Abstract

This paper examines whether global insurance mergers and acquisitions (M&As) create value for shareholders by conducting an event study of M&A transactions for the period 1990–2006. In the overall sample, insurance acquirers realised small positive cumulative average abnormal returns (CAARs), whereas targets realised substantial positive CAARs. Both cross-border and within-border transactions led to substantial value creation for targets. Market value gains for acquirers are centred in the U.S. and Europe; acquirer CAARs for Asian M&As are mostly insignificant. Targets realise significant market value gains in the U.S., Europe and Asia, with the largest gains for U.S. transactions. Acquirers from the insurance industry realise small market value gains from within-industry transactions, but cross-industry M&As are value-neutral. Targets realise significant market value gains in both cross- and within-industry transactions, but the within-industry gains are significantly larger. The results suggest that insurers should concentrate on focusing rather than diversifying transactions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

An important development in the financial services market is the integration of the previously separate segments of the financial services industry. Deregulation, advances in communications and information technology, and economic forces have led to the breakdown of the “firewalls” that traditionally separated financial intermediaries such as banks, thrift institutions, mutual fund companies and insurance companies worldwide, leading to mergers of large financial sector banking and insurance institutions such as Travelers-Citicorp and ING-Nationale Nederlanden. This has led to an expansion in the number of inter-industry mergers and acquisitions (M&As). Deregulation and factors such as improving technology and globalisation of financial and real markets have also driven an expansion of M&As within the insurance industry. The objective of this study is to analyse the market value impact of M&As in the global insurance industry on both target and acquiring firms. We conduct an event study analysis to determine the market value effects of change in control transactions where either the target or the acquirer is an insurance company.

The European Union (EU's) gradually deregulated the financial services sector through a series of banking and insurance directives, culminating in the virtual deregulation of financial services (except for solvency) in the Second Banking Coordination Directive, implemented in the early 1990s, and the third generation Insurance Directives, implemented in 1994.Footnote 1 The objective of the banking and insurance directives was to create a single European market in financial services. The introduction of the euro in 1999 also profoundly changed the economic landscape for financial services firms in the European market. European deregulation in insurance was particularly important, because insurers traditionally had been limited to operating within specific European countries, with little or no price competition, and cross-border transactions mainly limited to reinsurance and some commercial coverages. The third generation Insurance Directives introduced true price and product competition in European retail insurance markets for the first time.

Deregulation also occurred during the 1990s and earlier in several other countries, facilitating consolidation of the financial sector. Many countries opened up their national financial markets to international competition and permitted universal banking or at least consolidation across previously separate parts of the financial sector. Among the countries where significant deregulation occurred during the 1990s are Japan, Australia, the Netherlands and the U.K.Footnote 2,Footnote 3 However, in some countries, such as Japan, the deregulation of the 1990s represented a major change; whereas in others, such as the U.K., insurers had already been free of the most burdensome regulations for at least a decade.Footnote 4 As shown below, the number of transactions varies significantly across countries and depends upon the size of the market and the number of companies in the market prior to deregulation as well as cultural factors.Footnote 5

The contrast to Europe, where deregulation brought about major changes in insurers’ ability to compete, diversify and restructure, there have been few regulatory changes in the U.S. pertaining specifically to insurance. Insurance is primarily regulated by the states, and state regulators tend to focus heavily on solvency regulation. There have been no major changes in state regulation since about 1980 except for the adoption of the risk-based capital system in the early 1990s, which is directed towards solvency. State regulation of insurance does not restrict M&As. The principal U.S. national deregulation of the past 20 years was the passage of the Gramm–Leach–Bliley Act in 1999, which permitted financial holding companies to own banks, insurers and other financial firms for the first time since the 1930s.Footnote 6 These regulatory changes facilitated M&As between segments of the financial services industry both at the country level and globally. However, the majority of insurance M&A transactions are within the insurance industry (see below). Therefore, the surge in U.S. insurance M&As is only partly attributable to Gramm–Leach–Bliley. The large number of U.S. transactions is driven by fundamental factors such as the lack of cultural or language barriers for domestic transactions, the presence of a large insurance market populated by many insurers and the heavy reliance in the U.S. on capital market finance and other market activities5,Footnote 7

In spite of the high level of merger activity, the literature on global insurance mergers is rather limited.Footnote 8 In general, prior literature is equivocal as to the value-creation effects of M&As. Both multiple industry and banking studies often find that M&As are value destroying for acquirers and value creating for targets.Footnote 9

There have been a few studies analysing the valuation effects of M&As for insurance companies.Footnote 10 Four studies have analysed the valuation effects of bancassurance by studying mergers of insurers and banks.Footnote 11 These studies tend to be based on small samples and consider only bank-insurer transactions. They also focus on acquirers and do not consider wealth effects for targets.Footnote 12

There have been three prior studies of the valuation effects of U.S. insurance mergers. Akhigbe and MaduraFootnote 13 study large U.S. insurance M&As over the period 1985–1995 and find significant market value gains for both acquirers and targets. Boubakri et al.Footnote 14 examine M&A transactions for U.S. property-casualty (P-C) insurers for the period 1995–2000 and find value creation for bidders. Cummins and XieFootnote 15 analyse U.S. P-C M&As for the period 1997–2003 and find significant market value gains for both targets and acquirers.

The prior study most similar to the present paper is Cummins and Weiss.Footnote 16 They analyse European M&As using a sample where either the target or the acquirer is an insurance company, over the sample period 1990–2002. They find that acquirers realise small negative market value losses from M&A transactions but targets realised substantial market value gains.

The objective of the present study is to extend Cummins and Weiss16 to analyse the effects of M&As on the market value of target and acquiring firms in the international insurance market. Ours is the first paper to analyse international insurance M&As where either the target or the acquirer is an insurance company and the merger partner can be from any part of the financial industry. We extend the bancassurance M&A valuation literature by considering a broader sampling approach where one party to the transaction is an insurer, but the merger partner can come from any financial sector industry rather than restricting merger partners to the banking industry. Our paper adds information not provided by Akhigbe and Madura13 and Boubakri et al.14 by extending the analysis to include countries outside the U.S. Finally, with the exception of Akhigbe and Madura13 and Cummins and Weiss16, none of the prior insurance M&A valuation studies considers the wealth effects of M&As on targets but rather limit their analysis to acquirers. Hence, the present study is the most extensive analysis yet conducted that considers wealth effects of M&As for both targets and acquirers.

Our event study analysis is based on M&A transactions over the period 1990–2006, as reported in the Thomson Financial SDC Platinum database. Specifically, we obtain stock price data from the SDC database and study the market reaction to the M&A transactions on both target and acquiring firms in a series of event windows surrounding the transaction dates. Tests are conducted for differences in market value effects of mergers by country/region, by whether the transaction is focusing vs diversifying, and by whether the transaction is cross-border or domestic. Conducting an event study enables us to capture the market’s expectation of the net effect of M&A transactions on the present value of the expected future cash flows of the transacting firms and thus to determine whether M&As tend to create value for shareholders.

