Abstract

This paper proposes a decentralized closed-loop supply chain network model consisting of raw material suppliers, manufacturers, retailers, and recovery centers. We assume that the demands for the product and the corresponding returns are random and price-sensitive. Retailers and recovery centers face penalties associated with shortage demand and supply, respectively. We derive the optimality conditions of the various decision-makers, and establish that the governing equilibrium conditions can be formulated as a finite-dimensional variational inequality problem. The qualitative properties of the solution to the variational inequality are discussed. Numerical examples are provided to illustrate the effects of demand and return uncertainties on quantity shipments and prices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The topic of closed-loop supply chain (CLSC) modeling and analysis has been of great interest, both from practical and research perspectives due to the importance of managing reverse logistics flows (Fleischmann et al. 2000) and to the increasing consumer awareness of environmental issues (Bloomberg et al. 2002). Many researchers have addressed the management of reverse flows and CLSCs (see Souza (2013), for a recent critical review on CLSC models). Sheu et al. (2005) presented a mathematical approach to model logistics operational problems of green-supply chain management. Nagurney and Toyasaki (2005) proposed a variational inequality formulation to model the management of reverse supply chain flows including electronic waste and recycling. Hammond and Beullens (2007) expanded the model of Nagurney and Toyasaki (2005) to consider a CLSC network consisting of manufacturers and consumers at various demand markets. Yang et al. (2009) used the theory of variational inequality to develop a CLSC network consisting of raw material suppliers, manufacturers, retailers, consumers and recovery centers. The authors discussed several examples to show the effects of CLSC parameters on equilibrium flows and net revenues. Feng et al. (2014) proposed a CLSC network model with demand for the underlying product being both price and time dependent. From the design point of view, Ramezani et al. (2014) studied CLSC by incorporating a set of fuzzy constraints to account for the lack of knowledge and uncertain goal of the decision makers. However, as pointed out by Guide and Van Wassenhove (2009), there is limited contribution in the literature that addresses the complexity that arises from the large number of actors in a decentralized closed-loop supply chain system. Furthermore, Thierry et al. (1995) found that intensity of the competition is increased when combined with the product end-of-life issues. Therefore, a holistic approach to study the competition and interaction among the decision-makers within a CLSC network is needed in order to study the system behavior and obtain useful managerial insights.

The above studies do not consider the effects of the demand and return uncertainties on quantity shipments and prices. In fact, demands and returns for a product are not known with certainty but we may obtain some information such as the cumulative distribution functions based on historical data. Demand uncertainty is a known problem faced by firms to determine suitable levels of output before demand is known, which is classically known as the “newsboy” problem in operational research literature (e.g., Atkinson 1979; Chen and Chen 2010; Huang et al. 2011). Shi et al. (2011) studied the production planning problem for a multi-product closed loop system, in which the demands and their returns are uncertain and price-sensitive, but developed the model to include only the manufacturer’s decision-making problem. Qiang et al. (2013) proposed a CLSC network model using the variational inequality approach. They discussed the effects of competition, distribution channel investment, yield and conversion rate, combined with uncertainties in demand, on equilibrium quantity transactions and prices. However, the authors did not consider the return uncertainties in the above work. In particular, we note that Dong et al. (2004) studied the demand uncertainties in the decentralized supply chain network; but their model only considers the forward supply chain network. To our best knowledge, there are very few papers discussing both random return and demand in the CLSC network. The only work that we are aware of is the paper by Sun et al. (2013). The authors proposed a multi-period supply chain network model and assumed the end-of-life product return is random, depending on the collecting price. The authors studied the characteristics of the optimal price and designed a monotonic pricing policy.

In this paper, we extend the work of Yang et al. (2009) to consider demand and return uncertainties. In contrast to the aforementioned models, we propose a new CLSC model that captures demand and return uncertainties through price-dependent functions. Note that the proposed model fits in the framework of stochastic variational inequality/stochastic Nash equilibrium studied by Sobel et al. (1971), Ravat and Shanbhag (2011) and Jiang and Xu (2008). As argued in Jiang and Xu (2008), if the distribution functions of the random elements involved are assumed to be known then the problem reduces to a classical deterministic optimization problem. Throughout this paper, we assume that the distribution functions of the random demand and random returns are known. The case of unknown distribution functions is left for future work.

Using additive and multiplicative functions for both demand and return, we demonstrate the joint concavity of the retailers and recovery centers’ profits as functions of both shipment quantities and prices. This important result allows us to formulate the optimality conditions of all closed-loop supply chain members as a finite-dimensional variational inequality in which both retailers and recovery centers should account for penalties and salvage values associated with shortage and excess supply respectively. The variational inequality approach is commonly used to solve equilibrium problems, see for instance Dafermos (1980) and Shao et al. (2006) for traffic equilibrium, Dafermos (1990), He et al. (2011), and Jofré et al. (2007) for economic equilibrium and Friesz et al. (1984), Nagurney and Zhang (1996) and Takayama and Judge (1971) for spatial price equilibrium. To solve the variational inequality, we adopt the extra-gradient method of Khobotov (1987). Numerical examples are performed to illustrate the effect of demand and return uncertainties on quantity shipments and prices.

The contributions of this paper include the following:

-

i)

This paper proposes a closed-loop supply chain equilibrium model with the consideration of both demand and return uncertainties.

-

ii)

We consider that the demands and returns for a product are price-sensitive. Both demand and return have a deterministic and an uncertain components. The deterministic component is modeled using traditional linear, logarithmic, and power functions whereas the uncertain component is modeled using additive or multiplicative functions.

-

iii)

We consider that the distribution functions of the random demand and return are assumed to be known which allows us to formulate the closed-loop supply chain problem as a deterministic optimization problem.

-

iv)

We develop a new variational inequality formulation in which both retailers and recovery centers should account for penalties and salvage values associated with shortage and excess supply respectively.

-

v)

The model and the solution method allow us to evaluate the performance of closed-loop supply chains under demand and return uncertainties, and to assess the effectiveness of closed-loop supply chain decisions under the effects of uncertainty, reverse logistics and net revenues.

This paper is organized as follows: In Section 2, we present the CLSC network model with random demands and returns consisting of multiple tiers of supply chain members. In Section 3, the optimality conditions of the various decision makers are derived using the theory of variational inequality. Section 4 presents the equilibrium pattern and its qualitative properties. This section also outlines the solution algorithm and discusses convergence results. Section 5 presents several examples to describe the effects of random demands and returns on the equilibrium shipments and expected profits. Section 6 concludes the paper. Finally, all proofs are given in the appendices.

2 The Closed-Loop Supply Chain Network Model with Random Demands and Returns

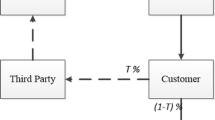

In this section, we present the closed-loop supply chain network model with random demands and returns. As shown in Fig. 1 (provided in Yang et al. (2009)), the network consists of two groups of supply chain members: (1) Forward supply chain members illustrated at the left side of Fig. 1, including raw material suppliers, manufacturers and retailers; (2) Reverse supply chain members displayed at the right side of Fig. 1, including retailers, recovery centers and manufacturers. Note that manufacturers and retailers are the nodes to connect the forward supply chain network and the reverse supply chain network to establish the closed-loop supply chain network.

2.1 Model Assumptions

Similar to the CLSC literature in the deterministic case, we make the following assumptions:

-

i)

The raw material suppliers only supply raw materials to the manufacturers in the forward supply chain.

-

ii)

The manufacturers in the closed-loop supply chain network produce a homogeneous product, from both raw materials and recycled materials. This assumption can be relaxed by taking into account the quality depreciation of products made from recycled materials.

-

iii)

Each retailer is responsible for dealing with its own demand market. Such an assumption has been used in CLSC literature (see Qiang et al. (2013)).

-

iv)

The recovery centers only collect the recyclable product shipments from the demand markets in the original supply chain. They only supply reusable materials to the manufacturers in this supply chain.

-

v)

All the supply chain members compete in a noncooperative manner under the Cournot-Nash equilibrium framework, that is, each decision maker will determine his optimal decision variables, given the optimal ones of the competitors. An other approach would be to consider a Stackelberg-Nash setting where each decision maker anticipate the reaction of other competitors to his decision (e.g., Sherali et al. (1983)). Such model would then fit the framework of EPECs (equilibrium programs with equilibrium constraints). While the latter are much more difficult to solve than variational inequalities, such approaches have been proposed in the literature, especially in the fields of energy and revenue management (e.g., Hu and Ralph (2007), Jiang et al. (2004), Metzler et al. (2003) and Oggioni et al. (2012)).

To consider uncertainties in CLSC, two more assumptions are made within the model:

-

i)

The demand for the product at each retailer outlet is random and depends on retailer prices.

-

ii)

The return for the recyclable product at each recovery center is random and depends on buy-back prices.

2.2 Model Definitions

Definitions of indices, parameters and variables in the closed-loop supply chain network are described below:

2.2.1 Indices

-

i index of manufacturers in the CLSC network, i = {1,…,I}.

-

j index of retailers in the CLSC network, j = {1,…,J}.

-

m index of recovery centers in the CLSC network, m = {1,…,M}.

-

n index of raw material suppliers in the CLSC network, n = {1,…,N}.

2.3 Parameters

-

\({\beta _{i}^{r}}\) fraction of usable material that can be transformed from raw materials for manufacturer i. \({\beta _{i}^{r}} \in [0,1]\).

-

\(\bar {\beta }_{i}^{r}\) fraction of useless raw material for manufacturer i. These useless materials are sent to the landfill \(\bar {\beta }_{i}^{r} =1-{\beta _{i}^{r}}\).

-

\({\beta _{i}^{u}}\) fraction of usable material that can be transformed from recycled materials for manufacturer i. \({\beta _{i}^{u}} \in [0,1]\).

-

\(\bar {\beta }_{i}^{u}\) fraction of useless recycled material for manufacturer i. These useless materials are sent to the landfill. \(\bar {\beta }_{i}^{u} =1-{\beta _{i}^{u}}\).

-

χ m fraction of usable recycled product that can be transformed to reusable material for recovery center m. χ m ∈ [0, 1].

-

\(\bar {\chi }_{m}\) fraction of useless recycled material for recovery center m. These useless materials are sent to the landfill. \(\bar {\chi }_{m} =1-\chi _{m}\).

-

r return ratio of used products at all demand markets.

-

f rec recycling fee (per product unit) charged by the corresponding Environment Protection Agency for manufacturing a given units of products.

-

s rec unit of subsidy of environment protection to recovery centers offered by the EPA.

-

c r cost (per unit of disposed raw materials) to the landfill.

-

c u cost (per unit of disposed reusable materials) to the landfill.

