Abstract

This paper includes 10 summaries for energy resource commodities including coal and unconventional resources, and an analysis of energy economics and technology prepared by committees of the Energy Minerals Division of the American Association of Petroleum Geologists. Unconventional energy resources, as used in this report, are those energy resources that do not occur in discrete oil or gas reservoirs held in structural or stratigraphic traps in sedimentary basins. Such resources include coalbed methane, oil shale, U and Th deposits and associated rare earth elements of industrial interest, geothermal, gas shale and liquids, tight gas sands, gas hydrates, and bitumen and heavy oil. Current U.S. and global research and development activities are summarized for each unconventional energy resource commodity in the topical sections of this report, followed by analysis of unconventional energy economics and technology.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Paul C. Hackley, Footnote 1 Peter D. Warwick 1

The Energy Minerals Division (EMD) of the American Association of Petroleum Geologists (AAPG) is a membership-based technical interest group having the primary goal of advancing the science of geology, especially as it relates to exploration, discovery, and production of unconventional energy resources. Research on unconventional energy resources changes rapidly, and exploration and development efforts for these resources are constantly expanding. Ten summaries derived from 2015 committee reports presented at the EMD Annual Meeting in Denver, Colorado in May 2015, are contained in this review. The complete set of committee reports is available to AAPG members at http://emd.aapg.org/members_only/. This report updates the 2006, 2009, 2011, and 2103 EMD unconventional energy reviews published in this journal (American Association of Petroleum Geologists, Energy Minerals Division 2007, 2009, 2011, 2014a).

Included herein are reviews of research activities in the U.S., Canada, and other regions of the world related to coal, coalbed methane, oil shale, U and Th deposits and associated rare earth elements of industrial interest, geothermal, gas shale and liquids, tight gas sands, gas hydrates, and bitumen and heavy oil. An analysis of energy economics and technology as related to unconventional resource commodities also is included. Please contact the individual authors for additional information about the topics covered in each section of this report. The following website provides more information about all unconventional resources and the AAPG-EMD: http://emd.aapg.org.

Coal

William A. Ambrose Footnote 2

World Overview and Future Technology Issues

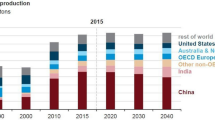

Coal still is the second largest energy commodity worldwide, exceeded only by oil. The world’s top 10 coal-producing countries since 2012 account for about 90% of the world’s total coal production, with China being the top coal-producing and -consuming country and Indonesia and Australia the top coal-exporting countries (Table 1). This report focuses on coal production in the top-three coal-producing countries (China, U.S., and India), which together represented ~65% of the world’s coal production [~5.16 billion metric tons (5.68 billion short tons, or bst)] at the beginning of 2013 (EIA 2015a). Brief highlights of other leading coal-producing countries are featured at the end of this report.

Over 30% of the world’s total energy demand and >40% of generated electricity comes from coal (World Coal Association 2015). The challenge for coal in the 21st century will be improving technology for electricity from coal to address increases in CO2 emissions, while at the same time continuing to provide access to energy for developing countries. A large portfolio of technologies including advanced power generation (high thermal efficiency) and CCS (carbon capture and storage) must be demonstrated and deployed to realize significant GHG (greenhouse gas) reductions from coal use. Lowering CO2 emissions from coal-fueled power plants will require an increase in thermal efficiency. The IEA roadmap for technology involving electricity generated from coal with CCS currently envisages slightly less than 280 gigawatts (GW) of CCS-equipped power plants worldwide by 2030. Roughly 630 GW of coal-fueled power plants with CCS would be required by 2050.

Coal Markets and Supply

A current global oversupply of coal, with surpluses at roughly 10 million metric tons [~11 million short tons (mst)] in 2014, has led to a downturn in global coal prices (Reuters 2014). This will move coal prices below profitable levels for many coal producers in 2015 and 2016, with the result of some mines having to close or suspend operations until more favorable prices return. Worldwide coal prices have been reduced by as much as 50% in the past 3 years because of increased production from exporters that include the U.S., Australia, South Africa, Indonesia, and Colombia. Reuters (2014) reported that the oversupply for seaborne steam (thermal) coal, used primarily for generation of electricity, was estimated by coal traders and analysts to range from 7 to 12 million metric tons (7.7–13.2 mst), and surplus coal could continue to be problematic into 2016. Demand for thermal coal in Asia, particularly in China, is slowing. Economic growth in China has recently slackened, and in combination with pressure from the government to use more natural gas to mitigate air-pollution problems, some coal mines may close. However, demand may pick up in 2016 as the thermal coal oversupply begins to fall as a result of coal mine closures. In other Asian markets, Indian utilities may require more imported coal if Coal India cannot meet demand. This could result in a 6% increase in demand to almost 790 million metric tons (~ 871 mst) by the end of fiscal year 2015.

China

China continues to be the number one producer and consumer of coal in the world (World Coal Association 2014), using more coal than the U.S., Europe, and Japan combined (Moore 2011; Vince 2012; Sweet 2013). China produced more than 4.2 billion metric tons (~ 4.37 bst) of coal in 2013 (EIA 2015b). China accounts for almost half of the world’s coal consumption (~78 quadrillion BTUs [British Thermal Units]) and is the world’s largest power generator (EIA 2015b). China possessed an estimated 122.5 billion metric tons (126 bst) of recoverable coal reserves in 2011, equivalent to ~13% of the world’s total coal reserves. China, as of 2012, had more than 18,000 coal mines, of which 95% were underground mines producing primarily bituminous coal, anthracite, and lignite (World Coal Association 2015). Much of China’s thermal coal resources occur in the north-central and northwestern parts of the country. In contrast, coking (metallurgical) coal reserves are found mostly in central and coastal parts of China.

Roughly two-thirds of coal in China is used for power generation (EIA 2015b). China has been a net coal importer since 2009, with recent increased imports resulting from increased demand as well as high internal coal transportation costs caused by bottlenecks in China’s railway capacity. These factors have made imported coal economically viable, particularly along coastal regions that are distant from coal mined in western China. China is attempting to consolidate its coal industry, as it has ~10,000 minor local coal mines where inadequate investment, outmoded equipment, and poor safety procedures control inefficient resource development.

Electricity generation in China is operated by state-owned holding companies, although limited private and foreign investments have recently been made in the electricity sector. Chinese power generation growth in 2014 was the slowest since 1998 and growth in steel production was also the weakest in more than 30 years. China has expanded the construction of natural gas-fired and renewable power plants to introduce power to remote population centers.

China’s coal production in 2014 is estimated to have dropped 2.5%, having produced 3.52 billion metric tons (3.88 bst) of coal in the first 11 months of 2014. China produced 3.7 billion metric tons (4.1 bst) in 2013. This is the first annual decline in coal production in China in more than a decade (Reuters 2015a). This decline is the result of weakening demand from industry and the power sector, oversupply, and initiatives from the government to reduce air pollution.

United States

U.S. coal consumption in 2014 showed no increase, with third-quarter production on par with that in 2013 (EIA 2015c). The average price of U.S. metallurgical and thermal coal exports during third-quarter 2014 was ~$95 per metric ton (~$86 per short ton) and ~$70 per metric ton (~$63.50 per short ton), respectively. Wyoming continues to be the top coal-producing state, with 85.7 million metric tons (~94.5 mst) of production from April to June 2014.

The decline in U.S. coal exports in 2014 was primarily controlled by a decrease in world coal demand, depressed international coal prices, and greater coal production in other coal-exporting countries. The EIA (2015d) projects coal exports will fall from 88 million metric tons (97 mst) in 2014 to an annual average of 73.5 million metric tons (81 mst) in 2015 and 2016. Coal consumption for electric power in the U.S. decreased by 0.8%, or 6.35 million metric tons (7 mst) in 2014. The EIA (2015d) predicts that power sector coal will decrease by 2.2% in 2015, mainly as a result of lower natural gas prices and coal plant retirements because of implementation of new air-quality and emission standards. An additional decline in coal consumption for electric power (0.5%) is projected in 2016.

