Abstract

New venture formation by academics has recently been recognized as an important source of knowledge spillover and technology transfer. However, the majority of studies have focused on the factors leading to academic entrepreneurship, while only few study the performance of these ventures. Moreover, this strand of the literature has focused solely on start-ups by university faculty. This study adds to these by including university graduates in the definition of academic entrepreneurs and controlling for the industry environment in which the new venture is founded; both aspects, which are recommended in recent studies. Longitudinal register data combined with responses from 1,151 first-time entrepreneurs in 2004 are used to explore the self-selection of individuals into certain industry environments and their subsequent performance—survival and growth—in the chosen environment. This study works from the hypothesis that university education (technical and non-technical) and industry experience increase new venture performance in high-profit and high-uncertainty industries, respectively, because of increased knowledge and skills; in addition, education and experience engender higher absorptive capacities and adaptability. The analysis controls for personal traits, social capital, and financial capital. Technical academics are found to perform better in both profitable and uncertain industries, whereas non-technical academics perform better only in profitable industries. Nevertheless, both types of academics are more likely to enter uncertain industries. The absorptive capacities of technical academics make these individuals particularly important in technology transfers to new ventures in unstable environments, which are important in developed economies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Entrepreneurship is recognized for creating growth, jobs, and competition in developed economies (Audretsch 2009; Haltiwanger et al. 2010). However, approximately one-half of new ventures close down within the first 3 years following start-up (Mata and Portugal 1994; Praag 2005). Likewise, high-employment growth among surviving ventures is the exception, not the rule. Furthermore, non-innovative entrepreneurs constitute a large share of the pool of new start-ups. As a result, there has been substantial political focus recently on the factors behind successful entrepreneurship, as defined by firm performance and the novelty of the product or service provided. Thus, entrepreneurs with a (technical) university degree are understood to be important because of their knowledge and skills related to new venture performance in general (Unger et al. 2011) and to university technology transfer in particular (Åstebro et al. 2012; Wennberg et al. 2011; Criaco et al. 2013). This research contributes to the studies on human capital in the form of university degrees and industry experience as these relate to new venture performance measured by survival and growth. More importantly, the self-selection of individuals with high human capital into certain industry environments and its importance for firm performance are assessed. Although there are theoretical frameworks that integrate individual human capital and the industry environment (Bhidé 2000), empirical studies of this type are rare and encouraged (Sarasvathy 2004). Indeed, existing studies reveal different effects of human capital on new venture performance, likely due to different study contexts not explored further (Unger et al. 2011). Likewise, the vast majority of studies focus on the causes (Karlsson and Wigren 2012), motivations (Hayter 2011; D’Este and Perkmann 2011), and barriers to academic entrepreneurship (Wright et al. 2009; O’Gorman et al. 2008) and not the subsequent performance of the new venture (Siegel and Wessner 2012; Zhang 2009; Criaco et al. 2013). The latter studies include a variety of performance indicators such as survival (Zhang 2009; Criaco et al. 2013), job creation (Zhang 2009; Siegel and Wessner 2012), VC capital raised and chance of IPO (Zhang 2009), patents applied for and licensing agreements consummated (Siegel and Wessner 2012). However, these studies all utilize a small bounded sample of start-ups from different data sources giving rise to potential selection bias. This study overcomes this problem by utilizing representative longitudinal register data. Second, it builds on the recent work by Åstebro et al. (2012) and Wennberg et al. (2011) that emphasize the importance of not focusing solely on start-ups founded by university faculty but also university students given the quality of the ventures started by the latter. Third, it includes the area of study, technical or non-technical, of the founders with a master’s degree or PhD degree. Finally, it controls for the industry start-up environment as outlined in (Unger et al. 2011) by including several industry characteristics of importance for new venture performance.

As acknowledged in the literature, the industry environment represents opportunities for entrepreneurial exploitation (Shane 2003). This study follows the theoretical framework of Bhidé (2000), in which expected profit, uncertainty, and investment requirements are the fundamental parameters that constitute the industry environment. It is a straightforward argument that high levels of expected profit will lead to the establishment of more firms and to better new venture performance because of the ability to obtain resources (Dess and Beard 1984). However, Bhidé (2000) argues that high-profit opportunities also require greater investment. Because the nascent entrepreneur is frequently capital constrained, these opportunities are more likely to be exploited by corporate initiatives. Thus, the average entrepreneur is forced to pursue low-investment—and low-expected-profit—opportunities, which leads to uncertain profit. When expected profit is low, opportunities with a skewed distribution of profit increase the chances of success compared to opportunities with a narrow distribution of profit. Individuals with high levels of human capital are expected to select and perform better in high-profit, high-investment, and low-uncertainty industries. First, their verifiable human capital (academic degree and industry experience) makes it easier for them to attract the necessary resources to form a start-up in these industries (Unger et al. 2011). Second, their human capital makes them more capable of identifying and realizing attractive opportunities in these industries (Parker 2004; Shane 2003; Davidsson and Honig 2003), which is necessary since these individuals have a high opportunity cost of entrepreneurship. Third, their knowledge and skills in the form of causal reasoning, including planning and prediction (Unger et al. 2011), are appropriate and effective for a larger venture in a stable environment (Sarasvathy 2008). Finally, individuals with high levels of human capital are also expected to perform better in low-profit, low-investment, and high-uncertainty industries because of their ability to obtain new knowledge and skills (Unger et al. 2011) and learn from experience (Weick 1996; Nielsen and Sarasvathy 2011). Nevertheless, these individuals will not select into uncertain industries because of the high opportunity costs (Unger et al. 2011; Davidsson and Honig 2003) that hinder technology transfers in unstable industries.

The analysis in this study takes into account the personal traits and social capital of the entrepreneur in investigating the effects of human capital on industry choice and subsequent performance. It is expected that creativity and the ability to tolerate ambiguity increase entry rates and the chances of success in uncertain environments (Cromie 2000). Tolerance of ambiguity describes an individual’s ability to address situations characterized by uncertainty, whereas an individual’s creativity influences the capacity to adapt to a changing and uncertain environment. An entrepreneur’s social capital is also expected to have a greater influence on new venture performance in uncertain industries (Brüderl and Preisendörfer 1998). In these environments, the need for moral support and individuals acting as sounding boards is likely to be higher. Furthermore, the ability to adapt to a changing and uncertain environment is valued more highly if the resources of more individuals can be utilized (Sarasvathy 2008).

