Abstract

In the context of green bonds playing an increasingly vital role in the green financial market, this study selects 61 green bonds issued in China from 2016 to 2021 as samples to examine the factors influencing green bond credit, including financial information and ratings of issuers, green certification, and government subsidies. First and foremost, based on AHP and entropy method, the financial composite index is constructed to evaluate the issuers’ finance. Additionally, the differences in the cost of green bonds issued by state-owned enterprises (SOEs) and semi-enterprises are explored by adding the property rights variable. Empirical results indicate that the issuer’s rating could significantly affect the credit spread. In addition, the green bond credit spreads of SOEs are more competitive than those of semi-enterprises. When the issuer is a SOE, green bond credit spread has a remarkable negative correlation with finance information. Furthermore, green certification and government grants are not the main factors. Finally, the green bond market, crucial to controlling the green financial system, is presented with specific recommendations for its growth in this study.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The expansion of the green economy has turned into a crucial national policy. Green bonds are an essential component of the green financial market since they are a specific category of bonds that raises money only for environmentally friendly projects. The Green Bond Support Project Catalogue issued in April 2021 has made more scientific definition criteria for green projects, which tremendously contributes to the optimization of green bond issuance management. The green bond market has experienced unprecedented development as a result of the continuous strengthening of national green bond legislation. According to the data from China Bond Information Network, by the end of August 2021, China had issued nearly 1,000 green bonds with a cumulative issue size of 1.5 trillion yuan, ranking second globally. However, a well-established market has not been created due to the late start and the peculiarities of green bonds.

For green enterprises, the Securities Law stipulates that public bond issuance cannot exceed 40% of the company's net assets, while the cumulative amount of debt issued by green companies is composed of green bonds and general bonds. The government offers a green channel for the issue of green bonds, but there are severe restrictions that funds must be invested in environmentally friendly initiatives. The government's support is focused on providing government subsidies and tax incentives for green projects, as well as providing certain implicit guarantees for green enterprises.

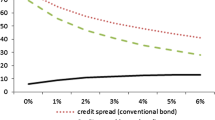

Credit spread is the main difference between the risk-free yield and the coupon rate of green bonds for the same period. In contemporary market economy, the credit spread ought to consider the supply and demand for market funds as well as the bond issuer's credit rating, maturity structure, and other risk premium considerations. (Liu et al., 2017). Can the credit spread of green bonds with special attributes such as green certification and government subsidies still reflect these relationships? Does the issuing of green bonds by issuers with various property rights differ in any way?

To address these issues, this paper examines green bond credit spread from issuer finances, nature of property rights, green certification, and government subsidies, identifying the factors influencing green bond credit spread and the differences between green bonds issued by state-owned and semi-enterprises. The primary innovations of this paper include the following three points: based on the complexity of the relationships among the financial elements of issuers, four components are assembled to create a thorough financial assessment index system for issuers: solvency, management capability, profitability, and development capability. The comprehensive weights of the indicators are determined by using AHP and entropy method. Secondly, this study presents a quantitative analysis of the relationship between green certification, government subsidies, and green bond credit spread. Finally, we examine the differences in green bond credit spread between state-owned and semi-enterprises related to nature of property rights.

The remainder of this study is assigned as follows: Literature review and research hypothesis section shows the relevant literature review concerning a comprehensive evaluation of corporate finance and factors influencing green bond credit spread and proposes the main hypothesis. In Issuer’s financial composite index measurement model section, we construct a novel financial composite index based on the AHP and entropy model. In Empirical research section, we analyze green bonds’ credit spread from the perspectives of finance and rantings of issuers, government subsidies, and green certification by establishing an econometric model, and further examine the differences between green bonds issued by state-owned and semi-enterprises. The conclusion is drawed in Conclusion and insight section.

