Abstract

A new generation of heterogeneous financing tools is designed to support responsible firms to develop sustainable projects. Also, carbon pricing as the most convenient environmental factor could help eco-friendly assets by creating a more environmentally friendly environment while altering the cost competitiveness of various industries. This paper compared the intrinsic nonlinear associations of carbon emission future price and green bonds (consisting of rigorously screened and green-labeled), with conventional sovereign bonds (in two versions of emerging and developed) and Islamic bonds (including normal and high-quality types). Applying an Elman neural network evaluation to the pairwise connectedness of each bond and carbon market during the period of 12/31/2012 to 8/4/2023, we found that with the exception of emerging sovereign bonds which are tightly related to the carbon market, both green-labeled and extra-financial eligible green bonds have more robust innate nonlinear linkages with the carbon market than developed conventional sovereign bonds and both Islamic versions. Moreover, the results show that extra-financial screening is more effective than the green-labeling process for create a more trustworthy affiliation with the carbon future market. By analyzing the results, policymakers and regulators can develop new indicators to detect and track greenwashing possibilities in environmentally friendly assets.

Graphical Abstract

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

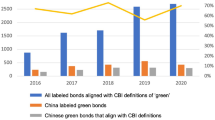

The importance of sustainable finance, particularly exemplified by the green bond market, has been growing significantly in the context of reducing carbon emissions. Green bonds provide financial resources for environmentally responsible projects or entities with an ecological focus, thus mitigating the negative externalities associated with pollution. They serve as a crucial mechanism for directing financial support toward investments in ecologically sustainable or low-carbon assets. The issuance of green bonds has witnessed a notable increase in recent years. In 2016, the volume of green bond issuance reached $100 billion, and by 2018, it had risen to approximately $170 billion. In 2022, global issuers engaged in transactions totaling $443.72 billion in the green bond market, marking a decrease from the $596.30 billion recorded in 2021. However, there was a notable 7% increase in issuance during the first half of 2023 compared to the previous year. According to Moody's Investors Service, sustainable bond issuance reached an impressive $950 billion in 2023.Footnote 1

The inception of the European Union Emissions Trading System (EU ETS) in 2005 heralded the establishment of the premier international carbon market, facilitating the exchange of allowances among regulated corporate entities and other stakeholders invested in market transactions. Over the past decade, the EU ETS carbon market has exhibited continual expansion regarding trade volume, monetary value exchanged, and the grouping of participants (Jin et al., 2020). Moreover, a recent pivotal outcome emanating from the 26th previous gathering of the United Nations (UN) Framework Convention on Climate Change, denoted as COP26, involves the necessity to engender a more profound grasp of climate-associated vulnerabilities, assets, and marketplaces, encompassing both government policymakers and academic providers of knowledge (Ren et al., 2022a, 2022b). The incremental uptick in climate-linked vulnerabilities has impelled nation-states and geographical sectors to institute a plethora of carbon-centric trading platforms or markets, thereby harmonizing economic progress with considerations regarding carbon emissions (Coates et al., 2001; Crecente et al., 2021; Ko et al., 2021; Ren et al., 2022a, 2022b; Zhou & Li, 2019).

Corresponding with the fundamental aims and transactions intrinsic within both the green bond and carbon emissions markets, a common aspiration arises, converging upon the mitigation of greenhouse gas emissions, notably carbon dioxide, coupled with the attainment of economically sustainable progress in an environmentally friendly manner (Flammer, 2021; Ren et al., 2022a, 2022b; Tolliver et al., 2020a, 2020b). Consequently, a requisite harmony between these markets becomes imperative. Given the contextual setting of worldwide efforts toward low-carbon advancement and economic integration, an assortment of distinctive characteristics defining these two markets has been extensively documented; however, the interdependent interplay connecting them has lamentably received sparse attention (Banga, 2019; Rannou, 2019).

The carbon market remains susceptible to exogenous economic variables (Chevallier, 2009; Guo & Feng, 2021; Ren et al., 2022a, 2022b; Zhang & Wei, 2010), while concurrently exhibiting an efficacious capacity to ameliorate the financial expenditures entailed in carbon emission abatement, in addition to institutionalizing pertinent mechanisms (Cui et al., 2014; Shi et al., 2022; Zhang et al., 2020a, 2020b; Zhu et al., 2020). Empirical inquiry has substantiated the claim that implementing a market-based pricing mechanism to mitigate carbon emissions accords superior economic viability and efficacy in contrast to traditional policy measures (Huang et al., 2022; Wu & Gong, 2021). Specifically, the Carbon Emissions Trading Scheme (CETS), an instrumental instrument promulgated within the framework of the Kyoto Protocol, emerges as a robust and widely employed market-oriented environmental policy instrument. It serves to internalize the adverse externalities arising from carbon emissions and chart a cost-effective trajectory for carbon abatement (Xin-gang et al., 2023; Du & Li, 2020; Fang et al., 2022a, 2022b; Li et al., 2022a). Notably, the enactment of CETS has yielded a substantial reduction (24.2%) in industrial CO2 emissions across all seven carbon emission trading pilot initiatives spanning 30 provinces of China during the period from 2008 to 2016 (Zhang et al., 2020a, 2020b). Moreover, the influence of carbon emission trading extends to the stimulation of eco-innovations, contingent upon variables encompassing enterprise dimensions and investments in research and development (Xin-gang et al., 2023). Conversely, within the context of the green-labeled bond market, certain insufficiencies and latent risks come to the fore when compared with the carbon market. For instance, Tolliver et al., (2020a, 2020b) conducted a comprehensive analysis of green bond issuance across 49 countries within the temporal span from 2007 to 2017, culminating in the insight that macroeconomic and institutional factors, in conjunction with the robustness of a nation's determined contributions, exert a positive influence upon the efficacy of the green bond markets. Moreover, it is noteworthy that the dynamism of the green bond markets leans toward a supply-oriented trajectory rather than one propelled by demand dynamics (Barua & Chiesa, 2019). This tendency is accentuated by a lack of formally structured institutions, the attendant perception of elevated issuer costs, a dearth of harmonized global benchmarks, protracted project approval timelines, inadequate green bond supply relative to investor appetite, the incipient stage of the market's development, and the susceptibility to manifestations of greenwashing (Deschryver & De Mariz, 2020; Flammer, 2021; Jain et al., 2022; Karpf & Mandel, 2018). These compounded factors collectively attenuate the degree of prominence with which the green bond market interfaces with other responsible market segments (Ren et al., 2022a, 2022b).

The concept of greenwashing refers to a strategic practice where positive information is selectively disclosed while unfavorable details are withheld, resulting in an exaggeratedly positive portrayal of corporate activities (Lyon & Maxwell, 2011). Recent studies on greenwashing have highlighted its complex nature, going beyond mere information disclosure (Lyon & Montgomery, 2015; Parguel et al., 2015). Zanasi et al. (2017) propose a range of criteria for evaluating greenwashing, including a comprehensive assessment of the product's entire life cycle, the accessibility, comprehensiveness, and verifiability of advertising content, the use of clear and non-misleading language, the promotion of sustainable initiatives only when they are effective, substantial, and voluntary, the involvement of stakeholders, the avoidance of deceptive "green" visual cues, and the adoption of reputable third-party certification systems. In essence, greenwashing involves the dissemination of inaccurate or deceptive information about an organization's environmental strategies, goals, incentives, and activities (Nemes et al., 2022). Within the context of the green bond market, Shi et al. (2023) introduce an index for assessing greenwashing, which aims to determine whether the issuance of green bonds genuinely stimulates increased environmentally conscious investments by issuing firms or if it is merely a facade referred to as greenwashing. Their empirical findings reveal that the issuance of green bonds has a positive impact on the number of green patent applications submitted by companies. However, this increase in quantity does not correspondingly result in an improvement in the quality of the green patents themselves.