The analyses in this research are based on register data from IDA (Integrated Database for Labour Market Research) combined with a questionnaire survey from 2008. IDA is a matched employer-employee longitudinal dataset covering all individuals and firms in Denmark. The survey stratum covering first-time entrepreneurs in 2004 was used for this study. Industries are separated by six-digit NACE classifications with certain restrictions that reduce the response population. The resulting response population consists of 1,151 individuals starting new ventures in 133 different industries. Seven indicators are constructed for industry environment based on information from 1999 to 2004, the pre-start-up period; these are reduced to two key variables through a principle component analysis that covers industry profitability and uncertainty, which is consistent with the framework of Bhidé (2000). OLS regressions with the industry components as explanatory variables are used to assess industry choice. Following the approach in Cooper et al. (1994), new venture performance is categorized into the following categories for the 2004–2006 period: non-survival, survival without employee growth, and survival with employee growth. This categorization enables the use of the ordered logit model (OLM).

Although industry experience is found to have a positive effect on new venture performance regardless of industry environment, the effects of having earned an academic degree also depend on whether the degree is technical or non-technical. First-time entrepreneurs with a technical degree perform better in both profitable and uncertain environments, whereas entrepreneurs with non-technical degrees only perform better in profitable environments. Surprisingly, however, both types of academics are more likely to select into uncertain industries. Individual tolerance of ambiguity and creativity are better predictors of start-ups in uncertain environments, although it does not increase the likelihood of success. This has important policy implications because of the need for technology transfer in unstable and stable industries. In light of the recent political focus on successful academic entrepreneurship (Siegel and Wessner 2012; Zhang 2009; Criaco et al. 2013), further research should investigate the mechanisms leading to success to encourage technical academics, university students as well as faculty (Åstebro et al. 2012; Wennberg et al. 2011), to pursue entrepreneurial careers.

2 Theory

Following the definition of Becker (1964), two indicators for human capital (investments) are chosen as important for industry choice and subsequent performance: education and industry experience. The industry environment is divided into two categories following the framework of Bhidé (2000): (1) industries characterized by high mean profits, high required investment, and low uncertainty in profits, and (2) industries with low mean profits, low required investment, and high uncertainty in profits (this category is also called a promising start-up environment).

2.1 Human capital and industry choice

According to Bhidé (2000), higher education discourages uncertain—but promising—start-ups because of the low expected payoff in relation to the risk. These individuals are in a better position to obtain financing for a new venture because education signals ability to investors. As a result of the high opportunity cost (i.e., the foregone wage on the labor market) and the easier access to financing, highly educated individuals choose high-profit (high investment, low uncertainty) industries when pursuing an entrepreneurial career (Unger et al. 2011; Davidsson and Honig 2003). Individuals with low educational levels, however, are expected to gravitate toward marginal start-ups in which there is low expected payoff and, furthermore, no chance of high payoff. Individuals with medium levels of education are most likely to enter into entrepreneurship that results in an inverted u-shape relationship between education and the promise of the start-up (Bhidé 2000). Industry experience is also expected to have a positive effect on the opportunity cost of entrepreneurship because of the positive relationship between industry experience and wage income that is documented in the labor market literature (Borjas 2010). Thus, highly experienced individuals are incentivized to choose high-profit (high investment and low uncertainty) industries, which is a real option because experience improves access to financing through external sources or personal networks created in the industry. This leads to the following two hypotheses:

Hypothesis 1a

Human capital increases the likelihood of start-up in high-profit (high investment and low uncertainty) industries.

Hypothesis 1b

Human capital decreases the likelihood of start-up in high-uncertainty (low investment and low profit) industries.

2.2 Human capital and new venture performance

In the literature is argued that education exerts a positive influence on new venture performance because highly educated individuals have the knowledge and skills to perceive and exploit more attractive opportunities (Parker 2004; Shane 2003; Davidsson and Honig 2003). Nevertheless, some scholars argue that the skills that make a successful entrepreneur cannot be or are not necessarily obtained through formal education (Parker 2004; Casson 2003). First, the literature often portrays successful entrepreneurs with certain personality traits, cognitive styles, work values, or attitudes; features that higher education does not enhance. Second, higher education might lead to more causal than effectual thinking (Sarasvathy 2001); the former is advantageous in established firms in stable environments, and the latter in new firms in uncertain environments. According to causal logic, market opportunities are waiting to be found (e.g., by intensive market research and business planning), whereas effectual logic posits that market opportunities are made (e.g., by using the available means to create different ends along the way). Nevertheless, introducing the concept of absorptive capacity (Cohen and Levinthal 1990), higher education levels are also expected to increase the success rate when operating in an unstable environment because education increases the ability to accumulate new knowledge and skills (Unger et al. 2011) and learning from experience (Weick 1996; Nielsen and Sarasvathy 2011) both of which are crucial for adapting to a changing environment. Existing empirical studies find that start-ups founded by academics are more likely to survive (Zhang 2009; Criaco et al. 2013), hire new employees, apply for patents, and consummate licensing agreements (Siegel and Wessner 2012). These studies, however, only include university faculty and not students. This focus is too narrow according to Åstebro et al. (2012) and Wennberg et al. (2011). The former study finds that recent university graduates are about twice as likely to found a new firm as university faculty (Åstebro et al. 2012). Moreover, firms started by graduates are not of low quality as expected. Similarly, Wennberg et al. (2011) find in a sample of university-educated entrepreneurs that commercial spin-offs perform better in terms of survival and growth than university spin-offs. Finally, in a meta-analytical review, Unger et al. (2011) find a small significant effect of human capital on entrepreneurial success but underline the importance of taking into account the moderating role of the industry context in future studies. Turning to industry experience, this is assumed to have identical effects as university education. Industry knowledge is an advantage for performance in stable environments because of the ability to predict and plan but also because coping with an uncertain and changing environment is easier with experience and access within the industry through personal networks. This relationship is supported in numerous empirical studies that show that spin-off entrepreneurs, in general, perform better than others (Phillips 2002; Agarwal et al. 2004; Praag 2005). Thus, the following two hypotheses are proposed:

Hypothesis 2a

Human capital increases new venture performance in high-profit (high investment and low uncertainty) industries.

Hypothesis 2b

Human capital increases new venture performance in high-uncertainty (low investment and low profit) industries.

