Abstract

We model family choice among health plans taking account of family, insurer and health care provider (e.g., doctor) characteristics not addressed by earlier models. We use an additively separable utility function permitting an intuitive treatment of how families trade health against consumption, and how income and health risk influence that trade-off. Health care provider quality affects expected health outcomes and the family’s choice set includes health maintenance organization and preferred provider organization (PPO) plans. We model how families value the PPO’s option to use out-of-network providers taking into account uncertainty about future diagnoses and incomplete information about provider quality. The model’s predictions are consistent with enrollment patterns in the National Health Interview Survey. The approach has implications for cost control and income-related disparities in quality of care.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Health maintenance organizations (HMOs) provide coverage only for care received from providers in the plan’s network. In contrast, preferred provider organizations (PPOs) offer enrollees the option to use out-of-network providers, although enrollees’ cost sharing is higher when they exercise this option. The flexibility to postpone choice until information is available about diagnosis and about the quality of the in- and out-of-network providers who specialize in treating the diagnosed condition, is an important advantage of a PPO. Nevertheless, apart from one paragraph in the Nobel Prize lecture of Robert Merton (1997, p. 106), no other author of whom we are aware has modeled this aspect of the PPO. In Merton’s words, the economic agent choosing among health plans, “solves an option-pricing problem as to the value of that flexibility.” In earlier work (Sengupta and Kreier (2011) we modeled the option to use out-of-network providers in a dynamic setting, with a focus on the stochastic evolution of health over the entire lifecycle. Here, we shift focus to income and the family’s budget constraint in a two-stage model.

The model takes account of important characteristics of real-world families and health plan choice sets that are not addressed by earlier models of health plan choice. Health and non-health care consumption enter the utility function as additively separable arguments, permitting an intuitive treatment of how families trade them against each other. Family income affects that tradeoff via the budget constraint. Quality is treated as a characteristic of the doctor or other health care provider (rather than the insurance plan), and linked to expected health outcomes via a health production function. Contract provisions for coverage of in- and out-of-network care are explicitly modeled. The model also accommodates quality differences in health plans’ provider networks. Finally, families’ willingness to pay for the option of out-of-network coverage is linked to their inability to predict whether in-network providers will be optimal to meet uncertain future health care needs. The model generates patterns of health plan choices that broadly conform to enrollment patterns observed in the National Health Interview Survey (NHIS) and provides a straightforward theoretical explanation for the consistent significance of income in econometric investigations of health plan choice.

Approaches that do not link provider quality to expected health outcomes, and that do not allow for the income-constrained tradeoffs families make between health and non-health care consumption may yield misleading assessments of institutional structures for providing health coverage. Relevant policy issues include promised cost-savings from managed competition and premium support, and the implications for income-related health disparities of choice-based approaches to providing health coverage. (For an example of managed competition cost-control promises, see Enthoven (2008). For a skeptical view, see Kreier (2006).)

Literature Review

One of the unresolved puzzles in the health policy literature is the emergence of PPOs as the dominant organizational form in the U.S. market for employer-sponsored health coverage (Hurley 2004). As of 2010, 58 % of individuals and households with employer-sponsored health coverage were enrolled in PPOs (Kaiser Family Foundation 2010). In addition, most Medicare beneficiaries have the option to enroll in private HMO and PPO plans through the Medicare Advantage program, while the health benefit exchanges created under the Affordable Care Act offer both PPO and HMO plans. (For a detailed overview of the PPO organizational form, see Hamer and Anderson (2000).)

A number of authors have developed interesting models of consumer choice among more-managed and less-managed health plans, or have explored demand-side cost sharing vs. supply-side tools such as capitation. (Chernew and Frick (1999), Pauly and Ramsey (1999), Miller (2006)). A 2003 paper (Capps et al. (2003)) described “option demand markets,” and analyzed HMOs in this context, but did not deal with PPOs. Bardey and Rochet (2010) modeled duopolistic competition between health plans, and designated the plan with the larger network as the PPO, but did not model the option to use out-of-network care, although they mentioned it in their introduction.

Peele and Lave (2000) reported that management and employees both view quality as a characteristic of the provider of care (for example, the doctor or hospital), rather than of the health insurance plan. Yet many economic models of health plan choice (Frank et al. (2000), Jack (2006), Olivella and Vera-Hernandez (2007)) have treated quality as a characteristic of the health plan contract that is independent of the health care provider.