-

\(\lambda _{j}^{+}\) per-unit salvage value of having excess supply at retailer j

-

\(\lambda _{j}^{-}\) per-unit cost of having excess demand at retailer j.

-

\(\lambda _{m}^{+}\) per-unit salvage value of having excess supply at recovery center m.

-

\(\lambda _{m}^{-}\) per-unit cost of having shortage at recovery center m.

2.4 Variables

-

q n i nonnegative raw material shipment from supplier n to manufacturer i. Group the shipments of all the raw materials into the column vector \(Q_{1}\in \mathbb {R}_{+}^{NI}\).

-

q m i nonnegative reusable material shipment from recovery center m to manufacturer i. Group the shipments of all the reusable materials into the column vector \(Q_{2}\in \mathbb {R}_{+}^{MI}\).

-

q i j nonnegative product shipment from manufacturer i to retailer j. Group the shipments of all the manufacturers into the column vector \(Q_{3}\in \mathbb {R}_{+}^{IJ}\).

-

p n i selling price from supplier n to manufacturer i.

-

p m i selling price from recovery center m to manufacturer i.

-

p i j selling price from manufacturer i to retailer j.

-

p j selling price at retailer outlet j. Group the prices of all the retailers into the column vector \(P_{1}\in \mathbb {R}_{+}^{J}\).

-

p m buy-back price from recovery center m. Group the prices of all the recovery centers into the column vector \(P_{2}\in \mathbb {R}_{+}^{M}\).

3 Equilibrium Conditions of the Closed-Loop Supply Chain Network Members

In this section, we derive the optimality conditions of the various decision-makers in the closed-loop supply chain.

3.1 Raw Material Suppliers and their Equilibrium Conditions

We assume that each raw material supplier n is faced with a procurement cost, \({f_{n}^{r}}\left (\sum \limits _{i=1}^{I} q_{ni}\right )\), which, in general, depends upon the entire material shipment, \(\sum \limits _{i=1}^{I} q_{ni}\). We associate with each raw material supplier and manufacturer pair (n, i) a transaction cost denoted by c n i (q n i ).

Given these two costs, we can express the criterion of profit maximization for each raw material supplier n as:

Equation 1 states that a raw material supplier’s profit is equal to sales revenue minus costs associated with procurement and transaction. Note that \(p_{ni}^{*}\) denote the optimal prices from each raw material supplier n to each manufacturer i. We will discuss later how these optimal prices are recovered after solving the complete closed-loop supply chain equilibrium model.

We assume that the raw material suppliers compete in noncooperative manner. Also, we assume that procurement and transaction cost functions for each supplier are continuous and convex. Therefore, the optimality conditions for all raw material suppliers simultaneously can be expressed as the following variational inequality (e.g. Nagurney et al. (2002)): Determine \(Q_{1}^{*}\in \mathbb {R}_{+}^{NI}\) satisfying:

3.2 Manufacturers and their Equilibrium Conditions

Each manufacturer i must decide on: (a) the amount of product to ship to retailers; (b) the amount of raw materials to get from suppliers; (c) the amount of reusable materials to input from recovery centers (see Fig. 2 adopted from Yang et al. (2009)). Manufacturer i, incurs a production cost from raw materials, \({f_{i}^{r}}\left ({\beta _{i}^{r}},\sum \limits _{n=1}^{N} q_{ni}\right )\), and a remanufacturing cost of reusable materials, \({f_{i}^{u}}\left ({\beta _{i}^{u}},\sum \limits _{m=1}^{M} q_{mi}\right )\). These costs depend on the recovery level (\({\beta _{i}^{r}}\) or \({\beta _{i}^{u}}\)) designed into the product.

We associate with each manufacturer and retailer pair (i, j) a transaction cost denoted c i j (q i j ). Also let c m i (q m i ) denotes the transaction cost associated with manufacturer i transacting with recovery center m.

To enforce environment legislation, recycling fees should be charged for manufacturers to make them financially responsible for the products they produced. The aggregate recycling fee for manufacturer i is equal to \(f^{rec}\sum \limits _{j=1}^{J}q_{ij}\) (Sheu et al. 2005).

Given the above costs, we can express the criterion of profit maximization for each manufacturer i as:

Equation 3 states that manufacturer i’s profit equals sales revenue less costs associated with production and transaction, payout to raw material suppliers and recovery centers, recycling fees and disposal cost. Constraint (4) states that the sum of all shipment quantities to retailers must be less than or equal to the sum of the quantities produced from raw materials and remanufactured from reusable materials. Once produced, the useless materials \(\left (\bar {\beta }_{i}^{r}\sum \limits _{n=1}^{N} q_{ni}+\bar {\beta }_{i}^{u}\sum \limits _{m=1}^{M} q_{mi}\right )\) would be sent to the landfill, thus the disposal cost for manufacturer i is equal to \(c^{r}\bar {\beta }_{i}^{r}\sum \limits _{n=1}^{N} q_{ni}+c^{u}\bar {\beta }_{i}^{u}\sum \limits _{m=1}^{M} q_{mi}\). Note that the optimal prices \(p_{mi}^{*}\) and \(p_{ij}^{*}\) become endogenous variables in the complete closed-loop supply chain equilibrium model.

We assume that the manufacturers compete in noncooperative manner. Also, we assume that production and transaction cost functions for each manufacturer are continuous and convex. Therefore, the optimality conditions for all manufacturers can be expressed simultaneously as the following variational inequality: Determine \((Q_{1}^{*},\,Q_{2}^{*},\,Q_{3}^{*},\gamma _{1}^{*})\in \mathbb {R}_{+}^{NI+MI+IJ+I}\) satisfying:

In inequality (5), γ 1i is the Lagrange multiplier associated with constraint (4) for manufacturer i, and γ 1 is the column vector of all the manufacturer’s multipliers.

3.3 Retailers and their Equilibrium Conditions

Each retailer j must decide jointly on the quantity to order from the manufacturers and the selling price in order to cope with the random demand while seeking to maximize its expected profit. Each retailer j is faced with a handling cost, which may include the display and storage cost associated with the product. For simplicity, we assume a constant handling cost c j ; all our results extend without loss of generality to increasing and convex functions \(c_{j}\left (\sum \limits _{i=1}^{I} q_{ij}\right )\). To avoid triviality, we assume that \(\lambda _{j}^{+} \leq p_{j}\).

We assume that the demand for the product at each retailer j, D j (p j , 𝜖 j ), is random and depends on the price p j and a random variable 𝜖 j independent of p j and defined on the range [A j , B j ]. We assume the mean demand is specified by a function y j (p j ) that captures the dependency between demand and price:

where y j (p j ) is continuous, nonnegative and three times differentiable. Let \(y^{\prime }_{j}(p_{j})\), \(y^{\prime \prime }_{j}(p_{j})\) and \(y^{\prime \prime \prime }_{j}(p_{j})\) denote the first, second and third derivative of y j (p j ).

Assumption 1

\(y_{j}^{\prime }(p_{j})\leq 0\) , \(y_{j}^{\prime \prime }(p_{j})\geq 0\) , p j y j (p j ) is concave in p j and \(p_{j} y^{\prime }_{j}(p_{j})\) is convex in p j .

The last concavity and convexity conditions amount to \(2y^{\prime }_{j}(p_{j})+p_{j} y^{\prime \prime }_{j}(p_{j}) \leq 0\) and \(2y^{\prime \prime }_{j}(p_{j})+p_{j} y^{\prime \prime \prime }_{j}(p_{j}) \geq 0\). The concavity condition was also used by Kocabiyikoglu and Popescu (2011). It can be easily verified that the following demand functions satisfy the conditions of Assumption 1:

-

i)

Linear: y j (p j ) = a j − b j p j , a j > 0, b j > 0, \(p_{j}\leq \frac {a_{j}}{b_{j}}\), j = 1,⋯ ,J.

-

ii)

Logarithmic: y j (p j ) = a j − b j ln(p j + 1), a j > 0, b j > 0, \(p_{j}\leq e^{\frac {a_{j}}{b_{j}}}-1\), j = 1,⋯ ,J.

-

iii)

Power: \(y_{j}(p_{j})=a_{j} - b_{j} p_{j}^{\gamma _{j}}\), a j > 0, b j > 0, 0<γ j ≤ 1, \(p_{j}\leq \left (\frac {a_{j}}{b_{j}}\right )^{\frac {1}{\gamma _{j}}}\), j = 1,⋯ ,J.

Note that the conditions p j smaller than some constants are only added to ensure positive demand.

In the literature, two types of demand functions are commonly used: the additive form where D j (p j , 𝜖 j ) = y j (p j ) + 𝜖 j , and the multiplicative form where D j (p j , 𝜖 j ) = y j (p)𝜖 j (Petruzzi and Dada 1999). For the additive demand model, we assume that E(𝜖 j ) = 0 and \(y_{j}(\bar {p}_{j})+A_{j}=0\) where \(\bar {p}_{j}\) is the maximum admissible level of p j . As discussed in Xu et al. (2010), this last condition will ensure a positive demand in the range of the price interval \([0,\bar {p}_{j}]\). For the multiplicative demand model, we assume that E(𝜖 j ) = 1 and \( y_{j}(\bar {p}_{j})=0\).

We assume that the random variable 𝜖 j has a continuous distribution F j (x) with density f j (x). Define the failure rate function of the 𝜖 j ’s distribution as:

and the generalized failure rate function as:

Assumption 2a

For each retailer j, the distribution of the random variable 𝜖 j has increasing failure rate (IFR) and \(\frac {1}{r_{j}(x)}\) is convex.

Assumption 2b

For each retailer j, the distribution of the random variable 𝜖 j has increasing generalized failure rate (IGFR) and \(\frac {1}{g_{j}(x)}\) is convex.

As discussed in Yao et al. (2006), the class of IFR distributions include: Uniform, Normal (as well as truncated Normal at zero), Exponential, Gamma (with shape parameter s ≥ 1), Beta (with parameters (r, s) being both ≥ 1), and Weibull distribution (with shape parameter s ≥ 1). The class of IGFR distributions generalizes that of IFR and include all previous distributions without parameters restrictions. It is also easy to check that all these distributions satisfy the conditions \(2 r^{\prime \prime }_{j}(x)-r_{j}(x)r^{\prime }_{j}(x)\geq 0\) and \(2 g^{\prime \prime }_{j}(x)-g_{j}(x)g^{\prime }_{j}(x)\geq 0\) which are required for the convexity of \(\frac {1}{r_{j}(x)}\) and \(\frac {1}{g_{j}(x)}\).

In the next subsections, we describe the equilibrium conditions of the retailers. We first focus on the additive demand case. We then turn to the multiplicative case.

