Abstract

Carbon dioxide (CO2) emissions entail a key component of greenhouse gases (GHGs) and are crucial for global warming and climate change issues. Although the environmental Kuznets curve (EKC) pattern of the emissions–income nexus has intrigued many researchers for a long time, few studies cover a wide range of economic sectors and a large number of countries, which calls for the re-investigation of sector-wise EKC arguments. Thereby, we investigate the long-run equilibrium relationship between CO2 emissions and per capita income in a panel of 86 developing and developed countries for the period from 1990 through 2015. Our findings show that the EKC holds for three sectors: the electricity and heat production sector, the commercial and public services sector, and the other energy industry own use sector with the turning points of approximately 21,000 USD, 3000 USD, and 5000 USD, respectively. Additionally, emissions decrease monotonically for the manufacturing industries and construction sector, the residential sector, and the agriculture, forestry, and fishing sector, whereas they increase monotonically with the development of the transport sector. Policymakers should consider adopting sector-specific environmental policies based on each sector’s unique income–emission relationship, to mitigate CO2 emissions effectively, and attain sustainable economic growth.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since the pioneering work of Grossman & Krueger (1991), many studies have evaluated the environmental Kuznets curve (EKC) hypothesis to investigate the relationship between economic development and emissions (Alola & Ozturk, 2021; Baloch et al., 2021; Sarkodie & Ozturk, 2020). However, a crucial issue is, the emission–income relationship can differ across economic sectors. From the perspective of carbon dioxide (CO2) emission dynamics, each economic sector has different features, depending on its energy requirements, variety of available energy resources, technological advancement, economies of scale, and governmental policies. Such diversified features cause different sectors to follow different paths of the structural transformation of energy dynamics during economic development, which could result in different patterns of the emissions–income relationship, across economic sectors. For example, the transportation sector experiences a surge in the movement of people and products, owing to globalization (Sharif et al., 2020); the residential sector experiences energy ladder patterns in the sense that households shift from dirty traditional fuels to clean modern fuels as their income level rises (Hosier & Dowd, 1987; Leach, 1992). Although some studies examine the sectoral emissions–income nexus while focusing on a specific sector, such as the manufacturing, transportation, and residential sectors, and on a specific country, region, or group of countries (Congregado et al., 2016; Raza et al., 2020; Wang et al., 2017; Zhang et al., 2019b), comprehensive studies on a wide range of economic sectors and countries are still scarce. This study attempts to fill this gap by examining the validity of the EKC argument in seven economic sectors, over 86 developed and developing countries.

Today, economies rely on fossil fuel energy, such as coal, oil, and natural gas significantly. This is one of the critical causal factors of higher carbon dioxide (CO2) emissions in the atmosphere and global warming. The World Bank estimates that per capita CO2 emissions had accelerated from 1.5 metric tons in 1980 to 7.5 metric tons in 2014. Moreover, the Intergovernmental Panel on Climate Change’s (IPCC) Special Report (2019) emphasizes that the global temperature will reach 1.5 °C above pre-industrial levels by 2040 if the uncontrolled emissions of global greenhouse gas continue, emphasizing the threat of environmental issues. Currently, many countries are the parties of the 2016 Paris Agreement to limit global warming well below 2 °C, which has shed light on the importance of curbing CO2 emissions at the global level. Moreover, as we strive for “achieving universal access to economic, safe and modern energy services by 2030” as stipulated in the Sustainable Development Goals (SDGs), reduction in CO2 emissions through transitioning to cleaner renewable energy sources, such as hydropower, solar, wind, and geothermal, has become an utmost priority for policymakers.

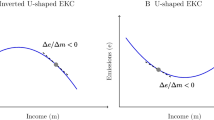

Many studies have found an association between CO2 emissions and income level (Apergis & Ozturk, 2015; Boutabba, 2014; Ganda, 2019; Jalil & Feridun, 2011; Kais & Sami, 2016; Ozturk & Acaravci, 2013; Shahbaz et al., 2019). These studies generally provide evidence of an inverted U-shape relationship, the environmental Kuznets curve (EKC) hypothesis, in which CO2 emissions increase with an increase in the income level until reaching a threshold level, and decline as the income level continues to surge beyond the threshold level. Most studies focus on the aggregate country-level of CO2 emissions. However, studies have not examined the income–emissions relationship at the sectoral level sufficiently.

Countries are likely to undergo economic and industrial structural changes as they develop, thereby some sectors expand, whereas others shrink. Additionally, each sector has unique characteristics regarding energy mix, energy intensity, energy alternatives, and technologies. For example, households in the residential sector switch their energy consumption from dirtier (e.g., firewood, charcoal, and bio-wastes) to clean sources (e.g., gas, electricity, and solar) as they achieve higher income levels (Leach, 1992; Saatkamp et al., 2000). The electricity and heat production sector is considered to transform from conventional non-renewable energy sources (e.g., coal, gas, and oil) to renewable energy sources (e.g., hydropower, nuclear power, and wind power) with the attainment of a higher income level (Wang et al., 2017). Such sectoral heterogeneity suggests that different sectors may have different patterns in the income–emissions relationship. This motivates us to investigate the sectoral income–emissions relationship in both developed and developing countries, which will help us implement a uniquely designed environmental regulatory framework for each sector to address environmental quality issues effectively.

Some empirical studies focus on sector-wise CO2 emissions. However, their coverage is generally limited to specific sectors, countries, or groups of countries. Among these studies, some examined the income–emissions relationship for specific sectors (Hashmi et al., 2020, for the service sector; Zhang et al., 2019b, for the manufacturing and construction sector; Anser et al., 2020, for the residential sector), for specific countries (Wang et al., 2017, for China; Aslan et al., 2018, for the USA; Gokmenoglu & Taspinar, 2018, for Pakistan; Prastiyo et al., 2020, for Indonesia), and a specific group of countries (Pablo-Romero & Sánchez-Braza, 2017, for the European Union; Raza et al., 2020, for 16 emerging countries; Murshed et al., 2020, for the Organization of the Petroleum Exporting Countries (OPEC) countries). In contrast, our study investigates the income–emissions relationship by covering a wide range of sectors and numerous developed and developing countries. In this respect, our study explores the prominent features of the diversity of sectoral emissions and reveals distinct income–emission patterns in multiple economic sectors, which is a novel contribution to the existing literature in the context of environment and development studies. Following the classification of the International Energy Agency (IEA), we consider CO2 emissions for seven economic sectorsFootnote 1: (i) electricity and heat production, (ii) manufacturing industries and construction, (iii) residential, (iv) transport, (v) agriculture, forestry, and fishing; (vi) commercial and public services; and (vii) other energy industry own use. We use panel data from 86 developed and developing countries from 1990 to 2015. Our analysis allows us to evaluate whether the EKC hypothesis holds for each sector comprehensively.

We examine the long-run income–emissions relationship with their short-run dynamics using a panel autoregressive distributed lag (ARDL) model proposed by Pesaran et al. (1999). Our analysis shows clear differences in the income–emissions relationship across sectors. The EKC hypothesis holds for three sectors (electricity and heat production, commercial and public services, and other energy industry own use). Regarding these three sectors, at the early stage of development, sector-wise CO2 emissions increase with an increase in income level. Once the income level reaches a threshold level, sector-wise CO2 emissions start declining. The results also show that as the income level increases, the commercial and public services sector first reaches its threshold income level, followed by the other energy industry own use sector and the electricity and heat production sector. In contrast, our study does not observe EKC patterns for the other four sectors (manufacturing industries and construction, residential, transport, agriculture, forestry, and fishing. Sector-wise CO2 emissions are negatively linked with the income level of the manufacturing industries and construction sector, the residential sector, and the agriculture, forestry, and fishing sector. However, these are positively associated with the income level in the transport sector. Several sensitivity tests were performed to confirm the consistency of the main results.

These findings make some key contributions to the design and implementation of environmental policies. First, developing countries should focus more on the sectors in which the EKC hypothesis holds (electricity and heat production, commercial and public services, and other energy industry own use) to mitigate the environmental degradation associated with economic progress. Second, both developed and developing countries could benefit from expediting the pace of emissions reduction in sectors where the emissions are negatively linked with the income level (manufacturing industries and construction, residential, agriculture, forestry, and fishing) by implementing appropriate policy measures. Third, both developed and developing countries should prioritize the transport sector in their national plans and programs to improve environmental quality, as this sector is vulnerable to the increase in emissions as their economies develop.

