Abstract

Improving the energy efficiency of conventional energy services is an essential way to cope with global CO2 emissions mitigation. To date, energy efficiency improvement (EEI) has been broadly introduced exogenously in integrated assessment models (IAMs) by virtue of the autonomous energy efficiency improvement (AEEI) coefficient; however, it is usually good at capturing the EEI driven by non-price factors, while weak in describing the EEI induced by policy incentives. In this paper, we introduce an endogenous EEI (EEEI) mechanism in an IAM, called E3METL, to explore the impacts of EEEI on the global macro-economy, CO2 emission paths, and timing of carbon mitigations. The results reveal that (1) introducing EEEI significantly improves gross world product (GWP) gains, and this positive effect is partly offset when carbon restriction policies are implemented; (2) R&D investment dedicated to enhance energy efficiency limits R&D expenditures for other alternative technologies, and this effect will impede the development of non-fossil technologies; (3) EEEI may perform as one of supporting factors to delay the actions of carbon reduction; moreover, the introduction of EEEI lowers the optimal carbon tax level by 7.8 % on average, as compared to the no EEEI case.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Energy efficiency improvement (EEI) is widely regarded as one of the best ways to achieve the joint goal of economic development and carbon mitigation, especially since carbon-based energy will remain the dominant of energy supply sources. Seeing from the micro level, EEI helps to reduce energy inputs per unit of output and leads to energy savings; while from macrocosmic point of view, EEI is conducive to ensuring energy security by lowering dependency on foreign energy. As a result, both growth rate of energy consumption and carbon intensity will decrease, which in turn helps to control CO2 emissions (IEA 2012). Thus, it is of great importance to improve energy efficiency, especially considering the seriousness of global warming and the need to reduce carbon emissions.

The potential of carbon reduction from EEI is substantial. Globally, EEI may contribute to as high as 40 % of greenhouse gas (GHG) mitigation with the marginal abatement cost under the threshold of 60 European Euros per metric ton of CO2 equivalent (McKinsey and Company 2010; Worrell et al. 2009). Regionally, EEI in China has increased since the Tenth Five-Year Plan, particularly in thermal power, iron and steel, and cement manufacturing sectors. In the period of the 11th Five-Year Plan, the energy savings resulting from EEI for China has added up to 630 million tons of coal equivalents (Zhang 2011). By 2020, the USA could save more than US$1 trillion in energy expenditures per annum by reducing its annual energy consumption by 23 % with respect to the baseline projection, if the government makes an effort to improve energy efficiency (McKinsey and Company 2010). Moreover, the European Union (EU) believes that its EEI could be increased by 20 % by 2020, with the implementation of specific measures (IEA 2012).

Today, abundant literature exists on energy efficiency, but most of these studies are oriented toward empirical analysis, including numerical estimation of regional energy efficiency, analysis of the driving effect of price-induced factors, as well as the rebound effect (Popp 2001; Fisher-Vanden et al. 2006; Hasanbeigi et al. 2013; Zhou et al. 2014). Actually, financial-related measures, enhancement standards, and economic restructuring play a significant role in improving energy efficiency (Filippini et al. 2004; Lin and Wang 2014). Besides, Popp (2001) argues that changes in energy prices negatively influence energy intensity, and in the case of the USA, more than two thirds of energy-consumption changes are induced by price-factor substitution. Hence, high-energy prices could promote transitions in energy-consumption behaviors, which in turn stimulate R&D investments associated with EEI (Nordhaus 2002; Fisher-Vanden et al. 2006). As for the relationship between the rebound effect and EEI, Binswanger (2001) points out that energy savings due to technological improvement will be overestimated by neglecting the rebound effect of energy consumption. Additionally, carbon control measures play a formidable role in energy efficiency enhancement, which further affects total amount of energy consumption and carbon tax level (Brännlund et al. 2007; Barker et al. 2009).

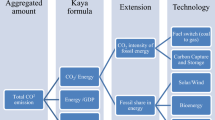

Global warming issues provide new opportunities for energy efficiency research, and how to consider EEI in a conventional integrated assessment model (IAM) framework has become a key factor that influences economic growth and carbon emission paths (Grubb et al. 2002). EEI is driven in large part by changes in energy prices, transitions in consumption behaviors, energy restructuring, and policy reforms (Popp 2001; Schumacher and Sands 2007). On this basis, EEI could be endogenously or exogenously considered in IAMs; however, the majority of current mainstream IAMs, such as DICE, ENTICE, WITCH, and DEMETER, view EEI as an exogenous process by virtue of the AEEI coefficient (Nordhaus 1994; Manne and Richels 1997; Bosetti et al. 2006; Kesicki and Yanagisawa 2015). In general, AEEI only includes EEI induced by all the non-price factors, while leaving out the EEI driven by price-induced consumption-behavior transitions and energy-structure adjustments (Dowlatabadi and Oravetz 2006; Ürge-Vorsatz and Metz 2009). In addition, the positive influence of R&D policy on EEI is also left untreated in these models. This may lead to an underestimation of the EEI levels and overstating of the carbon intensity (Popp 2004).

Based on the important role of EEEI in fighting climate change, incorporating EEEI in IAMs is important, but for now, there remains a scarcity of literature that focuses on this aspect. Popp (2006) proposes an innovation possibility frontier approach, and uses it to endogenize EEI in the ENTICE model, where he explores the impacts of the crowding-out effect of R&D investment on climate-economic systems. Gerlagh (2008) assesses the impact of induced technological change (ITC) for reaching the given CO2 concentration ceiling. However, the main focus of this work is not on EEI, and the essential contribution is that he finds the possibility of a shift in R&D from producing carbon-based services to carbon-saving technology. Hübler et al. (2012) emphasize the importance of R&D-based innovation and imitation in promoting new technologies, particularly the effect of international technology transfer for meeting global carbon goals, but they fail to explore the role of EEEI. Bibas et al. (2014) investigate the potential relationships between the timing of EEI policies and carbon abatement costs based on the hybrid dynamic computable general equilibrium (CGE) model IMACLIM-R, coming to the conclusion that early action will bring high short-term costs, while late action will lead to high long-term costs. Overall, EEI policies devote a lot of attention to reducing carbon reduction costs, especially when combined with innovation acceleration measures.

