Abstract

The paper investigates the factors driving shareholder value creation following extraordinary financial transactions in the European banking sector after the 2007–2008 crisis. The study analyzes a sample of transactions between commercial banks announced between 2010 and 2020, to verify whether these acquisitions resulted in the creation of value for acquirers. It is found positive and statistically significant abnormal returns for the acquirers at the time of announcement. When identifying some aspects of the target that influence the returns, the study tests whether the market, in a period of crisis, recognizes a premium if the target is “good.” The paper finds that the market valorizes target companies with low NPL ratios, high levels of capitalization with respect to the credit granted, and balanced exposure to interest rates.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

9.1 Introduction

The creation of shareholder value for companies involved in M&A transactions is one of the most discussed topics in the academic literature. Many authors have questioned whether an organization’s choice to grow by external means benefits shareholders or destroys value. In this context, a series of studies have focused on operations characterizing the banking sector, often obtaining conflicting results. Few studies, however, have analyzed the European market: until the 1990s, lack of cohesion among countries and of unified regulation made it difficult to identify common determinants of value creation. In the early 2000s, progressive integration at the European supranational level opened up new horizons and resulted in a growing body of related scholarship. Yet more recently, the 2008 financial crisis completely upset the traditional competitive logic of the sector, instituting radical and irreversible changes. New parameters have consequently emerged for evaluating the ability of banks to generate value for shareholders. The main objective of this chapter is therefore to identify the new drivers guiding the reactions of market participants to announcement of an acquisition. While the literature predating the financial crisis often focused on characteristics common to acquiring companies that could explain abnormal returns occurring on the date of disclosure of a corporate finance transaction, this study instead pays particular attention to the characteristics of target companies. The underlying hypothesis is that the market, in a period of crisis, awards premium returns to acquiring companies if the acquired credit institution has high levels of operational efficiency, a good ability to manage impaired positions, and sound capitalization.

The rest of the chapter is organized as follows. In Sect. 9.2, we recapitulate the main drivers of the consolidation of the European banking market in the period after the global financial crisis. We then summarize the pertinent background literature (Sect. 9.3). Next, Sect. 9.4 delves into our event study methodology, specifies the testable hypotheses and defines the sample selection. In Sect. 9.5, we present the main results of our analysis. Finally, Sect. 9.6 concludes reviewing the main thrust of our results, ventilate the potential limitations of our study, and sketches possible future avenues of research.

9.2 The European Banking Sector in the Post-Financial Crisis Era

The need to strengthen the European banking system in the years following the financial and sovereign debt crisis resulted in a series of both sector-specific and macroeconomic structural interventions. In this regard, three reforms have strongly impacted the operation and profitability of credit intermediation since 2010: (i) European Central Bank (ECB) monetary policy and interest rates, (ii) Non-Performing Loans and IFRS 9, and (iii) new capital requirements. Though these reforms have had negative consequences on growth outlook in the banking industry, they have increased the solidity of the sector and provided greater protections for the savings of account holders.

The highly expansive ECB monetary policy (i), implemented through acquisitions of assets on the open market (Asset Purchase Program) and Long-Term Refinancing Operations, has brought the main reference rates into negative territory. While on the one hand, this has allowed for an increased supply of credit to the real economy, enabling economic recovery, on the other hand, the drop in interest rates has also influenced the yields of loans, putting pressure on the Net Interest Margin, the main revenue source for banks.

Another factor weakening bank performance has been the explosion of Non-Performing Loans (ii), triggered by the economic crisis and poor growth prospects in the Eurozone. Recognizing the seriousness of the situation, banking authorities have proposed a reform of the accounting standards used by financial instruments so that provisions made against impaired positions better reflect expected and not incurred losses. The resulting IFRS 9 went into effect in 2014—replacing IAS 39, which was deemed inadequate for preventing situations of financial stress. Implementation of this new standard and the addenda introduced by the ECB, however, have had negative consequences on the profitability of banks: according to a 2019 PWC study, the initial adoption of IFRS 9 cost banks an average increase of 9% in loan loss provisions and about 51 basis points in terms of Core Tier 1 ratios.

Finally, the tightening of regulations regarding capital requirements (iii) has limited the ability of financial institutions to exploit the leverage effect and distribute wealth to shareholders in order to improve their resilience to high-stress scenarios. The new European CRR II and CRD V directives have further raised minimum CET1 ratios for Global-Systemically Important Banks to reduce systemic risk.

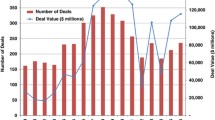

This period of crisis for the European banking sector has also had consequences on M&A activity. Since 2010, there has been a steady decline in both M&A volumes and values compared to the previous decade. Interestingly, in the last 20 years Italy has far outperformed other European countries in terms of the number of acquisitions, claiming about 26% of the total number of European transactions effected since 2000. There has also been a significant reduction in cross-border deals, which have literally stopped in the last decade. Analysis of deals closed in the last 20 years moreover reveals a clear preference for the acquisition of unlisted targets.

