Abstract

We investigate the major factors which drive income inequality in the OECD countries, using long panel data which span the period from 1870 to 2016. We consider two measures of inequality: the Gini coefficient and the income share of the top 10% of the population. Employing the panel vector auto-regression method, we show that a positive shock to the real interest rate and government spending is negatively and significantly associated with income inequality in the middle, as well as at the top end of the income distribution. An increase in real GDP per capita leads to an increase in income inequality, measured by the Gini coefficient, whereas an advance in financial development reduces it. We find that income inequality responds negatively to positive innovation shocks initially, but this effect becomes positive with some time lag for top-income inequality. Educational attainment significantly reduces top-income inequality. Our results are robust to alternative specifications, including the local projection method and estimations based on different samples. We also capture the time dynamics in our series using a time-varying nonparametric panel data model and show that the real interest rate and financial development are negatively associated with income inequality for most of the period in the post-World War II era, while the effect of real GDP per capita is positive and significant over the same period.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Income inequality in developed countries has increased considerably in the past few decades. For example, Cingano (2014) shows that income disparity in the Organisation for Economic Co-operation and Development (OECD) countries has been at the highest in the 30 years up to 2014. With the sharp rise in income inequality in recent decades, mostly in developed countries, there is renewed interest in the topic in academia and policy circles (see e.g. Aghion et al. 2018; Brueckner and Lederman 2018; Dabla-Norris et al. 2015; Jones and Kim 2018; Roine et al. 2009).

Since Kuznets’ (1955) seminal work, a large volume of literature has examined the factors which contribute to income inequality and its effects on society and the economy. Rising inequality causes high social costs, such as increased violence and criminal activities and worsening health outcomes (see e.g. Enamorado et al. 2016; Pickett and Wilkinson 2015), poor environmental quality (Hailemariam et al. 2019), lower economic growth (Alesina and Rodrik 1994; Brueckner and Lederman 2018; Madsen et al. 2018; Panizza 2002) reduced consumption (Bampinas et al. 2017).

A number of studies have examined and suggested several potential variables which explain inequality, such as household debt (Iacoviello 2008), innovation and technology (Acemoglu 2003; Aghion et al. 2018; Jones and Kim 2018), trade openness and globalisation (Jaumotte et al. 2013). Nevertheless, none of the related studies have used long-historical panel data beyond World War II, except Roine et al. (2009). Because income inequality is a slow-moving process, long historical data are required to capture the changes over time. However, the paucity of data on income inequality is the major challenge which constrains the study of long-term causes of income inequality in the existing literature. In this paper, we aim to fill this gap by employing long historical data of 146 years to capture the long-run response of income inequality to shocks to a system of variables using a panel vector autoregressive (PVAR) model and a nonparametric panel data model. To the best of our knowledge, the only paper closest to ours which has examined long-run variables that could explain inequality using long historical cross-country panel data is Roine et al. (2009). Although they contributed significantly to the understanding of long-term causes of inequality, there are two limitations in their work. Firstly, although they control for trends and time-invariant country-specific factors, their approach does not address the issue of endogeneity which may arise due to reverse causality, from income inequality to the explanatory variables or due to measurement errors. Secondly, Roine et al. (2009) use only top-income shares as a special and partial measure of income inequality. This measure captures only the specific feature of inequality, focusing on the concentrations of income at the top of the distribution while ignoring how the lower class fares relative to the middle class which can be captured by the Gini coefficient. The present study addresses these limitations in the analysis of the relationship between inequality and the factors driving it.

This study contributes to the literature by extending the work by Roine et al. (2009) on several fronts: (1) by using the panel VAR model while accounting for the issue of endogeneity, (2) by using a historical data set which covers a time period from 1870 to 2016 and (3) by using the Gini coefficient and top-income inequality (the top 10%) as the measures of inequality because these measures capture different and unique characteristics of income distributions. We use a long panel data series from 1870 to 2016 to envision the long-run relationship between income inequality and the variables which affect it, utilising the variations over time and across countries. (4) We capture the time-varying relationship between income inequality and the main explanatory variables using a flexible varying-coefficient nonparametric panel data technique.

We find that positive shocks to the real interest rate and government expenditures significantly reduce income inequality in the middle and high-income classes. A positive shock to per-capita income leads to an increase in income inequality, measured by the Gini coefficient, but it has a slightly negative effect on the top end of the income distribution. We find that financial development is negatively associated with the Gini coefficient, whereas educational attainment reduces top-income inequality. The response of income inequality to a positive innovation shock is negative for a short period following the shock, but it becomes positive with some time lag. Our estimates from the time-varying nonparametric panel data model show that our main findings hold for most of the period in the post-World War II era. The effect of innovation on income inequality is time-varying, where the coefficient is negative since the early 1990s and becomes positive after the global financial crises.

The rest of the paper is organised as follows: Sect. 2 presents a review of the related literature. Section 3 describes the data and methodology employed in this paper. Section 4 presents the main empirical findings and discussions from the PVAR model. Section 5 presents time-varying nonparametric local linear estimates, and Sect. 6 concludes the paper.

2 Literature review

A large volume of literature has examined topics on income inequality. The existing empirical literature identifies several factors as key causes of income inequality, such as increases in household debt (Iacoviello 2008), innovation and technology (Acemoglu 2003; Jones and Kim 2018; Aghion et al. 2018), trade openness and globalisation (Jaumotte et al. 2013), and monetary policy (Coibion et al. 2017; Furceri et al. 2018).

Lenza and Slacalek (2018) investigate the relationship amongst monetary policy, income and wealth inequality using quarterly data from 1991 to 2016, for the Eurozone countries. Their results suggest that the earnings heterogeneity channel plays a key role: An expansionary monetary policy compresses the income distribution, as lower-income households become richer. Doepke and Schneider (2006) and Doepke et al. (2015) also show that monetary policy has a re-distributive effect, where an increase in the interest rate lowers income inequality due to lower inflation which re-distributes wealth from upper-class lenders to middle-class borrowers.

