Abstract

This paper develops an integrated inventory model for a closed-loop supply chain (CLSC) system consisting of a manufacturer and a retailer. The demand and the returns of used products are assumed to be stochastic in nature. A carbon tax policy is implemented to cut down the emissions from transportation, production, and storage. To lessen the emissions from the operations, the manufacturer invests in green technologies. In addition, the take-back investment is also done by the manufacturer to increase the number of returned products collected from the market. A mathematical model is proposed to minimize the joint total cost incurred by the supply chain. An iterative procedure is employed to find the optimal values of the number of shipments, amount of investments, safety factor, shipment quantity, and the collection rate. A numerical example and a sensitivity analysis are presented to show the application of the model and to investigate the influence of key parameters on the performance of the model. The results show that by adjusting the production rate flexibly and setting the appropriate level of collection rate, the supply chain can maintain the emissions and cost. Furthermore, the green investment and take-back investment can be used as mechanism to cut down the emissions and to manage the requirement of used product in the production process.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The challenging issue in the supply chain management is the investigation of carbon emission reduction for achieving environmental sustainability. Efforts to reduce emissions need to be carried out because several important activities in the supply chain, such as production, transportation, and storage are sources of carbon emissions. To lessen the emissions, regulators often implement a strict carbon regulation on carbon emitters. One of the carbon regulations that has been successfully implemented in many countries to reduce the emission rates is a carbon tax. For example, China already has a plan to reduce its carbon emissions by 2030 to 68% below 2005’s emission level and Canada has a plan to reduce emissions by 30% below the 2002 emission level (Bai et al. 2020). The regulators’ policies on carbon reduction have brought pressure on manufacturers. Hence, the manufacturers seek ways to reduce the emissions from their operations by making a green investment. Green technologies that are proven to generate less emission are adopted and used in various operations.

The governments also encourage the manufacturers to manage their end-of-life products. In some countries, regulators often use take-back regulations to push the manufacturers to take back a proportion of products sold to end customers. This puts pressure on companies to implement CLSC management in their operations. To deal with such regulation, the manufacturers seek strategies to increase the number of used products collected from the market. One of the best strategies is to make investment in collection efforts. With this investment, companies can carry out promotions to increase consumer’s willingness to return used products. In fact, the returns of used products from end customers are generally stochastic. Consequently, the efforts on used products collection become more complex and should be synchronized with remanufacturing requirements.

The manufacturers’ decisions on adopting green technologies and making investment in collection efforts will influence the inventory decisions in CLSC. The decision on how much money to be invested in green technologies and collection efforts must be synchronized with decisions made by other supply chain’s parties. A joint economic lot size problem (JELP) was known to be an effective method to determine the inventory decisions in the supply chain. JELP is believed to be one of the key success factors in reducing carbon emissions in the supply chain (Schaefer and Konur 2015). Accordingly, the increasing concerns on environmental protections and reused products from customers and practitioners have driven the development of JELP toward a low carbon CLSC. The essence of the model is to coordinate the inventory decisions among parties involved in the CLSC by taking into account the carbon emissions.

The first integrated inventory model dealing with carbon emissions was studied by Wahab et al. (2011). They examined the impact of carbon emissions and imperfect manufacturing system on inventory decisions. Panja and Mondal (2019) developed a mathematical inventory model for supplier-manufacturer-retailer system and investigated the influence of delayed in payment and green degree of products on supply chain performances. Ghosh et al. (2017) proposed a two-stage inventory model and focused their study on formulating strategy to cut down the emissions from supply chain’s operations. They proposed a carbon cap regulation to control the emissions resulting from transportation, production, and storage. Later, Wangsa (2017) used a penalties and incentives regulation to control the emissions from the supply chain. Saga et al. (2019) proposed a vendor-buyer inventory model with stochastic demand and periodic review policy. The shortages are controlled by a service level constraint and the emissions are lessened by a penalties and incentives regulation. Some researchers focused their studies on investigating the carbon emissions in CLSC system. Sarkar et al. (2019) proposed a multi attribute CLSC model for returnable transport packaging with capacity and budget constraints. The influence of variable aspects of carbon emissions and transportation is incorporated in the model. Taleizadeh et al. (2019a, b) investigated the technology license and quality improvement efforts in CLSC system under carbon cap-and-trade policy. Samuel et al. (2020) formulated a deterministic mathematical model for CLSC comprising of customers, presorting centers, recycling centers, and refurbishment centers. They focused on studying the impact of the quality of returns on CLSC system under carbon-cap-and carbon cap and trade regulations. Jauhari et al. (2021) developed a CLSC model for manufacturer-retailer system under stochastic demand and returns. A carbon tax mechanism is used to control the emissions and take-back incentive is used to increase the return rate. Furthermore, Konstantaras et al. (2021) proposed a CLSC inventory model that integrates manufacturing, remanufacturing, and repair facilities under time-varying demand and carbon tax regulation.

The explanation above shows that the policies on carbon reduction and used product collection are important for CLSC to cope with carbon and take-back regulations and to respond to the customer’s demand on environmental protections. Our review to CLSC inventory literature reveals that no research has been done to consider green technologies investment, take-back investment, and stochastic returns. Based on this observation, the arising questions are:

-

a)

How the green technologies investment and take-back investment carried out by the manufacturer influence the inventory decisions and performance of CLSC?

-

b)

How should a CLSC manage the inventory level to deal with a stochastic return?

To answer the questions above, we develop a mathematical inventory model for a CLSC consisting of a manufacturer and a retailer with green investment, take-back investment, and stochastic return. A carbon tax regulation is used to control the emissions from transportation, production, and storage. Production system is utilized by the manufacturer to produce new products and to remanufacture used products. The manufacturer has a chance to control the production cost and the emissions from production by adjusting the production rate.

The remaining sections of this paper are structured as follows. The “Literature review” section provides a literature review for relevant papers. The “System description, notation and assumptions” section shows the description of investigated system and notation and assumptions utilized to construct the mathematical model. The “Mathematical inventory model” section shows the description of the model development. The “Solution method”, “Numerical example” and “Sensitivity analysis” sections present the methodology to obtain the solution, the application of the model and the sensitivity analysis, respectively. Finally, the “Conclusions and future research directions” section gives a conclusion and research directions.

