Abstract

The present study examines the drivers of Italian exports via an export equation with regional and time-varying impacts of local financial development. To this purpose, two-way fixed effects regression models with lagged variables and a system Generalized-Methods-of-Moments have been adopted to account for potential endogeneity problems and dynamic trade patterns. The analysis covers the period 2000–2013 and the sub-period 2000–2007. The results show that a mix of factors contributing to lift exports, including financial development, exerts a positive impact on trade flows. In particular, a rise in credit intensity and a reduction in financial risk push export propensity. The results further point to the relevant effect of non-price competitiveness factors, namely R&D and investments, in influencing the export behaviour of the Italian regions. The results hold for both the whole and the pre-crisis period, but the effects are generally stronger during the pre-crisis years.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The ability of a country to grow in economic terms and create job opportunities is closely related to the possibility of exporting in foreign markets. Understanding export drivers becomes thus of key importance to foster economic development. Most empirical analyses of export flows tend to be carried out in relation to countries or groups of countries, but in reality any economic event, comprising exports, has its own regional dimension that should not be overlooked. Indeed, given that regions can be considered as small, open economies that are increasingly involved in trade flows, one may attempt to apply and extend theory to investigate international trade patterns at the regional level.

In this context, the present study aims to empirically analyse some factors that influence the different export performance across Italian regions, using a set of potential determinants including non-price competitiveness and financial drivers, investigating in particular the role of local financial development in fostering exports. The analysis is carried out in a dynamic panel framework for the period 2000–2013 and for the pre-crisis years 2000–2007.

This study contributes to the extant literature in many ways. First, it specifically accounts for a regional dimension in shaping export flows. Generally, the literature on the drivers of Italian trade flows focuses mainly on the country level (e.g., Marquez and McNeilly 1988; Senhadji and Montenegro 1998; Caporale and Chui 1999; Hooper et al. 2000; OECD 2000; Lissovolik 2008; Algieri 2011, 2015) or micro cross-country comparisons at firm or industry level (Beck 2002, 2003; Greenaway et al. 2007; Muûls 2008; Manova 2008, 2013; Bartoli et al. 2014; Deloof and La Rocca 2014). This study looks at regional macro-data in order to account for regional specificities. In particular, we examine the factors driving both the total value of exports per region and the number of exporting firms per region, i.e., the extensive margin of trade. Second, this study moves the focus from the traditional demand-side drivers of exports used in the analyses at the country level, namely price and income factors, to a group of supply-side determinants— first and foremost financial factors—to explain the regions’ propensity to export. In this way, we try to evaluate if better local financial conditions improve the ability to export. The attention on the role of local financial development and other non-traditional drivers is motivated by empirical evidence and alternative theories that suggest that factors such as non-price competitiveness and financial conditions may play a crucial role in explaining export performances.

To our knowledge, while several studies have emphasized the importance of local finance for the regional economic growth of Italy (Guiso et al. 2004; Usai and Vannini 2005; Coccorese and Silipo 2012), a specific analysis of the linkage between local financial development and export performances at a regional level is still lacking. Exploring this link has implications for the theory of international trade. The Heckscher-Ohlin model predicts trade flows focusing on relative endowments of factors. In the Ricardian model, technological differences across countries or regions explain international trade flows. This study explores whether cross-region differences in the level of financial development and non-price competitiveness helps explaining exports.

The focus of the analysis is on Italy, since this country represents a very interesting case to investigate given its high degree of heterogeneity in terms of economic and financial development across geographical areas (Giannola et al. 2012). Even though Italy has been a unified country, from a political and legal point of view, for 150 years and, thus, can be considered a good case of normative integration, substantial differences in the degree of both real and financial development remain across regions and geographical areas. In particular, Italy is marked by a significant North-South divide, with the South characterized by lower export propensity, lower GDP per capita, higher unemployment, higher financial risk, weaker financial and business structures than the North and the Centre. The interest rate is also higher in areas with more crime (Bonaccorsi di Patti 2009), and the evidence indicates the presence of persistent interest rate differentials across the Italian regions (Dow et al. 2012). Even with identical technology and factor endowments between regions, comparative costs may differ when regions diverge in their domestic institutions of credit enforcement. Since financial services provided by local financial systems can be immobile across regions, competitiveness and trade could be influenced by the level of financial intermediation. Further, compared to studies using data available in several countries, an analysis of different regions within the same country does not need to control for differences in legal systems and is affected to a lesser extent by the problem of omitted variables.

The results are in line with our expectations. Both total export flows and extensive margins are influenced by a set of non-price competitiveness factors and regions with better-developed financial systems tend to have a better export performance. As expected, the total value of exports is relatively more responsive than the extensive margins to changes in non-price competitiveness and financial variables.

The remainder of the paper is organized as follows. Section 2 describes the economic background of the Italian regions. Section 3 briefly reviews the literature on the topic. Section 4 presents the theoretical model, the empirical analysis and discusses the main results. Section 5 concludes and draws some policy implications.