Literature review and research hypothesis

Literature review

Financial reporting may improve the performance of investment decisions by lowering information asymmetry between managers and investors along with among investors, that can alter adverse the cost of selection and subsequently the acquiring external capital cost (Roychowdhury et al., 2019). Previous research mainly selects indicators from financial structure, solvency, profitability, and management capacity of enterprises to establish the evaluation system, while the weights of indicators are mainly determined based on subjective assignment methods. Lev and Thiagarajan (1993) concluded that the quality of earnings is positively and significantly related to its sustainability, and the proportion of profit from the major activities mainly determines the quality of earnings and profitability of a company. According to the study of Liu et al. (2013) corporate finance research, AHP lacks objectivity and is more impacted by the makers when solving complicated situations. And in the study of the relationship between finance and credit spread, a single variable representing the financial capability of the company is the primary method. Beaver (1966) examined credit spread by introducing financial variables to build a univariate early warning model. However, this model cannot explain the relationships between the variables. Lambert et al. (2007) proved that the accuracy of accounting information may have a both direct and indirect impact on the capital cost. The core of the firm-specific information set accessible to regulators and investors consists of audited financial statements and related disclosures (Bushman & Smith, 2003). Wu et al. (2010) found that profitability, liquidity, and financial leverage are the most important factors in the corporate bankruptcy model.

Credit rating includes the issuer and the debt rating. Horrigan (1966) suggested that analysts give ratings based on data from financial information, and two-thirds of financial information is included in credit ratings. Jin and Han (2016) insisted that green bonds have several characteristics such as high credit ratings and low default risk by studying 272 green bonds issued internationally. In the examination of how credit ratings and credit spreads interact, debt yields, and ratings, the likelihood that a company won't be able to pay its debts is the main factor that determines these factors (Bhojraj & Sengupta, 2003). Farnsworth and Li (2007) developed a class of defaultable term structure models using the Bayesian approach, and the results show that a lower rating corresponds to a larger default.

Investors must be convinced of the legitimacy of the green features of green bond issuers. The term greenwashing describes initiatives or financial instruments that have undergone a modest makeover to give the impression of being environmentally beneficial but are not. Several green bond certification programs have emerged to combat these distortions and give investors a reliable indicator of how closely a certain bond complies with environmental standards (Ehlers & Packer, 2016). As the primary distinction between conventional fixed-income bonds and green bonds is based on the possibility of greenwashing, green bonds are required to have green certification. Greenwash risk is the possibility of using funds gained through green financing for non-green projects that fall short of expectations for environmental benefits (Jones et al, 2020; Shishlov et al., 2016). Investors responded favorably to the issuing announcement, with first-time issuers and bonds with third-party certification receiving a greater reaction (Flammer, 2021). There are still some problems associated with the existing green certification in China. Zhang and Chen (2022) pointed out that the Green Bond Assessment and Certification Practice Guidelines jointly issued by the People's Bank of China fail to make uniform regulatory requirements for issuers of green bond products to provide third-party assessments. However, all the analysis of green certification is still at the stage of qualitative analysis and lacks quantitative analysis.

Due to the quasi-public properties of environmental products, green finance is driven by both market and government forces (Campiglio et al., 2018). Private governance may not be transparent, legitimate, or accountable even while it is flexible and practical. These might be ensured by public governance, offering a cohesive foundation that can improve the efficacy of private authorities (Flammer, 2020). Investor support for policies to expand the market for green bonds is strongest for those that provide low-carbon assets preferred capital treatment and set minimum parameters for what constitutes green (Sangiorgi & Schopohl, 2021). Hong (2022) stated that a systematic top-level design and the application of powerful administrative force to intervene appropriately can break the old pattern of interests, and gradually overcome the fossil energy-dominated structure and industrial pattern of dependence on coal and other fossil energy materials. As the most direct instrument, policy subsidies have a pivotal role in green finance development. Tzelepis and Skuras (2004) proposed that government subsidies make firms have a large inflow of their cash, which improves the solvency of firms and has a positive impact on firm growth. To encourage more investment in green bonds, the government usually offers incentives to bondholders (Baldacci & Possamaï, 2022). In contrast, according to empirical research on government subsidies and the credit spread of green bonds (Yang & Shi, 2020), government subsidies for green projects are strongly and positively associated with a credit spread.

