory and methods. We analyze the coordinated control measures of the bullwhip effect under different scenarios to lower the inventory levels and inventory costs of the enterprises. The analysis will help enterprises better achieve the green growth model and the green transformation of the value chain.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

11.1 Inventory Management and Enterprises’ Green Growth Model

11.1.1 Concept of Inventory Management

Inventory management, also known as inventory control, is to manage and control the finished products and other resources in the whole process of production and operation in the manufacturing or service industry. The aim of inventory management is to keep the reserves at an economically reasonable level. Inventory management includes two parts: warehouse management and inventory control. The content of warehouse management refers to the scientific storage of stock materials to reduce losses and facilitate access. Inventory control is required to control a reasonable inventory level. A reasonable inventory level should meet the demand use and reduce the stock loss through the minimum input of materials and the lowest overhead. The content of the inventory management includes materials in and out of storage, the movement management of materials, inventory checking and the information analysis of inventory materials.

The objective of inventory management is to control the operation costs of the inventory system by adjusting the timing and quantity of replenishment. The target is to determine the optimal replenishment time and the optimal replenishment batch to minimize the operation costs of the inventory system. Effective inventory management can improve service levels, reduce the occupancy of inventory space, and decrease overall inventory costs. It will rationalize the allocation of stock capital and resources and accelerate the capital turnover of enterprises. A reasonable inventory mode or inventory management mode can help enterprises achieve more effective inventory control. How to balance the inventory level and the demand quantity is the key problem to be studied and solved by inventory management. Enterprises should minimize the inventory costs and the inventory levels on the premise of achieving the service levels expected by customers by selecting the reasonable inventory mode. The inventory mode includes various inventory management strategies, storage strategies and stock classification methods [1, 2], as shown in Table 11.1.

11.1.2 Inventory Management for Green Growth

The goal of inventory management under enterprises’ green growth model is to reduce inventory levels and inventory costs and realize resource savings. The realization methods include the zero inventory strategy and the cross-dock operation. The zero inventory strategy refers to purchasing through a just-in-time system, which means enterprises will purchase goods in accordance with the required quantity and quality to achieve zero inventory. The strategy can reduce inventory holding capital, decrease inventory management costs and timely avoid market risks. The cross-dock operation means that the finished vehicle goods provided by each supplier are not put into the warehouse after receipt but are immediately disassembled, sorted, stacked, loaded, and delivered to the customer delivery point according to the customer demand and the delivery location. All goods in cross-docking are kept out of the storage space of the warehouse. Overstock operations are especially suitable for the rapid processing of urgent orders and retailers directly delivering to customers. In the cross-dock operation, goods flow through a warehouse or distribution center rather than being stored. Through the strategy of cross-dock operations, the inventory levels can be greatly reduced to decrease the inventory management costs and the loss rate and speed up capital turnover. Efficient inventory management can lower the inventory levels and inventory costs and reduce the waste of resources to better realize the green growth of enterprises. Promoting a zero inventory strategy or low inventory strategies of nodal enterprises in the value chain including manufacturers, distributors and distribution centers, is an important component of implementing a green growth model. It plays an important role in realizing green growth.

The green growth of enterprises needs to effectively deal with the new requirements of inventory management in the value chain, the environmental issues with stock and the energy reuse problem in inventory control. The green value chain is a low entropy manufacturing mode to achieve the lowest harm of the raw materials, industrial production, product use, scrapping and secondary raw material on the environment. It is devoted to realize the highest resource efficiency in the whole life cycle from designing, manufacturing, and using to product scrapping and recycling. The green value chain considers the environmental attributes of products from the point of view of system integration in the whole life cycle of products and can change the original environmental protection method of end processing. It aims at environmental protection from the source and considers the basic attributes of the product. The product meeting the requirements of environmental objectives at the same time can ensure that the product should have basic performance, service life and quality. Achieving green growth requires enterprises to further reduce resource waste and lower inventory levels and costs. It indicates that a reasonable inventory management mode has important environmental and economic significance.

