Abstract

This study aims to enhance our understanding on the macroeconomic effects of autonomous energy efficiency improvement. We adopt a global computable general equilibrium model assuming future energy efficiency improvement until 2040 follows historical trends at a regional level including the USA, European Union, Japan, Russia, China, India, and Brazil over the period of 1995–2009. Results show that the global GDP would increase by 1.3% from 2015 to 2040, without making any regions worse off, if energy efficiency in all economic activities other than energy production gradually reaches 10% higher in 2040 than a baseline scenario. However, economy-wide rebound effects on energy use accumulate over time and vary from 55 to 78% across regions in 2040. The additional energy efficiency improvement by the same percentage for fossil and non-fossil energy pushes a stronger downward pressure on fossil fuel prices than on renewable prices, thus discouraging the share of renewables in the energy mix. We conclude that energy efficiency policy needs to be aligned with renewable and climate targets to control its rebound effect on energy use and related emissions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Energy is a vital input to an economy. As part of production factors such as labor and capital, using energy more productively enables economic growth by increasing the value obtained for each unit of energy. Enhancing the energy intensity of GDP can significantly reduce global mitigation costs (Kriegler et al. 2014; Kober 2014). Although energy efficiency and productivity can be viewed as somewhat interchangeable, there are differences in terms how these concepts are communicated and interpreted. Energy efficiency represents 37% of the global abatement of greenhouse gas (GHG) emissions required to limit global warming to 2°. Of the 161 Nationally Determined Contributions as part of the Paris Agreement, 143 mentioned energy efficiency, however few, contain targets (IEA 2018). The reason why countries might not develop a target may come from the concerns that a target would conflict with the goals around economic growth.

Energy productivity improvement can bring about an array of direct, indirect, and induced impacts that collectively cause macroeconomic effects. Progress in energy productivity can simply affect flows of energy inputs and prices, thus resulting in the reallocation of energy and non-energy resources across the economy. Energy productivity improvement in a given sector can trigger increased sectoral activity, which will indirectly stimulate the demand for other sectors through intermediate demand. The macroeconomic effect can also be induced by increased disposal income because of energy cost savings. Depending on how this income is invested, spent, or saved, the income effects would have a range of implications on energy-importing costs, competitiveness of firms, employment, supply, and demand of both non-energy and energy goods. All these channels may generate global impact through changes in trade patterns and international energy prices.

Few countries, such as Australia and the USA, have set up an economy-wide energy productivity target. For example, Australia’s National Energy Productivity Plan adopted in 2015 provides a framework to deliver 40% improvement in energy productivity by 2030. The advantage of this framework is to better coordinate energy efficiency, energy market reform, and climate policy. Between 2000 and 2015, the world experienced about a 60% increase in productive activities with an average annual growth rate of 3.2%, against a 41% increase in energy use with an average annual growth rate of 2.3%. Consequently, the energy productivity of productive activities of the global economy improves by about 14%, corresponding to an average annual growth rate of 0.88%.Footnote 1 The quantitative assessment on the macroeconomic benefits of energy productivity progress is yet scarce across major jurisdictions.

There is also a growing importance in enhancing the compatibility of an energy efficiency target with broader climate and energy policies. A related phenomenon is the so-called rebound effect, describing the situation in which the reduction rate of energy use is different from the increase in energy efficiency. For example, a 1% increase in energy efficiency does not lead to a 1% reduction in energy use. If the actual reduction in energy use is only 0.4%, then the rebound effect is 60%, meaning that 60% of the expected reduction in energy use has been unrealized. Recent evidence for large rebound effects also means that energy consumption growth may turn out to be spectacularly higher than what is currently being considered (Saunders 2015). The macroeconomic impact of energy efficiency improvement constitutes one of the major reasons for which rebound effects might be important, particularly in the context of fast-growing economies. Hence, assessing the macroeconomic effects of energy productivity improvement is essential to driving action towards the achievement of absolute reduction in energy use and associated GHG emissions.

To better understand these challenges, we adopt a global computable general equilibrium (CGE) model and construct a dataset of historical energy efficiency improvement in key regions including the USA, European Union, Japan, Russia, China, India, Brazil, and the rest of the world over the period of 1995–2009. Scenario analysis investigates economic output, energy demand, and associated emissions across sectors, economic agents, and countries because of improvements in energy productivity from 2015 to 2040. Results show that achieving 10% more energy productivity through 2040 than the 1995–2009 historical trends can help boost the global GDP by 1.3%, without making any regions worse off. However, economy-wide rebound effects on energy use increase over time and vary from 55 to 78% across countries in 2040. Additional energy productivity pushes a stronger downward pressure on fossil fuel prices than on renewable prices, thus discouraging the share of renewables in the energy mix. The findings highlight the importance of a right policy mix in addressing the adverse effects associated with changes in energy prices and rebound effects on energy use and related GHG emissions.

The remainder of the paper is structured as follows. The “Literature review” section reviews the literature and highlights the scientific originality of our study. The “Model and policy scenarios” section introduces the main features of the model and policy scenarios. The “Results and discussion” section presents results and key findings. The “Conclusions” section concludes with policy implications.