Although U.S. coal production for exports continues to be strong, coal’s share of the country’s overall energy production is declining, primarily the result of expanded natural gas production (Humphries and Sherlock 2013). Lower demand for coal in U.S. markets is controlled by increasingly strict federal regulations, lower natural gas prices, and coal plant retirements. Reuters (2012), based on data from North American Electric Reliability Corporation (2011), estimated that market conditions and environmental regulations will contribute to between 59 and 77 GW of coal plant retirements by 2016. Greatest loss of coal-fired electricity generation is projected to occur in the southeastern U.S., with 27–30 GW of plant retirements, followed by the northeastern U.S. (18–26 GW).

India

The coal industry in India was the world’s third largest in terms of production and the fifth largest in terms of reserves in 2012 (EIA 2015e). Coal India has a near-monopoly on the coal sector, of which the power sector comprises most of its coal consumption. India continues to undergo regulatory, technical, and distribution difficulties that limit production and prevent efficient transportation of coal to demand centers. Moreover, coal mines in the country are distant from the high-demand markets in western and southern India. Because coal production has failed to keep up with demand, particularly from the power sector which accounted for 69% of coal consumption in 2011, India imported 162.4 million metric tons (179 mst) and was the third largest coal importer in 2012. India imports thermal coal primarily from Indonesia and South Africa, as well as metallurgical coal from Australia (EIA 2015e). The Indian coal ministry plans to scale down its production target of 795 million metric tons (876.4 mst) in the period from 2016 to 2017, owing to perceived problems in rail transport and compliance with environmental regulations (Thakkar 2014). India possessed 249 GW of installed electricity generation capacity in 2014. However, owing to fuel shortages and limited transmission capacity, India still experiences electricity shortages and blackouts typically lasting from several hours to days.

Other Leading Coal-Producing Countries

Other leading coal-producing countries include Indonesia, Australia, Russia, South Africa, Germany, Poland, and Kazakhstan. Indonesia and Australia are the world’s largest and second largest exporters of thermal coal, respectively (Wulandari 2014; Cahyafitri 2014; Asmarini 2015; EIA 2015f, g). Although levels of coal production in Russia are modest, with 354 million metric tons (390 mst) in 2012, the country has inaugurated a long-term development plan for its flagging coal industry and is calling for an increase in coal production and electricity generation from coal (Dobrovidova 2014). Coal still represents >70% of South Africa’s total primary energy consumption, although its coal production is expected to peak in the next decade (Ryan 2014; EIA 2015h). Germany plans to reduce greenhouse gas emissions by 40% (from 1990 levels) by 2020 (Destatis 2015), although coal accounted for 43% of electricity generation in Germany in 2014. Coal production in Poland is the second largest in Europe, exceeded by Germany (EIA 2015i). Of the 3.9 quadrillion BTU (~980 trillion kilocalories/kg) of Poland’s primary energy consumption in 2012, coal represented 55%. Coal production in the same year was 143.3 million metric tons (158 mst), or ~20% of total coal production in Europe. Coal represented 63% of Kazakhstan’s total energy consumption in 2012 (EIA 2015j). A coal-to-liquids (CTL) facility is underway in Akmola Oblast in Kazakhstan (Urazova 2015). The experimental facility for processing low-rank coal into gasoline and diesel fuel will employ low-temperature plasma in the Fischer–Tropsch process. For every ton of coal delivered from the Maikuben Basin, plans are to produce 0.223 tons of liquid fuel at a cost of 23 cents (42 tenge) per liter.

Coalbed Methane

Brian J. Cardott, Footnote 3 Jeffrey R. Levine, Footnote 4 Jack C. Pashin, Footnote 5 David E. Tabet Footnote 6

Introduction

The evaluation and production of natural gas from coal beds falls under two broad categories, depending on the context in which the resource is being assessed and produced:

-

As an energy resource similar to other sources of natural gas, with the principal distinction being that the gas is coming from coal beds rather than conventional porous reservoir rocks. In this context, the produced gas is variously referred to as coalbed methane (CBM), coal bed natural gas, or coal seam gas (CSG).

-

Gas produced in association with coal mining operations—termed coal mine methane (CMM).

CMM development is driven by three incentives: (1) increased mine safety through the reduction of methane being released into mine workings, (2) the energy value of the produced gas, and (3) the abatement of fugitive methane being released into Earth’s atmosphere, where it acts as a potent greenhouse gas (GHG). In contrast, CBM development is driven largely by market forces related to its value as an energy resource, with additional governmental incentives occasionally being provided.

Much of the current interest in CMM is being sustained by programs sponsored through the United Nations, U.S. Department of Energy (DOE), U.S. Environmental Protection Agency (EPA), and other national organizations in countries including Australia, China, and Mexico.

The Global Methane Initiative web site (https://www.globalmethane.org/tools-resources/coal_overview.aspx) provides hyperlinks to resource overviews for countries having significant resources of coal, CBM, and CMM. The web site https://www.globalmethane.org/coal-mines/index.aspx#actionplans has a list of hyperlinks to action plans developed under the auspices of the Global Methane Initiative. The goal of this program is to find ways of reducing atmospheric emissions of methane arising from four major industrial sources: agriculture, coal mining, municipal solid waste, and oil and gas production.

Overview of Current CBM Production and Reserves

Production and reserves of natural gas from coal beds in the U.S. have declined since 2008 due, in part, to the drop in price for natural gas, but it is still an important resource globally. Research on CBM remains active, however, as indicated by 61 technical papers published in 2014, including a book edited by Thakur et al. (2014) that contains the proceedings of the North American Coalbed Methane Forum’s 25th Anniversary meeting. [The North American Coalbed Methane Forum celebrated 30 years of forums (1985–2015) at the meeting on May 20–21, 2015 (http://www.nacbmforum.com)]. Mastalerz (2014, her Fig. 7.3) provided a map showing world CBM resources, production, and exploration activities as of 2010. Global CBM resources and production are summarized in Tables 2 and 3.

Summaries of CBM Production for Selected Countries

United States of America

The EIA (2009a) shows a map of U.S. lower 48 states CBM fields (as of April 2009). U.S. annual CBM production peaked at 1.966 trillion cubic feet (Tcf; 55.67 billion m3) in 2008 (Fig. 1). CBM production declined to 1.466 Tcf (41.51 billion m3) in 2013, the lowest level since 2001, representing 5.5% of the U.S. total natural gas production of 26.5 Tcf (750.4 billion m3). Note that U.S. CBM production in EIA (2014a, their Table 15) is different than in EIA (2014b, their Table 1). According to EIA (2014a), the top 8 CBM-producing U.S. states during 2013 (production in billion cubic feet, Bcf; or million m3) were Colorado (444; 12.57), New Mexico (356; 10.08), Wyoming (331; 9.37), Virginia (93; 2.63), Oklahoma (65; 1.84), Alabama (62, 1.76), Utah (50; 1.42), and Kansas (30; 0.85). Annual CBM production by U.S. state (2008–2013) is available at EIA (2015o). Cumulative U.S. CBM production from 1989 through 2013 was 32 Tcf (0.91 billion m3). CBM production continues even though few new wells are being completed, reflective of the very long productive lives of CBM wells. U.S. Geological Survey (2014) includes hyperlinks to their CBM assessment publications and web pages. Ruppert and Ryder (2014) included coal and coalbed methane resources and production in the Appalachian and Black Warrior Basins.

U.S. annual CBM proved reserves peaked at 21.87 Tcf (619 billion m3) in 2007 and declined to 12.392 Tcf (351 billion m3) in 2013, the lowest level since 1999, representing 3.5% of the U.S. total natural gas reserves of 354 Tcf (10,024 billion m3) (Fig. 2). Annual CBM proved reserves by U.S. state (through 2013) are available at EIA (2015p).

