Abstract

We examine the link between corporate financing and investment decisions of European firms by using a novel firm-level survey of the European Investment Bank. The survey provides rich quantitative information of a wide range of financing sources and tangible and intangible investment types for a representative sample of EU28 firms in 2016. We provide new evidence and contribute to previous research in the following ways: first we consider the heterogeneous effect of internal and external finance on different tangible and intangible investment types. Second, our analysis focuses on a broad spectrum of non-financial corporations across size classes from different countries. By using a multinomial fractional response model to estimate the finance-investment link, we find that SMEs and large enterprises show a different financing behaviour for their investment activity. The results suggest that SMEs’ tangible asset investment is positively related to the use of bank finance, whereas internal finance is preferred for intangible asset investments.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Recovery of business investment in Europe has been particularly sluggish after the Great Recession (European Investment Bank 2017a; European Commission 2017). A big reason for this has been the distressed financial market that showed a sharp decline of credit supply, followed by a strong recession affecting the demand side. The aftermath of the crisis highlighted again that the availability of funding is a critical premise to pursue investment. In the context of investment as a crucial contributor to future growth, it is thus fundamental to policy makers to grasp a deeper understanding of what determines corporate finance and investment behaviour.

Hence, unlocking the determinants of corporate investment and investment finance has become a popular topic in research and ample literature aims to explain the impact of financing variables on investment behaviour. Departing from the influential Modigliani and Miller paradigm (1958), several theories emerged and posited the importance of capital structure and finance for corporate investment strategies, most notably trade-off and agency theories (Jensen and Meckling 1976; Myers 1977; Jensen 1986) and pecking order considerations (Myers and Majluf 1984; Myers 1984). Several strands of empirical studies highlight firm characteristics such as size or sector affiliation as influential for determining a firm’s financial structure (Lang et al. 1996; Aivazian et al. 2005; Martinez-Carrascal and Ferrando 2008). On the other hand, empirical research has broadly analysed the effects of financing constraints and excess leverage on investment (Fazzari et al. 1988; Kaplan and Zingales 1997; Cleary 2006).

However, many aspects of corporate financing choices and investment determinants are still uncovered or remain debatable. On the one hand, many studies focus on the effect of a single financing variable, such as cash flow, debt or equity on investment. On the other hand, much research is grounded on balance sheet or accounting data, which predominantly give information about physical capital outlays and provide at most unsatisfying information about the wide range of intangible investments. Furthermore, most studies on corporate financing and investment behaviour are often narrowed to a specific sector, firm size or country. We are contributing to this literature by looking at the possible diversification of different financing sources and matching them with types of investment across a wide sample of firms across sizes, countries and sectors.

In fact, there are good reasons to believe that the link between financing and investment decisions is of a very heterogeneous nature. First, availability and importance of certain financing avenues might be different for firms across different sectors, life-cycle stages and sizes. For instance, large firms are generally known to have broader access to finance than smaller firms: While large firms enjoy benefits from large scale lending or can collect funds from public equity and debt markets, small and young firms often face credit constraints due a short track record and limited collateral and informational opacity (Berger and Udell 1998). Secondly, firms may face different growth opportunities and hence pursue different investment strategies. While younger and smaller firms might have high growth prospects that entail high intangible assets growth, larger and older firms may rather focus on horizontal integration to expand business. Lastly, the availability of financing is likely to be different for different types of investment. For instance, the often exploratory nature of investment in intangible assets is accompanied by higher payoff risks, non-excludability of the outcome and hardly predictable total costs ex ante. This, in turn, affects the firm’s capacity to secure funding from banks, which prefer “redeployable” collateral (Williamson 1988) to safeguard loans and make investment in intangibles particularly prone to financing constraints (Bond et al. 2003; Aghion et al. 2012; Thum-Thysen et al. 2017).

This paper aims to address some shortcomings of the existing research with a novel survey-based approach, using recently released survey data from the European Investment Bank Investment Survey (EIBIS). The information of the survey opens up new possibilities for research in corporate finance and investment by—for the first time—providing quantitative information on a wide range of different source of financing and different investment types (tangible and intangible). It contains comprehensive information on financing and investment of a representative sample of 12,500 firms across various age groups, sizes, industry sectors and all EU member countries.

Using survey data, we are able to contribute to the existing research in the following ways: first, we provide new insights in corporate financing and investment behaviour by considering a wide range of financial instruments and a comprehensive range of tangible and intangible investment types. Instead of calculating the investment rate out of fixed assets, the survey data contains direct information of tangible and intangible investment types that goes beyond the scope of accounting principles for investment. Moreover, while the more detailed financing sources, like different types of debts and their link to investment, cannot be derived from balance sheet data, the survey provides details of different type of financing taken explicitly for investments. Second, due to the representativeness of the sample, we are able to draw a more holistic approach than most existing studies.

More specifically, we use financing and investment data and set up a multinomial fractional response model to estimate the correlation of financing sources and investment types by controlling for other types of finance and firm characteristics. Given a firm-specific amount of available finance, we consider different types of investment as competing spending positions that are naturally correlated with each other. In this way, we allow the error terms of different types of investment to correlate and are able to show finance-investment linkages while mutually accounting for all investment types. As the literature suggests, firm size is an important determinant of a firm’s financing and investment behaviour. We thus split the sample by firm size to see whether SMEs and large firms show different patterns in the investment finance behaviour. In a second step, we test the consistency of our results with a different approach. By relaxing the assumption of the rivalry of the various investment spendings, we consider the complementarity of different tangible and intangible investment types (European Investment Bank 2017a).

Our results first confirm that internal finance seems to be the most important source of funds for all investment types, particularly for intangible investment, irrespective of firm size. However, they also suggest that SMEs and large enterprises show different patterns for their external financing for investment. Bank finance, in contrast is important for tangible investment, especially for SMEs, and is negatively correlated with intangible investment. Furthermore, R&D investment, especially for SMEs, seems to benefit from available funds from insider finance and equity. Unsurprisingly, grants show a strong correlation with infrastructure investment, while leasing is highly important for investment in machinery and equipment.

The remainder is structured as follows: The next section will discuss the previous literature. Section 3 will provide some details on the EIBIS data and show some stylized facts about corporate investment and investment finance of European firms. Section 4 will introduce the construction of the variables and set up the methodological framework. Afterwards we present and discuss the results and check for consistency under different assumptions. Section 7 concludes the analysis and provides an outlook for future research.

2 Literature review

Corporate investment behaviour has occupied a prominent role in finance research over the past decades and a large body of the literature has provided robust empirical evidence that financial factors have a significant impact on firms’ investment decisions. Underlying theories and empirical evidence have become numerous and suggest a range of approaches. Besides behavioural theory that focuses on strategic factors such as net worth of a firm, investment opportunities and agency conflicts as main influential variables (Jensen and Meckling 1976; Myers 1977; Myers and Majluf 1984), market imperfections have been carved out and moved financial variables into the spotlight of research. A cost wedge between available internal and external funds, caused by asymmetric information, or the leverage function of debt motivate a large band of literature to examine the impact of financial variables such as cash flow or debt on firms’ investment decisions.

