Abstract

This paper examines the performance implications of efforts in absorptive capacity development for new ventures, companies in their eight first years of existence. We distinguish between corporate ventures (CVs) and ventures created by independent entrepreneurs (IVs) and explore the extent to which they vary in: (1) the emphasis on building different absorptive capacity dimensions and (2) their performance gains from absorptive capacity dimensions. Using data from 140 new ventures, our results show that CVs emphasize potential absorptive capacity (combining external knowledge acquisition and assimilation) more than IVs. Conversely, IVs focus more on exploiting external knowledge. We also find that efforts in activating realized absorptive capacity (combining external knowledge transformation and exploitation) have a negative effect on the performance of new ventures that is stronger for CVs than IVs. Yet, this negative effect of realized absorptive capacity on new venture performance is mitigated when combined with efforts in potential absorptive capacity in the case of CVs. The implications of our study for research into the multidimensional nature of absorptive capacity and the dynamic capabilities approach are discussed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

New ventures, companies in their eight first years of existence (McDougall et al. 1992), are limited in their histories, resources, and knowledge bases. At these early stages of a firm’s life cycle, a number of decisions need to be made about investing in the development of capabilities to compete, while concerns abound about the potential payoffs of such investments (Teece 2007).

Giving its role in the acquisition and exploitation of new external knowledge, absorptive capacity emerges as a crucial capability for new ventures. Exposure and access to diverse knowledge sources can increase new ventures’ ability to recognize opportunities (Cohen and Levinthal 1994), to innovate (Lewin et al. 2011; Liao and Chwo-Ming 2013; Zahra and George 2002), to expedite new product developments, and successfully commercialize new products. These activities would also enhance ventures’ learning (Lewin et al. 2011) and adaptation to changing market realities (Escribano et al. 2009).

Unfortunately, as they begin their operations new ventures need to build their absorptive capacity from scratch, under conditions of resource constrains and pressure to achieve results (Helfat and Lieberman 2002; Kor and Mesko 2013). Still, not all new ventures may face the same challenges. Ventures created by independent entrepreneurs (IVs) and those launched by corporations (CVs) vary substantially in the amount of resources and expertise they possess and in the urgency to develop capabilities (Bradley et al. 2011; Larrañeta et al. 2014; Shrader and Simon 1997; Zahra 1996). We argue that these different conditions of departure of CVs and IVs may have implications for the development of absorptive capacity and its performance consequences.

We build our study on the perspective that absorptive capacity is a multidimensional dynamic capability grounded in the firm’s knowledge base or organizational memory (e.g., Lane et al. 2006; Lewin et al. 2011; Zahra and George 2002), whose key dimensions—potential (combining external knowledge acquisition and assimilation) and realized (combining external knowledge transformation and exploitation)—have potentially different but complementary effects (Jansen et al. 2005; Lane et al. 2006; Zahra and George 2002). Specifically, we attempt to explain: (1) how differently do CVs and IVs build their absorptive capacity in terms of the emphasis on absorptive capacity dimensions and (2) how do CVs and IVs vary in their performance gains from absorptive capacity dimensions? We test these questions on a sample of 140 new ventures from seven industries.

By studying early efforts to build absorptive capacity and its performance effects we contribute to the literature on dynamic capabilities (Teece et al. 1997; Eisenhardt and Martin 2000; Winter 2003) signalling the uniqueness of the process of developing capabilities as firms begin their activities, where resource constrains and pressures to achieve results shape decisions and consequences. Specifically, we show that the relationships among absorptive capacity dimensions and the existing knowledge base of new ventures differ from those already theorized for established firms given their limited knowledge bases, mostly grounded on their founders’ human capital rather than in the form of organizational memory (Debrulle et al. 2014; Eisenhardt and Schoonhoven 1990; Hayton and Zahra 2005; Kor and Mesko 2013; Nielsen 2015). We also demonstrate the high costs new ventures face when building absorptive capacity from scratch which undermines the performance consequences of the dimensions of absorptive capacity. Our study therefore highlights the singular role of absorptive capacity for new ventures.

We first elucidate how resource constrains and pressures to achieve results are early organizational determinants of efforts to build absorptive capacity. The interest on organizational determinants of absorptive capacity dimensions has proliferated, yet empirical research is lacking (Volberda et al. 2010).

Second, we increase our understanding of the performance implications of absorptive capacity dimensions. Absorptive capacity studies have been centered on innovation and other potential intermediate outcomes of absorptive capacity dimensions (e.g., Ferragina and Mazzotta 2014; Lewin et al. 2011; Liao and Chwo-Ming 2013; Matusik and Heeley 2005; Schildt et al. 2012), whereas the direct impact of absorptive capacity on performance has received very little empirical attention (e.g., Lane et al. 2001; Tsai 2001; Wales et al. 2013). In addition, there has been much debate about the distinct but complementary roles of potential and realized absorptive capacity, but this has been so far mainly a theoretical discussion (e.g., Jansen et al. 2005; Lane et al. 2006; Volberda et al. 2010, Zahra and George 2002). To this respect our theory and findings highlight three issues. Our study indicates, first, that efforts to activate realized absorptive capacity harm the performance of new ventures, whereas previous studies have found that in established firms the overall effect of absorptive capacity appears to be positive (Lane et al. 2001; Tsai 2001) with diminishing returns after reaching certain level (Wales et al. 2013). New ventures, we suspect, suffer the costs of early absorptive capacity development (much higher than the costs of its maintenance) and have limited knowledge to capitalize on through realized absorptive capacity. The costs of developing and sustaining absorptive capacity have been consistently ignored in the literature (Volberda et al. 2010; Wales et al. 2013). Next, our study shows that this negative effect of realized absorptive capacity is mitigated when it is combined with efforts to generate potential absorptive capacity, signalling the important synergies of absorptive capacity dimensions.

Finally, and notably, our results highlight that the role of absorptive capacity appears to be substantively different for CVs and IVs due to their variations in resources and urgency to amass knowledge which determine not only their efforts on the different dimensions of absorptive capacity, but also how these efforts translate into effective performance.

2 Theory and hypotheses

2.1 The unique linkages among absorptive capacity potential and realized dimensions and the existing knowledge base of new ventures

The relationship between the dimensions of absorptive capacity and the firm knowledge base is complex, with relationships unfolding sequentially and multidirectionally (Lane et al. 2006; Todorova and Durisin 2007). When addressing this issue, existing research has implicitly focused on established firms. But, we believe that we need to distinguish among the linkages between absorptive capacity dimensions and the firm’s existing knowledge base across its life cycle in order to capture the distinct and particular nature of the firm at its early stages of development.

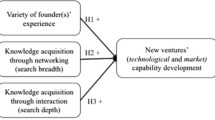

As Fig. 1 shows, scholars have argued that both potential absorptive capacity (combining external knowledge acquisition and assimilation) and realized absorptive capacity (combining external knowledge transformation and exploitation) interact with the existing firm knowledge base. The firm knowledge base is grounded on its organizational memory, the stored information from an organization’s history that can be brought to bear on present decisions (Walsh and Ungson 1991). The knowledge contained in this memory is of two types: procedural knowledge, in the form of skills and routines and declarative knowledge, in the form of more abstract or theoretical information (Moorman and Miner 1998). The firm organizational memory (in terms of both abstract knowledge and routines and capabilities) directs potential absorptive capacity by allowing firm members to recognize the importance of external knowledge and choose the type of knowledge that will be acquired (Cohen and Levinthal 1994; Lane and Lubatkin 1998; Todorova and Durisin 2007; Zahra and George 2002). It directs realized absorptive capacity by transforming knowledge previously accumulated to fit existing environmental needs (Cohen and Levinthal 1990; Garud and Nayyar 1994; Lewin et al. 2011; Todorova and Durisin 2007; Zhao and Anand 2009), and thereby helping to configure new products, strategies, and ideas (Jansen et al. 2005; Lane et al. 2006; Zahra and George 2002). In turn, potential and realized absorptive capacity increase the firm knowledge base or organizational memory through the accumulation and renewal of knowledge over time (Garud and Nayyar 1994; Lane et al. 2006; Zahra and George 2002), storing both external knowledge that has been assimilated and experiences of introductions of new products, strategies, and ideas. This interaction appears to have a relatively slow pace.

In the case of new ventures this logic may not fully apply. For new ventures, organizational memory might be limited given the fact that these companies have been in existence for only a short period of time. Most of the declarative and procedural knowledge is inherited from new ventures’ founders (Huber 1991) and therefore resides in their individual human capital (Becker 1964) rather than being grounded in the firm’s organizational memory in the form of routines. New ventures limited founders’ knowledge (Bradley et al. 2011; Shrader and Siegel 2007; Zahra 1996), will likely determine what external knowledge they value and try to acquire, but may not be sufficient to fuel the development of new products and ideas (note the thin arrow that connects the firm knowledge base and realized absorptive capacity at the early stages of the firm life cycle in Fig. 1). Moreover, the speed at which events unfold in new ventures (Bradley et al. 2011) disrupts a two-step process in which knowledge acquired externally is directly used rather than stored in the firm for a period of time before its actual use (from potential absorptive capacity to the knowledge base and then to realized absorptive capacity). For these reasons, it appears that new ventures’ realized absorptive capacity would most likely capitalize to a great extent on knowledge externally acquired through potential absorptive capacity (note the thick dashed arrow that connects potential and realized absorptive capacity exclusively at the early stages of the firm’s life cycle in Fig. 1).

2.2 High costs of absorptive capacity development in new ventures

The absorptive capacity literature has consistently ignored the costs of developing and sustaining absorptive capacity (Volberda et al. 2010; Wales et al. 2013). In general, the dynamic capabilities stream of research has very rarely addressed the issue of costs of developing and sustaining organizational capabilities (e.g., Winter 2003). Still, committing specialized resources to routinize behaviour involves costs for personnel, facilities, and equipment (Nelson and Winter 1982).

Systems to search for, acquire, communicate, store, retrieve, integrate, and exploit knowledge cost time and resources (Lewin et al. 2011). Teece (2007) suggests that creating capabilities from scratch costs more than maintaining and sustaining existing firm capabilities, and this implies that new ventures will face severe costs to build absorptive capacity.

However, the results might be worth the cost. As Fig. 1 shows, firm performance is determined by daily activities, which are sustained by organizational capabilities and refined by dynamic capabilities (Winter 2003). The question is what are the chances that efforts to build potential and realized absorptive capacity will refine and improve activities through the actual acquisition, assimilation, transformation, and exploitation of particular external knowledge? To the extent which the firm knowledge base drives the effectiveness of its capabilities, the new venture’s limited knowledge base grounded on their founders human capital (Debrulle et al.2014; Eisenhardt and Schoonhoven 1990; Hayton and Zahra 2005; Kor and Mesko 2013; Nielsen 2015; Shrader and Siegel 2007) rather than on the organizational memory may reduce its likelihood of success (note variations in size of the firm’s knowledge base across its life cycle in Fig. 1), but a proper alignment between potential and realized absorptive capacity could mitigate this liability.

2.3 Absorptive capacity in corporate versus independent ventures

CVs and IVs pressures to achieve results are different. IVs have an extreme urgency for profits, usually targeting a few niches and focusing more on profitability (Zahra 1996). Conversely, ventures developed by corporations can afford obtaining financial results at a slower pace, typically pursuing broadly defined markets, aiming to grow rapidly (McGrath 1995). To meet these diverse goals, venture managers make discretional decisions. Thus, CVs and IVs are apt to focus on different parts of the market, employ different strategic methods, and introduce different types of products (Larrañeta et al. 2014). These differences could drive them to emphasize different absorptive capacity dimensions, with potentially different performance implications.

CVs and IVs also vary significantly in their resources, but particularly in knowledge and expertise. CVs tend to surpass IVs in the knowledge endowments of their founders given their parents transferred experience and support (Bradley et al. 2011; Shrader and Simon 1997). Indeed, CVs often benefit from their corporate parents’ expertise, experiences, connections, and relationships with other companies. They also learn from their parents’ market and industry analyses, forecasts of technological changes, and general assessment of industry conditions. Corporate parents give their CVs guidance on how to position themselves, build relationships, and manage their operations (McGrath 1995). While CVs may enjoy some autonomy, they may also inherit routines from their parent companies (Bradley et al. 2011; Keil et al. 2009). IVs seldom have access to such vast knowledge. Their founders’ knowledge tends to be focused in certain areas, such as marketing and technology or manufacturing (Eisenhardt and Schoonhoven 1990; Zahra 1996). Thus, CVs and IVs may face different challenges in trying to accumulate and deploy new knowledge.

When CVs and IVs set forward the development of absorptive capacity they need to make critical decisions about assigning resources for building potential and realized absorptive capacity. Though new ventures need to build both absorptive capacity dimensions in a somehow sequential manner, once there is a certain minimum level of development of potential and realized absorptive capacity and the venture progresses in the establishment of routines CVs and IVs would differ in their emphasis on potential and realized absorptive capacity. How CVs and IVs differ in prioritizing the different dimensions of absorptive capacity based on their distinct resources and motivations, and how their efforts are linked to performance, remain empirical questions that we examine in the following sections of the paper.

2.3.1 Efforts to build potential absorptive capacity

Together, acquisition and assimilation of external knowledge compose what Zahra and George (2002) label potential absorptive capacity. Acquisition refers to a firm’s process for identifying, valuing, and acquiring externally generated knowledge that is critical to its operations. Assimilation denotes a firm’s use of its own components and routines that allow it to analyze, process, interpret, and understand the information obtained from external sources (Kim 1998; Szulanski 1996).

Several factors suggest that CVs place greater emphasis on potential absorptive capacity than do IVs. The corporate sponsor is a major source of new product ideas for CVs (Hisrich and Peters 1986). In return, CVs offer the sponsor a window on emerging technologies, create new revenue streams, and can lead to significant changes in the business concept (Winters and Murfin 1988). Indeed, corporate ventures’ main contribution is often to transfer valuable capabilities to other ventures or the parent firm’s existing business units (Keil et al. 2009). As a result, CVs may see external knowledge as essential both to creating new products that ensure their survival and subsequent market success and to achieving legitimacy with their sponsors.

CV founders’ bring within their human capital the prior experiences of their parent corporations (Wright et al. 2007). This enriched human capital can posse incentives for investments in building potential absorptive capacity as it creates an advantageous point of departure. CV founders’ experiences will put them in a better position to recognize the importance of external knowledge while facilitating its acquisition and assimilation (Nielsen 2015). Further this will speed up the process of building the venture organizational memory (Debrulle et al. 2014) as the incoming flow of knowledge could be stored for future uses. Also, the R&D that drives potential absorptive capacity requires sustained investments, and CVs often could use their corporate parent’s financial support, facilities, equipment, and research staff. In contrast, IVs are likely to find it difficult to obtain R&D funds from external capital sources (Zahra 1996), because the activities themselves are risky, the firms usually lack name recognition, and concerns persist about their survival. These arguments suggest that, because of their high R&D investments, CVs are better positioned than IVs to set efforts to develop potential absorptive capacity.

Finally, methods for seeking and accessing external knowledge, resources, markets, or technologies include licensing, contractual agreements, and inter-organizational relationships such as alliances. Because of their sponsors’ established market positions and strong name recognition, CVs are more likely to use many of these external sources of knowledge than IVs (Keil et al. 2009). CVs also have great incentives to acquire and assimilate external knowledge through potential absorptive capacity because they need to develop many products to serve their broadly defined markets (Larrañeta et al. 2014; Zahra 1996). For instance, Zahra et al. (2009) illustrate how absorptive capacity fuels corporate venturing activities. Besides, corporate parents’ reputation and experience in negotiating these agreements may help their CVs to acquire new partners. In contrast, IVs may find it difficult to gain access to external sources of knowledge, and may therefore devote fewer resources than CVs to develop potential absorptive capacity. We thus posit that:

Hypothesis 1

CVs surpass IVs in their emphasis on potential absorptive capacity.

2.3.2 Efforts to build realized absorptive capacity

Having the right knowledge is important but insufficient to create value. The firm has to be able to use and exploit that knowledge (Zahra et al. 2007). Together, transformation and exploitation of external knowledge compose what Zahra and George (2002) label realized absorptive capacity. Transformation denotes combining existing knowledge with the newly acquired and assimilated external knowledge. Exploitation, the final component of absorptive capacity, refers to a firm’s process that refines, extends and leverages new ventures’ knowledge base to create a competitive advantage (Zahra and George 2002).

We expect IVs to emphasize realized absorptive capacity more significantly than do CVs. Independent entrepreneurs establish their ventures for many reasons. Sometimes, they develop new ventures to exploit their own discoveries or, simply, to keep them employed. Other times ventures are formed to create and pursue opportunities resulting from technological advances or to create wealth for the owner (Dencker and Gruber 2015). This idea is usually in the mind of the entrepreneur; still the goal of the IVs is to commercially exploit this idea. As a result, IVs will focus on developing realized absorptive capacity as a means of ensuring rapid commercialization. In so doing, IVs need to combine its existing knowledge with externally generated knowledge, to adjust the idea to the market needs, a process in which the transformation component of absorptive capacity is crucial. Further, IVs need to emphasize leveraging the routines and processes necessary for exploiting that new knowledge boundle and finally succeeding in bringing to the market a new product. CVs, however, may sacrifice short-term profits as they pursue growth (Bradley et al. 2011; Larrañeta et al. 2014).

Compared to IVs, CVs usually have more formalized operations, structures, and routines. These structures and routines encourage specialization and division of labour (Block and MacMillan 1993) that may expedite the flow of new knowledge but prevent it from being shared, integrated, or even understood by all organizational members. Without sharing, it becomes difficult to transform and exploit external knowledge. CVs, therefore, need to have systems and components that ensure the sharing, integration and mutual understanding of the external knowledge (Keil et al. 2009). Without these systems, the transformation and exploitation of external knowledge become difficult. As noted, these activities are much simpler and easier for IVs to undertake where the founders are at the center of these companies’ operations. Founders also play a key role as link pins, connecting the firm with diverse stakeholders and learning from them (Autio et al. 2000; Sapienza et al. 2006). Because of their focus on rapid commercialization as a means of creating cash flow that ensures the survival of their ventures, founders are likely to emphasize realized absorptive capacity. Indeed, venture leaders have been found to play an essential role in facilitating knowledge creation processes and driving new ventures’ innovation performance (Caridi-Zahavi et al. 2016).

This is reinforced by IVs’ greater focus on applied R&D (Zahra 1996), which is often conducive to knowledge transformation and exploitation. IVs should be able to quickly and efficiently combine the new external knowledge, selectively acquired and assimilated with existing knowledge, and turn it through exploitation into products and services adapted to the market.

IV owners and founders have the managerial authority to facilitate rapid knowledge absorption, integration, transformation, and exploitation. They appreciate the importance of the combinative knowledge being developed through an effective transformation (Galunic and Rodan 1998; Kogut and Zander 1992. They are also positioned to determine its usefulness, and may even take part in developing various applications (Zhou and Li 2012). CVs, on the other hand, have to follow the rules and policies set by their corporate owners and frequently have to get approval before developing products, systems, and components of their own. This discussion suggests the following:

Hypothesis 2

IVs surpass CVs in their emphasis on realized absorptive capacity.

2.3.3 The performance effect of efforts to build potential and realized absorptive capacity

An extensive body of research links absorptive capacity to value creation (Cohen and Levinthal 1990; Lane and Lubatkin 1998; Schildt et al. 2012; Todorova and Durisin 2007; Volberda et al. 2010). This is not surprising given that the goal of developing absorptive capacity is to use and commercially apply externally acquired knowledge (Cohen and Levinthal 1989, 1990) and create products that markets value, improving performance.

The separate roles that researchers (e.g., Jansen et al. 2005; Zahra and George 2002) have distinguished for potential and realized absorptive capacity suggest that the generally positive effect of absorptive capacity (Lane et al. 2006) is reached through realized absorptive capacity (Lane et al. 2001; Volberda et al. 2010; Zahra and George 2002). Well-built capabilities to transform knowledge to match market demands and exploit it rapidly (realized absorptive capacity) have been found to improve established firms’ performance, through innovation and other value-creating activities (e.g., Escribano et al. 2009; Lane, et al. 2001; Lewin et al. 2011; Matusik and Heeley 2005; Tsai 2001; Volberda et al. 2010). Established firms tend to have broad knowledge bases that nurture realized absorptive capacity. In addition, once capabilities have been developed, sustaining them is unlikely to entail significant costs (Teece 2007; Winter 2003). However, in the case of new ventures these assumptions may not hold.

Early development of realized absorptive capacity requires important on-going investments in time and resources, such as dedicating employees to developing prototypes for products and services (Jansen et al. 2005; Lewin et al. 2011). Even when this resource allocation is strategic, as it prepares the venture for future product introductions and entrance to new markets (Cohen and Levinthal 1994), it is not likely to offer immediate payoffs; quite the opposite, investments in routines and processes to sustain realized absorptive capacity increase the new venture’s expenses (Volberda et al. 2010).Footnote 1 In addition, realized absorptive capacity is meant to act upon knowledge that has been previously absorbed (Zahra and George 2002); given that new ventures have narrow knowledge bases, grounded mostly on their founder’s human capital (Shrader and Siegel 2007) rather than on the organizational memory, the probability of effective deployment is reduced. Thus new ventures are unlikely to be able to offset the costs of building realized absorptive capacity with profits coming from new products and service introductions achieved through realized absorptive capacity.

However, these negative effects may be reduced as the chances of having knowledge to deploy through realized absorptive capacity increase (Volberda et al. 2010). Differences among firms in the effective exploitation of externally acquired knowledge are influenced by differences in their knowledge about the market (Narasimhan et al. 2006) and technologies; and much of the new venture’s knowledge of this kind is likely to come from external sources gathered through potential absorptive capacity (see Fig. 1). Despite new ventures will also incur in costs when building capabilities to acquire and assimilate external knowledge (potential absorptive capacity), this efforts will increase the chances to have knowledge to leverage through realized absorptive capacity (Volberda et al. 2010). Therefore, combined efforts at building potential and realized absorptive capacity are likely to enhance the new venture’s chances to achieve financial gains from absorptive capacity.

Still, our discussion suggests that the effects of absorptive capacity dimension on performance may not be of the same magnitude for CVs and IVs, due to their unique urgency to build capabilities to compete and the diverse resources, including their variations in knowledge bases grounded on the funders’ human capital that have driven them to build their respective absorptive capacity differently.

We have argued that we expect IVs to emphasize realized absorptive capacity more than CVs do, and this focus on building realized absorptive capacity may leave them less susceptible to realized absorptive capacity’s negative effects on performance, as it increases their chances of successfully commercializing the few new products or technologies around which IVs tend to be created (Shrader and Simon 1997; Zahra 1996). In contrast, CVs, in seeking to create new (or revitalize existing) sources of competitive advantage for their parent companies by expanding their competency pool (Keil et al. 2009; Nicholls-Nixon et al. 2000) through potential absorptive capacity, may scatter their efforts, undermining their direct performance gains from realized absorptive capacity. Indeed, some researchers argue that the financial and technical support the parent corporations give to their start-ups actually undermines the discipline they need to grow and be profitable (Bradley et al. 2011; Clayton et al. 1999; Larrañeta et al. 2014).

Nevertheless, CVs’ connections with their parent corporations may also help them profit from absorptive capacity. As we note above, CVs can try to acquire knowledge not only from competitors, customers, and so forth but also from the parent corporation; and this knowledge will be easier for them to acquire and assimilate than knowledge coming from other external sources (Bradley et al. 2011), because they already have related knowledge (Cohen and Levinthal 1990; Lane and Lubatkin 1998; Szulanski 1996; Vasudeva and Anand 2011; Zaheer et al. 2010). Their potential recognition and understanding of relevant knowledge from the parent will be high (Lane and Lubatkin 1998; Rosenkopf and Almeida 2003). In addition, parent corporations’ willingness to foster the activities of CVs will accelerate knowledge transfer between the two organizations. For IVs, on the contrary, efforts at building potential absorptive capacity will not easily translate into actual external knowledge acquisition and assimilation. Thus,

Hypothesis 3a

There is a negative link between efforts to activate realized absorptive capacity and new venture performance that is stronger for CVs than for IVs.

Hypothesis 3b

There is a positive link between the interaction of efforts to activate potential and realized absorptive capacity and new venture performance that is stronger for CVs than for IVs.

3 Methods

3.1 Sample and data

To test our hypotheses, we collected data from new ventures throughout Spain using archival sources, interviews with senior executives, and data from industry experts. The study’s original population was limited to firms 8 years old or younger (McDougall et al. 1992), drawn from seven different industries including biotechnology, agro-alimentary, aerospace, tile and ceramics, modern furniture, energy and environmental, and information and communications technology. They were identified based on academic publications and discussions with several experts. The study population was 201 companies that matched our search criteria. Of these firms, 70 % responded, for a final sample of 140 companies. Data were collected between September and December 2006.

We conducted face-to-face interviews with new ventures’ senior executives to ensure data reliability. The respondents were CEOs and other senior company officials (e.g., R&D managers). To avoid the potential for common method variance (CMV), (1) we consulted a panel of 14 industry experts, two for each of the seven industries (e.g., Chen et al. 1993); and (2) we attempted to interview an additional member of each of the 140 new ventures in our sample. This follow-up resulted in 25 responses (17.85 % of the sample). Median interrater agreement (rwg) for the absorptive capacity scale (James et al. 1993) was 0.84, indicating adequate agreement. Also, intra-class correlations revealed a strong level of interrater reliability (ICC [1] of 0.46).

Finally, we examined the non-response bias by comparing the new ventures for which responses were received against those for which no response was received. We used median tests to establish the comparison of size and performance across the sample and universe categories. The null hypothesis of equality of medians was almost always accepted (over 90 %). In addition, we used Mann–Whitney U test for independent samples to test if the distribution of size and performance is the same across sample and universe categories. Again, the null hypothesis of equality of distributions was always accepted.

3.1.1 Measurement and validation of constructs

In constructing our measures, we used valid, previously published scales to measure the independent, dependent, and control variables, as follows.

Independent variables

The study had two independent variables: origin and absorptive capacity dimensions and components, which we measured as follows.

Venture Origin. Following the literature (McDougall et al. 1992; Shrader and Simon 1997; Zahra 1996), we collected information about the origin of the venture by directly asking respondents. To triangulate the coding of new venture origin, we interviewed two experts who specialized in each of the seven industries we studied. We asked these 14 experts to assess the extent to which the new ventures they closely followed in their analysis were created by independent entrepreneurs or launched by corporations. The 14 experts rated 42 new ventures, representing 30 % of our sample. The correlation between expert responses and the venture managers’ responses was of 0.89 (p < .001). Our sample included 68 corporate and 72 independent ventures, which we coded 0 and 1, respectively.

In order to reduce concerns about the existence of a potential endowment effect of CVs from their parent corporations we run a t test comparing the mean values of total assets and equity capital of the CVs and IVs in our sample for the years under study (2005–2008) and the percentage of employees with University degrees which showed no significant differences among the two groups of ventures.

Absorptive Capacity. We departed from Jansen et al. (2005) scale for absorptive capacity and adapted it for our study while retaining most of its items and included additional ones. Two key reasons justify our scale adaptation: Jansen et al. (2005) scale was developed and originally used in the context of a single large corporation with multiple subunits and tried to capture the actual potential and realized absorptive capacity of the firm, whereas we focused on IVs and CVs and intended to gauge new venture efforts directed towards building potential and realized absorptive capacity. In summary, we included items from Kohli et al. (1993) MARKOR measure, in addition to the ones Jansen and colleagues already did, to capture the elements of market orientation than could enlace the development of the acquisition and assimilation components of absorptive capacity. We continued by including new items from existing scales in the literature for the transformation component (e.g. Boccardelli et al. 2004); and created new items based on theoretical developments for exploitation (e.g. Garud and Nayyar 1994).

We pre-tested our scales by conducting 12 in-depth interviews with new venture managers, who completed a questionnaire and indicated any ambiguity regarding the phrasing of the items. Afterwards, we improved the phrasing of the items by asking academic colleagues to provide their comments and suggestions, resulting in a final version of the questionnaire. The final scale to capture the absorptive capacity construct included 20 survey items that gauged the four dimensions of acquisition, assimilation, transformation, and exploitation (Zahra and George 2002). The items used to construct the measures were extracted from the literature (e.g., Boccardelli et al. 2004 Garud and Nayyar 1994; Iansiti and Clark 1994; Jansen et al. 2005; Kohli et al. 1993; Szulanski 1996; Zahra and George 2002). We asked respondents to indicate the extent to which their new ventures emphasized the various activities associated with absorptive capacity components. Items employed a five-point scale with responses ranging from “not at all used” (coded 1) to “very often used” (coded 5).

We ran an exploratory factor analysis (EFA) to assess the measures’ agreement with theoretical constructs. We used principal component analysis with a varimax rotation, where the items loaded on four factors when we retained only those items with loadings above 0.50. The first factor covered the acquisition of external knowledge (4 items; α = 0.86). The second covered assimilation (3 items; α = 0.91). The third covered transformation (9 items; α = 0.87). The fourth covered exploitation (4 items; α = 0.91).

Next, we confirmed the dimensionality of the absorptive capacity construct with confirmatory factor analysis (CFA), whose results indicated that the aforementioned four factors model fitted the data well. The analysis of the composite reliability of each factor was acceptable (recommended minimum value of each item loading ≥0.7). Then, we analyzed convergent and discriminant validity valuing the mean extracted variance of each factor (MEV) (recommended minimum value ≥0.5) and applying the procedure of Fornell and Larcker (1981). Finally, the goodness of fit of the model was confirmed with several indexes. All the goodness-of-fit indexes showed that the model fitted the data well [df = 255, Satorra-Bentler χ2 (p value) = .0739, goodness-of-fit index [GFI] = 0.859, adjusted goodness-of-fit index [AGFI] = 0.820, root-mean-square error of approximation [RMSEA] = 0.031, [90 % C Interval] = (0.000, 0.047)].

We developed an index for each component, using the simple arithmetic means on the relevant items. Cronbach’s alpha values suggested that the scales had sound measurement properties. Next, we developed an index for realized absorptive capacity by averaging the indices for transformation and exploitation, and an index for potential absorptive capacity by averaging the indices for acquisition and assimilation.

Dependent variable

We measured new venture performance using average return on equity (ROE) for the years 2007 and 2008, divided by the average ROE of each industry for those years, obtaining these objective figures from the SABI/AMADEUS database. While measuring new venture performance has been a subject of heated debate (Brush and Vanderwerf 1992), ROE is one of the mostly widely used measures (Robinson and McDougall 2001; Starr and MacMillan 1990; Zahra et al. 2000), mainly because it captures the firm’s success in making effective use of its funds, an important issue for many new ventures. By lagging the dependent variable 2 years we try to minimize concerns about endogeneity due to potential reverse causality between the dependent and independent variables of our research model.

Control variables

The analyses also controlled for several variables that affect CVs’ and IVs’ ability to obtain and deploy resources (Larrañeta et al. 2014): age, percentage of employees with university degrees, ownership structure, the venture’s previous performance, and environmental dynamism.

Venture age was measured by the number of years a new venture had been in existence. Percentage of employees with university degrees was measured for full-time employees as a mean to account for the venture human capital (Becker 1964). Ownership structure, which controlled for the differing motivations and incentives of owners, was measured using a dummy variable, coded 1 when over 50 % of the company was owned by the CEO and other employees, and 0 otherwise. The average ROE for the years 2005 and 2006, divided by the average ROE of each industry for those years, another control variable, was gathered from the SABI/AMADEUS database.

In addition, we collected data on the environmental dynamism of each of the seven industries in which the ventures operated, assessed by the panel of 14 industry experts using Baum and Wally’s (2003) scale of 5 items (α = 0.78).We averaged the responses of the two experts for each of the seven industries and used that value for every venture competing in the same industry.

4 Analysis

Table 1 provides the means, standard deviations, range, and correlations for all the study’s variables. New ventures’ average return on equity (ROE) for the years 2007 and 2008 is positively and significantly correlated with the previous average return on equity (ROE) for the years 2005 and 2006 and to new ventures’ origin (1 representing IVs). The data in Table 1 suggest that the measures are relatively independent from one another except for potential and realized absorptive capacity, which are highly correlated (.579 at p < .05). We examined the correlational properties of the data to ensure that multicollinearity is not a problem in the study and avoid its potential negative effect. First we reviewed the correlations among the independent and control variables: the correlation with the greatest magnitude is 0.579. Thus, even if we accept conservative criteria, such as 0.80 or 0.75 (Kennedy 1979), collinearity does not seem to be a problem. In a second check we examined the tolerance and variance inflation factor (VIF) of each independent and control variable. A common cut off threshold is a tolerance value of 0.10, which corresponds to a VIF of 10. The smallest tolerance of each independent variable is 0.456 and the largest VIF of each independent and control variable is 2.195, a sign that multicollinearity is not a problem. We ran the analyses standardizing all the study’s measures.

We ran a multivariate analysis of covariance (MANCOVA) to examine the potential for differences in components of absorptive capacity between CVs and IVs. MANCOVA was significant, and therefore we conducted a follow-up analysis of variance (ANOVA) to pinpoint variables on which CVs and IVs differed significantly. This test was followed by regression analyses that sought to determine the associations between efforts to activate the realized dimension of absorptive capacity and new venture performance and the interaction effect, within this relationship, of efforts to activate the potential dimension of absorptive capacity. We first ran the analyses for the overall sample of new ventures and then ran the analyses separately for CVs and IVs to determine whether these associations varied significantly by venture type.

5 Results

To examine hypotheses 1 and 2 we used MANCOVA where venture origin served as the independent variable and two dimensions of absorptive capacity were the dependent variables. We also entered all the study’s control variables as covariates. The multivariate effect of venture origin on the two dimensions of absorptive capacity was significant (Hotellings’s Trace = 0.139, F = 9.29, df = 2, 134, p < .001). Because MANOVA does not take into account covariations among variables, we carried out a logistic analysis to validate the previous results. The results of the logistic regression analysis (Logit) are consistent with the MANOVA results. This led us to examine the differences between CVs and IVs, using analysis of variance (ANOVA). The results of ANOVA are presented in Table 2 along with the means for the two dimensions of absorptive capacity for CVs and IVs. The means of potential absorptive capacity differed significantly (at p < .005) between CVs and IVs. As hypothesis 1 predicted, CVs significantly surpassed IVs in their emphasis on potential absorptive capacity. Given that here were no significant differences in the means of realized absorptive capacity we run the same multivariate and univariate analyses decomposing realized absorptive capacity on its two components: transformation and exploitation of external knowledge. The means of the transformation component were not significantly different whereas IVs had a significantly higher score than CVs on exploitation (at p < .05), partially confirming hypothesis 2.

To test hypotheses 3a and 3b, we used multiple regression analyses to examine the direct association between efforts to build realized absorptive capacity and venture performance, and the moderating effect of efforts to build potential absorptive capacity in that relationship, establishing differences by venture origin. The results for the entire sample and then the separated results for the subsamples of CVs and IVs appear in Table 3. The base model explains 20 % of the variance in performance for CVs and 4.5 % for IVs, with previous performance significantly and negatively associated with the performance of CVs but significantly and positively associated with the performance of IVs. As Table 3 indicates, the main effects models make a significant contribution to the base model (ΔR2 = 0.076 and ΔR2 = 0.059 respectively for CVs and IVs). As hypothesis 3a predicted, the separate regression results by venture type indicate a negative link between realized absorptive capacity and performance that is stronger for CVs (explaining 25.8 % of the variance in performance) than for IVs (explaining 8 % of the variance in performance).

Finally, the moderated model is significant only in the case of CVs, explaining 30.5 % of the variance in CVs’ ROE, making a significant contribution above and beyond the main effects model (ΔR2 = 0.053). Thus, as hypothesis 3b predicted, there is a positive link between the interaction of potential and realized absorptive capacity and CVs’ performance.

Figures 2 and 3 plot respectively the different relationship between the realized dimension of absorptive capacity and the performance of CVs and IVs, and the significant relationship between the potential and realized dimensions of absorptive capacity and the performance of CVs.

6 Discussion

New ventures often have limited knowledge bases and need to put efforts in developing their absorptive capacity to acquire, assimilate, transform and use externally generated knowledge to innovate and commercialize their technologies and achieve market success. Still, new ventures vary in their founding origins, which lead to differences in the amount of resources and expertise they possess and in the urgency to achieve results (Bradley et al. 2011; Larrañeta et al. 2014; Shrader and Simon 1997; Zahra 1996). These variations in resources and pressure to amass knowledge to compete have implications in the decisions made with regard to the development of absorptive capacity and in the performance gains from those decisions. Our study highlights the unique nature of new ventures which challenges the accepted associations between the firm knowledge base and the dimensions of absorptive capacity and their consequences for performance.

6.1 Early organizational determinants of efforts to build absorptive capacity dimensions

Resource constrains and pressures to achieve results are early organizational determinants of efforts to build absorptive capacity. However, variations in these limitations and pressures drive the decisions made towards the way absorptive capacity is configured. Our results show significant differences in the way CVs and IVs emphasize different dimensions of their absorptive capacity, due to the different challenges they face. Though, both sets of ventures try to build potential and realized absorptive capacity, CVs emphasize developing the potential absorptive capacity significantly more than IVs do. These results support our arguments that CVs have less urgency for financial results and seek to search deeply and acquire knowledge from multiple external sources because of their broad market scope, aggressive growth goals, and access to their sponsors’ networks, which connect them to diverse external knowledge sources. CVs’ enriched human capital through the parent companies experience and support plays a key role in the incentives to build potential realized absorptive capacity. These results support hypothesis 1.

Still, in our sample CVs and IVs did not differ significantly in their focus on transforming external knowledge, one of the two components of realized absorptive capacity (Table 2). Transformation is one the most important and complicated aspects of absorptive capacity (Zahra et al. 2007). It requires deciphering the heuristics that are embedded in incoming external knowledge, converting it into usable applications, and making it comprehensible to organizational users. Transformation requires integrating different types of knowledge (Iansiti and Clark 1994), synthesis and interpretation, which, in turn, demands complex organizational and cognitive skills. The lack of significant differences between CVs and IVs in transformation may simply reflect the importance of this activity to both types of ventures’. Garud and Nayyar (1994: 379) emphasize that knowledge transformation is essential for smaller companies, especially venture start-ups. Given these challenges, CVs and IVs might focus on the transformation component of absorptive capacity about equally.

The results also show that IVs focus more on those aspects of absorptive capacity that relate to commercially exploiting externally acquired knowledge. These results reflect IVs’ urgent need to bring new products to the market, achieve legitimacy and survival, and make a profit. As we have argued, IVs usually focus on rapidly commercializing their technologies and do so under severe resource constraints. Our results suggest that entrepreneurs tend to focus their attention on building this part of realized absorptive capacity, partially supporting hypothesis 2.

In general, the results add to the research on the organizational determinants of absorptive capacity dimensions, where empirical findings are limited (Volberda et al. 2010), particularly for the early stages of absorptive capacity development.

6.2 Early performance implications of efforts to build absorptive capacity dimensions

The results also increase our understanding of the performance implications of absorptive capacity dimensions. The attention of the absorptive capacity body of literature has been centred on innovation and other potential intermediate outcomes of absorptive capacity dimensions (e.g., Escribano et al. 2009; Liao and Chwo-Ming 2013; Matusik and Heeley 2005; Schildt et al. 2012; Volberda et al. 2010), whereas the direct impact of absorptive capacity on performance has received very little empirical attention. Lane et al. (2001), Tsai (2001) and Wales et al. (2013) have been among the few to study these effects empirically, but they studied the overall impact of absorptive capacity on performance, not distinguishing among its dimensions. Indeed, the existing debate about the distinct but complementary roles of potential and realized absorptive capacity has been so far mainly a theoretical discussion (e.g. Jansen et al. 2005; Lane et al. 2006; Volberda et al. 2010; Zahra and George 2002). Our study and results clarify these effects in three particular ways.

First, our results primarily indicate that efforts to activate realized absorptive capacity harm the performance of new ventures (overall sample results in Table 3). These results appear to contradict those positive (Lane et al. 2001; Tsai 2001) and positive but eventually saturated (Wales et al. 2013) effects previously found in established firms. The reason may be that new ventures suffer the costs of early absorptive capacity development, which are much higher than the costs of maintaining it (Teece 2007), and have limited knowledge to capitalize on through realized absorptive capacity (Bradley et al. 2011). High costs of early realized absorptive capacity development in combination with low probabilities of effective deployment due to narrow knowledge bases drive this negative impact on new venture performance.

Second, our results show that this negative effect is mitigated when efforts to build realized absorptive capacity are combined with efforts to build potential absorptive capacity, signalling the important synergies of absorptive capacity dimensions (overall sample results in Table 3). Todorova and Durisin (2007) have questioned the need to distinguish between the potential and realized dimensions of absorptive capacity; our results support that distinction, while at the same time they indicate that both dimensions contribute to an effective absorptive capacity.

Third, and very importantly, our results show that variations in firms’ pressures and resources (especially knowledge) determine the performance gains from absorptive capacity dimensions, as is shown in the different effects of efforts to activate realized absorptive capacity and its combination with efforts in potential absorptive capacity on the performance of CVs and IVs (results by venture origin in Table 3). These same findings advance our understanding of the complex relationship between the dimensions of absorptive capacity and the firm knowledge base and how that relationship influences performance, fundamentally because of the costs associated with absorptive capacity development. Specifically, our results support our theoretical claim that researchers need to refine the generally accepted relationship between the firm knowledge base and absorptive capacity dimensions in the case of new ventures (Cohen and Levinthal 1990; Zahra and George 2002) (Fig. 1).

We believe that by considering differences in venture origin we have somehow captured variations in the breadth of the venture knowledge base, and therefore the performance implications of variations in the existing knowledge base of the firm for early efforts in the development of absorptive capacity dimensions. Given that the knowledge bases of CVs are believed to be broader than those of IVs as CVs’ founders bring with them the prior experiences of their parent firms (Bradley et al. 2011; Larrañeta et al. 2014; Zahra 1996), our finding that efforts to build realized absorptive capacity harm new venture performance more for CVs than for IVs (hypothesis 3a) signals that firms have insufficient knowledge to nurture realized absorptive capacity at the early stages of their lifecycle. In addition, our finding that this negative effect is mitigated when those efforts are combined with efforts in potential absorptive capacity in the case of CVs, but not IVs (hypothesis 3b), supports our argument that new ventures’ realized absorptive capacity most likely capitalizes mainly on knowledge externally acquired through potential absorptive capacity rather than on their existing knowledge base (as represented in the dashed arrow that connects potential and realized absorptive capacity and the thin arrow that links the knowledge base and realized absorptive capacity at the early stages of a firm life cycle in Fig. 1). The existing knowledge base would determine the success of efforts to acquire and quickly assimilate externally generated knowledge (potential absorptive capacity), which then would drive the effectiveness of efforts to transform and exploit knowledge coming from external sources (realized absorptive capacity). These conclusions highlight the distinct and particular nature of firms at their early stages of development, making it worthwhile for researchers to target the universe of new ventures.

7 Limitations

Our results should be interpreted with caution because of the study’s limitations. For instance, the cross-sectional design we have used in this research makes it difficult to establish cause-effect relationships, even though we lagged our measure of performance (ROE). The study’s time frame may have also influenced the results reported here; a more longitudinal research design might have yielded different insights. Likewise, though the study has examined several different industries, it focuses on a single country and therefore the results may not apply to other locations or countries. There is also the possibility of survivor bias because the data were collected from existing companies.

8 Future research directions

The limitations we have just noted suggest several opportunities for future research. Notably, our theorizing about the foundations of new ventures absorptive capacity on the knowledge base of the founders rather than on the organizational memory speaks for the need to reflect in more detail about the role played by venture founder’s education and prior experience. There exists a vast literature that unpacks the nuances of founders’ prior experiences to gain a better understanding of the development of entrepreneurial ventures (Agarwal et al. 2004; Gruber et al. 2012; Helfat and Lieberman 2002; Kor 2003; Shane 2000). Drawing on that literature stream we might therefore question how the content (i.e. market vs. technological knowledge) and extent of prior experiences (i.e. breadth and depth across industries) of venture founding teams could differently affect potential and realized absorptive capacity It would also be beneficial to directly link new ventures’ additional motivations to build absorptive capacity (e.g., pursuing radical vs. incremental innovation and market orientation) to its various components. This would allow us to better understand why CVs and IVs might emphasize the four absorptive capacity components differently. Based on our results, and considering the close relation among absorptive capacity and market orientation manifested in the literature (e.g. Narasimhan et al. 2006) we can expect to find differences in market orientation between CVs and IVs. These potential differences may be a consequence of the different objectives and pressures to achieve performance rather than the knowledge bases of CVs and IVs.

Future researchers need to examine more closely the performance outcomes of absorptive capacity dimensions. Including costs in the equation raises the question of whether there exists an optimum level of absorptive capacity as Wales et al. (2013) signaled. It is unclear if there may be nonlinear effects of a highly developed absorptive capacity also for new ventures. Other potential outcomes of absorptive capacity may be equally affected by the rigidities that arise when capabilities are taken to an extreme. For instance, absorptive capacity can increase a firm’s innovation (Escribano et al. 2009). Yet high levels of absorptive capacity may homogenize incoming external knowledge by directing attention to the knowledge that matches what the firm already has, possibly reducing the flow of different or radically new data (Larrañeta et al. 2012). When this happens, new ventures become less able to conceive and introduce radical innovations over time.

Finally, our results highlighting the distinction between potential and realized absorptive capacity offer several opportunities for fruitful future research. Does a weak potential absorptive capacity depress realized absorptive capacity? Does successful realized absorptive capacity replenish potential absorptive capacity? What kind of balance among potential and realized absorptive capacity leads to better performance? Does the origin of the new venture play a role in these relations? Longitudinal designs, in particular, might be useful in addressing these questions, given that capability building takes time (Lane et al. 2006; Lewin et al. 2011; Volberda et al. 2010) and that the costs of developing capabilities exceed the costs of maintaining them (Teece 2007).

References

Agarwal, R., Echambadi, R., Franco, A. M., & Sarkar, M. (2004). Knowledge transfer through inheritance: Spin-out generation, development, and survival. Academy of Management Journal, 47(4), 501–522.

Autio, E., Sapienza, H. J., & Almeida, J. G. (2000). Effects of age at entry, knowledge intensity, and imitability on international growth. Academy of Management Journal, 43(5), 909–924.

Baum, J. R., & Wally, S. (2003). Strategic decision speed and firm performance. Strategic Management Journal, 24(11), 1107–1129.

Becker, G. S. (1964). Human capital: A theoretical and empirical analysis, with special reference to education. Chicago: University of Chicago Press.

Block, Z., & MacMillan, I. (1993). Corporate venturing: Creating new businesses within the firm. Boston, MA: Harvard Business School Press.

Boccardelli, P., Grandi, A., Magnusson, M., & Oriani, G. R. (2004). The value of managerial learning in R&D. In R. Bettis (Ed.), Strategy in transition. London: Blackwell.

Bradley, S. W., Aldrich, H., Shepherd, D. A., & Wiklund, J. (2011). Resources, environmental change, and survival: Asymmetric paths of young independent and subsidiary organizations. Strategic Management Journal, 32(5), 486–509.

Brush, C. G., & Vanderwerf, P. A. (1992). A comparison of methods and sources for obtaining estimates of new venture performance. Journal of Business Venturing, 7(2), 157–170.

Caridi-Zahavi, O., Carmeli, A., & Arazy, O. (2016). The influence of CEOs’ visionary innovation leadership on the performance of high-technology ventures: The mediating roles of connectivity and knowledge integration. The Journal of Product Innovation Management, 33(3), 356–376.

Chen, M.-J., Farh, J.-L., & MacMillan, I. C. (1993). An exploration of the expertness of outside informants. Academy of Management Journal, 36(6), 1614–1632.

Clayton, J., Gambill, B., & Harned, D. (1999). The curse of too much capital: Building new businesses in large corporations. McKinsey Quarterly, 3(1), 49–59.

Cohen, W. M., & Levinthal, M. D. A. (1989). Innovation and learning: Two faces of R&D. Economic Journal, 99(397), 569–596.

Cohen, W., & Levinthal, D. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152.

Cohen, W. M., & Levinthal, M. D. A. (1994). Fortune favors the prepared firm. Management Science, 40(2), 227–251.

Debrulle, J., Maes, J., & Sels, L. (2014). Start-up absorptive capacity: Does the owner’s human and social capital matter? International Small Business Journal, 32(7), 777–801.

Dencker, J. C., & Gruber, M. (2015). The effects of opportunities and founder experience on new firm performance. Strategic Management Journal, 36(5), 1035–1052.

Eisenhardt, K. M., & Martin, J. A. (2000). Dynamic capabilities: What are they? Strategic Management Journal, 21(10–11), 1105–1121.

Eisenhardt, K. M., & Schoonhoven, C. B. (1990). Organizational growth: Linking founding team, strategy, environment, and growth among U.S. semiconductor ventures. Administrative Science Quarterly, 35(2), 504–529.

Escribano, A., Fosfuri, A., & Tribó, J. A. (2009). Managing external knowledge flows: The moderating role of absorptive capacity. Research Policy, 38(1), 96–105.

Ferragina, A., & Mazzotta, F. (2014). FDI spillovers on firm survival in Italy: Absorptive capacity matters! Journal of Technology Transfer, 39(6), 859–897.

Fornell, C., & Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. Journal of Marketing Research, 8(1), 39–50.

Galunic, D. C., & Rodan, S. (1998). Resource recombinations in the firm: Knowledge structures and the potential for Schumpeterian innovation. Strategic Management Journal, 19(12), 1193–1202.

Garud, R., & Nayyar, P. R. (1994). Transformative capacity: Continual structuring by intertemporal technology transfer. Strategic Management Journal, 15(5), 365–386.

Gruber, M., MacMillan, I. C., & Thompson, J. D. (2012). From minds to markets: How human capital endowments shape market opportunity identification of technology start-ups. Journal of Management, 38(5), 1421–1449.

Hayton, J. C., & Zahra, S. A. (2005). Venture team human capital and absorptive capacity in high technology new ventures. International Journal of Technology Management, 31(3–4), 256–274.

Helfat, C. E., & Lieberman, M. B. (2002). The birth of capabilities: Market entry and the importance of pre-history. Industrial and Corporate Change, 11(4), 725–760.

Hisrich, R. D., & Peters, M. P. (1986). Establishing a new business venture unit within a firm. Journal of Business Venturing, 1(4), 307–322.

Huber, G. P. (1991). Organizational learning: The contributing processes and literature. Organization Science, 2(Special Issue), 88–115.

Iansiti, M., & Clark, K. B. (1994). Integration and dynamic capability: Evidence from product development in automobiles and mainframe computers. Industrial and Corporate Change, 3(3), 557–565.

James, L. R., Demaree, R. G., & Wolf, G. (1993). Rwg: An assessment of within-group interrater agreement. Journal of Applied Psychology, 78(2), 306–310.

Jansen, J. J. P., Van Den Bosch, F. A. J., & Volberda, H. W. (2005). Managing potential and realized absorptive capacity: How do organizational antecedents matter? Academy of Management Journal, 48(6), 999–1016.

Keil, T., McGrath, R. G., & Tukiainen, T. (2009). Gems from the Ashes: Capability creation and transformation in internal corporate venturing. Organization Science, 20(3), 601–620.

Kennedy, P. (1979). A guide to econometrics. Cambridge, MA: MIT Press.

Kim, L. (1998). Crisis construction and organizational learning: Capability building in catching-up at Hyundai Motor. Organization Science, 9(4), 506–521.

Kogut, B., & Zander, I. (1992). Knowledge of the firm, combinative capabilities, and the replication of technology. Organization Science, 3(3), 383–397.

Kohli, A. K., Jaworski, B. J., & Kumar, A. (1993). MARKOR: A measure of market orientation. Journal of Marketing Research, 30(4), 467–478.

Kor, Y. Y. (2003). Experience-based top management team competence and sustained growth. Organization Science, 14(6), 707–719.

Kor, Y. Y., & Mesko, A. (2013). Dynamic managerial capabilities: Configuration and orchestration of top executives’ capabilities and the firm’s dominant logic. Strategic Management Journal, 34(2), 233–244.

Lane, P. J., Koka, B., & Pathak, S. (2006). The reification of absorptive capacity: A critical review and rejuvenation of the construct. Academy of Management Review, 31(4), 833–863.

Lane, P. J., & Lubatkin, M. (1998). Relative absorptive capacity and interorganizational learning. Strategic Management Journal, 19(5), 461–477.

Lane, P. J., Salk, J., Marjorie, E., & Lyles, A. (2001). Absorptive capacity, learning, and performance in international joint ventures. Strategic Management Journal, 22(12), 1139–1161.

Larrañeta, B., Zahra, S. A., & Galán, J. L. (2012). Enriching strategic variety in new ventures through external knowledge. Journal of Business Venturing, 27(4), 401–413.

Larrañeta, B., Zahra, S. A., & Galán, J. L. (2014). Strategic repertoire variety and new venture growth. The moderating effects of origin and industry dynamism. Strategic Management Journal, 35(5), 761–772.

Lewin, A. Y., Massini, S., & Peeters, C. (2011). Microfoundations of internal and external absorptive capacity routines. Organization Science, 22(1), 81–98.

Liao, T., & Chwo-Ming, J. (2013). The impact of local linkages, international linkages, and absorptive capacity on innovation for foreign firms operating in an emerging economy. Journal of Technology Transfer, 38(6), 809–827.

Matusik, S. F., & Heeley, M. B. (2005). Absorptive capacity in the software industry: Identifying dimensions that affect knowledge and knowledge creation activities. Journal of Management, 31(4), 549–572.

McDougall, P. P., Robinson, R. J., & DeNisi, A. S. (1992). Modelling new venture performance: An analysis of new venture strategy, industry structure, and venture origin. Journal of Business Venturing, 7(4), 267–290.

McGrath, R. G. (1995). Advantage from adversity: Learning from disappointment in internal corporate ventures. Journal of Business Venturing, 10(2), 121–143.

Moorman, C., & Miner, A. S. (1998). Organizational improvisation and organizational memory. Academy of Management Review, 23(4), 698–724.

Narasimhan, O., Rajiv, S., & Dutta, S. (2006). Absorptive capacity in high-technology markets: The competitive advantage of the haves. Marketing Science, 25(5), 510–524.

Nelson, R., & Winter, S. (1982). An evolutionary theory of economic change. Cambridge: Harvard University Press.

Nicholls-Nixon, C. L., Cooper, A., & Woo, C. (2000). Strategic experimentation: Understanding change and performance in new ventures. Journal of Business Venturing, 15(5/6), 493–521.

Nielsen, K. (2015). Human capital and new venture performance: The industry choice and performance of academic entrepreneurs. Journal of Technology Transfer, 40(3), 453–474.

Robinson, K. C., & McDougall, P. P. (2001). Entry barriers and new venture performance: A comparison of universal and contingency approaches. Strategic Management Journal, 22(6/7), 659–685.

Rosenkopf, L., & Almeida, P. (2003). Overcoming local search through alliances and mobility. Management Science, 49(6), 751–766.

Sapienza, H. J., Autio, E., George, G., & Zahra, S. A. (2006). A capabilities perspective on the effects of early internationalization on firm survival and growth. Academy of Management Review, 31(4), 914–933.

Schildt, H. A., Keil, T., & Maula, M. V. (2012). The temporal effects of relative and firm-level absorptive capacity on interorganizational learning. Strategic Management Journal, 33(10), 1154–1173.

Shane, S. (2000). Prior knowledge and the discovery of entrepreneurial opportunities. Organization Science, 11(4), 448–469.

Shrader, R., & Siegel, D. S. (2007). Entrepreneurial team experience, strategy, and the long-term performance of high-growth, technology-based new ventures. Entrepreneurship Theory and Practice, 31(6), 893–907.

Shrader, R. C., & Simon, M. (1997). Corporate versus independent new ventures: Resource, strategy, and performance differences. Journal of Business Venturing, 12(1), 20–47.

Starr, J. A., & MacMillan, I. C. (1990). Resource cooptation via social contracting: Resource acquisition strategies for new ventures. Strategic Management Journal, 11(5), 79–92.

Szulanski, G. (1996). Exploring internal stickiness: Impediments to the transfer of best practice within the firm. Strategic Management Journal, 17(Special Issue: Knowledge and the Firm), 27–43.

Teece, D. J. (2007). Explicating dynamic capabilities: The nature and microfoundations of (sustainable) entreprise performance. Strategic Management Journal, 28(13), 1319–1350.

Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509–533.

Todorova, G., & Durisin, B. (2007). The concept and reconceptualization of absorptive capacity: Recognizing the value. Academy of Management Review, 32(3), 774–786.

Tsai, W. (2001). Knowledge transfer in intraorganizational networks: Effects of network position and absorptive capacity on business unit innovation and performance. Academy of Management Journal, 44(5), 996–1004.

Vasudeva, G., & Anand, J. (2011). Unpacking absorptive capacity: A study of knowledge utilization from alliance portfolios. Academy of Management Journal, 54(3), 611–623.

Volberda, H. W., Foss, N. J., & Lyles, M. A. (2010). Absorbing the concept of absorptive capacity; how to realize its potential in the organizational field. Organization Science, 21(4), 931–951.

Wales, W. J., Parida, V., & Patel, P. C. (2013). Too much of a good thing? Absorptive capacity, firm performance, and the moderating role of entrepreneurial orientation. Strategic Management Journal, 34(5), 622–633.

Walsh, J. P., & Ungson, G. R. (1991). Organizational memory. Academy of Management Review, 16(1), 35–57.

Winter, S. G. (2003). Understanding dynamic capabilities. Strategic Management Journal, 24(10), 991–996.

Winters, T. E., & Murfin, D. L. (1988). Venture capital investing for corporate development objectives. Journal of Business Venturing, 3(3), 207–227.

Wright, M., Hmieleski, K., Siegel, D. S., & Ensley, M. (2007). The role of human capital in technological entrepreneurship. Entrepreneurship Theory and Practice, 31(6), 791–805.

Zaheer, A., Hernandez, E., & Banerjee, S. (2010). Prior alliances with targets and acquisition performance in knowledge-intensive industries. Organization Science, 21(5), 1072–1091.

Zahra, S. A. (1996). Technology strategy and new venture performance: A study of corporate-sponsored and independent biotechnology ventures. Journal of Business Venturing, 11(4), 289–322.

Zahra, S. A., Filatotchev, I., & Wright, M. (2009). How do threshold firms sustain corporate entrepreneurship? The role of boards and absorptive capacity. Journal of Business Venturing, 24(3), 248–260.

Zahra, S. A., & George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Academy of Management Review, 27(2), 185–203.

Zahra, S. A., Ireland, R. D., & Hitt, M. A. (2000). International expansion by new venture firms: International diversity, mode of market entry, technological learning, and performance. Academy of Management Journal, 43(5), 925–950.

Zahra, S., Van deVelde, E., & Larrañeta, B. (2007). Knowledge conversion capability and the performance of corporate and university spin-offs. Industrial and Corporate Change, 16(4), 569–608.

Zhao, Z. J., & Anand, J. (2009). A multilevel perspective on knowledge transfer: Evidence from the Chinese automotive industry. Strategic Management Journal, 30(9), 959–983.

Zhou, K. Z., & Li, C. B. (2012). How knowledge affects radical innovation: Knowledge base, market knowledge acquisition, and internal knowledge sharing. Strategic Management Journal, 33(9), 1090–1102.

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Larrañeta, B., Galán González, J.L. & Aguilar, R. Early efforts to develop absorptive capacity and their performance implications: differences among corporate and independent ventures. J Technol Transf 42, 485–509 (2017). https://doi.org/10.1007/s10961-016-9488-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-016-9488-1