Abstract

This study investigates the empirical link between the social and financial performance of the Real Estate Investment Trusts (REITs) by utilizing the PVAR-Granger causality model and a fixed-effects panel data model with a rich dataset comprising 234 ESG-rated REITs across five developed economies from 2003 to 2019. The results suggest that investors pay attention to individual E/S/G metrics and price each component of ESG investing differently, with E-investing and S-investing practices being the significant financial performance factors of REITs. This study is the first attempt to test the social impact and risk mitigation hypotheses of the stakeholder theory of the corporation and the neoclassic trade-off argument to explore the association between corporate social responsibility and the market valuation of REITs. The full sample results strongly support the trade-off hypothesis, indicating that REITs’ environmental policies involve high financial costs that may drain off capital and lead to decreasing market returns. On the contrary, investors have attached a higher value to S-investing performance, especially in the post-GFC period from 2011 to 2019. A positive premium for S-investing supports the stakeholder theory as the social impact could be monetarized into a higher return and a lower systematic risk and give rise to a competitive advantage.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The demand for investment products with substantial environmental, social, and governance (ESG) credentials boomed in 2020 as the COVID-19 pandemic put the need for a sustainable world in the spotlight. Investors are increasingly conscious of total wealth maximization for all stakeholders, not only shareholder value. Real Estate Investment Trusts (REITs) are often overlooked to gain exposure to socially responsible investments, in part because numerous open-ended funds specifically publicize themselves as socially responsible. Nevertheless, ESG investing in the REIT industry has notably increased since the mid-2000s—i.e., the number of ESG-rated REITs rose from 43 in 2005 to 217 in 2018 in the developed countries, including the USA, the UK, Australia, Canada, and Japan. At the same time, the average environmental score of ESG-rated REITs in these countries has noticeably increased by 142.7%, from 13.1 to 31.8, whereas the average social and governance scores have increased by 21.8% (39 to 47.5) and 12.7% (44.1 to 49.7), respectively (Thomson Reuters DataStream database).

It is presumably because, over the past decade or so, investors have been increasingly driven by ESG factors, which, in turn, influence future returns. Hence, in line with the expectations of the stakeholders, corporations are likely to carry out more and better socially responsible investments that could improve the ESG metrics. A considerable body of research has focused on the impact of corporate social performance (CSP) on the corporate financial performance (CFP) of non-REIT listed companies and documented controversial results (Salzmann 2013). Existing meta-studies, in contrast, have suggested unambiguous evidence for a rather positive association between CSP and CFP. Similarly, the relevant literature on REITs has mainly found a positive association between CSP and CFP although some studies reported mixed empirical findings.Footnote 1 These puzzling results are possibly due to different databases, period, sample sizes, model specifications, and social performance criteria used in these studies. Despite the increase in REITs’ ESG commitments and a growing body of research on the impact of socially responsible investment on their performance, the association, if any, between social and financial performance has not been fully established for REITs.

This study uses the Thomson Reuters Worldscope and DataStream databases to construct a rich dataset comprising 234 ESG-rated REITs in the USA, the UK, Australia, Canada, and Japan, which together accounted for 82% of $1899.5 million of the total market cap of global REITs in 2019.Footnote 2 The study employs the PVAR-Granger causality model and a fixed-effects panel data model for cross-country analysis of the sign of the relationship between ESG investing and the market-based financial performance of REITs, respectively, between 2003 and 2019. We find strong evidence that REIT investors pay attention to individual E/S/G metrics and price each component of ESG investing differently, with environmental (E-investing) and social (S-investing) practices being the significant CSP factors influencing the financial performance of REITs. The CSP-CFP relationship for our sample is best explained by the stakeholder theory of corporation and the trade-off hypothesis as the PVAR Granger causality analysis suggests a direction of causality from the social performance to the financial performance. Specifically, the results suggest a significant negative association between E-investing and the financial performance of REITs, providing evidence for the trade-off hypothesis—i.e., the environmental policies and activities involve high financial costs that may drain off capital and other company resources and lead to declining market returns. The results further indicate a strong positive (negative) relationship between S-investing and the REIT stock return (systematic risk), which supports the social impact hypothesis of the stakeholder theory of the corporation.

Conflicting empirical findings on the CSP-CFP nexus inherently imply that the relationship between REITs’ financial performance and their success/failure in ESG commitments may largely depend on sample size, single/cross-country setting, and social performance metrics used. Our paper contributes to the literature in several ways. First, unlike the previous REIT research that has utilized a single-country setting (e.g., Newell and Lin Lee (2012); Brounen and Marcato (2018); and Eichholtz et al. (2012)), we employ a cross-country panel data analysis to explore the nexus. Our sample period goes back to 2003, which is relatively longer than prior studies (Morri et al., 2020 and Fuerst 2015), which also employed cross-country data but used only a 4- or 5-year time span. None of these papers has explored the nexus in both aggregated (ESG total score) and disaggregated (individual E/S/G scores) frameworks to understand how well REITs have implemented their ESG investments in relation to their stock market performance. . Moreover, in order to mitigate potential sample selection bias, a geographically diverse sample of REITs spanning 17 years was utilized in a cross-country analysis. Such an approach aims to examine the causal relationship and determine the direction of the association between Corporate Social Performance (CSP) and Corporate Financial Performance (CFP) within the REIT industry.

Second, we manually construct a new, rich dataset that includes market-based financial performance measures (excess return, the Sharpe ratio, and the beta). Our paper is one of the initial attempts to employ systematic firm risk as a dependent variable to explore the association between REITs’ ESG investing and stock performance. Third, our study, for the first time, tests the social impact hypothesis and risk mitigation view of the stakeholder theory of corporation and the neoclassic trade-off argument to explore the impact of socially responsible investing on the market valuation of REITs. Finally, our study provides the first empirical evidence of the causal positive relationship between S-investing and financial performance of REIT market, indicating that S-investing is a crucial component of ESG investing that could be monetarised into a higher excess (and risk-adjusted) return and a lower systematic risk. From a business ethics perspective, one can argue that socially ethical behaviors of REITs may generate a positive premium for their stocks and enable them to achieve competitive advantage due to their productive relationships with their stakeholders.

The following section provides a detailed literature review that consists of theoretical framework with hypotheses development and empirical studies of CSP-CFP nexus for REIT market with a conceptual discussion on the concept of CSP in the public real estate sector. The “Data description” section describes data and section 4 covers empirical specification including unit root tests, PVAR Granger causality test, and panel data methods. The “Results and discussion” section presents a discussion of the findings. Finally, the “Conclusion” section concludes the paper.

