Abstract

With the continuous advancement of the technological revolution and industrial transformation, environmental governance supported by digital finance has become an important engine for achieving carbon neutrality. Based on panel data from 30 provinces in China, this study discusses the spatial spillover effect and transmission mechanism between digital finance and environmental pollution. Our research results confirm that the inhibitory effect of digital finance on local environmental pollution gradually increases with the improvement of digital finance. Interestingly, digital finance has a significant positive spatial spillover effect on environmental pollution in surrounding areas. The mediating effect shows that digital finance can alleviate environmental pollution by improving technological innovation, industrial upgrading and industrial structure rationalization. A higher degree of marketization and governmental support can increase the positive influences of digital finance on pollution reduction. This research proves the effectiveness of digital finance in improving environmental governance, and it encourages policy-makers around the world to rely on digital finance to promote ecological governance and achieve high-quality economic development.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Since the industrial revolution, carbon emissions generated by the massive consumption of fossil fuels have worsened the global climate and have had acute impacts on the environment and the climate system. As the largest developing country, China’s economy has witnessed unprecedented growth over the past 44 years. However, urbanization and economic growth are highly dependent on industry, triggering a surge in fossil energy and carbon emissions (Rehman et al., 2021). In 2020, PM2.5 and PM10 in 168 key cities in China exceeded the CAAQS Grade II standard, reaching 61.9% and 38.7%, respectively (Hao et al. 2021; Zhu et al. 2022). According to data from Yale University, China’s EPI score is 37.3, ranking 120 in 180 countries and regions, with an increase of 8.4% over a decade period, and ranking 137 in air quality, with an increase of 6.7% over a decade period. At present, China’s economic development is at the critical stage of transformation and upgrading. In response to the deterioration of the ecological environment, China has gradually paid attention to the exploration and use of clean energy (Isoaho et al. 2017). Moreover, the Chinese government has actively formulated and implemented a series of pollution control strategies, regulatory policies and actions to address climate change, which have provided a strong impetus for the global achievement of the Paris Agreement and made significant contributions in this regard (Wu et al. 2021). Therefore, the pollution problem has become the greatest obstacle in the process of realizing carbon neutrality and green transformation in China (Chen and Chang 2020). If China achieves its carbon peak and carbon–neutral goals, it would mean a comprehensive transition of the economy and society to a green and low-carbon economy.

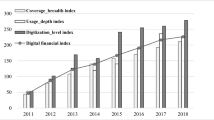

Financial innovation is the booster of economic growth, and it is the guarantee of green environmental development (Awan et al. 2021). As an important part of the digital economy, digital finance realizes financing, payment, investment and so forth through digital technology, which enhances the inclusiveness and convenience of financial services and improves technological innovation (Cao et al. 2021). With the integration of the digital economy and traditional finance, China’s digital financial index rose from 33.6 in 2011 to 334.8 in 2020, and digital financial inclusion has achieved vigorous development. Based on current studies, scholars have confirmed the role of digital finance in promoting economic growth and industrial upgrading. Research suggests that the financial system can optimize resource allocation and promote technological progress, and it has become an important driver of total factor productivity growth and economic growth (Han and Shen 2015; Lee and Lee 2022). As the public’s environmental concern gradually increase, the issue of whether digital finance promotes the green transformation of the economy has attracted attention from scholars. Ouyang and Li (2018) constructed a financial development index using indicators such as credit, insurance industry income and stock market value. The study found that financial development can significantly reduce regional energy consumption and carbon emissions. In the era of digital economy, the combination of artificial intelligence digital technology and the financial industry has had a subversive impact on the traditional financial operation (Li et al. 2020). Compared with traditional finance, digital finance reduces the risk resulting from information asymmetry in the transaction process by evaluating the collected user information through advanced technologies (Demertzis et al. 2018). Moreover, taking advantage of the intelligent internet platform and big data analysis, digital finance can accurately identify environmental protection industries and promote the flow of capital to green, low-carbon and high-tech industries. Technological innovation is not only a source of power for sustained economic growth but also an effective means to solve environmental and sustainable development problems (Chang et al. 2022). As an emerging financial model, digital finance expands the boundaries and efficiency of financial services and brings new opportunities to stimulate the vitality of technological innovation and carry out green technological innovation activities. However, some scholars have concluded that although financial development drives technological progress in society, it leads to an increase in energy consumption and carbon emissions through a rebound effect (Sorrell et al. 2009). Few scholars have discussed the influences of green finance on environmental pollution from spatial spillover and threshold effects. Our research mainly addresses the following questions. What is the impact and transmission mechanism of digital finance on environmental pollution when spatial correlation is considered? In the long run, does digital finance have a nonlinear effect on pollutant emissions? The research conclusions of this paper are of great significance for the government to innovate financial models and achieve ecological governance and carbon neutrality.

The contributions of our study are mentioned in the following aspects. First, digital finance and environmental pollution are contained in the same analytical framework. It helps to enrich and expand the breadth and depth of research in the field of environmental governance. Second, the spatial Durbin model is used to test the spatial spillover effects between finance and pollution. Simultaneously, the mediation effect is applied to discuss the impact mechanism of digital finance on environmental pollution. These models not only address the spatial spillover effects between variables but also examine the channels of influence of digital finance on environmental pollution. Third, to solve the endogeneity problem, the dynamic threshold model is introduced to test the effect of digital finance on environmental pollution from the perspectives of government support and marketization processes. This article evaluates the environmental effects of digital finance from multiple perspectives. It not only enriches the related theoretical research on digital finance and high-quality economic development but also provides practical and effective practical paths for China’s ecological environment governance and economic green transformation.

