Abstract

The aim of this paper is to explore the effects of spillovers driven by competition and forward and backward linkages between foreign firms and Italian firms. We adopt the firm dynamics framework, which allows us to test the impact of foreign firms’ activity on the probability that local firms will exit. The empirical analysis relies on continuous survival models (Cox proportional hazard models) and uses a representative firm level database from the period of 2002–2010 with data concerning more than 4,000 Italian manufacturing firms. Our estimates regarding the whole sample show that horizontal and vertical linkages have no impact on firm survival. To further test this finding, we perform a more disaggregated analysis that allows for heterogeneity across firms and sectors. We obtain evidence that the effects of FDI spillovers on firm survival follow specific patterns at both the intra- and inter-industry levels based on differences in productivity between Italian firms and foreign firms and on the technological intensity of the industry. Foreign firms’ activity reduces the exit probability of competitors and of downstream local customers (through forward linkages) with low productivity gap but has no impact on high productivity gap firms. Firms in high technology intensive sectors do not benefit from horizontal FDI while in low and medium technology sectors they do. Differences in absorptive capacity may explain these results. However, we also find that vertical linkages with foreign firms in the upstream supplying industries spur firm duration in medium and high tech sectors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

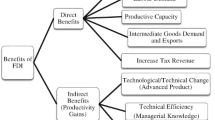

This paper studies the indirect impact of foreign direct investment (FDI) on the host country.Footnote 1 The vast literature investigating this complex issue indicates that the presence of affiliates of multinational firms affects domestic firms through competition in the marketplace, as well as through spillover effects, generated by pecuniary and knowledge externalities (Blomström and Kokko 1998). These effects can be observed by considering changes in productivity, employment and wage adjustments, firm death/survival. This study specifically examines how foreign investment impacts on domestic firm exit dynamics by using a hazard model approach on a panel of Italian firms.

The effect of competition in the form of FDI on domestic firm survival and the mechanism of that effect have not received much attention in the literature. A substantial body of studies have focused on examining the spillover effects on the productivity of local firms (see the surveys by Görg and Greenaway 2004; Hanousek et al. 2010; Iršová and Havránek 2013).Footnote 2 However, the positive correlation between the presence of foreign investment and higher productivity may depend on the selection of the most efficient firms due to competition, rather than on positive spillovers induced by foreign firms. Thus, competition and firm entry/exit dynamics might be a source of selection bias in the analysis of the impact of FDI on firm productivity. The measurement of productivity spillovers also entails the problem of input measurement, and therefore it faces the input endogeneity problem typical of productivity estimations.

This paper follows few seminal studies (Görg and Strobl 2003, 2004; De Backer and Sleuwaegen 2003; Burke et al. 2008; Kosová 2010), which rather than examining the productivity-FDI nexus investigate the transmission of FDI externalities to firm survival. This approach extends the literature on FDI and economic development (Caves 1974; Haddad and Harrison 1993; Aitken and Harrison 1999), linking it with studies of firm and industry dynamics (Audretsch 1991; Mata and Portugal 1994). Following this line of research, we deepen the analysis of several issues that remain neglected by this literature.

First of all, in line with the literature on FDI spillovers on productivity we investigate the potential horizontal and vertical foreign spillover effects. Hence, in the first step of our analysis we decompose the impact of FDI into inter-industry and intra-industry components, disentangling supplier and competitive effects on firm persistence in the market and in the region as compared to crowding out effects. Then, in the following steps we combine this decomposition with the analysis of two crucially linked and under-investigated questions. First, we investigate the relationship between local firms’ productivity gaps and the capacity for absorbing horizontal and vertical FDI spillovers and we check how this impacts on firm survival. Secondly, we verify how the industry’s technological intensity influences the domestic firms’ survival rates and the transmission of spillovers from FDI to domestic establishments. Both analyses lead us to results which are interpreted as suggesting a different absorptive capacity of domestic firms.Footnote 3

To our knowledge, this is the first paper to address these questions. The issue of firms’ absorptive capacity (Cohen and Levinthal 1990)Footnote 4 within and across sectors has been widely investigated in the literature on FDI spillover effects on productivity (Findlay 1978, Blomström and Kokko 1998; Kokko et al. 1996; Glass and Saggi 1998; Jabbour and Mucchielli 2007; Jordaan 2008; Girma and Gong 2008a, b, among the others) but has never been explored in the literature on the impact of FDI on the survival of local firms.

Our analysis also fills a gap of research for Italy. To the best of our knowledge, the externalities induced by foreign firms on the entry-exit dynamics of Italian firms have not yet been studied in the literature,Footnote 5 despite the fact that Italy is an interesting case study for many reasons. First of all, Italy provides a sort of natural experiment: Italian firms were used to very low levels of foreign presence, but have faced a rapid increase in competition from foreign multinationals over the last decade, with an increase in the number of foreign-controlled firms (from 11,396 in 2000 to 14,401 in 2007) and in the number of workers employed by those firms (from 950,038 in 2001 to 1,230,427 in 2007) (Ice-Istat 2012). This trend was interrupted beginning with the 2007 crisis and until 2011, but it is regaining momentum. Secondly, the economic importance of foreign firms outweighs their proportional share of the economy: although less than 1 per cent of firms in Italy are foreign owned, these firms accounted for approximately 12 per cent of net value added in 2007 (Unctad 2010). Moreover, foreign firms perform better than their Italian counterparts in terms of size, productivity, employment, and profitability (Istat 2010). However, these superior characteristics do not imply automatic beneficial effects on domestic firms. The capacity of domestic firms to absorb foreign spillovers is the key we adopt to interpret our results. We consider it as appropriate to the Italian context where the low propensity to innovate typical of small and medium Italian firms, the peculiar characteristics of the country’s industrial structure, i.e., the lack of a sizeable group of large companies, as well as the unique sector specialization of the economy, dominated by traditional low-tech manufacturing sectors producing consumer goods and by medium-tech specialised machinery sectors producing capital goods, suggests the presence of a technological gap with respect to foreign firms and lack of competitive strengths in more dynamic high-tech (Mariotti and Mutinelli 2012). This “distance” between domestic and foreign firms may affect the capacity of domestic firms to exploit technological spillovers from foreign multinationals, may result in a delay in the process of accumulation and diffusion of knowledge, and may lead to a poor capacity to compete with global firms in the domestic market.

This paper has several relevant policy implications. The fear of competition/crowding out by foreign multinationals, which are viewed as actors that tend to monopolise domestic markets, is currently fuelling a protectionist backlash against FDI among domestic workers. The issue of a potential displacement effect and increase in the closure of local firms cannot be overlooked, as it has crucial implications for the persistence of jobs and has an important impact on economic welfare. Firm turnover is a crucial factor in the fragility of the Italian economy: only 60 per cent of firms established in 2002 survived for 4 years (Istat 2010). Moreover, the issues analysed here provide important insights into FDI incentive policies, which are currently at the top of the agenda for Italian policy makers.Footnote 6

Our empirical analysis is conducted using a firm level database for the period 2002–2010 generated by combining three different sources: the IXth Survey 2001–2003 on Manufacturing Firms (Capitalia/Unicredit), AIDA and Mint-Italy (Bureau Van Dyck). This original database provides a rich body of microeconomic evidence for a stratified and randomly selected sample of more than 4,000 Italian manufacturing firms. The relationship between foreign investment and firm survival is investigated using a conditional analysis based on the Cox proportional hazard model (CPHM).

