Abstract

This study uses a quantitative methodology to investigate how the rise of digital money has affected efforts to increase green energy use in China. This work contributes to the body of knowledge by using a number of empirical methods, such as regression analysis, parametric quantile estimation, stability diagnostic tests, and sensitivity analysis. This study’s results further demonstrate the importance of digital financing in easing the adoption of renewable energy sources throughout China. Financing alternatives for renewable energy projects have increased as a result of digital finance’s integration of digital technology with financial services. A wider range of investors has been attracted through crowdfunding, peer-to-peer lending, and other alternative financing models made possible by digital platforms, allowing the development of small and medium-sized renewable energy projects that may have had trouble securing funding through more traditional channels. The impact of digital finance on energy management and optimization is also investigated. As a result, renewable energy sources have been more widely adopted due to increased energy efficiency, better grid integration, and more efficient energy delivery. This study presents substantial evidence of the beneficial benefits of digital finance on renewable energy use in China using rigorous empirical methodologies such as regression analysis, parametric quantile estimation, stability diagnostic tests, and sensitivity analysis. The results highlight the significance of using digital money to boost the use of renewable energy, lessen reliance on fossil fuels, and help create a greener, more sustainable future.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Promoting renewable energy consumption is essential in the fight against climate change and for achieving sustainable development on a global scale (Razzaq et al. 2023). By investing heavily in renewable energy sources including wind, solar, and hydro, China has become a major player in this space. However, there are several obstacles in the way of the broad adoption and integration of renewable energy sources into China’s energy system (Du et al. 2022). The introduction of digital finance, exemplified by mobile payments, blockchain, and online platforms, has completely altered China’s economic landscape. With the ability to fund, distribute, and use renewable energy in novel ways, the digital revolution has the potential to radically alter the energy sector (Lin and Ma 2022). As a result, studying how digital finance might encourage green energy usage in China is a tempting research opportunity (Zhang et al. 2022). For several reasons, it is critical to have a handle on how digital money is influencing the spread of renewable energy. Because of China’s massive population and fast growing middle class, the country has an insatiable want for energy and urgently needs clean, sustainable alternatives to fossil fuels. Financing alternatives for investing in and using renewable energy may be made more readily available and inexpensive via the use of digital finance. Second, renewable energy producers now have more options for gaining access to financing, streamlining transactions, and overcoming conventional financial restrictions thanks to digital finance platforms. Renewable energy projects may benefit from digital finance since it allows for cheaper financing options including crowdsourcing, smart contract-based transactions, and peer-to-peer lending.

Furthermore, by using blockchain technology, digital finance may increase openness and confidence in the renewable energy industry. Blockchain’s distributed and irreversible transaction records may boost renewable energy’s transparency, make it easier to issue renewable energy certifications, and encourage confidence between suppliers and buyers. Because of this increased openness, the growth of strong renewable energy markets may be encouraged, and investor and consumer confidence can be bolstered. Thus, studying how digital finance and the use of renewable energy interact in China is a promising area of study. Policymakers, industry stakeholders, and academics may overcome financial, technological, and regulatory hurdles to renewable energy adoption by better understanding the function of digital finance in this space. This study has the potential to aid in the long-term modernization of China’s energy infrastructure, helping the nation meet its goals of reducing its carbon footprint and ensuring a brighter, more prosperous future.

The fight against climate change and the pursuit of sustainable development need the incorporation of renewable energy sources into China’s energy infrastructure (Cao et al. 2021). Promoting the use of renewable energy sources may be aided by digital money, which includes mobile payments, blockchain, and online platforms. However, there has been little investigation into how exactly digital financing promotes green energy uptake in China. Therefore, the question that needs answering is how exactly digital finance helps increase the use of renewable energy sources in China (Wang et al. 2023). The goal of this study is to learn more about how the use of digital finance may facilitate and stimulate the development of renewable energy sources within China’s dynamic energy market. By solving this research puzzle, we can learn more about how digital finance might help promote the widespread use of renewable energy in China. Policymakers, industry stakeholders, and academics will be able to use the results to their advantage as they work to design methods to overcome monetary, technological, and regulatory hurdles. To maximize its potential, speed the transition to a cleaner and more sustainable energy system in China, and contribute to global efforts to mitigate climate change, it is crucial to understand the processes through which digital finance supports consumption of renewable energy (Wu et al. 2022).

This study makes significant theoretical and practical contributions to numerous fields by examining how digital finance might be used to increase renewable energy usage in China (Zhao et al. 2021). For starters, it will help us learn more about the significance of digital finance in the field of renewable energy. The research will provide light on how digital finance might help China overcome financial constraints and accelerate the use of renewable energy sources by examining the use of technologies including mobile payments, blockchain, and online platform. Researchers, politicians, and business leaders who want to use digital finance to facilitate environmentally responsible energy transformations may find this information invaluable. In addition, the study’s findings will help advance the field by illuminating the primary channels via which digital finance promotes the use of renewable energy (Yu et al. 2022). The research will shed light on the specific ways in which digital finance platforms offer financing alternatives, facilitate transactions, and incentivize the use of renewable energy in China via in-depth case studies, policy assessments, and business model evaluations (Ozturk and Ullah 2022). Stakeholders in the renewable energy industry who are interested in making the most of digital finance will find this research quite helpful (Chen 2022).

Also, the research will look at the monetary factors that are holding back renewable energy’s broad acceptance in China. This study will aid policymakers and financiers by shedding light on the potential of digital finance to reduce project costs, attract a wide range of investors, and promote novel financing structures. These findings will be used to influence the development of specific financial instruments and regulations to hasten the deployment of renewable energy sources, with the goal of resolving the conventional issues associated with a lack of money and high costs. More specifically, this study will investigate the potential for cooperation between digital finance and technology advances in the renewable energy industry. The research will emphasize the potential of digital finance technologies like blockchain, smart meters, and data analytics to improve energy management, grid integration, and transparent monitoring of renewable energy output and consumption. These results will aid in the design of renewable energy systems in China that are both more efficient and dependable. The study will then conclude with concrete policy suggestions based on the research results to boost the efficient use of digital finance in accelerating the adoption of renewable energy sources in China. The proposed solutions would include the legislative frameworks, market incentives, and supporting policies essential to establishing an enabling environment for digital finance in liberating renewable energy’s full potential. To hasten China’s move toward a low-carbon and sustainable energy future, the policy insights gleaned from this study will be invaluable. Overall, this study will provide significant additions to our knowledge of how digital finance may increase the use of renewable energy in China. Policymakers, industry stakeholders, and academics will all benefit from the innovative insights into the methods, advantages, and problems of integrating digital finance and renewable energy that will be provided by this study. The study’s long-term objective is to aid in the worldwide fight against climate change by contributing to the sustainable revamping of China’s energy infrastructure.