The debate on the nexus between financing sources and investment was triggered by the irrelevance theorem of Modigliani and Miller (1958), which states that a firm’s capital structure does not matter for its value. Contrasting this theory, empirical research focused on exploring the effect of financial variables on corporate investment. Starting with the seminal work by Fazzari et al. (1988), many empirical studies tested the hypothesis that financial frictions would hamper investment. Based on the assumption that financially constrained firms would rely more on internal funds, a higher sensitivity of investment or firms’ growth to internal sources was taken as evidence that financing constraints negatively affect investment (see also Fazzari et al. 1988; Carpenter and Petersen 2002). However, several studies criticised the way cash flow sensitivities and financing constraints are a meaningful predictor to changes in investment (Kaplan and Zingales 1997, 2000; Erickson and Whited 2010), due to mismeasurement of investment opportunities (Tobin’s Q) and sample splits that have no theoretical basis (Saltari and Travaglini 2001). Interestingly, a subsequent contribution by Saltari and Travaglini (2006) explores the effects of future constraints on current investment decisions of firms showing that these effects are included in the market value of the firm, and thus are captured by marginal q.

The literature dealing with the impact of external financing on investment focuses on the strategic and behavioural effects of leverage and equity rather than on the access to different type of external finance. Starting with Myers (1977), debt overhang models try to explain why a debt burden can lead to over and under investment. The empirical literature on external financing and investment is less extensive than the one focusing on cash flow and financing constraints. For example, Lang et al. (1996) and Aivazian et al. (2005), using US and Canadian data respectively, show that leverage is negatively related to investment and that this negative effect is significantly stronger for firms with low growth opportunities. Martinez-Carrascal and Ferrando (2008) test the effect of leverage and cash flow on investment to find a negative relationship between debt and investment while it is positive for cash flow.

While most of the empirical literature focuses on a single financing type, a scarce empirical literature has investigated the effect of different types of financing on investment. For example, Covas and Den Haan (2012) develop a model in which firms finance investment needs with both debt and equity. Since debt financing increases the likelihood of default, firms have an incentive to issue equity in order to avoid excessive leverage when they issue debt. Begenau and Salomao (2018) build a scenario in which small firms issue debt and equity pro-cyclically for a similar reason as in Covas and Den Haan (2012) and large firms prefer to finance their investment by debt during expansion due to the lower credit constraints that these firms face. Their main results depend on differences in funding needs and financial frictions across firms. First, smaller firms have higher funding needs because they are farther away from their efficiency scale and, second, debt financing is generally more costly to them as they have less pledgeable collateral. Hence, in good times, smaller firms respond to increased growth opportunities by investing and raising more funds following a pecking order from internal funds to debt and then equity (Myers and Majluf 1984).

Most of corporate investment research focuses on total investment that is captured by changes in fixed assets. Only few papers relate different types of investment to the type of external financing. For instance, Long and Malitz (1983) recognise that the specific investment characteristics determine the amount of financial leverage. Hall and Lerner (2009) highlight that R&D investment is likely to be financed by private equity and also Grundy and Verwijmeren (2017) find that investments with more volatile cash flows, like R&D investments, tend to be equity-financed. Investments in tangible assets, instead, tend to be debt-financed by issuing corporate bonds. However, the authors do not consider either internal financing or financing by bank loans and credit lines but mainly focus on debt and equity securities that are issued to finance new investment. Czarnitzki and Hottenrott (2011) provide empirical support that financing constraints are more harmful for R&D investments for small firms, because small firms have fewer internal financial resources as well as possibly less access to external sources of funds than large firms. Focusing on firms situated in a small region in Italy during the financial crisis, Calcagnini et al. (2011) provide evidence that the regional bank industry was more willing to finance traditional than innovative firms and that successful innovative companies tended to fund their investment by means of equity.

In this paper, we go beyond the classification used in previous literature by providing more details. We consider both internal finance, defined as retained earnings, and a wide range of external sources of finance, such as bank finance, equity, loans from family and friends, grants and others. We explore the interplay between available funding and investment decisions and check the relative importance of different financial sources. We also look at a sample split between SMEs and large enterprises, as capital structure research suggests their different pattern in terms of investment financing (Cressy and Olafsson 1997; Berger and Udell 1998; Beck et al. 2008).

3 Data description and stylized facts

The analysis is based on survey data from the European Investment Bank Investment Survey (EIBIS). The EIBIS survey offers researchers new opportunities for corporate finance and investment research as it contains representative quantitative firm-level data on different financing and investment variables. In this section, we present an overview of the data and the sample characteristics and then draw some stylized facts about the sample that already points out some preliminary results for the subsequent empirical analysis.

3.1 EIBIS data characteristics

The European Investment Bank Investment Survey (EIBIS) is a survey that focuses on corporate finance and investment across the European Union (EU). The first wave was conducted from July until October 2016 and covers almost 12,500 non-financial corporations across all 28 EU member countries. It includes firms in the NACE categories C to JFootnote 1 with a minimum of five employees and all firm sizes (micro to large).

The survey design is unique as it collects qualitative and quantitative data on firm characteristics and firm performance, past investment activities and future plans, sources of finance, financing issues and other challenges that firms face when pursuing their investment plans (European Investment Bank 2017b). In fact, the most important feature of the survey is that it provides quantitative information on the use of financial sources directly used for investment as well as quantitative information on investment expenditures on different types of investment in terms of proportions of total investment. This makes it possible for the first time to examine the linkages between various sources of financing and various types of investment across a wide sample of firms across several countries and across firm sizes, ages and industry sectors. The sampling distribution was targeted to reach a representative sample of firms across countries, sizes and industry sector. Table 1 shows the distribution of the sample across each category.

3.2 Financing of European firms

The survey gives information about the firms’ specific financing behaviour. Firms are asked first to provide the proportions of their financing for investment coming from three distinct sources of finance: (1) internal finance or retained earnings (e.g. cash or profits), (2) intra-group lending (e.g. loans from parent company), and (3) external financing sources. Then firms are asked about the specific proportions of their external financing sources such as bank loans, other bank finance such as overdrafts or credit lines, market-based finance (newly issued bonds or newly issued equity), leasing or hire purchase, factoring or invoice discounting (e.g. selling invoices to a factoring company for usually less than the face value of the debt sold), loans from family and friends, grants (e.g. support from public sources) or other sources. In total, 8296 firms responded to the two questions about the use of financial sources.Footnote 2

