Abstract

We examine the impact of house purchases by large buy-to-rent investors on local real estate markets. First, we present micro-level evidence of positive externalities from institutional entry. We show that returns on repeat sales of properties near purchases by buy-to-rent investors are significantly greater if the repeat sale concluded after the buy-to-rent purchase rather than before. Secondly, we highlight the potential channel underlying such an externality as a supply side effect. Specifically, we show that properties outside the price range normally paid by buy-to-rent investors experienced smaller gains after nearby buy-to-rent purchases. Thus, buy-to-rent investors appear to increase the value of properties in an area by reducing the local supply. Lastly, we document mortgage market effects due to institutional purchases and related supply effects. We show that mortgage use increased after the buy-to-rent purchases of nearby properties and that the increase arises from existing lenders that operate in the market rather than new lenders entering the market.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In much of the country, real estate prices increased steadily over 2000–2006, declined sharply from 2006 to 2009, and continued to fall into 2011. A number of authors claim that prices were irrationally high in 2005–2006. Less appreciated is that in 2010–2013, some value investors believed that single family home prices in some cities presented a historic buying opportunity. Warren Buffett, on February, 27, 2012 on the CNBC show Squawkbox, said he would like to buy “a couple hundred thousand” single family homes if it were practical to do so. Sophisticated investors recognized this opportunity and large scale buy-to-rent investors entered the market for single family homes. Typically, such large investors focused their investment strategies in the commercial real estate market and in structures that involved multiple rental units. However, technological advances reduced the transaction costs for managing properties that are geographically dispersed. Such investors bought a large number of homes, implemented renovations and then rented to generate cash flows.

In this paper, we use over 100,000 single family home purchases by eight large buy-to-rent investors in seven states to examine the relation between house purchases by these investors and nearby property price appreciation. We find that the buy-to-rent investors purchase homes in areas that had suffered large price depreciation. Using repeat sales, we find that over the next year, properties within ¼ mile of a buy-to-rent purchase appreciated by 10.5% more than properties 50–75 miles away, and 3.4% more than properties located 5–10 miles away. Properties within ¼ mile of a buy-to-rent purchase continued to appreciate at a more rapid rate than distant properties in the second and third years after the buy-to-rent purchase.

There are several possible explanations for the extra price appreciation of properties near buy-to-rent purchases. The explanations are not mutually exclusive and more than one may be at work. One reason buy-to-rent purchases are associated with increases in the value of nearby properties is that they decrease the supply of properties for sale in an area. Supply of housing in total is not reduced, but the supply of properties available for sale is reduced while the supply of rental properties is increased. Households may have different preferences for homeownership and renting. Following the seminal work of Henderson and Ioannides (1983) and subsequent literature, homeowership can be characterized as having a dual objective of consumption and investment. In contrast, renting involves a consumption objective. If markets comprise of households that prefer homeownership, then such bidders will face a reduced supply of homes available for purchase due to buy-to-rent investors. Hence, markets comprising of households that are not indifferent between owning and renting may be affected by buy-to-rent purchases and the corresponding reduction in supply of homes for sale.

We find evidence that supports the hypothesis that a reduction in the supply of properties from buy-to-rent purchases increased prices of nearby properties. Buy-to-rent investors typically invest in a specific segment of the housing market. Thus, all else being equal, we should expect larger price appreciation for properties in the price range that buy-to-rent investors target. That is what we find. In addition, the number of transactions near a buy-to-rent property decrease after the buy-to-rent purchase. A decrease in quantity accompanied by an increase in price is, of course, exactly what we would expect from a reduction in supply. In some sense, this mirrors the foreclosure contagion effect documented in the literature. For instance, Anenberg and Kung (2014) present evidence that the negative externality on property prices due to a nearby foreclosure can be attributed to a supply effect, wherein an increase in supply of foreclosed homes reduces property prices. We highlight that the observed positive externality from buy-to-rent purchases may result from a decrease in the excess supply of properties on the market.

A second reason why properties near buy-to-rent purchases may have appreciated more than distant properties is that buy-to-rent investors may have bought in areas where property prices were more depressed. This is almost certainly part of the reason for the price appreciation of properties near buy-to-rent purchases. We do find that nearby property prices had fallen more before buy-to-rent purchases than had prices of distant properties. We use Zillow zip code single family home indices to show that after controlling for price declines since 2007, a greater number of buy-to-rent purchases was, in general, associated with greater price appreciation. Buy-to-rent purchasers buying in the most depressed areas does not seem to explain all of the difference in appreciation of nearby and distant properties.

Elimination of negative externalities from foreclosed homes is a third possible reason why prices of properties near buy-to-rent purchases increased more than prices of distant properties. A large proportion of the properties purchased by buy-to-rent investors were foreclosed. Foreclosed properties may be vacant and may not be maintained as well as occupied houses. They may also attract vandalism and crime. By purchasing these houses, buy-to-rent investors may eliminate eyesores and nuisances that lower the value of nearby properties. Our evidence suggests though that this was not a major factor in the appreciation of nearby properties. The difference in appreciation between properties near buy-to-rent purchases and distant properties is greater when the buy-to-rent purchase is a foreclosure, but not by much. Most of the difference in price appreciation is there when buy-to-rent investors purchase a property that is not in foreclosure.

We also explore mortgage market effects that arise from buy-to-rent purchases. We show that mortgage use increased much more for properties that were close to the buy-to-rent bundle than for distant properties. This may suggest that lenders believed buy-to-rent investors are eliminating an excess supply of properties in the area, and that a foreclosure would be easier to dispose of if the borrower defaulted. Thus, our results document a mortgage market externality where mortgage use increased for properties near buy-to-rent purchases after the purchases occurred.

Overall, past work has focused on a purchase discount by institutional investors and macro level evidence on the effect of such purchases on the local market. We contribute by examining the micro level effect on nearby properties, highlighting the potential underlying channel as a supply side effect and documenting a mortgage market externality that arises from institutional purchases. The remainder of the paper is organized as follows. In Section 2, we discuss the impact of the financial crisis on the housing market and describe how institutional investors participated in the single family home market. Section 3 describes the data. In Section 4, we present our main findings and Section 5 offers conclusions.

Institutional Investors in Residential Markets

Typically, past work on institutional investment in the residential market has focused on Real Estate Investment Trusts (REITs). For instance, Adams et al. (2015), Li et al. (2018), Ling et al. (2019), and Beracha et al. (2019) study REITs that invest in real estate markets. However, the underlying assets are usually properties that are not classified as single family homes. Instead, the underlying assets provide streams of rental income from multiple units that are located within the same physical structure, thus making it relatively less costly to manage.

There has been a shift in rental preferences since the recent financial crisis. Edelman (2014) notes that in early 2013, 43 million American households rented, as compared to 36.7 million before the crisis. Schnure (2014) observes that the number of families renting single family homes increased from 11.3 million in 2007 to 13.2 million in 2011. The decline was not evenly distributed across the country. Over 2007–2010, single family rental homes increased 48% in Phoenix, 41% in Atlanta, and 36% in Chicago. There has also been an increase in institutional purchases since the financial crisis. Khater (2013) notes that many cities saw sharp declines in real estate inventories in 2012 due to institutional buying activity. Cities that had rapidly increasing institutional buying included Atlanta, Detroit, Las Vegas, Phoenix, Los Angeles, Riverside, and Sacramento.