Literature review

Theoretical literature and hypothesis development

There is no emerging agreement on the most appropriate classification of theories in corporate social responsibility (CSR) research (Frynas and Yamahaki 2016). The theoretical and empirical research surrounding the nexus remains inconclusive but highlights the non-static nature of this relationship (Qureshi et al. 2021). This paper attempts to investigate the CSP-CFP nexus for REITs by testing the validity of key theories such as stakeholder theory and trade-off theory.

The ongoing debate on the CSP-CFP relationship involves three important empirical issues. The first issue is the direction of causation: Does social performance affect the financial performance of corporations or the opposite, does financial performance affect social performance, or is there a bilateral relationship between the two? Corporate social responsibility theories have conflicting views on the CSP-CFP relationship. For instance, according to the stakeholder theory and trade-off theory, there is a unidirectional causality running from CSP to CFP, whereas available funds and managerial opportunism hypotheses imply a causality from CFP to CSP (Preston and O’bannon 1997). In the REIT literature, there is a lack of empirical work on the causal relationship between social and financial performance. To our knowledge, Cajias et al. (2014) are the only study investigating the Granger causality in the CSP-CFP relationship for the US real estate companies, which found no evidence for causality. Because of the conflicting views in theory and lack of empirical evidence, we have no a priori expectation for the direction of causality. Thus, our hypothesis for REIT markets is the following:

The direction of causality between corporate social performance (ESG score) and financial performance is unclear.

By employing the panel VAR-Granger causality model, our study finds that the direction of causality is from the social performance (ESG score) to the financial performance of REITs in the developed markets of the USA, UK, Australia, Canada, and Japan (PVAR Granger causality analysis will be discussed later in the “Unit root tests and PVAR Granger causality test” section).

The second issue is the scarcity of simultaneous analysis of aggregated and disaggregated ESG scores in relation to CFP: Does each component of the E/S/G measure provides different insights into the corporate’s financial performance beyond those that the aggregated ESG score demonstrates? Bouslah et al. (2013) and Brounen and Marcato (2018) have documented that the individual E/S/G components consolidated in the overall ESG score might have different impacts on corporate risk and return. This is partly because heterogeneity among corporate stakeholders might create a mismatch between the ESG components—e.g., employees and Greenpeace put different emphasis on the issues of labor conditions (S-score) and environmental pollution (E-score). As we expect, each individual E/S/G measure has a different effect on the financial performance compared to the overall ESG rating. Our second hypothesis is the following:

REIT investors price each component of ESG investing differently; therefore, E-investing, S-investing, and G-investing have different impacts on the financial performance of REITs.

The third issue is the sign of the relationship: Are social and financial performances positively or negatively associated, or not associated at all? Theoretical and/or empirical research has remained inconclusive regarding the sign of the CSP-CFP relationship (Wang et al. 2016). Thus, we do not have a priori expectation on the sign of association between E/S/G scores and REIT’s financial performance and follow the main theoretical arguments and empirical outcomes below.

The social impact hypothesis and risk mitigation view of the stakeholder theory of corporation predict that social and financial performance tend to be positively associated over the long term (Freeman 1984). The theory states that stakeholders have different interests in a corporation and have different impacts upon it, and the corporation is responsible for meeting their interests. A firm that attempts to lower its implicit costs by socially irresponsible actions will, as a result, incur higher explicit costs, giving rise to a competitive disadvantage. On the contrary, an open-minded employee relations policy may cost less. Indeed, it can result in “substantial gains in morale and productivity, yielding a competitive advantage compared to less responsible firms” (Waddock and Graves 1997, p. 306). Moreover, the failure to meet the expectations of various non-shareowner constituencies will generate market fears, which, in turn, will increase a company’s risk premium and result in higher costs. The risk mitigation argument based on the stakeholder theory predicts that CSP is negatively related to firm risk—i.e., higher social performance can generate moral capital or goodwill among stakeholders, which provides insurance-like protection that reduces a firm’s risk exposure (Godfrey et al. 2009). Moral capital creates relational wealth in different forms among different stakeholder groups, including affective commitment among employees, legitimacy among communities and regulators, trust among partners, credibility and enhanced brand among customers, and higher attractiveness for investors (Godfrey 2005). This relational wealth reduces uncertainty about a firm’s future cash flows and, therefore, reduces its risk.

Hence, our third hypothesis is the follwing:

Higher corporate social performance (E-score/S-score/G-score) leads to better financial performance for REITs—i.e., higher return and lower risk, all other things being equal.

The trade-off hypothesis, in contrast, asserts that socially responsive activities involve financial costs, which may steal capital and other resources from the firm and result in declining stock prices relative to the market average, and may put corporations at a relative disadvantage compared to less socially active firms. This hypothesis reflects the classic statement of Friedman (1970) and other neoclassical economists’ arguments that there are few readily measurable economic benefits to socially responsible behavior while numerous costs exist (Waddock and Graves 1997). According to Friedman (1970, reprinted in 2007, p.178): “there is one and only one social responsibility of business—to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, …” Managerial attention to interests other than those of investors is a breach of trust that inevitably reduces the welfare of shareowners (Preston and O’bannon 1997). The trade-off hypothesis may have a relation with the agency theory and overinvestment hypothesis. According to this hypothesis, based on an over-incentivized behaviors of managers, overinvestment in ESG may eventually reduce shareholder value (Barnea and Rubin 2010; Chacon et al. 2022). Hence, an alternative hypothesis to be tested against the third hypothesis is REITs’ higher CSP ((E-score/S-score/G-score) leads to worse financial performance—i.e., lower return and higher risk, all other things being equal.

Empirical literature

CSP in REITs: conceptual framework

The real estate industry has a special responsibility for decarbonization because of its 40% share of global carbon dioxide emissions (United Nations Environment Program 2019). Intangible benefits of decarbonizing the built environment through REITs have a significant benefit spectrum in the physical market depending on the property focus of the equity REITs, from health care to lodging/resorts or industrial/office buildings. The potential benefits of ESG ratings are far beyond firm-level performance or public image considerations and offer a wide range of positive externalities concerning environmental and social responsibility and corporate governance quality.

REITs can contribute to decarbonization by improving their operational efficiency for energy and water use and developing environmental management systems. Examples of environmental policies include seeking green building certifications for their properties, adopting biodiversity, land conservation, and eco-friendly building design techniques, issuing green bonds to fund sustainability projects, reducing emissions at buildings, and encouraging sustainable commuting (IEA 2019). REITs can also improve their social performance by supporting and contributing to community organizations while ensuring their workforces are inclusive and diverse, and providing a safe working environment (NAREIT 2019). Finally, REITs can boost their ESG performance in terms of good governance policies and practices. ESG metrics developed by global data providers such as MSCI, S&P, and Morningstar generally suggest that better governance could be achieved by establishing a high-quality reporting-disclosure framework, minimizing potential conflicts of interest, avoiding fraud and bribery, supporting diversity and independence in the board, and developing fair compensation policy for executives. While there is no single best corporate governance structure, ESG-minded investors prefer democratic, transparent, and equitable fund management strategies, focusing on long-term growth.

