Abstract

The existing literature on the short- and long-run impacts of economic growth on income inequality indicates that positive and negative output shocks have worsened the income distribution in the United States. In this paper, we report our empirical examination of the opposite; that is, the impact of positive and negative income inequality shocks on the real output levels. Using the same time-series data, over the period 1917–2012, in a more comprehensive manner, by employing six measures of income distribution, we examined the impact of an increase/decrease in income inequality on economic growth, using the NARDL approach. The results provide evidence in support of a long-run asymmetric impact between income inequality and the real output levels, since the long-run coefficients of positive changes have positive signs, while the signs of those of negative changes are negative, indicating that a decrease or an increase in income inequality improves the real output level in the US.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The relationship between economic growth and income inequality has long been of importance in the field of economics. A substantial number of studies have asserted that income inequality has positive impacts on economic growth (see Benabou 2000; Deininger and Olinto 2000; Chen 2003; Nahum 2005; Voitchovsky 2005; Lopez 2006; Frank 2009; Shin 2012; Chan et al. 2014; Wahiba and El Weriemmi 2014; Henderson et al. 2015; Saari et al. 2015; Babu et al. 2016), while some have found the opposite (see Alesina and Rodrick 1994; Perotti 1996; Lui 1997; Deininger and Squire 1998; Mo 2000, 2009; Panizza 2002; Knowles 2005; Ostry et al. 2014; Wan et al. 2006; Sukiassyan 2007; Nissim 2007; Majumdar and Partridge 2009; Ogus Binatli 2012; Fang et al. 2015; Muinelo-Gallo and Roca-Sagalés 2013; Rubin and Segal 2015). The theoretical reasoning for negative and positive relationships between income inequality and economic growth is as per the following discussion.

The negative relationship between income inequality and economic growth can be explained in terms of the theory of credit market imperfection. This theory, according to Galor and Zeira (1993), Piketty (1997) and Aghion et al. (1999) states that an inverse relationship exists between income inequality and economic growth as a result of the inadequate funds of low-income households available for investment. It is argued that low-income households have insufficient and limited access to investment funds, owing to the existence of imperfections in the credit market. This, in one way or another, makes it difficult for these households to invest their available resources. Thus, investments are feasible only for the few rich with a high incomes, and consequently, there is a decline in the marginal productivity of capital and lagging economic growth.

In addition, Bertola (1993), Perotti (1993), Alesina and Rodrick (1994), Persson and Tabellini (1994), and Benabou (1996), using a more extensive political economy ideology, have argued that economic inequality would probably lead to distorted redistribution policies, a situation that could reduce labor incentives and retard economic growth. Even if veritable redistribution policies are not executed, persuasion to obstruct their establishment and successive political misrepresentation could impede economic growth, by squandering economic resources that would otherwise have been used to further enhance production activities in the economy. Similarly, Gupta (1990), Alesina and Perotti (1996), Benhabib and Rustichini (1996), in their socio-political instability views, are of the opinion that an increase in income inequality could raise the possibility of poor masses engaging in highly damaging activities such as rioting, revolution and crime and the likes while the resulting economic and/or political instability and skepticism in the whole economic system could lead to a decrease in investment stimuli, thereby impeding economic growth in the long run.

On the positive relationship between income inequality and economic growth, it has been argued that income inequality could increase in the early stages of economic development (Mercan and Azer 2013). According to Galor and Tsiddon (1997a), this is only feasible when a native environmental externality is the dominant factor in human capital accumulation before the dominance of the general technological externality in the distribution of human capital (Hsing 2004; Hayakawa and Venieris 2018). In periods characterized by significant technological advancements, a reduction in the relative significance of initial conditions enhances inequality. At the same time, an accumulation of skilled and highly capable individuals in technologically advanced sectors could enhance economic growth (Galor and Tsiddon 1997b). Forbes (2000), on the other hand, argues that a positive relationship between income inequality and economic growth could be feasible in the short and medium-term. He posits that the relationship between income inequality and economic growth could possibly be negative in the long run and positively significant in the short run. This finding is in line with Li and Zou’s (1998) study, which used a fixed-effect model in a cross-country panel analysis. Despite the extensive existing literature on income inequality and economic growth, there remains considerable disagreement on the effect of income inequality on economic growth.

Inferring from the above, it would be theoretically correct to assume that an increaseFootnote 1 in the level of income inequality will have a different effect on economic growth than a decrease in income inequality. Following the relationship between the variables, an increase in income inequality (a negative shock) indicates bad news, while a decrease in income inequality (a positive shock) signifies good news for the level of real output. For instance, a decrease in the level of income inequality, through a tax reduction would have a positive shock on economic growth. It was argued that progressive taxation with negative net tax rates for the low-income earner are meant to result in the lowest level of consumption and also to reduce income inequality among various groups. According to Biswas et al. (2017), taxation at various levels of the income distribution has heterogeneous effects on individuals and members of households’ motivation to work, invest, and consume. However, reducing income inequality, through poverty alleviation programs and schemes, between low- and median-income individuals and families stimulates small and medium business growth, the supply of female labor and consumption expenditure, and hence, results in economic growth. On the other hand, reducing income inequality between median and high-income families suppresses economic growth, through inhibiting the creation of jobs, the growth of small businesses and the supply of female labor. These asymmetric economic growth effects are associated with both demand- and supply-side factors, that is, changes in labor supply and small-scale business activity (Biswas et al. 2017). For example, overall US trends in income inequality were examined in the study of Piketty and Saez (2003, 2006), where they constructed several time-series measures of the percentage of the top US incomes for the period between 1913 and 1998. They found that income inequality in the US has shown a definite U-shaped (negative and positive) pattern. At the wake of this century, income inequality decreased considerably, especially during World War II and the Great Depression.