9.3 Literature Review

The literature on mergers and acquisitions in the banking sector has been heavily influenced by the evolution of the global financial system. In the 1980s and 1990s, the deregulation of lending in Europe and the U.S. gave rise to a merger wave that was also supported by increased globalization and shrinking cultural distances among countries. Despite a brief pause in 2002–2003, this consolidation process was interrupted less by the global financial crisis of 2007–2008 than by the consequences triggered by that crisis.

M&A was a key theme in the literature of the pre-crisis years, fueling several strands of research. One strand focused on identifying why banks seek external sources of growth (Focarelli & Pozzolo, 2001; Focarelli et al., 1999; Hagendorff et al., 2008; Hernando et al., 2008; Pasiouras et al., 2007). Among the key findings in this path of inquiry was that diversification, in terms of both product (e.g., bancassurance agreements) and geographical area, influences the likelihood that a credit institution will undertake an acquisition. The attractiveness of a given country’s banking sector, possibility of exploiting economies of scale, and potential advantages resulting from the restructuring of underperforming companies have also been found to affect acquisition processes. Another strand of literature much debated in the first decade of the 2000s focused on the merger premium. On this topic, American literature has been more prolific than the European scholarship, whose main findings are encapsulated in two studies: Diaz and Azofra (2009) and Hagendorff et al. (2010). These studies find that acquiring companies seem willing to pay more for targets with high growth rates and lower risk if located in countries with less stringent regulation.

Though M&A has therefore taken a back seat in recent year compared to more topical issues, such as the impact of regulation or the determinants of bank performance, the creation of shareholder value has always remained central to the scholarship. This primary position derives from the multiple applications of knowledge about shareholder value creation: in addition to indicating whether shareholders and investors benefit on the day a transaction is announced, research on the creation of shareholder value also enables identification of the determinants influencing increases in stock market returns. Tourani and Van Beek (1999) were among the first to apply the methodology of short-term event studies in the European market, finding negative but not significant announcement returns for the bidding company. On the other hand, evidence of positive and statistically significant returns has been found in research on target companies. Using a sample of 54 deals selected from between 1988 and 1997, Cybo-Ottone and Murgia (2000) found statistically significant positive returns at the announcement date for the shareholders of bidding companies. The authors also ascertained that the creation of value was greater in cases in which deals were directed toward banks within the same country or toward financial institutions that would enable greater product diversification for the acquiring company. In the wake of these results, Lepetit et al. (2004) also found evidence of non-significant positive returns for acquiring companies, particularly when the transaction is made with the purpose of product diversification (e.g., credit institutions in insurance).

According to a study by Campa and Hernando (2006), though returns for target companies are positive at announcement, returns for acquiring shareholders are significantly negative, even over longer periods of analysis (i.e., one month after the event). These authors find that, in the long run, both acquiring and target companies experience negative abnormal returns, even if they are not statistically significant. Hagendorff et al. (2008) analyzed the determinants of abnormal returns in detail for the first time, examining whether investor protection in a target’s country (i.e., the level of protection enjoyed by the company’s shareholders) influences how investors react to the announcement of a transaction. Performing a comparative analysis across Europe and the U.S., this study identified an inverse relationship of returns: acquiring banks realize higher returns when the target is located in an economy with a low level of protection (such as European economies). Analysis of the study’s sample of 53 European mergers from 1996 to 2004 moreover confirmed the presence of statistically significant positive returns for acquiring shareholders.

After publication of Hagendorff et al. (2008), analysis of the determinants of abnormal returns became the central object of study in Asimakopoulos and Athanasoglou (2013), Beltratti and Paladino (2013), and all subsequent studies. Asimakopoulos and Athanasoglou (2013) found that acquiring shareholders benefit more from domestic transactions and from transactions between listed banks, concluding that acquisitions of smaller, less efficient intermediaries do not generate increases in shareholder wealth. Beltratti and Paladino (2013) shifted to the years of the financial crisis: the study focuses on value creation in M&A transactions from between 2007 and 2010, confirming the hypothesis that, due to uncertainty, investors react only partially at the announcement of a transaction but positively at its completion date. This finding contradicts the previous evidence of long-term negative returns (e.g., Campa & Hernando, 2006). According to Beltratti and Paladino (2013), returns at the announcement date are positively related to the ROE and leverage of the bidding company. It is thus likely that, during the crisis, market participants concluded that banks with more profitability and capitalization were better able to exploit synergies from an acquisition.