Empirical studies of CSP-CFP nexus in REITs

Albeit a large body of research has documented a positive relationship between different sustainability measures and corporate financial performance, knowledge of the financial effects of corporate social investing through ESG criteria remains fragmented (Friede et al. 2015) and very limited for the REIT industry. Previous research on REITs has primarily focused on corporate governance (e.g., Hartzell et al. (2006), Bianco et al. (2007); Bauer et al. (2010); Campbell et al. (2011)) and reported its weak relationship with the CFP. This is mainly due to the strongly regulated business environment as stated by Ghosh and Petrova (2021) and Bauer et al. (2010). The literature on the REIT’s risk-return characteristics regarding socially responsible investments is scarce. Several researchers suggest that higher CSP may lower volatility and a market risk premium (Eichholtz et al. 2013; Westermann et al. 2022) and lead to additional diversification benefits (Newell et al. 2011). Some empirical studies, on the contrary, suggest a lack of abnormal return related to portfolio greenness (Eichholtz et al. 2012; Ooi and Dung 2019) and indicate no risk-adjusted return from CSR practices (Westermann et al. 2022). On the other hand, Fan et al. (2022) argue that costly ESG investments may deteriorate the firm’s fundamentals and increase the company’s risk.

The studies investigating the CSP-CFP empirical relationship employing ESG metrics are of the primary concern of our study; therefore, we summarize this line of research regarding the data sources, single/cross-country samples, time periods, variable selection, and modeling strategies as well as the empirical evidence provided. Previous studies have employed various data sources and country samples. For instance, Newell and Lin Lee (2012) used the CSR ratings of Corporate Monitor for E, S, and G rating factors for 16 Australian REITs. Examining the USA REIT market, Cajias et al. (2014) employed the MSCI ESG (formerly KLD) database for 341 publicly traded real estate companies, whereas Brounen and Marcato (2018) utilized Global Real Estate Sustainability Benchmark (GRESB), Thomson Reuters, and KLD datasets for the aggregate ESG scores. Among the cross-country case studies, Morri et al. (2021) and Fuerst (2015) used the GRESB database to study 50 European REITs and approximately 400 international REITs in North America, Asia, and Europe. Chacon et al. (2022) also employ the GRESB database for a global sample of 15 countries in a 3-year sample of 2019 and 2021.

Existing literature has predominantly focused on single-country analysis, including Australia (Newell and Lin Lee 2012; Westermann et al. 2022) and the USA (Cajias et al. 2014; Brounen and Marcato 2018; Aroul et al. 2022). Only three studies so far (Fuerst 2015; Morri et al., 2020, Chacon et al. 2022) have investigated the CSP-CFP relationship in a cross-country setting. Furthermore, these studies have utilized short-time periods, ranging from 3 to 9 years, in their analysis, except for Brounen and Marcato (2018), who used an 18-year sample period for the US REITs. Regarding the variable selection, prior research has investigated the nexus by using the operating performance indicators such as ROA and ROE (Morri et al., 2020), financial performance indicators of the total return and excess or risk-adjusted return (Newell and Lin Lee 2012; Brounen and Marcato 2018; Westermann et al. 2022) or both indicators (Fuerst 2015) as the dependent variable. Although some studies employed a risk factor as an independent variable (Newell and Lin Lee 2012; Cajias et al. 2014; Aroul et al. 2022), to our knowledge, no prior research has employed a risk factor as the dependent variable in the long-term analysis in a cross-country setting. As the only exception, Fan et al. (2022) employ the overall volatility and systematic risk (Beta) as the dependent to measure the risk of US REITs during the period of 2007 and 2021.

As the modeling approach, existing studies have generally utilized panel regression analysis to explore the CSP-CFP nexus. Given that only a single study (Cajias et al. 2014) performed the Granger causality test and employed panel regressions, we could argue that lack of causality analysis is an ongoing modeling challenge in this line of research for REITs. The scarcity of simultaneous analysis of aggregated and disaggregated ESG scores in relation to CFP is another research gap in the literature. Brounen and Marcato (2018) highlighted this knowledge gap and incorporated total ESG scores and disaggregated E/S/G scores using different sub-periods from 2002 to 2016. The present study differs from Brounen and Marcato (2018) and Fan et al. (2022) by using a cross-country panel data analysis and having the systematic firm risk (or beta) as the dependent variable in an ESG score-based empirical specification in this sample. This study also uses a more extended period for disaggregated level analysis to minimize possible modeling problems arising from short time spans.

In summary, there are conflicting theoretical and empirical views in the literature focusing on the CSP-CFP nexus. Empirically driven nature of the investigations adopting various databases, sample sizes, time periods, variable selection, and modeling strategies might contribute to different results across different studies on this topic. Although previous research has mainly suggested a decline in risk and an increase in a firm’s financial performance with the ESG or GRESB metrics, systematic comparative work on the CSP-CFP empirical nexus employing ESG ratings in a cross-country REITs market setting is still at an embryonic stage. Our understanding of the association between individual E/S/G metrics and CFP, namely, insights from disaggregated analysis of ESG factors, is less apparent.

Data description

This study uses a comprehensive dataset provided by the Thomson Reuters Asset4 database, where ESG scores are mainly classified under the following quartiles.Footnote 3 ESG score within the first quartile (0 to 25) indicates poor relative performance and insufficient degree of transparency in reporting data publicly; ESG scores up to the median (> 25 to 50) indicate satisfactory relative performance and a moderate degree of transparency; ESG scores in the third quartile (from > 75 to 100) indicate good (excellent) relative performance and above average (high) degree of transparency in reporting data.

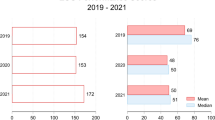

Our sample covers 234 ESG-rated REITs in five developed markets, where 163(69.7%) REITs publicly reporting ESG scores are from the USA, 22(9.4%), 20(8.5%), and 19(8.1%) REITs from Australia, the UK, and Canada, respectively. The number of Japanese REITs is 10 with a 4.3% share in the sample. According to our calculations based on EPRA and Thomson Reuters databases, the share of the equity market cap of ESG-rated REITs to the total market cap of public REITs in each country is 81% for Australia, 83% for the UK, 82% for Canada, 28% for Japan, and 65% for the USA in 2019. To better grasp the representativeness of our sample, we further calculate the ratio of the total market cap of ESG-rated REITs (our sample) to the total market cap of overall public REITs in five countries in 2018 and 2019, which are 82% and 63%, respectively.Footnote 4

The preliminary analysis of the ESG scores across the sample reveals that the UK and the Australian REITs recorded the highest ESG total scores of 54.5 and 45.5, on average, respectively, during the period 2003–2019. The US and Canadian REITs have performed moderately well, separately reporting overall ESG scores of 38.7 and 34.9. Japanese REITs have experienced the worst ESG performance, with an overall score of 21.9. Concerning the individual E/S/G scores, the UK REITs have by far the highest environmental score of 61.1, whereas the other country REITs have displayed notably lower E-scores, ranging from 13.0 (Canada) to 39.1 (Australia). The governance score is more equally distributed than the environment score—e.g., Japanese REITs have the lowest G-score of 31.5, whereas Canadian REITs have the highest score of 48.9. The S-score across countries indicates the UK and the Australian REITs have experienced the best social performances as they reported 55.5 and 51.1 scores, respectively. Once again, Japanese REITs have recorded the lowest S-score, 16.9, on average. Overall, REITs in the UK and Australia have recorded superior ESG performance, particularly in terms of environmental and social scores. Japanese REITs, in contrast, have been unsuccessful in their ESG-investing, especially in social responsibility and governance quality.