The primary aim of this research is to examine the complex and nonlinear relationship between green bonds and their heterogeneous non-green counterparts, specifically in the context of future carbon emission prices. Additionally, the study seeks to understand the connections between the carbon-green bond nexus and the relationships that exist between the carbon market and other bond categories, with the goal of identifying potential instances of greenwashing within the realm of green bonds. Building upon the foundational concept articulated by Lyon and Maxwell (2011), this study aims to provide precise insights into the genuine alignment of green bonds with the carbon market, in order to identify cases of greenwashing. To achieve this objective, the study makes several contributions from five distinct dimensions. Firstly, a novel metric is introduced to detect greenwashing in environmentally focused industries, specifically within the field of green bonds. This innovation involves the development of a carbon-related greenwashing index, which is motivated by the increasing importance of climate-related risk disclosure efforts, driven by initiatives and frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD), the Carbon Disclosure Project (CDP), the Science-based Target Initiative (SBTi), the Net-Zero Asset Owner Alliance, the RE100 + , and the UNFCCC COP-affiliated "Race to Net Zero." Recognizing the pivotal role played by the carbon emission market, In and Schumacher (2021) coined the term "carbon-washing" to provide a suitable conceptual framework for effectively categorizing instances of carbon-related greenwashing. Secondly, the study employs a pairwise time-varying parameter vector autoregressive (TVP-VAR) connectedness framework, similar to methodologies utilized by Siddique et al. (2023), Tiwari et al. (2022), and Wei et al. (2023). This approach enables the dynamic assessment of relationships between different bond categories and the carbon market. Thirdly, the study suggests the use of a carbon-related greenwashing index based on an Elman recurrent neural network (ENN). This neural network architecture is capable of handling sequential data and addresses challenges associated with vanishing or exploding gradients. It is particularly suitable for analyzing lengthy input sequences and mitigating potential issues of signal loss resulting from input overwriting. The accuracy of predictive outcomes generated by the ENN is leveraged to understand the quality of the underlying nonlinear information that drives the interdependence between environmentally oriented markets. Fourthly, the research examines the robustness of the ENN's training process by employing five distinct weight and bias adjustment strategies. These strategies include the conjugate gradient backpropagation with Polak–Ribiére updates, the resilient backpropagation algorithm, the conjugate gradient backpropagation with Fletcher-Reeves Updates, the one-step secant method, and the Levenberg–Marquardt optimization method. Lastly, the study investigates the interplay between the carbon market and various financial instruments, including: (1) conventional sovereign bonds, categorized based on the developmental status of their respective countries—emerging and developed; (2) green bonds, characterized by different screening patterns that range from standard to rigorous assessments of their eco-friendly attributes; and (3) faith-based fixed-income debt securities, encompassing both baseline and top-tier sukuk offerings.

The primary objective of this study is to examine the complex and nonlinear relationship between green bonds and their diverse non-green counterparts in relation to future carbon emission prices. The research also aims to compare the characteristics of the carbon-green bond nexus with the connections observed between the carbon market and other bond categories. Through this comparative analysis, the study seeks to identify potential instances of greenwashing within the domain of green bonds. Inspired by the conceptual framework proposed by Lyon and Maxwell (2011), the study aims to provide precise insights into the genuine alignment between green bonds and the carbon market, with the goal of detecting manifestations of greenwashing. The study contributes to the field in five distinct dimensions. Firstly, the study introduces an innovative indicator designed to identify instances of greenwashing in environmentally focused sectors, including the realm of green bonds. This contribution involves the development of a carbon-related greenwashing index, which is motivated by the increasing importance of climate-related risk disclosure efforts driven by initiatives and frameworks such as the Task Force on Climate-related Financial Disclosures (TCFD), the Carbon Disclosure Project (CDP), the Science-based Target Initiative (SBTi), the Net-Zero Asset Owner Alliance, the RE100 + , and the UNFCCC COP-affiliated "Race to Net Zero." Recognizing the significant influence of the carbon emission market, In and Schumacher (2021) coined the term "carbon-washing" to categorize instances of carbon-related greenwashing. Secondly, the study utilizes a pairwise time-varying parameter vector autoregressive (TVP-VAR) connectedness methodology, similar to approaches employed by Siddique et al. (2023), Tiwari et al. (2022), and Wei et al. (2023). This analytical approach allows for the dynamic assessment of linkages between different bond categories and the carbon market. The third dimension of the study involves the development of a carbon-related greenwashing index using an Elman recurrent neural network (ENN). This neural network architecture is well-suited for handling sequential data and addresses challenges associated with vanishing or exploding gradients. It also mitigates the potential loss of early signals as new inputs overwrite contextual information. By evaluating the predictive accuracy of the ENN, insights can be gained into the quality of the underlying nonlinear information that drives the interdependencies within environmentally linked markets. The fourth contribution focuses on investigating the robustness of the ENN's training process. This is accomplished by applying five distinct strategies for adjusting weight and bias values, including methods such as conjugate gradient backpropagation with Polak–Ribiére updates, resilient backpropagation algorithm, conjugate gradient backpropagation with Fletcher-Reeves Updates, one-step secant method, and Levenberg–Marquardt optimization method. Lastly, the fifth dimension of the study explores the interconnections between the carbon market and various financing instruments. This includes conventional sovereign bonds categorized based on developmental levels, encompassing both emerging and developed countries; green bonds with different screening patterns, ranging from standard to rigorous assessments of their eco-friendly attributes; and faith-based fixed-income debt securities, including baseline and top-tier sukuk offerings.

The analysis reveals a significant trend: green bonds, including both subtypes, demonstrate a stronger and more authentic nonlinear relationship with the carbon market compared to developed sovereign inflation-linked bonds, conventional sukuk, and higher-quality sukuk. However, it is important to note that emerging sovereign inflation-linked bonds exhibit the most accurate representation of underlying nonlinear connections with the carbon market. This alignment can be attributed to several factors, such as their reliance on carbon-intensive industries in the manufacturing sector. Additionally, these bonds are associated with a substantial volume of emissions credit issuance through clean development mechanism projects under the UN's Kyoto Protocol. The significant contribution of emerging nations' agricultural and forestry sectors, which are influenced by carbon offset projects and REDD + initiatives, further reinforces the intricate interdependence. By comparing the performance of sovereign bonds in developed markets, it becomes possible to differentiate various categories of green bonds and distinguish them from allegations of greenwashing. This distinction is particularly relevant for pioneering green bonds, which demonstrate superior accomplishments in terms of alignment with the carbon market. The insights derived from these findings have significant implications for policymakers, regulators, and participants in the financial industry. They can serve as a valuable reference for developing more precise and effective strategies to identify and address instances of greenwashing within the realm of environmentally conscious assets.

This paper is structured as follows: Sect. 2 provides a comprehensive review of the relevant literature, Sect. 3 explains the methodology employed, Sect. 4 presents the dataset and preliminary analyses, Sect. 5 discusses the research findings, Sect. 6 explores the implications and implications of the findings, and finally, Sect. 7 presents the conclusions and remarks drawn from the study.

2 Literature review

The scholarly discourse on the green bond market can be categorized into six thematic groups. The first group examines various aspects of the market, including pricing trajectories, economic implications, investor responses, and greenwashing. Baldi and Pandimiglio (2022) investigate the relationship between ESG scoring, greenwashing risk, and the returns of green bonds, finding an inverse correlation between project scale and yield, as well as a positive link between greenwashing risk and yield. Cheong and Choi (2020) provide a comprehensive survey of advancements in green bond research across multiple dimensions. Ren et al., (2022a, 2022b) use wavelet-based quantile techniques to explore the interplay between the carbon market and the green bond market, finding positive effects of carbon prices on green bonds during market extremities. Xu et al. (2022) uncover instances of greenwashing in China's green bond market, noting elevated credit spreads for green bonds compared to conventional bonds. Shi et al. (2023) detect greenwashing practices in green bonds and highlight the influence of market demand on issuers' green innovation pursuits. Zhang et al. (2021) evaluate China's green credit policy and find that firms with strong environmental disclosures may not receive preferential credit allocation due to greenwashing scrutiny, but entities with genuine green innovation tendencies are more likely to secure loans, emphasizing the importance of substantive environmental commitment.