We do not observe evidence of displacement effects at the sector level, and only limited evidence at the regional level. We actually find some evidence of positive spillovers. However, these effects appear to be quite heterogeneous across firms and sectors. For the overall sample, we find no evidence that local firms survive longer as the fraction of foreign sales in their industries increases. When the data are split into firms with high and low productivity gaps, the proxy variable for horizontal spillover becomes significant for the low productivity gap group but not for the high gap group. We also find that the latter type of firms experience negative regional spillovers. Furthermore, for Italian firms belonging to low and medium–low technology intensive sectors, competition with FDI affiliates in the same sector has a positive impact on firm survival, whereas firms belonging to more advanced sectors, in which they are more disadvantaged with respect to foreign firms in terms of productivity, experience no within-industry effect. Overall, our findings suggest that FDI spillovers on firm survival at the intra-industry level, where relationships are based on competition, demonstration and imitation effects, strongly depend on firms’ productivity gaps. Differences in absorptive capacity may explain why FDI increases the survival of low productivity gap firms, but not of high productivity gap firms. As for the inter-industry linkages, where competition is based on input–output relationships, the evidence also show positive effects of upstream linkages with foreign firms for low gap domestic firms but not for the high gap class. However, firms in more advanced sectors also benefit from linkages with foreign suppliers maybe due to provision of sophisticated and high quality input goods, while firms in low technology sectors do not.

The paper is organised as follows. Section 2 presents a review of our main empirical research questions in light of existing theoretical models and empirical results reported in the literature on the impact of FDI on firm survival. Section 3 describes the data, the variables of interest, and the control variables and provides preliminary descriptive statistics. Section 4 presents the econometric model adopted and reports the estimation results. Finally, Sect. 5 summarises the findings of our work.

2 The impact of foreign ownership on domestic and foreign firm survival: theoretical and empirical review

2.1 FDI effects: a theoretical overview of our research questions

Our analysis aims to test some key questions in the literature on FDI spillover on firm survival.Footnote 7 First, we investigate the potential horizontal and vertical foreign spillover effects in the market and in the region, and we evaluate their impact on firm persistence compared to crowding out effects. The theoretical a priori knowledge of how a foreign presence affects host country firm survival is ambiguous. Foreign establishments are likely to intensify competition and force domestic establishments out of the market, as described in some prominent works (Aitken and Harrison 1999 Footnote 8; Haddad and Harrison 1993; Djankov and Hoekman 2000), or alternatively, they may enhance the chances of domestic firm survival via knowledge or pecuniary spillovers (Blomström and Kokko 1998). The net effect is likely to vary according to many different factors such as the firms’ technology level, sector, and institutional framework.

In addition to these factors, it is crucial to disentangle two different channels of transmission of effect on firm survival: horizontal intra-industry competition and vertical inter-industry linkages. Thus, we test for the importance of these two different channels through which FDI may impact the survival chances of domestic-owned firms. The horizontal linkages between domestic- and foreign-controlled affiliates mainly takes place through competition for market shares and also through imitation and labour mobility (Blomström and Kokko 1998), Conversely, the vertical inter-industry linkages, which can be upstream or downstream, affect local firm interactions with foreign firms through the purchase of intermediate inputs or the sale of products (Markusen and Venables 1999).Footnote 9

Previous studies found that it was difficult for intra-industry FDI spillovers to affect productivity, as the diffusion of technology and know-how to local competitors is not in the strategic interest of the foreign affiliates. In contrast, spillovers are more likely to occur from both upstream and downstream inter-industry linkages (Görg and Greenaway 2004; Castellani and Zanfei 2007; Wang 2013). Based on this acquired knowledge on productivity spillovers, we should expect to find no evidence of intra-industry effects of FDI on survival, but significant vertical spillovers. The reason for this would be that when FDI affiliates are customers of domestically owned firms they often provide them with technical assistance to ensure a stable stream of input suppliers with high standards. These backwards linkages with domestic suppliers may lead to vertical FDI downstream spillovers and to increased productivity and lower prices in upstream industries (Blalock and Gertler 2008). However, a selection effect might also be induced if local suppliers may not be able to achieve the higher product standards or delivery conditions demanded by foreign firms. Furthermore, according to the literature, local firms may benefit from their upstream foreign firm suppliers through several potential channels such as through the increased availability of inputs, through their qualitative improvement and/or the price decline of intermediates as shown in Bernard et al. (2003) and in Javorcik (2004).

Our second research question regarding the role of the local firm’s proximity to foreign firms based on theoretical considerations does not have a clear expected answer too. The literature on technology diffusion commonly assumes that there is a potential technology gap between domestic firms and MNEs (due to MNEs’ firm-specific assets) and that this gap creates an opportunity for knowledge externalities and the transfer of more efficient technology and managerial practices from foreign to domestic firms, as emphasised in early case studies and industry-level findings (Caves 1974; Blomström 1986). However, the intensity of linkages between foreign and domestic firms and the extent to which those linkages will generate technology transfers depends on the economic distance between foreign and domestic firms. It is shown in the literature that the extent of FDI spillovers is a function of domestic firms’ ability to absorb technology. In the UNCTAD report (2001) it is shown that linkages with FDI firms are more likely when the technological and managerial gaps between foreign affiliates and domestic firms are not too wide. However, the theoretical and empirical literature supports conflicting views. Caves (1996) argues that the likelihood that MNEs will crowd out local firms is larger in developing than in developed countries because of the higher productivity/technology gap between domestic and foreign firms. Cohen and Levinthal (1989) maintain that increased R&D activities boost efficiency indirectly, by accelerating assimilation of technologies developed elsewhere. This view is also supported by the technological-accumulation literature (see Cantwell 1989; Kokko 1994; Takii 2005; Dimelis 2005; Jabbour and Mucchielli 2007; Hamida and Gugler 2009). By contrast, Findlay (1978), and more recently Jordaan (2008), find that the potential for positive spillovers is higher when the technology gap between domestic firms and MNEs is large. Their argument is that firms with lower levels of technology have a greater scope for technological accumulation, in that they have a larger body of established knowledge to assimilate.

Two basic approaches are usually adopted in literature to investigate this issue. One is to divide the plants in the sample according to some perceived proxies for absorptive capacity, and compare the degrees of spillovers across the sub-samples (see Kokko et al. 1996; Girma and Wakelin 2001), The second approach is to linearly interact a proxy for absorptive capacity with the FDI variable of choice. Such a proxy can be R&D intensity or initial level of technology gap from the frontier (Kinosita 2001; Girma and Gong 2008b). Girma and Gong (2008b) have explored the role of absorptive capacity in FDI spillovers by interacting the horizontal FDI variables with an indicator of R&D expenditure and employee training, which are found to be both conducive to positive intra-industry technology transfers. To investigate the issue of absorptive capacity, we follow the first approach: we verify the patterns of spillovers on firm survival conditional on different categories of firms according to their productivity gaps which we expect to affect their absorptive capability features.Footnote 10 Absorptive capacity is arguably more important for horizontal technology transfer through imitation or demonstration effects. However, it might also affect the degree of vertical linkages. This is why we explored both possibilities, and we found that the results of the absorptive capacity related to intra-industry and inter-industry FDI linkages actually differ.

Regarding our last question, i.e., whether the industry’s technological intensity affects the impact of FDI on domestic firm survival rates, the literature again provides mixed predictions. Some authors have argued that domestic firms in high technology sectors should be more likely to benefit from positive spillovers as they can be assumed to have relatively high levels of technology themselves, and thus possess the necessary stock of knowledge that allows them to receive spillovers from multinationals (Görg and Strobl 2003). However, a counterargument put forward is that high-tech sectors are generally more competitive, and MNEs have a greater incentive to prevent technology leakages to their competitors in these sectors (Burke et al. 2008). Thus, our expectations on this research question are also ambiguous.

In summary, existing theoretical knowledge does not clearly indicate the spillover effects of MNEs on the survival of host country firms. Therefore, these questions must be answered through empirical analysis.

2.2 The empirical evidence on the impact of FDI on survival

Our empirical strategy was designed following the empirical literature on the effect of inward FDI on the survival of domestic entrants and/or incumbent firms. We are building on a limited body of empirical evidence, as only a few recent empirical works have extended the analysis of FDI externalities to firm survival (see the overview of the literature in Table 1).