Literature review

The existing literature on energy and development does show that energy can exert a significant influence on the development process (Toman and Jemelkova 2003). The extent to which different countries use energy as an input to generate economic output or value added varies significantly (Oseni 2011). It is widely recognized that energy efficiency improvement can bring about multiple benefits across economic, social, and environmental areas (ACEEE 2011; IEA 2014).

The macroeconomic impact of energy productivity improvements can have both short-run and long-run effects. Short-run effects may influence economy competitiveness. For example, a recent study shows that firms whose energy productivity was among the worst in their sector could achieve growth in annual profits of 2.2 to 13.8% by increasing energy efficiency to bring it in line with that of their best-performing peers (Australia 2016). Long-run effects can affect the structure of an economy because of changes in relative prices of production factors. Wei and Liu (2017) have identified the role of labor and capital inputs in determining the macroeconomic benefits of energy productivity improvements.

There exist various modeling approaches to assessing the broader economic consequences of such energy productivity improvement. The IEA combines a CGE model and an energy-system simulation model to produce an Efficient World Scenario (EWS) to assess how implementing only economically viable energy efficiency measures would affect energy markets, investment, and GHG emissions (OECD/IEA 2012). While the EWS would contribute to more than half of the overall reduction in global GHG emissions, this would imply an increase in global GDP of 1.1% relative to the baseline in 2035 with most countries benefiting from the energy efficiency improvement (Château et al. 2014). Nordhaus (2008) calibrates a global growth model, well known as the Dynamic Integrated Climate-Economy (DICE) model, which is particularly suitable to investigate how to best divide today’s world GDP between consumption and savings and how much energy to use in production of goods and services. The DICE model includes a measure of energy efficiency that allows studying the welfare effects of energy efficiency improvements and their implications on the optimal tax on GHG emissions. The Energy-Environment-Economy Global Macro-Economic (E3ME) model builds on a global macroeconometric model coupled with a detailed energy system representation. The E3ME can be used to study the short- and long-term impact of interaction between energy and economic growth (Cambridge Econometrics 2014). The Emissions Prediction and Policy Analysis (EPPA) model combines the features of CGE and growth models, as well as a detailed energy system description (Paltsev et al. 2005). Sharma et al. (2014) uses input-output framework to examine macroeconomic impacts of improving energy efficiency in key Asian countries from 2010 to 2050. Most traditional models consider autonomous energy efficiency improvement as an exogenous factor, with recent study exploring the endogenous treatment of energy efficiency improvements to be determined within the model (Duan et al. 2017).

While each modeling approach has trade-offs between strengths and weaknesses, this study adopts a model of Global Responses to Anthropogenic Change in the Environment (GRACE), which is a relatively well-established global CGE model (Aaheim and Rive 2005; Liu and Wei 2016; Aaheim et al. 2018). The existing study with strong focus on the macroeconomic impact of energy productivity improvements by using a global CGE model is less common. We integrate energy intensity indicators estimated from historical data for the period of 1995–2009 into the GRACE model. Referring to traditional macroeconomic models, we consider the observed long-run historical trend of reduced energy requirement per unit of output as an exogenously factor. The objective of this paper is to provide an empirical evidence of macroeconomic benefits of energy productivity improvements and consequently economy-wide rebound effects at the global level.

Little literature, except Barker et al.’s (2009), Wei and Liu’s (2017), and Webster et al.’s (2008), estimates energy consumption change derived from global macroeconomic effects. Several studies focus on the economy-wide rebound effects from energy efficiency improvement in a single country (Barker et al. 2007; Turner 2009; Wei and Liu 2017). Barker et al. (2009) reported the global rebound effect on energy use to be 31% by 2020 and 52% by 2030. Wei and Liu (2017) shows that a 10% improvement in energy efficiency for all final energy use at the global level may lead to an actual reduction in energy use and related emissions, in the long term, as low as 3% and 1%, respectively. By using a global CGE model, this study will provide further insights into the extent to which the economic growth resulting from improved energy productivity can change the future energy use, and how the energy productivity change will interact with the targets of renewable energy and GHG emissions.

Model and policy scenarios

The GRACE model

The GRACE model follows standard assumptions of CGE models such as profit maximization of producers and utility maximization of consumers. The GRACE model has been applied to studies on climate change and climate policy analysis (e.g., Aaheim et al. 2012; Glomsrød et al. 2013; Liu and Wei 2016; Underdal and Wei 2015; Glomsrød et al. 2016). In the model, the world is divided into eight regions: Brazil, China, European Union, Japan, Russia, India, the USA, and the Rest of the World. In a region, the economy is described by production activities in eleven sectors including agriculture, manufacturing (steel and iron, cement, and other manufacturing goods), transport, services, and energy sectors (coal, crude oil, refined oil, gas, and electricity). In the electricity sector, electricity is generated from nine technologies including fossil-fueled (coal, gas, and oil) and non-fossil-fueled (nuclear, hydro, biomass, wind, solar, and other renewables).

The base year (2011) economic data are taken from GTAP v9 database (Badri et al. 2015), where the cost structure of electricity generation technologies is estimated in Tables 4.1A and 4.2A of OECD/NEA (2010). Total supply of productive resources including labor, capital, and natural resources are determined exogenously and updated yearly in a region. Labor supply follows population growth in the medium fertility scenario of UNPD (2015). At the beginning of a year, new capital is generated from the previous year’s investments. Labor is homogenous and can be employed by any activity in a region, whereas capital and natural resources are immobile across activities. Global investments are allocated to a region based on the expectation of the region-specific rate of return to capital (ERRC). A more detailed description of the GRACE model is provided in the Appendix.