The scholarly dialogue pertaining to the intricate landscape of the green bond market is encompassed within an extensive body of literature, which can be methodically classified into six distinct thematic clusters. These groupings provide nuanced insights into specific dimensions, challenges, and opportunities within this dynamically evolving domain. The subsequent overview presents these clusters, elucidating their contributions and perspectives. The initial set of studies undertakes a thorough exploration of the multifaceted intricacies inherent in the green bond market. These investigations emphasize topics such as pricing trajectories, economic ramifications, investor reactions, and the pertinent issue of greenwashing. Noteworthy within this cluster is the research conducted by Baldi and Pandimiglio (2022), who undertook a meticulous inquiry into the impact of Environmental, Social, and Governance (ESG) scoring on greenwashing risk and its association with the returns of green bonds. Their analysis revealed a compelling inverse relationship between project scale and yield, along with a positive correlation between greenwashing risk and yield. Empirical validation using extensive global data spanning the period from 2012 to 2020 substantiated their conceptual framework, thereby uncovering investors' willingness to accept reduced returns for projects with significant environmental impact. However, heightened concerns regarding greenwashing resulted in a demand for higher yields. Expanding upon these insights, Cheong and Choi (2020) provided a comprehensive survey encompassing contemporary scholarly advancements across various dimensions of green bonds, including market valuation, economic and environmental consequences, corporate evaluation, and the financing of genuinely sustainable endeavors. Extending the discourse, Ren et al., (2022a, 2022b) employed innovative wavelet-based quantile techniques to unravel the intricate interplay between the carbon market and the green bond market. Their findings illuminated the positive effects of carbon prices on green bonds, particularly during periods of market extremity. In continuation of this line of inquiry, Xu et al. (2022) conducted an empirical exploration utilizing a unique dataset, revealing instances of greenwashing in China's green bond market. Their observations indicated that greenwashing practices exert tangible influence, manifested by elevated credit spreads compared to conventional bonds. This underscores the perception among market participants that greenwashing poses a risk to the credibility and financial performance of green bond issuers. Concurrently, Shi et al. (2023) employed a rigorous detection methodology to identify indications of greenwashing within the context of green bonds. Their research highlighted those issuers of green bonds may not substantially enhance their genuine green innovation capabilities. Instead, strategic pursuits of green innovation are often driven by market demand for sustainable investments. This raises critical questions regarding the actual environmental progress catalyzed by green bonds, thereby emphasizing the necessity for vigilant oversight of environmental claims made by issuers. In the evaluation conducted by Zhang et al. (2021) regarding the effectiveness of China's green credit policy, the study emphasized that firms with robust environmental disclosures may not necessarily receive preferential credit allocation due to rigorous scrutiny of greenwashing during the evaluation process. However, the study revealed that entities demonstrating pronounced tendencies toward green innovation are more likely to secure loans, underscoring the pivotal role of substantial environmental commitment in financial decision-making.

Shifting our focus to the second cluster of studies, a comprehensive body of research highlights the potential of green bonds to engender positive environmental outcomes, while emphasizing the crucial role of transparency in accomplishing these goals. Within this thematic grouping, a series of investigations have delved into the implications of green bond issuance on both corporate environmental performance and financial dynamics. Yeow and Ng (2021) conducted an extensive examination of the influence of certified green bonds on corporate environmental and financial performance. Their findings revealed a favorable impact of certified green bonds on environmental performance, while no corresponding effect on financial performance was observed. This underscores the capacity of green bonds as a mechanism to drive ecological improvements, while suggesting that financial outcomes may not align immediately with environmental gains. Expanding on this discourse, Fatica and Panzica (2021) undertook a meticulous exploration of the repercussions of green bond issuance on environmental commitment. Their research indicated that issuers of green bonds experienced a decrease in carbon intensity, particularly in cases where the bonds facilitated the financing of projects with a climate-friendly focus. This observation underscores the instrumental role that green bonds can play in spurring issuers to adopt more environmentally conscious initiatives, thereby contributing to the broader objective of sustainability. By scrutinizing the intricate relationship between market valuation and greenwashing, Du (2015) provided an enlightening perspective. The study unveiled the adverse impact of greenwashing on market reactions, underscoring the significance of genuine environmental commitment in evoking favorable market responses. Additionally, the research indicated that corporations demonstrating superior environmental performance garnered heightened cumulative abnormal returns, reinforcing the notion that authentic environmental responsibility can translate into positive financial outcomes.

Directing to the third cluster of studies, this segment examines various pertinent facets within the domain of the green bond market, with specific emphasis on regulation, disclosure practices, and adherence to established green standards. The research conducted within this grouping provides valuable insights into the complexities that shape the operation and ethical foundations of the green bond landscape. Tuhkanen and Vulturius (2022) shed light on noticeable discrepancies between corporate climate targets and the frameworks prescribed by green bonds. This observation highlights the urgent necessity for regulatory interventions aimed at harmonizing the market with overarching sustainability objectives. The findings underscore the pivotal role of regulatory mechanisms in aligning the green bond market with authentic environmental imperatives. Shifting our attention to the context of China, Lin (2023) embarked on an exploration of the determinants that influence the quality of green bonds. The study elucidated the impact of factors such as political affiliations, Western associations, and regulatory endorsements in shaping compliance with global green standards. This insight illuminates the multifaceted dynamics that contribute to the alignment of green bonds with internationally recognized benchmarks. In a related vein, Zhao (2022) delved into the issue of greenwashing within China's green bond market. The study advocated a series of countermeasures against deceptive practices, including enhanced information disclosure, vigilant government oversight, and the implementation of robust green certification protocols. This research underscores the significance of transparent and accurate disclosure practices, while emphasizing the regulatory role in safeguarding the integrity of the green bond market.

Advancing our understanding, the fourth cluster of studies makes significant contributions to our comprehension of the financial dimensions and market dynamics inherent in the realm of green bonds. This grouping focuses on two primary aspects: the examination of green bond premiums and the intricate interplay between investor preferences and these premiums. Dorfleitner et al. (2022) delved into the asset pricing implications of green bonds, unraveling distinctive patterns regarding green bond premiums. Their findings revealed a noticeable positive premium associated with bonds that align with environmental considerations, particularly those augmented by external evaluations. This observation highlights investors' willingness to assign higher valuations to bonds that adhere to eco-conscious principles. This research enhances our understanding of the financial intricacies within the green bond market. Moving forward, Immel et al. (2022) conducted a comprehensive examination of the relationships between green bond premiums and Environmental, Social, and Governance (ESG) ratings. This exploration shed light on the intricate mechanisms through which investor preferences influence green bond premiums. An important observation from their study related to the significant influence of governance factors on bond spreads, revealing the intricate role played by ESG components in shaping market dynamics. The findings provide valuable insights into the complex interplay between investor choices, ESG considerations, and financial outcomes within the context of green bonds.

