Abstract

Grounding our work on the resource-based view of the firm, we study and quantify the impact of non-financial resources added by venture capital (VC) on the growth performance of investee companies. While most of the literature compares VC-backed companies with similar companies that did not receive external financing, our originality stems from the use of a counterfactual of companies that received external quasi-equity financing (in the form of participative loans) but not non-financial resources. We use a difference-in-difference (DD) estimator to disentangle the effect of an injection of financial resources (which can be used by companies to acquire non-financial resources) from the contribution of the unique non-financial resources brought in by VC (which companies cannot otherwise acquire). Our results are based on a large sample of young Spanish SMEs that received either VC (915) or participative loans (1551) between 2005 and 2013 as first type of financing. We find that the contribution of the non-financial resources leads to yearly increases of 12.86% in employment, 38.13% in total assets, and 54.03% in sales. Furthermore, we find that only the most experienced VC firms contribute with valuable non-financial resources.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There is overwhelming evidence that entrepreneurial ventures (hereafter, EVs)Footnote 1 receiving venture capital (hereafter, VC) perform better than non-VC-backed EVs across many dimensions, including employment and sales growth (e.g., Bertoni et al. 2011; Engel and Keilbach 2007). The higher performance of VC-backed companies is attributed to the effect of three different factors: (i) the detailed screening process performed by VC firms (hereafter, VCs), which ensures that VC-backed companies have higher potential with respect to other ventures (Amit et al. 1998; Chan 1983); (ii) the funding provided (i.e., financial resources), which allows financially constrained companies to undertake investment opportunities that they would otherwise forgo (Bertoni et al. 2010, 2013); and (iii) a complex bundle of services, such as professionalization, networking, and signaling, which are not present in other forms of external finance (Gorman and Sahlman 1989; Kaplan and Strömberg 2004; Lerner 1995; Sapienza et al. 1996). In this work, we focus on this third contribution of VC, which we refer to as the ability to add “non-financial resources”; in the literature, this ability is often called the VC “non-financial value added.”

Many efforts have been made by scholars (e.g., Baum and Silverman 2004; Chemmanur et al. 2011) to understand to what extent the better performance of VC-backed EVs is due to screening (i.e., VCs are better able to pick winners) or to the direct effect of VC involvement (i.e., the joint effect of financial and non-financial resources provided to portfolio companies). The ability of VCs to add non-financial resources is also largely documented in the literature (e.g., see Large and Muegge 2008). For instance, Sørensen (2007) finds that more experienced VCs not only select better companies, but also have a stronger “influence” on EVs’ probability to go public. Chemmanur et al. (2011) highlight the efficiency gains of the monitoring from a VCs. Bernstein et al. (2016) show that when VCs can visit their target companies more easily due to the introduction of a new airplane connection, the target’s performance improves. Hsu (2004) proves that entrepreneurs are willing to pay more for equity to partner with a reputed VCs, possibly because they provide valuable non-financial resources.

Most of these contributions are related to the US VC market, which is way ahead the development of VC markets elsewhere in the world. Nevertheless, as highlighted by Proksch et al. (2017), value-adding activities are complex and highly diverse, and therefore depend on the context. In Europe, the evidence on the existence of non-financial value of VC is limited. Croce et al. (2013) analyze the effect of the non-financial resources added by European VCs on company performance by resorting to total factor productivity. They claim it is solely influenced by non-financial resources because the financial injection is accounted for by the increase in the inputs (capital and labor). However, total factor productivity could be an imperfect measure to isolate the non-financial resources added by VCs. We argue that the financial resources injected could also be used by EVs to improve their efficiency not only by increasing the inputs, but also by upgrading their quality (i.e., acquiring better technologies or hiring better engineers and managers). Additionally, existing literature demonstrates the existence of non-financial resources added by VC, without directly quantifying their impact on the investment performance.

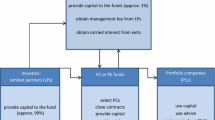

As non-financial resources are specific of VC investments, and not present in some alternative financial instruments (e.g., loans, or even crowdfunding), understanding to what extent the higher performance of VC-backed EVs is beyond the pure injection of money can be informative for both entrepreneurs seeking support and policy makers interested in spurring growth. Hence, the extent to which the non-financial resources provided by VCs contribute to the higher performance of VC-backed EVs is an important research question, especially outside the US. We aim to contribute to this topic by proposing an empirical approach to isolate the impact of non-financial resources from that of financial resources added by VCs on the growth of portfolio companies. Specifically, we adopt a classic difference-in-difference (DD) methodology. However, in contrast to the common approach of comparing the performance of VC-backed companies with that of companies that did not receive any external financing (e.g., Engel and Keilbach 2007), we use as counterfactual EVs that received external financial resources but did not receive any additional non-financial resources. Our approach to quantify non-financial value added is based on new ways to finance entrepreneurial ventures that are emerging at the crossroads between private and public equity (Colombo et al. 2016). We focus on the case of participative loans (hereafter, PLs), which are hybrid instruments used by governmental agencies to finance EVs as an alternative to government-backed VC and R&D grants. Similar to VC, PLs are a form of long-term quasi-equity finance awarded after a detailed screening process. Despite the differences in the respective contracts, VC and PLs share some similarities (e.g., selection, type of security, holding periods, and liquidation rights). Our key assumption is that they bring qualitatively similar financial resources to target companies. However, unlike VC, the public institution granting PLs does not provide any non-financial resources.

Grounding our theory on the resource-based view of the firm (Barney 1991), we expect VC to have a stronger effect than PLs on the performance of EVs because of VC’s ability to add social and human capital, which are non-financial resources fundamental to building sustained competitive advantage for EVs (Ireland et al. 2003). We also argue that different types of VCs may have different abilities to improve social and human capital in portfolio EVs, depending on their own resource endowments and investment strategies. Specifically, we focus on the experience and portfolio management strategy of VCs as possible drivers of their ability to add non-financial resources. We test our hypotheses on a representative sample of Spanish EVs receiving VC and PLs between 2005 and 2013. We compare the impact of PLs and (different types of) VCs on growth using a DD estimator.

The main contribution of our work is the introduction of a new approach to measure the magnitude of the effect of the non-financial resources added by VCs by directly and explicitly disentangling it from the impact of financial resources. In addition, we provide theoretical grounding and empirical evidence on which characteristics of VCs drive their ability to add non-financial resources to portfolio EVs.

The structure of this paper is as follows: In Sect. 2, we present the theoretical background and develop our hypotheses. In Sect. 3, we present the data and describe the DD methodology used. We show our main results in Sect. 4, which also includes further robustness checks, primarily aimed at addressing the potential bias arising from differences in the selection criteria of VCs and PLs. Finally, in Sect. 5, we discuss our findings and conclude.

2 Theoretical background and hypothesis development

According to the resource-based view, a firm must have a bundle of valuable, rare, imperfectly imitable and non-substitutable resources to build sustained competitive advantage (Barney 1991; Penrose 1959; Wernerfelt 1984). The entrepreneurship literature shows that the human and social resources of the entrepreneurs are the most important sources of competitive advantage for EVs (Davidsson and Honig 2003). However, sometimes, the internal endowment of human and social resources in the entrepreneurial team is limited. Many EVs are created by individuals with sophisticated technical skills but scant managerial, commercial, and social skills (Colombo and Grilli 2005). In these cases, EVs have to invest in their human and social capital to sustain their competitive advantage (Bosma et al. 2004), and financial resources become fundamental to acquiring key external non-financial resources (Ireland et al. 2003).

However, as explained by agency theory, the access of EVs to financial resources is extremely difficult. EVs are especially affected by information asymmetries because of a lack of track records and the often technology-intensive nature of their activities (Carpenter and Petersen 2002a). The lack of tangible assets to be pledged as collateral further worsens their credibility as potential borrowers. As a result, EVs face severe adverse selection and moral hazard problems in raising external capital to finance their investment projects (Berger and Udell 1998; Binks et al. 1992; Carpenter and Petersen 2002b). Many EVs resort exclusively to internal finance and are unable to access valuable external resources, including human and social capital, which could be crucial for developing and sustaining their competitive advantage. In fact, financially constrained EVs undertake fewer investments and achieve lower growth than those that are not financially constrained (Carpenter and Petersen 2002b).

2.1 Provision of financial resources by VCs and PLs to EVs

VCs are prominent providers of financial resources to EVs (Hellman and Puri 2000; Kortum and Lerner 2000). These financial intermediaries are able to reduce the problems associated with information asymmetries ex ante, due to a detailed screening process (Amit et al. 1998; Gorman and Sahlman 1989; Tyebjee and Bruno 1984), and ex post, by designing contracts to incentivize portfolio company managers (Admati and Pfleiderer 1994) and by developing monitoring mechanisms in portfolio firms (Fiet et al. 1997; Lerner 1995; Mitchell et al. 1997). By injecting financial resources into portfolio EVs, VCs relax their financial constraints, as documented by a reduction in their investment-cash flow sensitivity (Bertoni et al. 2011, 2013; Engel and Stiebale 2014). EVs can use financial resources to acquire important tangible (e.g., plant and equipment) and intangible (e.g., human and social capital) resources to build sustained competitive advantage (Ireland et al. 2003). This use of financial resources can at least partially explain the higher growth rates reported for VC-backed companies with respect to other EVs (Colombo and Grilli 2010; Davila et al. 2003; Engel and Keilbach 2007).Footnote 2

Since VC is only accessible for a limited number of EVs (Sahlman 1990), the “funding gap” is sometimes bridged by policy schemes developed by governmental agencies. Among the different instruments used, including R&D, investment subsidies, subsidized loans, loan guarantees, and government-backed VC, new ways to finance entrepreneurial ventures are emerging at the crossroads between private and public equity (Colombo et al. 2016). In particular, we highlight the emergence of hybrid instruments that share the characteristics of both equity and loans: PLs. Similar to regular loans, PLs have predetermined maturity (similar to the average holding period of VC investments) and interest payments. The latter are divided into two components. The first component is independent of the company’s performance and is usually determined by the reference interest rate (e.g., Euribor) plus a spread. The second component is performance-contingent, as it is based on the company’s net profits in the relevant year (similar to a dividend). There is usually a grace period in which the company does not reimburse the loan, thus making the cash flow pattern of this instrument similar to that of equity. In addition, PLs are subordinated to any other loan and are computed as equity for the purpose of financial analysis.

As in the case of VC, the institutions granting PLs manage ex ante information asymmetries via a process of careful selection. To be eligible for obtaining a PL, applicants must go through a rigorous screening process that assesses the viability and innovativeness of the business plan and the professionalization of the management team. Since the institution granting the PLs receives a large number of applications related to various emerging and established technologies, officials can gain sizeable insight into which companies are most promising and use this knowledge to overcome information problems (Lerner 2002). PL contracts further manage information asymmetries by aligning the interests of the granting agencies with those of the entrepreneurial companies by sometimes requiring the beneficiary company to complete a simultaneous capital increase.

There are similarities between VC and PLs also regarding the characteristics of the instruments used. First, VC and PLs share hybrid debt/equity attributes. In fact, VCs seldom rely on pure equity when investing in startups but rather prefer to use a mix of preferred equity, straight debt, convertible debt, and convertible equity (Cumming 2005). Similarly, PLs are hybrid debt-equity contracts in which the interest payments have a performance-contingent component. Both VCs and PLs are senior to straight equity in the case of liquidation and are both usually allocated by rating agencies in the equity basket. Second, VC and PLs are comparable in terms of duration (between 4 and 9 years). Additionally, VC-backed and PL-backed EVs share common characteristics: they both actively look for external financing and are both selected by external investors after a careful screening of their potential.

Therefore, similar to VC, PLs represent an injection of long-term finance into selected promising EVs that are financially constrained. In addition, beneficiary firms are also able to increase long-term funding from banks because of the PL certification effect (Martí and Quas 2018). Hence, the receipt of PLs should relax financial constraints (Carpenter and Petersen 2002b), thus allowing EVs to have access to the external social and human capital resources required to build competitive advantage. Supporting this idea, Bertoni et al. (2019) show that PLs significantly boosted the growth in the number of employees of beneficiaries in a sample of Spanish companies. As a result, we expect that EVs receiving either VC or PLs will experience significant growth after the injection of financial resources.

2.2 Provision of non-financial resources by VCs to EVs

Even though PLs are comparable with VCs as providers of external long-term financial resources, VC and PL contracts are not similar across all dimensions. VC contracts include strict monitoring and other post-investment provisions (e.g., presence in the board, qualified majorities for strategic decisions, among others) and provide valuable non-financial resources to portfolio companies (Busenitz 2007; Large and Muegge 2008; Luukkonen et al. 2013; Proksch et al. 2017). VCs can boost the human capital of EVs by performing a “coaching” function, providing financial, administrative, marketing, strategy, and management advice (Gorman and Sahlman 1989; Lerner 1995; Sahlman 1990; Sapienza 1992; Sørensen 2007), and a “professionalization” function, introducing human resource policies (e.g., stock option plans) and hiring external managers (Bottazzi et al. 2008; Hellmann and Puri 2002). Moreover, VCs boost the social capital of EVs by granting them access to their networks (Hochberg et al. 2007), by encouraging the establishment of alliances (Colombo et al. 2006; Hsu 2006; Lindsey 2008), and by endorsing portfolio firms to third parties (Stuart et al. 1999). These functions facilitate access to external resources such as potential new customers, alliance partners, skilled workers, professional services, banks, and other financial intermediaries. In brief, VCs directly help EVs attract and build both human and social capital.

In contrast, the post-investment clauses in PL contracts focus on collection of the pre-determined and contingent interest payments and on the repayment schedule. The institution granting PLs does not monitor the way in which the awarded companies are managed and, therefore, does not directly improve the human and social capital of beneficiary companies.

Since the differences between VC and PLs are mostly related to the post-investment relationship with the beneficiary EV, PLs represent an appropriate counterfactual for measuring the effect of the non-financial resources provided by VCs to their portfolio companies on their competitive advantage. Resorting to several growth measures to quantify gains in competitive advantage (for similar approaches, see, e.g., Colombo and Grilli 2005), we argue that the superior growth of VC-backed EVs, when compared with that of PL-backed EVs, should be related to the extra valuable, rare, imperfectly imitable and non-substitutable human and social capital (i.e., non-financial resources) received. We thus outline our first hypothesis as follows:

-

Hypothesis 1. VC-backed EVs grow significantly more than PL-backed EVs.

2.3 Drivers of VC investors’ provision of non-financial resources to EVs

Previous research suggests that there is high heterogeneity across VCs (for a review, see Da Rin et al. 2013) and that VCs’ ability to add human and social resources to their portfolio EVs may be influenced by VC characteristics. For instance, experience, reputation, partners’ human capital, and the number of companies in their portfolio are key drivers of VCs’ ability to add value (Drover et al. 2017). We do not pretend to theorize on the human or social capital of VC investment managers. Instead, we consider the factors that can help VCs attract better managers and develop their networks, thus effectively providing non-financial resources to their portfolio EVs. Specifically, we focus on VC experience and portfolio management strategy.

VCs strongly rely on their experience to effectively coach their portfolio companies (Clarysse et al. 2013; Sørensen 2007). Most reputed VCs may have access to larger networks of suppliers, customers, and potential managers (Hellmann and Puri 2002; Hochberg et al. 2007) and are thus in a position to contribute more to the venture’s social capital. Moreover, the reputation of experienced VCs may communicate unobserved qualities about the company to the market (Megginson and Weiss 1991; Pollock et al. 2010) and arguably boost the company’s visibility in social networks and their ability to hire skilled human resources. Along these lines, ample empirical evidence shows that the experience and reputation of VC managers has a positive influence on the performance of target EVs in terms of initial public offering (IPO) rates, IPO valuations, and efficiency (e.g., Chemmanur et al. 2011; Nahata 2008; Sørensen 2007). Therefore, we posit the following hypothesis:

-

Hypothesis 2. Only EVs backed by experienced VCs grow more than PL-backed EVs.

The ability of VCs to add non-financial resources also strongly depends on their portfolio management strategy (Da Rin et al. 2013; Drover et al. 2017). The effectiveness of VCs’ assistance on the performance of investee firms increases with the effort and commitment of VC managers (De Clercq and Fried 2005; Jääskeläinen et al. 2006). The attention devoted by VCs to each of their portfolio companies is likely to influence the constructive coaching provided by VC managers (Fulghieri and Sevilir 2009). One of the constructs used in the literature to analyze the extent to which VCs are able to devote attention to portfolio companies and to apply a “hands-on” approach is the ratio between the number of portfolio EVs and the number of venture managers overseeing them (Balboa and Martí 2007; Cumming 2006). A high number of portfolio companies per VC manager tends to undermine the quality of advice (Bernile et al. 2007; Kanniainen and Keuschnigg 2003) and, therefore, limits the extent to which VCs provide non-financial resources to their portfolio companies. Based on these arguments, our third hypothesis is as follows:

-

Hypothesis 3. Only EVs backed by VCs devoting attention to their portfolio EVs grow more than PL-backed EVs.

3 Methodological approach and data

3.1 Empirical approach

We isolate the effect of the provision of non-financial resources by VCs from the effect of financial resources by means of a DD estimator applied to the growth of VC-backed and PL-backed EVs. The DD estimator is computed as the difference in outcome for VC-backed EVs around the VC injection year as compared with the difference in the outcome of the PL-backed EVs around the PL injection year (for recent applications to the VC context, see Bernstein et al. 2016; Bronzini et al. 2019; Dutta and Folta 2016).

In this study, the treatment of interest is having received non-financial resources from VCs. VC-backed EVs are the treated companies, and PL-backed EVs are the non-treated ones. We analyze changes in performance in EVs that obtain their first external financing (either VC or PL). We compare changes before and after the financing event for VC-backed (affected by the treatment) and PL-backed (not affected by the treatment) EVs. In the post-financing period, both PL-backed and VC-backed EVs are expected to grow because of the financial resources received. However, we expect the growth of VC-backed EVs to be higher than that of PL-backed EVs because of the non-financial resources added by VCs (Hypothesis 1).

3.2 Sample selection

Our sample is based on the Webcapitalriesgo database, which includes information on the population of VC-backed and PL-backed companies in Spain and is updated every year. Since the 1990s, Webcapitalriesgo actively collaborates with the Spanish Private Equity and Venture Capital Association (ASCRI) to produce the annual activity reports.

For VC-backed companies, the database contains detailed information on the VCs involved, including experience, sources of funds, number of portfolio firms, and number of VC managers, which are not usually available in secondary datasets. Regarding PLs, the dataset includes companies that were awarded PLs by either ENISA (a government-backed Spanish institution) or INVERTEC (a program implemented by Catalonia’s regional government). The data on supported companies were directly provided by both granting institutions.

We used information on the population of companies, founded between 1996 and 2013, that received either their first round of VC financing or their first PL between 2005 and 2013. We focus on companies that were 10 years old or younger at the time of the first VC or PL funding. The population consists of 2552 EVs, 985 of which received VC and 1840 of which received PLs. Of these companies, 273 received both VC and PLs at some point in their lives. Specifically, 163 received VC before PLs, 25 received PLs before VC, and 85 received PLs and VC in the same year. Hereafter, we refer to VC-backed companies as the 960 companies that received VC as their first external source of entrepreneurial finance or that received VC and PL in the same year. PL-backed EVs are, instead, the 1592 companies that received PLs as their first source of entrepreneurial finance. The rationale behind this classification is that companies backed by both PLs and VC received both financial (VC and PLs) and non-financial (only VC) resources from their investors and are therefore similar to other VC-backed EVs.

Because of missing data in the variables of interest, in this study, we do not use the full population described above but rather a sample of 915 VC-backed and 1551 PL-backed EVs. The distribution of the subsample is not significantly different from the distribution of the population (Pearson χ2 (9) = 0.1922 for industries; Pearson χ2 (16) = 0.8636 for regions). Table 1 shows the distribution of VC-backed and PL-backed EVs effectively used in the estimation process (i.e., 915 VC-backed and 1551 PL-backed EVs) across industries and regions. The two distributions are significantly different (Pearson χ2 (9) = 139.974, p value < 0.1 for industries; Pearson χ2 (16) = 269.515, p value < 0.1 for regions). Within the sample of VC-backed EVs, the most common activity sectors are software, professional services, and R&D services. Within the sample of PL-backed EVs, we find a stronger tendency to operate in trade services, professional services, other low-technology sectors, and software. In terms of regions, both VC-backed and PL-backed EVs are concentrated in Andalusia, Catalonia, and the Madrid region, albeit in a different order.Footnote 3

We build a company-year panel dataset to test our hypotheses (Source: Orbis). We include up to 5 years of observations before (“pre-funding” period) and up to 5 years of observations after (“post-funding” period) funding. For companies that were financed when they were younger than 5 years old, we have fewer observations in the pre-funding period. As our dataset covers up to 2016, we have fewer than 5 observations in the post-funding period for companies that were financed after 2011. Our results are similar if we use 3 years before funding and 3 years after funding or if we impose that all companies in the sample are observed for the same number of years before and after funding.

3.3 Model specification

We test our hypotheses on the total assets, employment and sales growth of EVs using a DD panel specification with company fixed effects. Our basic model, excluding control variables, is as follows:

We define three dependent variables (Yi,t), lnTotalAssetst, lnEmployeest, and lnSalest, equal to the logarithm of total assets, number of employees, and gross sales of EVs, respectively, plus 1. PostFint is the time dummy separating the pre-financing period from the post-financing period: it changes from 0 to 1 in the year in which a company receives the first round of financing from either VCs or PLs. Its coefficient captures the differences in size (in other terms, growth) around the financing event, i.e., the “first difference” of the DD estimator. VCbacked is a time-invariant dummy equal to 1 for treated EVs, i.e., those that received VC. Its coefficient would capture time-invariant differences between VC- and PL-backed EVs. However, as we use a fixed-effect specification, we do not actually estimate the coefficient of VCbacked, and its effect is captured by EVs’ fixed effects. The coefficient of PostFini,t should capture the difference in size around the financing event for PL-backed companies, i.e., the effect of financial resources. The coefficient of the interaction between PostFini,t and VCbackedi captures how much the differences in size for VC-backed EVs around the financing event were larger (or smaller) than those for PL-backed EVs, i.e., the DD estimator. According to Hypothesis 1, the coefficient of the interaction between PostFini,t and VCbackedi, which measures the effect of the non-financial resources added by VCs on the performance of EVs, should be positive and significant.

We include EV fixed effects (ηi). This approach is preferred to random-effect estimators when the treatment is not randomly assigned, and some individuals are more likely to be treated than others based on some time-invariant characteristics (Besley and Case 2000). For instance, VC-backed EVs may be systematically different from PL-backed EVs due to their inner quality or the long-term prospects of their businesses. The EV fixed-effect terms should capture such differences. A Hausman test confirmed that the fixed-effect estimator is more desirable than a random-effect estimator in our setting (χ2 (21) = 610.72 for employment growth, χ2 (21) = 2321.90 for total assets growth, and χ2 (21) = 205.28 for sales growth, all with p value < 1%). We also cluster standard errors at the company level to correct for both autocorrelation and heteroscedasticity (Bertrand et al. 2004).

In each model, we control for company age in logarithms (lnAget); liquidity, measured as the logarithm of cash and cash equivalents, lagged (lnCasht-1); intangibles, measured by the ratio of intangibles to total assets, lagged (Intangiblest-1); and year dummies. Moreover, to better capture the effect of the injection of financial resources, in the regressions, we also include lnAmountt, i.e., the cumulated amount of funding received from VCs or in the form of PLs until year t by the focal company (the results are similar if we control for the non-cumulative amounts injected in each year). The amounts are expressed in terms of the logarithms of EUR received.

Table 2 summarizes the definition of all variables of interest and provides summary statistics for the entire sample. The correlation matrix is shown in Table 3.

In addition, we study two drivers of the ability of VCs to add non-financial resources: experience (Hypothesis 2) and portfolio management strategy (Hypothesis 3). To do so, we classify all VCs into two exclusive categories for each driver.

As suggested by Sørensen (2007), we measure experience (Hypothesis 2) with the number of successfully exited investments (i.e., divestments via trade sale or initial public offering) carried out by each VCs in the previous 5 years. The dummy variable ExperiencedVC is equal to 1 if the EV was funded by a VC that, at the time of the investment, belonged to the group of most experienced investors, i.e., those with the highest number of successful divestments made in the previous 5 years. As thresholds, we consider the 25th, 50th, and 75th percentile of the distribution of the number of successful divestments. The dummy InexperiencedVC is equal to 1 for EVs backed by VCs that did not belong to the experienced group at the time of the investment (i.e., VCbaked − ExperiencedVC). To test our hypothesis on portfolio management strategy (Hypothesis 3), we consider the number of portfolio EVs per investment manager for each VC, which indicates how much attention VC managers can dedicate to each of their portfolio EVs. The dummy AttentiveVC is equal to 1 for EVs receiving VC from investors belonging to the group showing the lowest values for the ratio of the number of EVs per investment manager (we also computed the results for different thresholds), whereas the dummy UnattentiveVC is equal to 1 for EVs receiving funding from the remaining VCs (i.e., VCbacked − AttentiveVC).

For each dimension, we substitute the variable VCbacked in our baseline model with the set of two dummy variables identifying the EVs backed by VCs in each category (e.g., for experience, we use ExperiencedVC and InexperiencedVC). The interactions between PostFint and each of the two dummies correspond to the DD estimators capturing the effect of the non-financial resources provided by each category of investors. For each driver, we expect only one of the two groups of VCs to have a significant effect (i.e., the most experienced and the most “attentive”).

3.4 Descriptive statistics and the parallel trend assumption

In Table 4, we show statistics of the variables of interest for the two groups of EVs in the year of their first financing. The number of employees, total assets, sales, and the availability of cash were not significantly different for VC-backed and PL-backed EVs 1 year before funding. Table 4 also reports statistically (but not economically) significant differences in age (VC-backed EVs were only half a year younger) and in the ratio of intangibles to total assets (0.22 versus 0.2). However, we find significant differences in the amount of funding received, as the average “ticket” received by VC-backed EVs was 5 times greater than that of PL-backed ones.

However, the DD approach does not specifically require treated and untreated companies to be similar by the time of the treatment. A rather crucial premise of the DD methodology is the so-called parallel trends assumption, which requires that, before the treatment, both groups exhibit the same slope (trend) along the performance measure under investigation (Roberts and Whited 2013). To test this assumption, we study the growth patterns of VC-backed and PL-backed EVs in the years before and after receiving external financing. Figure 1 shows the trends in the average number of employees, sales and total assets (in logs) in the 5 years before and 5 years after the first funding event for VC-backed and PL-backed EVs. To build the graph, we considered only companies for which we have accounting information in all the years considered to use a consistent sample to compute averages. The figure shows that the trends of the outcome variables were parallel across groups before the funding event (i.e., before year 0) and suggest that the DD approach is suitable for our data.Footnote 4 The graphs also show that, in this sample, VC-backed EVs tend to be smaller than PL-backed EVs before financing, but the differences decrease in the following years, consistent with higher growth rates for the VC-backed EVs after treatment.

Trends in average total assets, employment, and sales of VC-backed and PL-backed companies, from 5 years before financing to 5 years after financing. The graph shows the average level of total assets, employment, and sales (in logarithms) in the 10 years around the first investment (t = 0). It is based on all VC-backed and PL-backed companies in the population, for which accounting data was available at least from 5 years before the treatment till 5 years after

4 Results

4.1 Financial and non-financial value added

In Table 5, we show the impact of our independent variables and controls on EV employment, total assets, and sales growth. For each dependent variable, we show three specifications: a model including only standard control variables (columns I–III), a model in which we include our independent variables (columns IV–VI), and a full-fledged model (columns VII–IX) in which we also control for the financial resources received thus far (lnAmountt).

In columns I–III, the control variable models show that older companies with more cash have a higher number of employees, assets, and sales, while companies with more intangible assets have lower employment levels and higher assets and sales. Such results are similar to those in other model specifications. In columns IV-VI, the coefficient of PostFint is significant at the 1% for employment and total assets. The coefficients are, respectively, equal to 0.109 and 0.203, corresponding to increases of 11.52% (exp(0.109) − 1) in employment and 22.51% (exp(0.203) − 1) in total assets. The interaction between PostFint and VCbacked captures the difference in the increase in performance between VC-backed and PL-backed EVs (i.e., the DD estimator). The coefficient of the interaction is positive and significant along the three dimensions, at least at the 5% confidence level. Compared with PL-backed EVs, VC-backed EVs grew more in terms of employment (exp(0.170) − 1, i.e., 18.53%), total assets (exp(0.387) − 1, i.e., 47.26%), and sales (exp(0.484) − 1, i.e., 62.26%) after the first financing event. The results suggest that VC boosts the growth of target companies more than PLs, arguably because of the non-financial resources received, which supports Hypothesis 1. In terms of magnitude, the effect of the non-financial resources added by VCs on growth goes well beyond that of the financial resources provided by both VCs and PLs along all growth dimensions.

In columns VII–IX, we replicate the analysis by controlling for the amount of financial resources injected. lnAmountt has positive and significant coefficients along all growth dimensions, with a p value < 1% for employment and total assets and p value < 10% for sales, suggesting that the injection of financial resources allows companies to hire more employees, invest more in assets, and, ultimately, register higher sales. Interestingly, the coefficient of PostFint loses significance in these models, consistent with the fact that the effect of the financial resources added by VCs or PLs is captured by the amount injected. On the other hand, the coefficient of PostFint*VCbacked remains sizable and significant (at the 10%, 1%, and 5% level, respectively, for growth in employment, assets, and sales). In terms of magnitude, we find similar results to those reported in columns IV–VI: 12.86% (exp(0.121) − 1) increase in employment, 38.13% (exp(0.323) − 1) increase in total assets, and 54.03% (exp(0.432) − 1) increase in sales.

We can compare these results, which are especially important in the case of total assets and sales,Footnote 5 with the impact of financial resources, represented by the coefficient of lnAmountt. The non-financial value added increases sales by 54.03 percentage points, while the financial value added is 1.31% (exp(0.013) − 1) for each unit of the variable lnAmountt. As the average value for such variable is equal to 12.947 (see Table 2), we estimate an average effect of 16.94 (1.31% × 12.947) percentage points in the model for sales. In other words, on average, the increase due to the non-financial value added is 3 times that of the financial value added. Similarly, non-financial and financial value added increases total assets by 38.13 and 20.88 ((exp(0.016) − 1) × 12.947)) percentage points, respectively. For employment, the effects of the non-financial and financial resources added by VCs are similar: 12.86 and 13.01 ((exp(0.010) − 1) × 12.947) percentage points, respectively.

4.2 VC firms’ heterogeneity and the provision of non-financial resources

In Table 6, we show the results concerning our hypotheses relating to the drivers of the ability of VCs to provide non-financial resources: experience (Hypothesis 2) and portfolio management strategy (Hypothesis 3).

In panel A, we report the results on experience, measured by the sum of the number of successful divestments (i.e., exits via trade sale or initial public offering) completed in the previous 5 years. We provide different thresholds to classify VCs as experienced (i.e., the dummy ExperiencedVC = 1), ranging from above the first quartile VCs (i.e., including 75% of VCs, in columns I–III), the second quartile VCs (i.e., including the top 50% VCs, in columns IV–VI), and the third quartile VCs (i.e., including the top 25% VCs, in columns VII–IX) of the sum of successful divestments. The interaction between PostFint and ExperiencedVC is positive and significant in all models, while the interaction between PostFint and InexperiencedVC is only significant for employment growth in the least demanding threshold and for total assets growth in the second quartile threshold. Interestingly, the coefficients for the top 25% experienced VCs are greater than those reported in Table 5 for all VCs. According to the results in columns VII–IX, the non-financial value added increases employment by 22.51 (exp(0.203) − 1) percentage points (versus 12.86 for all VCs), total assets by 58.72 (exp(0.462) − 1, versus 38.13 for all VCs) percentage points, and sales by 138.45 percentage points (exp(0.869) − 1, versus 54.03 for all VCs). Hence, we find that the most experienced VCs have a stronger effect on EVs’ growth, firmly supporting Hypothesis 2.

In panel B, we consider the effect of VC portfolio management strategy, captured by the ratio between the number of portfolio EVs and the number of investment managers of each VCs. We also defined three thresholds for attention (i.e., the dummy AttentiveVC = 1), with the most demanding one being the ratio having a value below the first quartile, shown in columns I–III. The second threshold defined a VCs as attentive if the ratio was below the median. The results are shown in columns IV–VI. Finally, the results on the least demanding threshold, which are reported in columns VII–IX, include VCs with a ratio below the last quartile (i.e., 75% of VCs). The interaction between PostFint and AttentiveVC is not significant in any of the three models when attention is defined by a ratio of portfolio EVs per VC investment manager below the first quartile (columns I–III). It only has positive and significant coefficients in the model on total assets growth for VCs with a ratio below the median, or in the models on employment and total assets growth for VCs with a ratio below the third quartile. In these latter cases, we do not find significant interactions for UnattentiveVC. This finding provides very limited support for Hypothesis 3.

In sum, we find that the non-financial value added by VCs is driven by those with broader experience, but not necessarily by those with a small number of portfolio EVs monitored by each investment manager.

4.3 Robustness checks

The key assumption for the consistency of the DD estimator is that the average change in the outcome variable would have been the same for treated and untreated EVs if they both received the treatment. We ensured this by verifying the parallel trends assumption and by choosing fixed-effect specifications that capture time-invariant differences in the characteristics of treated and untreated EVs. Even though VC-backed EVs were similar to PL-backed EVs at the time of the first financing, we follow the suggestion by Roberts and Whited (2013) to apply the DD approach to a sample of more homogeneous treated and untreated EVs, selected with a matching algorithm. Further, some studies argue that the DD methodology in combination with matching “…improves the quality of non-experimental evaluation results significantly” (Blundell and Costa Dias 2000, p. 438; see also Abadie 2005). Therefore, as a robustness check, for the treated VC-backed companies, we selected a counterfactual of matched PL-backed EVs, using two alternative matching algorithms. First, we performed company-level 1:1 propensity score matching (PSM) in the year before the first funding. To compute the propensity score (i.e., the probability of being VC-backed rather than PL-backed), we selected slightly different matching variables for each growth measure. In all three models, we used lnAget, industry, region and year dummies as matching variables. In addition, in the model for employee growth, we also used lnEmployeest and the logarithmic growth of employees (lnEmployeest − lnEmployeest-1); in the model for total assets growth, we used lnTotalAssetst and the logarithmic growth of total assets (lnTotalAssetst − lnTotalAssetst-1); and in the model for sales growth, we included lnSalest and the logarithmic growth of sales (lnSalest − lnSalest-1). We then picked the closest (i.e., nearest neighbor) PL-backed EV for each VC-backed EV based on the propensity score. Second, we applied coarsened exact matching (CEM) (Iacus et al. 2012) in the year before the financing event. In contrast to PSM, CEM allows for the ex-ante control of the balancing of the matched sample. As matching variables, we used the age, NACE industry code (4 digits), region, and foundation year of the EVs. CEM identifies the strata of all the combinations of the coarsened continuous and the categorical matching variables and eliminates all treated and untreated EVs that do not share common characteristics with EVs in the other group 1 year before the first financing. Once the matched samples were selected with either PSM or CEM, we replicated our main analysis. The results are shown in columns I–III (PSM) and IV–VI (CEM) of Table 7 and are robust to our previous estimates.

Another challenge to the validity of the DD methodology is that the treatment may be endogenous. VC is provided after careful screening of companies’ business plans, which is probably based on unobservable time-varying characteristics, such as the potential to develop innovative products that will soon be market-ready. PLs are also granted after a detailed screening process. Nevertheless, the two selection processes can be different because of the different nature and objectives of the institutions carrying out the processes (VCs versus a public body for PLs). If some companies have unobservable time-varying characteristics that make them simultaneously more likely to obtain VC (rather than PL) and achieve high growth if financial resources are injected, then the treatment is endogenous, and we may have overestimated its effect on company growth.

Researchers often include the lagged dependent variable in the regressors of the DD specification to reduce endogeneity concerns (Bertrand et al. 2004). Besley and Case (2000) encourage the use of an instrumental variable approach when the DD framework could be potentially weakened by treatment endogeneity. We embrace both approaches and resort to a dynamic panel model, with an AR(1) component and exogenous instruments: the difference-generalized method of moments approach (Arellano and Bond 1991). Specifically, we consider the lagged dependent variable as predetermined and lnAmountt-1, PostFint and its interaction with VCbacked as endogenous. We use the first differences of the predetermined variables from t − 1 and of the Intangiblest-1, lnCasht-1 and the endogenous variables from t − 2 as moment conditions. As strictly exogenous instruments, we include year dummies and VCfundraisingonGDPinRegiont-1, defined as the amount of funds raised by VCs in each Spanish region (source: Webcapitalriesgo), divided by the GDP in that region (source: Eurostat) and lagged by 1 year. Following Brander et al. (2015), we believe that this variable captures exogenous variations in the likelihood that a company will receive VC (rather than PLs). We use the robust two-step covariance matrix developed by Windmeijer (2005). The results of these models are reported in columns VII–IX of Table 7. The Arellano-Bond tests for AR(1) and AR(2) confirm that using the second lag of the differences in the variables as an instrument is a valid approach. Additionally, the Hansen test confirms that the instruments are exogenous. Our results relating to the variable of interest, PostFint × VCbacked, are robust in this model specification, showing even larger coefficients for employment and sales growth.Footnote 6

We conducted several other robustness checks. First, as a last check on the endogeneity of the treatment, we repeated our analysis based on the sample of 273 companies that received both VC and PLs. We used EVs that received VC before PLs or at the same time, as the treated group, and EVs that received PLs before receiving VC as the counterfactual. As all these companies went through the selection of both VC and PLs, endogeneity issues are virtually nonexistent in this sample. Second, we used random-effects estimation rather than fixed-effect estimation. Third, we restricted the sample to companies that are younger than 5 years by the time of the first financing. Fourth, we changed the observation window to 3 (rather than 5) years of observations before and after funding. Fifth, we excluded companies for which we have any gaps in the accounting information during the observation window (as recommended by Besley and Case 2000), and we resorted to a cross section rather than panel specification to reduce concerns of serial correlation (Bertrand et al. 2004). Finally, we also repeated our estimates excluding all EVs (273) that received both VC and PLs. Our results, which are discussed in more detail in the available online (Tables A1-A4), are largely robust to all of these changes.

5 Discussion and conclusions

VC investors have attracted substantial academic interest for their unique ability to “add value” to portfolio companies beyond the injection of financial resources. The first contribution of this paper is to provide a theoretical framework for explaining how VCs can add value to their portfolio EVs. In the resource-based view of the firm, the competitive advantage of EVs is driven by three categories of unique resources: financial, human capital, and social capital (Ireland et al. 2003). VCs could improve the competitive advantage of their portfolio companies both indirectly, by injecting financial resources that can be used by EVs to improve their human and social capital, and directly, by granting EVs access to non-financial resources that they could not otherwise acquire, such as a network of contacts, mentoring, and coaching.

Disentangling the impact of the financial and non-financial resources added by VCs on EV performance is a difficult empirical issue but still fundamental to justifying the reputation of VCs as prominent financers of EVs. Our second contribution is the design of a methodology that allows us to estimate the magnitude of the effect of the VC provision of non-financial resources. For our sample of VC-backed EVs, we use a counterfactual of companies that received a similar form of external financial resources (namely, PLs) from institutions that do not provide non-financial resources. We find that both VC-backed and PL-backed companies grew after the financing event, arguably because those resources were used to acquire key non-financial resources that contributed to improving the competitive advantage of the EVs. Moreover, our DD estimator indicates that VC-backed EVs grew more than PL-backed EVs after the first financing, in terms of employment (12.96%), total assets (38.13%), and sales (54.03%), arguably due to the addition of non-financial resources. We also quantify the growth attributable to the financial resources received by all funded EVs on average, which is similar in the employment growth model (13.01%), but lower in terms of total assets (20.88%) and, especially, sales growth (16.94%). We explain the higher growth of VC-backed EVs by the unique non-financial contribution of VCs.

Our results depend on the critical assumption that the effect of the financial resources added by VCs and PLs are similar. For this condition to be met, the VC-backed and PL-backed EVs in our sample should have similar observable and unobservable characteristics, implying that VCs and the institution providing PLs should have similar selection criteria, which is possibly not the case. For instance, they may have different risk profiles or different abilities to assess the market potential of EVs. Although our results may be influenced by differences in the selection criteria of VCs and PLs (and this is an inherent limitation of this study), our set of robustness checks confirms that they are not solely driven by such differences.

Another stated assumption of this paper is that, contrary to VC, PLs do not entail any non-financial resources. However, the institution granting PLs usually requires the beneficiary company to complete a simultaneous capital increase, which could sometimes be provided by other external investors that add non-financial resources, such as business angels. While we carefully control for the additional financial resources injected in the form of PLs, we have no information on which companies received business angel investments. Nevertheless, our results point to the fact that VCs provide non-financial resources, the effect of which on growth goes beyond that of the non-financial resources added by other external investors, such as business angels, and reassure us of the validity of our claims. All in all, our results firmly endorse the ability of VC to add value and provide non-financial resources that EVs cannot otherwise acquire (i.e., resources that “money cannot buy”).

Our third contribution concerns the analysis of the drivers of the ability of VCs to add non-financial resources. The literature on VC heterogeneity is extremely developed, although highly fragmented (see Da Rin et al. 2013, for a review). We contribute to this literature by considering two characteristics of VCs, namely, their experience and portfolio management strategy, which arguably determine their ability to add human and social capital to their investee EVs. We find that only VC firms that have broad experience are able to contribute to the growth of EVs. Conversely, we do not find the same support for the degree of attention devoted by VCs to their portfolio EVs. It seems that the quality of the coaching and monitoring function largely exceeds the abundance of managers overseeing portfolio EVs. Hence, we complement the literature on the key importance of VCs’ experience (Clarysse et al. 2013) and portfolio management strategy (Balboa and Martí 2007; Cumming 2006) by documenting to what extent these characteristics influence the ability of VCs to add non-financial resources and not only their capacity to select better companies (Sørensen 2007).

Our results have important implications for practitioners. For VCs, attaining a critical mass in terms of experience is a necessary condition for ensuring the growth of portfolio companies, which ultimately leads to investment success. Entrepreneurs should also be aware that not all VCs are similar in their non-financial contribution: VCs experience is a crucial important factor to consider when selecting the most appropriate VCs to approach. This paper also justifies the efforts of policy makers in supporting the VC industry, as we show that VCs are unique in their ability to add non-financial resources in addition to money.

Our study has some limitations that open the way to future research. First, our analysis is limited to the Spanish context. Spain presents a relatively well-developed VC market (the fourth largest in terms of the amount invested) in Europe (Invest Europe 2016) and is therefore an interesting test bed for our hypotheses. However, a replication of this study on a larger international database would ensure the generalizability of our results. For this purpose, other instruments that are similar to VC in terms of funding effects, but do not add any non-financial resources, should be used as the counterfactual. Injections of preferred shares after careful selection and without any post-investment monitoring are an ideal candidate for such analysis. Second, we lack direct measures of the human and social capital of VC firms, such as the education and working experience of their manager or their position in the VC networks (e.g., Hochberg et al. 2007; Zarutskie 2010). Such measures would allow a more explicit test of the drivers of the ability of VCs to contribute to the human and social capital of their portfolio EVs. Third, along the same lines, information on the human and social capital of target companies and their evolution before and after the receipt of VC investments could allow for studying how VCs influence the financial and non-financial resources of their ventures (Ko and Mckelvie 2018) and, in turn, how these resources lead to higher growth. Fourth, it would be interesting to apply our approach to examine whether the effectiveness of the non-financial resources added by VCs depends on the idiosyncratic characteristics of EVs. For instance, a venture’s absorptive capacity, i.e., its ability to access and internalize externally generated knowledge (Zahra and George 2002), may positively moderate the extent to which the non-financial resources added by VCs can trigger growth.

Notes

We define EVs as recently established SMEs (for a similar approach, see Stuart et al. 1999).

In this regard, despite the reluctance of Ray et al. (2004) about the use of aggregate variables (i.e., performance measures) as a proxy for sustained competitive advantage, we agree with Wernerfelt (1984) that we could resort to such variables when we compare companies receiving and not receiving those valuable resources, especially when several performance measures are jointly used to represent competitive advantage.

Madrid and Catalonia concentrate the most populated and developed cities, with access to banking and consultancy services. Andalusia is the largest region in Spain, and very well connected with Madrid via speed trains. It is not surprising that our results hold stronger in the subset of sample EVs operating in such “cluster” regions (such results are available from the authors upon request).

In addition, we also test the equivalence of trends for the full sample by computing the percentage change of sales, total assets and employment during the 5 years before the funding event, finding that on average such percentage change is not significantly different for VC-backed and PL-backed companies. As an alternative approach, we replicated our main analysis on sales, total assets and employment growth, but restricted the sample to the pre-financing observation period only. Besides control variables and company fixed effects, we included a variable counting the years since the founding and the interaction between such variable and a dummy identifying VC-backed companies. Interestingly, such interaction is not significant, suggesting that VC-backed companies did not have a different trend in growth rates than PL-backed companies before the financing. Such results are available from the authors upon request.

These high-growth rates are not rare in the case of recently-established SMEs.

We have also repeated the model on total assets excluding lnCasht-1 to control for the potential redundancy of this variable with the lagged dependent variable. The results do not change.

References

Abadie, A. (2005). Semiparametric difference-in-differences estimators. Review of Economic Studies, 72(1), 1–19. https://doi.org/10.1111/0034-6527.00321.

Admati, A. R., & Pfleiderer, P. (1994). Robust financial contracting and the role of venture capitalists. Journal of Finance, 49(2), 371–402. https://doi.org/10.1111/j.1540-6261.1994.tb05146.x.

Amit, R., Brander, J. A., & Zott, C. (1998). Why do venture capital firms exist? Theory and Canadian evidence. Journal of Business Venturing, 13(6), 441–466. https://doi.org/10.1016/S0883-9026(97)00061-X.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58(2), 277–297. https://doi.org/10.2307/2297968.

Balboa, M., & Martí, J. (2007). Factors that determine the reputation of private equity managers in developing markets. Journal of Business Venturing, 22(4), 453–480. https://doi.org/10.1016/j.jbusvent.2006.05.004.

Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120. https://doi.org/10.1177/014920639101700108.

Baum, J. A. C., & Silverman, B. S. (2004). Picking winners or building them? Alliance, intellectual, and human capital as selection criteria in venture financing and performance of biotechnology startups. Journal of Business Venturing, 19(3), 411–436. https://doi.org/10.1016/S0883-9026(03)00038-7.

Berger, A. N., & Udell, G. F. (1998). The economics of small business finance: the roles of private equity and debt markets in the financial growth cycle. Journal of Banking and Finance, 22(6–8), 613–673. https://doi.org/10.1016/S0378-4266(98)00038-7.

Bernile, G., Cumming, D., & Lyandres, E. (2007). The size of venture capital and private equity fund portfolios. Journal of Corporate Finance, 13(4), 564–590. https://doi.org/10.1016/j.jcorpfin.2007.04.004.

Bernstein, S., Giroud, X., & Townsend, R. R. (2016). The impact of venture capital monitoring. Journal of Finance, 71(4), 1591–1622. https://doi.org/10.1111/jofi.12370.

Bertoni, F., Colombo, M. G., & Croce, A. (2010). The effect of venture capital financing on the sensitivity to cash flow of firm’s investments. European Financial Management, 16(4), 528–551. https://doi.org/10.1111/j.1468-036X.2008.00463.x.

Bertoni, F., Colombo, M. G., & Grilli, L. (2011). Venture capital financing and the growth of high-tech start-ups: disentangling treatment from selection effects. Research Policy, 40(7), 1028–1043. https://doi.org/10.1016/j.respol.2011.03.008.

Bertoni, F., Ferrer, M. A., & Martí, J. (2013). The different roles played by venture capital and private equity investors on the investment activity of their portfolio firms. Small Business Economics, 40(3), 607–633. https://doi.org/10.1007/s11187-011-9384-x.

Bertoni, F., Martí, J., & Reverte, C. (2019). The impact of government-supported participative loans on the growth of entrepreneurial ventures. Research Policy, 48(1), 371–384. https://doi.org/10.1016/j.respol.2018.09.006.

Bertrand, M., Duflo, E., & Mullainathan, S. (2004). How much should we trust differences-in-differences estimates ? Quarterly Journal of Economics, 119(1), 249–275. https://doi.org/10.1162/003355304772839588.

Besley, T., & Case, A. (2000). Unnatural experiments? Estimating the incidence of endogenous policies. Economic Journal, 110(467), 672–694. https://doi.org/10.1111/1468-0297.00578.

Binks, M. R., Ennew, C. T., & Reed, G. V. (1992). Information asymmetries and the provision of finance to small firms. International Small Business Journal, 11(1), 35–46. https://doi.org/10.1177/026624269201100103.

Blundell, R., & Costa Dias, M. (2000). Evaluation methods for non-experimental data. Fiscal Studies, 21(4), 427–468. https://doi.org/10.1111/j.1475-5890.2000.tb00031.x.

Bosma, N., Van Praag, M., Thurik, R., & De Wit, G. (2004). The value of human and social capital investments for the business performance of startups. Small Business Economics, 23(3), 227–236. https://doi.org/10.1023/B:SBEJ.0000032032.21192.72.

Bottazzi, L., Da Rin, M., & Hellmann, T. (2008). Who are the active investors?. Evidence from venture capital. Journal of Financial Economics, 89(3), 488–512. https://doi.org/10.1016/j.jfineco.2007.09.003.

Brander, J. A., Du, Q., & Hellmann, T. F. (2015). The effects of government-sponsored venture capital: international evidence. Review of Finance, 19(2), 571–618. https://doi.org/10.1093/rof/rfu009.

Bronzini, R., Caramellino, G., & Magri, S. (2019). Venture capitalists at work: a diff-in-diff approach at late-stages of the screening process. Journal of Business Venturing, (forthcoming). https://doi.org/10.1016/j.jbusvent.2019.105968.

Busenitz, L. W. (2007). Innovation and performance implications of venture capital involvement in the ventures they fund. In H. Landstrom (Ed.), Handbook of research on venture capital (pp. 219–235). Cheltenham: Edward Elgar Publishing Limited.

Carpenter, R. E., & Petersen, B. C. (2002a). Capital market imperfections, high-tech investment, and new equity financing. Economic Journal, 112(477), F54–F72. https://doi.org/10.1111/1468-0297.00683.

Carpenter, R. E., & Petersen, B. C. (2002b). Is the growth of small firms constrained by internal finance? Review of Economics and Statistics, 84(2), 298–309. https://doi.org/10.1162/003465302317411541.

Chan, Y.-S. (1983). On the positive role of financial intermediation in allocation of venture capital in a market with imperfect information. Journal of Finance, 38(5), 1543–1568. https://doi.org/10.2307/2327586.

Chemmanur, T. J., Krishnan, K., & Nandy, D. K. (2011). How does venture capital financing improve efficiency in private firms? A look beneath the surface. Review of Financial Studies, 24(617), 4037–4090. https://doi.org/10.1093/rfs/hhr096.

Clarysse, B., Bobelyn, A., & del Aguirre, I. P. (2013). Learning from own and others’ previous experience: the contribution of the venture capital firm to the likelihood of a portfolio company’s trade sale. Small Business Economics, 40(3), 575–590. https://doi.org/10.1007/s11187-011-9381-0.

Colombo, M. G., & Grilli, L. (2005). Founders’ human capital and the growth of new technology-based firms: a competence-based view. Research Policy, 34(6), 795–816. https://doi.org/10.1016/j.respol.2005.03.010.

Colombo, M. G., & Grilli, L. (2010). On growth drivers of high-tech start-ups. The role of founders’ human capital and venture capital. Journal of Business Venturing, 25(6), 610–626. https://doi.org/10.1016/j.jbusvent.2009.01.005.

Colombo, M. G., Grilli, L., & Piva, E. (2006). In search of complementary assets: the determinants of alliance formation of high-tech start-ups. Research Policy, 35(8 SPEC. ISS), 1166–1199. https://doi.org/10.1016/j.respol.2006.09.002.

Colombo, M. G., Cumming, D. J., & Vismara, S. (2016). Governmental venture capital for innovative young firms. Journal of Technology Transfer, 41(1), 10–24. https://doi.org/10.1007/s10961-014-9380-9.

Croce, A., Martí, J., & Murtinu, S. (2013). The impact of venture capital on the productivity growth of European entrepreneurial firms: “screening” or “value added” effect? Journal of Business Venturing, 28(4), 489–510. https://doi.org/10.1016/j.jbusvent.2012.06.001.

Cumming, D. J. (2005). Agency costs, institutions, learning, and taxation in venture capital contracting. Journal of Business Venturing, 20(5), 573–622. https://doi.org/10.1016/j.jbusvent.2003.07.001.

Cumming, D. J. (2006). The determinants of venture capital portfolio size: empirical evidence. The Journal of Business, 79(3), 1083–1126. https://doi.org/10.1086/500670.

Da Rin, M., Hellmann, T. F., & Puri, M. (2013). A survey of venture capital research. In R. S. G. Constantinides & M. Harris (Eds.), Handbook of the economics of finance (Vol. 2, pp. 573–648). New York: Elsevier. https://doi.org/10.1016/B978-0-44-453594-8.00008-2.

Davidsson, P., & Honig, B. (2003). The role of social and human capital among nascent entrepreneurs. Journal of Business Venturing, 18(3), 301–331. https://doi.org/10.1016/S0883-9026(02)00097-6.

Davila, A., Foster, G., & Gupta, M. (2003). Venture capital financing and the growth of startup firms. Journal of Business Venturing, 18(6), 689–708. https://doi.org/10.1016/S0883-9026(02)00127-1.

De Clercq, D., & Fried, V. H. (2005). Executive forum : how entrepreneurial company performance can be improved through venture capitalists ’ communication and commitment. Venture Capital, 7(3), 285–294. https://doi.org/10.1080/13691060500258943.

Drover, W., Busenitz, L., Matusik, S., Townsend, D., Anglin, A., & Dushnitsky, G. (2017). A review and road map of entrepreneurial equity financing research: venture capital, corporate venture capital, angel investment, crowdfunding, and accelerators. Journal of Management, 43(6), 1820–1853. https://doi.org/10.1177/0149206317690584.

Dutta, S., & Folta, T. B. (2016). A comparison of the effect of angels and venture capitalists on innovation and value creation. Journal of Business Venturing, 31(1), 39–54. https://doi.org/10.1016/j.jbusvent.2015.08.003.

Engel, D., & Keilbach, M. (2007). Firm-level implications of early stage venture capital investment — An empirical investigation. Journal of Empirical Finance, 14(2), 150–167. https://doi.org/10.1016/j.jempfin.2006.03.004.

Engel, D., & Stiebale, J. (2014). Private equity, investment and financial constraints: firm-level evidence for France and the United Kingdom. Small Business Economics, 43(1), 197–212. https://doi.org/10.1007/s11187-013-9530-8.

Fiet, J. O., Busenitz, L. W., Moesel, D. D., & Barney, J. B. (1997). Complementary theoretical perspectives on the dismissal of new venture team members. Journal of Business Venturing, 12(5), 347–366. https://doi.org/10.1016/S0883-9026(97)00015-3.

Fulghieri, P., & Sevilir, M. (2009). Size and focus of a venture capitalist’s portfolio. Review of Financial Studies, 22(11), 4643–4680. https://doi.org/10.1093/rfs/hhp012.

Gorman, M., & Sahlman, W. A. (1989). What do venture capitalists do? Journal of Business Venturing, 4(4), 231–248. https://doi.org/10.1016/0883-9026(89)90014-1.

Hellman, T., & Puri, M. (2000). The interaction between product market and financing strategy: the role of venture capital. Review of Financial Studies, 13(4), 959–984. https://doi.org/10.1093/rfs/13.4.959.

