Abstract

This research analyzes the success of mergers and acquisitions (M&A) for European acquiring insurers using a stock market perspective. In contrast to previous papers that use an event study approach, our analysis is based on the stochastic dominance methodology, in which we analyze short and long term capital market reactions following an M&A announcement. In addition, we examine firm- and transaction-specific determinants associated with superior M&A success. Using a sample of 102 European insurance M&A transactions over the period 1993–2009, our results indicate that acquiring insurers are second-order dominated by their benchmark portfolio in the short term. In the long run, we find no evidence of stochastic dominance compared to their non-acquiring counterparts. Moreover, we find that geographically diversifying acquirers are rewarded by the market, and that transactions in which the acquirer and target have a business relationship before the M&A announcement outperform transactions without pre-M&A participation in the short-term. Finally, we detect a positive relationship between cash payment and acquirers’ M&A success.

Zusammenfassung

Wir analysieren die Auswirkungen von Mergers and Acquisitions (M&As) auf akquirierende europäische Versicherungsunternehmen aus einer Kapitalmarktperspektive. Im Gegensatz zu bisherigen Studien, welche ausschließlich auf der Methodik der Ereignisstudien basieren, verwenden wir das Kriterium der stochastischen Dominanz, um die kurz- und langfristige Aktienkursreaktion im Anschluss an die Verkündung von M&A-Transaktionen zu untersuchen. Zusätzlich analysieren wir firmen- und transaktionsspezifische Charakteristika, welche die Auswirkungen von M&As beeinflussen. Unser Datensatz umfasst 102 M&A-Transaktionen getätigt durch europäische Versicherungsunternehmen in den Jahren 1993 bis 2009. Unsere Ergebnisse belegen, dass Portfolios aus akquirierenden Versicherern von ihren Benchmarkportfolios kurzfristig dominiert werden (stochastische Dominanz zweiter Ordnung). Langfristig finden wir hingegen keine Hinweise auf stochastische Dominanz zwischen den jeweiligen Portfolios. Des Weiteren verdeutlichen unsere Ergebnisse, dass M&As zwischen Unternehmen aus verschiedenen Ländern vom Kapitalmarkt honoriert werden. Zudem wirken sich bestehende Geschäftsbeziehungen vor einer M&A-Transaktion sowie die Zahlungsweise (Barzahlung gegenüber Bezahlung mit Aktien) positiv auf die Erfolgsaussichten der jeweiligen Transaktion aus Sicht des akquirierenden Versicherungsunternehmens aus.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Mergers and acquisitions (henceforth, M&As) are in many respects an important determinant of success in the insurance sector. For example, M&As increase an insurer’s geographical reach and product range (Amel et al. 2004), lead to economies of scale and scope (Cummins et al. 1999), and let insurers benefit from financial synergies (Chamberlain and Tennyson 1998). In the European Union, the ongoing process of deregulation and liberalization in the financial sector has resulted in an unprecedented wave of M&As in the European insurance industry (Cummins and Weiss 2004). This process was intended to create a single European financial service sector. As a consequence, European insurance firms expanded into foreign insurance markets through cross-border M&As as well as to other segments of the financial industry through M&As with the banking sector.

This development generates many questions of high importance given the practical relevance of M&A activity within the insurance industry.Footnote 1 The most fundamental of these questions is whether M&A transactions create value for insurance firms? In addition, with regard to the large degree of heterogeneity in the outcome of M&A transactions in the insurance sector, the success of M&As depends on the characteristics of the specific deal, for example, the size of the transaction or geographical origin of the target firm. Therefore, a second major question regarding the success of M&A transaction is which factors lead to successful M&A transactions in the insurance industry?

A vast number of studies have examined the value of M&A for insurance firms: Most studies indicate that insurance M&As convey benefits to the shareholders of target companies. However, researchers have not yet established a consistent pattern that describes the added value that these deals confer on the acquiring insurance companies from a stock market perspective. Several studies suggest significant underperformance by the acquiring party following insurance M&As (e. g., Schertzinger 2008; Staikouras 2009). In contrast, others, such as BarNiv and Hathorn (1997), Boubakri et al. (2006), and Cummins and Xie (2009), indicate the opposite.

These studies measure the stock price effect of M&A transactions in the insurance sector using an event study methodology. However, this methodology is associated with several shortcomings. For example, it is based on a set of rather strong assumptions (McWilliams and Siegel 1997) and does not adequately control for investors’ risk choices (Falk and Levy 1989). Moreover, additional difficulties associated with event studies include the choice of a benchmark index and non-normality of abnormal returns (Abhyankar et al. 2005). Thus, Javidan et al. (2004) argue that “the conflicting findings and the theoretical shortcomings in this approach point to the need for new and innovative thinking and methodologies” (p. 257). Therefore, several studies use stochastic dominance criteria (SD) as an alternative to event studies (for example, Abhyankar et al. 2005; Falk and Levy 1989).

In this research, we examine the capital market reaction of acquiring insurers following the announcement of M&A by using tests of stochastic dominance instead of relying on event study approaches. By using the criteria of stochastic dominance, the entire distribution of returns is evaluated rather than the mean only as in event studies. Hence, using stochastic dominance can overcome the problems associated with the use of event studies and therefore provides a more sophisticated analysis of the impact of M&A transactions on acquiring firms’ stock prices. In addition, we investigate whether firm- and transaction-specific factors can explain the huge variations in the outcome of individual M&A transactions and aim to identify conditions under which post-M&A performance in the insurance industry is increased or decreased.

We use a sample of 102 European insurance M&A transactions over the period 1993 to 2009 with the stochastic dominance methodology to study short- and long-term capital market reactions following the announcement of insurance M&As. We find that, in the short term, acquiring insurers are second-order dominated by their benchmark portfolio. In the long run, we find no evidence of stochastic dominance compared to their non-acquiring counterparts. Moreover, our results indicate that geographically diversifying acquirers outperform geographically focused acquirers and that transactions in which the acquirer and the target firm have a business relationship before the announcement outperform transactions without pre-M&A interactions in the short-term. Finally, we detect a positive relationship between cash payment and acquirers’ M&A success.

This study extends the existing literature on insurance M&A success by providing evidence on the short- and long-run stock market effects of M&A transaction for acquiring insurance firms using a stochastic dominance methodology. In addition, we provide evidence on firm- and transaction-specific determinants that affect the stock price response following M&As in the European insurance sector. This provides valuable insights for managers and shareholders in the insurance sector, as we provide evidence on M&A successes in the insurance industry using a novel methodology that overcomes the shortcomings of existing studies. In case such transactions destroy value rather than creating it, insurance firms should question the efforts and resources devoted in the course of such transactions (Cummins and Weiss 2004). Moreover, the study provides important policy implications. The process of deregulation and liberalization in the European Union has intended to enhance economic efficiency in the financial sector. However, the efficiency of such policies might be questioned in cases where M&As resulting from this process are value-reducing rather than value-creating.