The strong ties that exist between state-owned companies and banks, with a long-time span and deep spatial crossover, reduce financial friction (Brandt & Li, 2003). State-owned enterprises are politically responsible for stabilizing the economy, regulating the market and ensuring employment, and playing a certain non-market function (Shleifer & Vishny, 1994). Bronzini and Piselli (2016) examined the positive impact of government R&D subsidies on SMEs in northern Italy, which is proven to be significantly greater than that of large firms. Howell (2017) suggested that since R&D has the non-competitive and non-exclusive nature of a public good, this positive spillover effect makes private returns much lower than social returns, and R&D subsidies make up for the loss of firms due to technology spillovers, thus improve the R&D efficiency of firms, and promote R&D investment to a certain extent. Li (2022) stated that the incentive effect of government R&D subsidies is more significant for non-SOEs than SOEs based on firm heterogeneity empirically.

In conclusion, it is apparent that there are still a few issues with the credit spread study of green bonds in China: first and foremost, the existing research only uses a single variable to measure the financial situation of the company, ignoring the relationship between the financial variables, and the evaluation methods used are very subjective and random. Secondly, there is a lack of empirical research concerning green certification and the transmission mechanism of policy to the green project. Finally, the nature of green corporate property rights and the price of green bond financing have not been further studied.

To solve the above problems, this paper first constructs a comprehensive financial index system, covering the issuer's solvency, profitability, management capacity, and development ability to reflect the issuer's financial information comprehensively. The method for determining the weights of indicators is also explored. The correlation between green bond credit spread, financial information, government subsidies, and green certification, is experimentally examined. Finally, the moderating effect of the type of green bond property rights is studied.

Main hypothesis

In this paper, the following assumptions are put out considering the analyses above mentioned:

-

H1: The better the financial position of the green bond issuer, the lower the green bond credit spread.

-

H2: Green certification of green bond issuers helps reduce green bond credit spread.

-

H3: Government grants are significantly and positively correlated with a green bond credit spread.

-

H4: In comparison to green bonds issued by semi-firms, state-owned enterprise bonds often have a lower credit spread.

Issuer’s financial composite index measurement model

Issuer’s financial composite index evaluation system

Comprehensive analysis of corporate finance integrated the interrelated corporate activities to give a comprehensive evaluation of the correlation between the general situation and earnings. The financial objective of a company is to maximize capital appreciation. Sustained growth and profitability are the prerequisites for maintaining capital appreciation, while profitability is influenced by operating capacity and financial leverage. When an enterprise's asset structure is dominated by debt or even insolvency, there will be a huge conflict of interest between creditors and shareholders, and the excessive debt burden will induce shareholders to seek self-interest strategies and make enterprises prefer to invest in high-risk and high-return innovative projects (Jensen & Mecking, 1976). Considering a single indicator cannot be integrated to reflect the issuer’s financial information, it is vital to build a financial composite index of the issuer based on multiple indicators. Therefore, in accordance with the principles of scientific, objectivity, feasibility, comparability, representativeness, and orientation, in this study, we construct a novel system index for the issuers’ financial information evaluation, including 4 first-level indicators and 16 s-level indicators, such as current ratio and quick ratio, shown in Table 1.

Source of sample data

61 green bonds (including 41 corporate bonds, 18 medium-term notes, and 2 targeted financing instruments) are selected in consideration of the representativeness of green bonds and the availability of financial data. The data of green bonds are obtained from the Wind database, and the financial data are obtained from the financial statements of the green enterprises in the latest fiscal year before the issuance of green bonds and the CSMAR database.

Data processing

-

1.

Indicator dimensionless. Indicator dimensionless refers to the processing of raw data to obtain the same metric, the same value domain, and the same direction. Let a green enterprise financial index be Ci, \(i=1, 2, \cdots 16\), and its standardized value be \({{C}_{i}}^{\prime}, i=1, 2, \cdots 16\).