An overwhelming portion of the available evidence is focused on intra-industry spillovers on firm survival. De Backer and Sleuwaegen (2003) analyse firm entry and exit across Belgian manufacturing industries and find evidence that foreign direct investment discourages the entry and stimulates the exit of domestic entrepreneurs in the short term, but that the crowding out effect is moderated or even reversed in the long-run as a result of learning, demonstration, networking and linkage effects. Similar findings are reported in the study by Kosová (2010), which uses 1994–2001 firm-level data for the Czech Republic and shows that crowding out is only a short term phenomenon, while domestic firms benefit from technology spillovers 2 years after foreign entry.Footnote 11 Furthermore, Bandick (2010) shows the crucial role of firm internationalisation: foreign presence has negative effects on the survival of purely domestic firms while it does not affect the exit rate of Swedish MNEs and Swedish exporting plants. Several studies have investigated the role of the technology level of the sector on intra-industry spillovers. Görg and Strobl (2003 and 2004) only find positive spillover effects rather than competition/crowding out in high tech industries in Ireland, a result that is also confirmed by Ayyagari and Kosová (2010). Conversely, Burke et al. (2008) find a negative effect of foreign presence on the survival of UK single-plant firms in more innovative industries, and a net positive effect in less innovative industries.Footnote 12

Our empirical investigation follows a different direction of analysis in line with a limited set of recent contributions focusing on differentiating the effects of FDI on the survival of domestic plants, disentangling intra-industry and upstream and downstream inter-industry linkages. The results of this small body of literature are not as optimistic as those of earlier studies which were mainly focused on advanced economies. Girma and Gong (2008a) study China, finding that market competition from FDI in the same sector and FDI in downstream sectors have a deleterious impact on the survival probability of State-owned enterprises and on their growth, while no discernible spillover effects can be attributed to FDI in upstream sectors. Kejžar (2010) examines the role of FDI on firm survival for a sample of Slovenian manufacturing firms from 1994 to 2004, finding that incumbent firms experience a decrease in their survival probability upon the entry of a foreign firm by greenfield investment within a particular industry. There is no significant evidence that inward FDI stimulates survival through horizontal competition, but foreign firms’ activity reduces the exit probability of local customers (through forward linkages) while exit is affected positively by backward linkages (downstream MNE purchasing from upstream local firms). However, for an advanced economy with strong FDI like Canada, Wang (2013) finds that while plants tend to have shorter lives due to competition with FDI affiliates operating in the same industry, conversely, they benefit from FDI affiliates operating in both upstream and downstream industries as input suppliers and customers.

Based on the current literature, we innovate in two important directions: we decompose horizontal and vertical FDI spillovers on survival by looking first at firms’ productivity gaps and secondly at their sectors’ technological intensities. Both issues have not been addressed so far.

Our empirical approach is motivated by some peculiar features of the Italian economy. While Italy is an advanced country, the importance of foreign investment in “filling the gap” in terms of capital and technology is an appropriate question for the Italian economy. Thus, some problems of this economy can be understood by applying the framework categories of productivity gap and absorptive capacity, which are more often adopted in developing contexts. The Italian production system features low levels of investment in R&D and innovation in general, in addition to the presence of a large number of micro and small firms. R&D expenditures by both the private and public sectors accounted for slightly more than 1.2 % of GDP in 2010, compared with 2.2 for France, 2.8 for Germany, and the OECD average of 2.3 % (Eurostat 2010).Footnote 13 Small firms typically achieve slow R&D innovation and have a poor ability to absorb new technologies from inward FDI-related spillovers because of their lack of scientific and technical staff and global experience. The weak presence of medium and large firms in the Italian economy, which could drive the use of more advanced tools and methodologies, prevents the diffusion of innovation to the entire production structure.

3 Data and preliminary statistics

This section presents our dataset (Sect. 3.1), the variables adopted and some preliminary descriptive statistics (Sect. 3.2).

3.1 Dataset construction

The empirical analysis was conducted using a representative firm level database for the period 2002–2010 resulting from the intersection of three different sources: the IXth Survey on Manufacturing Firms conducted by Capitalia, and AIDA (Analisi Informatizzata delle Aziende) and Mint-Italy, both compiled by Bureau Van Dyck.Footnote 14 The Capitalia database was a survey conducted in waves that sampled more than 4,000 Italian manufacturing firms and was run by Unicredit. We use the IXth Capitalia survey, i.e., the 2001–2003 wave of the survey, run in 2004 through questionnaires distributed to a sample of 4,289 firms with more than 10 employees.Footnote 15 The sample is stratified, with randomly selected (it reflects the sectoral, geographical and dimensional distribution of Italian firms) firms with 11–500 employees while a census was conducted for firms with more than 500 employees. To create a long-term panel we build a “catch-up” panel, where the Capitalia dataset units of analysis are located in the present by subsequent observations drawn from the AIDA dataset, which collects annual accounts of Italian corporate enterprises and contains information on a wide set of economic and financial variables.Footnote 16 Matching all firms in the 2001–2003 Capitalia dataset with AIDA information produced a sample of 4,066 firms (94.8 per cent of the Capitalia sample) whose exit dynamics were followed from 2004–2010. The third dataset we adopt (Mint-Italy) is a firm level database of Italian companies, banks and insurance companies with variables on export and import activities. Variables describing the internationalisation activity of firms are drawn from AIDA, Capitalia and Mint-Italy. In particular, using the ownership status variable in AIDA, we define domestic multinationals (DMNEs) as non foreign-owned firms with 10 % or more of its direct ownership in firms located outside of Italy; foreign multinationals (FMNEs) are defined as Italian firms with a foreign ultimate beneficial owner.Footnote 17 Each variable included in the database was deflated through the producer price index (3-digit NACE industry level) provided by ISTAT (Italian Institute of Statistics).

In the final dataset, firm level information is available on a wide set of economic and financial variables such as sales, costs and number of employees, value added, fixed tangible assets, start-up year, sector of activity, and legal and ownership status. Each foreign initiative is reported by sector, degree of ownership and capital invested.

The following procedure was used to identify firm exit. We consider a firm to have exited if its legal status variable in the AIDA dataset is failure, liquidation, or bankruptcy. We consider the time of exit as the time when a firm enters a liquidation or bankruptcy process, whichever starts earlier. We rely on the start (rather than the end) of these processes, as a firm ceases to operate freely on the market once it enters any such process. To accurately identify the timing of any legal cessation of a firm’s activity, we complement these variables by checking the balance sheet data.Footnote 18 We further control for firm status by also considering AIDA information on the type of procedure a firm is undergoing.Footnote 19 This last piece of information allows us to avoid counting firms with changes in categories due to mergers, acquisitions, or changes in location or sector as exited, and ensures that our data represent “true exit”.Footnote 20 Omitting all observations that do not fit the definition of exit and excluding firms with insufficient data for inclusion in the empirical analysis yields an unbalanced sample of 20,335 firm-year observations with no missing data for any of the variables used in the analysis.Footnote 21

3.2 Variable specification and expected signs

This section describes the specifications and the expected signs for the set of variables used in this empirical analysis. We try to capture the externalities stemming from foreign multinationals by measuring the intensity of their interactions with Italian firms considering the importance of FDI in the same region and industry and in upstream and downstream sectors.

The test of FDI spillovers is further carried out by splitting the sample using two binary variables at the firm level (GAP CLASS HIGH and GAP CLASS LOW) that denote firms with low and high productivity gaps, respectively, and two binary variables at the macrosector level (TECH CLASS HIGH and TECH CLASS LOW) for firms belonging to high and medium high or low and medium–low technology sectors, respectively (OECD taxonomy).

The key explanatory variables for our analysis are the variables related to FDI.