The article proceeds as follows. In the next section, we provide a literature review on the determinants of M&A success and discuss our hypotheses. In the third section, we describe the data and methodology. Then we present the empirical results and, finally, we offer conclusions.

2 Review of literature and hypotheses development

A vast amount of studies analyze the effect of M&A transactions on insurance sector firms in both short and long term.Footnote 2 For example, Cummins and Xie (2009), BarNiv and Hathorn (1997), and Boubakri et al. (2006) analyze the market response to M&As in the US property-liability insurance sector. Cummins and Weiss (2004) and Schertzinger (2008) analyze the market-value effects of M&As in the European insurance sector following the deregulation process occurring in recent decades. Akhigbe and Madura (2001) analyze the stock price effects that result from mergers between insurance companies including both life and property-liability insurance firms. Moreover, several studies (e. g. Staikouras 2009; Cybo-Ottone and Murgia 2000) analyze the stock-price effect of cross-sector M&As between banks and insurance firms. Table 1 summarizes the findings of previous research with respect to M&A success for the short and long term.

The main objective of the acquiring firm’s shareholders is “making a net addition to the wealth of the company’s owners” (Love and Scouller 1990, p. 5). The shareholder value perspective is the most prominent perspective from which M&A transactions successes can be assessed.Footnote 3 Proponents of the capital-market-based approach argue that M&A activities should follow the principle of shareholder wealth maximization, and hence evaluate its success by the change in shareholders’ wealth as measured by share price changes (e. g., Jensen 1984; Rappaport 1986).

Most papers use a standard event study methodology.Footnote 4 However, event studies are associated with several shortcomings arising from the fact that they are based on a set of rather strong assumptions (McWilliams and Siegel 1997). In addition, returns have to follow a normal distribution in order to provide reliable estimates (Falk and Levy 1989). Moreover, the underlying Capital Asset Pricing Model (CAPM) implies that all investors hold the market portfolio, that is, they invest in all risky assets. If they do not, the abnormal returns generated by the CAPM model might indicate an incorrect choice of the risk index rather than capturing market inefficiency. Moreover, previous studies show that long-run abnormal returns generated by event studies provide negative results in any fixed sample (Viswanathan and Wei 2004), which makes an event study framework inappropriate for our study (and for previous studies on the long term success of M&As) because we analyze the long-term effects of M&A. Moreover, event studies rely on the choice of the correct underlying index and face difficulties regarding cross-sectional correlations at the times of events (Abhyankar et al. 2005).

These studies show that analyzing M&A success based on an event study methodology can lead to imprecise results. Therefore, several studies (for example, Falk and Levy 1989; Abhyankar et al. 2005) use stochastic dominance (SD) tests instead of relying on event study approaches. This analysis compares the short- and long-term return distributions of acquiring firm portfolios with benchmark portfolios using the first two orders of stochastic dominance.Footnote 5 Such an approach has several advantages when compared to event studies. First, the entire distribution instead of just the mean of returns for acquiring firms and the benchmark portfolio are compared (Abhyankar et al. 2005). Moreover, no return model or underlying index has to be used to estimate abnormal returns. In addition, normality of returns does not have to be assumed and the approach is independent of the investors’ level of risk aversion (Falk and Levy 1989).

Previous studies highlight that insurance M&As on average create value for shareholders of the target firms as well as for the combined entity of acquirer and target (Table 1). For the European insurance industry, however, previous studies analyzing the effects of M&A transactions show negative wealth effects for acquiring insurers’ shareholders (Cummins and Weiss 2004; Schertzinger 2008). Based on the argumentation of Lubatkin (1983), the finding of negative wealth effects for shareholders of European insurance acquirers leads to the following conclusion: (1) either European insurance M&A transactions do not provide real benefits to the acquiring insurance company, or (2) these deals do provide real benefits that have not been detected by earlier research. In order to clarify this issue, we investigate whether European insurance M&As in general are able to generate real benefits to acquiring firm shareholders by using tests of stochastic dominance instead of relying on event study approaches. Our hypotheses development follows a two-step design.

In the first step, we formulate a hypothesis regarding the overall performance effect of European insurance transactions. From a theoretical perspective, the stock-price effect of M&A transactions is ambiguous: Cummins and Weiss (2004) state that M&As should not add value given that they merely combine the rights to cash flows that are already held by diversified investors.Footnote 6 Therefore, investors should be indifferent between receiving future cash flow streams from two individual firms versus from a combined firm consisting of the two individual firms. However, this relies on a number of assumptions that barely hold in practice. For example, M&A transactions can destroy shareholder value if, for example, transactions costs exceed the benefits of M&A transactions. Alternatively, economic production theory explains value gains from M&As due to economies of scale and scope.Footnote 7 Hence, theoretical justifications for both negative and positive stock-price effects exist.

However, previous event studies document largely consistent (partly significant and partly insignificant) negative short-term abnormal returns for European insurance acquirers around the moment of an M&A announcement (Cummins and Weiss 2004; Schertzinger 2008). Even in a long-term event horizon, transactions conducted by European insurance companies, on average, destroy shareholder value (Schertzinger 2008). Our analysis aims to examine if these results remain consistent if a superior methodology (SD) is used. Accordingly, we enunciate our first hypothesis as follows:

H1

European insurance acquirers underperform their non-acquiring counterparts.

In the second step, we formulate hypotheses regarding the determinants that potentially influence the outcome of an insurance transaction. As outlined in the literature review, substantial and significant differences exist between specific effects arising from individual M&A transactions. This great variety of individual M&A outcomes is mainly attributed to differences in underlying M&A structure and/or strategy. Following previous research, we focus our analysis on determinants of M&A success which can be categorized into two groups: (1) firm-specific determinants, and (2) transaction structuring and management phase determinants of M&A success. We first investigate the impact of firm-specific characteristics on insurance M&A success.

Floreani and Rigamonti (2001), Cummins and Xie (2005, 2009), and Schertzinger (2008) include size (measured by the logarithm of company’s equity market value at the announcement date) as a factor in their analyses to assess whether larger insurers are more capable in realizing synergy potentials, thus creating value from M&As. From a theoretical perspective, Cummins and Xie (2008) state that larger firms experience significantly lower total factor productivity, pure technical efficiency, and scale efficiency change than smaller firms. Larger firms also experience significant reductions in cost and revenue efficiency change. This suggests that a large scale confers disadvantages in terms of productivity and efficiency change, for example due to higher coordination costs and agency problems in large organizations. Accordingly, we set our hypothesis as follows:

H2a

Small insurance acquirers outperform large insurance acquirers at the time of M&A announcement, whereas no dominance relationship exists between small and large acquirers in the long term.