In this paper, we employ an integrated assessment model (E3METL) that was specially developed to innovate the energy efficiency advancement mechanism, to avert the possible deviation due to that IAMs fail to separate endogenous EEI from exogenous energy efficiency enhancement.Footnote 1 The E3METL model has been applied in a few papers already, analyzing a variety of subject matters (Duan et al. 2013; Duan et al. 2014; 2015), but none of them focus on energy efficiency. Based on the hybrid EEI mechanism, we aim to answer the following questions: What is the impact of EEEI on the macro-economy and macro-carbon abatement costs? How will EEEI change the carbon emission trajectories and what about its carbon reduction potential? Will the R&D related to EEEI crowd out the R&D associated with the other alternative innovations, and if so, how do we evaluate this effect? How will EEEI affect the optimal carbon tax and the timing of carbon reduction actions?

The remainder of this paper is structured as follows. In Section “Model,” we briefly introduce the E3METL model and describe its multi-energy technological evolution mechanism and exogenous and endogenous EEI mechanism; data and calibration are also included in this part. Section “Results” covers the main results and corresponding analysis, as well as a sensitivity discussion of key EEEI parameters. A result comparison and discussion are presented in Section “Concluding remarks.” Conclusions and policy recommendations are provided in Section “Concluding remarks.”

Model

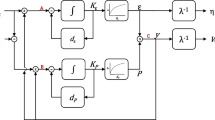

The economy-energy-environmental model with endogenous technological change by employing logistic curves (E3METL) consists of a macro-economy module, energy-technology module, and climate-change module to fulfill the task of this study. E3METL is written in GAMS and optimized by using the nonlinear programming (NLP) algorithm of the CONOPT solver (Duan et al. 2014). In comparison to the pioneering IAMs, E3METL features its technical process: first, the revised logistic model is incorporated to substitute for the conventional constant elasticity substitution (CES) function approach.Footnote 2 With respect to the CES method, the revised logistic model allows us to consider more energy technologies with fewer parameters, which provides a feasible bridge for linking bottom-up and top-down models (Duan et al. 2013). Second, we develop a two-factor learning curve model by combining a learning-by-doing (LBD) process with a learning-by-searching (LBS) process to describe endogenous energy technological change, which greatly helps to overcome the forgetting-by-not-doing (FBND) effect when considering endogenous technological advancement by virtue of a one-factor learning model. Third, policy variables, such as carbon taxes and subsidies, which are widely regarded as key factors affecting technological change, are directly embedded in the revised logistic technical mechanism, and this makes it convenient to explore the impacts of policy reforms on technological diffusion (Duan et al. 2013).

E3METL is a perfect foresight inter-temporal optimal model. Hence, solving the model involves maximizing the aggregated and discounted utility objective, subject to a combination of policy instruments and carbon constrains. Generally, the utility objective is represented by population-weighed per capita consumption:

where C t denotes consumption and POP t represents population, which is given exogenously in this model. R t is called the discount factor, which could be used to allocate dynamic utility inter-temporally, i.e.,

where \( \rho (t)={\rho}_0{e}^{-{d}_{\rho }t} \) is the pure time preference rate, ρ 0 and d ρ represent the initial pure time preference rate and the corresponding annual decline rate, respectively, and Δt is the length of period (Nordhaus and Boyer 2000).

The production process is described through a Cobb-Douglas production function with capital κ, labor POP, and energy Eas inputs. The output can be used for consumption C, investment I, energy costs EC, and total energy R&D expenditure TRD, of which TRD includes two parts: R&D for carbon-free technologies, such as biomass BIO, nuclear NUC, hydropower HYD, and the other renewable OTHRE, and R&D for EEI, i.e.,

Industrial CO2 emission is the only GHG that is endogenously calculated in E3METL; the other GHGs, CO2 from land-use changes and sulfate aerosols, are taken as exogenous (Nordhaus 1994). Thus, total CO2 emission TotEM is the sum of endogenous part EMT ANT and exogenous part EM NAT:

CO2 emissions can be controlled by levying carbon tax (ad valorem) on carbon-based energy, and carbon tax is endogenized in the optimal policy scenario. The effect of carbon tax implementation can be summarized as follows: In the short term, the carbon tax level must be higher when facing stringent carbon control, which will in turn reduce the consumption of fossil fuels; in the long term, the increasing cost of fossil energy will enhance the market competitiveness of non-fossil technologies, which may greatly benefit the energy consumption transition from carbon-based energy to non-carbon energy; from a consumption perspective, higher energy costs not only lead to energy savings, but change people’s energy-consumption behaviors, which may make green energy became more preferable; from a production perspective, the implementation of carbon tax policy incentivizes enterprises’ R&D activities, especially for developing carbon-free technologies and improving energy efficiency.

Exogenous EEI method

To date, AEEI has been broadly used to cope with the exogenous EEI process in IAMs. A.S. Manne was regarded as the first researcher to introduce the AEEI coefficient into energy-economic system models; in his work, AEEI is defined to describe EEI that is induced by all the non-price factors, such as changes in technical standards and autonomous energy restructuring (Manne and Richels 1991). In general, AEEI is implied in the energy-adjoint parameter β t ,

and through the first-order condition of Eq. (5), i.e., ∂Y t /∂E t = P t , we can get

where η represents the ease of substitution between capital-labor combination and energy, \( {P}_t^{ref} \) is the reference marginal energy productivity, and \( {Y}_t^{ref} \) is the initial reference output. In addition, the reference energy inputs can be described as

where AEEI t denotes autonomous energy efficiency improvement and is determined by the initial level AEEI 0 and the corresponding annual decline rate DEEI (Nordhaus 1994).

Endogenous EEI mechanism

Exogenous EEI is likely to affect the simulation results, especially for carbon emission trajectories and economic growth. However, the estimation and calibration of the AEEI level is often difficult, while high (or low) AEEI values may lead to underestimation (or overestimation) of future CO2 emissions and carbon-reduction costs (Dowlatabadi and Azar 1999; Grubb et al. 2002). Thus, the AEEI-based exogenous energy efficiency has long been criticized (Löschel 2002).