Literature review

Finance and environmental pollution

The existing research has explored the interaction between finance and environmental pollution from different perspectives and methods. In general, there are three different viewpoints: facilitation, inhibition and irrelevance. Some scholars argued that financial development can effectively allocate capital resources, improve the utilization efficiency of funds and promote capital flow to low-polluting industries (Moosa and Ramiah 2018). Financial growth helps improve the level of technological innovation and productivity, enhance the efficiency of energy use and thus improve environmental quality (Chang 2015; Zakaria and Bibi 2019). For instance, Al-Mulali et al. (2015) studied the relationship between financial development and carbon dioxide emissions in 129 countries through OLS and the Granger causality test. The results show that financial development greatly contributes to reducing carbon emissions and improving environmental quality. Shahbaz et al. (2018) explored the influencing factors of carbon emissions in France from 1955 to 2016 and found that financial activities reduced pollution emissions in France.

However, some scholars hold the opposite view and suggest that in the process of financial reform, once low-interest bank credit flows to traditional polluting industries (steel, petrochemical), it will also increase the output of energy-intensive products and deteriorate the ecological environment (Dong et al. 2020; Acheampong 2019). Shahbaz et al. (2020b) discussed the relationship between financial development and environmental degradation in the United Arab Emirates, 1975QI–2014QIV, and found that there is a U-shaped and inverted N-shaped relationship between financial reform and carbon emissions. Adams and Klobodu (2018) found that financial infrastructure plays an essential role in pollution based on a study of 26 African countries. Additionally, financial development can effectively stimulate residents to increase their consumption of cars and washing machines, which indirectly increases energy consumption and aggravates pollution. In addition, some scholars believe that financial development has no impact on environmental quality. Omri et al. (2015) analysed the relationship between the financial environment and trade growth of 12 MENA countries and found that financial development exerts no impact on CO2 emissions. Dogan and Turkekul (2016) also found that financial development does not affect environmental pollution by testing the EKC curve in the USA.

Development of digital finance

With the application of digital technology, related research on digital finance has attracted the attention of scholars (Ozili 2018; Butticè and Vismara 2021; Lu et al. 2022). At present, the research on digital finance mainly includes measurement indicators, digital financial tools and its effects on the economy, society and environment. Specifically, there are four representative indicators for digital finance, including financial inclusion data founded by the Alliance for Financial Inclusion, Global Findex database, G20 Financial Inclusion Indicators and the Peking University Digital Financial Inclusion Index of China and Ant Financial Services Group. These financial databases are quite convenient for the study of digital finance (Demirgüç-Kunt and Klapper 2012).

In addition, digital finance has brought many changes to economic and social development (Siddik et al. 2020). Digital finance provides new and important financial products, services and software for economic development and changes the way the public communicate and interact (Gomber et al. 2017). Relying on big data, digital finance has overcome the limitations of traditional finance, such as information asymmetry, high transaction costs and limited mortgage loans, and has built a safer digital risk control system of inclusive finance (Ozili 2018). Compared with traditional finance, digital finance not only improves the efficiency of financial services and promotes the reform of financial structure but also enhances the market competition effect among banks and improves the service quality, diversification and convenience of banks (Durai and Stella 2019). By increasing online financial services, digital finance helps traditional finance reduce its dependence on physical channels and expand financing channels for SMEs and individuals (Ketterer 2017). Moreover, digital finance is essential in enterprise development, consumption, industrial structure upgrading, regional innovation and the income gap. Cao et al. (2021) found that digital finance can improve China’s energy-environmental performance through green technology innovation. Chen and Zhang (2021) believed that digital finance is conducive to the servitization of manufacturing. Li et al. (2020) found that digital finance can stimulate household consumption through online shopping and payments. Interestingly, due to the frequent use of digital finance, the Kenyan public has become a trusted member of the financial community (Kusimba 2018). Some energy start-ups provide modern energy to the poor through pay-as-you-go, and customers can use energy assets more conveniently through prepayment or lease (Winiecki and Kumar 2014).

In summary, scholars have done abundant research on the impact of financial development on economic development, industrial upgrading, bank credit risk, household consumption and productivity. However, in the context of carbon neutrality and sustainable development, the discussion on the role of digital finance on environmental quality is still insufficient. Moreover, it has not yet reached a consensus on the impact of finance on pollution emissions. The related research has the following shortcomings. First, the existing literature discusses more about the direct effect of digital finance on environmental quality and pays little attention to the spatial spillover effect. Second, most of the literature only analyses the impact of digital finance on pollution from an empirical perspective, and there are relatively few studies that discuss the impact mechanism between the two in detail. Therefore, the digital finance and pollution are included in the same empirical model to broaden the scope of research on environmental governance. The SDM model and the mediation effect model are applied to test the spatial spillover effects and influence path of digital finance on pollution. It can provide practical and effective practical paths for ecological governance and green transformation.