Hellmann, T. F., & Puri, M. (2002). Venture capital and the professionalization of start-up firms: empirical evidence. The Journal of Finance, 57(1), 169–197. https://doi.org/10.1111/1540-6261.00419.

Hochberg, Y. V., Ljungqvist, A., & Lu, Y. (2007). Whom you know matters: venture capital networks and investment performance. Journal of Finance, 62(1), 251–301. https://doi.org/10.1111/j.1540-6261.2007.01207.x.

Hsu, D. H. (2004). What do entrepreneurs pay for venture capital affiliation? Journal of Finance, 59(4), 1805–1844. https://doi.org/10.1111/j.1540-6261.2004.00680.x.

Hsu, D. H. (2006). Venture capitalists and cooperative start-up commercialization strategy. Management Science, 52(2), 204–219. https://doi.org/10.1287/mnsc.1050.0480.

Iacus, S. M., King, G., & Porro, G. (2012). Causal inference without balance checking: coarsened exact matching. Political Analysis, 20(1), 1–24. https://doi.org/10.1093/pan/mpr013.

Invest Europe. (2016). European private equity activity data 2007–2015. 6 May 2016. https://www.investeurope.eu/research/invest-europe-publications/#i. Accessed 14 November 2016.

Ireland, R. D., Hitt, M. A., & Sirmon, D. G. (2003). A model of strategic enterpreneurship: the construct and its dimensions. Journal of Management, 29(6), 963–989. https://doi.org/10.1016/S0149-2063(03)00086-2.

Jääskeläinen, M., Maula, M., & Seppä, T. (2006). Allocation of attention to portfolio companies and the performance of venture capital firms. Entrepreneurship Theory and Practice, 30(2), 185–206. https://doi.org/10.1111/j.1540-6520.2006.00117.x.

Kanniainen, V., & Keuschnigg, C. (2003). The optimal portfolio of start-up firms in venture capital finance. Journal of Corporate Finance, 9(5), 521–534. https://doi.org/10.1016/S0929-1199(02)00021-4.

Kaplan, S. N., & Strömberg, P. (2004). Characteristics, contracts, and actions. Journal of Finance, LIX(5), 2177–2210. https://doi.org/10.1111/j.1540-6261.2004.00696.x.

Ko, E., & Mckelvie, A. (2018). Signaling for more money: the roles of founders’ human capital and investor prominence in resource acquisition across different stages of firm development. Journal of Business Venturing, 33(4), 438–454. https://doi.org/10.1016/j.jbusvent.2018.03.001.

Kortum, S., & Lerner, J. (2000). Assessing the contribution of venture capital to innovation. The Rand Journal of Economics, 31(4), 674–692. https://doi.org/10.2307/2696354.

Large, D., & Muegge, S. (2008). Venture capitalists’ non-financial value-added: an evaluation of the evidence and implications for research. Venture Capital : An International Journal of Entrepreneurial Finance, 10(1), 21–53. https://doi.org/10.1080/13691060701605488.

Lerner, J. (1995). Venture capitalists and the oversight of private firms. The Journal of Finance, 50(1), 301–318. https://doi.org/10.2307/2329247.

Lerner, J. (2002). When bureaucrats meet entrepreneurs: the design of effective “public venture capital” programmes. Economic Journal, 112(477), F73–F84. https://doi.org/10.1111/1468-0297.00684.

Lindsey, L. (2008). Blurring firm boundaries: the role of venture capital in strategic alliances. Journal of Finance, 63(3), 1137–1168. https://doi.org/10.1111/j.1540-6261.2008.01354.x.

Luukkonen, T., Deschryvere, M., & Bertoni, F. (2013). The value added by government venture capital funds compared with independent venture capital funds. Technovation, 33(4–5), 154–162. https://doi.org/10.1016/j.technovation.2012.11.007.

Martí, J., & Quas, A. (2018). A beacon in the night: government certification of SMEs towards banks. Small Business Economics, 50(2), 397–413. https://doi.org/10.1007/s11187-016-9828-4.

Megginson, W. L., & Weiss, K. A. (1991). Venture capitalist certification in initial public offerings. Journal of Finance, 46(3), 879–903. https://doi.org/10.1111/j.1540-6261.1991.tb03770.xfr.

Mitchell, F., Reid, G. C., & Terry, N. G. (1997). Venture capital supply and accounting information system development. Entrepreneurship Theory and Practice, 21(4), 45–62. https://doi.org/10.1177/104225879702100404.

Nahata, R. (2008). Venture capital reputation and investment performance. Journal of Financial Economics, 90(2), 127–151. https://doi.org/10.1016/j.jfineco.2007.11.00.

Penrose, E. T. (1959). The theory of the growth of the firm. New York: Oxford University Press.

Pollock, T. G., Chen, G., Jackson, E. M., & Hambrick, D. C. (2010). How much prestige is enough? Assessing the value of multiple types of high-status affiliates for young firms. Journal of Business Venturing, 25(1), 6–23. https://doi.org/10.1016/j.jbusvent.2009.01.003.

Proksch, D., Stranz, W., Röhr, N., Ernst, C., Pinkwart, A., & Schefczyk, M. (2017). Value-adding activities of venture capital companies: a content analysis of investor’s original documents in Germany. Venture Capital : An International Journal of Entrepreneurial Finance, 19(3), 129–146. https://doi.org/10.1080/13691066.2016.1242573.

Ray, G., Barney, J. B., & Muhanna, W. A. (2004). Capabilities, business processes, and competitive advantage: choosing the dependent variable in empirical tests of the resource-based view. Strategic Management Journal, 25(1), 23–37. https://doi.org/10.1002/smj.366.

Roberts, M. R., & Whited, T. M. (2013). Endogeneity in empirical corporate finance. In Handbook of the Economics of Finance (Vol. 2, pp. 493–572). Amsterdam: Elsevier. https://doi.org/10.1016/B978-0-44-453594-8.00007-0.

Sahlman, W. A. (1990). The structure and governance of venture-capital organizations. Journal of Financial Economics, 27(2), 473–521. https://doi.org/10.1016/0304-405X(90)90065-8.

Sapienza, H. J. (1992). When do venture capitalists add value? Journal of Business Venturing, 7(1), 9–27. https://doi.org/10.1016/0883-9026(92)90032-M.

Sapienza, H., Manigart, S., & Vermeir, W. (1996). Venture capitalist governance and value added in four countries. Journal of Business Venturing, 11(6), 439–469. https://doi.org/10.1016/S0883-9026(96)00052-3.

Sørensen, M. (2007). How smart is smart money? A two-sided matching model of venture capital. Journal of Finance, 62(6), 2725–2762. https://doi.org/10.1111/j.1540-6261.2007.01291.x.

Stuart, T. E., Hoang, H., & Hybels, R. C. (1999). Interorganizational endorsements and the performance of entrepreneurial ventures. Administrative Science Quarterly, 44(2), 315–349. https://doi.org/10.2307/2666998.

Tyebjee, T. T., & Bruno, A. V. (1984). A model of venture capitalist investment activity. Management Science, 30(9), 1051–1066. https://doi.org/10.1287/mnsc.30.9.1051.

Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Management Journal, 5(2), 171–180. https://doi.org/10.1002/smj.4250050207.

Windmeijer, F. (2005). A finite sample correction for the variance of linear efficient two-step GMM estimators. Journal of Econometrics, 126(1), 25–51. https://doi.org/10.1016/j.jeconom.2004.02.005.

Zahra, S. A., & George, G. (2002). Absorptive capacity: a review, reconceptualization, and extension. Academy of Management Review, 27(2), 185–203. https://doi.org/10.2307/4134351.

Zarutskie, R. (2010). The role of top management team human capital in venture capital markets: evidence from first-time funds. Journal of Business Venturing, 25(1), 155–172. https://doi.org/10.1016/j.jbusvent.2008.05.008.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

ESM 1

(DOCX 77.4 kb)

Rights and permissions

About this article

Cite this article

Quas, A., Martí, J. & Reverte, C. What money cannot buy: a new approach to measure venture capital ability to add non-financial resources. Small Bus Econ 57, 1361–1382 (2021). https://doi.org/10.1007/s11187-020-00352-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-020-00352-w