As discussed earlier, an increase in the level of income inequality is conducive to adopting distortionary redistributive and economic growth retarding policies, which slow down the growth process (see Persson and Tabellini 1994; Alesina and Rodrick 1994; Benhabib and Rustichini 1996). In addition, due to financial market imperfections, an increase in the level of income inequality would overemphasize the negative impacts of credit constraints on small business growth and human capital accumulation, thus reducing economic growth (Galor and Zeira 1993; Galor and Moav 2004). Moreover, an increase in income inequality might increase economic growth. According to Guvenen et al. (2013), a rise in inequality creates the motivation to work harder, invest more, and assume risks in order to enjoy higher rates of returns. This can also stimulate gross savings and, thus, capital accumulation, since the few rich have a lower marginal propensity to consume (Biswas et al. 2017). Our empirical results show that increasing and decreasing income inequality do have asymmetric impacts on economic growth.

Several authors have investigated the impact of income inequality on economic growth, and vice versa, using time-series econometric models. While some have employed panel-data-based approaches, others have focused solely on the United States, due to the availability of long-span time-series data. At the cross-country level, one could mention Forbes (2000), who investigated the hypothesis for a panel of 45 countries and concluded that both in the short and medium run, a rise in a country’s level of income inequality has a positive significant relationship with economic growth. This result is in line with the work of Li and Zou (1998), which concluded that income inequality is not harmful to economic growth. The opposite was the case with Alesina and Rodrick (1994), Persson and Tabellini (1994) and Banerjee and Duflo (2003), with the latter using non-parametric approaches. These studies revealed that the rate of economic growth is an inverted U-shaped function of the net variations in income inequality. According to them, variations in the level of income inequality, no matter the direction, are correlated with reducing economic growth. The non-linearity approaches employed in their studies made their empirical findings sufficient to highlight why previous studies on the existing relationship reported between income inequality and economic growth demonstrate a lack of consensus.

Using time-series models to examine the relationship between the level of income inequality and economic growth for the United States, Ram (1991) concluded that there is an inverse relationship between income inequality and economic growth. This result was confirmed by Hsing and Smyth (1994) and Jacobsen and Giles (1998). Meanwhile, in a panel framework, the same modelling approach was employed by Frank (2009), who constructed annual indicators of income inequality over the period 1945–2004 for individual states in the US. Using a panel autoregressive distributed lag (ARDL) model, he concluded that in the long-run, income inequality has contributed positively to economic growth. A recent study by Bahmani-Oskooee and Motavallizadeh-Ardakani (2018) on the impact of growth on inequality, using a nonlinear autoregressive distributed lag (NARDL) model for each state in the US over the period of 1959–2013, found that economic growth has impacted positively on income inequality, but within 20 states. It was found that economic growth has an asymmetric impact on income inequality both in the short and long-run. These found that increases and decreases in real output levels have worsened income inequality.

Based on this premise, our study sought to examine the presence of the short-run and long-run asymmetric effects of income inequality on real GDP per capita, i.e., the impact of an increase or decrease in income inequality on the real output levels in the US. This study used a larger sample size, over the period of 1917–2012 (96 years). The sample size appears to be large enough to cover different economic growth/development stages in the US; hence a reliable and robust time-series empirical outcome. Additionally, unlike previous studies that used only the Gini coefficient as a measure of income inequality in the US, our study employed six measures of income distribution, namely the Atkinson index, the Gini coefficient, a relative mean deviation (Rmeandev), Theil’s entropy index, and the Top 10% and Top 1% income shares, respectively. The choice of these income inequality indicators was supported by the importance of examining the reliability of the income inequality proposition using different inequality indicators. Using diverse indicators would allow a more meaningful empirical analysis of the pathogenic impacts of inequalities in various intervals of the income scale (see Wagstaff 2002; Weich et al. 2002). Third, unlike the studies of Bahmani-Oskooee and Motavallizadeh-Ardakani (2018) examined the impact of growth on inequality in the US, this study examines the opposite. We investigated the impact of inequality on the growth of output, and the effects of negative inequality and positive inequality shocks (increase and decrease of inequality) on the economic growth of the US.

The major objective of this study was to examine the short- and long-run (increase and decrease) asymmetric effects of income inequality on real output levels over a long time span in the United States. In order to achieve the research objective, we employed a nonlinear ARDL model approach, developed recently by Shin et al. (2014a, b), which is an asymmetric extension of the linear ARDL cointegration model proposed by Pesaran et al. (2001), to capture the short- and long-run asymmetric behavior of the model. We found that the long-run coefficients of positive changes have positive signs while the signs of those of negative changes were negative, indicating that a decrease or an increase in income inequality improves the real output levels in the US.