Literature Review

Inventory Models in CLSC

Schrady (1967) was the first to introduce an inventory model for reverse logistic. He considered instantaneous rates of manufacturing and remanufacturing and suggested a procedure to obtain the optimal procurement and repair lots. The Schrady’s model was then developed by many scholars by taking into account some different conditions. Nahmias and Rivera (1979) proposed a deterministic model by addressing the capacity restriction for storage and repair shops and assumed a finite rate of recovery. Ritcher (1996a, b) formulated an economic order quantity (EOQ) model for single-stage system with waste disposal and two types of facilities. The collection of the used products from the market is done in the first facility and the production and repair processes are done in the second facility. The investigation on the effect of different holding cost rates in a system with multiple production/remanufacturing cycle policy was done by Teunter (2001). Dobos and Richter (2004) considered a single-stage inventory system by addressing a multiple repair system. Furthermore, various works have been done by many scholars for example, assembly systems (El Saadany and Jaber 2011), switching cost (El Saadany and Jaber 2008), partial backorder (Hasanov et al. 2012).

To improve supply chain performance, some scholars developed inventory models with attention to the collaboration and coordination between parties involved in the CLSC. Bhattacharya and Kaur (2014) considered different return policies and investigated their effects on inventory decisions and system’s performance. Son et al. (2015) analyzed the impact of information sharing structure on inventory decisions. They formulated a model and assumed that the collection and remanufacturing rates are stochastic in nature. Giri and Glock (2017) considered learning process to construct a manufacturer-retailer model under stochastic demand. The production and inspection processes are influenced by the learning process and the returned products collected from the market and raw materials are processed simultaneously in the same production facility. Jauhari et al. (2018) proposed a CLSC made of a manufacturer and a retailer by considering the effect of learning in production and remanufacturing and assumed that the production process is imperfect. They used a multiple cycle policy to formulate the mathematical model and suggested an iterative procedure to obtain the solutions that maximize the annual total profit. As’ad et al. (2019) investigated the influence of replenishment strategies on lot sizing, shipment and production sequence decisions in a CLSC under a consignment stock policy. Taleizadeh and Moshtagh (2019) modeled a multi-stage CLSC with different markets. The manufactured products and remanufactured products are sold to the primary market and secondary market, respectively. They assumed that the returns depend on the product’s quality. Thus, as the quality set by the manufacturer is getting higher, the returned products will be smaller. Taleizadeh et al. (2019a, b) used a discount policy for increasing the number of returned products. The discount is given based on the product’s quality. Dwicahyani et al. (2020) developed a three-stage CLSC model considering imperfect production process and rework. The defective products generated from the production are reworked in a station and sold to the primary market as new products. The returned products categorized as unrecoverable are sold to the secondary market with a discounted price.

CLSC with Carbon Emissions

The growing interest on environmental protection has pushed the scholars to develop CLSC by addressing the carbon emissions. Bazan et al. (2015) was among the first scholars who proposed a sustainable CLSC by accounting the energy required for production and remanufacturing and the emissions released from some activities in the investigated system. They employed a carbon tax regulation to lessen the emissions from transportation, production, and remanufacturing. Dwicahyani et al. (2017) analyzed the impact of energy usage and carbon emission generation in a two-stage CLSC made of a depot and a distributor. The number of remanufacturing times is assumed to be finite, and the collected products classified as unrecoverable are disposed with a certain cost. Bazan et al. (2017) studied the benefit of implementing vendor managed inventory and consignment stock in CLSC. They also considered environmental aspects, such as carbon emissions, energy consumption and remanufacturing generation and investigated their effects on system’s performance. The impact of energy consumption and carbon emissions in multi-echelon system was also analyzed by Hasanov et al. (2019). They used a reverse channel containing a disassembly center and remanufacturing center to manage the returned products collected from the market.

More recently, Mishra et al. (2020) proposed a carbon cap-and-trade policy to control the emissions from transportation, storage, and order replenishment. Recently, Liao and Li (2021) proposed a mathematical model to show how the market uncertainty influences the operation and remanufacturing processes of a CLSC. They showed that the proposed model can be used to reduce the carbon emissions and improve the environmental efficiency. Modak and Kelle (2021) proposed a CLSC by taking into account the corporate social responsibility and carbon emission tax. A mathematical model is proposed to find some decision variables, recycling investment, order quantity, pricing, and the amount of donations, in order to maximize the total profit. De and Giri (2020) focused on reducing transportation cost and carbon cost from various transportation modes under a capacity restriction. The model addressed some different policies to lessen the emissions viz. carbon cap, carbon-cap and-sale, carbon tax and carbon-cap and-purchase. Wang and Wu (2021) analyzed the impact of used product collection on emission reduction. A cap-and-trade regulation is used to control the emissions and two scenarios on product collections are investigated. In the first scenario, the manufacturer collects the products directly from the market and in the second scenario, the retailer collects the products from the market.

Research Gap

The above reviews show that there have been a lot of research dealing with inventory management in CLSC. The differences between the proposed model and the previously published models are described as follows. First, some CLSC models have been developed to investigate the impact of carbon reduction on inventory decisions, but none has studied the influence of adopting green technologies investment. Previous works, including Bazan et al. (2015), Dwicahyani et al. (2017), and Mishra et al. (2020) mostly considered some carbon regulations, such as carbon tax and carbon cap and trade, to control the emissions from supply chain’s operations and neglected the role of green technologies in reducing the emissions. In the proposed model, investment on green technologies is incorporated and used as an effective way to cut down the emissions from manufacturer’s operations. Second, in contrast to most previous models that considered a fixed production rate, the proposed model adopts production rate adjustments as mechanism to control both emissions from production and production cost. Further, the amount of emissions from production and the production cost are linked to the production rate. Third, in the proposed model, collection rate is set as decision variable and can be controlled by investment on collection efforts. In addition, its relation to the used product’s storage is also investigated. The previous works mostly treated the collection rate as a fixed parameter and its relation to the used product’s storage was neglected.