The entrance of institutional investors into the market for single family homes has been studied in a few academic papers. Mills et al. (2019) study reasons why large institutional investors entered the market for single family homes after the financial crisis. The authors argue that the large inventory of homes made it easier for buy-to-rent investors to create geographically concentrated pools of similar homes. Additionally, the authors posit that tight mortgage financing gave large firms an advantage in competing for houses and drove demand for rental units. Finally, technological developments like the widespread use of mobile devices and internet connectivity made property management that is spatially distributed more efficient. The authors also provide a macro level estimate of the effect of institutional entry on local house prices. A contemporaneous paper by Ganduri et al. (2019) studies the purchase of 1763 single family homes by institutional investors in three bulk sales under the FHFA’s bulk sale initiative. Buyers were required to bid on the entire portfolio of houses and so could not choose to buy in locations that they felt were most promising. This makes their choice of any specific property independent of their expectations for local price appreciation. The authors find that prices of nearby properties increase following the purchases, which suggests that institutional investments provide positive externalities.

Other papers look at participation by both small investors and institutional investors in the market for single family homes. Allen et al. (2018) examine 72,128 single family home transactions in Miami-Dade County, Florida, between January, 2009 and September, 2013. The study notes that investors are the buyers in 34.1% of transactions. The authors show that investors in single family homes in Miami-Dade County, Florida purchase at a discount to single-purchase buyers. In addition, the authors estimate that a 10% increase in purchases by investors (e.g. 40% to 50%) in a census tract increases house prices there by 0.20%. Smith and Liu (2017) examine the prices paid by institutional investors for houses in Atlanta over 2000–2014. They find, that after adjusting for house characteristics, cash purchase and distressed sale discounts, institutional investors purchased houses at significant discounts of 6.3% to 11.8% relative to owner-occupiers.

We add to the literature by providing a micro level perspective on the potential channel underlying positive externalities from buy-to-rent investors on property prices. In the following sections, we present evidence that suggest that the externality arising from buy-to-rent purchases may result from a decrease in the excess supply of properties on the market. In addition, we examine related mortgage market effects.

Data

Our source of data on real estate transactions is Zillow, which in turn obtains them from county deed records. Our data has all real estate transactions in most U.S. counties over 2000–2015. For each transaction, we have the date of the sale, the identity of the buyer and seller, the price paid for the property, the state, county, city and street address of the property, and the property’s latitude and longitude. Our mortgage information includes whether the mortgage was a fixed rate mortgage or an ARM, the amount borrowed, term of the mortgage, and the identity of the lender. In most cases, we also have annual assessed values of the properties.

We restrict our study to seven states: Arizona, California, Florida, Georgia, Illinois, Nevada, and North Carolina. Each of these states is mentioned in prospectuses of large buy-to-rent investors and in articles on the investors that appeared in the popular press. All of these states saw significant activity by buy-to-rent investors over 2010–2015. The “sand states” of Arizona, California, Florida and Nevada experienced especially large run-ups in house prices over 2000–2006, and very sharp downturns in house prices afterwards.

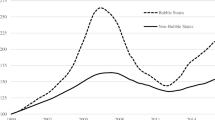

Housing Markets before and after the Financial Crisis

There is some variation from city to city in the timing of the housing price peaks, but in general, prices peaked around the same time. Figure 1 shows monthly median home values by state from Zillow. In each of the states in our sample, prices peaked in 2006 and reached minimum levels in 2012. North Carolina was a state that experienced a modest decline in home prices over this time, with median values falling from about $155,000 to about $135,000. For the sand states, Arizona, California, Florida and Nevada, the decline was much steeper. From 2006 to 2012, median prices fell about 50% in Florida and Arizona. In California prices declined a little less, in Nevada a bit more.Footnote 1

Part of the decline in house prices may be due to buyers having difficulty obtaining a mortgage. Following the financial crisis, some lenders conserved capital to build reserves and others adopted more stringent lending standards. Some potential homebuyers had damaged credit ratings following defaults on previous mortgages. Others had little equity for a down payment after losing money on previous house purchases.

Figure 2 shows the monthly proportion of purchases with mortgages in each state over 2003–2015. In each state, the proportion of properties purchased with mortgages is highest before 2007. In Illinois and North Carolina, the proportion of properties bought with mortgages declines more or less smoothly over 2007–2015. In the other states, the proportion of properties bought with mortgages declined sharply after 2007. In Nevada, about 80% of properties were purchased with mortgages over 2003–2005. In 2008–2009, it was about 35%. In California, about 80% of properties were bought with mortgages over 2003–2005, but less than 50% over 2008–2009.

Institutional Investors

We focus on the impact of house purchases by eight major buy-to-rent investors: Altisource, American Homes 4 Rent, American Residential Properties, Colony American Homes, Invitation Homes, Progress Residential, Silver Bay Realty Trust and Starwood Waypoint Realty Trust. These investors are among the largest if not the largest buy-to-rent investors and account for a large proportion of the total institutional investment in single family homes. These large investors have relatively liquid balance sheets that facilitate purchase of large portfolios of properties. Purchases by these investors were concentrated in a few states. We examine purchases in the states of Arizona, California, Florida, Georgia, Illinois, North Carolina, and Nevada. These investors purchased additional houses in other states, including Tennessee, Indiana, and Ohio, but the bulk of their purchases were in the seven states that we examine.

Prospectuses and company press releases suggest that all of these buy-to-rent investors have a similar business model. They are typically organized as real estate investment trusts (REITs). Many of their houses are purchased for cash at foreclosure auctions at a discount to prices of houses that are not in foreclosure. They are generally unable to conduct interior inspections before purchase, and rely on computer models to determine which houses to buy and how much to pay. They typically spend $20,000 to $25,000 to renovate properties before renting them out. They attempt to take advantage of economies of scale by purchasing large numbers of houses in a metropolitan area. Buy-to-rent investors prefer to rent to middle class families. Their preferred purchase is a three-bedroom, two-bathroom house in a good school district. All of these buy-to-rent investors entered real estate markets at about the same time.

We follow an iterative process to identify buy-to-rent purchases. We identify the list of subsidiaries of each of the eight major buy-to-rent investors from publicly available sources. We then match these institutional names with buyer names in the deed data using a matching algorithm to identify properties that were purchased.Footnote 2 Panel A of Table 1 reports the number of house purchases that we identify in the Zillow data for each of these investors in each state. In total, they purchased over 100,000 homes. The largest number, 39,770 were in Florida. Invitation Homes, a subsidiary of Blackstone, was the most active buyer with 29,384 house purchases. There is some specialization by investors in different states. For example, almost half of American Residential Properties purchases are in Arizona. For the most part though, investors spread their purchases across all seven states.

Panel B of Table 1 presents the proportion of houses bought by buy-to-rent investors that had been foreclosed and the proportion that were foreclosed and bought in auctions. Auctioned properties are generally foreclosed houses, but not all foreclosed houses are bought at auction. About 24% of the properties of Invitation Homes, the largest purchaser of houses, were in foreclosure when bought. American Homes 4 Rent, the second largest purchaser, acquired 32.5% of their properties from foreclosures. Foreclosed houses were 47.5% of purchases in 2012. The proportion declined each year from 2013 to 2015 as fewer foreclosures took place. Foreclosed houses are a large proportion of purchases in all states, but are largest in Georgia (47.4%) and California (35.0%). With the exception of Arizona, where the ratio is 0.2757 for zip codes without buy-to-rent purchases and 0.3862 for zip codes with buy-to-rent investors, individual state results confirm that buy-to-rent investors were active in the zip codes that had experienced sharp declines in house sales. In Illinois, house sales declined 10% in zip codes that buy-to-rent investors avoided, and over 62% in zip codes where they were active. In Nevada, house sales actually increased by over 80% in zip codes without buy-to-rent purchases but declined by 65% in areas where they were active.