The remaining sections of this paper are as follows. Section two discusses, in detail, the data and methodology employed in the study. In section three, we report the empirical results and present a discussion on the findings, while the concluding remarks to be found in section four.

2 Data and methodology

2.1 Data

In this study, real GDP per capita is a measure of economic growth over the period 1917 to 2012, measured at constant 2009 US dollar values. We proxied income distribution for income inequality. The income distribution dataset for the income inequality measures for Gini, Artkin05, RMeanDev and Theil was obtained from the work of Frank (2009); the Top 1% and Top 10% are as collected for the World Wealth and Income Database (WWID); while the data on real GDP per capita was sourced from the Global Financial Database (GFD).

2.2 Methodology

In order to examine the asymmetric impacts, that is, the short-run and long-run impacts of decreases and/or increases in income inequality on the real output levels in the case of the United States, we made use of NARDL approach as our econometric tool. The NARDL approach recently developed by Shin et al. (2014a, b) was used in this study to examine the presence of the short-run and long-run asymmetric effects of inequality on real GDP per capita. To measure income inequality, six measures of income distribution were used: the Atkinson Index, the Gini coefficient, the Relative Mean Deviation, Theil’s Entropy Index, the Top 10% income share and the Top 1% income share.

The ARDL cointegration model developed by Pesaran et al. (2001), to allow for short- and long-run asymmetric behavior in the adjustment process. To capture this asymmetric behavior, both in the short and long run, the authors split the explanatory variables into their positive and negative partial sums, as follows: \(x_{t}^{{}} = x_{0}^{{}} + x_{t}^{ + } + x_{t}^{ - }\). Here, the two components \(x_{t}^{ + }\) and \(x_{t}^{ - }\) are, respectively, positive and negative partial sum decompositions of \(x_{t}^{{}}\), such that

This approach of partial sum decomposition was initially used by Granger and Yoon (2002) in advancing the concept of hidden cointegration, and by Schorderet (2001) in the context of the nonlinear relationship between unemployment and output. The usefulness of this decomposition is that positive and negative partial sums reflect, respectively, the increase and decrease of the explanatory variable.

To achieve this end, we used the following NARDL \((p, q)\) model:

where \(x_{t}^{{}} = x_{0}^{{}} + x_{t}^{ + } + x_{t}^{ - }\) is a \(k \times 1\) vector of exogenous regressors entering the model asymmetrically via the partial sums \(x_{t}^{ + }\) and \(x_{t}^{ - }\), as defined above. \(\theta_{j}^{ + }\) and \(\theta_{j}^{ - }\) are the asymmetric distributed lag parameter, \(\phi_{j}\) are the autoregressive parameter, \(p\) and \(q\) represent the respective lag orders for the dependent variable \(z_{t}\) and the exogenous variables \(x_{t}^{{}}\) in the distributed lag component, and \(\varepsilon_{t}\) is i.i.d. the zero mean random variable with finite variance \(\sigma_{\varepsilon }^{2}\).

Following Pesaran et al. (2001), we rewrote Eq. (1) in error correction terms as:

where, \(\rho = \sum\nolimits_{j = 1}^{p} {\phi_{j - 1} }\), \(\theta^{ - } \sum\nolimits_{j = 0}^{q} {\theta_{j}^{ - } }\), \(\theta^{ + } \sum\nolimits_{j = 0}^{q} {\theta_{j}^{ + } }\), \(\varphi_{0}^{ - } = \theta_{0}^{ - }\), \(\varphi_{0}^{ + } = \theta_{0}^{ + }\), while \(\varphi_{j}^{ - } = - \sum\nolimits_{i = j + 1}^{q} {\theta_{j}^{ - } }\) and \(\varphi_{j}^{ + } = - \sum\nolimits_{i = j + 1}^{q} {\theta_{j}^{ + } }\) for \(j = 1, \ldots ,q - 1\), and \(\pi_{t} = z_{t} - \beta^{{ +^{\prime}}} x_{t}^{ + } - \beta^{{ -^{\prime}}} x_{t}^{ - }\) is the nonlinear error correction model (ECM) term; \(\beta^{ - } = \frac{{ - \theta^{ - } }}{\rho }\) and \(\beta^{ + } = \frac{{ - \theta^{ + } }}{\rho }\) are the associated asymmetric long-term parameters.

In order to deal with the possibility of a non-zero contemporaneous correlation among the residuals and regressors in Eq. (2), we took into consideration the reduced-form data generating process for \(\Delta x_{t}\), given that our focus was on conditional nonlinear ARDL modeling; consequently, we derived the following conditional NARDL ECM:

If the coefficients associated with the partial sum variables in the short run, the long run, or both, differ significantly, an asymmetric impact on the dependent variable can be established. In addition, we could compute the asymmetric positive and negative long-run coefficients, respectively, as follows: \(\mathop L\nolimits_{{\mathop X\nolimits^{ + } }} = \frac{{ - \theta_{{}}^{ + } }}{\rho }\) and \(\mathop L\nolimits_{{\mathop X\nolimits^{ - } }} = \frac{{ - \theta_{{}}^{ - } }}{\rho }\).

The statistical significance of these coefficients provides insights into the long-term relationships between the dependent variable and the respective independent variables. A positive sign for these coefficients indicates that positive or negative shocks in the exogenous variables have positive or negative long-run effects, respectively, on the dependent variable, while a negative sign implies the opposite effect.