In more detail, two variables capture horizontal spillovers:

-

\( {\text{FDI}}\_{\text{OWN}}\_{\text{INDUSTRYj}},\quad {\text{t}} = {\text{Y}}_{\text{j,t}}^{\text{FOR}} /{\text{Y}}_{\text{j,t}}^{\text{Total}} \quad {\text{whereY}}_{\text{j,t}}^{\text{FOR}} \) represents foreign firm turnover and \( {\text{Y}}_{\text{j,t}}^{\text{Total}} \) is the turnover of all firms in sector j at time t (Source: Eurostat). This variable measures the importance of the foreign presence in the host industry in the same firm’s sector using the 2 digit Ateco 2002 sectorial classification. Footnote 22 If foreign firms lead to horizontal spillovers, then firms operating in the sectors in which foreign firms produce a large share of their output are more likely to benefit from these spillovers in terms of lower exit rates. Conversely, if foreign firms intensify the competition in that sector (because of their higher quality products, more productive technologies, etc.), and if the competition effects dominate the spillover effects, then these variables should increase the firm’s probability of exit.Footnote 23

-

\( {\text{FDI\_SHARE\_REGION}}_{{{\text{i}} \in {\text{r,t}}}} {\text{ = Y}}_{\text{r,t}}^{\text{FOR}} / {\text{Y}}_{\text{r,t}}^{\text{Total}} , {\text{whereY}}_{\text{r,t}}^{\text{FOR}} \) is the production of foreign firms in region r at time t, and \( {\text{Y}}_{\text{r,t}}^{\text{Total}} \) represents the production of all firms in region r at time t.Footnote 24 If there are regional spillovers (not at the sector level), then FDI in the region of the firm would have a positive impact on the survival of domestic and other foreign firms, which might also be due to agglomeration effects. If the foreign firms instead increase competition, for instance by increasing the demand for scarce factors such as skilled labour, then the impact might be negative.

Furthermore, two variables are used to capture vertical spillovers:

-

\( {\text{FDI}}\_{\text{UP}}_{{{\text{i}} \in {\text{j}},{\text{t}}}} = \sum\nolimits_{{{\text{k}} \ne {\text{j}}}} {{\text{FDI}}\_{\text{OWN}}\_{\text{INDUSTRYk}},{\text{t}} \times \frac{{{\text{USE}}_{{{\text{k}}, {\text{t}}}}^{\text{j}} }}{{\sum {{\text{USE}}_{{{\text{k}}, {\text{t}}}}^{\text{j}} } }}} \) is constructed as a weighted average of FDI_OWN_INDUSTRY in all upstream industries k of industry j, where the weights are input-sharesFootnote 25 that industry j purchases from all its upstream industries (including non-manufacturing industries).Footnote 26 This variable measures FDI in upstream industries k that affect firm i in industry j by providing intermediate inputs to industry j, i.e., the variable represents the proportion of a domestic firm’s inputs produced by foreign firms.

-

\( {\text{FDI}}\_{\text{DOWN}}_{{{\text{i}} \in {\text{j}},{\text{t}}}} = \sum\nolimits_{{{\text{k}} \ne {\text{j}}}} {{\text{FDI}}\_{\text{OWN}}\_{\text{INDUSTRYk}}, {\text{t }} \times \frac{{{\text{BUY}}_{{{\text{j}}, {\text{t}}}}^{\text{k}} }}{{\sum {{\text{BUY}}_{{{\text{j}}, {\text{t}}}}^{\text{k}} } }}} \) is constructed as a weighted average of \( {\text{FDI}}\_{\text{OWN}}\_{\text{INDUSTRY}} \) in all industries downstream of industry k, where the weights are the shares of its output that industry j sells to all of its downstream industries k (including non-manufacturing industries), i.e., the proportion of the firm’s output that is used by foreign firms.Footnote 27

If vertical relations are used to transfer knowledge from foreign firms, then these two variables are expected to have a positive impact on technological activities.

A caveat should be noted regarding the limitations of the spillover measures we use, which entails some restrictive assumptions. As spillovers cannot be measured at the firm level due to the lack of data on inter-firm linkages, vertical spillovers need to be calculated by using the technical coefficients derived by the Input/Output tables as weights.Footnote 28 This methodology is common practice in the literature, as it is generally unknown how much each firm (plant) sold to foreign-owned buyers or purchased from foreign suppliers. Several firm-level studies such as Javorcik (2004), Langer and Taymaz (2006), Wang (2013), Barrios et al. (2011), and Gerussi et al. (2013) have used this method of decomposition of inter-firm linkages, which was introduced in a seminal study by Blalock and Gertler (2003). Blalock and Gertler (2008) argue that while this measure is not perfect, it avoids endogeneity problems regarding domestic firms‘ decisions to supply foreign firms and to adopt the more advanced foreign technology into their production process. Interindustry FDI measures can be viewed as a measure of the available technology through inter-industry linkages.

The divisions of our sample at the industry level by technology classes and by productivity gaps are carried out using the following variables:

-

TECH CLASS,Footnote 29 a technology macro sector dummy that indicates two technology classes: TECH CLASS LOW, encompassing low and medium–low technology sectors, and TECH CLASS HIGH for high and medium high technology sectors (following the OECD taxonomy in Table 7).

-

GAP, the difference between the mean productivity of foreign firms in the sector and the productivity of each firm in the same sector, used as a proxy for the domestic technological gap. Higher positive values of this variable indicate a low productivity of domestic firms and also signals a greater technological distance between domestic and foreign firms (see Jabbour and Mucchielli 2007).Footnote 30 We also build the binary variable GAP CLASS, which indicates two technology gap classes: GAP CLASS LOW (low technology gap firms) and GAP CLASS HIGH (high technology gap firms), which contain firms below and above the 50th percentile of the variable GAP, respectively.

To eliminate the effects on firm survival resulting from the presence of FDI, we also control for several firm and industry factors that are known in the literature to be related to a firm’s duration. At the firm level, we include variables such as size, productivity, wages, capital intensity, export status, ownership, and several financial indicators. Moreover, as our key FDI explanatory variables only have industry-level variation and could be correlated with many other industry-wide variables, we introduce several industry-level variables as controls, such as trade exposure, turnover growth, entry rate, exit rate, minimum efficient scale, and industry concentration. In particular, the changes in the share of foreign turnover in sector j at time t (FDI_OWN_INDUSTRYj, t) could be influenced both by changes in foreign sales and by changes in domestic sector sales. If the share of foreign turnover increases because sector turnover decreases, there may be fewer local firms at the sector level due to foreign competition rather than to a spillover effect. Thus, to enable proper identification of the FDI effect, sector turnover must be held constant. For this reason, we introduced turnover growth in our estimates, measured as the sales growth of all firms in sector j at time t, and used this variable as a proxy for market demand. The introduction of this variable allows us to interpret positive FDI proxy variable values as resulting from expanding market shares of foreign firms rather than from a decline of the domestic sector.Footnote 31 Table 2 presents a more detailed description of all the variables in our analysis, along with their sources and expected relationships with firm exit.

We also performed a correlation matrix among all the variables and we carried out the variance inflation factor (VIF) in order to check for multicollinearity. Correlations between the independent variables are generally low, with the exception of some cases (correlation between the variables expshare and impshare, wage and productivity, FDIUP and FDIDOWN). However, the VIF test (which is 2.13 on average and always below 5.10 for each variable) reassures us that there is no serious multicollinearity among regressors in our estimation.Footnote 32

In Table 3 we describe the mean characteristics of firms with respect to all the explanatory variables listed in Table 2. We consider the whole sample as well as samples disaggregated according to different types of firm global engagement (exporting, non-exporting, foreign multinationals, domestic multinationals, purely domestic firms) to take into account the superior characteristics of globally engaged firms as compared to domestic non-exporting firms. In agreement with the models of Helpman et al. (2004), more globalised domestic firms are much larger and more productive. Domestic multinationals are the largest domestic firms (more than 500 employees) followed by exporting firms, which also have greater productivity and higher labour costs than non-exporting domestic firms. However, it is worth underlining that foreign firms outperform the most internationalised national firms such as domestic multinationals (larger size, age, productivity and profit margin, lower collateral and indebtedness, and greater solvency). This preliminary finding justifies developing our analysis on potential spillovers from FDI.