Using data for 32 advanced and emerging market countries over the period from 1990 to 2013, Furceri et al. (2018) find that a contractionary monetary policy exacerbates income inequality, while an expansionary monetary policy ameliorates income inequality. Similarly, Coibion et al. (2017) show that a contractionary monetary policy has significantly contributed to an increase in consumption and income inequality in the USA since 1980. As argued by Coibion et al. (2017), the impact of the monetary policy on income distribution comes through the policy’s effect on the real interest rate, in the intermediate term. In this regard, they identify three channels through which the real interest rate may lead to an increase in inequality. Firstly, the income-composition channel: A reduction in real interest rates will disproportionately lead to higher increases in the income of those with claims to ownership of firms, given that wages rise more slowly than profits. Secondly, the financial segmentation channel: The financial market tends to process information more efficiently and quickly; thus, agents who trade in the financial markets are more likely to be the first to acquire information about changes in real interest rates, compared to other economic agents. As a result, economic agents who are more connected to the financial markets are likely to benefit, through increased income and consumption, compared to unconnected agents. Thirdly, the portfolio channel: Low-income households tend to hold a higher proportion of their wealth in cash. An expansionary monetary policy induces higher inflation, and such inflation results in a transfer of wealth from low-income households to high-income households, causing an increase in consumption inequality. However, two other mechanisms decrease the real interest rate and reduce inequality. The first mechanism is savings re-distribution: An expansionary monetary policy decreases real interest rates, that will, in turn, benefit borrowers at the expense of savers (see also Doepke and Schneider 2006). In a related study, Mumtaz and Theophilopoulou (2017) use quarterly data from 1969 to 2012 for the United Kingdom and find that a contractionary monetary policy causes an increase in inequality.

The second mechanism is the heterogeneity of earnings: A contractionary monetary policy and/or slow economic growth is likely to lead to higher unemployment rates in lower-income households. In addition, wage rigidity across the income distribution is most likely to disproportionately affect low-income earners, due to varying degrees of complementarity or substitutability with physical capital vis-à-vis different agents’ skill-sets. Thus, it is more likely that there will be a decrease in inequality after an expansionary monetary policy shock. Because the real interest rate has a theoretically ambiguous effect on inequality, it is an empirical question to ascertain the overall effect of changes in the interest rate on income distribution. We address this aspect by accounting for the real interest rate in the panel VAR model we estimate.

Pi and Zhang (2018) consider a two-sector economy and show that the development of skill-biased technological change increases the skilled-unskilled wage inequality. Using a New Keynesian model with incomplete asset markets, an asymmetric search and matching frictions across skilled and unskilled workers, Dolado et al. (forthcoming) show that an unanticipated expansionary monetary policy increases labour income inequality between high- and low-skilled workers.

Das and Mohapatra (2003) examine the link amongst stock market liberalisation, income growth and inequality, and find that stock market growth leads to uneven income distribution. Kumhof et al. (2015) develop a theoretical model in which high-income earners accumulate more wealth than low-income earners, by making loans to low-income earners, thus causing a wider distribution of income. (Iacoviello 2008) constructed a heterogeneous agents model which mimics the time-series behaviour of the earnings distribution in the USA from 1963 to 2003. The analysis of this model shows that an excessive increase in credit from high-income earners to low-income households is the primary driving force behind income inequality. Beck et al. (2007) find that financial development benefits the poor and reduces income inequality. In contrast, Jauch and Watzka (2016) show that financial development increases income inequality in a broad panel of countries.

Using state-level data for the period from 1976 to 2013, Aghion et al. (2018) find a positive correlation between measures of innovation and the top-income inequality in the US. Jaumotte et al. (2013) examine the relationship between trade and financial globalisation and income inequality using data for 51 developed and developing countries for the period from 1981 to 2003. Employing a fixed-effect model, they find that trade globalisation reduces income inequality, whereas financial globalisation increases inequality, where innovation is the leading factor. Adrián Risso and Sánchez Carrera (2019) conduct an empirical study using a panel data set of 74 countries over the period from 1996 to 2014 and conclude that innovation leads to a reduction in income inequality. However, for this to happen, the research and development (R&D) should reach a certain threshold before it starts contributing to a lower Gini coefficient. Chu and Cozzi (2018) also suggest that promoting innovation by increasing R&D subsidy reduces income inequality.

Roine et al. (2009) investigate the long-term causes of the top-income inequality, using long historical data for 16 developed countries for the period from 1900 to 2006, which covers most of the twentieth century. Using first-differenced generalised least squares (GLS, FDGLS) and dynamic first differences (DFD), they show that economic growth and financial development are pro-rich, causing an increase in top-income inequality. Jauch and Watzka (2016) use a data set of 138 developed and developing countries over the years 1960–2008 and find a positive relationship between financial development and income inequality. However, Shahbaz et al. (2015) find a negative long-run relationship between financial development and income inequality. In addition, they show that government spending has a negative effect on the upper-middle class and a positive effect on the nine lowest deciles, but no impact on the rich. Along these lines, Anderson et al. (2017) conduct a meta-regression analysis of 84 studies and conclude that there is a moderate negative relationship between government spending and income inequality.

Gregorio and Lee (2002) examine the link between education and inequality in a broad panel of countries, using data for the period from 1960 to 1990. They show that higher educational attainment and more equal distribution of education play a significant role in reducing income inequality.

In sum, the existing studies provide mixed evidence for the role of various factors in income inequality. What is common amongst the existing studies which have examined the causes of income inequality is that they use short-span data, mostly from the post-World War II era, except for Roine et al. (2009). Due to the slow-moving nature of income inequality, long historical cross-country data are required to understand the complex evolution and variations of inequality across time and between countries. This paper aims to fill this gap in the literature. In particular, we extend the work by Roine et al. (2009), by estimating a panel VAR model using long historical panel data spanning the period from 1870 to 2010 and by addressing endogeneity issues. We also depart from Roine et al. (2009) by employing a broad measure of income inequality (the Gini coefficient) along with the partial measure of top-income inequality. The advantage of using the panel VAR technique is that it allows the variables in our model to be endogenous and interdependent. Moreover, capturing the time-dynamics in the series using an appropriate technique is important in the study of income inequality.

3 Data and methodology

3.1 Data

To investigate the long-term effects of various shocks on income inequality, we use a long historical data set which spans 146 years in 17 developed economies, including Australia, Belgium, Canada, Denmark, Finland, France, Germany, Italy, Japan, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland, the United Kingdom and the USA. The data for the real interest rate, government spending, household debt, financial development, stock market returns and real GDP per capita are from Jordà et al. (2017), available in the Jordà–Schularick–Taylor Macro-history Database. The data for income inequality, education and innovation are from Madsen et al. (2018). We utilise two measures of income inequality: the income share of the top 10% and the Gini coefficient. The top-income inequality measures the share of pre-tax income earned by the richest 10% of the population in OECD countries. We also use the Gini coefficient, as this measure captures different features of the income distribution compared to the income share of the top 10% of the population. Table 1 shows the summary statistics for the variables.

As shown in Table 1, there are significant variations in income inequality across the countries. For example, the Gini coefficient has a mean value of 33.6 with a standard deviation of 9.5, whereas the top 10% income shares have a mean value of 36.0 with a standard deviation of 8.1. The other variables also exhibit significant variations.

We examine the time-series properties of the variables by performing panel unit root tests. To test for the stationarity of the series, we employ the cross-sectionally augmented panel unit root test proposed by Pesaran (2007). The test statistic is computed as a simple average of the individual cross-sectionally augmented ADF (CADF) tests. The advantage of this test is that it accounts for cross-sectional correspondence in units. Under the null hypothesis, all of the series in the panel contain a unit root. Under the alternative hypothesis, at least one of the series follows a stationary process. The results of the panel unit root test are reported in Table 2.

As shown in Table 2, the test fails to reject the null hypothesis of a unit root in the series in levels for most of the variables (except for the Gini coefficient, the real interest rate and trade). However, the null of a unit process is rejected for all of the variables in the first differences. This suggests that most of the variables are integrated of order 1, I(1), and hence, all estimations in this paper are specified in first differences.

3.2 Methodology

We employ a panel VAR (PVAR) model initially proposed by Holtz-Eakin et al. (1988) to examine the dynamic impacts of the real interest rate, financial development, income, trade openness, household debt, human capital, technological innovation and government expenditure on income inequality. The appealing feature of the PVAR method is that it combines the traditional VAR model, where all the variables in the system are considered to be endogenous, with the panel-data approach, which accounts for unobserved individual heterogeneity (Holtz-Eakin et al. 1988; Love and Zicchino 2006; Canova and Ciccarelli 2013). With the increased availability of panel data, the PVAR technique has become a workhorse in applied macroeconomics and finance literature (see e.g. Love and Zicchino 2006).Footnote 1

The rationale which motivates our choice of the PVAR model is that income inequality and the explanatory variables are interrelated, and thus, the effect of a particular shock could pass to each other through their dynamic interactions. That is, the major advantage of using the PVAR model is that it allows for multiple variables to be endogenous, and interdependent in the VAR system, which is the main issue in the study of inequality. Prominent studies, such as Dees et al. (2007) and Canova and Ciccarelli (2009), underscore that PVARs provide an excellent way to model a system of interrelated variables to understand how shocks are transmitted across countries in an integrated global economy.

Based on the results of the panel unit root tests in Table 2, we specify the model in first-differences of all of the variables to ensure stationarity in the panel VARs. Specifically,

where \(y_{it}\) denotes a vector of G dependent variables and \(Y_t=(y_{it}^{'},\ldots , y_{Nt}^{'})'\) for country \(i=1,\ldots ,N\), and time \(t=1,\ldots ,T\). \(e_{it}\) denotes a vector of disturbance terms which are independently and identically distributed with \(\Sigma _{ii}\) covariance matrices. The covariance matrices of the disturbance term in the VARs of country i and j are defined as \(cov(e_{it}, e_{jt})\), implying that the lagged variables of country i can influence the current value of the country j variables. The identification is achieved based on the Cholesky decomposition of \(\Sigma \) by imposing a recursive structure on the PVAR system. In addition, we compute the Hansen J statistic of over-identifying restrictions in the estimation of the PVAR model.

The simple impulse response function \(\Phi _i\) and the forecast-error variance decomposition can be obtained from the infinite-order vector moving-average representation of the model,

where \(\Phi _i\) are the infinite-order vector moving-average parameters. These parameters can be transformed into the orthogonalised impulse-responses \(P\Phi _i\), where P is a matrix such that \(P'P=\Sigma \) which can be used to orthogonalise the contemporaneously correlated innovations, \(e_{it}\) as \(e_{it}P^{-1}\). The matrix P imposes identification restrictions in the recursive structure of the PVAR model with the system of dynamic equations. We construct the confidence intervals for the estimated orthogonalised impulse-response functions using a Monte Carlo simulation of 200 draws with Gaussian approximation.

To capture the contributions of each shock in explaining the variations in income inequality, we compute the forecast-error variance decomposition following the estimations of the impulse-response functions. Let \(Y_{it+h}\) be a vector observed at time \(t+h\), and \(E[Y_{it+h}]\) is the h-step-ahead predicted vector at time t. The h-step-ahead forecast error is computed as:

Similar to the derivations of the impulse responses, we utilise the orthogonalised shocks \(e_{it}P^{-1}\) to perform the decomposition of the normalised contribution to the h-step-ahead forecast-error variance of variable n given by

Finally, the optimal lag orders are chosen using consistent moment and model selection criteria (MMSC) for generalised method of moments (GMM) models proposed by Andrews and Lu (2001), as in Abrigo and Love (2016). Based on the three-model selection criteria proposed by Andrews and Lu (2001), the smallest values for MMSC-BIC, MMMSC-AIC and MMSC-QIC are obtained when the lag length is 1. Here AIC is Akaike information criterion, BIC is Bayesian Information Criterion, and QIC is the quasi information criterion.

We remove country fixed effects using the forward orthogonal deviation procedure, and we fit a first-order PVAR model in a GMM framework. This procedure preserves the orthogonality between the variables which are transformed and the lagged regressors, as it removes only the mean of all the future observations available for each country-year. Therefore, the lagged regressors can be used as instruments to estimate the parameters with the system GMM (see Arellano and Bover 1995).

The PVAR method offers an excellent way to get point estimates of the average effects of the covariates on income inequality; however, this method does not reveal the time-dynamics and how the relationship has evolved. To capture the time-varying effects of the main explanatory variables on income inequality, we also employ a flexible nonparametric panel data technique with a local linear dummy variable (LLDVE) estimator proposed initially by Li et al. (2011) and further explored in empirical studies by Silvapulle et al. (2017) and Hailemariam et al. (2019). The LLDVE technique allows the estimation of time-varying coefficient and trend functions without the imposition of restrictive assumptions.

To estimate the time-varying relationship between income inequality and the main explanatory variables, we estimate the following specification:

where I denotes the measure of income inequality, \(f_i(t)=f_i(t/T)\) for \(i=1,2,3, \ldots , N\) are unknown trend functions and \(\beta _j(t)=\beta _j(1/T)\), for \(j=1,2,\ldots ,N\) denote the time-varying coefficient estimates; \(\alpha _i\) represents unobserved individual effects; and \(\varepsilon _{it}\) is the disturbance term, and \(X_{it}\) denotes the vector of the explanatory variables. Confidence intervals for the coefficient estimates are constructed using the wild bootstrapping method.

4 Results and discussion

In this section, we present and discuss the main empirical results from the PVAR model, including the estimates of the impulse response functions as well as robustness checks, panel Granger causality tests and forecast error variance decomposition.

4.1 Impulse responses

Figures 1 and 3 show the orthogonalised impulse functions (IRFs) of income inequality measured by the Gini coefficient and the top-income shares (income share of the top 10%). Figures 2 and 4 report the cumulative impulse responses of both measures of income inequality, estimated using Eq. (1). The black line shows the estimated responses of income inequality to a one-standard-deviation shock to the explanatory variables. The shaded region shows the 95% confidence interval for the estimates constructed using a Monte Carlo simulation of 200 draws based on a Gaussian approximation.

As shown in Fig. 1, the impulse response of the Gini coefficient to a positive real GDP per-capita shock is positive and statistically significant. The response is hump-shaped, reaching a maximum within about 2 years following the shock and declines thereafter. Specifically, a one-standard-deviation shock to national per-capita income is associated with an increase in the Gini coefficient of up to 3% points before the effect declines permanently in later years. Interestingly, higher real interest rates and government spending significantly reduce the Gini coefficient. Trade (% of GDP) and stock returns seem to have a positive but only transitory effect on income inequality, while financial development is associated with lower inequality following a short-lived jump at the start of the impact. The response of financial development to income inequality is negative and persistent except the initial brief spike. This is in line with previous findings of Beck et al. (2007) who document that financial development significantly reduces income inequality by boosting the income share of the poor.

While the orthogonalised impulse responses in Fig. 1 are useful to provide insights into the timing, as well as the magnitude of the average effects of a one-time structural shock on income inequality, but they do not capture the long-term effects of the shocks on income inequality. Therefore, we also compute cumulative responses to a shock in period t at horizon h as the cumulative sum of the orthogonalised impulse responses from horizon 0 to h. Figure 2 shows that the cumulative impulse response of the Gini coefficient to shocks to real GDP per capita, interest rate and government spending is in line with the results in Fig. 1, and the effects are strongly persistent. However, the cumulative response of educational attainment and stock returns is not significant. Trade and innovation are positively associated with the Gini coefficient, with the effect declining after a few years following the shock. The cumulative effects of the shocks to innovation and financial development differ from the one-time orthogonalised responses suggesting the importance of time-dynamics in the shock process over these variables. We address this issue in Sect. 5 by using a time-varying nonparametric panel model, which allows a smooth evolution of the coefficient functions over time. We follow the argument by Chu and Cozzi (2018) who state that innovation ought to reach a certain level to have an impact on reducing inequality.

Figures 3 and 4 show the orthogonalised impulse responses and cumulative impulse responses of top-income inequality to the shocks to the variables in the PVAR system, respectively. Similar to the results in Figs. 1 and 2, the response of top-income inequality to shocks to the real interest rate and government spending is negative and statistically significant. As shown in Fig. 3, a one-standard-deviation positive shock to government spending leads to a decline in top-income inequality of up to 5% points following the shock before the effect is reversed to zero. Figure 4 shows that the cumulative effect of the shocks on top-income inequality is persistent for most of the variables except for stock returns and financial development. This shows that if the government implements an expansionary fiscal policy, the economy moves towards a more even income distribution. That is, progressive taxation leads to re-distribution of income and hence, lowers uneven income distribution (Roine et al. 2009).

Unlike the response of the Gini coefficient to a shock to real GDP per capita, the results in Figs. 3 and 4 show that a positive real GDP per-capita shock leads to a significant reduction in top-income inequality. Figure 4 depicts that the cumulative response of top-income inequality to a the real interest rate shock decreases immediately before levelling-up. This might imply that higher real interest rates tend to immediately reduce entrepreneurship income, as the cost of loans goes up and vice versa. The accumulated impulse response by the top-income earners to stock returns shocks is positive, but the effect is not statistically significant.

The response of income inequality to positive innovation shocks is negative upon impact but turns out to be positive eventually. This points to the ripple effect that innovation has on income distribution in an economy in the long-run. Also, the results in Figs. 3 and 4 show that the orthogonal impulse response and cumulative impulse responses of income inequality to trade openness shocks are statistically significant. The orthogonal impulse response of top-income inequality to schooling shocks is negative and significant upon impact but dies off after about 5 years, while the cumulative impulse response is persistent and remains statistically significant. This is consistent with the findings of Galor and Moav (2004) which document the importance of human capital and access to credit in fostering economic development and reducing inequality. In an extensive survey using a meta-regression analysis, Abdullah et al. (2015) also find that education reduces top-income inequality by boosting the income of the earners at the bottom of the distribution and reducing that of the top of the distribution.

According to the cumulative impulse responses in Fig. 4, the response of top-income inequality to household debt shocks starts positive but quickly dies off. Compared to Fig. 2, the cumulative impulse response of the Gini coefficient from the household debt shocks is sustained. This shows that the Gini coefficient is affected more by household debt shock. This result confirms previous findings by Iacoviello (2008) and Berisha et al. (2018), who find a positive relationship between household debt and income inequality. Interestingly, an increase in household debt causes an increase in income inequality, regardless of the measure of income inequality (i.e. either for the top-income inequality or the Gini coefficient). However, the impact on top-income inequality is less pronounced. This supports the notion that the top-income earners extend loans to lower-income groups which leads to more income being transferred from lower-income to higher-income groups, thus increasing the Gini coefficient.

In sum, monetary policy and household debt shocks seem to have an important effect on income distribution regardless of the measure of income inequality. In relation to existing studies, our results lend support to the findings of several recent studies, such as Berisha et al. (2018), Doepke et al. (2015), Doepke and Schneider (2006) and Davtyan (2017). As argued by Doepke et al. (2015), an increase in interest rates generated by higher expected inflation has a significant reducing effect on income inequality. One channel through which a tight monetary policy reduces income inequality is through re-distribution effect of changes in inflation. As documented by Doepke and Schneider (2006), an announcement of a higher inflation target by a central bank has a re-distributive effect in favour of the poor as middle-aged middle-class households. These types of households tend to have the largest mortgage-debt burden, and thus, significantly benefit from the re-distributive effect at the expense of wealthy retirees. That is, a contractionary monetary policy which increases the interest rate induces lower inflation, and unanticipated lower inflation results in a transfer of wealth from higher-income households to lower-income households, leading to a decrease in inequality.

Nevertheless, our results contradict other recent studies, such as Furceri et al. (2018) and Mumtaz and Theophilopoulou (2017), who document that contractionary monetary policy shocks are associated with higher income inequality. In addition, Furceri et al. (2018) show that the negative effect of a contractionary policy is larger for lower-income households, compared to higher-incomes households. Along these lines, Mumtaz and Theophilopoulou (2017) also find supporting evidence that a contractionary monetary policy causes an increase in earnings, income and consumption inequality in the United Kingdom.

4.2 Granger causality test

In this section, we perform panel Granger causality tests to confirm the existence of causality from each of the explanatory variables to income inequality. The null hypothesis is the absence of causality, while the alternative hypothesis states the existence of Granger causality that runs from an explanatory variable to the measure of income inequality. The results for the Granger causality test are reported in Table 3.

As shown in Table 3, all of the covariates except for stock returns and schooling, Granger cause the income inequality measured by the Gini coefficient. Similarly, all of the covariates (except for financial development and stock returns) Granger cause top-income inequality at conventional significant levels, confirming our main results.

4.3 Robustness Check

As the data set covers a long period in the past, data quality and comparability might be a concern for earlier periods, especially in the pre-war period. In this section, we re-estimate the impulse responses of the Gini coefficient to the shocks to each variable for the sub-sample from 1960 onward to check if our results from the post-World War II data are similar to our main findings for the full sample. Figure 5 shows the orthogonalised impulse responses using data for the sub-sample 1960 onward. As shown in Fig. 5, the response of income inequality to the shocks to the explanatory variables is qualitatively similar to our estimates using the full sample presented in Fig. 1.Footnote 2

Further, we perform a sensitivity analysis using the local projection method proposed by Jordà, (2005). As the impulse response functions in the PVAR model are computed period-by-period moving forwards iteratively, they may entail biases, particularly at longer horizons due to potential model misspecification. To circumvent this issue, Jordà, (2005) proposes an innovative method to derive impulse response functions by estimating local projections at each point in time instead of extrapolating into distant horizons to avoid the risk of model misspecification. Following Jordà, (2005), the impulse-response at period \(t+s\) from experimental shocks, \(d_{i,t}\) at period t is given by

where \(d_i\) is an additively conformable vector to \(y_i\), the operator E(.|.) is the best, mean square error predictor and \(X_t=(y_{t-1}, y_{t-2},\ldots , y_{t-p})\). Projecting \(y_{t+s}\) onto the linear space generated by \(X_t\) yields the local projection which consists of h-regressions:

where \(\alpha ^s\) is a vector of \(n \times 1\) constants, and \(B_i^{s+1}\) are coefficient matrices for each lag i and \(s+1\) horizons. The impulse response estimates from the local projection specification above are given by:

where \(\hat{B}_1^s\) are the coefficients in the impulse response with normalisation of \(B_1^0=I\).

The impulse responses from the local projection method are presented in Figs. 8 and 9 in the appendix. The figures show that the estimates from the local projection method are generally consistent with our main findings from the PVAR model. As shown in Fig. 8, a positive shock to the real interest rate, government spending, innovation and financial development are negatively associated with top-income inequality, whereas a household debt shock is positively associated with top-income inequality. The results in Fig. 9 also generally are consistent with the result for the response of the Gini coefficient to the shocks to the main covariates.

4.4 Forecast error variance decomposition

To quantify the magnitude of the contributions to the variations in income inequality, that is explained by the shocks to one of the independent variables, we present the forecast-error variance decomposition (FEVD) for the total effect accumulated over the 10-year forecast horizon. Table 4 presents the FEVD results, showing the contribution of each shock in the variations in income inequality. As shown in Panel A of Table 4, shocks to income and government spending contribute the largest percentage of variations in the Gini coefficient, accounting for about 26% of the total variations. The magnitude of the contributions of these variables is increasing with the forecast horizon. Specifically, the importance of national per-capita income in explaining the variations in income inequality doubles as the forecast horizon increases to 10 years. However, the lowest contributors are the number of years of education, stock returns and real interest contributing only less than 3%, combined. The contributions of the innovation shocks range between 2.7% and 3.9% in the 10-year forecast horizon.

Panel B of Table 4 shows that the variation in income inequality captured by the top-income inequality is mainly explained by shocks to government spending, the number of years in school and innovation, which account for about 33% of the total variations in income inequality. The variables which contribute weakly to explaining variation in inequality are stock returns, the real interest rate and financial development; these variables jointly explain only 4% of the variation. Shocks to interest rates affect the Gini coefficient more than the top-income inequality. This result confirms that as the real interest rate increases, it leads to higher income for the rich, by increasing the burden of the debt held by lower-income households. This result is similar to that of Berisha et al. (2018). However, unlike their findings, in our study, the equity channel is relatively weak in explaining the variation in income inequality. Unlike the findings of Jones and Kim (2018) and Aghion et al. (2018), in our study, the contribution of innovation to income inequality is limited. This could be explained by the inclusion of many variables in the model and the longer data set used in the analysis. For example, there was lower variability in innovation changes in nineteenth century compared to the twenty-first century.

5 Time-varying nonparametric estimates

The point estimates from the PVAR model are useful to summarise the average relationship between income inequality and the covariates, but these estimates do not capture the time-varying effects of these variables on income inequality. To capture the time-dynamics in the series, we estimate a time-varying nonparametric panel data model which allows the coefficients to evolve smoothly over time.Footnote 3 In this section, we present our estimates of the time-varying nonparametric coefficient and trend functions from the LLDV estimator described in Sect. 3.2.

5.1 Nonparametric time-varying coefficient functions

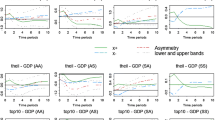

Figure 6 presents the LLDV estimates of the time-varying coefficient functions and their 90% confidence intervals. As shown in Fig. 6, the estimated time-varying coefficient function on real GDP per capita is positive and statistically significant for most of the sample period under consideration. Specifically, an increase in per-capita national income is associated with an increase in income inequality measured by the Gini coefficient for the period after 1980. More precisely, a 1% increase in real GDP per capita is associated with about a 0.2% increase in the index of the Gini coefficient in this period except for recent years. This result is in line with the findings of Dabla-Norris et al. (2015) who document that income inequality is at a record high in developed economies, indicating that the difference between the rich and the poor is widening. The estimate for the time-varying coefficient function on the real interest rate has been mostly negative and statistically significant for most of the post-World War II period except for a brief period in the early 1960s. This result lends support to evidence documented by Berisha et al. (2018) that show that there is a negative relationship between income inequality and interest rates. Interestingly, income inequality has become more responsive to the real interest rate recently, and the trend has been downwards since 2012. Our results for the time-varying effects of real GDP per capita and the real interest rate are in line with the average relationship shown by the parametric estimates in the previous sections. However, our LLDV estimates show that there is little evidence in support of the role of government expenditure in income inequality.

The LLDVE shows that the effect of innovation on income inequality is time-varying. As shown in Fig. 6, innovation is mostly negatively associated with income inequality from 1990 to 2016. However, the relationship turns out to be positive and statistically significant in the post-global financial crisis (GFC) period (see Aghion et al. 2018 for a related study). An interesting result emerges from the coefficient trend of financial development. As shown in the bottom of Fig. 6, an increase in financial development is associated with lower income inequality for most of the sample period, and the effect becomes pronounced since 2000. This result is in line with the findings of Beck et al. (2007) who find that financial development measured by private credit reduces income inequality by boosting the incomes of the poorest quintile. They show that there are two channels through which financial development may affect the poor: changes in income distribution and aggregate growth. The plausible explanation is that credit market imperfections with transactions costs impede access to credit by the poor who lack collateral and good credit histories. Thus, promoting access to credit and relaxing credit constraints will disproportionately benefit the poor and reduce inequality (see also Galor and Zeira 1993; Galor and Moav 2004).

5.2 Common and country-specific trends

We now turn into our kernel estimates of the common and country-specific trend functions of income inequality measured by the Gini coefficient. Figure 7 presents the common and country-specific trend function together for each country to facilitate comparisons. The blue line indicates the estimated common coefficient function with narrow confidence bands represented in red dots. The country-specific trend functions are represented by dashed black lines. As shown in Fig. 7, the estimated common trend function for income inequality is growing at an increasing rate since 1980. This result supports earlier evidence by Dabla-Norris et al. (2015), who argue that income inequality has been at its highest in recent decades for developed countries.

The country-specific trend functions follow closely the common trend functions for most countries. The patterns of the individual trends in Fig. 7 show that the country-specific trend functions are well above the common trend for Australia, Canada, Germany and Sweden suggesting that income inequality in these countries is the primary cause of the upwards-sloping common trend. Interestingly, the individual trends for some of the countries in our sample, including Finland, France, Portugal and Switzerland, have been slightly declining in recent periods.