In addition, the short-run symmetry restriction can be tested by using a standard Wald test (WSR) for the null hypothesis: \(H_{0} :\mathop \sum \nolimits_{j = 0}^{q - 1} \lambda_{j}^{ + } = \mathop \sum \nolimits_{j = 0}^{q - 1} \lambda_{j}^{ - }\) or \(\lambda_{i}^{ + } = \lambda_{i}^{ - } \;{\text{for}}\; {\text{all}}\; i = 0, \ldots , q - 1.\) When imposing such restrictions in the presence of an asymmetric long-term relationship, we obtain:

Similarly, the long-run symmetry is also tested through a Wald test (WLR) for the null hypothesis: \(H_{0} : L_{{x^{ + } }} = L_{{x^{ - } }}\). In the case where both null hypotheses are not rejected, the NARDL model is reduced to the traditional linear ARDL, meaning that no asymmetry is present between the two variables.

The NARDL model offers many benefits over the traditional methods for investigating the cointegration relationship, such as those described in Engle and Granger (1987), Johansen and Juselius (1990), and others. One of such benefit is that it can test for long- and short-run asymmetries between the independent and dependent variables. Also, it has the ability to combine I(0) and I(1) regressors and capture the hidden cointegration, which is not possible using the standard methods.Footnote 2 In addition, it performs better in testing for cointegration relationships in small samples, compared with alternative cointegration procedures (Romilly et al. 2001).

In practice, the pattern of dynamic adjustment is based on the specified model. There are four distinct cases in Eqs. (5)–(8); the three restricted specifications by imposing short-run and long-run symmetry restrictions in Eqs. (5)–(7), either jointly or separately, and the unrestricted specification by incorporating asymmetries in both the short-run and long-run. For the purpose of our analysis, we used the NARDL model to investigate the possible existence of both long- and short-run asymmetries in the response of real GDP per capita to increases/decreases in inequality measures. We considered the following four regressions of the NARDL-based error correction model presented above; however emphasis was placed on the unrestricted specification (Eq. 8).

where GDP is the real gross domestic product per capita, while Ineq is the inequality measure. Note that all variables are taken in the natural logarithm. Since the data are on an annual basis, the maximum order of the lags in the NARDL model was chosen to be 3.

3 Empirical results

We first subjected each time series to the augmented Dickey and Fuller (1981) and Phillips and Perron (1988) unit root tests. The results for these tests are given in Table 1. Clearly, both the ADF and PP unit root tests showed that all variables are stationary at first difference and there is no I(2) variable.

The methodology adopted in this paper is as follows: Eqs. (5)–(8), presented above, are estimated by Ordinary Least Squares (OLS) for all considered inequality measures. For each equation, following Shin et al. (2014a, b), we started with a maximum lag order, pmax = qmax = 3, and then dropped all insignificant stationary regressors sequentially.

The results for the estimation are given in Tables 2, 3, 4, 5. Table 2 shows the estimation results for the symmetric ARDL regression (SS). In this model, both the long-run and short-run relationships between GDP per capita and inequality measures are assumed to be symmetric. The estimated long-run coefficients (\(L_{X}\)) are not significant for all considered inequality measures. Table 3 indicates that similar results are also obtained when allowing only the short-run relationships to be asymmetric (regression AS). However, assuming that there are asymmetric long-run relationships, the estimation results for Eqs. (3) and (4) in Tables 4 and 5, respectively, provide evidence of statistically significant asymmetric long-run coefficients in some cases. For both equations, the long-run coefficients of positive changes (\(L_{{X^{ + } }} )\) are statistically significant at the conventional 5% level for atkin05, Theil and top 10%, while those of negative changes (\(L_{{X^{ - } }} )\) are statistically significant for Theil, top 10% and top 1%, except for the Theil in Eq. (4). For the Gini and Rmeandev inequality measures, the long-run coefficients of both positive and negatives changes are insignificant at the conventional 5% level. Note that the long-run coefficients of positive changes have positive signs, while the signs of those of negative changes are negative. This indicates that inequality shocks, whether positive or negative, have a positive long-run effect on GDP. Our finding is consistent with the work of Frank (2009); that is that income inequality interacts positively with the real output levels.

Further, we employed the Wald tests to check the suitability of a nonlinear model and to examine the long- and short-run asymmetries. More interestingly, from the results in Tables 4 and 5, the Wald tests (WLRx) indicate a clear rejection, at the level of 5%, of the null hypothesis of long-run symmetry in all cases, showing a strong nonlinear long-run relationship between income inequality and output. With regard to the analysis of short-run dynamic asymmetry, we found that for Eq. (2), the Wald test (WSRx) rejects the null hypothesis of short-run symmetry for all cases, except for when Rmeandev is considered as an explanatory variable (see Table 3). However, when we also allow for long-run asymmetry—Eq. (4)—the Wald test rejects the null hypothesis of short-run symmetry only for Atkin05 and Top1%.