Empirical methodology

Unit root tests and PVAR Granger causality test

To test whether corporate social performance (or ESG score) affects the corporate financial performance or financial performance affects social performance, or if there is a reciprocal causality between the two, the Granger causality test is used. It should be noted that Granger causality test (Granger 1969) requires the use of stationary time series data. In other words, if the data is non-stationary in the level form, it needs to be transformed into stationary form in order to be used for the Granger causality test (Huang 1995; Feige and Pearce 1979). Therefore, before we run the causality tests, we carry out panel data unit root tests so as to investigate the stationarity of our variables.

The utilization of panel data unit root tests has become widely available among empirical scientists owing to advances in time series econometrics and panel data analysis during the last 3 decades that is initiated by Levin and Lin (19921993). Currently, a variety of tests for unit-roots (or stationarity) in panel datasets are available.Footnote 5 There are two generations of tests available among the panel unit-root testing framework: first generation and second generation. The former category of tests assumes that they are convenient if there is no correlation between cross-sectional units, whereas the latter category of tests is characterized by the rejection of the cross-sectional independence hypothesis (Hurlin and Mignon 2007). In this regard, a simple test of weak cross-section dependence (CD) proposed by Pesaran (2015) is applicable before employing the appropriate unit-root test to our variables.

Table 1 presents the results for the Pesaran weak CD test for all our variables, indicating that we reject the null hypothesis of weak CD. Therefore, we have to employ second generation panel unit root tests that allow for cross-sectional dependence. Among those, due to the unbalanced structureFootnote 6 of our dataset, the only available option is the Fisher test.

Table 2 summarizes the results for the Fisher type test performs unit-root tests on each panel by combining the p-values from the panel-specific unit-root tests using the four methods proposed by Choi (2001). For all our variables, we strongly reject the null hypothesis being tested that all panels contain a unit root. Therefore, we can conclude that our series are stationary at levels, and we may proceed with the Granger-causality test.

In this regard, such a causal relationship is represented:

where it is assumed that the disturbances \({u}_{it}\) and \({u}_{it}^{^{\prime}}\) are uncorrelated. Equation (1) indicates that variable X Granger-causes Y provided that \({\beta }_{l}\)’s are statistically different from zero as a group, whereas \({\gamma }_{l}\)’s are not statistically different from zero as a group. Similarly, Y Granger-causes X given that \({\beta }_{l}\)’s are not statistically different from zero in Eq. (1), while the set of the lagged X coefficients in Eq. (2),\({\lambda }_{l}\)’s, are statistically different from zero. Feedback or bilateral causality is indicated when the sets of X and Y coefficients are statistically different from zero in both equations. The most important feature that distinguishes the panel VAR model from the VAR model in the time series is the individual effects (\({\mu }_{i}\)) in the model.

Table 3 shows the overall results from Granger causality Wald tests with the suggested lags for each equation of the underlying panel VAR model which is estimated using the generalized method of moments (GMM) developed by Abrigo and Love 2016).Footnote 7As the Granger-causality test is sensitive to the chosen lag in the causality model, we are interested in finding the correct lag length, i.e., correct order, by using the order selection criteria. In this regard, CD: R2 criterion, which indicates the overall coefficient of determination for GMM models capturing the proportion of variation explained by the relevant panel VAR model, is used.

Panel data methods: fixed effects vs. random effects.

This study employs linear regressions with panel data and estimates the following empirical model to investigate the sign of the relationship between CSP and the financial performance of REITs.

where i represents each REIT company denoting the cross-section dimension, and t represents the time-series dimension. Financial performance is the dependent variable, and CSP is the variable of interest and measured either by an equally-weighted average of or individual E, S, and G scores. \({X}_{it}\) is the K-dimensional vector of firm-specific variables that changes over time without a constant term. \(\theta\) is a Kx1 matrix, and \({\vartheta }_{it}\) represents the effects of the omitted variables that will change across the individual firms and time periods. \({\mu }_{i}\) is a 1 × 1 scalar intercept representing the unobserved effects, which are constant over time. The random error term is assumed to be distributed independently identically with mean zero and constant variance.

Two different panel data methods, namely random effects or fixed effects, can be used to estimate our model. Based on the Hausman (1978) test results, we find that the specification test is strongly rejected in all our specifications, implying that the random effects estimator would lead to inconsistent results. The fixed effects estimator is, therefore, the appropriate methodology for our data to obtain unbiased and consistent results. Although the most common drawback of fixed-effects models is the impossibility of including time-constant explanatory variables (Sassen et al. 2016), this is not the case for our model as our explanatory variables are time-variant. Besides, we use year-fixed effects to control for changing macroeconomic conditions denoted by \({\mathrm{Year}}_{t}\), mainly to capture the impact of the Global Financial Crisis (GFC) in 2008 and 2009. Finally, we adopt cluster-robust standard errors at the firm levelFootnote 8 to mitigate the concerns about cross-sectional and time-series dependence.

Using a panel dataset of 1408 firm-year observations over the period 2003–2019,Footnote 9 we examine the effect of ESG scores on three market-based measures of financial performance: (1) excess return, (2) risk-adjusted performance of a portfolio by its Sharpe ratio, and (3) systematic firm risk or beta factor. Excess return over a risk-free rate is calculated by subtracting 3-month interbank offered rates from the end-of-year stock return. The risk-adjusted performance of a REIT portfolio is measured by its Sharpe ratio—i.e., the ratio of the annual excess return over risk-free rate to the volatility of excess returns—where REIT stock volatility is calculated by using the annualized standard deviation of weekly stock returns over the previous 12 months (see Auer and Schuhmacher 2016; Bouslah et al. 2013). The beta factor is obtained from the beta index of REIT companies, considering a timeframe of 60 months.Footnote 10

The model variables are listed in Table 4. We retrieved all financial data from the Thomson Reuters Worldscope and DataStream databases and utilized two risk-free rate proxies obtained from Bloomberg, namely the 3-month LIBOR and overnight indexed swap rate.Footnote 11 ESG scores are obtained from the Thomson Reuters Asset4 database that evaluates CSP based on three pillars of environmental, social, and corporate governance performance. Among the country-specific variables, M3 index is derived from the OECD statistics and GDP, and the inflation rate is obtained from the World Economic Outlook, IMF.