The findings support the general contention that M&A deals are more likely to be value creating for targets than for acquiring firms. Acquirers achieve small market value gains in Europe and the U.S. but not in Asia. Targets realise large market value gains in all regions. Market-value gains for targets are similar for both cross-border and within-border transactions. Acquirers gain value for transactions within the insurance industry, but cross-industry transactions are value neutral for acquirers. Targets gain from both within- and cross-industry transactions, but the within-industry gains are larger.

The paper proceeds as follows: The next section reviews the prior literature and develops hypotheses concerning the economic effects of M&As. The subsequent section explains our sample selection and event study methodology. The penultimate section presents the results, and the final section concludes.

Literature review and hypotheses

M&As in the global insurance industry can be motivated by either pure production theory arguments or by diversification arguments. This section reviews the relevant prior literature and develops our predictions about whether M&A activities are likely to be value-creating.

Literature review

This section reviews the principal prior literature on the relationship between M&As and firm value. We focus mainly on papers that analyse market valuation effects; a large literature on other aspects of M&As is not covered here. We also focus on studies that primarily emphasise the insurance industry, although we do cover one banking study that has special relevance for our analysis. Papers are discussed chronologically rather than by importance.

A relatively early paper on the valuation effects of M&As in the insurance industry is Akhigbe and Madura.13 They study the valuation effects of 88 large U.S. insurance company mergers over the sample period 1985-1995. A standard event study methodology is used with ex post regression analysis to relate cumulative abnormal returns to firm and deal characteristics. The findings indicate significant positive market value gains for both acquirers and targets and that the magnitude of the gains is conditioned on the type, size and location of the insurance companies.

Cummins and Weiss16 analyse European M&As, using a sample where either the target or the acquirer is a European insurance company. They utilise an event study methodology to analyse both cross-border and domestic transactions. Their sample consists of 256 change in control transactions for the sample period 1990–2002. The results show that European M&As created small negative cumulative average abnormal returns (CAARs) for acquirers (generally less than 1 per cent) across various windows surrounding the transaction date. Targets, however, realised substantial positive CAARs. They find that cross-border transactions were value-neutral for acquirers, whereas within-border transactions led to a significant loss in value for acquirers. For targets, both cross-border and within-border transactions created significant value.

Fields et al.Footnote 17 study the valuation effects of bancassurance mergers, that is, mergers where either the target or the acquirer is an insurance company and the other party to the transaction is a bank. A standard event study methodology is used to conduct a multiple-country analysis, where the majority of firms are from the U.S. and Europe. The analysis incorporates 129 transactions over the sample period 1997–2002. The findings indicate that bancassurance mergers produce positive abnormal returns for bidders. Mergers that extend the geographical market of the bidder appear to produce substantially more positive abnormal returns within the same market area. Fields et al.Footnote 18 utilise the same sample but extend the analysis to consider the determinants of the cumulative abnormal returns observed for bidding firms. They find that higher CEO stock ownership results in less positive gains for shareholders. The results also imply that bidder gains are principally driven by increases in operating cash flows anticipated from the merger rather than risk reductions.

StaikourasFootnote 19 provides an event study analysis of financial transactions involving banks and insurance companies. The analysis includes cases where banks bid on insurers, insurers bid on banks, or corporate divestments of previously established bank-insurance structures. A global sample is used, for the sample period 1990–2006. The analysis considers 51 merger transactions plus a 10-transaction control sample consisting of bank or insurer mergers with target non-financial firms. The results indicate that bank bidders earn significant positive returns, while insurance bidders experience significant losses. Bank-insurance divestments either produce significant negative returns or are value-neutral.

Focarelli and PozzoloFootnote 20 do not study valuation effects of M&As but rather seek to identify the determinants of cross-border M&As for banks and insurance companies. They analyse 403 cross-border deals in the banking sector and 231 in the insurance sector, for the sample period 1990–2003. The study is global with 47 potential countries of origin for the cross-border transactions. The findings indicate that distance and economic and cultural integration are important determinants for banks’ and insurers’ expansion abroad. Implicit barriers to foreign entry are more important in explaining the behaviour of banks than for insurance companies.

Boubakri et al.14 examine the long-run performance of M&As in the U.S. P-C insurance industry, focusing on acquirers. The sample consists of firms where the bidders are U.S. P-C insurers and the targets are (not necessarily U.S.) P-C insurers. The sample consists of 177 M&A transactions over the sample period 1995–2000. They investigate whether M&A transactions create value for bidders’ shareholders and assess how corporate governance mechanisms affect such performance. The results show that M&A transactions create value for acquirers in the long run as buy-and-hold abnormal returns are positive and significant after three years. Internal corporate governance mechanisms such as board independence and CEO share ownership are significant determinants of the long-term positive performance of bidders.

Cummins and Xie15 analyse the efficiency effects of U.S. P-C M&As for the period 1997–2003. They estimate the valuation effects of M&As using an event study methodology and estimate book value efficiency scores using data envelopment analysis. The results show that acquirers, targets and divesting firms all have significant positive abnormal returns around announcement dates. They also find that efficient acquirers and targets have higher cumulative abnormal returns (CAARs) but inefficient divesting firms have higher CAARs.

Chen and TanFootnote 21 examine the risk and wealth effects for acquirers in M&As between banks and insurers, where the acquirers are European banks. They investigate 72 cross-border and domestic deals for the sample period 1989–2004. Risk is analysed using market value return data, and an event study is conducted to measure wealth effects. They find that acquirers’ total risks remain constant, and there are no changes in systematic risk (beta) with respect to the world market and home banking index. The event study shows significant positive wealth effects from the transactions for acquirers. The study does not analyse wealth effects for targets.

A banking study with relevance to our analysis is Amihud et al.Footnote 22 They analyse the effects of cross-border mergers on the risk and abnormal returns of acquiring banks. The sample period is 1985–1998, and the sample includes 214 international mergers where either the target or the acquirer was a bank, and the partner in the transaction was headquartered in a different country. The findings indicate that the risk of acquirers remains constant and that acquirers realise significant negative abnormal returns from the transactions.

The results of the present study—small positive wealth gains for acquirers—are in general agreement with the findings of Akhigbe and Madura,13 Fields et al.,Footnote 23 Boubakri et al.,14 and Cummins and Xie15 for the insurance industry and are also consistent with the findings of Staikouras19 and Chen and Tan21 for bank acquirers. Our findings for acquirers are not consistent with those of Cummins and Weiss16 for European insurers or with Amihud et al.22 findings for banks. Our finding of significant positive gains for targets is consistent with Akhigbe and Madura,13 Cummins and Weiss,16 and Cummins and Xie15 but not consistent with the findings of Staikouras19 for insurance acquirers of banks.