Figure 3 depicts the number of purchases by all of the Wall Street investors combined by month for four counties with a large number of purchases: Maricopa County, Arizona (Phoenix), Clark County, Nevada (Las Vegas), Broward County, Florida, and Los Angeles County, California. In each case, the number of purchases was particularly large during the second half of 2013. In the case of Los Angeles County, purchases were high in 2012, and for Broward County, Florida and Clark County, Nevada, heavy buying continued well into 2014. For the most part though, investor activity is roughly synchronous across locations.

Results

Institutional Purchases and Prices of Nearby Properties

Buy-to-rent institutional investors sometimes buy houses that are very close to each other. We don’t want to treat buy-to-rent purchases of very close properties as independent observations, so we identify bundles of purchases by institutional buyers in the following way. Starting with all institutional purchases in a state within a calendar quarter, we identify the pair of homes that were located closest to one another. Distances are straight-line distances calculated from the properties’ latitude and longitude. If the pair were within ½ mile of each other, we identify them as a bundle. We define the center of the bundle as the average latitude and longitude of the houses in the bundle. With two houses, this means that each is within ¼ mile of the bundle center. We then go through the set of all institutional purchases a second time and pick out the next closest pair of houses. If the pair is within ½ mile of each other this is a second bundle. If instead, the closest pair is a new house and the center of the previous bundle, the new house is added to the bundle, and the new center is the average of the latitudes and longitudes of the three houses that make up the bundle. We continue this process until all other houses purchased by institutional buyers are more than ½ mile from existing bundles or other institutional house purchases. Houses that are more than ½ mile from any others are treated as bundles by themselves. Bundles are small. About 79% are one house, and about 94% are one or two houses. A number, however, include over 10 houses. We do not require that all houses in a bundle be purchased by the same buy-to-rent investor.

We then find all repeat sales of properties within ¼ of a mile of the center of each bundle in which the second sale took place in the quarter just before or within four quarters after the quarter of the institutional purchases. As a control, we also find all repeat sales of properties in the same state between 50 and 75 miles away from the center of the bundle in which the second transaction of the repeat sale occurred in the quarter before or the four quarters after the buy-to-rent purchase. These properties are also at least 50 miles from the center of any other bundle. Using all repeat sales, we estimate the following regression

Where P2 is the price of the property in the second transaction, P1 is the price in the first transaction, γBundle, BuyYear is a fixed effect for the combination of the institutional buy bundle and the purchase year for the first transaction in the repeat sale. D<1/4Mile is a dummy variable that is one if the property is no more than ¼ miles from the center of the bundle, DAfterInsBuy is a dummy variable that is one if the second transaction in the repeat sale took place in the four quarters following the institutional purchases in the bundle, and zero if the transaction took place in the quarter before the institutional purchases.

Note that we use fixed effects to control for the location of the property and the year of the first transaction in the repeat sale. Hence the coefficient of DAfterInsBuy reflects the difference in returns of properties that were bought around the same time but sold before and after the institutional purchases, while the coefficient on the product of D<1/4Mile and DAfterInsBuy is the additional difference in returns for properties that were bought around the same time but sold before and after the institutional purchases and were located near the center of the bundle.

We first estimate (1) using transactions from all seven states. Results are reported in Panel A of Table 2. Regression (1) reports results when we do not cluster standard errors on the repeat sale and include every repeat sale. There are a total of 1,030,838 observations in this regression and 248,829 fixed effects for bundles of institutional purchases. So, on average, about four sales take place within a year of institutional bundle purchases. The intercept coefficient is 0.041.Footnote 3 In this case, it indicates that sellers made e0.041–1 = 4.2% on their properties if they sold before the institutional purchases. The coefficient on D<1/4Mile is −0.251. Recall that there are fixed effects for each combination of property purchase year and buy-to-rent purchase bundle, so this coefficient implies that sellers who had nearby properties and sold in the year before the buy-to-rent purchase lost e−0.251 – 1 = 22.2% more than sellers who bought properties in the same year 50 to 75 miles away. This is not surprising. Buy-to-rent investors bought into areas with depressed house prices. Our sample consists of sales that took place in 2010–2015, and sellers typically purchased their properties before the collapse of real estate prices in 2007–2009. The coefficient on the dummy variable for after institutional purchases is −0.007 with a t-statistic of −2.1. Prices for properties located 50 to 75 miles from the buy-to-rent bundle decreased in value in the year after the buy-to-rent purchase, but only by a small amount. The coefficient on the interaction between being close to a buy-to-rent bundle and selling after the institution purchased is 0.105 with a t-statistic of 13.4. Property prices increased significantly in the year after buy-to-rent institutional investors bought houses, but only for properties near their purchases.

In the regression reported in the second column, we cluster standard errors on the repeat sales. In doing this, we acknowledge that the same repeat sale, when used with different bundles of institutional purchases in different months, does not provide independent observations. In this regression, we also exclude repeat sales with the largest and smallest 1% of returns. Very large returns could reflect expensive property improvements. Very small returns may occur if the second transaction in a repeat sale is not an arm’s length transaction. Very large or small returns could also be due to data errors.

Coefficient estimates for the second regression are very similar to the coefficient estimates in the first regression. Exclusion of outliers has little effect on the estimated impact of institutional purchases on nearby property prices. Clustering of standard errors does reduce t-statistics, but coefficients remain statistically significant, particularly on the dummy variable for being within a ¼ mile of a buy-to-rent bundle, and the interaction between that dummy variable and the dummy for after the buy-to-rent investor purchased property. Again, prices increase after buy-to-rent investors purchase houses, and they increase far more for properties located close to the buy-to-rent purchases. This regression, with outliers discarded and clustering of standard errors on repeat sales, will be the baseline regression for work in the rest of the paper.

By using only one quarter before the buy-to-rent purchase as the before period, we minimize the possibility that some of the price appreciation occurred before the actual buy-to-rent purchase. A disadvantage of using just one quarter as a before period is that there may be few or no nearby repeat sale transactions before a buy-to-rent purchase. In regression (3), we use four quarters before the buy-to-rent purchase as the before period. The number of observations more than doubles from the second regression and the t-statistic on the interaction between the repeat sale being completed after the buy-to-rent purchase and the property being close to the buy-to-rent purchase increases from 4.0 to 6.0. The coefficient on the interaction increases marginally from 0.073 to 0.096. It doesn’t appear the prices of nearby properties increased very much during the year prior to the buy-to-rent purchase.

For the fourth regression, we continue to omit outliers and cluster standard errors on the repeat sale. This time though, we use six months, rather than one year for the after period. Results are basically unchanged, with the coefficient on the interaction between the dummy variable for after institutional purchases and the dummy variable for being within ¼ of a mile of the buy-to-rent property decreasing from 0.073 to 0.069. This is not a statistically significant difference.