Acquirers may benefit from their know-how and experience of previous M&A transactions (Schertzinger 2008; Cummins and Xie 2005, 2009; Boubakri et al. 2006). Firms that frequently engaged in acquisition behavior in the past possess the necessary experience to conduct post-merger integration in the aftermath of an M&A (Boubakri et al. 2006). Moreover, frequent transactions signal both willingness to expand and superior future prospects, which should be rewarded by the stock market. Schertzinger (2008), however, finds a quadratic relationship between acquisition experience and financial performance for European insurance acquirers. He suggests that acquirers without transaction experience and acquirers with an extensive acquisition record created substantially more value than acquirers with medium transaction experience. This U‑shaped relationship should hence be interpreted as advising insurance managers either to pursue a strategy of organic growth or fully rely on external growth by means of M&A. Based on the findings of Schertzinger (2008), we develop our second hypothesis:

H2b

Both inexperienced and most experienced insurance acquirers outperform medium experienced insurance acquirers.

With regard to the effect of target company characteristics on acquirer post-M&A performance, previous studies found that the target firm’ relative size is a relevant factor. Although relatively large targets are more difficult to integrate, a successful integration will most likely lead to substantial value creation (Boubakri et al. 2006; Schertzinger 2008). Consequently, conducting and completing a large transaction successfully is more likely to create substantial wealth for shareholders in terms of higher post-acquisition returns (Floreani and Rigamonti 2001; Cummins and Xie 2009; Staikouras 2009). Hence, with respect to previous research findings the following hypothesis can be offered:

H2c

Large insurance M&A transactions outperform small transactions.

Next, we propose hypotheses on several determinants of the transaction structuring and management phase.

Geographic or industry diversification versus geographic or industry focus has been the most commonly analyzed cross-section in previous studies.Footnote 8 While empirical studies from the US document a positive market reaction arising from geographically focusing M&As to acquiring insurers in the short-term, geographically focusing deals from Europe reveal a negative relationship with financial performance of acquiring insurers in the short term. Consequently, geographically diversifying deals are associated with a significant positive market reaction for European insurance acquirers (Floreani and Rigamonti 2001; Cummins and Weiss 2004; Boubakri et al. 2006; Schertzinger 2008). These findings suggest that regional market power effects or scale economies are more important than risk diversification or economies of scope.Footnote 9 Hence, we propose the following hypothesis:

H3a

Geographically diversifying M&A transactions outperform geographically focusing M&A transactions.

With regard to industry diversification, several arguments in the literature support related M&A transactions and industry diversification. On the one hand, synergies are expected to be larger and easier to realize in related than in unrelated M&As (see, e. g., Spiss 2008; Hazelkorn et al. 2004), and cross-industry transactions “may aggravate agency problems by allowing cross-subsidization to poor subsidiaries” (Shim 2011, p. 124). On the other hand, pro-conglomeration theories provide explanations for positive effects that range from risk reduction due to a broader business range to financial synergies and economic benefits from internal capital markets and lower capital costs (see, e. g., Schertzinger 2008; Boesecke 2009). However, a broad consensus has emerged in previous event studies that industry-focusing transactions lead to a significant positive market reaction quickly around the time of the M&A announcement (e. g., Floreani and Rigamonti 2001; Cummins and Weiss 2004; Schertzinger 2008) but may lead to insignificant value creation in the long term (Boubakri et al. 2006; Schertzinger 2008), whereas industry diversification, on average, leads to negative short-term abnormal returns and destroys value of the acquiring insurer in the long-term. Consequently, we develop the following hypothesis:

H3b

Returns from industry-related M&A transactions are higher than those from unrelated deals.

According to Cummins and Xie (2009), acquirers’ ownership in targets prior to announcing transactions has a significant positive short-term effect on M&A transaction success. This finding is also confirmed by non-insurance literature (e. g., Grossmann and Hart 1980; Mikkelson and Ruback 1985; Shleifer and Vishny 1986). A positive market reaction can be theoretically justified by lower total cost of the M&A transaction for acquirers and a higher level of success in the transaction and integration process (Sudarsanam 2010). Accordingly, we offer the following hypothesis:

H3c

Transactions in which the acquirer has a pre-M&A participation in the target outperform those with no pre-M&A participation.

Payment method is an additional potential factor influencing the success of insurance M&As. From a theoretical perspective, the market often interprets the payment method as a signal of the acquiring firms’ financial condition and insiders’ valuation. Due to market imperfections resulting from information asymmetries with respect to the true value of the involved firms, acquiring firm managers will try to finance the acquisition via the most cheapest and convenient mode. Accordingly, they are more likely to choose payment via stock if their stock is overvalued (as this is the cheaper method), whereas they will prefer cash when their company’s shares are undervalued (Myers and Majluf 1984). As a result of this signaling effect, an acquiring firm’s stock price is expected to decline in response to an announcement of a stock-financed M&A but rise after announcement of a cash-financed M&A transaction. Hence, various authors argue that transactions with a significant synergy potential are preferably financed by cash, because the acquirer alone will stand up to reap all potential synergy gains from combining the two entities (Wuebben 2007). Moreover, as argued by Myers and Majluf (1984), if the acquiring company has a substantial amount of excess cash, a cash-financed transaction is considered the lesser evil compared to investment in other unprofitable projects and will ultimately lead to a positive (or at least less negative) financial performance. Thus, despite the contrary evidence of previous short-term event studies on M&A in the insurance industry, we offer the following hypothesis:

H3d

Transactions financed through cash payment outperform stock-financed transactions.

3 Data and methodology

3.1 Sample and data

Information on M&A deals in the European insurance industry was obtained from a variety of data sources. Respective announcement and completion dates were obtained from Bloomberg and Thomson Reuters and cross-checked using press releases and/or the financial statements of the involved companies.Footnote 10 In order to obtain meaningful results, we restrict our sample of M&A transactions using the following criteria before undertaking the analyses. We restrict our investigation to M&A transactions announced between 1993 and 2009 and completed in 2012. This time frame not only includes the two most recent M&A waves, the fifth (1993–2000) and the sixth (2003–2007), which are characterized by similar characteristics and motivational factors, it also includes the most up-to-date data set available when considering the three-year post-M&A performance of acquiring insurers.

Given that small acquisitions are less likely to result in any abnormal post-acquisition performance, previous studies either make use of the relative acquisition size (e. g., Loderer and Martin 1992; Moeller et al. 2003) or utilize absolute transaction value (e. g., Akhigbe and Madura 2001; Schertzinger 2008). In our study, the transaction value has to equal or exceed 8% of the acquiring firm’s current market capitalization at the beginning of the transaction year.Footnote 11 While inevitably somewhat arbitrary, this 8% cut-off point was chosen because hardly any deals conducted had a relative size between 6% and 8%.Footnote 12 Furthermore, this cut-off point guarantees that all included transactions were sufficiently large to significantly influence the acquirer’s market value.

We further require targets to include insurers, banks, and other financial-services firms in order to focus on deals involving financial-services firms.Footnote 13 Moreover, we only include friendly M&A deals and remove hostile ones from our sample.Footnote 14 Next, we exclude insurance companies if stock prices are not available for up to three years following the M&A announcement.