Mechanism analysis

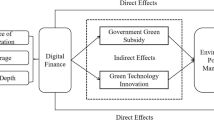

The impact mechanism of digital finance on environmental pollution

With the support of cloud computing and artificial intelligence, digital finance, as a new financial model integrating traditional finance and internet technology, accelerates the integration of market financial resources and realizes financial informatization and intelligence (Gomber et al. 2017). The impact of digital finance on environmental pollution can be analysed from the perspective of supply and demand. Digital finance accelerates the flow of funds and stimulates the vitality of the market through more adequate information from the perspective of supply. It also provides multiple financing channels for enterprises, eases financing constraints and guides enterprises to transform into a low-carbon and green development model (Chang et al. 2021). On the other hand, digital finance provides consumers with consumer credit based on massive consumption data, reduces the difficulty for residents to obtain financial services and releases consumption potential from the perspective of demand (Li et al. 2020). Moreover, it reshapes a convenient and intelligent financial system, which not only improves the accessibility of information but also expands financing channels for enterprise innovation and improves the efficiency of financial resource allocation and the quality of economic development (Ozili 2018).

Technological innovation effect

Generally, green innovation activities have the characteristics of a long cycle, large capital investment and uncertain output results. The transformation of innovation achievements, market promotion and application and after-sales service all require continuous financial support (Wang and Luo 2020). Digital finance mainly improves enterprises’ green innovation from two aspects. First, relying on digital technologies, digital finance can help enterprises evaluate innovation through internet technology and promote the transformation of enterprise innovation from experience-driven to data-driven. In addition, digital finance also improves the success rate of technology research and the transformation of technological achievements. Second, unlike traditional finance, which selects credit customers according to the company’s assets and profitability, digital finance provides financial innovation and technical research support for small firms in remote areas based on the characteristics of inclusive and precise services (Shofawati 2019). By collecting enterprises’ nonfinancial information, digital finance establishes a more complete credit rating, eases financing constraints and increases SMEs’ engagement in innovative activities. In addition, green innovation can improve the energy efficiency and the transformation of polluting industries and reduce environmental pollution (Cao et al. 2021).

Industrial upgrading effect

Digital finance can affect industrial upgrading and environmental pollution mainly through the following channels. The first influence channel is the development of the tertiary industry. As a part of the service industry, digital finance has the characteristics of resource savings and environmental friendliness, which can generate new industry models and new business forms and promote the transformation of industrial structures through the market-oriented application of information technology and business model innovation. Digital finance can make full use of internet technology to build a supply and demand docking platform for financial resources, reduce transaction costs and improve transaction efficiency. It realizes the integration of the digital economy and the real economy and promotes industrial transformation (Feng and Zhang 2021). Additionally, digital finance mitigates factor mismatches and reduces factor substitution costs. Digital finance relies on the internet and intelligent business models to break the constraints of time and space and guide the transfer of factors to high-efficiency industries. Therefore, digital finance can promote industrial upgrading and optimize environmental quality by increasing the proportion of green industries (Wan et al. 2022).

Industrial rationalization effect

As the core of the modern economic system, digital finance enhances the rational utilization of funds by dispersing risks and providing liquidity, optimizes the rational allocation of resources and guides resources to agglomerate in green industries (Chen and Zhang 2021). On the one hand, digital finance relies on digital technology to make the information in the financial service process more sufficient and weaken the problems of information asymmetry, moral hazard and adverse selection. In addition, it can also improve information transparency, reduce trust risks and transaction costs and improve the allocation efficiency of capital elements. On the other hand, digital finance can enhance the rationalization of industrial structure by optimizing labour resource allocation. Specifically, digital finance can encourage entrepreneurship through financial support, create new jobs, provide human capital investment and adequate credit for vulnerable groups and reduce the negative impact of labour dislocation on resource allocation (Durai and Stella 2019). Furthermore, the rationalization of the industrial structure can improve the utilization efficiency of various resource elements and reduce energy consumption and environmental pollution. The impact mechanism of digital finance and environmental pollution is shown in Fig. 1

Methodology and data

Methodology

Basic linear model

To check the effect of digital finance on pollution, a benchmark linear measurement model was constructed. Considering that environmental pollution may be affected during the earlier stage (Ren et al. 2021), we add the lagging one-stage variable \({POL}_{it-1}\) to the model. The equation is as follows:

where DF indicates digital finance; X contains all the control variables, involving economic development (\({PGDP}_{it}\)), population agglomeration (\({POD}_{it}\)), financial development (\({FIN}_{it}\)) and opening level (\({OPEN}_{it}\));\({\beta }_{0}{, \beta }_{1}, {\beta }_{2},\dots ,{\beta }_{n}\) are the coefficients; and \({\mu }_{i}\) and \({\nu }_{t}\) denote the province effects and time effects, respectively. \({\varepsilon }_{it}\) is the error term.

Spatial Durbin model

There are three types of spatial economic models: the lag model (SLM), error model (SEM) and Durbin model (SDM). SLM models focus on the spatial characteristics of the explained variables, and the SEM model mainly examines the spatial influence of unobservable random shocks. The SDM model covers the advantages of SEM and SLM and is frequently adopted in empirical research (Yang et al. 2021a, 2021b). In addition, the SDM model can calculate the spillover effect between regions, which more accurately reflects the spatial correlation. Therefore, to accurately analyse the spatial spillover effects of DF on environmental pollution, we set up the spatial measurement model as follows based on a multidimensional spatial weight matrix.

where ρ is the spatial spillover coefficient and \({W}_{\mathrm{it}}\) is the spatial weight matrix. According to Hao et al. (2021), we utilize the 0–1 spatial weight matrix (\({W}_{ij}^{G}\)) to test the spatial spillover effect. Based on the above matrix, if province i has the same edge as province j, then \({W}_{ij}^{G}\)=1; otherwise, \({W}_{ij}^{G}\)=0. The formula of Moran’s I is as follows.

Additionally, this paper uses z values for statistical tests.