2 The Economic Background

Italy is characterized by a strong North-South divideFootnote 1. Although internal economic disparities are evident in almost every single country in the EU, Italy presents high regional contrasts in terms of GDP per capita, which ranges from 138.5% of the average Italian GDP in Valle d’Aosta to 60.4% in Calabria; unemployment rate, which varies from 5.3% in Trentino to 22.9% in Calabria (Table 1); and export values, which go from 27.5% of GDP in Lombardy to 0.1% of GDP in Calabria and Molise in 2014 (ISTAT 2016). At a more aggregated level, GDP per capita in the richest North-West area is as high as € 30,821, more than twice that of the poorest Italian Mezzogiorno (South) at € 16,761 (Table 2). Although there were some improvements from the 1950s to 1970s, the divide is estimated to be similar to post-war levels, with employment rates dropping and migration to the North increasing, especially among the most well educated population (Gonzales 2011; D’Antonio and Scarlato 2007). This long-lasting heterogeneity has been further deepened by the euro-area crisis since 2009. During the recession years, the South was more affected than the North, while the embryonic (weak) recovery appears to be driven by the North (The Economist 2015).

Regarding the financial conditions, at the end of 2014, the banking system was operating in Lombardy and Veneto through 6004 and 3287 financial branches spread across all municipalities in the regions, respectively. Bank deposits recorded the highest stock of 285,356 million euros in Lombardy, followed by 127,686 million euros in Veneto. The two regions contribute to the composition of the amount of total Italian deposits to about 22.2 and 10%, respectively. The lowest deposit levels are registered in the southern regions, particularly in Basilicata and Molise (see Table 3).

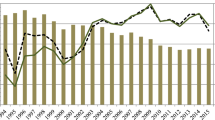

Figure 1 shows the export dynamics distinguished by macro-areas. The North is always displaying better performances than the other areas, although all the regions registered severe drops in export flows during the global financial crisis. Regional export propensity can depend on different price and non-price variables including, among the others, technological competitiveness and financial development. This latter factor has attracted much attention in the current literature.

3 Literature Review

A growing body of theoretical and empirical research has recently pointed out the level of financial development as a source of competitiveness in international trade (Svaleryd and Vlachos 2005; Becker et al. 2013; Manova 2013). Financial development is one of the most important mechanisms of resource allocation in a capitalist economy (Samba and Yan 2009); the efficiency with which financial resources are channelled by the financial system is very significant for promoting business and economic activities. Exporting involves higher entry costs than selling to the domestic market: firms need to acquire information about foreign markets, customize products to fit foreign tastes and set up distribution networks (Baldwin and Krugman 1989; Dixit 1989; Bartoli et al. 2014). Furthermore, because most entry costs must be paid up-front, only firms with sufficient liquidity (retained earnings or firm’s cash flows) can cover them. To meet the liquidity requirements, exporters usually access trade finance from banks and other financial institutions or trade credit from their business partners. This renders financial markets crucial for any export activity. Auboin (2009) has estimated that up to 90% of world trade relies on some type of trade finance. Thus, the higher the up-front costs, the more important it becomes to have a well-developed financial system to finance them. Baldwin (1989) developed one of the first models in which financial markets are a source of comparative advantage. In his \(2\times 2\times 1\) model (two countries, two sectors and one factor), the demand for one of the goods is subject to demand shocks, while the other is not. He demonstrated that countries with better developed financial systems and, therefore, better possibilities of diversifying risk stemming from the demand shocks, specialize in ‘risky’ commodities due to lower risk premium and lesser marginal costs.

While Baldwin has highlighted the risk diversification function of financial markets, Kletzer and Bardhan (1987), building on the Heckscher–Ohlin model, have provided a theoretical framework where credit market imperfections (when credit for working capital or trade finance is needed to pay for the cost of operations before the revenues from sales are received) can lead to different comparative costs even with identical technologies and endowments. These two authors have shown that the differences between countries in terms of credit-contract conditions and enforcements lead to differences in comparative advantages, since countries facing higher interest rates or rationed credit will not specialize in processed goods that require more external financial support. Rajan and Zingales (1998), while establishing a positive linkage between financial development and economic growth, conclude that in countries with well-developed financial systems, industries that rely more significantly on external finance grow faster. Industries with higher external finance also need to have larger scales, higher research and development (R&D), higher working capital and value added in production. They argue that their results have important implications for the patterns of international trade since financial systems shape the international specialization among countries. This, in turn, affects development and long-term growth of less developed regions.

Starting from the studies by Baldwin (1989), Kletzer and Bardhan (1987) and Beck (2002) has intensely investigated the relationship between financial development and international trade. In his analysis, the author first shows theoretically that countries endowed with a well-developed financial system tend to specialize in sectors with increasing returns to scale, then he demonstrates empirically that a well-developed financial sector translates into a comparative advantage in the production of manufactured goods. The author has further confirmed (Beck 2003) the existence of ‘the financial comparative advantage’ hypothesis, according to which countries with superior financial systems enjoy higher exports and trade surpluses in industries that can more easily access to external financing.