Inventory management for enterprises’ green growth model forms a closed-loop system to reduce pollution emissions and waste residues. The closed-loop system includes recycling and remanufacturing activities besides the processes of traditional procurement, production, and marketing. The green value chain requires enterprises to realize closed-loop management to achieve the efficient reuse of resources. It can be implemented through the complete supply chain cycle, from procurement, production, sales, and recycling to remanufacturing. Simultaneously, it is of great significance for the sustainable development of enterprises to provide services for customers at a lower cost and form effective closed-loop management. Inventory management is an important component of activities in reverse logistics and plays an important role in the transformation of the green value chain. Producers in green value chains must meet consumer demand for products and accept the recycling of used products. Manufacturers can order raw materials from outside to make finished products and reproduce products by repairing recycled products. The inventory management of the green value chain needs to coordinate the relationship between ordering and remanufacturing to achieve the established service level at the lowest cost. Inventory control can reduce resource waste and improve operational efficiency, which plays an important role in optimizing the green value chain.

11.2 Inventory Management and Bullwhip Effect

11.2.1 Bullwhip Effect

The bullwhip effect refers to the phenomenon of amplified demand information disturbance throughout the supply chain when each nodal enterprise makes the order decision only according to the demand data of adjacent subordinate enterprises. The bullwhip effect will result in damage to the interests of companies, inventory backlog, occupancy of capital and disrupted operation schedules [9,10,11,12,13]. Forrester [14] first proposed the amplification effect of demand information and proved its existence through system dynamics simulation modeling. The analysis put forward that the main reason for the bullwhip effect is irrational decisions among organizational subjects in supply chains, which leads to a distorted transmission of demand information among upstream node enterprises. Burbidge [15] observed that the bullwhip effect is generated from the isolated decision-making, management and implementation of enterprises and analyzed the causes of demand information variation and the restraining measures. Sterman [16] proved that the bullwhip effect is caused by the irrational behaviors of participants in the supply chain and the incorrect judgment of feedback information. Information volatility in the value chain can be controlled by cultivating managers’ systematic thinking. An important milestone in the field of the bullwhip effect is in Lee et al. [11,12,13], who made a systematic quantitative analysis of demand information distortion for the first time. The analysis indicated that the main causes of the bullwhip effect are batching order, price fluctuation, shortage gaming and demand signal processing.

The restraining and coordinating measures of the bullwhip effect mainly include information sharing, stable price control, limited supply, shortening lead time, accurate forecasting technology, adjusting ordering strategy and so on. Information sharing: The bullwhip effect is essentially the distortion and disturbance of market information and demand data throughout the supply chain. The bullwhip effect can be effectively restrained by encouraging nodal enterprises in the supply chain to strengthen cooperation and share demand and inventory information. In addition, the management model integrating modern information technology is widely applied in the supply chain, which has a significant effect on reducing the inventory backlog and smoothing the information fluctuation in the supply chain. Stable price control: Consumers’ prediction of future prices and their purchase behavior in advance will result in a bullwhip effect. The corresponding solution is to appropriately reduce the frequency and amplitude of product discounts and maintain price stability. Limited supply: Shortage gaming between downstream retailers and upstream suppliers is another important cause of the bullwhip effect. The game behavior in ordering can be restrained by suppliers adopting a reasonable allocation mechanism to limit the supply quantity. Shortening lead time: Chen et al. [17] proved that the lead time between organizational entities in the supply chain would amplify the bullwhip effect. Promoting the negotiation between downstream retailers and upstream suppliers and formulating an appropriate lead time can coordinate information variation in the supply chain. Accurate forecasting techniques and adjusting ordering strategies: Encouraging enterprises in the supply chain to select the optimal forecasting method and inventory strategy can reduce the forecasting error and the expected cost. The minimum mean square error prediction technique and the order-up-to inventory policy are widely adopted to effectively mitigate the information distortion in the supply chain [18]. However, the above measures can suppress the bullwhip effect only to a certain extent and cannot completely eliminate the fluctuation of order information in the supply chain. In particular, with the development of modern information technology and the emergence of new business models, the market environment, supply chain structure, and interaction of logistics and information flow in a supply chain will become more complex. How to coordinate the bullwhip effect in complex supply chain contexts has significant research value.

