Abstract

Transshipments enable supply chains to reduce inventories while maintaining fill rates by sharing stored goods between different locations. In this paper, the supply chain is composed of the external manufacturer, the central warehouse and three identical retail outlets. Transshipment lead times are assumed to be negligible, while supply lead times are assumed to be deterministic as long as the sender is not out of stock. Any demand that cannot be satisfied immediately or after transshipments is lost or backlogged. A quick approximation method to estimate the expected transshipment quantities is provided. Simulation results strongly support the fit of the approximation. Numerical studies confirm the effect of lead time demand distributions on several performance measures.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

One approach to addressing the operating efficiency of distribution networks is to allow lateral transshipments between stocking locations at the same level (see [3]). By means of inventory pooling, stocking locations at the same echelon may reduce their safety stocks while maintaining or improving fill rates. Thus, transshipments reduce the costs of supply chain operations. The aim of this paper is to extend a single-level model according to [4] and to provide a simple method to estimate the expected transshipment quantities.

2 The Model

We consider a single-product two-level supply chain (One Warehouse, N Retailer) consisting of the external manufacturer, the central warehouse and three identical retail outlets under periodic review inventory management. The transshipment lead times are negligible, while the replenishment lead times are composed of deterministic shipment times and stochastic delays caused by stockouts at the central warehouse.

The incoming demand can lead to two consequences: If the pre-transshipment stock on hand exceeds the demand, the retail outlet fulfills it immediately and keeps an inventory surplus which can be offered to other retail outlets experiencing shortages. If the local demand exceeds the pre-transshipment stock on hand, the retail outlet requests an immediate lateral transshipment from the others.

Transshipments are subject to greedy policy constraints, cf. [2]. We utilize Risk Balancing Policy (RBP) equalizing the next period stockout probability for both sending or both receiving retail outlets to determine quantities to transship, cf. [4]. The remaining demand, which can’t be fulfilled even by means of lateral transshipments, is backlogged or lost. At the end of each review period, every retail outlet attempts to increase its inventory position up to \(S_r\). The central warehouse fills the orders as far as possible and raises its own inventory position up to \(S_c\). We also utilize RBP at the central warehouse in case the central warehouse is unable to fulfill the orders completely. At the end of the period, the stock on hand is forwarded to the next period, while the backorders are backlogged or lost.

The objective function is to minimize the expected costs which are holding costs and transshipment costs.

We assume \(\tau < \eta _c \le \eta _r\) with respect to the unit cost parameters, and \(b_r\) denotes the desired end-customer fill rate after transshipments.

Considering the objective values from (1), we obtain the economic benefit of the transshipment policy at any particular point of the solution space:

Any transshipment flow decreases the end-of-period inventories at the retail outlets. Consequently, these outlets have to order more from the central warehouse, so the end-of-period inventories at the central warehouse are non-increasing, too. In order to minimize (1), the initial order-up-to levels \(S_r\) and \(S_c\) are pre-specified.

Let \({\mathrm {E}} I^+_i\) be the expected end-of-period on hand inventory, let \(\mathrm E I^-_i\) be the expected backordered demand at the retail outlet \(i\), and let \(X\) be the demand the retail outlet \(i\) is experiencing. Clearly, \(\mathrm E I^+_i - \mathrm E I^-_i = S_r - \mathrm E X\). Assuming any stationary distribution for \(X\), we have \(\varDelta \mathrm E I^+_i - \varDelta \mathrm E I^-_i = \varDelta S_r\). Analogously, we conclude \(\varDelta \mathrm E I^+_c - \varDelta \mathrm E I^-_c = \varDelta S_c - \varDelta \mathrm E Z^{\prime }\), \(Z^{\prime }\) being the demand of three retail outlets addressed to the central warehouse. If we consider lost sales, we expect \(|\varDelta \mathrm E Z^{\prime }| = |\varDelta \mathrm E I_i^+|\). Otherwise, we expect \(\varDelta \mathrm E Z^{\prime } = 0\).

