Abstract

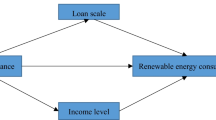

The objective of this study is to examine how digital finance influences renewable energy performance in China. Empirical data from China between 2007 and 2019 is used to evaluate the relationship among these variables. The study uses two techniques, quantile regression (QR) and generalized methods of moments (GMM), to draw empirical conclusions. The results reveal that digital finance significantly influences the renewable energy performance, ecological growth, and financial performance of cities in China. Specifically, digital finance accounts for 45.92% of the variation in renewable energy indicators, 27.60% in ecological growth, and 24.39% in the improved financial performance of renewable energy at the city level. The study also observes that the city-level score for digital finance, renewable energy, and other indicators is heterogeneous in movement. Factors contributing to this heterogeneity include high population (16.05%), access to digital banking (23.11%), province-level renewable energy performance (39.62%), household financial stability (22.04%), and household renewable energy literacy (8.47%). Based on these findings, the study recommends practical implications for key stakeholders.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The practical and theoretical effects of digital financing are explored by looking at the pricing of renewable power markets and the pricing of channelling money. Evidence suggests that the typical cost of environmentally friendly finance is high. Borrower bond rates and, indeed, the motivation for investors to engage in exploitative behavior are lowered due to the mechanism’s ability to convey an image of sophistication to prospective purchasers. Acquiring a digital finance license is essential. Earlier studies have shown that banks and other financial organizations can now afford to engage in environmentally conscious businesses thanks to the widespread availability of digital financing. The studies revealed that digital financing is made available to support environmental operations that lessen the impact of global warming on both current and future generations of people living in advanced economies (Alsagr and van Hemmen 2021). Both groups of individuals might then use a Pareto-optimal stimulating effect. Several market governments, including China, have clearly stated goals for their electricity system. As a result, the current rate about doing expenditure is insufficient to achieve renewable energy performance objectives, and the global financial system will need to ramp up the production of renewable energy from the information. The attainment of SDG7 and SDG13 via renewable energy and digital financing probably helps through financial systems (Gu et al. 2023). Digital finance has been proposed as the most cutting-edge method of tackling this issue (Alsagr 2023). Considering this logic, the following research aims to investigate the influence of digital finance on renewable energy performance and financial performance at the city level in China. It is the research motivation.

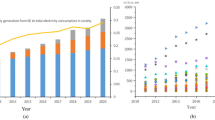

Since electricity is among the most critical factors in ensuring long-term prosperity, meeting the growing demand for electricity, transportation, and other power-hungry uses presents one of the biggest challenges for the Chinese ability to thrive. Blockchain technology and cloud computing greatly aided the development of digital finance, customer “credit pictures,” and correcting information imbalances during trading (Bag et al. 2020). Online lending, credit services, digital insurance, and online investment management are essential functions of digital financial platforms. By the end of 2020, the sum of all digital purchases made in China using the Alipay system and mobile payments had surpassed two billion and fourteen thousand Chinese yuan, making China the undisputed leader in this sector. This development lowered transaction costs and made financial services more accessible to a larger population. A stable financial system maintains competitive prices for its services, opens access to credit and data, and addresses any other issues that may occur, improving operational efficiency and environmental quality. It does this by bolstering the competitive market mechanism, motivating enterprises to enhance their pooled investment and efficient resource usage (Golosnoy et al. 2019). Because of this, the economy thrives, which helps to maintain a low-carbon atmosphere. Chinese economic stability is at risk without the use of renewable energy. China’s economy cannot survive without the use of renewable energy. There is a widening REP chasm because of the significant differences in population density, economic growth, and government attitude between China’s provinces. This has implications for the correct distribution of REP variables and the national average REP values. Therefore, it warrants research on such topicality by considering Chinese settings. Previous studies have shown that digital finance seems more secure and reliable than analog options. If LOT is used to assess debt economies’ financial viability, bond markets may be assigned lower risk ratings. Money in the bank is exchanged far more often than “non-green” products and services. The major goal of these studies is to evaluate and contrast market liquidity using several metrics, particularly the current price. Green bonds are universally acknowledged because they are more transparent, with significantly faster assessments. Several companies have prioritized ecological sustainability, although there are still certain roadblocks to overcome.

Our research provides several significant empirical and theoretical contributions. First, the research uses an empirical approach to analyzing the conflicting and incomplete evidence around the impact of digital funding on the use of sources of renewable energy. Second, the research contributes to our understanding of how digital finance influences renewable energy performance, hoping it will inspire confidence in future research conducted in Chinese contexts. Considering that the specified factors, such as reliance on renewable energy, digital finance, and renewable energy performance, have been less explored, this research adds experimentally by examining them. The assessment of the renewable energy performance index is used for this investigation. Third, the studies above add to stakeholder practices by suggesting valuable guidelines for future decision-making and policy creation.

Literature review

Digital finance and renewable energy performance

The development of the financial sector has significant implications for the energy sector and the natural environment. More energy is consumed and more pollution is released when investment and economic growth are stimulated in this way. Research indicates that the expansion of China’s economy was a significant factor in the rise in carbon emissions. Yang et al. (2022) showed that the expansion of the financial sector contributed to a rise in China’s REP and increased CO2 emissions. Calado et al. (2021) claim that something about the setting acts as a stimulant and fosters monetary growth. China’s development has led to higher REP and better environmental performance; according to research by Hanssen et al. (2018), economic growth has a sizeable chilling effect on energy use, even though this effect varies widely between regions. The size of a country’s economy can be affected by the country’s financial development level. While this happens, the banking sector provides emergency money for innovation, stimulating innovative strategies for cleaning up the energy sector and reducing emissions (Sironen and Mononen 2018). In-depth investigations of the correlation between DF and GREP are now possible. This was made possible by consistently updating and improving these records. The relationship between online banking and haze pollution is inverted U-shaped, similar to the Kuznets curve. When seen via a geographical lens, the findings given by Marttunen and Mustajoki (2018) are fascinating. They point out that this finding is significant because inclusive digital finance reduces the CO2 created locally and has a beneficial CO2 spillover effect on nearby places.