3.3.1 Additive Demand Case

Let \(s_{j} = \sum \limits _{i=1}^{I} q_{ij}\) denote the total supply at retailer j obtained from all the manufacturers. If demand for the product does not exceed s j , then the revenue of retailer j is p j D j (p j , 𝜖 j ) and each of the s j − D j (p j , 𝜖 j ) leftovers is disposed at the unit salvage value \( \lambda _{j}^{+} \leq p_{j}\). Alternatively, if demand exceeds s j , then the revenue of retailer j is p j s j and each of the D j (p j , 𝜖 j ) − s j shortages incurs a per-unit shortage cost \(\lambda _{j}^{-}\). Let \(Q_{j}=(q_{ij})_{i=1}^{I}\). Then, the profit of retailer j, W j (Q j , p j ), is the difference between sales revenue and the total costs:

Defining z j = s j − y j (p j ), the profit W j (Q j , p j ) can be computed as:

The expected values of leftover and shortage of retailer j, \(e_{j}^{+}(z_{j})\) and \(e_{j}^{-}(z_{j})\) are computed as:

Therefore, each retailer j seeks to maximize its expected profit, π j (Q j , p j ) = E(W j (Q j , p j )):

Objective function (6) states that the expected profit of retailer j, which is the difference between the expected revenue and the sum of the expected leftover and shortage, the handling cost and the payout to the manufacturers, should be maximized.

Similar to Kocabiyikoglu and Popescu (2011), we define the lost-sales rate (LSR) elasticity for a given pair ( s j , p j ) as:

where \(\delta _{j}=\min \{\lambda _{j}^{-} -\lambda _{j}^{+},0\}.\) The LSR elasticity measures the percentage change in the rate of lost sales with respect to the percentage change in price. For each pair (s j , p j ), we define the set \({{\Gamma }_{j}^{1}}=\{(Q_{j},p_{j})\in {\mathbb {R}_{+}^{I+1}} \,|\, {\eta _{j}^{1}}(s_{j},p_{j})\geq 1/2\}\). The following results demonstrates that the set \({{\Gamma }^{1}_{j}}\) is convex, the function π j (Q j , p j ) is jointly concave in Q j and p j and the optimal solution \((Q_{j}^{*}, p_{j}^{*})\) belongs to the set \({{\Gamma }^{1}_{j}} \) under the conditions of Assumptions 1 and 2a.

Lemma 1

In the additive case, if conditions of Assumptions 1 and 2a are satisfied, then the set \({{\Gamma }^{1}_{j}}\) is convex.

Proof

See Appendix A. □

Theorem 1

In the additive case, if conditions of Assumptions 1 and 2a are satisfied, then the function π j (Q j , p j ) is jointly concave in Q j and p j in the set \({{\Gamma }^{1}_{j}}\).

Proof

See Appendix B. □

Proposition 1

In the additive case, if conditions of Assumptions 1 and 2a are satisfied, then the optimal solution \((Q_{j}^{*}, p_{j}^{*})\) belongs to the set \({{\Gamma }^{1}_{j}}\).

Proof

See Appendix C. □

Under the conditions of Theorem 1, the function π j (Q j , p j ) is jointly concave in Q j and p j and as pointed in Lemma 1, the set \({{\Gamma }^{1}_{j}}\) is convex therefore the optimality conditions for all retailers could be expressed simultaneously as the following variational inequality: Determine \((Q_{2}^{*},P_{2}^{*})\in {\Gamma }^{1} \subset \mathbb {R}_{+}^{IJ+J}\) satisfying:

where \(z_{j}^{*}=s_{j}^{*}-y_{j}(p_{j}^{*})\) and \({\Gamma }^{1}=\bigotimes \limits _{j=1}^{J}{{\Gamma }^{1}_{j}}\).

3.3.2 Multiplicative Demand Case

In the multiplicative demand case, the profit W j (Q j , p j ) can be written as:

where \(Q_{j}=(q_{ij})_{i=1}^{I}\) and \(z_{j}=\frac {s_{j}}{y_{j}(p_{j})}\). Therefore, the expected profit of retailer j is computed as:

Similar to the additive case, we define the lost-sales rate (LSR) elasticity for a given pair (s j , p j ) as:

and the set \({{\Gamma }^{2}_{j}}=\{(Q_{j},p_{j})\in \mathbb {R}_{+}^{I+1} \,|\, {\eta _{j}^{2}}(s_{j},p_{j})\geq 1/2\}\).

The following results demonstrates that the set \({{\Gamma }^{2}_{j}}\) is convex, the function π j (Q j , p j ) is jointly concave in Q j and p j and the optimal solution \((Q_{j}^{*}, p_{j}^{*})\) belongs to the set \({{\Gamma }^{2}_{j}}\) under the conditions of Assumptions 1 and 2b.

Lemma 2

In the multiplicative case, if conditions of Assumptions 1 and 2b are satisfied, then the set \({{\Gamma }^{2}_{j}}\) is convex.

Proof

See Appendix D. □

Theorem 2

In the multiplicative case, if conditions of Assumptions 1 and 2b are satisfied, then the function π j (Q j ,p j ) is jointly concave in Q j and p j in the set \({{\Gamma }^{2}_{j}}\).

Proof

See Appendix E. □

Proposition 2

In the multiplicative case, if conditions of Assumptions 1 and 2b are satisfied, then the optimal solution \((Q_{j}^{*}, p_{j}^{*})\) belongs to the set \({{\Gamma }^{2}_{j}}\).

Proof

See Appendix F. □

Under the conditions of Theorem 2, the function π j (Q j , p j ) is jointly concave in Q j and p j and as pointed in Lemma 2, the set \({{\Gamma }^{2}_{j}}\) is convex therefore the optimality conditions for all retailers could be expressed simultaneously as the following variational inequality: Determine \((Q_{3}^{*},P_{1}^{*})\in {\Gamma }^{2} \subset \mathbb {R}_{+}^{IJ+J}\) satisfying:

where \(z_{j}^{*}=\frac {s_{j}^{*}}{y_{j}(p_{j}^{*})}\) and \({\Gamma }^{2} =\bigotimes \limits _{j=1}^{J}{{\Gamma }^{2}_{j}}\).

3.4 Recovery Centers and their Equilibrium Conditions

Recovery centers are assumed to buy-back the amount of used product from consumers at various demand markets. Each recovery center m must decide jointly on the quantity to sell to the manufacturers and the buy-back price in order to cope with the random return while seeking to maximize its expected profit.

Corresponding to the recycling fees, recovery center m would obtain a subsidy equal to s rec from the corresponding environment protection agency for each unit of recyclable product (see Sheu et al. 2005). Before selling the reusable materials to the manufacturers in the original supply chain, each recovery center m must pick up, clean, inspect and disassemble the amount of used product incurring a unit recycling cost of \({c_{m}^{u}}\).

We assume that the return for the recyclable product associated to each recovery center m, R m (p m , 𝜖 m ), is random and depends on the buy-back price p m and a random variable 𝜖 m independent of p m and defined on the range [A m , B m ]. We assume the mean return is specified by a function y m (p m ) that captures the dependency between return and buy-back price:

where y m (p m ) is continuous, nonnegative and two times differentiable. Lets denote \(y^{\prime }_{m}(p_{m})\) and \(y^{\prime \prime }_{m}(p_{m})\) the first and second derivative of y m (p m ).

Assumption 3

\(y^{\prime }_{m}(p_{m})\geq 0\) , \(y_{m}^{\prime \prime }(p_{m})\leq 0\) and p m y m (p m ) is convex in p m .

The last convexity condition amount to \(2y^{\prime }_{m}(p_{m})+p_{m} y^{\prime \prime }_{m}(p_{m}) \geq 0\). It can be easily verified that the following supply functions satisfy the conditions of Assumption 3:

-

i)

Linear: \(y_{m}(p_{m}) = b_{m} p_{m}-a_{m}= b_{m} (p_{m}-{p_{m}^{0}})\), where \({p_{m}^{0}}=a_{m}/b_{m}\), b m > 0, m = 1,⋯ ,M.

-

ii)

Logarithmic: \(y_{m}(p_{m}) = b_{m} \ln (p_{m}+1) -a_{m}= b_{m} (\ln (p_{m}+1)-\ln ({p_{m}^{0}}+1))\), where \(\ln ({p_{m}^{0}}+1)=a_{m}/b_{m}\), b m > 0, m = 1,⋯ ,M.

-

iii)

Power: \(y_{m}(p_{m})=b_{m} p_{m}^{\gamma _{m}} -a_{m}=b_{m} (p_{m}^{\gamma _{m}}-{{p_{m}^{0}}}^{\gamma _{m}})\), where \(({{p_{m}^{0}}})^{\gamma _{m}}=a_{m}/b_{m}\), b m > 0, 0<γ m ≤ 1, m = 1,⋯ ,M,

Note that \({p_{m}^{0}}\) is used to simplify notations and it denotes the price over which the return becomes positive.

As in the retailer problem, two types of return functions are used in our model: the additive form where R m (p m , 𝜖 m ) = y m (p m ) + 𝜖 m , and the multiplicative form where R m (p m , 𝜖 m ) = y m (p m )𝜖 m . For the additive return model, we assume that E(𝜖 m ) = 0 and \(y_{m}(\bar {p}_{m})=0\) where \(\bar {p}_{m}\) is the minimum admissible level of p m . For the multiplicative return model, we assume that E(𝜖 m ) = 1 and \(y_{m}(\bar {p}_{m})\) =0.

In the next subsections, we describe the equilibrium conditions of the recovery centers. We first start with the additive return case. We then turn to the multiplicative case.

3.4.1 Additive Return Case

Let \(q_{m} = \sum \limits _{i=1}^{I} q_{mi}\) denote the total quantity shipped from recovery center m to all the manufacturers. If the actual transformed return quantity χ m R m is less than the total quantity q m , there is a unit understocking cost equal to \(\lambda _{m}^{-}+ {c_{m}^{u}}+c^{u} \bar {\chi }_{m}\). This is because recovery center m has to make an emergency call to acquire and clean used products from other markets to compensate the shortage so as to satisfy the total order from manufacturers. Once disassembled, the unit disposal cost of recovery center m for sending the unusable materials to the landfill is \(c^{u} \bar {\chi }_{m}\). If the actual transformed return quantity χ m R m is more than the quantity q m , there is a salvage value equal to \(\lambda _{m}^{+}\leq \lambda _{m}^{-}\). Therefore, the expected total cost of recovery center m is given by:

where the expected values of excess supply and shortage of recovery center m, \(e_{m}^{+}(z_{m})\) and \(e_{m}^{-}(z_{m})\) are computed as:

and \(z_{m} = \frac {q_{m}}{\chi _{m}}- y_{m}(p_{m})\). In equation (10), the total expected cost is the the sum of the recycling and disposal cost, the expected payout to the consumers, and the expected surplus and shortage. Given the above expected costs, each recovery center m seeks to maximize its expected profit:

where \(Q_{m}=(q_{mi})_{i=1}^{I}\).