Economic motivations for M&As

Two principal hypotheses have been developed concerning the effects of M&As on targets and acquirers—the value-enhancement or synergy hypothesis, and the hypothesis that M&As are primarily driven by non-value-enhancing behaviour by managers. Value-enhancing motivations include achieving economies of scale and scope, improving X-efficiency, gaining market power, achieving earnings diversification and improving other aspects of financial performance.Footnote 24 Non-value-enhancing motivations include various agency theoretic explanations such as managerial hubris, empire-building, increasing manager compensation and expense preference behaviour.Footnote 25

Perhaps the most frequently cited rationale for a takeover is economies of scale—firms expand to obtain optimal operating scale and thereby reduce average unit costs of production. The usual source of cost scale economies is the spreading of fixed costs over a broader output base. For insurers, important fixed costs include computer systems and software development costs. Another source of scale economies that is expected to be particularly important for insurers is earnings diversificationFootnote 26 in view of the importance of the law of large numbers in insurance. M&As can permit insurers to expand the policyholder pool more rapidly than through organic growth. If M&As generate scale economies, the performance of both the target and the acquirer will be improved after M&A transactions.

Corporate control theoryFootnote 27 argues that takeover is an efficient means to replace inefficient managers of target companies. If managers of acquiring firms are more capable than those of acquired firms, they can improve the efficiency of targets. This theory predicts that poorly performing firms are more likely to be acquired and that the performance of targets will improve after the takeover. Acquiring firms are also expected to gain from the takeover activity if they have the ability to bring operating synergies to the post-takeover entity. On the other hand, there is some evidence in the insurance industry that acquirers might prefer efficient targets, especially firms possessing competencies in certain areas or product lines.26 For example, M&As may enable insurers to acquire technologies, obtain new distribution systems and achieve other objectives. Thus, M&As can lead to improvements in efficiency and create market value gains for both targets and acquirers.

M&As also can be motivated by financial synergies. Financial synergy theory argues that, with asymmetric information in financial markets, a firm with insufficient liquid assets or financial slack may not undertake all valuable investment opportunities.Footnote 28 Such firms can increase their value by merging with slack-rich firms if the information asymmetry between the two firms is smaller than that between the slack-poor firm and outside investors. Thus, takeover may be an efficient means to alleviate information asymmetries and achieve financial synergies. M&As can also facilitate the development of internal capital markets, which have been shown to be efficient for insurance groups.Footnote 29

Non-value maximising motives for M&A focus on agency theory and managerial hubris. The agency cost theory of M&As argues that takeover activity often results from acquiring firm managers’ acting in their own self-interests rather than in the interests of the firm’s owners.27 Managers may be motivated to increase their compensation by increasing the size of the firm through non-value-enhancing mergers or engaging in “expense preference” behaviour by over-consumption of perquisites. To the extent that M&As are primarily motivated by managerial self interest, they are unlikely to generate operating or financial synergies that lead to improvements in efficiency or productivity.

According to the managerial hubris hypothesis, even if managers try to maximise the value of the firm, they might overestimate the value of what they buy because of hubris.Footnote 30 This is particularly true in waves of consolidation, when managers blindly follow the markets or when multiple bidders compete for the same target. Managers also could underestimate the cost of post-merger integration or overestimate their ability to control a larger institution. Thus, a transaction that is believed to benefit the acquirer could simply be a poor strategic decision where benefits are overestimated or costs are underestimated.

Although M&As may arise from both value-maximising and non-value-maximising motives, on balance we argue that M&As are likely to create value for targets and acquirers. Insurance is a competitive industry, and it is unlikely that firms with predominantly non-value-maximising behaviour will succeed or survive in the long run. In addition, the prior literature provides evidence that M&As are associated with efficiency gains in both life and P-C insurance.Footnote 31 Accordingly, we specify the following hypotheses:

H1:

-

Mergers and acquisitions are value-creating for acquirers.

H2:

-

Mergers and acquisitions are value-creating for targets.

Cross-border vs domestic M&As

Deregulation also provides a potential motive for M&A transactions.Footnote 32 The European insurance industry traditionally was subject to stringent regulationFootnote 33; and a separate market existed in every European country. Competitive intensity was generally low, with minimal price and product competition.Footnote 34 Cross-border transactions were rare, except for reinsurance and some commercial coverages. The EU’s third generation Insurance Directives represented a major step in creating conditions in the EU resembling those in a single deregulated national market.Footnote 35

As mentioned, deregulation in many other countries, including Australia, Japan, the Netherlands and, to a lesser extent, the U.K., also provided an impetus for M&As.Footnote 36 U.S. insurers are motivated to conduct M&A transactions both domestically and internationally and have never faced major U.S. regulatory impediments to this type of activity within the insurance industry. Cross-industry mergers in the U.S. became possible following the passage of the Gramm–Leach–Bliley Act in 1999.

Expanding into other national markets by acquiring firms located in those markets is likely to be more effective than creating start-up firms because local firms have superior knowledge of the language, culture and legal systems of their home countries. Local firms also already possess the requisite physical, human and technological resources necessary to conduct their operations. Cross-border acquisitions are likely to be particularly effective in achieving diversification gains for both acquirers and targets because the correlations of insurance underwriting returns between the cross-border target and the acquiring firm are likely to be lower than those with potential targets in the acquirer’s home country. M&As also may provide a more cost-effective means to achieve diversification than buying reinsurance, which tends to have high expense and profit loadings. Thus, expanding geographically through M&As is expected to be value-creating, suggesting the following hypotheses:

H3:

-

Cross-border transactions are value-creating for acquirers.

H4:

-

Cross-border transactions are value-creating for targets.

Focusing vs diversifying M&As

According to the conglomeration hypothesis, economies of scope provide another potential rationale for M&As.Footnote 37 Scope economies can be present for costs, revenues and for profits. If cost (revenue) economies of scope are present, the cost of producing two outputs jointly in a single firm will be lower (higher) than if the outputs were produced by two separate firms. Cost economies of scope generally arise from the joint use of inputs such as managerial expertise, customer lists and brand names. Revenue economies of scope are said to arise due to reductions in consumer search costs and improvements in service quality from the joint provision of related products such as life insurance and auto insurance. This is the “one-stop shopping” argument often utilised to justify financial sector mergers.

Many of the arguments supporting the conglomeration hypothesis have been called into question in the literature, where proponents of the strategic focus hypothesis argue that firms can maximise value by focusing on core businesses and core competencies. A fundamental argument is that conglomeration exacerbates managerial incentive conflicts and agency costs by increasing the span of control, motivating central managers to add divisions to protect their human capital, and providing more opportunities for the misalignment of incentives between central and divisional managers.Footnote 38 Conglomeration also can lead to inefficient investment decisions by providing additional free cash flow or unused debt capacity.Footnote 39,Footnote 40 Internal capital markets also may be less efficient than external capital markets, leading to value-destroying cross-subsidisation among divisions.Footnote 41

There is some empirical evidence for the existence of scope economies between life and P-C insurance, although findings suggest that economies may exist only for specific types of producers and products.37 More recent research provides evidence of diseconomies of scope in the U.S. insurance industry.Footnote 42 Moreover, DelongFootnote 43 finds that activity focusing bank mergers in the U.S. create value but that diversifying mergers do not. On balance, these arguments suggest the following hypotheses regarding focusing M&A transactions, defined as transactions within the same industry segment:

H5:

-

Focusing M&As are more likely to create value for acquirers than diversifying M&As.