Moving to the fifth conglomeration of analyses, this assortment is committed to delving into the intricate landscapes of sustainability initiatives within corporate environments, with a particular emphasis on the realms of obscuring environmental harm and environmental communications. The investigations conducted within this thematic domain provide invaluable insights into the multifaceted challenges and opportunities inherent in corporate sustainability endeavors. Bricker and Justice (2022) undertook an enlightening analysis of ExxonMobil's endorsement of carbon pricing within the context of environmental communication. The study illuminated the potential issues surrounding this communication strategy, raising questions about the authenticity of the company's dedication to sustainability. This inquiry into the communication strategies employed by corporations underscores the importance of transparent and honest communication in fostering credibility and trust within sustainability initiatives. Adopting a more comprehensive view, Yildirim (2023) conducted an exploratory investigation into the multifaceted nature of obscuring environmental harm, offering a nuanced perspective that acknowledges both its negative implications and potential positive roles. The study delved into the intricate dynamics through which obscuring environmental harm can drive companies toward improved environmental performance, albeit through the lens of reputational concerns. By examining the dual dimensions of obscuring environmental harm, this research contributes to a more holistic understanding of the complexities surrounding corporate sustainability efforts.

The final assortment of analyses contributes to an enhanced comprehension of pivotal facets encompassing green finance, voluntary carbon markets, and strategies to effectively address and mitigate the risks of obscuring environmental harm. The investigations conducted within this thematic domain provide invaluable insights into the pivotal role these components play in advancing sustainability aims while ensuring transparency and credibility. Streck (2021) engaged in a comprehensive analysis of voluntary carbon markets, illuminating their instrumental role in facilitating the low-carbon transition. The study emphasized the imperative of robust standards and heightened transparency within these markets to ensure their efficacy in driving sustainable environmental transformations. This research underscores the foundational role of transparency and stringent standards in fostering the integrity and effectiveness of voluntary carbon markets. Pang et al. (2022) embarked on an exploration of the impact of green finance on green technology and carbon efficiency. The study highlighted the transformative potential of green finance in propelling sustainable technological advancements. This underscores the instrumental role those financial mechanisms can play in fostering the development and deployment of green technologies to mitigate environmental impact. Shi et al. (2023) centered their inquiry on the effects of green bonds on green investments and the associated risks of obscuring environmental harm. Their work underscored the necessity of vigilant monitoring and effective regulation to navigate the challenges posed by obscuring environmental harm and ensure the genuine impact of green investments. This highlights the multifaceted considerations essential for establishing a credible and impactful green finance ecosystem. Cao et al. (2022) emphasized the pivotal role of high-quality carbon information disclosure in curbing obscuring environmental harm and elevating corporate value. This insight underscores the significance of transparent disclosure practices in reinforcing the credibility of sustainability initiatives and enhancing overall corporate performance. Lastly, Zhang (2023) delved into regulatory-driven corporate obscuring environmental harm, emphasizing the vital roles played by monitoring and enforcement mechanisms in upholding credible green policies. The study underscored the necessity of effective oversight to ensure that regulatory initiatives translate into meaningful sustainability outcomes.

It should be noted that in recent miscellaneous scholarly investigations, a range of subjects pertaining to environmental concerns and the challenges posed by climate change have been explored. Notably, Lorente et al. (2023) have determined that the climate change index, green financial assets, and clean energy exert significant influence within financial markets and play a crucial role in fostering international harmony by mitigating geopolitical risks. In a comparative analysis conducted at the country level, Naeem et al. (2023) have documented higher interdependencies between clean energy stocks and the stocks of United Arab Emirates, Qatar, and Saudi Arabia, while observing moderate to lower interdependencies between clean energy stocks and the stocks of Bahrain, Kuwait, and Oman. Abban et al. (2023) have posited that the proliferation of renewable energy sources in a given nation leads to a reduction in carbon emissions within that country as well as neighboring nations. Furthermore, their findings lend support to the notion that CO2 emissions originating from a specific region can extend to neighboring countries and even distant trading partners. Turi et al. (2022) have conducted an assessment of the potential of wind energy projects in Pakistan, focusing on the challenges faced and proposing a way forward. Additionally, Shaheen et al. (2022) have investigated the role of cleaner technology in natural resource management from an environmental sustainability perspective in China. In a similar vein, Pan et al. (2023), utilizing panel data from 283 cities in China, have discovered that the internet serves as a form of cleaner technology and effectively facilitates the promotion of low-carbon urban transitions. Lastly, Kvasničková Stanislavská et al. (2023), through trend analysis, have identified ESG (Environmental, Social, and Governance), Social Impact, and Charity as communication growth areas, while noting a decline in Twitter-based communication related to Green initiatives and Philanthropy.

A gap in research emerges across these diverse study groupings, highlighting the imperative for holistic approaches that effectively bridge the divide between theoretical insights and practical implementation. While the studies within each thematic cluster furnish invaluable understandings into specific dimensions of the subject matter, there remains a pronounced need for interdisciplinary investigation that seamlessly integrates these findings into actionable strategies, policies, and regulatory frameworks. This integrative methodology is critical for fostering authentic sustainability, mitigating risks, and bolstering the integrity of the market. The existing body of research, though rich and informative, often remains confined to individual thematic silos. To effect meaningful change and drive impactful transformations, it is crucial to cultivate a comprehensive comprehension that transcends disciplinary boundaries. This entails forging connections between the intricate financial intricacies explored within these studies and the practical application of sustainability initiatives in real-world contexts. Interdisciplinary research endeavors can facilitate the synthesis of findings across various dimensions, enabling the formulation of comprehensive strategies that address multifaceted challenges. This could involve synergizing financial expertise with regulatory insights, technological innovations with ethical considerations, and market dynamics with ecological imperatives. By transcending traditional disciplinary confines, researchers can cultivate a more nuanced understanding of the complex interplay between theory and practice. The ultimate goal of such integrated research is to cultivate actionable insights that inform the development of policies, practices, and strategies with the potential to drive tangible sustainability outcomes. Bridging the divide between theory and practice is pivotal in realizing a cohesive approach that not only advances theoretical comprehension but also translates into effective solutions on the ground. By doing so, researchers can substantively contribute to the transformation of green finance and related markets, ensuring that sustainability aims are not just theoretical ideals but tangible realities that benefit societies and ecosystems.

3 Methodology

At the outset of our investigation, we employed a time-varying parameter vector autoregressive (TVP-VAR) approach to quantify the dynamic variations in the Total Connectedness Index (TCI) between the carbon market and individual bonds. Subsequently, we harnessed an Elman recurrent neural network (ENN) to assess the time-varying TCIs, thereby facilitating a comparative analysis of their intrinsic nonlinear characteristics. This integrative methodology enabled us to delve into the nuanced interplay between these financial instruments, thereby shedding light on their intricate dynamics over time.

3.1 TVP-VAR approach

In alignment with several recent empirical studies conducted by researchers such as Hu et al. (2023), Ha (2023), and Antonakakis et al. (2023), our investigation draws upon the framework of connectivity as described by Antonakakis et al. (2020). We also provide a concise overview of the time-varying parameter vector autoregressive (TVP-VAR) technique. This methodological choice has gained considerable prominence in academic literature due to its notable merits. Specifically, the TVP-VAR-based connectedness method stands out for its ability to avoid arbitrarily selecting a rolling window size. By doing so, this approach protects against potential loss of valuable observations and minimizes sensitivity to outliers. The fundamental TVP-VAR(p) model is expressed as follows:

We employ the method of time-varying coefficients and time-varying variance–covariance matrices to estimate the generalized connectedness process described by Diebold and Yılmaz (2014). This procedure is grounded in the framework of generalized impulse response functions (GIRF) and generalized forecast error variance decompositions (GFEVD), aligning with techniques advanced by Koop et al. (1996) and Pesaran and Shin (1998). The calculation of GIRF involves:

Progressing further in our analytical methodology, we proceed to calculate the generalized forecast error variance decompositions (GFEVD) denoted by \(\tilde{\phi }_{{{\text{ij}},{\text{t}}}} \left( {\text{H}} \right)\). This computation captures the directional connectedness from variable j to variable i, providing a quantification of the impact exerted by variable j on variable i with respect to their corresponding proportions of forecast error variance. The formulation of \(\tilde{\phi }_{{{\text{ij}},{\text{t}}}} \left( {\text{H}} \right)\) is expressed as follows:

The denominator in the expression previously mentioned encapsulates the aggregate impact emerging from the summation of disturbances, whereas the numerator depicts the cumulative effect derived from a perturbation occurring in variable i. This ratio provides perceptiveness into the percentage of sway exerted by a distinctive perturbation in variable i regarding the aggregate effects. To codify the Total Connectedness Index (TCI), we combine the computed GFEVD values for all directional relations across the financial variables under examination. This amalgamation generates an extensive gauge of the total interlinkage inside the monetary framework. The formation of the TCI involves:

The concept of total directional connectedness to other variables, with respect to variable i, characterizes the manner in which a shock initiated in variable i spreads to all other variables j. This metric encompasses the dynamics through which shocks propagate across the entire system. The formulation of total directional connectedness to others is outlined as follows:

The notion of total directional connectedness from other variables, with respect to variable i, evaluates the degree to which variable i is affected by directional associations from other variables j. This metric measures the influence of variables j on variable i within the framework of directional associations. The calculation of total directional connectedness from others is formulated as:

3.2 Elman neural network (ENN)

Contrary to the more simplistic linear techniques underlying conventional temporal series forecasting schemes, artificial neural networks proffer the advantage of accommodating intricate non-constant relationships between responsive variables and predictors, as applied to indoor temperature anticipation management (Jang et al., 2019; Luo, 2020). Given the malleability of artificial neural networks, a sensible rationale exists for the development of an online artificial neural network model that can be seamlessly incorporated and executed through pre-existing automated construction management systems. Capitalizing on the functionalities of artificial neural networks, the pursuit of an online model aligns with the potential to harness established control protocols for real-time operations. In the domain of nonlinear subsystem identification with unknown time lags, both the Time Delay Neural Network (TDNN) (Han et al., 2006; Ren & Rad, 2007) and the ENN (Pham & Liu, 1996) emerge as promising options. These configurations flaunt comparatively simpler designs and can be effectively programmed within prevailing automatic control devices. Their suitability is underscored by their aptitude for nonlinear model recognition and dynamic response examination within time-delay systems (Liu et al., 2021). Particularly, the ENN surfaces as a robust contender for addressing the challenges of nonlinear identification and predictive modeling within dynamic systems. Its potency lies in its ability to accommodate the evolving qualities inherent to time-varying contexts, thereby enhancing forecasting precision. This efficacy stems from the network's intrinsic dynamic behavior and memory attributes (Yongchun, 2010). As a consequence, ENN exhibits a remarkable capacity to adapt to the nuances of time-varying systems, outfitting it to aptly capture nonlinear relationships and deliver precise predictions while retaining all references.

Put forth by Elman (1990), ENN presents itself as a singular manifestation of partial recurrent network that operates in accordance with the principles of a regression-based neural web. Its architecture comprises four unique layers: the input layer, concealed layer, feedback layer, and output layer, as visually illustrated in Fig. 1. Notably, this design intimately resembles that of a forward network, while infusing components of recurrent interconnection. In this configuration, the input layer acts as a conduit for transferring signals, while the output layer undertakes generating linear weighted outputs. Situated between these layers, the concealed layer assumes the pivotal role of serving as an intermediary, effectively facilitating the mapping of intricate relationships. The feedback layer, a critical part of the ENN architecture, retains information from prior iterations. This design feature endows the Elman network with the aptitude to adeptly process dynamic information, thereby bestowing it with a pronounced capacity for capturing and modeling temporal dependencies (Yongchun, 2010). The distinctiveness of the ENN lies in its amalgamation of traits from both conventional feedforward perceptrons and pure recurrent webs. The feedforward loop, encompassing the input layer, concealed layer, and output layer, harbors variable weights that connect adjacent layers. However, the distinguishing attribute of the Elman web emerges in its integration of a backward loop. This loop incorporates a context layer, responsible for retaining information from previous inputs. Notably, the connections between the context layer and the concealed layer remain fixed throughout the network's operation. This configuration dispenses with the need for explicit state inputs or training signals, a quality that sets the Elman web apart from static feedforward networks. By leveraging its internal connections, the Elman web is endowed with dynamic qualities, rendering it particularly adept in the realm of dynamic system identification. Its aptitude to aptly capture and model temporal relationships positions it as a potent tool for examining systems characterized by time-evolving dynamics (Lin & Hong, 2011). In essence, the ENN can be perceived as a specialized variant of the conventional feedforward neural web, augmented with memory neurons and local feedback mechanisms. These augmentations empower the network to retain contextual information and significantly enhance its competence in processing sequential data. This singular architecture renders the ENN as a valuable asset for addressing intricate tasks requiring temporal analysis and dynamic system modeling (Wang et al., 2009).

The diagram illustrating the structural arrangement of the Elman recurrent neural network provided by Hao et al. (2020)

In a conceptual alignment with the empirical investigation led by Hao et al. (2020), the architectural design of the ENN adheres to a formation reminiscent of a feedforward mechanism. However, the distinctive trait distinguishing the ENN lies in its integration of a retrospective layer, which presents a novel approach for temporal data amalgamation. This approach involves combining the interior layer state from the anterior timeframe with the current inputs to the system. Unlike conventional feedforward networks, where insights flow exclusively in a single direction, the ENN's retrospective layer introduces a feedback loop that eases the dynamic incorporation of contextual information. To elucidate, the notation \(x_{{\text{c}}} \left( k \right) = x\left( {k - 1} \right)\) signifies that the feedback state vector, denoted as \(x_{{\text{c}}}\), relates to the interior layer state at the previous timeframe \(\left( {k - 1} \right)\). This configuration allows the ENN to tap into the network's past contextual insights, effectively leveraging prior interior layer information to steer the current processing. Consequently, the interior layer state at the present timeframe is computed as follows:

The formulation of the output layer state within the ENN can be expressed as follows:

The determination of the output layer state in the ENN entails the amalgamation of the feedback state vector \(x_{{\text{c}}}\) from the preceding temporal iteration with the input vector \(u\). These input vectors undergo a metamorphosis through designated weight matrices \(w_{1}\), \(w_{2}\), and \(w_{3}\), and subsequently traverse activation functions \(f\left( {*} \right)\) and \(g\left( {*} \right)\) within the hidden and output layers, respectively. This systematic procedure endows the ENN with the capability to adeptly capture intricate temporal interconnections intrinsic to sequential data.

4 Data

We have conducted an exhaustive examination of three distinct bond categories in order to establish a comprehensive framework for comparing heterogeneous bond types. Initially, we focused on two versions of the most convenient bonds, namely the S&P Global Developed Sovereign Inflation-Linked Bond Index and its emerging market counterpart. The Developed Sovereign Inflation-Linked Bond Index, a comprehensive and market value-weighted index, was designed to monitor the performance of the inflation-linked securities market in developed economies. On the other hand, the emerging market counterpart is specific to emerging economies. Inflation-linked bonds represent a unique asset class that serves as a hedge for investors concerned about potential portfolio devaluation due to inflationary pressures. These bonds provide an optimal solution for investors grappling with uncertain market expectations and an increased desire for investment security (Chopra et al., 2021). Subsequently, we incorporated green bonds into our investigation, specifically the S&P Green Bond Index and the S&P Green Bond Select Index. Both indices are designed to measure the performance of globally issued green-labeled bonds. However, the latter index is subject to more rigorous financial and non-financial eligibility criteria. Lastly, our analysis included the Dow Jones Sukuk Investment Grade Index and the Dow Jones Sukuk Higher Quality Investment Grade Index, which serve as proxies for faith-based bonds that have emerged as financing instruments for Shariah-compliant projects. The temporal starting point for our analysis of Islamic bonds (Dow Jones Sukuk Higher Quality Investment Grade Index and Dow Jones Sukuk Investment Grade Index) was set as December 31, 2012. This allowed for an analytical timeframe spanning from December 31, 2012, until the estimation of results for this scholarly article on August 4, 2023.