The following theorem demonstrates that the function π m (q m i , p m ) is jointly concave in Q m and p m under the conditions of Assumption 3.

Theorem 3

In the additive case, if conditions of Assumption 3 are satisfied, then the function π m (Q m ,p m ) is jointly concave in Q m and p m .

Proof

See Appendix G. □

Under the conditions of Theorem 3, the function π m (q m i , p m ) is jointly concave in Q m and p m and therefore the optimality conditions for all recovery centers could be expressed simultaneously as the following variational inequality : Determine \((Q_{3}^{*},P_{1}^{*})\in \mathbb {R}_{+}^{MI+M}\) satisfying:

\(\forall (Q_{2},P_{2})\in \mathbb {R}_{+}^{MI+M}\), where \(z_{m}^{*}=\frac {q_{m}^{*}}{\chi _{m}}- y_{m}(p_{m}^{*})\).

3.4.2 Multiplicative Return Case

In the multiplicative demand case, the expected profit of recovery center m is given as:

where \(Q_{m}=(q_{mi})_{i=1}^{I}\) and \(z_{m}= \frac {q_{m}}{\chi _{m} y_{m}(p_{m})}\).

The following theorem demonstrates that the function π m (q m i , p m ) is jointly concave in Q m and p m under the conditions of Assumption 3.

Theorem 4

In the multiplicative case, if conditions of Assumption 3 are satisfied, then the function π m (Q m ,p m ) is jointly concave in Q m and p m .

Proof

See Appendix H. □

Under the conditions of Theorem 4, the function π m (q m i , p m ) is jointly concave in Q m and p m and therefore the optimality conditions for all recovery centers could be expressed simultaneously as the following variational inequality : Determine \((Q_{2}^{*},P_{2}^{*})\in \mathbb {R}_{+}^{MI+M}\) satisfying:

\(\forall (Q_{2},P_{2})\in \mathbb {R}_{+}^{MI+M}\), where \(z_{m}^{*}= \frac {q_{m}^{*}}{\chi _{m} y_{m}(p_{m}^{*})}\).

4 Equilibrium Conditions of the CLSC

4.1 Equilibrium Conditions

In equilibrium, we must have that the total reusable materials recovery centers could sell to all manufacturers should not exceed a fraction r of the transformed shipments of the total retailers’ supply:

Note that r is the return ratio of used products at all demand markets and the transformation rate χ m is allowed to depend on each recovery center m. Constraint (15) can be rewritten as:

where γ 2 is the Lagrange multiplier associated with constraint (15).

As in the supply chain equilibrium literature (e.g., Yang et al. 2009; Qiang et al. 2013), we must have that the sum of the optimality conditions for all raw material suppliers, as expressed by inequality (2), the optimality conditions for all manufacturers, as expressed by inequality (5), the optimality conditions for all retailers, as expressed by inequality (7) in the additive case and inequality (9) in the multiplicative case, and the optimality conditions for all recovery centers, as expressed by inequality (12) in the additive case and inequality (14) in the multiplicative case, must be satisfied.

Definition 1

(Closed-loop supply chain network equilibrium with random additive demand and return). The equilibrium state of the closed-loop supply chain with random additive demand and return is one where the flows between tiers of the network coincide, and the shipments and prices satisfy the sum of the optimality conditions (2), (5), (7), (12) and (16).

The summation of inequalities (2), (5), (7), (12) and (16) after algebraic simplification, yields the following result:

Theorem 5

The equilibrium conditions governing the closed-loop supply chain model with random additive demand and return are equivalent to the solution of the variational inequality problem given by: determine \((Q_{1}^{*},Q_{2}^{*},Q_{3}^{*}, P_{1}^{*},P_{2}^{*},\gamma _{1}^{*},\gamma _{2}^{*})\in {\Omega }\) satisfying

where \({\Omega } = \{(Q_{1},Q_{2},Q_{3},P_{1},P_{2},\gamma _{1},\gamma _{2})\in \mathbb {R}_{+}^{NI+MI+IJ+J+M+I+1}\,|\, (Q_{3},P_{1})\in {\Gamma }^{1}\}\).

Proof

The formulation is developed using the standard variational inequality theory (e.g., Nagurney (2013)). □

Definition 2

(Closed-loop supply chain network equilibrium with random multiplicative demand and return). The equilibrium state of the closed-loop supply chain with random multiplicative demand and return is one where the flows between tiers of the network coincide, and the shipments and prices satisfy the sum of the optimality conditions (2), (5), (9), (14) and (16).

The summation of inequalities (2), (5), (9), (14) and (16) after algebraic simplification, yields the following result:

Theorem 6

The equilibrium conditions governing the closed-loop supply chain model with random multiplicative demand and return are equivalent to the solution of the variational inequality problem given by: determine \((Q_{1}^{*},Q_{2}^{*},Q_{3}^{*}, P_{1}^{*},P_{2}^{*},\gamma _{1}^{*},\gamma _{2}^{*})\in {\Omega }\) satisfying

where \({\Omega } = \{(Q_{1},Q_{2},Q_{3},P_{1},P_{2},\gamma _{1},\gamma _{2})\in \mathbb {R}_{+}^{NI+MI+IJ+J+M+I+1}\,|\, (Q_{3},P_{1})\in {\Gamma }^{2} \}\).

For easy reference in the subsequent sections, variational inequalities (17) and (18) can be rewritten in standard variational inequality form as follows: determine X ∗ ∈ Ω, such that

where X≡(Q 1, Q 2, Q 3, P 1, P 2, γ 1, γ 2) and \(\mathcal {F}(x) \equiv (\mathcal {F}_{ni},\mathcal {F}_{mi},\mathcal {F}_{ij}, \mathcal {F}_{j}, \mathcal {F}_{m}, \mathcal {F}_{i},\mathcal {F}_{0})\) (with the specific components of \(\mathcal {F}(x)\) being given by the respective functional terms preceding the multiplication signs in (17) or (18)).

4.2 Qualitative Properties

In this section, we provide some qualitative properties of the solution to variational inequality (19). In particular, we derive existence and uniqueness results and investigate properties of the function \(\mathcal {F}\) that enters this variational inequality.

Since the feasible set is not compact, we cannot derive existence simply from the assumption of the continuity of the functions. Nevertheless, we can impose a rather weak condition to guarantee the existence of a solution.

Let Ω b ≡ {(Q 1, Q 2, Q 3, P 1, P 2, γ 1, γ 2)|0≤(Q 1, Q 2, Q 3, P 1, P 2, γ 1, γ 2)≤b} where b = (b 1, b 2, b 3, b 4, b 5, b 6, b 7) ≥ 0 and Q 1 ≤ b 1, Q 2 ≤ b 2, Q 3 ≤ b 3, P 1 ≤ b 4, P 2 ≤ b 5, γ 1 ≤ b 6, and γ 2 ≤ b 7. Indeed Ω b is a bounded closed convex subset of \(\mathbb {R}_{+}^{NI+MI+IJ+J+M+I+1}\).

Theorem 7

(Existence- Additive case). Suppose that there exist positive constants R 1 and S 1 such that

Then variational inequality ( 17 ) admits at least one solution.

Proof

Following the proof of Proposition 1 in Nagurney and Zhou (1993), it is possible to construct b 1, b 2, b 3, b 4, b 5, b 6 and b 7 large enough so that the variational inequality (17) will satisfy the following boundedness condition:

Thus, variational inequality (17) admits at least one solution X b ∈Ω b , from the standard theory of variational inequalities, since Ω b is compact and the functions are continuous. □

Theorem 8

(Existence- Multiplicative case). Suppose that there exist positive constants R 2 and S 2 such that

Then variational inequality ( 18 ) admits at least one solution.

Proof

Similar to the one used in Theorem 7. □

We now explore additional qualitative properties of the vector function \(\mathcal {F}\) that enters the variational inequality problem. In particular, we show that \(\mathcal {F}\) is monotone (strictly monotone), which is fundamental in establishing the convergence of the algorithmic scheme used to solve variational inequality (19).

Theorem 9

(Monotonicity) Assume the following cost functions, \({f^{r}_{n}},{f^{r}_{i}},{f^{u}_{i}},c_{ni}, c_{mi}\) , and c ij are convex. Further assume that the conditions in Theorem 1 (additive case) or Theorem 2 (multiplicative case) are satisfied for each j, j = 1, .., J and the conditions in Theorem 3 (additive case) or Theorem 4 (multiplicative case) are satisfied for each m, m = 1, ..., M. Then the vector function \(\mathcal {F}\) defined in ( 19 ) is monotone, that is,

Proof

See Appendix I. □

Theorem 10

(Uniqueness) Assume the following cost functions, \({f^{r}_{n}},{f^{r}_{i}},{f^{u}_{i}},c_{ni},c_{mi}\) , c ij and c j are strictly convex. Further assume that the conditions in Theorem 1 (additive case) or Theorem 2 (multiplicative case) are satisfied for each j, j = 1, .., J and the conditions in Theorem 3 (additive case) or Theorem 4 (multiplicative case) are satisfied for each m, m = 1, ..., M. Then variational inequality ( 19 ) admits a unique solution.

Proof

Under the strict convexity of the cost functions, \({f^{r}_{n}},{f^{r}_{i}},{f^{u}_{i}},c_{ni},c_{mi}\),and c i j , we can follow the proof of Theorem 9 to show that \(\mathcal {F}(x)\) is strictly monotone. Under the strict monotonicity of \(\mathcal {F}(x)\), uniqueness follows from the standard variational inequality theory. □

4.3 Solution Algorithm

The extragradient method of Khobotov (1987) is utilized to compute the solution of variational inequality (19). As discussed by Tinti (2005), the algorithm is guaranteed to converge if the function \(\mathcal {F}\) that enters the variational inequality is pseudomonotone (and that a solution exists). Details on the numerical complexity of the extragradient algorithm are outlined in Monteiro and Svaiter (2010), Monteiro and Svaiter (2012) and Huang et al. (2012).

After solving variational inequality (19), we can recover the equilibrium prices \(p_{ni}^{*}\), \(p_{mi}^{*}\) and \(p_{ij}^{*}\).

Take the prices \(p_{ni}^{*}\). Since the objective function (2) is continuously differentiable concave and the feasible set is convex, the Karush-Kuhn-Tucker optimality conditions, which represent optimality conditions for the variational inequality problem (see Facchinei et al. (1999)), take the form:

If there is a positive shipment quantity \(q_{ni}^{*}> 0\) then

Using the same argument, prices \(p_{mi}^{*}\) and \(p_{ij}^{*}\) are obtained as follows:

5 Numerical Examples

To illustrate the effects of randomness on the equilibrium solutions, we apply the extragradient algorithm to several numerical examples (e.g. Nagurney et al. (2002)). The algorithm is implemented in Matlab and has been successfully tested for validity on the numerical examples provided in Tinti (2005). The optimal solution of the deterministic model (Yang et al. 2009) will be used as a starting point in all numerical tests.