Researchers have also focused on how digital finance may benefit the economy and the environment. As the conventional wisdom goes, green economic growth depends on developing ecologically sound financial markets (GREP). Digital finance is examined by Kabir (2022), who concludes that it promotes ecologically friendly economic growth in India. Kabir et al. (2022) analyze the Belt and Road area, finding that digital finance moderates public spending and green economic growth. This trend is now positive throughout Asia, and Shaktawat and Vadhera (2022) contend that digital financing can lessen an organization’s environmental impact while promoting green growth. According to researchers, implementing digital financing would be helpful for the green growth agenda and is technically viable (Pofoura et al. 2022). You can accomplish this goal without compromising on economic growth or anti-poverty initiatives. Several academics have studied the relationship between REP expansion and factors, including firm efficiency, productivity, and behavior. Sun et al. (2020) looked at how company behavior and resource reliance influenced REP. Chinese efforts to achieve GREP can use the Internet’s vast potential. The report at the 19th National Congress of the Communist Party of China emphasizes the deep Internet, big data, artificial intelligence, and green economics. Considering the significance of digital banking to China’s economic, social, and environmental future, the government has made its widespread adoption a primary goal again in 2018. Now more than ever, it’s crucial to take advantage of the benefits of digital information transmission to encourage the creation of novel approaches to environmental governance if we want to promote green economic growth. This is because its application maximizes the benefits of digital information transfer. The proliferation of digital finance poses a danger to the established financial system since it affects every aspect, from market participants to trading instruments.

Renewable energy and financial performance

A country’s economic growth is strongly correlated with its propensity for technical innovation and the pursuit of the development of renewable energy sources. One of the most significant factors in how rapidly new technologies are produced is the amount of money invested in R&D (Wang et al. 2022). Another is how well people comprehend renewable energy sources. As it stands, we may evaluate the pace of technological progress in two ways: research and development input and research and development output. Depending on where we are in the financial industry’s history, REP’s success will require either a “bank-oriented” or “market-oriented” financial model. Saving energy and reducing emissions are possible if the current financial model can keep up with demand (Zhang et al. 2022). This will not be possible if it cannot keep up with demand. However, if this does not occur, rapid financial growth will restrict REP, leading to rapid economic expansion and pollution (Yang et al. 2022). Investment and patent registration are two time-consuming and money-consuming steps to innovate in renewable energy sources. Over the past few years, banking has shown to be a stable finance option for REP. The low transaction costs in this industry are primarily to blame for this phenomenon toward energy efficiency financing via public supports (Iqbal and Bilal 2021).

Digital banking facilitates the matching and mobilizing of investment capital, increasing the amount of money available for REP and, thus, the overall economy. The financial sector requires a well-managed credit and risk management system to mediate between savers and spenders effectively. The electronic currency that utilizes big data technology to determine a consumer’s creditworthiness and risk level levels the playing field between individuals and financial institutions (Iqbal et al. 2021). Investors saw REP as a high-risk enterprise with the potential for big rewards, but they were informed, which enhanced the company’s ability to raise funds (Li et al. 2021). Customers can use this data to make a more well-informed decision about whether or not to put money into REP. REP quickly overcame the fundraising impasse it had been suffering due to its newly discovered openness to communicate with investors (Zhou and Li 2022). This paper builds on the theoretical and empirical foundation established by the few previous investigations into the interplay among digital funding, technological innovation in renewable energy, and green growth (Wu and Xu 2020; Yin and Xu 2022). There is not much literature on the subject, but what there is serves as a solid theoretical and empirical foundation for the present work (Amigo-Jorquera et al. 2019). Most scholars put a premium on quantifying the phenomenon, pinpointing influential components, and assessing roles when addressing the advent of new technology for renewable energy sources (Podvalny et al. 2017; Shahzad et al. 2022; Shi et al. 2020).

Furthermore, when unanticipated shifts in policy and social shocks occur, they create an anomalous data distribution that is challenging for typical linear estimators to deal with (Gouveia et al. 2019). The study’s goal is to furnish new data that can be used to promote China’s economic greenness and to supply policy references that can be used in implementing these strategies (Castaño-Rosa et al. 2020; Chen et al. 2021; Li and Umair 2023). To this end, we will examine how technical advancements influence various forms of green growth in renewable energy and digital financing (Alharbi et al. 2023; Bei and Wang, 2023; Bornmann et al. 2008).