The fifth regression includes only repeat sales of properties that were within 1/10 of a mile of a bundle of institutional purchases, and that occurred within one quarter before or four quarters after the institutional purchases. A distance of 1/10 of a mile is about one city block. Using this shorter distance has a small impact on the coefficient on the interaction between being close to the buy-to-rent bundle and selling after the bundle is purchased, raising it from 0.073 in the second regression to 0.087. The impact of institutional purchases on properties within 1/10 of a mile is somewhat larger than the impact on properties within ¼ of a mile, but the difference is not statistically significant. Finally, the sixth regression includes only repeat sales within 1/10 of a mile of the cluster of institutional purchases in which the second transaction took place no later than two quarters after the purchases. The coefficient on the interaction between being close to a buy-to-rent bundle and selling after the buy-to-rent purchase is 0.084.

To summarize, Panel A of Table 2 shows clearly that prices of properties near buy-to-rent purchases fell more than prices of properties 50 to 75 miles away before the buy-to-rent purchases. After the buy-to-rent investors purchased, nearby properties appreciated significantly more than properties 50 to 75 miles away. As a whole, Panel A demonstrates that our results are robust to changes in methodology. These results hold whether outliers are included or not, whether nearby is defined as 1/10 mile or ¼ mile, and whether the before and after period is six months or one year.

In the second regression, which we use as a benchmark for the rest of the paper, the coefficient on the dummy variable for after the buy-to-rent purchase is 0.016 and the coefficient on the interaction between the dummy for after the buy-to-rent purchase and within ¼ mile is 0.073. This indicates that properties near the buy to rent purchase appreciated in total by e0.016 + 0.073 -1 = 9.3% after the purchase.

Panel B presents some robustness tests. A concern may be that buy-to-rent investors propped up prices in the short-run by reducing the stock of properties, but that prices fell later. Rental houses are often thought to lower values of nearby properties. Residents who rent, rather than own, are less likely to care about the appearance and upkeep of their houses. They may not expect to live in the area for long and may be less inclined to participate in community affairs. Wang et al. (1991) estimate that two rental houses in a five house grouping lowers house values by about 2%. To examine the long-term impact of buy-to-rent purchases, we estimate the following regression, using repeat sale transactions completed one quarter before and up to twelve quarters after the buy-to-rent purchase.

The dummy variable DAfterInsBuy is set to one if the repeat sale is completed up to twelve quarters after the buy-to-rent purchase, while the dummy variable D2ndYearAfterBuy is set to one if the repeat sale was completed at least five quarters after the buy-to-rent purchase and the dummy variable D3rdYearAfterBuy equals one if the repeat sale was completed nine to twelve quarters after the buy-to-rent purchase. As before, outliers are discarded and standard errors are clustered on the repeat sale.

The first regression uses an after period of 12 quarters, but doesn’t include dummies for the second and third years after the buy-to-rent purchase. Results are similar to what we find when we use one year as the after period for buy-to-rent purchases. The dummy variable for being close to the buy-to-rent purchase is −0.224, suggesting that properties near the buy-to-rent purchase that were sold before the buy-to-rent investors bought had lower returns than properties that were farther away. The coefficient on the interaction between the dummy variable for being close to the buy-to-rent purchase and the dummy variable for selling after the purchase is 0.112. Nearby properties experienced greater appreciation in the three years after a buy-to-rent purchase than distant properties.

Regression (2) includes separate dummy variables for the second and third years after the buy-to-rent purchase, and interactions between these dummy variables and the dummy variable for being close to the buy-to-rent purchase. The coefficient on the interaction between being after the buy-to-rent purchase and being close to the buy-to-rent purchase is 0.078. For the year after the buy-to-rent investor bought, prices increased by 7.8% more for properties near the buy-to-rent purchase than for distant properties. The coefficient on the interaction between more than one year after the institutional buy and being close to the purchase is 0.061. Prices increased by an additional 6.1% for close properties than distant properties in the second year. Likewise, the coefficient on the interaction between close and more than two years after the institutional buy is 0.064. In the third year after the buy-to-rent investor’s purchase, prices of nearby properties increased by an additional 6.4% relative to prices of distant properties. The sum of the coefficients 0.078 + 0.061 + 0.064 = 0.203 indicate that in the three years after the buy-to-rent purchase, prices of nearby properties made up almost all of the extra losses that they incurred before the buy-to-rent purchase.

In the long-run, it is possible that buy-to-rent purchases could depress the prices of nearby properties. Homeowners make more desirable neighbors than renters. Our after period of three years may be too short to capture the long-run effects of buy-to-rent purchases on prices of nearby properties.

So far, we have compared the price appreciation of properties near buy-to-rent purchases with the price appreciation of distant properties, which we define as 50–75 miles away. These distant properties would, in general, not be in the same metropolitan area as the buy-to-rent purchase. This has the advantage that any supply effect from buy-to-rent purchases is unlikely to affect the distant properties. On the other hand, distant properties outside of a metropolitan area may be affected by very different economic conditions and supply and demand factors. They may make a very noisy control group.

The last three regressions in Panel B use properties that are five to ten miles away from the buy-to-rent purchase as the distant properties. A distance of five to ten miles puts the distant properties in the same metropolitan area and often in the same city. As before, a property that is close to one buy-to-rent purchase is not treated as a distant for any other buy-to-rent purchase. Regression (3) includes just one year as an after period. In this regression, the coefficient on the dummy for being close to a bundle of buy-to-rent purchases is −0.115. Prior to the buy-to-rent purchases, nearby properties underperform properties five to ten miles away by 11.5%. The dummy variable for after the buy-to-rent purchase has a coefficient of 0.045. Prices of properties five to ten miles from the buy-to-rent purchase appreciated by 4.5% more if sold in the year after the buy-to-rent purchase than in the quarter before. The coefficient on the interaction between being close to the buy-to-rent purchase and selling in the year afterwards is 0.034. Close properties appreciated by 3.4% more after the buy-to-rent purchase than did properties five to ten miles away. So, properties close to the buy-to-rent purchase experience greater returns after the purchase than do properties in the same metropolitan area that are a few miles away.

The last two regressions in Panel B compare returns of properties close to buy-to-rent purchases with the returns of properties five to ten miles away over three years after the buy-to-rent purchase. Regression (4) includes one dummy variable that is one if the second transaction in the repeat sale occurred anytime in the three years after the buy to rent purchase. The coefficient is 0.069 with a t-statistic of 8.4. Distant properties sold in the three years after the buy-to-rent purchase appreciated by 6.9% more than properties sold in the quarter before. The interaction between the after dummy and the dummy for being close to the buy-to-rent purchase is 0.055. Properties near the purchase appreciated by 5.5% more after the buy-to-rent purchases than did properties five to ten miles away. In the last regression, dummy variables for after the buy-to-rent purchase, at least one year after the buy-to-rent purchase, and at least two years after the buy-to-rent purchase are included along with interactions with the dummy for after the purchase. This regression indicates that on average, properties five-to-ten miles away appreciated in each of the three years following the buy-to-rent purchase. The interactions with the close to the buy-to-rent house dummy indicate that properties located near the buy-to-rent purchases appreciated by more in each of the three years.

A simple explanation for the increase in the value of properties near buy-to-rent purchases is that buy-to-rent investors bought properties in areas where properties were selling for particularly depressed prices. The higher returns around buy-to-rent purchases could then be a result of a rebound in property prices. To see if buy-to-rent investors selected properties in especially depressed areas we turn to coarser real estate price data: Zillow’s median single family home prices by zip code. For each zip code in our seven sample states, we use the median single family house price to calculate the return on houses from the end of January 2007 to the beginning of each quarter from 2012 through 2014. These are the quarters when the great majority of the buy-to-rent purchases took place. We then calculate the distribution of returns before the quarter for zip codes where buy-to-rent investors bought houses and for zip codes without buy-to-rent purchases in the quarter.