In this context, the endogenous EEI mechanism is introduced into E3METL, in order to cope with the shortcomings of the exogenous EEI method. In addition, incorporating EEI provides the conventional IAM system a full endogenous growth engine by successfully linking endogenous energy efficiency, technological change, as well as economic growth together in an IAM system (Bibas et al. 2014). The EEI is largely inspired by a specific R&D investment that promotes the production and accumulation of energy-related knowledge capital. This knowledge capital could substitute for conventional carbon-based energy services and allows output to be produced with fewer CO2 emissions.Footnote 3 IfF t represents the total fossil energy inputs and S f , t denotes the market share of fossil fuels in total primary energy consumption, then the EEI mechanism could be described as follows (Popp 2004):

Through the introduction of EEI, carbon-based energy service is divided into two parts: conventional fossil fuels and energy-related knowledge capital. In this equation, κ denotes the ease of substitution between fossil fuels F t and knowledge stock KDE t , where κ = 1 means perfect substitution, and generally speaking, κ < 1.α ee is a scaling factor that determines the energy savings resulting from the new knowledge. Given the decay rate of knowledge δ ee , the dynamic iteration equation of KDE t can be given as follows:

IPF t in Eq. (9) is called the innovation possibility frontier and shows how energy R&D creates new knowledge, i.e., (Popp 2004)Footnote 4;

Technology evolutionary mechanism

The conventional logistic technical model is revised and introduced into E3METL to describe multiple energy technological diffusions. In contrast to the classic logistic curve, the improvement involves two aspects: first, the changes in market shares with respect to changes in time is revised to the rate of change in market shares with respect to relative changes in prices; second, policy effects are directly reflected in the energy costs, including both fossil fuels and non-fossil fuels. Hence, this energy evolutionary mechanism can be shown as

In this formula, S i , t and \( {\overset{\sim }{S}}_i\in \left(0,1\right) \) represent the market share of alternative energy i and the corresponding market potential, respectively. ϑ i is the substitution parameter that determines the ease of substitution between alternative i and the marker technology (fossil energy is chosen as the marker technology in this work). P i , t is the so-called relative price, i.e.,Footnote 5

where ctax f , t and subs i , t denote the tax rate for carbon-based fuels and subsidy rate for non-carbon energy. From a cost perspective, the closer P i , t is to 1, the easier the alternatives will substitute for the marker. Obviously, P i , t = 1 means a theoretically perfect substitution. The change of relative price P i , t lies in the strength of policy implementation, the cost evolution of fossil fuels, and carbon-free technologies (Duan et al. 2015).

In this paper, the price of fossil fuels C f , t is the sum of the marginal cost of carbon extraction q f , t and a markup, in which the markup is constant and covers transportation costs, distribution costs, and current taxes (Nordhaus and Boyer 2000). q f , t is rising over time due to the scarcity of resources. If CumC t means cumulative carbon-based energy extraction, and CumC MAX represents the maximum extraction potential, then the marginal extraction cost q f , t takes the following form (Nordhaus 1994, 2002):

After defining the price of carbon-based energy, the next step is to consider the prices of non-carbon technologies. In fact, the price of alternative energy C i , t is declining as a result of induced energy technological change. Technological change in E3METL takes two forms: LBD-based endogenous technological change and LBS-based endogenous technological change. The former provides the original knowledge flows for technological advancement, while the latter acts as an extender that complements the obsolescence of knowledge due to FBND. On this basis, we develop a two-factor learning curve model by combining the LBD process and the LBS process and use it to examine the cost evolution of alternative energy. This learning model is shown as follows (Barreto and Kypreos 2004):

In the above equation, KD i , t and KS i , t represent knowledge stock resulting from the LBD process and LBS process, respectively. Like a physical capital stock, the knowledge capital stock is dynamically accumulated by adding up the depreciated previous knowledge stock and new-added knowledge:

where IPF i , t is the innovation possibility frontier function, as defined in Eq. (10). b i and c i are learning indexes of LBD process and LBS process, respectively, and they can be transformed into learning rates by the following formulas:

where \( l{r}_i^{lbd} \) and \( l{r}_i^{lbs} \) are corresponding learning rates, defined as the rates at which the costs decline each time the knowledge stock doubles (Barreto and Kypreos 2004).

Data and calibration analysis

The optimization of E3METL depends on a series of initial values of key variables, including energy consumption, market shares, gross world product (GWP), investment, consumption, and capital stock. The majority of the needed macro-economic data and technical data are from the World Bank (2012) and IEA (2002, 2004; 2012); the rest is from Gerlagh and van der Zwaan (2004) and Popp (2006). According to Nordhaus and Boyer (2000), the initial cost of carbon-based energy is estimated to be 276.29 $/tC.Footnote 6 The costs of non-carbon energy show a wide distribution, since they are affected by many factors, such as differences in geographical locations and technical development patterns and phrases. In general, the cost of hydropower and nuclear power is much closer to that of fossil energy; the cost of biomass and offshore wind is more than twice the price of fossil fuels; while the cost for onshore wind and PV solar could be even higher (as much as 5–8 times), as compared to the cost of fossil fuels (Gerlagh and van der Zwaan 2003; Anderson and Winne 2004). In terms of this, the initial costs of biomass, nuclear, hydro, and the other renewables are estimated to equal 830, 470, 550, and 1032 $/tC, respectively.

At present, the gross data of R&D expenditures remains unavailable, so we use data from OECD countries. Based on the OECD R&D data, the gross R&D expenditure is estimated to be 50 billion US dollars, of which 2 % is related to energy, i.e., 1 billion US dollars (Popp 2004). According to Anderson (1997), R&D related to renewables may account for 10 % of the total energy R&D expenditure, and the remainder could be assumed to be R&D investment for energy efficiency. Given this, we can allocate the initial R&D investment for different technologies in terms of their initial market shares.

In addition to initial input values, the reliability of model results lies in some key parameter assumptions and calibrations. As for the general parameters, such as capital-value share, elasticity between capital-labor input and energy, scaling factors, and substitution parameter and learning rates, we keep the same estimations and assumptions as the previous studies, so here, our emphasis is put on discussing the new-induced parameters (Duan et al. 2013, 2015). Popp (2001) empirically investigates the returns to R&D in 13 high energy-intensive sectors, and suggests that 1 US dollar of R&D investment may lead to 4 US dollars of energy savings, and the return to R&D is declining over time. This result fits largely with previous research (Mansfield 1977; Pakes 1985; Jaffe 1986). According to this rate of return, we set the scaling factor of knowledge capital to be 0.336. Meanwhile, the initial knowledge stock could be well obtained by calibrating the initial total energy inputs. The ease of substitution between knowledge capital associated with EEI and fossil fuels has a close relationship with the substitution elasticity between energy prices and energy R&D expenditures (McKinsey and Company 2010). Popp (2002) indicates that the long-term elasticity between energy prices and R&D investments is around 0.35. Starting from this value, we get a projection of energy R&D investment from 2000 to 2010; we then compare this projection with the real historical R&D data, and the ease of substitution parameter κ is finally valued when the differences between these two series of data are minimized (here, we get κ = 0.38). Additionally, parameters for innovation possibility frontiers are from Popp (2004, 2006).

Results

The intention of this work is to simulate the impacts of EEEI on the carbon trajectory and the global economy under the given carbon-control target. Additionally, exploring the crowding-out effect of R&D related to EEI to R&D associated with renewables is also a focus. To fulfill these tasks, we have to consider two types of scenarios: the business-as-usual (BAU) case and the optimal policy case, and in each, we need to compare the results with EEEI to the results without EEEI. In the so-called optimal policy case, a carbon tax will be endogenously considered as the policy instrument to reduce CO2 emissions; while the target is to achieve the 450 ppmv (parts per million by volume) stabilization of atmospheric carbon-dioxide concentrations target by the end of the twenty-first century. Based on this, we design four detailed scenarios, as follows:

-

a.

BAUcase: This is a case without EEEI and includes no policy constraints.

-

b.

NPcase: EEEI is introduced in this case, but without implementing carbon control.

-

c.

BAUPcase: Optimal carbon control policy is implemented, without induced EEEI.

-

d.

OPcase: This is a case combined with optimal policy and EEEI.

Note that AEEI is exogenously considered in all the scenarios, we assume the initial AEEI level is 0.7 %, and it decreases gradually at a rate of 0.2 % per annum. These value assumptions are a little lower than those given in the DEMETER model, while consistent with the DICE model (Nordhaus 1994; Nordhaus and Boyer 2000; Gerlagh and van der Zwaan 2003, 2004).

Effect of EEEI on GWP and mitigation costs

The introduction of EEEI significantly improves the gross world product (GWP) gains, and this positive effect will be weakened when the carbon constrain is incorporated (see Fig. 1). For example, in the no policy case, the GWP gains could be as high as 0.39 %, versus 0.41 % in the optimal policy case. Additionally, the positive effect of EEEI on GWP gains in the optimal policy case starts to crowd out those in the no policy case from 2040; and by 2100, the corresponding GWP gains in these two cases will have decreased to 0.16 and 0.26 %, respectively. EEEI is driven by R&D investment, and the considerable return to R&D makes production more effective, which is why introducing EEEI positively affects GWP gains. Similarly, the declining pattern of GWP gains actually reflects the law of diminishing R&D returns.

As we observed, the highest economic loss under the given carbon-control target will be 3 %, occurring in 2060; when moving to the EEEI case, the relative GWP loss will reduce to 2.1 % (Fig. 2). Does this mean that incorporating EEEI contributes to the reduction of the macro-economic cost of carbon abatement? The answer is yes. To support this finding, we calculate the cumulative costs over a 100-year time span (from 2000 to 2100) for the EEEI case and no EEEI case, respectively. The results show that the accumulative GWP loss will decrease by around 6.32 % when EEEI is introduced.

Evolution of energy structure by introducing EEEI

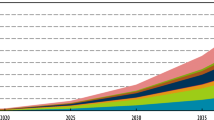

Not surprisingly, carbon controls restrain the gross energy demand to some extent, and this restraining effect could be effectively counteracted by the introduction of EEEI (see Fig. 3). In the no EEEI case, by 2100, energy demand will decrease by 10.5 %; while in the presence of EEEI, the decrease shrinks to 8.7 %. As the EEEI mechanism defined, knowledge capital inspired by R&D investment can substitute for conventional energy services, which may reduce the dependence of economy on carbon-based energy, which in turn eases the negative effect of carbon controls on gross energy demand. Besides, from Fig. 3, we could observe a significant transition from conventional fossil fuels to non-fossil energy, particularly after 2050 when non-fossil energy starts to dominate the energy market; by the end of this century, non-fossil energy will have accounted for 82.4 % of total energy consumption in the present of carbon controls.

On the whole, the proportion of knowledge capital related to EEEI in the total energy demand takes a hump-shaped pattern, particularly when the carbon mitigation target is given, which is illustrated by Fig. 4. The highest proportion occurs in 2060, with the value of 5.27 % for the no EEEI case; however, for the EEEI case, this value increases to 6.24 %. After introducing EEEI, the energy input becomes a mix of three parts: carbon-based fossil fuels, carbon-free alternatives, and knowledge capital associated with energy efficiency. In general, the demand for fossil fuels is relatively stable; thus, the contribution of knowledge capital to the total energy consumption is mainly determined by the development of non-carbon technologies. On the one hand, it is highly unlikely that carbon-free alternative energy could be extensively used in the foreseeable future, due to the higher cost and the inherent law of technical diffusion; on the other hand, continuous R&D investments accelerate the accumulation of knowledge capital stock of energy efficiency. That is why the share of knowledge capital in the energy supply market keeps increasing during the early stage of carbon control. In the late period of policy implementation, the costs of non-carbon technologies become competitive compared to that of fossil energy, because of the learning effect, and then the market proportion of knowledge capital will be partly crowded out by non-fossil energy.

Crowding-out effect of EEI R&D

Figure 5 presents the growth paths of R&D investment and the shares of R&D expenditure to GWP under all the considered cases. Overall, the R&D investment keeps growing for all the cases, although to different extents, and emission restrictions may induce more R&D. For example, in 2100, the R&D expenditure is 14.39 billion US dollars when no EEEI is considered, versus 47.74 billion US dollars in the EEEI case; if carbon emissions are constrained, the R&D investment will further expand to 166.95 and 239.81 billion US dollars, respectively, for the two scenarios. When looking at the proportion of R&D to GWP, we find that it does not increase as the R&D expenditure grows for the no policy case (BAUcase and NPcase). This may be largely attributed to the fact that the growth rate of R&D is lower than that of the GWP. However, this situation will change if carbon emissions are controlled. As shown in Fig. 5, the proportion of R&D to GWP appears to grow in the optimal policy case (BAUPcase and OPcase), and in 2100, this proportion will reach 0.019 and 0.094 %, respectively, for the no EEEI case and EEEI case. The carbon reduction target is achieved by imposing a carbon tax on fossil energy; the implementation of carbon tax raises the price of fossil fuels, which in turn directly drives the R&D activities, especially for improving energy efficiency and developing alternative technologies.Footnote 7

The R&D investment dedicated to enhancing energy efficiency significantly crowds out the R&D investment for the other alternative technologies, which can be seen in Fig. 6. To be specific, the crowding-out effect keeps growing under the no carbon control policy case, and it reaches 22.5 % in 2100; if we introduce the carbon-constraint target, the path of the crowding-out effect takes a bell-shaped pattern, and the turning point appears in 2060, with a specific value of 18 %. After that, the crowding-out effect begins to decrease, and by 2100, it will have been shrunk to 5.7 %. This suggests that introducing a carbon control policy could effectively ease the crowding-out effect of EEI R&D to R&D of other alternatives. In the early stages of policy implementation, the energy supply market is still dominated by fossil fuels; hence, the majority of R&D flows to the EEI sector. With the enhancement of the learning effect, the costs of alternatives keep declining, and gradually they become competitive with respect to the cost of fossil energy. In this context, R&D investment associated with non-carbon technologies starts to taper off, which should be responsible for the weakening crowding-out effect of EEI.

The development of alternative technologies is significantly influenced by the crowding-out effect of R&D related to EEEI. As depicted in Table 1, whether or not the carbon control policy is considered, the market share of non-fossil energy in the EEEI case is lower than that in the no EEEI case. For instance, if no carbon control is introduced, then the market share of non-fossil energy under the EEEI case will decrease by 0.13 % in 2100, as compared to the no EEEI case; moving to the carbon-restraining case, the share of alternatives in the OPcase is 2.68 % lower than that in the BAUPcase. Besides, as shown in Table 1, non-fossil energy only accounts for 30.71 % of the total energy supply in the BAUcase at the end of the twenty-first century; if carbon restriction is incorporated, the contribution of non-carbon energy will increase to over 82 %, corresponding to the BAUPcase. Thus, introducing a carbon control policy plays an important role in accelerating the diffusion of carbon-free technologies indeed.

Timing of CO2 reduction

Carbon emissions are reduced mainly by implementing carbon tax policy, and we could obtain endogenous carbon tax levels by introducing emission cap, i.e., the atmospheric CO2 stabilization goal. Figure 7 shows how the trajectories of carbon tax evolve when carbon emissions are restrained. It is easy to observe that the carbon taxes perform as an S-shaped curve for both the BAUPcase and OPcase. By 2100, the level of carbon tax will have been expended to 138 and 149.4 $/tC, respectively, with and without EEEI taken into account. On average, the carbon tax level will be around 7.8 % lower in the EEEI case than that in the no EEEI case. In addition, the carbon tax tapers off later rather than sooner after introducing EEEI. The reason behind this is that the introduction of EEEI cuts down the carbon intensity, and makes production proceed with fewer CO2 emissions, which reduces the urgency of early action for carbon abatement.

Sensitivity analysis for key EEEI parameters

The E3METL model with EEI has made several necessary assumptions to accomplish the optimization; it is thus of great necessity to perform a sensitivity analysis for these key variables closely related to R&D to see how modeling results are affected by such assumptions of parameter values. These key parameters cover returns to R&D α ee , ease of substitution between knowledge capital and conventional energy κ, and knowledge decay rate δ ee . The detailed setting of parameter values is presented in Table 2. For each parameter, we set three cases: base value case, low-value case, and high-value case (note that the base values are extracted from the basic model). To be specific, for the decay rate δ ee , we obtain the high-value case by doubling the base value; while for the low-value case, we assume that there is no knowledge depreciation. When coming to α ee and κ, the high value and the low value are set by adding 50 % and netting 50 % of the base value, respectively.

Not surprisingly, accelerating obsolescence of knowledge capital decreases the GWP gains from induced EEI; on the contrary, slow decay of knowledge contributes to improved GWP gains. As shown in Fig. 8-I, for the no policy case, the percentage change of GWP gains is 39.66 % as the decay rate doubles to 10 %, versus −8.5 % as the decay rate falls to 0 %. When moving to the carbon control case, the percentage change of GWP gains from induced EEEI is 45.3 and −12.7 %, respectively, for the high- and low-decay rate cases. It follows that GWP gains a relatively better robustness to the decay rate of knowledge.

As would be expected, the decrease in substitution elasticity between the knowledge capital resulting from EEEI and fossil fuels leads to a substantial increase of GWP gains by introducing EEEI under both cases with and without carbon control. For example, a 50 % decrease of the substitution parameter will reduce the GWP gains by −89.8 % in the no policy case, versus −139.7 % for the optimal policy case (Fig. 8-II). Furthermore, the percentage changes of GWP gains for both the high-value case and the low-value case are larger when we consider the carbon restriction policy. The sensitivity test tells us that the results are more sensitive to the ease of substitution between the knowledge capital and conventional energy, which implies that the reliable estimation of this parameter is meaningful and of great importance.

In addition to the decay rate and substitution elasticity, the rate of return to R&D is also a key parameter that might affect the GWP gains from induced EEEI (Popp 2006). Under the base value case, the parameter value of return is set by assuming each dollar of EEEI R&D leads to 4 US dollars of energy saving according to Popp (2004). Here, we intend to explore the effects of changes of return to R&D on GWP gains with and without carbon control policy. Figure 8-III reveals that a 50 % decrease of R&D return reduces the GWP gains by 59.49 % under the no policy case, versus 73.23 % under the optimal policy case. In contrast, adding the rate of R&D return in half leads to a 68.41 % increment of GWP gains under the no policy case, and it further rises up to 76.07 % while turning to the carbon control case. Obviously, the GWP gains effect resulting from changes in half for the parameter of R&D return performs more than a half, which suggests that uncertainty of the potential returns to R&D of EEEI is worthy of focus, although it seems challenging (Popp 2006).

Concluding remarks

Enhancing energy efficiency is an important way to curb CO2 emissions, especially since carbon-based energy will dominate the energy supply market for the foreseeable future. Currently, mainstream IAMs treat EEI as an exogenous process by virtue of the AEEI coefficient. This approach does not support the endogenous EEI separated from the conventional energy-efficiency sector, and thus fails to incorporate the impact of R&D incentives on the EEI. This could affect the long-term substitution relationship between fossil fuels and non-fossil energy and lead to a deviation of evaluation for carbon abatement costs (Popp 2004; Bibas et al. 2014). In this context, we developed an EEEI mechanism and differentiated the EEI from exogenous EEI in E3METL to explore the role of EEEI that is depicted by a series of key indicators, such as GWP gains, macro-climatic loss, energy consumption, R&D investment, as well as optimal carbon tax in a carbon-constrained world.

Actually, Popp (2006) first endogenizes EEI in the ENTICE model through an innovation possibility frontier approach, while research on EEI is not its focus. Specifically, this study differs from Popp (2006) in which the energy-efficiency issue is not discussed directly, and its main intention is to explore the effects of introducing of backstop technology on an integrated energy economic system (ENTICE). We separate endogenous energy-efficiency advancements from the conventional exogenous EEI mechanism, and try to explore the role of EEI. When considering conclusions, Popp (2006) emphasizes the welfare-gaining potential of adding backstop technology to the modeling system even without climate policy, but this potential will be limited by the crowding-out effects of other productive R&D. Thus, Popp (2006) highlights the importance of the opportunity costs related to R&D when backstop technologies are considered; rather than cover backstop technology, energy efficiency innovation is the center of our focus here. After that, Bibas et al. (2014) put great emphasis on studying the impact of EEI, particularly the timing of EEI efforts, on carbon abatement costs; their focus is to study the impact of EEI technology transfers between industrialized regions and industrializing regions on climate actions, while our objective is to examine the integrated effects of R&D-based endogenous EEI, such as the crowding-out effect on the diffusion of non-carbon energy technologies. Seeing from the results, Bibas et al. (2014) believe that EEI policies play an effective role in reducing policy costs and promoting economic growth with the condition that technology transfer from industrialized regions to industrializing regions is accelerated. Additionally, the timing of technology transfer action determines the trade-off between short- and long-term policy costs. Through our study, we obtain some new findings indeed.

One of our main conclusions is that the introduction of EEEI significantly improves GWP gains for both cases with and without carbon restriction policies. This is partly because of the reduced direct expenditure resulting from energy savings, and partly due to the fact that induced EEI will reduce investments in energy infrastructure. Additionally, macro-carbon abatement costs will decrease when the EEEI is considered, which means that failing to consider EEEI will potentially overestimate the mitigation costs for reaching the 450-ppmv carbon-concentration ceiling. The second interesting finding is that the specific R&D investments for EEEI crowds out other technical investments, and introducing a carbon restriction policy would ease this crowding-out effect to a large extent. This finding may largely adhere to what Popp (2004) concludes, while refute the argument in Buonanno et al. (2003) that the relationship between R&D related to energy and other R&D will complement rather than crowd out each other. Another particularly interesting fact reveals that the introduction of EEEI tends to delay adoption of carbon mitigation action and reduce the carbon tax level. This implies that the additional potential of carbon mitigation resulting from EEEI eases the urgency of reducing CO2 emissions, making more carbon emitters hold the wait-and-see attitude. Therefore, the introduction of EEEI could be one of the supporting factors for delaying the action of carbon reduction (Wigley et al. 1996).

The conclusions provide several valuable suggestions for policymakers. First, R&D for EEI is profitable. GWP gains will be significantly improved in the absence of carbon control; when carbon restriction policy is considered, the R&D related to EEI will reduce the macro-carbon abatement cost. Thus, it is meaningful for governments to encourage and support R&D activities related to EEI, no matter whether carbon space is strictly restrained or not. It should be followed by two measures: the first is to make more public funds available to support R&D EEI innovation and the second is to inspire enterprises’ motivation in EEI R&D activities and make policies attract more private funds to the energy-efficiency sector. This is very important, especially considering the scarcity of public funds in the energy R&D field (Popp 2004). Second, R&D for EEI could relieve the urgency of carbon reduction and allow time to wait for new cost-effective carbon reduction technologies to appear. This allows enterprises flexibility in determining how and when to cut down their CO2 emissions and effectively prevents production capital from phasing out too early. Third, R&D-based EEI could lower the optimal carbon tax level, which in turn eases enterprises’ carbon tax burden for achieving the given carbon-control goal. This means that dedicating the R&D activities of EEI innovation is a much more positive option as compared to an imposed carbon tax in response to carbon mitigation. Finally, the existence of the crowding-out effect of EEI R&D implies that when authorities create EEI policies, they should weigh the possible impacts of these policies on the development of alternative technologies. Creating effective policies that balance energy efficiency improvement and non-carbon technological diffusion warrants deeper concern.

Sensitivity analysis of key parameters is necessary to test the robustness of the model results and helps to convince our conclusions. In this work, GWP is chosen as the representative key indicator to examine the parameter sensitivity. We find that doubling or halving the decay rate of knowledge trigger a relatively limited change of GWP, which sufficiently confirms the robustness of model results to the knowledge decay rate. With respect to the decay rate of knowledge capital, GWP is more sensitive to the other key parameters, i.e., the ease of substitution between the knowledge capital and conventional energy and returns to R&D, which implies that the reliable estimation of this parameter is worth paying great attention despite it might be very challenging due to data unavailability.

Several limitations should be discussed. First, seeing from the model, some input data, particularly for energy initial costs and some technology parameters has not been updating due to data unavailability, which should affect our simulation results to some extent. Second, E3METL is a single-sector model, and we have not taken inter-sectoral links into account; hence, extending the current model framework to a multi-sectoral version is a promising direction. From research problem perspective, in addition to the crowding-out effect, the spillover effect is also a significant aspect of R&D market failure. As discussed in Schnelder and Goulder (1997), if the spillover effect of R&D is considered, carbon tax may not be a cost effective option anymore, with the mix policy of carbon taxes and R&D subsidies instead. Additionally, the climate change issue is full of uncertainties, including climate sensitivities, energy prices, economic growth, as well as technological innovation. In fact, all these uncertainties greatly affect the timing of carbon reduction and the evaluation of carbon abatement costs (Babonneau et al. 2012). Thus, extending the model to allow it to consider multiple uncertain climate effects is an important future step.

Notes

According to Fisher-Vanden et al. (2006), around two thirds of energy-consumption changes can be attributed to price factors, while the rest (one third) comes from non-price factors. However, AEEI usually covers the energy efficiency improvement resulting from non-price factors, while captures few EEI induced by price, particularly by policy incentives, which could be largely responsible for the possible deviation.

CES method is first proposed in Arrow et al. (1961), and the general formula is Y = A(αK −ρ + βL −ρ)−1/ρ, here ρ ≤ 1and ρ ≠ 0. We could obtain two representative conclusions from this formula: first, when ρ → 0, it reduces to the classical Cobb-Douglas production function; second, the elasticity of substitution between capital stock and labor factor is constant and equals to 1/(1 − ρ).

Endogenous energy efficiency is enhanced through the substitution of knowledge capital for carbon services, and this substitution may be driven by productivity improvement of current production processes, introduction of more efficient technology, or the adoption of some carbon-control measures (Popp 2004).

Empirical studies suggest that returns to energy R&D are diminishing over time (Popp 2001). On this basis, the function form of the innovation possibility frontier should be satisfied with the following two conditions: first, ∂IPF t /∂RD ee , t > 0 and second, ∂2 IPF t /∂KDE t ∂RD ee , t < 0 (Popp 2004).

In general, C f , t /C i , t show a wide frequency distribution; hence, the ratio here means the mean value, so does the relative price P f , t (Anderson and Winne 2004).

In this work, non-carbon energy is measured by carbon ton equivalent (CTE), which can be converted in terms of the equivalent calorific value between fossil and non-fossil energy; therefore, $/tC is also employed to measure the cost of non-fossil energy (Gerlagh et al. 2003; Popp 2004).

We can observe from Fig. 5 that R&D investment on energy efficiency is several fold higher than that on non-fossil technologies. This is consistent with the reality, actually, the amount of R&D investment on new energy technologies only accounts for about 10 % of total energy R&D expenditures, which implies that nearly 90 % of energy R&D investment relates to energy efficiency improvement of conventional fuels (REN21 2015).

References

Anderson, D. (1997). Renewable energy technology and policy for development. Annual Review of Energy and the Environment, 22, 187–215.

Anderson, D., & Winne, S. (2004). Modelling innovation and threshold effects in climate change mitigation. In Working paper 59. Tyndall: Centre for Climate Change Research.

Arrow, K. J., Chenery, H. B., Minhas, B. S., & Solow, R. M. (1961). Capital-labor substitution and economic efficiency. The Review of Economy and Statistics, 43(3), 225–250.

Babonneau, F., Haurie, A., Loulou, R., & Vielle, M. (2012). Combining stochastic optimization and Monte Carlo simulation to deal with uncertainties in climate policy assessment. Environmental Modeling and Assessment, 17, 51–76.

Barker, T., Dagoumas, A., & Rubin, J. (2009). The macroeconomic rebound effect and the world economy. Energy Efficiency, 2, 411–427.

Barreto, L., & Kypreos, S. (2004). Endogenizing R&D and market experience in the “bottom-up” energy-system ERIS model. Technovation, 24, 615–629.

Bibas, R., Méjean, A., & Hamdi-Cherif, M. (2014). Energy efficiency policies and the timing of action: an assessment of climate mitigation costs. Technological Forecasting and Social Change, 90, 137–152.

Binswanger, M. (2001). Technological progress and sustainable development: what about the rebound effect? Ecological Economics, 36, 119–132.

Bosetti, V., Carraro, C., Galeotti, M., Massetti, E., & Tavoni, M. (2006). WITCH: a world induced technical change hybrid model. The Energy Journal, 27, 13–38.

Brännlund, R., Ghalwash, T., & Nordström, J. (2007). Increased energy efficiency and the rebound effect: effects on consumption and emissions. Energy Economics, 29, 1–17.

Buonanno, P., Carraro, C., & Galeotti, M. (2003). Endogenous induced technical change and the costs of Kyoto. Resource and Energy Economics, 25, 11–34.

Dowlatabadi, H., & Azar, C. (1999). A review of technical change in assessment of climate policy. Annual Review of Energy and the Environment, 24, 513–544.

Dowlatabadi, H., & Oravetz, M. A. (2006). US long-term energy intensity: backcast and projection. Energy Policy, 34, 3245–3256.

Duan, H. B., Fan, Y., & Zhu, L. (2013). What’s the most cost-effective policy of CO2 targeted reduction: an application of aggregated economic technological model with CCS? Applied Energy, 112, 866–875.

Duan, H. B., Fan, Y., & Zhu, L. (2014). Optimal carbon taxes in carbon-constrained China: a logistic-induced energy economic hybrid model. Energy, 69, 345–356.

Duan, H. B., Fan, Y., & Zhu, L. (2015). Modeling the evolutionary paths of multiple carbon-free energy technologies with policy incentives. Environmental Modeling and Assessment, 20, 55–69.

Filippini, M., Hunt, L. C., & ZoriĆ, J. (2004). Impacts of energy policy instruments on the estimated level of underlying energy efficiency in the EU residential sector. Energy Policy, 69, 73–81.

Fisher-Vanden, K., Jefferson, G. H., Jingkui, M., & Jianyi, X. (2006). Technology development and energy productivity in China. Energy Economics, 28, 690–705.

Gerlagh, R., & van der Zwaan, B. C. C. (2003). Gross world product and consumption in a global warming model with endogenous technological change. Resource and Energy Economics, 25, 35–57.

Gerlagh, R., & van der Zwaan, B. C. C. (2004). A sensitivity analysis of timing and costs of greenhouse gas emission reductions under learning effects and niche markets. Climatic Change, 65, 59–71.

Gerlagh, R. (2008). A climate-change policy induced shift from innovations in carbon-energy production to carbon-energy savings. Energy Economics, 30, 425–448.

Grubb, M., Köhler, J., & Anderson, D. (2002). Induced technical change in energy and environmental modeling: analytic approaches and policy implications. Annual Review of Energy and the Environment, 27, 271–308.

Hasanbeigi, A., Morrow, W., Sathaye, J., Masanet, E., & Xu, T. F. (2013). A bottom-up model to estimate the energy efficiency improvement and CO2 emission reduction potentials in the Chinese iron and steel industry. Energy, 50, 315–325.

Hübler, M., Baumstark, L., Leimbach, M., Edenhofer, O., & Bauer, N. (2012). An integrated assessment model with endogenous growth. Ecological Economics, 83, 118–131.

International Energy Agency (IEA) (2002). Key world energy statistic. Paris: OECD Publishing.

International Energy Agency (IEA) (2004). Renewable energy. Paris: OECD Publishing.

International Energy Agency (IEA) (2012). World energy outlook 2012. Paris: OECD Publishing.

Jaffe, A. B. (1986). Technological opportunity and spillover of R&D evidence from firms’ patents, profits, and market value. American Economic Review, 76, 984–1001.

Lin, B. Q., & Wang, X. L. (2014). Exploring energy efficiency in China’s iron and steel industry: a stochastic frontier approach. Energy Policy, 72, 87–96.

Löschel, A. (2002). Technological change in economic models of environmental policy: a survey. Ecological Economics, 43, 105–126.

Manne, A. S., & Richels, R. G. (1991). Global CO2 emission reductions: the impacts of rising energy costs. The Energy Journal, 12, 87–107.

Manne, A., & Richels, R. G. (1997). On stabilizing CO2 concentrations: cost-effective emission reduction strategies. Environmental Modeling and Assessment, 2, 251–265.

Mansfield, E. (1977). Social and private rates of return from industrial innovations. The Quarter Journal of Economics, 91, 221–240.

McKinsey and Company (2010). Energy efficiency: a compelling global resource. New York: Mckinsey & Company.

Kesicki, F., & Yanagisawa, A. (2015). Modeling the potential for industrial energy efficiency in IEA’s world energy outlook. Energy Efficiency, 8, 155–169.

Nordhaus, W. D. (1994). Managing the global commons, the economics of climate change. Cambridge, MA: MIT Press.

Nordhaus, W. D., & Boyer, J. (2000). Warming the world, economic models of global warming. Cambridge, MA: MIT Press.

Nordhaus, W. D. (2002). Modelling induced innovation in climate-change policy. In A. Grubler, A. Nakicenovic, & W. D. Nordhaus (Eds.), Technological change and environment (pp. 182–209). Washington, DC: Resources for the Future.

Pakes, A. (1985). On patents, R&D, and the stock market rate of return. Journal of Political Economy, 93, 390–409.

Popp, D. (2001). The effect of new technology on energy consumption. Resource and Energy Economics, 23, 215–239.

Popp, D. (2002). Induced innovation and energy prices. American Economic Review, 92, 160–180.

Popp, D. (2004). ENTICE: endogenous technological change in the DICE model of global warming. Journal of Environmental Economics and Management, 48, 742–768.

Popp, D. (2006). ENTICE-BR: the effects of backstop technological R&D on climate policy models. Energy Economics, 28, 188–222.

REN21. (2015). Renewables 2015 Global Status Report. Paris, France. ISBN 978–3–9815934-6-4.

Schnelder, S. H., & Goulder, L. H. (1997). Achieving low-cost emissions targets. Nature, 389, 13–14.

Schumacher, K., & Sands, R. D. (2007). Where are the industrial technologies in energy-economy models? An innovative CGE approach for steel production in Germany. Energy Economics, 29, 799–825.

Ürge-Vorsatz, D., & Metz, B. (2009). Energy efficiency: how far does it get us in controlling climate change. Energy Efficiency, 2, 87–94.

Wigley, T. M. L., Richels, R., & Edmonds, J. A. (1996). Economic and environmental choices in the stabilization of atmospheric CO2 concentrations. Nature, 379, 240–243.

World Bank. (2012). World Bank development indicator database. World Bank: Washington D C http://data.worldbank.org/indicator.

Worrell, E., Bernstein, L., Roy, J., Price, L., & Harnisch, J. (2009). Industrial energy efficiency and climate change mitigation. Energy Efficiency, 2, 109–123.

Zhang, P. (2011). The 11th five-year plan goal on energy saving has basically achieved. China Petroleum and Chemical Industry, 2, 50.

Zhou, P., Sun, Z. R., & Zhou, D. Q. (2014). Optimal path for controlling CO2 emissions in China: a perspective of efficiency analysis. Energy Economics, 45, 99–110.

Acknowledgments

Financial support for this work was provided by the Ministry of Education, Humanities and Social Sciences Youth Fund Project, No. 14YJC630029, and the National Natural Science Foundation of China under grant Nos. 71503242, 71210005. The authors would like to express their gratitude to the excellent comments from group members of the Center for Energy and Environmental Policy Research (CEEP), Chinese Academy of Sciences (CAS). Special thanks should also be given to all the anonymous reviewers for their extensive feedback.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Summary of abbreviations.

- IAMs:

-

Integrated assessment models

- AEEI:

-

Autonomous energy efficiency improvement

- EEI:

-

Energy efficiency improvement

- EEEI:

-

Endogenous energy efficiency improvement

- GWP:

-

Gross world product

- R&D:

-

Research and development

- GHGs:

-

Greenhouse gases

- EU:

-

European Union

- NLP:

-

Nonlinear programming algorithm

- CES:

-

Constant elasticity substitution

- LBD:

-

Learning-by-doing

- LBS:

-

Learning-by-searching

- FBND:

-

Forgetting-by-not-doing

- CTE:

-

Carbon ton equivalent

- $/tC:

-

US dollar per ton of carbon

- BAU:

-

Business-as-usual

- CGE:

-

Computable general equilibrium

- DICE:

-

Dynamic integrated climate economy model

- ENTICE:

-

Model for endogenous technological change

- DEMETER:

-

De-carbonization model with endogenous technologies for emissions reductions

- WITCH:

-

World-induced technical change hybrid model

Rights and permissions

About this article

Cite this article

Duan, H., Zhang, G., Fan, Y. et al. Role of endogenous energy efficiency improvement in global climate change mitigation. Energy Efficiency 10, 459–473 (2017). https://doi.org/10.1007/s12053-016-9468-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12053-016-9468-1