In our investigation of the carbon market domain, we focused on the utilization of carbon emissions futures, which are intricately connected to emissions trading systems and carbon markets. These mechanisms are designed to mitigate greenhouse gas emissions by establishing a market-based framework for the allocation and exchange of emission allowances. These allowances represent the permission to emit a specific quantity of greenhouse gases, typically measured in metric tons of carbon dioxide equivalent (CO2e). Bond-related data were sourced from spglobal.com, while data on carbon emissions futures were obtained from investing.com. All data points were subjected to numerical log-transformation. A comprehensive list of variable names and their corresponding abbreviations can be found in Table 1, while Table 2 presents the descriptive statistics. The mean and median values of the variables indicate relatively small magnitudes, mostly ranging between approximately −0.01 and 0.01. This pattern suggests that, on average, the variables are centered around zero. Among the variables, EMB exhibits the widest range, with values ranging from a maximum of 5.8478 to a minimum of −9.5524. In contrast, SUKH has the narrowest range, with a maximum of 0.7162 and a minimum of −1.2607. The broad range observed underscores the high volatility associated with these variables. Additionally, EMB has the highest standard deviation of 0.9074, while SUKH has the lowest at 0.1297. The variables exhibit a diverse spectrum of both positive and negative skewness. Particularly noteworthy is the pronounced negative skewness of SUKI at −1.3806, while DEB demonstrates the least skewness at −0.2758. In terms of kurtosis, SUKI reports the highest value of 16.2945, whereas GBIS exhibits the lowest kurtosis value of 7.7493. These findings are further supported by the Jarque–Bera statistics, confirming the non-normality of the variables as indicated by both skewness and kurtosis. Specifically, SUKI has the highest JB value of 20,126.7. Furthermore, the Phillips–Perron and augmented Dickey–Fuller tests strongly reject the presence of a unit root across all variables, indicating their stationarity. Similar conclusions are drawn from the KPSS test, which fails to detect any evidence of a unit root. Figure 2 presents a boxplot visualization of the variables, where the box represents the interquartile range and the median is indicated by an interior line. The whiskers extend to the minimum and maximum values, with outliers represented as dots. Upon analyzing the medians, it is observed that SUKH, SUKI, and GBIS are all centered around zero, with median values closely aligned to this point. GBI and EMB have slightly negative median values in close proximity to zero. In contrast, DEB and CRN exhibit positive median values, approximately 0.01 and 0.14, respectively. In terms of dispersion, EMB stands out with the widest interquartile range, spanning from approximately −0.4 to 0.6, indicating a significant distribution. Conversely, SUKH and SUKI have the narrowest spreads, characterized by compact interquartile ranges adjacent to zero. The whiskers indicate notable variation in the overall range. Notably, EMB has the highest maximum value, approaching 6, while CRN exhibits a relatively high maximum exceeding 24. Other variables have maximum values below 3. Regarding minimum values, EMB once again has the lowest figure near −9, while the remaining variables tend to range between approximately −1 and −3. Particularly striking are the extreme outlier values of SUKI and EMB, which deviate significantly from the whisker boundaries compared to other variables. The outliers for SUKH, GBIS, and GBI are positioned closer to the whisker ranges, while DEB and CRN do not exhibit any outliers in their respective distributions.

5 Results and their analysis

The application of the time-varying parameter vector autoregressive (TVP-VAR) methodology, incorporating an optimal lag length determined by the Akaike information criterion (AIC), yields outcomes that are visually presented in Fig. 3. The Total Connectedness Index (TCI) demonstrates a dynamic temporal nature, offering insights into the underlying nonlinearity of the evolutionary and dynamic structures of the community, which comprises a diverse group of participants who adaptively engage. Based on this observation, this study aims to comprehensively investigate the essential nonlinearity and its predictive effectiveness within each distinct TCI case. The empirical dataset covers 2746 operational days and is divided into discrete temporal segments. A designated subset, representing 10% of the most recent observations and lasting for 274 days, is allocated for the rigorous evaluation of the performance of the Elman network, while the majority of the dataset is used for robust training purposes. Figure 4 precisely illustrates the significant outcomes, juxtaposing the predicted values with the actual empirical data for each unique manifestation of the TCI.

The predicted and actual values for each Total Connectedness Index (TCI). The plot employs a dual trajectory scheme to illustrate the information, with a blue line featuring a plus sign representing the forecasted connectedness for the latest 274 days, and a green line depicting the actual data points. This scheme visually showcases the distinction between the predicted values and the observed values of connectedness, enabling easy comparison and evaluation of the forecasted performance against the actual data

Upon initial examination of the comparison between the blue projected line and the green reference trajectory in Fig. 4, a notable deduction can be made. Specifically, in the context of the EMB case, there is a remarkable convergence between the two trajectories, indicating a state of heightened precision and minimal disparities in the forecasts. Conversely, in the DEB case, the predictive path generally adheres to the underlying pattern of the reference trajectory, albeit with discernible divergences, suggesting a moderate level of accuracy accompanied by relatively elevated predictive errors compared to the EMB scenario. In contrast, the trajectory resulting from the forecasting process for the GBI scenario significantly deviates from the intended target, revealing considerable disparities and indicating a substantial shortfall in prediction accuracy, along with an increased magnitude of predictive errors. Interestingly, within the GBIS context, the predictive line demonstrates a propensity to capture the inherent fluctuations in the reference pattern, implying a superior level of accuracy and a reduction in the magnitude of predictive errors. Conversely, the predictive track associated with SUKI exhibits a noticeably contrasting trend when compared to the reference trajectory, indicating a significant lack of precision in the predictions, accompanied by pronounced errors. It is worth noting that this inadequacy in predictive accuracy is partially mitigated in certain instances within the SUKH context, where errors tend to diminish.

The regression analysis results presented in the primary column of Fig. 5 highlight the consistent presence of correlation coefficients exceeding 0.9 across various training, validation, test, and comprehensive scenarios. This finding supports the conclusion that the neural network's predictions exhibit a strong agreement with the target values across diverse datasets and different situations. The correlation coefficient, a metric used to measure the strength and direction of the linear relationship between two variables, plays a crucial role in this context. The target values represent the true or desired outputs, while the network's outputs represent its predicted numerical approximations. A correlation coefficient of 0.9 or higher indicates a significant positive linear relationship, indicating that the network's predictions closely align with the target values. The consistent presence of a high correlation coefficient across diverse datasets and scenarios demonstrates the Elman network's ability to adapt and maintain consistent coherence. This suggests that the network has effectively learned the underlying patterns in the training dataset and is capable of accurately predicting values for previously unseen data instances. The attainment of a substantial correlation coefficient across all partitions (including training, validation, test, and comprehensive aggregates) confirms the network's consistent performance, unaffected by constraints of specific datasets or particular scenarios. This comprehensive observation further strengthens the proposition that the Elman network has successfully internalized the inherent structures of the dataset, showcasing its proficiency in providing accurate predictions across various contextual domains. However, it is important to note that while a high correlation coefficient indicates alignment with target values, it does not guarantee the infallibility of the network's predictions or its absolute achievement of desired levels of precision.