Peele and Lave also found that employers believe that, “low-wage employees might prefer a plan with low premiums and limited out-of-pocket expenditures (such as an HMO), even if it restricted provider choice, whereas professional and senior management personnel might prefer to maintain broad provider choice, even if they had to pay more out of their own pockets,” (p. 17). A discrete choice experiment by Zweifel et al. (2006) revealed that willingness-to-pay for choice of provider increased with income and the presence of chronic conditions among Swiss respondents. Wedig (2010) found that willingness to pay for a larger HMO network increased with income. A raft of econometric studies reported that higher income enrollees tend to gravitate to PPOs (for example, Gruber and Washington (2005); Beeson Royalty and Solomon (1999); Studdert et al. (2002); Buchmueller (2006); Pauly and Herring (2007)).

While income is consistently found to be an important factor in empirical work on health plan choice, many theoretical models are limited by construction in their ability to account for this fact. For example, adapting the utility function developed by Baumgardner (1991), both Pauly and Ramsey (1999) and Chernew and Frick (1999) modeled utility as a function of an aggregate monetized sum. In these models, health’s contribution to this sum is invariant to income level, ensuring that willingness to pay for a given increment in health is the same across income levels. Chernew and Frick treated willingness to pay to avoid “more managed” care the same way. Bardey and Rochet (2010) explicitly assumed that health plan premiums were small enough relative to income to permit income effects to be ignored in the model.

Other models do not address the role of income in health plan choice because they confine their analysis to situations in which health, health care expenditures, or health coverage are exogenously determined. Jack (2006) and Olivella and Vera-Hernandez (2007) assumed that a third party pays for health coverage, so that the individual’s choice of health plan has no impact on his consumption of goods other than health care. Similarly, a series of ingenious papers by W. Kip Viscusi and coauthors (Viscusi and Evans (1990), Evans and Viscusi (1991), Sloan et al. (1998)) assumed that health care expenditures are covered by a third party. Both Lillard and Weiss (1997) and Finkelstein et al. (2008) modeled poor health as an absorbing state unaffected by health care, and coverage as exogenously determined, although they came to opposite conclusions about the impact of poor health on the marginal utility of income.

In summary, survey and discrete choice experimental data suggest that willingness to pay for provider choice increases with income and chronic health problems. Econometric investigations of health plan choice find that higher income is predictive of PPO enrollment. Yet most theoretical models have been limited by construction in their ability to explain why higher income leads to a higher willingness to pay for provider choice. In particular, they have not linked provider quality to expected health outcomes, or they have not allowed income to affect the tradeoffs enrollees make between consumption and health. In addition, no other author of whom we are aware has formally modeled the option to use out-of-network coverage. The purpose of the model developed here is to address these gaps in the literature.

Enrollment Patterns in the NHIS

This section presents health plan enrollment patterns among respondents to the NHIS. This analysis is not an empirical model of health plan choice (i.e., the demand side of the market for health insurance), because the NHIS data reveal neither the menu of health plans in each family’s choice set, nor the prices (family share of premiums) of alternatives to the plan in which the family is enrolled. Rather, the analysis is a reduced form exploration at the national level of correlations among family characteristics and health plan enrollment. Those correlations emerge from the interaction of demand and supply side factors.

Variables and Descriptive Statistics

The NHIS is a cross-sectional survey of a representative sample of the civilian, non-institutionalized U.S. population, consisting of more than 30,000 households, conducted by the National Center for Health Statistics. We construct a subset of the data for 2004–2007 to have a representative sample of families with employer-provided coverage.

In several cases the NHIS does not report variables of interest to us at the family level. For example, the NHIS reports plan membership at the level of the individual. We create a family-level variable that equals 1 if a majority of a family’s members are PPO enrollees. Our family-level “chronic condition” variable equals 1 if any family member reports a limitation due to a chronic condition. All analyses are performed with appropriate family sampling weights.Footnote 1

Table 1 reports sample means for HMO and PPO enrollees. PPO enrollees are, on average, higher-income, more educated, more likely to be white, and in better health but more likely to have a limitation caused by a chronic health condition. The family’s share of health plan premium and its out-of-pocket expenses are higher for PPO enrollees. The variables used in the multivariate analysis are described in more detail below.