The impact of the financial crisis was also the central theme in Rao-Nicholson and Salaber (2015). Focusing on cross-border transactions, this study noted that, after 2007, only acquisitions involving buyers in developing countries and targets in developed countries generated positive and significant returns for shareholders. Kyriazopoulos and Drymbetas (2015) returned focus to the pre-crisis period and confirmed the absence of significant returns to bidding shareholders at the announcement of domestic deals. However, taking a longer time period (–10, +10 days) into account, abnormal returns became negative. The authors also concluded that a more balanced capital structure in the target company positively effects value creation. According to Kyriazopoulos (2016), in M&A transactions between banks in Eastern Europe, acquirers have positive and statistically significant returns if an acquisition is paid for with cash on hand and if the target’s country is characterized by high industry competitiveness.

The most recent study in this area was conducted by Leledakis and Pyrgiotakis (2019). Analyzing returns for acquirers using a sample of 312 extraordinary transactions among commercial banks announced between 1998 and 2016, this study observed negative overall returns. However, after dividing the sample into “pre-crisis” (M&A from 1998 to 2008) and “crisis” (M&A from 2008 on) subgroups, the authors noted negative and statistically significant abnormal returns in the “pre-crisis period” and positive returns in the “crisis” period. Moreover, as in Beltratti and Paladino (2013), returns turned out to be positively influenced by the leverage of the acquirer and degree of market concentration of the target country (measured by the Herfindahl–Hirschman Index and Concentration-5 Index).

Brief mention should also be made of the findings of studies focused specifically on the US market. Unlike the European literature, US scholarship has obtained statistical evidence that the shareholders of bidding companies do not benefit from increases in wealth from acquisitions (DeLong, 2001; DeLong & DeYoung, 2007). Brewer and Jagtiani (2013) have also found evidence of a positive relationship between acquisition of the status of Too-Big-To-Fail by bidding credit institutions and those institutions’ returns at the announcement of the transaction through which they attained that status.

9.4 Research Methodology

9.4.1 Event Study

To analyze the creation of shareholder value on the date of a merger announcement, an event study was performed. This widely employed methodology measures the impact of an exogenous event on the market price of a security in the short term. Event studies assume the efficiency of markets and rationality of operators, presuming that the information transmitted by an event will be immediately reflected in the prices of securities.

The informational content of an event is measured through comparison of abnormal returns with a benchmark return, also called a normal return, which is calculated using a model for estimating expected returns. If abnormal returns differ in a statistically significant way from normal returns in the time window in which an event takes place, it is possible to conclude that the information contained in the event has had an impact on the value of the companies under analysis.

This chapter followed the event methodology proposed by Campbell et al. (1997), which involves the following steps: (i) event identification; (ii) sample selection; (iii) identification of abnormal returns; (iv) estimation procedure; (v) significance testing; and (vi) interpretation and conclusion. For step (i), an event window of 21 days was used, which is in line what is suggested by the literature; this time period included the 10 days both before and after the event date (day 0) and an estimation window of 240 days, which is equal to a time span extending from 251 to 11 days before the merger announcement date (250 trading days correspond approximately to one calendar year). Therefore, L1 = T1 – T0 is defined as the duration of the estimation window and L2 = T2 – T1 as the duration of the event window. Step (ii) will be discussed more extensively below. Steps (iii) and (iv) consist in the estimation of abnormal returns, i.e., returns considered abnormal compared to a benchmark expected return. In this study, the market model was used to estimate benchmark returns. This is the most frequently used model in the literature, due to its predictive power and simplicity of application.

After estimating the market model parameters based on the returns in the estimation window, it was possible to calculate the abnormal returns (ARs) of each security in the event window as:

where \({R}_{i,t}\) represents the return of the i-th security at time t in the event window. It is common practice to aggregate Ars around the event date to obtain the Cumulative Abnormal Returns (CARs):

where \({T}_{1} \le {\tau }_{1}\le {\tau }_{2}\le {T}_{2}\). . The significance tests under (v) are designed to test for the existence of a causal relationship between an abnormal return and an event. Using a sample of securities, returns can be further aggregated by security. Given a number of securities equal to N, the Average Abnormal Return (AAR) is defined for period t and the Cumulative Average Abnormal Returns (CAARs) are determined.

The following hypothesis test was therefore constructed:

Rejecting the null hypothesis, it is possible to conclude that an event has a statistically significant impact on the market value of the securities included in the sample. AARs and CAARs have an important statistical property: under the null hypothesis H0, they normally distribute with a mean of zero and variance equal to the variance of the error term of the market model.

The tests performed on the AARs and CAARs in this study were both parametric and nonparametric, since using only parametric tests could lead to unreliable conclusions if the assumption regarding the normal distribution of AARs were incorrect. The parametric tests performed were the cross-sectional t-test, portfolio method t-test, and the test proposed in Patell (1976). While in the first two, it is possible to over-reject the null hypothesis due to event-induced volatility, Patell’s test uses Standardized Abnormal Returns (Ars). The non-parametric tests employed were the Corrado (1989) Rank Test and the Cumulative Rank Test proposed in Hagnäs and Pynonnen (2014). The latter test is essentially an extension of the former, since in its original formulation, the Corrado Rank Test was not intended for CARs.