H6:

-

Focusing M&As are more likely to create value for targets than diversifying M&As.

Transactions and market value gains by country

It is also possible to develop some predictions about differentials in numbers of transactions and market value gains by country. In general, the number of transactions is likely to be larger in countries that have large insurance markets with numerous companies. Thus, the number of transactions is expected to be large in the U.S., the U.K. and in continental Europe but is predicted to be much smaller in Asia and Australia. Having a strong and well-developed market-based financial sector is also likely to be correlated with the number of transactions, again predicting relatively large numbers in the U.S. and the EU. Although Japan, Korea and Taiwan have well-developed financial sectors, the relatively small numbers of financial institutions in those countries is likely to limit the number of transactions.

There also are likely to be differences among countries in the market value gains from M&A transactions. In countries that already have high insurance penetration (premiums as percentage of gross domestic product (GDP)) and insurance density (premiums per capita), gains from M&As may be relatively high because acquisitions provide a mechanism to expand the insurer’s pool of business more effectively than through organic growth. Total life and non-life insurance premiums are 7.4 per cent of GDP in North America, 7.9 per cent in Western Europe, 11.6 per cent in advanced Asian markets,Footnote 44 and only 3.0 per cent in emerging Asia.Footnote 45 Insurance density (premiums per capita) is highest in North America and advanced Asian markets and somewhat lower in Europe. Premiums per capita are low in emerging Asian markets. Hence, we would expect M&A gains to be largest in well-developed insurance markets.

Certain regulations may limit gains from M&As, for example, regulations about privacy and the sharing of consumer information may impact the efficacy of M&A strategies. Such restrictions are relatively weak in the U.S. For example, while the Gramm–Leach–Bliley Act requires financial institutions to inform customers of their policies towards sharing information among affiliates, it imposes no restrictions on such information-sharing.Footnote 46 The 1995 EU Data Protection Directive is more restrictive, and various EU countries have gone even further in regulating the sharing of data.Footnote 47 In Asia, there is no coherent approach but most countries are far behind in implementing data protection.Footnote 48 The presence of cultural and language barriers within the EU are also likely to reduce gains from M&As in comparison with U.S. domestic transactions. This discussion suggests the following hypothesis:

H7:

-

The gains from M&A transactions are larger for transactions where at least one merger partner is headquartered in the U.S.

Methodology and sample selection

Data and sample selection

The data on M&A transactions was obtained from the Thomson Financial SDC database. In selecting the sample, we capture all change in control transactions during the sample period 1990–2006 where either the acquirer or target was an insurance company. A change in control transaction is defined as an acquisition that increases the stake of the acquiring institution from less than 50 to 50 per cent or more of the ownership shares of the target institution.Footnote 49 We decided to use the universe of transactions rather than a sample because the statistical power of our tests will be improved with a larger sample size. The sample period was selected to bracket the introduction of the EU’s third generation Insurance Directives and other deregulatory measures around the world in other countries such as Australia, Japan and the Netherlands. Insurance companies were defined as all firms with four-digit Standard Industrial Classification (SIC) codes in the insurance industry.Footnote 50 The stock price data for the event study is obtained from the Thomson Datastream database.

Because either the target or the acquirer (not both) had to be an insurer, transactions are included in the sample where insurers are acquired by non-insurance firms such as banks, other financial firms and industrials, and where insurance firms acquire non-insurers, as well as within the insurance industry (insurer-to-insurer) transactions. Countries were included in the study if they have well-developed insurance markets or have significant developing insurance markets. The countries included in the study are listed in Table 1.

Event study methodology

The standard market model event study methodology is used.Footnote 51 The analysis involves computing the returns for each of the transactions in our sample using stock price data. For each transaction included in the study, the event study methodology computes the abnormal return associated with a specified event, controlling for the predicted return on the stock on the same day. The predicted return is computed using the market model. The market model is estimated for each of our companies based on the security’s returns over the 250 trading-day period ending 30 days prior to the event date.

Using the parameters estimated from this market model and the movement of the market index during the event period, we compute the expected return on each stock during each day of the event window. The daily unexpected or abnormal return (AR) for each security is obtained by subtracting the expected return from the actual return on each day. We utilise several event windows for the study, extending a maximum of 15 days before and after the event date. The notation for an event window extending m days prior to the event date and p days following the event date is (−m, +p), with the event date as day 0. The mean cumulative abnormal return is expected to be zero in the absence of abnormal performance.

As is customary in the event study literature, we present the results of more than one test of the significance of our CAARs. Specifically, we conduct three significance tests—the Patell Z score, the standardised cross-sectional Z score (SCS-Z) and the generalised sign Z score.Footnote 52 The Patell Z is the standard event study parametric test statistic, often referred to as a test that assumes cross-sectional independence. The SCS-Z generalises the Patell test by controlling for event-induced increases in variance. The SCS-Z test also has desirable properties when clustering exists in the sample. The generalised sign Z is a non-parametric test statistic that does not require as stringent assumptions about return distributions as the two parametric tests and also controls for possible asymmetries in return distributions.

Empirical results

This section reports the empirical analysis. First, subsection “Insurance M&As: Deals and deal volume” describes the data in more detail. Then, subsection “Event study results” presents the results of the event study analysis.

Insurance M&As: deals and deal volume

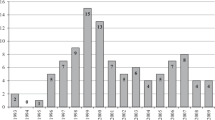

The number of deals and deal volume by year are shown in Figure 1. The number of deals is shown as columns plotted on the left axis, and the deal volume in millions of USD is plotted on the right axis. The deals shown in the figure are change in control transactions. There are at least 150 deals in each year of the sample period with a total of 4,068 deals over the entire sample period. The number of deals peaked during the late 1990s with more than 300 transactions taking place each year from 1996 to 2000. Deal volume exceeded USD120bn per year from 1997 to 2001 and exceeded USD100bn in 2003, 2005 and 2006. Total deal value for the entire period covered by the study is more than USD1.3tn. In proceeding with the study, the sample size was reduced considerably because of the necessity of having Datastream stock price data for the firms included in the event study.Footnote 53

The number of deals and deal value by country are shown in Table 2. The number of deals is shown in Panel A of Table 2 and the deal value is shown in Panel B. Acquiring countries are shown as rows in the table, while targets are shown in columns. Only the largest 13 countries are shown; M&A transactions in other countries are classified under “other”. As expected, the largest number of transactions in terms of targets was within North America (1,200), 1,073 in the U.S. and 127 in Canada. The U.S. thus accounts for 54.5 per cent of all transactions and North America for 61.0 per cent. The next largest number, 668, involved European targets, with the largest number of targets in the U.K. (278) and France (75). Thirty-two transactions involved Bermuda targets, and there were only 57 target transactions in Asia.Footnote 54 Overall, there were 1,968 total transactions. There were 1,628 within-border and 340 cross-border transactions (17.3 per cent cross-border). For the cross-border transactions, the vast majority were intra-region (e.g. within Europe, North America, or Asia-Pacific) rather than cross-region. This makes sense if firms conduct most of their cross-border activities in regions with which they are most familiar.Footnote 55

Table 2, Panel B shows the value of deals in millions of U.S. dollars by country of the acquirers and targets. Overall, total deal value amounted to USD 729.7bn for the sample period, an average of USD 42.9bn per year. The U.S. dominates with 52.6 per cent of total worldwide deal value, measured by target transactions,Footnote 56 followed by the U.K. (12.8 per cent), Switzerland (9.6 per cent) and the Netherlands (5.0 per cent). Others with significant deal volume include France, Belgium and Italy. Cross-border deals dominate in Australia, Bermuda, Germany, the Netherlands and Switzerland. Overall, 78.5 per cent of the deal volume (USD572.9bn) represented within-border transactions.