Dynamic threshold panel model

To study the influence of digital finance on environmental contamination under different levels of threshold variables, we choose digital finance, government support and marketization level as threshold variables. Referring to Wu et al. (2021), we construct the threshold panel model:

where \({q}_{it}\) is the threshold variable and c indicates the threshold value.

Selected variables

Environmental pollution

Because of the accessibility of data, this paper constructs an environmental pollution indicator system (see Table 1). Referring to Ren et al. (2022), we utilize the entropy method to determine the indicator weight for each indicator. Specifically, we standardize the specific indicators of different dimensions and units and then calculate the weight, entropy and difference coefficient. Finally, the annual comprehensive score of each province is obtained, that is, the environmental pollution index of each province.

Digital finance

The Digital Inclusive Finance Index, jointly compiled by the Institute of Digital Finance of Peking University and Ant Financial Services Group, is used to measure the overall development level of digital finance in China (Li et al. 2020). It measures the breadth of coverage, depth of use and degree of digitalization of digital finance, along with subindexes such as payment, insurance, monetary funds, credit services, investment and credit. The index covers 31 provinces, 337 cities at the prefecture level and above and approximately 2,800 counties in mainland China, which helps us better understand the development status and trend of digital inclusive finance in China (Fig. 2). In this paper, we divide the digital finance index by 100 to improve the accuracy and rationality of the analysis.

Mediation variables and threshold variables

(1) Technological innovation (TI)

Regarding the measurement of technological innovation output, R&D investment and patents are the main reference indicators used by many researchers to measure regional technological innovation capabilities. It is common to directly use patents as the result of innovative R&D in previous studies. The reason is that patent data are highly available, and the patent evaluation process is relatively objective. The patent data issued by the National Bureau of Statistics of China mainly include two types: the patents granted and patent applications. The quantity of patent applications is not enough to represent the actual innovation ability. The patents authorized by the patent certification body are granted protection rights such as xenophobia and monopoly (Pan et al. 2019). Authorized patents not only participate in transactions in the market but are also integrated into the industry and transformed into actual technical products. Therefore, the technical innovation indicator is measured by the number of patents granted (Khan et al. 2020).

(2) Industrial structure upgrading (STR)

Traditional economic growth mainly depends on high input and high waste of energy. With rapid economic growth, the industrial structure dominated by the industry has led to progressively severe environmental contamination. The upgrading of the industrial structure can optimize the environment and alleviate resource shortages. Therefore, the ratio of the added value of the tertiary industry to the added value of the secondary industry is used to express the effect of industrial upgrading (Ren et al. 2021).

(3) Industrial structure rationalization (RIS)

We use industrial structure rationalization to show the level of coordination among the different industries and the effective utilization of resources. It reflects the coupling degree of the factor input and output structure. The existing measurement indicators for industrial structure rationalization include the structural deviation degree and Theil index. However, the degree of structural deviation fails to reflect the role of the three industries in the economy and cannot effectively measure the rationalization of China’s industrial structure in the new era. Therefore, referring to Zhu et al. (2019), this paper uses the Theil index to represent industrial structure rationalization. The index effectively measures the employment structure of various industries and personnel. If the index is closer to 0, it means that the industrial structure is more reasonable, and the larger the index, the more unreasonable the industrial structure. The equation is as follows:

where \({Y}_{i,m,t}\) represents the added value of the mth industry in area i and \({L}_{i,m,t}\) represents the employees of the mth industry in area i.

(4) Marketization level (MAR)

This study uses the provincial marketization index compiled by Yang et al. (2020) as a substitute variable for the marketization process.

(5) Government support (GOV)

Government public fiscal expenditures can optimize capital allocation and promote economic efficiency and industrial structure adjustment. The ratio of government public expenditure to GDP is used to value the degree of government support.

Control variables

(1) Economic development (PGDP)

Numerous studies have found that economic growth inevitably results in a fall in environmental quality. Generally, economic development needs to consume a large amount of fossil energy, which inevitably leads to increased environmental pollution. The per capita GDP is selected to denote the degree of economic development in this paper (Yang et al. 2021c).

(2) Financial development (FIN)

On the one hand, funds and technology play a key role in environmental governance. On the other hand, corporate green technological innovation is inseparable from the support of financial services. This paper uses the loans of financial institutions at the end of the year as a percentage of GDP to measure the financial level (Wu et al. 2021).

(3) Population agglomeration (POD)

Population gatherings can increase resource consumption and cause a decline in environmental quality. Referring to Xu et al. (2020), the urban population density is selected to measure the level of population agglomeration.

(4) Foreign direct investment (OPEN)

There is a technology spillover effect on foreign direct investment. It is an important way for the host country to develop and spread technological innovation. The gradual expansion of foreign direct investment not only promotes the economic growth of the host country but also increases carbon dioxide emissions and aggravates the deterioration of the host country’s natural environment. Referring to Wu et al. (2020), the actual use of foreign capital as a percentage of GDP is used to denote the level of openness.

Except for Tibet, Taiwan, Hong Kong and Macao, this paper chooses 30 provinces in China, and the study period is 2011–2019. We obtain these data from the China Statistical Yearbook, government work reports and national economic and social operation bulletins. The descriptive statistics of the chief variables are shown in Table 2.