Table 4 presents the same descriptive statistics for separate subgroups of gap and technology classes of firms. As expected, firms with higher productivity gaps are on average smaller, less productive, less capital intensive, pay lower wages, have far lower profit margins and solvency, and are much more indebted. The averages of these indicators across sectors with different technology intensities are also as expected: firms belonging to sectors with lower technological intensities are on average smaller, less productive, pay lower wages, have far lower profit margins and solvency, and are much more indebted, while they exhibit higher capital intensity and collateral. However, it is worth noting that firms in less technology advanced sectors have lower technology gaps with foreign firms.Footnote 33

4 Modelling and estimation results

4.1 Empirical model: FDI impact on firm duration

This section reports the econometric estimates of our model:

relating the exit of firm i in industry j at time t to the FDI within the sector and within the region, which captures the competition and knowledge spillover effects of FDI (horizontal spillover), and also to upstream and downstream FDI spillovers, which capture the forward and backward vertical linkage effects (vertical spillovers). X i,j,t is a vector of both firm and industry characteristics (see Table 2 for the full list of firm and industry covariates), and \( e_{it} \sim N(0,\sigma^{2} ) \) is the error term accounting for stochastic shocks at the firm level.

We estimate a hazard model. The synoptic overview of the literature in Table 1 shows that the use of Cox’s proportional hazard firm level panel estimates (CPHM) is quite common in the literature on firm survival (see the whole IO literature, e.g., Audretsch and Mahmood 1995 and other seminal studies such as Görg and Strobl 2003; Mata and Portugal 1994). The advantage of the Cox model is its ability to address the chronology of failure (estimating partial likelihoods)Footnote 34 and the presence of censored data.Footnote 35 However, as in our case, firm exit is a continuous variable (a firm can exit after two and a half years)Footnote 36 and we do not know the exact moment when the event (interruption of firm activity) takes place, as it is recorded in specific time-discrete intervals due to balance sheet reporting (i.e., we only have annual observations on firm exit) we estimated both a continuous hazard model (Cox proportional hazard model) and a discrete time version of it, i.e., the complementary log–log or “clog-log” model (Jenkins 2005). As the results of the clog–log estimates were qualitatively the same as those of the Cox model, we only present the results of this latter.Footnote 37

The hazard function h ij (t) is given by

This function defines the probability of exit in a certain time period as a function of a set of time-varying covariates, conditional on surviving until that time period, where h(t) is the baseline hazard function, X is a vector of explanatory variables, and β is a corresponding vector of coefficients. The β parameters are estimated by the maximisation of the partial likelihood function, which does not require the specification of h(t). Subscripts i, j, and t denote “firm”, “industry”, and “time”, respectively. Note that the Cox proportional hazards model estimates the probability of the hazard, i.e., exit. Time is measured after entry, i.e., the time is equal to the age of the firm. The change in the hazard rate with age is incorporated into the underlying non-parametric hazard function, h (t). The underlying assumption of Cox’s model is that the hazard function h ij (t) of a firm i, i.e., the rate at which firms exit at age t given that they have survived up to age t − 1, depends only on the time at risk, h (t) (the so-called baseline hazard), and explanatory variables affecting the hazard independent of time, exp(X ijt β).

The Cox proportional hazard model imposes the restriction that the hazard functions for different values of the explanatory variables are proportional to each other and that their coefficients are constant over time (“firm age” in our case, as we consider age length as the spell length). We tested the proportional hazards assumption for each explanatory variable using the Schoenfeld test and found that the hypothesis of proportional effects is rejected for wages in some estimates. Therefore, the age-varying interactions of the wage variable are added in these estimates.Footnote 38

4.2 Estimation results

The results of the econometric estimates are presented in Table 5.Footnote 39 All models are stratified by year (so that each year is permitted to have a different age-dependent baseline hazard function) to take into account the effects of the business cycle and other macroeconomic shocks on survival.Footnote 40 All standard errors are clustered by firms. The coefficients are presented in exponential form to express the ratio by which the dependent variable (likelihood of failure) changes as the explanatory variable increases (hazard ratio). Values below (above) the unit indicate a negative (positive) impact of the explanatory variable on the hazard rate. In the case of a dummy variable covariate, the hazard ratio can be interpreted as the increase in the overall hazard rate for the firm when the dummy is equal to 1, while all other variables are held constant.

The results of our analysis are quite sensible. As predicted, productivity is highly correlated with firm exit, with a coefficient statistically significant at the 1 % level.Footnote 41 In order to better check our result on the productivity variable we re-run our regressions removing each time one of the following variables (PTPM, solvency, wage), which are closely related to productivity.Footnote 42 After dropping PTPM the coefficient of the productivity variable increased, hence we decided to remove PTPM. Conversely, we have decided to keep the wage variable in our final estimates as it adds further information. The wages have an immediate positive effect on the probability of exit that we can call a “direct” effect; apparently the increase in the cost of personnel increases the difficulty for the firms. This is not surprising as firms are relatively less competitive if they pay higher wages for given productivity levels. However, the interaction between time (age) and wage has a significant negative effect on exit probabilities. This supports the hypothesis that higher wages reflect a higher relative skill intensity, leading to higher sunk costs and hence to a lower probability of exit. This finding is consistent with previous studies (see Van Beveren 2007). The coefficients of solvency and turnover growth are also significant (at 5 %), corresponding to reductions in the hazard rate of 2 and 92 %, respectively. It is worthwhile observing that the high partial effect of productivity which we find can also be related to innovation. Labour productivity is associated with firm characteristics and firm’s specific decisions such as to invest in R&D, which we could not include in our specification as our proxy variable for innovation (R&D) was not robust due to the high number of missing values. Hence innovation might also explain the significant impact of productivity on increase in duration.

Looking at the key variables of our analysis, the FDI related variables, the overall results provide no evidence of horizontal spillovers. These results show that firm survival in Italy is not positively affected by the increased presence of foreign MNEs within the same industry or region, unlike the results shown in Görg and Strobl (2003) for Ireland, Burke et al. (2008) for the UK, and Ayyagari and Kosová (2010) for the Czech Republic. We also find no evidence of a positive impact of vertical linkages.Footnote 43

One possible explanation for these unexpected findings is provided by the argument of Rodríguez-Clare (1996) that positive externalities only arise when certain conditions are met regarding the quality/competitiveness of local input supply and customers in vertically related sectors and of competitors in the same sectors. Several are the possible underlying mechanisms through which host countries might be hurt by the entry of foreign firms. When foreign firms act as customers of local firms they are quite selective and this may enhance competition among local suppliers and lower prices. When acting as suppliers, foreign firms may be not able to provide the intermediates needed by domestic firms. Hence, specific actions and endowment of indigenous firms are important sources of heterogeneous behaviour.

However, in estimating the hazard model using data for all manufacturing industries, we have implicitly assumed that the effect of the explanatory variables is uniform across different firm types. In the next section we remove this restriction.

4.3 Testing for the impact of productivity gap and technology on firms’ absorptive capacities

In this section we check for two sources of potential heterogeneity in our data: the firm’s productivity gap and the technology level of the sector. We use the dummy variable GAP to capture differences in firm behaviour based on their productivity gaps with respect to foreign firms and we split our sample into i) high gap (GAP CLASS HIGH) and ii) low gap firms (GAP CLASS LOW). Furthermore, using another dummy variable to capture the different behaviours of firms based on their technology levels, we split our sample into two clusters of technology levels: (1) low and medium–low technology (TECH CLASS LOW and (2) high and medium–high technology industries (TECH CLASS HIGH). In the sub-samples, both the baseline hazard and the effect of the explanatory variables can be dissimilar between firm groups. To check whether these differences in the covariates are significant, a likelihood ratio test of differences was performed to compare the restricted and unrestricted model coefficients, with the null hypothesis that both coefficients are equal. The resulting likelihood ratio test statistics were highly statistically significant, allowing us to reject the null hypothesis that the data can be pooled across the different firm types. Then, we test the hypothesis that firms with different productivity levels and technology regimes are likely to be affected in different ways by FDI related variables and by the other control variables.