Theoretical framework

Numerous countries and nations worldwide have already committed to being carbon neutral. Economies must speed up the conversion from environmentally damaging fossil fuels to green and sustainable energy to meet emission-reduction objectives (Sun et al. 2022). Yet, the present speed of expenditure is inadequate to meet environmental independence goals. Greenhouse investments have dropped significantly due to delayed economic and social development, high borrowing costs, and economic concerns. This might hamper efforts to increase the use of renewable energy sources, which is essential for achieving SDG7 and SDG13 and ensuring reliable energy supplies (Zhao et al. 2022). Despite the recent establishment of several innovative digital financing options in many countries (such as green bonds, green banks, green credit guarantees, carbon taxes, charcoal trade, pay-to-keep, and community trust funds), the green building investment data demonstrates that they are inadequate, and other approaches are necessary to obtain financing (Ahmad et al. 2022). The five main tasks of a financial system are the transmission of value, the storage of value, the exchange of valuation, the financing of value production, and the management of order to incentivize, all of which may be improved via technological and economic innovations. According to many sources, the opposite is true (Zheng et al. 2022). Digital finance can increase openness, accountability, decentralization of the financial sector, regulatory compliance, innovation, cost-effectiveness, productivity, and velocity and bridge cooperation and interaction (Bilal et al. 2022). The digital finance needed to reach the SDGs could be expanded through the use of technologies like artificial intelligence (AI), distributed ledger latest technology (DLT) or blockchain, peer-to-peer borrowing portals, big data, mobile and online reimbursements, the Internet of Things (IoT), ranked match platforms (such as crowd lending), and lemmatization of eco-friendly assets (Chang et al. 2023). However, following such theoretical and policy lines, this research investigates the study’s topicality.

Data and methodology

Data collection and measurement

The study collected data for renewable energy performance, digital finance, and financial performance from the World Bank and statistical databases. The data range covers from 2012 to 2020. The Institute of DF at Peking University and Ant Financial Services Group created the Digital Financial Development Index. The report aims to track the development of China’s online financial sector (DF Index). The index considers cost, availability, safety, insurance, bank reserves, credit service providers, investment prospects, and credit. The index also considers creditworthiness. It measures the level of digitalization, the use of DF, and the presence of environmental coverage.

In most cases, measures of individual behavior can be used to estimate the degree to which a population engages in digital financial inclusion. The quantity of Alipay accounts, the regularity with which Alipay is utilized, the number of borrowers availing themselves of online consumer loans, and the number of borrowers availing themselves of online business loans are all examples of such metrics. Platforms like Alipay that give consumers individualized carbon savings data are metaphorically represented by an “Ant Forest.” It connects users’ digital identities and transaction data with their “green energy” earnings from carbon reduction activities. Ultimately, Ant Forest incentivizes users who plant trees to counteract their carbon footprints. The Ant Financial Group’s Ant Pay department initiated Ant Forest. To this end, inclusive digital finance creates more opportunities for everyone to participate in environmental protection. Developing green financial services is a step forward in seeking a greener lifestyle and industrial base. Furthermore, there are many connections between digital and digitally accessible finance (Muhammad, and Fatima,, and Sharif. 2016). The DF index is multiplied by 100 and then divided by 100 to ensure accuracy and consistency throughout the research.

The total number of patents for renewable energy performance has been the primary focus of most previous studies that attempted to define REP. Using the REP number as the only basis for estimates is that it fails to account for technology’s natural decrease and expansion. Technological advances, such as the faster-than-expected depreciation of currently in-use infrastructure, do not always come without unintended effects. Due to time gaps, the impact of new technology on future development is sometimes not immediately apparent. As the older technology is gradually phased out in favor of the newer one, both the value of the technology and the benefits produced via research will decrease. When discussing the propagation of new technologies, both “spillovers” and “diffusion of knowledge” describe the same underlying phenomenon. The average number of patent applications per industry is also quite different (Nielsen et al. 2014). The amount of REP patents issued in any given year is thus obviously not indicative of the state of REP in that year (the cause and effect relationship). We will employ the REP metric Lin et al. and Popp established to make this determination. This measure takes into account both the expiration and proliferation of patents. These are the constituent steps that make up the entire calculation:

where Rpat refers to the patent on renewable energy that was issued. According to Pop (2002), the values of 1 and 2, 0.36 and 0.30, respectively, are closer to the genuine price of the patent. This finding has been echoed by several academics, indicating that it is a well-accepted theory Table 1. The default settings for Popp are 0.36 for the depreciation rate and 0.3 for the diffusion rate. The variables listed in Table 2 are described there.

Quantile regression analysis technique

Moment quantile regression is the third and last step of the empirical framework (MMQR). A unique valuation strategy, the method of moments quantile regression (MMQR), developed by Bouzarovski (2017), was implemented in the study. Because of “conditional heterogeneous covariance effects,” the MMQR allows the distribution to be slanted in favor of eco-friendly progress (Filippi et al. 2009). On the other hand, panel quantile regression restricts itself to mean shifts exclusively. The MMQR is so effective because it considers the whole picture. The MMQR is the method of choice when there are endogenous explanatory variables to include in the model and when the panel data is to be defined by individual-specific effects. The ability of the MMQR to give credible estimates is not hindered by the fact that the model being used has nonlinear components. This method has the potential to be adapted to location-based asymmetry because the parameters can change depending on where in the conditional distribution the independent variable, green growth, is located. Conditional probability distributions are utilized throughout the process to achieve this goal successfully. Because of the use of conditional probability distributions in the methodology, this is feasible. These reasons suggest that the MMQR strategy is the best way to deal with heterogeneity and endogeneity while considering asymmetry and nonlinear linkages (Guasch-Ferré et al. 2022). MMQR is frequently misunderstood as an intuitive technique, although it provides estimates limited by structural quantiles. The conditional quantile estimates, Q (| X), are as follows, based on the locational-scale variant model:

Assuming P to be a probability, we gain one if and only if Pi + Z is greater than 0.