Panel C of Table 2 shows the average deal value by country. The largest average deal value is for U.K. acquisitions of Swiss firms. Other relatively large average deal values are for U.S. acquisitions of firms from Belgium, Germany and the Netherlands, and for French acquisitions of German firms. Not surprisingly, the largest average deals involve transactions in large, highly developed economies.

Table 3 reports on M&A deals broken down by industry type; where either the acquirer or takeover target must be an insurance firm. Panel A reports the results by number of deals; Panel B reports results by deal value. Table 3 shows that 70.0 per cent of transactions and 65.3 per cent of deal volume were cross-industry, where each segment of the insurance industry is considered as a separate industry. However, when the four segments of the insurance industry are considered to be a single industry, then 45.1 per cent of transactions (41.0 per cent of volume) represent cross-industry deals. Under either definition, there is considerable cross-industry M&A activity during the sample period, evidence of financial sector convergence.

Table 3 also reveals that 39.2 per cent of all deals by number and 55.2 per cent by value involve life insurance targets, and 36.0 per cent by number and 44.8 per cent by deal value involve life insurance acquirers. Interestingly, 9.4 per cent of all deals by number and 9.7 per cent of deals by volume involve insurers acquiring commercial banks. Conversely, 16.9 per cent of deals by volume involve commercial banks acquiring life insurers, although these deals account for only 1.4 per cent of deals by number. Thus, banks tended to acquire relatively large life insurers. The average deal sizes by industry are shown in Panel C of Table 3. The largest average deal sizes are for commercial bank acquisitions of life insurers and property-casualty insurer acquisitions of other types of insurers.

Several transactions provide examples of the breaking down of traditional firewalls in financial markets. The largest such transaction during our sample period was the merger of the insurer Travelers Group with the banking institution Citicorp in 1998 to form Citigroup, a transaction that was legalised retrospectively through the passage of the Gramm–Leach–BlileyFootnote 57 Act in 1999. A large transaction involving previously separate parts of the insurance industry was CGU’s takeover of Norwich Union in 2000 to form Aviva. At the time of the merger, CGU was the U.K.’s largest composite insurance group, and Norwich Union was the second largest life insurer. The combined group became the U.K.’s largest general insurer, also offering life insurance, pensions and investments. Following Dutch deregulation permitting the merger of banks and insurers in 1990, the Dutch insurance company Nationale-Nederlanden merged with the Dutch banking institution NMB Postbank to form Internationale Nederlanden Group (ING).

The largest transactions occurred in the life insurance sector. The most active firm in terms of deal volume is Travelers, which engaged in more than USD81bn in M&A transactions over the period. Also very active in deal volume were Aviva (USD29bn) and AXA (USD22bn). The most active firms in terms of numbers of transactions are Aon with 20 transactions and Aviva with 19. Swiss Re was also quite active, with 18 transactions totalling USD16.5bn.

Event study results

The first stage in the event study analysis was to match SDC transactions with Thomson Datastream codes in order to capture the Thomson Datastream data on M&As for traded insurers in the overall SDC sample. With some loss of data due to incomplete stock return information, the sample for the event study consists of 1,790 acquirers and 309 targets. This section analyses the event study results by investigating several event windows, with the discussion emphasising the (−1, +1), (−2, +2) and (−5, +5) results.Footnote 58 To test Hypotheses 3–6, the results also are broken down in terms of cross-border vs within-border transactions and cross vs within-industry transactions. The country/regional analysis focuses on Europe, Asia and the U.S.

Overall results: acquirers and targets

Hypotheses 1 and 2 state that M&A transactions are value-increasing for both acquirers and targets. The overall event study results in Table 4 provide evidence on these two hypotheses. The results show small and statistically significant value gains for acquirers in the (−1, +1) and (−2, +2) windows and small significant gains (by one of three tests) in the (−5, +5) window. The gain in the (−1, +1) window is 0.52 per cent.Footnote 59 Thus, unlike Cummins and Weiss16 and consistent with Hypothesis 1, we find evidence of market value gains for acquirers in the insurance industry. This result is consistent with Akhigbe and Madura’sFootnote 60 earlier findings for U.S. M&As.

The target results in Table 4 provide support for Hypothesis 2. Consistent with both Cummins and Weiss16 and Akhigbe and Madura,13 we find substantial market value gains for M&A targets. The gains are statistically significant at the 1 per cent level or better.Footnote 61 For example, the mean cumulative abnormal returns for the (−1, +1), (−2, +2) and (−5, +5) windows are 10.8, 11.5 and 12.3 per cent, respectively.Footnote 62 Hence, for deals where one party to the transaction is an insurer, M&As are value-creating for both acquirers and targets, with targets showing particularly large market value effects. The magnitude of the gains for targets in our study is consistent with Cummins and Weiss’s16 findings for European insurers.

Results: country/regional analysis

We next analyse the overall results by specific country/region. After detailed preliminary analysis, we decided to focus the analysis on the U.S., Europe (including the U.K.) and Asia (including Pacific rim countries such as Australia and New Zealand). The geographically decomposed results for acquirers are shown in Table 5.Footnote 63 Table 5 results show that the overall results are strongly driven by the U.S., not surprisingly, given that U.S. acquirers constitute a substantial component of the overall sample. Table 5 shows significant market value gains for U.S. acquirers of 0.43 and 0.53 per cent for the (−1, +1) and (−2, +2) windows, respectively. The market value gain for European acquirers is similar for the (−1, +1) window (0.50 per cent) but is smaller for the (−2, +2) window (0.29 per cent). Because the results for Asia generally show no significant gains for acquirers, the table of Asian acquirer results is not included in the paper to conserve space. The insignificant results for Asian acquirers may be partly due to the small sample size in Asia but also could imply that Asian M&As are value-neutral for acquirers. Thus, the results for the U.S. and Europe support Hypothesis 1, that is, M&As create value for acquirers on average. Hypothesis 1 is not supported for Asian transactions.