Empirical analysis

Spatial econometric model

Spatial autocorrelation measures the degree of spatial aggregation of spatial units and is the basis for spatial econometric analysis. Following Feng and Wang (2020), this study examines the spatial correlation of ecological efficiency in 30 Chinese provinces during the 2011–2019 period. Moran’s I is used to detect spatial correlations between areas. We can see that the Moran index of environmental pollution and digital finance is greater than 0 from Table 3. This means that environmental pollution and digital finance have a positive spillover effect.

To identify the spatial aggregation characteristics of environmental pollution more intuitively, the Moran index scatter plots of pollution in 2011 and 2019 are provided in Fig. 3. There are four quadrants in the Moran index scatter plot. From Fig. 3, we can see that most of the 30 provinces in 2011 and 2019 are distributed in the first and third quadrants, and a few provinces are distributed in the other two quadrants. This more intuitively verifies that environmental pollution is spatially dependent, indicating that the environmental pollution of different provinces has a significant positive correlation. This finding is consistent with Ren et al. (2021).

Benchmark model and spatial econometric model

The results of the baseline model are displayed in Table 4. In this study, we use OLS, FE and RE to regress Eq. (1). To further correct the deviation of the regression results caused by the endogeneity and autocorrelation between variables, generalized moment estimation (GMM) is used to further test Formula (1). From the regression results of OLS, FE, RE and GMM, it can be inferred that digital finance can reduce environmental pollution at the 1% significance level. Digital finance is helpful in broadening the channels for people to participate in environmental protection and increasing the transparency of environmental protection public welfare activities (Cao et al. 2021). The public is deeply involved in environmental protection through the digital financial platform, which greatly enhances the public’s willingness to protect environmental protection. Digital finance advocates the concept of green consumption. Mobile payment can reduce the use of cash, and online financial services can reduce the frequency of the public going to the bank for business (Masmoudi et al. 2019). Digital finance is useful to enlarge the source of capital, solve information asymmetry and spread risks over a wider range. Moreover, digital finance also enhances the efficiency of capital allocation and greatly diminishes the transaction costs of enterprises. It provides convenient financial support for corporate green technology research and development (Sun 2020).

Table 4 indicates that there is spatial autocorrelation between environmental protection in various provinces of China. We analyse the effect of local digital finance on environmental pollution based on the 0–1 adjacency weight matrix. We found that digital finance can curb environmental pollution in the region, which is consistent with the conclusion of the benchmark regression. In the spatial spillover effect, the estimated coefficients of W*DF are significantly positive, indicating that the progression of local digital finance increases the environmental pollution of neighbouring regions. The possible explanation is that digital finance has many advantages, such as stimulating individual entrepreneurship and corporate innovation and expanding social consumption. The progression of local digital finance has a “siphon effect” on entrepreneurship, technological innovation and consumption in neighbouring regions, which may lead to the loss of technology, talent and capital in neighbouring regions (Xu and Sun 2021). Moreover, the “siphon effect” inhibits the effective use of technological innovation and industrial upgrading in surrounding areas, making digital finance a potential risk of forming a “beggar-thy-neighbour” pollution reduction model among neighbouring areas (Song et al. 2021).

Mediation effect

In the mechanism analysis, this study takes technological innovation, industrial rationalization and industrial upgrading as mediation variables and adopts a mediation effect model to examine the effect of digital finance on environmental pollution (Table 5).

This article measures the effect of technological innovation by selecting the number of invention patents granted. The regression outcome of Model (1) indicates that digital finance improves regional technological innovation capabilities; it is in line with the view that digital finance promotes technological innovation of enterprises (Liu et al. 2022). The estimation result of Model (2) shows that technological innovation can significantly reduce pollutant emissions. This finding is consistent with Shahbaz et al. (2020a). According to the judgment criteria of the mediation effect, technological innovation plays an intermediary role in the impact of digital finance on environmental contamination; that is, digital finance can improve regional technological innovation to lessen environmental contamination. Digital finance can optimize the allocation effectiveness of social capital and guide the flow of social capital to more efficient emerging industries. It improves the effective supply of financial capital and directly affects the development of technological innovation activities (Cao et al. 2021). Moreover, convenient digital financial services also help companies improve productivity and decrease environmental contamination in the production process.

Industrial upgrading is regarded as a mediation variable. The empirical results are revealed in columns (3)–(6) in Table 5. We find that the mediation effect of industrial upgrading and industrial structure rationalization is valid. The main reason is that financial development has become a critical factor affecting the transformation of industrial structure. The factor allocation of digital finance is conducive to optimizing the allocation of funds among industries and stimulating consumption diversity, which is conducive to promoting industrial upgrading and thus achieving pollution reduction (Qin et al. 2021).

The threshold regression model

Previous studies have shown that China has an enormous territory and regional diversity in financial resources. Therefore, the pollution reduction effect of financial resources may show a nonlinear relationship. To verify the potential nonlinear effects of DF, this study constructs a panel threshold regression model of digital finance and environmental contamination. According to the existence test of the threshold effect, we find that the inhibitory influence of digital finance on environmental pollution has a single threshold effect (Table 6).

We find that the pollution reduction effect of digital finance is divided into two stages (Table 7). When the digital finance index is lower than 2.218, the impact coefficient of digital finance on environmental pollution is − 0.0427; when the DF variable exceeds 2.218, the negative effect of DF on pollution gradually increases (− 0.0756). In general, the negative effect of DF on pollution has gradually increased with the improvement of digital finance. As the intensity of government support continues to increase, the negative effect of DF on pollution first increases and then decreases. Therefore, moderate government subsidies and support are conducive to the role of digital finance in reducing pollution. Furthermore, we have also found that increased marketization can increase the energy conservation and contamination reduction effects of digital finance. Generally, government intervention in the financial market restricts the flow of capital elements, resulting in inefficient allocation of financial resources. Promoting market-oriented reforms can weaken the government’s power to intervene in the economy. The increase in the level of marketization reduces the rent-seeking behaviour of enterprises, which is conducive to transferring more capital to technological innovation and reducing environmental pollution from the source.