Figure 1a, b depict the average usage of sources of finance across country, size, sector and age in Euro-area and non-Euro-area countries. Figure 1a already shows a lot of heterogeneity in financing behaviour across countries in Europe. Most noticeable is the fact that, on average, firms tend to finance their investment predominantly through internal sources. Except for France, internal finance is on average the main source of finance for investment, making on average 68.3% of total financing volume EU-wide. The difference between Euro-area countries and non-Euro-area countries is on average 4 percentage points with a greater variation in Euro-area countries. A considerable contribution to investment funding is also made by external finance, which accounts, on average, for 29.8% of the total funding volume, while intra-group finance accounts for only a small proportion (1.9%). The most dominant role here is unsurprisingly played by bank loans (15.6% of total financing), while non-Euro-area countries have a significantly lower share of bank funding. In Denmark, Hungary, and the United Kingdom, loans from banks do not even account for the second biggest share. Leasing as well as other types of bank finance, such as overdrafts and other credit lines, are also used to a considerable extent (7.4 and 3.1% respectively), while market-based finance (equity and bond issues), factoring, loans from family and friends, grants such as public subsidies, and other sources play on average only a small role. However, predominantly in non-Euro countries, grants seem to play a bigger role for some transitory economies (Croatia, Hungary, Poland and Romania). Also, Italy, Spain and the United Kingdom finance more investment from factoring than other European countries. The large cross-country variation in the breakdown of investment finance between internal and external sources suggests a strong country-dependence concerning the firms’ use of financial sources. In general, for external financing, bank loans and leasing play the most important role, with the exception of a few, traditionally less bank-based economies such as the United Kingdom (Bond et al. 2003).

a Average share of financial sources across country. Source: authors own calculation based on EIBIS 2016. Base: all firms that invested in the last financial year (excluding “don’t know” and “refused” responses). Q.27/Q.29: Approximately what proportion of your investment in the last financial year was financed by each of the following? b Average share of financial sources across size, industry sector and age. Source: authors own calculation based on EIBIS 2016. Base: all firms that invested in the last financial year (excluding “don’t know” and “refused” responses). Q.27/Q.29: approximately what proportion of your investment in the last financial year was financed by each of the following? c Number of sources of finance used by firm size. Source: authors own calculation based on EIBIS 2016. The figure shows the frequency of the number of different sources of finance the firms used to finance their investment

Figure 1b shows that investment finance is also very heterogeneous across industry sectors. While resorting to internal finance makes by far the highest proportions across all sectors, firms in infrastructure use a significantly higher proportion of external finance (38.1%). This might be related to the fact that these firms are in general more capital-intensive, which is likely to make it easier for them to present the collateral required for the access to some external financing sources. Moreover, firms that are active in the infrastructure sector use on average a significantly higher proportion of leasing then firms active in other sectors. This seems viable, as leasing is usually used for equipment and vehicle rental, which accrues mostly to the infrastructure sector (Leaseurope 2015). Large enterprises use a significantly higher share of external finance than SMEs (34.2 and 29.1%, respectively). While the ranking of most-used external sources is the same (bank loans, leasing, other bank loans), large enterprises use a higher share of intra-group lending (4.5 vs. 1.4%). This is not surprising, as SMEs usually are not organised in parent and subsidiary companies. However, it is interesting that large enterprises on average rely more on grants than SMEs (2 vs. 1.5%). The biggest difference is observed in the use of bank loans. While the proportion of leasing and other bank finance is more or less the same, SME bank loan financing is more than 4 percentage points less than for large enterprises.

The high average share of internal finance in the EIBIS sample is consistent with findings from other survey data such as the WBES (Beck et al. 2008) and accounting data (Corbett and Jenkinson 1997). However, it is worth mentioning that the biggest part of firms that gave information about their financing behaviour (4553 of 8926) stated to having used internal finance as the only source of finance for investment.

The literature constantly highlights firm’s size to be an important determinant of both the range and types of funding available to it (Cressy and Olafsson 1997; Berger and Udell 1998; Börner et al. 2010). For the analysis, it is therefore interesting to learn about the diversification and availability of financing sources in the sample. Figure 1c shows the distribution of the number of financing sources used by SMEs and by large enterprises. As predicted by the literature, the data shows the limited diversification of financing sources of SMEs in contrast to large enterprises. Most of SMEs used only one type of finance for their investment (nearly 60%), while only 45% of large enterprises reported to having used only one source of finance. This pattern reverses sharply when looking at the firms using two or more finance sources. While for both size groups very few firms use three or more different financial instruments, the percentage of large enterprises is almost twice as high as for SMEs.

3.3 Investment behaviour of European firms

The EIBIS also provides information about the proportions firms have invested in different types of tangible and intangible assets. Firms were asked how much investment meant for maintaining or increasing the firm’s future earnings was undertaken in either tangible assets such as land, business buildings and infrastructure, and machinery and equipment or in intangible assets such as research and development (R&D) (including the acquisition of intellectual property), software, data, IT networks and website activities, training of employees, and organisation and business process improvements (including restructuring and streamlining). Importantly, the types of intangible investments in the EIBIS go beyond the typical definition of investment in national and firm accounts. Rather, the definition of investment in the survey follows a broader concept that comprises not only tangible fixed assets and computerised information but also considers innovative property and economic competency as future value-bringing assets (Corrado et al. (2005)).Footnote 3 Table 2 lists the different types of investment from the survey against the common definition of investment in accounts. It shows that not all investment expenditures reported in the survey are capitalised as capital formation in accounting data. Because of the difficulty of measuring future benefits, intangibles such as organisational capital and training are treated as intermediate costs in the financial statements. The expensing of these intangible asset types, rather than the capitalisation, is in contrast to the treatment of tangible assets, which are capitalised initially and then depreciated. Thus, while the tangible asset expenditures on land, buildings and infrastructure or machinery and equipment are captured as investment in firm accounts, only a few intangible asset types, such as R&D and software databases, are captured as such. However, regardless of their capitalisation in accounts, information from the survey on investment in training of employees or making organisational and business improvements, can be included into the analysis.

Similar as for the sources of finance, Fig. 2a, b show the breakdown of investment by type across country, size, sector and age. In both Euro-area and non-Euro-area countries, the tangible asset investment (e.g. investment in land, buildings and infrastructure, and machinery and equipment) account for the biggest share in total investment outlays, with a large concentration of investment in machinery and equipment across all countries, sizes, sectors and age groups (almost 50%, on average). Investment in intangible assets is led by software, data, IT networks and website activities (13.5%), followed by investment in training of employees (10.8%). The intangible investment types training of employees and organisation and process improvements (dashed pattern in the figures) are a novelty of the survey because these investment types are usually not covered by balance sheet and accounting data. Together these investment types account on average for 17% of the total investment outlays. Notably, non-Euro-area countries exhibit a greater variation of investment patterns than Euro-area countries regarding tangible asset spendings. In total, non-Euro-area countries have, on average, higher outlays on machinery and equipment and tangible assets in general (67.2 vs. 62.2% in the Euro area). Bulgaria leads in share of tangible asset investment with more than 77% of total outlays while the Netherlands and Cyprus have a noticeable lower share of investment in tangible assets (51%) and implicitly a higher share of investments in intangibles.