The Xit distribution is stationary, meaning it does not change for any individual over time (t). The uniform distribution over time (t), or Uit, is orthogonal to Xit and has the same value for each individual I. The following inferences can be drawn based on Eq. 1:

Y it is the dependent variable, while Q (|Xit) identifies Xit as the independent variable. The independent variables, Xit′, include DF, REP, GOV, CAP, and LAB (green growth). Concerning Xit, the structural quintiles dependent on environmentally friendly growth are geographically concentrated and dependent on one another. An individual’s quintile’s scalar value can be mathematically represented as ai() = ai + IQ, as seen above (). The consistent and appropriate effects that the parameter has on the various forms of data. Because q() is a product of the optimization problem, it represents the quintiles sample (th) quite accurately:

From this equation, we can get the following definition of the check function. Assume that (1)AIA = 0 and that TAIA > 0.

GMM analysis technique

The GMM estimator was used in the first formula devised by Arellano and Bond to find the lag of the dependent variable. After rigorous testing, the generalized method of moments (GMM) estimator has emerged as the method that yields the most reliable results. This is because of the potential for endogeneity and the significant variations across time and space in panel data. The GMM estimator is employed to discover population-level antecedents using endogenous regresses, wherein precise individual variability is disregarded. To achieve this goal, we must instead generalize across a larger population and ignore the precise heterogeneity of individual outcomes. Estimates from least-squares, fixed-effect, or OLS methods cannot be trusted. To account for unobserved heterogeneity and calculate components, the generalized method of moments (GMM) employs an endogenous fixed effects estimate with a lagging dependent variable. The GMM employs two distinct auto-regressive models: (1) a basic model with no hidden, independent components and (2) a more elaborate model with hidden, independent components. This finding illustrates that it is possible to sidestep the endogeneity problem when comparing two variables. As demonstrated by Roodman, GMM estimates help address challenges like serial correlation and unobservable heterogeneity. Using the vector-valued function g(X), we may satisfy the moment criteria necessary for GMM, which are as follows:

The letter E stands for anticipation, whereas Yt denotes wide-ranging perception. For the input to be point-identified, the function m () must return a value that is not zero for 0.

Given the new information, this assertion should have a lower error margin. It has been found that the value anticipated, zero, is the absolute minimum that can be achieved. Within the framework of GMM theory, various norms are considered, and each norm’s influence on the overall estimator is presented.

Weighting matrix W, with transposition denoted by m(T). The generalized method of moment (GMM) estimator can thus be written as T denotes transposition and W is a weighting matrix. The GMM estimator can therefore be written as

Results from the MMQR are provided which also include a comprehensive analysis of the impact of the explanatory variables over all nine quantiles of the conditional distribution of green growth. The coefficients in the bottom, middle, and upper groups differ substantially in sign, significance, and magnitude. This research by Gross et al. (2003) proves that the variables utilized to explain plant development have distinct impacts at different growth phases. The results show that in the central and eastern regions, DF significantly impacts GREP in the medium to upper quantiles.

Contrarily, the western areas have a negligible effect on the lower quantiles (ranging from the first to the third). These results suggest that eastern regions have an efficient and trustworthy digital financial system that reduces access barriers to credit and information, improves productivity and ecological sustainability, and provides services at reasonable prices. Newer studies have revealed similar results. A similar trend may be seen in the eastern regions, where more REP promotes green growth in an unbalanced fashion through the effective use of resources. Environmentally friendly energy use and environmentally friendly transportation are two examples. Furthermore, this study supports the claim that REP was unsuccessful in the western and central regions in improving growth levels in the lowest to medium quantiles.

Result and discussion

Quantile regression results

To account for potential endogeneity within the model variables, GMM is employed in this study. The results display the combined sample results for China and those for the country’s eastern, central, and western hubs. Consistent with prior findings, the findings of Model 1 indicate that DF and REP make essential contributions to the expansion of the green economy worldwide. It is also true that comparable findings can be discovered in the western, central, and eastern regions, although the coefficient varies quite a little from one region to the next. Estimates comparable to those provided by MMQR indicate that the eastern region is affected by DF and REP to a greater degree than any other region. The eastern region of the USA has a more established digital infrastructure and a wider penetration of green growth than the midwest and western regions combined. The DF regression coefficients for the entire nation and the western, central, and eastern regions are respectively 0.285%, 0.327%, 0.239%, and 0.265%. Reducing credit and information barriers, boosting productivity, and improving ecological standards are only some of the benefits of a robust and trustworthy digital financial system in the east.

The government has given directives and is conducting digital finance activities to encourage investors to spend more on digital infrastructure and expand the green economy. Investors must follow these guidelines. Investing and funding digital financial sector initiatives may also lead to long-term commercial advantages. Examples include investors in environmentally friendly digital technologies who may get a return soon since China is quickly shifting to a green economy. Environmentally conscientious investors can save money on taxes. Thus, investors favor digital finance portfolios for predictable income and other perks. The legislative branch must support innovation as an economic engine and invest more in renewable energy innovation infrastructure. They must promote renewable technologies and remove regional institutional barriers to green growth.

The results suggest the following policy adjustments. Policymakers should use the technology revolution’s many chances to further their organization’s strategic objectives. One opportunity is the continual use of digital finance in manufacturing new financial products. The broader exploration of the potential applications of digital finance throughout the economy and blockchain is another potential. Decision-makers must seek such possibilities, and legislators should also address the sector’s regional growth inequality to maximize digital finance’s multiplier impact on the economy and help create a green economy. This lets them maximize their green economy potential. They may then fully benefit from digital finance’s impact on the economy and help build a sustainable one. Public policymakers should advocate for “one region, one policy” to alleviate unequal green growth among regions.