Further analysis

We analyse the effect of the development of digital finance on environmental contamination from the aspects of cover breadth, application depth and digitization level (Table 8). From the perspective of structural effects, the cover breadth, application depth and digitization level of digital finance inclusion have a significantly negative effect on contamination. Among them, the application depth of digital finance has the greatest impact on environmental pollution, and the degree of digitalization has the least impact. The possible reason is that the application depth of digital finance includes the use of services such as internet payment, internet credit and internet wealth management. The continuous improvement of the application depth can further improve the digital inclusive financial system and green high-quality development. Due to the limitations of related infrastructure, the degree of digitalization does not play an active role in environmental governance. The coverage of digital financial inclusion mainly refers to the account coverage of the network, which can efficiently determine the problem of incoordination and imbalance in China’s financial development.

Robustness and endogenous test

We use two methods to test the robustness of the results. (1) In replacing the spatial matrix, we run the regression model again by replacing the 0–1 adjacency matrix with the economic matrix. (2) In replacing the dependent variable, the full array index method was used to calculate the pollution index, and the SDM methods were used to estimate the model. (3) This study attempts to solve the endogenous problem through instrumental variables. The fibre-optic cable data of each province are selected as the instrument variable of DF. The distribution of fibre-optic cables may affect the popularization of the internet and digital finance. Therefore, selecting the number of fibre-optic cables as the instrumental variable of regional digital finance meets the correlation requirements. Furthermore, the number of post offices does not directly affect regional pollution, which meets the exogenous requirements of instrumental variables. Therefore, this paper takes the interaction term of multiplying the length of the optical fibre cable by time as the instrumental variable of digital finance. According to the robustness results (column 1), when an economic matrix is used to re-estimate the model, the coefficients of DF are positive, which proves that our regression results are robust. Moreover, the regression results of the full array index method also show that digital finance reduces pollution (column 2). From the endogenous test (columns 3–4), the first-stage regression results indicate that the fibre-optic cable promotes digital finance, and the instrumental variable is related to digital finance. According to the second-stage regression results in the second column, the coefficient of digital finance is still positive. Hence, the above empirical results are reliable (Table 9).

Conclusion

Since previous studies have ignored the impact of digital finance on pollution, this paper systematically analyses digital finance and environmental pollution to enrich and expand the breadth and depth of research in the field of environmental governance. According to the empirical analysis, some practical conclusions are drawn. (1) The development of digital finance can significantly inhibit environmental pollution. (2) There is a significant positive spatial spillover effect of digital finance on environmental pollution. (3) Through the analysis of the intermediary model, we found that digital finance affects pollution through three channels: technological innovation, industrial upgrading and rationalization of industrial structure. (4) The degree of marketization and government support can enhance the inhibitory effect of digital finance on pollution. Therefore, we propose some policy recommendations.

First, the research conclusion shows that digital finance has a significant inhibitory effect on environmental pollution, through which the degree of marketization and government support can alleviate environmental pollution. Therefore, local governments should continue to support and encourage digital finance, vigorously advance the construction of infrastructure conducive to the development of digital finance and improve the supporting equipment. Given that the degree of marketization and government support are important in the influence of digital finance on environmental pollution, the government should optimize the business environment and stimulate market vitality. Second, considering the spatial spillover effect of digital finance on environmental pollution, especially China’s vast territory and huge differences in economic and financial development levels among provinces, it is necessary to strengthen the coordination and cooperation of regional financial development and environmental protection, popularize the knowledge of digital finance for residents and enterprises in poor and remote areas and give better play to the radiation role of digital finance to reduce environmental pollution. Third, the results indicate that digital finance is conducive to inhibiting environmental contamination through technological innovation, industrial upgrading and rationalization of industrial structure. Therefore, while enjoying the convenience brought by digital finance, enterprises should vigorously strengthen technological innovation, increase R&D investment, improve innovation levels, implement cross-regional innovation cooperation and improve resource utilization. In addition, local governments should actively support the transformation and upgrading of industries to facilitate the rational development of industrial structure.

This paper makes an exploration of the influence of digital finance on environmental pollution, but there are still limitations, which can be further expanded in the future. Firstly, this paper does not discuss the heterogeneity of the impact of digital finance on pollution. Future research can analyse the heterogeneous impact of digital finance on pollution from the aspects of geographic location, economic development level and institutional environment. Second, the gradual integration of mobile internet technology and the traditional financial industry provides a convenient channel for easing corporate financing constraints, which will have an impact on corporate productivity and energy efficiency. Therefore, future research can analyse the role of AI development between digital finance and environmental governance in the context of digital economy development. Third, superior institutional quality plays an important role in financial development and technological innovation. Therefore, scholars can analyse the impact of institutional quality on financial digitization and technological progress from the perspective of property rights, regulations and marketization. In addition, scholars can analyse the emission reduction effect of digital finance using more microdata (such as enterprise level, industry level).

Data availability

Not applicable.