When Ci is the positive indicator, \({{C}_{i}}^{\prime}=\frac{{C}_{i}-\mathrm{min}({C}_{i})}{\mathrm{max}\left({C}_{i}\right)-\mathrm{min}({C}_{i})}i=1, 2, \cdots 16\); when \({C}_{i}\) is the negative indicator, \({{C}_{i}}^{\prime}=\frac{{\mathrm{max}(C}_{i}) - ({C}_{i})}{\mathrm{max}\left({C}_{i}\right)-\mathrm{min}({C}_{i})}i=1, 2, \cdots 16\). For the moderate indicators, refer to Wen and Ren (2011), the indicators smaller than the optimal value are sorted in a positive order, and those larger than the optimal value are processed according to the formula \({{C}_{i}}^{\prime}=2\times {C}_{max}-{C}_{i}\), and then the results are sorted in a negative order. After identifying the best-fit model using the distribution curves, the normalized values were calculated.

-

2.

Data translation. To remove the deviation of 0 and 1 after dimensionless, it is necessary to translate the coordinates after dimensionless, the translation formula is \({{C}_{i}}^{\prime\prime}={{C}_{i}}^{\prime}+b\) where \({{C}_{i}}^{\prime\prime}\) is the index value after translation and the translation distance is b, this paper chooses b = 0.000001.

Determination of indicator weights

The determination of indicator weights is essential to the evaluation results. AHP method as a subjective weight method, synthesizes the experts' subjective judgments scientifically considering the experts' profound understanding of the essence of the research topic, the components, and the interrelationships. While the entropy method as an objective assignment method is less influenced by subjective factors, it determines the weight of each index based on the information entropy of the data and makes corrections. To unify both of their advantages, this paper presents a combination of AHP and entropy model to determine the weights of indexes, thus both subjective and objective information can be conveyed to achieve better results. The main procedures include three steps: computing the subjective weights \({\omega }_{i}\) based on the AHP approach, deriving the objective weights \({w}_{i}\) using the entropy method, and then computing the combined weights Wi. The specific steps are presented as follows.

-

1.

The hierarchical analysis model is used to calculate the weight of each layer of indicators. According to the comprehensive evaluation system of enterprise finance, the hierarchical structure model of enterprise financial indicators is established, including the target layer, criterion layer, indicator layer, etc. In this paper, the target layer is the comprehensive financial assessment of green enterprises, while the solvency, management capability, profitability, and development capability constitute the criterion layer. And their respective indicators constitute the corresponding indicator layer with 16 indicator layer indicators and then build a complete hierarchical structure model.

Based on the financial composite index measurement model, the expert team is invited to construct the judgment matrix by 9-scalar method (Saaty, 1990). The maximum characteristic root \({\lambda }_{max}\) of the judgment matrix is then calculated based on \(\left|A-\lambda E\right|=0\); the consistency test is performed, and the consistency indicator is \(CI=\frac{{\lambda }_{MAX}-n}{n-1}\), if \(CI<0.1\), passes the consistency test; if it does not, the judgment matrix is adjusted and repeated until it does. Finally, the weights of the indicators \({\omega }_{i}\) in the index layer are determined according to \({A\omega }_{i}={\lambda }_{MAX}{\omega }_{i}\).

-

2.

The entropy weight method is used to determine the weights of indicators. Note \({e}_{i}=\frac{1}{\text{ln}(n)}-\sum\limits_{i=1}^{n}\frac{{C}_{i}}{\textstyle\sum_{i=1}^{n}{C}_{i}}\mathrm{ln}\left(\frac{{C}_{i}}{{\textstyle\sum }_{i=1}^{n}{C}_{i}}\right)\), where ei is the sample size. The smaller the entropy value \({e}_{i}\) is, the larger the coefficient of variation among the indicators, and the more important the indicator is. The weight of the indicator under the entropy weighting method can be obtained by the formula, which is \({w}_{i}=\frac{1-{e}_{i}}{{\sum }_{i=1}^{n}(1-{e}_{i})}\).

-

3.