In addition to analysis of the data (vi) obtained, a cross-sectional multiple linear regression was also performed to search for the determinants of CARs.

9.4.2 Objectives of the Analysis

As highlighted above, short-term studies of the European banking system have obtained mixed results, particularly in determining the Ars of an acquiring firm. Leledakis and Pyrgiotakis (2019), for instance, suggest that investor expectations have changed in the post-financial crisis period: bidding shareholders benefit on average from statistically significant value increases. The first objective of this chapter is therefore to confirm this effect on a sample of M&A transactions announced from 2010 to 2020 using the event study methodology described above.

In addition to measuring the magnitude of abnormal returns in the sample and their statistical significance, the second objective of this chapter is to identify some factors that influence the CARs. For this type of analysis, it is common practice to use a cross-sectional regression that takes the CAR of a given acquisition as the dependent variable with respect to some independent variables. European scholarship has devoted particular attention to analyzing the characteristics of the acquirerFootnote 1 and the operation,Footnote 2 underestimating the impact a target company can also have on the bidding company’s returns—not just in terms of profitabilityFootnote 3 but also in terms of operational efficiency, asset quality, level of capitalization, and diversification. This study therefore addresses a set of characteristics of target companies to evaluate if they impact the expectations of the acquirer. In the cross-sectional regression, the following assumptions were made:

Hypothesis 1

Asset Quality and Capitalization: investors should react positively to the acquisition of targets that have good asset quality and a good level of capitalization.

Hypothesis 2

Business Model: investors should react positively when the acquisition involves targets whose business models are efficient and have balanced exposure to interest rates.

Hypothesis 3

Hypothesis 3—Diversification: investors should react positively to deals that allow for diversification of the acquirer’s business model.Footnote 4

Hypothesis 4

Behavioral Finance and Merger Waves: according to the theory of behavioral finance and merger waves, on the announcement date of an extraordinary transaction, overvalued companies should experience negative returns.Footnote 5

The first three hypotheses refer to variables exclusively linked to the characteristics of the target. The fourth hypothesis, on the other hand, verifies whether the theory of behavioral finance applies even in a period of crisis such as that experienced by the European financial sector in the last decade. In addition to these variables, other variables related to the bidding company have been found to have significant impact on CARs by some studies.

9.4.3 Selection of the Sample

The deals sample was extracted from Securities Data Company (SDC) Platinum by the provider Refinitiv, with a reference time frame including all M&A deals announced from January 1st, 2010 to November 30th, 2020. The sector of each deal was identified by SDC’s “DA” (i.e., Commercial Banks, Bank Holding Companies) and “DB” (i.e., Savings and Loans, Mutual Savings Banks) codes. The geographic area of the sample was Europe (understood in a broad sense to include neighboring countries that—due to trade relations, market affinity, and the presence of relevant international financial institutions—are considered part of the European banking system). In Table 9.1, you can find a summary of deals by country. To enable collection of the target variables, some minimum information about each deal was required for inclusion in the sample: transactions without a stated value for the acquisition or in which the percentage of acquired shares was less than 3% were excluded. Further adjustments were necessary to avoid overlapping estimation windows for acquisitions made by the same company, to eliminate NPL purchases by banking institutions operating in the servicing sector, and to merge transactions announced jointly for the same target but aimed at different groups of shareholders. The sample thus contained 153 transactions.

The necessity of adding the target variables to the cross-sectional regression also affected the sample size: target lending institutions whose data could not be found were removed from the cross-sectional analysis. The final sample for the multiple linear regression therefore included 108 transactions.

To allow for further layers of analysis, the sample was divided into sections. Panels A and B were identified based on the listing status of the target, with Panel A encompassing listed companies and Panel B unlisted companies. Panels C, D, and E, on the other hand, divided the sample based on the geographic macro-area of the acquirer: “Southern Europe,” “Eastern Europe,” and “Northwestern Europe,” respectively.

9.5 Empirical Results

9.5.1 Results of the Event Study

Tables 9.2 and 9.3 present the main results of the event study for the entire sample of 153 deals. The results show that bidding investors react positively to the announcement of a deal. The average return on day zero was +0.78% and was found to be statistically significant. In addition, the 3-day and 5-day CAARs around the announcement date were also positive and statistically significant, highlighting that acquirers achieve an average gain of +0.88% and +0.96%, respectively. Despite being significant under parametric tests, the 5-day CAARs did not pass the Rank Test. This suggests that either event-induced volatility or the assumption of a normal distribution of ARs might have led to erroneous rejection of the null hypothesis.