Results are shown in Table 3. The first two rows describe the distribution of returns from January 2007 up to the first quarter of 2012. There are 4836 zip code areas in our sample states with no purchases by buy-to-rent investors during the first quarter of 2012. The median zip code level return up to the first quarter of 2012 is −34.93%, with an interquartile range of −55.36% to −17.25%. There are 154 zip codes in our seven sample states with buy-to-rent purchases during the first quarter of 2012. The median return across these zip codes is much lower at −69.52%. The interquartile range is −87.10% to −57.53%. During the first quarter of 2012, buy-to-rent investors were indeed purchasing houses in areas with particularly depressed prices. This is true in every other quarter as well. The zip codes with buy-to-rent purchases in general have lower house returns from January 2007 to the beginning of the quarter than do zip codes without buy-to-rent purchases. The distributions do, however, overlap.

Comparing rows of the table reveals that the proportion of zip codes with buy-to-rent purchases increased almost tenfold from the first quarter of 2012 to the second quarter of 2013. Comparing rows of Table 3 also reveals that for both zip codes with buy-to-rent purchases and zip codes without, the distribution of returns from January 2007 to the beginning of the quarter steadily shift to the right as we move to later quarters. This reflect the general increase in real estate prices over 2012–2014.

Buy-to-rent investors purchase properties in areas where prices are especially depressed. So, is the increase in prices of properties near buy-to-rent purchases just a rebound of severely depressed prices? To test this, we find pairs of five-digit zip codes in a state that meet two criteria. First, the return from January 2007 to the beginning of a quarter, as measured by changes in the Zillow single family index, must be within 1% for the two zip codes. So, if the return for one zip code is −40.0%, the return for the other must be between −39.6% and 40.4%. Second, one of the zip codes must have buy-to-rent purchases during the quarter while the other zip code has none. We then use matched-sample t-tests to see if returns of zip codes with and without buy-to-rent purchases are different in the quarter of the purchase and in the two quarters afterwards.

The geographic areas defined by zip codes are much larger than the areas we used in Table 2. Even in urban areas, five digit zip codes cover several square miles. The disadvantage of using zip code level returns rather than the finer geographic areas that we use in the rest of the paper is that it is possible that a buy-to-rent purchase may have a large impact on close properties but that the price impact is diluted when measured over an entire zip code. The big advantage of looking at zip code level returns is that indices make it easy to control for returns before the buy-to-rent purchases.

Results are presented in Table 4. The first three rows report matched zip code results across all seven states. In total, across all states and all quarters from 2012 through 2014, we are able to match 1678 pairs of zip codes in which the two zip codes have near identical returns before the quarter, one zip code has buy-to-rent purchases in the quarter and the other has none. In the period from January 2007 until the beginning of the quarter, the mean return is −37.76% for zip codes with buy-to-rent purchases and − 37.75% for zip codes without buy-to-rent purchases. A matched sample t-statistic for the difference is −0.23. The tiny differences in returns between zip codes with and without buy-to-rent purchases before the purchases take place means that differences in returns afterwards cannot be attributed to a rebound effect. The mean return in the quarter of the buy-to-rent purchases in 2.98% for zip codes with buy-to-rent investors and 2.55% for matching zip codes. The mean difference, 42 basis points, is highly significant with a t-statistic of 8.87. Real estate in zip codes with buy-to-rent purchases continues to outperform real estate in matching zip codes for the two quarters after the buy-to-rent purchases. For the first quarter after the buy-to-rent purchases the difference is 29 basis points with a t-statistic of 6.38. For the second quarter it is 21 basis points with a t-statistic of 4.27.

Results for matched zip code pairs in individual states are shown in the remainder of the table. In general, results for individual states are similar to the results for all states together. In each case, the differences in the mean returns of zip codes with buy-to-rent purchases and matching zip codes are tiny and insignificant before the buy-to-rent purchases. Differences in returns between zip codes with buy-to-rent purchases and other zip codes are positive for the quarter of the buy-to-rent purchases and the two subsequent quarters for most states. Results are particularly strong for Florida and North Carolina. They are weak for Arizona and Illinois, but Illinois has few observations.

Results in Tables 3 and 4 confirm that buy-to-rent investors buy in areas that have experienced particularly large price declines. The abnormal returns after their purchases are not just a price rebound, however. Properties in zip codes in which buy-to-rent investors buy houses outperform other zip codes with near identical price declines before the purchases.

Supply Side Effects

Wall Street investors generally buy houses in price ranges that allow them to profitably rent to middle class tenants. Expensive houses are difficult to rent. Cheap houses require more maintenance and have tenants who are more likely to miss payments. We consider purchase price as a measure of whether a property is a good substitute for a property purchased by a buy-to-rent investor. Purchases by Wall Street investors reduce the supply of properties in the price range in which they buy, but not the supply of either very cheap or very expensive properties. The real estate market is not perfectly segmented by price. Nevertheless, if purchases by buy-to-rent investors increase property prices by restricting supply we would expect the difference in appreciation between properties near buy-to-rent purchases and distant properties to be largest for price ranges purchased by buy-to-rent investors. If property prices near buy-to-rent purchases are increasing because prices in the area are low, we might expect nearby properties to appreciate even if they are much cheaper or more expensive than the property bought by buy-to-rent investors.

For each state, we calculate the distribution of purchase prices paid by buy-to-rent investors over 2010–2015. Results are shown in Panel A of Table 5. The distribution of prices across all states is shown in the first row. The median price is $144,184, while the 5th percentile price is $65,000 and the 95th percentile price is $305,000. Distributions of prices for each individual state are presented in the following rows. Prices are generally higher in California and lower in Georgia. The range of prices in individual states is usually narrower than the distribution across all states.

For comparison purposes, Panel B provides the distribution of prices in all transactions over 2010–2015. For all states together, and for the individual states, the dispersion of prices in all transactions exceeds the dispersion of prices paid by buy-to-rent investors. The 5th and 95th percentiles of prices paid by buy-to-rent investors are close to the 25th and 75th percentile of all prices both for all states and for individual states. This confirms that buy-to-rent investors purchase houses in a specific segment of the market, in a price range that appeals to middle-class renters.

To see if returns for properties that are outside of the price range of buy-to-rent investors are affected less by buy-to-rent purchases, we run the following regression using repeat sales of properties within ½ mile of the center of a bundle of houses purchased by an investor.

Where γInstHouse,BuyYear is a fixed effect for the buy-to-rent purchase bundle and the purchase year of the repeat sale property, P1 < 5th Pct is a dummy variable if the first price in the repeat sale was less than the 5th percentile of purchase prices for buy-to-rent investors, P1 > 95th Pct is a dummy variable if the first price in the repeat sale was greater than the 95th percentile of purchase prices for buy-to-rent investors, and DAfterInsBuy is a dummy variable that is one if the second transaction in the repeat purchase took place after the purchase by the buy-to-rent investor. By using ½ mile rather than ¼ mile we are better able to include nearby properties that sold for very different prices than the properties purchased by buy-to-rent investors. We do not include more distant properties. We include only repeat sales in which the second sale occurred within 12 months of the purchase of the cluster of houses. Regression estimates are provided in Panel A of Table 6.