Australia

Flores (2013, his Fig. 9.15) included a map showing coal seam gas (CSG) potential in Australia noting that the coal beds range in age from Permian to Tertiary in about 30 coal-bearing basins. Blewett (2012) included maps showing the distribution of demonstrated black coal and gas resources in Australia. CSG reserves in 2012 are divided into six coal basins in eastern Australia: Surat Basin (69%), Bowen Basin (23%), Gunnedah Basin (4%), Gloucester Basin (2%), Sydney Basin (1%), and Clarence-Moreton Basin (1%) (Flores 2013). The EIA (2015g) reported that economically recoverable CSG reserves in Australia were 33 Tcf (934 billion m3) in 2012, primarily in the Surat and Bowen Basins in Queensland. Commercial CSG production in Australia began in 1996 and was 246 Bcf (6.97 billion m3) in 2012 (~13% of total natural gas production).

China

A map showing coal basins and CBM resources in China is available at https://www.globalmethane.org/tools-resources/coal_overview.aspx. EIA (2015b) reported that CBM production from wells and underground coal mines in China was 441 Bcf (12.49 billion m3) in 2012. Tao et al. (2014) indicated there were 12,574 CBM wells in China at the end of 2012; the Southern Qinshui Basin is the largest CBM-producing basin in China. The first CBM exploration well in China was drilled in 1991 (Zhang et al. 2014). Flores (2013) indicated that a significant amount of the CBM resources in China are from coal mine methane (CMM) with the first CMM project in 1991. Information on coal mine methane activity in China is available from U.S. Environmental Protection Agency (2015). According to Dodson (2014), “Chinese shale gas production fell so far short of expectations that the Asian behemoth quickly turned to CBM” and “CBM may well find itself relied on increasingly in China, as the country looks to offset its coal dependence.”

Canada

CBM production in Canada comes mainly from Cretaceous and Tertiary coals in the Western Canada Sedimentary Basin (Flores 2013). According to the web site http://www.energy.alberta.ca/NaturalGas/750.asp, there were 19,269 CBM wells in Alberta, Canada as of December 31, 2012. Most of the new production was from the Horseshoe Canyon Formation with some deep wells to the Mannville Formation coals.

Oil Shale

Alan K. Burnham Footnote 7

Oil shale is a kerogen-rich petroleum source rock that never got buried deep enough to experience the times and temperatures necessary to generate oil and gas. Worldwide, oil shale is a substantial potential energy resource that potentially could yield a trillion barrels (159 billion m3) of oil and gas equivalent (Burnham 2015). Estimates of the resource vary considerably (Knaus et al. 2010; Dyni 2003; Boak 2013), but taking the highest value for each country from these estimates plus a contribution from a largely uncharacterized resource in Mongolia, (Oil & Gas Journal 2013) one obtains a potential resource of about 7.5 trillion barrels (1.2 trillion m3). Most of that resource is in the U.S., and most of that is in the Green River Formation—about half the world total. Russia, China, Israel, Jordan, and DR Congo each have resources of at least 100 billion barrels (15.9 billion m3). Recovery factors are hard to estimate due to grade variations and yet-unproven in situ technology required to process most of the resource, but even 20% recovery seems highly optimistic. A new assessment is sorely needed.

Prior to the discovery of commercial natural petroleum deposits, oil shale was a significant source of heating and lighting oil, particularly in Scotland in the 19th century. In the U.S., interest in oil shale awakens every 30 years or so with concerns about conventional petroleum prices and energy security then wanes with new discoveries and lower prices. Oil shale activities in other parts of the world are less variable due to a variety of economic factors. Prior to the most recent drop in oil prices (2014), the future of oil shale looked bright, at least in certain parts of the world. The current status is in flux, but it is too early to know whether we are seeing a repeat of the 1980s or a shorter-term correction.

Although the U.S. has the largest oil shale (kerogen) resource, Estonia and China are currently the largest producers, processing it both for electric power by burning and for shale oil by retorting (destructive distillation). The unfortunate recent use of the term “shale oil” for oil produced by hydraulically fracturing mature petroleum source rocks and adjacent more permeable lithologies is a source of major confusion in both public and scientific circles, as the resources and production methods are completely different. The U.S. EIA (2015q) and most industry has adopted the term “tight oil” for what is sometimes called “shale oil” because it is a more appropriate description.

As shown in Figure 3, oil shale mining peaked in 1980 at ~43 million tons (47 short tons) per year, declined to ~16 million tons (18 short tons) per year in 2000, but has grown steadily since to ~33 million tons (36 million short tons) per year in 2014, of which 90% was split between China and Estonia. Brazil produced most of the rest. From the portion retorted, China averaged about 16,000 barrels of oil per day (bopd) (~2500 m3/day), Estonia 14,000 bopd (~2200 m3/day), and Brazil nearly 4000 bopd (640 m3/day). The Chinese and Estonian numbers include new capacity added during 2014 and are projected to rise a little in 2015.

History of oil shale extraction updated from Dyni (2003) using a variety of industry and government sources. 1 metric ton = 1.1 short ton

New oil shale development is proposed in the three currently producing countries and in Jordan, the U.S., Australia, Morocco, Mongolia, Israel, Canada, and Uzbekistan. How fast this expansion proceeds depends strongly on the price of crude oil, but it is likely that some research and development and incipient commercial production will occur in order to refine processing technology, environmental factors, and economics under the presumption that oil prices will go up during the years before significant commercial production. Projections prior to the recent oil price collapse were ~300 million tons (441 short tons) of oil shale mined per year and 400,000 bopd (64,000 m3/day) by 2030 (Boak 2013).

The two primary extractive processes for producing shale oil are hot-gas retorts and hot-solids retorts (Burnham and McConaghy 2006; Crawford and Killen 2010). Many variations of each exist, with the Fushun, Kiviter, Petrosix, and Paraho processes being the dominant hot-gas types used in China, Estonia, Brazil, Australia, and the US and the Galoter, Petroter, Enefit and Alberta Taciuk Process (ATP) processes being the hot-solids types used in Estonia and China and potentially the US, Jordan and Morocco. New hot-solids retorts have achieved design throughput for Enefit (Eesti Energia) and VKG in Estonia and Fushun/ATP in China. Enefit is pursuing a commercial development in Utah on both private and US land (via its Bureau of Land Management Research, Development, and Demonstration (US BLM RD&D) lease) using its hot-solids technology.

The two new types of processes being researched are in-capsule and in situ heating (Burnham and McConaghy 2006). In-capsule heating is a new type of process invented by Red Leaf Resources (http://www.redleafinc.com/), in which shallow oil shale is mined and used to create stadium-sized rubble beds encapsulated by bentonite-clay engineered earthen walls. The original concept was that oil shale would be heated indirectly to retorting temperatures by flowing hot gas through embedded tubes, with heat distributed by conduction and convection and the spent shale abandoned in place. In situ heating was resurrected from Swedish technology of the mid-20th century by Shell using more modern drilling technology and heating cables (Ryan et al. 2010), and several companies are researching variations of in situ heating in the U.S. and Israel. Shell recently abandoned its US BLM RD&D leases in preference for a demonstration of its in situ conversion process in Jordan, and it started in situ heating for a small pilot test in Jordan in 2015. Israel Energy Initiatives was recently denied a permit in Israeli to conduct a pilot test of a similar process and is considering its options.

The first commercial shale oil production in the U.S. will likely use Red Leaf’s EcoShale in-capsule heating technology in a joint Utah project with Total S.A. Red Leaf obtained the necessary permits from the State of Utah and started construction on a 5/8th commercial-scale demonstration that would produce >300,000 barrels (>47,700 m3) of oil over 400 days. However, the drop in crude oil prices has caused them to re-optimize the design, switching from indirect to direct hot-gas retorting, and then to restart construction in 2017. TomCo Energy also plans to use the EcoShale process in Utah.

Energy Competition in the Uranium, Thorium, and Rare Earth Industries in the U.S. and the World: 2015

Michael D. Campbell, Footnote 8 James R. Conca, PhD Footnote 9

Introduction

After the 2011 Fukushima tsunamis and damage to Japan’s Daiichi nuclear power plant, uranium prices dropped about 60% in value over the ensuing years. But the decline in the price evident in Figure 4 appears to have run its downward course by mid-2014. As illustrated in the two charts in Figure 4, since bottoming near $28 in mid-2014, spot uranium prices gained nearly 40% to reach their current level around $38.50 (as of May 2015), see I2M Web Portal (I2M Web Portal 2015a) for recent discussions on future price expectations.

Energy Competition

Nuclear fuel prices represent a very small segment of the total cost to produce electricity by nuclear power relative to other energy sources. The supply of nuclear fuel is available from an increasing number of uranium mine sites today, and therefore, new nuclear plant construction is based more on its total plant cost and financing (including insurance costs), concerns about nuclear waste disposal and public opinion than with those impacting other competing energy sources, even if the latter have major impact on the environment.

In contrast, the technologies associated with the operation of renewable energy generation do not have established records in their operation and maintenance costs, within a scaled-up grid of significant size, without substantial state and federal subsidies.

Considering that the “fuel” costs to drive wind and solar are zero, albeit available at variable wind speeds and receiving radiation only during daylight, these technologies still involve moving parts to produce electricity that must be maintained by humans and/or stored in batteries or backed up by grid-power that is usually of lower cost than those of the renewables, such as produced by nuclear, hydroelectric and natural gas. For cost comparisons, see I2M Web Portal (2015b).

Energy Selection

Many favorable aspects underlie using nuclear heat to boil water to turn turbines to generate electricity that have supported the construction and continuous operation of more than 100 plants in the U.S. (Fig. 5) and nearly 400 plants worldwide for the past 50 years. Currently, the main criteria applied to select a source of energy are based on short-term economics and political influences. Because the nuclear plants have been built in fortress-like extended-life designs that cost billions of dollars to bring on line, many of them have now lasted decades and have produced electricity both reliably, safely, and at low relative cost over the past 50 years.

Currently operating U.S. Nuclear Power Reactors. U.S. Nuclear Regulatory Commission (NRC) (2015). NRC regions by color code

Factors that can be considered that impact energy-type selection, such as the costs of competing fuels, their safety records, public opinion, and media coverage, can even include sociological factors as far afield as the relationship of technology and employment needs to be addressed. In the present climate, these factors all bear heavily on the availability, price, and use of nuclear fuels, i.e., uranium and thorium, for the generation of electricity within nuclear power plants.

Energy Economics

There has been a remarkable resilience to the positive media views about nuclear power’s resurgence in the U.S. and world today as the existing plants exceed their design lives, with an understanding that all plants will need to be replaced with new nuclear technology sooner or later. Another significant economic issue is the extensive storage onsite of nuclear waste, and the current lack of an offsite, long-term underground nuclear storage waste alternative. In addition, with the success of horizontal drilling and hydraulic fracturing technology in developing shale gas and oil deposits in the U.S. and around the world, new natural gas resources are reaching the markets and have driven down the cost of fuel for generation of electricity to levels that compete with nuclear power. With the glut of new oil and gas, the price has fallen so low that some U.S. shale oil and gas fields are becoming uneconomic to produce so natural gas prices will likely tend to fluctuate in the future. This over supply of oil and gas, developed by the petroleum industry and national policy, is already evident by the employment downsizing underway today in the oil and gas industry, especially in the smaller companies.

The U.S. is leaving the land acquisition, leasing, and delineation stages of shale gas production and is entering the consolidation stage where operations will become more efficient and fewer, but larger, companies will control the market. Price volatility will decrease and prices will increase just as the U.S. connects to the world market through development of the liquefied natural gas (LNG) infrastructure. Immediate markets will include Europe and Japan as long as the prices are attractive.

Added to this economic condition, and with the renewed interest in gas-fired power plants based on cheap natural gas, competition also comes from renewable energy resources that the general public, led by current national policies, associated federal agencies, and the media, have suggested as the answer to energy selection in the U.S. Nuclear adversaries and pro-solar and wind proponents have released media feeds promoting renewables and listing accomplishments sometimes without fully providing the economic evidence for such claims (Rosenbloom 2006; I2M Web Portal 2015c, d).

If the climate is to be a consideration and if the end cost of electricity, without government subsidies, is to be included in an assessment of the best approach to energy utilization, then nuclear power can prevail in delicate balance with natural gas between costs and the environment on the basis that nuclear power has been and continues to be a preferred energy resource, e.g., capacity factor (Fig. 6).

Comparative Energy Capacity Factors (Nuclear Energy Institute 2015a)

The Annual Report of the Uranium (Nuclear Minerals and REE) Committee or UCOM (American Association of Petroleum Geologists, Energy Minerals Division 2015) discusses these issues and others in more detail, and from which this summary is drawn. This summary also draws on the I2M Web Portal (2015a), which provides links to abstracts and reviews of media articles and technical reports with a focus on current uranium prices, exploration, mining, processing, and marketing (I2M Web Portal 2015e), as well as on topics related to uranium recovery technology, nuclear power, economics, reactor design, and operational aspects (I2M Web Portal 2015f), and related environmental and societal issues involved in such current topics as energy resource selection, climate change, and geopolitics (I2M Web Portal 2015g). This report summary also draws from the 2014 UCOM Mid-Year Report (American Association of Petroleum Geologists, Energy Minerals Division 2014b) as support.

Current university and government research and recent industrial developments on thorium are also discussed in the 2015 UCOM Annual Report (American Association of Petroleum Geologists, Energy Minerals Division 2015, pp. 26–27), and captured by the I2M Web Portal (2015h). Other potential energy sources such Helium-3 (I2M Web Portal 2015i), and related environmental and societal issues are captured as well.

In addition, current university and government research and recent industrial developments in the rare earth industry are discussed in the 2015 UCOM Annual Report (American Association of Petroleum Geologists, Energy Minerals Division 2015, p. 30, 32), and captured by the I2M Web Portal (2015j). For the full list of coverage of the various sources of energy and associated topics, in the form of more than 4000 abstracts and links to media articles and technical reports to date (and increasing each day) from sources in the U.S. and around the world, see (I2M Web Portal 2015k).

Uranium Demand

Eighty-nine percent (89%) of the fuel requirements of the current fleet of nuclear reactors will be met by Canada, Australia, and Kazakhstan, and supplied from other sources, totaling some 377 million pounds U3O8 per year. As uranium prices rise, more in situ uranium mines in the U.S. will come on stream as Japan re-starts their reactors and other countries bring new construction on-line, such as China, India, and a number of others in the next few years. But other deposits now being developed in the world will also come on-line to compete on the world markets.

The U.S. is the largest consumer of uranium in the world, currently requiring more than 50 million pounds U3O8 annually, yet producing only about 4.7 million pounds domestically. China consumes 19 million pounds per year, expected to reach 73 million pounds by 2030. China currently produces about 4 million pounds U3O8 per year, and is planning to build additional nuclear power capacity, nearly tripling by 2020, to alleviate problems with air pollution created by mining, importing and burning coal to generate electricity.

Vietnam has committed to building a number of nuclear power plants in the north and in the south of Vietnam (World Nuclear Association 2015a). Vietnam has significant hydroelectric power, but currently still needs coal and natural gas for electric power.

India also is in the midst of a major build out of nuclear power generation. A 500-MW prototype fast breeder reactor (PFBR) at Kalpakkam in Tamil Nadu is targeted to produce power in 2015–2016 (India Business Standard 2015). The country’s installed capacity is now at 5780 MW, but that is set to nearly double in the next 4 years to 10,080 MW, which also puts pressure on the world uranium demand and price. In mid-April 2015, Indian Prime Minister Narendra Modi visited Canada. While there, he signed a 5-year deal to buy 3000 tons U3O8 in order to fuel India’s nuclear reactors (Market Oracle 2015). The agreement is worth C$350 million dollars, just over C$58.00/pound U3O8. Narendra’s meeting was the first India–Canada governmental visit in 42 years and the first nuclear contract between these two nations.

Given the anticipated near-term demand for uranium, a significant rise in the uranium commodity price may drive stock prices up, which in turn will drive new rounds of mergers and acquisitions of uranium properties and the companies holding them, as well as driving new exploration and processing plant development.

Uranium Production in the U.S

U.S. production of uranium concentrate in the fourth quarter 2014 was 1,100,111 pounds U3O8, down 25% from the previous quarter and up 16% from the 4th Quarter 2013. During the fourth quarter 2014, U.S. uranium was produced at seven U.S. uranium facilities, one less than in the previous quarter (EIA 2015r). Uranium was produced by mill at White Mesa Mill in Utah, first operating-processing alternate feed in 4PthP Quarter 2014. Uranium was produced by in situ-leach plants at Alta Mesa Project (Texas), Crow Butte Operation (Nebraska), Hobson ISR Plant/La Palangana (Texas), Lost Creek Project (Wyoming), Nichols Ranch ISR Project (Wyoming), which started production in 2014, Smith Ranch-Highland Operation (Wyoming), and the Willow Creek Project (Wyoming). U.S. uranium concentrate production totaled 4,905,909 pounds U3O8 in 2014. This amount is 5% higher than the 4,658,842 pounds U3O8 produced in 2013. U.S. production in 2014 represented about 11% of the 2014 anticipated uranium market requirements of 46.5 million pounds U3O8 for U.S. civilian nuclear power reactors (EIA 2015s).

EIA (2015t) reported that U.S. uranium mines produced 4.9 million pounds U3O8 in 2014, 7% more than in 2013. Two underground mines produced uranium ore during 2014, one less than during 2013. Uranium ore from underground mines is stockpiled and shipped to a mill, to be milled into uranium concentrate (called yellowcake, a yellow or brown powder). Additionally, seven in situ-leach (ISL) mining operations produced solutions containing uranium in 2014 (one more than in 2013) that was processed into uranium concentrate at ISL plants. Total production of U.S. uranium concentrate in 2014 was 4.9 million pounds U3O8, 5% more than in 2013, from eight facilities. The Nichols Ranch ISR Project started producing in 2014. The ISL plants are located in Nebraska, Texas and Wyoming. Total shipments of uranium concentrate from U.S. mill and ISL plants were 4.6 million pounds U3O8 Rin 2014, 1% less than in 2013. U.S. producers sold 4.7 million pounds U3O8 of uranium concentrate in 2014 at a weighted-average price of $39.17 per pound U3O8.

The EIA (2014g) reported that although most of the uranium used in domestic nuclear power plants is imported, domestic uranium processing facilities still provide sizeable volumes of uranium concentrate to U.S. nuclear power plants. In 2013, the percentage of uranium concentrate produced was distributed among seven facilities in four states. Wyoming accounted for 59% of domestic production, followed by Utah (22%), Nebraska (15%), and Texas (4%).

Uranium is processed into uranium concentrate either by grinding up ore mined from an open pit or from underground and then processed into yellowcake, or by using oxygen and liquid mixtures to dissolve the uranium occurring in sandstone from depths of 300 feet to more than 1200 feet in the subsurface by a process known as in situ leaching.

Today, most plants incorporate in situ leaching; Utah’s uranium mill serves a separate function involving upgrading the uranium product. The output of the mill and the leach plants is uranium concentrate, known as U3O8 or yellowcake, which is transported to conversion and enrichment facilities for further processing before being fabricated into the pellets used in nuclear fuel to generate the heated water that runs steam generators to produce electricity.

Uranium Exploration in the U.S

Uranium exploration data for 2014 reflected the lower price of uranium and were expectedly down substantially from previous years. In the meantime, Google search results (I2M Web Portal 2015l) show a multitude of mergers, acquisitions, and consolidations, and company downsizing of properties held are moving at a fast pace, while the price continues to look for support in the nuclear power industry markets for fuel (Uranium Investing News 2015a). Recent exploration can be monitored on-line (I2M Web Portal 2015e), and by using a more generalized term (I2M Web Portal 2015m), exploration for related commodities as well.

As reported by the EIA (2015t), total uranium drilling in 2014 was 1752 holes covering 1.3 million feet, 67% fewer holes than in 2013 and the lowest since 2004. Expenditures for uranium drilling in the U.S. were $28 million in 2014, a decrease of 43% compared with 2013. Therefore, total expenditures for land, exploration, drilling, production, and reclamation were $240 million in 2014, 22% less than in 2013.

Expenditures in the U.S

Expenditures for U.S. uranium production, including facility expenses, were the largest category of expenditures at $138 million in 2014 but were down by 18% from the 2013 level, as expected. Uranium exploration expenditures were $11 million and decreased 50% from 2013 to 2014. Expenditures for land were $12 million in 2014, a 21% decrease compared with 2013. Reclamation expenditures were $52 million, a 5% decrease compared with 2013.

All of these declines were in direct response to the decline in the price of yellowcake that was associated with the shutdown of the Japanese reactors and overall impact of the damage to the reactors caused by Fukushima tsunamis in 2011. However, the price is still expected to rise over the coming months (Money Morning 2008).

Significant Field Activities in the U.S

The Rapid City Journal (2015) reported that Powertech Uranium, now Azarga Uranium, and adversaries of a planned uranium mining operation in Custer and Fall River counties, South Dakota saw a recent NRC (U.S. Nuclear Regulatory Commission) decision as a victory for both sides. The lengthy decision came months after NRC’s Atomic Safety and Licensing Board took testimony on a contested license the NRC granted to develop Azarga Uranium’s Dewey-Burdock in situ leach uranium operations near Edgemont, South Dakota. The licensing board found in favor of Powertech on five of the adversarial challenges relating to water quality and quantity. It did, however, revise the Powertech license, instructing the company to improve efforts to find and properly abandon existing drill holes at the site to prevent contamination by rainfall draining into the subsurface. Recently, drilled holes have standard procedures in place for appropriate abandonment using cement and bentonite, if needed. The thousands of historical holes are to be sealed when encountered.

Dewey-Burdock Project Manager Mark Hollenbeck of Edgemont said that they were “very happy” with the science-based decisions that the Court made. Hollenbeck said that all of the licensing board’s decisions upheld the Powertech scientific presentations and data on water quality and hydrology. The licensing board did rule in favor of the Oglala Sioux Tribe on the unspecified threat the mining operation would pose to Native American cultural, historic, and religious sites in the well-fields, but these could be easily managed with the cooperation of the Tribe.

Historical Uranium Reserves Estimates in the U.S

Currently known uranium reserves in seven western states are estimated to total nearly 340 million pounds U3O8 (EIA 2015u); about one-third of the reserves are in Wyoming. Other known reserves are in Arizona, Colorado, Nebraska, New Mexico, Texas, and Utah. Uranium deposits have also been identified in Alaska, North Dakota, and South Dakota, and in several other states, mostly in the western U.S. The largest known undeveloped uranium property in the U.S., and allegedly the seventh largest in the world, is located on private land at Coles Hill in south-central Virginia, near the North Carolina border. The deposit at Coles Hill is estimated to contain some 60 million pounds of uranium in a hard-rock environment, which would be mined by open pit and later by underground methods and processed onsite to produce U3O8. The development of this deposit has been stalled by local opposition.

Christopher (2007) prepared a technical report on the Virginia project. A geological summary of the deposit is provided by Dahlkamp (2010). It has yet to be confirmed that these reserves have been included in the EIA estimate of U.S. uranium reserves.

The EIA (2015u) estimated at the end of 2008 that U.S. uranium reserves totaled 1227 million pounds of U3O8 at maximum forward cost (MFC) of up to $100 per pound U3O8. At up to $50 per pound U3O8, estimated reserves were 539 million pounds of U3O8. Based on average 1999–2008 consumption levels (processed uranium into fuel pellets then inserted into assemblies loaded into nuclear reactors), uranium reserves available at up to $100 per pound of U3O8 represented about 23 years of operation (EIA 2015u). At up to $50 per pound U3O8, however, uranium available through in situ leaching was about 40 percent of total reserves, somewhat higher than uranium in underground mines in that cost category. ISL is the dominant mining method for U.S. production today. These estimates are likely conservative because proprietary industrial reserve information may be substantially greater than government estimates of economic tonnage and grade of particular deposits.

The EIA (2015t) announced that as of the end of 2014, estimated uranium reserves were 45 million pounds U3O8 at MFC of up to $30 per pound of U3O8. At up to $50 per pound, estimated reserves were 163 million pounds U3O8. At up to $100 per pound, estimated reserves were 359 million pounds U3O8. At the end of 2014, estimated uranium reserves for mines in production were 19 million pounds U3O8 at a maximum forward cost of up to $50 per pound. Estimated reserves for properties in development drilling and under development for production were 38 million pounds U3O8 at MFC of up to $50 per pound.

The EIA (2015t) claimed that the uranium reserve estimates from the 2015t report cannot be compared with the much larger historical dataset of uranium reserves published in the EIA (2015u). The earlier (EIA 2015u) reserve estimates were made based on data collected by EIA and data developed by the National Uranium Resource Evaluation (NURE) program, operated out of Grand Junction, Colorado, by DOE and predecessor organizations. The EIA (2015t) data covered Roughly 200 uranium properties with reserve estimates, collected from 1984 through 2002.

The NURE data covered roughly 800 uranium properties with reserve estimates, developed from 1974 through 1983. Although the EIA (2015t) data collected by the Form EIA-851A survey covered a much smaller set of properties than the earlier report (EIA 2015u), the EIA believes that within its scope the EIA-851A data provides more reliable estimates of the uranium recoverable at the specified forward cost than estimates derived from 1974 through 2002. In particular, this is because the NURE data have not been comprehensively updated in many years and are no longer a current data source. However, these data are very useful and suggest that there are many additional uranium properties in the U.S. that deserve additional exploration, the essential question of which revolves around just how many of these will be found to contain economic reserves of uranium. If history is any guide to the future, more reserves will be identified as prices begin to rise over the near future and beyond.

Employment in the Uranium Industry

The EIA (2015u) estimated total employment in the U.S. uranium production industry was 787 person-years in 2014, a decrease of 32% from the 2013 total and the lowest since 2006. Exploration employment was 86 person-years, a 42% decrease compared with 2013. Mining employment was 246 person-years, and decreased 37% from 2013. Milling and processing employment was 293 person-years, a 30% decrease from 2013. Reclamation employment decreased 19% to 161 person-years from 2013 to 2014. Uranium production industry employment for 2014 was in nine States: Arizona, Colorado, Nebraska, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming.

Nuclear Power Plant Operations in the U.S

Ninety-nine nuclear reactors are currently licensed in the U.S. (Fig. 5), five of which have been recently closed or are in the process of being shuttered. Nuclear plants operate continuously and generate 63 percent of U.S. carbon-free electricity, but competitive electricity markets do not value these attributes and some may be shuttered on economic grounds. Vermont’s only nuclear plant is a case in point. The company’s operating revenues at the Yankee 604-megawatt plant were squeezed by a combination of sagging electricity demand, low energy prices, and restructured markets that undervalue nuclear energy’s contributions. Industry executives warned that more nuclear plants are under financial strain and could close—a prospect that is of concern to all regulators, especially since nuclear power is the preferred energy resource, e.g., capacity factor (Fig. 6). When a mid-size nuclear reactor in Vermont permanently and prematurely shuts down, it exacerbates instabilities in the energy markets of a community and region already impacted by economic uncertainties in that area. When Vermont lost its only nuclear power plant at the end of 2014, the region’s electricity grid lost 604 megawatts of clean, around-the-clock generating capacity, and the area will see an increase in carbon dioxide emissions, a move that runs counter to national goals to reduce these emissions (Nuclear Energy Institute 2015b).

Small Nuclear Reactors

Small modular reactors (SMRs) are getting increased attention over the period, continuing an upward trend in developing SMRs for standby use in case of disasters, for remote areas, including off-world, as well as for operating sector grids in small towns or in large cities where a number of SMRs would be located around the city. Numerous research and development programs are underway on SMRs by many companies in the U.S. and overseas. Additional, updated information and media items on SMRs are compiled at I2M Web Portal (2015n) and described by World Nuclear Association (2015b).

Spent Fuel Storage

Spent nuclear fuel data are collected by the EIA for the Office of Civilian Radioactive Waste Management (OCRWM). The spent nuclear fuel (SNF) data include detailed characteristics of SNF generated by commercial U.S. nuclear power plants. From 1983 through 1995, these data were collected annually. Since 1996, these data have been collected every 3 years. The latest available detailed data cover all SNF discharged from commercial reactors before December 31, 2002, and are maintained in a database. Additional information on spent fuel storage is available from the Nuclear Energy Institute (2015c).

Nuclear Power Construction Overseas

Nuclear power plant construction is expanding rapidly in China, India, Russia, and more than ten other countries. In particular, for review of current reports on nuclear activities involving Russia readers are referred to (World Nuclear Association 2015b) and (I2M Web Portal 2015o); Ukraine (World Nuclear Association 2015c; I2M Web Portal 2015p), and Kazakhstan (World Nuclear Association 2015d; I2M Web Portal 2015q).

Thorium Activities

Ideas for using thorium as an energy resource have been around since the 1960s, and by 1973, there were proposals for serious, concerted research in the U.S. However, programs came to a halt due to the development of nuclear weapons.

The 1960s and 1970s were the height of the Cold War and weaponization was the driving force for all nuclear research. Nuclear research that did not support the U.S. nuclear arsenal was not given priority (Warmflash 2015). Conventional nuclear power using a fuel cycle involving uranium-235 and/or plutonium-239 was seen as meeting two objectives with one solution: reducing U.S. dependence on foreign oil, and creating the fuel needed for nuclear bombs. Thorium power, on the other hand, did not have military potential. And by decreasing the need for conventional nuclear power, a potentially successful thorium program would have actually been reported by some as threatening to U.S. interests in the Cold War environment.

Global leaders today are concerned about proliferating nuclear technology which has led several nations to take a closer look at thorium power generation of electricity, especially China and India, with technical assistance from the U.S. (Halper 2015). Hayes (2015) indicated that China, India, and a few others are actively pursuing research on a thorium-based nuclear fuel cycle for electricity production. This is based largely on the fact that India has not yet identified abundant uranium resources, but does have substantial thorium ores.

Scientists in Shanghai have been ordered to accelerate plans to build the first fully functioning thorium reactor within 10 years, instead of 25 years as originally planned (Evans-Pritchard 2015). China faces fierce competition from overseas and to get there first will not be an easy task, says Professor Li Zhong, a leader of the program.

As reported in the technical and public press over the past few years, thorium shows promise as an economically viable fuel source someday, but the potential use of it in the U.S. does not appear to be likely in the near term. However, nuclear giant, Westinghouse, a unit of Toshiba, is part of an international consortium with Thor Energy (Uranium Investing News 2015b), a private Norwegian company, and continues to fund and manage further assessments of using thorium to replace uranium to generate the heat in nuclear power reactors.

Rare Earth Activities

There are two parallel themes to consider when discussing the topic of rare earth elements. One discusses the exploration and mining of REEs, and the other concerns the economic processing of the ores to provide a marketable product stream. Gerden (2015) reported that there have been some recent developments in the former by Russia. They have announced they are in the final stage of a company plan to focus on the development of the world-class Burannoey deposit of the Tomtorsky rare earth element trend, where reserves are estimated at 20 million tons of ore, valued at US$8 billion (either in-place, or on some unspecified basis of costs), with the development of other deposits in the trend when required. Operational lifetime of the Burannoey project alone is estimated at 40–50 years.

A joint venture of Rostec (a Russian state corporation established to promote development, production, and export of hi-tech industrial products for civil and defense sectors), and ICT Group, one of Russia’s leading investment holdings, is developing the Burannoey project. The volume of investments in the project is estimated at 145 billion rubles (US$4.5 billion).

Successful implementation this project would make Russia one of the world’s largest producers and exporters of rare earth metals when it reaches full operation. During Soviet times, the production of rare earth metals in the country was at the level of 8500 tons per year. Production took place in more than 30 regions of the USSR. However, since the collapse of the USSR in 1990 and the number of political and economic problems in the country, the production of REEs in Russia has almost stopped, while Russia became a net importer.

There have also been breakthroughs in processing that could reduce China’s current control of the REE prices and product (Matich 2015), at least of those elements of the REE group that are highly sought after, but also very expensive (Frontier Rare Earths 2015). The company Rare Earth Salts (RES) announced that it has a defined path to near-term commercialization of its rare earth separation technology. Company CEO Allen Kruse has said that their low-cost technology will allow rare earth companies to directly compete with domestic Chinese pricing. The RES technical team claims to have demonstrated some of the lowest operating costs and highest efficiency in the industry with their environmentally friendly process, projected the cost to be below $4 per kilogram. Another key advantage is the functional independence of the RES separations technology with various rare earth concentrate feedstocks. Their technology allows them to reportedly combine concentrates from multiple partners and feedstock types without sacrificing separation effectiveness (Matich 2015).

To review current reports, media items, and other information compiled for the rare earth industry, see (I2M Web Portal 2015r) and U.S. Geological Survey (2015).

Geothermal Energy

Paul Morgan Footnote 10

Introduction

Geothermal Energy contributes to the global energy economy through electrical power production, direct heat and cooling, and as a convenient thermal reservoir for heat pumps. Electrical power production is most commonly associated with geothermal energy but residential and commercial buildings account for more than one-third of the total energy consumption in the U.S. and most of that energy is used for space heating and cooling, and hot water. In many places, geothermal resources can provide hot water and heating and cooling more efficiently than other energy resources, and ground-source heat pumps provide electrical energy savings of 75–80% or more for heating and cooling over the direct use of electricity for conventional heating and cooling. The direct use of geothermal hot water for district heating systems is growing, especially in Europe, and there is a steady growth in the use of ground-source heat pumps in Europe and the U.S. The thermal energy output/savings of these systems is very large, but difficult to quantify in the U.S. because national data have not been compiled. In examples where geothermal water is cascaded from power generation to district heating, the thermal energy recovered is typically several times larger than the electrical energy generated because the thermal energy can be recovered at a lower temperature and there are no losses in energy conversion. Direct-use and ground-source heat pumps remain underused geothermal resources. However, although they have global relevance, they have local application. This report focuses on the primary use of geothermal resources for power production and other transportable products.

One of the benefits of geothermal electrical power production with respect to wind or solar is that it provides base-load electricity providing power without the fluctuations of wind or the diurnal and seasonal cyclicity, and weather fluctuations of wind and solar. Most geothermal power plants have a capacity factor of >90%, equaling or exceeding the capacity factors of nuclear power plants because they are very simple with no fuel or boilers. They typically have multiple turbines and wells so that maintenance of individual components can take place while the system is operating. Lower capacity factors are only common during development or expansion stages of operation, or if the internal load factors of the systems, such as well pumps, are included in the capacity factor calculations (counting pumps integral to the system against the capacity factor of a geothermal system is equivalent to counting the mining, refining and disposal energy of uranium or CO2 against the capacity factor of a nuclear or coal-fired power plant). Most power plants (coal, oil, nuclear) cannot be started quickly and there is a problem accommodating the fluctuating power delivery from wind and solar. To some extent, this fluctuating power delivery may be accommodated by transferring solar and wind power from one part of a grid where it is being generated to another part of a grid where generation is lacking. However, this requires excess power capacity and flexibility in switching power around a grid that may not be available because of limitations in line capacities. The main current solution to pick up rapid shortfalls in power generation is gas-fired power plants; these plants can change their generating load relatively rapidly (hydroelectric power plants are also very flexible but opportunities to build new hydroelectric power plants are limited). However, the rapid growth in wind and solar has required an almost one-to-one building of gas-fired power plants to back-up these fluctuating renewable resources.

Geothermal power plants have traditionally been run at or near full generating capacity because the plants were designed to operate most efficiently in that mode. However, within limits, the resource is not required to be withdrawn at the full capacity of the generating plant, and, with changes in design, plants can be constructed to provide power to the grid as needed up to the capacity of the system. Such a mode of operation lowers the efficiency of the geothermal power generation, but provides an alternative solution to standby gas-fired power plants. Flexible geothermal operations have recently been demonstrated by several projects, including the Puna Geothermal Venture plant which generates 38 MW, and has contracted 16 MW of flexible capacity in Hawaii (Nordquist et al. 2013; GEA 2015a). (Operators in the Geysers field, located in northern California, operated in various modes in the past, including traditional base load, peaking, and load-following. However, flexible operations ceased in the early 1990s in response to low demand and lower costs of generation within the utility’s system from hydro, coal, and natural gas power plants.) Most growth in geothermal power production is for base-load electricity, especially in countries where geothermal is primary growth in the nations’ electricity system. This report concentrates growth in base-load, geothermal electrical power production. A major source of information for this summary has been reports from the GEA, with special reference to the 2015 Annual U.S. & Global Geothermal Power Production Report (GEA 2015b).

United States Geothermal Development 2014–2015

The overall geothermal installed generating, or nameplate capacity was about 3.5 GW with about 2.7 GW net capacity in 2014–2015. As discussed in the introduction, the difference in these two numbers is primarily in energy used to operate pumps used to produce and dispose of the geothermal fluids: the net capacity rather than the nameplate capacity should be used when calculating capacity factors for geothermal power plants. There was little significant growth in online geothermal generating capacity in the U.S. market in 2014–2015 but there was about 1250 MW of geothermal power under development with about 500 MW in limbo awaiting power-purchase agreements (PPAs). There was an increase in the number of states in which geothermal projects were under development (Fig. 7). Expansion of geothermal in the U.S. market was limited by almost no growth in demand for new power, and uncertainties and unbalanced mechanisms for valuing new power in terms of tax credits and other financial incentives. The uncertain U.S. geothermal market resulted in consolidation and restructuring of a number of companies in the U.S. market. The U.S. geothermal industry will be closely watching the final result of the U.S. Environmental Protection Agency Clean Power Plant rule and individual state actions that encourage clean power that supplies base-load power and balances intermittent supplies of clean energy. The developing planned and installed geothermal capacities by state and number of developing projects by state are shown in Figures 8 and 9. The locations of these geothermal power plants are shown in Figure 10.

States with operational and/or developing geothermal generating projects. Source GEA (2012)

Planned capacity additions under development and installed nameplate capacities in the U.S. by state. Planned capacity additions are the estimated installed capacities in MW of the power plants. Source GEA (2015b, Fig. 7)

Number of U.S. developing geothermal generating projects by state. During the past few years, demonstration and exploration projects have occurred in additional states such as Washington, Texas, North Dakota, Louisiana, Montana, Mississippi, and Wyoming. Source GEA (2015b, Fig. 8)

Existing and planned geothermal power plants in United States (modified from NRDC (2015). Colors show the relative potential for enhanced geothermal resources (i.e., recovered through the creation of engineered geothermal systems) in the basement

U.S. Department of Energy Geothermal Programs

The U.S. Department of Energy is currently funding two programs associated with geothermal. The first program is a play fairways exploration program, following the play fairways concept in hydrocarbon exploration. The purpose of this program is to develop concepts of geothermal exploration models for different types of geothermal resources in type geological/tectonic/geothermal settings. The second program is to assist in developing technologies for mineral recovery from geothermal brines with a particular emphasis on rare earth, strategic, and other valuable minerals. The Frontier Observatory for Research in Geothermal Energy (FORGE) is a third program for which participant teams have been selected and funding is scheduled to start in later 2015. The first two phases of this program are to select a site for the “observatory.” The third phase is to develop a crystalline basement Enhanced Geothermal Systems (EGS) system that will serve as a research test site for scientists and engineers.

The budget for the Department of Energy Geothermal Technologies Office increased by more than 20% from FY2014 to FY2015. The presidential budget requests a further 74.55% increase for FY2016 (Table 4). However, indications at the time of writing this report (June 2015) are that the Congressional Budget Committee will reduce the geothermal budget to something close to the FY2014 level rather than approve an increase. A more optimistic outlook at this time is level funding for FY2016.