Analyzing event window returns over a longer time period, however, this observation was reversed: in the 10 days following the announcement, the CAARs of acquiring companies became negative, though not statistically significant. Specifically, the [0.5] and [0.10] CAARs were –0.02% and –0.51%. This could indicate that, after an initial positive reaction, the market enacts a downward revision of expectations regarding the value creation of companies involved in the transaction. Finally, analysis of CAAR [–10, +10], which covers the entire event window, demonstrates that acquirers experience statistically significant negative returns of –1.92%.

The gains experienced during the days around the announcement fail to offset the negative abnormal returns that occur when taking the longer time frame into consideration. These results are aligned with scholarship that has found evidence of positive, though not significant, CAARs (Cybo-Ottone & Murgia, 2000; Hagendorff et al., 2008; Lepetit et al., 2004). In addition, since the positive returns of the sample were also significant, the findings of the recent study by Leledakis and Pyrgiotakis (2019) seem confirmed by these results. It is therefore possible to conclude that changes in the banking sector in the last decade have also had an impact on the reactions of investors to announcements of M&A deals. Consolidation can be seen as a value-generating process, given the negative earnings outlook and high regulation of the banking sector. Finally, the negative CAR for the entire event window aligns with the similar non-significant results Kyriazopoulos and Drymbetas (2015) obtained using a panel of domestic deals.

Table 9.4 shows the results of the event study after division of the sample based on the listing status of the target into Panel A (listed) and Panel B (unlisted).

The CAARs obtained in Panel A are in line with the analysis of the entire sample: a positive effect can be observed around the time of announcement, but the overall effect is negative if the analysis is extended to include the entire event window. However, compared to the whole sample, the 3-day and 5-day CAARs, though positive, are not significant. Furthermore, the returns for CAAR [–10, 10] and for CAAR [0, 10] are decidedly negative, at –4.58% and –2.72%, respectively. Panel B, on the other hand, shows significant and positive returns in each event window. In particular, in the three days around the announcement date, bidders experience positive and significant ARs of +1.23%.

Joint analysis of the two panels reveals different behavior based on whether the acquiring company is involved in a transaction with a listed or unlisted credit institution. Though both cases demonstrate an increase in value at the announcement date, in cases where a target is unlisted, the acquirer’s shareholders benefit from positive returns throughout the event window. Therefore, to test the hypothesis that the acquisition of an unlisted financial institution creates greater value for acquiring shareholders than the acquisition of a listed target, a t-test was performed to analyze the difference in averages between two independent samples. The results, reported in Table 9.5, seem to confirm the hypothesis, especially for CAAR [–10, 10] and CAAR [0, 10], whose t-test values are statistically significant at the 10% level.

Table 9.6 presents the results of the event study based on Panels C, D, and E, reflecting the following respective geographic areas of origin for acquiring companies: Southern Europe, Eastern Europe, and Northwestern Europe. Panel C, which represents Southern Europe, reveals considerable uncertainty: beyond the day of announcement, there is no statistical significance to confirm positive or negative returns on average in the identified time windows.

For acquirers in the region of Eastern Europe, M&A transactions do not create shareholder value. CAARs are negative in both the ten days leading up to a deal and the ten days following it, with an overall negative return in the event window of –4.63%. On the other hand, for acquirers in Northwest Europe, CAARs are positive: banking M&A deals create value. On the day of announcement, there is an average gain of 1.63%, which becomes 2.32% over a 3-day window and reaches 3.27% in a 5-day window. To test whether the difference between the two regions (Eastern and Northwest Europe) was significant, a t-test was also performed for the difference in averages of the two independent samples (Table 9.7). The results confirm that, on average, the shareholders of acquirers located in Northwestern European countries benefit from higher value creation than the shareholders of companies located in Eastern European countries.

There could be various reasons why reactions differ across the three geographic areas identified. The absence of statistical significance in the returns in Panel C could reflect the uncertainty characterizing the countries that suffered most from the sovereign debt crisis due to the fragility of their banking systems. The results for Panel D are partially in line with the findings of Leledakis and Pyrgiotakis (2016), which studied a sample of 69 M&A deals announced in Eastern European countries from 1995 to 2015.

9.5.2 Cross-Sectional Regression

This section presents the results of the cross-sectional regression, employing CAR [–1, +1] as the dependent variable with respect to the independent variables. The 3-day CAR was selected because of its statistical significance (demonstrated in Table 9.3). Table 9.8 displays the results of the multiple linear regression performed on the entire sample. Model (1) includes all variables, while model (2) includes only variables related to the acquired company; model (3) shows variables related to the acquirer and to the deal. This division aims to isolate the effect of the variables in relation to the target.

The variables related to the target company seem to have a greater influence on the 3-day CAR than the set of variables related to the type of deal and acquiring company: the Adjusted R-Squared coefficient of model (2) is higher than that of model (3).