The results of significance tests for differences in mean CAARs between U.S. and European transactions are presented in the last column of Panel B of Table 5. The tests are mostly insignificant, with two significant results showing slightly larger gains for U.S. transactions. Thus, the results provide only weak support for Hypothesis 7 that M&A gains are larger where at least one merger partner is headquartered in the U.S.

Table 6 provides the results for targets for our selected country/regions. There are two primary conclusions based on Table 6: (1) There are significant market value gains for targets in the U.S., Europe and Asia. This provides further support for Hypothesis 2 and shows that the target results are not driven solely by the U.S. (2) The market value gains for targets are substantially larger in the U.S. than they are for Europe or Asia. For example, the market value gain for targets in the (−2, +2) window is 8.8 per cent for Asia (including Japan), 7.4 per cent for Europe (including the U.K.), and 16.8 per cent for the U.S. Significance tests for differences in mean CAARs between U.S. and European transactions and between U.S. and Asian transactions are shown in the last two columns of Panel B of Table 6. The tests show that the U.S. mean CAARs are significantly larger than the European CAARs for all windows tested and likewise for the Asian comparisons. Tests for differences in mean CAARs between European and Asian transactions (Panel C) are sometimes significant but are not consistently higher or lower for Europe or Asia. Thus, the gains are clearly largest for the U.S., supporting Hypothesis 7 and providing evidence that the U.S. is a more fertile environment for M&As than Europe or Asia in terms of market value gains.

Results: cross-border vs within-border transactions

To provide evidence on Hypothesis 3, that cross-border M&As create value for acquirers, Table 7 breaks down the overall acquirers’ results into cross-border (Panel A) and within-border (domestic) transactions (Panel B). The results for cross-border transactions (Panel A) are positive and statistically significant for several windows. For example, for the (−1, +1) and (−2, +2) windows the average market value gains are 0.46 and 0.74 per cent, respectively. For the domestic transactions, that is, focusing on windows that include returns pre- and post-event-day, there are small market value gains for acquirers in the (−1, +1) and (−2, +2) windows, but there are weakly significant negative returns for the (−10, +10) window (not shown). Hence, the results support Hypothesis 3 for cross-border acquisitions; but, for domestic transactions, the evidence is conflicting and Hypothesis 3 is not clearly supported.

Table 8 reports the equivalent cross-border and within-border (domestic) transaction results for targets. In both cases, the CAARs are large, positive and statistically significant for nearly all windows shown. For example, for the (−1, +1) and (−5, +5) windows, the gains are 10.6 and 11.5 per cent for cross-border transactions and 10.9 and 12.6 per cent for domestic transactions, respectively. The results support Hypothesis 4—cross-border transactions are value-creating for targets. Significance tests for differences in mean CAARs between cross-border and domestic transactions are shown in the last column of Panel B of Table 8. Except for two (−x, 0) windows, the test results are not statistically significant. Hence, cross-border and within-border transactions appear to generate comparable market value gains for targets. This provides evidence of convergence of insurance markets involved in these transactions, suggesting that firms entering non-home markets through M&As are generally not at a disadvantage.

Results: cross- and within-industry analysis

This section discusses the results for cross-industry and within-industry M&A transactions. This enables us to provide information on Hypotheses 5 and 6, that focusing M&As are more likely to create value for acquirers and targets, respectively, than diversifying M&As.

We first consider the results for acquirers. Table 9 shows the acquirer CAARs for the case where both the acquirer and target are insurance companies (Panel A) and where the acquirer is an insurance company but the target is from some other industry (any industry except insurance company or insurance agent/broker) (Panel B). The results provide support for Hypothesis 5, that focusing transactions are more likely to create value for acquirers than diversifying transactions. The CAARs for the (−1, +1) and (−2, +2) windows are 0.66 and 0.48 per cent, respectively, for transactions where the acquirer and target are both insurers. Both CAARs are statistically significant by at least two significance tests. By contrast, when the acquirer is an insurer and the target is not, the (−1, +1) CAAR is negative and statistically insignificant, and the (−2, +2) CAAR is positive but only weakly significant by one significance test and insignificant by the other two tests. Thus, the results in Panels A and B of Table 9 support Hypothesis 5. Acquiring insurance companies thus should be very sceptical of cross-industry acquisitions.

Table 10 shows the within- and cross-industry results for targets. Panel A shows results for targets where both the acquirer and target are insurers, and Panel B shows results where the acquirer is an insurer but the target is from some other industry. There are two conclusions from Table 10: (1) Both insurance and non-insurance targets realise substantial market value gains from being involved in M&A transactions. For example, the (−2, +2) CAAR is 14.3 per cent for insurance targets and 11.3 per cent for non-insurance targets, both of which are statistically significant at the 0.1 per cent level. (2) The market value gains are higher for insurance targets than for non-insurance targets. For example, the (−5, +5) CAAR is 15.3 per cent for insurance targets and 11.0 per cent for non-insurance targets. Significance tests for differences in mean CAARs between insurance targets and non-insurance targets, shown in the last column of Panel B, are all highly significant except for the (−x, 0) windows. The results overall support Hypothesis 6—market value gains are larger for insurance targets than for non-insurance targets, that is, focusing transactions create more value for targets than diversifying transactions. This provides further evidence supporting the strategic focus hypothesis for the insurance industry.

Conclusions

This paper presents an empirical analysis of M&A transactions in the international insurance sector. The M&A transactions included in the study are those where either the acquirer or the target is in the insurance industry. We examine change in control transactions reported in the Thomson SDC Platinum database for which stock return data exists in the Thomson Datastream global stock price database. We examine the effect of M&A transactions on both acquiring and target firms by analysing how the stock prices of the relevant entities performed relative to the overall market during the period immediately pre- and post-announcement, over various event windows. The analysis extends across the global insurance market and breaks down the results by country/region, by cross-border vs within-country transactions and by whether the transaction was within- or cross-industry (i.e. focusing or diversifying).

The findings of the event study analysis can be summarised as follows:

-

There were a substantial number and volume of M&A deals involving insurance firms during our sample period (1990–2006). Considering all deals, there were 4,068 deals with a total deal value of more than USD1.3tn. Approximately 45 per cent of deals (41 per cent of deal volume) were cross-industry, meaning that the acquirer was from the insurance industry and the target was from some other industry.

-

Focusing on change in control deals, the largest number of deals in terms of targets was in the U.S. (1,073 deals), and the next largest number (668) involved European targets. There were only 57 target transactions in Asia. The high number of deals in the U.S. and Europe supports the argument that M&As are more likely in markets with high insurance penetration. The relatively small number of deals in advanced Asian markets, which also have high insurance penetration, is due to other factors such as a small number of insurers.

-

Based on the overall results, there are small and statistically significant gains for acquirers in the (−1, +1) and (−2, +2) windows. There are large and highly significant gains for targets based on the overall sample. The finding of small positive gains for acquirers is consistent with prior insurance research for the U.S.13 but not consistent with prior literature showing that European M&As are value neutral for acquirers.16 The finding of large positive gains for M&A targets is consistent with Akhigbe and Madura13 and Cummins and Weiss.16

-

Breaking the results out by country/region, we find small significant market value gains for acquirers in the U.S. and Europe but not in Asia. We find significant market value gains for targets in the U.S., Europe and Asia. The gains for targets are larger in the U.S. than they are in Europe or Asia. Thus, the U.S. was a particularly fertile environment for M&As during our sample period, but targets achieved market value gains globally.