6 Concluding remarks

In this study, we empirically examine the impact of long-run shocks to a system of variables on income inequality, considering the Gini coefficient and the income share of a nation’s top 10% earners as the two measures of income inequality which capture different characteristics of the income distribution. We employ the panel VAR method and alternative techniques using long historical panel data that span more than a century, which allows us to examine the long-run interaction between these variables. Utilising the panel VAR technique allows us to simultaneously investigate the role of the real interest rate, trade openness, financial development, innovation, government spending and household debt have on income inequality while accounting for endogeneity issues and unobserved heterogeneity. We also employ a flexible nonparametric panel data model with time-varying coefficients and trend functions to account for the time-varying dynamics in the series.

The main results for the PVAR model reveal that an increase in the real interest rate leads to a significant decrease in income inequality in the middle, as well as at the top end of the income distribution. An increase in national per-capita income is positively and significantly associated with an increase in income inequality, measured by the Gini coefficient. Financial development reduces income inequality measured by the Gini coefficient suggesting that it disproportionately raises the income share of the incomes of the poor which narrows the gap in income with the rich. The effect of innovation on income inequality is negative upon impact, but this effect becomes positive with some time lag. The response of top-income inequality to schooling is negative and statistically significant, suggesting the importance of human capital in boosting the income share of the poor. We find that household debt exacerbates income inequality. Our main results are robust to alternative specifications, including the local projection method and estimations based on different samples.

We also capture the time-dynamics in our series using a time-varying nonparametric panel data model. The local linear estimates from the nonparametric model reveal that the effect of the main variables on income inequality is time-varying in terms of magnitudes. However, the results confirm most of our main findings of the average relationships obtained from the parametric models. Specifically, growth in real GDP per capita is positively and significantly associated with income inequality for most of the period since the late 1960s. Increases in the real interest rate and financial development are negatively associated for most of the period in the post- World War II era. The effect of innovation on income inequality is time-varying, where the coefficient is negative since the early 1990s and turns to be positive after the global financial crisis. There is little evidence for the role of government spending. Overall, our estimates from the time-varying nonparametric panel data model show that, on average, our main findings hold for most of the period in the post-World War II era.

Our results suggest that policymakers need to take re-distributive effects of monetary and fiscal policy changes into account. In particular, greater independence of central banks with a focus on prices stability might be effective in reducing income inequality. Our results also suggest other important policy implications depending on the type of inequality measure. To foster equality and development in the lower- and middle-income classes, policymakers should expand social welfare schemes and reduce household debt.

Notes

Other models such as global VARs (GVARs) are very useful to study the aggregated impacts or on spill-overs of shocks from a large economy. However, as large-scale factor models and due to the issue of the curse of dimensionality, GVARs are restrictive, as they impose a specific structure on inter-dependencies using some weights for aggregating the foreign component of the shocks. For example, GVARs can be estimated by imposing restrictions on the coefficient matrix such that only cross-country averages (assuming N is sufficiently large) enter the PVAR model (see e.g. Dees et al. 2007). As we have a small sample N \((N=17)\), we employ PVAR models which allow focusing on the effects of the various shocks on income inequality in each country and variable in the structural analysis with fewer restrictions.

Further, we make a sensitivity test regarding the identification based on Cholesky decomposition by res-estimating our PVAR model with different orderings of the variables. We find that the results are invariant to alternative orderings. Moreover, the p-value of the Hansen J test for overidentifying restriction obtained from the PVAR estimation is 0, suggesting that we cannot reject the null hypothesis that the exclusion restriction is valid.

Because the time-varying nonparametric technique requires balanced panel data, our sample is restricted to be from 1960 onward.

References

Abrigo MR, Love I (2016) Estimation of panel vector autoregression in Stata. Stata J 16(3):778–804

Abdullah A, Doucouliagos H, Manning E (2015) Does education reduce income inequality? A metaregression analysis. J Econ Surv 29(2):301–316

Acemoglu D (2003) Technology and inequality. National Bureau of Economic Research, Cambridge

Adrián Risso W, Sánchez Carrera EJ (2019) On the impact of innovation and inequality in economic growth. Econ Innov New Technol 28(1):64–81

Aghion P, Akcigit U, Bergeaud A, Blundell R, Hémous D (2018) Innovation and top income inequality. Rev Econ Stud 86(1):1–45

Alesina A, Rodrik D (1994) Distributive politics and economic growth. Q J Econ 109(2):465–490

Anderson E, Jalles Dórey MA, Duvendack M, Esposito L (2017) Does government spending affect income inequality? A Meta-regression analysis. J Econ Surv 31(4):961–987

Andrews DW, Lu B (2001) Consistent model and moment selection procedures for GMM estimation with application to dynamic panel data models. J Econom 101(1):123–164

Arellano M, Bover O (1995) Another look at the instrumental variable estimation of error-components models. J Econom 68(1):29–51

Bampinas G, Konstantinou P, Panagiotidis T (2017) Inequality, demographics and the housing wealth effect: panel quantile regression evidence for the US. Finance Res Lett 23:19–22

Beck T, Demirgü-Kunt A, Levine R (2007) Finance, inequality and the poor. J Econ Growth 12(1):27–49

Berisha E, Meszaros J, Olson E (2018) Income inequality, equities, household debt, and interest rates: evidence from a century of data. J Int Money Finance 80:1–14

Brueckner M, Lederman D (2018) Inequality and economic growth: the role of initial income. J Econ Growth 23(3):341–366

Canova F, Ciccarelli M (2009) Estimating multicountry VAR models. Int Econ Rev 50(3):929–959

Canova F, Ciccarelli M (2013) Panel vector autoregressive models: a survey. In: VAR models in macroeconomics-new developments and applications: essays in honor of Christopher A. Sims. Emerald Group Publishing Limited, pp 205–246

Chu AC, Cozzi G (2018) Effects of patents versus R&D subsidies on income inequality. Rev Econ Dyn 29:68–84

Cingano F (2014) Trends in income inequality and its impact on economic growth. In: OECD social, employment and migration working papers, no. 163. OECD, Paris