5.1 Impact of Model Parameters

Example 1.1

In the first basic example, we consider a closed-loop supply chain network consisting of two raw material suppliers, two manufacturers, two retailers and two recovery centers. The recycling fee, unit of subsidy and the unit cost of landfill are set to 8, 6 and 2, respectively ( f rec = 8, s rec = 6, c r = c u = 2). Also, we set \({\beta ^{i}_{u}} =\chi _{m} =0.7\), \({\beta ^{1}_{r}} =0.6\), \({\beta ^{2}_{r}} =0.7\), and r = 1. The transaction cost functions, procurement cost functions, production cost functions and handling cost functions faced by all supply chain members are given by:

The unit penalties of having excess supply/demand of retailers are given by:

The unit recycling cost, unit penalties of having excess supply/demand of recovery centers are given by:

The demand functions at retailer outlets are given by:

where, in this subsection, 𝜖 j is uniformly distributed in [−4,4] (additive model) and uniformly distributed in [0.8,1.2] (multiplicative model), j = 1,2.

Finally, the return functions associated to recovery centers are given by:

where, in this subsection, 𝜖 m is uniformly distributed in [−4,4] (additive model) and uniformly distributed in [0.8,1.2] (multiplicative model), m = 1,2.

Table 1 displays the optimal equilibrium solutions, the total revenue of all supply chain members, the number of iterations required for the convergence of the extragradient algorithm, and the CPU time (on a Dell Laptop with Intel Core i5 @2.4 GHz) for both deterministic (model of Yang et al. (2009)) and random (our model) cases. It is easy to show that the optimality/equilibrium conditions are satisfied with good accuracy. In contrast with the deterministic case, incorporating randomness in the model induces retailers to decrease their quantity shipments (\(q_{ij}^{*})\) implying shortage at each retail outlet ( z j < 0 in the additive case and z j < 1 in the multiplicative case). Also, recovery centers are facing shortage ( z m > 0 in the additive case and z m > 1 in the multiplicative case) based on the current shortage and salvage values. The optimal prices, the optimal quantities and the total revenue have all decreased due to uncertainty.

We have also tested the impact of demand and return distributions on the equilibrium solutions. We keep the same data as in Example 1.1 and for the additive model we tried different demands and return distributions. Table 1 displays the results for the uniform distribution \(\mathcal U[-4,4]\) with variance σ 2 = 64/12 ≈ 5.33, the Weibull distribution (shifted to have a mean of 0) with parameters λ = 2, k = 2 and variance σ 2 = 4 − π ≈ 0.85 and the normal distribution with mean μ = 0 and variance σ 2 = 4. Comparing the expected total profits of retailers and recovery centers \(({\Pi }_{j}^{*})\) and \(({\Pi }_{m}^{*})\), we observe higher total revenue in the Weibull distribution case and lower revenue in the uniform distribution case. This is due to the impact of the variance on the expected profits. The more variability in the distribution, the lower expected profits will be due to the increase in uncertainty.

In all future examples, all results reported correspond to the variational inequality (17) involving additive demand and return functions. We have tested the same examples using multiplicative demand and return functions and obtained comparable results.

Example 1.2 (Variant 1 of Example 1.1)

In Example 1.2, we increase the a j s associated with both retailers by 50 but keep the remainder of the data as in Example 1.1. This implies that the demand associated with each retailer outlet increases.

The extragradient method requires 10729 iterations for convergence and yields the new equilibrium pattern shown in the third column of Table 2. Observe that with a higher a j for each retailer, all quantity shipments increase since the demand increase at each retailer outlet and the optimal prices and expected profits also increase.

To study the effect of changing the parameter a j on the optimal prices \(p_{j}^{*}\) and quantities \(q_{ij}^{*}\), analytically, one notice that \(\frac {\partial ^{2} {\Pi }_{j}}{\partial p_{j} \partial a_{j}}= F_{j}(z_{j})+b_{j}(p_{j}+\lambda _{j}^{-} - \lambda _{j}^{+})f_{j}(z_{j})\ge 0\) and \(\frac {\partial ^{2} {\Pi }_{j}}{\partial s_{j} \partial a_{j}}= (p_{j}+\lambda _{j}^{-} - \lambda _{j}^{+})f_{j}(z_{j})\ge 0\). Therefore, the optimal price \(p_{j}^{*}\) and optimal quantity \(s_{j}^{*}\) both increase with a j .

Example 1.3 (Variant 2 of Example 1.1)

To construct Example 1.3, we keep the data as in Example 1.1, but now we decrease the a m s associated with both recovery centers by 5. Hence, the return amount associated to each recovery center decreases.

The extragradient algorithm converges in 9119 iterations and yields the new equilibrium pattern shown in the fourth column of Table 2. When the return amount associated to each recovery center decreases, buy-back prices p m increase and the reusable material shipments, \(q_{mi}^{*}\), as well as the expected profits, \(\pi _{m}^{*}\), decline due to the decrease of the return amount associated to each recovery center.

To study the effect of changing the parameter a m on the optimal prices \(p_{m}^{*}\) and quantities \(q_{mi}^{*}\), analytically, one notice that \(\frac {\partial ^{2} {\Pi }_{m}}{\partial p_{m} \partial a_{m}}= 1+b_{m}(\lambda _{m}^{-} - \lambda _{m}^{+})f_{m}(z_{m})\ge 0\) and \(\frac {\partial ^{2} {\Pi }_{m}}{\partial q_{m} \partial a_{m}}= -(\lambda _{m}^{-} - \lambda _{m}^{+})f_{m}(z_{m})/\chi _{m}\le 0\). Therefore, the optimal price \(p_{m}^{*}\) increases and optimal quantity \(q_{m}^{*}\) decreases with a m .

Example 1.4 (Variant 3 of Example 1.1)

In Example 1.4, we keep the same data as in Example 1.1 with the following change: we increase the weight associated with undersupply at all retail outlets from 2 to 250. Also, we set the weights associated with oversupply at all retail outlets to 0. Hence, we now have that \(\lambda _{j}^{+}=0,\,\lambda _{j}^{-}=250\) for j = 1, 2.

The extragradient method for this example requires 13301 iterations for convergence and yields the equilibrium pattern shown in the fifth column of Table 2. When the penalty associated with shortage increases and there is no salvage value on oversupply by each retailer, we obtain positive values of z j implying oversupply at each retail outlet. The total expected profit of each retailer has significantly decreased due to the high values of the shortage penalties.

To study the effect of changing the parameter \(\lambda _{j}^{-}\) on the optimal prices \(p_{j}^{*}\) and quantities \(q_{ij}^{*}\), analytically, one notice that \(\frac {\partial ^{2} {\Pi }_{j}}{\partial p_{j} \partial \lambda _{j}^{-}}= b_{j}(1-F_{j}(z_{j}))\ge 0\) and \(\frac {\partial ^{2} {\Pi }_{j}}{\partial s_{j} \partial \lambda _{j}^{-}}= 1-F_{j}(z_{j})\ge 0\). Therefore, the optimal price \(p_{j}^{*}\) and optimal quantity \(s_{j}^{*}\) both increase with \(\lambda _{j}^{-}\). The same analysis applies to \(\lambda _{j}^{+}\).

Example 1.5 (Variant 4 of Example 1.1)

The fifth numerical example is constructed from the first example with the data retained but with following change: we increase the weight associated with undersupply at all recovery centers from 100 to 250. Also, we set the weights associated with oversupply at all recovery centers to 0. Hence, we now have that \(\lambda _{m}^{+}=0,\,\lambda _{m}^{-}=250\) for m = 1, 2.

The extragradient method for this example requires 14516 iterations for convergence and yields the equilibrium pattern shown in the sixth column of Table 2. When the penalty associated with shortage increases and there is no salvage value on oversupply by each recovery center, we obtain negative values of z m implying oversupply at each recovery center. Note that the total expected profit of each recovery center has decreased due to the high values of the shortage penalties.

To study the effect of changing the parameter \(\lambda _{m}^{-}\) on the optimal prices \(p_{m}^{*}\) and quantities \(q_{mi}^{*}\), analytically, one notice that \(\frac {\partial ^{2} {\Pi }_{m}}{\partial p_{m} \partial \lambda _{m}^{-}}= b_{m} F_{m}(z_{m})\ge 0\) and \(\frac {\partial ^{2} {\Pi }_{m}}{\partial q_{m} \partial \lambda _{m}^{-}}= -F_{m}(z_{m})/\chi _{m}\le 0\). Therefore, the optimal price \(p_{m}^{*}\) increases and optimal quantity \(q_{m}^{*}\) decreases with \(\lambda _{m}^{-}\). The same analysis applies to \(\lambda _{m}^{+}\).

Example 1.6

The sixth numerical example consists of three raw material suppliers, two manufacturers, two retailers and two recovery centers. we retain the same functions and parameters as in Example 1.1 but now we add data for the third raw material supplier. In particular, we assume that the procurement costs and the transaction costs associated with the new supplier are of the same form as given above for the other raw material suppliers.

The extragradient algorithm converges in 2926 iterations and yields the new equilibrium pattern displayed in the seventh column of Table 2. Note that, in comparison to the results in Example 1, with the addition of a new raw material supplier, shipment quantities, \(q_{ni}^{*}\), prices, \(p^{*}_{ni}\), and expected profits, \(\pi ^{*}_{n}\), are now lower due to the competition.

5.2 Impact of Demand Functions

In this subsection, we test the impact of demand functions on the equilibrium solutions. We keep the same data as in Example 1.1. For the demand functions, we consider three examples. Example 3.1 corresponds to the linear demand case: y 1(p 1) = 290 − p 1; y 2(p 2) = 300 − p 2. Example 3.2 illustrates the logarithmic demand case: y 1(p 1) = 290−50ln(p 1 + 1); y 2(p 2) = 300 − 50ln(p 2 + 1). Example 3.3 corresponds to the power demand function: \(y_{1}(p_{1})=290 - 17 p_{1}^{0.5}; \,\, y_{2}(p_{2})=300- 17 p_{2}^{0.5}\). Table 3 displays the optimal equilibrium solutions, the total revenue of all supply chain members, the number of iterations required for the convergence of the extragradient algorithm, and the CPU time for these three examples. Comparing the quantities \(q_{ij}^{*}\), we observe lower values in the logarithmic demand case and higher values in the linear demand case. This is due to the impact of the rate of decrease of the expected demand y j (p j ) with respect to the retailer price \(p_{j}^{*}\). The faster demand decreases with respect to the retailer price \(p_{j}^{*}\), the lower quantities \(q_{ij}^{*}\) retailers will order from manufacturers. A decrease in \(q_{ij}^{*}\) will result in a decrease in the quantities \(q_{mi}^{*}\) and \(q_{ni}^{*}\), a decrease in the prices \(p_{mi}^{*}\), \(p_{ni}^{*}\), \(p_{ij}^{*}\) and \(p_{m}^{*}\) as well as a decrease in the expected profits \({\Pi }_{n}^{*}\), \({\Pi }_{i}^{*}\) and \({\Pi }_{m}^{*}\) and the total revenue. Note that the expected profits \({\Pi }_{j}^{*}\) have increased based on the current model parameters.