We use the following control variables commonly adopted in the relevant literature, including Westermann et al. (2022), Sassen et al. (2016), Auer and Schuhmacher (2016), and Newell and Lin Lee (2012). Firm size measured as the natural log of market capitalization in US Dollar accounts for the size effect on REIT’s financial performance. Leverage controls the impact of REIT’s capital structure on the firm’s market risk and return and is calculated as the total debt-to-total assets ratio. We included REIT’s stock market liquidity as a possible influencing factor on market return and risk, which is measured as the volume of shares traded divided by the number of shares outstanding at the company’s year-end. We used the price-to-book ratio to capture different risk characteristics for growth and value companies, calculated as the stock price per share to book value per share. We also included the company total risk and operating expenses to consider REIT’s market risk and operating performance, respectively.

As the indicator of return uncertainty, total risk reflects the firm’s stock volatility and is measured by using the annualized standard deviation of weekly stock returns over the previous 12 months. Operating cost is measured as the natural log of total operating expenses and used to explore if REITs with lower operating costs would have better financial performance. Finally, we controlled for the dividend pay-out ratio, which could be interpreted as a signal for managers’ perception of certainty of future earnings. Pay-out ratio is calculated as the ratio of dividends per share to the price per share with a time lag of one year since dividend cash flows are time-lagged (Sassen et al. 2016). For all other control variables, we employed current values. Country-specific variables are employed to control macroeconomic conditions. In this respect, we use average consumer price changes to control inflation rates of our sample countries. Additionally, we use M3 and GDP to control variations in broad money supply or excess liquidity and the size of the sample economies. Table 5 presents basic descriptive statistics for model variables.

Results and discussion

Full sample regression analysis results

The sign of association between ESG total and individual scores and REIT financial performance, estimated by using Eq. (3) for the full sample period, are shown in Tables 6, 7. ESG total score has a negative link with REIT’s Sharpe ratio (with an estimated coefficient of − 0.52 and − 0.62) and excess return (estimated coefficient of − 0.13 and − 0.16), whereas it has no association with REIT beta during the overall study period. Coefficient values for the Sharpe ratio are more prominent in magnitude than those for the excess return measure. The estimated coefficients for company-level control variables indicate that REIT size (market cap), stock market liquidity (turnover ratio), price-to-book value ratio, and dividend pay-out ratio are all positively related to REIT excess return and the Sharpe ratio. REIT total risk and operating expenses are, in contrast, negatively associated with their financial performance as anticipated. Country-specific macroeconomic indicators do not have any statistically significant association with financial performance (excess return and beta) of REITs.

To understand which E/S/G factor affects financial performance, we regressed our return and risk measures on the individual E/S/G scores rather than the aggregated ESG score (see Table 7) to test our first hypothesis. Table 7 displays a strong negative relationship between E-score and return measures—i.e., a negative association with Sharpe ratio and excess return at 1% and 5% significance levels, respectively. In contrast, the estimated coefficients of the S-score and G-score are insignificant with a positive and negative sign, correspondingly. Noticeably, the negative relationship between E-score and REIT return measures has a dominating impact on REIT’s CSP (ESG total score) and CFP nexus. Once again, the company- and country-specific control variables have similar estimated coefficient values with the same signs. It is important to highlight that a higher S-score is negatively associated with REIT beta, indicating that S-investing reduces firm’s systematic risk; a higher E-score, in contrast, is associated with higher systematic risk. Furthermore, no relationship between corporate governance (G-score) and financial performance is found. These results provide sufficient evidence to accept the first hypothesis of each component of E/S/G that investing has different impacts on the financial performance of REITs’.

Overall, results from the full-sample analysis indicate that the environmental component of ESG investing is negatively (positively) associated with REITs’ return (systematic risk). These estimates provide evidence against our second hypothesis that a higher E-score (or environmental performance) leads to a lower financial performance, which the trade-off hypothesis might explain. Specifically, REITs’ environmental policies and practices involve high financial costs that may drain off capital and other company resources and result in declining stock prices and market returns. As our study is one of the initial attempts to analyze REITs’ CSP-CFP nexus by investigating the association between financial performance and (dis-)aggregated ESG scores in cross-country setting, the only comparable evidence that uses disaggregated ESG scores is provided by Brounen and Marcato (2018) and Fan et al. (2022). In this respect, studying a sample of 194 USA REITs, Brounen and Marcato (2018) found that a higher E-score is associated with a significant negative excess return. Using a sample of listed US equity REITs, Fan et al. (2022) also document that environmental impact is negatively associated with future stock returns, and social and governance ratings are positively related to future stock returns. The authors further argue that the overall ESG score cannot significantly predict future stock returns in the REITs, consistent with the findings in Pedersen et al. (2021).

We also find that neither the social nor governance component of ESG investing has a significant association with REIT market return measures, whereas the former has a weak negative relationship with beta. Previous studies (Bauer et al. 2010; Bianco et al. 2007; and Hartzell et al. 2006) also found no significant relationship between corporate governance and USA REIT performance and explained this weak impact of G-investing on REIT’s performance by the strongly regulated business environment in the REIT industry (Ghosh and Petrova 2021; Bauer et al. 2010).

Sub-period regression analysis results

Table 7 presents regression analysis results for the same range of models shown in Table 6, after the GFC from 2011 to 2019. Considering that both the financial and other company-specific indicators still exhibited poor performance in 2010, we define the post-GFC subperiod from 2011 onwards. We find no statistically significant association between ESG total score and REIT excess return and the Sharpe ratio (Table 8), although ESG total score is negatively related to REIT beta (model 7). An insignificant relationship between ESG total score and REIT return measures is because the dominating negative association between E-score and REIT returns is now offset by the strong positive relationship between S-score and REIT return measures (Table 9). Moreover, S-score has a solid negative relationship with REIT beta with the estimated coefficients of − 0.48 (model 7) and −0.43 (model 8), which is already reflected in the ESG total score-beta relationship in model 7 in Table 5a. In line with the full sample case, G-score has no significant association with REIT financial performance either through excess return or systematic risk measure. In the post-GFC period, stock market investors have attached a higher value to REITs’ S-investing; S-score exhibits a strong positive association with CFP through not only higher excess return and the Sharpe ratio but also a lower beta.