Calculate the indicators’ comprehensive weights. In this paper, on basis of the objective weights and the subjective weights, the final weight of each indicator is coupled as \({W}_{i}=\alpha {w}_{i}+(1-\alpha ){\omega }_{i}\), where \(0\le \alpha \le 1\). It can be seen from the formula that the composite weights change with the change of the parameter \(\alpha\), when \(\alpha \text{=}0\) and \(\alpha \text{=}1\) respectively correspond to the objective weights and the subjective weights. This paper takes \(\alpha \text{=}0.5\), and then calculates the composite weights of indicators. The results are given in Table 2.

Issuer’s financial composite index calculation

The evaluation indexes of the issuers' finances were integrated through the formula \(Index=\sum\limits_{i=1}^{16}({W}_{i}\times {p}_{i})\), and the composite indexes of 61 green bond issuers were obtained. The results are presented in Table 3.

Empirical research

Variable description

-

1.

The green bond credit spread (CS) is the main difference between the coupon rate of green bonds and the yield of treasury bonds with the same remaining maturity. The selected treasury bond data contains the yield to maturity of treasury bonds with 1, 5, 7, 10, 15, and 20 years. The interpolation approach is used to figure out the missing yield to maturity for a year's worth of government bonds.

-

2.

Index is defined in Issuer’s financial composite index measurement model section, used to measure the financial status of enterprises in all aspects. Different from measuring the profitability and solvency of enterprises through a single variable Yang and Shi (2020), the index includes 16 indicators covering the solvency, operation, profitability, and development of enterprises to portray the financial status of green enterprises, and their weights are calculated by the AHP-entropy method. If the financial status of green enterprises is better and the financial evaluation index is higher, then the probability of default is relatively small, reflecting the issuer's ability to repay the capital and interest of green bonds.

-

3.

Green bond issuer rating (Grade) is an assessment of green enterprises and green bonds made by professional rating agencies, which can better describe the comprehensive characteristics of the issuer. Compared with the financial indexes of enterprises, the credit rating of development entities provided by third parties is more objective, which is an important basis for investors to judge the ability of enterprises to repay debt and interest and to assess the risk of bonds. In this paper, credit ratings are assigned as follows: AAA = 7, AA + = 6, AA = 5, AA- = 4, A + = 3, A = 2, A- = 1, and unrated = 0. The higher rating of the credit, the lower the default risk and the lower the issuance rate.

-

4.

Government subsidies (Govern). Currently, the development of China's green bond market is characterized by an obvious top-down drive, which is greatly influenced by the policy replication of the relevant governments (Wang & Cao, 2016). On the one hand, government subsidies affect the current cash flow of green issuers, and on the other hand, they provide a certain implicit guarantee for green bonds issuance. In this paper, the logarithm of government subsidies for green projects concerning green bonds is selected as the proxy variable for government subsidies, and it is expected that government subsidies and green bond credit spread are negatively correlated.

-

5.

Green certification (Green). As one of the distinctive characteristics that set green bonds apart from other fixed-income bonds, green certification is additional information to the issuer's financial and credit ratings. This additional information can help to reduce the information asymmetry between investors and green bond issuers and lower the issuer's cost of financing. In this paper, the dummy variable of whether third-party green certification is used, and if the green project is green-certified, Green = 1; otherwise, Green = 0. It is anticipated that third-party green certification and the heartache spread of green bonds would be negatively correlated.

-

6.

The nature of the issuer's property rights (SOE) is a dummy variable. When the green bond issuer is a state-owned enterprise, SOE equals to 1; otherwise, SOE is expressed to 0.

The control variables in the model are mainly green bond characteristic variables (Characteristic), as follows: (1) Green bond debt rating (Credit), this paper assigns the following values to the debt rating: AAA = 7, AA + = 6, AA = 5, AA- = 4, A + = 3, A = 2, A- = 1, unrated = 0. (2) Green bond issue size (Scale), defined as the natural logarithm of the amount of green bond issue. The larger the issue size of a bond, the more liquid it is, and the more active the secondary market trading will be, so the bond issue rate will be relatively low. Thus, the expected green bond issue size is negatively related to the issue interest rate; (3) Green bond issue maturity (Maturity). This variable refers to the duration of green bonds in one year (Yu, 2005). According to Yu (2005), the longer a bond lasts, the less frequently it is traded, which means the less liquid, and therefore the wider the bond spread; however, from the perspective of information asymmetry, the longer a bond lasts, the more information it discloses, which reduces the issuance rate by lowering the information asymmetry between green bond issuers and investors. In this paper, we do not expect the relationship between bond life and credit spread.