Literature review

Renewable energy consumption in China

China’s attempts to move toward a more sustainable energy system have been greatly aided by the rapid development in the country’s use of renewable energy. China, the world’s biggest producer of greenhouse gases, is aware of the benefits renewable energy can bring to the fight against climate change, the cleanup of the air we breathe, and the maintenance of long-term energy security. This paper surveys the state of renewable energy consumption in China, including its history, current problems, and projected growth. China has made great gains in recent years toward widespread use of renewable energy. Massive investments in wind, solar, hydropower, and biomass energy projects have resulted from the government’s lofty ambitions for renewable energy output and consumption. China has taken the renewable energy industry by storm, and now accounts for a significant portion of worldwide renewable capacity and production (Li et al. 2023). China’s wind power industry has grown rapidly in recent years, with massive wind farms cropping up all across the country. These projects have helped cement China’s status as a worldwide leader in wind power and expanded the country’s use of renewable energy overall. Supportive government regulations, technology advances, and cost reductions have all contributed to the rapid expansion of the solar energy sector. China has made great strides toward its renewable energy targets via the widespread construction of both large-scale solar farms and distributed solar systems, such as rooftop installations (Li et al. 2023).

China’s reliance on hydroelectric power as a renewable energy source remains strong. The nation’s hydroelectric plants, which are spread out around the country, help to generate electricity and regulate the country’s water supply (Zhang et al. 2022). Biomass energy, which is produced from the combustion of organic matter and agricultural byproducts, is another popular renewable energy option. Numerous benefits have resulted from China’s rapidly expanding use of renewable energy sources. It has helped China diversify its energy supply, decrease its dependency on fossil fuels, and improve its energy security. Because it produces much less emissions than traditional fossil fuel-based power production, renewable energy has also been essential in reducing air pollution issues. In addition, the clean energy industry has benefited from the proliferation of renewable energy technology via increased innovation, the creation of new employment opportunities, and increased economic growth. But there are problems that come along with China’s expanding use of renewable energy. Intermittent renewable energy sources, such as wind and solar electricity, are a major challenge since they create integration and stability problems for the system. Advanced energy management technologies and grid infrastructure improvements are necessary to effectively control the fluctuating production of renewables and provide a dependable power supply. To properly address this dilemma, it is essential that energy storage technologies, such as batteries, continue to progress (Wu et al. 2022).

A further big difficulty is raising the capital required to maintain and increase usage of renewable energy (Li et al. 2023). China has invested heavily in renewable projects, but more funding is needed to ensure their sustained progress and innovation. The responsibility for attracting private investments, fostering R&D, and establishing efficient project finance methods falls on the shoulders of policymakers. Taking the changing fuel price into account, Zhang and Umair (2023) discovered that the United States’ carbon dioxide emissions are inversely proportional to its utilization of renewable energy, but the correlation between nuclear power and greenhouse gas production is weak—a global analysis of the factors impacting CO2 emissions, focusing on the top 24 European nations. The effectiveness of renewable sources and the role of economic expansion in renewable power output and per Income reduction were both approved (Zhao et al. 2022). In contrast, they use fossil fuels to generate electricity, increasing carbon dioxide emissions. Another factor in lowering carbon dioxide emissions is advances in energy efficiency. In conclusion, China’s use of renewable energy has come a long way, making a substantial impact on the country’s efforts to slow climate change, cut pollution, and guarantee reliable energy supplies. China’s energy mix has been diversified thanks to the rise of wind, solar, hydropower, and biomass energy sectors, all of which have contributed to the country’s robust economic prosperity. Grid integration, energy storage, and funding all provide ongoing difficulties. Resolving these issues is essential if China is to continue its rapid adoption of renewable energy and speed its way toward a low-carbon energy future (Tu et al. 2021; Zheng et al. 2022).

Developing renewable energy through digital finance

Digital finance has emerged as a significant instrument in accelerating renewable energy projects, in response to the worldwide urgency to generate renewable energy as a solution to climate change (Iqbal and Bilal, 2021). In this piece, we look at how crowdfunding, blockchain, and other types of digital money might help advance the renewable energy sector. Alternative funding sources for renewable energy projects may be found in digital finance, which includes innovations like mobile payments, peer-to-peer lending, and crowdfunding platforms (Li et al. 2021). In particular, crowdfunding removes the restrictions placed on small-scale and community-driven renewable energy projects by conventional financing methods and expands their access to cash. The renewable energy industry stands to benefit greatly from blockchain technology, which is yet another exciting use of digital money. Blockchain facilitates safe, transparent, and decentralized transactions by generating an immutable record of ownership and transactions. Blockchain makes it possible for people and communities to trade energy directly with one another in the context of renewable energy, doing away with middlemen and lowering transaction costs. It also allows for thorough monitoring and verification of renewable energy production, increasing trust and reducing fraud (Hao et al. 2023a).