a Average share of investment types across country. Source: authors own calculation based on EIBIS 2016. Base: all firms that invested in the last financial year (excluding “don’t know” and “refused” responses). Q.13: in the last financial year, how much did your business invest in each of the following with the intention of maintaining or increasing your company’s future earnings? b Average share of investment type across size, industry sector and age. Source: authors own calculation based on EIBIS 2016. Base: All firms that invested in the last financial year (excluding “don’t know” and “refused” responses). Q.13: in the last financial year, how much did your business invest in each of the following with the intention of maintaining or increasing your company’s future earnings? c Number of types of investment by firm size. Source: authors own calculation based on EIBIS 2016. The figure shows the frequency of different types of investment

The breakdown of investment types largely reflects expected differences between size groups and industry sectors (Fig. 2b). The share of tangible asset for large enterprises is significantly higher than for SMEs (69 vs. 62.3%), which is largely accountable to a higher share of investments in land, buildings and infrastructure. On the other hand, the average share of investment in software, data, IT networks and website activities and training activities is considerably lower than for SMEs (4 percentage points difference). R&D investment, in turn, is relatively higher for large enterprises (8 vs. 5.7% for SMEs). Higher R&D spendings among large enterprises could reflect the fact that larger enterprises have a higher capacity for R&D projects and the adhering current spendings. Furthermore, the breakdown of investment by type is very heterogeneous across industry sectors. Capital-intensive sectors such as construction and infrastructure industries invest most in tangible assets, while the service sector has the smallest share of machinery and equipment but the biggest share of software, data, IT networks and website activities. Unsurprisingly, the largest proportion of R&D outlays is featured by the manufacturing sector (11% as opposed to 3.6–4.8% in the other sectors). Looking at the breakdown of investment types across age, it shows a relatively homogenous variation of investment types. Solely the youngest firms exhibit a considerably lower share of investment in land, buildings and infrastructure.

In contrast to the diversification of financing sources across firm size, the dispersion of investment types seems to be a bit more balanced. The majority of firms invested in three or four different areas, only a small share of firms stated to have invested in a sole investment area. Nevertheless, Fig. 2c reveals again an interesting difference in pattern between SMEs and large enterprises. The majority of large enterprises reported to have invested in four or more different types of investment (58%), while for SMEs the distribution is skewed towards less investment types (66%). This pattern indicates that large enterprises may, on average, pursue a more diversified investment strategy than SMEs.

4 Methodology and econometric specification

The descriptive statistics of the survey data revealed some information about the distributional characteristics of financing and investment. Although the heterogeneity in financing and investment behaviour is large across countries and industry sectors, theory predicts that differences in financing behaviour across size groups are due to intrinsic characteristics not directly chosen by the firms. For instance, while investment behaviour for firms that operate in different sectors could be due to the nature of their business field, SMEs face different access to finance as they are more informationally opaque, have a short track record, insufficient collateral, a higher default risk and small transaction volumes. The subsequent empirical analysis aims to test the different relations between SMEs’ and large enterprises’ financing behaviour and their investment behaviour, using an approach that is able to incorporate a more holistic range of relevant variables.

4.1 Construction of main variables: investment and financing sources

In EIBIS firms were asked about how much they have invested in each of the six investment types (land, buildings and infrastructure, machinery and equipment, R&D, software, data, IT networks and website activities, training of employees, and organisation and business or process improvements) following the intention of maintaining of increasing their company’s future earnings.

We assume that each firm has invested the amount within the limits of its financial possibilities or opportunities. In order to account for this assumption, the respective amount of investment is divided by the total amount of investment in order to retrieve the percentage of total investment by type. The dependent six variables, hence, reflect the proportions of the respective investment type and take on the values between 0 and 1 and sum up to 1 in total.

The independent variables—the financing sources—are derived from the two questions of the survey that ask about the financing behaviour of the firms and are available as proportions of the total financing volume and sum up to 100% per observation. For the econometric analysis, the different types of finance have been grouped into six different categories, according to their inherent characteristics. Internal finance is directly taken from the survey. Insider financeFootnote 4 includes intra-group lending and loans from family and friends, which feature the fact that the lender has at least some insider information about the borrowing company. Bank loans and other bank finance, such as overdrafts or other credit lines are grouped in Bank finance. Market-based finance comprises the proportions of newly issued bonds and newly issued equity. Grants is defined as support from public services and Other finance includes the shares of leasing, factoring.

While the survey contains 8926 valid responses to the first question of financing behaviour (excluding “don’t know” or “refused” responses), only 4224 firms answered to have used external finance, which means that a very large share only used internal or—to a lesser extent—intra-group lending. Moreover, additional 154 firms were not considered in the analysis because they answered to have used external finance in the first question but did not specify which type of external finance it is, in the second question.

We constructed some control variables to account for unobserved heterogeneity. Beyond the usual explanatory variables related to firms’ characteristics like size, age, industry sector and location of the business activity, we included two variables to account for firms’ investment opportunities and profitability. Previous research suggests that high-growth firms are more likely to require external financing, as internal resources are not sufficient to finance their growth ambitions (Carpenter and Petersen 2002; Cassar 2004). In the survey firms are asked whether they plan to invest more, about the same, or less in the next financial year. The variable Invest More hence takes on the value 1 if the firm said it was planning to invest either the same or more and 0 otherwise. Additionally, profitable firms are found to be more flexible and rely more on internal funds for their investment, since higher profits increase their internal finance capacities (Cosh et al. 2009; Hall 1992). In the survey firms report whether they have generated a profit, loss or if they break even. The variable Profit hence takes value 1 if the firm answered to have generated a profit and 0 otherwise.

4.2 Econometric specification

In the analysis, we assume that each firm has a limited amount of finance available to fund its investment. Under this assumption, each firm allocates its total available funds to the different investment opportunities. In the econometric analysis we need to take into consideration the special characteristics of our dependent variable, i.e. the fact that the proportions of the different types of investment over total investment are bounded within the interval [0, 1]. This implies some distributional properties that make linear popular models such as ordinary least squares not well suited for the analysis (Papke and Wooldridge 1996; Buis 2010).

Therefore, we use a quasi-maximum likelihood estimation (QMLE) solution suggested by Papke and Wooldridge (1996) to estimate the conditional mean with bounded fractional data: the Fractional Response Model (FRM). If the focus is exclusively on conditional first moments, the QMLE yields consistent estimates and is asymptotically normal regardless of the true conditional distribution, provided the conditional mean is correctly specified (Mullahy, (2015). The FRM respects the boundness of the dependent variable, predicts values within the interval limits of the dependent variable and accounts for the non-linearity of the data, thereby yielding a better fit than linear models or models that rely on beta distributions.

As our dependent variable consists of multiple answers that are each a proportion of a total, a multivariate model specification is needed in order to account for the properties of the conditional distribution on proportional data without requiring transformations of the response variables.Footnote 5 The resulting vector of investment types proportions, \(y \equiv (y_{1} ,\; y_{2} , \ldots , y_{M} )^{\prime}\), is corresponding to a set of shares for a given number of answers (M) of exhausted and mutually exclusive categories which strictly all sum up to 1 (unity). That means, if the share of one category of investment goes up, the share of another category most go down. Estimating each share ym in a separately decomposed deterministic function of covariates would fail to guarantee that, similarly to actual shares, predicted shares fall into the unit simplex, due to a non-zero probability of greater than unity or negative predictions.