Authorities must also create regional restrictions that allow for eco-friendly expansion tactics. Instead of increasing spending on research and development and implementing renewable technology innovation without considering regional differences in labor and capital structure, policymakers should create incentive policies for renewable technology innovation tailored to each region. If eastern countries with sophisticated economies wish to maximize renewable technology innovation’s contribution to sustainable economic growth, they must continue investing in research and development. Central and western governments, whose economies are less developed, should learn from eastern policymakers to encourage renewable technology research. Financiers should focus on renewable energy project finance, infrastructure funds, and public markets for green investment prospects. This research needs to explore how digital banking and renewable energy performance affect other industries due to regional data.

Generalized method of moments (GMM)

Furthermore, it provides substantial, cost-effective assistance for regional services. Efforts to curb renewable energy and protect the environment benefit from a more robust competitive market system, encouraging businesses to boost their investments for economic growth. The results are consistent with the findings of most studies (Lin and Okyere 2023). Like ESTI covers energy-saving measures, waste management tools, and pollution avoidance techniques, REP covers environmental management and pollution prevention through recycling and waste reduction.

Providing reliable and affordable renewable energy to all is goal seven of the United Nations’ sustainable development agenda, this highlights the importance of increasing people’s access to renewable energy sources. Furthermore, China is trying to support the spread of renewable energy sources to achieve a percentage of power generated from renewable sources equal to fifty percent by 2030. Even though renewable energy projects have high upfront costs and a long investment payback period, there is an urgent need for financial support to construct the infrastructure for renewable energy and investigate the technologies that are tied to it. According to the results, more FI will lead to more investment in the renewable energy sector, enhancing the use of renewable energy.

The marginal productivity of REP is most outstanding in the east because the entire eastern section has coefficient values of 0.096%. In contrast, the western part has coefficient values of 0.139%, and the central part has coefficient values of 0.152%. Rising emissions and industrialization have prompted the Chinese government in the eastern regions of the country to increase its push for the adoption of green energy technology, the elimination of renewable energy through the incorporation of eco-friendly technologies, the attainment of maximum green growth at the lowest possible cost, and the improvement of resource usage efficiency. These goals can be broken down as follows. The findings align with those of more recent research on the same subject.

Significant advancements have been made in China’s renewable energy sector for several years. The development of renewable energy sources in China may need to be improved by disparities in economic growth and regional scientific and technological innovation. Digital finance is illustrated by the more significant financial inclusion that allows for better investments in the renewable energy sector. A significant initial investment is required to deploy technology and infrastructure, which is incredibly challenging for the many renewable energy startups currently in operation. Businesses in this field would benefit from more accessible access to financial services to receive the assistance they need to invest in green energy technology (enterprises that previously could not acquire financial support).

We use the quantile regression technique to determine the magnitude of the gap in China between FI and RED. Even though factors such as REP growth, export volume, and financial expenditure all play a part in determining RER consumption, the elasticities of FI, FP, and RER remain the same across quantiles. Because FI has a consistently positive elasticity across quantiles on RED, it was evident that doing so can significantly enhance RED in locations with high or low demand for renewable energy. This is the case because FI has a consistently positive elasticity on RED. In addition, the expansion of financial inclusion has a more significant impact on the demand for renewable energy in regions where the utilization of renewable energy is increasing rapidly. Furthermore, regulating factors like government engagement, labor input, and capitalization positively foster ecologically responsible expansion.

Erogeneity and marginal efficiency estimates

The growing role of fiscal expenditure in REP enables the Chinese government to increase social consumption, improve public service facilities and infrastructure, and provide high-quality development for Chinese firms. This is further explained in the following sentence. This finding is consistent with the consensus in the academic community. However, their relative weight differs by location. There is a positive lag in all regions, showing that the realization of green growth in the past significantly impacts green growth. The highly optimistic slowed-down green growth demonstrates this. Consistent with the findings of several recent investigations, the autoregressive and instrument tests verify the reliability and consistency of GMM estimators. The findings corroborate the validity of the study’s instruments and support AR’s prediction that second-order autocorrelation should be absent. To address difficulties like serial correlation and unobservable heterogeneity, GMM estimations might be employed, as Wang and Zhi (2016) show. In addition, the Hansen test statistic result can be any value between 0.413 and 0.554. The findings of Hansen’s test indicate that the over-identifying limits are appropriate, which indicates that the instruments are highly reliable; thus, the null hypothesis is not rejected.

In addition, there is a positive link between the extreme quantiles, which suggests that eastern China has a more incredible REP than the rest of the country. Our findings confirmed the assumption that investment in an environmentally friendly economic expansion is promoted by R&D spending on renewable energy, which is consistent with the findings of earlier studies. The GOV is statistically significant at the 1st through 9th quantiles of the grid, except the 5th quantile. This supports the assumption that eastern provinces such as Lin and Okyere (2023) are more critical interventionist provinces than the rest of China. Increased government investment has benefited several areas, including public health, the production of renewable energy, the management of economic affairs, the operation of environment-related technology, and the reduction of violent crime. The capitalization (Cap) coefficient has a significant statistical influence at lower and intermediate quantiles, but at higher quantiles, it has less effect than at lower quantiles.

DF and REP’s impact on China’s eastern, central, and western eco-friendly growth was examined from 2007 to 2019, and the DF index tracks digital technologies. DF’s actions make matching contributions and funding REP easy. An empirical study uses novel MMQR to estimate green growth’s asymmetric components, while GMM accounts for model-variable endogeneity. MMQR suggests that DF affects vegetation growth in the center and eastern areas, especially at higher quantiles (4th and 6th). In western and central areas, REP did not substantially increase growth in the first through sixth quantile-quantile ranking, suggesting a statistically significant and positively associated positive association between the East and renewable technology innovation. Government involvement encourages green vegetation growth across all quantile grids (except the fifth quantile); all quantiles except the sixth indicated this. The western area has the most capital investment and labor input, while the middle and higher quantiles have the lowest (the eastern and central regions). The GMM estimator confirms that DF and REP have a positive and substantial influence, although the eastern area has a more significant effect than the central and western regions Table 3.