11.2.2 Bullwhip Effect and Inventory Management

By restraining the bullwhip effect, enterprises can reduce inventory levels and inventory costs to achieve more effective inventory management and control. The bullwhip effect of the supply chain will directly lead to inventory overstocking and misleading production plans for upstream enterprises, increase inventory costs and reduce the efficiency of the supply chain. Therefore, coordinated control measures should be adopted to restrain the bullwhip effect in the supply chain. When suppliers at all levels of the supply chain make supply decisions based only on the demand information from their neighboring subvendors, the distortion of demand information transfers upstream throughout the supply chain. When the distorted ordering information reaches the source supplier, such as the general seller or the manufacturer, there will be a huge deviation between the obtained demand information and the customer demand information. The coefficient of variation of demand is much larger than that of distributors and retailers. As a result of the demand amplification effect, upstream suppliers tend to maintain higher inventory levels than downstream retailers to cope with the uncertainty of orders. Thus, it artificially increases the risks of upstream suppliers in the supply chain and even leads to the distortion of production, supply and marketing.

Reasonable inventory management strategies also can reduce the bullwhip effect in supply chains. Different inventory strategies will have significant impacts on demand information mutation. The bullwhip effect of manufacturers and retailers can be minimized by adopting optimal inventory strategies. In the research field of the bullwhip effect, the widely used inventory strategies include the order-up-to inventory policy, (s, Q) policy and (s, S) policy. Therefore, the order-up-to inventory policy is widely used in supply chain analysis, has been proven to be a locally optimal inventory strategy, and can minimize the total discounted holding and shortage costs [11]. Order-up-to inventory policy: The retailer sets the corresponding order-up-to level according to the expected lead-time demand of consumers and places orders to upstream suppliers according to the order-up-to level and the actual inventory level in each period. In addition, each node enterprise in the supply chain independently manages inventory and sets inventory control targets and corresponding strategies. A lack of information communication and exclusive inventory information between each other will inevitably produce demand information distortion and time delays. Thus, suppliers cannot meet market demand quickly and accurately. The vendor managed inventory (VMI) policy can effectively mitigate the bullwhip effects of enterprises. Suppliers should make accurate predictions of demand according to real-time sales data, determine order quantity more accurately and reduce the uncertainty of prediction, thus decreasing the safety inventory and supply costs. At the same time, the VMI policy allows suppliers to respond to the user demand more quickly, improve the service level, and effectively lower the inventory level. The VMI policy promotes the sharing of information about enterprises in the supply chain so that the bullwhip effect can be inhibited significantly.

In summary, the coordinated control of the bullwhip effect can reduce the inventory levels and inventory costs in the supply chain, thus achieving more effective inventory management. However, adopting a reasonable inventory management strategy can mitigate the bullwhip effect. Therefore, it plays an important role in realizing the green growth of enterprises to reduce inventory costs and resource waste by restraining the bullwhip effect.

11.3 Bullwhip Effect in Green Value Chain

The green value chain realizes the circular and efficient utilization of resources by establishing a closed-loop system from procurement to resource recovery. In addition to the activities of the traditional supply chain, the recycling, remanufacturing and distribution of recycled products also should be considered [19]. The processes of product recovery and remanufacturing in reverse logistics supplement the traditional supply chain [20]. The inventory control and management of the value chain is an important component of all reverse activities. The coordinated control of the bullwhip effect in the value chain can decrease inventory costs and inventory levels, reduce enterprise resource waste, and improve operation efficiency. It plays an important role in optimizing the green value chain.

For environmental protection and resource conservation, most of the research on the bullwhip effect in the value chain mainly focuses on the recovery and reuse of products. Product return in the value chain will directly affect the retailer’s inventory levels and ordering decisions, thus affecting the retailer’s ordering information transfer to upstream suppliers and the bullwhip effect. The bullwhip effect in traditional offline retail has been extensively studied. Scholars have proven that product return in the value chain can restrain the bullwhip effect and improve the operation efficiency through statistics, simulation, and empirical research methods [21, 22]. The process of reverse logistics in the green value chain mainly includes product recovery, product return and exchange, reuse, and remanufacturing. Therefore, the bullwhip effect in the green value chain is mainly focused on product recycling and remanufacturing. Based on statistical theories and methods, this chapter focuses on the impact of new factors, such as product return, remanufacturing and different value chain structures, on bullwhip effects and their coordination strategies. We establish the demand function and the ordering model based on the characteristics of the green value chain. Then, we study the bullwhip effect and the expected cost of retailers under different value chain scenarios, and analyze the impact of product return on value chain performance [23,24,25,26,27,28,29,30].

We measure the impacts of different retail policies on the bullwhip effect and inventory costs. The research design is as follows:

-

(1)

Build a closed-loop supply chain system network by comparing the differences with the traditional supply chain. The supply chain system is usually composed of three or more parties, such as manufacturers, remanufacturers, retailers, logistics service providers and consumers. Identify the interaction relationships and the transmission processes of logistics and information flow among the organization subjects in the supply chain system.