In addition, we carried out various diagnostic test statistics to confirm the robustness of the model. In Tables 2, 3, 4 and 5, we report the SC(k), which is the Godfrey (1978) test for kth order of serial correlation; the RRT, which depicts Ramsey’s (1969) RESET test statistic for checking the model’s specification and functional form; the Jarque-Bera (1980) test statistic, for normality; and the LMtest statistic, for heteroscedasticity. These statistics are Chi square distributed. The insignificant coefficients of these diagnostic tests, except for the normality test, confirm that the model is a correctly specified nonlinear model, auto-correlation and heteroscedasticity free. Lastly, the size of the coefficient of determination is reported to judge the model’s goodness of fit.

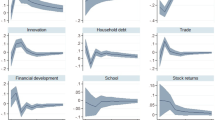

Next, we move to the dynamic multipliers,Footnote 3 which indicate the patterns of dynamic asymmetric adjustment of the real output levels from its initial long-run equilibrium to a new long-run equilibrium in the long-run, after a positive or negative unit shock affecting a particular level of income inequality/distribution. The predicted dynamic multipliers for the nonlinear adjustment of the real output levels relative to the shock in different measures of income inequality are shown in Fig. 1. These dynamic multipliers are conducted based on the four best-fitting nonlinear ARDL discussed earlier. In these tables, the blue dashed line and the green line curves display the asymmetric adjustment to negative and positive shocks, respectively, at a specific forecast horizon. In addition, the red dashed (asymmetry curve) depicts the linear combination of the dynamic multipliers relative to negative and positive shocks; it is plotted simultaneously with its lower and upper bands (dotted black lines) at a 95% bootstrap confidence interval level.

Generally, the pattern of the dynamic multipliers varies when short- or long-run asymmetry or both are incorporated in the model. Considering the best-fitting model for the inequality-output scenario, i.e., model long-run symmetry (AA) and short-run asymmetry (SA), the long-run adjustment path displays a stronger reaction of the real output levels to a unitary increase or decrease in income distribution. The cumulative income inequality responses are significantly positive or negative. The new long-run equilibrium state between the income inequality and real output levels is reached after 2 years. The asymmetric income inequality pass-through is, however, persistent over time and takes a considerable period of time to converge with the long-run multipliers.

In the short-run, the dynamic multipliers’ patterns when both the short- and long-run asymmetries are considered (AA) show that an income inequality positive shock has a greater positive effect on GDP than a negative shock for the Gini, Rmeandev and Top10%. For the Theil inequality measure, a positive shock has a smaller positive impact on GDP compared with the negative impact of a negative shock. When considering the Top1% indicator as a measure of inequality, it seems that a positive shock has a greater negative effect on GDP than a negative shock, while the opposite is observed for the Atkin05 indicator. Turning now to the long-run patterns of dynamic multipliers for the (AA) regression, a negative shock to inequality has a greater positive impact on GDP than a positive shock for the Gini and Top1% indicators, while the opposite occurs for the Theil and Top10%. For the Atkin05 inequality indicator, a negative shock impacts negatively on the long-run GDP, while a positive shock has a less important positive effect. Finally, the dynamic multipliers for the Rmeandev, in the long-run, show a negative response for GDP to a positive shock, while a negative shock has a greater positive effect.

With regard to the (SA) regression, i.e., when only the long-run asymmetry is incorporated in the model, the dynamic multiplier graphs show that both positive and negative shocks for inequality have positive effects on long-run real output for all cases. It is also worth noting that the effects are quantitatively larger for a positive than negative shock for all considered inequality measures, except for the Top1%.

3.1 Empirical discussion and policy implication

An increase in income inequality (a negative shocks) indicates bad news and hence, a negative impact while a decrease in income inequality (a positive shocks) signifies good news and, hence, a positive impact for real output. For an instance, a decrease in the income inequality level, due to a tax reduction, would have a positive shock (positive impact) on economic growth. Progressive taxation with negative net tax rates for the low-income earner is meant to enable the lowest level of consumption and also to reduce income inequality among various groups. Taxation at various levels of the income distribution has heterogeneous effects on individuals and/or household members’ motivation to work, invest, and consume. In addition, as discussed earlier, reducing income inequality, through poverty alleviation programs and schemes, between low- and median-income individuals and families stimulates small and medium business growth, the female labor supply and consumption expenditure, and hence, has a positive impact on economic growth. Conversely, a reduction in income inequality between median- and high-income families reduces economic growth through reducing job creation, small business growth and the female labor supply. These asymmetric economic growth effects are associated with both demand- and supply-side factors, that is, changes in the supply of labor and small-scale business activity (Biswas et al. 2017).

On the other hand, an increase in the income inequality level is conducive to the adoption of distortionary redistributive and economic-growth-retarding policies, which slow down (negative shocks) the growth process (see Persson and Tabellini 1994; Alesina and Rodrick 1994; Benhabib and Rustichini 1996). In addition, due to financial market imperfections, an increase in the income inequality level would overemphasize the negative impacts of credit constraints on small business growth and human capital accumulation, thus reducing economic growth (Galor and Zeira 1993; Chen and Fleisher 1996; Galor and Moav 2004). Moreover, an increase in income inequality might increase economic growth. According to Guvenen et al. (2013), a rise in inequality creates the motivation to work better, invest more, and assume risks, in order to enjoy higher rates of return and, hence, an increase in economic growth. This can also stimulate gross savings and, thus, capital accumulation, since the few rich have a lower marginal propensity to consume (Biswas et al. 2017).