With regard to previous insurance M&A studies on the effects of M&A deals on acquiring insurers’ post-M&A performance, it becomes clear that these effects may differ considerably across geographical areas. Consequently, it does not make sense to investigate the effects of US, European, and/or global deals in one joint sample. We hence geographically restrict the empirical analysis to transactions involving Western European insurance acquirers.Footnote 15 Target firms, however, may come from all over the world, as we exclusively assess the performance effects of acquiring insurance firms and do not evaluate the financial benefits accruing to target-firm shareholders.

In addition, we exclude insurance companies that did not survive the full investigation period. Previous empirical research has shown that results of tests including only survivors and tests including both survivors and non-survivors do not significantly differ (Higson and Elliot 1998). Accordingly, we consider this potential survivorship bias to be the lesser evil as compared with the expected stronger bias when including these non-survivors in our final sample.Footnote 16

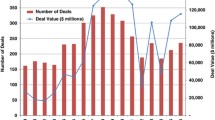

Company-specific data including acquirer, target, and benchmark company name, subindustry, country of incorporation, information on the M&A transaction itself (e. g., announcement and completion dates, transaction value, payment method, percentage of shares preowned, and percentage of shares acquired), and foreign exchange rate data are extracted from the Bloomberg database. Our initial data consist of all insurance companies that are publicly traded and included in the STOXX Europe 600 Insurance Index (ISIN EU0009658822) and in the Bloomberg database. In order to produce a reasonably homogenous final sample of similarly sized insurance acquirers, we use a cut-off threshold of 1% market value of the insurance company with the highest market value at the beginning of the respective year.Footnote 17 Our final sample consists of 102 M&A deals undertaken by 62 European insurance acquirers over the period 1993–2009. While Table 2 provides a list of the acquiring insurers in our sample, Fig. 1 illustrates the number of M&A transactions considered in this paper.Footnote 18

It can be seen that M&A activity occurs in waves. In terms of transaction numbers, M&A activity peaked in the years 1999–2007 at 15 and 8, respectively, and then decline to 4 in 2008–2009. The investigated transactions totaled an absolute transaction value of €245 bn, which represents an average transaction volume of around €2.40 bn and a relative transaction valueFootnote 19 of 32.20%. Out of the 102 targets, 29 can be classified into the “Multi-Line” category, 20 as “Life/Health”, 17 as “Property/Casualty”, 15 as “Brokers and Reinsurers”, and 21 as “Banks and Financial Services”. The geographic breakdown of targets reveals that Europe is home to close to 70% of all targets. In addition, 30 target companies are headquartered in America and one target in Asia. The following sections discuss the methodology and the variables used in the analysis in more detail.

3.2 Estimation strategy

This paper uses the stochastic dominance (SD) approach to examine the benefits of insurance M&As accruing to shareholders of the acquiring insurance companies. We compare the short-term daily returnFootnote 20 distributions and long-term buy-and-hold returnFootnote 21 distributions of acquiring firm portfolios with benchmark portfolios, using the first two orders of stochastic dominance.Footnote 22

The benchmark portfolio is constructed using a book-to-market adjusted control firm benchmark, as this approach is the most suitable for our estimation methodology and is also the most commonly used method in previous studies (e. g., Abhyankar et al. 2008). Hence, the list of control firms comprises the same 62 companies included in the sample of potential acquirers. This approach ensures that each acquiring insurer is matched only to a control firm also belonging to the insurance industry, which in turn “control[s] for changes in performance attributable to industry or economy-wide factors,” as outlined by Kruse et al. (2002, p. 7). Following Lyon et al. (1999), we match the sample of acquiring firms to non-acquiring insurance companies, not only based on industry and subindustry, but also based on the market-to-book performance ratio.Footnote 23

In order to establish a dominance relationship between two different groups (acquirers and non-acquirers), we descriptively compare the empirical cumulative distribution functions at all points in the sample. In the short-term investigation, empirical distribution curves (step curves) of daily returns are compared in terms of first- and second-order stochastic dominance, whereas buy-and-hold return distributions are compared in the long-term investigation.

Based on the empirical distribution functions, we perform a two-step testing procedure similar to the one applied by Abhyankar et al. (2008). In a first step, we test whether the M&A portfolio dominates the benchmark portfolio in the sense of first- and/or second-order SD, that is, X SD1 and/or SD2 Y, by comparing the respective two distributions of returns. In the second step, we test the converse hypothesis, that is, whether the benchmark portfolio first- and/or second-order dominates the M&A portfolio (Y SD1 and/or SD2 X). The results can be interpreted as follows: If the first hypothesis – i. e. that the M&A portfolio kth-order dominates the benchmark portfolio – is declined and the second hypothesis – that the benchmark portfolio kth-order dominates the M&A portfolio – is confirmed, we conclude that there is a kth-order dominance relationship of the benchmark portfolio over the M&A portfolio (with k = 1,2).Footnote 24 In contrast, if we fail to reject the first hypothesis (i. e., M&A portfolio SDk benchmark portfolio) and reject the second hypothesis (i. e., benchmark portfolio SDk M&A portfolio), we can infer that the M&A portfolio (descriptively) dominates the benchmark portfolio in the sense of kth-order stochastic dominance.Footnote 25 However, if the two hypotheses of the first and second steps are either both rejected or both confirmed in the sense of SDk, we conclude that there is no kth-order stochastic dominance relationship between the M&A and the benchmark portfolio returns.Footnote 26 Table 3 provides variable definitions and descriptive statistics for each subsample with respect to the M&A transactions studied in our analyses.

4 Results

4.1 SD relationship results regarding M&A success in the European insurance industry

Table 4 reports our results on the SD relation between acquirer and benchmark portfolio with regard to our hypothesis H1. The results suggest that in the short-term, acquiring insurance companies show a negative (relative) performance, as the acquirer portfolio is second-order dominated by the benchmark portfolio. In particular, in four of the six event windows, from (0; +2D) to (0; +5D)Footnote 27, the distribution of dividend-adjusted simple daily returns of the benchmark portfolio dominates the distribution of dividend-adjusted simple daily returns of the M&A portfolio.Footnote 28 Hence, our results indicate that M&A transactions are value reducing for acquiring insurance firms’ investors. However, the negative relative performance disappears over a long-term horizon. In all three long-term periods, those comprising the month preceding the month in which the M&A announcement is made to one, two, and three years beyond it, the benchmark portfolio does not dominate the acquirer portfolio in terms of first- and second-order dominance. Moreover, the average buy-and-hold returns of the acquirer portfolio are higher than those of the benchmark portfolio; in a single three-year period after M&A activity, the buy-and-hold returns for shareholders in European insurance acquirers averaged 21.50% compared to an average increase of just 5% for shareholders in non-acquiring peer companies. Hence, our SD comparison suggests that M&A transactions in the insurance industry do not tend to damage shareholder wealth in the long term.