We use a multivariate fractional response model as specified by Mullahy (2015) and we specify the M conditional means of the dependent variable to have a multinomial logit functional form. That is

enforcing the properties that the conditional mean ranges between 0 and 1 (Eq. 2) and the conditional means of all dependent variables sum to unity (Eq. 3). It additionally allows the dependent variables to take on the values 0 and 1 with non-zero probability (\(y_{i} \in [0, 1]\)) (Eqs. 4 and 5):

Hence, under the assumption that each investment type is competing for the available financial funds, we estimate a multivariate fractional logit model (MFLOGIT), based on a Bernoulli QMLE, which accounts for the intrinsic issues of estimating multivariate fractional response data. The maximization of the Bernoulli quasi log-likelihood is relatively easy and is therefore less prone to noise. The model is specified to have a multinomial functional form, except that the expected conditional mean is estimated, rather than the expected probability.

The econometric equation can be formulated as:

where Investment Types is the set of k dependent variables (containing Land_Buildings, Machinery_Equipment, Research_Development, Software_Data_Networks, Training, and Organisation_Process). G(.) takes on a logistic functional form of the share of Financing Instruments of a firm’s current financing mix at level \(i \in\) {internal finance, bank finance, market-based finance, insider finance, grants finance, and other finance}, the control variables Profitable and Invest More and δ a set of firm-specific dummies to control for unobserved heterogeneity across country groups, industry sectors, size and age groups and the error term ε. As the independent variables among the different financing instruments constitute shares that sum up to 1 (100% of total financing), we choose internal finance to be the reference variable among the set of different i financial sources. The model is estimated applying fully robust sandwich standard errors to allow for heteroscedasticity-robust standard errors, since variance is unlikely to be constant.

Due to the normalisation of the dependent variables, interpretation of the signs and magnitudes of the coefficients are not straightforward and at most informative about relative magnitudes (Mullahy 2015). Moreover, due to the large number of parameters of the multivariate regression estimated in this analysis, multiple-comparison situations may arise for hypothesis testing. For these reasons, when discussing the main results of our analysis we will report average partial effects (APEs). APEs provide convenient information about the average magnitude and signs of the relation that are invariant with respect to the particular normalisation chosen. Although the average partial effects are comparable to results obtained from running linear regressions, calculating average partial effects from a non-linear model still takes into account the non-linear relation of the data, thus yielding a better fit than a linear model (Gallani and Krishnan 2017).

5 Empirical results

The presentation of the econometric results will follow in two parts: First, we present the outcome of the overall sample in order to carve out overall linkages of financing and investment behaviour of European firms. Second, as we are interested in the differential effects of financing on investment behaviour between SMEs and large enterprises, we look at the results of the split sample for SMEs and large enterprises.

5.1 Results for all firms

Table 3 shows the average partial effects of the multivariate fractional response model explained in the previous chapter for all enterprises in the sample. For a better traceability of the results, the significant results are highlighted: Positive significant APEs appear in italics and negative significant APEs in bold. The six columns show the results for the six investment types as dependent variables and the five financial sources as independent variables, with internal finance as the reference category, controlling for firm size, age, country group and sector fixed effects. Also, controlling for expected future growth (investment) and profitability is important because it captures investment opportunities and could, hence, highlight different financing and investment patterns (Fazzari et al. 1988; Barclay and Smith 1995). Hence, we also control for firms that are profitable or have positive investment prospects in the next fiscal year. Although in our analysis we do not model the interactions of market imperfections on investment (as, for instance, in Calcagnini et al. 2015), we are confident that the use of our set of dummies control for these effects. Looking at the impacts of the various financial sources on the different types of investment reveals that the financing behaviour for certain investment types is very heterogeneous. Starting with the effect of financial sources on tangible asset investments for land, buildings and infrastructure investments and machinery and equipment, the significant effects largely reflect expected results. For example, bank finance has a positive effect on tangible asset investment, indicating that one percentage point increase of bank finance compared to the use of internal funds leads, on average, to an increase of investment into land, buildings and infrastructure, and machinery and equipment of 0.08 percentage points. Given that banks prefer to use physical assets to secure their loans (Hall and Lerner 2009), tangible investments are positively linked with the use of bank finance. On the other hand, the results for bank finance show the expected negative relation to intangible asset investments such as R&D, software, databases and IT networks, and training (Covas and Den Haan 2012; Grundy and Verwijmeren 2017). Market-based finance and grants have, on average, a positive effect on infrastructure investments, while other finance, which includes leasing, shows a negative relation. Unsurprisingly, leasing has a strong effect on investments in machinery and equipment: a one-percentage point increase in the use of other finance (leasing and factoring) is associated with an increase in machinery and equipment outlays of 0.38 percentage points.

When looking at the effect of financial sources on intangible investments, we see some interesting pattern. While bank finance, leasing and factoring are negatively linked to most intangible asset investments, the results indicate a strong preference for market-based finance, insider finance and grants for R&D investments. The importance of these financing avenues with respect to internal finance reflects findings of previous research, which predicts a harder conveyability of R&D projects to banks and suggests the compatibility of equity-linked high-risk targeted sources (Bhagat and Welch 1995; Hall and Lerner 2009; Grundy and Verwijmeren 2017) or sources that mitigate the costs of asymmetric information to estimate the riskiness of the project (Berger and Udell 1998; Thum-Thysen et al. 2017). In the case of investment related to software data, IT networks and website activities, and training of employees, all significant APEs show a negative impact of external finance with respect to internal finance indicating that, on average, internal finance plays the most important role for these investment types.

As seen before in Fig. 2b, SMEs invest a significantly lower share in land, buildings and infrastructure than large enterprises, whereas they invest a relatively higher share of their total investment outlays in intangible assets such as software, data and networks, training of employees, and organisation and process improvements. Significant differences for investments in machinery and equipment and R&D are not observable. It can thus be verified that the investment behaviour of SMEs is significantly different from large enterprises, except for machinery and equipment and R&D.

5.2 Results for SMEs and large enterprises

As a next step, we split the sample between SMEs and large enterprises to further explore the differences in the financing and investment behaviour across firm size. Table 4 shows the average partial effects of our model for the SME subsample (panel A) and the large enterprises (panel B) without the firm size dummy. At first sight, we can clearly see some differences between the two subsamples, as the financial sources show different significant impacts on the different investment types.