The statistical significance of coefficients T_NPL_Ratio and T_Equity_Loans confirms Hypothesis 1—Asset Quality and Capitalization, according to which investors would prefer financial institutions with low NPL levels and high levels of capitalization. The variable T_NPL_Ratio assumes a negative quadratic relationship with returns at the announcement date. This could indicate that the market reacts positively to NPL ratio levels in the target that are judged sustainable and reacts negatively to excessive levels that could require costly de-risking in the future. The output of the model also presents results that are partially aligned with expectations for Hypothesis 2—Target Structure: on the one hand, the negative influence on the CARs of variables T_Loans_Assets and T_Deposits_Assets confirms that the market rewards acquisitions of target companies with more diversified balance sheet structures that are less linked to interest rates. On the other hand, the findings show no evidence for the hypothesis that the acquirer can create more value through acquisition of a credit institution with high operational efficiency, as measured through the variable T_Cost_Income. The coefficient associated with this variable is positive and statistically significant, suggesting that investors see a potential to exploit synergies by restructuring inefficient targets. Hypothesis 3—Diversification is not confirmed. In fact, in the output of model (1), the variable T_Diversif is not significant, despite having a positive influence on the dependent variable.

Moreover, the dummy variable D_Domestic highlights that transactions between companies within the same nation on average benefit from a positive return of +1.84% compared to cross-border transactions. In model (3), the dummy is also found to have greater impact and statistical significance. With respect to Hypothesis 4—Behavioral Finance and Merger Waves, there is insufficient empirical evidence to confirm the hypothesis that overvalued companies finance acquisitions through share trading. The interaction between A_Pbv and D_Stocks was also tested, but lack of significance led to its exclusion. Finally, the characteristics of acquiring companies show low levels of significance when compared to the characteristics of targets. CARs are positively affected by the acquirer’s Roe (A_Roe) and the number of deposits divided by total assets (A_Deposits_Assets). The variable A_Serial turns out to be significant only in model (3): “serial” acquirers who made more than 4 transactions in the 2010–2020 period were rewarded by the market in terms of announcement returns.

The models presented here were subjected to statistical analysis of outliers, high leverage and influence, heteroscedasticity (Breush–Pagan test), and multicollinearity (Variance Inflation Factor). No critical issues were found. However, three observations were eliminated from the 108 originally identified because they simultaneously indicated outliers, high leverage, and influence. This elimination significantly improved the overall significance of the model.

Models (4) and (5) shown in Table 9.9 respectively refer to the multiple linear regression of CAR [–1, +1] and all independent variables for cases in which listed or unlisted targets were involved in the transaction.

If the output of the event study revealed noteworthy results, the cross-sectional regression performed on both panels did not bring to light any relevant findings with respect to the hypotheses. In model (4), analysis of Panel A (transactions concluded with listed banks) revealed that investors focus on the deposits to total assets ratio for both target and acquirer company. The only significant variables in model (5) were those related to Hypothesis 1—Asset Quality. However, the low overall significance of the model does not allow us to make inferences or draw conclusions based on the data presented in the output.

In the analysis of the cross-sectional regression for Panels C, D and E, on the other hand, a critical point emerged regarding the sample size: while Panel C includes 54 observations, constituting just over 50% of the total sample, Panels D and E, taken individually, did not contain a sufficient number of M&As to obtain significant results. It was, therefore, necessary to merge these panels to achieve significant results.

To account for the diversity across geographic areas, dummy variable D_West was added, which takes a value of 1 if the observation is classified in Panel E (Northwest Europe) and 0 if belonging to Panel D (Eastern Europe). This variable was added due to the results of the analysis of the differences among clusters in Table 9.10 and shows that acquirers located in the Northwest region obtained a higher average gain at the announcement date than those in the Eastern region.

The output of model (6) again highlights the relevance of NPLs, especially if interpreted in light of the weakness of the banking sector in the countries of Southern Europe. Furthermore, it seems evident that the market rewards domestic transactions with an average gain of +5.196%. This result is consistent with the need repeatedly stressed by the ECB to initiate a consolidation process to ensure the solidity of the national financial systems of Southern Europe, which are strongly dominated by small savings and cooperative banks. Here, the event window returns are also positively influenced by the ROE and M&A track records of acquiring companies, meaning the market positively assesses the acquirer’s ability to generate value and increase its size through numerous acquisitions.

Finally, model (7) does not present any particularly relevant insights. Though confirming that transactions in the North-West cluster benefit from an average gain of +0.8% with respect to those in the East, the dummy variable D_West results in a non-significant coefficient. Also in this case, Hypothesis-1 seems to be verified, since the significance of the NPL ratio of the target is confirmed.