Table 4 shows that environmentally responsible growth is more widespread in western regions in the context of increasing capital spending. Because marginal productivity falls more quickly in emerging countries than in developed countries, the marginal contribution of capital is more significant in the former. The West is defined not only by its mountains, woods, and meadows but also by its lower rate of industrialization, which results in higher environmental quality, reduced energy use, and an abundance of natural resources that are good for the environment. Increasing investments in this subject have beneficial effects on favorable effects on economic systems as a whole, which is excellent news for the natural environment. A more significant labor force in higher quantiles does not have the same effect as a more significant labor force in lower quantiles; both promote green growth, but the latter does not have the same effect as the former. According to these findings (Cap), the marginal contribution of labor is at its maximum in the west and the east and at its lowest in the middle, where there is a larger workforce but less productivity in green growth. The sector is motivated to invest in greener transformation by low input costs and a reasonable labor supply, particularly when compared to places in the country’s center, where manufacturing prices and labor costs are higher. This is especially the case compared to places in the country’s center. These findings supported the concept that labor plays a role in economic growth Tables 5, 6, 7, 8 and 9.

Robustness estimation

Table 10 highlights the robustness of the research findings. We applied multiple sensitivity assessment approaches to investigate the efficiency of the model outputs. We partially address the reversed causation issue by estimating the impact of last year’s expansion of digital banking services on this year’s wealth inequality. The latest estimate findings imply that the indicator of financial technology participation in the preceding year, 0.0240, is essential at the 1% level, showing that digital finance in the prior year still significantly impacts renewable energy performance (REP) in the present period. We revise our economy gauge for our second metric, total factor productivity.

The magnitude and relevance of the linear regression of digital finance are compatible with the background analysis findings, suggesting the importance of online payments to industrial prosperity and verifying the prior results. To get around any omitted variables, we employ the Internet availability rate in each province as an indirect indicator for online payment inclusivity.

Conclusion and policy implication

This research aims to evaluate the impact of digital finance, renewable energy performance, and financial performance in Chinese cities. China’s data from 2007 to 2019 is used to evaluate the interplay of many factors. Quantile regression (QR) and generalized methods of moments (GMM) are used to derive an empirical conclusion. Research results clarified the significant impact of digital financing on the efficiency of renewable energy production, the expansion of China’s ecological infrastructure, and the country’s municipal budgets. The findings also show that the financial performance of renewable energy in China’s cities was improved by 24.39% thanks to digital finance. In comparison, the metrics for renewable energy were affected by digital finance by 45.92%. There is a large variation in the city-level scores for digital banking, renewable energy, and other research measures. High population (16.05%), access to digital banking (23.11%), the provincial role of renewable energy performance towards renewable (39.62%), household financial stability (22.04%), and household renewable energy literacy (8.47%) were identified as primary factors of this variation. Recommendations for practical action are made for important stakeholders based on the results of such studies.

Strategically, renewable energy (RE) has a major role to play in environmental sustainability, particularly in the objective of carbon neutrality. If renewable energy (RE) can reduce carbon emissions, then its percentage of total energy consumption must be sufficient to meet the world’s needs. Many nations are racing to meet carbon neutrality objectives by aggressively developing renewable energy (RE). Subsidies are regarded as the most effective economic instrument to boost RE growth. It is true, however, that the evolution of RE harms the natural environment as well. In this time of fast growth and development, the government has the authority to conserve wildlife and the natural environment. In the meantime, the most pressing issue is reducing the costs associated with the market. The advancement of technology may efficiently reduce the expenditure of a revolution. As a result, the industry urgently needs to raise the scope of investment and technical innovation throughout this era to accomplish the greatest energy production at the quickest pace. RE’s economic edge is bolstered by its large output and technological breakthroughs. Because of this, the advancement of RE is predicted to have significant strategic importance for environmental sustainability, particularly in pursuing carbon-neutral objectives. During this time, carbon dioxide will also impact RE, indicating that the necessity of this energy reform will be exacerbated as environmental circumstances worsen. Public knowledge of low-carbon consumption should not be disregarded since this might significantly impact how industries produce their products. Finally, because of the method’s constraints and the inconsistent data in statistics, we could not reveal the disparities in the RE’s performance. To a certain extent, the variations in performance between conventional and renewable energy sources may be used to predict the next stage in global energy production. On the other hand, local authorities might use the differences across the areas to establish a more focused development plan. In any case, we feel that this research’s findings may help direct the course of RE’s future expansion.

Data availability

The data that support the findings of this study are openly available on request.