-

(2)

Determine the market demand process, which will directly affect the retailer’s ordering decision and the bullwhip effect of the closed-loop supply chain. Constructing the demand function depends on the supply chain complexity, market environment and research objectives. The demand function in bullwhip modeling is more complicated due to the drastic fluctuation of demand information in the retail market and the complexity of the supply chain. Select the optimal demand forecasting technology and inventory strategy to make the retailer’s order decision based on the market demand information. Different forecasting techniques will lead to different forecasting accuracies. Meanwhile, different inventory strategies also will have significant impacts on ordering decisions. Therefore, adopting the optimal forecasting method and inventory strategy plays an important role in suppressing information distortion. When modeling the bullwhip effect, the minimum mean square error prediction technique and order-up-to inventory strategy are widely identified as the optimal demand forecasting technique and inventory strategy, respectively. Quantify the bullwhip effect and the expected cost of the retailer according to the ordering decisions in different supply chain contexts. The quantitative expression of the bullwhip effect is derived as the ratio or the difference between the order variance and the demand variance. To simplify its quantitative expression, scholars usually directly adopt the order variance as a substitute. In addition, the bullwhip effect usually leads to inventory overstocking of upstream suppliers, thus increasing the inventory costs. Therefore, analyzing the bullwhip effect and inventory costs are mutually reinforcing in measuring information fluctuation in the supply chain.

-

(3)

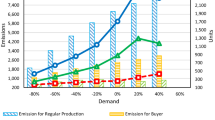

Make simulations and sensitivity analyses according to the bullwhip effect and expected costs of the supply chain. Measure the impacts of parameters in the supply chain on the information fluctuation, such as the replenishment lead time, delivery lead time, return lead time and return rate, etc. Draw the research conclusions and the management enlightenment based on the analytical results.

The parameters of the models in this chapter are shown in Table 11.2:

Considering a closed-loop supply chain with a manufacturer, a remanufacturer, a logistics center and a retailer, the external demand of a single product is expressed in Eq. 11.1:

where \(\mu\) is the constant term of the market demand and \(\varepsilon_t \ N\left( {0,\sigma^2 } \right)\) is the demand shock, an independently and normally distributed random variable. In addition, the inappreciable probability of negative demand is due to a large constant term of demand.

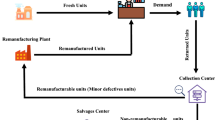

Consider a green value chain system for recycling and remanufacturing, as shown in Fig. 11.1. The total lead time in the reverse logistics in Fig. 11.1 is defined as the indirect return period. Thereinto, \(L_r\) is the lead time of the remanufacturer and \(l\) is the return lead time of the consumers, which refers to the delivery lead time from the consumers to the remanufacturer. Since there is only one return channel, both intact and defective products will be delivered to the remanufacturer by the logistics center. Then, after \(l\) periods, the remanufacturer receives the total returned products from the consumers. The remanufacturer receives the returned products from the logistics center as \(r_{t,1}\):

where \(0 \le \theta_1 \le 1\) is the defective rate, and \(\zeta_{t,1} \ N\left( {0,\sigma_{\xi_1 }^2 } \right)\) is the random disturbance, an independently and normally distributed random variable. Assume that shock term \(\zeta_{t,1}\) has no relation with market demand \(d_t\). Then, the covariance is zero as \(Cov\left( {d_t ,\zeta_{t^{\prime},1} } \right) = 0,\left( {\forall t,t^{\prime}} \right)\).

This research adopts the assumption that the time delay of the remanufacturing process is neglected to simplify the supply chain model. When a remanufacturer receives defective returns \(r_{t,1}\) at period \(t\) to undergo the remanufacturing process, the actual output in the remanufacturing process will be \(M_t\):

where \(\xi\) is the average yield rate of the remanufacturer and \(\varsigma_t \ N\left( {0,\sigma_\varsigma^2 } \right)\) is the random term irrelevant with the demand shock. Therefore, we obtain the covariance \(Cov\left( {\varsigma_t ,r_{t^{\prime},1} } \right) = 0,\left( {\forall t,\forall t^{\prime}} \right)\). The total quantity delivered by the remanufacturer to the retailer \(M_t\), the remanufacturing lead time \(L_r\) and the manufacturing lead time \(L\) are well known by the retailer. The remanufacturer informs the retailer as soon as the remanufacturing process is finished. Thus, there is no asymmetric information between the remanufacturer and the retailer. The reproduced items are then sent into the retailer’s stock to partially satisfy the market demand supposing that those reproduced products function as well as new products. Therefore, the returned products received by the retailer in period \(t\) are \(r_t\):