Connecting renewable energy project developers, investors, and customers is facilitated by digital finance platforms and online markets (Zhu and Li 2021). By facilitating connections between investors and renewable energy projects, these markets help both parties achieve their sustainability objectives. They streamline the buying process for renewable energy, giving customers more options for how to get their power. The expansion of the clean energy industry is aided by the ease with which renewable energy sources may be implemented. Digital finance enables data-driven insights and analytics to improve renewable energy systems beyond only funding and transactions. Smart meters and data analytics tools capture data on electricity use, generation, and grid status in real time. This information helps with resource allocation, energy management, and the integration of renewable energy sources into the grid. More efficient, dependable, and adaptable renewable energy systems are possible with the use of digital finance and data analytics (Chang 2022). China’s digital banking industry has expanded rapidly thanks to the country’s adoption of cutting-edge tools like big data and AI. Digital finance is a relatively recent development in the world of finance that comprises a wide range of novel financial business models that provide high efficiency, low transaction costs, and improved data visualization. It aims to remedy the flaws of conventional banking by offering alternative solutions (Ding et al. 2022). Supporting digital finance, client credit profiles, and lessening information asymmetry in trade procedures have all benefited greatly from technological advancements like blockchain and cloud computing (Yang and Masron 2022). Overcoming credit and information barriers, increasing efficiency, and promoting environmental quality all benefit from a stable and reliable financial system that provides access to low-cost services. Digital finance helps promote low-carbon environmental preservation and robust economic development by bolstering the competitive market mechanism, wherein enterprises are more likely to invest collaboratively and make efficient use of available resources (Li et al. 2022a).

Given the depletion of fossil fuels and the need to save energy and minimize emissions, renewable energy is of critical importance to China’s economy (Lin and Huang 2023). Hydropower, wind power, solar power production, and biomass power generation all have sizable installed capacities in China, demonstrating the country’s progress in developing these renewable energy sources. However, the Renewable Energy Technology Innovation (RETI) gap across Chinese provinces has expanded due to regional inequalities in terms of location, economic growth, and governmental position (Lyu et al. 2023). Because of this discrepancy, national productivity, resource allocation, and rates of RETI are all impacted negatively. That is why it is so important to rigorously study the elements that affect province RETI levels and how they're converging (Abbas et al. 2023). Green energy has helped stabilize China’s economy by reducing the negative effects of importing fossil fuels in the face of fluctuating global oil prices. Even though RETI is becoming more widespread, many nations still struggle to fully implement it because of expensive prices and quick technical advancements. The debate also sheds light on the fact that the eastern area of China is the most productive and has the strictest environmental pollution control measures, highlighting the geographical disparity in green growth per capita throughout China. Growth in green GDP per capita has also been substantial in the west in recent years. A thorough evaluation of the two-indicator system, however, shows that the Chinese government must make serious efforts to strike a balance between green GDP per capita and the low-carbon environment (Iqbal et al. 2021). The impact of digital green financing and RETI on sustainable development is an important area for further study. There is policy relevance and practical importance in understanding the theoretical interpretation and empirical analysis of this topic in the post-epidemic age (Shahbaz et al. 2022).

The majority of the literature so far has focused on how digital green financing and RETI affect environmental outcomes such pollution from industry, air quality, and carbon emissions (Khan and Rehan 2022). The unequal effect of digital green financing and renewable energy technology innovation on green growth has been the subject of very few research. Through technology advancement, capital allotment, and industrial upgradation, green finance has been found to reduce financial exclusion, increase the efficiency with which green activities may access financial resources, and decrease carbon emissions (Hu et al. 2023). To fully grasp the effects of digital green finance, RETI, and green growth on fostering sustainable development, however, further study is required. In conclusion, digital finance offers substantial prospects for expanding the use of renewable energy (Muganyi et al. 2021). Digital finance improves the renewable energy industry by creating new funding opportunities, increasing transparency, and streamlining transactions via crowdfunding, blockchain technology, and online platforms. It encourages the development of the market for renewable energy sources and helps smooth the way for the switch to a more environmentally friendly energy infrastructure (Hao et al. 2023b). By harnessing the power of digital finance, stakeholders can hasten the adoption of renewable energy, reap its full advantages, and help build a more sustainable and resilient future (Cui et al. 2023).

Methodology

Theoretical framework

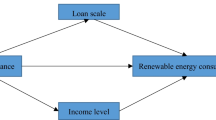

Numerous critical aspects interact to provide the theoretical basis for understanding how digital finance might increase usage of renewable energy (Dong et al. 2022). Innovation in technology, broadened access to finance, crowdsourcing, blockchain, and the importance of digital platforms all play a part. Collectively, they help spread the word about and use of renewable energy (Chen 2022). Within this structure, technological advancement plays a key role. Innovations in mobile payment systems, P2P lending, and crowdfunding have completely altered the traditional banking system. These technology advancements have made it easier for people and communities to take part in renewable energy efforts, lowered the transaction costs involved, and expanded access. One further crucial factor to think about is digital finance. There is a possibility that digital finance might help underprivileged communities get access to conventional banking services (Hepburn et al. 2021). Formerly excluded people are now able to participate in the use of renewable energy sources because of digital platforms providing them with access to financial resources (Wang, Gao). The expansion of the market for renewable energy that results from this policy is a boon to the industry as a whole. In this context, crowdfunding stands out as a key technique. Crowdfunding for renewable energy projects is made possible by digital finance platforms that promote direct interaction between project creators and prospective investors (Yang et al. 2023). This increased accessibility to funding encourages investment in renewable energy infrastructure from a wide range of stakeholders (Ali et al. 2023).

Digital finance platforms increase participation and investment in renewable energy projects by establishing confidence among investors via increased transparency and accountability. Within this theoretical setting, blockchain technology functions as a transformational force. Peer-to-peer energy trade is made possible by blockchain because of its decentralized, transparent, and secure nature. Consumers may cut out the middlemen and trade green energy directly with one another via blockchain-based platforms (Zhang et al. 2022). The elimination of middlemen and the increased agency of local communities are two key benefits of this decentralized model for the renewable energy industry. In addition to facilitating transparent and accountable use of renewable energy, blockchain technology offers comprehensive monitoring and verification of renewable energy production. The widespread use of renewable energy is greatly aided by online platforms. These sites act as markets where consumers can easily access and choose renewable energy sources, investors can find projects that correspond with their sustainability objectives, and renewable energy initiatives can easily get finance. Information asymmetry is mitigated, the financing process is streamlined, and more renewable energy alternatives are made available via online platforms that bring together project developers, investors, and customers (Tu et al. 2021). Because of these factors, the market for renewable energy is expanding, and more people are using it. Finally, the theoretical framework stresses the importance of technical advancement, digital finance, crowdfunding, blockchain technology, and digital platforms in boosting renewable energy usage. By using these elements, digital finance facilitates more participation from a wider variety of stakeholders in green energy efforts, increases openness and accountability, allows for the trading of energy between individuals, and simplifies the process of gaining access to renewable energy (Chang 2022). To further encourage renewable energy consumption via digital finance, governments, investors, and industry stakeholders may benefit from understanding and utilizing this paradigm.

Empirical structure of study

According to the standard framework for manufacturing theory, this research developed a straightforward conceptual framework for renewable energy consumption. According to this view, Chinese energy consumers do not waste any power immediately but instead use it to make other things. Indeed, most people and companies do not use renewable energy directly, but they use the power created from it to make other things (such as light bulbs, water heaters, space heaters, and stoves). Using Filippini’s model, we can define the output (x) of energy consumption according to the input (E), the kind of power, and the devices used to process the input (A).

Q1 represents the share of renewable energy in total electricity production, and Q2 represents the share of combustion in total electricity production. Accordingly, we may define the cost of output (C) using Eq. (2).

P1 and P2 stand in for the cost of the two different electricity rates, PT for the cost of other forms of energy, and PA for the cost of the appliances themselves. Moreover, the utility value (u) may be described as an expression (see Eq. (3)) of the energy goods bought (x), the other items obtained (y), and the desired qualities of people and enterprises (z).

According to this theory, consumer preferences are better understood as a two-stage optimum problem. The first phase aims at optimizing the benefits to customers and businesses, while the second phase minimizes manufacturing costs. On the one hand, expanded financial access will change how people and companies generally want to spend their money. Still, on the other, it will make renewable energy and modern appliances more affordable. In this research, we utilize the demand for renewable energy as the factor that depends on and digital finance as the primary independent factor. Additional regulating factors consist of GDP growth (Li et al. 2022b), export activity, alternative energy sources, and monetary outlays. What follows is a definition of the empirical model:

where REC is the renewable energy consumption, DF is the digital finance, and X is an indicator of control that includes the gross domestic product, export intensity, renewable energy resources, and rate of economic spending and green funding for renewable energy generation. Additionally, I stands for “province” and “t” for “year.”

This leads to an interesting follow-up question: how does access to affordable credit impact the demand for renewable energy sources? To investigate the influence process between FI and RED via mediation, this research uses the combined production capacity of four forms alternative energy sources. The methodology is outlined below:

The regulating factor M, and HP, NP, WP, and PP are the dependent variables. In this context, FI directly influences RED through a neutralizing system, denoted by _3. The overall treatment effects (Zhong et al. 2022). If both _2 and _n is significant, then _2_n indicates backdoor influence of FI on RED. Understanding the mechanism that acts as a mediator between FI and RED in China is made more accessible by the MER.

Research data

The research spans the years 2009 and 2019 and looks at how digital finance and environmental laws influenced China’s efforts to reduce resource usage. One of the independent factors vital to sustainable development is digital finance, a major driver of cutting-edge digital technologies. The renewable energy consumption is measured by using the % of total final total energy consumption. The research evaluates digital financial inclusion in China’s major cities using the Peking University Digital Financial Inclusion Index (PKU-DFIIC), a set of 33 financial indicators broken down into three dimensions: coverage breadth (account coverage rate), usage depth (payment, money funds, credit, insurance, investment, credit investigations), and digitalization level (mobility, affordability, credit, convenience). In place of strict environmental laws, environmental levies are imposed. Given its substantial impact to environmental deterioration, economic development is also considered a control variable. In order to account for cyclical and seasonal fluctuations within the short time frame of the research, the data is converted from years to quarters using the quadratic match-sum method. In addition, a natural logarithm transformation is used to create mirror images of the data. Using these variables table explains the descriptive statistics of study. Table 1 shows the descriptive statistics of the research.

Results and discussion

Regression analysis

Cross-sectional dependency testing is often overlooked, which may lead to inaccurate and unreliable estimates. For this reason, the pre-benchmark tests for regression are conducted using the Breusch-Pagan LM and Pesaran-scaled LM (Khan and Rehan 2022) analyses. The findings of the test, summarized in the following table, show that the null assumption is false and that the data are centered on their descriptive setting. Table 3’s last column displays the findings of an analysis of regression using the S-GMM techniques for static panel estimates to investigate the impact of financing on demand for renewable energy. As the S-GMM technique may help with the issue of possible variability and sectional dependency. Fixed panel information estimate is handled using the ordinary least squares (OLS) approach, changing panel data estimation is handled using the dynamic generalized method of moments (D-GMM) method, and the findings are shown in columns (1) through (5) of this article. Considering that the coefficient signs across all of our standard approaches are uniform, we are confident in our findings reported in Table 2.

The coefficient of economic inclusion is positive and statistically significant at the 2% level, suggesting that it may raise demand for green energy. If we can raise FI by 3%, we can boost demand for renewable energy by 4.623%. In addition, growth in gross domestic product and renewable energy ratio can boost demand for renewable energy. This former conclusion is in line with the results of other research (Qin et al. 2022; Ren et al. 2021), which found that economic growth may increase need for alternative energy sources. The second finding demonstrates that regions rich in sources of clean energy are more favorable to expansion than standard one’s industry (Ren et al. 2023; Tang et al. 2023; Wang et al. 2022). This may be because the availability of these resources will determine how challenging it will be to grow the alternative energy sector in a particular region. Renewable energy consumption is inversely connected to China’s export intensity. Previous research (Wu and Huang 2022; Yin et al. 2023) has shown that exports with more significant economic advantages also result in greater energy use and pollution. Since renewable energy sources are more cost-effective than conventional ones (like coal), exporting fewer items with a large energy footprint might help improve RED. In addition, the LFE elasticity does not affect RED using the OLS, FE, FGLS, or D-GMM model but does under the S-GMM model.

Breusch-Pagan LM test and stability diagnostic

To test the stability of the evaluated outcomes of regression, we first use the S-GMM technique to switch out the variables in Columns (1) and (2) of Table 4 from renewable energy demand per capita to total sustainable energy request and the percentage of power produced from renewable energy. The computed FI coefficients on both TRED and PRED show positive and predictable indicators. Specific elasticity values for FI on TRED and PRED are 3.245 and 5.867, respectively (Table 3). These findings show that the key conclusions we draw from the standard regression we used are sound. It is also possible to conclude that economic inclusion will increase the overall demand for renewable energy and the share of power produced by renewable sources.

Second, this research swaps out the index of economic inclusion for FICB, FIUD, and FIDD to examine the sustainability of the findings. The outcomes are expected to be favorable if the S-GMM is used. FICB, FIUD, and FIDD’s calculated values on RED are 3.176, 5.756, and 6.487, respectively (Table 4). Because economic reform might decrease the cost of funding clean energy sources organizations, these findings suggest that expanding length, increasing utilization and a higher technological standard successful strategy for increasing need for alternative energy sources in China. These findings are consistent with the formal analysis of regression used for this investigation.

The UN’s planned SDG number seven is to provide access to dependable, low-cost, environmentally friendly energy (Lee and Wang 2022; Qin et al. 2022). As a result, making more renewable energy sources accessible is a crucial objective. Additionally, China is actively pushing the growth of renewables to raise the percentage of power produced from renewable energy to 60% by 2031 (Qin et al. 2022; Lee et al. 2023). Financial assistance is urgently required to develop green energy infrastructure, and study associated technologies (Liu et al. 2022; Ma et al. 2022), notwithstanding the high initial cost and lengthy investment return time of projects involving renewable energy. An increase in FI, as predicted, may attract more investment with regard to the field of green energy and boost the use of green power. There has been a rise in China’s use of renewable energy sources in recent years. While China is committed to expanding its renewable energy sector, progress may be hampered by differences between regions in economic expansion and scientific/technological development. Higher spending on the renewable energy sector is made possible by greater digital finance, demonstrating the traits of green finance. Because many businesses working with renewable energy are only starting, significant resources are needed to develop new technologies and build the necessary infrastructure. The expansion of green energy technology may be aided by providing more accessible financial services for businesses like these, who were previously unable to get funding.

Quantile parametric estimates

Table 5 displays the quantitative findings of a study that uses the quantile regression method to examine the imbalanced connection between FI and RED in China. We can see how these variables fluctuate throughout time. Table 5 shows that the flexibility of FI and RER on green power demand is stable over quantiles, but the effects of GDP growth, exports, and financial outlays are competing. Raising FI may considerably enhance renewable energy use in regions either significantly RED in China, as shown by the excellent elasticity of FI on RED consistently at various measure levels. Furthermore, locations with more renewable solid energy development are those where funding has a more significant impact on renewable energy demand.

The gross domestic product elasticity stops making a difference at very high quantiles. The regions shown with the highest renewable consumption are all located in the southwest, where GDP is relatively low. This has little to no effect on renewable energy demand. Further, an export value significantly impacts higher quantiles, suggesting that the volume of exports would disproportionately impact areas with substantial demand for renewable energy. The effect of renewable energy sources on demand is constant across all quantiles, but the flexibility for economic outlays negligible between the 60th and 95th percentiles. To examine the variation in the effect of FI on RED, the 35 provinces are divided into two areas according to their physical position. Table 6 displays the outcomes utilizing S-GMM model and depicts the two areas' provinces. Consistently positive test results suggest that the model is workable with the given panel’s information and that all IVs are successful. There is a positive correlation between FI and RED in both panels. An increase of 1 percentage point in FI will lead to an increase of 5.854% in demand for renewable energy in the southern areas and an increase of 7.854% in the market for alternative energy sources in such areas, north. That is to say, increased FI has an exponential impact on the development of the renewable energy sector in northern China. Beneficial and considerable effects of economic growth and the use of clean energy sources may be seen in every subsection. Notably, in the southern area, the effect of the amount of fiscal spending is negative, suggesting that the municipal administration’s concentration on minerals development and power may result in a decrease in demand for renewable energy.

Table 7 displays the mechanism of mediation results, from which numerous conclusions may be drawn. As can be seen in Columns (2)–(5) of Table 7, approximated findings suggest that FI has a positive relationship with WP and PP. In contrast, its effects on HP and NP are not meaningful. These suggest that FI enhancement may boost output from wind and PV but has little effect on output from hydro or nuclear. All four of HP, NP, WP, and PP have beneficial results for RED. In particular, we get coefficients of 4.3687, 5.3498, 6.675, and 7.4532. These findings indicate that rising levels of HP, NP, WP, and PP may achieve rising levels of use of renewable energy per capita. Third, using Eq. (13) and the ability from Table 7, we find that the MER for WP and PP is 32.57% and 22.34%, respectively (Table 6), whereas the relationship between HP and NP and the demand for solar power is minimal.

Sensitivity analysis

These findings might be attributed to the development of wind power and solar power innovations, the decline in associated prices, and the flexibility of the required levels of funding and installations. It is important to remember that the government supports incentives for renewable energy power production (other than hydropower) and actively promotes sustainable investments of social assets in this sector (Feng et al. 2022; Fu et al. 2023). The increasing need for renewable energy sources is a direct result of the boom in the wind power and solar energy-generation sectors, both of which have benefited from the fast advancements (Hao et al. 2023c).

Furthermore, the price of wind power on land and solar electricity is expected to drop by 88% and 61% between 2019 and 2051, as reported by Bloomberg New Energy Finance (Cheng et al. 2023; Delina 2023). The mean annual increases for HP, NP, WP, and PP in China were 7.87%, 43.78%, 78.57%, and 342.7%, respectively, between 2013 and 2019; the quantity of wind energy produced (i.e., 453.78 billion kWh in 2019) exceeds calculation of nuclear production of energy (Table 7). The amount of solar power production is increasing (i.e., For reasons that may include ongoing costs for basic materials used in hydroelectric and nuclear power plants and a significant initial investment, growing FI has little impact on the growth of these industries). The following findings reveal the influence mediation relationship between economic inclusion and green energy demand.