First, let us consider \(\varDelta S_c = \varDelta S_r = 0\). Every transshipment flow is triggered by demand which can’t be fulfilled without transshipment. This demand can be satisfied only once. As every transshipment flow has exactly one source or exactly one destination, we expect \(|\varDelta \mathrm E I^+_i| = |\varDelta \mathrm E I^-_i| = |\varDelta \mathrm E I^+_c| = \mathrm E T\) to be the case, if \(S_c \ge 3 S_r\).

At some particular points of the solution space lying on the line \(S_c=3S_r\), we utilize analytic estimates of \(\mathrm E I^+_c\), \(\mathrm E I^+_i\) in case transshipments are not allowed. With an initial \(S_c\) being reasonably high and \(\varDelta S_c\) being sufficiently small or \(S_c\) being still increasing, we expect \(\varDelta \mathrm E I^-_c \approx 0\). Consequently, \(\varDelta \mathrm E I^+_c \approx \varDelta S_c\).

Further, we expect \(|\varDelta \mathrm E I^+_i| = |\varDelta \mathrm E I^-_i| > \mathrm E T > |\varDelta \mathrm E I^+_c|\) as a result of transshipment flows initiated to compensate the insufficient order-up-to level at the central warehouse, if \(S_r \ge \mathrm E X\), \(S_c < 3S_r\).

Unfortunately, we are not able to find out \({\mathrm {E}} I^+_i\) and \(\mathrm E I^+_c\) analytically due to the limited supply from the central warehouse. Nonetheless, \(\varDelta \mathrm {E}C (S_r, S_c)\) is expected to be negative at any point of the solution space. As a result, the point of the solution space with the maximum transshipment quantity coincides with the minimum objective value.

The expected quantity \(ET\) to transship at time \(t\) is dependent on both \(S_r\) and \(S_c\). For the desired end-customer fill rates \(b_r = \{0.90\), \(0.95\}\), we expect to find minimum objective values setting \(S_r \ge \mathrm E X\), \(S_c < 3 S_r\). We look at \(\mathrm E T\) and develop an analytic approximation requiring no sophisticated computing efforts.

3 Approximation Procedure and Simulation Results

We are utilizing normal demand with parameters \({\mathrm {E}} X = \{200,400,800\}\) and \(\sigma _X=75\) as an initial point for our numerical studies. For gamma distributed demand, the corresponding parameter values resulting in the same values for \(\mathrm E X\) and \(\sigma _X\) are identified. For the ease of the simulation, random demand values are rounded to the nearest integer. Negative demand values, if any, are replaced by zero.

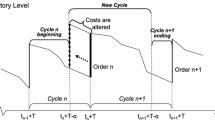

In our approximation approach, we need to differ between the following regions of the solution space, as shown in Fig. 1. For three identical retail outlets, \(S_c = 3 S_r\) defines a reasonable upper bound for \(S_c\). For a long-term view, \(S_c = 3 S_r\) is sufficient to establish a fill rate of 100 % at the central warehouse. Any order-up-to level \(S_c > 3 S_r\) would only increase the costs of the system and have no effect on \(\mathrm ET\). The dash line represents the fill rate constraint bounding the feasible region to the bottom and to the left.

Figure 2 depicts the expected transshipment quantities per period for particular \(S_r\) and \(S_c\) values. \(S_r < \mathrm E X\) is suppressed, as it leads to fill rates which are insufficient for any reasonable application.

For \(S_r \le \mathrm EX\), \(S_c < 3 S_r\), the expected transshipment quantity is an increasing s-shaped curve depending on \(S_c\) independently of \(S_r\). For \(S_r > \mathrm EX\), \(S_c < 3 S_r\), it is a unimodal first increasing and then decreasing curve in \(S_c\) which is dependent on \(S_r\), too. Above the diagonal, the expected transshipment quantity is constant in \(S_c\) depending only on \(S_r\).

This behaviour can be explained by demand-triggered versus supply-triggered transshipment flows. Stockouts at the retail outlets can occur despite inventory positions as high as \(S_r\). In this case, high demand triggers transshipment flows immediately. Stockouts at the central warehouse cause time-delayed transshipment flows as a consequence of the fact that retail outlets are not able to raise their inventory positions up to \(S_r\). The interaction between the central warehouse and the retail outlets determines transshipment flows in the close neighbourhood of \(S_c = \mathrm E Z\), if \(S_c < 3 S_r\) and \(S_r \ge \mathrm EX\), \(Z\) being the threefold convolution of the demand \(X\). For this reason, the horizontal (vertical) piece of the fill rate constraint can be approximated easily by ignoring any interdependences from the interaction between the central warehouse and the retail outlets.