To derive the order-up-to level, retailers need to use forecasting techniques to predict the mean lead-time demand. The three most commonly used forecasting techniques in bullwhip modeling are minimum mean square error (MMSE), moving average (MA) and exponential smoothing (ES). Among them, MMSE has the smallest error. The MMSE is provided by the conditional expectation given to previous observations and is considered an optimal forecasting procedure that minimizes the mean-squared forecasting error. Thus, this paper uses the MMSE forecasting technique and the order-up-to policy to analyze the bullwhip effect in the value chain. It will be conducive to comparative analysis of the bullwhip effect and expected costs under different value chain scenarios and thus not affected by different inventory strategies and forecasting techniques in the value chain. We suppose that the retailer in the value chain has adopted the optimal inventory policy and the optimal forecasting technique [11]. Accordingly, the prediction of the market demand \(\hat{d}_{t + i}\) is \(\hat{d}_{t + i} = E\left( {d_{t + i} \left| {d_{t - 1} } \right.} \right)\) made at the end of period \(t - 1\). \(L\) is the manufacturing lead time or the retailer's replenishment lead time, and the estimated lead-time demand during \(\left[ {t,t + L} \right)\) is:

We adopt the following sequence of events during the replenishment period. The retailer observes consumer demand \(d_{t{ - }1}\) and return data \(r_{t - 1}\) at the end of period \(t - 1\), calculates the order-up-to level \(y_t\), and then places an order of quantity \(q_t\) to the manufacturer at the beginning of period \(t\) according to its current inventory level. After lead time \(L\), the retailer receives the product from the manufacturer at the beginning of period \(t + L\).

The order-up-to policy is one of the most widely studied policies of supply chain models. When demands are stationary, resupply is infinite, product purchase cost is stationary, and there is no fixed order cost, the order-up-to policy is considered as the locally optimal inventory policy. The policy can minimize the total discounted holding and shortage costs [11]. Assuming that the retailer adopts the order-up-to inventory policy, the ordering decision is as follows:

The order-up-to level consists of an anticipation stock that is retained to meet the expected lead-time demand and a safety stock for hedging against unexpected demand. Therefore, the order-up-to level is updated in every period according to the following:

where \(\hat{D}_t^L\) is the lead-time demand equal to the sum of the demands of \(L\) periods, \(z\) is a constant that has been set to meet a desired service level and is often referred to as the safety factor, and the estimate of the standard deviation of the \(L\) period forecasting error is \(\hat{\sigma }_t^L = \sqrt {Var\left( {D_t^L - \hat{D}_t^L } \right)}\).

In a traditional supply chain without product returns, the retailer’s ordering decision is \(q_t = y_t - \left( {y_{t - 1} - d_{t - 1} } \right)\) with the order-up-to replenishment policy. However, in a green value chain, items returned from the remanufacturer can partly satisfy the actual demand of the retailer, assuming that the remanufactured products function as well as new products. Thus, the practical lead-time demand should be the total demand short of the total return quantity, as \(\hat{D}_t^L - \hat{R}_t^L\). Therefore, the actual order-up-to level of the green value chain is:

where \(\hat{D}_t^L = E\left( {\sum_{i = 0}^{L - 1} {d_{t + i} } } \right)\) is a prediction of lead-time demand during the time interval \(\left[ {t,t + L} \right)\), and \(\hat{R}_t^L = E\left( {\sum_{i = 0}^{L - 1} {r_{t + i} } } \right)\) is an estimate of the total return quantity of \(L\) periods from the remanufacturer during interval \(\left[ {t,t + L} \right)\). \(\hat{\sigma }_t^L = \sqrt {Var\left( {\left( {D_t^L - \hat{D}_t^L } \right) - \left( {R_t^L - \hat{R}_t^L } \right)} \right)}\) is the prediction for the standard deviation of the forecasting error during \(L\) periods. In addition, \(z = \Phi^{ - 1} \left[ {{P / {P + H}}} \right]\) is a safety factor with the standard normal distribution \(\Phi\) [11, 13]. \(P\) and \(H\) denote the penalty and holding costs of the retailer, respectively. Accordingly, the ordering decision of the retailer in period \(t\) is:

where \(r_{t - 1}\) is the return volume received by the retailer at \(t - 1\).

Substituting (11.8) into (11.9), the ordering level of the retailer is rewritten as:

Apparently, because the total return quantity of \(L\) periods \(R_t^L\) is different in different value chain contexts, the expected costs of the retailer also are different. When the manufacturing lead time is larger than that of the remanufacturer, the product returns contain unknown information that needs to be estimated and considered in the ordering decisions for the retailer. The estimate of the total return quantity of the retailer during \(\left[ {t,t + L} \right)\) is:

When \(L > L_r\), the total return quantity from the remanufacturer during periods \(\left[ {t,t + L} \right)\) includes the remanufactured quantity \(\sum_{i = 1}^{L_r } {M_{t - i} }\) and the future yield \(\sum_{i = 0}^{L - L_r - 1} {M_{t + i} }\). Because \(\sum_{i = 1}^{L_r } {M_{t - i} }\) is the known information, we have:

In addition, the retailer has to forecast the future returns from the remanufacturer during \(\left[ {t,t + L} \right)\):

The expect of future return from the remanufacturer during \(\left[ {t,t + L} \right)\) is:

When the lead time of the manufacturer is smaller than that of the remanufacturer, which means \(L \le L_r\), the total return quantity of \(L\) periods of retailer \(R_t^L\) is known information. The estimate of the total return quantity during \(\left[ {t,t + L} \right)\) is:

Because \(\sum_{i = L_r - L + 1}^{L_r } {M_{t - i} }\) is known information, the estimate of the output is:

Thus, the prediction error of total return quantity under different value chain scenarios can be expressed as follows:

Therefore, the differences in estimated total returns at period \(t\) and period \(t - 1\) are expressed as:

Lemma 11.1

Variances of the forecasting error of lead-time demand in two return modes and policies under different business contexts remain constant.

Proof:

When \(L > L_r \wedge l \ge L - L_r - 1 \wedge l_1 \ge L - 1\), variances of the forecasting error of lead-time demand are:

When \(\rm{ }L > L_r \wedge L - L_r - 1 > l \wedge L - 1 > l_1\), variances of the forecasting error of lead-time demand are:

When \(L > L_r \wedge L - L_r - 1 > l \wedge l_1 \ge L - 1\), variances of the forecasting error of lead-time demand are:

When \(L > L_r \wedge l \ge L - L_r - 1 \wedge L - 1 > l_1\), variances of the forecasting error of lead-time demand are:

When \(L \le L_r \wedge l_1 \ge L - 1\), variances of the forecasting error of lead-time demand are:

When \(L \le L_r \wedge L - 1 > l_1\), variances of the forecasting error of lead-time demand are:

Lemma 11.1 proves that \(\hat{\sigma }_t^L = \hat{\sigma }_{t^{\prime}}^L ,\left( {\forall t,t^{\prime}} \right)\). Substituting (11.5) and (11.18) into (11.10), the ordering quantity of the retailer in period \(t\) is derived as:

This section analyzes the bullwhip effect expression of retailers under different value chain scenarios, which depends on the variance of the order quantity of retailers \(\sigma_q^2 = Var\left( {q_t } \right)\). When the retailer adopts the MMSE prediction method and order-up-to inventory strategy, the order quantity expression under different value chain scenarios can be expressed by (11.25) as \(\sigma_{q,r}^2\):

This section deduces the analytical expression of the bullwhip effect in the green value chain. Determining the order level of retailers is an important prerequisite step to derive the bullwhip effect. The bullwhip effect is calculated as the ratio of the retailer’s order variance to the market demand variance [11, 13]. When the ratio is greater than one, the bullwhip effect exists in the value chain. Such disturbance of information usually leads to potential costs in the value chain, including large overstocking of inventory, loss of profit and disordered capacity planning. Therefore, the bullwhip effect in the value chain should be restrained and coordinated. When the retailer adopts the MMSE prediction method and order-up-to inventory strategy, the order quantity expression under different value chain scenarios can be expressed as:

As the shipment inventory during the replenishment lead time is normally distributed with mean \(\hat{D}_t^L - \hat{R}_t^L\) and standard deviation \(\hat{\sigma }_t^L\), the expected inventory cost for the retailer in period \(t\) is given as:

where \(\overline{F}_t \left( {D_t^L - R_t^L } \right)\) is the true distribution of \(D_t^L - R_t^L\) with variance \(\left( {\hat{\sigma }_t^L } \right)^2\). \(y_t\) is the optimal order-up-to level of the retailer \(y_t = \hat{D}_t^L - \hat{R}_t^L + z\hat{\sigma }_t^L\). \(L\left( x \right)\) is \(L\left( x \right) = \int_x^\infty {\left( {{\text{y}} - x} \right)} d\Phi \left( y \right)\) convex and decreasing in \(x\), and \(H\left( {z + L\left( z \right)} \right) + PL\left( z \right) \le H\left( {x + L\left( x \right)} \right) + PL\left( x \right)\forall x \ge z\).

The following two conclusions can be drawn by solving the models:

-

(1)

Relationships between the manufacturer/remanufacturer’s lead times and return lead time have a remarkable effect on operational efficiency, i.e., expected costs and bullwhip effect, and optimizing the decisions of return polies under different value chain situations.

-

(2)

Product recycling cannot always restrain the order information fluctuation in the value chain. Consumers’ product return behavior can diminish the information mutation of the value chain only if the ordering lead time is larger than the return period, which means that the total return period is enclosed in an ordering period. Returned products will be delivered into the retailer’s inventory to partly balance out the fluctuation of current demand and thus can alleviate the information mutation. In addition, retailers can timely adjust the forecast of future actual demand to improve the accuracy of ordering decisions when the return period is included in an ordering period.

11.4 Summary

The green growth of enterprises requires optimizing the inventory control strategy in the value chain and improving the efficiency of inventory management. Promoting a zero inventory strategy or low inventory strategies of nodal enterprises in the value chain is an important component of implementing a green growth model, which plays an important role in realizing green growth. To realize green transformation, enterprises need to form a closed-loop system from product design to resource recovery and utilization, promote the efficient reuse and sustainable development of resources, and then implement the coordination of “green” and “growth”. Therefore, inventory management and control play an important role in the green growth model and value chain reconstruction. Inventory control of the value chain can reduce resource waste and improve operational efficiency, which is an important component of the green growth model. To achieve green growth and a green value chain of enterprises through efficient inventory management, this chapter studies the significant influence of product return on the bullwhip effect and inventory costs under different value chain scenarios. We analyze the coordinated control measures of the bullwhip effect of the green value chain to decrease the inventory levels and inventory costs of enterprises. The analysis helps managers improve the efficiency of the green value chain and realize the green growth of enterprises.

References

Chakraborty, A., & Chatterjee, A. K. (2016). A surcharge pricing scheme for supply chain coordination under JIT environment. European Journal of Operational Research, 253(1), 14–24.

Jiang, N., Zhang, L. L., & Yu, Y. (2015). Optimizing cooperative advertising, profit sharing, and inventory policies in a VMI supply chain: A Nash bargaining model and hybrid algorithm. IEEE Transactions on Engineering Management, 62(4), 449–461.

Dong, Y., Dresner, M., & Yao, Y. (2014). Beyond information sharing: An empirical analysis of vendor-managed inventory. Production and Operations Management, 23(5), 817–828.

Sana, S. S. (2011). A production-inventory model of imperfect quality products in a three-layer supply chain. Decision Support Systems, 50(2), 539–547.

Subhash, W., Bibhushan, A., & Prakash. (2008). Service performance of some supply chain inventory policies under demand impulses. Studies in Informatics and Control, 17(1), 43–54.

Wadhwa, S., Bibhushan, & Chan, F. T. S. (2009). Inventory performance of some supply chain inventory policies under impulse demands. International Journal of Production Research, 47(12), 3307–3332.

Ravinder, H. V., & Misra, R. B. (2014). ABC analysis for inventory management: Bridging the gap between research and classroom. American Journal of Business Education, 7(3), 257–264.

Brzeziński, S., & Grondys, K. (2015). Optimization of gross margin in outsourcing of management of inventory of spare parts of production equipment. Applied Mechanics and Materials, 708, 173–177.

Gao, D., Wang, N., He, Z., & Tao, J. (2017). The bullwhip effect in an online supply chain: A perspective of price-sensitive demand based on the price discount in e-commerce. IEEE Transactions on Engineering Management, 64(2), 134–148.

Gao, D., Wang, N., Jiang, B., Gao, J., & Yang, Z. (2022). Value of information sharing in online retail supply chain considering product loss. IEEE Transactions on Engineering Management, 69(5), 2155–2172.

Lee, H. L., Padmanabhan, V., & Whang, S. (1997). The bullwhip effect in supply chains. Sloan Management Review, 38(3), 93–102.

Lee, H. L., Padmanabhan, V., & Whang, S. (1997). Information distortion in a supply chain: The bullwhip effect. Management Science, 43(4), 546–558.

Lee, H. L., So, K. C., & Tang, C. S. (2000). The value of information sharing in a two-level supply chain. Management Science, 46(5), 626–643.

Forrester, J. W. (1958). Industrial dynamics: A major breakthrough for decision makers. Harvard Business Review, 36(4), 37–66.

Burbidge, J. L. (1983). Five golden rules to avoid bankruptcy. Production Engineering, 62(10), 965–981.

Sterman, J. D. (1989). Modeling managerial behavior: Misperceptions of feedback in a dynamic decision making experiment. Management Science, 35(3), 321–339.

Chen, F., Drezner, Z., Ryan, J. K., & Simchi-Levi, D. (2000). Quantifying the bullwhip effect in a simple supply chain: The impact of forecasting, lead times, and information. Management Science, 46(3), 436–443.

Dejonckheere, J., Disney, S. M., Lambrecht, M. R., & Towill, D. R. (2003). Measuring and avoiding the bullwhip effect: A control theoretic approach. European Journal of Operational Research, 147(3), 567–590.

Jena, S. K., & Sarmah, S. P. (2014). Price competition and co-operation in a duopoly closed-loop supply chain. International Journal of Production Economics, 156(10), 346–360.

Akcali, E., & Cetinkaya, S. (2011). Quantitative models for inventory and production planning in closed-loop supply chains. International Journal of Production Research, 49(6–8), 2373–2407.

Hosoda, T., & Disney, S. M. (2015). The impact of information sharing, random yield, correlation, and lead times in closed loop supply chains. European Journal of Operational Research, 246(3), 827–836.

Zhou, L., & Disney, S. M. (2006). Bullwhip and inventory variance in a closed loop supply chain. OR Spectrum, 28(1), 127–149.

Yang, Y., Lin, J., Liu, G., & Zhou, L. (2021). The behavioural causes of bullwhip effect in supply chains: A systematic literature review. International Journal of Production Economics, 108120.

Ponte, B., Puche, J., Rosillo, R., Fuente, D., & Talley, W. (2020). The effects of quantity discounts on supply chain performance: Looking through the bullwhip lens. Transportation Research Part E: Logistics and Transportation Review, 143, 102094.

Yin, X. (2021). Measuring the bullwhip effect with market competition among retailers: A simulation study. Computers & Operations Research, 132, 105341.

Michna, Z., Disney, S. M., & Nielsen, P. (2020). The impact of stochastic lead times on the bullwhip effect under correlated demand and moving average forecasts. Omega, 93, 102033.

Tombido, L., & Baihaqi, I. (2020). The impact of a substitution policy on the bullwhip effect in a closed loop supply chain with remanufacturing. Journal of Remanufacturing, 10(3), 177–205.

Tombido, L., Louw, L., & van Eeden, J. (2020). The bullwhip effect in closed-loop supply chains: A comparison of series and divergent networks. Journal of Remanufacturing, 10(3), 207–238.

Tombido, L., Louw, L., van Eeden, J., & Zailani, S. (2022). A system dynamics model for the impact of capacity limits on the bullwhip effect (bwe) in a closed-loop system with remanufacturing. Journal of Remanufacturing, 12(1), 1–45.

Papanagnou, C. I. (2022). Measuring and eliminating the bullwhip in closed loop supply chains using control theory and Internet of Things. Annals of Operations Research, 310(1), 153–170.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Singapore Pte Ltd.

About this chapter

Cite this chapter

Gao, D., Wang, N., Jiang, Q., Jiang, B. (2022). Inventory Management. In: Enterprises’ Green Growth Model and Value Chain Reconstruction. Springer, Singapore. https://doi.org/10.1007/978-981-19-3991-4_11

Download citation

DOI: https://doi.org/10.1007/978-981-19-3991-4_11

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-19-3990-7

Online ISBN: 978-981-19-3991-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)