-

Breaking down the results into cross-border and within-border (domestic) transactions, we find small positive gains in the shortest windows for acquirers and substantial gains for targets in both cross-border and within-border transactions. The gains are similar in magnitude for the cross-border and within-border transactions, suggesting cross-border deals do not create competitive or efficiency disadvantages.

-

We also compare M&A transactions within the insurance industry with transactions where the acquirer is in the insurance industry and the target is in some other industry. The results show that acquirers realise small market value gains from within-industry transactions but that cross-industry gains are either value-neutral or lead to market value losses for acquirers. There are large and significant market value gains for targets in both within- and cross-industry transactions, but the gains are larger for within-industry deals. Hence, the results provide further support for the strategic focus hypothesis—focusing deals are more likely to create value than diversifying deals.

Further research is needed to identify the longer-term effects of M&A transactions, to investigate the impact of the recent financial crisis on the global insurance M&A market generally, and to incorporate some information concerning the level of disclosure, regulation and corporate governance effectiveness in the period surrounding M&A deals. Further analysis of cross-border transactions based on more detailed data would also be valuable to investigate the driving factors motivating cross-border transactions. A more detailed analysis of the characteristics of targets and acquirers in general, such as their size and financial ratings, also would be important to help to elucidate the motivations for M&As. It would also be useful to analyse the efficiency effects of global insurance M&As, similar to the U.S. analysis by Cummins and Xie.15

Notes

Swiss Re (1996); Group of 10 (2001).

Deregulation measures in specific countries are traced in Swiss Re (1996) for Europe and Group of 10 (2001) for developed insurance markets worldwide. Besides the EU’s third generation Directives, there were several specific law changes in individual European countries. Japan introduced the “Big Bang” deregulatory policy in 1996, and Australia gradually deregulated financial services, with major changes in 1984, 1992 and 1997. The U.K. introduced the “Big Bang” reform of the London Stock Exchange in 1986 and other reforms in the 1980s and 1990s gradually permitting universal banking. For further details and specifics on other countries, see Group of 10 (2001).

As in Group of 10 (2001), most of the M&A transactions in our sample involve a U.S. acquirer or target insurer.

Consolidation during the decade of the 1990s is analysed in Group of 10 (2001). The report analyses financial sector consolidation in the 11 G10 countries plus Spain and Australia, but does not conduct market value analysis of the effects of M&As. Our results are consistent with the G10 report for the years when our sample periods overlap, not surprisingly, given that the G10 also used the Thomson Financial SDC database as their data source for M&As.

For example, Dobbs et al. (2007); Asimakopoulos and Athanasoglou (2013).

This literature is reviewed in more detail below (see the subsection “Literature review”).

Another M&A study that considers banks and insurers is Focarelli and Pozzolo (2008). They do not study valuation effects of M&As but rather seek to identify the determinants of cross-border M&As.

For example, Berger et al. (2001).

For example, Shleifer and Vishny (1988).

Regulation affected prices, contractual provisions, the establishment of branches, solvency standards and other aspects of insurance operations.

The diversification discount literature also casts doubt on the conglomeration hypothesis. This literature shows that diversified firms have lower values than their subsidiaries taken independently (e.g. Berger and Ofek, 1995; Comment and Jarrell, 1995).

Advanced Asian markets include Hong Kong, Japan, South Korea, Taiwan and Singapore.

Jentzsch (2007, p. 120).

The first pass through the SDC database produced a substantial number of transactions involving minority stakes. We decided to exclude the minority stake transactions and analyse only the change in control transactions. This decision was made both to focus on the transactions most likely to create value and to be consistent with the prior literature (e.g. Cybo-Ottone and Murgia, 2000; Delong, 2001; Cummins and Weiss, 2004).

The SICs included in the study are 6311, life insurance; 6321, accident & health insurance; 6331, fire, marine & casualty insurance; 6399, insurance companies NEC; and 6411, insurance agents, brokers, & service.

For further discussion of the significance tests, see Cowan (2002) and MacKinlay (1997).

Some observations also were lost because the region of the target or acquirer is not reported.

As discussed above, even in the developed Asian markets, the number of companies is much smaller than in Europe and the U.S., providing fewer potential targets for M&A transactions.

This and other trade theory arguments about M&As are discussed in Focarelli and Pozzolo (2008).

To provide some perspective, we compare the average deal value per year for the U.S. with the total book capitalisation of the U.S. life and property-casualty insurance industries in 1998, the approximate mid-point of our sample period. Total insurance industry book capitalisation was USD503.1bn in 1998, and the average deal value for U.S. targets per year was USD22.7bn. Therefore, the average deal value per year was about 4.5 per cent of insurer equity capital. The data on book capitalisation of U.S. insurers is from the Federal Reserve Flow of Funds Accounts.

At the time, the Travelers-Citicorp deal was viewed as the prototype of bank-insurance integration. However, the deal did not work out particularly well. In August 2002, Citigroup spun off the P-C division of Travelers, which was later merged with St. Paul Companies. Travelers was viewed by Citigroup as a drag on its stock price due to the cyclical nature of property-casualty insurance business and its exposure to catastrophes such as the 2001 World Trade Center terrorist attacks. In January 2005, Citigroup sold its Travelers life insurance and annuity business to MetLife. The deal included an agreement that allowed MetLife to distribute its products through Citigroup offices worldwide. This is a typical bank-insurance arrangement in the U.S., where banks distribute private-label branded insurance and annuity products underwritten (manufactured) by insurance companies that the banks do not own, that is, banks tend to be distributors rather than underwriters of insurance. For further discussion, see Staikouras (2009).

Originally, the event study tables also covered longer event windows: (−10, +10), (−15, +15), (−10, 0), (−15, 0), (0, +10) and (0, +15). These windows were removed at the recommendation of a referee in order to shorten the paper. The results in the wider windows generally support the same conclusions as the windows shown in the paper.

Putting the approximately 0.5 per cent gain in perspective, multiplying 0.005 by the total deal value of USD729.7bn amounts to USD3.6bn. We leave the reader to gauge the economic significance of this amount.

Based on results not shown in the paper due to space limitations, the results by year reveal significant gains by targets in all years and significant gains by acquirers in most years. There is no particular pattern by year.

We consider the target market value gains to be clearly economically significant, in that 10 per cent of the total deal value equals USD73.0bn billion.

Breaking down Europe by country or analysing the U.K. separate from continental Europe produced similar results. In Asia, the number of observations in specific countries is not sufficient to do a meaningful analysis.

References

Akhigbe, A. and Madura, J. (2001) ‘Intra-industry signals resulting from insurance company mergers’, The Journal of Risk and Insurance 68 (3): 489–506.