System Description, Notation, and Assumptions

System Description

The system under investigation consists of a manufacturer who produces new items and remanufactures used items and a retailer who sells items to the market. The retailer orders a lot size of nQ items to the manufacturer and incurs an ordering cost, A, for each order. To respond the retailer’s order, the manufacturer produces items with lot size nQ with finite production rate, P, and incurs setup cost K for each production run. Shipment size of Q items will be delivered over n times from the manufacturer to the retailer with transportation cost, F. The retailer incurs holding cost, hR, for each item stored in the warehouse per unit time. The manufacturer incurs holding cost, hM and hrec for each item and used item, respectively, stored in the warehouse. The demand from end consumers that cannot be fulfilled by the retailer is backordered and will be fulfilled in the next order period. The retailer will incur backorder cost, π, for each backordered item.

The manufacturer has a production system which can be used to convert raw materials to new items or remanufacture used items. Raw materials are purchased from supplier and used items are collected from the market. The manufacturer incurs raw material procurement cost, \({C}_{raw}\), for each material purchased and incurs used item cost, \({C}_{used}\), for each item collected from the market. Since the raw materials are more expensive than the used items \({(C}_{raw}>{C}_{used})\), the manufacturer makes serious efforts to increase the returns of used items by making a take-back investment. Because the used items obtained from the market have different quality levels, the manufacturer must conduct an inspection to categorize the items. A screening cost, \({C}_{insp}\), paid by the manufacturer for each item inspected in the manufacturing system. Used items collected by the manufacturer contain \(\beta\) portion of recoverable items and \(1-\beta\) portion of unrecoverable items. The used items categorized as unrecoverable items will be disposed at cost \({C}_{was}\). Then, the recoverable items will be sent to the remanufacturing process. The remanufactured items and new items produced by manufacturing system have the same quality level and will be sold to the primary market. Furthermore, manufacturer also incurs production cost that depends on the production rate. Parameters Xg1 and Xg2 express independent production cost parameter and dependent production cost parameter, respectively.

The regulator implements a carbon tax policy to control the emissions. A carbon tax, Ctax, is levied for each emission resulted from the system. Three main activities in the supply chain are included in the emissions calculation, which are production, storage, and transportation. The emissions resulting from production activity depend upon the production rate while the emissions resulting from holding items depend upon the inventory level. Parameters a, b and c denote the emissions parameters for production process and WR, WM and Wrec denote the amount of emissions resulting from retailer’s warehouse, manufacturer’s warehouse, and used item’s warehouse, respectively. Emissions from transportation activity are calculated based on direct emission factor, \({\vartheta }_{T1}\), and indirect emission factor, \({\vartheta }_{T2}\). Fuels consumption, \(\varepsilon\), and distance from manufacturer to retailer, J, are considered in calculating direct emissions and product weight, x, and demand, D, are considered in calculating indirect emissions. To reduce the emissions from production and storage activities, the manufacturer invests R dollars in a green investment.

Notation

The following notation is used to formulate the proposed mathematical inventory model:

Parameters for the retailer:

- D:

-

demand rate (units/year)

- σ:

-

standard deviation of demand (units/year)

- A:

-

ordering cost ($/order)

- F:

-

transportation cost ($/shipment)

- hR:

-

holding cost per unit item ($/unit/year)

- π:

-

backorder cost per unit item ($/unit)

- Ts:

-

delivery time (year)

- WR:

-

carbon emission released from retailer’s warehouse per unit time (kg CO2/unit/year)

- Ctax:

-

tax charged to emissions ($/kg CO2)

- ϑT1:

-

indirect emission factor for transportation (kg CO2/liter)

- ϑT2:

-

direct emission factor for transportation (kg CO2/kg)

- ε:

-

fuels consumption for transporter (liters/km)

- ρ:

-

fuels price ($/liter)

- J:

-

distance from manufacturer to retailer (km)

- x:

-

weight of product (kg/unit)

Parameters for the manufacturer:

- K:

-

setup cost ($/setup)

- hM:

-

holding cost per unit item ($/unit/year)

- hrec:

-

holding cost per unit recoverable items ($/unit/year)

- WM:

-

carbon emission released from the manufacturer’s warehouse (kg CO2/unit/year)

- Wrec:

-

carbon emission released from storing recoverable items (kg CO2/unit/year)

- Xg1:

-

production’s per unit time cost for operating the machine independent of production rate ($)

- Xg2:

-

increase in production’s unit machining cost due to one unit increase in production rate ($/unit)

- a:

-

emission parameter for production process (ton year2/unit3)

- b:

-

emission parameter for production process (ton year/unit2)

- c:

-

emission parameter for production process (ton/unit)

- Craw:

-

procurement cost for raw material ($/unit)

- Cused:

-

used items cost ($/unit)

- Cwas:

-

waste disposal cost ($/unit)

- Cinsp:

-

screening cost ($/unit)

- πrec:

-

shortage cost for recoverable items ($/unit)

- g:

-

collection efforts parameter

- β:

-

recovery rate

- θ:

-

maximum fraction of emission reduction, 0< θ<1

- m:

-

parameter for green investment, m>0

- Pmax:

-

maximum production rate (units/year)

- Pmin:

-

minimum production rate (units/year)

Decision variables:

- n :

-

number of deliveries per production batch

- Q :

-

delivery quantity (units)

- P :

-

production rate, Pmin<P< Pmax, (units/year)

- R :

-

green investment ($)

- τ :

-

collection rate

- k :

-

safety factor

- k rec :

-

safety factor for recoverable items

Assumptions

The following assumptions are used to develop the mathematical model.

-

1.

The investigated system comprises of a manufacturer who produces items and remanufactures used items and a retailer who sells the items to end customers.

-

2.

Retailer adopts a continuous review policy to control the inventories in order to satisfy the demand from end customers.

-

3.

The manufacturing system owned by the manufacturer can be used to produce new items and to remanufacture used items collected from the market.

-

4.

Remanufactured items have a similar quality level as new items and are sold to the primary market.

-

5.

The manufacturer has an opportunity to lessen the emissions from production and storage activities and to increase the number of collected items by green investment and take-back investment, respectively.

-

6.

Green investment cannot completely reduce the carbon emissions resulted from production and storage.