The first column provides the regression estimate when observations from all states are included. As before, we use fixed effects for each combination of purchase bundle and year of the first transaction in the repeat sale. Standard errors are clustered by the repeat sale. The regression intercept is −0.226, indicating that on average, owners who lived within ½ mile of a buy-to-rent bundle and sold in the four quarters before the bundle purchase suffered significant losses. The coefficient of P1 < 5th Pct is 0.575, suggesting that these owners sold property for significant gains in the year before the bundle purchase. It is possible though, that owners of cheap property spent more on repairs and renovations than other owners, and the returns could therefore be exaggerated. The coefficient on the dummy variable for expensive properties is −0.040. Returns on these properties were particularly low if sold before investors purchased the nearby bundle of homes.

Of course, our main concern is the impact of buy-to-rent investors’ purchases on prices of nearby properties. The coefficient on the dummy variable for a second sale that took place after the investor purchase is 0.114. Prices of nearby properties were significantly higher in the year after the purchase of houses by Wall Street investors. The coefficient on the cheap property after the bundle purchase is −0.038, with a t-statistic of −7.2. The coefficient on the interaction between after the institution purchase and an expensive property is −0.017 with a t-statistic of −5.5. Properties outside the price range purchased by Wall Street investors appreciated less after the investor purchases. This is consistent with prices appreciating because buy-to-rent investors remove the excess supply of properties from the market. Externalities from nearby vacant houses should affect the values of all nearby properties, regardless of their value.

Regressions for individual states are shown in the remaining columns. The coefficients on the interaction between cheap properties and the dummy variable for after the investor purchase are negative for every state except Georgia, and are statistically significant for Florida, Illinois, Nevada and North Carolina. The coefficients on the interaction between expensive properties and the dummy variable for after the investor purchase are negative for all states, and statistically significant for Arizona, California, Florida, Illinois and Nevada. Overall, investor purchases had less impact on the returns to nearby properties outside their price range, than on the returns of properties with similar prices, thus lending credence to a supply side effect as the channel underlying positive externalities from buy-to-rent purchases.

As a robustness test, we rerun regression (3) using dummy variables for properties with prices below the 25th and above the 75th percentile of buy-to-rent prices rather than dummy variables for prices below the 5th or above the 95th percentile of buy-to-rent prices. Table 5 shows that across all states, and within each state, the interquartile range of buy-to-rent purchases is much narrower than the interquartile price range of all properties. Hence purchases by buy-to-rent investors make up a larger proportion of all transactions within the buy-to-rent interquartile range than outside of it.

Panel B of Table 6 presents the regression estimates. The first column reports the regression that includes observations from all states. Results are similar to Panel A. The coefficient on the dummy variable for after the institutional purchase is 0.116 and is highly significant. Nearby properties sold for 11.6% more after a buy-to-rent investor’s purchase than in the quarter before. The interaction between the dummy variable for a price below the 25th percentile of the buy-to-rent prices and the dummy variable for after the buy-to-rent purchase is −0.023. The price appreciation was 2.3% less for properties that are cheap relative to buy-to-rent purchases. Note that the coefficient of −0.023 is slightly less in absolute value than the coefficient of −0.038 for the analogous coefficient in Panel A. This is consistent with the market for properties below the fifth price percentile being affected less by buy-to-rent purchases than properties between the 5th and 25th percentiles. That is what we would expect if the properties purchased by buy-to-rent investors are better substitutes for the properties within the 5th to 25th percentile than for properties below the 5th price percentiles. The interaction between the dummy variable for a price above the 75th percentile of the buy-to-rent prices and the dummy variable for after the buy-to-rent purchase is −0.009. The price appreciation was 0.9% less for properties that are expensive relative to buy-to-rent purchases. The coefficient is, again, smaller in magnitude than the analogous coefficient of −0.017 in Panel A.

The remaining columns of Panel B report regressions for individual states. The coefficient on the interaction between the dummy variable for a price less than the 25th percentile and the dummy variable for after the nearby institutional investor purchase is negative and significant for Florida, Illinois, Nevada and North Carolina. The coefficient on the interaction between the dummy variable for a price greater than the 75th percentile and the dummy variable for after the nearby buy-to-rent purchase is negative and significant for Arizona, California, Florida, Illinois, and Nevada.

Do Buy-to-Rent Investors Buy in Anticipation of Increased Demand?

An alternative explanation for the increase in prices of nearby properties following buy-to-rent purchases is that buy-to-rent investors buy homes in areas that they correctly forecast will see increased demand. Part of that demand could come from the increased mortgage use that we document later in this paper. To see if demand increased near buy-to-rent purchases, we calculate the total number of purchases within a quarter mile of each buy-to-rent bundle in the quarter or year before the purchase and the total number in the quarter or year after the purchase. We then calculate the ratio of the number of purchases afterwards to the total number of purchases before and after the buy-to-rent investment. So, if a particular buy-to-rent purchase took place in the first quarter of 2012, we calculate the ratio of purchases in the second quarter of 2012 to the total number in the second quarter of 2012 and the fourth quarter of 2011. A ratio of 0.5 means that equal numbers of purchases took place in the quarter before and the quarter after the buy-to-rent investment. A ratio of 0.67 means that there were twice as many purchases in the quarter after the buy-to-rent investment than in the quarter before.

Panel A of Table 7 reports the distribution of ratios of purchases after the buy-to-rent investment to total purchases. The first row reports ratios when quarters before and after are compared. The median value is 0.500, meaning there was an equal number of property purchases before and after the buy-to-rent investment. The mean is 0.474, indicating fewer transactions after the buy-to-rent investment than before. So, there was no increase in demand following buy-to-rent purchases. In fact, demand may have declined. This is seen more clearly in the next two rows of the table. The second row shows ratios of purchases in the year after the buy-to-rent investment to the total number of purchases in the year before and the year after. Here the median is 0.455 and the mean is 0.441. The last row shows the distribution of ratios when the numerator is the number of transactions in the second year after the buy-to-rent investment and the denominator is the sum of purchases in the year before and the second year after. Now, the median is 0.333 and the mean is 0.323.

As a whole, there was no increase in demand after the buy-to-rent investments. The combination of a smaller number of transactions and higher prices is exactly what we would expect if supply decreased.

There were some areas in which the number of transactions after the buy-to-rent purchase exceeded the number before. It is interesting to see if these areas experienced particularly large property price increases. Using just repeat sales within ¼ mile of a buy-to-rent transaction, we regress the price appreciation of the repeat sale on a dummy variable for after the buy-to-rent purchase, a dummy variable for a large number of buys afterwards, and the interactions of the two. A large number of buys is either defined as more buys after than before, or at least twice as many buys afterwards as before. We also include fixed effects for the combination of the buy-to-rent bundle and year of the first transaction in the repeat sale.

Regression estimates are presented in Panel B of Table 7. In all regressions, the intercept is negative, indicating that owners lost money if they sold before the buy-to-rent investment, while the coefficient on the dummy variable for after the buy-to-rent investment is positive, indicating the prices rebounded afterwards. In the first two regressions, where the before and after periods are one quarter, the interactions between after and a large number of purchases are small and insignificant. In regression (3) the before and after periods are one year and a large number of buys is defined as more buys after the buy-to-rent purchase than before. The coefficient on the interaction is 0.0102, indicating that property prices increased about 1% more after the buy-to-rent purchase if the number of transactions increased. The t-statistic for the interaction coefficient is 2.37. In regression (4), the before and after periods are again one year but a large number of buys is defined as twice as many buys after the buy-to-rent purchase as before. The coefficient on the interaction term is now 0.0122, suggesting that property prices increased about 1.22% more after the buy-to-rent purchase if the number of transactions doubled. In this case the t-statistic is just 1.63 though.