Table 5 presents the coefficients estimated for the pooled sample and for the four subsamples.

Our results support the splitting of the sample, as the FDI coefficients appear to be highly sensitive to technology gap and to technology level, confirming the heterogeneity of FDI effects across firms.

We had unclear expectations regarding the results of the disaggregated samples. However, following the previous literature on productivity spillovers and the technology gap between domestic firms and MNE (Kokko 1994; Blömstrom and Kokko 1998; Imbriani and Reganati 1997; Sjöholm 1999), we expect that a higher relative efficiency is related to a higher absorptive capacity.

We first focus on the high/low gap disaggregation. We find positive and significant intra-sectoral spillovers in the group of firms with a low technology gap. The significantly negative effect of foreign firms’ presence on the probability of local firms exiting through forward linkages, provides evidence that the presence of foreign affiliates does reduce the exit probability of their downstream local customers with a low productivity gap. The existence of positive upstream spillovers when the gap is low suggests that domestic firms that are relatively more efficient also have a higher absorptive capacity, which allows them to benefit from the supplies of intermediate goods and machinery from MNEs. In other words, our findings support the conclusion that being a customer of foreign companies (i.e., having forward linkages) has a beneficial effect on survival, but only for more productive firms that are able to exploit the positive inter-sectoral externalities resulting from MNEs.Footnote 44 Conversely, the horizontal and vertical FDI spillover coefficients are both not significant for high productivity gap firms, while, in addition to this, higher regional concentrations of FDI have a weak positive impact on exit for these type of firms while a weak negative impact on the low gap firms. This proves the necessity for local firms to bridge the efficiency gap with foreign entrants in order to make the most of inter-firm linkages without being displaced by fitter, foreign firms. Moreover, even after splitting the sample, we do not find evidence of downstream spillovers i.e., there is no evidence that the presence of foreign firms would significantly affect the probability of shutting down for their upstream local suppliers (through backward linkages).

These results can be interpreted on the basis of several economic arguments. We can conjecture that MNEs in upstream industries provide domestic firms with inputs that are more varied, technologically more advanced or less expensive, or may ensure that their inputs are accompanied by the provision of complementary services (Javorcik 2004). However, it is likely that firms with high productivity gaps cannot fully exploit these benefits, i.e., that a certain level of absorptive capacity is needed to enable domestic firms to assimilate the technology brought in by the foreign affiliates. Moreover, while backward linkages to upstream supplying industries reduces the exit probability, there is no significant evidence that inward FDI stimulates firm duration through downstream local customers (through forward linkages). Thus, foreign firms do not seem to facilitate knowledge transfer to local firms to enable them to produce intermediate inputs more efficiently although, we do not find like Girma and Gong (2008a, b) for China that local firms are more likely to exit as forward linkages (MNE purchasing inputs from local firms) increase.

Some results are worth noting regarding the other sector and firm specific variables. Size, which was not a significant determinant of exit in the overall sample, becomes significant once the sample is split according to the productivity gap. Small size has a positive influence on the survival of high gap firms. If this result does not depend on the fact that high gap firms are predominantly small, then we can argue that these firms can improve their chances of survival by reducing their numbers of employees. Productivity is significant and consistently reduces exit, but only for firms with high productivity gaps. The sector export intensity also improves survival for firms with low productivity gaps, which confirms that productivity is a pre-condition to obtain a premium from global competition. In addition, more efficient firms benefit from higher industry concentrations, with a significant decrease in their hazard rate, while they are less likely to survive in sectors characterised by the existence of a higher minimum efficient scale containing larger firms. Finally, the coefficient on the technology dummy variable (TECH CLASS LOW) is significant (at 1 %) and greatly reduces the risk of exit for low gap firms. This indicates that low GAP firms benefit more from higher spillovers on survival in less advanced sectors than in more advanced sectors.

Turning to the disaggregation of our sample by technology sectors, our results highlight that the presence of multinationals within the same sector has a positive effect on plant survival only for firms operating in low and medium–low tech sectors. Conversely, in the high and medium–high tech sub-samples, horizontal FDI variables are statistically insignificant. The easier imitation and less fierce competition in less advanced sectors might explain our results, suggesting that within industries with more innovation, spillover effects are offset by the higher competition pressure that results from the effects of foreign firms. Another interpretation of our results could be based on the productivity gap. As shown in Table 4, the productivity gap between domestic manufacturing firms and foreign firms in our sample is higher in more advanced sectors than in less technology intensive sectors, most likely due to the Italian model of specialisation which focuses on high product quality within less technology intensive sectors to which Made in Italy products belong to. In less advanced industries, local firms might have a greater ability to benefit from spillovers from foreign firms competing in the same sector due to their lower productivity gaps. This is quite a different result compared with other countries, where domestic firms in high tech sectors have been found to have a greater absorptive capacity than plants operating in low-tech sectors (Görg and Strobl 2003 for Ireland and Ayyagari and Kosová 2010 for the Czech Republic). However, the high technology sector features positive upstream spillovers, i.e., in high tech industries, domestic firms benefit from supplies of intermediate goods and machinery from MNEs.

Some results should be highlighted with respect to the other sector and firm specific variables. Size, which was not a significant determinant of exit in the overall sample, becomes significant once the sample is split according to the technology intensity. Small size has a positive influence on the survival of low technology firms, while it strongly increases exit in the high technology sectors. Then we can argue that low tech firms can improve their chances of survival by reducing their numbers of employees, while size is quite relevant to survive in more advanced sectors. In these sectors, larger firms not only benefit from a size but also from a wage premium over time. Productivity consistently reduces firm exit in low and medium–low technology sectors. These results suggest that the competition dynamics is different between more and less advanced sectors.

5 Conclusions

FDI affiliates in a host country interact with indigenous plants in many ways: they compete for market shares with domestically owned plants in the same industry, supply intermediate inputs to domestically owned plants and purchase products by domestically owned plants. Through these economic linkages, FDI is likely to have a significant impact on domestic firms. These effects can be observed through changes in productivity, employment and wage adjustments, and plant/firm death or survival. In this paper, we examined the effects of FDI on the exit dynamics of manufacturing firms located in Italy. The presence of FDI in Italy exerts complex effects on manufacturing firms’ selection through competition and spillover effects.Footnote 45

We first examine our overall sample of Italian manufacturing firms and find that their survival rates are not affected by competition from FDI affiliates operating in the same industry or region or by FDI linkages.

However, we bring our analysis a step further. We carry out a disaggregated analysis and we verify the relevance of spillovers in relation to firm productivity gap with respect to foreign firms and to the sector technology. This disaggregated analysis provides a more detailed picture of the role of FDI spillovers on firm exit in Italy. More specifically, our results contribute to the wide (and controversial) literature on technology gap, absorptive capacity and spillover linkages adding new evidence related to the issues of firm selection and survival dynamics. Overall, our results suggest that inward investment may indeed improve domestic sectors through various linkages, but these relationships are quite heterogenous across firms and sectors. We observe that only Italian firms with low productivity gaps are actually able to exploit spillovers from foreign competitors (both horizontally and via forward linkages between MNEs and local buyers of intermediate goods). Less efficient firms are not able to take advantage of this opportunity. Thus, our results do not support the broad conclusion that FDI has a positive impact on the survival of indigenous firms. The net effect of foreign firms on the survival of domestic firms seems to depend on the absorptive capacity of the domestic firms, and positive externalities only arise when certain conditions are met regarding the quality/competitiveness of local firms.