Furthermore, an increase in income inequality has been argued to stimulate distorted redistribution policies, a situation that could reduce the labor incentive, or human capital, and hence, would result in a reduction in economic growth. As our empirical results have suggested, this may not be true in the United States, where production activities are highly capital intensive. A reduction in human capital as a result of little or no education due to high income inequality, could positively improve economic growth. For an example, the introduction of robotic machines due to the level of technological advancement in manufacturing companies across the United States would rather increase production activities; hence an increase in real output. In a highly capital-intensive and industrialized nation like the United States, an increase/decrease in the level of income inequality may not necessarily mean a decrease/increase in output, but rather, an increase in economic growth.

Lastly, based on our empirical findings, the asymmetric impact of income inequality, whether an increase or a decrease, appears to improve the real output levels in the United States. Thus, our finding is more or less consistent with the works of Frank (2009) and Bahmani-Oskooee and Motavallizadeh-Ardakani (2018) for the United States; that is, that economic growth has worsened the level income inequality in the US. The implication of this finding is that if a decrease or increase in income inequality improves the real output levels in the case of US, economic growth may not necessarily be an alternative welfare policy for reducing the level of inequality. Thus, policy makers should shift their attention from using an increase in real per capita income or output levels as a measure welfare improvement, as it may not necessarily indicate an increase in labor productivity or a reduction in the level of income.

4 Concluding remarks

The study of the nonlinearity properties of time-series variables has recently assumed a significant and notable role in empirical studies. This shows that researchers have come to realize the importance of asymmetry behaviors inherent in time-series data, particularly in social science research and in this present complex modern economy. In this paper, we report our examination of the presence of short- and long-run asymmetric effects of inequality on real GDP per capita, using time-series annual frequency data, for the period 1917–2012 for the United States. Unlike Frank’s (2009) panel model, Bahmani-Oskooee and Motavallizadeh-Ardakani’s (2018) NARDL model, as well as previous studies that examined whether economic growth has linear and nonlinear asymmetric impacts on income inequality, our study substantiates and confirms the causal relationship between income inequality and economic growth. We investigated whether an increase or decrease in income inequality has short-run and a long-run asymmetric effects on the real output levels.

In summary, the strengths of the nonlinear ARDL approach, as discussed previously, have been established in the case of the long- and short-run asymmetric effects of the inequality-output relationship. Due to the different measures of income distribution employed in this study (rather than using only the Gini coefficient as a measure of income inequality), our empirical findings suggest that assuming a long-run linear (symmetry) relationship where the primary relationship is nonlinear (asymmetric) will counter efforts to examine for the presence of a stable long-run relationship and lead to a pseudo-dynamic analysis. We found that an income inequality shock, whether positive or negative, will have a positive long-run impact on the real output levels, with the effects being quantitatively larger for a positive than a negative shock. This is a novel contribution to the inequality-output literature.

This study emphasizes the significance of accurately capturing short-run and long-run symmetries/asymmetries in the quest to substantiate potential differences in the response of the real output levels to negative and positive income inequality shocks, using different measures of income distribution. Our empirical result provides evidence in support of a long-run asymmetric impact between income inequality and the real output levels, since the long-run coefficients of positive changes have positive signs, while the signs of those of negative changes are negative, indicating that a decrease or increase in income inequality improves the real output levels in the United States. Economic growth appears not to be a feasible policy solution for dealing with an increase or decrease in income inequality, as it has worsened income inequality in the US (Frank 2009; Bahmani-Oskooee and Motavallizadeh-Ardakani 2018). Therefore, in order to curb income inequality and promote equitable income distribution, alternative economic welfare policies must be put in place.

Notes

Negative income inequality in this study refers to a decrease in the level of income inequality, which is expected to have a positive (impact) shock on the real output, or income level, and vice versa.

According to Granger and Yoon (2002), two times series are hidden-cointegrated if their positive and negative components are cointegrated with each other.

The cumulative dynamic multiplier effects of a unit change in \(x_{t}^{ + }\) and \(x_{t}^{ - }\) on \(y_{t + j}\) , respectively, can be computed as follows: \(m_{h}^{ + } = \mathop \sum \nolimits_{j = 0}^{h} \frac{{\partial y_{t + j} }}{{\partial x_{t}^{ + } }}\) and \(m_{h}^{ - } = \mathop \sum \nolimits_{j = 0}^{h} \frac{{\partial y_{t + j} }}{{\partial x_{t}^{ - } }}, h = 0,1,2 \ldots\) . Note that as \(h \to \infty , m_{h}^{ + } \to L_{{X^{ + } }}\) and \(m_{h}^{ - } \to L_{{X^{ - } }}\), where \(L_{{X^{ + } }}\) and \(L_{{X^{ - } }}\) are the long-run coefficients of positive and negative changes, respectively.

References

Aghion, P., Caroli, E., & Garcia-Penalosa, C. (1999). Inequality and economic growth: The perspective of the new growth theories. Journal of Economic Literature,37(4), 1615–1660.

Alesina, A., & Perotti, R. (1996). Income distribution, political instability, and investment. European Economic Review,40(6), 1203–1228.