5.3 Impact of Return Functions

In this subsection, we test the impact of return functions on the equilibrium solutions. We keep the same data as in Example 1.1. For the return functions, we consider three examples. Example 4.1 corresponds to the linear return case: y 1(p 1) = p 1−35; y 2(p 2) = p 2−40. Example 4.2 illustrates the logarithmic return case: y 1(p 1) = 50ln(p 1 + 1)−179.176=50(ln(p 1 + 1) − ln(36)); y 2(p 2) = 50ln(p 1 + 1)−185.679 = 50(ln(p 1 + 1)−ln(41)). Example 4.3 corresponds to the power return function: \(y_{1}(p_{1})=25(p_{1}^{0.5}-35^{0.5}); \,\, y_{2}(p_{2})=30(p_{1}^{0.5}-40^{0.5})\). Table 3 displays the optimal equilibrium solutions, the total revenue of all supply chain members, the number of iterations required for the convergence of the extragradient algorithm, and the CPU time for these three examples. Comparing the quantities \(q_{mi}^{*}\), we observe higher values in the power return case and lower values in the linear return case. This is due to the impact of the rate of increase of the expected return y m (p m ) with respect to the buy-back price \(p_{m}^{*}\). The faster the return increases with respect to the price \(p_{m}^{*}\), the higher quantities \(q_{mi}^{*}\) manufacturers will order from recovery centers. An increase in \(q_{mi}^{*}\) will result in an increase in the quantities \(q_{ij}^{*}\) and \(q_{ni}^{*}\), an increase in the price \(p_{ni}^{*}\), as well as an increase in the expected profits \({\Pi }_{n}^{*}\), \({\Pi }_{j}^{*}\) and \({\Pi }_{i}^{*}\) and the total revenue. Note that the prices \(p_{ij}^{*}\), \(p_{mi}^{*}\) and \(p_{m}^{*}\) and the expected profits \({\Pi }_{m}^{*}\) have decreased based on the current model parameters.

6 Conclusion

In this paper, a new closed-loop supply chain network equilibrium model was developed allowing us to consider random demands and random returns in a closed-loop system consisting of raw material suppliers, manufacturers, retailers and recovery centers that collect the recycled product directly from consumers at demand markets.

Using additive and multiplicative functions to model randomness in demand and return, we derived the equilibrium conditions of all supply chain members and then showed they satisfy a variational inequality problem. Qualitative properties were discussed and a solution algorithm based on the extragradient method was suggested to solve the model.

Numerical examples illustrated the flexibility of the model and showed the effects of randomness on the equilibrium shipments and expected profits. With our model, one can fine-tune the model parameters, the demand and return distributions, as well as the demand and return functions to quantify the effects on the equilibrium shipments, prices and expected profits in the closed-loop supply chain, which can also generate some implications for policy makers. Moreover, although the cost functions in our examples are hypothetical, we believe that some interesting managerial implications are reported.

This work establishes the foundation for closed-loop supply chain (CLSC) network problems in the case of random demands and returns. The proposed model can serve as an experimental tool to assist managers and policy makers in the long-term operation of closed-loop supply chains under the concerns of uncertainty, environment and net revenues. Future research may include the development of a multiperiod CLSC network model that considers inventory management, and the integration of multiple products, quality depreciation of recycled materials and the quality of return collected from the demand markets into the closed-loop supply chain network.

References

Atkinson AA (1979) Incentives, uncertainty, and risk in the newsboy problem. Decis Sci 10(3):341–357

Bloomberg D, LeMay S, Hanna J (2002) Logistics. Prentice Hall

Chen L-H, Chen Y-C (2010) A multiple-item budget-constraint newsboy problem with a reservation policy. Omega 38(6):431–439

Dafermos S (1980) Traffic equilibrium and variational inequalities. Transp Sci 14(1):42–54

Dafermos S (1990) Exchange price equilibria and variational inequalities. Math Program 46(1):391–402

Dong J, Zhang D, Nagurney A (2004) A supply chain network equilibrium model with random demands. Eur J Oper Res 156(1):194–212

Facchinei F, Fischer A, Kanzow C, Peng J-M (1999) A simply constrained optimization reformulation of kkt systems arising from variational inequalities. Appl Math Optim 40(1):19–37

Feng Z, Wang Z, Chen Y (2014) The equilibrium of closed-loop supply chain supernetwork with time-dependent parameters. Transp Res Part E: Logist Transp Rev 64:1–11

Fleischmann M, Krikke HR, Dekker R, Flapper SDP (2000) A characterisation of logistics networks for product recovery. Omega 28(6):653–666

Friesz TL, Harker PT, Tobin RL (1984) Alternative algorithms for the general network spatial price equilibrium problem. J Reg Sci 24(4):475

Guide VDR, Van Wassenhove LN (2009) Or forum-the evolution of closed-loop supply chain research. Oper Res 57(1):10–18

Hammond D, Beullens P (2007) Closed-loop supply chain network equilibrium under legislation. Eur J Oper Res 183(2):895–908

He B-S, Xu W, Yang H, Yuan X-M (2011) Solving over-production and supply-guarantee problems in economic equilibria. Netw Spat Econ 11(1):127–138

Hu X, Ralph D (2007) Using epecs to model bilevel games in restructured electricity markets with locational prices. Oper Res 55(5):809–827

Huang D, Zhou H, Zhao Q-H (2011) A competitive multiple-product newsboy problem with partial product substitution. Omega 39(3):302–312

Huang N, Ma C, Liu Z (2012) A new extragradient-like method for solving variational inequality problems. Fixed Point Theory Appl 2012(1):1–14

Jiang H, Ralph D, Scholtes S (2004) Equilibrium problems with equilibrium constraints: A new modelling paradigm for revenue management, report. In: The 4th annual INFORMS revenue management and pricing section conference

Jiang H, Xu H (2008) Stochastic approximation approaches to the stochastic variational inequality problem. IEEE Trans Autom Control 53(6):1462–1475

Jofré A, Rockafellar RT, Wets RJ (2007) Variational inequalities and economic equilibrium. Math Oper Res 32(1):32–50

Khobotov EN (1987) Modification of the extra-gradient method for solving variational inequalities and certain optimization problems. USSR Comput Math Math Phys 27(5):120–127

Kocabiyikoglu A, Popescu I (2011) An elasticity approach to the newsvendor with price-sensitive demand. Oper Res 59(2):301–312

Metzler C, Hobbs BF, Pang J-S (2003) Nash-cournot equilibria in power markets on a linearized dc network with arbitrage: formulations and properties. Netw Spat Econ 3(2):123–150

Monteiro RD, Svaiter BF (2010) On the complexity of the hybrid proximal extragradient method for the iterates and the ergodic mean. SIAM J Optim 20 (6):2755–2787

Monteiro RD, Svaiter BF (2012) Iteration-complexity of a newton proximal extragradient method for monotone variational inequalities and inclusion problems. SIAM J Optim 22(3):914–935

Nagurney A (2013) Network economics: a variational inequality approach, vol 10. Springer Science & Business Media

Nagurney A, Toyasaki F (2005) Reverse supply chain management and electronic waste recycling: a multitiered network equilibrium framework for e-cycling. Transp Res Part E: Logist Transp Rev 41(1):1–28

Nagurney A, Zhang D (1996) On the stability of an adjustment process for spatial price equilibrium modeled as a projected dynamical system. J Econ Dyn Control 20(1):43–62

Nagurney A, Zhou L (1993) Networks and variational inequalities in the formulation and computation of market disequilibria: the case of direct demand functions. Transp Sci 27(1):151–161

Nagurney A, Dong J, Zhang D (2002) A supply chain network equilibrium model. Transp Res Part E: Logist Transp Rev 38(5):281–303

Oggioni G, Smeers Y, Allevi E, Schaible S (2012) A generalized nash equilibrium model of market coupling in the european power system. Netw Spat Econ 12(4):503–560

Petruzzi NC, Dada M (1999) Pricing and the newsvendor problem: a review with extensions. Oper Res 47(2):183–194

Qiang Q, Ke K, Anderson T, Dong J (2013) The closed-loop supply chain network with competition, distribution channel investment, and uncertainties. Omega 41(2):186–194

Ramezani M, Kimiagari AM, Karimi B, Hejazi TH (2014) Closed-loop supply chain network design under a fuzzy environment. Knowl-Based Syst 59:108–120

Ravat U, Shanbhag UV (2011) On the characterization of solution sets of smooth and nonsmooth convex stochastic nash games. SIAM J Optim 21(3):1168–1199

Shao H, Lam WH, Tam ML (2006) A reliability-based stochastic traffic assignment model for network with multiple user classes under uncertainty in demand. Netw Spat Econ 6(3–4):173–204

Sherali HD, Soyster AL, Murphy FH (1983) Stackelberg-nash-cournot equilibria: characterizations and computations. Oper Res 31(2):253–276

Sheu J-B, Chou Y-H, Hu C-C (2005) An integrated logistics operational model for green-supply chain management. Transp Res Part E: Logist Transp Rev 41(4):287–313

Shi J, Zhang G, Sha J (2011) Optimal production planning for a multi-product closed loop system with uncertain demand and return. Comput Oper Res 38(3):641–650

Sobel MJ et al (1971) Noncooperative stochastic games. Ann Math Stat 42(6):1930–1935

Souza GC (2013) Closed-loop supply chains: a critical review, and future research*. Decis Sci 44(1):7–38

Sun X, Li Y, Govindan K, Zhou Y (2013) Integrating dynamic acquisition pricing and remanufacturing decisions under random price-sensitive returns. Int J Adv Manuf Technol 68(1–4):933–947

Takayama T, Judge GG (1971) Spatial and temporal price and allocation models. Technical report, North-Holland Amsterdam

Thierry M, Salomon M, Van Nunen J, Van Wassenhove L (1995) Strategie issues in product recovery management. Calif Manage Rev 37(2):114–135

Tinti F (2005) Numerical solution for pseudomonotone variational inequality problems by extragradient methods. In: Variational analysis and applications. Springer, pp 1101–1128