We also observe that Italian firms in low-medium low technology sectors take advantage of positive externalities from MNEs in the same sector. This might be because they are less disadvantaged with respect to foreign firms in terms of productivity, and hence better able to absorb the knowledge spillovers spreading from competing foreign firms. In contrast, the survival rate of domestic firms belonging to more advanced sectors is not affected by inward FDI, which might depend on the fact that competitive pressure and selection effects are likely to compensate spillovers because of the higher technology gap between domestic firms and foreign firms and the more intense competition and stronger market share/control characteristics of foreign competition in these sectors. However, foreign firms’ activity reduces the exit probability of downstream local customers (through forward linkages).

With respect to the issue of whether the impact of foreign investment determines higher productivity due to selection of the most efficient firms by increased competition or due to positive spillovers, our regression results and analysis show mixed conclusions. For low gap and low tech companies foreign presence does not increase exit and may actually reduce it. Similarly, upstream foreign presence seems to increase survival of downstream local customers in high tech class industries. Overall, it appears that selection due competition is not more likely than spillover effects. However, our findings strongly support that the extent of spillover effects on domestic firms depend on their relative position with respect to foreign firms which affects their capability features. In particular, our results suggest a lower absorptive capacity in presence of a higher productivity gap.

These findings lead to the following policy implications and recommendations. An important lesson that can be drawn from our analysis is that the incidence of positive spillovers from FDI is neither automatic nor unconditional. The policy challenge is therefore to ensure that firms have the right organisational and incentive structures to develop adequate absorptive capacity. In general, the efforts to attract inward investment cannot neglect the aspects of technological capability, the sector to be targeted and the features of the host country firms. Thus, any policy of investment promotion should also implement measures to support local firms, including the suppliers and customers of foreign MNEs. As we find a lack of positive spillover effects on high-tech firms, complementarities between policies is crucial. Innovation and knowledge diffusion are specific complementary policy measures that are needed to enable firms to benefit from FDI spillovers. Government policy first aim should be enhancing the efficiency of medium and small firms and making them more competitive through enhancing R&D capabilities. Besides, some economists argue that any policy to encourage FDI is doomed to fail unless firms are allowed to compete with other enterprises fairly through the elimination of policy-induced burdens and through policies specifically aimed to improve productivity by infrastructure investment, reduction in energy and labour costs, support to youth and labour training. These are auxiliaries policies which should be associated to current programmes to attract FDI.

These final considerations should help policy makers to target specific sectors and priorities and also to select foreign firms more suitable for enhancing domestic competition. The widespread diffusion of general attraction incentives for FDI as policy instruments is unfortunate. Policy makers need to be able to disentangle the drivers of higher domestic firm survival and business growth in the presence of global competition by considering local firm characteristics and technological capability, as well as the sector and domestic market features needed to enhance spillover effects.

The outcomes of this study could be investigated further by obtaining more detailed firm level data better able to capture the foreign and local firm linkages within and across sectors. Secondly, future studies should test for the differential impact of Greenfield FDI (increased capacity and price reduction) versus M&As (where domestic firm competition and market structure should not be altered) and also study the effects of other MNE features such as their country of origin and the MNEs’ degrees of control over their affiliates. Another important task is to disentangle horizontal and vertical FDI types to test for the market orientation of FDI (export platform FDI and market seeking FDI versus cost saving FDI) (Wang 2013). Unfortunately, our current data do not allow us to study these issues.

Notes

Direct effects stem from the superior characteristics of multinational firms compared to those of domestic firms: affiliates of multinational firms tend to be larger and more productive, internalise greater technological know-how and modern management practices, and attract more skilled labour than domestic firms (Doms and Jensen 1998).

Absorptive capacity is expected to be different according to the distance of the firm productivity from the foreign firm mean productivity in the same industry. More specifically if a firm has got spillover and it is operating close to the foreign firms’ technology we interpret it as evidence of a relatively high absorptive capacity.

Cohen and Levinthal (1990) say absorptive capacity is "the ability of a firm to recognize the value of new, external information, assimilate it, and apply it to commercial ends”.

In September 2013 the Italian government has launched the Programme “Destination Italy” aimed to attract foreign capitals for medium long term investment.

For an overview of our research questions and expected results, see Table 8 in the “Appendix”.

These authors argue that foreign firms producing at lower marginal costs than indigenous firms have an incentive to increase output and attract demand away from indigenous firms (the “market stealing” or crowding-out effect). This will cause host country rivals to cut production, which, if they face fixed costs of production, will raise their average cost and therefore reduce their probability of survival. They argue that even though technology spillovers exist, the negative competitive effect may outweigh positive technology spillovers.

The channels of impact on firm survival in sectors that supply inputs to multinationals are described by Markusen and Venables (1999). According to this model, the presence of multinationals has three effects on the host economy. First, there is a negative competition effect: the increase in total output due to multinational production decreases the market price, which leads to the exit of some domestic firms. Second, there is a demand effect as multinationals create additional demand for domestically produced intermediate goods through linkages with indigenous suppliers, inducing the entrance of new intermediate producers. Finally, a derived third effect takes place through a decrease in the price of intermediates, which induces the entry of domestic firms producing final goods. The latter two positive effects may or may not outweigh the potential negative competition/displacement effect.

In this paper, absorptive capacity is deemed to be inversely related to the distance of the firm productivity from the foreign firm mean productivity in the same industry. As a result, a firm is considered to have a relatively high absorptive capacity if it is operating close to the foreign firms’ technology.

It takes time to create linkages with foreign entrants. Domestic firms may have to upgrade their production facilities/workforce skills/R&D capabilities. Initially, foreign entry induces negative effects on net entry due to the dominance of the competition effect forcing weaker domestic firms out of the market. These negative effects are moderated over time or even reversed by the positive spillover effects. The result is a U-shaped pattern for the effect of FDI on net entry rates.

The explanation the authors provide for this result is that in dynamic (technology driven) industries, the relationship between firms is more likely to be competitive. In contrast, in static industries, new ventures are more imitative and thus have more scope to benefit from knowledge spillovers from foreign firms.

The reasons for the low R&D activity and slow innovation in Italy are strongly connected to the size structure of the production system, with 94 % of firms employing fewer than 9 employees (Istat 2008), and large firms (with 250 employees or more) amounting to <1 %.

The firm level dataset AIDA was supplied to the University of Salerno by the commercial data provider Bureau Van Dyck, while access to the Bureau Van Dyck Mint-Italy dataset and to the Capitalia 2001–2003 database were provided confidentially to the authors alone. Questions related to access to the firm level data can be forwarded to the authors.

A drawback of the dataset is that it does not capture the smallest firms. As they are also the most likely to exit, this may lead to an underestimation of overall exit. However, data for very small firms are often irregular and misreported, representing a source of potential bias.

The AIDA dataset reports the unconsolidated balance sheets of corporate firms.

The AIDA database offers a flexible definition of ultimate ownership (over 25 % or over 50 %). In our analysis we considered a share of 25 %.

If a firm is out of the register, it must have already been liquidated and its record must have been deleted from the register. Thus, we assign firm exit as the year in which the firm reports its last sales. Also, we allow for a two-year prior exit window to incorporate reporting delays or mismatches between calendar and fiscal years. For example, if a firm began a liquidation process in 2009 but its last reported sales are in 2007, we assume that the firm exited in 2007. Then, Exit it = 1 in the year when the firm exits and 0 in all prior years, and the firm is missing in the years following its exit.

For a detailed list of exit according to the type of procedure, see Table 6 in “Appendix”.

By using this detailed information on exit, we avoid to a great extent the problem of “the catch-all meaning of the exit events recorded in business registries” (Bottazzi and Tamagni 2011).

Firms without complete records for some of the variables that were fundamental for our analysis were eliminated. Moreover, the dataset was carefully cleaned to exclude firms with abnormal values and unusual changes in observations. In cases where the value of the variable was missing, although the main variables such as sales, production or labour were reported, we considered non-reported values to be zero values.