Several other authors have studied the effects of financial development on international trade (Braun and Larrain 2004; Svaleryd and Vlachos 2005; Wynne 2005; Matsuyama 2005; Hur et al. 2006; Manova 2008; Antras and Caballero 2009; Amiti and Weinstein 2011; Demir and Dahi 2011; Becker et al. 2013; Manova 2013) and have concluded, in line with Beck (2002, 2003), that comparative advantages stem not only from differences in technology and factor endowments as the classical theories by Ricardo and Heckscher-Ohlin postulate, but also from differences in financial development across countries. Countries with lower levels of financial development indeed have a lower share of exports in industries with higher external finance dependence. Svaleryd and Vlachos (2005) found a positive relationship between financial sector development, the specialization pattern of international trade and comparative advantage. Greenaway et al. (2007) have shown that firms’ financial health and their ability to enter export markets are linked. They have suggested that exporters exhibit better financial health than non-exporters. Easy access to credit can help overcome market frictions by reducing the costs of transferring information and wealth between savers and investors. It can certainly be stated that, when financial systems fulfil their functions, the cost of financial intermediation lowers, economic growth increases and exports surge. Muûls (2008) has shown that firms are more likely to be exporters when they enjoy higher productivity and lower credit constraints.

With reference to Italy, Minetti and Zhu (2011) have suggested that credit rationing is an obstacle to export especially for firms operating in high-tech industries and in industries that heavily rely on external finance. De Bonis et al. (2015) have shown that a longer relationship with banks fosters the internationalization of Italian firms. Frazzoni et al. (2014) have found that a strengthening of the firm-bank relationship increases the propensity to export by about 25%. Bartoli et al. (2014) have provided an empirical analysis of the role of bank support in affecting the firms’ export decisions and have shown that bank support can help small businesses exporting at the extensive as well as the intensive margin.

It should be noted that all these studies outline the importance of financial activity for economic performance at firm level considering medium and large vs. small firms, or distinguishing among countries and/or sectors. In the present study, we consider the total value of exports and the number of exporters as dependent variables without distinguishing between micro-data or micro-sectors, but differentiating between regions.

4 A Panel Analysis of Regional Exports

4.1 Export Specification

The model proposed in this study focuses the attention on financial factors and non-price competitiveness triggers, such as technological competitiveness and investments. The introduction of these factors can be justified by tenets of new trade theory (NTT) that highlight both the significance of increasing returns to scale in production and consumer willingness for greater product variety and quality (Krugman 1989; Feenstra 1994; OECD 2000; Hummels and Klenow 2005; Broda and Weinstein 2006; Fabrizio et al. 2007; Benkovskis and Wörz 2012) and the new strand of the literature that accounts for a financial dimension of exporting decisions (Greenaway et al. 2007).

The export equation is estimated using a panel analysis in which regions denote the cross-section dimension and years denote the time-series dimensionFootnote 2, i.e.

with \(\hbox {i}=1{\cdots }20\) and \(\hbox {t}=2000{\cdots }2013\) indicating all Italian regions and time periods. We consider two different dependent variables \(exp_{it}\), namely i) the total goods exports in 20 regions in value terms and ii) the number of export operators by region. The latter is a proxy of the number of exporting firms and allows us to analyse the extensive margin of exports. c is the intercept parameter. X is the vector containing lagged financial factors, and Y is the vector comprising a group of lagged controls which affect supply-side determinants of exports. One can consider a one-way error component model for disturbances, with:

where \(\alpha _{i}\) is the unobserved regional-specific effects and \(e_{\mathrm{it}}\) is the remainder disturbance. In a traditional setting, two alternative specifications, using fixed effects and random effects modelling can be adopted. The fixed effects model assumes the \(\alpha _{i}\) to be fixed parameters to be estimated and the remainder disturbances stochastic with \(e_{\mathrm{it}}\) independent and identically distributed i.i.d(0, \(\sigma _e^2\)). The fixed effects specification controls for heterogeneity among regions in the intercept parameter. The random effects model assumes \(\alpha _{i}\) to be random so that \(\alpha _{i} \sim \) i.i.d(0, \(\sigma _\alpha ^2\)) and \(e_{\mathrm{it}} \sim \) i.i.d(0, \(\sigma _e^2\)). In addition, the vectors X and Y are independent of the \(\upalpha _{i}\) and \(e_{\mathrm{it}}\), for all i and t. The random effects model is the appropriate specification if one draws N individuals randomly from a large population which is not our case. Put differently, the random effects model treats the heterogeneity across regions as a random component.

Alternatively, one can consider the regression model (1) with two-way error components disturbances:

where \(\delta _{t}\) represents the unobservable time effect that is regional-invariant. If \(\alpha _{i}\) and \(\delta _{t}\) are assumed to be fixed parameters to be estimated and the remainder disturbances stochastic with \(e_{it} \sim \) i.i.d(0, \(\sigma _e^2\)), then (3) represents a two-way fixed effects error component model. If \(\alpha _{i} \sim \) i.i.d(0, \(\sigma _\alpha ^2 )\), \(\delta _{t}\sim \) i.i.d(0, \(\sigma _\delta ^2\)) and \(e_{\mathrm{it}} \sim \) i.i.d(0, \(\sigma _e^2\)) independent of each other, then (3) is the two-way random effects model.