Policy scenarios

Business-as-usual scenario

In this study, we design a business-as-usual (BAU) scenario, where energy productivity is represented by average changes in energy efficiency by region and energy (coal, oil, gas, and electricity) based on an estimation from historical data (Wei and Liu 2019), which are time series on energy use and value added in the World Input-Output Database 1995–2009 (WIOD; Timmer 2012). The energy productivity changes vary significantly in existing energy-economic models, particularly at the regional and sectoral levels (Sugiyama et al. 2014). The efficiency changes of household energy use follow the average of total production activities in a region (Wei and Liu 2019). The energy productivity is assumed to increase at the same rate in a region until 2040 in the BAU scenario.

The BAU scenario 2011–2040 roughly follows the regional energy consumption and economic growth described in the New Policies Scenario (NPS) (IEA 2015). Given the energy productivity improvement over time, we calibrate total consumption of coal, oil, and gas by introducing a regional tax/subsidy on each of coal, oil, and gas, respectively. Similarly, for each of the nine electricity generation technologies, we introduce a regional tax/subsidy to align with the NPS data. During the calibration, we assume non-fossil-fueled electricity to be consumed within a region.

We estimated the average changes in yearly labor and capital productivity by sector and region based on the WIOD database (Timmer 2012), which is adopted in this study. In BAU, we keep the same change rates of labor and capital productivity as the estimated average changes in all sectors other than agriculture, where the change rates are set to be half of the estimated ones. For developing regions including Brazil, China, India, and the Rest of the World, we also assume the initial land productivity for agriculture as half of the estimated changes in labor productivity to ensure that agriculture does not contribute too much to the regional GDP in the simulation period. This assumption implies that these developing regions would gradually follow the historical development pattern of developed regions, i.e., shrinking share of agriculture in GDP. Without this assumption, these regions would depend heavily on agricultural output in the coming decades, which is not realistic.

Furthermore, regional wage rates grow proportional to that of GDP in the region. Specifically, the wage rate increases at the same rate as GDP in Japan, 90% in European Union and Russia, 80% in China, 50% in Brazil and the USA, 45% in India, and 30% in the Rest of the World. This is achieved by adjusting labor productivity over time.

Finally, we proportionally adjust the productivity of labor, capital, and natural resources for all production activities to achieve the GDP growth described in the NPS scenario (IEA 2015). After the whole calibration, we adopt the calibrated parameters to endogenously generate regional GDP and energy consumption in the BAU scenario. Notice that now we also change the closure rule for the labor market to allow flexible labor supply by assuming exogenous wage rates. The change in the closure rule allows the simulation of the effect on labor demand driven by energy efficiency improvements in alternative scenarios.

Alternative energy productivity scenarios

To study the impact of changes in autonomous energy productivity, we consider two energy efficiency scenarios other than BAU. One is optimistic scenario where the energy efficiency smoothly improves from 2015 until 2040 when the energy efficiency of all fossil and non-fossil energy used by all non-energy sectors in all regions reaches 10% higher than the 2040 BAU ones. The energy efficiency in energy production sectors is assumed the same as the BAU level. In other words, yearly energy efficiency is 0.38% higher in non-energy sectors than BAU over the period. By contrast, the other scenario is pessimistic where the energy efficiency of all energy used by non-energy sectors smoothly becomes 10% lower than the 2040 BAU one, a yearly decrease of 0.42% compared with BAU from 2015 to 2040.

It would be interesting to make energy productivity endogenous in the alternative scenarios, i.e., assuming that energy productivity improvement is not autonomous and driven by a certain level of investments. A typical treatment of endogenous energy efficiency improvements assumes that the energy efficiency investments should be economically efficient, meaning that the benefits obtained from these investments have to be greater to motivate such decisions so that the investors can obtain returns from their investments at least at the average rate of the whole economy growth (e.g., Duan et al. 2017). This assumption then implies that the endogenous energy efficiency mechanism would always be harmless for the economic growth. As this study focuses on the long-run trends of autonomous energy productivity improvements, we treat energy productivity as an exogenous factor consistently in both BAU and alternative scenarios. It is worth noting that introducing the endogenous mechanism of energy productivity will reinforce our findings.

Results and discussions

Economic implications

Over the study period 2015–2040, achieving 10% more energy efficient than the BAU would result in a cumulative boost to the global economy of 41.7 trillion US dollars (USD), about 2.5 times the 2014 GDP of the USA and representing a 1.3% increase compared with the BAU. Six countries or regions account for 74% of cumulative global GDP gains in the optimistic scenario (Fig.1). The USA, European Union, Japan, China, India, and Brazil receive the largest boost representing 8, 8.3, 2.5, 7.9, 2.9, and 1.5 trillion USD, respectively. The rest of the world also benefits from the global economic context. However, the global GDP in case of 10% less energy efficient scenario would experience a cumulative loss of 47.3 trillion USD in 2040, being 1.4% lower than the BAU.

In the optimistic scenario over the period 2015–2040, the annual growth rate of GDP is improved by 0.11–0.14 percentage points compared with the BAU in all the key regions but Russia (Fig. 2). The Russian economy depends heavily on the petroleum sector where it receives lower growth in export revenues due to reduced global demand and prices. In 2040, the global GDP rises by 2.8% when the energy efficiency improves by 10% compared with BAU. China’s economy gains USD 898 billion—13% of China’s GDP in 2011, 3.2% higher than the BAU. The USA and European Union economies see the gains of USD 785 and 810 billion, increased by 2.8% and 3.1% compared with the BAU, respectively. India’s GDP grows by 3.3%, corresponding to USD 356.4 billion.

Energy efficiency has long-term sustainable benefits, as the GDP elasticity with respect to the energy efficiency improvement increases steadily from 17 in 2016 to 28% in 2040 (Fig. 3). Progressive improvement of energy efficiency materializes incrementally in the whole economy. Therefore, global GDP benefits are increasing steadily over time with the cumulative impact of energy efficiency improvement. The deviation trends initiated in the short run are reinforced in the long run.

Energy efficiency improvement increases supply of energy service (product of physical energy use and energy efficiency) and triggers structural reallocation of primary factors in production, including capital, labor, and energy service, across sectors and regions. On the one hand, consumers substitute consumption of the cheaper energy service for the consumption of other goods and services while maintaining a constant level of utility. For producers, cheaper energy service substitutes for the use of capital, labor, and materials in producing a constant level of output. On the other hand, the cost savings from energy efficiency improvement allows consumers to increase consumption of all goods and services for a higher level of utility and encourages a higher level of output to be produced in the economy, thereby increasing the demand of all production inputs. With the combination of these substitution and output effects, economy-wide rebound effects on energy use derived from energy efficiency improvement are estimated to vary from 55 to 78% across countries and regions in 2040. This means a 10% higher energy efficiency will effectively reduce the BAU energy consumption of the whole economy by 2.2–4.5%. The capital and labor inputs are reallocated accordingly, but with a much smaller deviation from the BAU (Fig.4).

Energy efficiency improvement results in savings in energy expenditures and encourages production of all non-energy goods. The production of energy-intensive goods increases more than that of other non-energy goods. This results in relatively more supply and hence lower prices of energy-intensive goods than that of other non-energy goods. In our case, the lower relative prices lead to less income allocated to energy-intensive sectors including transport, steel, and cement than that allocated to other non-energy sectors. Thus, energy efficiency improvement entails shift in output and price levels of different sectors across countries, resulting in a geographical reallocation of certain sectoral activities and sectoral income. Figure 5 shows the corresponding changes in value added by country and by sector in 2040 compared with the BAU. Generally, the non-energy sectors benefit from energy efficiency improvement as production costs decrease. By contrast, the energy transformation sectors experience a slowdown. The income allocated to services and manufacturing goods in 2040 sees the largest net growth in the optimistic energy efficiency scenario, reaching additional gains of USD 3025 and 1331 billion compared with the BAU. Both sectors together capture 88% of additional value added in the non-energy sectors and primarily contribute to inducing redistribution of sectoral activities across regions.

In share terms, the value added of agriculture, services, and manufacturing activities see the most notable changes (Fig. 6). The value added of services increases greatly in the USA, European Union, and China, with each region capturing around 20% of worldwide additional value added. These countries also take the lead in the manufacturing industry, collectively representing around half of worldwide additional sectoral value added. China and India account for about 10% each of additional value added in the steel and iron sector, while China remains the largest recipient of rebalanced activities in agriculture, cement, and transport sectors. However, Russia greatly suffers from oil and natural gas sectors. The USA, European Union, and China experience a significant slowdown in the electricity sector. While the USA and the European Union also suffer from crude oil refinery activities, China is more exposed to the loss in coal production.

Energy system and climate mitigation impacts

In the optimistic efficiency scenario, the world reduces total primary energy consumption by 3.2% in 2040 compared with the BAU, with energy savings reaching 578 Mtoe in the same year. In the pessimistic scenario, the energy demand change compared with the BAU is much stronger in all the countries. The world primary energy consumption in 2040 could grow by 3.7%, corresponding to an increase of 672 Mtoe compared with the BAU (Fig. 7).

Over time, lower energy demand resulted from energy efficiency improvement contributes to increasing the renewable energy share in all countries, since the total primary energy demand is lowered at a more rapid speed than the renewable use. Thus, the share of non-fossil fuels in the primary energy consumption increases along with energy efficiency improvement in all three scenarios. For example, at the global level, the share of non-fossil energy use increases from 18.6 in 2020, 22.9 in 2030 to 25.4% in 2040 under the BAU (Fig. 8).

When the optimistic efficiency scenario is compared with the BAU scenario, additional energy efficiency pushes a stronger downward pressure on fossil fuel prices than on renewables prices although all energy is assumed the same percentage efficiency changes. Therefore, the reduction in the energy demand mainly comes from relatively more expensive renewables in all the countries, with the smallest contribution from the coal demand (Fig. 9). For example, under the BAU and optimistic efficiency scenarios, China’s coal consumption peaks around in 2030 although the optimistic energy efficiency scenario could encourage slightly more coal consumption than the BAU from 2035. The European Union also consumes more natural gas in the optimistic efficiency scenario compared with the BAU from 2033. The global reduction in renewables use would reach 419 Mtoe against 159 Mtoe for reduction in fossil fuel use. Consequently, the share of global non-fossil energy use in 2040 is lowered from 25.4 in the BAU to 23.9% in the optimistic efficiency scenario. The lower share of non-fossil fuels in the primary energy consumption is observed in all the countries. This trend is inversed in the pessimistic scenario, where the countries see a higher share of non-fossil fuels in total primary energy consumption compared with the BAU (Fig. 8).

The energy structure change becomes more obvious in the electricity system. Figure 10 demonstrates that majority of electricity demand reduction comes from non-fossil-fueled electricity including hydropower, nuclear power, wind power, and solar power in the optimistic scenario. By contrast, the demand for fossil-fueled power increases in all regions but Russia and the Rest of the World, although total fossil fuel use is reduced in every regional economy.

Hence, a general energy efficiency improvement for all energy use in non-energy sectors seems to discourage non-fossil energy use relatively due to lower prices of fossil fuels. This discouragement might be mitigated if the efficiency improvement of non-fossil energy use is improved at a larger extent than that of fossil fuel use. In this case, the direct fossil fuel use in non-fossil sectors follows the same efficiency improvement as the BAU scenario and the efficiency improvement of fossil fuel use in a regional economy is relatively less than that of non-fossil electricity. As a result, the share of global non-fossil energy use in 2040 is slightly lowered to 24.2 from 25.4% in the BAU.

With the combined effects of a greater GDP growth and total primary energy reduction, the energy efficiency impact on energy intensity of GDP is significant. In 2040, the energy intensity of global GDP is reduced by 38% compared with 2015 in the optimistic efficiency scenario compared with 34% in the BAU. The compound annual rate of energy intensity improvement between 2015 and 2040 is 1.88% in the optimistic efficiency scenario compared with 1.65% in the BAU. The global energy intensity in 2040 is increased by around 5.8% in the optimistic efficiency scenario compared with the BAU while the changes differ across regions (Fig. 11).

Due to rebound effects on fossil fuel consumption and reduction in renewable use, the impact of energy efficiency improvement on emission mitigation is not as significant as on energy intensity of GDP. The carbon intensity of global GDP is reduced by 3.7% in 2040 compared with the BAU (Fig. 11). Compared with the BAU, the cumulative global emissions over 2015–2040 are reduced by 0.7%, corresponding to 6018 MtCO2. In the BAU case, the INDC targets of carbon intensity in China and India (reduction by 60–65% compared with 2005 level in China and by 33–35% compared with 2007 level in India) are not binding because energy efficiency improvement reduces energy demand while encouraging further GDP growth. China’s CO2 emissions in the optimistic scenario are estimated to peak in 2030, 5 years ahead of the BAU case. When energy is used less efficient in the pessimistic scenario than in the BAU, carbon intensity targets become binding in both countries. However, for Brazil, the emissions from fossil fuels are increasing over time in both scenarios. Hence, it has to reduce emissions from other sources to fulfill its INDC target of reducing emissions by 37% in 2025 compared with the 2005 level.

Limitations and cautions

It is worth mentioning some limitations in the research. This study does not consider investment costs associated with the energy efficiency improvement. We assume that an overall 10% increase in baseline energy efficiency level from 2015 to 2040 represents an autonomous technological change and non-price intervention. In the literature, non-price driven energy efficiency improvements are mainly captured by this autonomous technological change. In reality, the consumer may not constantly optimize their behavior to maximize their well-being and profits for some reasons. The bounded rationality often comes from imperfect information, limit of cognitive efforts and the time available to the decision (Simon 1955). Both personal motivation and social environment can affect consumer behavior in addition to financial or price incentives (Benabou and Tirole 2003). A growing body of empirical evidence suggests that non-financial incentives may dominate financial incentives, in particular within individual energy choice settings (Jessoe et al. 2014). By informing residential consumers of electricity use compared with that of their neighbors, non-price interventions can substantially and cost effectively change consumer behavior to reduce energy consumption (Allcott 2011). Altruism and green identity also play important roles, with environmental concerns becoming a relevant aspect of consumer decisions (Kotchen and Moore 2007).

Second, this uniform 10% increase in energy efficiency may not fully reflect heterogeneous energy efficiency pathways across countries at various development levels. The energy efficiency in developed regions might be too high to progress at the same rate as that in developing regions in the forecastable future. However, our assumption of 10% increase in BAU energy efficiency level till 2040 reflects the lower bound of autonomous energy efficiency improvement regardless of current energy efficiency levels. Given the market and economic context in developing regions, the energy efficiency improvement might face certain barriers such as effective incentive mechanisms and lack of social awareness and skilled workers. The assumptions on energy efficiency improvement need further specification depending on the real circumstances.

Our results may be affected by the quality of data sources such as capital measures for developing economies. It would be interesting to study if the results are robust to different data sources. For example, the income shares in sectoral production of factors may differ if another base year is adopted, which may change the calibrated production functions in the model and affect simulated results as pointed out by Gollin (2002). It is also possible to update the estimated energy productivity based on the dataset for 2000–2014 released in the WIOD webpage. The alternative values of key parameters set in the model may also affect our results. However, we would not expect dramatic changes in our results if these alternative data are chosen.