In Fig. 5, the Hinton matrix represents the weights and biases of ENN using squares. The squares are perceptually scaled between −1 and 1, and their colors indicate the polarity of values, with positive values represented by green hues and negative values by red hues. Examining the Hinton matrix, an interesting observation emerges regarding the magnitudes of weights in the hidden neurons and their nonlinear connections. In the EMB architecture, there is a prevalence of small, red-colored squares, indicating the presence of relatively modest negative values in the weights and biases. This suggests a configuration characterized by closely associated parameters. In contrast, the DEB architecture exhibits larger squares with both red and green shades, indicating a wider spatial distribution of weight values, encompassing both positive and negative orientations. These values display enhanced dispersion compared to EMB. The GBI architecture is distinguished by small, sparsely distributed squares in shades of red and green, primarily located near the origin. Similarly, the GBIS configuration reveals medium-sized squares densely packed with green, suggesting moderate positive parameter values that exhibit strong correlations. The SUKI model is characterized by variable-sized red squares, ranging from small to large, indicating a broad range of negative weight and bias values. On the other hand, the SUKH architecture is typified by clusters of large green squares, signifying strongly positive parameter magnitudes. In terms of color distribution, EMB, GBI, and SUKI predominantly exhibit red squares, indicating a prevalence of negative parameter values. In contrast, DEB and GBIS show a relatively balanced distribution of red and green squares, representing a combination of positive and negative values. SUKH is characterized by a predominance of green squares, indicating a prevalence of positive parameter values. Regarding square dimensions, EMB and GBI stand out with smaller square sizes, suggesting smaller parameter magnitudes. GBIS features medium-sized squares, indicative of moderate parameter magnitudes. Meanwhile, DEB, SUKI, and SUKH are marked by larger squares, suggesting significant parameter magnitudes. Analyzing the spatial distribution and dispersion of squares, EMB exhibits tightly localized clusters of squares with minimal global dispersion. This dense square configuration implies a high correlation among parameters within localized subsets. DEB, on the other hand, displays more dispersed squares, combining localized clustering with broader global distribution. The moderate density suggests a mixture of correlated and independent parameters. In contrast, GBI shows a scarcity of squares without distinct clusters, indicating a predominant independence among parameters without significant correlations. GBIS strikes a middle ground, with a moderate spread of squares occasionally forming localized clusters but lacking tightly organized arrangements. The moderate density suggests a combination of loosely correlated and independent parameters. SUKI exhibits a wide-ranging dispersion of squares without pronounced clusters, indicating primarily independent parameters with minimal correlations. Conversely, SUKH is characterized by tightly clustered squares localized within the visual domain, signifying a preponderance of highly correlated parameters within localized subsets.

Figure 6 presents an error histogram plot, featuring two axes: the horizontal axis represents errors, which correspond to the disparity between predicted or output values and their respective true or target values. This axis serves to quantify the magnitude of errors. The vertical axis, on the other hand, represents instances, reflecting the frequency or count of instances associated with specific error magnitudes. The horizontal error axis is discretized into 20 equally spaced bins, each encompassing a particular range of error values. The analysis of this histogram provides valuable insights into the relative bias, variance, presence of outliers, and overall error performance of the variables under investigation. Upon examining the error distribution, it becomes apparent that EMB exhibits a robust performance, as evidenced by a tightly clustered unimodal distribution centered around zero error. This distribution signifies minimal bias and variance in its predictions. Similarly, DEB demonstrates a peak around zero error, albeit with a slightly broader spread, indicating commendable performance accompanied by slightly elevated variance compared to EMB. In contrast, GBI and GBIS exhibit broad, flattened distributions that span a wide spectrum from significant negative to substantial positive errors. The presence of considerable variance and the occurrence of outliers at both ends of these distributions highlight the unpredictable nature of their predictive behavior. The SUKI displays a compact yet displaced distribution, indicating systematic bias within its predictions. Lastly, the distribution of SUKH centers around zero error, demonstrating moderate dispersion, although not as minimal as observed in EMB and DEB. This configuration suggests reasonable levels of bias and variance, characterizing an intermediate performance level among the assessed variables.

20-bin error histograms. The horizontal axis illustrates the computation of errors as the discrepancy between targets and outputs, while the vertical axis represents the frequency of occurrences. This visual representation of the distribution of errors provides valuable insights into the performance of the network and the patterns of error. It facilitates the identification of outliers, regions characterized by elevated error rates, and inherent biases in prediction. The systematic utilization of a histogram of errors with 20 bins effectively presents the error distribution of the Elman network, thereby enhancing the analytical and interpretative aspects associated with prediction errors

During the final phase of the study, the mean absolute error (MAE) metric was employed to assess the intricacies of the underlying nonlinear relationships between each bond and the carbon market. The selection of MAE was motivated by its established reputation as a robust indicator for evaluating prediction accuracy. The results obtained from this analysis are presented in Table 3 and Fig. 7, highlighting that EMB demonstrates the most accurate inherent nonlinear connection with the carbon market, while SUKI exhibits the least accurate relationship. Further examination, excluding EMB, reveals that GBIS and GBI perform optimally in capturing non-rectilinear relationships with the carbon market. These models exhibit significant nonlinear associations surpassing the performance of DEB, SUKH, and SUKI. Additional insights are derived from Table 4 and Fig. 8, where different networks employing diverse training functions are evaluated to analyze the sensitivity of outcomes to the trainers. Notably, EMB yields the lowest overall error rates, with all methods producing MAE values below 0.29. DEB and GBI exhibit moderate error rates ranging from 0.39 to 0.43 across most methods. Similarly, GBIS records a moderate MAE around 0.38, except when employing the one-step secant method, which results in higher MAE values. Conversely, both SUKI and SUKH demonstrate the highest error rates across all methods, ranging from 0.58 to 0.73. Regarding optimization techniques, The conjugate gradient backpropagation with Polak–Ribiére updates, the resilient backpropagation algorithm, the conjugate gradient, and Backpropagation with Fletcher-Reeves updates yield closely aligned MAE rates for each variable. However, The one-step secant method consistently yields higher MAE values, particularly pronounced for DEB, GBIS, SUKI, and SUKH. Meanwhile, the Levenberg–Marquardt optimization outcomes generally fall between the conjugate gradient backpropagation with Polak–Ribiére updates, the resilient backpropagation algorithm, the conjugate gradient, and backpropagation with Fletcher-Reeves updates, and the one-step secant method. Remarkably, the results reaffirm the primary approach with minimal variations in MAE values, thereby maintaining the consistent ranking of distinct methods.

6 Discussion

The growing connection between the Emerging Sovereign Inflation-Linked Bond Index and carbon markets appears to demonstrate its potential to effectively capture the inflationary consequences associated with carbon pricing and regulations in developing economies. This index encompasses nascent nations likely to have greater susceptibility to decoupling policies and exhibit stronger linkages to carbon markets (Abbasi et al., 2022; Wang & Jiang, 2020; Jin & Kim, 2019; Appiah et al., 2018). Compared to advanced economies, emerging economies typically have greater reliance on manufacturing, fossil fuels, and carbon-intensive sectors (Cetin & Bakirtas, 2020; Rahat & Nguyen, 2022; Singh et al., 2023; Steinberger et al., 2013). Additionally, significant carbon credit markets exist within emerging economies (Jaspal, 2023; Jürgens et al., 2006; Yüksel Mermod & Dömbekci, 2011). Furthermore, these economies have seen rapid expansion in carbon trading markets and exchanges recently, directly impacting industries (Chen et al., 2022; Howie et al., 2020; Sun et al., 2016). Moreover, the United Nations' Kyoto Protocol's clean development mechanism projects are predominantly situated in emerging economies (Winkelman et al., 2011; Nautiyal, 2012; Lloyd & Subbarao, 2009; Ottonelli et al., 2023). The rising populations and escalating energy needs in emerging economies contribute to their swift expansion. How these economies generate electricity to satisfy growing demand, whether via fossil fuels or renewables, greatly affects the carbon market's size. In contrast, advanced economies already exhibit lower carbon intensity, with carbon trading markets initially developing due to advantages like flexibility, cost savings, and efficacy (Shi et al., 2022). Furthermore, emerging economies have become focal points for renewable energy investment and development. Major markets like China, India, and Brazil are seeing record renewable energy installation to meet surging energy needs (Bhat, 2018; Fang et al., 2022a, 2022b; Polzin et al., 2015). Additionally, many emerging economies have substantial agricultural and forestry sectors directly impacted by carbon offset projects and REDD + programs (Angelsen & Rudel, 2013; Matthews et al., 2014). As these projects grow, they can affect commodity prices and agricultural carbon emissions, thereby influencing emerging sovereign debt. Furthermore, demographic shifts and rapid urbanization in emerging economies strain energy and food resources (Bakirtas & Akpolat, 2018; Hosan et al., 2022), causing price hikes reflected in sovereign inflation-linked bonds.