4.2 SD relationship results on firm-specific determinants

Table 5 presents the pairwise SD results with respect to our hypotheses H2 (H2a to H2c). In order to test hypothesis H2a, we split the full sample of 102 transactions into two equal-size subsamples, one consisting of 51 below-median-sized insurance firms and another consisting of 51 above-median-sized insurance acquirers (see Table 3). Similarly, the respective benchmark companies are split into these two subsamples. We first investigate whether the subgroup of large acquirers stochastically dominates (SD1 and SD2) its benchmark subgroup shortly after the M&A announcement. Subsequently, we test the reverse hypothesis, that is, whether the benchmark portfolio shows SD1 and/or SD2 over the large-sized acquirer portfolio. In a next step, we analyze whether the daily short-term return distribution of the small acquirer portfolio shows SD1 and/or SD2 over the distribution of daily returns of the corresponding benchmark firm portfolio and the converse hypothesis, that is, whether the benchmark portfolio shows SD1 and/or SD2 over the M&A portfolio of small acquirers. After assessing the stochastic dominance relations between daily return distributions of the two acquirer subsamples and the daily return distributions of their corresponding benchmark portfolios, we determine the dominant relationship between the M&A subsamples of small acquirers and large acquirers. Thus, in a further descriptive comparison, the two distributions of daily abnormal returns of the small acquirer subsample and large acquirer subsample are compared with respect to SD1 and SD2. Once again, dominance of the abnormal return distribution of the small acquirer subsample over the abnormal return distribution of the large acquirer subsample is tested, and then we investigate whether the large acquirer subsample dominates the small acquirer subsample in terms of SD1 and/or SD2. The same procedure is applied for the long-term analysis.

In case of the determinant “acquirer’s size” (hypothesis H2a), we do not find a short-term stochastic dominance relationship between any of the two acquirer-size-based subsamples and the corresponding benchmark subsample (see Panel A). However, as expected, small insurance acquirers stochastically dominate large insurance acquirers at the time of M&A announcement, as the small acquirer subsample is found to be second-order dominant over the large acquirer portfolio; simultaneously, a dominance relationship of the large acquirer subsample over the small acquirer subsample is rejected. Also consistent with hypothesis H2a, we do not find a dominance relationship between small and large acquirer samples in the long-term descriptive comparison. Yet the subsample of small acquirers is found to be second-order dominant over its corresponding benchmark subsample in the long term. Consequently, our short- and long-term findings provide evidence for hypothesis H2a. From an investor’s perspective, our results suggest that large acquirers are not better in identifying and realizing synergy potentials compared to small insurance acquirers.

To test for hypothesis H2b, we divide all transactions according to an acquirer’s transaction experience into three groups: “No experience”, “Medium experiences”, and “Highly experienced” (see Table 3). According to our hypothesis H2b, which is based on Schertzinger’s (2008) findings, we expect a U-shaped relationship between an acquirer’s transaction experience and its post-M&A success. However, our results (see Panel B) are contrary to our expectations and reveal that acquirers with either no or high M&A experience are less likely to produce a positive performance over their non-acquiring competitors. The subsample of no-experience acquirers is dominated by the benchmark portfolio on a short-term basis, whereas highly experienced acquirers are dominated by their benchmark insurers in both short- and long-term. In contrast, transactions where the bidder has medium transaction experience are found to second-order stochastically dominate not only their benchmark group but also the inexperienced acquirer subgroup (“No experience”) over a long-term period. From a theoretical standpoint, our findings seem to support the idea from the learning curve theory and closely related experience curve theory that (if transaction experiences are homogenous) an increased number of M&A transactions might provide learning and experience curve benefits for the acquirer with regard to many aspects of the transaction process (e. g., valuation of the target, negotiation of the deal price, and post-merger integration).Footnote 29

The test results for hypothesis H2c are reported in Panel C. Here, we focus on the relative deal size (defined as deal volume divided by acquirer’s market value at announcement) and its relationship to post-M&A performance (see Table 3). As expected, small insurance transactions underperform in the short term. Our SD comparison not only detects a second-order SD relationship of the benchmark portfolio over the portfolio of small transactions, but also reveals that the small transactions subsample is dominated by the subsamples of relative large and medium-sized transactions at SD2. Hence, the results provide evidence for a significant positive relationship between relative deal size and acquirer’s market performance in the short term. In contrast, our long-term results show that the subsample of transactions with the largest relative deal volumes is dominated by both the medium and small transactions subsamples in the sense of SD2. In addition, the results reveal that the medium relative deal size subsample second-order dominates its benchmark subsample. In summary, consistent with previous insurance M&A literature, our analysis reveals a positive short-term relationship between relative deal size and the acquirer’s subsequent financial performance. However, this positive short-term relationship vanishes over time and becomes negative in the long term. Long term findings suggest that insurance acquirers can better cope with M&A transactions with relatively smaller targets over a post-M&A period of several years. Possible theoretical interpretations for this finding include diseconomies of scale and scope, agency problems, and organizational, administrative, and integration problems arising from the large relative size of the target firm.Footnote 30

4.3 SD relationship results on the transaction structuring and management phase determinants

In addition to the above results discussing firm characteristics’ impacts on post-M&A performance, Table 6 presents the results for our hypotheses on the various determinants of the transaction structuring and management phase (H3a to H3d). With regard to H3a, the SD results indicate that geographically diversifying insurance transactions (acquirer’s target is headquartered in another country) are significantly positively related to acquirers’ post-M&A performance (see Panel A). More precisely, geographically diversifying transactions dominate their geographically focused counterparts in both short and long term, and lead to a dominant long-term performance compared to the corresponding non-acquiring benchmark insurance firms. Moreover, geographically focused transactions are found to be second-order dominated by their benchmark firm subsample in the short term, which further confirms the validity of hypothesis H3a. Based on our findings, we suggest that the benefits of international diversification (i. e., synergies arising from intangible and information-based assets and portfolio diversification) outweigh potential harms and costs of geographic expansion and increase the wealth of acquiring insurers investors.