Mathematical Inventory Model

Retailer’s Inventory Model

In this section, a retailer model is developed by referring to the work of Ben-Daya and Hariga (2004) who developed a JELP model consisting of single vendor and single buyer. The demand follows a normal distribution with mean D and standard deviation σ and the lead time depends upon the delivery lot size (Q). In this continuous review policy, as soon as the inventory level reaches the reorder point, rop, where \(rop=DL+k\sigma \sqrt{L}\), a retailer places an order of nQ items to the manufacturer (See Hadley and Within 1963). By assuming that \(L={~}^{Q}\!\left/\!\!{~}_{P}\right.+{T}_{s}\), the average inventory per unit time at the retailer is given by

The retailer incurs a shortage cost which is formulated by

where

The formulation of transportation cost that depends on the number of deliveries, fuel consumption and traveling distance, is given by the following expression;

By considering the above transportation cost elements and the product weight, the carbon emissions generated from transportation activity can be calculated as follows;

The emissions from storage activity depends on the average of inventory. Equation (6) shows the amount of emissions from retailer’ storage activity.

Thus, the formulation of inventory cost for retailer per unit time that consists of ordering cost, transportation cost, holding cost, shortage cost and carbon emission cost is presented by Equation (7)

Manufacturer’s Inventory Model

To respond the order from a retailer, a manufacturer produces items with a quantity of nQ units per production cycle and delivers Q units over n shipments to the retailer. The inventory profile for manufacturer-retailer system is depicted in Figure 1. The average inventory for the manufacturer can be calculated by subtracting the accumulated retailer’s deliveries from accumulated manufacturer’s production, that is

The manufacturer incurs setup cost that depends on the setup frequency. Equation (9) presents the setup cost per unit time charged to the manufacturer.

In the manufacturer side, the manufacturing system is used for production and remanufacturing processes. Thus, the cost of producing items is assumed to be the same as the cost of remanufacturing used items (See Giri and Glock 2017) . In addition, the cost for production/remanufacturing depends on the production rate (Khouja and Mehrez 1994). Equation (10) formulates the production cost per unit time.

The manufacturer needs sufficient used items for remanufacturing. Thus, the manufacturer collects used items from the market. It is assumed that the returns of used items from the market follow a normal distribution with mean τD and standard deviation \(\sigma \sqrt{\tau }\) (Mitra 2009). A safety stock is required by the manufacturer to ensure that used items which are categorized as recoverable (\({y}_{rec})\) are available for the remanufacturing process (See Mawandiya et al. 2020).

The safety stock of recoverable items can also be formulated by

Equation (13) shows the number of recoverable items required for remanufacturing process.

Therefore, the average inventory level for recoverable items is given by:

Because the returns are stochastic in nature, a shortage will occur when the number of recoverable items is less than the number of items required for the remanufacturing. The expected shortage for recoverable items per unit time is given by:

To increase the number of collected items from the market, the manufacturer has to make an investment, namely take-back investment. Investments can be made in the form of promotional programs to increase consumer willingness to return used products or build facilities to handle product returns from consumers. The amount of money invested by the manufacturer to increase the products return depends on the quadratic value of the collection rate (Jauhari et al. 2020). The take-back investment is formulated as follows;

In the manufacturer, carbon emissions are released from both storage and production activities. To calculate the emissions from manufacturer’s storage, we use a similar approach as for retailer’s storage emissions calculation. In addition, we use the method proposed by Bogaschewsky (1995) to calculate the emissions from production. To cope with the tax regulation imposed by the regulator, the manufacturer intends to reduce the emissions from his operations by using a green investment. The manufacturer can invest money to adopt the green technologies to lessen the emissions from some operations. For example, companies engaged in the fashion sector can invest on developing a biological dyeing process and green chemicals to minimize its environmental impact by using fewer chemicals than less energy (H&M Group 2018). Other companies, such as Panasonic and Home Depot, use low-emission vehicles to deliver the products and utilize machines that use renewable energy to lessen the overall emissions. Suppose that the manufacturer invests R dollars to buy green technologies. The green technologies are utilized by manufacturer to minimize the emissions resulting from production and storage activities. The green technologies have a maximum fraction of emissions reduction, that is θ. According to Lou et al. (2015), the fraction of the emissions reduction obtained when R is invested on green technologies can be formulated as follows;

Thus, the fraction of the remaining emissions is \(\left\{1-\theta \left[1-{e}^{-mR}\right]\right\}\). The amount of carbon emissions from production, holding items, and holding recoverable items after investment are given by the following equation.

The manufacturer cost that consists of setup cost, holding cost, production cost, shortage cost, waste disposal cost, raw material cost, used items cost, emissions cost, take-back investment, and green investment is expressed as follows;

Joint Total Cost Function

The total inventory cost for supply chain can be derived by summing up the retailer cost and the manufacturer cost. Equation (20) presents the joint total cost for the supply chain.

where,

Solution Method

In this section, a solution methodology is presented to solve the proposed problem. The objective is to minimize the joint total cost by simultaneously determining some decision variables that are the number of deliveries, shipment lot, safety factor, collection rate and green investment. To determine the solutions, we take the first partial derivative of JTC with respect to Q, P, k, krec, \(\tau\) and R, respectively, and we get the following equations:

The optimal values of Q, P, k, krec, \(\tau\) and R can be derived by setting Equations (24)–(28) equal to zero. This leads to the formulations below;

For a condition where \(\delta <0\), Equation (30) probably yields an infeasible solution. Thus, we need to reformulate the formulation and we obtain the following expression.

It is obvious that the parameters Q, P, k, krec, τ, and R are not independent of each other. For example, Q and P are needed to compute k, which in turn is a prerequisite for determining Q and P. Therefore, to solve the above problem, we formulate an efficient iterative procedure by adopting the basic algorithm developed by Ben-Daya and Hariga (2004). First, a procedure is started by computing the initial value of P and Q, which can be done by setting the stochastic parameters and the decision variables equal to zero. Second, the value of k is computed by using Equation (31) which is in turn used to update the value of P and Q. Third, the values of krec, R and τ can be determined by entering the value of the previously obtained variables into Equations (32), (33), and (34), respectively, and setting the other variables equal to zero. This procedure is repeated until a sufficiently stable solution (\(Q,P,k,{k}_{rec},R\), \(\tau\)) is reached. Finally, the optimal solution of the proposed model can be determined by evaluating the joint total cost obtained for each n. The proposed procedure for solving the problem is listed below;

-

1.

Set n=1 and \({JTC}_{n-1}\left({Q}_{n-1},{{P}_{n-1}, k}_{n-1},{k}_{rec,n-1},{{R}_{n-1},\tau }_{n-1},n-1 \right)=\infty\)

-

2.