A positive premium for S-investments supports our second hypothesis of “higher social performance (S-score) leads to a higher financial performance for REITs through higher return and lower risk,” which might be explained by the social impact and risk mitigation hypotheses of the stakeholder theory of corporation. According to the social impact argument, a corporation that attempts to lower its implicit costs by reducing or ignoring socially responsible actions will, therefore, incurs higher explicit costs, giving rise to a competitive disadvantage. In contrast, a broad-minded employee relations policy may have a lower cost, resulting in substantial gains in morale, productivity, and competitive advantage compared to less responsible firms. The risk mitigation argument predicts that the performance of S-investing is negatively related to firm risk. It might be possible to claim that successful social investments of REITs generate a reservoir of positive moral capital or goodwill that creates relational wealth among different stakeholders, which in turn reduces financial risk (McGuire et al. 1988).

A considerable number of non-REIT studies have supported the risk mitigation view by documenting a negative relation between the performance of social-investing (S-score) and systematic risk for S&P 500 firms (Oikonomou et al. 2012), for Fortune 1000 companies (Luo and Bhattacharya 2009) and a sample of UK firms (Salama et al. 2011). The current study provides the first empirical support for the risk mitigation argument of the stakeholder theory of corporation in explaining the negative relationship between the performance of S-investing and systematic risk for the developed REIT markets.

Our results suggest that the negative relationship between E-investing and REIT returns is persistent as the analysis involves both long-term (full sample, 2003–2019) and mid-term (post-GFC sub-sample 2011–2019) periods. This finding seems rather counter-intuitive because a higher environmental score is positively related to cost-effectiveness and better financial performance (e.g., Guenster et al. (2011)). Nevertheless, Eichholtz et al. (2012) and Coën et al. (2018) reported insignificant results for portfolio greenness and financial performance of REITs, whereas several researchers found a negative relationship between high costs of certification and firm value (Mariani et al 2018) as well as environmental regulation and firm value (Brounen and Marcato 2018; Rassier and Earnhart 2010). As discussed previously, the negative results provide evidence for the trade-off hypothesis. Empirical literature reveals some plausible explanations for this negative relation, as well. For instance, Guenster et al. (2011) claimed that eco-efficiency is value-relevant but is incorporated slowly into a company’s stock price. In the same line of time-effect argument, Derwall et al. (2011), Brounen and Marcato (2018), and Brounen et al. (2021) argued that environmental awareness needs longer to gain any positive performance impact. While costs have a clear footprint in the short-term profit and loss accounts, the benefits of ESG investment are intangible, difficult to quantify and materialize in the short term. Hence, it could be argued that high costs of certification and environmental regulation support the trade-off hypothesis, and the time-effect argument may play a role in this negative relationship.Footnote 12

Conclusion

Now, more than ever, investors understand the value of integrating ESG metrics into their investment decisions to reduce risks, discover opportunities, and consequently influence corporates’ resource-allocation decisions. Existing knowledge on the financial outcomes of corporate social investing through ESG criteria remains fragmented and scarce in the REIT industry. Using a rich dataset comprising 234 ESG-rated REITs across five developed economies from 2003 to 2019, this paper examines the statistical relationship between ESG investing and the financial performance of REITs.

Our paper adds to the corporate social performance (CSP) and corporate financial performance (CFP) nexus in the REIT market in several ways. From a practical perspective, the main contributions of the present study can be summarized as follows: (1) our study involves a longer period analysis in a cross-country setting; (2) it attempts to employ systematic firm risk as a new dependent variable in this setting; (3) it is also the first study in a cross country sample to test (i) the nexus for both aggregated and disaggregated levels, and (ii) social impact hypothesis and risk mitigation view of the stakeholder theory for REITs; (4) finally, the present study is the first application of causality analysis for a cross-country REIT sample and also a rare study to fill the existing knowledge gap about the lack of causality analysis for a REITs sample (as the only exception, see, Cajias et al. 2014).

We have four main findings. Firstly, the PVAR Granger causality analysis suggests a direction of causality from the CSP to the CFP, and the full sample regression results for the aggregated ESG scores suggest a negative CSP-CFP relationship for the REITs. This result is in line with those of Mariani et al. (2018), Coën et al. (2018), and Westermann et al. (2022). Moreover, our results provide mixed evidence of the statistical relationship between individual E/S/G investing and the financial performance of REITs. This evidence set suggests that REIT investors pay attention to individual E/S/G metrics and price each component of ESG investing differently, and E/S/G investments have different implications for the financial performance of REITs. For example, the dataset shows that the UK (Japanese) REITs have the highest (the lowest) environmental (social) sustainability score. This may be the main reason for the component-based variations in the linkage between E-S-G investing and firm-level financial performance in a cross-country setting. This finding implies that firm-level ESG policies may prioritize based on the industry-specific ESG performance component.

Secondly, empirical evidence from the full-sample analysis suggests while E-investing is negatively associated with REITs’ excess return, S-investing and G-investing components have no significant association with the financial performance of REITs. From the perspective of environmental sustainability, this evidence suggests strong support for the trade-off hypothesis—i.e., REITs’ environmental activities such as owning green building certifications, adopting land conservation and eco-friendly building design techniques, and reducing emissions at buildings involve high financial costs that may drain off company resources and result in diminishing market returns. This evidence supports the belief of the high investment costs of E-investing may discourage further development in sustainable REITs and result in a decline in the positive environmental impact of securitized real estate assets.

Thirdly, stock market investors have attached a higher value to REITs’ social investment performance in the post-GFC period, from 2011 to 2019; a positive premium for S-investing supports the social impact hypothesis and risk mitigation views of the stakeholder theory of the corporation. Therefore, it is possible to argue that the socially ethical behavior of REITs (S-investing) may generate a positive premium for the REIT stocks and create a competitive advantage through their productive relationships with their stakeholders, especially in the expansion period of the post-GFC era. On the other hand, governance practices have not improved the financial performance of REITs over the 17-year study period. We may speculate that ESG investing may provide less information on its inherent ethical impact, namely, the governance investment quality (G scores). This is presumably because of the growing commercial character of the ESG rating at the expense of its moral and ethical dimensions (Fleischman et al 2019) in the corporate sector.

Literature reveals that previous studies mostly focus on environmental sustainability due to the challenging nature of measuring social or governance issues for real property (see, Chacon et al. 2022). Our paper provides mixed evidence for the relationship between risk and socially responsible investing from the challenging S&G investing in REITs. In this respect, fourthly, while S-investing reduces a firm’s systematic risk; a higher E-score, increases the systematic risk. We are cautious in interpreting the results due to inconsistencies in the evidence set. In this respect, on the one hand, S-investing may reduce financial risk and encourage firms to be more sustainable (see, Chollet and Sandwidi 2018), but, on the other hand, the negative impact of environmental investment on the firm risk and market return may discourage REITs environmental investments. We may interpret the latter evidence with the overinvestment hypothesis arguing overinvestment in environmental sustainability (and hence ESG) may eventually detriment REITs market value in terms of both declining return and increasing risk perspectives (see, Chacon et al. 2022; Fan et al 2022).