References

Acheampong AO (2019) Modelling for insight: does financial development improve environmental quality? Energy Econ 83:156–179

Adams S, Klobodu EKM (2018) Financial development and environmental degradation: does political regime matter? J Clean Prod 197:1472–1479

Al-Mulali U, Tang CF, Ozturk I (2015) Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ Sci Pollut Res 22(19):14891–14900

Awan U, Shamim S, Khan Z, Zia NU, Shariq SM, Khan MN (2021) Big data analytics capability and decision-making: the role of data-driven insight on circular economy performance. Technol Forecast Soc Chang 168:120766

Butticè V, Vismara S (2021) Inclusive digital finance: the industry of equity crowdfunding. J Technol Transf 47:1–18

Cao S, Nie L, Sun H, Sun W, Taghizadeh-Hesary F (2021) Digital finance, green technological innovation and energy-environmental performance: evidence from China’s regional economies. J Clean Prod 327:129458

Chang CP, Wen J, Zheng M (2022) Environmental governance and innovation: an overview. Environ Sci Pollut Res 29:1–2

Chang K, Cheng X, Wang Y, Liu Q, Hu J (2021) The impacts of ESG performance and digital finance on corporate financing efficiency in China. Appl Econ Lett 9:1–8

Chang SC (2015) Effects of financial developments and income on energy consumption. Int Rev Econ Financ 35:28–44

Chen S, Zhang H (2021) Does digital finance promote manufacturing servitization: micro evidence from China. Int Rev Econ Financ 76:856–869

Chen X, Chang CP (2020) Fiscal decentralization, environmental regulation, and pollution: a spatial investigation. Environ Sci Pollut Res 27(25):31946–31968

Demertzis M, Merler S, Wolff GB (2018) Capital Markets Union and the fintech opportunity. J Financ Regul 4(1):157–165

Demirgüç-Kunt A, Klapper LF (2012) Measuring financial inclusion: the global findex database. World Bank Policy Res Work Paper 4:6025–6086

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23(2):1203–1213

Dong Q, Wen S, Liu X (2020) Credit allocation, pollution, and sustainable growth: theory and evidence from China. Emerg Mark Financ Trade 56(12):2793–2811

Durai T, Stella G (2019) Digital finance and its impact on financial inclusion. J Emerg Technol Innov Res 6(1):122–127

Feng G, Zhang M (2021) A literature review on digital finance, consumption upgrading and high-quality economic development. J Risk Anal Crisis Response11(4):89–197

Feng Y, Wang X (2020) Effects of urban sprawl on haze pollution in China based on dynamic spatial Durbin model during 2003–2016. J Clean Prod 242:118368

Gomber P, Koch JA, Siering M (2017) Digital finance and FinTech: current research and future research directions. J Bus Econ 87(5):537–580

Han J, Shen Y (2015) Financial development and total factor productivity growth: evidence from China. Emerg Mark Financ Trade 51(sup1):S261–S274

Hao Y, Ba N, Ren S, Wu H (2021) How does international technology spillover affect China’s carbon emissions? A new perspective through intellectual property protection. Sustain Prod Consum 25:577–590

Isoaho K, Goritz A, Schulz N (2017) Governing clean energy transitions in China and India. Polit Econ Clean Energy Transit 1:231–249

Ketterer JA (2017) Digital Finance. New Times, New Challenges. New Opportunities.-Discussion paper No. IDB-DP-501. Inter-Amer Dev Bank 3:1–45

Khan Z, Hussain M, Shahbaz M, Yang S, Jiao Z (2020) Natural resource abundance, technological innovation, and human capital nexus with financial development: a case study of China. Resour Policy 65:101585

Kusimba S (2018) “It is easy for women to ask!”: gender and digital finance in Kenya. Economic Anthropology 5(2):247–260

Lee CC, Lee CC (2022) How does green finance affect green total factor productivity? Evidence from China. Energy Econ 107:105863

Li J, Wu Y, Xiao JJ (2020) The impact of digital finance on household consumption: evidence from China. Econ Model 86:317–326

Liu J, Jiang Y, Gan S, He L, Zhang Q (2022) Can digital finance promote corporate green innovation? Environ Sci Pollut Res 29(24):35828–35840

Lu Z, Wu J, Li H, Nguyen DK (2022) Local bank, digital financial inclusion and SME financing constraints: empirical evidence from China. Emerg Mark Financ Trade 58(6):1712–1725

Masmoudi K, Abid L, Masmoudi A (2019) Credit risk modeling using Bayesian network with a latent variable. Expert Syst Appl 127:157–166

Moosa I, Ramiah V (2018) Environmental regulation, financial regulation and sustainability. In: Research handbook of finance and sustainability. Edward Elgar Publishing 1:372–385

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252

Ouyang Y, Li P (2018) On the nexus of financial development, economic growth, and energy consumption in China: New perspective from a GMM panel VAR approach. Energy Econ 71:238–252. https://doi.org/10.1016/j.eneco.2018.02.015

Ozili PK (2018) Impact of digital finance on financial inclusion and stability. Borsa Istanbul Rev 18(4):329–340

Pan X, Ai B, Li C, Pan X, Yan Y (2019) Dynamic relationship among environmental regulation, technological innovation and energy efficiency based on large scale provincial panel data in China. Technol Forecast Soc Chang 144:428–435

Qin L, Raheem S, Murshed M, Miao X, Khan Z, Kirikkaleli D (2021) Does financial inclusion limit carbon dioxide emissions? Analyzing the role of globalization and renewable electricity output. Sustain Dev 29(6):1138–1154

Rehman A, Ma H, Chishti MZ, Ozturk I, Irfan M, Ahmad M (2021) Asymmetric investigation to track the effect of urbanization, energy utilization, fossil fuel energy and CO2 emission on economic efficiency in China: another outlook. Environ Sci Pollut Res 28(14):17319–17330

Ren S, Hao Y, Wu H (2022) How Does Green Investment Affect Environmental Pollution? Evidence from China. Environ Resour Econ 81(1):25–51. https://doi.org/10.1007/s10640-021-00615-4

Ren S, Hao Y, Xu L, Wu H, Ba N (2021) Digitalization and energy: How does internet development affect China’s energy consumption? Energy Econ 98:105220. https://doi.org/10.1016/j.eneco.2021.105220

Shahbaz M, Haouas I, Sohag K, Ozturk I (2020a) The financial development-environmental degradation nexus in the United Arab Emirates: the importance of growth, globalization and structural breaks. Environ Sci Pollut Res 27(10):10685–10699

Shahbaz M, Nasir MA, Roubaud D (2018) Environmental degradation in France: the effects of FDI, financial development, and energy innovations. Energy Econ 74:843–857

Shahbaz M, Raghutla C, Song M, Zameer H, Jiao Z (2020b) Public-private partnerships investment in energy as new determinant of CO2 emissions: the role of technological innovations in China. Energy Econ 86:104664

Shofawati A (2019) The role of digital finance to strengthen financial inclusion and the growth of SME in Indonesia. KnE Soc Sci 3:389–407

Siddik M, Alam N, Kabiraj S (2020) Digital finance for financial inclusion and inclusive growth. In: Digital transformation in business and society, vol 10. Palgrave Macmillan, Cham, pp 155–168

Song Y, Liu D, Wang Q (2021) Identifying characteristic changes in club convergence of China’s urban pollution emission: a spatial-temporal feature analysis. Energy Econ 98:105243

Sorrell S, Dimitropoulos J, Sommerville M (2009) Empirical estimates of the direct rebound effect: a review. Energy Policy 37(4):1356–1371

Sun C (2020) Digital finance, technology innovation, and marine ecological efficiency. J Coast Res 108(SI):109–112

Wan J, Pu Z, Tavera C (2022) The impact of digital finance on pollutants emission: evidence from Chinese cities. Environ Sci Pollut Res 1:1–20

Wang X, Luo Y (2020) Has technological innovation capability addressed environmental pollution from the dual perspective of FDI quantity and quality? Evidence from China. J Clean Prod 258:120941

Winiecki J, Kumar K (2014) Access to energy via digital finance: overview of models and prospects for innovation. Consultative Group to Assist the Poor (CGAP), Washington, DC, USA, pp 1–29

Wu H, Hao Y, Ren S (2020) How do environmental regulation and environmental decentralization affect green total factor energy efficiency: evidence from China. Energy Econ 91:104880

Wu H, Xue Y, Hao Y, Ren S (2021) How does internet development affect energy-saving and emission reduction? Evidence from China. Energy Econ 103:105577

Xu F, Wang Z, Chi G, Zhang Z (2020) The impacts of population and agglomeration development on land use intensity: new evidence behind urbanization in China. Land Use Policy 95:104639

Xu Z, Sun T (2021) The Siphon effects of transportation infrastructure on internal migration: evidence from China’s HSR network. Appl Econ Lett 28(13):1066–1070

Yang D, Wang G, Lu M (2020) Marketization level, government intervention and firm M&As: evidence from the local SOEs in China. Appl Econ Lett 27(5):378–382

Yang X, Wang J, Cao J, Ren S, Ran Q, Wu H (2021a) The spatial spillover effect of urban sprawl and fiscal decentralization on air pollution: evidence from 269 cities in China. Empir Econ 11:1–29

Yang X, Wang W, Wu H, Wang J, Ran Q, Ren S (2021c) The impact of the new energy demonstration city policy on the green total factor productivity of resource-based cities: empirical evidence from a quasi-natural experiment in China. J Environ Plann Manag 7:1–34

Yang X, Wu H, Ren S, Ran Q, Zhang J (2021b) Does the development of the internet contribute to air pollution control in China? Mechanism discussion and empirical test. Struct Chang Econ Dyn 56:207–224

Zakaria M, Bibi S (2019) Financial development and environment in South Asia: the role of institutional quality. Environ Sci Pollut Res 26(8):7926–7937

Zhu B, Zhang M, Zhou Y, Wang P, Sheng J, He K, ... Xie R (2019) Exploring the effect of industrial structure adjustment on interprovincial green development efficiency in China: a novel integrated approach. Energy Policy, 134, 110946

Zhu J, Chen L, Liao H (2022) Multi-pollutant air pollution and associated health risks in China from 2014 to 2020. Atmos Environ 268:118829

Funding

This work was supported by the Major Program of the National Social Science Foundation of China (21&ZD151) and the Beijing Commercial Development Research Center (JD-YB-2022–050).

Author information

Authors and Affiliations

Contributions

Qingjie Zhou: conceptualization, methodology, funding acquisition, and supervision. Mingyue Du: conceptualization, project administration, formal analysis, data curation, and writing-original draft. Yifan Hou: writing-review and editing and validation. Siyu Ren: conceptualization, methodology, and supervision.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Du, M., Hou, Y., Zhou, Q. et al. Going green in China: how does digital finance affect environmental pollution? Mechanism discussion and empirical test. Environ Sci Pollut Res 29, 89996–90010 (2022). https://doi.org/10.1007/s11356-022-21909-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-21909-0