In order to test our hypothesis H3b, the transactions in our sample are subdivided according to industry focus into industry-focused and industry-diversifying transactions (see Table 3). Contrary to previous studies, the descriptive comparison outlines a second-order dominance relationship of the subsample of industry-diversifying insurance acquirers over the subsample of industry-focused insurance acquirers (see Panel B). In addition, our short-term comparison reveals a second-order dominance of the benchmark subsample over the industry-focused subsample, which further underpins the short-term dominance of industry-diversifying transactions in our European sample. The long-term SD results, however, are not conclusive and do not allow for any directional causal inference. The subsample of industry-focused transactions dominates its benchmark subsample while simultaneously being dominated by the subsample of industry-diversifying transactions. Our long-term findings, hence, emphasize the need for a more differentiated analysis of the influence of this determinant, taking greater account of both geographic and industry dimensions.Footnote 31

Hypothesis H3c refers to the influence of an acquirer’s pre-merger participation in the target before announcement and states that, in the short term, transactions where the acquiring insurance company has a pre-M&A participation in the target outperform transactions where no such pre-M&A business relationship exists between acquirer and target. Our results (see Panel C) confirm our hypothesis, as the subsample of acquirers with no pre-M&A business relationship is second-order dominated by the subsamples of acquirers having a business relationship with the target before announcement and the subsample of benchmark insurers subsequent to the M&A announcement. In contrast, no dominance relationship between any two subgroups is observed over a long-term horizon. Our result are unique as, to our knowledge, no previous study addresses this issue on a long-term basis. In summary, we can state that if acquirers have a business relationship with the target before the M&A announcement, the acquirer experiences a positive abnormal market reaction to the transaction announcement. This can theoretically be explained by lower costs of the transaction process and an easier integration process (Sudarsanam 2010). However, this positive valuation effect disappears over time, as we do not observe any performance differences between the various subgroups in the long term.

With regard to our hypothesis H3d, method of payment, we note that most acquisitions in our sample are paid either exclusively via cash or with a combination of cash and stock (see Table 3). However, we also observe that cash payments are primarily used in smaller deals that are less cash intensive, while larger acquisitions are predominantly financed with stock swaps or a mix of cash and stocks.Footnote 32 Our SD relation results confirm hypothesis H3d (see Panel D); a second-order dominance relationship of the various subsamples (i. e., all-cash subsample, subsample of transactions financed by a mixture of cash and equity, and subsample of non-acquiring benchmark insurers) over the subsample of all-stock financed transactions is observed in our European insurance sample in the short and long term. Returns are more pronounced for acquisitions paid with cash rather than for stock payment deals. In addition, the subsample of cash-financed transactions is second-order dominant over its benchmark subsample (in the long-term analysis), and the subsample of transactions financed with a mixture of cash and stock is second-order dominated by the subsample of benchmark insurers. Hence, our SD results provide support for the outperformance of all-cash-financed transactions.

5 Conclusion

Although there is a substantial body of literature describing the theoretical benefits of insurance M&A, there is little empirical evidence to support such assertions. Thus, widespread uncertainty surrounds the ultimate success prospects of insurance M&A activity, particularly given that some studies have generated conflicting results. Therefore the general purpose of this paper is to improve the understanding of previous findings on insurance M&As. In contrast to previous papers, our analysis is based on the stochastic dominance methodology, which overcomes the shortcomings of the event study approach.

Our study analyses the success of 102 M&A transactions, undertaken by publicly traded Western European insurance firms between 1993 and 2009. Our results support those arising from previous short-term studies, in that we find the acquirer portfolio to be second-order dominated by a benchmark portfolio of comparable insurance firms that did not take part in M&As. Our analysis applies the idea of stochastic dominance in order to evaluate insurance M&As and goes on to show that such underperformance decreases with the passage of time, and that over the long-term no dominance relationship between the two portfolios exists. Accordingly, our findings do not support Schertzinger’s (2008) finding of a significant negative relationship between M&A activity and acquiring insurers’ financial performance in the European market. They also fail to correlate with the positive relationship found by Boubakri et al. (2006) in a US context.

Our study has several important implications for investors, shareholders and managers of insurance firms, particularly for those managing European firms that acquire through M&As. Managers should highlight the average acceptable long-term performance effects. This communication strategy will help to mitigate the negative market response to the announcement of M&A activity. In addition, it would be helpful for shareholders and investors to be aware of the time-dependent effects involved and make investment decisions in light of this. In summary, M&A transactions seem to be a viable model, likely to lead to success, and this applies in both US and European insurance markets.

Notes

We confine our literature review to those studies focusing on financial and strategic aspects of M&As. Consequently, we do not include studies from the organizational behavior literature in our analyses, as this strand of literature investigates the acquisition’s impact upon the organization (and people) and focuses on the cultural, human, and organizational elements of the M&A process.

Event studies are used to discern whether (or not) M&A transactions induce significant abnormal returns. See Browne and Warner (1980, 1985) for details on the event study methodology. Such studies examine the stock market’s response to acquirers, targets or the combined entity, when M&A transactions are announced, and use market data to quantify the short- and long-term effects of M&A on company performance. Besides using the event study method, the two related papers by Cummins and Xie (2005, 2009) also conduct an efficiency analysis. By linking frontier efficiency with market values, this approach measures the relationship between stock market returns and efficiency and therefore combines the two most popular empirical methodologies.

See the Data and Methodology section for a more comprehensive description of our estimation approach.

Finance theory postulates that investors hold diversified portfolios including value-weighted shares of all companies in the economy, i. e. the so-called “market portfolio”.

See Cummins and Weiss (2004) for a more comprehensive discussion.

Cybo-Ottone and Murgia (2000) as well as Floreani and Rigamonti (2001) include a variable for geographical focus in their multi- and univariate analyses; Cummins and Weiss (2004) analyze geographical focus in two univariate cross-sections; Cummins and Xie (2005) investigate geographical and industry focus in their multi- and univariate analyses; Fields et al. (2005) include a geographic diversification measure in their univariate comparison; Fields et al. (2007) conduct multi- and univariate analyses to investigate the geographic dimension; Boubakri et al. (2006) examine geographical and industry focus in their multivariate analysis; and Schertzinger (2008) evaluates geographical and industry focus through cross-sectional analyses. In addition, Staikouras (2009) only examines the influence of industry relatedness on M&A success, while Elango (2006) restricts his empirical analysis to investigating the geographical dimension only.

More precisely, the US literature on this topic indicates that the level of relatedness between US bidder and target firms (in terms of product-market similarity) is positively correlated with M&A success. The studies provide evidence for the “diversification discount” phenomenon in the US insurance industry by suggesting that focus-enhancing transactions in the US appear on average to be more profitable than diversifying ones. US insurers that increase their geographical and/or industry focus generally dominate insurance acquirers that pursue a diversification strategy in terms of short- and long-term post-M&A performance. In contrast, full diversification strategies in the European insurance market increase shareholder value in the short- and long-terms. However, as pointed out by Schertzinger (2008), European insurers extensively pursuing a full focus strategy may also enhance value for their shareholders in the long term.

Identifying the exact date on which a transaction was first publicly announced is essential for the proper execution, in particular, of short-term, capital market-based event studies (Spiss 2008).

Current market capitalization is measured on the day prior to the announcement day, reported by Bloomberg. If this current market value could not be determined, we use the book value from the balance sheet date preceding the announcement date. Floreani and Rigamonti (2001) and Megginson et al. (2004) employ a similar methodology to eliminate small and insignificant M&A transactions from their sample.

Previous empirical studies use relative cut-off points ranging from 2% (e. g., Floreani and Rigamonti 2001) to 5% (e. g., Spiss 2008) to 10% (e. g., Asquith 1983). As a robustness check, we also conducted an additional test with a minimum deal value of 10% of acquirer’s market value. Overall, our results remain unchanged.