Amihud, Y., DeLong, G.L. and Saunders, A. (2002) ‘The effects of cross-border bank mergers on bank risk and value’, Journal of International Money and Finance 21 (6): 857–877.

Asimakopoulos, I. and Athanasoglou, P.P. (2013) ‘Revisiting the merger and acquisition performance of European banks’, International Review of Financial Analysis 29 (September): 237–249.

Berger, A.N., Cummins, J.D., Weiss, M.A. and Zi, H. (2000) ‘Conglomeration versus strategic focus: Evidence from the insurance industry’, Journal of Financial Intermediation 9 (4): 323–362.

Berger, A.N., DeYoung, R. and Udell, G.F. (2001) ‘Efficiency barriers to the consolidation of the European financial services industry’, European Financial Management 7 (1): 117–130.

Berger, P.G. and Ofek, E. (1995) ‘Diversification’s effect on firm value’, Journal of Financial Economics 37 (1): 39–65.

Boubakri, N., Dionne, G. and Triki, T. (2008) ‘Consolidation and value creating in the insurance industry: The role of governance’, Journal of Banking and Finance 32 (1): 56–68.

Buch, C.M. and DeLong, G. (2004) ‘Cross-border bank mergers: What lures the rare animal?’ Journal of Banking and Finance 28 (9): 2077–2102.

Cate, F.H. (2000) Personal information in financial services: The value of a balanced flow, working paper, Washington, DC: Financial Services Coordinating Council.

Chen, Z. and Tan, J. (2011) ‘Does bancassurance add value for banks?—Evidence from mergers and acquisitions between European banks and insurance companies’, Research in International Business and Finance 25 (1): 104–112.

Comment, R. and Jarrell, G.A. (1995) ‘Corporate focus and stock returns’, Journal of Financial Economics 37 (1): 67–87.

Cowan, A.R. (2002) Eventus: User’s Guide, Ames, IA: Cowan Research.

Cummins, J.D., Tennyson, S. and Weiss, M.A. (1999) ‘Consolidation and efficiency in the U.S. property-liability insurance industry: Productivity and efficiency effects’, Journal of Banking and Finance 23 (2–4): 325–357.

Cummins, J.D. and Weiss, M.A. (2004) Consolidation in the European insurance industry: Do mergers and acquisitions create value for shareholders, in Brookings-Wharton Papers on Financial Services 2004, Washington, DC: Brookings Institution Press, pp. 217–258.

Cummins, J.D., Weiss, M.A., Xie, X. and Zi, H. (2010) ‘Economies of scope in financial services: A DEA efficiency analysis of the U.S. Insurance industry’, Journal of Banking and Finance 34 (7): 1525–1539.

Cummins, J.D. and Xie, X. (2008) ‘Mergers and acquisitions in the U.S. property-liability insurance industry: Productivity and efficiency effects’, Journal of Banking and Finance 32 (1): 30–55.

Cummins, J.D. and Xie, X. (2009) ‘Market values and efficiency in US insurer acquisitions and divestitures’, Managerial Finance 35 (2): 128–155.

Cybo-Ottone, A. and Murgia, M. (2000) ‘Mergers and shareholder wealth in European banking’, Journal of Banking and Finance 24 (6): 831–859.

Dekle, R. (1998) ‘The Japanese ‘Big Bang’ financial reforms and market implications’, Journal of Asian Economics 9 (2): 237–249.

Delong, G. (2001) ‘Stockholder gains from focusing versus diversifying bank mergers’, Journal of Financial Economics 59 (2): 221–252.

Dobbs, R., Goedhart, M. and Suonio, H. (2007) ‘Are companies getting better at M&A?’ McKinsey on Finance 22 (Winter): 7–11.

Fields, L.P., Fraser, D.R. and Kolari, J.W. (2007a) ‘Bidder returns in bancassurance mergers: Is there evidence of synergy?’ Journal of Banking and Finance 31 (12): 3646–3662.

Fields, L.P., Fraser, D.R. and Kolari, J.W. (2007b) ‘Is bancassurance a viable model for financial firms?’ The Journal of Risk and Insurance 74 (4): 777–794.

Focarelli, D. and Pozzolo, A. (2008) ‘Cross-border M&As in the financial sector: Is banking different from insurance?’ Journal of Banking and Finance 32 (1): 15–29.

Group of 10 (2001) Report on Consolidation in the Financial Sector, Basel, Switzerland: Bank for International Settlements.

Honda, E. (2003) ‘Financial deregulation in Japan’, Japan and the World Economy 15 (1): 135–140.

Jensen, M. (1986) ‘Agency cost of free cash flow, corporate finance, and takeovers’, American Economic Review 76 (2): 323–329.

Jentzsch, N. (2007) Financial Privacy: An International Comparison of Credit Reporting Systems, 2nd edn, Berlin: Springer-Verlag.

MacKinlay, A.C. (1997) ‘Event studies in economics and finance’, The Journal of Economic Literature 35 (1): 13–39.

Myers, S.C. and Majluf, N.S. (1984) ‘Corporate financing and investment decisions when firms have information that investors do not have’, Journal of Financial Economics 13 (2): 187–221.

Neale, F.R. and Peterson, P.P. (2005) ‘The effect of the gramm-Leach-bliley act on the insurance industry’, Journal of Economics and Business 57 (4): 317–338.

Powell, L.S., Sommer, D.W. and Eckles, D.L. (2008) ‘The role of internal capital markets in financial intermediaries: Evidence from insurer groups’, Journal of Risk and Insurance 76 (2): 439–461.

Roll, R. (1986) ‘The hubris hypothesis of corporate takeovers’, Journal of Business 59 (2): 197–216.

Scharfstein, D. and Stein, J. (2000) ‘The dark side of internal capital markets: Divisional rent-seeking and inefficient investment’, Journal of Finance 55 (6): 2537–67.

Shleifer, A. and Vishny, R.W. (1988) ‘Value maximization and the acquisition process’, Journal of Economic Perspectives 2 (1): 7–20.

Staikouras, S.K. (2009) ‘An event study analysis of international ventures between banks and insurance firms’, Journal of International Financial Markets, Institutions & Money 19 (4): 675–691.

Swiss Re (1996) Deregulation and Liberalization of Market Access: The European Insurance Industry on the Threshold of a New Era in Competition, Sigma No. 7/1996, Zurich, Switzerland: Swiss Reinsurance Company Ltd.

Swiss Re (2000) Europe in Focus: Non-Life Markets Undergoing Structural Change, Sigma No. 3/2000, Zurich, Switzerland: Swiss Reinsurance Company Ltd.

Swiss Re (2014) World Insurance in 2013: Steering Towards Recovery, Sigma No. 3/2014, Zurich, Switzerland: Swiss Reinsurance Company Ltd.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Cummins, J., Klumpes, P. & Weiss, M. Mergers and Acquisitions in the Global Insurance Industry: Valuation Effects. Geneva Pap Risk Insur Issues Pract 40, 444–473 (2015). https://doi.org/10.1057/gpp.2015.18

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/gpp.2015.18