The rest of the paper is organized as follows. Section 2 comprises the literature review. Section 3 describes the empirical analysis, which encompasses data and model specifications. Section 4 presents the empirical results and related discussions. Section 5 concludes the study and provides policy suggestions.

2 Literature review

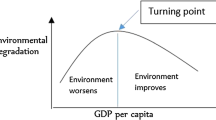

2.1 The environmental Kuznets curve hypothesis

The environmental Kuznets curve (EKC) is the hypothesized association between economic development and environmental degradation. EKC is named after Kuznets (1955), who first conceptualized the bell-shaped relationship between income inequality and economic development. The EKC concept emerges following Grossman & Krueger's (1991) study, which shows that the relationship between pollution and economic growth resembles an inverted U-shaped curve. Environmental degradation and pollution increase in the early stages of economic development. However, they subside with further economic growth after reaching a certain income level.

Grossman (1995) presented three possible channels for a bell-shaped EKC pattern: the scale effect, composition effect, and technique effect. First, at the early stage of development, a country experiences a scale effect in which the pollution level rises along with increased economic activities. At this stage, environmental quality continues to deteriorate as policymakers overlook environmental issues, and people have a greater tolerance for pollution. Second, as the country enters a more advanced stage of development, the economy undergoes a structural transformation from dirtier to cleaner economic activities, including the movement of resources from the polluting industrial sector to the cleaner service sector as well as the establishment of cleaner industries, which is considered the composition effect. Third, technological progress accelerates at the final stage of economic development as governments implement environment-saving policies, and citizens demand a healthier and cleaner environment, resulting in a lower level of environmental degradation under the technique effect. Many empirical studies support the concept of nonlinear relationships (Chen et al., 2019, for China; Usman et al., 2019, for India; Sun et al., 2020, for the Organization for Economic Cooperation and Development (OECD) region and Belt and Road region; Churchill et al., 2020, for Australian states and territories; Alola & Ozturk, 2021, for the USA; Baloch et al., 2021, for the OECD countries; Sarkodie & Ozturk, 2020, for Kenya). Some studies extend the EKC concept even further by incorporating other macroeconomic variables, such as industrial structure and urbanization. For example, Wang & Wang (2021a) investigated the nonlinear effects of population aging on CO2 emissions in 137 countries by employing a panel threshold regression (PTR) model, and indicated that the associations between industrial structure and CO2 emissions with the increase in population aging are positive, negative, and have an inverted U-shaped in high-income, upper-middle-income, and low-income countries, respectively. Additionally, following the increase in population aging, the associations between urbanization and CO2 emissions in high-income countries have an inverted U-shape, whereas the associations in the upper-middle, lower-middle, and low-income groups are nonlinear and positive.

Although many empirical studies support the EKC hypothesis, they have often been criticized for various issues (Kaika & Zervas, 2013). First, the assumption of a normal distribution of world income level in the EKC hypothesis has been criticized as it may result in an inaccurate estimate of the turning point for the EKC. This is attributed to the fact that a significantly larger number of people are below the world’s mean income level, which causes world income distribution to be highly skewed (Stern et al., 1996; Stern, 2004a). Second, it is often argued that developing countries cannot reduce pollutant emissions at a later stage of development compared with what developed countries had achieved in the past. This is attributed to the fact that developed countries take advantage of developing countries with less strict regulations by relocating their domestic pollution-intensive industries to developing countries, and the developing countries are not in a position to outsource their pollution-intensive industries to other countries any further (Cole, 2004; Stern et al., 1996). Third, even if developed countries reduce production-based pollution through technological advancement and structural changes, their consumption remains pollution-intensive (Wagner, 2010). Therefore, the overall effect may cause higher environmental degradation, which the EKC hypothesis may not reflect (Kaika & Zervas, 2013). Fourth, some empirical studies claim that the EKC hypothesis does not hold for pollutants that have long-term effects on human health and the quality of life and a comparatively high abatement cost (Arrow et al., 1995; Dinda, 2004). Finally, several studies criticize the previous empirical findings related to the EKC hypothesis for the limited coverage and poor quality of data (Stern et al., 1996), assuming that every country would follow a similar EKC pattern in the panel data, ignoring the heterogeneity of countries in nature (De Bruyn et al., 1998), omitted variable bias (Stern, 2004b), problems of using a mixture of stationary and non-stationary series leading to misleading inferences in panel unit root tests (Lee & Lee, 2009), and the assumption of unidirectional causality running from income to environmental quality (Arrow et al., 1995; Stern et al., 1996).

Several related studies do not provide clear evidence of the EKC hypothesis. For example, Zoundi (2017) investigated 25 selected African countries over the period from 1980 through 2012, and showed that the EKC hypothesis does not hold. Using data that spanned from 1857 to 2007, Esteve & Tamarit (2012) failed to observe the EKC relationship between per capita CO2 and per capita income for the Spanish economy. Some studies also verify different shapes of the nonlinear relationship between income and CO2 emissions, such as N- and U-shaped relationships (e.g., an N-shaped EKC by Lorente & Álvarez-Herranz, 2016, for 17 OECD countries; Bekun et al., 2021a, for 10 sub-Saharan African countries; a U-shaped EKC by Ozcan, 2013, for 12 Middle East countries), and argue that the income–emissions relationship may be more complicated than what the EKC hypothesis assumes.

Existing related studies also discuss the role of other macroeconomic indicators, such as trade openness, energy consumption, renewable energy, and urbanization, in relation to CO2 emissions in various regions and countries. For example, Adedoyin et al. (2021a) showed that sustainable and alternative energy are negatively associated with CO2 emissions, while trade openness and income are positively associated with CO2 emissions in 27 European Union countries. Nathaniel et al. (2021) found that CO2 emissions are positively related to urbanization, natural resources, economic growth, and globalization, while human capital is negatively related to CO2 emissions in 18 Latin American and Caribbean countries. Several studies also showed that CO2 emissions are negatively associated with economic growth, trade openness, and economic policy uncertainty (Adedoyin et al., 2021b; Udemba et al., 2021; Wada et al., 2021).

2.2 Sector-wise CO2 emissions and the income level

Recently, in the wake of climate change issues, studies on the EKC hypothesis for the income–pollution nexus in different economic sectors have received attention. Most of these studies provide evidence of the EKC hypothesis for sectoral CO2 emissions. For example, Congregado et al. (2016) investigated the existence of the EKC hypothesis for the income–pollution nexus in five economic sectors (commercial, electrical, industrial, residential, and transport sectors) in the USA, by applying the dynamic ordinary least squares (DOLS) method with structural breaks for the period from 1973Q1 to 2015Q2, and proved that the EKC holds in all sectors except the industrial sector. Using panel data and panel fixed effects regression, Wang et al. (2017) examined the relationship between economic growth and industrial CO2 emissions in three sectors, including the mining, manufacturing, electricity, and heat production sectors in China spanning from 2000 through 2013, and found evidence of the EKC hypothesis in the electricity and heat production sector. Zhang et al. (2019b) examined the nexus between income and CO2 emissions in the manufacturing and construction industry sector of 121 countries throughout 1960–2014, using the panel fixed effects estimation and confirmed that the EKC hypothesis can be validated in 95 out of 121 countries, during the stated study period. Employing fully modified ordinary least squares (FMOLS) for the panel data of 16 emerging economies, Raza et al. (2020) found the validity of the EKC hypothesis in the residential sector.

Among related studies on sector-wise CO2 emissions, some fail to provide evidence of the EKC hypothesis, while others observe various shapes of the nonlinear income–emissions relationship. For example, Fujii & Managi (2013) identified the N-shaped pattern between income level and CO2 emissions in nine industries in the OECD from 1970 to 2005, using a panel regression analysis. Moutinho et al. (2020) confirmed the U-shaped relationship between economic development and sectoral CO2 emissions in three sectors (agriculture, forestry, and fisheries; construction; remaining activities) out of seven sectors of 12 oil-producing and exporting countries (OPEC) from 1992 to 2015, using the panel-corrected standard error (PCSE) model. Erdoğan et al. (2020) could not prove the existence of the EKC hypothesis in the energy, transport, and other sectors of 14 G20 countries during the period from 1991 to 2017.

Although many studies examine the linkage between sector-wise CO2 emissions and income level, the scope of their studies is limited to a specific sector, country, or group of countries. To the best of our knowledge, this study is the first to examine the existence of the EKC pattern of the income–emissions relationships, incorporating both developed and developing countries, and covering a comprehensive range of economic sectors. By addressing the distinguished features of sectoral heterogeneity representing different income–emission nexuses in multiple economic sectors, our study could make a valuable contribution to the existing literature in the context of environment and development studies. Furthermore, evaluating the presence of the EKC pattern for each sector enables environmental regulators to plan and implement effective environmental policies to mitigate pollution issues in different economic sectors.

3 Methodology and data

3.1 Data

This study employs yearly panel data from 86 developing and developed countries from 1990 to 2015.Footnote 2 Table 1 presents a list of the sample countries. We use the database of the International Energy Agency (IEA) on CO2 emissions from fuel combustion to obtain sector-wise CO2 emissions. Our study analyzes the total CO2 emissions and seven sectors (components) of (i) electricity and heat production; (ii) manufacturing industries and construction; (iii) residential; (iv) transport; (v) commercial and public services; (vi) agriculture, forestry, and fishing; and (vii) other energy industry own useFootnote 3 (International Energy Agency, 2021) to ascertain the relationships between sector-wise CO2 emissions and per capita income level. We use the World Development Indicators (WDI) of the World Bank to acquire other variables such as per capita GDP, total final energy consumption, and total renewable energy share.

Table 2 presents the descriptive statistics of the variables used in the analysis. Regarding sector-wise CO2 emissions, the electricity and heat production sector produces the largest share of CO2 emissions on average, followed by the transport sector. The other energy industry own use sector produces the smallest share of CO2 emissions. Table 3 presents the correlation matrix of the variables. As expected, CO2 emissions positively correlate with the total energy consumption and negatively correlate with renewable energy share. Additionally, CO2 emissions are positively correlated with income levels.

3.2 Model specification

This study aims to investigate the nonlinear relationship between income level and sector-wise CO2 emissions. To identify the relationships, we consider the following model specifications for each sectorFootnote 4:

where \({lnCO}_{2it}\) is the log of sector-wise CO2 emissions (kt of CO2) in country \(i\) in year \(t\), \({lnY}_{it}\) is the log of the income level, \({X}_{k,it}\)’s are other control variables expected to relate to CO2 emissions, and \({u}_{it}\) is the error term. The design of the empirical model specification and the selection of explanatory variables are based on the existing literature (Ganda, 2019; Liu et al., 2017; Sugiawan & Managi, 2016; Zoundi, 2017). The quadratic specification of income level is extensively used in research related to the EKC hypothesis of the income–emissions relationship. The quadratic model specification captures the nonlinear linkage between sector-wise CO2 emissions and per capita income level. This study uses real GDP per capita as a measure of a country’s income level. Additionally, we incorporate the log of the total final energy consumption (terajoules) and the share of renewable energy in the total final energy consumption for other control variables into the model.

We employ a panel ARDL model to estimate the short- and long-run dynamics of the relationship between income level and CO2 emissions. The panel ARDL model is more advantageous than other dynamic panel models, such as the fixed effects and the generalized methods of moment (GMM) estimators introduced by Anderson & Hsiao (1981, 1982), Arellano (1989), and Arellano & Bover (1995). It can be used to investigate a long-run relationship regardless of whether the variables are stationary at the level, at the first difference, or an integration of both (Pesaran et al., 2001). Furthermore, the ARDL estimates are unbiased, despite some regressors being endogenous (Harris & Sollis, 2003; Jalil & Ma, 2008). Additionally, the ARDL model is reliable for small samples (Haug, 2002).

To estimate the short-run and long-run associations between income level and CO2 emissions, this study considers a panel ARDL model for Eq. (1), which takes the following error correction form:

where Δ is the difference operator, \(\ln {\text{CO}}_{2it}\) is the log of sector-wise CO2 emissions (kt), \(Z_{it}\) is the vector of explanatory variables (the log of GDP per capita and its squared value, the log of GDP per capita square, the log of total final energy consumption, and renewable energy share), \(ECT_{it}\) is the error correction term, and \(\varepsilon_{it}\) is the error term. The coefficient \(\varphi_{i} = \left( {1 - \mathop \sum \nolimits_{j = 1}^{p} \alpha_{ij} } \right)\) on the error correction term captures the speed of convergence to the long-run equilibrium. The coefficient of the error correction term must be significantly negative (i.e., \(\varphi_{i} < 0\)), so that the system converges to the long-run equilibrium. The long-run coefficient is given by \(\theta_{i} = - \frac{{\mathop \sum \nolimits_{j = 0}^{q} \beta_{ij} }}{{\varphi_{i} }}\). The coefficients of the short-run dynamics are given by \(\alpha_{ij}^{*} = - \mathop \sum \nolimits_{d = j + 1}^{p} \alpha_{i,d}\) and \(\beta_{ij}^{*} = - \mathop \sum \nolimits_{d = j + 1}^{p} \beta_{i,d}\). A panel ARDL model estimation can be performed using the mean group (MG) or panel mean group (PMG) estimator (Pesaran & Smith, 1995; Pesaran et al., 1999). The MG estimator allows parameters to differ across countries, while the PMG estimator imposes a homogeneity restriction on the long-run coefficients. However, it allows short-run coefficient and error variances to vary across countries. We perform the Hausman test to ascertain whether the MG or PMG estimator is appropriate for our panel ARDL model.

4 Results

4.1 Panel unit root tests

The panel ARDL model requires that all the variables are stationary at the level or the first difference (Pesaran et al., 1999, 2001). Previous studies examined the stationarity of variables using traditional unit root tests, such as Levin et al. (2002), Breitung (2000), Im et al. (2003), and Hadri (2000). However, these traditional unit root tests assume cross-sectional error independence in the panel data and are likely to suffer bias and inconsistencies (Banerjee et al., 2004; Phillips & Sul, 2003). Therefore, we need to ascertain whether the variables have cross-sectional dependence or independence in testing the stationarity of the variables. To verify the presence of cross-section dependence, we apply the cross-section dependence (CD) test introduced by Pesaran (2004). It is applicable to various panel data models, including stationarity and unit root dynamic heterogeneous panels with short periods and large cross-section units. Moreover, it is robust to the presence of unit roots and structural breaks. Table 4 presents the results of the CD test statistics, which confirm the presence of cross-section dependence for all the variables at the 1% significance level. Once all the variables are cross-sectionally dependent, we examine the stationarity of each variable using the cross-sectionally augmented IPS (CIPS) test of Pesaran (2007), allowing for heterogeneity and cross-sectional dependence. The test is based on an extended version of standard augmented Dickey–Fuller (ADF) regressions with the cross-sectional averages of lagged levels and first differences of the individual time series. Table 5 shows the CIPS test statistics, which confirm that all the variables are stationary at the level or the first difference at the 1% significance level. This result allows us to proceed with the analysis of panel cointegration and ARDL estimation.

4.2 Panel cointegration test

Most studies consider cointegration tests that are based on residual-based cointegration tests as proposed by Engle & Granger (1987), Kao (1999), and Pedroni (2004), which require the long-run cointegrating vector at levels equal to the short-run adjustment process in their differences. This restriction is considered a common-factor restriction. Failure to comply with such a restriction results in a loss of power for residual-based cointegration tests (Banerjee et al., 1998; Kremers et al., 1992). The loss of power may result in a failure to reject the null hypothesis of no-cointegration, even in cases where cointegration is significantly suggested by theory (Westerlund, 2007).

Westerlund (2007) developed panel cointegration tests based on structural dynamics rather than relying on common-factor restrictions. This cointegration test provides better size accuracy and higher power than other residual-based cointegration tests. Westerlund (2007) proposed four test statistics: group mean statistics (Gτ and Gα) and panel statistics (Pτ and Pα). The group mean statistics are designed to test whether at least one cross section is cointegrated. In contrast, the panel statistics are designed to test whether the entire panel is cointegrated. The test statistics of the cointegration tests in Table 6 show that the Gτ and Pτ statistics (except the agriculture, forestry, and fishing sector) are statistically significant, which implies that there is a cointegration or long-run relationship among the variables.

4.3 ARDL estimation

After the completion of the stationarity and cointegration tests, we estimate the ARDL model. As suggested by Pesaran & Smith (1995) and Pesaran et al. (1999), we perform the Hausman test to select the MG or PMG estimator. The Hausman test statistics are insignificant for all sectors, implying that the PMG estimator is preferable to the MG estimator (Table 7). Therefore, we adopt the PMG-ARDL model to estimate the income–emissions relationship for each sector.

Table 7 presents the long-run and short-run coefficients of the PMG-ARDL models with linear and quadratic specifications for the total CO2 emissions and sector-wise CO2 emissions. Regarding the model with total CO2 emissions as the dependent variable, the estimates show that the final energy consumption is positively related to the total CO2 emissions, and renewable energy share is negatively related to the total CO2 emissions. The long-run coefficients of the log of real GDP per capita and its square term are significantly positive and negative, respectively, confirming the validity of an inverted U-shaped environmental Kuznets curve for the income–emissions relationship. CO2 emissions increase at the beginning of the development stage of a country and decline after reaching a certain threshold income level (also known as the turning or reversal point). The threshold income level is approximately 16,000 USD for the total CO2 emissions. Our results for the inverted U-shaped income–emission relationship for the total CO2 emissions are consistent with the findings of recent studies such as Alola & Ozturk (2021), Baloch et al. (2021), Bekun et al. (2021b), and Sarkodie & Ozturk (2020).

More importantly, considering sector-wise CO2 emissions as the dependent variable of the ARDL model, we observe the apparent heterogeneity of the income–emissions relationship across sectors. Based on the estimated long-run coefficients of the log of real GDP per capita and its square term, all the sectors can generally be divided into three groups: (i) the sectors supporting the EKC hypothesis, (ii) the sectors with a negative income–emissions relationship, and (iii) the sectors with a positive income–emissions relationship. Figure 1 presents a summary of the main results.

The first group supporting the EKC hypothesis encompasses three sectors: the electricity and heat production sector, the commercial and public services sector, and the other energy industry own use sector. In these sectors, the estimated long-run coefficients of the log of real GDP per capita and its square term are significantly positive and negative, respectively, similar to the case of the total CO2 emissions. Given the large share of CO2 emissions from the electricity and heat production sector, the nonlinear pattern of the income–emissions relationship in the sector could be a source of the EKC pattern for the total CO2 emissions. The estimated turning point for the electricity and heat production sector is approximately 21,000 USD, which is close to that for the total CO2 emissions. Additionally, the estimated threshold income level for the commercial and public services sector and the other energy industry own use sector is approximately 3,000 USD and 5,000 USD, respectively, which are significantly lower than those for the electricity and heat production sectors. Regarding the three sectors that exhibit the EKC pattern, sector-wise CO2 emissions increase at the early stage of the development of a country. However, CO2 emissions peak out first for the commercial and public services sector, then for the other energy industry own use sector, and finally for the electricity and heat production sector.

Our results regarding the electricity and heat production sector are consistent with the findings of Aslan et al. (2018), showing that the EKC holds in the electrical sector in the USA. However, they are in contrast to the findings of Akbar et al. (2021) who showed that the economic growth drives the aggregate demand for energy in the belt and road initiative (BRI) countries, resulting in an elevated level of CO2 emissions in the electricity and heat production sector. Concerning the commercial and public services sector, our results coincide with the findings of Hashmi et al. (2020) regarding the service sector in Pakistan, and those of Azizalrahman and Hasyimi (2019) regarding the commercial sector of upper-middle-income countries. However, Aslan et al. (2018) failed to confirm the existence of the EKC phenomenon in the commercial sector in the USA, implying that the USA is unsuccessful in using environmentally friendly technologies in the commercial sector.

The difference in turning points across sectors may relate to the argument of Grossman (1995) that the EKC pattern comes from three channels: scale, composition, and technique effects. Compared to the other two sectors, the electricity and heat production sector is likely to have a more substantial scale effect owing to the argument that countries at the early stages of development focus on increasing electricity demand along with economic growth. In contrast, the commercial and public services sector and the other energy industry own use sector tend to experience the composition effect associated with the transformation from dirtier to cleaner economic activities and the technique effect associated with the adoption of advanced technology and the clean energy-oriented regulations of governments.

The second group, supporting a negative income–emissions relationship, comprises three sectors: the manufacturing industries and construction sector, the residential sector, and the agriculture, forestry, and fishing sector.Footnote 5 In these sectors, we observe that sector-wise CO2 emissions monotonically decline with rising income levels. The negative relationship generally implies that the composition and technique effects offset the scale effect in these sectors. At the early stage of the development of manufacturing industries and construction sector, CO2 emissions are relatively high owing to the high dependency on inefficient technology and traditional forms of energy sources such as burning wood, charcoal, and bio-waste. This sector further undergoes a transformation process toward modern technology with high energy efficiency as the manufacturing and construction industries develop, resulting in a reduction in CO2 emissions. Our results in the manufacturing industries and construction sector are inconsistent with the findings of previous studies, showing the validity of the EKC hypothesis (Fujii & Managi, 2013, for three industrial sectors, including the construction industry in the OECD member countries; Fujii & Managi, 2016, for the industrial sector in 39 developing countries; Xu & Lin, 2016 for the manufacturing industry in China).

The negative income–emissions relationship in the residential sector can be explained by the fuel-switching behavior of households proposed by the ‘energy ladder model’ (Hosier & Dowd, 1987; Leach, 1992). According to the energy ladder model, households in the residential sector often switch fuels from dirtier to cleaner ones, driven mainly by income level and fuel costs (Saatkamp et al., 2000). Our findings are in line with those of Ma et al. (2019), in which the transition from coal to electricity in the residential building sector of China is driven by economic development, resulting in a reduction in CO2 intensity over the past decade. However, our findings are inconsistent with the findings of Anser et al. (2020), which confirm the existence of a U-shaped income–emission relationship in the residential sector in the South Asian Association for Regional Cooperation (SAARC) member countries. Moreover, the monotonically declining property of CO2 emissions in the agriculture, forestry, and fishing sector with an increase in the income level suggests that the composition and technique effects dominate the scale effect in the process of economic development, similar to the case of the manufacturing industries and construction sector. Our results regarding the agriculture, forestry, and fishing sector are inconsistent with the findings of Zhang et al. (2019a), which showed an inverted U-shape income–emissions relationship in the agriculture, forestry, and fishing sector in China’s main grain-producing areas, suggesting that the improvement in energy-saving technologies in this sector will be apparent at a later stage of development.

The transport sector falls under the third group, in which CO2 emissions monotonically increase with economic development.Footnote 6 Although energy efficiency in the transport sector improves through composition and technique effects along with economic development, our results show a positive income–emissions relationship. This is partly attributed to the argument that economic development is generally associated with globalization, and triggers greater movements of people and products, including business trips, tourism, and trade of goods and services. In this case, the scale effect associated with increased demand for transport services dominates the composition and technique effects, causing CO2 emissions to surge along with economic development. Our results regarding the transport sector are consistent with the findings of Habib et al. (2021) and Wang and Wang (2021c) in G20 countries and China, respectively. However, our results contrast with the findings of Kharbach & Chfadi (2017) and Godil et al. (2020), which show a negative relationship between income and CO2 emissions in the transportation sector of the Morocco and US economies, respectively, implying that the transportation systems of these countries are fuel-efficient with clean energy use.

4.4 Robustness checks

The previous subsection revealed that three sectors follow the EKC patterns of the income–emissions relationships, three sectors follow the monotone decreasing pattern, and one sector follows the monotone increasing pattern. In this subsection, we validate these results using the sensitivity tests. Some studies, such as Stern et al. (1996), criticize the assumption that the normal distribution of world income level may derive unreliable estimates in the EKC argument as a significantly larger number of people are below the world’s mean income level. Therefore, we divide our sample countries into two groups of developed and developing countries and estimate the model with the linear, rather than the quadratic, specification for each group. Applying the World Bank’s income classification, countries in the high-income category are considered developed, and those in the other income categories (upper-middle, lower-middle, and low-income categories) are considered developing.

Table 8 shows the results of the subsampling sensitivity analyses. The total CO2 emissions and sector-wise CO2 emissions in the electricity and heat production sector and the other energy industry own use sector are positively related to the income level for developed countries but negatively related to the income level for developing countries. This finding is consistent with the EKC hypothesis for the two sectors. Contrasting to the baseline findings in the previous subsection, the estimation shows that the commercial and public services sector fails to exhibit the EKC pattern. The sector has a negative income–emissions relationship for both developed and developing countries, although the negative relationship is less substantial for developing countries. Moreover, consistent with the previous baseline findings, the manufacturing industries and construction sector, the residential sector, and the agriculture, forestry, and fishing sector exhibit a negative income–emissions relationship, irrespective of developed and developing countries, while the transport sector has a positive income–emissions relationship. Therefore, the results of the sensitivity tests are generally consistent with the main results.Footnote 7

5 Conclusion

This study investigates the long-run equilibrium relationship between income level and sectoral CO2 emissions in the context of the EKC hypothesis for the panel data of 86 countries, using the PMG-ARDL model. Our empirical results confirm that the income–emissions relationship follows the EKC pattern upon considering the total CO2 emissions at the aggregate level. More importantly, we present some clear pictures of the income–emissions relationships for different sector-wise CO2 emissions. First, the three sectors (electricity and heat production, commercial and public services, and other energy industry own use) follow the EKC patterns. Among these three sectors, CO2 emissions peak out first for the commercial and public services sector, followed by the other energy industry own use sector and the electricity and heat production sector. As a country develops, the composition and technique effects dominate the scale effect in these sectors. Second, the three sectors (manufacturing industries and construction, residential, and agriculture, forestry, and fishing) do not follow the EKC patterns but exhibit a negative income–emissions relationship, where economic development is associated with the reduction in CO2 emissions, partly because the composition and technique effects are substantial from the early stage of development. Third, the transport sector also fails to show the EKC patterns but exhibits a positive income–emissions relationship since the scale effect might be dominant at any stage of economic development.

Previous studies examined the income–emissions relationship at the aggregate level of CO2 emissions or sectoral level in a specific country or region. However, the generalization of these findings for policy formulation might be inappropriate since sector-specific characteristics, such as energy requirement, technological advancement, resource endowment, and alternative energy sources, could make each sector’s income–emissions relationship differ. Considering this fact, we investigate the income–emissions relationship in seven economic sectors for a large panel of developed and developing countries. Our findings provide some important policy implications. First, the electricity and heat production sector, the commercial and public services sector, and the other energy industry own use sector with an inverted U-shaped income–emissions pattern suggest that these sectors require well-crafted environmental policy interventions by the governments of developing countries, especially the electricity and heat production sector, as it has the highest threshold value. Second, a monotonically declining income–emissions relationship in the manufacturing industries and construction sector, the residential sector, and the agriculture, forestry, and fishing sector suggests that emissions decline with economic growth in developed and developing countries. Both developed and developing countries could expedite the pace of emissions reduction along the economic development path by implementing appropriate policy measures. Third, a monotonically increasing income–emissions association in the transport sector indicates that the environmental degradation caused by the sector further exacerbates as a country develops. Therefore, unlike other sectors, the transportation sector requires a swift transition toward modern renewable energy sources to enhance energy efficiency and reduce environmental costs.

Although this study investigates the sectoral income–emissions relationship in the context of the EKC hypothesis in developed and developing countries, there are some limitations. For example, our study does not incorporate the relationship between CO2 emissions and other macroeconomic variables in the context of the EKC hypothesis. Several studies have examined the relationship between emissions and other macroeconomic indicators, such as tourism revenue (Paramati et al., 2017; Zhang & Gao, 2016), renewable energy (Bento & Moutinho, 2016), financial development (Ozatac et al., 2017), urbanization (He et al., 2017; Pata, 2018; Wang et al., 2016), and the recovery of economic growth and energy consumption in the context of the COVID-19 pandemic (Wang & Zhang, 2021c). Similarly, the EKC analysis can be undertaken with various pollutant indicators such as greenhouse gas (GHG) emissions, CO2, methane (CH4), nitrous oxide (N2O), ecological footprint (Ali et al., 2021), methane emissions (Adeel-Farooq et al., 2020), nitrogen oxide emissions (Murshed, 2021), and deforestation rates (Ozatac et al., 2017). Our study only considers CO2 emissions for sectoral EKC analyses. Therefore, the investigation with the inclusion of other macroeconomic and pollutant indicators might help create a more comprehensive understanding of the pattern of the sectoral EKC phenomenon, which could be conducted in future research.

Notes

For the details, see International Energy Agency (2021).

Owing to data unavailability, the coverage of the commercial and public services sector, the agriculture, forestry, and fishing sector, and the other energy industry own use sector is 57, 60, and 61 countries, respectively.

It is worth noting that other energy industry own use sector contains emissions from fuel combusted in oil refineries, for the manufacture of solid fuels, coal mining, oil and gas extraction and other energy-producing industries. Any CO2 emissions from the use of electricity or heat generation are included in the electricity and heat production sector. The manufacturing industries and construction sector comprise CO2 emissions from the combustion of fuels in the industry only.

Additionally, we estimate the linear model specification.

The estimated coefficients of the log of real GDP per capita and its square term are significantly positive and negative, respectively, for the manufacturing industries and construction sector and the agriculture, forestry, and fishing sector. However, the threshold income level is very small, so the income–emissions relationship is negative. Additionally, regarding the residential sector, the estimated coefficients of the log of real GDP per capita and its square term are significantly negative and positive with the large threshold income level, which implies that the income–emissions relationship is negative.

The estimated coefficients of the log of real GDP per capita and its square term are significantly positive and negative with the large threshold income level, which suggests that the income–emissions relationship is positive.

Additionally, we perform two additional sensitivity tests. First, we use per capita CO2 emissions as the dependent variable. Second, we introduce two additional control variables: total natural resource rent (% of GDP) and total trade (% of GDP). Some studies emphasize the crucial roles of natural resource rents and trade openness in relation to CO2 emissions (Bekun et al., 2019; Wang and Wang, 2021b; Wang and Zhang, 2021a, 2021b). We obtain the data of total natural resource rent and the total trade from the World Development Indicators and the Penn World Table, respectively. These sensitivity tests are performed using the nonlinear quadratic specification. The results are presented in Table 9 of Appendix.

References

Adedoyin, F. F., Alola, A. A., & Bekun, F. V. (2021a). The alternative energy utilization and common regional trade outlook in EU-27: Evidence from common correlated effects. Renewable and Sustainable Energy Reviews, 145, 111092. https://doi.org/10.1016/j.rser.2021.111092

Adedoyin, F. F., Ozturk, I., Agboola, M. O., Agboola, P. O., & Bekun, F. V. (2021b). The implications of renewable and non-renewable energy generating in Sub-Saharan Africa: The role of economic policy uncertainties. Energy Policy, 150, 112115. https://doi.org/10.1016/j.enpol.2020.112115

Adeel-Farooq, R. M., Raji, J. O., & Adeleye, B. N. (2020). Economic growth and methane emission: Testing the EKC hypothesis in ASEAN economies. Management of Environmental Quality: An International Journal, 32(2), 277–289. https://doi.org/10.1108/MEQ-07-2020-0149

Akbar, M. W., Yuelan, P., Maqbool, A., Zia, Z., & Saeed, M. (2021). The nexus of sectoral-based CO2 emissions and fiscal policy instruments in the light of Belt and Road Initiative. Environmental Science and Pollution Research, 28(25), 32493–32507. https://doi.org/10.1007/s11356-021-13040-3

Ali, S., Yusop, Z., Kaliappan, S. R., & Chin, L. (2021). Trade-environment nexus in OIC countries: Fresh insights from environmental Kuznets curve using GHG emissions and ecological footprint. Environmental Science and Pollution Research, 28(4), 4531–4548. https://doi.org/10.1007/s11356-020-10845-6

Alola, A. A., & Ozturk, I. (2021). Mirroring risk to investment within the EKC hypothesis in the United States. Journal of Environmental Management, 293, 112890. https://doi.org/10.1016/j.jenvman.2021.112890

Anderson, T. W., & Hsiao, C. (1981). Estimation of dynamic models with error components. Journal of the American Statistical Association, 76(375), 598–606. https://doi.org/10.1080/01621459.1981.10477691

Anderson, T. W., & Hsiao, C. (1982). Formulation and estimation of dynamic models using panel data. Journal of Econometrics, 18(1), 47–82. https://doi.org/10.1016/0304-4076(82)90095-1

Anser, M. K., Alharthi, M., Aziz, B., & Wasim, S. (2020). Impact of urbanization, economic growth, and population size on residential carbon emissions in the SAARC countries. Clean Technologies and Environmental Policy, 22(4), 923–936. https://doi.org/10.1007/s10098-020-01833-y

Apergis, N., & Ozturk, I. (2015). Testing Environmental Kuznets Curve hypothesis in Asian countries. Ecological Indicators, 52, 16–22. https://doi.org/10.1016/j.ecolind.2014.11.026

Arellano, M. (1989). A note on the Anderson-Hsiao estimator for panel data. Economics Letters, 31(4), 337–341. https://doi.org/10.1016/0165-1765(89)90025-6

Arellano, M., & Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. Journal of Econometrics, 68(1), 29–51. https://doi.org/10.1016/0304-4076(94)01642-D

Arrow, K., Bolin, B., Costanza, R., Dasgupta, P., Folke, C., Holling, C. S., Jansson, B.-O., Levin, S., Mäler, K.-G., Perrings, C., & Pimentel, D. (1995). Economic growth, carrying capacity, and the environment. Ecological Economics, 15(2), 91–95. https://doi.org/10.1016/0921-8009(95)00059-3

Aslan, A., Destek, M. A., & Okumus, I. (2018). Sectoral carbon emissions and economic growth in the US: Further evidence from rolling window estimation method. Journal of Cleaner Production, 200, 402–411. https://doi.org/10.1016/j.jclepro.2018.07.237

Azizalrahman, H., & Hasyimi, V. (2019). A model for urban sector drivers of carbon emissions. Sustainable Cities and Society, 44, 46–55. https://doi.org/10.1016/j.scs.2018.09.035

Baloch, M. A., Ozturk, I., Bekun, F. V., & Khan, D. (2021). Modeling the dynamic linkage between financial development, energy innovation, and environmental quality: Does globalization matter? Business Strategy and the Environment, 30(1), 176–184. https://doi.org/10.1002/bse.2615

Banerjee, A., Dolado, J., & Mestre, R. (1998). Error-correction mechanism tests for cointegration in a single-equation framework. Journal of Time Series Analysis, 19(3), 267–283. https://doi.org/10.1111/1467-9892.00091

Banerjee, A., Marcellino, M., & Osbat, C. (2004). Some cautions on the use of panel methods for integrated series of macroeconomic data. The Econometrics Journal, 7(2), 322–340. https://doi.org/10.1111/j.1368-423X.2004.00133.x

Bekun, F. V., Alola, A. A., Gyamfi, B. A., & Ampomah, A. B. (2021a). The environmental aspects of conventional and clean energy policy in sub-Saharan Africa: Is N-shaped hypothesis valid? Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-021-14758-w

Bekun, F. V., Alola, A. A., Gyamfi, B. A., & Yaw, S. S. (2021b). The relevance of EKC hypothesis in energy intensity real-output trade-off for sustainable environment in EU-27. Environmental Science and Pollution Research, 28(37), 51137–51148. https://doi.org/10.1007/s11356-021-14251-4

Bekun, F. V., Alola, A. A., & Sarkodie, S. A. (2019). Toward a sustainable environment: Nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Science of the Total Environment, 657, 1023–1029. https://doi.org/10.1016/j.scitotenv.2018.12.104

Bento, J. P. C., & Moutinho, V. (2016). CO2 emissions, non-renewable and renewable electricity production, economic growth, and international trade in Italy. Renewable and Sustainable Energy Reviews, 55, 142–155. https://doi.org/10.1016/j.rser.2015.10.151

Boutabba, M. A. (2014). The impact of financial development, income, energy and trade on carbon emissions: Evidence from the Indian economy. Economic Modelling, 40, 33–41. https://doi.org/10.1016/j.econmod.2014.03.005

Breitung, J. (2000). The local power of some unit root tests for panel data. In Advances in econometrics (Vol. 15, pp. 161–177). Emerald (MCB UP ). https://doi.org/10.1016/S0731-9053(00)15006-6N.

Chen, Y., Wang, Z., & Zhong, Z. (2019). CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renewable Energy, 131, 208–216. https://doi.org/10.1016/j.renene.2018.07.047

Churchill, S. A., Inekwe, J., Ivanovski, K., & Smyth, R. (2020). The Environmental Kuznets Curve across Australian states and territories. Energy Economics, 90, 104869. https://doi.org/10.1016/j.eneco.2020.104869

Cole, M. A. (2004). Trade, the pollution haven hypothesis and the environmental Kuznets curve: Examining the linkages. Ecological Economics, 48(1), 71–81. https://doi.org/10.1016/j.ecolecon.2003.09.007

Congregado, E., Feria-Gallardo, J., Golpe, A. A., & Iglesias, J. (2016). The environmental Kuznets curve and CO2 emissions in the USA: Is the relationship between GDP and CO2 emissions time varying? Evidence across economic sectors. Environmental Science and Pollution Research, 23(18), 18407–18420. https://doi.org/10.1007/s11356-016-6982-9

De Bruyn, S. M., van den Bergh, J. C. J. M., & Opschoor, J. B. (1998). Economic growth and emissions: Reconsidering the empirical basis of environmental Kuznets curves. Ecological Economics, 25(2), 161–175. https://doi.org/10.1016/S0921-8009(97)00178-X

del Pablo-Romero, M., & P., and Sánchez-Braza, A. (2017). Residential energy environmental Kuznets curve in the EU-28. Energy, 125, 44–54. https://doi.org/10.1016/j.energy.2017.02.091

Dinda, S. (2004). Environmental Kuznets curve hypothesis: A survey. Ecological Economics, 49(4), 431–455. https://doi.org/10.1016/j.ecolecon.2004.02.011

Engle, R. F., & Granger, C. W. J. (1987). Co-integration and error correction: Representation, estimation, and testing. Econometrica, 55(2), 251. https://doi.org/10.2307/1913236

Erdoğan, S., Yıldırım, S., Yıldırım, D. Ç., & Gedikli, A. (2020). The effects of innovation on sectoral carbon emissions: Evidence from G20 countries. Journal of Environmental Management, 267, 110637. https://doi.org/10.1016/j.jenvman.2020.110637

Esteve, V., & Tamarit, C. (2012). Is there an environmental Kuznets curve for Spain? Fresh evidence from old data. Economic Modelling, 29(6), 2696–2703. https://doi.org/10.1016/j.econmod.2012.08.016

Fujii, H., & Managi, S. (2013). Which industry is greener? An empirical study of nine industries in OECD countries. Energy Policy, 57, 381–388. https://doi.org/10.1016/j.enpol.2013.02.011

Fujii, H., & Managi, S. (2016). Economic development and multiple air pollutant emissions from the industrial sector. Environmental Science and Pollution Research, 23(3), 2802–2812. https://doi.org/10.1007/s11356-015-5523-2

Ganda, F. (2019). Carbon emissions, diverse energy usage and economic growth in south africa: Investigating existence of the environmental kuznets curve (EKC). Environmental Progress & Sustainable Energy, 38(1), 30–46. https://doi.org/10.1002/ep.13049

Godil, D. I., Sharif, A., Afshan, S., Yousuf, A., & Khan, S. A. R. (2020). The asymmetric role of freight and passenger transportation in testing EKC in the US economy: Evidence from QARDL approach. Environmental Science and Pollution Research, 27(24), 30108–30117. https://doi.org/10.1007/s11356-020-09299-7

Gokmenoglu, K. K., & Taspinar, N. (2018). Testing the agriculture-induced EKC hypothesis: The case of Pakistan. Environmental Science and Pollution Research, 25(23), 22829–22841. https://doi.org/10.1007/s11356-018-2330-6

Grossman, G., and Krueger, A. (1991). Environmental Impacts of a North American Free Trade Agreement (No. w3914; p. w3914). National Bureau of Economic Research. https://doi.org/10.3386/w3914.

Grossman, G. M. (1995). Pollution and growth: What do we know? In The economics of sustainable development (pp. 19–46). Cambridge University Press.

Habib, Y., Xia, E., Hashmi, S. H., & Ahmed, Z. (2021). The nexus between road transport intensity and road-related CO2 emissions in G20 countries: An advanced panel estimation. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-021-14731-7

Hadri, K. (2000). Testing for stationarity in heterogeneous panel data. The Econometrics Journal, 3(2), 148–161. https://doi.org/10.1111/1368-423X.00043

Harris, R. I. D., & Sollis, R. (2003). Applied time series modelling and forecasting. Wiley.

Hashmi, S. H., Hongzhong, F., Fareed, Z., & Bannya, R. (2020). Testing non-linear nexus between service sector and CO2 emissions in Pakistan. Energies, 13(3), 526. https://doi.org/10.3390/en13030526

Haug, A. A. (2002). Temporal aggregation and the power of cointegration Tests: A Monte Carlo study. Oxford Bulletin of Economics and Statistics, 64(4), 399–412. https://doi.org/10.1111/1468-0084.00025

He, Z., Xu, S., Shen, W., Long, R., & Chen, H. (2017). Impact of urbanization on energy related CO2 emission at different development levels: Regional difference in China based on panel estimation. Journal of Cleaner Production, 140, 1719–1730. https://doi.org/10.1016/j.jclepro.2016.08.155

Hosier, R. H., & Dowd, J. (1987). Household fuel choice in Zimbabwe. Resources and Energy, 9(4), 347–361. https://doi.org/10.1016/0165-0572(87)90003-X

Im, K. S., Pesaran, M. H., & Shin, Y. (2003). Testing for unit roots in heterogeneous panels. Journal of Econometrics, 115(1), 53–74. https://doi.org/10.1016/S0304-4076(03)00092-7

International Energy Agency. (2021). CO2 emissions from fuel combustion February 2021 edition: Database documentation. International Energy Agency.

Jalil, A., & Ma, Y. (2008). Financial development and economic growth: Time series evidence from Pakistan and China. Journal of Economic Cooperation Among Islamic Countries, 29(2), 29–68.

Jalil, A., & Feridun, M. (2011). The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Economics, 33(2), 284–291. https://doi.org/10.1016/j.eneco.2010.10.003

Kaika, D., & Zervas, E. (2013). The environmental Kuznets curve (EKC) theory. Part B: Critical issues. Energy Policy, 62, 1403–1411. https://doi.org/10.1016/j.enpol.2013.07.130

Kais, S., & Sami, H. (2016). An econometric study of the impact of economic growth and energy use on carbon emissions: Panel data evidence from fifty eight countries. Renewable and Sustainable Energy Reviews, 59, 1101–1110. https://doi.org/10.1016/j.rser.2016.01.054

Kao, C. (1999). Spurious regression and residual-based tests for cointegration in panel data. Journal of Econometrics, 90(1), 1–44. https://doi.org/10.1016/S0304-4076(98)00023-2

Kharbach, M., & Chfadi, T. (2017). CO2 emissions in Moroccan road transport sector: Divisia, Cointegration, and EKC analyses. Sustainable Cities and Society, 35, 396–401. https://doi.org/10.1016/j.scs.2017.08.016

Kremers, J. J. M., Ericsson, N. R., & Dolado, J. J. (1992). The power of cointegration tests. Oxford Bulletin of Economics and Statistics, 54(3), 325–348. https://doi.org/10.1111/j.1468-0084.1992.tb00005.x

Kuznets, S. (1955). Economic growth and income inequality. The American Economic Review, 45(1), 1–28.

Leach, G. (1992). The energy transition. Energy Policy, 20(2), 116–123. https://doi.org/10.1016/0301-4215(92)90105-B

Lee, C.-C., & Lee, J.-D. (2009). Income and CO2 emissions: Evidence from panel unit root and cointegration tests. Energy Policy, 37(2), 413–423. https://doi.org/10.1016/j.enpol.2008.09.053

Levin, A., Lin, C. F., & James Chu, C. S. (2002). Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics, 108(1), 1–24. https://doi.org/10.1016/S0304-4076(01)00098-7

Liu, X., Zhang, S., & Bae, J. (2017). The impact of renewable energy and agriculture on carbon dioxide emissions: Investigating the environmental Kuznets curve in four selected ASEAN countries. Journal of Cleaner Production, 164, 1239–1247. https://doi.org/10.1016/j.jclepro.2017.07.086

Lorente, D. B., & Álvarez-Herranz, A. (2016). Economic growth and energy regulation in the environmental Kuznets curve. Environmental Science and Pollution Research, 23(16), 16478–16494. https://doi.org/10.1007/s11356-016-6773-3

Ma, M., Ma, X., Cai, W., & Cai, W. (2019). Carbon-dioxide mitigation in the residential building sector: A household scale-based assessment. Energy Conversion and Management, 198, 111915. https://doi.org/10.1016/j.enconman.2019.111915

Moutinho, V., Madaleno, M., & Elheddad, M. (2020). Determinants of the Environmental Kuznets Curve considering economic activity sector diversification in the OPEC countries. Journal of Cleaner Production, 271, 122642. https://doi.org/10.1016/j.jclepro.2020.122642

Murshed, M. (2021). LPG consumption and environmental Kuznets curve hypothesis in South Asia: A time-series ARDL analysis with multiple structural breaks. Environmental Science and Pollution Research, 28(7), 8337–8372. https://doi.org/10.1007/s11356-020-10701-7

Murshed, M., Nurmakhanova, M., Elheddad, M., & Ahmed, R. (2020). Value addition in the services sector and its heterogeneous impacts on CO2 emissions: Revisiting the EKC hypothesis for the OPEC using panel spatial estimation techniques. Environmental Science and Pollution Research, 27(31), 38951–38973. https://doi.org/10.1007/s11356-020-09593-4

Nathaniel, S. P., Nwulu, N., & Bekun, F. (2021). Natural resource, globalization, urbanization, human capital, and environmental degradation in Latin American and Caribbean countries. Environmental Science and Pollution Research, 28(5), 6207–6221. https://doi.org/10.1007/s11356-020-10850-9

Ozatac, N., Gokmenoglu, K. K., & Taspinar, N. (2017). Testing the EKC hypothesis by considering trade openness, urbanization, and financial development: The case of Turkey. Environmental Science and Pollution Research, 24(20), 16690–16701. https://doi.org/10.1007/s11356-017-9317-6

Ozcan, B. (2013). The nexus between carbon emissions, energy consumption and economic growth in Middle East countries: A panel data analysis. Energy Policy, 62, 1138–1147. https://doi.org/10.1016/j.enpol.2013.07.016

Ozturk, I., & Acaravci, A. (2013). The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Economics, 36, 262–267. https://doi.org/10.1016/j.eneco.2012.08.025

Paramati, S. R., Alam, Md. S., & Chen, C.-F. (2017). The Effects of tourism on economic growth and CO2 emissions: A comparison between developed and developing economies. Journal of Travel Research, 56(6), 712–724. https://doi.org/10.1177/0047287516667848

Pata, U. K. (2018). The effect of urbanization and industrialization on carbon emissions in Turkey: Evidence from ARDL bounds testing procedure. Environmental Science and Pollution Research, 25(8), 7740–7747. https://doi.org/10.1007/s11356-017-1088-6

Pedroni, P. (2004). Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometric Theory. https://doi.org/10.1017/S0266466604203073

Pesaran, M. H. (2004). General diagnostic tests for cross-sectional dependence in panels. IZA Discussion Paper No. 1240. http://ftp.iza.org/dp1240.pdf.

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. Journal of Applied Econometrics, 22(2), 265–312. https://doi.org/10.1002/jae.951

Pesaran, M. H., Shin, Y., & Smith, R. P. (1999). Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American Statistical Association, 94(446), 621–634. https://doi.org/10.1080/01621459.1999.10474156

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326. https://doi.org/10.1002/jae.616

Pesaran, M. H., & Smith, R. (1995). Estimating long-run relationships from dynamic heterogeneous panels. Journal of Econometrics, 68(1), 79–113. https://doi.org/10.1016/0304-4076(94)01644-F

Phillips, P. C. B., & Sul, D. (2003). Dynamic panel estimation and homogeneity testing under cross section dependence. The Econometrics Journal, 6(1), 217–259. https://doi.org/10.1111/1368-423X.00108

Prastiyo, S. E., Irham, H., & S., and Jamhari. (2020). How agriculture, manufacture, and urbanization induced carbon emission? The case of Indonesia. Environmental Science and Pollution Research, 27(33), 42092–42103. https://doi.org/10.1007/s11356-020-10148-w

Raza, S. A., Shah, N., & Khan, K. A. (2020). Residential energy environmental Kuznets curve in emerging economies: The role of economic growth, renewable energy consumption, and financial development. Environmental Science and Pollution Research, 27(5), 5620–5629. https://doi.org/10.1007/s11356-019-06356-8

Saatkamp, B. D., Masera, O. R., & Kammen, D. M. (2000). Energy and health transitions in development: Fuel use, stove technology, and morbidity in Jarácuaro, México. Energy for Sustainable Development, 4(2), 7–16. https://doi.org/10.1016/S0973-0826(08)60237-9

Sarkodie, S. A., & Ozturk, I. (2020). Investigating the Environmental Kuznets Curve hypothesis in Kenya: A multivariate analysis. Renewable and Sustainable Energy Reviews, 117, 109481. https://doi.org/10.1016/j.rser.2019.109481

Shahbaz, M., Kumar Mahalik, M., Shahzad, J. H., & S., and Hammoudeh, S. (2019). Testing the globalization-driven carbon emissions hypothesis: International evidence. International Economics, 158, 25–38. https://doi.org/10.1016/j.inteco.2019.02.002

Sharif, A., Afshan, S., Chrea, S., Amel, A., & Khan, S. A. R. (2020). The role of tourism, transportation and globalization in testing environmental Kuznets curve in Malaysia: New insights from quantile ARDL approach. Environmental Science and Pollution Research, 27(20), 25494–25509. https://doi.org/10.1007/s11356-020-08782-5

Stern, D. I. (2004a). Economic Growth and Energy. In Encyclopedia of Energy (pp. 35–51). Elsevier. https://doi.org/10.1016/B0-12-176480-X/00147-9

Stern, D. I. (2004b). The rise and fall of the environmental Kuznets curve. World Development, 32(8), 1419–1439. https://doi.org/10.1016/j.worlddev.2004.03.004

Stern, D. I., Common, M. S., & Barbier, E. B. (1996). Economic growth and environmental degradation: The environmental Kuznets curve and sustainable development. World Development, 24(7), 1151–1160. https://doi.org/10.1016/0305-750X(96)00032-0

Sugiawan, Y., & Managi, S. (2016). The environmental Kuznets curve in Indonesia: Exploring the potential of renewable energy. Energy Policy, 98, 187–198. https://doi.org/10.1016/j.enpol.2016.08.029

Sun, H., Samuel, C. A., Kofi Amissah, J. C., Taghizadeh-Hesary, F., & Mensah, I. A. (2020). Non-linear nexus between CO2 emissions and economic growth: A comparison of OECD and B&R countries. Energy, 212, 118637. https://doi.org/10.1016/j.energy.2020.118637

Udemba, E. N., Güngör, H., Bekun, F. V., & Kirikkaleli, D. (2021). Economic performance of India amidst high CO2 emissions. Sustainable Production and Consumption, 27, 52–60. https://doi.org/10.1016/j.spc.2020.10.024

Usman, O., Iorember, P. T., & Olanipekun, I. O. (2019). Revisiting the environmental Kuznets curve (EKC) hypothesis in India: The effects of energy consumption and democracy. Environmental Science and Pollution Research, 26(13), 13390–13400. https://doi.org/10.1007/s11356-019-04696-z

Wada, I., Faizulayev, A., & Victor Bekun, F. (2021). Exploring the role of conventional energy consumption on environmental quality in Brazil: Evidence from cointegration and conditional causality. Gondwana Research, 98, 244–256. https://doi.org/10.1016/j.gr.2021.06.009

Wagner, G. (2010). Energy content of world trade. Energy Policy, 38(12), 7710–7721. https://doi.org/10.1016/j.enpol.2010.08.022

Wang, Q., & Wang, L. (2021a). The nonlinear effects of population aging, industrial structure, and urbanization on carbon emissions: A panel threshold regression analysis of 137 countries. Journal of Cleaner Production, 287, 125381. https://doi.org/10.1016/j.jclepro.2020.125381

Wang, Q., & Wang, L. (2021b). How does trade openness impact carbon intensity? Journal of Cleaner Production, 295, 126370. https://doi.org/10.1016/j.jclepro.2021.126370

Wang, Q., & Zhang, F. (2021a). The effects of trade openness on decoupling carbon emissions from economic growth – Evidence from 182 countries. Journal of Cleaner Production, 279, 123838. https://doi.org/10.1016/j.jclepro.2020.123838

Wang, Q., & Zhang, F. (2021b). Free trade and renewable energy: A cross-income levels empirical investigation using two trade openness measures. Renewable Energy, 168, 1027–1039. https://doi.org/10.1016/j.renene.2020.12.065

Wang, Q., & Zhang, F. (2021c). What does the China’s economic recovery after COVID-19 pandemic mean for the economic growth and energy consumption of other countries? Journal of Cleaner Production, 295, 126265. https://doi.org/10.1016/j.jclepro.2021.126265

Wang, S., Fang, C., & Wang, Y. (2016). Spatiotemporal variations of energy-related CO2 emissions in China and its influencing factors: An empirical analysis based on provincial panel data. Renewable and Sustainable Energy Reviews, 55, 505–515. https://doi.org/10.1016/j.rser.2015.10.140

Wang, W., & Wang, J. (2021c). Determinants investigation and peak prediction of CO2 emissions in China’s transport sector utilizing bio-inspired extreme learning machine. Environmental Science and Pollution Research, 28(39), 55535–55553. https://doi.org/10.1007/s11356-021-14852-z

Wang, Y., Zhang, C., Lu, A., Li, L., He, Y., ToJo, J., & Zhu, X. (2017). A disaggregated analysis of the environmental Kuznets curve for industrial CO2 emissions in China. Applied Energy, 190, 172–180. https://doi.org/10.1016/j.apenergy.2016.12.109

Westerlund, J. (2007). Testing for error correction in panel data. Oxford Bulletin of Economics and Statistics, 69(6), 709–748. https://doi.org/10.1111/j.1468-0084.2007.00477.x

Xu, B., & Lin, B. (2016). Reducing CO2 emissions in China’s manufacturing industry: Evidence from nonparametric additive regression models. Energy, 101, 161–173. https://doi.org/10.1016/j.energy.2016.02.008

Zhang, L., & Gao, J. (2016). Exploring the effects of international tourism on China’s economic growth, energy consumption and environmental pollution: Evidence from a regional panel analysis. Renewable and Sustainable Energy Reviews, 53, 225–234. https://doi.org/10.1016/j.rser.2015.08.040

Zhang, L., Pang, J., Chen, X., & Lu, Z. (2019a). Carbon emissions, energy consumption and economic growth: Evidence from the agricultural sector of China’s main grain-producing areas. Science of the Total Environment, 665, 1017–1025. https://doi.org/10.1016/j.scitotenv.2019.02.162

Zhang, Y., Chen, X., Wu, Y., Shuai, C., & Shen, L. (2019b). The environmental Kuznets curve of CO2 emissions in the manufacturing and construction industries: A global empirical analysis. Environmental Impact Assessment Review, 79, 106303. https://doi.org/10.1016/j.eiar.2019.106303

Zoundi, Z. (2017). CO2 emissions, renewable energy and the Environmental Kuznets Curve, a panel cointegration approach. Renewable and Sustainable Energy Reviews, 72, 1067–1075. https://doi.org/10.1016/j.rser.2016.10.018

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

About this article

Cite this article

Htike, M.M., Shrestha, A. & Kakinaka, M. Investigating whether the environmental Kuznets curve hypothesis holds for sectoral CO2 emissions: evidence from developed and developing countries. Environ Dev Sustain 24, 12712–12739 (2022). https://doi.org/10.1007/s10668-021-01961-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-021-01961-5