For \(S_r \le \mathrm EX\), \(S_c < 3 S_r\), the expected quantities to transship are not sensitive to changes in \(S_r\). As a result, we consider the central warehouse as the only significant factor determining \(\mathrm {E}T (\cdot , S_c)\) in this part of the solution space. For the ease of computation, we assume \(\tfrac{S_c}{3}\) to be an appropriate order-up-to level for one of three identical retail outlets.

Above the diagonal, the expected quantities to transship are not sensitive to changes in \(S_c\). These quantities are approximated in the same manner for each particular \(S_r\) value.

For \(S_r > \mathrm EX\), \(S_c < 3 S_r\), we approximate \(\mathrm ET(S_r, S_c) \) as the weighted average of (3) for the particular value of \(S_c\) and (4) for the particular value of \(S_r\). The weights \(p_n(\alpha )\) versus \(1-p_n(\alpha )\) are calculated with \(n\)th-degree polynomials of \(\alpha \) where \(n\) is an odd number. Let \(\alpha = P(Z \le S_c)\) denote the non-stockout probability of a single stocking location serving the completely pooled demand \(Z\), \(S_c\) being the particular order-up-to level for the periodic review policy.

Polynomials with \(\lceil n/2 \rceil \) binomial coefficients perform well for \(S_r\) values up to \(S_r \approx \mathrm E X + 2\sigma _X\). We suggest using 9th- or higher degree polynomials to improve the fit of the approximation, especially where \(\mathrm E T(S_r\), \(S_c)\) is still increasing in \(S_c\) for a given \(S_r\). Though this approximation procedure doesn’t need sophisticated computations, it establishes an impressive fit (\(R^2 > 0.98\)) for enabling reliable estimates of the expected transshipment quantities.

The solution of the entire model can be achieved by numerical methods which are beyond the scope of this paper. Herer et al. [1] describe an optimization procedure combining the advantages of simulation and stochastic optimization which can be utilized to find the minimum objective value, taking into account the relevant fill rate constraint.

4 Conclusion

Lateral transshipments lead to substantial cost benefits due to lower order-up-to levels required to establish the desired end-customer fill rate. The economic benefits depend strongly on the lead time demand distribution and unit costs under consideration. The simulation confirms cost reductions of approximately {40.55 %, 25.50 %} at the optima for \(b_r = \{0.90\), \(0.95\}\) referring to normal demand with \(\mathrm EX = 200\), \(\sigma _X = 75\), \(\eta _r = \eta _c\) and \(\tau = 0.9 \eta _r\). Additionally, there are some marginal improvements in terms of fill rates that the end-customers are the recipients of despite the lower order-up-to levels.

References

Herer, Y. T., Tzur, M., & Yücesan, E. (2006). The multilocation transshipment problem. IIE Transactions, 38(3), 185–200.

Nonås, L., & Jörnsten, K. (2007). Optimal solutions in the multi-location inventory system with transshipments. Journal of Mathematical Modelling and Algorithms, 6(1), 47–75.

Paterson, C., Kiesmüller, G., Teunter, R., & Glazebrook, K. (2011). Inventory models with lateral transshipments: A review. European Journal of Operational Research, 210(2), 125–136.

Tagaras, G. (1999). Pooling in multi-location periodic inventory distribution systems. Omega, 27(1), 39–59.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer International Publishing Switzerland

About this paper

Cite this paper

Serin, A., Hillebrand, B. (2014). Inventory Management with Transshipments Under Fill Rate Constraints. In: Huisman, D., Louwerse, I., Wagelmans, A. (eds) Operations Research Proceedings 2013. Operations Research Proceedings. Springer, Cham. https://doi.org/10.1007/978-3-319-07001-8_59

Download citation

DOI: https://doi.org/10.1007/978-3-319-07001-8_59

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-07000-1

Online ISBN: 978-3-319-07001-8

eBook Packages: Business and EconomicsBusiness and Management (R0)