Overall, in light of the above evidence and implication sets, we argue that the financial return of ESG investing in REITs looks rather fragmented. This picture brings into consideration of potential financial performance problem of adopting ESG practices into REITs (see, Fan et al. 2022). We mainly suggest that company boards and sustainability (and/or ESG) departments of REITs may essentially focus on long-term value creation for their companies or funds but also carefully manage conflicted performance components. In this respect, as also suggested by our evidence set, they may be specifically careful on the cost side of environmental investments in their ESG framework.

This study focuses on five developed REIT markets to investigate the CSP-CFP relationship due to the limited number of REITs with publicly reported ESG metrics in other countries. Further research may cover all ESG-rated REITs globally to improve the generalization of the research outcomes and explore cross-country comparisons over a more extended period. For future research, it would also be interesting to study the effect of REIT-market-specific factors (e.g., ownership structure, involvement in development activities, and accounting standards for property valuation) and to explore whether and to what extent the COVID-19 pandemic will change the existing CSP-CFP relationship for real estate corporations.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on a reasonable request.

Notes

We selected five countries because according to EPRA Global Real Estate Total Markets Table, the number of REITs reporting ESG scores publicly is very limited with a short history in France (7), Spain (3), Belgium (8), Singapore (7), the Netherlands (3), Hong Kong (2), and Germany (2).

Available at: https://www.refinitiv.com/en/sustainable-finance/esg-scores (accessed on: 5 July, 2021).

The number of REITs in our sample is 217 and 181 for 2018 and 2019, respectively. For the year 2018 (2019), our sampled ESG-rated REITs had $1162 ($977) billion market cap when the total market cap for all public REITs in five developed countries was $1416.3 (1553) billion, indicating 82% (63%) share.

For more information, see Baltagi (2008).

Im-Pesaran-Shin (IPS) test would be another option; however, our dataset does not provide sufficient number of observations for some panel-units, and therefore this test cannot be carried out.

Stata 16 is not able to run the Granger-causality tests with the existing embedded commands for an unbalanced panel dataset. Therefore, throughout the analysis held in this section, we utilized from Abrigo and Love (2016) which contributed user-written codes to Stata for these advanced panel data techniques. The relevant paper is also a source of discussion on the theoretical background.

Alternative approach would be bootstrapping the standard errors. Our results were insensitive in computing the variance of all estimates with 200 replications.

Our initial sample comprised 1667 firm-year observations. Missing control variables have reduced the final sample to an unbalanced panel of 1408 firm-year observations. The sample period starts from 2003 as Thomson Reuters Asset4 database publishes ESG scores since 2002.

Sassen et al. (2016) also used the historical beta index obtained from DataStream database.

We use the Overnight Indexed Swap rate data to reflect the impact of counterparty credit risk into risk-free rate variable.

We re-ran our regression models with alternative operating performance measures, including return on equity, return on investment, and return on total assets. Our estimation results are robust and insensitive to the exercises, which are available upon request.

Abbreviations

- CFP :

-

Corporate financial performance

- CSP :

-

Corporate social performance

- CSR :

-

Corporate social responsibility

- ESG :

-

Environmental social performance

- GDP :

-

Gross domestic product

- GFC :

-

Global financial crisis

- GRESB :

-

Global Real Estate Sustainability Benchmark

- IMF :

-

International Monetary Fund

- LIBOR :

-

London Interbank Offered Rate

- OECD :

-

Organization for Economic Cooperation and Development

- REITs :

-

Real Estate Investment Trusts

References

Abrigo MR, Love I (2016) Estimation of panel vector autoregression in Stata. Stand Genomic Sci 16(3):778–804

Aroul RR, Sabherwal S, Villupuram SV (2022) ESG, operational efficiency and operational performance: evidence from Real Estate Investment Trusts. Manag Financ 48(8):1206–1220. https://doi.org/10.1108/MF-12-2021-0593

Auer BR, Schuhmacher F (2016) Do socially (ir)responsible investments pay? New evidence from international ESG data. Q Rev Econ Finance 59:51–62

Barnea A, Rubin A (2010) Corporate social responsibility as a conflict between shareholders. J Bus Ethics 97(1):71–86

Bauer R, Eichholtz PMA, Kok N (2010) Corporate governance and performance: the REIT effect. Real Estate Econ 36:1–29

Bianco C, Ghosh C, Sirmans CF (2007) The impact of corporate governance on the performance of REITs. J Portf Manag 33(5):175–191

Bouslah K, Kryzanowski L, M’Zali B (2013) The impact of the dimensions of social performance on firm risk. J Bank Finance 37:1258–1273

Brounen D, Marcato G (2018) Sustainable insights in public real estate performance: ESG scores and effects in REIT markets. Berkeley Lab, Berkeley

Brounen D, Marcato G, Op’t Veld H (2021) Pricing ESG equity ratings and underlying data in listed real estate securities. Sustainability 13(4):2037

Cajias M, Fuerst F, McAllister P, Nanda A (2014) Do responsible real estate companies outperform their peers? Int J Strateg Prop Manag 18(1):11–27

Campbell RD, Ghosh C, Petrova M, Sirmans CF (2011) Corporate governance and performance in the market for corporate control: the case of REITs. J Real Estate Financ Econ 42(4):451–480

Chacon R, Feng Z, Wu Z (2022) Does investing in ESG pay off? Evidence from REITs around the COVID-19 pandemic. Evidence from REITs around the COVID-19 pandemic (June 27, 2022). Available at SSRN: https://ssrn.com/abstract=4147749

Choi I (2001) Unit root tests for panel data. J Int Money Financ 20:249–272

Chollet P, Sandwidi BW (2018) CSR engagement and financial risk: a virtuous circle? International evidence. Glob Financ J 38:65–81. https://doi.org/10.1016/j.gfj.2018.03.004

Coën A, Lecomte P, Abdelmoula D (2018) The financial performance of green REITs revisited. J Real Estate Portf Manag 24(1):95–105

Derwall J, Koedijk K, Ter Horst J (2011) A tale of values-driven and profit-seeking social investors. J Bank Finance 35(8):2137–2147

Eichholtz P, Kok N, Yonder E (2012) Portfolio greenness and the financial performance of REITs. J Int Money Financ 31(7):1911–1929

Eichholtz P, Kok N, Quigley JM (2013) The economics of green building. Rev Econ Stat 95(1):50–63

Fan KY, Shen J, Hui ECM (2022) ESG Materiality and responsible investment: evidence from Real Estate Investment Trusts. Available at: https://l24.im/RI5 (accessed on: 4 May 2023)