Compute the initial value of \(P\) by using the formulation below

$$P=\sqrt{\frac{{X}_{1}}{{X}_{2}}}$$ -

3.

Compute Q by using the following expression

$$Q=\sqrt{\frac{2D\left\{\frac{A}{n}+F+\rho \varepsilon J+{C}_{tax}{\vartheta }_{T1}\varepsilon J+\frac{K}{n}\right\}}{\left({h}_{R}+{C}_{tax}{W}_{R}\right)+{h}_{M}{G}_{2}}}$$ -

4.

Compute \(k\) by substituting \(Q\) into Equation (31).

-

5.

Compute \({k}_{rec}\) by substituting \(Q\) and \(P\) into Equation below

$${F}_{s}\left(2{k}_{rec}\right)=1-\frac{nQ{h}_{rec}}{{4\pi }_{rec}D}\left[1-\frac{D}{P}\right]$$ -

6.

Compute \(R\) by substituting \(Q\) and \(P\) into Equation below

$$R=-\frac{1}{m}ln\left(\frac{1}{{C}_{tax}m\theta \left\{\frac{{W}_{M}Q}{2}\left(n\left[1-\frac{D}{P}\right]-1+\frac{2D}{P}\right)+D\left(a{P}^{2}-bP+c\right)\right\}}\right)$$ -

7.

Compute \(\tau\) with Equation (34). If \(\tau\) >1, set \(\tau\)=1.

-

8.

Update the values of \(Q\) and \(P\) by substituting the previous values of \(Q,P,k,{k}_{rec},R\) and \(\tau\) into Equations (29) and (35), respectively.

-

9.

Calculate \(k\) and \({k}_{rec}\) by substituting the new values of \(Q\) and \(P\) into Equations (31) and (32), respectively.

-

10.

Update \(R\) and \(\tau\) by using Equations (33) and (34), respectively.

-

11.

Repeat steps 8‒10 until there is no change in the values of \(,P,k,{k}_{rec},R\) and \(\tau .\)

-

12.

Set \({Q}_{n}=Q\), \({P}_{n}=P\) \({k}_{n}=k\), \({k}_{rec,n}={k}_{rec}\), \({R}_{n}=R\) and \({\tau }_{n}=\tau\). Compute \({JTC}_{n}\left({Q}_{n},{P}_{n},{k}_{n},{k}_{rec,n},{R}_{n},{\tau }_{n},n\right)\) by using Equation (28).

-

13.

If \({JTC}_{n}\left({Q}_{n},{P}_{n},{k}_{n},{k}_{rec,n},{R}_{n},{\tau }_{n},n\right)\le {JTC}_{n-1}\left({Q}_{n-1},{{P}_{n-1}, k}_{n-1},{k}_{rec,n-1},{{R}_{n-1},\tau }_{n-1},n-1\right)\), repeat steps 2‒12 with n=n+1; otherwise go to step 14.

-

14.

Compute \(JTC\left(Q,P,k,{k}_{rec},R, \tau ,n\right)\)=\({JTC}_{n-1}\left({Q}_{n-1},{{P}_{n-1}, k}_{n-1},{k}_{rec,n-1},{{R}_{n-1},\tau }_{n-1},n-1\right)\). \(Q,P,k,{k}_{rec},R, \tau\) and n are the solution of the proposed problem.

Numerical Example

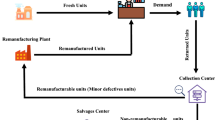

In this section, a numerical example is provided to capture the main features of the proposed model and to illustrate how the proposed procedure can be used to solve the inventory problem in a CLSC system. The values of parameters involved in this numerical example are as follows: D = 1000, σ = 5, A = 100, F = 50, hR = 1, \(\pi\)=50, Ts = 0.05, WR = 10, \({\vartheta }_{T1}\)=2.6, \({\vartheta }_{T2}\)=2.5, \(\varepsilon\)=0.3, JB=400, x=0.05, K=400, hM=0.5, WM=8, Wrec =7, Ctax=0.618, X1=5000, X2=0.0008, a=0.0000012, b=0.0008, c=8.4, β=0.7, Craw=10, Cused=3, g=4200, Cwas=0.5, Cinsp=0.2, \({h}_{rec}\)=0.3, \({\pi }_{rec}\)=30,\({P}_{min}\)=1200, \({P}_{max}\)=3000, \(\rho\)=0.75, m = 0.005, and \(\theta\) =0.7. Figure 2 shows the investigated CLSC system.

By utilizing the proposed procedure, the solution of the above problem can be easily obtained. The optimization results are described as follows. The manufacturer must set the production rate to 1863.81 units/year. The manufacturer produces 497.48 units and remanufactures 502.52 units. The delivery from manufacturer to retailer will be done 2 times in each production run with the quantity of 308.27 units. The optimal values of safety factor, safety factor for recoverable items and return rate are 1.7, 1.88 and 0.72, respectively. To increase the number of collected items and to reduce the emissions from the operations, the manufacturer needs to invest $1082.24 in take-back investment and $685.61 in green investment. Furthermore, under this inventory decision, the manufacturer, retailer, and supply chain must bear inventory cost of $16,962.72, $2554.72, and $19,517.44, respectively.

The convexity of model is represented in Figs. 3, 4, 5, and 6 and these figures show the global minimum point graphically. In Figure 3a, 3D plots are presented to verify the solutions obtained in Eq. (20) as function of the \(JTC\). Two variables for the 3D plots are shipment quantity \(\left(Q\right)\) and production rate \(\left(P\right)\) with fixed decision variables \(\left(n, R,\tau ,k,{k}_{rec}\right)\). Figure 3b shows the 2D or contour plot of the the \(JTC\). By Figures 3a–b, it is clear that the joint total cost is globally optimum when the optimum value of the ordered quantity is 308.27 units and production rate is 1863.81 units/year, whereas joint total optimum cost is $19,517.44/year. The impact of the production rate \(\left(P\right)\) and green investment \(\left(R\right)\) on total cost is illustrated in Figures 4a–b. Figures 4a–b show the convexity and countor plot of the \(JTC\) with fixed \(\left(n, Q,\tau ,k,{k}_{rec}\right)\), respectively. From Figures 4a–b, it can easily find out that the minimum of joint total cost is globally optimum when the production rate is 1863.81 units/year and green investment is $685.61. Figures 5a–b provide the impact of variation in the shipment quantity \(\left(Q\right)\) and collection rate \(\left(\tau \right)\) on the joint total cost with fixed \(\left(P, R,n,k,{k}_{rec}\right)\). Similarly, the convexity and countor plot of \(JTC\) with respect to production rate \(\left(P\right)\) and number of deliveries \(\left(n\right)\) cases are elaborated in Figures 6a–b, respectively.

