Abstract

In this paper, using Japanese prefecture data sets for the period of 2006–2015, we attempt to empirically examine the validity of the environmental Kuznets curve (EKC) hypothesis for Japan. Overall, it is found that there is a monotonic nexus between CO2 emissions and per capita income, therefore implying that the EKC does not exist.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

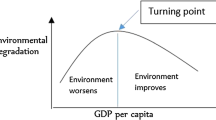

The concern with emissions of greenhouse gases (GHG) such as carbon dioxide (CO2), methane (CH4), nitrous oxide (N2O), Hydrofluorocarbons (HFCs), Perfluorocarbons (PFCs) and Sulphur hexafluoride (SF6), which causes the greenhouse effect leading to global warming and climate change, has been growing in particular among developed countries. In recent years, protest demonstrations for environment protection have been held across the world. In 1997 the protocol to the United Nations framework convention on climate change (the Kyoto protocol) was adopted and, as a consequence, 37 countries committed themselves to binding targets for the reduction of GHG emissions. The environmental Kuznets curve (EKC) proposed by Grossman and Krueger (1991, 1995) suggests that economic development causes an environmental deterioration, but after reaching a certain level of income, the growth leads to an environmental improvement. Although over the past decade a number of empirical studies have been made on the relationship between economic growth and air pollution such as CO2 emissions, the existence of the EKC is still controversial. For instance, utilizing a panel data regression Al-Mulali and Ozturk (2016), Bilgili and Bulut (2016), Churchill et al. (2018), Hailemariam et al. (2019), Hassan and Salim (2015), Jebli et al. (2016) and Musolesi et al. (2010) demonstrate that an inverted U-shaped (or bell-shaped) EKC hypothesis is verified for 27 advanced economies, the Organization for Economic Cooperation and Development (OECD) member countries or the European Union (EU). In contrast, Boluk and Mert (2014) conclude based on the panel data analysis during the period 1990–2008 that there is no evidence of the EKC hypothesis for 16 EU countries. As for the United States, Aslan et al. (2018) and Roach (2013) adopt a rolling-window approach and a dynamic state-level panel regression, respectively and validate the presence of the EKC shape, whereas Dogan and Ozturk (2017) and Soytas et al. (2007) utilize an auto-regressive distributed lag (ARDL) model and a Granger causality test, respectively and stress that the hypothesis is not valid for the economy. By the same token, using the ARDL model and a bootstrap panel causality test, Iwata et al. (2012), Onafowora and Owoye (2014), Rafindadi (2016) and Yilanci and Ozgur (2019) argue that the EKC holds in Japan. On the contrary, Ajmi et al. (2015) and Shahbaz et al. (2017) employ a time-varying Granger causality test and nonparametric econometric methods, respectively and find no supporting evidence for the hypothesis. By using ordinary least squares (OLS) regression on Japanese prefecture data sets for 1975–1999, Yaguchi et al. (2007) demonstrate that per capita income does not affect the emissions of CO2.

The objective of this paper is to examine the validity of the EKC hypothesis for Japan. We attempt to provide an empirical investigation by using Japanese prefecture data sets in order to capture the relationship between CO2 emissions and income at the domestic level. We classify into three groups of prefectures according to the average income level for 10 years (2006 to 2015): high income (over 2,800,000 Japanese yen),Footnote 1 middle income (ranging from 2,500,000 to 2,800,000 yen),Footnote 2 and low income (less than 2,500,000 yen).Footnote 3 The hypothesis underlying our empirical study is that the nexus between emissions of CO2 and income has an inverted bell-shape, given the expiration of the Kyoto protocol in 2012 and the expensive renewable energy.

The remainder of the paper is organized as follows. Section 2 describes the data and methodology, and the empirical results are given in Sect. 3. Section 4 concludes.

2 Data and methodology

2.1 Data

In our model we use an annual balanced panel data for 47 prefectures in Japanspanning from 2006 to 2015. The choice of span is owing to the limited availability of data. The variables used are per capita CO2 emissions (in tons; CO2) as a proxy for environmental pollution, per capita income (in local currency; INC) as a proxy for economic development, per capita income squared (INC2) and the ratio of renewable energy to the total energy consumption (REC). The data for CO2 is taken from Ministry of the Environment (ghg-santeikohyo.env.go.jp), income and population are from Cabinet Office (www.cao.go.jp), and the rest are from Agency for Natural Resources and Energy (www.enecho.meti.go.jp). REC is expressed in natural logarithms.

2.2 Methodology

We apply the first-difference generalized method of moment (GMM) estimator, proposed by Arellano and Bond (1991), for a dynamic panel model with lagged dependent variables. The GMM model is given by:

with the following moment conditions:

This GMM estimator is known to obtain additional instruments by utilizing all the orthogonality conditions. According to Baltagi (2001), the GMM estimation is more efficient than Instrumental Variable (IV) estimation, suggested by Anderson and Hsiao (1981), because the latter method does not make use of all the available moment conditions and therefore leads to consistent but not necessarily efficient estimates of the parameters.

3 Results

Prior to regression analysis, in order to check for weak stationarity, we apply the well-known panel unit root test developed by Levin et al. (2002; the LLC test),Footnote 4 which the null hypothesis of non-stationary is tested for common unit root process. Table 1 reports the results of the panel unit root tests. Model (1–4) denote dynamic panel models with data for total, high-, middle- and low-income prefectures, respectively. It is observed that all level series are stationary at the five percent level of significance (i.e. zero order integration, I(0)), though the series without trend of income and income squared in model (4) are not stationary.

Table 2 shows the results of the GMM estimation for CO2 equation. Overall, one can observe that all estimated coefficients, with the exception of CO2(− 1) in model (2), are statistically significant at the conventional probability level. In addition, it is observed that the results of the Sargan test (p-value) show no evidence of over-identification problem in all estimations. As is seen from the table, in each model, the sign of the coefficient for income is positive and that of income squared is negative, thereby suggesting an inverted U-shape relationship between CO2 emissions and income. It is found, however, that the estimated turning points (TP) occur at 4,184,549 Japanese yen in model (1), 5,000,000 yen in model (2), 2,867,079 yen in model (3) and 4,503,891 yen in model (4), respectively, which are out of the range of sample income. Hence, one can say that there is a monotonic relation between CO2 and income. At the same time, it is interesting to note that the turning point in model (2) occurs at a lower per capita income as compared to other models. This may account for the difference of industrial structure and geographical conditions among three groups of prefectures. For example, the three largest industrial districts (Keihin, Chukyo and Hanshin) are located in the group of high-income prefectures, while huge solar power plants were being constructed in 10 out of 16 low-income prefectures during the sample period.

As a robustness check, we attempt to examine the relationship between renewable energy consumption and income. The results of the GMM for REC equation are presented in Table 3. We can see that all coefficients estimated, except income and income squared in model (3) (at the 15 percent significance level), show statistical significance at the five percent level. At the same time, the p-value of the Sargan test is significant in all models, thus suggesting the validity of the instrumental variable. Likewise, it is found that the results for each model suggest that an increase in income initially leads to an increase in the ratio of renewable energy to the total energy consumption, but afterward the ratio declines with increasing income. Furthermore, it is observed that the turning points are within the sample income range, thus confirming that the relationship between REC and income exhibits a bell-shape. The positive relation may be explained by the adoption of renewable energy, driven by the government subsidizing enterprises via New Energy and Industrial Technology Development Organization (NEDO). One possible explanation for the negative nexus may be that the energy supply cannot meet the increase in energy demand following economic growth, and therefore the utilization of additional fossil fuels increases. On top of that, this can be interrupted by the limitations of current technology. Another possible explanation might be due to the fact that the first commitment period, which started in 2008, under the Kyoto Protocol expired in 2012, and Japan has no binding targets in the second period of 2013–2020.

Given that, although the ratio of renewable to total energy consumed initially increases with rising income, there is a consistently positive relationship between CO2 and income, it is safe to say that there might be another important factor (e.g. deforestation through solar power plant installation) affecting the CO2 emissions.

4 Conclusions

In this paper, using the GMM technique based on a panel of data for 47 Japanese prefectures over the period 2006–2015, we have attempted to investigate empirically whether the EKC hypothesis holds not only for Japan as a whole but also for three income-based groups of prefectures. We have found that there is a monotonic emissions-income relation. Additionally, it is found that there exists an inverted U-shape relationship between the ratio of renewable to total energy consumption and per capita income.

Overall, in order to protect environmental quality, it is necessary for the economy to promote not only renewable energy technologies, which are capital intensive, but also carbon dioxide capture and utilization (CCU) system, which is highly technology intensive. For instance, it is well known that CO2 can be used as a feedstock for industrial production such as building materials (e.g., carbonates, concrete), chemical intermediates (e.g., formic acid, methanol, syngas), fuels (e.g., liquid fuels, methane), polymers and urea, as well as for plants and algae cultivation. Like renewable energy, however, these products made of CO2 are still expensive and not popular. Hence, it is important to note that policy makers need to create the incentive to expand the market for CO2 products. Besides, it must be noted that the destruction of natural resources such as deforestation also leads to an increase in CO2 emissions.

Notwithstanding the limited data, we believe that this study may contribute to existing literatures on the linkage between environment and income.

Notes

Ibaragi, Tochigi, Gunma, Saitama, Chiba, Tokyo, Kanagawa, Toyama, Fukui, Shizuoka, Aichi, Mie, Shiga, Osaka, and Hiroshima.

Miyagi, Yamagata, Fukushima, Niigata, Ishikawa, Yamanashi, Nagano, Gifu, Kyoto, Hyogo, Wakayama, Okayama, Yamaguchi, Tokushima, Kagawa, and Fukuoka.

Hokkaido, Aomori, Iwate, Akita, Nara, Tottori, Shimane, Ehime, Kochi, Saga, Nagasaki, Kumamoto, Oita, Miyazaki, Kagoshima, and Okinawa.

The model is given by: \(\Delta Y_{i,t} = \alpha_{i} + \beta Y_{i,t - 1} + \mathop \Sigma \nolimits_{k = 1}^{n} \varphi_{k} \Delta Y_{i,t - k} + \delta_{i} t + \varepsilon_{it}\). The null hypothesis of \(\beta = 0\) will be tested against the alternative hypothesis of \(\beta < 0\).

References

Ajmi, A.N., Hammoudeh, S., Nguyen, D.K., Sato, J.R.: On the relationships between CO2 emissions, energy consumption and income: the importance of time variation. Energy Econ. 49, 629–638 (2015)

Aslan, A., Destek, M.A., Okumus, I.: Bootstrap rolling window estimation approach to analysis of the environment Kuznets curve hypothesis: evidence from the USA. Environ. Sci. Pollut. Res. 25, 2402–2408 (2018)

Al-Mulali, U., Ozturk, I.: The investigation of environmental Kuznets curve hypothesis in the advanced economies: the role of energy prices. Renew. Sustain. Energy Rev. 54, 1622–1631 (2016)

Anderson, T.W., Hsiao, C.: Estimation of dynamic models with error components. J. Am. Stat. Assoc. 76, 598–606 (1981)

Arellano, M., Bond, S.: Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 58, 277–297 (1991)

Baltagi, B.H.: Econometric Analysis of Panel Data, 2nd edn. Wiley, Chichester (2001)

Bilgili, F., Kocak, E., Bulut, U.: The dynamic impact of renewable energy consumption on CO2 emissions: a revisited environmental Kuznets curve approach. Renew. Sustain. Energy Rev. 54, 838–845 (2016)

Boluk, G., Mert, M.: Fossil & renewable energy consumption, GHGs (greenhouse gases) and economic growth: evidence from a panel of EU (European Union) countries. Energy 74, 439–446 (2014)

Churchill, S.A., Inekwe, J., Ivanovski, K., Smyth, R.: The environmental Kuznets curve in the OECD: 1870–2014. Energy Economics 75, 389–399 (2018)

Dogan, E., Ozturk, I.: The influence of renewable and non-renewable energy consumption and real income on CO2 emissions in the USA: evidence from structural break tests. Environ. Sci. Pollut. Res. 24, 10846–10854 (2017)

Grossman, G. M. and Krueger, A. B. (1991). “Environmental impacts of a North American free trade agreement”, NBER Working Paper No. 3914.

Grossman, G.M., Krueger, A.B.: Economic growth and the environment. Q. J. Econ. 110, 353–377 (1995)

Hailemariam, A., Dzhumashev, R. and Shahbaz, M. (2019). “Carbon emissions, income inequality and economic development”, Empirical Economics, pp. 1–28.

Hasan, K., Salim, R.: Population ageing, income growth and CO2 emission: empirical evidence from high income OECD countries. J. Econ. Stud. 42, 54–67 (2015)

Iwata, H., Okada, K., Samreth, S.: Empirical study on the determinants of CO2 emissions: evidence from OECD countries. Appl. Econ. 44, 3513–3519 (2012)

Jebli, M.B., Youssef, S.B., Ozturk, I.: Testing environmental Kuznets curve hypothesis: The role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol. Indic. 60, 824–831 (2016)

Levin, A., Lin, C., Chu, J.: Unit root test in panel data: asymptotic and finite-sample properties. J. Econom. 108, 1–24 (2002)

Musolesi, A., Mazzanti, M., Zoboli, R.: A panel data heterogeneous Bayesian estimation of environmental Kuznets curves for CO2 emissions. Appl. Econ. 42, 2275–2287 (2010)

Onafowora, O., Owoye, O.: Bounds testing approach to analysis of the environment Kuznets curve hypothesis. Energy Econ. 44, 47–62 (2014)

Rafindadi, A.A.: Revisiting the concept of environmental Kuznets curve in period of energy disaster and deteriorating income: empirical evidence from Japan. Energy Policy 94, 274–284 (2016)

Roach, T.: A dynamic state-level analysis of carbon dioxide emissions in the United States. Energy Policy 59, 931–937 (2013)

Shahbaz, M., Shafiullah, M., Papavassiliou, V.G., Hammoudeh, S.: The CO2-growth nexus revisited: a nonparametric analysis for the G7 economies over nearly two centuries. Energy Econ. 65, 183–193 (2017)

Soytas, U., San, R., Ewing, B.T.: Energy consumption, income, and carbon emissions in the United States. Ecol. Econ. 62, 482–489 (2007)

Yaguchi, Y., Sonobe, T., Otsuka, K.: Beyond the environmental Kuznets curve. A comparative study of SO2 and CO2 emissions between Japan and China. Environ. Dev. Econ. 12, 445–470 (2007)

Yilanci, V., Ozgur, O.: Testing the environmental Kuznets curve for G7 countries: evidence from a bootstrap panel causality test in rolling windows. Environ. Sci. Pollut. Res. 24, 24795–24805 (2019)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ito, K. The relationship between CO2 emissions and income: evidence from Japan. Lett Spat Resour Sci 14, 261–267 (2021). https://doi.org/10.1007/s12076-021-00277-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12076-021-00277-2