Conclusions

Energy efficiency is commonly considered a short-term and cost-effective tool to mitigate the climate change. By comparing the simulation results of a suit of energy-economic models and integrated assessment models, The SE4AllFootnote 2 global tracking framework reveals that energy efficiency progress remained at only two-thirds of the rate needed to achieve the objective by 2030 (WB and IEA 2017). If all countries achieve their commitments to the 2015 Paris Agreement, the world will only achieve an annual energy intensity improvement of 2% for 2016–2030, well below the average of 2.6% needed to reach the UN Sustainable Development Goal 7 on energy efficiency. Efficiency improvements become even more essential to achieving a climate target when fewer technological options exist for reducing emissions.

Our study estimates macroeconomic impacts of autonomous energy productivity improvement based on a global multi-regional CGE model. Energy intensity of the GDP over the period of 1995–2009 is used to approximate the BAU for energy productivity change across regions. Achieving 10% more energy efficiency than the BAU helps boost the global GDP by 1.3% from 2015 to 2040, with services and manufacturing sectors seeing the largest gains. This study provides further evidence that more stringent energy efficiency targets must be in place to achieve economic growth together with emissions abatement and energy transition.

Our study illustrates that the effects of energy productivity improvements mainly reduce the demand of renewables rather than fossil fuels in the absence of appropriate policy instruments. This unexpected result may conflict with the targeted share of non-fossil fuels or renewables in primary energy consumption. The key issue is how, if any, energy efficiency can make non-fossil fuels or renewables cheaper. Energy efficiency must lead to reduced prices of non-fossil fuels or renewables by a larger proportion than those of fossil fuels. In many countries, governments would need to implement a strong policy on the control of fossil-fuel energy consumption while improving energy efficiency. In the same sense, energy efficiency must make energy efficient goods or services more economically competitive compared with energy-intensive goods or services. By that, energy efficiency can be used as a driver to change the composition of the economy rather than focusing only on energy-intensive activities.

Energy productivity can greatly contribute to the economic growth, which in turn generates significant economy-wide rebound effects. Our study suggests that the economy-wide rebound effects can vary from 55 to 78% across countries in 2040. Increased use of energy triggers larger economic output so that energy intensity of the economic output falls. Therefore, achieving a relative climate target in terms of emissions per unit of GDP seems feasible. However, energy efficiency may not lead to absolute emission reduction because of increased consumption of fossil fuels in some countries. While improving energy productivity is a powerful and cost-effective tool to promote economic growth, its role in reducing energy consumption and GHG emissions must be considered cautiously. In case the economy-wide rebound effects are strong, more stringent energy efficiency targets must be placed to compensate the increase of energy consumption without scarifying macroeconomic benefits of energy efficiency improvement.

For further research, it might be useful to examine macroeconomic impacts of energy efficiency with various constraints of labor and capital factors and with more detailed data on energy efficiency investments.

Notes

The estimates are based on the productive sectors that contribute to the value added of a given economy and excluding the residential sector.

Short for “Sustainable Energy for All.” Former UN Secretary-General Ban Ki-moon launched SE4ALL in September 2011 as a global initiative to support SDG7.

References

Aaheim, A., Amundsen, H., Dokken, T., & Wei, T. (2012). Impacts and adaptation to climate change in European economies. Global Environmental Change-Human and Policy Dimensions, 22(4), 959–968. https://doi.org/10.1016/j.gloenvcha.2012.06.005.

Aaheim, A., Orlov, A., Wei, T., & Glomsrød, S. (2018). GRACE model and applications. Report (Vol. 2018:01). Oslo, Norway: CICERO.

Aaheim, A., & Rive, N. (2005). A model for global responses to anthropogenic changes in the environment (GRACE). Report (Vol. 2005:05). Oslo, Norway: CICERO.

ACEEE. How does energy efficiency create jobs. In American Council for an Energy Efficient Economy Fact Sheet, 2011: Washington DC

Allcott, H. (2011). Social norms and energy conservation. Journal of Public Economics, 95(9), 1082–1095.

Australia, C. (2016). Could boosting energy productivity improve your investment performance? A guide for investors. https://www.environmental-finance.com/assets/files/research/17-05-2016-climateworks.pdf. Accessed 23 Jan. 2018.

Badri, N., Aguiar, A., & McDougall, R. (Eds.). (2015). Global trade, assistance, and production: the GTAP 9 data base: Center for Global Trade Analysis, Purdue University, http://www.gtap.agecon.purdue.edu/databases/v9/v9_doco.asp.

Barker, T., Dagoumas, A., & Rubin, J. (2009). The macroeconomic rebound effect and the world economy. Energy Efficiency, 2(4), 411–427. https://doi.org/10.1007/s12053-009-9053-y.

Barker, T., Ekins, P., & Foxon, T. (2007). The macro-economic rebound effect and the UK economy. Energy Policy, 35(10), 4935–4946.

Benabou, R., & Tirole, J. (2003). Intrinsic and extrinsic motivation. The Review of Economic Studies, 70(3), 489–520.

Cambridge Econometrics. (2014). E3ME technical manual, Version 6.0. Cambridge, UK: Cambridge Econometrics.

Château, J., B. Magné, & Cozzi, L. (2014). Economic implications of the IEA efficient world scenario. /content/workingpaper/5jz2qcn29lbw-en https://doi.org/10.1787/5jz2qcn29lbw-en.