Discussion

There have been enormous breakthroughs in the growth of the renewable energy (RE) industry. Despite this, several obstacles remain that might stunt its past and future development. The lack of available funds stands out among these other difficulties. When compared to fossil fuels, renewable energy’s high initial investment prices and longer return times are major roadblocks. To reach global RE goals, we need large funding for digital finance for renewable energy projects, which comes with its own set of dangers. The scope and nature of the projects will determine which finance alternatives will be made available. Equity finance or venture capital may work effectively for smaller enterprises using innovative technology, whereas bank loans or debt financing are more common for bigger projects. These sources of funding might be difficult to get into without the backing of a stable financial system. Government funding, foreign funding, commercial banks, and non-banking entities are all mentioned as potential contributors to RE development. Research shows that improved access to credit has a crucial impact in boosting RE usage. Provides access to debt and equity finance via stock markets and sophisticated financial institutions for green energy entrepreneurs. In addition, a robust financial system makes it easier to finance low- or zero-carbon projects at reduced interest rates. This reasoning backs up the claim that a robust financial system encourages the expansion of the renewable energy sector, which in turn attracts investment and sustainably meets consumers’ energy needs.

The purpose of this research is to assess how China’s changing financial landscape affects the country’s growing appetite for renewable energy. This study adds to the growing body of work on finance and renewable energy by analyzing the impact of financial structure on renewable energy use. It also calculates the economic growth threshold and value at which financial structure substantially affects renewable energy consumption and investigates the route by which financial structure influences renewable energy consumption: economic growth. In addition, the research examines the correlations between financial framework and renewable energy use, accounting for regional differences. This research uses the practicable generalized least squares and fixed-effects model to show that the financial structure of the BRICS nations is a barrier to the widespread adoption of renewable energy. However, it greatly increases the use of renewable energy across the board, in China, the developed world, and the developing world. In addition, the financial framework promotes economic development, which in turn enhances the usage of renewable energy. Beyond a certain level of economic development, the research finds, the influence of financial structure on the adoption of renewable energy sources becomes more pronounced.

Given the importance of economic growth, especially in China, several studies have looked at how that has affected the expansion and use of renewable energy. Differing definitions and proxies of financial progress, however, account for the lack of consistency across these researches. Growth in the financial sector may be measured in terms of both its size and structure, such as the ratio of direct to indirect finance or private credit to GDP. Recent studies have highlighted the significance of financial structure and its consequences for environmental and economic concerns, while the former serves as a significant indicator for evaluating the connection between renewable energy usage and finance. Corporate governance, information asymmetry, financing costs, credit limitations, and credit channels are all improved by a well-developed financial structure. Assuming other variables remain constant, these characteristics promote expansion in the economy. There are a number of pathways via which the monetary structure influences the uptake of renewable energy. First, it lowers the cost of capital and eliminates credit restrictions, allowing businesses to raise their investments in green practices and grow their operations, which in turn increases the use of renewable energy. In addition, a robust financial system boosts technological development and GDP expansion. Investment and finance in renewable energy sources are made easier as a result of its attention to issues of information asymmetry and moral hazards. Finally, the value of eco-sustainable enterprises is on the rise as the relevance of CSR increases and publicly listed companies are required to provide more information. Because of this, the public offering of more environmentally responsible companies is stimulated by a healthy financial system, which in turn increases the use of renewable energy sources.

Conclusion and policy implications

Conclusion

In conclusion, digital financial integration has emerged as a major engine for the development of renewable energy use in China. Financing for renewable energy projects has been much more accessible thanks to a number of novel platforms and solutions that have been established with the help of digital technology and financial services. Several major conclusions may be drawn from this study. (a) To begin, the variety of funding choices for renewable energy projects in China has greatly increased thanks to digital finance. (b) Alternative finance methods like crowdsourcing, peer-to-peer lending, and others have gained ground via digital platforms, drawing in more investors and decreasing the need for conventional banking services. (c) Many renewable energy projects, especially those of a smaller or medium scale, that may have had trouble being funded via more traditional channels have been made possible as a result. (d) Renewable energy transactions are now more efficient and transparent thanks to digital financing. The transaction costs for purchasing and selling renewable energy have decreased and the number of middlemen involved has decreased because to technological advancements like blockchain, smart contracts, and digital payment systems. Increased confidence among market players and more competitive pricing have boosted demand for renewable energy. Moreover, better energy management and optimization have resulted from the rise of digital banking. Our research has shed light on the ways in which digital finance has been instrumental in increasing the use of renewable energy in China. According to the results, the financial structure has a significant effect on the renewable energy industry. Investment and innovation in renewable energy technologies are greatly aided by a matured financial system that is marked by effective corporate governance, less information asymmetry, and lower financing costs. As a consequence, more renewable sources of energy are used, creating a more stable energy system.

Policy implications

Several policy implications for maximizing the potential of digital finance to increase renewable energy consumption in China may be gleaned from the study’s results. In order to create innovative financial products and platforms that meet the needs of renewable energy projects, policymakers should encourage collaboration between traditional financial institutions and digital technology companies. By working together, we can lower the cost of borrowing and make more financial options available. Governments should provide transparent and encouraging policies that encourage the growth of digital finance in the renewable energy industry. Data privacy, security, and consumer protection are all part of this, as is the promotion of interoperability and transparency standards. To enable universal access to digital banking platforms, policymakers should prioritize investments in digital infrastructure, such as internet connections and data centers. Maximizing the advantages of digital finance for renewable energy consumption will also need actions to improve digital literacy and technical abilities among consumers and enterprises. Research and development should be encouraged, with a particular emphasis on the integration of renewable energy sources and digital finance. Investing in research, encouraging partnerships between universities and businesses, and spreading information are all ways to ensure the industry is always evolving. The adoption of renewable energy sources, the reduction of reliance on fossil fuels, and China’s contribution to a sustainable and ecologically friendly future may all be accelerated by adopting these policy initiatives. The results of this research have important implications for policymakers looking to increase demand for renewable energy sources in China. The creation of a stable finance framework that backs renewable energy projects should be the top priority for legislators. This involves facilitating the availability of equity and venture finance, especially for smaller, technology-focused businesses. Debt funding and bank loans are equally crucial for large-scale renewable energy projects. It is also important to improve the availability of capital for environmentally responsible enterprises by working to increase their corporate governance and transparency. Policymakers should think about enacting incentives and rules that require publicly listed companies to disclose environmental information. Investments in renewable energy sources will become more valuable and appealing as a result of this.

Future research directions

There are numerous intriguing routes for future research that might further enhance our knowledge of the complicated interaction between China’s financial system and its usage of renewable energy. Green bonds and carbon pricing are two examples of particular financial instruments and procedures that might be studied in the context of their effect on the adoption of renewable energy sources in the context of future research. It would be helpful for policymakers and investors to get insight into the efficacy of these instruments in mobilizing financial resources for renewable energy projects. Second, further work is required to understand how financial structure affects renewable energy usage in various Chinese provinces and cities, since there is significant regional heterogeneity within the country. This will help policymakers encourage the use of renewable energy sources in particular geographic areas by crafting more nuanced and nuanced regulations. There is need for more research on the interplay between financial framework and technical innovation in the renewable energy industry. If politicians and investors want to speed up the shift to renewable energy, they would benefit from learning more about the relationship between financial growth and technical innovation. Finally, given digital finance’s fast expansion and its potential to transform the renewable energy environment, future study might examine emerging trends and technologies in digital finance and their consequences for renewable energy use. This involves researching the effectiveness of digital financial technologies like crowdsourcing and blockchain technology in attracting investors to green energy projects. Future studies may help fill up our understanding of the link between financial framework and renewable energy use if they focus on these knowledge gaps. By providing policymakers and investors with this information, we may help speed the adoption of renewable energy in China and elsewhere, leading to a more secure energy future.

Data availability

The data supporting this study’s findings are available on request.

Change history

21 September 2024

This article has been retracted. Please see the Retraction Notice for more detail: https://doi.org/10.1007/s11356-024-35117-5

References

Abbas J, Wang L, Belgacem SB, Pawar PS, Najam H, Abbas J (2023) Investment in renewable energy and electricity output: role of green finance, environmental tax, and geopolitical risk: Empirical evidence from China. Energy 269:126683

Ali K, Jianguo D, Kirikkaleli D (2023) How do energy resources and financial development cause environmental sustainability? Energy Rep 9:4036–4048

Cao S, Nie L, Sun H, Sun W, Taghizadeh-Hesary F (2021) Digital finance, green technological innovation and energy-environmental performance: evidence from China’s regional economies. J Clean Prod 327:129458

Chang J (2022) The role of digital finance in reducing agricultural carbon emissions: evidence from China’s provincial panel data. Environ Sci Pollut Res 29(58):87730–87745

Chen P (2022) Is the digital economy driving clean energy development?-New evidence from 276 cities in China. J Clean Prod 372:133783

Cheng Y, Lv K, Zhu S (2023) How does digital financial inclusion promote green total factor productivity in China? An empirical analysis from the perspectives of innovation and entrepreneurship. Process Saf Environ Protect 174:403–413

Cui J, Wang W, Chen Z, Ren G, Gao X (2023) How digitalization and financial development impact eco-efficiency? Evidence from China. Environ Sci Pollut Res 30(2):3847–3861

Delina LL (2023) Fintech RE in a global finance centre: expert perceptions of the benefits of and challenges to digital financing of distributed and decentralised renewables in Hong Kong. Energy Res Soc Sci 97:102997

Ding X, Gao L, Wang G, Nie Y (2022) Can the development of digital financial inclusion curb carbon emissions? Empirical test from spatial perspective. Front Environ Sci 10:2093

Dong K, Taghizadeh-Hesary F, Zhao J (2022) How inclusive financial development eradicates energy poverty in China? The role of technological innovation. Energy Econ 109:106007

Du M, Hou Y, Zhou Q, Ren S (2022) Going green in China: how does digital finance affect environmental pollution? Mechanism discussion and empirical test. Environ Sci Pollut Res 29(60):89996–90010

Feng S, Chong Y, Li G, Zhang S (2022) Digital finance and innovation inequality: evidence from green technological innovation in China. Environ Sci Pollut Res 29(58):87884–87900

Fu Z, Zhou Y, Li W, Zhong K (2023) Impact of digital finance on energy efficiency: Empirical findings from China. Environ Sci Pollut Res 30(2):2813–2835

Hao X, Li Y, Ren S, Wu H, Hao Y (2023a) The role of digitalization on green economic growth: does industrial structure optimization and green innovation matter? J Environ Manag 325:116504

Hao Y, Wang C, Yan G, Irfan M, Chang CP (2023b) Identifying the nexus among environmental performance, digital finance, and green innovation: new evidence from prefecture-level cities in China. J Environ Manag 335:117554

Hao X, Wen S, Xue Y, Wu H, Hao Y (2023c) How to improve environment, resources and economic efficiency in the digital era? Resour Policy 80:103198

Hepburn C, Qi Y, Stern N, Ward B, Xie C, Zenghelis D (2021) Towards carbon neutrality and China’s 14th Five-Year Plan: clean energy transition, sustainable urban development, and investment priorities. Environ Sci Ecotechnol 8:100130

Hu J, Zhang H, Irfan M (2023) How does digital infrastructure construction affect low-carbon development? A multidimensional interpretation of evidence from China. J Clean Prod 396:136467

Iqbal S, Bilal AR (2021) Energy financing in COVID-19: how public supports can benefit? China Finance Rev Int 12(2):219–240

Iqbal S, Bilal AR, Nurunnabi M, Iqbal W, Alfakhri Y, Iqbal N (2021) It is time to control the worst: testing COVID-19 outbreak, energy consumption and CO 2 emission. Environ Sci Pollut Res 28:19008–19020

Khan MA, Rehan R (2022) Revealing the impacts of banking sector development on renewable energy consumption, green growth, and environmental quality in China: does financial inclusion matter? FrontEnergy Res 10:941

Lee CC, Wang F (2022) How does digital inclusive finance affect carbon intensity? Econ Anal Policy 75:174–190

Lee CC, Zhang J, Hou S (2023) The impact of regional renewable energy development on environmental sustainability in China. Resour Policy 80:103245

Li G, Wu H, Jiang J, Zong Q (2023) Digital finance and the low-carbon energy transition (LCET) from the perspective of capital-biased technical progress. Energy Econ 120:106623