Health Plan

We designate the family plan as that to which the majority of its (interviewed) members belong. An overwhelming majority of families (98.4 %) reported the same plan across all members, justifying our decision to perform the analysis on the family level. We exclude families with equal numbers of members in HMO and PPO plans (less than 1 % of the sample).

Health Measures

-

a)

Self Reported Health Status: We code responses from 5 to 1, so a higher number implies better self-reported health. We find a small but highly significant difference in the mean family health rating of PPO and HMO enrollees (4 compared to 3.9). The non-parametric Wilcoxon-Mann–Whitney test suggests that a different distribution applies under the two plans, with PPO families generally reporting better health.

-

b)

The Health and Activities Limitation Index (HALEX): Scores range from .10 (most dysfunctional living state) to 1.0 (healthiest state). The means test and the Wilcoxon rank sum test show that there is a small but positive and highly significant difference in the average HALEX score of PPO and HMO families.

-

c)

Limitation Caused by a Chronic Condition: A binary variable indicating if any family member has a limitation caused by a chronic condition. We find a small but significantly positive difference in the proportion of such families in a PPO compared to an HMO. The chronic nature of the limitation is not adequately addressed by the HALEX, which ranks a limitation by its extent, and not by its duration.

Socioeconomic Factors

-

a)

Family Income: The NHIS provides top-coded interval data for family earnings. We fit a Pareto distribution to this data, and use the Pareto imputed mean for the top-coded category, and Pareto imputed midpoints for the intervals above the median income, and simple midpoints for the intervals below. All pre-2007 values are expressed in 2007 dollars. We find a significant difference in average incomes (of $4367) between PPO and HMO families. (Table 1.)

-

b)

Children in Family: A slightly larger proportion of families enrolled in HMOs have children.

-

c)

Highest Level of Education in Family: Families enrolled in a PPO have more education on average (for the member with the highest education level) than those enrolled in an HMO.

-

d)

Race-Ethnicity: Non-Hispanic Whites are more likely to belong to a PPO than an HMO. All others are more likely to belong to an HMO, with Hispanic families most likely to be enrolled in HMOs.

Multivariate Regression Results

We perform three multivariate analyses: i) a binary logistic regression of plan enrollment against family characteristics (Table 2), ii) an ordered logistic regression of self-reported health status against plan enrollment and family characteristics, including the presence of a chronic limitation (Table 3), and iii) a linear regression of the family’s average HALEX score against plan enrollment and family characteristics (Table 3). We discuss each regression in turn below.

Binary Logistic Regression with Plan Enrollment as the Dependent Variable

The dependent variable takes the value 1 for a PPO and 0 for an HMO. Since health may be both an outcome and a determinant of plan choice, it deserves special consideration in the empirical specification. If enrollment in the PPO increases access to higher quality care, then PPO enrollment is likely to improve health status (as compared to health in an HMO), so that a component of health is endogenous to plan choice. However, exogenous health changes also influence plan enrollment. The binary variable, chronic limitation in the family, is a proxy for the exogenous portion of health status. While care can alleviate chronic conditions, it is unlikely to reverse a chronic condition diagnosis.Footnote 2

While families certainly consider health plan premiums and cost-sharing provisions when making enrollment decisions, the NHIS data contains this information only for the plan in which the family enrolls, and not for alternative options. Therefore, we do not include cost variables in the regression and do not interpret the regression as a model of plan choice.

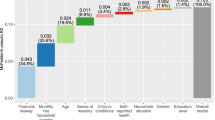

Table 2 presents the coefficients from the logistic regression, and the marginal effects (ME) that show the estimated change in the probability of being in a PPO for a unit change in the independent variable. We illustrate selected results from the logistic regression in Fig. 1. Income and chronic limitation both are positively and significantly associated with PPO enrollment. Race and ethnicity also exert a strong role.

Regression Results with Health Status as the Dependent Variable

We next conduct an ordered logistic regression of self-reported health status on choice of health plan. As discussed above, chronic condition serves as a proxy for the portion of health status that is exogenous to health plan choice. Table 3 presents these results. After controlling for income, education, race and ethnicity, and the presence of a chronic limitation in the family, PPO enrollment is associated with a modest but highly significant improvement in self-reported health status. A regression with HALEX as the dependent variable produces similar qualitative results (Table 3).

In summary, our key findings are the following: i) PPO enrollment is positively associated with income and the presence of a chronic health condition, and ii) after controlling for chronic condition status, PPO enrollees report better health. This result is robust to controls for income, education level, and race/ethnicity.