Duan, H., Zhang, G., Fan, Y., & Wang, S. (2017). Role of endogenous energy efficiency improvement in global climate change mitigation. Energy Efficiency, 10(2), 459–473.

Glomsrød, S., Wei, T., Aamaas, B., Lund, M. T., & Samset, B. H. (2016). A warmer policy for a colder climate: can China both reduce poverty and cap carbon emissions? Science of the Total Environment, 568, 236–244. https://doi.org/10.1016/j.scitotenv.2016.06.005.

Glomsrød, S., Wei, T., & Alfsen, K. (2013). Pledges for climate mitigation: the effects of the Copenhagen accord on CO2 emissions and mitigation costs. Mitigation and Adaptation Strategies for Global Change, 18(5), 619–636. https://doi.org/10.1007/s11027-012-9378-2.

Gollin, D. (2002). Getting income shares right. Journal of Political Economy, 110(2), 458–474.

IEA. (2014). Capturing the multiple benefits of energy efficiency. Paris: International Energy Agency.

IEA (2015). World energy outlook 2015. International Energy Agency.

Jessoe, K., Rapson, D., & Smith, J. B. (2014). Towards understanding the role of price in residential electricity choices: evidence from a natural experiment. Journal of Economic Behavior & Organization, 107, 191–208.

Kober, T. (2014). Impact of energy efficiency measures on greenhouse gas emission reduction, ECN (ECN-E–14-038). https://www.ecn.nl/publications/E/2014/ECN-E%2D%2D14-038. Accessed 14 Feb 2018.

Kotchen, M. J., & Moore, M. R. (2007). Private provision of environmental public goods: household participation in green-electricity programs. Journal of Environmental Economics and Management, 53(1), 1–16.

Kriegler, E., Weyant, J. P., Blanford, G. J., Krey, V., Clarke, L., Edmonds, J., Fawcett, A., Luderer, G., Riahi, K., Richels, R., Rose, S. K., Tavoni, M., & van Vuuren, D. P. (2014). The role of technology for achieving climate policy objectives: overview of the EMF 27 study on global technology and climate policy strategies. Climatic Change, 123(3), 353–367. https://doi.org/10.1007/s10584-013-0953-7.

Liu, Y., & Wei, T. (2016). Linking the emissions trading schemes of Europe and China - combining climate and energy policy instruments. Mitigation and Adaptation Strategies for Global Change, 21(2), 135–151. https://doi.org/10.1007/s11027-014-9580-5.

Nordhaus, W. D. (2008). A question of balance: weighing the options on global warming policies: Yale University Press.

OECD/IEA (2012). World energy outlook. World Energy Outlook. Paris: International Energy Agency.

OECD/NEA (2010). Projected costs of generating electricity 2010: OECD/Nuclear Energy Agency, OECD Publishing.

Oseni, M. O. (2011). Analysis of energy intensity and its determinants in 16 OECD countries. Journal of Energy and Development, 35(1–2), 101–140.

Paltsev, S., Reilly, J. M., Jacoby, H. D., Eckaus, R. S., McFarland, J., Sarofim, M., et al. (2005). The MIT emissions prediction and policy analysis (EPPA) model: Version 4. http://globalchange.mit.edu/files/document/MITJPSPGC_Rpt125.pdf. Accessed 8 Dec. 2010.

Saunders, H. D. (2015). Recent evidence for large rebound: elucidating the drivers and their implications for climate change models. The Energy Journal, 36(1), 23–48.

Sharma, D., S. Sandhu and S. Misra (2014). Energy efficiency improvement in Asia: macroeconomic impacts, Asian Development Bank.

Simon, H. A. (1955). A behavioral model of rational choice. The Quarterly Journal of Economics, 69(1), 99–118.

Sugiyama, M., Akashi, O., Wada, K., Kanudia, A., Li, J., & Weyant, J. (2014). Energy efficiency potentials for global climate change mitigation. Climatic Change, 123(3–4), 397–411.

Timmer, M. (2012). The world input-output database (WIOD): contents, sources and methods. http://www.wiod.org/publications/source_docs/WIOD_sources.pdf. Accessed August 2013.

Toman, M. A., & Jemelkova, B. (2003). Energy and economic development: an assessment of the state of knowledge. The Energy Journal, 4, 93–112.

Turner, K. (2009). Negative rebound and disinvestment effects in response to an improvement in energy efficiency in the UK economy. Energy Economics, 31(5), 648–666. https://doi.org/10.1016/j.eneco.2009.01.008.

Underdal, A., & Wei, T. (2015). Distributive fairness: a mutual recognition approach. Environmental Science & Policy, 51, 35–44. https://doi.org/10.1016/j.envsci.2015.03.009.

UNPD (2015). World population prospects: the 2015 revision. http://esa.un.org/unpd/wpp/index.htm. Accessed 29 Jan. 2016.

WB, & IEA (2017). Global tracking framework 2017: progress toward sustainable energy. International Bank for Reconstruction and Development/The World Bank and the International Energy Agency.

Webster, M., Paltsev, S., & Reilly, J. (2008). Autonomous efficiency improvement or income elasticity of energy demand: does it matter? Energy Economics, 30(6), 2785–2798. https://doi.org/10.1016/j.eneco.2008.04.004.