We also adopted two different proxies for horizontal FDI to check the robustness of our results: one proxy was the effect of the production of foreign firms in Italy in sector k at time \( t\left( {{\text{Y}}_{\text{k,t}}^{\text{Estere}} } \right) \) on the value of the production of all firms in sector k at time \( t\left( {{\text{Y}}_{\text{k,t}}^{\text{Totali}} } \right) \); another was the share of total employment accounted for by foreign affiliates in each industry. These results are not reported here for the sake of brevity.

Region is defined as the NUTS2-level region (Eurostat).

Source: Istat, Input–Output Tables. The information on the proportion of sector j’s inputs purchased from upstream sectors k \( \left( {\sum\nolimits_{{{\text{k}} \ne {\text{j}}}} {\frac{{{\text{USE}}_{{{\text{k}},{\text{t}}}}^{\text{k}} }}{{\sum {{\text{USE}}_{{{\text{k}},{\text{t}}}}^{\text{k}} } }}} } \right) \) is available for 2 digit sectors according to the Ateco91 classifications for 1995, 2000 and 2005. We used the coefficients for 2005.

The formula excludes inputs supplied within each sector because they are already captured through the variable FDI _OWN_INDUSTRY. In addition, the input/output coefficients are calculated excluding products supplied for final consumption and imports of intermediate goods to ensure that only domestically sourced inputs are considered as domestic intermediate consumption.

Source: Istat, Input–Output tables. The information on the proportion of sector j’s output used by k downstream sectors \( \left( {\sum\nolimits_{{{\text{k}} \ne {\text{j}}}} {\frac{{{\text{BUY}}_{{{\text{j}},{\text{t}}}}^{\text{k}} }}{{\sum {{\text{BUY}}_{{{\text{j}},{\text{t}}}}^{\text{k}} } }}} } \right) \)) is available for 2 digit sectors according to the Ateco91 classifications for 1995, 2000 and 2005. We used the coefficients related to 2005.

Given that the magnitudes of Upstream FDI and Downstream FDI are affected only by changes in the level of FDI, as input–output shares do not change, the level of FDI are the driving factor in the empirical analysis. Implicit in the construction of Upstream and Downstream FDI is also the assumption that the inter-industry input–output shares for each plant/firm in an industry are identical, and are the same as the share at the industry level.

We follow the common use in the literature of the ‘technology gap’ proxied through measures of the ‘productivity gap’ between foreign and domestic firms. We also tested for another proxy of the technology gap, the gap in intangible assets, but this variable was not significant.

We thank the anonymous referee for raising this point.

A VIF of 10 and a tolerance test, defined as 1/VIF, lower than 0.1 are generally used as a cut off value to check on the degree of collinearity. It means that above those thresholds the variable could be considered as a linear combination of other independent variables. See Kutner et al. (2004). Both the correlation table and the results of the VIF and tolerance tests, not included for the sake of brevity, are available upon request.

We performed a t test to compare means to check the statistical significance of these mean differences across subgroups of gap and technology classes of firms.

It departs from the Maximum Likelihood method (Cox 1972).

On the right side when the event at issue has not yet occurred at the time of observation, on the left side when the risk period leading to the event started before the beginning of the observation time.

The durations of firms in this sample range from 1 to 142 years, with a mean of 28 years for the full sample (Table 3). Thus, we can consider duration as a continuous variable.

These results are not presented in the paper for the sake of brevity but are available upon request. See Jenkins (2005) for an overview of complementary log–log proportional hazard models and other discrete time hazard models.

Our data are left truncated given that only firms that survived more than some minimum amount of time are included in the observation sample. In our case, the survey starts in 2002, so for all firms founded at time t < 2002, only those with relatively long durations survived long enough to remain available for sampling at time 2002. This problem was taken into account, as suggested by Jenkins (2005), including the use of the enter option to indicate the entry time.

For an overview of our results, see Table 8 in “Appendix”.

We could not stratify by industry as few observations were available in some sector and also we have many control variables at the sector level, which eliminate most of our sector dummies and account for possible differences in productivity across sectors.

As our explanatory variable productivity is expressed in log the hazard is the exponentiated coefficient multiplied by the log of the variable (exp(logxb). This corresponds to the estimated coefficient (see Jenkins 2005). Hence, the coefficient tell us the elasticity of change in the dependent variable corresponding to a percentage change in the productivity. In the specific case, a 1 % increase in value added per employee is associated with a 30 % reduction in exit probability.

We thank an anonymous referee for suggesting us this further check. We did not attach for the sake of brevity these further estimates used to test for the robustness of our results, however, they are available upon request.

Our results are robust to endogeneity issues. While at an aggregate level a positive effect of FDI related variables on survival could suffer from an endogeneity problem due to the fact that multinationals generally locate in high productivity industries (Aitken and Harrison 1999), the endogeneity of FDI at the industry level is not a problem when using micro-level data (Wang 2013). Besides, the inclusion of other industry covariates along with those at the firm level already control for the possible endogeneity of FDI. Most of the literature on FDI spillovers treats the level of FDI as exogenous (see Javorcik 2004; Blalock and Gertler 2008).

For an overview of our conclusions and policy implications, see Table 8 in “Appendix”.

References

Aitken, B. J., & Harrison, A. (1999). Do domestic firms benefit from direct foreign investment? Evidence from Venezuela. American Economic Review, 89(3), 605–618.

Audretsch, D. B. (1991). New-firm survival and the technological regime. Review of Economics and Statistics, 60(3), 441–450.

Audretsch, D. B., & Mahmood, T. (1995). New-firm survival: New results using a hazard function. Review of Economics and Statistics, 77(1), 97–103.

Ayyagari, M., & Kosová, R. (2010). Does FDI facilitate domestic entry? Evidence from the Czech Republic. Review of International Economics, 18(1), 14–29.

Bandick, R. (2010). Multinationals and plant survival. Review of World Economics, 146(4), 609–634.

Barrios, S., Görg, H., & Strobl, E. (2011). Spillovers through backward linkages from multinationals: Measurement matters! European Economic Review, Elsevier, 55(6), 862–875.

Bernard, A. B., Eaton, J., Jensen, B. J., & Kortum, S. (2003). Plants and productivity in international trade. American Economic Review, 93(4), 1268–1290.

Blalock, G., & Gertler, P. (2003). Technology from foreign direct investment and welfare gains through the suply chain. Mimeo: Cornell University.

Blalock, G., & Gertler, P. (2008). Welfare gains from foreign direct investment through technology transfer to local suppliers. Journal of International Economics, 74(2), 401–421.

Blomström, M. (1986). Foreign investment and productive efficiency: The case of Mexico. Journal of Industrial Economics, 35(1), 97–110.

Blomström, M., & Kokko, A. (1998). Multinational corporations and spillovers. Journal of Economic Surveys, 12(3), 247–277.

Bottazzi, G., & Tamagni, F. (2011). Big and fragile: When size does not shield from default. Applied Economics Letters, 18(14), 1401–1404.

Bridges, S., & Guariglia, A. (2008). Firms in financial distress, a survival model analysis. Scottish Journal of Political Economy, 55(4), 444–464.

Burke, A., Görg, H., & Hanley, A. (2008). The impact of foreign direct investment on new firm survival in the UK: Evidence for static versus dynamic industries. Small Business Economics, 31(4), 395–407.

Cantwell, J. (1989). Technological innovation and multinational corporations. Oxford: Basil Blackwell.

Castellani, D., & Zanfei, A. (2007). Multinational companies and productivity spillovers: Is there a specification error? Applied Economics Letters, 14(14), 1047–1051.

Caves, R. E. (1974). Multinational firms, competition and productivity in host country markets. Economica, 41(162), 176–193.

Caves, R. E. (1996). Multinational enterprise and economic analysis. Cambridge University Press.