Regarding the potential interrelation between sukuk financial instruments and carbon emission trading markets, while government-affiliated entities and sovereign sukuk, sukuk issued by the financial industry via Islamic banks and institutions, and sukuk for large-scale construction and real estate developments are the primary targets for sukuk issuance, the energy sector has a 10.89% direct share in sukuk as of April 10, 2022, according to Bloomberg and BondEvalue (2022) [For more information see: https://bondblox.com/news/a-guide-on-sukuk-for-fixed-income-investors]. This indicates that although the energy industry is not the predominant recipient of sukuk financing, it still comprises a sizable portion of the market. Governments were the most substantial issuers of sukuk at 37.50% of the total market, followed by the financial sector at 28.45%. With these prevailing arrangements, conventional sukuk lacks significant inherent nonlinear reliance on the carbon market and emissions trading. This absence of an intrinsic relationship to carbon provides considerable impetus for policymakers and academic scholars to approach designing innovative eco-friendly sukuk as a progression in Islamic financial markets (see Alam et al., 2016; Liu & Lai, 2021; Moghul & Safar-Aly, 2014; Abdullah & Keshminder, 2022; Keshminder et al., 2022; Musari & Hidayat, 2023; Ali et al., 2023).

Our empirical interrogations illuminating the interlinkages between green bond vehicles and carbon emission trading ecosystems elucidate pronounced innate nonlinear dependencies and correlations. Specifically, judiciously selected green bonds exhibit a marked degree of inherent nonlinear relationality with carbon markets, intimating meaningful fundamental characteristics. These deductions cohere with the deductions of Jin et al. (2020), suggesting tighter entanglements between green bonds and carbon markets compared to energy markets. Additionally, mobilizing US S&P price indices, Hammoudeh et al. (2020) discerned salient time-varying causal flows from the US carbon index to the US green bond domain between 2013 and 2015. Tiwari et al. (2022) further this discourse by delineating reciprocal causal connectivities between carbon valuations and the green bond ecology. Notably, they establish that the influence of green bonds on the carbon market supersedes their impact on renewable energy equities. Furthermore, Li et al., (2022a, 2022b) demonstrate that the green bond index exacts positive impacts on carbon valuations in the short and medium durations, while simultaneously exacting negative impacts on the carbon efficiency index. Aligning with these empirical deductions, China has actuated green financial tools encompassing green bonds, carbon emissions trading, and green credits, as illuminated by Zhou et al. (2020). These tools serve as mechanisms for sustainable development, enabling the furtherance of a green economy (Li et al., 2022a, 2022b). Jin et al. (2020) additionally buttress our deductions by elucidating robust correlations between carbon futures returns and green bond index returns. Furthermore, they exhibit that, compared to volatility, commodity, and energy indices, the green bond index constitutes the most efficacious risk hedge for carbon futures. Shen et al. (2021), mobilizing a novel cross-sectional autoregressive distributed lag (CS-ARDL) approach, explored the role of natural resource rents, green investment, financial development, and energy consumption in mitigating carbon emissions. Their deductions confirm a negative association between green investment and CO2 levels. Our empirical investigation illuminates the intricate and meaningful interconnection between green bond assets and carbon emission trading markets. These findings augment the growing body of scholarship in this domain and accentuate the potential for harnessing these financial vehicles to catalyze decarbonization endeavors. Prospective academic inquiry should prioritize configuring optimal architectures that leverage coordinated policy interventions and technical standardization to optimize the synergies between green Islamic finance and carbon markets.

7 Conclusion

Within the realm of sustainable finance, an area that emphasizes ecological considerations in investment decisions, there has been a growing interest in the intersection of various financial tools and the imperative for environmental conservation. Carbon valuation, a critical factor in environmental decision-making processes, has the potential to not only foster eco-friendly economic environments but also alter competitive dynamics across different industries. This academic investigation undertook a meticulous examination of the complex interconnections within the sphere of responsible finance and carbon emissions. A robust methodology was employed, involving extensive data collection, advanced theoretical frameworks, and empirical analysis.

The importance of the issue explored in this academic research cannot be understated. The burgeoning field of sustainable finance, illustrated by the expanding green bond market, seeks to channel investments toward eco-conscious initiatives. Meanwhile, the advent of carbon markets, exemplified by the European Union Emissions Trading System, marks a new phase in market-based strategies to mitigate greenhouse gas emissions. The study acknowledges the mutual goal of these domains—to reduce carbon emissions and foster eco-friendly economic growth—and strives to unravel the intricate interaction between them. This integration of sustainable finance and carbon markets presents a promising route to align financial tools with ecological objectives, necessitating a thorough understanding of the complex relationships that underpin it.

Addressing this urgent matter, the research thoroughly investigated the inherent nonlinear relationships between future carbon emission prices and various bond categories. The analysis covered a range of bonds, including rigorously vetted and green-labeled green bonds, traditional sovereign bonds from developed and emerging economies, and quality-categorized Islamic bonds. The academic inquiry utilized the ENN, a groundbreaking tool capable of uncovering intricate, sequential patterns. Moreover, a dynamic pairwise connectedness analysis rooted in a TVP-VAR theoretical framework was employed. This dual methodological approach enabled the exploration of dynamic associations between each bond type and the carbon market, illuminating the underlying nonlinear relationships that dictate these connections. Significantly, the empirical results of the study bear considerable implications for the domain of sustainable finance and responsible investment. The analysis demonstrated that emerging sovereign inflation-linked bonds possess a unique affinity for the carbon market, while both types of green bonds—especially those subjected to rigorous extra-financial screening—exhibit strong and genuine inherent nonlinear associations with the carbon market. These insights emphasize the potential of green bonds, particularly rigorously vetted versions, to go beyond symbolic alignment and truly incorporate environmental imperatives into their core. A standout finding from this study is the exceptional performance of green bonds, particularly those subjected to stringent extra-financial screening. The observed strong and genuine nonlinear relationships between these green bonds and the carbon market underscore their potential to serve as authentic catalysts for environmentally responsible investments. This insight reinforces the concept that green bonds, when crafted with strict ecological criteria, hold potential as effective mechanisms for directing funds toward projects that make substantial contributions to environmental sustainability. Such bonds can move beyond mere symbolic gestures and make significant progress toward instigating meaningful change in the financial landscape. Furthermore, the research's innovative contribution extends to the detection of greenwashing in eco-friendly assets. By introducing a carbon-related greenwashing index and leveraging the predictive accuracy of the ENN model, the study offers a groundbreaking approach for policymakers, regulators, and market participants to evaluate the authenticity of environmentally responsible financial instruments. This pioneering effort provides a crucial tool in protecting the integrity of the sustainable finance landscape and aligning it with true environmental objectives.