The traditional panel Eq. (1) can be transformed in a dynamic relationship by adding a lagged dependent variable among the regressors, i.e.:

One can assume a one-way (as in Eq. (2)) or a two-way (as in Eq. (3)) error component model for disturbances. We choose the latter variant in our baseline empirical study to account for any potential common shock across regions due to the exclusion of traditional variablesFootnote 3 such as the effective exchange rate and the world real GDPFootnote 4 from the model. The dynamic modelling controls for possible sources of endogeneity and the lagged dependent variable accounts for persistence in export flows and exporters’ participation. The inclusion of a lagged dependent variable can render the OLS estimator biased and inconsistent because \(exp_{{ i, t-1}}\) can be correlated with the error term. The bias is larger when t is smaller (e.g., Baum 2006; Roodman 2006; Baltagi 2013). In our case, t is not very small relative to i, thus we both apply the fixed-effects OLS estimator and a generalized method-of-moment (GMM) using the robust system-GMM (S-GMM) estimatorFootnote 5. The latter uses the level Eq. 4 to obtain a system of two equations: one differenced and one in levels. The variables in levels in the second equation are instrumented with their own first differences. This increases efficiency with respect to the original difference-GMM (D-GMMFootnote 6) proposed by Arellano and Bond (1991). The S-GMM methodology developed by Arellano and Bover (1995) and Blundell and Bond (1998) uses extra moment conditions that rely on certain stationarity conditions of the initial observations. It has been shown that when these conditions are satisfied, the resulting system-GMM estimator has much better finite sample properties in terms of bias and root mean squared error than the difference-GMM estimator.

4.2 Dataset

The vector \(X_{it}\) includes four financial development indicators, namely credit intensity, financial risk, number of financial branches per 1000 people and fido money lending (short-term loans). These variables are time- and region-variant and could influence export supply capacity.

It should be noted that all the considered financial variables capture different features of financial development. Credit intensity measures the availability of finance and essentially describes the activity of banks and financial intermediaries in credit market. The financial risk variable is an indicator of credit quality. The number of branches relative to population captures the demographic penetration of the banking system. Fido money lending explains short-term loans (less than a year) to finance temporary working capital needs.

In detail, credit intensity is the ratio between bank credits or loans to the private business sector and real GDP. This is by far the most frequently used measure of financial development in the literature (Beck et al. 2000; Beck 2002, 2003; Levine et al. 2000; Svaleryd and Vlachos 2005; Braun and Raddatz 2007). The expected sign of the coefficient of this variable is positive, since more credit tends to facilitate export flows. A smaller ratio, instead, should indicate a lower supply of credit by financial institutions (due to a higher financial vulnerability with a consequent credit crunch) or a lower demand from the private sector (due to a smaller economic activity). In both cases, there would be a negative effect on production and exports.

Financial risk is the decay rate of the loan facilities. It has been constructed as the ratio of non-performing loans to loan flows. An increase in financial risk is expected to have negative effects on exports, since banks and financial intermediates are more prone to finance firms when financial risk is low.

The number of financial branches per 1000 people is a proxy for demographic branch penetration. Higher branch intensity would indicate higher possibilities of access and the opportunity to use financial services by households and enterprises. Indeed, higher demographic penetration would indicate fewer potential clients per branch and thus easier access to credit. However, it should be mentioned that an increase in the number of branches not necessarily reflects a more efficient financial system. Indeed, Europe is witnessing a period of consolidation and a structural change away from a highly fragmented banking sector towards fewer and bigger players. This tendency, together with technological progress and e-banking, brings about a reduction in the number of financial branches without implying more limited access to credit per se.

Fido money lending mirrors the total value of global short-term credit lines used by businesses.

\(Y_{it}\) is a vector of control variables that includes two economic indicators of the new trade theory which influence the supply side of exports. The variables are R&D expenditure on GDP and gross fixed capital formation (GFCF), which reflect to some extent the worker skills and the quality of physical capital. Both variables mirror non-price competitiveness factors.

GFCF is the gross fixed capital formation (excluding residential investment) as a share of GDP, and controls for the effect of capital accumulation. An increase in the ratio should bring an increase in export capacity.

The ratio of R&D expenditures to GDP, which is defined as R&D intensity, controls for innovation and human capital. R&D is crucial both in the production of goods and services of higher quality, and in the development of new varieties of products. In short, technological competitiveness is measured by R&D intensity and it is expected to impact exports positively.

The considered variables are expressed in natural logarithms.

All data were collected from the database compiled by the National Institute of Statistics (ISTAT), Eurostat and the Lombardy region, one of the most economically relevant Italian regions, which gathers and merges information from the Bank of Italy. Detailed information on data sources are reported in the “Appendix” (Table 10).

The correlation matrix has been computed to provide a first look at the data (see Table 4). It is interesting to notice that R&D is positively correlated to credit. Carlin and Mayer (1999) and Levine et al. (2000) have shown that financial development positively affects the levels of R&D and growth, respectively. The correlation between R&D and credit is, however, not so high, thus both variables can enter the model. Conversely, not all the four financial variables enter the model given their very high inter-correlation. For our analysis we consider only credit intensity and financial risk.

To have a first idea of the situation across macro areas (North, Centre and South), we report the mean values of some variables entering the model (Table 5). It is clear that South Italy shows the worse economic performances with the exception of the value of investment to GDP.