9.6 Conclusions

The empirical evidence shows that when acquisitions in the European banking sector are announced, shareholders of the acquiring company benefit from positive returns on average. While many authors have tried to verify whether there are characteristics common to acquiring companies that influence value creation in M&A transactions, little attention has been given to the traits of target companies. This study therefore shows that the characteristics of a target financial institution, which relate to the main issues briefly discussed in the first section of this chapter—interest rates, NPLs, capital requirements, and declining M&A volumes—are among the main determinants of a bidding company’s abnormal returns.

Segmenting the sample into different panels also revealed noteworthy results. When targets are listed entities, the CARs of acquirers are negative, whereas if targets are private companies, returns are positive. This could indicate that market participants negatively discount the possibility of integrating two corporate cultures and two different modus operandi that are already well-established in the market. Analysis of the determinants, however, did not reveal particularly significant results in economic terms.

On the other hand, division of the transactions by geographic area brought to light differences among the various regions of the Eurozone, especially with regard to Southern Europe. In fact, while there are positive CARs for acquirers in Northwestern Europe and negative CARs for those in Eastern Europe, returns in Southern Europe are more uncertain. This situation could be explained by the fragility of the financial systems in Southern European countries, which suffered most from the sovereign debt crisis and have faced drastic austerity policies to contain public debt. This hypothesis, which emerged through analysis of the results of the event study, could be confirmed by the significance of certain coefficients in the output of the model. Firstly, the attention paid by investors to asset quality. Secondly, the theme of domestic banking consolidation mentioned above, which was underscored by the +5.19% return that acquiring companies involved in domestic transactions gained on average. Finally, the characteristics of acquiring companies were found to be more significant than those pertaining to the full sample. Market participants are more confident about value creation in M&A transactions if acquirers have high levels of profitability and a solid track record of external growth.

Though the results obtained by this study demonstrate a good level of significance overall, the analysis has some limitations. The first is linked to the assumptions underwriting use of the event study methodology. Though choice of the market model as the method for estimating expected benchmark returns is recognized in the literature as the most effective, its reliability depends exclusively on the R-Squared level of the simple linear regression in relation to the market portfolio (Stoxx Europe 600 Banks index). Furthermore, use of the market model assumes the normality of daily returns, which could often be erroneous. To overcome these problems, multifactor models could be used, such as the three-factor Fama–French model; this would allow for more specification among the abnormal returns obtained. A second limitation of this study concerns the sample size for the cross-sectional regression. Although the full sample of 153 transactions is in line with much of the literature in terms of quantity, the reduction of the sample due to lack of data about some target companies could have deprived the analysis of some important observations. However, it is also worth noting that the absence of data mainly affected small transactions with sizes that were significantly below average. Such operations could hardly have influenced the distribution of CAARs or AARs. Finally, a larger sample size would have allowed for more meaningful results from the cross-sectional regression analysis performed on the panels divided by geographic area of origin.

This study’s results offer numerous insights for future work in event studies and the European banking industry. Many analysts agree that it will be necessary in the next few years to resume the financial consolidation process interrupted in 2007, for reasons of both competitiveness and recovery of profitability. In fact, most credit institutions have already made all the capital adjustments necessary to ensure full compliance with discretionary requirements; avoiding having to recapitalize distressed institutions or to carry out further de-risking operations will make the merging of organizations easier. In conclusion, the onset of a new wave of M&A in the industry could once again shift the focus of the literature back toward finding new drivers to explain value creation. Along this, it could be interesting to address the potential role of ESG scores in shaping the M&As activities in banking. Indeed, as suggested by the previous three chapters, ESG scores synthesize a new view of value creation and it would be worth studying whether this drives bank M&As beyond shareholder value creation.

Notes

- 1.

- 2.

- 3.

- 4.

- 5.

References

Asimakopoulos, I., & Athanasoglou, P. (2013). Revisiting the merger and acquisition performance of European banks. International Review of Financial Analysis, 29(C), 237–249.

Beltratti, A., & Paladino, G. (2013). Is M&A different during a crisis? Evidence from the European banking sector. Journal of Banking and Finance, 37, 5394–5405.

Brewer, E., & Jagtiani, P. (2013). How much did banks pay to become too-big-to-fail and to become systemically important? Journal of Financial Services Research, 43(1), 1–35.

Campa, J. M., & Hernando, I. (2006). M&As performance in the European financial industry. Journal of Banking and Finance, 30, 3367–3392.

Chidambaran, N. K., John, K., Shangguan, Z., & Vasudevan, G. (2010). Hot and cold merger markets. Review of Quantitative Finance and Accounting, 34(3), 327–349. https://doi.org/10.1007/s11156-009-0133-z

Corrado, C. J. (1989). A nonparametric test for abnormal security-price performance in event studies. Journal of Financial Economics, 23, 385–395.

Cybo-Ottone, A., & Murgia, M. (2000). Mergers and shareholder wealth in European banking. Journal of Banking & Finance, 24(6), 831–859.