Wei, T., & Liu, Y. (2017). Estimation of global rebound effect caused by energy efficiency improvement. Energy Economics, 66, 27–34. https://doi.org/10.1016/j.eneco.2017.05.030.

Wei, T., & Liu, Y. (2019). Estimation of resource-specific technological change. Technological Forecasting and Social Change, 138, 29–33. https://doi.org/10.1016/j.techfore.2018.08.006.

Acknowledgements

We are grateful for constructive comments from four anonymous reviewers. This study was supported by the Research Council of Norway (grant 209701 and 250201) and the Key Project of the National Social Science Foundation (No. 15AJY004). Any errors that remain are the responsibility of the authors.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

This appendix can be found from Appendix A of Wei and Liu (2017).

Appendix

A brief description of the GRACE model

GRACE is a recursively dynamic computable general equilibrium (CGE) model. The model finds a static general equilibrium solution for a year given exogenous settings, which can be updated over time. In this version, key intertemporal exogenous settings include supply and productivity of labor and capital stock at the beginning of a year. In the BAU scenario, regional productivity of labor and capital stock is updated over time and their values are calibrated to obtain the exogenous regional GDP growth. Regional labor supply changes over time at the same rates of regional growth of population size. In the beginning of a year other than the base year, regional capital stock is adjusted by deducting depreciation of the existing capital stock and adding new capital stock generated from previous year investments, which are financed by total savings from all regions. In mathematical form, we have:

where Kr, t is the available capital stock in a region r at the beginning of a year t; δ is the depreciation rate of 4% annually for all regions; and Ir, t is the investments in a region r during a year t. Regional investments (Ir, t) are financed by a common pool of global savings, which is the sum of regional savings. For each region, we assume that if capital stock grows at a region-specific growth rate of capital stock (\( {\hat{K}}_r \)), then at a given time s, investors would expect a constant rate of return to capital. Hence, the expected rate of return to capital (Rr, s + h) in an instantaneous time h > 0 is only related to the change in capital stock other than the region-specific growth:

where σ > 0 is elasticity of the expected rate of return with respect to the capital stock, which is assumed 10 in the GRACE model. Differentiation with respect to h on both sides yields:

where the “.” above a variable represents the derivative with respect to time. The above expression can be rewritten as:

By assuming t = s + h. A discrete version of the above Eq. A2 is:

By using Eq. A1, we have:

Which is adopted in GRACE to allocate global investments to regions by equalizing the changes in regional rates of return to capital, i.e., for any two regions r and rr,

Hence, the allocation of investments across regions does not depend on the elasticity of the expected rate of return with respect to the capital stock (σ).

In the end of a year, total returns to capital of all regions are allocated to regions proportional to shares of regional savings at the beginning of the year. After receiving its share of returns to capital and other income (labor income and various taxes), a region allocates a fixed share of its income for global savings, which is then used for global investments. The other part of the regional income is proportionally allocated for private and public consumptions.

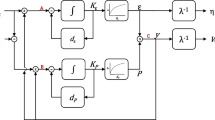

International trade is modeled through a nested constant elasticity of substitution (CES) function (Fig. 12). The parameters starting with small letter “e” indicate the elasticities of substitution at the level where they stay. An Armington good combines domestic production and an aggregate of imports from all other regions. Exceptions of the elasticities are made for the following sectors: (a) refined oil (eARM = 6), (b) electricity (eARM = 0.5; eIMP = 0.3), and (c) gas and coal (eIMP = 4). With the trade of a good, the importing country pays a fixed unit cost to the international transport sector. The international transport is provided by a Cobb-Douglas composite of regional transport services.

Figure 13 illustrates the economic activities of a region. Together with intermediate inputs of goods and services, available productive resources—capital, labor, and natural resources—are utilized to produce goods and services, which can export to other regions and meet final demand for domestic private and public consumption and investments together with imported substitutes. Investments form new capital for the next period. As by-products, greenhouse gas emissions accompany with these economic activities. CO2 emissions from fossil fuels are linked to fossil fuels used by producers and households by fixed emission factors.

Sectoral production is simulated by two types of nested CES functions. One type is illustrated in Fig. 14 for production of primary energy, i.e., crude oil, coal, and gas. To highlight the dependence on natural resources, the top level is a combination of the natural resource (RES) and an aggregate of remaining inputs. At the middle level, the remaining inputs are a Leontief composite of intermediate goods and value added, where the value-added combines capital (CAP) and labor (LAB).

The other type of production functions (Fig. 15) is for goods and services other than the primary energy. The top level is a Leontief composite of intermediate inputs other than energy and an aggregate of value added and energy inputs (VA Energy). The next level is a combination of value added and energy inputs. The value added is further a combination of capital and labor. The energy inputs are a combination of electricity (ELC) and other energy inputs as a Cobb-Douglas aggregate of crude oil (CRU), coal (COL), refined oil (REF), and gas (GAS).

Figure 16 illustrates the demand structures of consumers and investors. At the top level, substitution can be made between energy and the other goods (non-energy). At the bottom level, the energy combines five energy goods and the non-energy combines all the other goods.

Rights and permissions

About this article

Cite this article

Liu, Y., Wei, T. & Park, D. Macroeconomic impacts of energy productivity: a general equilibrium perspective. Energy Efficiency 12, 1857–1872 (2019). https://doi.org/10.1007/s12053-019-09810-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12053-019-09810-1