We utilize the “Global Industry Classification Standard” (GICS) classification codes to identify acquired firms belonging to the “Financials” sector, which we subsequently classify into particular financial-services activity areas (i. e., respective subindustry).

According to Morck et al. (1988), friendly M&A transactions involve different strategic reasons and underlying motives by the respective acquirer in comparison to hostile deals. As mood of the M&A deal (i. e., friendly or hostile) is additionally found to be an important determinant in M&A success, transactions should be divided according to mood.

Western European countries, as defined by Bloomberg, comprise Andorra, Austria, Belgium, Cyprus, Denmark, Faroe Island, Finland, France, Germany, Gibraltar, Greece, Guernsey, Iceland, Ireland, Isle of Man, Italy, Jersey, Lichtenstein, Luxembourg, Malta, Monaco, Netherlands, Norway, Portugal, Reunion, San Marino, Spain, Svalbard and Jan Mayen Islands, Sweden, Switzerland, and the United Kingdom. Our dataset only includes insurers that are headquartered in the above mentioned countries. Previous empirical studies regularly use the respective firm’s headquarters as determining the firm’s country of origin (e. g., Cummins and Xie 2005; Schertzinger 2008; Spiss 2008).

This particularly holds when analyzing the success of M&A transactions in the insurance case. In the insurance industry, liquidation is less likely to occur compared to other industries (for a detailed explanation on this, see Farny 2011, p. 203).

Cummins and Xie (2009) also use a cut-off point for very small insurance companies, which they justify by noting that “extremely small firms are atypical and may bias the estimation” (p. 135).

To conserve space, we do not report the respective M&A transactions investigated in this study. However, a detailed list of all transactions by announcement date and respective characteristics can be obtained from the authors upon request.

Relative transaction value is calculated as transaction value divided by acquirer market capitalization.

These are adjusted by quotation changes, dividend payments, rights issues, and stock splits. Short-term daily returns are estimated over a period ranging from the date of the initial M&A announcement up to five trading days after that date. See Table 3 for more details.

These are calculated as monthly simple net returns over three periods, which run from the month prior to the month in which the initial announcement is made, to the announcement month plus one year, plus two years, and finally plus three years. See Table 3 for more details.

The book-to-market ratio is defined as the book value of common equity divided by the market value of common equity.

To ultimately establish Y SDk X, the benchmark portfolio (Y) is required to have a larger mean than the M&A portfolio (X).

As a necessary condition for X SDk Y, the M&A portfolio (X) mean is required to exceed the benchmark portfolio (Y) mean.

As an example, the two-step testing procedure for the characteristic “acquirer’s absolute size” is as follows: We first compare the short-term (long-term) distribution function of simple daily returns (buy-and-hold returns) of a group of large acquirers with the distribution of simple daily returns (buy-and-hold returns) of a group consisting of the respective benchmark firms that did not conduct a M&A transaction. As a result, we reveal a stochastic dominance relation between the two portfolios. In a second step, we are able to establish a dominance relationship between a portfolio of large acquirers and a second portfolio consisting of all small-sized acquirers. In order to investigate such a short-term (long-term) dominance relationship, the distribution of abnormal (with respect to the respective benchmark firm) returns (abnormal buy-and-hold-returns) of the large acquirer’s portfolio is compared with the distribution function of abnormal returns (buy-and-hold abnormal returns) of the small acquirer’s portfolio.

We additionally perform SD analyses starting from two days before announcement up to five days after the announcement day, i. e. (−2D; 0) to (−2D, +5D), in order to check whether our results are robust. As expected, the results remain qualitatively the same, which confirms our initial results. We do not report the results to conserve space; however, they are available from the authors upon request.

To check for robustness, we perform two further tests: First, we exclude 13 transactions that did not generate a change in controls and run the analyses. Second, we exclude 17 transactions that had a relative deal volume of less than 10% from the sample of observations and run the analyses once more. Both test results confirm our previous finding regarding the short-term effects of insurance M&A. To conserve space, we do not report the results; however, they are available from the authors upon request.

The empirical study of Haleblian and Finkelstein (1999) offers statistical evidence of a consistent positive influence of multiple homogeneous acquisitions on an acquirer’s post-acquisition success.

To clarify the performance effect of the industry and geographical dimensions, we combine these two variables into a single construct. We divide the sample according to geographical and industrial orientation of each transaction into a subsample of full focusing transactions, a subsample of fully diversifying M&As and a subsample of either (1) geographically focused and industry-diversifying or (2) geographically diversifying and industry-focused transactions. Second-order stochastic dominance of the full-diversifying acquirer portfolio over the full-diversifying and mixed portfolio is found in the short- and long-term SD investigation. In addition, full-diversifying acquirers, on average, second-order dominate non-acquiring benchmark insurers in the long term. Further confirmation of the dominance of a full diversification strategy comes from our short-term analysis, which uncovers a second-order dominance relationship of the benchmark portfolio over both full-focusing and mixed portfolios on the days after the M&A announcement, whereas no dominance relationship was found between the return distributions of the full-focusing portfolio and corresponding benchmark portfolio. We do not report the results to conserve space; however, they are available from the authors upon request.

A similar conclusion is also reached by Floreani and Rigamonti (2001) in their global sample of pure insurance transactions.

References

Abhyankar, A., Ho, K.Y., Zhao, H.: Long-run post-merger stock performance of UK acquiring firms: a stochastic dominance perspective. Appl Financ Econ 15(10), 679–690 (2005)

Abhyankar, A., Ho, K.-Y., Zhao, H., Value versus growth: Stochastic dominance criteria. Quant Finance 8, 693–704 (2008)

Akhigbe, A., Madura, J.: Intra-industry signals resulting from insurance company mergers. J Risk Insur 68(3), 489–505 (2001)

Amel, D., Barnes, C., Panetta, F., Salleo, C.: Consolidation and efficiency in the financial sector: A review of the international evidence. J Bank Finance 28(10), 2493–2519 (2004)

Asquith, P.: Merger bids, uncertainty, and stockholder returns. J Financ Econ 11, 51–83 (1983)

BarNiv, R., Hathorn, J.: The merger or insolvency alternative in the insurance industry. J Risk Insur 64(1), 89–113 (1997)

Barrett, G., Donald, S.: Consistent tests for stochastic dominance. Econometrica 71, 71–104 (2003)

Boesecke, K.: Value creation in mergers, acquisitions, and alliances. Gabler, Wiesbaden (2009)

Boubakri, N., Dionne, G., Triki, T.: Consolidation and value creation in the insurance industry: the role of governance. J Bank Finance 32(1), 56–68 (2006)

Brown, S.J., Warner, J.B.: Measuring security price performance. J Financ Econ 8(3), 205–258 (1980)

Brown, S.J., Warner, J.B.: Using daily stock returns – the case of event studies. J Financ Econ 14, 3–31 (1985)

Chamberlain, S.L., Tennyson, S.: Capital shocks and merger activity in the property-liability insurance industry. J Risk Insur 65, 563–595 (1998)

Cummins, J.D., Weiss, M.A.: Consolidation in the European insurance industry: do mergers and acquisitions create value for shareholders? For Presentation at the Brookings/Wharton Conference, 8. Jan 2004. The Brookings/Wharton Conference Papers. (2004)

Cummins, J.D., Xie, X.: Efficiency and value creation in acquisitions and divestitures: evidence from the US property-liability insurance industry. Working Paper. Wharton School Center for Financial Institutions, University of Pennsylvania, Philadelphia (2005)

Cummins, J.D., Xie, X.: Mergers and acquisitions in the US property-liability insurance industry: productivity and efficiency effects. J Bank Finance 32, 30–55 (2008)

Cummins, J.D., Xie, X.: Market values and efficiency in US insurer acquisitions and divestitures. Manag Finance 35(2), 128–155 (2009)

Cummins, J.D., Tennyson, S., Weiss, M.A.: Consolidation and efficiency in the US life insurance industry. J Bank Finance 23(2), 325–357 (1999)

Cybo-Ottone, A., Murgia, M.: Mergers and shareholders wealth in European banking. J Bank Finance 24, 831–859 (2000)

Elango, B.: When does cross-border acquisition of insurance firms lead to value creation? J Risk Finance 7(4), 402–414 (2006)

Falk, H., Levy, H.: Market reaction to quarterly earnings’ announcements: a stochastic dominance based test of market efficiency. Manage Sci 35(4), 425–446 (1989)

Farny, D.: Versicherungsbetriebslehre, 5th edn. Versicherungswirtschaft, Karlsruhe (2011)

Fields, L.P., Fraser, D.R., Kolari, J.W.: Is bancassurance a viable model for financial firms? J Risk Insur 74, 777–794 (2005)

Fields, L.P., Fraser, D.R., Kolari, J.W.: Bidder returns in bancassurance mergers: Is there evidence of synergy? J Bank Finance 31, 3646–3662 (2007)

Floreani, A., Rigamonti, S.: Mergers and shareholders’ wealth in the insurance industry. Working Paper. Universita del S.Cuore, Milan (2001)

Grossmann, S.J., Hart, O.D.: Takeover bids, the free-rider problem, and the theory of the corporation. Bell J Econ 11, 42–64 (1980)

Haleblian, J., Finkelstein, S.: The influence of organizational acquisition experience on acquisition performance: a behavioral learning perspective. Adm Sci Q 44, 29–56 (1999)

Hazelkorn, T., Zenner, M., Shivdasani, A.: Creating value with mergers and acquisitions. J Appl Corp Finance 16, 81–90 (2004)

Higson, G., Elliott, J.: Post-takeover returns: the UK evidence. J Empir Finance 5, 27–46 (1998)

Javidan, M., Pablo, A.L., Singh, H., Hitt, M., Jemison, D.: Where we’ve been and where we’re going. In: Pablo, A.L., Javidan, M. (eds.) Mergers and acquisitions: creating integrative knowledge, pp. 245–261. Blackwell, Oxford (2004)

Jensen, M.C.: Takeovers: folklore and science. Harv Bus Rev, (1984). doi:10.2139/ssrn.350425

Kruse, T.A., Park, H.Y., Park, K., Suzuki, K.I.: The value of corporate diversification: Evidence from post-merger performance in Japan. AFA 2003 Meetings, Washington, DC. (2002)

Loderer, C., Martin, K.: Post acquisition performance of acquiring firms. Financ Manage 21, 69–79 (1992)

Love, J.H., Scouller, J.: Growth by acquisitions. The lessons of experience. J Gen Manag 15(3), 4–19 (1990)

Lubatkin, M.: Mergers and the performance of the acquiring firm. Acad Manag Rev 8, 218–225 (1983)

Lyon, J.D., Barber, B.M., Tsai, C.-L.: Improved methods for tests of long-run abnormal stock returns. J Finance 1, 165–201 (1999)

McWilliams, A., Siegel, D.: Event studies in management research: theoretical and empirical issues. Acad Manag J 40(3), 626–657 (1997)

Megginson, W.L., Morgan, A., Nail, L.: The determinants of positive long-term performance in strategic mergers: corporate focus and cash. J Bank Finance 28, 523–552 (2004)

Merchant, H., Schendel, D.: How do international joint ventures create shareholder value? Strateg Manag J 21, 723–737 (2000)

Mikkelson, W., Ruback, R.S.: An empirical analysis of the interfirm equity investment process. J Financ Econ 14, 523–553 (1985)

Moeller, S.B., Schlingemann, F.P., Stulz, R.M.: Firm size and the gains from acquisitions. J Financ Econ 73, 201–228 (2003)

Morck, R., Shleifer, A., Vishny, R.W.: Characteristics of targets of hostile and friendly takeovers. In: Auerbach, A. (ed.) Corporate takeovers: causes and consequences. University of Chicago Press, Chicago (1988)

Myers, S.C., Majluf, N.S.: Corporate financing and investment decisions when firms have information that investors do not have. J Financ Econ 13, 187–221 (1984)

Rappaport, A.: Creating shareholder value: the new standard for business performance, 1st edn. Simon & Schuster, New York (1986)

Schertzinger, A., 2008, Value creation by European insurance M&A, Dissertation, European Business School Oestrich-Winkel, Germany.

Shim, J.: Mergers & acquisitions, diversification and performance in the U.S. property-liability insurance industry. J Financ Serv Res 39, 119–144 (2011)

Shleifer, A., Vishny, R.W.: Greenmail, white knights and shareholders’ interest. Rand J Econ 17, 293–309 (1986)

Spiss, L., 2008, Acquirer performance in mergers and acquisitions, Dissertation, St. Gallen.

Staikouras, S.K.: An event study analysis of international ventures between banks and insurance firms. J Int Financ Mark Inst Money 19, 675–691 (2009)

Sudarsanam, S.: Creating value through mergers and acquisitions. Prentice Hall, London (2010)

Viswanathan, S., Wei, B.: Endogenous events and long run returns. Working Paper. Fuqua School of Business, Duke University, Durham (2004)

Wuebben, B.: German mergers & acquisitions in the USA: Transaction management and success, 1st edn. (2007)

Author information

Authors and Affiliations

Corresponding author

Additional information

This paper is based on the dissertation of Sven Bach (Success of Mergers and Acquisitions in the Insurance Industry: What Can We Learn from Previous Empirical Research) but extends some of the basic ideas of the dissertation.

Rights and permissions

About this article

Cite this article

Altuntas, M., Bach, S. & Rauch, J. Determinants of M&A success in the European insurance industry. ZVersWiss 105, 391–420 (2016). https://doi.org/10.1007/s12297-016-0348-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12297-016-0348-8