Xu M, Chen YF, Xu X (2010) The effect of demand uncertainty in a price-setting newsvendor model. Eur J Oper Res 207(2):946–957

Yang G-F, Wang Z-P, Li X-Q (2009) The optimization of the closed-loop supply chain network. Transp Res Part E: Logist Transp Rev 45(1):16–28

Yao L, Chen YF, Yan H (2006) The newsvendor problem with pricing: extensions. Int J Manag Sci Eng Manag 1(1):3–16

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Proof of Lemma 1

Knowing that \(y^{\prime }_{j}(p_{j})<0\), one sees that \(-(p_{j}+\delta _{j}) y_{j}^{\prime }(p_{j})r_{j}(z_{j})\ge \frac {1}{2}\) is equivalent to M j (s j , p j )≤0 where \(M_{j}(s_{j},p_{j})=\frac {1}{r_{j}(z_{j})}+2(p_{j}+\delta _{j})y_{j}^{\prime }(p_{j})\). It is easy to verify that:

Note that \(\frac {\partial ^{2} M_{j}}{\partial {s_{j}^{2}}}\ge 0\) if \(2(r_{j}^{\prime }(z_{j}))^{2}-r_{j}(z_{j}) r_{j}^{\prime \prime }(z_{j})\ge 0\). The determinant of the hessian of M j , given by \({\Delta }_{j}=\frac {\partial ^{2} M_{j}}{\partial {s_{j}^{2}}}\frac {\partial ^{2} M_{j}}{\partial {p_{j}^{2}}}-\left (\frac {\partial ^{2} M_{j}}{\partial s_{j}p_{j}}\right )^{2}\) simplifies to

From Assumptions 1 and 2a, \(2(r_{j}^{\prime }(z_{j}))^{2}-r_{j}(z_{j}) r_{j}^{\prime \prime }(z_{j})\ge 0\), \(r_{j}^{\prime }(z_{j})\ge 0\), \(2y_{j}^{\prime \prime }(p_{j})+p_{j}y^{\prime \prime \prime }(p_{j})\ge 0\) and \(y_{j}^{\prime \prime }(p_{j})\ge 0\) therefore Δ j has the same sign as \(2y_{j}^{\prime \prime }(p_{j})+(p_{j}+\delta _{j})y^{\prime \prime \prime }(p_{j})\). For y ″′(p j ) ≥ 0, one notice that \(2y_{j}^{\prime \prime }(p_{j})+(p_{j}+\delta _{j})y^{\prime \prime \prime }(p_{j})\ge 0 \) Since y ″(p j ) ≥ 0 and \(p_{j}+\delta _{j}\ge p_{j}-\lambda _{j}^{+}\ge 0\). Next for y ″′(p j )≤0, \(2y_{j}^{\prime \prime }(p_{j})+(p_{j}+\delta _{j})y^{\prime \prime \prime }(p_{j})\ge 0 \) since \(2y_{j}^{\prime \prime }(p_{j})+p_{j}y^{\prime \prime \prime }(p_{j})\ge 0\) by Assumption 1 and δ j y ″′(p j ) ≥ 0 since δ j ≤ 0 by definition. Hence Δ j ≥ 0 implying that the function M j is convex which in turn implies that the set \({{\Gamma }^{1}_{j}}\) is convex.

Appendix B: Proof of Theorem 1

First, without loss of generality, assume that \(p_{Ij}^{*}=\min \limits _{j} \{p_{ij}^{*}\}\). Optimization problem (6) can then be formulated as follows:

where \(\tilde {Q}_{j}=(q_{ij})_{i=1}^{I-1}\), \({{\Pi }_{j}^{1}}(s_{j},p_{j})=p_{j} y_{j}(p_{j}) -(p_{j}+\lambda _{j}^{-}) e_{j}^{-}(z_{j})+ \lambda _{j}^{+} e_{j}^{+}(z_{j}) - c_{j} s_{j} -p_{Ij}^{*} s_{j}\) and \({{\Pi }_{j}^{2}}(\tilde {Q}_{j})=- \sum \limits _{i=1}^{I-1} (p_{ij}^{*}-p_{Ij}^{*}) q_{ij}\).

Clearly, the function \({{\Pi }_{j}^{2}}(\tilde {Q}_{j})\) is concave. We need to prove that \({{\Pi }_{j}^{1}}(s_{j},p_{j})\) is concave. One easily verifies that the first derivative of \({{\Pi }_{j}^{1}}\) with respect to s j and p j are given by

Straightforward computations show that:

Let H j denotes the hessian matrix associated with \({{\Pi }_{j}^{1}}(s_{j},p_{j})\). The matrix H j is computed as:

with \(H_{s_{j}s_{j}}=- \left (p_{j}+\lambda _{j}^{-}-\lambda _{j}^{+}\right ) f_{j}(z_{j}), H_{p_{j}s_{j}}=H_{s_{j}p_{j}}=y^{\prime }_{j}(p_{j}) \left (p_{j}+\lambda _{j}^{-}-\lambda _{j}^{+}\right ) f_{j}(z_{j})+1-F_{j}(z_{j})\)and \(H_{p_{j}p_{j}}=-y_{j}^{\prime }(p_{j})^{2}\left (p_{j}+\lambda _{j}^{-}-\lambda _{j}^{+}\right ) f_{j}(z_{j})+2y_{j}^{\prime }(p_{j}) F_{j}(z_{j})+y_{j}^{\prime \prime }(p_{j}) \left [\left (p_{j}+\lambda _{j}^{-}-\lambda _{j}^{+}\right )\right . \left .F_{j}(z_{j})-\lambda _{j}^{-}\right ]\).

We will show that the matrix − H j is positive definite. Clearly, \(-H_{s_{j}s_{j}} =\left (p_{j}+\lambda _{j}^{-}-\lambda _{j}^{+}\right ) f_{j}(z_{j})>0\). If we show that d e t( − H j ) ≥ 0 then \(-H_{p_{j}p_{j}}\geq \frac {\left (H_{p_{j} s_{j}}\right )^{2}}{-H_{s_{j}s_{j}}}\geq 0\). d e t( − H j ) is calculated as:

The first term in the above is nonnegative because \(2 y^{\prime }_{j}(p_{j})+ p_{j} y_{j}^{\prime \prime }(p_{j})\leq 0 \). The second term is also nonnegative because \(y_{j}^{\prime \prime }(p_{j})\geq 0\). The last term is nonnegative since it can be written as \(2 (1-F_{j}(z_{j}))^{2}\left [\eta ^{1}_{j}(s_{j},p_{j})-1/2\right ]+2 (1-F_{j}(z_{j}))^{2}\max (\lambda _{j}^{-}-\lambda _{j}^{+},0)(-y_{j}^{\prime }(p_{j})r_{j}(z_{j}))\) and \({\eta ^{1}_{j}}(s_{j},p_{j})\ge 1/2\). Hence, we have d e t( − H j ) ≥ 0 implying that the matrix − H j is positive definite. Therefore, \({{\Pi }_{j}^{1}}\) is concave in the set \({{\Gamma }^{1}_{j}}\).

Appendix C: Proof of Proposition 1

We need to show that the optimal vector \((s_{j}^{*},p_{j}^{*})\) belongs to the set \({{\Gamma }^{1}_{j}}\). In other words, we will show that \({\eta _{j}^{1}}(s_{j},p_{j})\ge 1/2\) when \(\frac {{\partial {\Pi }_{j}^{1}}}{\partial p_{j}}=0\).

Since \(y_{j}^{\prime }(p_{j})\le 0\) and \(y_{j}(p_{j})-e_{j}^{-}(z_{j})\ge 0\) one see that when \(\frac {{\partial {\Pi }_{j}^{1}}}{\partial p_{j}}=0\) one has \((p_{j}+\lambda _{j}^{-}-\lambda _{j}^{+})F_{j}(z_{j})-\lambda _{j}^{-} > 0\).

The last inequality holds if y j (p j ) + κ j (z j ) ≥ 0 where \(\kappa _{j}(z_{j})=-e^{-}_{j}(z_{j})-\frac {F_{j}(z_{j})}{2r_{j}(z_{j})}.\) Note that κ j (A j ) = A j and \(\kappa _{j}^{\prime }(z_{j})=\frac {1-F_{j}(z_{j})}{2}+\frac {r^{\prime }(z_{j})F(z_{j})}{2r_{j}(z_{j})^{2}}\geq 0\) because \(r_{j}^{\prime }(z_{j})\geq 0\). This yields κ j (z j ) ≥ A j for all z j ∈[A j , B j ]. Then \(y_{j}(p_{j})+\kappa _{j}(z_{j})\ge y_{j}(\bar {p}_{j})+A_{j} =0\). Therefore, \({\eta _{j}^{1}}(s_{j},p_{j})\ge 1/2\) when \(\frac {{\partial {\Pi }_{j}^{1}}}{\partial p_{j}}=0\).

Appendix D: Proof of Lemma 2

Knowing that z j = s j /y j (p j ) ≥ 0, one sees that \(\frac {-(p_{j}+\delta _{j}) y_{j}^{\prime }(p_{j})g_{j}(z_{j})}{y_{j}(p_{j})}\ge \frac {1}{2}\) is equivalent to N j (s j , p j )≤0 where \(N_{j}(s_{j},p_{j})=\frac {y_{j}(p_{j})}{g_{j}(z_{j})}+2(p_{j}+\delta _{j})y_{j}^{\prime }(p_{j})\). It is easy to check that:

Note that \(\frac {\partial ^{2} N_{j}}{\partial {s_{j}^{2}}}\ge 0\) if \(2(g_{j}^{\prime }(z_{j}))^{2}-g_{j}(z_{j}) g_{j}^{\prime \prime }(z_{j})\ge 0\). The determinant of the hessian of N j is given by

From Assumptions 1 and 2b, \(2(g_{j}^{\prime }(z_{j}))^{2}-g_{j}(z_{j}) g_{j}^{\prime \prime }(z_{j})\ge 0\), \(g_{j}^{\prime }(z_{j})\ge 0\), \(2y_{j}^{\prime \prime }(p_{j})+p_{j}y^{\prime \prime \prime }(p_{j})\ge 0\) and \(y_{j}^{\prime \prime }(p_{j})\ge 0\) therefore Θ j has the same sign as \(2y_{j}^{\prime \prime }(p_{j})+(p_{j}+\delta _{j})y^{\prime \prime \prime }(p_{j})\). For y ″′(p j ) ≥ 0, one notice that \(2y_{j}^{\prime \prime }(p_{j})+(p_{j}+\delta _{j})y^{\prime \prime \prime }(p_{j})\ge 0 \) since y ″(p j ) ≥ 0 and \(p_{j}+\delta _{j}\ge p_{j}-\lambda _{j}^{+}\ge 0\). Next for y ″′(p j )≤0, \(2y_{j}^{\prime \prime }(p_{j})+(p_{j}+\delta _{j})y^{\prime \prime \prime }(p_{j})\ge 0 \) since \(2y_{j}^{\prime \prime }(p_{j})+p_{j}y^{\prime \prime \prime }(p_{j})\ge 0\) by Assumption 1 and δ j y ″′(p j ) ≥ 0 since δ j ≤ 0 by definition. Hence Θ j ≥ 0 implying that the function N j is convex. We can then conclude that the set \({{\Gamma }^{2}_{j}}\) is convex.