Coibion O, Gorodnichenko Y, Kueng L, Silvia J (2017) Innocent bystanders? monetary policy and inequality. J Monet Econ 88:70–89

Dabla-Norris ME, Kochhar MK, Suphaphiphat MN, Ricka MF, Tsounta E (2015) Causes and consequences of income inequality: a global perspective. International Monetary Fund, Washington, DC

Das M, Mohapatra S (2003) Income inequality: the aftermath of stock market liberalization in emerging markets. J Empir Finance 10(1–2):217–248

Davtyan K (2017) The distributive effect of monetary policy: the top one percent makes the difference. Econ Model 65:106–118

Dees S, Mauro FD, Pesaran MH, Smith LV (2007) Exploring the international linkages of the Euro area: a global VAR analysis. J Appl Econom 22(1):1–38

Doepke M, Schneider M (2006) Inflation and the redistribution of nominal wealth. J Polit Econ 114(6):1069–1097

Doepke M, Schneider M, Selezneva V (2015) Distributional effects of monetary policy. Unpublished manuscript

Dolado JJ, Motyovszki G, Pappa E (forthcoming) Monetary policy and inequality under labor market frictions and capital-skill complementarity. Am Econ J Macroecon

Enamorado T, Lpez-Calva LF, Rodrguez-Casteln C, Winkler H (2016) Income inequality and violent crime: evidence from Mexico’s drug war. J Dev Econ 120:128–143

Furceri D, Loungani P, Zdzienicka A (2018) The effects of monetary policy shocks on inequality. J Int Money Finance 85:168–186

Galor O, Zeira J (1993) Income distribution and macroeconomics. Rev Econ Stud 60:35–52

Galor O, Moav O (2004) From physical to human capital accumulation: inequality and the process of development. Rev Econ Stud 71:1001–1026

Gregorio JD, Lee JW (2002) Education and income inequality: new evidence from cross-country data. Rev Income Wealth 48(3):395–416

Hailemariam A, Dzhumashev R, Shahbaz M (2019) Carbon emissions, income inequality and economic development. Empir Econ 59:1139–1159

Hailemariam A, Smyth R, Zhang X (2019) Oil prices and economic policy uncertainty: evidence from a nonparametric panel data model. Energy Econ 83:40–51

Holtz-Eakin D, Newey W, Rosen HS (1988) Estimating vector autoregressions with panel data. Econometrica 56(6):1371–1395

Iacoviello M (2008) Household debt and income inequality, 1963–2003. J Money Credit Bank 40(5):929–965

Jauch S, Watzka S (2016) Financial development and income inequality: a panel data approach. Empir Econ 51(1):291–314

Jaumotte F, Lall S, Papageorgiou C (2013) Rising income inequality: technology, or trade and financial globalization? IMF Econ Rev 61(2):271–309

Jones CI, Kim J (2018) A Schumpeterian model of top income inequality. J Polit Econ 126(5):1785–1826

Jordà Ò, Schularick M, Taylor AM (2017) Macrofinancial history and the new business cycle facts. NBER Macroecon Annu 31(1):213–263

Jordà, (2005) Estimation and inference of impulse responses by local projections. Am Econ Rev 95(1):161–182

Kumhof M, Ranciere R, Winant P (2015) Inequality, leverage, and crises. Am Econ Rev 105(3):1217–45

Kuznets S (1955) Economic growth and income inequality. Am Econ Rev 45(1):1–28

Lenza M, Slacalek J (2018) How does monetary policy affect income and wealth inequality? evidence from quantitative easing in the Euro area. In: ECB working paper no. 2190. https://ssrn.com/abstract=3275976

Li D, Chen J, Gao J (2011) Nonparametric timevarying coefficient panel data models with fixed effects. Econom J 14(3):387–408

Love I, Zicchino L (2006) Financial development and dynamic investment behavior: evidence from panel VAR. Q Rev Econ Finance 46(2):190–210

Madsen JB, Islam MR, Doucouliagos H (2018) Inequality, financial development and economic growth in the OECD, 1870–2011. Eur Econ Rev 101:605–624

Mumtaz H, Theophilopoulou A (2017) The impact of monetary policy on inequality in the UK: an empirical analysis. Eur Econ Rev 98:410–423

Panizza U (2002) Income inequality and economic growth: evidence from American data. J Econ Growth 7(1):25–41

Pesaran MH (2007) A simple panel unit root test in the presence of crosssection dependence. J Appl Econom 22(2):265–312

Pi J, Zhang P (2018) Skill-biased technological change and wage inequality in developing countries. Int Rev Econ Finance 56:347–362

Pickett KE, Wilkinson RG (2015) Income inequality and health: a causal review. Soc Sci Med 128:316–326

Roine J, Vlachos J, Waldenström D (2009) The long-run determinants of inequality: what can we learn from top income data? J Pub Econ 93(7–8):974–988

Shahbaz M, Loganathan N, Tiwari AK, Sherafatian-Jahromi R (2015) Financial development and income inequality: is there any financial Kuznets curve in Iran? Soc Indic Res 124(2):357–382

Silvapulle P, Smyth R, Zhang X, Fenech J-P (2017) Nonparametric panel data model for crude oil and stock market prices in net oil importing countries. Energy Econ 67:255–267

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix A

Appendix A

1.1 Impulse responses from local projection method

This appendix presents the impulse responses of top income inequality and Gini coefficient, estimated from the local projection method proposed by Jordà, (2005). Figures 8 and 9 show the response of income inequality measured in income share of top 10% and the Gini coefficient, respectively.

Rights and permissions

About this article

Cite this article

Hailemariam, A., Sakutukwa, T. & Dzhumashev, R. Long-term determinants of income inequality: evidence from panel data over 1870–2016. Empir Econ 61, 1935–1958 (2021). https://doi.org/10.1007/s00181-020-01956-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-020-01956-7