First of all, the results for the whole sample are largely driven by SMEs. Looking at SMEs only, we see that bank finance shows the expected effects for tangible and intangible asset investments but some coefficients change significance with respect to the overall sample. For example, relative to internal finance, insider finance becomes an important source to finance tangible investments in land, buildings and infrastructure, while the coefficient for equity and corporate bonds (market-based finance) becomes insignificant. According to Berger and Udell (1998), young and small firms and the beginning of their growth inception rely on initial insider finance. Hence, our results indicate that smaller firms rely on insider finance more than large enterprises when investment is needed to establish infrastructure. Furthermore, with the exception of R&D, we cannot observe any positive effect of external finance on intangible investment, which indicates a pecking order of financing sources: small firms have high reliance upon their internal sources for intangible asset investments for software, databases and IT networks and training and do not use bank finance. The complete absence of significant APEs for investment in organisation and process improvements, on the other hand, indicates indifference of the use of financing sources for this investment type.

Second, the subsample for large enterprises tells a different story. Fewer coefficients of external financing sources are significantly different from internal funds. This indicates that, for some investment types, large enterprises seem to be less sensitive to external financing sources with respect to the use of internal funds. Especially in light of the high average share of bank loans among large enterprises (Fig. 1b), the average marginal effects for bank loans are significant only for investment in land, buildings and infrastructure (positive effect), and software, data, IT networks and website activities (negative effect). Other bank finance, in contrast, does not seem to have a significant impact on investment decisions at all. Also worth noticing is the relatively high positive effect that market-based finance exerts on investment in land, buildings and infrastructure. Interestingly, grants and other sources also have a positive effect on this type of investment. Like for the SMEs sample, leasing has a large positive effect on machinery and equipment and a negative effect on land, buildings and infrastructure and R&D. Looking at the single investment type reveals some crucial differences in financing patterns. By contrast to the SME subsample, insider finance, grants and market-based finance are all insignificant for large enterprises. Only other finance (driven by leasing) is significantly different from internal finance and has a positive effect on R&D. For intangible investments overall, all significant average marginal effects show a negative relation. An exception is the positive effect of insider finance on investment in organisation and process improvements. For investment in training of employees, no external financing source is significantly different from internal funds, which suggests that there are no preferences of any financial sources for this type of investment.

6 Robustness check

The model we used in the previous section inherits by definition the feature that firms have only a specific amount of finance available, as the investment positions are competing in the way that they are mutually exclusive and strictly sum up to 1. The assumption behind this is that each firm disposes of a different degree of access to finance. Within its firm-specific financial boundaries, a firm will choose the amount of different types of investment according to its investment needs and its very specific investment strategy. The advantage of this model is that we can, to some extent, alleviate the question of the measuring the impact of financing constraints on investment. However, the major shortcoming of this approach is that the model assumes that financing was available independently of the planned investment project. This could be problematic, as most probably firms will seek financing after having decided for a specific project. For example, it is most likely that firms that have the need to invest in new machinery will apply for a bank loan for this specific project. However, while this argument is definitely true for the application of bank loans, this condition might not hold for other financing sources such as grants or loans from family and friends that might be granted without a specific investment target. Furthermore, we cannot infer from the data the direction of causality of finance and investment.Footnote 6

Nevertheless it is important to tackle this question. For that reason, we check the robustness of our results by applying a different model that will ease the assumption of a fixed available amount of finance for all investment types. Now, instead of considering the shares of the six investment types over total investment, we look at the amounts that were spent on each investment type independently. While our previous model captured the shares of all investment types at one time, this approach allows us to run a regression for each investment types independently, which would relax the constraint that each investment type is competing for the available financial funds. The assumption behind this is that firms seek financing according to their type-specific investment needs.

Hence, the dependent variables are now the ratios of the amounts spent on the specific investment type to fixed assets.Footnote 7 For the independent variables, we take the total amount of investment and multiply it by the shares of financing sources used by the firm and we normalised over fixed assets. Again, we control for the willingness to invest more as a proxy for growth perspectives, profitability and firm age, sector and region.

The resulting model is a linear OLS and can be formulated as:

where again Investment Types is the set of k ratios of Land_Buildings, Machinery_Equipment, Research_Development, Software_Data_Networks, Training, and Organisation_Process to fixed assets. Financing Instruments is a vector of a firm’s current financing mix over fixed assets at level \(i \in\) {internal finance, bank finance, market-based finance, insider finance, grants finance, and other finance}. The control variables are Profitable and Invest More and δ is a set of firm-specific dummies to control for unobserved heterogeneity across country groups, industry sectors, size and age groups and the error term ε.

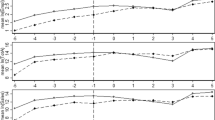

Panel A and panel B of Table 5 show the results of the subsamples of SMEs and large enterprises. As we can infer from Fig. 2b and the results from the baseline model, internal finance plays an important role in investment finance. Especially for SMEs, internal finance has positive significant coefficients for all investment types. For SMEs, we see that bank finance is positively linked to investment in tangible assets—a result that matches with the findings of the previous model. As in the baseline model, insider finance is important for investment in land, buildings and infrastructure and other finance, such as leasing, is key for investment in machinery and equipment. Again, looking at intangible investments, grants and insider finance are the important sources of external finance. Interestingly, bank finance has a positive significant effect for investment in organisation and process improvement, which suggests that banks might be willing to grant loans for projects that spur up efficiency of a firm.

In the case of large enterprises, we also find some similarities with the baseline model. For most investment types, the use of internal finance has a positive effect on investment. Furthermore, the positive link between grants for infrastructure projects and leasing for machinery and equipment investments is confirmed. Interestingly, large enterprises prefer bank finance to internal funds for investment in land, buildings and infrastructure. A likely explanation for this result could be that large enterprises prefer to use bank loans to finance large-volume infrastructure projects as they can access these loans to relatively better conditions than using their internal funds, which might be necessary for other spending positions. In line with previous results, grants do not play an important role in intangible investment financing and it is the case of bank loans. The analysis confirms the negative effect of market-based finance on software, data and IT networks and the positive effect of insider finance on organisation and process improvements.

However, compared to the previous analysis, the results reveal some differences. Most noticeable is the difference in the financing of intangible assets for SMEs. While in the baseline model market-based finance, insider finance and grants played a positive effect with respect to internal finance, in this specification only funds from grants seem to remain an important external financing source. Conversely, while with respect to internal finance, insider finance was not important for investment in intangible assets, the coefficients have now a positive significant effect on software, data and IT networks and training of employees, when the two financing sources are viewed independently. This effect suggests that both financing sources are important for these types of investment.

In general, the results seem to be consistent throughout both approaches, which bring us to conclude that the estimates of the first model are likely not to be prone to simultaneity issues. Nevertheless we need to stress that the results are not directly comparable for two different reasons: First, the two models consider different assumptions about the availability of funds and the rivalry of investment types for available financial funds. Second, the coefficients of the fractional response model always refer to internal finance, whereas the effects of coefficients in the second model can be interpreted independently. Moreover, the appearance of very large standard errors for some coefficients points out that the confidence intervals are wide, indicating that the sample size might be too small to infer representative results. Indeed, in some cases the response variation for these two types of finance was not very large.