Regressions (3) and (4) suggest that when there is both a decrease in supply from buy-to-rent purchases and an increase in demand, property prices increase by more than when there is just a contraction in supply. The supply and demand effects are complementary.

Elimination of Foreclosure Externalities

We use price appreciation of nearby properties to estimate returns to buy-to-rent investors. Some of that price appreciation may not be due to a general increase in property values, but instead due to the elimination of negative externalities from purchases of foreclosed houses by buy-to rent investors. For instance, Gerardi et al. (2015) document negative externalities from foreclosed properties on near-by homes. To test the importance of eliminating externalities, we regress returns on repeat sales within ¼ mile of a buy-to-rent bundle purchase on a dummy variable that equals one if a house in the bundle was in foreclosure when purchased. That is, we estimate

where P2 is the price in the second transaction, P1 is the price in the first transaction, γZipCode,BuyYear is a fixed effect for the combination of the zip code and the purchase year for the first transaction in the repeat sale. DAfterInsBuy is a dummy variable that is one if the second transaction in the repeat sale took place in the four quarters following the institutional purchases in the bundle, and zero if the transaction took place in the quarter before the institutional purchases.

Results are shown in Table 8. The first regression includes properties in all states. The coefficient on the dummy variable for after the buy-to-rent purchase is 0.073. Recall that all of the repeat sales in this regression are of properties within ¼ mile of buy-to-rent purchases, and property prices around the buy-to-rent bundles increased about 7.3% in the year following the buy-to-rent purchase. Of more interest in the coefficient on the interaction between the buy-to-rent property being foreclosed and the dummy variable for after the buy-to-rent purchase. It is 0.024, with a t-statistic of 8.0. Properties that are close to buy-to-rent purchases earn returns of e.073–1 = 7.6% over the next year. If the buy-to-rent investor buys a foreclosed property, nearby properties appreciate by e0.073 + 0.024–1 = 10.2%. Returns are particularly high if the buy-to-rent investor buys a foreclosed property, but they are large and significant even if the property is not foreclosed. Eliminating the negative externalities of foreclosed properties is not the only reason nearby properties appreciate after buy-to-rent purchases.

The remaining columns of the table provide results for individual states. With the exception of Nevada, property price appreciation is larger after buy-to-rent purchases if the bundle contains a foreclosed property. It is also generally true though that the extra price appreciation around buy-to-rent bundles that contain a foreclosure is small relative to the appreciation that comes from being close to a bundle. This is especially true for the sand states of Arizona, California, Florida and Nevada which had experienced large price declines over 2006–2011. In California for example, the coefficient on the dummy variable for after a buy-to-rent purchase is 0.139, while the coefficient on the interaction between after the buy-to-rent purchase and foreclosure is 0.026. In the sand states, nearby properties appreciated significantly after buy-to-rent purchases, but they increased only slightly more if a foreclosed property was included in the bundle.

The results in Table 8 suggest that elimination of externalities from foreclosed properties is not an important reason why nearby properties appreciate after a purchase by a buy-to-rent investor. It is true that the difference in appreciation between properties close to and distant from buy-to-rent purchases is greater if the buy-to-rent bundle included foreclosed homes. But, the difference in appreciation is almost as large if the buy-to-rent investment does not include foreclosed homes.

Mortgage Market Effects

After 2006, fewer properties were bought using mortgages. This was especially true for the areas where buy-to-rent investors chose to purchase houses. As we have seen, these areas experienced significant price appreciation after buy-to-rent purchases. In this section, we see whether the increase in prices was accompanied by an increase in mortgage use by buyers.

To test this, we re-estimate regression (1). This time, rather than using the return on the repeat sale transaction as the dependent variable, we use an indicator variable for the use of a mortgage during purchase. That is,

Each observation is sale of a property that is close to a buy-to-rent investor’s bundle of purchases or distant from that bundle. Close is defined as within ¼ mile of the center of the bundle, while distant is 50 to 75 miles away. The transaction must occur within the quarter prior to the acquisition of property by the buy-to-rent investor, or in the four quarters afterwards. Fixed effects are included for each bundle. Standard errors are clustered on the property sales.

Results are shown in Table 9. Panel A provides regression results when transactions from all states are included. The first regression uses ¼ mile as the distance for a close property and uses transactions from one quarter before and one year after the buy-to-rent purchases. The intercept coefficient is 0.336, indicating that 33.6% of purchases 50–75 miles away from the buy-to-rent bundle used mortgages before the buy-to-rent purchase. The proportion of purchases within ¼ mile of the buy-to-rent bundle that occurred before the buy-to-rent purchase that used a mortgage was lower by 2.3%. Regression (1) indicates that after the buy-to-rent purchase, the proportion of purchases 50 to 75 miles away that used mortgages increased by 0.9%. Nearby properties increased an additional 3.9% for a total of 4.8%.

Mortgage use increased much more for properties that were close to the buy-to-rent bundle than for distant properties. Following buy-to-rent purchases, lenders appear to have become more willing to lend to buyers purchasing property near the buy-to-rent bundle. It is possible that lenders believed that buy-to-rent investors are eliminating an excess supply of properties in the area, and that a foreclosure would be easier to dispose of if the borrower defaulted. It is also possible that lenders believed the buy-to-rent investor would be willing to purchase the property if the borrower defaulted. Alternatively, the increase in mortgages could reflect a change in the type of buyers. It may be that more houses were bought by buyers to live in following buy to rent purchases. Individuals who invest in houses are less likely to use mortgages than homebuyers who intend to live in the properties.

In regression (2) and the remaining regressions in Panel A, standard errors are clustered on the buy-to-rent bundles. This reduces t-statistics, but the coefficient on the interaction between a property being located near the buy-to-rent bundle and the transaction occurring after the buy to rent purchase remains positive and highly significant in each regression. Mortgages are more likely to be used for properties near the buy-to-rent purchases after the purchase takes place.

In regression (4), close to the bundle is defined as being within 1/10 of a mile rather than ¼ mile. This is roughly one city block. Now the coefficient on the dummy for being located close to the bundle is a statistically significant −0.036. Prior to the buy-to-rent purchase, mortgages were less common for nearby properties. The coefficient on the interaction between close to the bundle and after the bundle purchase increases to 0.050 with a t-statistic of 5.1. Buy-to-rent purchases seem to have a particularly large effect on the likelihood of using a mortgage to purchase very close properties.

Panel B reports regression estimates for each individual state. Intercepts and other coefficients vary substantially across states, suggesting that a lot of information may be lost by putting all states into the same regression. In the individual state regressions, with the exception of North Carolina, the coefficient on the interaction between close to the buy-to-rent bundle and after the buy-to-rent purchase is positive. For California, Florida, and Illinois, the coefficient on the interaction is larger than in the regression with all states, and significant at the 1% level. Mortgage use increased for properties near buy-to-rent purchases after the purchases occurred.

Is the Increase in Mortgage Lending Coming from Existing Lenders or from New Entrants?

Mortgage lending increases after buy-to-rent purchases, but it is not clear whether the increase in mortgage lending occurs because new lenders step in to take the place of lenders that went out of business after the financial crisis, or because old lenders were more willing to loan to buyers.