Other control variables (Control), include time dummy variables and industry dummy variables. The sample of green bonds selected in this paper is issued between 2016 and 2021, so five-time dummy variables are set from 2017-to 2021. The sample covers seven industries in Wind primary industry classification indicating six industry dummy variables are set (Table 4).

Empirical model

Based on the construction of the issuer's financial composite index, to test hypotheses 1–3, motivated by Yu's ideas (Yu, 2005), the basic model (1) is constructed as follows.

where CS, Index, SOE, Govern, Green, Characteristic respectively refer to credit spread, green bond issuer financial composite index, issuer property rights nature, green subsidy, and green certification. Control includes bond characteristics variables, and annual and industry variables.

To test hypothesis 4, model (2) is constructed in this paper as follows:

In model (2), \(Index^{\prime}\), \(Soe^{\prime}\), and \(Grade^{\prime}\) are the centralized indicators of issuer financial composite index, issuer property rights nature, and credit rating, respectively. The cross-product terms \(Index^{\prime} \times SOE^{\prime}\) and \(Grade^{\prime} \times SOE^{\prime}\) are added to the model with the centralized indicators to test the moderating effect of issuer property rights nature on the relationship between financial index, credit rating and financing costs.

Research sample and data sources

Since China started issuing green bonds in 2016, the number of available sample bonds is limited. Therefore, due to the availability and completeness of the data, this paper takes the listed green enterprises in Shanghai and Shenzhen as the research subjects, including two categories of state-owned enterprises and semi-enterprises. 61 green bonds (including 41 corporate bonds, 18 medium-term notes, and 2 directed financing instruments) issued in the interbank and Shanghai-Shenzhen exchanges from 2016 to 2020 are screened as described in Issuer’s financial composite index measurement model section. The green bond issuance rates, third-party certifications, government subsidies, and issuance terms used in this paper are taken from the Wind database, the issuers' financial data are collected from the CSMAR database, and the Treasury bond yields with the same remaining maturity are from the China Bond Information Network (http://www.chinabond.com.cn).

Descriptive statistics of data

Tables 5 and 6 provide the descriptive statistics report for the variables related to SOEs and semi-corporations, respectively. The statistical results in Table 5 reveal that: (1) the mean value of CS is 1.2895%, and the range of variation is between 0.3368% and 4.1800%, indicating a positive credit spread for green bonds issued by SOEs, and there is a default risk for SOEs; (2) the mean value of Index is 0.1826, and the financial composite index of issuers fluctuates between 0.0896 and 0.3122. This indicates that some SOEs are in poor financial condition when issuing green bonds; (3) the sample of green bonds issued by SOEs has a mean value of certification of 0.51 meaning that more than half of these bonds are green certified; (4) the mean value of Govern is 7.3967, with a range of variation from 0 to 19.6880, and the actual average government subsidy is 17.9965 million yuan with a range of variation from 0 to 3551.214 million yuan, indicating a large difference in the presence or absence of government subsidies; (5) the mean value of Grade is 6.5900, demonstrating that the average SOE rating is above AA + and the overall rating is relatively high.