7 Conclusions

In this paper, we explored new insights into financing and investment behaviour of European firms using a unique and recently available survey database from the EIBIS 2016. It was possible for the first time to show the linkages of specific financing instruments to a wide range of investment types that go beyond the information derived from balance sheet data. Using the survey-based approach, we are able to alleviate some shortcomings of the existing research: First, it is possible to have a look at the effect of financing sources by instrument type. Second, instead of calculating the investment rate out of the change in fixed assets, the survey data contains direct information of the amounts of tangible and intangible investment types. Third, while the use of finance derived from balance sheet data cannot directly be linked to investment expenditures, financing information in the survey is by construction related to investment outlays. Furthermore, as the sample is representative for firms in 28 European countries, we are able to draw a more holistic approach than most studies.

More specifically we provide new results on investment and investment finance testing the linkages with two different models. First, we use the available proportions of financing and investment data and set up a multinomial fractional response model to estimate the correlation of financing sources and investment types by controlling for other types of finance and firm characteristics. Given a specific amount of available finance, we consider different types of investment as competing spending positions that are naturally correlated with each other. In this way, we allow the error terms of different types of investment to correlate and we are able to show finance-investment linkages while mutually accounting for all investment types. Second, we test the consistency of the results by using a second model that opens up the rivalry constraints of the different investment types and relaxes the assumption that financing sources are chosen independently of the decision in what to invest. By using this approach, we test whether the effect of financing sources on investment types changes when we impose the assumption that firms might look for financing according to their firm-specific investment strategy or needs.

Our results confirm findings from previous research in many aspects. The general importance of internal funds for investment expenditures is not only reflected in the high share of internal funds over the total financing volume, but is also derived from the econometric analysis. The results also suggest that bank finance is predominantly used to finance tangible investment, while firms turn to internal finance, insider finance, grants and equity to finance intangible assets. This holds especially for R&D expenses by small firms. With respect to firms’ internal financing volumes, external finance plays a negative role on intangible investment, while non-bank-finance sources are nevertheless important when regarded independently. Furthermore, we showed that grants play an important role for financing land, buildings and infrastructure investments, while leasing is strongly linked to investment in machinery and equipment. Comparing subsamples of SMEs and large enterprises, the results suggest some differences. External financing sources, compared to the use of internal funds, have an overall negative impact for large firms’ intangible asset investment, except for insider finance for investment into organisation and process improvements. For SMEs, insider finance and grants are the most important external financing sources for intangible investments and, for R&D, equity finance plays a significant role as well.

Our findings have important policy implications. While bank finance is generally an important source of finance, the overall results suggest that internal finance is still the most crucial source of finance for intangible investments. While insider finance is important for some types of intangible investments, grants are only observed to have a positive effect only on SMEs R&D investment. As intangible investments represent a growing share of the economy, they are, in many cases, complementary to tangible investments. Hence, due to the complementarity of tangible and intangible investments, a better promotion of intangible investments through grants-backed credit lines could channel more bank finance to intangible asset investments and boost overall investment.

Although the estimates are consistent across two models, we are aware that the analysis suffers from a few drawbacks. First, the data sample is only cross-sectional, which allows only for a static view without taking into consideration cyclical effects of investment finance. Second, as is often the case in investment finance, the analysis might suffer from endogeneity or reverse causality issues,Footnote 8 as financing or investment decisions might be simultaneously influenced by private information that is only observed by the firm. Third, the variation for some external financing sources is very low, which could bias the results or make them at least less representative. As the EIBIS is planned to take place several rounds, a future panel analysis could improve our results.

Notes

This includes the following industries: C: manufacturing; D: electricity, gas, steam and air conditioning supply; E: water supply; sewerage, waste management and remediation activities; F: construction; G: wholesale and retail trade; repair of motor vehicles and motorcycles; H: transportation and storage; I: accommodation and food service activities; J: information and communication.

Respondents with incomplete answers (i.e. answering the first question with having used a certain proportion of external finance but did not specify their answer the second question) have been dropped out.

Corrado et al. (2005) suggest an conceptual approach to incorporate intangible assets in accounting schemes in order to better capture sources of growth and measure economic activity: Expanding the core concept of business investment in national and firm accounts by treating much business spending on intangibles that is traditionally seen as current consumption as investment, they plead to include computerized information such as software and databases, innovative property, such as scientific research and development (R&D) and non-scientific inventive and creative activities, and economic competencies, which captures knowledge embedded in firm-specific human and structural resources, including organisational structures or training activities as investment positions.

Berger and Udell (1998) define insider finance as "[…] funds generated within the firm or from the entrepreneur and other insiders that have superior information about the firm." (p. 661). In this analysis, the financing sources intra-group lending, equity and loans from family and friends are considered "insider finance" as they all feature the fact that lenders have at least some superior information about the firm and its investment opportunities compared to banks.

See Aitchison (1982) for an early discussion about how to treat compositional data.

See Long and Malitz (1983), that examine the effect of investment on financing behaviour.

In the investment literature, it is common to divide by total assets. However, in the dataset at hand, only current fixed assets are available. Furthermore, lagged independent variables are widely used in order to mitigate endogeneity or simultaneously issues. The cross-sectional EIBIS dataset from 2016 does not allow for this option. However, by construction of the survey, the financing variables can be directly linked to the financing of investment. All constructed ratios are winsorised at the 1 per cent level.

For a discussion about endogeneity and reverse-causality issues in corporate finance and investment research, see (Roberts and Whited (2013).

References

Aghion, P., Askenazy, P., Berman, N., Cette, G., & Eymard, L. (2012). Credit constraints and the cyclicality of R&D investment: Evidence from France. Journal of the European Economic Association, 10(5), 1001–1024.

Aitchison, J. (1982). The statistical analysis of compositional data. Journal of the Royal Statistics Society, 44(2), 139–177.

Aivazian, V., Ge, Y., & Qiu, J. (2005). The impact of leverage on firm investment: Canadian evidence. Journal of Corporate Finance, 11(1–2), 277–291.

Buis, M. (2010). Analyzing proportions. 8th German Stata Group Meeting in Berlin.

Barclay, M. J., & Smith, C. W. (1995). The maturity structure of corporate debt. The Journal of Finance, 50(2), 609–631.

Beck, T., Demirgüç-Kunt, A., & Maksimovic, V. (2008). Financing patterns around the world: Are small firms different? Journal of Financial Economics, 89(3), 467–487.

Begenau, J., & Salomao, J. (2018). Firm financing over the business cycle. http://dx.doi.org/10.2139/ssrn.2533716.

Berger, A., & Udell, G. (1998). The economics of small business finance: The roles of private equity and debt markets in the financial growth cycle. Journal of Banking and Finance, 22(6–8), 613–673.

Bhagat, S., & Welch, I. (1995). Corporate research and development investments: International comparisons. Journal of Accounting and Economics, 19(2–3), 443–470.

Bond, S., Elston, J. A., Mairesse, J., & Mulkay, B. (2003). Financial factors and investment in Belgium, France, Germany, and the United Kingdom: A comparison using company panel data. The Review of Economics and Statistics, 85(1), 153–165.