2.3 Control variables

In testing the above hypotheses, it is important to take into account individual (aside from human capital) and contextual factors that can influence industry choice and new venture performance (Sarasvathy 2004; Shane 2003). The importance of adding these controls is outlined below.Footnote 1

2.3.1 Tolerance of ambiguity

Risk and uncertainty characterize the choices that the entrepreneur must make, which has been widely studied in the personal traits literature (Brockhaus 1980; Begley 1995; Koh 1996) with respect to entrepreneurship in which measures of risk-taking propensity and tolerance of ambiguity are typically present when identifying who becomes an entrepreneur (Cromie 2000). The results of these studies are mixed, which might be the result of operationalization issues. Tolerance of ambiguity describes an individual’s ability to address uncertainty, such as making decisions with incomplete information. Successful entrepreneurs must have a high tolerance of ambiguity to be comfortable due to financial risk and socio-psychological risks (de Vries 1977). Thus, entrepreneurs with a high tolerance of ambiguity are expected to be more likely to select into unstable environments and achieve higher performance with new ventures because they are more comfortable in the environment.

2.3.2 Creativity

The literature often portrays entrepreneurs as creative individuals characterized by thinking in non-conventional ways, challenging existing assumptions and engaging in flexible and adaptive problem solving (Cromie 2000). The assumption that entrepreneurs differ from others when looking at creativity or innovativeness is supported in Caird (1991), Cromie and O’Donaghue (1992), and Koh (1996). Furthermore, Utsch and Rauch (2000) find that innovativeness has a positive and significant effect on both profit and firm growth when it mediates between achievement orientation and venture performance. Returning to the idea of causal and effectual thinking from Sarasvathy (2008), it is clear that creativity plays a vital role in the latter type of thinking, which is preferred by expert entrepreneurs. The advantage of effectuation compared to causation may be explained by the inherent uncertainty in entrepreneurial decisions. The need to adapt to unforeseen events is emphasized in Bhidé (2000). Hmieleski and Ensley (2004) find that improvisational behavior improves new venture performance when one must deviate from the business plan in a rapidly changing and uncertain environment. Thus, it is expected that creative individuals select into unstable environments and achieve higher performance with new ventures.

2.3.3 Social capital

Successful venturing requires that the entrepreneur be able to obtain the necessary resources, such as information, customers and suppliers, in addition to capital and labor. In obtaining these resources, the social network of the entrepreneur is frequently assumed to play a significant role. In the literature, information from the entrepreneur’s network ties is often assumed to be more useful than information from formal sources (Brüderl and Preisendörfer 1998). Ostgaard and Birley (1996) find that time devoted to making contact with new suppliers and new investors has positive effects on firm performance. Lee and Tsang (2001) find that extroversion influences the frequency and breadth of external communication, which have significant and positive effects on firm performance. Finally, the need for entrepreneurs to receive moral support from strong ties is frequently emphasized in the literature and supported in empirical studies (Hisrich et al. 2005; Hanlon and Saunders 2007). Following the above line of reasoning, ownership with others is also expected to lead to superior performance, as more resources are available. In sum, entrepreneurs with more social capital are expected to achieve higher performance with a new venture, especially, in uncertain environments.

2.3.4 Wealth and initial investment

Wealth is important because more capital allows the new venture to cope with random shocks from the environment during the critical early years (Brüderl et al. 1992). A small initial investment might be necessary because of capital constraints (Bhidé 2000), which is supported in Praag (2005), Praag et al. (2005), and Parker and Praag (2006). One way to address this problem is the real options approach (McGrath 1999), in which the financier only commits to small initial investment in the new venture, after which she has an option to make another investment if the business meets certain milestones (Shane 2003). Importantly, the real options approach is also understood as an attractive approach when the entrepreneur is not capital constrained (McGrath 1999). When beginning a new firm in a highly dynamic environment, the firm must be able to adapt to find its place in the market. In summary, wealth and small initial investment are expected to be positively related to performance, particularly in uncertain environments.

2.4 Industry environment

Dess and Beard (1984) categorize the dimensions of organizational task environments from Aldrich (1979) into three broad categories: munificence (capacity), dynamism (stability-instability, and turbulence), and complexity (homogeneity-heterogeneity, and concentration-dispersion). The three organizational task environments influence an organization’s ability to obtain sustained growth and slack resources (munificence), to predict and plan for the future (dynamism), and to acquire inputs and divest outputs (complexity) (Dess and Beard 1984). In more recent work, Bhidé (2000) focuses on what he calls promising start-ups defined from an investments-uncertainty-profits diagram of the environment. Promising start-ups are characterized by low levels of investment, high uncertainty, and low levels of likely profit. Other initiatives include marginal start-ups (low investment, low uncertainty, and low profit) and corporate initiatives (high investment, low uncertainty, and high profit) (Bhidé 2000). It is straightforward to argue that (expected) high industry profits will lead to the formation of more firms and, using the munificence arguments discussed above, better performance by new ventures. Nevertheless, Bhidé (2000) argues that high expected profit opportunities also call for high investment. As the nascent entrepreneur is capital constrained as argued earlier, these opportunities are more likely to be exploited by larger corporate initiatives. Thus, the nascent entrepreneur is forced to pursue low investment and, therefore, low expected profit opportunities, which means that uncertainty in profits is important. Although the expected profits are low, opportunities with a skewed distribution of profit increase the chance of success (promising start-up) compared to opportunities with a narrow distribution of profit (marginal start-up).

Many studies include variables for industry investment requirements and profitability in exploring new venture formation and performance. Beginning with investment requirements, Dean et al. (1998), Dean and Brown (1995) and Dean and Meyer (1996) find a negative effect on formation, while Acs and Audretsch (1989) do not. Regarding the survival of new ventures, Audretsch (1991) and Audretsch and Mahmood (1995) both find that the industry capital-labor ratio has a negative effect on 10-year firm survival, although the former study finds a positive effect on short-run survival (4 years). Some of these studies also include different indicators for industry profitability. Dean et al. (1998) find that profitability has a positive effect on large-firm formation, whereas Acs and Audretsch (1989) find that profitability increases the industry net entry rate. Surprisingly, Audretsch and Mahmood (1995) find that the industry price–cost margin has a negative effect on long-run survival (10 years). Audretsch (1991) finds that industry concentration—a proxy for industry profits—increases short-run survival (4 years) but not 10-year survival. No indicator for profit uncertainty was included in the above studies.

If the categories industry profitability and industry uncertainty are broadened into industry munificence and industry dynamism, respectively, as in the earlier literature, then industry growth and industry growth instability are important variables. Industry munificence, represented by industry growth, is primarily beneficial for new entrants because new entrants will not necessarily be required to compete with existing firms for customers (Shane 2003). Several studies have shown that growing industries attract more new ventures (Dean and Brown 1995; Dean and Meyer 1996; Dean et al. 1998; Acs and Audretsch 1989). Whether the decision to start up in a high growth industry is the right decision has also been studied extensively by evaluating new firm performance. Mata and Portugal (1994), Gimeno et al. (1997) and Eisenhardt and Schoonhoven (1990) all find a positive effect of industry growth on firm survival. Other measures of firm performance have also been investigated, but to a lesser extent. Eisenhardt and Schoonhoven (1990) find that industry growth has a positive effect on firm growth, while Gimeno et al. (1997) find that gross state product growth increases entrepreneurial earnings. All of these studies, except Mata and Portugal (1994) and Gimeno et al. (1997), do not account for the instability of industry growth or the dynamic aspects of industry growth (e.g., a more competitive environment for new ventures). The former study finds that the number of new firms in the industry increases the likelihood of failure for new ventures. The latter study utilizes responses from entrepreneurs on expected changes in the number of competitors and expectations about how rapidly the business is changing and does not find that subjective environmental dynamism has a significant effect on firm exit or entrepreneurial earnings.

Following the framework of Bhidé (2000) and the empirical research discussed above, this study conducts a principle component analysis to create two key components for an industry environment, which will be discussed in the methodology section below.

3 Methodology

Register data from IDA (Integrated Database for Labour Market Research) combined with a questionnaire survey from 2008 are used in the analysis. IDA is a matched employer-employee longitudinal dataset that includes all persons and firms in Denmark from 1980. Furthermore, IDA contains an entrepreneurship register that lists the main founders of all new businesses since 1994. IDA is used to create a variable for new venture performance and indicators for industry environment, human capital, and financial capital. Furthermore, the sampling for the 2008 survey was based on information from IDA up through 2004, which was the latest year available at the time. The stratum containing first-time entrepreneurs in 2004 was used for this study. The population, sample, and response population for this stratum contain 7,250, 4,389, and 1,384 individuals, which indicates a sample size close to the population size and a response rate of 32 %.Footnote 2 The indicators for personal traits and social capital were derived based on the survey.

3.1 New venture performance

The usual applied measures of new venture performance are survival or growth in employees, sales, or profits. Several studies, including studies based on IDA, show that the likelihood of failure for new ventures is high; 3 years after start-up, one-half of all new ventures are closed (Mata and Portugal 1994; Praag 2005). In addition, few new ventures experience high growth, which makes survival an important performance measure. However, the theory presented in Bhidé (2000) relates to growth in new ventures. Therefore, the performance measure in this study will include both survival and growth. Following the approach in Cooper et al. (1994), new venture performance in the period 2004 to 2006 (the latest year available) is categorized as follows: non-survival, survival without employee growth, and survival with employee growth. A firm is considered to have survived if it existed with real activity in 2006, whereas growth is defined as growing at least 50 % from 2004 to 2006 and adding at least one full time equivalent employee.Footnote 3 Applying this definition of firm performance resulted in 440 non-surviving entities (38 %), 551 surviving without growth (48 %), and 160 surviving with growth (14 %). Cooper et al. (1994) use the performance measure as a dependent variable in a multinomial logit model (MLL). However, it is straightforward to argue that the performance measure is naturally ordered, with non-survival being least desirable and survival with growth most desirable, which allows for use of the OLM because the distances between the categories are not required to be identical in this model. Using OLM for the analyses reduces the regression output compared to MLL because there is only one set of regression coefficients. However, the parallel regression assumption (proportional odds assumption) must be tested.

3.2 Industry environment

Seven indicators are initially constructed for the industry environment based on information from 1999 to 2004, the pre-start-up period. These 6 years are chosen because of a structural break in the data in 1999 and because industry choice is likely to be based on industry characteristics in the period close to the start-up date, which assumes adaptive expectations. Industries are separated by six-digit NACE classifications with certain restrictions that reduce the response population.Footnote 4 The resulting response population consists of 1,151 individuals starting up in 133 different industries.

Following the method in Dess and Beard (1984), indicators for industry growth and instability are created. Growth is estimated by the OLS regression of the number of firms in the industry and the net after-tax income in the industry as the dependent variable, respectively; time (6 years) is the only explanatory variable (besides the constant term). To control for industry size, the coefficient (growth indicator) is divided by the mean value of the dependent variable. Industry instability is calculated from the same regressions, dividing the standard deviation (instability indicator) by the mean value of the dependent variable. This calculation gives a measure of firm and profit growth, in addition to firm and profit instability. Furthermore, the mean and standard deviation of the net income after tax in 2004 for the firms in each industry are calculated. These calculations provide a measure of expected profit and profit uncertainty. Finally, the industry mean fixed assets are calculated because industries with high expected profit are assumed to require high levels of investment (Bhidé 2000).

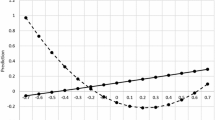

Because the indicators for industry environment are assumed to be correlated, it is appropriate to reduce the number of indicators to be used as moderator variables in the analyses, which is accomplished by using principle component analysis to obtain two components that measure industry profitability and uncertainty.

3.3 Human capital and control variables

Three variables covering education and industry experience are created from IDA. Beginning with education, two dummy variables indicate (1) whether the entrepreneur has a university degree at a masters or PhD level and (2) whether that degree is in a field of technical science (natural science, engineering, or medical science), by contrast to a field in the social sciences or humanitiesFootnote 5 A total of 140 out of the 1,151 entrepreneurs have an academic degree at a masters or PhD level (43 are technical). The continuous variable for industry experience measures the number of years that the first-time entrepreneur worked in the same four-digit NACE industry 5 years prior to start-up.

Control variables for personal traits (i.e., tolerance of ambiguity and creativity), social capital (e.g., frequent contact with former colleagues and co-ownership), and financial capital (initial investment and personal wealth) are created from IDA and the survey. A detailed description of these variables can be found in Tables 1 and 2 shows descriptive statistics. From paper-and-pencil surveys such as the one used in this study, a small number of missing values for each indicator are expected. However, if all individuals with one or more missing values were excluded, the number of observations would be substantially reduced when conducting analyses that include multiple indicators (e.g., multiple regression models). Thus, a better way to address this problem is to impute the missing values such that they do not significantly influence the main results of the analyses. In this study, missing values for the survey indicators are imputed using regression imputation with gender, age, foreign origin, education, personal income, and household wealth as explanatory variables.

4 Results

4.1 Industry environment

The correlation of the seven industry indicators can be observed in Table 3. The following indicators have a significant (5 % level) and strong positive correlation (coefficient above 50): (1) Growth in number of firms and instability in number of firms; (2) Growth in profits and (a) growth in number of firms and (b) instability in number of firms; (3) Mean firm profits and deviation firm profits; (4) Mean firm-fixed assets; and (a) Mean firm profits and (b) deviation firm profits. Table 4 shows the results of the principle component analysis.Footnote 6 The eigenvalues indicate that at least components one and two are important; the third component has an eigenvalue of slightly below one. The three components explain 39, 33, and 14 %, respectively, of the variance in the seven variables.

Interpreting the coefficients of the three industry components in Table 5, a high score on component one is roughly associated with (1) High mean firm profits, (2) High deviation firm profits, and (3) High mean firm fixed assets. For component two, the factors are (1) High growth in number of firms, (2) High instability in number of firms, and (3) High growth in profits. Finally, for component three, a high score is only associated with high instability in profits. Thus, based on the highest component loading, the three industry indicators comprise profitability (component 1), instability in firms (component 2), and instability in profits (component 3).

4.2 Human capital and industry choice

Table 6 shows the results of OLS regressions assessing the industry choice of first-time entrepreneurs. The dependent variables are industry profitability (Model 1) and instability in firms (Model 2). The third and final industry component—instability in profits—was excluded for the following reasons: (1) it had a relatively low eigenvalue compared to the other two components, (2) there is no selection into these industries dependent on human capital and the other controls, and (3) it did not have a significant influence on firm performance at a 5 % level of significance. In the remainder of this paper, the two industry components will be referred to as industry profitability and uncertainty. In both models, the three main explanatory variables cover human capital—academic degrees in technical or non-technical scientific fields—and experience in the start-up industry. Control variables for the two personal traits—tolerance of ambiguity and creativity—are included.

Model 1 shows that entrepreneurs with an academic degree founded their new venture in less-profitable industries than entrepreneurs without an academic degree. However, the model further reveals that this is only the case for academics in the fields of social sciences and humanities. Turning to Model 2, an academic degree increases the uncertainty of the start-up industry for both technical and non-technical degree holders. Finally, high profitability and low uncertainty characterize the environment in which first-time entrepreneurs with prior work experience from the industry founded their venture. Control variables measuring personal traits show the expected results. Entrepreneurs with a high tolerance of ambiguity select into more uncertain industries. Creative entrepreneurs choose more uncertain and less profitable industries. Based on the R2 statistics of the two models, it is notable that the uncertainty of the industry chosen by first-time entrepreneurs is significantly better explained by human capital and personal traits than the profitability of the industry.

4.3 Human capital and new venture performance

Table 7 shows the results from ordered logistic regression models of new venture performance. Model 1 includes the two components that cover industry environment (i.e., profitability and uncertainty) and the three indicators for human capital. Moreover, control variables for personal traits, social capital, and financial capital are included. Models 2 and 3 add additional interaction variables for profitability and human capital (Model 2) and profitability and personal traits, social capital, and financial capital (Model 3). Models 4 and 5 mirror the previous two except that industry profitability is replaced with industry uncertainty in the interaction terms.

Model 1 initially shows that industry profitability and uncertainty have the expected positive and negative effects on new venture performance. Surprisingly, first-time entrepreneurs with an academic degree perform worse than non-academic entrepreneurs, regardless of whether the degree is technical or non-technical. Finally, years of experience in the start-up industry have the expected positive effect on new venture performance. Model 2 supplements these findings by revealing that academics do not perform worse when controlling for industry profitability; for mean values of industry profitability, the negative coefficient for academics is insignificant at the 5 % level. On the contrary, being an academic increases performance in high-profit industries in general. Finally, the positive effect of industry experience is found to be independent of industry profitability. These findings are robust when interaction effects are introduced on the control variables. Notably, the coefficient for industry profitability becomes insignificant in Model 3, which indicates that for individuals without the included personality traits, social capital, and financial capital, starting up in high-profit industries does not increase performance. In Model 4, academics do not perform different from non-academics for mean values of industry uncertainty. Surprisingly, the positive effect of a university degree on performance in high-uncertainty industries is only observed for technical degrees. As discussed above, industry experience has a positive effect on new venture performance independent of the industry environment. These results are robust when interactions are introduced between uncertainty and the control variables in Model 5.

The control variables confirm that, in general, financial capital and social capital have positive effects on new venture performance, whereas personal traits in the form of tolerance of ambiguity and creativity are insignificant. Thus, social capital is found to be more important for success in high-profit industries.

4.4 Brant test

Before further discussion of the findings, possible violations of the parallel regression assumption are assessed. The results from the Brant test of Models 3 (profitability interactions) and 5 (uncertainty interactions) in Table 7 are presented in Table 8. Beginning with Model 3, four violations of the Brant test are evident. First, wealth influences the chance of new venture survival more than growth. Second, creativity influences survival positively—but growth negatively—for mean values of industry profitability. Third, ownership with others has only a small positive effect on survival but a large positive effect on growth for mean values of profitability. Finally, in high-profit industries, each year of prior work experience in the industry has a small positive effect on survival but a large negative effect on growth.

The first three violations can also be observed for Model 5 with four additional violations. As expected, high levels of initial investment in high-uncertainty industries have a small positive effect on survival but a large negative effect on growth because of the inability to adapt to the changing environment. The three remaining violations are all related to human capital in the form of academic education. First, an academic degree has a large negative effect on survival but a large positive effect on growth for mean values of industry uncertainty. Second, in high-uncertainty industries, a non-technical degree has a negative effect on performance, whereas the opposite is true for technical academics; the effect on growth is larger than the effect on survival for both groups.

5 Discussion

The purpose of this study is to expand upon previous research (Siegel and Wessner 2012; Zhang 2009; Criaco et al. 2013; Åstebro et al. 2012; Wennberg et al. 2011) by exploring the importance of human capital for industry choice and subsequent performance of first-time entrepreneurs when accounting for different industry environments and controlling for personal traits, social capital, and financial capital. The two primary components of industry environment—profitability and uncertainty—are initially found to have the expected positive and negative effects, respectively, on new venture performance. It was hypothesized that individuals with more human capital—measured by having earned an academic degree or by having worked for a certain number of years in the start-up industry—would be more likely to select into high-profit, high-investment, and low-uncertainty industries for two reasons: (1) their higher levels of human capital would make their opportunity costs (measured as their foregone wages on the labor market) higher and cause them to pursue high-profit opportunities, and (2) their knowledge and skills can be signaled to outside parties, which would make them less likely to be capital constrained (Unger et al. 2011; Davidsson and Honig 2003). Based on the same logic, these individuals are less likely to choose low-profit, low-investment, and high-uncertainty industries. These hypotheses (1a and 1b) are supported for industry experience but not regarding university education. Academics are more likely to establish their first venture in more uncertain industries; in addition, non-technical academics (i.e., social science and humanities) are also more likely to establish their first venture in less profitable industries. This might be explained by innovation-driven industries that are characterized by uncertainty and that employ a more educated workforce per se. Notably, however, only non-technical academics enter less profitable industries, which may be attributed to two causes: (1) they are more capital constrained than technical academics because their knowledge is more general with respect to the product or service on which they want to base their new venture, and (2) they have lower opportunity costs in the labor market, which makes them more willing to pursue opportunities in less-profitable industries. Thus, academics—including those in the fields of natural science, engineering and medical science—select into more uncertain industry environments, which is crucial for technology transfers in developed economies because only high-profit (high-investment and low-uncertainty) opportunities will be exploited by corporate initiatives (Bhidé 2000).

The next assessment is whether the performance of first-time entrepreneurs with more human capital is superior in both types of industry environments, which would be consistent with this study’s hypotheses (2a and 2b). The effects of industry experience on the survival and growth of new ventures are well established in the empirical literature (Phillips 2002; Agarwal et al. 2004; Praag 2005). These effects are supported in the present research, which also finds that prior industry experience is equally important in both certain and uncertain environments. Industry experience is important for uncertain environments because the ability to adapt to changing environments is required and this ability is based on the knowledge gained and the networks created in the industry. Thus, it is always worth supporting spin-off entrepreneurs, although they are more likely to appear in stable environments because of their higher opportunity costs in the labor market. Having earned a masters or PhD degree in a technical or non-technical field increases performance in high-profit (high-investment and low-uncertainty) industries, which can be explained by the required initial investment, knowledge and skills in these attractive industries. Moreover, greater levels of education might lead to more causal reasoning (compared to effectual reasoning), and this planning and predicting behavior is valuable when operating on a larger scale in a stable environment. Simultaneously, individuals with higher levels of education are also expected to be better at adapting to a changing environment because of their higher absorptive and learning capacities (Cohen and Levinthal 1990; Weick 1996; Nielsen and Sarasvathy 2011). Notably, technical academics are found to perform better than non-academics in uncertain environments, and they are more likely to survive and grow with their new venture because their learning capacity is greater; this may be because non-technical academics have more general knowledge about the product or service provided compared to technical academics, which makes the latter more capable of changing their product or service to meet demand conditions. In relation to this, a salient critique of the current method of teaching how to found a new venture in business economics has been developed around the focus on causal reasoning (e.g., making a detailed business plan based on market analyses) instead of effectual reasoning (e.g., making an open business plan based on the entrepreneur’s resources) (Sarasvathy 2008); the critique argues that the latter should be used in an uncertain environment, although the former is the focus of current business economics. Finally, selecting individuals with higher ex-ante absorptive capabilities into the technical sciences might also explain these results. Surprisingly, none of the indicators for personal traits—tolerance of ambiguity and creativity—is found to significantly influence the chances of success with new ventures. Overall, these findings are consistent with previous research that shows that personal traits are better at predicting entry into entrepreneurship than new venture performance (Cromie 2000). New venture performance is dependent on other factors, including levels of human, social and financial capital.

These findings underline the importance of encouraging academics with technical degrees to become entrepreneurs because of their superior performance in stable and unstable industry environments, which makes technology transfers possible, especially, in the latter environments. Further research might explore the causes of the differences in performance between technical and non-technical academics in uncertain industry environments with the intention of improving university entrepreneurship policy and education. Exploring the relationship between higher education in different fields of study, on the one hand, and adaptive capabilities, causal/effectual reasoning regarding the start-up process, intrinsic/extrinsic work values, and entrepreneurial opportunity costs, on the other hand, might prove valuable as these aspects are important for the likelihood of start-up and subsequent performance. In light of the policy focus on academic entrepreneurship, a variable that indicates whether the new venture was started while working/studying at a university, or based on an idea developed at a university, would be useful. Likewise, information on whether the entrepreneur had received entrepreneurship education at the university would be beneficial to assess the effects of this on new venture performance. Moreover, the difference between faculty and students regarding industry choice and subsequent performance could be explored following an approach like Åstebro et al. (2012) using both quantitative and qualitative data. This is important given that new ventures started by university students are often excluded in the technology transfer literature (Åstebro et al. 2012; Wennberg et al. 2011), although, they are large in number and not of lower quality as compared with ventures started by university employees. This is likely due to lack of data on students as policy makers have focused on the creation of intellectual property by faculty (Åstebro et al. 2012). Thus, it is difficult to assess how master students would be different from PhD students when founding a new venture. On the contrary, it is assumed to be important whether the new venture spin out from a university context or corporate context with the former environment providing more novel technological knowledge (Wennberg et al. 2011). In addition, exploring gender differences in the industry choice and subsequent performance of academic entrepreneurs could be interesting given that females are less likely to be entrepreneurs and jacks-of-all-trades than men (Backes-Gellner and Moog 2013) and might be less likely to choose balanced educational paths preferred by entrepreneurs (Backes-Gellner et al. 2010).

A sensitivity analysis (Brant test) showed that the above findings regarding new venture performance hold for both the chances of survival and growth. However, a two-step Heckman model taking into account the industry self-selection of individuals in the performance analysis would test the robustness of the results. This is not done given the lack of a good instrument variable and that the two industry components from the PCA are continuous variables. Moreover, in quantitative studies such as this study, certain limitations are difficult to avoid. Although the register data used are longitudinal and representative, their combination with a one-off questionnaire survey gives rise to possible problems with causality. The survey was conducted in 2008 among first-time entrepreneurs who established ventures in 2004. Thus, when arguing that individuals with deeper contacts to former colleagues are more likely to perform better in their new venture, reverse causality cannot be ruled out. That is, entrepreneurs behind successful new ventures are more likely to contact others for help (and others are more likely to contact them). However, because personality traits are assumed to be fairly stable over time for middle-aged individuals, and because the human and financial capital measures are based on IDA data from the start-up year, this is not considered to be a problem in the study. A more notable issue is the validity and reliability of the personal trait measures, i.e., tolerance of ambiguity and creativity. These are only measured by two reversed statements instead of by multiple items. Nevertheless, even in the psychological literature on personality traits, it is difficult to find consensus among researchers about the validity and reliability of existing scales (Gartner 1988; Cromie 2000). Conversely, the simple measurement used in this study exchanges complexity in measurement with transparency. The same critique can be made regarding the social capital metrics, in which ego-centric social network analyses include several qualitative characteristics, such as anchorage, density, reachability and range (O’Donnell et al. 2001), which are nearly impossible to ascertain in quantitative analyses but, nevertheless, are important for an assessment of an entrepreneur’s social network resources.

6 Conclusion

There are multidisciplinary theoretical frameworks in the entrepreneurship literature, but few empirical studies attempt to introduce concepts from different disciplines into entrepreneurship analysis. This study attempts to explore the importance of human capital in new venture performance in different industry environments. Based on a principal component analysis, two industry components were derived, one for profitability (and investment) and one for uncertainty (instability). Employing these industry components as moderator variables resulted in both expected and novel findings when controlling for personal traits and for different levels of social and financial capital. The most notable finding was that only academics with technical degrees performed better than non-academics in both stable and unstable industry environments, which makes these entrepreneurs particularly important for policy purposes. This study calls for more qualitative research aiming at explaining the mechanisms behind the superior performance of these academic entrepreneurs in uncertain industry environments not excluding students.

Notes

This study does not provide further discussion regarding whether personality traits are strictly inborn, malleable until the age of approximately 30 or constantly affected by the environment.

Only entrepreneurs behind businesses meeting the requirements of full-time equivalent employees and industry-specific turnover levels (both set by Statistics Denmark) are included. Furthermore, businesses initiated in the agricultural and energy sector are excluded because of the level of government regulation.

The restriction in Cooper et al. (1994) is that at least two employees are added. Adding identical restrictions in this study resulted in only 68 growth entrepreneurs, which was found to be too low for the statistical analyses. However, a three-year time span for growth and no full-time equivalent correction in Cooper et al. (1994) are likely to reduce the difference in definition between the two studies.

First, new firms not included in the accounting registers in IDA are excluded (turnover and employee requirements). Second, new firms in industries that do not exist throughout the entire period are excluded (industry classification change). Third, industries with fewer than 100 firms in one of the years are excluded (niche industries). Finally, two and three respondents are excluded because of extreme values for start-up year fixed assets and industry-mean fixed assets, respectively, based on information from IDA.

A lower level of aggregation would be preferred for the latter variable (e.g., separating business science from the social sciences and humanities), but given the number of observations, the variable is binary.

The PCA is performed on 1,151 observations (entrepreneurs) instead of 233 observations (industries). This indicates that the PCA on industry indicators is weighted by the number of start-ups in each industry.

References

Acs, Z. J., & Audretsch, D. B. (1989). Small firm entry in US manufacturing. Economica, 56(222), 255–265.

Agarwal, R., Echambadi, R., Franco, A. M., & Sarkar, M. B. (2004). Knowledge transfer through inheritance: Spin-out generation, development, and survival. Academy of Management Journal, 47(4), 501–522.

Aldrich, H. E. (1979). Organizations and environments. Englewood Cliffs, NJ: Prentice-Hall.

Åstebro, T., Bazzazian, N., & Braguinsky, S. (2012). Startups by recent university graduates and their faculty: Implications for university entrepreneurship policy. Research Policy, 41(4), 663–677.

Audretsch, D. B. (1991). New-firm survival and the technological regime. The Review of Economics and Statistics, 73(3), 441–450.

Audretsch, D. B. (2009). The entrepreneurial society. Journal of Technology Transfer, 34(3), 245–254.

Audretsch, D. B., & Mahmood, T. (1995). New firm survival: New results using a hazard function. The Review of Economics and Statistics, 77(1), 97–103.

Backes-Gellner, U., & Moog, P. (2013). The disposition to become an entrepreneur and the jacks-of-all-trades in social and human capital. The Journal of Socio-Economics, 47, 55–72.

Backes-Gellner, U., Tuor, S. N., & Wettstein, D. (2010). Differences in the educational paths of entrepreneurs and employees. Empirical Research in Vocational Education and Training, 2(2), 83–105.

Becker, G. S. (1964). Human capital. New York: Columbia University Press.

Begley, T. M. (1995). Using founders status, age of firm, and company growth rate as the basis for distinguishing entrepreneurs from managers of smaller businesses. Journal of Business Venturing, 10(3), 249–263.

Bhidé, A. V. (2000). The origin and evolution of new businesses. Oxford: Oxford University Press.

Borjas, G. J. (2010). Labor economics (5th ed.). New York: McGraw-Hill.

Brockhaus, R. H. (1980). Risk taking propensity of entrepreneurs. Academy of Management Journal, 23(3), 509–520.

Brüderl, J., & Preisendörfer, P. (1998). Network support and the success of newly founded businesses. Small Business Economics, 10(3), 213–225.

Brüderl, J., Preisendörfer, P., & Ziegler, R. (1992). Survival chances of newly founded business organizations. American Sociological Review, 57(2), 227–242.

Caird, S. (1991). The enterprising tendency of occupational groups. International Small Business Journal, 9(4), 75–81.

Casson, M. (2003). The entrepreneur: An economic theory (2nd ed.). Cheltenham: Edward Elgar.

Cohen, W. M., & Levinthal, D. A. (1990). Absorptive capacity: A new perspective on learning and innovation. Administrative Science Quarterly, 35(1), 128–152.

Cooper, A. C., Gimeno-Gascon, F. J., & Woo, C. Y. (1994). Initial human and financial capital as predictors of new venture performance. Journal of Business Venturing, 9(5), 371–395.

Criaco, G., Minola, T., Migliorini, P., & Serarols-Tarrés, C. (2013). “To have and have not”: Founders’ human capital and university start-up survival. The Journal of Technology Transfer,. doi:10.1007/s10961-013-9312-0.

Cromie, S. (2000). Assessing entrepreneurial inclinations: Some approaches and empirical evidence. European Journal of Work and Organizational Psychology, 9(1), 7–30.

Cromie, S., & O’Donaghue, J. (1992). Assessing entrepreneurial inclinations. International Small Business Journal, 10(2), 66–73.

D’Este, P., & Perkmann, M. (2011). Why do academics engage with industry? The entrepreneurial university and individual motivations. The Journal of Technology Transfer, 36(3), 316–339.

Davidsson, P., & Honig, B. (2003). The role of social and human capital among nascent entrepreneurs. Journal of Business Venturing, 18(3), 301–331.

De Vries, M. F. R. K. (1977). The entrepreneurial personality: A person at the crossroads. Journal of Management Studies, 14(1), 34–57.

Dean, T. J., & Brown, R. L. (1995). Pollution regulation as a barrier to new firm entry: Initial evidence and implications for future research. The Academy of Management Journal, 38(1), 288–303.

Dean, T. J., Brown, R. L., & Bamford, C. E. (1998). Differences in large and small firm responses to environmental context: Strategic implications from a comparative analysis of business formations. Strategic Management Journal, 19(8), 709–728.

Dean, T. J., & Meyer, G. D. (1996). Industry environments and new venture formations in U.S. manufacturing: A conceptual and empirical analysis of demand determinants. Journal of Business Venturing, 11(2), 107–132.

Dess, G. G., & Beard, D. W. (1984). Dimensions of organizational task environments. Administrative Science Quarterly, 29(1), 52–73.

Eisenhardt, K. M., & Schoonhoven, C. B. (1990). Organizational growth: Linking founding team, strategy, environment, and growth among U.S. semiconductor ventures. Administrative Science Quarterly, 35(3), 504–529.

Gartner, W. B. (1988). ”Who is an entrepreneur?” is the wrong question. American Journal of Small Business, 12(4), 11–32.

Gimeno, J., Folta, T. B., Cooper, A. C., & Woo, C. Y. (1997). Survival of the fittest? entrepreneurial human capital and the persistance of underperforming firms. Administrative Science Quarterly, 42(4), 750–783.

Haltiwanger, J., Jarmin, R. S., & Miranda, J. (2010). Who creates jobs? small vs. large vs. young. US Census Bureau Center for Economic Studies Paper No. CES-WP-10-17.

Hanlon, D., & Saunders, C. (2007). Marshaling resources to form small new ventires: Toward a more holistic understanding of entrepreneurial support. Entrepreneurship Theory and Practice, 31(4), 619–641.

Hayter, C. S. (2011). In search of the profit-maximizing actor: Motivations and definitions of success from nascent academic entrepreneurs. The Journal of Technology Transfer, 36(3), 340–352.

Hisrich, R., Peters, M., & Shepherd, D. (2005). Entrepreneurship. New york: McGraw-Hill.

Hmieleski, K. M., & Ensley, M. D. (2004). Frontiers of entrepreneurship research, chapter an investigation of improvisation as a strategy for exploiting dynamic opportunities, 596–606. Babson Park, MA: Babson Collage.

Karlsson, T., & Wigren, C. (2012). Start-ups among university employees: The influence of legitimacy, human capital and social capital. The Journal of Technology Transfer, 37(3), 297–312.

Koh, H. C. (1996). Testing hypothesis of entrepreneurial characteristics. Journal of Managerial Psychology, 11(3), 12–25.

Lee, D. Y., & Tsang, E. W. K. (2001). The effects of entrepreneurial personality, background and network activities on venture growth. Journal of Management Studies, 38(4), 583–602.

Mata, J., & Portugal, P. (1994). Life duration of new firms. The Journal of Industrial Economics, 42(3), 227–245.

McGrath, R. G. (1999). Falling forward: Real options reasoning and entrepreneurial failure. Academy of Management Review, 24(1), 13–30.

Nielsen, K. & Sarasvathy, S. D. (2011) Passive and Active Learning from Enterpreneurship: An Empirical Study of Re-Entry and Survival. DRUID Working Paper No. 11-12.

O’Donnell, A., Gilmore, A., Cummins, D., & Carson, D. (2001). The network construct in entrepreneurship research: A review and critique. Management Decision, 39(9), 749–760.

O’Gorman, C., Byrne, O., & Pandya, D. (2008). How scientists commercialise new knowledge via entrepreneurship. The Journal of Technology Transfer, 33(1), 23–43.

Ostgaard, T. A., & Birley, S. (1996). New venture growth and personal networks. Journal of Business Research, 36(1), 37–50.

Parker, S. C. (2004). The economics of self-employment and entrepreneurship. Cambridge: Cambridge University Press.

Parker, S. C., & Praag, M. V. (2006). Schooling, capital constraints, and entrepreneurial performance: The endogenous triangle. Journal of Business and Economic Statistics, 24(4), 416–431.

Phillips, D. J. (2002). A genealogical approach to organizational life chances: The parent-progeny t ransfer among Silicon Valley law firms, 1946-1996. Administrative Science Quarterly, 47(3), 474–506.

Praag, M. V. (2005). Successful entrepreneurship: Confronting economic theory with empirical practice. Cheltenham: Edward Elgar Publishing.

Praag, M. V., Wit, G. D., & Bosma, N. (2005). Initial capital constraints hinder entrepreneurial venture performance. The Journal of Private Equity, 9(1), 36–44.

Sarasvathy, S. D. (2001). Causation and effectuation: Toward a theoretical shift from economic inevitability to entrepreneurial contingency. The Academy of Management Review, 26(2), 243–263.

Sarasvathy, S. D. (2004). The questions we ask and the questions we care about: Reformulating some problems in entrepreneurship research. Journal of Business Venturing, 19(5), 707–717.

Sarasvathy, S. D. (2008). Effectuation - Elements of entrepreneurial expertise. Cheltenham: Edward Elgar Publishing.

Shane, S. (2003). A general theory of entrepreneurship: The individual-opportunity nexus. Northampton, MA: Edward Elgar.

Siegel, D. S., & Wessner, C. (2012). Universities and the success of entrepreneurial ventures: Evidence from the small business innovation research program. The Journal of Technology Transfer, 37(4), 404–415.

Unger, J. M., Rauch, A., Frese, M., & Rosenbusch, N. (2011). Human capital and entrepreneurial success: A meta-analytical review. Journal of Business Venturing, 26(3), 341–358.

Utsch, A., & Rauch, A. (2000). Innovativeness and initiative as mediators between achivement orientation and venture performance. European Journal of Work and Organizational Psychology, 9(1), 45–62.

Weick, K. E. (1996). Drop your tools: An allegory for organizational studies. Administrative Science Quarterly, 41(2), 301–313.

Wennberg, K., Wiklund, J., & Wright, M. (2011). The effectiveness of university knowledge spillovers: Performance differences between university spinoffs and corporate spinoffs. Research Policy, 40(8), 1128–1143.

Wright, M., Piva, E., Mosey, S., & Lockett, A. (2009). Academic entrepreneurship and business schools. The Journal of Technology Transfer, 34(6), 560–587.

Zhang, J. (2009). The performance of university spin-offs: An exploratory analysis using venture capital data. The Journal of Technology Transfer, 34(3), 255–285.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Nielsen, K. Human capital and new venture performance: the industry choice and performance of academic entrepreneurs. J Technol Transf 40, 453–474 (2015). https://doi.org/10.1007/s10961-014-9345-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-014-9345-z