Sensitivity Analysis

In this section, a sensitivity analysis is performed to investigate the influence of the changes in key parameters on the model’s solution. Thus, we focus on evaluating some parameters, which are maximum green reduction, emission parameter, carbon tax, recovery rate and investment parameter. To assess the influence of θ on the model’s solution and costs, a one-way sensitivity analysis is performed in which 7 values of θ are tested, ranging from 0.14 to 0.98 with an increment of 0.14, while keeping all other parameters at their base value. Table 1 summarizes the results of the investigation on θ. As can be seen in the table, as θ increases the production rate, shipment frequencies, safety factor and collection rate increase. The increase in θ will encourage the manufacturer to speed up the production and makes more frequent deliveries. Figure 7 shows that the percentage of emissions reduction achieved by the green investment increases due to the increase in θ. For example, when θ = 0.28, the percentage of emission reduction achieved by the manufacturer is 25.43% and when θ increases to 0.98, the percentage of emission reduction increases to 96.21%. The manufacturer is likely to take the advantage of reducing emission levels to near the maximum allowable percentage of reductions. As a result, the amount of emissions from manufacturer is significantly decreased, which leads to the decreasing of emissions from supply chain (See Figure 8). We further observe that both investments tend to increase due to the increase in θ. Besides investing more money in the green efforts, the manufacturer also seeks to take the advantages of having more used items by increasing the take-back investment. We note that all parties will benefit from both investments, which can be realized by the cost savings obtained.

To show the benefits of adopting the green investment, we investigate the performance of the proposed model compared to the model without green investment, which is presented in Table 2. Clearly, the proposed model provides a lower total cost compared to the model without investment. By applying the green investment, the manufacturer cost and retailer cost decrease while the retailer cost increases, which leads to the significant decrease in the total cost. We observe that a 20.3% cost saving can be realized by conducting such investment. By looking at the results in Table 2, we understand that the cost saving can be obtained by a significant decrease in total emissions generated from the manufacturer’s operations. It shows that almost half of total emissions can be reduced by the investment.

The proposed model encourages the system to have a larger production rate and shipment lot, which results in a higher inventory level. Moreover, the number of used items collected from the market in the proposed model is larger than that of in the model without investment. With green investment, the manufacturer must take more used items from the market, which leads to larger remanufactured items produced from the manufacturing system. However, this action will cause a significant increase in take-back investment.

As for investment parameter, a one-way sensitivity analysis is also carried out where 7 different values of g are tested, ranging from 840 to 10,920 with an increment of 1680, while keeping all other parameters at their base value. Table 3 shows the influence of the changes in g on model’s behavior. The higher g indicates that the investment is getting more expensive to be done. It is observed from the table that the more expensive investment, the lower collection rate. Facing an expensive investment, the manufacturer needs to reduce the number of used items collected from the market and adjust the production rate to the lower level. Consequently, the number of remanufactured items decreases while the number of manufactured items increases (see Figure 9). By lowering the production rate, the emissions released from production can be reduced, which leads to the reduction of the total emissions resulting from the system.

We also find that the changes in g gives significant impact on the production batch and investment. As g increases gradually, the production batch increases which consequently increases the production cycle. The take-back investment paid by the manufacturer seems to increase when g increases from 840 to 2520 and continues to decrease as g increases from 2520 to 10,920. It is logical, since reducing the take-back investment will give the manufacturer an opportunity to maintain the total cost. In addition, the amount of green investment seems to change slightly with the change of g. Furthermore, we may see that the cost incurred by the manufacturer and supply chain increase while the cost incurred by the retailer decreases slightly due to the increase in g.

In this section, we also focus on investigating the effect of carbon tax on model’s behavior. We experiment with 7 different values, ranging from 0.1236 to 1.6068 with an increment of 0.2472, while keeping all other parameters unchanged, and the results are reported in Table 4. Facing a higher tax, the manufacturer will strive to reduce the emissions from the operations. The results from the table indicate that if carbon tax is getting higher, the production rate, shipment frequencies, shipment lot, safety factor, and collection rate are getting lower. The manufacturer seeks to lessen the emissions from production and storage by reducing the production rate, collection rate, and safety factor for recoverable items. Setting the production rate to the lower level will naturally reduce the emissions from production while adjusting the collection rate and safety factor for recoverable items will reduce the inventory level for recoverable items, which leads to the reduction of the emissions from storage. For the retailer, the efforts to reduce the emissions from transportation and storage can be done by decreasing the shipment frequencies and inventory level. By using such decisions, the total emissions generated from manufacturer, retailer and supply chain can be maintained at an appropriate level, thereby minimizing the impact of increased carbon tax (See Figure 10).

It is also interesting to study how the influence of carbon tax change on the investments. Figure 10 clearly shows the behavior of the investments made by the manufacturer. It can be observed that the take-back investment has a behavior that is opposite to the green investment’s behavior toward the changes in taxes. If tax becomes more expensive, the green investment increases while the take-back investment decreases. This makes practical sense, as increasing the green investment will provide opportunities for the manufacturer to lessen the emissions. Besides, by decreasing the amount of money invested in collection efforts, the manufacturer can reduce the number of items collected from the market, thereby lessening the emissions from storage. Although efforts to reduce emissions have been carried out in various ways above, the costs incurred by the parties and supply chain will significantly increase. It seems that the average percentage increase in retailer cost (30.7%) is higher than the average percentage increase in the manufacturer cost (6.48%).

In the manufacturer system, production activity is the largest carbon emitters. The production process generally requires a large amount of energy generated from fuel combustion. Therefore, in this section, we want to study the impact of the changes in production emissions parameter, a, on the model. This parameter is closely related to the level of emissions resulting from the combustion of certain types of fuel used to generate energy. We test 7 different values for the ratio ranging from 0.00000072 to 0.0000036 with increment 0.00000048, while keeping all other parameters at their base value. The impact of the changes in a on the model is provided in Table 5. It shows that if a increases, the production rate decreases. When the production system becomes increasingly dangerous due to high emission levels, it is beneficial for the system to adjust the production rate to the lower level. Another strategy is to increase the investment in green technology (See Figure 11). Besides controlling the production rate, the manufacturer can maintain the overall emissions by green investment. Furthermore, it is seen that the take-back investment decreases due to the increase in a. We note that the investment’s behavior is similar to the behavior when they face increase in carbon tax.

To gain further insights, we also study the influence of recovery rate on the model. Recovery rate shows the manufacturer’s capability to recover the used items collected from the end customers. To that end, a sensitivity analysis is done on the recovery rate where 7 different values are tested, ranging from 0.49 to 0.91 with an increment 0.07 while setting the other parameters at their base value. The results from Table 6 show that if recovery rate increases, collection rate increases as well. This is intuitively correct, since increasing the number of used items will give the opportunity to the manufacturer to remanufacture more items, thereby increasing the cost saving from raw material procurement. Figure 12 shows how the number of remanufactured items increases due to the increase in recovery rate. We observe that the changes in the shipment lot and production rate are closely related to the changes in shipment frequencies. Moreover, the recovery rate gives significant impact on take-back investment and total cost. The amount of money invested by the manufacturer increases drastically due to the increase in recovery rate. As collection rate must be increased, the manufacturer needs to invest more money to increase the efforts in collection activity. However, the green investment seems to be insensitive to the changes in recovery rate. Finally, we note that as the manufacturer’s capability in recovering the used items is increasing, the manufacturer and the supply chain can get more benefits, reflecting by the significant reduction in total cost.

Conclusions and Future Research Directions

This paper developed an integrated inventory model for CLSC system under stochastic demand and return. We proposed a mathematical model by addressing two types of investments, green technologies investment and take-back investment. Facing a carbon tax regulation imposed by the regulator, the manufacturer adopts green technologies to curb the emissions from the operations. In addition, the manufacturer has a chance to invest money to increase the number of used products collected from end customers. The manufacturer also has an opportunity to adjust the production rate flexibly. The adjustment of the production rate can be used by the manufacturer to control both production cost and emissions from the production.

The results obtained from the sensitivity analysis give some interesting insights. First, the results show that the changes in the parameters discussed require adjustments to the production rate and collection rate. Interestingly, the model gives flexibility to the manager to set both decision variables. By adjusting the production rate and collection rate to appropriate level, the system can maintain the total cost and emissions. Second, green investment gives significant benefits to the supply chain, that is reducing the total cost and emissions. Clearly, as the maximum green reduction increases, the emissions decrease and the production batch, production rate and collection rate increase. In reality, the maximum green reduction will depend on the type of technology used by the system. Thus, the managers need to pay more attention in choosing the right technology. Third, if carbon tax imposed by regulator is getting higher, it is beneficial for the system to increase the green investment and decrease the take-back investment. Fourth, when the production becomes more harmful, the manufacturer should decrease the production rate to reduce the emissions from production. Fifth, if the manufacturer can increase the capability to recover the returned products, it is beneficial for the system to invest more money in take-back activity.

The model can be extended into various ways. First, future studies may be done by considering other carbon regulations, such as carbon cap-and-trade and carbon penalty. Second, the model can be developed by considering different types of production technology. Mostly, each technology requires different cost and produces different emission levels. Facing this condition, the manufacturer should determine the best strategy to comply with the trade-off between the cost and the emission level. Furthermore, the involvement of green transporters, such as electric truck and drone, in the inventory decision-making may also provide some new insights.

Data availability

My manuscript has no associated data, or the data will not be deposited.

References

As’ad R, Hariga M, Alkhatib O (2019) Two stage closed loop supply chain models under consignment stock agreement and different procurement strategies. Appl Math Model 65:164–186

Bai Q, Xua J, Chauhan SC (2020) Effects of sustainability investment and risk aversion on a two-stage supply chain coordination under a carbon tax policy. Comput Ind Eng 142:106324

Bazan E, Jaber MY, El-Saadany AMA (2015) Carbon emissions and energy effects on manufacturing–remanufacturing inventory models. Comput Ind Eng 88:307–316

Bazan E, Jaber MY, Zanoni S (2017) Carbon emissions and energy effects on a two-level manufacturer-retailer closed-loop supply chain model with remanufacturing subject to different coordination mechanisms. Int J Production Economics 183(part B):394–408

Ben-Daya M, Hariga M (2004) Integrated single vendor single buyer model with stochastic demand and variable lead time. Int J Prod Econ 92(1):75–80

Bhattacharya R, Kaur A (2014) Single stage closed loop manufacturing-remanufacturing system profitability with different combinations of internal and external return flows: an analytical study. Int J Logist Syst Manag 17(4):416–446

Bogaschewsky R (1995) Natürliche Umwelt und Produktion. Gabler-Verlag, Wiesbaden

De M, Giri BC (2020) Modelling a closed-loop supply chain with a heterogeneous fleet under carbon emission reduction policy. Trans Res E: Logist Transp Rev 133:1–24

Dobos I, Richter K (2004) An extended production/recycling model with stationary demand and return rates. Int J Prod Econ 90(3):311–323

Dwicahyani AR, Jauhari WA, Rosyidi CN, Laksono PW (2017) Inventory decisions in a two-echelon system with remanufacturing, carbon emission, and energy effects. Cogent Eng 4:1–17

Dwicahyani AR, Kholisoh E, Rosyidi CN, Laksono PW, Jauhari WA (2020) Inventory model optimisation for a closed-loop retailer-manufacturer-supplier system with imperfect production, reworks and quality dependent return rate. Int J Serv Oper Manag 35(4):528–556

El Saadany AMA, Jaber MY (2008) The EOQ repair and waste disposal model with switching. Comput Ind Eng 55(1):219–233

El Saadany AMA, Jaber MY (2011) A production/remanufacture model with returns’ subassemblies managed differently. Int J Prod Econ 133(1):119–126

Ghosh A, Jha JK, Sarmah SP (2017) Optimal lot-sizing under strict carbon cap policy considering stochastic demand. Appl Math Model 44:688–704

Giri BC, Glock CH (2017) A closed-loop supply chain with stochastic product returns and worker experience under learning and forgetting. Int J Prod Res 55(22):6760–6778

Hadley G, Within TM (1963) Analysis of Inventory Systems. Prentice-hall, Englewood Cliffs

Hasanov P, Jaber MY, Zolfaghari S (2012) Production, remanufacturing and waste disposal models for the cases of pure and partial backordering. Appl Math Model 36(11):5249–5261

Hasanov P, Jaber MY, Tahirov N (2019) Four-level closed loop supply chain with remanufacturing. Appl Math Model 66:141–155

H&M Group (2018) H&M Sustainability Report. https://hmgroup.com/content/dam/hmgroup/groupsite/documents/masterlanguage/CSR/reports/2018_Sustainability_report/HM_Group_SustainabilityReport_2018_%20FullReport.Pdf

Jauhari WA, Hendaryani O, Kurdhi NA (2018) Inventory decisions in a closed-loop supply chain system with learning and rework. Int J Procure Manag 11(5):551–585

Jauhari WA, Septian RD, Laksono PW, Dwicahyani AR (2020) A Closed-loop Supply Chain Inventory Model Considering Limited Number of Remanufacturing Generation and Environmental Investigation. IOP Conf Ser: Mater Sci Eng 943(1):012054

Jauhari WA, Adam NAFP, Rosyidi CN, Pujawan IN, Shah NH (2020) A closed-loop supply chain model with rework, waste disposal, and carbon emissions. Oper Res Persp 7:100155

Khouja M, Mehrez A (1994) Economic production lot size model with variable production rate and imperfect quality. J Oper Res Soc 45(12):1405–1417

Konstantaras I, Skouri K, Benkherouf L (2021) Optimizing inventory decisions for a closed–loop supply chain model under a carbon tax regulatory mechanism. Int J Prod Econ 239:108185

Liao H, Li L (2021) Environmental sustainability EOQ model for closed-loop supply chain under market uncertainty: a case study of printer remanufacturing. Comput Ind Eng 151:106525

Lou GX, Xia HY, Zhang JQ, Fan TJ (2015) Investment strategy of emission-reduction technology in a supply chain. Sustainability 7:10684–10708

Mawandiya BK, Jha JK, Thakkar JJ (2020) Optimal production-inventory policy for closed-loop supply chain with remanufacturing under random demand and return. Oper Res: Int J 20:1623–1664

Mishra M, Hota SK, Ghosh SK, Sarkar B (2020) Controlling waste and carbon emission for a sustainable closed-loop supply chain management under a cap-and-trade strategy. Mathematics 8(4):466. https://doi.org/10.3390/math8040466

Mitra S (2009) Analysis of a two-echelon inventory system with returns. Omega 37(1):106–115

Modak NM, Kelle P (2021) Using social work donation as a tool of corporate social responsibility in a closed-loop supply chain considering carbon emissions tax and demand uncertainty. J Oper Res Soc 72(1):61–77

Nahmias N, Rivera H (1979) A deterministic model for repairable item inventory system with a finite repair rate. Int J Prod Res 17(3):215–221

Panja S, Mondal SK (2019) Analyzing a four-layer green supply chain imperfect production inventory model for green products under type-2 fuzzy credit period. Comput Ind Eng 129:435–453

Richter K (1996a) The EOQ and waste disposal model with variable setup number. Eur J Oper Res 95(2):313–324

Richter K (1996b) ‘The extended EOQ repair and waste disposal model. Int J Prod Econ 45(1–3):443–447

Saga RS, Jauhari WA, Laksono PW, Dwicahyani AR (2019) Investigating carbon emissions in a production-inventory model under imperfect production, inspection errors and service-level constraint. Int J Logistic Syst Manag 34:29–55

Samuel CN, Venkatadri U, Diallo C, Khatab A (2020) Robust closed-loop supply chain design with presorting, return quality and carbon emission considerations, Journal of Cleaner Production, https://doi.org/10.1016/j.jclepro.2019.119086

Sarkar B, Tayyab M, Kim N, Habib MS (2019) Optimal production delivery policies for supplier and manufacturer in a constrained closed-loop supply chain for returnable transport packaging through metaheuristic approach. Comput Ind Eng 135:987–1003

Schaefer B, Konur D (2015) Economic and environmental considerations in a continuous review inventory control system with integrated transportation decisions. Transp Res Part E 80:142–165

Schrady DA (1967) ‘A deterministic model for reparable items. Nav Res Logist Q 14(3):391–398

Son Y, Kim T, Omar M (2015) The beneficial effect of information sharing in a two-stage reverse supply chain. Int J Procure Manag 8(6):688–709

Taleizadeh AA, Haghighi F, Niaki STA (2019) Modeling and solving a sustainable closed loop supply chain problem with pricing decisions and discounts on returned products. J Clean Prod 207:163–181

Taleizadeh AA, Moshtagh MS (2019) A consignment stock scheme for closed loop supply chain with imperfect manufacturing processes, lost sales, and quality dependent return: multi levels structure. Int J Prod Econ 217:298–316

Taleizadeh AA, Alizadeh-Basban N, Niaki STA (2019b) A closed-loop supply chain considering carbon reduction, quality improvement effort, and return policy under two remanufacturing scenarios. J Clean Prod 232:1230–1250

Teunter RH (2001) Economic order quantities for recoverable item inventory system. Nav Res Logist 48(6):484–495

Wahab MIM, Mamun SMH, Ongkunaruk P (2011) EOQ models for a coordinated two-level international supply chain considering imperfect items and environmental impact. Int J Prod Econ 134:151–158

Wang Z, Wu Q (2021) Carbon emission reduction and product collection decisions in the closed-loop supply chain with cap-and-trade regulation. Int J Prod Res 59(14):4359–4383 (in press)

Wangsa ID (2017) Greenhouse gas penalty and incentive policies for a joint economic lot size model with industrial and transport emissions. Int J Ind Eng Comput 8:453–480

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Jauhari, W.A., Wangsa, I.D. A Manufacturer-Retailer Inventory Model with Remanufacturing, Stochastic Demand, and Green Investments. Process Integr Optim Sustain 6, 253–273 (2022). https://doi.org/10.1007/s41660-021-00208-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41660-021-00208-0