DeLong, G., & DeYoung, R. (2007). Learning by observing: Information spillovers in the execution and valuation of commercial bank M&As. Journal of Finance, 62(1), 181–216.

DeLong, G. L. (2001). Stockholder gains from focusing versus diversifying bank mergers. Journal of Financial Economics, 59(2), 221–252.

DeYoung, R., Evanoff, D., & Molyneux, P. (2009). Mergers and acquisitions of financial institutions: A review of the post-2000 literature. Journal of Financial Services Research, 36(2), 87–110.

Diaz, B., & Azofra, S. S. (2009). Determinants of premiums paid in European banking mergers and acquisitions. International Journal of Banking, Accounting and Finance, 1(4), 358–380.

Focarelli, D., Panetta F., & Salleo C. (1999). Why do banks merge? (Working Paper n. 361). Banca d’ Italia Research Department.

Focarelli, D., & Pozzolo A. F. (2001b). Where do banks expand abroad? An empirical analysis (Working Paper). Banca d’ Italia Research Department.

Hagendorff, J., Collins, M., & Keasey, K. (2008). Investor protection and the value effects of bank merger announcements in Europe and the US. Journal of Banking & Finance, 32(7), 1333–1348.

Hagendorff, J., Hernando, I., Nieto, M., & Wall, L. (2010). What do premiums paid for bank M&As reflect? The Case of the European Union. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1537585

Hagnäs, T., & Pynnonen, S. (2014). Testing for cumulative abnormal returns in event studies with the rank test. https://doi.org/10.2139/ssrn.2479228

Hernando, I., Nieto, M. J., & Wall, L. D. (2008). Determinants of domestic and cross-border bank acquisitions in the European Union (Paolo Baffi Centre Research Paper n. 2008-33; Banco de Espana Working Paper n. 0823).

John, K., Mateti, R. S., Shangguan, Z., & Vasudevan, G. (2013). Does overvaluation of bidder stock drive acquisitions? The case of public and private targets. International Journal of Banking, Accounting and Finance, 5(1/2), 188–204.

Kyriazopoulos, G. (2016). Wealth effects from banks mergers and acquisitions in Eastern Europe. International Journal of Economics and Financial Issues, 6, 588–595.

Kyriazopoulos, G., & Drymbetas, E. (2015). Long-term performance of acquirers involved in domestic bank M&As in Europe. International Journal of Financial Research, 3(1), 100–116.

Leledakis, G. N., & Pyrgiotakis, E. G. (2016). U.S. bank M&As in the post-Dodd-Frank Act era: Do they create value? MPRA Paper 73290, University Library of Munich.

Leledakis, G. N., & Pyrgiotakis, E. G. (2019). Market concentration and bank M&As: Evidence from the European sovereign debt crisis. https://doi.org/10.2139/ssrn.3443171

Lepetit, L., Patry, S., & Rous, P. (2004). Diversification versus specialization: An event study of M&As in the European banking industry. Applied Financial Economics, 14(9), 663–669.

Pasiouras, F., Tanna, S. K., & Gaganis, C. (2007). What drives acquisitions in the EU banking industry? The role of bank regulation and supervision framework, bank specific and market specific factors. (Economics, Finance and Accounting Applied Research Working Paper Series, n. 2007-3). Coventry University.

Patell, J. M. (1976). Corporate forecasts of earnings per share and stock price behavior: Empirical tests. Journal of Accounting Research, 14, 246–276.

Rao-Nicholson, R., & Salaber, J. (2015). Impact of the financial crisis on banking acquisitions: A look at shareholder wealth. International Journal of the Economics of Business, 22(1), 87–117.

Rhodes–Kropf, M., Robinson, D. T., & Viswanathan, S. (2005). Valuation waves and merger activity: The empirical evidence. Journal of Financial Economics, 77(3), 561–603. https://doi.org/10.1016/j.jfineco.2004.06.015

Shleifer, A., & Vishny, R. W. (2003). Stock market driven acquisitions. Journal of Financial Economics, 70(3), 295–311. https://doi.org/10.1016/s0304-405x(03)00211-3

Tourani Rad, A., & Van Beek, L. (1999). Market valuation of European bank mergers. European Management Journal, 17(5), 532–540.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Gigante, G., Baldacchini, M., Cerri, A. (2023). Drivers of Shareholder Value Creation in M&A: Event Study of the European Banking Sector in the Post-financial Crisis Era. In: Wachtel, P., Ferri, G., Miklaszewska, E. (eds) Creating Value and Improving Financial Performance. Palgrave Macmillan Studies in Banking and Financial Institutions. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-031-24876-4_9

Download citation

DOI: https://doi.org/10.1007/978-3-031-24876-4_9

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-031-24875-7

Online ISBN: 978-3-031-24876-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)