Change history

20 September 2024

This article has been retracted. Please see the Retraction Notice for more detail: https://doi.org/10.1007/s11356-024-35072-1

References

Ahmad B, Iqbal S, Hai M, Latif S (2022) The interplay of personal values, relational mobile usage and organizational citizenship behavior. Interact Technol Smart Educ 19(2):260–280

Alharbi SS, Al Mamun M, Boubaker S, Rizvi SKA (2023) Digital finance and renewable energy: a worldwide evidence. Energy Econ 118:106499. https://doi.org/10.1016/j.eneco.2022.106499

Alsagr N (2023) Financial efficiency and its impact on renewable energy investment: empirical evidence from advanced and emerging economies. J Clean Prod 401:136738

Alsagr N, van Hemmen S (2021) The impact of financial development and geopolitical risk on renewable energy consumption: evidence from emerging markets. Environ Sci Pollut Res 28:25906–25919

Amigo-Jorquera C, Guerrero-González MJ, Sannazzaro J, Urquiza-Gómez A (2019) Does energy poverty have a female face in Chile? Takuya: Latin American Science. Technol Soc 2(1):378–390. https://doi.org/10.1080/25729861.2019.1608038

Bag S, Wood LC, Mangla SK, Luthra S (2020) Procurement 4.0 and its implications on business process performance in a circular economy. Resour Conserv Recycl 152:104502. https://doi.org/10.1016/j.resconrec.2019.104502

Bei J, Wang C (2023) Renewable energy resources and sustainable development goals: evidence based on digital finance, clean energy, and environmentally friendly investment. Resour Policy 80:103194. https://doi.org/10.1016/j.resourpol.2022.103194

Bilal AR, Fatima T, Iqbal S, Imran MK (2022) I can see the opportunity that you cannot! A nexus between individual entrepreneurial orientation, alertness, and access to finance. Eur Bus Rev 34(4):556–577

Bornmann L, Mutz R, Daniel HD (2008) Are there better indices for evaluation purposes than the h index? A comparison of nine different variants of the h index using data from biomedicine. J Am Soc Inform Sci Technol 59(5):830–837. https://doi.org/10.1002/ASI.20806

Bouzarovski S (2017) Energy poverty: (Dis)assembling Europe’s infrastructural divide. Energy Poverty: (Dis)Assembling Eur Infrastruct Divide:1–117. https://doi.org/10.1007/978-3-319-69299-9

Calado H, Gutierrez D, Pegorelli C, Kirkfeldt TS, Hipólito C, Moniz F, McClintock W, Vergílio M, Guerreiro J, Papaioannou E (2021) A tailored method for strategic environmental assessment in maritime spatial planning. J Environ Assess Policy Manage 23(01n02):2250009. https://doi.org/10.1142/S1464333222500090

Castaño-Rosa R, Solís-Guzmán J, Marrero M (2020) Energy poverty goes south? Understanding the costs of energy poverty with the index of vulnerable homes in Spain. Energy Res Soc Sci 60. https://doi.org/10.1016/J.ERSS.2019.101325

Chang L, Iqbal S, Chen H (2023) Does financial inclusion index and energy performance index co-move?. Energy Policy 174:113422

Chen Y, Kumara EK, Sivakumar V (2021) Investigation of the finance industry on risk awareness model and digital economic growth. Ann Oper Res. https://doi.org/10.1007/s10479-021-04287-7

Filippi A, Tedeschi L, Parretti D, Ricci S, Morelli P, Grilli P, Rossi A, Innocenti F (2009) Lifestyle counseling in primary care: long-term effects on cholesterol level. Eur J Gen Pract 15(3):136–140. https://doi.org/10.3109/13814780903362560

Golosnoy AS, Provotorov VV, Sergeev SM, Raikhelgauz LB, Kravets OJ (2019) Software engineering math for network applications. J Phys: Conf Ser 1399(4):044047. https://doi.org/10.1088/1742-6596/1399/4/044047

Gouveia JP, Palma P, Simoes SG (2019) Energy poverty vulnerability index: a multidimensional tool to identify hotspots for local action. Energy Rep 5:187–201. https://doi.org/10.1016/J.EGYR.2018.12.004

Gross R, Leach M, Bauen A (2003) Progress in renewable energy. Environ Int 29(1):105–122. https://doi.org/10.1016/S0160-4120(02)00130-7

Gu X, Alamri AM, Ahmad M, Alsagr N, Zhong X, Wu T (2023) Natural resources extraction and green finance: Dutch disease and COP27 targets for OECD countries. Resour Policy 81:103404

Guasch-Ferré M, Li Y, Bhupathiraju SN, Huang T, Drouin-Chartier JP, Manson JAE, Sun Q, Rimm EB, Rexrode KM, Willett WC, Stampfer MJ, Hu FB (2022) Healthy lifestyle score including sleep duration and cardiovascular disease risk. Am J Prev Med. https://doi.org/10.1016/j.amepre.2022.01.027

Hanssen F, May R, van Dijk J, Rød JK (2018) Spatial multi-criteria decision analysis tool suite for consensus-based siting of renewable energy structures. J Environ Assess Policy Manage 20(03):1840003. https://doi.org/10.1142/S1464333218400033

Iqbal S, Bilal AR, Nurunnabi M, Iqbal W, Alfakhri Y, Iqbal N (2021) It is time to control the worst: testing COVID-19 outbreak, energy consumption and CO 2 emission. Environ Sci Pollut Res 28:19008–19020

Iqbal S, Bilal AR (2021) Energy financing in COVID-19: how public supports can benefit?. China Finance Rev Int 12(2):219–240

Kabir KH, Khan MA, Hasan K, Aftab S (2022) Driving forces of adaptation decision and strategies to climate-related events: case on farming households in south–west coastal Bangladesh. J Environ Assess Policy Manage:2250019. https://doi.org/10.1142/S1464333222500193

Kabir Z (2022) The Role of Social Impact Assessment (SIA) in the development of a mine closure plan in regional Australia. J Environ Assess Policy Manage:2250015. https://doi.org/10.1142/S1464333222500156

Li CZ, Umair M (2023) Do digital finance development goals affects renewable energy in China? Renew Energy 203(December 2022):898–905. https://doi.org/10.1016/j.renene.2022.12.066