4.3 Empirical Analysis

With the objective to appraise the drivers of export flows and extensive margins, we estimate a two-way fixed effects error component model with lagged independent variables, a two-way fixed effects error component model with dependent and independent lagged variables (Eqs. 1 and 3) and a S-GMM modelFootnote 7 (Eq. 4). The lagged dependent variable among regressors captures persistency in export flows and exporters’ participation. The lagged exporters’ participation indeed controls for hysteresis caused by exporting entry sunk costs i.e., previous exporting history subject to sunk entry cost as well as firm and industry characteristics. The results of the three models when the total value of exports is considered as dependent variable are reported in Table 6. The estimates when the number of export operators is entered as dependent variable are presented in Table 7. All the models control for time effects whenever unexpected variation or special events may affect the outcome variablesFootnote 8. In detail, the first three columns in Tables 6 and 7 show the two-way fixed effects with and without lagged dependent variables among regressors and the robust S-GMM estimationFootnote 9 for the entire sample 2000–2013. The fourth to sixth columns report the same estimations for the pre-crisis period, 2000–2007. In both models (two-way fixed effects and S-GMM) the variables credit intensity, gross fixed capital formation, financial risk and R&D intensity are lagged one-period for two main reasons. It takes time for financial and non-price competitiveness factors to exert effects on exports, at the same time, one-period lagged variables allow us to avoid, to a certain extent, endogeneity problems in the fixed effects framework.

The selection of the fixed effects model rather than the random modelFootnote 10 was based on the Hausman \(\upchi ^{2}\) test, which tests the null hypothesis according to which, if there is no correlation between the independent variables and the unit effects, the two estimation methods (fixed and random) should yield coefficients that are ‘similar’, but the random effects model is efficient against the alternative hypothesis that the fixed effects estimation is preferable. Given that the Hausman test reported at the bottom of Tables 6 and 7, returned a p-value of 0.0000, the fixed effects model was selected (Table 6).

We found that the fixed effects and the S-GMM regressions produce similar results in terms of signs and significance of variables for both the entire sample and the pre-crisis years. In particular, export values and extensive margins at regional level are significantly explained by financial factors, giving a preliminary indication that financial development matters. In the export equations, all the significant variables have the expected sign.

The variable gross fixed capital formation to GDP is positive and significant at 1% in most of the cases. This variable reflects the investment ‘effort’ of each region. It is not surprising that those regions with higher levels of investments enjoy the upper levels of exports. In particular, a 1% increase in GFCF leads to a rise in export value flows (Table 6) and in the number of export operators (Table 7) that ranges between about 0.3 and 0.7% during the years 2000–2013. The significant values were higher during the pre-crisis years. The gross fixed capital formation should be thought of as a supply-side determinant of export performance since it is conducive to an increase in overall production capacity, and thus to an upsurge in export capacity.

The variable credit intensityFootnote 11 is positive and significant for the complete period of investigation both in the fixed effects and in the S-GMM models: a 1% increase in credit intensity, with other variables remaining constant, yields a 0.4–0.5% increase in export flows (Table 6) and a 0.2% rise in the number of export operators (Table 7). This implies that credit intensity has a higher effect on exports flows than extensive margins. During the pre-crisis period this variable is not always significant. In any case, the higher is the ratio, the lesser financial vulnerability. The variable, as mentioned, reflects both demand and supply conditions. On the supply-side, a deterioration in the ability or willingness of banks to provide financing will have a greater adverse impact on production and, therefore, on export activities. On the demand side, smaller credit intensity would indicate that banking services are more limited in use, since they are likely only to be affordable to wealthier or larger businesses.

Conversely, the higher the financial risk, the smaller the export flows and the number of exporting firms. A 1% raise in the financial risk, in fact, generates a drop in exports that ranges from 0.03% to about 0.2% during the years 2000–2013 and before the financial crisis. Similarly, a 1% increase in the financial risk leads to a reduction in the number of export operators that varies between 0.03 and 0.1% during the same period. These results support the idea that credit quality is significant for explaining the level of export performance of Italian regions, and that financial development determines the degree of credit availability for international trade. This occurs because credit tightening, and thus the lack of developed financial systems, augments transaction costs and represents a trade barrier with a trade-inhibiting effect for export flows and exporters’ participation (UNCTAD 2007).

The variable R&D, when significant, is linked with positive sign to export flows and exporter operators. Specifically, a 1% upsurge in technological innovation generates a 0.1–0.2% rise in the number of exporters and export values in the fixed effects and S-GMM models. The fact that the coefficient of technological innovation is significant in several cases would suggest that R&D investments are important to foster exports above all in high- and medium-tech manufactures, thus upgrading the Italian specialization which is more focused towards medium-low and low-tech productions.

In a nutshell, the total value of exports and extensive margins benefit from credit support to the private sector and increases in gross fixed capital formation and in R&D. Additionally, export flows and exporter participation are characterized by a high degree of persistency. The fact that we have found that the level of financial development does have significant effects on the total value of exports and on the number of exporters underlines the importance of financial sector development for economic development beyond its positive impact on economic growth given that it shapes trade, and therefore it increases the priority that financial sector reforms should have on policy makers’ agendas. In fact, banks could help fostering export values and participation not only by placing more credit in the system, but also by achieving better performances as intermediaries. Both the fixed effects and S-GMM panel models confirm these findings. However, controlling for the potential endogeneity and dynamic patterns in the export equation (S-GMM) produces less conservative estimates of the financial factors than that obtained when employing the fixed effect specifications.

The consistency of the two-step robust GMM estimator depends on the validity of the instruments used in the model as well as the assumption that the error term does not exhibit serial correlation. In our case, we verified that the three conditions identified by Arellano and Bond (1991) are satisfied: a significant AR(1) serial correlation, lack of AR(2) serial correlation and a robust Hansen J-test (high p-value). Indeed, the null hypothesis of no autocorrelation is rejected for AR(1) and not rejected for AR(2) at 5% significance level, as well the null hypothesis of the Hansen J-test that ‘the instruments as a group are exogenous’ cannot be rejected, thus demonstrating that the models are well specified (Tables 6, 7).

Overall, the fixed effects models show significant effects of regressors in driving the export dynamics, as evidenced by high \(\hbox {R}^{2}\). All the coefficients for both fixed effect and S-GMM models are jointly significant (F-test) and have the expected signs so that the specifications of the models are consistent with the rationale of the export model.

4.4 Disaggregated Analysis of Exports towards Extra and Intra EU28 markets

We next use the same panel data analysis to examine how financial and non-price competitiveness factors affect exports towards extra and intra-EU28 countries over time. As columns 1–6 show (Table 8), all measures of credit intensity and technological competitiveness significantly increase exports in the EU28 and extra-EU28 markets. The financial risk coefficients remain uniformly negative under the fixed effects and S-GMM specifications, but it turns out not significant in affecting exports towards the extra-EU 28 markets when the temporal fixed effects model is considered.

4.5 Disaggregated Analysis for Macro-areas

In order to complete the analysis, we estimate three export specifications distinguished for macro-areas, namely the North, the Centre and the South in a dynamic S-GMM setting for the period 2000–2013. In this case, we use the one-step robust variant of the S-GMM, given the reduced sample size. The results are reported in Table 9.

Some interesting features emerge. First, financial development matters for all the areas, and the northern regions benefit more from credit intensity than central areas. Second, financial risk is more important for the Southern regions than the Northern regions. Third R&D expenditure drives more the Mezzogiorno’s exports than the Northern ones (see Table 9).

5 Conclusions

This study has examined the importance of non-price competitiveness and financial factors in explaining the export performances of 20 Italian regions over the period 2000-2013 and the pre-crisis years. While trade studies are increasing, scarce attention yet has been paid to ‘credit features’ in affecting export flows and extensive margins (i.e., the exporting participation). This study has therefore introduced a group of variables to account for financial development and credit at the regional level.

We used a dynamic panel data analysis to account for persistency in export flows and extensive margins and possible endogeneity problems.

The results of our study suggest that supply-side factors are significant determinants of export performance and exporting behaviour. This finding is robust to the different adopted estimation techniques, to the period of investigation, macro-geographical differentiations and destination markets.

Financial factors exert a strong and robust impact on regional trade. On average, higher financial development, meaning more credit availability, translates into higher values of exports and higher extensive margins. We interpret higher values for the average size of credit to GDP both as supply and demand conditions. Thus a decrease in credit availability would indicate that on the one side the banking services are more limited in use, with a consequent drop in the total value of exports and in the number of exporters. On the other hand, the variable would also point to an adverse willingness of banks to give credit with negative consequences for export flows and exporting behaviour. This result is highly relevant in the sense that it confirms that financial development is, among other factors, behind export performance. Financial risk has a negative impact on the level of export flows and the number of exporting firms of Italian regions. This is because a higher ratio indicates a lower ability to meet financial obligations, leading to lower exports.

The analysis also reveals that investments and R&D intensity are important in boosting exports. This is because investments increase overall production capacity and thus intensify exports.

Moreover, it emerges that total values of exports are relatively more reactive than extensive margins to percentage changes in non-price competitiveness and financial variables.

These results could have interesting policy implications in the sense that if financial facilities are one of the mechanisms to achieve a higher stage of export performance, policies should pursue the generation of greater endowments of financial capital in those regions where this asset is relatively scanty. A reform of the financial sector that nurtures the level of external finance available to firms in a region could have an impact on the industrial structure of that region’s exports. In addition, economic policies that promote technological non-price competitiveness and create a market-friendly environment for the development of private firms are also desirable to foster exports and exporters’ participation.

Notes

The North comprises the following regions: Lombardy, Liguria, Piedmont, Emilia Romagna, Friuli-Venezia Giulia, Trentino Alto Adige, Valle d’Aosta and Veneto. The Centre includes: Tuscany, Umbria, Marche and Lazio. The South includes: Abruzzi, Molise, Campania, Puglia, Basilicata, Calabria, Sicily and Sardinia.

See Baltagi (2013).

We would like to thank an anonymous referee for this suggestion.

It should be mentioned that the Levin-Lin-Chu test for non-stationarity was also implemented to check for the presence of unit roots among the variables. The results have indicated that all variables are I(0), therefore no panel cointegration techniques have to be applied, and therefore we proceed directly to the GMM estimation, which allowed us to account also for a dynamic panel structure.

The D-GMM estimator takes differences in Eq. (1) in order to remove the fixed effects such that, in the absence of serial correlation in e, instruments based on second and more lags of X and Y are valid. However, the D-GMM estimator can lead to proliferation and weakness of the instruments, resulting in enhanced finite sample bias (toward OLS) and low power of the Hansen over-identification test.

The GMM estimators have one- and two-step variants, with two-step estimates asymptotically more efficient.

The estimated time dummy values for the entire and reduced sample are not reported for reason of space.

Compared to the OLS model, S-GMM does not assume normality and it allows for heteroskedasticity in the data. Dynamic panel models are known for having common problem with the heteroskedasticity of data, which fortunately they can control (Baltagi 2013). Accordingly, we implement two-step estimates that yield theoretically robust results (Roodman 2006). We can obtain, in fact, robust Sargan tests, i.e., the (robust) Hansen J-tests, which are not available in one-step non-robust estimation.

The random effect results are not reported for reason of space, but are available from the authors upon request.

We have obtained similar results when the variable number of financial branches was used instead of credit intensity.

References

Algieri B (2011) Modelling export equations using an unobserved component model: the case of the Euro Area and its competitors. Emp Econ 41(3):593–637

Algieri B (2015) Price and non-price competitiveness in export demand: empirical evidence from Italy. Empirica 42(1):157–183

Amiti M, Weinstein DE (2011) Exports and financial shocks. Q J Econ 126:1841–1877

Antras P, Caballero RJ (2009) Trade and capital flows: a financial frictions perspective. J Political Econ 117:701–744

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58:277–297

Arellano M, Bover O (1995) Another look at the instrumental variables estimation of error components models. J Econometr 68:29–51

Auboin M (2009) Boosting the availability of trade finance in the current crisis: background analysis for a substantial G20 Package. CEPR Working Paper 35

Baldwin R, Krugman PR (1989) Persistent trade effects of large exchange rate shocks. Q J Econ 104(4):635–654

Baldwin RE (1989) Exporting the capital market: comparative advantage and capital market imperfections. In: Audretsch DB, Sleuwaegen L, Yamawaki H (eds) The convergence of international and domestic markets. North-Holland, Amsterdam, pp 135–152

Baltagi BH (2013) Econometric analysis of panel data. Wiley, Chichester

Bartoli F, Ferri G, Murro P, Rotondi Z (2014) Bank support and export: evidence from small Italian firms. Small Busi Econ 42:245–264

Baum FC (2006) An introduction to modern econometrics using stata. Stata, Texas

Beck T (2002) Financial development and international trade: is there a link? J Int Econ 57:107–131

Beck T (2003) Financial dependence and international trade. Rev Int Econ 11(2):296–316

Beck T, Demirgüç-Kunt A, Levine R (2000) A new database on financial development and structure. World Bank Econ Rev 14:597–605

Becker B, Chen J, Greenberg D (2013) Financial development, fixed costs, and international trade. Rev Corp Financ Stud 2(1):1–28

Benkovskis K, Wörz J (2012) Non-Price competitiveness gains of central, eastern and southeastern European Countries in the EU Market, ECB, Focus on European Economic Integration (Q3/2012), pp 27–47

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87(1):115–143

Bonaccorsi di Patti E (2009) Weak institutions and credit availability: the impact of crime on bank loans. QEF, 52, Banca d’Italia

Braun M, Larrain B (2004) Finance and the business cycle: international, inter-industry evidence. J Financ 60(3):1097–1128

Braun M, Raddatz C (2007) Trade liberalization, capital account liberalization and the real effects of financial development. J Int Money Financ 26:730–761

Broda C, Weinstein D (2006) Globalization and the gains from variety. Q J Econ 121(2):541–585

Caporale GM, Chui MKF (1999) Estimating Income and price elasticities of trade in a cointegration framework. Rev Int Econ 7(2):254–264

Carlin W, Mayer C (1999) Finance, investment and growth. CEPR Working Paper No. 2233, London

Coccorese P, Silipo DB (2012) Il ruolo della finanza nello sviluppo e nel declino dell’economia italiana. In: Messori M, Silipo DB (eds) Il modello di sviluppo dell’economia italiana quarant’anni dopo. Milano, Egea, pp 129–143

D’Antonio M, Scarlato M (2007) I laureati del Mezzogiorno: una Risorsa Sottoutilizzata o Dispersa, Quaderno SVIMEZ No. 10

De Bonis R, Ferri G, Rotondi Z (2015) Do firm-bank relationships affect firms’ internationalization? Int Econ 142:60–80

Deloof M, La Rocca M (2014) Local financial development and the trade credit policy of Italian SMEs. Small Busi Econ. doi:10.1007/s11187-014-9617-x

Demir F, Dahi OS (2011) Asymmetric effects of financial development on South-south and south-north trade: panel data evidence from emerging markets. J Dev Econ 94:139–149

Dixit A (1989) Entry and exit decisions under uncertainty. J Political Econ 97(3):620–638

Dow S, Montagnoli A, Napolitano O (2012) Interest rates and convergence across Italian regions. Reg Stud 46(7):893–905

Edwards L, Wilcox O (2003) Exchange rate depreciation and the trade balance in South Africa. In: Paper prepared for the National Treasury

Fabrizio S, Igan D, Mody A (2007) The dynamics of product quality and international competitiveness. IMF Working Paper No. 97, Washington DC: International Monetary Fund

Feenstra R (1994) New product varieties and the measurement of international prices. Am Econ Rev 84(1):157–177

Frazzoni S, Mancusi ML, Rotondi Z, Sobrero M, Vezzulli A (2014) Relationships with banks and access to credit for innovation and internationalization of SMEs, paper available on line: http://www.siecon.org/online/wp-content/uploads/2014/10/Frazzoni-Mancusi-Rotondi-Sobrero-Vezzulli-275.pdf

Giannola A, Lopes A, Zazzaro A (2012) La convergenza dello sviluppo finanziario tra le regioni italiane dal 1890 ad oggi, MoFiR, Money and Finance Research Group, working paper \(\text{n}^{\circ }\) 74, September

Goldstein M, Khan MS (1985) Income and price effects in foreign trade. In: Jones R, Kenen P (eds) Handbook of International Economics, vol II. North-Holland, Amsterdam, pp 1042–1099

Gonzales S (2011) The north/south divide in Italy and England: discursive construction of regional inequality. Eur Urban Reg Stud 18(1):62–76

Greenaway D, Guariglia A, Kneller R (2007) Financial factors and exporting decisions. J Int Econ 73(2):377–395

Guiso L, Sapienza P, Zingales L (2004) Does local financial development matter? Q J Econ 119:929–969

Hooper P, Johnson K, Marquez J (2000) Trade elasticities for G-7 countries, Princeton studies in international economics, No. 87. University Press, Princeton

Hummels DM, Klenow PJ (2005) The variety and quality of a nation’s exports. Am Econ Rev 95(3):704–723

Hur J, Raj M, Riyanto YE (2006) Finance and trade: a cross-country empirical analysis on the impact of financial development and asset tangibility on international trade. World Dev 34(10):1728–1741

ISTAT (2016) Noi Italia and Indicatori territoriali per le politiche di sviluppo, Rome

Kletzer K, Bardhan P (1987) Credit markets and patterns of international trade. J Dev Econ 27:57–70

Krugman P (1989) Differences in income elasticities and trends in real exchange rates. Eur Econ Rev 33(5):1031–1054

Levine R, Loayza N, Beck T (2000) Financial intermediation and growth: causality and causes. J Monet Econ 46:31–77

Lissovolik B (2008) Trends in Italy’s nonprice competitiveness, IMF Working Paper No. 124, Washington DC: International Monetary Fund

Manova K (2008) Credit constraints, equity market liberalizations and international trade. J Int Econ 76:33–47

Manova K (2013) Credit constraints, heterogeneous firms, and international trade. Rev Econ Stud 80:711–744

Marquez J, McNeilly C (1988) Income and price elasticities for exports of developing countries. Rev Econ Stat 70(2):306–314

Matsuyama K (2005) Credit market imperfections and patterns of international trade and capital flows. J Eur Econ Assoc 3(2–3):714–723

Minetti R, Zhu SC (2011) Credit constraints and firm export: microeconomic evidence from Italy. J Int Econ 83:109–125

Muûls M (2008) Exporters and credit constraints. A firm-level approach. Working Paper 200809-22, National Bank of Belgium

OECD (2000) Modelling manufacturing export volumes equations: a system estimation approach, by Murata, K., Turner, D., Rae, D., Le Fouler L., OECD Economics Department Working Papers, No. 235, OECD Publishing

Rajan R, Zingales L (1998) Financial dependence and growth. Am Econ Rev 88:559–587

Roodman D (2006) How To Do xtabond2: An Introduction to “Difference” and “System” GMM in Stata, Center for Global Development Working Paper No. 103

Samba MC, Yan Y (2009) Financial development and international trade in manufactures: an evaluation of the relation in some selected Asian countries. In J Busi Manag 4(12):52–69

Senhadji AS, Montenegro CE (1998) Time series analysis of export demand equations: a cross-country analysis, IMF Working Paper, No. 149, Washington DC: International Monetary Fund

Svaleryd H, Vlachos J (2005) Financial markets, the pattern of industrial specialization and comparative advantage: evidence from OECD countries. Eur Econ Rev 49:113–144

UNCTAD (2007) Trade and development report. UNCTAD, Geneva

Usai S, Vannini M (2005) Banking structure and regional economic growth: lessons from Italy. Ann Reg Sci 39:691–714

The Economist (2015) A tale of two economies, 16 May

Windmeijer F (2005) A finite sample correction for the variance of linear efficient two-step GMM estimators. J Econom 126:25–51

Wynne J (2005) Wealth as a determinant of comparative advantage. Am Econ Rev 95:226–254

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Algieri, B., Aquino, A. & Mannarino, L. Non-Price Competitiveness and Financial Drivers of Exports: Evidences from Italian Regions. Ital Econ J 4, 107–133 (2018). https://doi.org/10.1007/s40797-016-0047-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40797-016-0047-6