The statistical results in Table 6 reveal that: (1) the mean value of CS is 2.7978%, with a range of variation from 1.6378% to 4.2502%, showing that the default risk of green bonds issued by the overall semi- enterprises is greater than that of state-owned enterprises; (2) the mean value of Index is 0.1990, with the issuer financial composite index fluctuating from 0.1021 to 0.4774, indicating that it is similar to that of SOEs, which is more stable; (3) the mean value of Certification is 0.70, showing that the sample with green certification accounts for a larger ratio of the total non-state-owned enterprise sample; (4) the mean value of Govern is 9.1088, with a range of variation from 0 to 19.6880, indicating that, similar to state-owned enterprises, there is a large difference in whether or not there is government subsidy for green projects; (5) The mean value of Grade is 5.40, indicating that the average rating of SOEs is above AA, which is slightly lower than SOEs but still relatively high.

Empirical results

The correlation test results and variance inflation factor test (VIF) results for the explanatory and control variables of this paper are given in Tables 7 and 8. As shown in Table 7, the correlation coefficient between SOE and Grade is 0.427, showing a strong correlation, while the correlation coefficients of all other variables are small. In addition, as shown in Table 8, the VIF test results of the main explanatory variables are all less than 1.5, which indicates that there is no multicollinearity.

Based on the correlation type test and VIF test, this paper uses credit spread CS as the explanatory variable, Index, SOE, Certification, Govern and Grade as the main explanatory variables, and Characteristic (includeing Credit, Scale and Maturity), Year and Industry are as control variables. The calculation results are presented in Table 9.

Analysis of the regression model parameters in Table 9 leads to the following.

-

1.

The regression coefficient of the issuer financial composite index (Index) is negative but not significant, not consistent with the traditional fixed-income bond theory and is inconsistent with hypothesis 1 of this paper. However, it is consistent with the results of Gao and Ji (2018). The issuance of green bonds does not depend on the financial status of the issuer to a certain extent, and the issuance of green bonds by the issuing company is a manifestation of protecting the ecological environment and practicing social responsibility (Gao & Ji, 2018). In addition, in terms of the special characteristics of green bonds, green bonds are fixed-income instruments that fund investments with advantages for the environment or the climate (Ehlers & Packer, 2017). The specialty of green bonds is mainly reflected in the restriction that the funds raised shall be invested in green projects, but there are no clear regulations on the issuer's qualification. Therefore, the financial status of the issuer is not a decisive factor in determining the credit spread of green bonds.

-

2.

The effect of green certification on a credit spread is significant but positively correlated, which is not consistent with hypothesis 2. Green certification, as a unique attribute of green bonds, is crucial to ensure the green attributes of green bonds and prevent the risk of greenwashing of green bonds. First, the green certification standard is not yet unified. At present, green certification is mainly based on the GBP principles, CBI standards, and domestic guidelines based on the People's Bank of China's Bulletin, which has not yet formed a unified certification standard. Second, although green certification is a unique attribute of green bonds, it is not a necessary attribute. China's green certification for green bonds is mainly encouraged and not mandatory, which to a certain extent leads to a lack of motivation for the development of certification bodies. The lack of regulation and development motivation is the reason Wang and Cao (2016) suggested that the strength of local certification bodies for green bonds in China is still weak.

-

3.

The coefficient of government subsidies (Govern) is negative but not significant, in contradiction with hypothesis 3 of this paper. It indicates that government subsidies do not reduce the financing costs for green bond issuers, regardless of the nature of their property rights. Government subsidies, as the main way of the direct intervention of administrative power in the green financial market in China at present, improve the debt servicing ability of green enterprises while enhancing the rating qualification of the debt issuer. However, the excessive use of administrative force is not only inefficient but also may distort the market mechanism. Therefore, government subsidies as a means of government intervention in the green bond market have certain limitations.

-

4.

Property Right (SOE) is significantly negatively correlated with a credit spread, which verifies hypothesis 4 of this paper, indicating that the credit spread of green bonds issued by SOEs is significantly lower compared to those of non-SOEs. Meanwhile, the regression coefficients of the cross product of the issuer financial composite indicator and the nature of ownership are significantly negative at the 5% level observed from Model 2, which supports Hypothesis 1. When the issuer is a state-owned enterprise, the financial status is still an important reference for investors, and good financial status is important for reducing the green bond issuers financing cost.