We identify all lenders in each state that originated at least 50 mortgages in the 12 months before a buy-to-rent purchase. Using all bundles of buy-to-rent purchases, we count the total number of sales that occurred within a ¼ mile of the buy-to-rent purchase in the prior year. For each individual lender, we count the number of mortgages underwritten by the lender within ¼ mile of a buy-to-rent purchase j in the prior year, and standardize it by dividing by the total number of purchases within a ¼ of a mile of a buy-to-rent purchase j, with or without mortgages, over the same period. We then subtract the ratio of the lender’s number of mortgages 50–75 miles from a buy-to-rent purchase j to the total number of all purchases 50–75 miles from a buy-to-rent purchase j. Summing across all bundles gives the before difference for lender i:

We calculate a similar after difference for lender i using mortgages and sales in the year after buy-to-rent purchases,

We then calculate a difference in differences for lender i:

We have already seen that after buy-to-rent purchases, the proportion of properties near buy-to-rent purchases that were bought with mortgages increased more than the proportion of properties far from buy-to-rent purchases that were bought with mortgages. Examining these difference in differences for each lender i allows us to see if mortgage lenders who were active before buy-to-rent purchases increased their mortgage lending near the buy-to-rent purchases afterwards.

Results are shown in Table 10. The first row shows the median and mean before difference, after difference, and difference in differences for Arizona lenders. The median before difference of 0.00027 indicates that before the buy-to-rent purchase, most of the Arizona lenders provided mortgages for a higher proportion of purchases near the buy-to-rent purchase than for purchases 50–75 miles away. Both the median and mean after difference are positive, indicating that after the buy-to-rent purchase, Arizona lenders also provided mortgages for a larger percentage of purchases near buy-to-rent purchases than far from the purchases. The mean and median of the difference in differences is shown in the next column. Both are 0.00116. Most lenders, and lenders on average, increased the proportion of purchases that they helped finance with mortgages more for purchases near buy-to-rent bundles than for purchases farther away. The t-statistic of 2.6 indicates that the mean difference in differences is statistically significant.

The next four columns replicate the first four, but use periods of six months before and after the buy-to-rent purchases. Results are similar. Mean and median differences in differences are larger, indicating that most lenders increased their mortgage lending for purchases near buy-to-rent bundles more than for purchases 50–75 miles away. The succeeding rows show results for California, Florida, Illinois, Nevada, and North Carolina. Median differences in differences are always positive while mean differences are positive for every state except North Carolina. Mean differences in differences for one-year before and after periods are positive and statistically significant for Arizona, Florida, Illinois, and Nevada.Footnote 4

As a whole, the results in Table 10 indicate that existing lenders increased mortgage lending around buy-to-rent bundles after the buy-to-rent purchases by more than they increased lending elsewhere. The increase in mortgage lending after buy-to-rent purchases did not come from entry into the market by new lenders.

Conclusions

In the aftermath of the financial crisis, house prices were much lower than they had been a few years before. Many potential homebuyers were shut out of the market as a result of foreclosures, losses on previously owned houses or tightened mortgage lending standards. Large numbers of foreclosed properties were available for purchase. Large, sophisticated investors that buy to rent entered the market for single family homes.

We show that properties that were close to buy-to-rent purchases appreciated much more than distant properties over the two years following the buy-to-rent investments. We relate the positive externality to a supply side effect and show that prices of nearby properties in the same price range as the buy-to-rent purchases appreciated more than properties that were much cheaper or much more expensive. The appreciation of nearby properties may also reflect the elimination of externalities from buy-to-rent investors purchasing foreclosed properties. This cannot be a complete explanation though as we show that nearby properties increased in value more than distant properties regardless of whether the buy-to-rent purchase included foreclosed properties.

Finally, we document mortgage market effects that may arise from buy-to-rent purchases and show that mortgage use increased after the buy-to-rent purchases for nearby properties and that the increase arose from existing lenders that operate in the market rather than new lenders entering the market.

Notes

The algorithm matches based on the “spelling distance” between the institution name and buyer name specified in the deed transactions. The matching algorithm is not perfect and does a better job for full names rather than acronyms.

These regressions are run using Stata. In Stata, when fixed effects are used, the intercept is the average fixed effect.

Georgia is omitted because lender identities are seldom included in the mortgage data.

References

Adams, Z., Füss, R., & Schindler, F. (2015). The sources of risk spillovers among US REITs: Financial characteristics and regional proximity. Real Estate Economics, 43(1), 67–100.

Allen, M., Rutherford, J., Rutherford, R., & Yavas, A. (2018). Impact of investors in distressed housing markets. Journal of Real Estate Finance and Economics, 56, 622–652.

Anenberg, E., & Kung, E. (2014). Estimates of the size and source of price declines due to nearby foreclosures. American Economic Review, 104(8), 2527–2551.

Beracha, E., Feng, Z., & Hardin, W. G. (2019). REIT operational efficiency: Performance, risk, and return. The Journal of Real Estate Finance and Economics, 58(3), 408–437.

Edelman, S. (2014). Meet the new landlords: The rise of single-family investors in the housing market. Community Investment, 26(2), 26–29.

Ganduri, Rohan, Steven Xiao, and Serena Xiao, 2019, The rise of institutional investment in the residential real estate market, working paper, Emory University.

Gerardi, K., Rosenblatt, E., Willen, P., & Yao, V. (2015). Foreclosure externalities: New evidence. Journal of Urban Economics, 87, 42–56.

Henderson, J. V., & Ioannides, Y. M. (1983). A model of housing tenure choice. The American Economic Review, 73(1), 98–113.

Khater, S. (2013). The rise of institutional investors and the decline of REOs. The MarketPulse Vol, 2(3), 3–5.

Li, Q., Ling, D.C., Mori, M. and Ong, S.E., 2018, The wealth effects of REIT property acquisitions and dispositions: The creditors’ perspective. The Journal of Real Estate Finance and Economics, pp.1–30.

Ling, D.C., Wang, C. and Zhou, T., 2019, The geography of real property information and investment: Firm location, Asset Location and Institutional Ownership. Real Estate Economics.

Mills, J., Molloy, R., & Zarutskie, R. (2019). Large-scale buy-to-rent investors in the single-family housing market: The emergence of a new asset class. Real Estate Economics, 47(2), 399–430.

Schnure, Calvin, 2014, Single family rentals: Demographic, structural and financial forces driving the new business model, working paper, National Association of Real Estate Investment Trusts.

Smith, Patrick, and Crocker Liu, 2017, Institutional investment, asset illiquidity and post-crash housing market dynamics, forthcoming, Real Estate Economics.

Wang, K., Grissom, T., Webb, J., & Spellman, L. (1991). The impact of rental properties on the value of single-family residences. Journal of Urban Economics, 30, 152–166.

Acknowledgements

We are grateful to Hank Bessembinder, Francois Cocquemas, Shane Corwin, Yuliya Demyanyk, David Echeverry, Paul Gao, David Hutchison, Alberto Rossi, Sophie Shive, Lin Sun and seminar participants at Arizona State University, Florida International University, Florida State University, University of Illinois-Chicago and the University of Notre Dame for comments. The authors declare that they have no conflict of interest. Data provided by Zillow through the Zillow Transaction and Assessment Dataset (ZTRAX). More information on accessing the data can be found at http://www.zillow.com/ztrax. The results and opinions are those of the authors and do not reflect the position of Zillow Group.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of Interest/Competing Interests

The authors declare that they have no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

D’Lima, W., Schultz, P. Buy-to-Rent Investors and the Market for Single Family Homes. J Real Estate Finan Econ 64, 116–152 (2022). https://doi.org/10.1007/s11146-020-09790-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-020-09790-5