Li G, Zhang R, Feng S, Wang Y (2022b) Digital finance and sustainable development: evidence from environmental inequality in China. Busi Strat Environ 31(7):3574–3594

Li W, Chien F, Ngo QT, Nguyen TD, Iqbal S, Bilal AR (2021) Vertical financial disparity, energy prices and emission reduction: empirical insights from Pakistan. J Environ Manage 294:112946

Li X, Shao X, Chang T, Albu LL (2022a) Does digital finance promote the green innovation of China’s listed companies? Energy Econ 114:106254

Lin B, Huang C (2023) How will promoting the digital economy affect electricity intensity? Energy Policy 173:113341

Lin B, Ma R (2022) How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J Environ Manag 320:115833

Liu Y, Xiong R, Lv S, Gao D (2022) The impact of digital finance on green total factor energy efficiency: evidence at China’s city level. Energies 15(15):5455

Lyu K, Yang S, Zheng K, Zhang Y (2023) How does the digital economy affect carbon emission efficiency? Evidence from energy consumption and industrial value chain. Energies 16(2):761

Ma R, Li F, Du M (2022) How does environmental regulation and digital finance affect green technological innovation: evidence from China. Front Environ Sci 782

Muganyi T, Yan L, Sun HP (2021) Green finance, fintech and environmental protection: evidence from China. Environ Sci Ecotechnol 7:100107

Ozturk I, Ullah S (2022) Does digital financial inclusion matter for economic growth and environmental sustainability in OBRI economies? An empirical analysis. Resour Conserv Recycl 185:106489

Qin X, Wu H, Li R (2022) Digital finance and household carbon emissions in China. China Econ Rev 76:101872

Razzaq A, Sharif A, Ozturk I, Skare M (2023) Asymmetric influence of digital finance, and renewable energy technology innovation on green growth in China. Renew Energy 202:310–319

Ren S, Hao Y, Xu L, Wu H, Ba N (2021) Digitalization and energy: how does internet development affect China’s energy consumption? Energy Econ 98:105220

Ren Y, Li B, Liang D (2023) Impact of digital transformation on renewable energy companies’ performance: evidence from China. Front Environ Sci 10:2702

Shahbaz M, Wang J, Dong K, Zhao J (2022) The impact of digital economy on energy transition across the globe: the mediating role of government governance. Renew Sustain Energy Rev 166:112620

Tang D, Chen W, Zhang Q, Zhang J (2023) Impact of digital finance on green technology innovation: the mediating effect of financial constraints. Sustainability 15(4):3393

Tu CA, Chien F, Hussein MA, RAMLI MM YA, S. PSI MS, Iqbal S, Bilal AR (2021). Estimating role of green financing on energy security, economic and environmental integration of BRI member countries. The Singapore Economic Review, 1–19

Wang X, Wang X, Ren X, Wen F (2022) Can digital financial inclusion affect CO2 emissions of China at the prefecture level? Evidence from a spatial econometric approach. Energy Econ 109:105966

Wang Y, Wu Q, Razi U (2023) Drivers and mitigants of resources consumption in China: discovering the role of digital finance and environmental regulations. Resour Policy 80:103180

Wu M, Guo J, Tian H, Hong Y (2022) Can digital finance promote peak carbon dioxide emissions? Evidence from China. Int J Environ Res Public Health 19(21):14276

Wu Y, Huang S (2022) The effects of digital finance and financial constraint on financial performance: firm-level evidence from China’s new energy enterprises. Energy Econ 112:106158

Yang C, Masron TA (2022) Impact of digital finance on energy efficiency in the context of green sustainable development. Sustainability 14(18):11250

Yang G, Xiang X, Deng F, Wang F (2023) Towards high-quality development: how does digital economy impact low-carbon inclusive development?: mechanism and path. Environ Sci Pollut Res:1–26

Yin X, Qi L, Zhou J (2023) The impact of heterogeneous environmental regulation on high-quality economic development in China: based on the moderating effect of digital finance. Environ Sci Pollut Res 30(9):24013–24026

Yu M, Tsai FS, Jin H, Zhang H (2022) Digital finance and renewable energy consumption: evidence from China. Financial Innov 8(1):58

Zhang D, Mohsin M, Taghizadeh-Hesary F (2022) Does green finance counteract the climate change mitigation: asymmetric effect of renewable energy investment and R&D. Energy Econ 113:106183

Zhang Y, Umair M (2023) Examining the interconnectedness of green finance: an analysis of dynamic spillover effects among green bonds, renewable energy, and carbon markets. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-27870-w

Zhao H, Yang Y, Li N, Liu D, Li H (2021) How does digital finance affect carbon emissions? Evidence from an emerging market. Sustainability 13(21):12303

Zhao L, Saydaliev HB, Iqbal S (2022) Energy financing, COVID-19 repercussions and climate change: implications for emerging economies. Climate Change Economics 13(03):2240003

Zheng X, Zhou Y, Iqbal S (2022) Working capital management of SMEs in COVID-19: role of managerial personality traits and overconfidence behavior. Econ Anal Policy 76:439–451

Zhong S, Li A, Wu J (2022) How does digital finance affect environmental total factor productivity: a comprehensive analysis based on econometric model. Environ Dev 44:100759

Zhu J, Li Z (2021) Can digital financial inclusion effectively stimulate technological Innovation of agricultural enterprises?—A case study on China. Natl Account Rev 3:398–421

Author information

Authors and Affiliations

Contributions

Conceptualization, methodology, and writing—original draft, data curation, visualization, editing: Jing Ma.

Corresponding author

Ethics declarations

Ethical approval and consent to participate

The authors declared that they have no known competing financial interests or personal relationships, which seem to affect the work reported in this article. We declare that we have no human participants, human data, or human issues.

Consent for publication

We do not have any person’s data in any form.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article has been retracted. Please see the retraction notice for more detail: https://doi.org/10.1007/s11356-024-35117-5

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ma, J. RETRACTED ARTICLE: How digital finance promotes renewable energy consumption in China?. Environ Sci Pollut Res 30, 102490–102503 (2023). https://doi.org/10.1007/s11356-023-29504-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-29504-7