International Geothermal Development

For the third consecutive year, the global power industry sustained a 5% growth rate. The world market reached 12.8 GW of geothermal power operational through 24 countries with primary growth in Turkey, Kenya, Indonesia, and the Philippines (Figs. 11, 12). There are also 11.5–12.3 GW of planned capacity additions in 80 countries and 630 projects as of the end of 2014. Fourteen of those 80 countries are expected to bring 2 GW of power online over the next 3–4 years based on current construction and the GEA predicts that the global market will reach between 14.5 and 17.6 GW by 2020 (Figs. 11, 13).

International geothermal power nameplate capacity (MW) from 2005 to 2014 (actual) and projected to 2020. Planned capacity additions, pilot plants, and utility-scale geothermal plants built in the first half of the 20th century and then decommissioned are excluded in the time series. Source GEA (2015b, Fig. 1)

2015 geothermal installed capacity (nameplate). Source Bertani (2015)

Major international geothermal markets, installed capacity, announced developing capacity, and announced near-term geothermal goals which include government and private sector development goals. Mexico has set a general renewable energy goal of 35% from renewables by 2024; however, this goal is not geothermal specific. The U.S. goal is the Imperial Irrigation District’s objective of building out geothermal capacity at the Salton Sea Resource Area by 2032. Estimates are rounded to nearest 5 MW and “net capacity” was used when nameplate capacity was not available. Source GEA (2015b, Fig. 2)

Two factors are spurring the growth in the international geothermal market both in terms of the installed capacity and in the number of participating countries. The first factor is that geothermal energy is a cost-competitive green renewable energy source and part of the solution toward lowering the emissions that contribute to global climate change. This factor allows the World Bank’s Energy Sector management Assistance Program (ESMAP) to mobilize assistance through the Clean Technology Fund toward scaling up geothermal energy. The second factor is that geothermal energy is a domestic resource that is available in many countries that are lacking in other energy resources: high-grade geothermal resources are generally concentrated on active plate boundaries that lack mature sedimentary basins rich in fossil fuels. The World Bank and other multi-lateral organizations focused on early-risk mitigation has funded a number of programs to initiate development in a number of geothermal-rich/fossil-fuel poor nations where surface exploration has been completed but additional financing is needed to confirm the commercial viability of the geothermal resources. ESMAP estimates that as many as 40 countries could meet a large proportion of their electricity demand through geothermal power (World Bank 2014). Some of this development is illustrated in Figures 14, 15.

Totals of developing nameplate capacities in MW in developing markets. Estimates are rounded to the nearest 5 MW and “net capacity” is used when nameplate capacity was not available. Source GEA (2015b, Fig. 4)

Totals of developing capacity and numbers of projects by country or territory. The large amount of developing capacity for Indonesia could be the result of a backlog of projects stalled by prolonged power-purchase agreements, delayed permits related to the use of conservation or protected areas and resistance from local communities. Source GEA (2015b, Fig. 5)

Job Creation

Geothermal development requires a wide range of skills and hundreds of people are typically employed in the siting and building of a geothermal power plant. This number decreases to tens in the actual operation and maintenance of the plant. In common with many natural assets, most geothermal resources have unique local characteristics so that exploration for the resources, engineering the sustainable development of the resource, and even power plant design are tailored to the specific physical and chemical qualities of the resource. Scientific and technical professionals with degrees, such as geologists, geochemists, geophysicists, and engineers are essential in resource exploration, development, and operation. In the development of the resources, trained technical workers, such as drill-rig operators, welders, mechanics, and safety managers, are the main players. Behind the scenes, an additional professional workforce of project managers, assembly workers, administrative staff, archeologists, sales managers, and lawyers provide support services for the development of renewable resources (Jennejohn 2010). An example of the types of skills required in the different stages of the development of a geothermal resource is shown in Figure 16, together with the typical number of persons employed in each stage of development for a 50 MW power plant. Many resources are not initially developed to their full potential and additional capacity is added to the geothermal field after a few or more years of successful operation. Therefore, the high rate of employment during the development and building stage of a power plant may be extended by a decade or more as more capacity is added to the exploitation of a geothermal system.

A. Job types through the project timeline for the exploration and development of a new geothermal field. B. Typical numbers of jobs involved in the different stages in the project timeline for the exploration of a new geothermal field and development of a 50 MW power plant. Source Jennejohn (2010, Fig. 1 and Table 2)

Global Technology and Manufacturing

There are three basic common types of geothermal electrical power generation: dry steam, flash, and binary. With dry steam, the resource is sufficiently hot that there is no water associated with the geothermal fluid. Steam is delivered directly into a turbine to rotate a generator to make electricity. Condensed steam is reinjected to replenish the geothermal reservoir. Resources associated with flash power plants are either a mixture of water and steam or superheated water and flashed to steam and water when the pressure is reduced at the surface. The steam is separated, delivered to a turbine to generate electricity as with the dry steam plant. The water is eventually reinjected to maintain the reservoir fluid. Binary plants use the lowest temperature resource of the three types of plant, and the geothermal fluid is used to heat a secondary fluid, with a lower boiling temperature than water, in a heat exchanger. The geothermal fluid is then returned to the geothermal reservoir to be reheated. The secondary fluid is vaporized in the heat exchanger and is used to turn a turbine or screw-expander, which is used to rotate a generator to produce electricity. As the secondary fluid exits the turbine or screw-expander, it is cooled and condensed and pumped back to the heat exchanger to be recycled. Two types of secondary fluids are commonly used: organic fluids (Organic Rankine Cycle type power plants), and a mixture of ammonia and water (Kalina power plants).

The cost of the power plants per megawatt of electricity generated increases as the temperature of the geothermal fluid decreases, as shown in Figure 17. The primary reason for this increase in cost is the decrease in efficiency of generation as the temperature decreases: the efficiency roughly depends on the difference between the input and output temperature of the fluid entering and exiting the turbine or screw-expander. However, this simply translates into a slower amortization of the exploration and development costs with low-temperature resources. The fuel is essentially free. Efficiencies may be improved by multiple-stage or hybrid plants in which superheated water is flashed first to a pressure greater than atmospheric pressure and then a second time to atmospheric pressure with steam used to turn a turbine at each flashing stage. Alternatively, hot water from a flash power plant may be directed to a binary power plant for power generation in a hybrid power plant. There are many options of improving the efficiency of single-stage power plants, the most simple of which is to use condensed hot water from the turbine for direct use, a common practice in northern Europe.

Power plant capital costs (2009$/kW) estimated by Geothermal Electricity Technology Evaluation Model and used in RE Futures for hydrothermal power plants. Source NREL (2012, Figs. 7–5)

Developing nations with high-temperature geothermal resources are primarily building flash power plants. The manufacture of equipment for this market is dominated by Japanese companies, such as Mitsubishi, Toshiba, Fuji, and Ansaldo/Tosi. General Electric has a small, but significant share (5–6%). In Europe and the U.S., most new plants are binary power plants and are of the Organic Rankine Cycle type. This market is dominated by Ormat. A current breakdown of equipment suppliers is given in GEA (2015b).

Concluding Remarks

The international geothermal energy market is enjoying steady sustained growth and that growth is expected to continue. The growth is based primarily on countries with the domestic availability of high-grade geothermal resources but a lack of other fuel resources from which to generate electricity. In other countries, growth in the use of geothermal resources is more erratic and more dependent on baseline energy prices, reliability of supply of fossil-fuel resources (short- and long-term), and government policies and incentives. For example, in most of Europe, geothermal resources are low grade, but energy prices are high, and there are incentives, either through individual countries or through European Economic Community grants to develop alternative energy resources. Germany currently receives most of its natural gas supplies from Russia and would like to reduce its dependence on this source. It has an aggressive program to use alternative energy sources. It has installed about 27 MWe geothermal electricity generating capacity, but about 150 MWt thermal geothermal district heating capacity using resources with insufficient temperature to generate electricity (Agemar et al. 2014).