A Two-Stage Model of Health Plan Choice

We model a family’s choice between an HMO and a PPO health plan as a two-stage decision-making process: In stage one, the family chooses between the two plans. In stage two, the family selects a health care provider (from within or outside the network), subject to constraints established by its earlier choice of plan.

Uncertainty and Nature of the Solution

Uncertainty in the model is rooted in the incomplete information available to a family when it chooses a health plan: (i) the family does not know what diagnosis it will receive, but it does know the probability of developing each health condition, and (ii) the family does not know the quality of the best available provider in each network to treat each condition, but does know the probability of each plan’s network containing providers at each quality level. The family selects in stage one the health plan that yields the highest expected utility in stage two. Thus, even though the family chooses a health plan before choosing a health care provider, choice of plan is based on prior analysis of the quality of health care provider the family considers optimal to choose in each possible future state. That is, the stage one choice of health plan is determined through a process of backwards induction.

Building Blocks of the Model

The building blocks of the model consist of three equations: a utility function, a budget constraint and a health constraint. We list these equations first and then discuss the assumptions underlying each in turn:

-

a)

Utility function: U(C, HS) = u(C) + v(HS)

-

b)

Budget constraint: C = Y − P j − OOP j,k,n

-

c)

Health constraint: HS = H n + h n (Q).

The two components of the utility function, u(C) and v(HS), each display conventional characteristics, with positive first and negative second derivatives. The additively separable functional form permits an intuitive treatment of the income-constrained tradeoffs the family makes between consumption and health.Footnote 3 While the marginal utility of consumption is independent of health condition, the marginal utility of income depends on health condition because income is used to purchase health care, and the marginal utility of health care depends on diagnosis. Consumption is constrained to be non-negative.

The budget constraint depends on the family’s exogenously determined income (Y), the premium it pays for health coverage (P), and its out-of-pocket health care expenses (OOP). Out-of-pocket expenses are endogenously determined, and depend on the contractual provisions of the chosen health plan (j), the family’s choice of an in- or out-of-network provider (k), and the severity of health condition diagnosis (n). We assume that: (i) the market has an established “reasonable and customary price” (RCP n ) for treatment of each diagnosis and that this price is higher for more severe conditions, (ii) the PPO’s coverage of out-of-network care is subject to cost-sharing determined by a co-insurance rate (α), and iii) the PPO contract places a ceiling on out-of-pocket costs, denoted as MAX. There is no cost sharing in either health plan for in-network care. Summarizing (i)–(iii), out-of-pocket costs conform to the following schedule:

k = In Network | k = Out of Network | |

j = HMO | OOP = 0 | OOP = RCP n |

j = PPO | OOP = 0 | OOP = min{α*RCP n , MAX} |

Finally, under the health constraint, the family’s health status, HS is the sum of two components: The first term, H n , is the level of health the family would experience given its exogenously determined health condition n, if it were to receive no health care. Greater severity corresponds to larger n, so that H n is smaller for larger values of n. The second term, h n (Q k ), is the health production function. This function governs the increment to health a family will experience if treated by a provider of quality Q. Note that this function is indexed by n, indicating that the incremental impact of health care depends on the underlying diagnosis. Specifically, we assume that differences in provider quality make a bigger difference to health for more serious health conditions, that is, we assume that the slope of the health production function is steeper for more serious health conditions (h ′ n (Q) < h ′ n + 1 (Q)). We also assume that, for any given level of health provider quality, receiving health care makes a bigger difference to health for more serious health conditions (h n (Q) < h n + 1(Q)). To state these two conditions in more intuitive terms: We assume that it is more important to take a child in for treatment if he has scarlet fever than if he has a cold, and we also assume that having a good doctor is more important if the child has scarlet fever than if he has a cold.

As noted above, the family’s stage 1 choice of health plan depends on it first analyzing the choice of health care provider it would make under all possible circumstances. The family’s stage 2 choice of health care provider is a constrained maximization problem:

At the start of stage 2, the family has already chosen a health plan, discovered the health condition from which it suffers and learned the quality of the providers who specialize in treating that condition.Footnote 4 For this reason, j and n are treated as fixed by the family in this stage of the decision-making process. It only remains for the family to choose its health care provider, k. If the highest quality provider is outside the network, the family must weigh the utility benefit of improved health due to using a higher quality provider, against the utility cost of reduced consumption due to a higher level of out-of-pocket spending.

Once the stage 2 analysis is complete, the family is ready to make its stage 1 selection of health plan. Recall that during stage 1, the family does not know what health condition it will have, but it does know the probability of receiving each diagnosis (π n ). It also does not know the quality of the providers appropriate for treating each condition. However, it does know the probabilities (θ j,Q,IN and θ j,Q,OON ) of the best available in-network and the best available out-of-network provider being of any given quality in each plan.

The family chooses a health plan through backwards induction. For each health plan j and for each health condition n, it calculates its conditional expected utility (EU j,n ), assuming that it would choose its provider optimally (Bellman 1954). In other words, the family solves the stage 2 constrained maximization problem for each possible combination of health plan (j), health condition (n) and quality of relevant in- and out-of-network providers (Q k ), and then weights the utility it would achieve in each case by the appropriate probability.

To derive expected utility conditional on health plan, the family sums the appropriate set of expected utilities across health conditions, weighting the terms by the corresponding values of π n :

It then completes stage 1 by choosing the health plan, j*, that yields the highest expected utility, so the optimal plan may be written as:

An Example with Simplifying Assumptions

In the example presented in this subsection, we assume that: i) health care providers specializing in the treatment of condition n come in only two quality levels, higher quality \( \left(\overline{Q}\right) \) and lower quality \( \left(\underline{Q}\right) \) and ii) the set of available out-of-network providers always includes at least one provider of higher quality, so that θn,OON,j equals 1 for both health plans for all health conditions.

Because notation gets cumbersome even with this simple distribution, we introduce some shorthand symbols. All of these are to be understood as conditional on the family having health condition n, allowing us to dispense with the n subscript. First we define symbols for the health-related utility the family will experience if it uses a higher quality provider \( \left(\overline{v}\right) \) or a lower quality provider \( \left(\underline{v}\right) \):

Next, we define symbols for the consumption-related utility the family will experience depending on the health plan in which it is enrolled, and on whether it uses an in- or out-of-network provider in the following schedule:

k = In Network | k = Out of Network | |

j = HMO | u IN,hmo ≡ u(Y − P hmo ) | u OON,hmo ≡ u(Y − P hmo − RCP n ) |

j = PPO | u IN,ppo ≡ u(Y − P ppo ) | u OON,ppo ≡ u(Y − P ppo − min[α*RCP n , MAX]) |

We can now describe the expected utility under each health plan conditional on each health condition in a reasonably compact format:

In Eqs. 4 and 5, the first term, weighted by θ IN,j , shows the family’s utility in the event that a higher quality provider is available in plan j’s network. The second term, weighted by (1 - θ IN, j ), shows the family’s utility in the event that a higher quality provider is not available in the plan’s network. Note that the first term will always be larger for the plan with the lower premium, and the difference will be larger for lower income families, because the second derivative of u(c) is negative.

Assuming the PPO premium is higher, the possible advantages of the PPO come to light only when a higher quality provider is not available in-network. In this case, it may be optimal for the family to exercise its option to use a higher-quality OON provider. It will exercise this option if and only if the extra health-related utility \( \left(\overline{v}-\underline{v}\right) \) outweighs the consumption-related utility lost due to OON cost-sharing (u IN,j − u OON,j ). Thus, when the higher-quality provider is not available in-network, the family will go out-of-network only if \( {u}_{OON,j}+\overline{v}>{u}_{IN,j}+\underline{v} \).

As income falls, the consumption-related utility loss increases for a given quantity of out-of-pocket spending. Hence, in both health plans there is a critical level of income below which the family will use an in-network provider. The critical income level is lower for the PPO, because the PPO’s out of network (OON) cost sharing is less than the full price that the family enrolled in the HMO must pay to use an out-of-network provider.