Alesina, A., & Rodrick, D. (1994). Distributive politics and economic growth. Quarterly Journal of Economics,109, 465–490.

Babu, M. S., Bhaskaran, V., & Venkatesh, M. (2016). Does inequality hamper long-run growth? Evidence from emerging economies. Economic Analysis and Policy,52(4), 99–113.

Bahmani-Oskooee, M., & Motavallizadeh-Ardakani, A. (2018). Inequality and growth in the United States: Is there asymmetric response at the state level? Applied Economics,50(10), 1074–1092.

Banerjee, A. V., & Duflo, E. (2003). Inequality and growth: What can the data say? Journal of Economic Growth,8(3), 267–299.

Benabou, R. (1996). Inequality and growth. NBER Macroeconomics Annual,11, 11–74.

Benabou, R. (2000). Unequal societies: Income distribution and the social contract. American Economic Review,90(1), 96–129.

Benhabib, J., & Rustichini, A. (1996). Social conflict and growth. Journal of Economic Growth,1(1), 125–142.

Bertola, G. (1993). Market structure and income distribution in endogenous growth models. American Economic Review,83(2), 1184–1199.

Biswas, S., Chakraborty, I., & Hai, R. (2017). Income inequality, tax policy, and economic growth. The Economic Journal,127(601), 688–727.

Chan, K. S., Zhou, X., & Pan, Z. (2014). The growth and inequality nexus: The case of China. International Review of Economics and Finance,34(4), 230–236.

Chen, B. L. (2003). An inverted-U relationship between inequality and long-run growth. Economics Letters,78(2), 205–212.

Chen, J., & Fleisher, B. M. (1996). Regional income inequality and economic growth in China. Journal of Comparative Economics,22(2), 141–164.

Deininger, K. & Olinto, P., (2000). Asset distribution, inequality, and growth. The World Bank Development Research Group, Working Paper No. 2375, World Bank, Washington, DC.

Deininger, K., & Squire, L. (1998). New ways of looking at old issues: Inequality and growth. Journal of Development Economics,57(2), 259–287.

Dickey, D. A., & Fuller, W. A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica,49(4), 1057–1072.

Engle, R. F., & Granger, C. W. (1987). Co-integration and error correction: Representation, estimation, and testing. Econometrica,55, 251–276.

Fang, W., Miller, S. M., & Yeh, C. C. (2015). The effect of growth volatility on income inequality. Economic Modelling,45(1), 212–222.

Forbes, K. J. (2000). A reassessment of the relationship between inequality and growth. American Economic Review,90(4), 869–887.

Frank, M. W. (2009). Inequality and growth in the United States: Evidence from a new state-level panel of income inequality measures. Economic Inquiry,47(1), 55–68.

Galor, O., & Moav, O. (2004). From physical to human capital accumulation: Inequality and the process of development. The Review of Economic Studies,71(4), 1001–1026.

Galor, O., & Tsiddon, D. (1997a). The distribution of human capital and economic growth. Journal of Economic Growth,2(1), 93–124.

Galor, O., & Tsiddon, D. (1997b). Technological progress, mobility, and economic growth. The American Economic Review,87, 363–382.

Galor, O., & Zeira, J. (1993). Income distribution and macroeconomics. The Review of Economic Studies,60(1), 35–52.

Godfrey, L. G. (1978). Testing against general autoregressive and moving-average error models when the regressors include lagged dependent variables. Econometrica,46(6), 1293–1301.

Granger, C. W., & Yoon, G. (2002). Hidden cointegration University of California San Diego. Economics Working Paper Series,2, 1–48.

Gupta, D. K. (1990). The economics of political violence: The effect of political instability on economic growth. Westport: Praeger.

Guvenen, F., Kuruscu, B., & Ozkan, S. (2013). Taxation of human capital, and wage inequality: A cross-country analysis. Review of Economic Studies,81(2), 818–850.

Hayakawa, H., & Venieris, Y. P. (2018). Duality in human capital accumulation, and inequality in income distribution. Eurasian Economic Review,7, 1–26.

Henderson, D. J., Qian, J., & Wang, L. (2015). The inequality-growth plateau. Economics Letters,128(1), 17–20.

Hsing, Y. (2004). Impact of income inequality on economic growth: the case of Taiwan and Policy implications. Journal of Social and Economic Development, 6(2), 194.

Hsing, Y., & Smyth, D. J. (1994). Kuznets’s inverted-U hypothesis revisited. Applied Economics Letters,1(7), 111–113.

Jacobsen, P. W., & Giles, D. E. (1998). Income distribution in the United States: Kuznets’ inverted-U hypothesis and data non-stationarity. Journal of International Trade and Economic Development,7(4), 405–423.

Jarque, C. M., & Bera, A. K. (1980). Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Economics Letters,6(3), 255–259.

Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration—With applications to the demand for money. Oxford Bulletin of Economics and Statistics,52(2), 169–210.

Knowles, S. (2005). Inequality and economic growth: The empirical relationship reconsidered in the light of comparable data. Journal of Development Study,41, 135–159.

Li, H., & Zou, H. F. (1998). Income inequality is not harmful for growth: Theory and evidence. Review of Development Economics,2(3), 318–334.

Lopez, H. (2006). Growth and inequality: Are the 1990s different? Economics Letters,93(1), 18–25.