Li W, Chien F, Ngo QT, Nguyen TD, Iqbal S, Bilal AR (2021) Vertical financial disparity, energy prices and emission reduction: empirical insights from Pakistan. J Environ Manage 294:112946

Lin B, Okyere MA (2023) Race and energy poverty: the moderating role of subsidies in South Africa. Energy Econ 117:106464. https://doi.org/10.1016/j.eneco.2022.106464

Marttunen M, Mustajoki J (2018) Use of analyst-generated stakeholder preference profiles in multi-criteria decision analysis — experiences from an urban planning case. J Environ Assess Policy Manage 20(03):1840002. https://doi.org/10.1142/S1464333218400021

Muhammad J, Fatima, & Sharif. (2016) Environmental Kuznets curve and financial development in Pakistan. Renew Sustain Energy Rev 54:406–414

Nielsen M, Ravensbeck L, Nielsen R (2014) Green growth in fisheries. Marine Policy 46:43–52. https://doi.org/10.1016/j.marpol.2014.01.003

Podvalny SL, Podvalny ES, Provotorov VV (2017) The controllability of parabolic systems with delay and distributed parameters on the graph. Proc Comput Sci 103:324–330. https://doi.org/10.1016/j.procs.2017.01.115

Pofoura AK, Sun H, Mensah IA, Liu F (2022) How does eco-innovation affect CO2 emissions? evidence from sub-Saharan Africa. J Environ Assess Policy Manage:2250017. https://doi.org/10.1142/S146433322250017X

Shahzad U, Gupta M, Sharma GD, Rao A, Chopra R (2022) Resolving energy poverty for social change: research directions and agenda. Technol Forecast Soc Change 181:121777. https://doi.org/10.1016/J.TECHFORE.2022.121777

Shaktawat A, Vadhera S (2022) Sustainability assessment of renewable energy performance in context to India using multicriteria analysis with and without incorporating risk analysis. J Environ Assess Policy Manage:2250020. https://doi.org/10.1142/S146433322250020X

Shi Y, Tiwari AK, Gozgor G, Lu Z (2020) Correlations among cryptocurrencies: Evidence from multivariate factor stochastic volatility model. Res Int Business Finance 53. https://doi.org/10.1016/j.ribaf.2020.101231

Sironen S, Mononen L (2018) Spatially referenced decision analysis of long-term forest management scenarios in Southwestern Finland. J Environ Assess Policy Manage 20(03):1850009. https://doi.org/10.1142/S1464333218500096

Sun Y, Ding W, Yang Z, Yang G, Du J (2020) Measuring China’s regional inclusive green growth. Sci Total Environ 713. https://doi.org/10.1016/j.scitotenv.2019.136367

Sun L, Fang S, Iqbal S, Bilal AR (2022) Financial stability role on climate risks, and climate change mitigation: implications for green economic recovery. Environ Sci Pollut Res 29(22):33063–33074

Wang Y, Zhi Q (2016) The role of digital finance in environmental protection: two aspects of market mechanism and policies. Energy Proc 104:311–316. https://doi.org/10.1016/j.egypro.2016.12.053

Wang S, Sun L, Iqbal S (2022) Green financing role on renewable energy dependence and energy transition in E7 economies. Renew Energ 200:1561–1572

Wu L, Xu L (2020) The role of venture capital in SME loans in China. Res Int Business Finance 51. https://doi.org/10.1016/j.ribaf.2019.101081

Yang Y, Liu Z, Saydaliev HB, Iqbal S (2022) The economic impact of crude oil supply disruption on social welfare losses and strategic petroleum reserves. Resour Policy 77:102689. https://doi.org/10.1016/J.RESOURPOL.2022.102689

Yin X, Xu Z (2022) An empirical analysis of the coupling and coordinative development of China’s digital finance and economic growth. Resour Policy 75. https://doi.org/10.1016/j.resourpol.2021.102476

Zhang L, Huang F, Lu L, Ni X, Iqbal S (2022) Energy financing for energy retrofit in COVID-19: recommendations for green bond financing. Environ Sci Pollut Res 29(16):23105:23116

Zheng X, Zhou Y, Iqbal S (2022) Working capital management of SMEs in COVID-19: role of managerial personality traits and overconfidence behavior. Econ Anal Policy 76:439–451

Zhou M, Li X (2022) Influence of digital finance and renewable energy resources over the sustainable development goal of clean energy in China. Resour Policy 78(May):102816. https://doi.org/10.1016/j.resourpol.2022.102816

Zhao L, Saydaliev HB, Iqbal S (2022) Energy financing, COVID-19 repercussions and climate change: implications for emerging economies. Clim Chang Econ 13(03):2240003

Funding

This work was supported by the key project of Henan Xing Cultural Project Cultural Research in Henan Province in 2022: Research on the Theory and Practice of Plateau Formation in Henan County Economy under the new Development Pattern (Project No. 2022XWH008).

Author information

Authors and Affiliations

Contributions

Chong Wang: conceptualization, methodology, and writing the original draft. Shubing Wang: data curation, visualization, and editing.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

We declare that we have no human participants, human data, or human issues.

Consent for publication

We do not have any individual person’s data in any form.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This article has been retracted. Please see the retraction notice for more detail: https://doi.org/10.1007/s11356-024-35072-1"

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wang, C., Wang, S. RETRACTED ARTICLE: Does digital financing influence renewable energy performance in China?. Environ Sci Pollut Res 30, 85708–85720 (2023). https://doi.org/10.1007/s11356-023-28288-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-28288-0