It is not possible to draw such clear-cut conclusions about how differences in health condition severity affect the decision to use a higher-quality OON provider (holding income constant). The health-related utility gain from using a higher quality provider increases as severity of diagnosis increases, but so does the consumption-related utility loss from cost sharing for an out-of-network provider. The choice now depends on the relative sizes of the gain and the loss. It is clear, however, that families enrolled in a PPO will go OON for conditions above some critical severity level because, by construction, OON costs are capped at MAX while health-related utility gains from higher quality care increase without limit as severity increases. In some circumstances, it may be optimal for the family enrolled in the PPO to go OON for severity levels below one critical value and above a second critical value, while it may find it optimal to use lower-quality in-network providers for health conditions falling in the intermediate severity range.Footnote 5

In conclusion, conditional on enrollment in the PPO, higher income families will find it optimal to exercise the option to go out-of-network over a wider range of health conditions than will lower income enrollees. Since the PPO’s option to go out of network increases the family’s expected utility only in those states in which the family would find it optimal to go out of network, this in turn implies that the PPO will tend to be the choice of wealthier families. Of course, families with a “high enough” probability of contracting “severe enough” conditions will enroll in the PPO, but the critical level of health risk will be lower the higher the family’s income.

Simulation Results

We carried out simulations of this example to illustrate how income and health risk affect decision-making in the model. Using natural log functions for u and v, we simulated behavior at 50 evenly spaced income levels over a range of 8–204 monetary units, 50 evenly spaced health condition severity levels over a range of 0–196, and for 10 health risk profiles in a four-step process.

-

Step i)

At each of the 2500 income-health condition severity combinations, we calculated the family’s utility for each combination of health plan, provider quality, and in- or out-of-network out-of-pocket expenditures, allowing us to simulate the family’s choice of an in- or out-of-network provider in each set of circumstances.

-

Step ii)

Using the results from step i and the probabilities of each plan containing a high quality provider in its network, we calculated expected utility for each health plan at each of the 2500 income and severity level combinations.

-

Step iii)

We constructed 10 health risk profiles, with expected severity levels (E(n)) ranging from 25.6–140, and with higher risk profiles having first order stochastic dominance over lower risk profiles.

-

Step iv)

Using the results from steps ii and iii, we simulated the family’s choice of health plan by determining which plan yielded higher expected utility at each of the 500 health risk profile-income combinations.

For our base case specification, we set the HMO premium at 4.2 monetary units, and the PPO premium at 5.1 monetary units.Footnote 6 We specified out-of-network cost sharing in the PPO at 20 % of reasonable and customary charges (α = .2) with a cap on out-of-pocket expenses of 5 (MAX = 5). We set the chance of finding a high quality provider in-network at 50 % for all health conditions in both plans’ networks. (We present below an alternative specification in which the chance of finding a high quality provider is greater in the PPO network.) Reasonable and customary charges ranged from 0 to a maximum of 192.08 monetary units, using the formula RCP n = n 2/200. Health status was determined by the formula, HS = (201- n) + (n*Q/2), with Q taking the values of either 1 or 2.

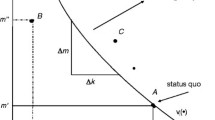

In the base case specification, the family chose the HMO at all risk profiles at incomes of 20 and below, while it chose the PPO at all risk profiles at incomes of 44 and above. At income levels between 20 and 44, the critical risk profile above which the PPO was chosen fell as income rose. (Fig. 2).

We experimented with a wide variety of parameterizations of the model, changing premiums, co-insurance, out-of-pocket maximums, and the probabilities of finding high quality providers in the two plans’ networks. Figure 3 contrasts the base case with two of these alternative specifications. In the top panel, the probability of finding a high quality provider in-network is greater for the PPO than for the HMO. Not surprisingly, the area of income-health risk space in which families find the PPO optimal increases relative to the base case. In the bottom panel, we increase the co-insurance level and out-of-pocket ceiling for the PPO relative to the base case, leading to a decrease in the area of income-health risk space in which families find the PPO optimal. However, higher income (controlling for health risk) and higher health risk (controlling for income) still lead families to opt for the PPO over the HMO in all the parameterizations we investigated.Footnote 7

Conclusion

This paper offers a model of health plan choice that incorporates some important characteristics of families and choice sets not addressed by previous models. The model links the value families place on the option to go out of network to their expectation that using higher quality health care providers will lead to better health. Building on the intuitively plausible view that families gain utility from both consumption and health, it explains why the monetary value of the option to use OON providers (the family’s willingness to pay for it) depends both on income and on health risk. The model generates health plan enrollment patterns that are broadly consistent with those observed in the NHIS. Controlling for health risk, PPO’s tend to be the optimal choice for higher income families and, controlling for income, PPO’s tend to be the optimal choice for families with higher health risks.

The model suggests skepticism about claims that properly managed competitive markets will automatically lead across the board to tightly integrated health plans and lower costs. Instead, in the face of uncertainty about future health needs and given the impossibility of judging the quality of network providers for every possible diagnosis, plans offering the option to receive coverage for out-of-network care are likely to continue to attract customers, particularly higher income customers and those with higher health risk.

Because it explicitly links health care provider quality to health outcomes via the health production function, the model also provides a useful framework for thinking about health disparities across income groups. In particular, analysis of choice-based approaches to the provision of health coverage, such as the health benefit exchanges established under the Affordable Care Act, should take account of the possibility that lower income families may opt for health plans that constrain their choice of provider, or that have lower quality providers in their networks, which has implications for those families’ health, at least to the extent that higher quality health care translates into better health outcomes. The magnitude of the impact likely will depend on the details of institutional arrangements and, in particular, on the levels of subsidies for low- and moderate-income families, as well as on regulatory oversight of provider networks.

This model, like all models, deals with a simplified version of reality. The heterogeneity of products offered in the US health insurance market is dazzling. Health plans vary in cost-sharing provisions, network composition, provider payment arrangements and organizational culture both within and across organizational types. In this paper, we focus on the option to receive coverage for out-of-network care, differences in health plans’ provider networks and differences in cost-sharing provisions, but we do not address provider payment arrangements or contractual limitations such as gate keeping.

Families are even more multi-dimensional than health plans, and many family characteristics correlate with both income and health status. One family characteristic that strongly correlates with both income and health, and also plays a role in health plan choice, is geographic location. A rational family choosing among plans will consider the location of the providers in the plan’s network relative to the family’s place of residence. But on the supply side, plans will be aware of the residential location of the demographic group to which they expect to appeal as they construct their provider networks. The complexities of health plan and family characteristics, and the simultaneity of demand and supply side characteristics, pose challenges for empirical testing of the theoretical model developed here.

Notes

Additional details on the dataset construction using the Person file and the Family file in the NHIS along with STATA code used in the analysis are available upon request from the authors.

In aggregate time series estimations where endogeneity issues are common, one can often lag an endogenous variable to achieve exogeneity. Even though we have cross-sectional data, the chronic condition variable has a similar “pre-existing” time element, as it is defined in terms of duration of a health condition.

See Fernandez (2001) for a model of school funding using an additively separable utility function in consumption and educational quality.

As nothing significant would change with the inclusion of a lump sum discovery cost, we assume here that once health condition is revealed, discovery of relevant provider quality is costless. However, an interesting refinement of the model might include discovery costs that varied with family characteristics. For example, discovery costs might be lower for families with higher education levels or higher for families with limited English language proficiency.

In simulations not reported here but available from the authors, using higher quality OON providers yielded higher utility at the high and low ends of the severity range, while staying in-network yielded higher utility at intermediate severity levels. The range over which staying in-network yielded higher utility was wider the lower the family’s income level.

If we interpret a monetary unit as $1000, these figures are roughly equal to the average employee share of family premium plus deductible for each type of plan in the Kaiser Family Foundation 2010 employer survey.

Additional simulation results available from the authors.

References

Bardey, D., & Rochet, J.-C. (2010). Competition among health plans: a two-sided market approach. Journal of Economics and Management Strategy, 19(2), 435–451. Summer 2010.

Baumgardner, J. R. (1991). The interaction between forms of insurance contract and types of technical change in medical care. RAND Journal of Economics, 22(1), 36–53. Spring 1991.

Beeson Royalty, A., & Solomon, N. (1999). Health plan choice: price elasticities in a managed competition setting. Journal of Human Resources, 34(1), 1–41. Winter 1999.

Bellman, R. (1954). Some problems in the theory of dynamic programming. Econometrica, 22(1), 37–48. Jan., 1954.

Buchmueller, T. (2006). Price and the health plan choices of retirees. Journal of Health Economics, 25(1), 81–101. January 2006.

Capps, C., Dranove, D., & Satterthwaite, M. (2003). Competition and market power in option demand markets. RAND Journal of Economics, 34(4), 737–63. Winter 2003.

Chernew, M. E., & Frick, K. D. (1999). The Impact of managed care on the existence of equilibrium in health insurance markets. Journal of Health Economics, 18(5), 573–92. October 1999.

Enthoven, A. (2008). Health care with a few bucks left over New York times, December 28, 2008: Op-Ed section, online version www.nytimes.com.

Evans, W. N., & Viscusi, W. K. (1991). Estimation of state-dependent utility functions using survey data. Review of Economics and Statistics, v73(n1), 94–104. February 1991.

Finkelstein, A., Luttmer, E. F. P., Notowidigdo, M. J. (2008). What good is wealth without health? The effect of health on the marginal utility of consumption. NBER Working Paper Series: 14089.

Fernandez, R. (2001). Sorting, education, and inequality. NBER Working Paper Series, (8101):173–193, 2001.

Frank, R. G., Glazer, J., & McGuire, T. G. (2000). Measuring adverse selection in managed health care. Journal of Health Economics, 19(6), 829–54. November 2000.

Gruber, J., & Washington, E. (2005). Subsidies to employee health insurance premiums and the health insurance market. Journal of Health Economics, 24(2), 253–76. March 2005.

Hamer, R., Anderson, D. (2000). Inter-study report: PPO operations and markets, February 2000, accessed Feb. 6, 2011 at http://www.kff.org/insurance/upload/PPO-Operations-and-Markets-Report.pdf.

Hurley, R. E., Strunk, B. C., & White, J. S. (2004). The puzzling popularity of the PPO: PPOs have overtaken HMOs as the most popular health benefit option among U.S. workers–to the surprise of many analysts. Health Affairs, 23(2), 56–68. March/April 2004.

Jack, W. (2006). Optimal risk adjustment with adverse selection and spatial competition. Journal of Health Economics, 25(5), 908–26. September 2006.

Kaiser Family Foundation and Health Research and Educational Trust. (2010). Employer health benefits 2010 annual survey, available at http://ehbs.kff.org/pdf/2010/8085.pdf

Kreier, R. (2006). Economic theory and political reality: managed competition and U.S. health policy. Politics & Policy, 34(3), 579–605. September, 2006.

Lillard, L. A., & Weiss, Y. (1997). Uncertain health and survival: effects on end-of-life consumption. Journal of Business and Economic Statistics, v15(n2), 254–68. April 1997.

Merton, R. C. (1997). Applications of option-pricing theory twenty-five years later. Nobel Lecture, 9, 1997.

Miller, N. H. (2006). Insurer-provider integration, credible commitment, and managed-care backlash. Journal of Health Economics, 25(2006), 861–876.

Pauly, M. V., & Herring, B. (2007). The demand for health insurance in the group setting: can you always get what you want? Journal of Risk and Insurance, 74(1), 115–40. March 2007.

Pauly, M. V., & Ramsey, S. D. (1999). Would you like suspenders to go with that belt? an analysis of optimal combinations of cost sharing and managed care. Journal of Health Economics, 18(4), 443–58. August 1999.

Olivella, P., & Vera-Hernandez, M. (2007). Competition among differentiated health plans under adverse selection. Journal of Health Economics, 26(2), 233–50. March 2007.

Peele, P. B., & Lave, J. R. (2000). Employer-sponsored health insurance: are employers good agents for their employees? Milbank Quarterly, 78(1), 5–32.

Sengupta, B., & Kreier, R. (2011). A dynamic model of health plan choice from a real options perspective. Atlantic Economic Journal, 39(3), 401–419. September, 2011.

Sloan, F. A., Viscusi, W. K., Chesson, H. W., Conover, C. J., & Whetten-Goldstein, K. (1998). Alternative approaches to valuing intangible health losses: the evidence for multiple sclerosis. Journal of Health Economics, 17(4), 475–497. August 1998.

Studdert, D. M., Bhattacharya, J., Schoenbaum, M., Warren, B., & Escarce, J. J. (2002). Personal choice of health plans by managed care experts. Medical Care, 40(5), 375–386. May 2002.

Viscusi, W. K., & Evans, W. N. (1990). Utility functions that depend on health status: estimates and economic implications. American Economic Review, 80(3), 353–74. June 1990.

Wedig, G. J. (2010). Consumer Choice and the Decline in HMO Enrollments. doi:10.2139/ssrn.1621710.

Zweifel, P., Telser, H., & Vaterlaus, S. (2006). Consumer resistance against regulation: the case of health care. Journal of Regulatory Economics, 29, 319–332.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kreier, R., Sengupta, B. Income, Health, and the Value of Preserving Options. Atl Econ J 43, 431–448 (2015). https://doi.org/10.1007/s11293-015-9479-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11293-015-9479-x