Lui, H. K. (1997). Income inequality and economic development. Hong Kong: City University of Hong Kong Press.

Majumdar, S. & Partridge, M. D. (2009). Impact of economic growth on income inequality: A regional perspective. In 2009 Annual Meeting, July 26–28, 2009, Milwaukee, Wisconsin (No. 49270). Agricultural and Applied Economics Association.

Mercan, M., & Azer, O. A. (2013). The relationship between economic growth and income distribution in Turkey and the Turkish Republics of Central Asia and Caucasia: Dynamic panel data analysis with structural breaks. Eurasian Economic Review,3(2), 165–182.

Mo, P. H. (2000). Income inequality and economic growth. Kyklos,53(3), 293–315.

Mo, P. H. (2009). Income distribution polarization and economic growth: Channels and effects. Indian Economic Review,44, 107–123.

Muinelo-Gallo, L., & Roca-Sagalés, O. (2013). Joint determinants of fiscal policy, income inequality and economic growth. Economic Modelling,30, 814–824.

Nahum, R. A. (2005). Income inequality and growth: A panel study of Swedish counties 1960–2000. Uppsala: Department of Economics, Uppsala University.

Nissim, B. D. (2007). Economic growth and its effect on income distribution. Journal of Economic Studies,34(1), 42–58.

Ogus Binatli, A. (2012). Growth and income inequality: A comparative analysis. Economics Research International,12(2), 1–7.

Ostry, M. J. D., Berg, M. A., & Tsangarides, M. C. G. (2014). Redistribution, inequality, and growth. Washington, DC: International Monetary Fund.

Panizza, U. (2002). Income inequality and economic growth: Evidence from American data. Journal of Economic Growth,7(1), 25–41.

Perotti, R. (1993). Political equilibrium, income distribution, and growth. The Review of Economic Studies,60(4), 755–776.

Perotti, R. (1996). Growth, income distribution, and democracy: What the data say. Journal of Economic Growth,1(2), 149–187.

Persson, T., & Tabellini, G. (1994). Is inequality harmful for growth? The American Economic Review,84(3), 600–621.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics,16(3), 289–326.

Phillips, P. C., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika,75(2), 335–346.

Piketty, T. (1997). The dynamics of wealth distribution and the interest rate with credit rationing. The Review of Economic Studies,64(2), 173–189.

Piketty, T., & Saez, E. (2003). Income inequality in the United States, 1913–1998. The Quarterly Journal of Economics,118(1), 1–41.

Piketty, T., & Saez, E. (2006). The evolution of top incomes: a historical and international perspective. American Economic Review, 96(2), 200–205.

Ram, R. (1991). Kuznets’s inverted-U hypothesis: Evidence from a highly developed country. Southern Economic Journal,57(4), 1112–1123.

Ramsey, J. B. (1969). Tests for specification errors in classical linear least-squares regression analysis. Journal of the Royal Statistical Society. Series B (Methodological),31(2), 350–371.

Romilly, P., Song, H., & Liu, X. (2001). Car ownership and use in Britain: A comparison of the empirical results of alternative cointegration estimation methods and forecasts. Applied Economics,33(14), 1803–1818.

Rubin, A., & Segal, D. (2015). The effects of economic growth on income inequality in the United States. Journal of Macroeconomics,45, 258–273.

Saari, M. Y., Dietzenbacher, E., & Los, B. (2015). Sources of income growth and inequality across ethnic groups in Malaysia, 1970–2000. World Development,76, 311–328.

Schorderet, Y. (2001). Revisiting Okun’s law: A hysteretic perspective. San Diego: University of California, Mimeo.

Shin, I. (2012). Income inequality and economic growth. Economic Modelling,29(5), 2049–2057.

Shin, Y., Yu, B., & Greenwood-Nimmo, M. (2014). Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt (pp. 281–314). Springer, New York.

Shin, Y., Yu, B., & Greenwood-Nimmo, M. (2014). Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In Festschrift in Honor of Peter Schmidt (pp. 281–314). Springer, New York, NY.

Sukiassyan, G. (2007). Inequality and growth: What does the transition economy data say? Journal of Comparative Economics,35(1), 35–56.

Voitchovsky, S. (2005). Does the profile of income inequality matter for economic growth? Journal of Economic Growth,10(3), 273–296.

Wagstaff, A. (2002). Inequality aversion, health inequalities and health achievement. Journal of Health Economics,21(4), 627–641.

Wahiba, N. F., & El Weriemmi, M. (2014). The relationship between economic growth and income inequality. International Journal of Economics and Financial Issues,4(1), 135–143.

Wan, G., Lu, M., & Chen, Z. (2006). The inequality-growth nexus in the short and long run: Empirical evidence from China. Journal of Comparative Economics,34(4), 654–667.

Weich, S., Lewis, G., & Jenkins, S. P. (2002). Income inequality and self-rated health in Britain. Journal of Epidemiology and Community Health,56(6), 436–441.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Nasr, A.B., Balcilar, M., Gupta, R. et al. Asymmetric effects of inequality on real output levels of the United States. Eurasian Econ Rev 10, 47–69 (2020). https://doi.org/10.1007/s40822-019-00129-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-019-00129-x