Appendix E: Proof of Theorem 2

As in the additive case, optimization problem (8) can be reformulated as:

where \(\tilde {Q}_{j}=(q_{ij})_{i=1}^{I-1}\), \({{\Pi }_{j}^{1}}(s_{j},p_{j})=p_{j} y_{j}(p_{j})(1- e_{j}^{-}(z_{j}))+y_{j}(p_{j})\left ( \lambda _{j}^{+} e_{j}^{+}(z_{j}) - \lambda _{j}^{-} e_{j}^{-}(z_{j})\right ) - c_{j} s_{j}-p_{Ij}^{*} s_{j}\)and \({{\Pi }_{j}^{2}}(\tilde {Q}_{j})=- \sum \limits _{i=1}^{I-1} (p_{ij}^{*}-p_{Ij}^{*}) q_{ij}\).

Clearly, the function \({{\Pi }_{j}^{2}}(\tilde {Q}_{j})\) is concave. We need to prove that \({{\Pi }_{j}^{1}}(s_{j},p_{j})\) is concave. Let us consider the first derivative of \({{\Pi }_{j}^{1}}\) taken with respect to s j and p j :

Straightforward computations show that:

Let H j denotes the hessian matrix associated with \({{\Pi }_{j}^{1}}(s_{j},p_{j})\). The matrix H j is computed as:

with \(H_{s_{j}s_{j}}=- \frac {1}{y_{j}(p_{j})}\left (p_{j}+\lambda _{j}^{-}-\lambda _{j}^{+}\right ) f_{j}(z_{j}), H_{p_{j}s_{j}}=H_{s_{j}p_{j}}=\frac {z_{j}}{y_{j}(p_{j})}y^{\prime }_{j}(p_{j})\left (p_{j}+\lambda _{j}^{-}-\lambda _{j}^{+}\right ) f_{j}(z_{j})+1-F_{j}(z_{j})\) and

We will show that the matrix − H j is positive definite. Clearly, \(-H_{s_{j}s_{j}} =\frac {1}{y_{j}(p_{j})}\left (p_{j}+\lambda _{j}^{-}-\lambda _{j}^{+}\right ) f_{j}(z_{j})\) is positive. If d e t( − H j )>0 then \(-H_{p_{j}p_{j}}> \frac {\left (H_{p_{j} s_{j}}\right )^{2}}{-H_{s_{j}s_{j}}}> 0\).

The first term in the above is nonnegative because \(2 y^{\prime }_{j}(p_{j})+ p_{j} y_{j}^{\prime \prime }(p_{j})\leq 0 \). The second term is also nonnegative because \(y_{j}^{\prime \prime }(p_{j})\geq 0\). The last term is nonnegative since it can be written as \(2 (1-F_{j}(z_{j}))^{2}\left [\eta ^{2}_{j}(s_{j},p_{j})-1/2\right ]+2 (1-F_{j}(z_{j}))^{2}\max (\lambda _{j}^{-}-\lambda _{j}^{+},0) \frac {-y_{j}^{\prime }(p_{j})g_{j}(z_{j})}{y_{j}(p_{j})}\) and \({\eta ^{2}_{j}}(s_{j},p_{j})\ge 1/2\). Hence, we have d e t( − H j ) ≥ 0 implying that the matrix − H j is positive definite. Therefore, \({{\Pi }_{j}^{1}}\) is concave in the set \({{\Gamma }^{2}_{j}}\).

Appendix F: Proof of Proposition 2

We need to show that the optimal vector \((s_{j}^{*},p_{j}^{*})\) belongs to the set \({{\Gamma }^{2}_{j}}\). In other words, we need to show that \({\eta _{j}^{2}}(s_{j},p_{j})\ge 1/2\) when \(\frac {{\partial {\Pi }_{j}^{1}}}{\partial p_{j}}=0\).

Since \(y_{j}^{\prime }(p_{j})\le 0\) and \({\int }_{A_{j}}^{z_{j}}xf_{j}(x)\,dx+z_{j}(1-F_{j}(z_{j}))\ge 0\) one see that when \(\frac {{\partial {\Pi }_{j}^{1}}}{\partial p_{j}}=0\) one has \(\left (p_{j}+\lambda _{j}^{-}-\lambda _{j}^{+}\right ){\int }_{A_{j}}^{z_{j}}xf_{j}(x)\,dx -\lambda _{j}^{-}> 0\).

The last inequality holds if ψ j (z j ) ≥ 0 where \(\psi _{j}(z_{j})={\int }_{A_{j}}^{z_{j}}xf_{j}(x)\,dx+z_{j}(1-F_{j}(z_{j}))-\frac {{\int }_{A_{j}}^{z_{j}}xf_{j}(x)\,dx}{2g_{j}(z_{j})}.\) Note that ψ j (A j ) = A j and \(\psi _{j}^{\prime }(z_{j})=\frac {1-F_{j}(z_{j})}{2}+\frac {g_{j}^{\prime }(z_{j}){\int }_{A_{j}}^{z_{j}}xf_{j}(x)\,dx}{2g_{j}(z_{j})^{2}}\geq 0\) because \(g_{j}^{\prime }(z_{j})\geq 0\). This yields ψ j (z j ) ≥ A j for all z j ∈[A j , B j ]. Then ψ j (z j ) ≥ 0. Therefore, \({\eta _{j}^{2}}(s_{j},p_{j})\ge 1/2\) when \(\frac {{\partial {\Pi }_{j}^{1}}}{\partial p_{j}}=0\).

Appendix G: Proof of Theorem 3

As in the retailer case, without loss of generality, we assume that \(p_{mI}^{*}=\max \limits _{i} \{p_{mi}^{*}\}\). Optimization problem (11) can be then reformulated as:

where \(\tilde {Q}_{m}=(q_{mi})_{i=1}^{I-1}\), \( {{\Pi }_{m}^{1}}(q_{m},p_{m})=p_{mI}^{*} q_{m} + s^{rec}y_{m}(p_{m}) -\left ({c_{m}^{u}}+c^{u} \bar {\chi }_{m}\right )q_{m} -p_{m} y_{m}(p_{m})+\lambda _{m}^{+} e_{m}^{+}(z_{m}) - \lambda _{m}^{-} e_{m}^{-}(z_{m})\)and \({{\Pi }_{m}^{2}}(\tilde {Q}_{m})=\sum \limits _{i=1}^{I-1} (p_{mi}^{*}-p_{mI}^{*})q_{mi}\).

Clearly, the function \({{\Pi }_{m}^{2}}(\tilde {Q}_{m})\) is concave. We need to show that \({{\Pi }_{m}^{1}}(q_{m},p_{m})\) is concave. The first derivative of \({{\Pi }_{m}^{1}}\) taken with respect to q m and p m and are given as:

Straightforward computations show that:

Let H m denotes the hessian matrix associated with \({{\Pi }_{m}^{1}}(q_{m},p_{m})\). The matrix H m is calculated as:

with \(H_{q_{m}q_{m}}=-\frac {1}{{\chi _{m}^{2}}} \left (\lambda _{m}^{-}-\lambda _{m}^{+}\right ) f_{m}(z_{m}), H_{p_{m}q_{m}}=H_{q_{m}p_{m}}=\frac {y^{\prime }_{m}(p_{m})}{\chi _{m}}\left (\lambda _{m}^{-}-\lambda _{m}^{+}\right ) f_{m}(z_{m})\)and \(H_{p_{m}p_{m}}=-y_{m}^{\prime }(p_{m})^{2}\left (\lambda _{m}^{-}-\lambda _{m}^{+}\right ) f_{m}(z_{m})-2y_{m}^{\prime }(p_{m}) +y^{\prime \prime }_{m}(p_{m}) \left [\left (\lambda _{m}^{-}-\lambda _{m}^{+}\right )F_{m}(z_{m})+s^{rec}-p_{m}+\lambda _{m}^{+}\right ]\).

We will show that the matrix − H m is positive definite. Clearly, \(-H_{q_{m}q_{m}} =\frac {1}{{\chi _{m}^{2}}} \left (\lambda _{m}^{-}-\lambda _{m}^{+}\right ) f_{m}(z_{m})>0.\) If d e t( − H m ) ≥ 0 then \(-H_{p_{m}p_{m}}\ge \frac {\left (H_{p_{m} q_{m}}\right )^{2}}{-H_{q_{m}q_{m}}}\ge 0\).

The first part of the last term is nonnegative because \(2 y^{\prime \prime }_{m}(p_{m})+ p_{m} y_{m}^{\prime \prime }(p_{m})\geq 0 \). The second part is also nonnegative because \(y_{m}^{\prime \prime }(p_{m})\leq 0\). Hence, we have d e t( − H m ) ≥ 0 implying that the matrix − H m is positive definite. Therefore, \({{\Pi }_{m}^{1}}\) is concave.

Appendix H: Proof of Theorem 4

Similar to the additive case, optimization problem (13) can be reformulated as:

where \(\tilde {Q}_{m}=(q_{mi})_{i=1}^{I-1}\), \( {{\Pi }_{m}^{1}}(q_{m},p_{m})=p_{mI}^{*} q_{m} + s^{rec}y_{m}(p_{m}) -\left ({c_{m}^{u}}+c^{u} \bar {\chi }_{m}\right )q_{m} -p_{m}y_{m}(p_{m})+y_{m}(p_{m})\left (\lambda _{m}^{+} e_{m}^{+}(z_{m}) - \lambda _{m}^{-} e_{m}^{-}(z_{m})\right )\)and \({{\Pi }_{m}^{2}}(\tilde {Q}_{m})=\sum \limits _{i=1}^{I-1} (p_{mi}^{*}-p_{mI}^{*})q_{mi}\).

Clearly, the function \({{\Pi }_{m}^{2}}(\tilde {Q}_{m})\) is concave. We need to show that \({{\Pi }_{m}^{1}}(q_{m},p_{m})\) is concave. The first derivative of \({{\Pi }_{m}^{1}}\) taken with respect to q m and p m and are computed as:

Straightforward computations show that:

Let H m denotes the hessian matrix associated with \({{\Pi }_{m}^{1}}(p_{m},p_{m})\). The matrix H m is calculated as: