Abstract

This paper develops a dynamic framework for analyzing an individual’s choice between a Preferred Provider Organization (PPO) and a Health Maintenance Organization (HMO) under uncertainty regarding future health. We explicitly model health as a stochastic process whose fluctuations arise from three sources, one deterministic and two stochastic. Health evolves over time with a downward drift over the lifespan. In addition, health is subject to small, mean zero random fluctuations. Finally, there exists a small possibility every period of a serious illness resulting in a large, discrete fall in health. Under this characterization of health uncertainty, we develop a Real Options model valuing flexibility in health plan choice which takes into account the embedded flexibility to receive coverage for out-of-network care if the PPO health plan is chosen. Our model suggests that greater health problems increase the value of the option to go out of network for the PPO enrollee.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Almost 56% of the U.S. population had employment-related health coverage in 2009 (United States Bureau of the Census 2010. p. 20). Many workers and their family members face a choice among plans with different organizational structures, including health maintenance organizations (HMOs) and preferred provider organizations (PPOs). While both PPOs and HMOs selectively contract with health care providers, PPOs afford their members the option to receive coverage for out-of-network care, an option available to an HMO enrollee only by paying the full market price. Secondly, PPO enrollees typically have access to larger networks than HMOs. Cost-sharing is higher when a PPO enrollee uses out-of-network care than when he remains in-network. However, there is generally a contractually-defined out-of-pocket maximum for the year, so that PPOs promise catastrophic coverage for out-of-network care. A household survey conducted by the Center for Studying Health System Change (HSC) in 1998 and 1999 found that 64% of families had a choice of health plans (Trude 2000). While the HSC did not report on the proportion of families whose choice sets included both HMO and PPO plans, the Kaiser Family Foundation’s 2010 employer survey found that over half (54%) of covered workers worked for firms offering plans that fit into two or more organizational categories. This included 67% of workers at the largest firms (Kaiser Family Foundation 2010). The vast majority of Medicare beneficiaries also have the option through the Medicare Advantage program to join private HMO and PPO plans, and in some parts of the country, beneficiaries face literally dozens of choices (Gold 2008). The health insurance exchanges that figure in current legislative proposals to overhaul American health care financing also could be expected to include both HMO and PPO options.

In the 1970s, health maintenance organizations were widely viewed as the remedy for the U.S.’s stubbornly high health care costs. As recently as a decade ago, there was a widespread expectation that cost pressures would lead to ever more tightly managed health coverage. Instead, health maintenance organizations have ceded market share to preferred provider organizations and similar types of coverage, such as Point of Service plans, which now enroll two-thirds of Americans with employer-sponsored coverage (Hurley et al. 2004). Nevertheless, advocates of the managed competition approach to reforming U.S. health coverage continue to argue that properly structured competition among plans would favor the rise of tightly integrated HMO model plans.Footnote 1

Our main argument in the present paper is that the flexibility a PPO provides to use out-of-network care, even if the agent never exercises that option, is an important reason for the increasing dominance of PPOs. A similar point was made by Robert Merton, who noted in his Nobel Prize lecture (1997, p.106) that the consumer choosing among health plans, “…solves an option-pricing problem as to the value of that flexibility.”Footnote 2

While we explicitly model choice among health plans, it is important to note that we are implicitly comparing the well-being of individuals who have an employer-provided menu of health plan choices to those who do not. Consider two individuals of identical income and health status, both of whom are currently enrolled in the same health plan, but one of whom has the option to change to another plan. Although both derive the same present value from the plan in which they are currently enrolled, the one who has the option to switch to another plan in the future also derives value from the existence of that option, and so is better off.

A Real Option Approach

Real Options Theory provides a framework for analyzing a variety of decisions made under uncertainty. Though this theory started as an outgrowth of finance, it has found use in numerous branches of economics as an approach to valuing flexibility. Possible responses to future states of nature may be interpreted as options that the agent presently holds, which he may or may not choose to exercise when new information becomes available. These options are akin to financial options in that they provide their holders the right, but not the obligation, to take a certain course of action in the future. Such real options have value, even though they may not be traded in liquid markets. Using option pricing techniques to value such non-financial options provides insight into how strategic flexibility affects economic outcomes.

Today, this body of theory stands as the bridge between pure finance and other areas of Decision analysis; its scope is vast and varied. For example, these ideas are used extensively in the literature on investment under uncertainty for modeling such diverse decisions as investment in research and development, new technology adoption, the firm’s entry and exit decision, and expansions in its scale. Applications also abound in natural resource valuation. Real options analysis has also been used to evaluate strategic environmental and educational policy, and in the analysis of migration decisions of households.Footnote 3

Real Options Theory makes intensive use of the mathematical techniques of financial option pricing, derived from the work of Black and Scholes (1973) and Merton (1973). Financial option pricing methods typically make use of a portfolio of existing traded assets to replicate the risks associated with the asset on which an option is taken out, and apply the Black-Scholes formulation to value these options. This is known as the contingent claims method. This method is appropriate in the case of financial markets because of the existence of a variety of traded assets on which extensive data is available. In non-financial applications of option pricing, where markets are relatively incomplete, a stochastic dynamic programming methodology can be adopted as an alternative (for an extensive discussion of the two approaches, see Dixit and Pindyck (1994)). The difference in the two approaches is ultimately one of emphasis; financial applications stress the valuation of options while Real Options models emphasize the decision making aspect of the problem (Boyer et al. 2004).

The Real Options framework is especially suited to analyzing the intertwined choices of health plan and health care provider. The household that is offered a choice between an HMO and a PPO health plan implicitly prices the option of going out of network that is available under the PPO when it makes its health plan selection. And if the initial choice is to enroll in an HMO, the household receives not only the benefits of the plan, but also the value of the option to switch to a PPO in the future. Indeed, the value of joining an HMO would be lower if the household were barred from changing plans should events make it optimal to do so. Note that the option of switching between an HMO and a PPO is a European option, and can only be exercised during a specific time called open enrollment while the choice of moving in and out of network is akin to an American option, that can be exercised at any point in time. The implications of this difference are taken up the following section. The rest of this paper is organized as follows. The following section describes the specification of our dynamic model of health plan choice. The section after describes the nature of the solution. Then the next section describes the data we use for calibration of the model. The final section describes our numerical results.

The Model

The household’s choice of a health plan can be viewed as an Optimal Switching problem, in which a household that is currently enrolled in a plan optimally decides each period whether to stay with the plan or switch to the alternative plan at an associated cost. Optimal switching models are characterized by the existence of m distinct regimes or states that an economic agent may move between. The source of uncertainty comes from the evolution of a continuous state variable S, that moves stochastically over time. On observing the current state of nature, the agent can move from regime i to j at a lump-sum cost C ij and receive a flow of payments per unit of time in the new regime j. The objective is to choose a regime to maximize the discounted flow of payments given that optimal policies will be followed in the future, in accordance with Bellman’s Optimality Principle (Bellman 1954).

Time Horizon

We adopt an infinite time horizon framework, which makes the problem computationally simpler than a finite time horizon. Without a terminal date, the problem for the optimizer becomes identical every period, so the optimization problem becomes independent of calendar date t.Footnote 4

State Space

The state space contains variables whose values define the state of nature for the optimizer in any given period. The state space defined for the HMO-PPO problem is mixed, consisting of one continuous state and one discrete state. The continuous state for this problem is the individual’s health status h, which fluctuates through time. The discrete state j is the regime or plan in which the individual is currently enrolled. In our case, this variable takes on the values j = {HMO,PPO}, depending on the health plan in which the agent is currently enrolled.

Choice Variable

The choice variable in this model, k, is also discrete, and also may take the values k = {HMO,PPO}. The distinction between j, the state variable, and k, the choice variable is easiest to explain in a discrete time exposition: The current discrete state is the agent’s health plan at the beginning of this period. The optimal discrete choice made this period is the health plan in which the individual will be enrolled at the beginning of next period, which then becomes the discrete state for that period.Footnote 5 The second choice facing the individual is whether to use an in-network or an out-of-network provider. Conditional on the values of the state variables j and h, the choice of in-network or out-of-network provider will determine out-of-pocket costs and health outcomes.

State Transition Equations

While differences in premiums, income, and access to out-of-network providers under each plan all affect the optimal choice of health plan, the evolution of health (h) is the source of uncertainty in the model.Footnote 6 Health is subject to random, mean-zero fluctuations around a trend line that slopes downward with age. In addition, with each period the agent faces the possibility of developing a serious illness, causing a large, discontinuous drop in health (a health shock). This is described formally through the state transition equation of h, which governs the behavior of the state variable h over time:

This equation models the evolution of health as a combined Brownian motion and Poisson jump process with downward drift. Brownian motion is the continuous time analog of a random walk. The drift is represented by the first term, ∝ hdt, where ∝ is negative. The second term captures the continuous volatility of Brownian motion. The variance parameter is σ, and dz represents an increment of the Weiner process such that \( z = \varepsilon \sqrt {{dt}} \), where \( \varepsilon \sim N(0,1) \). Finally, the third term represents the possibility of a discontinuous drop in h (a Poisson jump). The magnitude dq is the increment of a Poisson process with a mean arrival rate of λ, such that a health shock causes h to fall to 1–φ of its original value. In other words, over each interval of time dt, there is a small probability λdt that h will fall by 100φ%. Thus, we could also express the state transition equation for h as:

As explained earlier, the state transition for j is determined by the optimizer’s previous optimal choice of health plan k. The plan in which the agent finds himself each period is determined by the plan he optimally chose in the previous period. The agent knows the four parameters of the state transition equation of h namelyFootnote 7:

-

i)

α- the downward drift in health with age,

-

ii)

σ- the per-period volatility of health,

-

iii)

λ- the Poisson intensity, or frequency, of a downward jump in h, which determines the probability of experiencing a health shock, and

-

iv)

ϕ- the size of the downward Poisson jump as a percentage of the current health state, or the average severity of such an illness.

The Reward Function

In our model of health plan choice, the reward associated with each plan depends on the health status one can maintain under the plan, and the premium, expressed as a fraction of income, that one pays for the plan. If the individual uses in-network providers, the per period effective return of being enrolled in plan j is:

The coefficient a j reflects the current-period impact on health-related symptoms of enrollment in a given plan. Since PPOs typically have broader networks, pay providers more, and make less intensive use of such cost control mechanisms as incentive payments, referrals, and utilization review, we assume that a HMO < 1 and a PPO = 1. Note, however, that the magnitude of a j will not affect the stochastic evolution of health—that is, it will not change the value h t+1 . The term b j c t represents the agent’s monetary payment for plan j, expressed as a fraction of his income. Since premiums and out-of-pocket costs such as deductibles are typically higher for a PPO, we assume that b HMO < 1 and b PPO = 1.

The reward function is altered when the individual uses out-of-network providers, which we assume to be of higher quality. First, the health-related return becomes, δh t where δ is larger than a PPO . Paralleling the role of a j , δ reflects the current period impact on health-related symptoms from the use of out-of-network providers, and does not affect the stochastic evolution of health. In addition, in the special case where the agent experiences a health shock (downward Poisson jump), we provide that the PPO enrollee may mitigate that shock by using a high-quality, out-of-network health care provider. Without this mitigation, the health shock reduces health by the factor 1–ϕ. Use of an out-of-network provider changes this effect to 1–ϕ–γ, where γ is greater than zero and less than ϕ. This mitigation effect changes h itself, and thus feeds into the future evolution of health. When the individual uses out-of-network care, the reward function will reflect the associated extra monetary cost, c ON , expressed as a fraction of income. In addition to the cost parameters, the agent knows the values of aj, bj, δ and γ.

The Cost of Switching Plans

While switching health plans may not entail explicit monetary costs, indirect transaction costs arise from various sources. These include the cost of researching alternatives and inertia or a status quo bias (Strombom et al. 2002). We define C jk to be the lump-sum cost of changing plans, which we assume to be equal to zero if j = k. We also assume that C HMO,PPO = C PPO,HMO , or that switching costs are independent of the direction of the switch.Footnote 8 Even though the model is solved in continuous time, where the individual makes a choice per unit of time (every instant), so that the timing issues of open enrollment are squeezed into a very small time frame, the lump sum cost of switching between an HMO and a PPO implies, in essence, a partial irreversibility of that decision. Note that going in and out of network is a more continuous and perfectly reversible move (with no sunk costs associated with moving), where the premium (per-period cost of a health plan) is simply augmented by the cost of going out of network, where the latter decision is similar to an American option that can be exercised any time.

The Discount Rate

The final parameter in the model is ρ, the discount rate.

Nature of the Solution

Consider the following analogy to financial options: given the plan in which the individual is currently enrolled, he or she derives value from two sources. If the current plan is an HMO, the individual receives a discounted flow of services (at the associated premium), as well as the option to switch to the PPO in the future. The PPO provides an analogous flow of services and two option values. The first is the option to go out of network at the associated cost, while the second is the option to switch to an HMO plan.Footnote 9 Note that each of these options would be exercised under different states of nature, the former at a low range of h (where an illness may make it optimal for the individual go out of network) and the latter at a high range of h.

The solution to the agent’s choice of plan and provider problem is made up of, a) the value of being in a particular regime or plan (the normal returns augmented by the option value(s)) and b) the associated threshold values of h that prompt the exercise of a particular option.

The three threshold values of h are: i) h * HP , the threshold at which an individual switches from an HMO to a PPO, ii) h * PH , the threshold that prompts the reverse movement and iii) h * ON , the threshold at which a PPO enrollee chooses to go out of network, at an extra monetary cost. The exact values of these parameters will depend on income, plan premiums, cost-sharing provisions for using out-of-network care, and the various parameters of the model. We are particularly interested in how these thresholds are affected by the parameters that govern the evolution of h.

Regions of the State Space

At a given point in time, h can take on any value in its state space [0, ∞). The nature of the problem and its solution are clarified by breaking up this h-state space into different regions, each one associated with a different optimal reaction to the given state of nature—that is, to the current values of h and j (the current health care plan). Figure 1 provides a diagrammatic illustration, where a higher h (as we move to the right) implies better health. The upper long horizontal line shows the h-state space for an individual initially enrolled in a PPO, while the lower line shows the h-state space for an individual initially enrolled in an HMO. The short vertical lines mark the values of h, at which a switch occurs (or an option is exercised) and arrows denote the direction of the switch. The regions of the state space are separated by the three threshold values of h. For example, if j = HMO and h lies in [h * HP , ∞), the optimal strategy is to stay in the HMO. In Fig. 1, this region is represented by the right segment of the lower line. Notice the wedge between h * HP and h * PH . This wedge results from the partial irreversibility of health plan choice due to the costs of switching, which play an analogous role to sunk costs in a firm’s entry and exit decisions. When h lies in this wedge between the thresholds, it is optimal to stay with the current plan. This region is the region of inactivity and captures the inertia, or status quo-bias, effect.Footnote 10

The Value Functions

The basic dynamic programming technique splits the decision sequence into two parts, the immediate period and the continuation period. In continuous time, the optimality condition is:

Given that j solves the maximization problem, the right-hand side summarizes the per-period value received by the agent from his choice of plan. For example, ρV(h t , HMO) represents the value received if an HMO plan is optimally chosen. Expanding \( \frac{1}{{dt}}E\left( {dV} \right) \) requires using some standard methodology from stochastic calculus. We apply Ito’s Lemma for differentiating V(h t ), a function of the stochastic variable h to get the following:

Note that the last term on the right-hand side is the expectation that h will fall to (1–ϕ) of its original value in a given period. If an individual optimally chooses an HMO, his value function must satisfy the following condition:

Where the time subscript has been Note that if the agent starts out in an HMO and chooses to stay in the HMO or h lies on [h * HP , ∞), the above condition still must hold. Similarly, if he starts out in a PPO and chooses to stay there, but does not make use of the out-of-network option (or h lies on [h *ON , h *PH ]), the following condition will hold:

If, however, the agent chooses to be in a PPO and is currently using the out-of-network option, or h lies on [0, h *ON ], the value function will satisfy the following:

The reward function now reflects the per period benefits and costs of going out of network.Footnote 11 Access to higher quality care is reflected in δ, which is greater than a PPO . The PPO premium is augmented by the cost of going out-of-network. The last term on the right hand side reflects the mitigation effect of using out-of-network care following a health shock. The parameter γ lies between 0 and ϕ.Footnote 12

The Solution

The solution will be made up of two parts: i) The three threshold values of h: h * HP , h * PH and h * ON and ii) The three value functions V(h, HMO), V(h, PPO IN ) and V(h, PPO OUT ). The second order differential equation in a variable following Geometric Brownian Motion has a known solution of the form V(h) = h β. Standard differential equations methodology yields the following solutions for Eqs. 5, 6, and 7 Footnote 13:

The three terms in Eq. 8 have quite intuitive interpretations. The first is the present value of the stream of h that the agent receives under the HMO plan. Since α is negative, this implies that he discounts h at a higher rate than the normal discount rate. The second is the present value of the stream of premium payments to the HMO. The last term captures the option value of moving to a PPO should it become optimal to do so in the future.

The first two terms in Eqs. 9 and 10 have interpretations analogous to those of Eq. 8. The last two terms in Eq. 9 capture the value of the two options open to the PPO enrollee who is currently using in-network care—going out-of-network and switching to the HMO. If h falls below the h * ON threshold, he would seek medical help outside the network. If h rises above the h * PH threshold, the individual would move back to an HMO.Footnote 14 The three value functions defined above have four undetermined coefficients, A 1 , A 2, A 3 and A 4 . Along with the unknown thresholds, we have a total of seven unknowns. We impose seven side conditions to determine that these ensure continuity and differentiability of the value functions at the thresholds.Footnote 15 We then pass this system of seven non-linear equations in h through a root finding algorithm such as Broyden, to solve for our seven unknowns. Together these seven unknowns completely determine the three value functions and the three thresholds in our model.

Data Description

The data come from the National Health Interview Survey (NHIS) conducted by the National Center for Health Statistics (NCHS) that contains information on a broad range of health related topics. We construct a subset of the data for the four years spanning from 2004 to 2007 to have a sample of individuals and families who have private health insurance and rely on either a PPO or an HMO for coverage. Based on available information, the sample sizes used in the tables and estimations range from 18,000 to 57,000 observations. Selected household characteristics under each plan are presented in Table 1.

Health Variables

Self-Reported Health Status

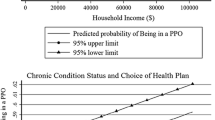

Respondents in the standard NHIS family core questionnaire are asked the question “Would you say that your health in general is: Excellent, Very Good, Good, Fair, or Poor?” This ranking is recoded from 5 to 1 in our analysis, so a higher number implies better self-assessed health. We find a small but highly significant difference in the mean health rating of PPO and HMO enrollees, with the former averaging a higher rating (4 compared to 3.9). While the median rating for both groups was the “Very Good” category (rating of 4), the non parametric Wilcoxon-Mann-Whitney Test further suggests that a different distribution of (self-reported) health status applies under the two plans, with PPO members generally reporting better health. The test ranks each observation’s self-reported health and sums them by plan, and tests for a rank-sum difference across the plans. Finally, an Ordered Logit regression of health status on the choice of health plan (holding income and age constant) produces a significant coefficient, compounding the evidence that health outcomes may indeed be different across the two plans. (Each of these three tests produced results significant at the one percent level.) These results are confirmed when we use the average health assessment of members of a family instead of an individual’s health rating (see Table 1).

Health and Activities Limitation Index (HALEX)

The HALEX health indicator has been used by the NCHS to predict future years of healthy life and is based on two types of questions collected by the NHIS. The first assesses activity limitation through six categories ranging from “not limited” to “unable to perform activities of daily living (ADLs).” Self-reported health is categorized as discussed above. These two items make up a classification matrix with 30 possible combinations that are then assigned a single score based on correspondence analysis. Scores are assigned to each classification ranging from .10 (most disabled state) to 1.0 (healthiest state). This index provides a more continuous health measure than self reported health status alone, which is useful for the numerical simulations of the Real Options Model. We approximate the variable h by the HALEX scores of individuals in the NHIS. Unfortunately, we do not have panel data on health. Instead, we proxy the parameters governing the evolution of h by looking at the age distribution of HALEX. We do this by constructing the average HALEX score of respondents of a given age, and by looking at the movement in this average as age increases. Parameters α and σ are estimated from the log difference in the HALEX series (constructed over the age variable) for different age groups and are presented in Table 2. We find that the higher age groups have a higher rate of deterioration in h. The absolute value of α increases by a factor of 8, from 0.001 to 0.008, from the under-34 to the over-65 age category. Our estimate of σ representing the variability of health, is roughly constant across age groups until age 55, at which point it doubles in value. Given the usual caveats about using a cross sectional age profile to impute the time series properties of an age dependent variable, this result does have an intuitive explanation. As one gets older, one’s health also becomes more uncertain in the short term, with the possibility of complications from minor illnesses increasing.

Limitation Caused by a Chronic Condition

We also make use of the binary variable in the NHIS dataset that indicates whether a person has a functional limitation caused by a chronic condition. Despite the better average reported health of PPO enrollees, we find a small but significantly positive difference in the proportion of PPO enrollees with functional limitations in the household compared to HMO enrollees. We use the frequency of functional limitations in different age groups to approximate the probability of being afflicted with a limiting illness. We use this as a proxy for the Poisson Probability of a serious illness, from which we get the Poisson intensity parameter, λ. Moreover, the percentage downward jump in h if one develops a chronic condition can be further estimated by comparing the mean HALEX for individuals with and without a chronic limitation. The size of the percentage difference in HALEX is our estimate of ϕ. Estimated values of ϕ and λ for different age groups are also provided in Table 2. Unsurprisingly, λ increases with age, with the numbers increasing quite drastically after the age of 50. The ϕ parameter increases gradually until tipping down in the highest age group. Since ϕ measures the percent fall in health from a chronic limitation, its behavior depends on the relative behavior of the HALEX of those with a chronic condition to those without, as we move across age groups.

While self-assessed health tends to be better for PPO members, there exist health conditions that would persist under either plan. For instance, if a person has a functional limitation due to a chronic condition of diabetes or cancer, he may report better health due to better medical access in a PPO (when compared to someone with the same chronic condition in an HMO), but it is likely that his limitation status remains unaltered. In fact, the presence of such a condition may make him more likely to join a PPO. The chronic nature of the limitation is not adequately addressed by the HALEX, which ranks limitation by its severity and not duration. We use this variable in attempting to distinguish between the endogenous and exogenous measures of health (to plan choice), a crucial distinction in the specification of the model. Since health is both an outcome and a determinant of plan choice, the endogenous-exogenous distinction is addressed by how we approximate health condition in the data. In our model, plan choice affects the reward function through a higher level of health in a PPO, but characteristics of health that are exogenous to plan choice, like the rate of health deterioration α the short-term variation in health σ the probability of developing a serious illness λ and its severity ϕ, affect an individual’s selection of health plan.

Household Budget Variables

Individual and Household Income

The NHIS provides top-coded interval data for an individual and family’s earnings in the previous year. We fit a Pareto Distribution to this data for each year and use the Pareto imputed mean for the top-coded category, as well as Pareto imputed midpoints for the intervals above the median income, and simple midpoints for the intervals below. All pre-2007 values are expressed 2007 dollars. We find a significant and positive difference in average incomes (of $6000) of PPO and HMO enrollees. We use this variable to scale the premium costs associated with the current health plan. At the household level, we find that Combined Family Income (that is also top-coded and measured in intervals), is significantly higher for PPO families (see Table 1).

Health Insurance Premiums and Other Out of Pocket Costs

The NHIS contains information on health insurance premiums including payroll deductions as well as costs paid out-of-pocket that do not qualify for reimbursement. We find that an average family in a PPO spends $432 more annually than a family under an HMO plan.

Numerical Results

The value functions laid out in Eqs. 8, 9, and 10 have two components. The first component of each value function has a straightforward interpretation as the present value of the stream of net returns under the current regime. If one were to stay in the current regime forever due to a lack of choice, the value functions would only include these present value estimates. Flexibility of health plan choice in the face of new information is summarized by the option values embedded in the value functions, which augment the traditional net present value calculations. Since we are primarily interested in the flexibility aspect of the health plan decision, it is this part of the solution that we emphasize in our presentation. The option values of particular interest are i) The option of switching from an HMO to a PPO which is represented in Eq. 8 by \( {A_1}{h^{{\beta_1}}} \) and ii) The option of going out of network if currently a PPO enrollee, represented in Eq. 9 by \( {A_2}{h^{{\beta_1}}} \).Footnote 16 Each of these option values depends on β 1, the solution to the nonlinear equation \( \alpha \beta + \frac{1}{2}{\sigma^2}\beta \left( {\beta - 1} \right) + \left( {\lambda - \rho } \right) - \lambda {(1 - \phi )^\beta } = 0 \). Hence, parameters that increase the option value of switching from an HMO to a PPO are the same as those that increase the option value of switching from in-network to out-of-network care for a PPO enrollee. We simulate the effects on the first option value as various health parameters change; the second option value would behave in a qualitatively identical manner, but at a different scale.

Probability of a Chronic Limitation

A higher likelihood of a serious illness (or one that results in a chronic limitation in activity) increases the option value of joining a PPO, as well as that of going out of network if one is already in a PPO. Figure 2 illustrates this effect. In this case, the age groups of 55 to 64 and 65 and above have very similar option values, as do age groups 35 to 44 and 45 to 54. As the probability of a chronic limitation increases to more than 20%, we see a convergence in option values for all age groups. Access to better paid doctors and more choice makes a PPO more valuable when one is more likely to seek medical care. This result is consistent with our observation that a significantly higher proportion of PPO enrollees have a chronic condition as compared to HMO enrollees (See Table 1 for numbers at the household level). Note that the option values estimated for each age group for a range of λ use the estimated parameters of α, σ, and ϕ for the respective age groups.

Severity of a Chronic Limitation

The likelihood of developing a chronic limitation is as important as the severity of this limitation. In our specification, this is measured by the size of the Poisson Jump downwards where h falls to a fraction (1–ϕ) of its original value. Figure 3 shows the results of a simulation of the effects of higher severity on the PPO option value. Note that the option values for the older age groups are much larger than the lower age groups. One of the reasons we see this effect is that the size of the jump (ϕ) matters more when the jump is more likely to occur (governed by the Poisson intensity factor λ). As we see in Table 2, λ varies quite a bit by age category, drastically increasing for the oldest groups, while ϕ does not vary as much. In Fig. 2, we study how the value of λ affects the value of the PPO option at different ages, holding λ constant across age groups. In Fig. 3, we allow the value of λ to vary by age group, while keeping ϕ constant across groups. For the oldest age group, the option starts out with a high value and increases at a slow rate as we increase ϕ. For the 55 to 64 age group, we see the biggest change in the option value from a higher level of ϕ. With a high λ, a higher ϕ has a larger effect on this group compared to the three age groups below it, which remain close with a gradual increase in the option value in each case. Low probabilities of a chronic limitation dampen the effects of a higher ϕ.

Variation in Health and its Rate of Deterioration

Interestingly, as the downward drift in health (α) increases, the value of the PPO option, as well as the out of network option, falls (see Fig. 4).Footnote 17 This reflects the fact that as h goes to zero, the difference between h (health under a PPO) and ah (health under an HMO, where a < 1) goes to zero as well. In other words, when we get to very low levels of health, the difference in the benefits of the plans becomes insignificant, while the difference in the premiums remains the same. A higher α simply implies that h goes to zero faster, so we get a lower option value. In summary, as the choice of health plan only affects the level of health and not the rate of decrease in health, a larger steady decrease in h more than offsets the level of PPO health benefit (compared to the higher premiums), so that a switch may not be as valuable. The reason we find higher option values for the older age groups (in Figs. 2 and 3) is in spite of a higher α and not because of it. Older age groups also have a higher value of the λ and σ parameters. In Fig. 4, we hold the values of the other parameters constant at the average levels for the entire sample and only vary α to isolate this effect.

As we see from Fig. 5, a greater variance in h increases the PPO option value. Given more erratic health, we would find the PPO more attractive. All three parameters λ, ϕ, and σ contribute to the volatility in h; the first two in a discrete sense, and the third in a more continuous way. Hence, it is not surprising that that a higher value of σ, like higher values of λ and ϕ, increases the option values of interest.

Conclusion

Our model suggests that a lower rate of health deterioration, more erratic health, a higher probability of serious illness, and a higher expected severity of serious illness all increase the value of the option to go out of network for the PPO enrollee, as well as the value of the option to switch to a PPO plan in the future for the HMO enrollee. More generally, we provide a model of the circumstances that might predispose individuals to value the PPO’s option to use out-of-network providers. We believe this real options approach is useful for understanding the increasing market share as such plans have been captured over the last 10 to 15 years, despite continuing concerns over the cost of health care that have lead many observers to expect that competition among plans would favor more tightly managed health maintenance organizations.

Notes

Merton cites two papers in this area, but neither pertains directly to the household’s choice of health plan. One (Hayes et al. 1993) discusses futures markets for health care claims, while the other (Magiera and McLean 1996) applies real options analysis to hospital capital investment decisions. Capp et al. (2003) use an option analogy to characterize the markets in which HMOs act as “intermediaries [that] sell networks of suppliers to consumers who are uncertain about their needs” as “option demand markets” but do not deal with PPOs. Finally, Gerard Wedig (2010) argues that Selective Contracting (SC) practiced by HMOs limit the choices of consumers, which has led to lower enrollment trends. His analysis is restricted to one dimension of choice, the available hospitals in the network for a consumer, conditional on their type of illness. While he does not explicitly model the out-of-network option available under a PPO, his results suggest that choice of hospitals under a plan is an important determinant of enrollment. Since the out-of-network option is exercised less often the larger the in-network choice set, our results corroborate his findings.

Even though we use an infinite horizon model, a finite life is approximated by the stipulation of a downward drift in health status, h, so that expected health approaches zero in the long-run. Standard models of utility maximization over an infinite horizon with a positive discount rate employ a similar approximation, since rewards from periods very far in the future approach zero.

While the model is mathematically much easier to solve in a continuous time framework, doing so obscures some of the subtleties of timing issues. A seamless and immediate transition between regimes is not a realistic scenario, given that employers and health plans generally allow a change in health plan once a year. Qualitatively however, the optimization problem remains the same, since the agent makes the stay or switch decision per unit of time, whether that unit is a year, or a given instant.

Due to data limitations, we do not treat income as stochastic in this model. An interesting extension of the model would be to introduce uncertainty about the evolution of income with income varying with health status, that is, with capacity to work.

In reality, the agent may only have some idea of the distributions of these parameters and not their exact values. As with most economic models exercises, we make this simplifying assumption to keep the model tractable.

This simplifying assumption makes no significant qualitative difference in the model, as will be clear from the theoretical solution.

The switch from a PPO to an HMO based on health fluctuations would be a rare event, given that income rises and health tends to fall over the lifespan. We therefore expect the value of the corresponding option to be close to zero. This expectation was confirmed in the computational results.

Modeling the choice of health plan in this manner is in the spirit of Dixit’s (1989) work on the entry and exit problem of a competitive firm. In the entry-exit case, the variable driving the decision is the price of the output. In the traditional analysis, the threshold price for entry is minimum average total cost, and the threshold price for exit is minimum average variable cost. (These will be equal in the long-run, of course, as all costs become variable.) At prices that fall between the minimum ATC and AVC, there is a region of inactivity: firms that are in the market stay in the market, while firms that are out of the market stay out of the market. Dixit shows that this traditional approach implicitly assumes that firms believe with certainty that current prices will prevail forever. When firms take account of the uncertainty of future prices, the region of inactivity widens.

In reality, an HMO enrollee can go out of network at their own expense. We assume this cost to be prohibitively high and do not model that decision.

A number of possible complications that are beyond the scope of the present work deserve mention. Uncertainty could be introduced into the relationship between health care and health. In particular, out-of-network care could be modeled as increasing the expected value of health after a health shock, rather than improving health with certainty. Furthermore, a more realistic model might recognize that diseases that decrease health by similar amounts can respond differently to treatment—some diseases are curable and others are not. Terminal illness, which would increase the value of α, could also be modeled.

Using the terminology for differential equations, β 1 is the solution to the auxiliary equation the \( \alpha \beta + \frac{1}{2}{\sigma^2}\beta \left( {\beta - 1} \right) + \left( {\lambda - \rho } \right) - \lambda {\left( {1 - \phi } \right)^\beta } \) which must be solved numerically.

In this case, we do not constrain the coefficient of the negative or positive root to be zero.

For a thorough treatment of these conditions, refer to Dixit and Pindyck (1994) and Dixit (1994). A simple interpretation of these conditions is that we are imposing continuity (value matching) and differentiability (smooth pasting) at the thresholds. For example, the two conditions at h * PH would be V(h * PH, HMO) = V(h * PH, PPO)- C s and V ′ (h * PH, HMO) = V ′ (h * PH, PPO). We also impose a super-contact condition at h * ON ; we do not face a switching cost between in-network and out-of-network care, but pay a per-period cost of paying for going out of network, that is included in the value function of going out of network for a PPO enrollee. See Wirl (2008) for a discussion.

Note that A 3 β 3 is the option value of switching back to an HMO from a PPO, which is an unlikely choice. Our numerical solution for A 3 is very close to zero, confirming this intuition.

This aspect of the model may seem less counterintuitive if the reader considers how advanced age and a frail state of health affect the value of health interventions more generally. For example, a frail elderly person might be more likely to choose to forgo aggressive chemotherapy or complex surgery than would be a younger and stronger individual.

References

Bellman, R. (1954). Some problems in the theory of dynamic programming. Econometrica, 22(1), 37–48.

Boyer, M., Gravel, E., & Lassere, P. (2004). Real options and strategic competition, a survey, Economics and CIRANO, University of Montreal, Working Paper.

Black, F., & Scholes, M. S. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81(3), 637–654.

Capps, C., Dranove, D., & Satterthwaite, M. (2003). Competition and market power in option demand markets. RAND Journal of Economics, 34(4), 737–763.

Dixit, A. (1989). The entry and exit decisions under uncertainty. Journal of Political Economy, 97(3), 620–638.

Dixit, A. (1994). The art of smooth pasting. Harwood Academic Publishers.

Dixit, A., & Pindyck, R. S. (1994). Investment under uncertainty. Princeton University Press.

Enthoven, A. C. (2005). The U.S. Experience with Managed Care and Managed Competition, Wanting It All: The Challenge of Reforming the U.S. Health Care System, Federal Reserve Bank of Boston, 97–117.

Gold, M. C. (2008). Medicare Advantage in 2008 Henry J. Kaiser Family Foundation Medicare Issue Brief, June, 2008, II–III.

Hayes, J. A., Cole, J. B., & Meiselman, D. I. (1993). Health insurance derivatives: the newest application of modern financial risk management. Business Economics, 28(2).

Hurley, R. E., Strunk, B. C., & White, J. S. (2004). The puzzling popularity of the PPO: PPOs have overtaken HMOs as the most popular health benefit option among U.S. workers-to the surprise of many analysts. Health Affairs, 23(2), 56–68.

Kaiser Family Foundation (2010). Employer Health Benefits 2010 Annual Survey, available at http://ehbs.kff.org.

Kreier, R. (2006). Economic theory and political reality: managed competition and U.S. health policy. Politics & Policy, 34(3), 579–605.

Magiera, F. T., & McLean, R. A. (1996). Strategic options in capital budgeting and program selection under fee-for-service and managed care. Health Care Management Review, 21(4), 7–17.

Merton, R. C. (1973). Theory of rational option pricing. Bell Journal of Economics and Management Science, 4(1), 141–183.

Merton, R. C. (1997). Applications of option-pricing theory 25 years later. Nobel Lecture, December 9 1997.

Sengupta, B. (2009). Real Options and Migration: Undocumented Workers and their Choices: The Case of Mexican Migration to the United States and Rural to Urban Migration in Developing Countries. Lambert Academic Publishing.

Schwartz, E. S., & Trigeorgis, L. (Eds.) (2001). Real options and investment under uncertainty. MIT Press.

Strombom, B. A., Buchmueller, T. C., & Feldstein, P. J. (2002). Switching costs, price sensitivity and health plan choice. Journal of Health Economics, 21(5), 89–116.

Trude, S. (2000). Who Has a Choice of Health Plans? Center for Studying Health System Change Issue Brief, no. 27, 2–4.

United States Bureau of the Census (2010). Income, Poverty, and Health Insurance Coverage in the United States: 2009, 20–24 Available at http://www.census.gov/prod/2010pubs/p60-238.pdf.

Wedig, G. (2010). Consumer Choice and the Decline in HMO Enrollments, Working Paper Series, Social Science Research Network, June 7, 2010.

Wirl, F. (2008). Reversible stopping implies super contact. Computational Management Science, (Oct 2008), 393–401.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Sengupta, B., Kreier, R.E. A Dynamic Model of Health Plan Choice from a Real Options Perspective. Atl Econ J 39, 401–419 (2011). https://doi.org/10.1007/s11293-011-9287-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11293-011-9287-x