Feige EL, Pearce DK (1979) The casual causal relationship between money and income: Some caveats for time series analysis. Rev Econ Stat 521–533

Fleischman GM, Johnson EN, Walker KB, Valentine SR (2019) Ethics versus outcomes: managerial responses to incentive-driven and goal-induced employee behavior. J Bus Ethics 158(4):951–967

Freeman RE (1984) Strategic management: a stakeholder approach. Pitman, Boston

Friede G, Busch T, Bassen A (2015) ESG and financial performance: aggregated evidence from more than 2000 empirical studies. J Sustain Financ Invest 5(4):210–233

Friedman M (1970) A friedman doctrine: The social responsibility of business is to increase its profits. The New York Times Magazine 13(1970):32–33

Frynas JG, Yamahaki C (2016) Corporate social responsibility: review and roadmap of theoretical perspectives. Business Ethics: a European Review 25(3):258–285

Fuerst F (2015) The financial rewards of sustainability: a global performance study of real estate investment trusts. Available at SSRN 2619434

Ghosh C, Petrova M (2021) The effect of legal environment and regulatory structure on performance: crosscountry evidence from REITs. J Real Estate Financ Econ 63:40–81

Godfrey PC (2005) The relationship between corporate philanthropy and shareholder wealth: a risk management perspective. Acad Manag Rev 30:777–798

Godfrey PC, Merrill CB, Hansen JM (2009) The relationship between corporate social responsibility and shareholder value: an empirical test of the risk management hypothesis. Strateg Manag J 30:425–445

Granger CW (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica: Journal of the Econometric Society 1:424–38

Guenster N, Bauer R, Derwall J, Koedijk K (2011) The economic value of corporate eco-efficiency. Eur Financ Manag 17(4):679–704

Hartzell J, Sun L, Titman S (2006) The effect of corporate governance on investment: evidence from REITs. Real Estate Econ 34(3):343–376

Hausman JA (1978) Specification tests in econometrics. Econometrica: Journal of the Econometric Society 1251–1271

Huang BN (1995) Do Asian stock market prices follow random walks? Evidence from the variance ratio test. Appl Financ Econ 5:251–256

Hurlin C, Mignon V (2007) Second generation panel unit root tests. HAL Id: halshs-00159842

IEA (2019) The 2019 Global status report for buildings and construction. https://www.iea.org/reports/global-status-report-for-buildings-and-construction-2019 (accessed on 12 April 2021)

Levin A, Lin CF (1992) Unit root tests in panel data: asymptotic and finite-sample properties. University of California. San Diego, Discussion Paper, (92–93)

Levin A, Lin CF (1993) Unit root tests in panel data: new results. University of California at San Diego, Economics Working Paper Series

Luo X, Bhattacharya CB (2009) The debate over doing good: corporate social performance, strategic marketing levers, and firm-idiosyncratic risk. J Mark 73:198–213

Mariani M, Amoruso P, Caragnano A, Zito M (2018) Green real estate: does it create value? Financial and sustainability analysis on European green REITs. Int J Bus Manag 13:80–92

McGuire JB, Sundgren A, Schneeweis T (1988) Corporate social responsibility and firm financial performance. Acad Manag J 31:854–872

Morri G, Anconetani R, Benfari L (2021) Greenness and financial performance of European REITs. J Eur Real Estate Res 14(1):40–61

NAREIT (2019) Nareit guide to ESG reporting frameworks. https://www.reit.com/sites/default/files/media/PDFs/Research/Nareit_Guide_to%20ESG_Reporting_2_21_19.pdf (accessed on 8 April 2021)

Newell G, Lin Lee C (2012) Influence of the corporate social responsibility factors and financial factors on REIT performance in Australia. J Prop Invest Financ 30(4):389–403

Newell G, Wen Peng H, Yam S (2011) Assessing the linkages between corporate social responsibility and A-Reit performance. Pac Rim Prop Res J 17(3):370–387

Oikonomou I, Brooks C, Pavelin S (2012) The impact of corporate social performance on financial risk and utility: a longitudinal analysis. Financ Manage 41:483–515

Ooi JT, Dung DD (2019) Finding superior returns in green portfolios: evidence from Singapore REITs. J Sustain Real Estate 11(1):191–215

Pedersen LH, Fitzgibbons S, Pomorski L (2021) Responsible investing: the ESG efficient frontier. J Financ Econ 142(2):572–597

Pesaran MH (2015) Testing weak cross-sectional dependence in large panels. Economet Rev 34(6–10):1089–1117

Preston LE, O’bannon DP (1997) The corporate social-financial performance relationship: a typology and analysis. Bus Soc 36(4):419–429

Qureshi MA, Akbar M, Akbar A, Poulova P (2021) Do ESG endeavors assist firms in achieving superior financial performance? A case of 100 best corporate citizens. SAGE Open 11(2):21582440211021600

Rassier DG, Earnhart D (2010) Does the porter hypothesis explain expected future financial performance? The effect of clean water regulation on chemical manufacturing firms. Environ Resource Econ 45(3):353–377

Salama A, Anderson K, Toms JS (2011) Does community and environmental responsibility affect firm risk? Evidence from UK panel data 1994–2006. Business Ethics: A European Review 20(2):192–204

Salzmann AJ (2013) The integration of sustainability into the theory and practice of finance: an overview of the state of the art and outline of future developments. J Bus Econ 83(6):555–576

Sassen R, Hinze AK, Hardeck I (2016) Impact of ESG factors on firm risk in Europe. J Bus Econ 86(8):867–904

United Nations Environment Program (2019) 2019 Global status report for buildings and construction. https://wedocs.unep.org (accessed on 10 April 2023).

Waddock SA, Graves SB (1997) The corporate social performance-financial performance link. Strateg Manag J 18(4):303–319

Wang Q, Dou J, Jia S (2016) A meta-analytic review of corporate social responsibility and corporate financial performance: the moderating effect of contextual factors. Bus Soc 55(8):1083–1121

Westermann S, Niblock SJ, Kortt MA (2022) Does it pay to be responsible? Evidence on corporate social responsibility and the investment performance of Australian REITs. Asia-Pac J Account Econ 29(4):1102–1119

Author information

Authors and Affiliations

Contributions

Isil Erol collected and constructed the data, interpreted the empirical findings, and supervised the paper. Umut Unal conducted the quantitative analysis. Yener Coskun developed a literature review section, edited related parts, and developed the final revision of the paper. All the authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethical approval

Not applicable

Consent to participate

Not applicable

Consent for publication

Not applicable

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Arshian Sharif

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Erol, I., Unal, U. & Coskun, Y. ESG investing and the financial performance: a panel data analysis of developed REIT markets. Environ Sci Pollut Res 30, 85154–85169 (2023). https://doi.org/10.1007/s11356-023-28376-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-28376-1