Börner, C., Grichnik, D., & Reize, F. (2010). Finanzierungsentscheidungen mittelständis cher Unternehmer—Einflussfaktoren der Fremdfinanzierung deutscher KMU. Schmalen-bachs Zeitschrift für betriebswirtschaftliche Forschung, 62(2), 227–275.

Calcagnini, G., Favaretto, I., & Giombini, G. (2011). Financial models of small innovative firms: An empirical investigation. In G. Calcagnini & I. Favaretto (Eds.), The economics of small businesses. An international perspective. Contribution to Economic Series. Berlin: Springer.

Calcagnini, G., Ferrando, A., & Giombini, G. (2015). Multiple market imperfections, firm profitability and investment. In European Journal of Law and Economics, 40(1), 95–120.

Carpenter, R. E., & Petersen, B. C. (2002). Is the growth of small firms constrained by internal finance? The Review of Economics and Statistics, 84(2), 298–309.

Cassar, G. (2004). The financing of business start-ups. Journal of Business Venturing, 19(2), 261–283.

Cleary, S. (2006). International corporate investment and the relationships between financial constraint measures. Journal of Banking and Finance, 30(5), 1559–1580.

Corbett, J., & Jenkinson, T. (1997). How is investment financed? A study of Germany, Japan, UK and US. In The Manchester School, 65, 69–93.

Corrado, C., Hulten, C., & Sichel, D. (2005). Measuring capital and technology: An expanded framework. In Measuring capital in the new economy (pp. 11–46). NBER Chapters. National Bureau of Economic Research.

Cosh, A., Cumming, D., & Hughes, A. (2009). Outside entrepreneurial capital. Economic Journal, 540(119), 1494–1533.

Covas, F., & Den Haan, W. J. (2012). The role of debt and equity finance over the business cycle. The Economic Journal, 122(565), 1262–1286.

Cressy, R., & Olafsson, C. (1997). European SME financing: An overview. Small Business Economics, 9(2), 87–96.

Czarnitzki, D., & Hottenrott, H. (2011). R&D investment and financing constraints of small and medium-sized firms. Small Business Economics, 36(1), 65–83.

Erickson, T., & Whited, T. M. (2010). Erratum: Measurement error and the relationship between investment and q. Journal of Political Economy, 118(6), 1252–1257.

European Commission. (2017). Investment in the EU Member States, Institutional Paper 062.

European Investment Bank. (2017a). Investment Report 2017/2018: From recovery to sustainable Growth. Economics Department, European Investment Bank.

European Investment Bank. (2017b). Surveying corporate investment activities, needs and financing at the EU. Economics Department, European Investment Bank.

Fazzari, S., Hubbard, R. G., & Petersen, B. (1988). Financing constraints and corporate investment. Brookings Papers on Economic Activity, 1988(1), 141–195.

Gallani, S., & Krishnan, R. (2017). Applying the fractional response model to survey research in accounting. Harvard Business School Working Papers 16-016.

Grundy, B., & Verwijmeren, P. (2017). The external financing of investment. Unpublished manuscript.

Hall, B. H. (1992). Investment and research and development at the firm level: Does the source of financing matter? NBER Working Papers 4096. National Bureau of Economic Research, Inc.

Hall, B. H., & Lerner, J. (2009). The financing of R&D and innovation. NBER Working Papers 15325. National Bureau of Economic Research, Inc.

Jensen, M. C. (1986). Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review, 76(2), 323–329.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Kaplan, S. N., & Zingales, L. (1997). Do investment-cash flow sensitivities provide useful measures of financing constraints? The Quarterly Journal of Economics, 112(1), 169–215.

Kaplan, S. N., & Zingales, L. (2000). Investment-cash flow sensitivities are not valid measures of financing constraints. The Quarterly Journal of Economics, 115(2), 707–712.

Lang, L., Ofek, E., & Stulz, R. (1996). Leverage, investment, and firm growth. Journal of Financial Economics, 40(1), 3–29.

Leaseurope. (2015). Key Facts and Figures. Fact sheet. Leaseurope.

Long, M. S., & Malitz, I. B. (1983). Investment patterns and financial leverage. Working Paper 1145. National Bureau of Economic Research.

Martinez-Carrascal, C., & Ferrando, A. (2008). The impact of financial position on investment—an analysis for non-financial corporations in the euro area. ECB Working Paper Series No. 943. European Central Bank.

Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporate finance and the theory of investment. The American Economic Review, 48(3), 261–297.

Mullahy, J. (2015). Multivariate fractional regression estimation of econometric share models. Journal of Econometric Methods, 4(1), 71–100.

Myers, S. C. (1977). Determinants of corporate borrowing. Journal of Financial Eco nomics, 5(2), 147–175.

Myers, S. C. (1984). The capital structure puzzle. Journal of Finance, 39(3), 575–592.

Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187–221.

Papke, L. E., & Wooldridge, J. M. (1996). Econometric methods for fractional response variables with an application to 401(K) plan participation rates. Journal of Applied Econometrics, 11(6), 619–632.

Roberts, M. R., & Whited, T. M. (2013). Endogeneity in empirical corporate finance. In Handbook of the economics of finance (vol. 2, pp. 493–572).

Saltari, E., & Travaglini, E. (2001). Financial constraints and investment decisions. Scottish Journal of Political Economy, 48(3), 330–344.

Saltari, E., & Travaglini, G. (2006). The effects of future financing constraints on capital accumulation: Some new results on the constrained investment problem. Research in Economics, 60(2), 85–96.

Thum-Thysen, A., Voigt P., Bilbao-Orsori B., Maier C., & Ognyanova, D. (2017). Unlocking investment in intangible assets in Europe. European Commission, Discussion paper 47.

Williamson, O. E. (1988). Corporate finance and corporate governance. Journal of Finance, 43, 567–591.

Acknowledgements

We would like to thank Debora Revoltella, Maarten Buis, Rozalia Pal, the participants at the ECB workshop “Euro area business investment in a global context—the role of cyclical and structural factors and frictions” and at the International Conference on Small Businesses, Banks, Finance, Innovation and Growth 2017, and two anonymous referees for highly valuable suggestions and comments. This research was conducted while the authors were visiting the European Investment Bank, whose hospitality and support are gratefully acknowledged. All errors and omissions remain our own. The views expressed do not necessarily reflect those of the European Investment Bank and of the European Central Bank.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Summary statistics

1.2 Questionnaire

The EIBIS questionnaire can be found in http://www.eib.org/about/economic-research/eibis.htm.

Rights and permissions

About this article

Cite this article

Ferrando, A., Preuss, C. What finance for what investment? Survey-based evidence for European companies. Econ Polit 35, 1015–1053 (2018). https://doi.org/10.1007/s40888-018-0108-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40888-018-0108-4

Keywords

- Tangible and intangible investment

- Internal and external finance

- R&D investment

- SME finance

- Multivariate fractional response model