The regression analysis of the control variables also reveals that the issue size of green bonds (Scale) has a negative but insignificant effect, which is not in line with the traditional bond interest rate and may be related to the fact that the green bond market in China is still in the process of development and improvement before the formation of a standardized green financial product design. Maturity of green bonds has a significant negative relationship with issue spread, indicating that the longer the duration of the bond, the more information is disclosed from the perspective of reducing information mismatch between investors and financiers, which reduces the risk aversion of investors and thus reduces credit spread.

Conclusion and insight

This paper examines green bond credit spreads based on property rights from issuer finance, green certification, and government subsidies. The results indicate that: (1) The cost of financing green bonds issued by state-owned enterprises is lower than that of semi-enterprises; (2) Finances and credit spreads have a very unfavorable link with state-owned businesses, which suggests that well-founded finances are conducive to reducing the financing costs of state-owned green enterprises. (3) Green certification and government subsidies are not prominent factors influencing the cost of green bond financing, and there is a lack of unified and comprehensive standards for defining green certification, which lacks horizontal comparability.

Based on the above results, this study obtains the following insights: (1) Green enterprises should improve the operation mechanism of corporate finance. In addition to lowering an organization's financing costs, green bond issuing may also increase an organization's social responsibility, as the green bond issuing process continues. Corporate financial information is one of the key bases for third-party rating agencies and investors on the basic operation of enterprises, and timely disclosure of corporate financial information can lower the information asymmetry between investors and financiers, which allows mitigating the financing cost of enterprises according to reducing the risk aversion of investors. (2) Accelerate the improvement of green certification standards. In the initial development of China's green bond market, the government, as the main guide, adopts diverse measures like tax incentives to promote the green bond market growth, but meanwhile, the government should be aggressive in policing and monitoring the expansion of the green bond market and defining what is green.

Data availability

The questionnaire questions can be provided on request to the lead author - zengshouzhen@nbu.edu.cn.

References

Beaver, W. H. (1966). Financial ratios as predictors of failure. Journal of Accounting Research, 4, 71–111.

Baldacci, B., & Possamaï, D. (2022). Governmental incentives for green bonds investment. Mathematics and Financial Economics, 16, 593–658.

Bhojraj, S., & Sengupta, P. (2003). Effect of corporate governance on bond ratings and yields: The role of institutional investors and outside directors. The Journal of Business, 76(3), 455–475.

Brandt, L., & Li, H. (2003). Bank discrimination in transition economies: Ideology, information, or incentives? Journal of Comparative Economics, 31(3), 387–413.

Bronzini, R., & Piselli, P. (2016). The impact of R&D subsidies on firm innovation. Research Policy, 45(2), 442–457.

Bushman, R. M., & Smith, A. J. (2003). Transparency, financial accounting information, and corporate governance. Economic Policy Review, 9(4), 65–87.

Campiglio, E., Dafermos, Y., Monnin, P., Ryan-Collins, J., Schotten, G., & Tanaka, M. (2018). Climate change challenges for central banks and financial regulators. Nature Climate Change, 8(6), 462–468.

Ehlers, T., & Packer, F. (2016). Green Bonds – certification, shades of green and environmental risks. Retrieved from http://unepinquiry.org/wp-content/uploads/2016/09/12_Green_Bonds_Certification_Shades_of_Green_and_Environmental_Risks.pdf

Ehlers, T., & Packer, F. (2017). Green bond finance and certification. BIS Quarterly Review, 89.

Farnsworth, H., & Li, T. (2007). The dynamics of credit spreads and ratings migrations. Journal of Financial and Quantitative Analysis, 42(3), 595–620.

Flammer, C. (2020). Green bonds: Effectiveness and implications for public policy. Environmental and Energy Policy and the Economy, 1(1), 95–128.

Flammer, C. (2021). Corporate green bonds. Journal of Financial Economics, 142(2), 499–516.

Gao, X. Y., & Ji, W. P. (2018). Issuer characteristics and issuance credit spread of green bonds. Finance and Economics Science, 11, 26–36.

Hong, Y. R. (2022). Discussion on the development pattern of green bonds in the context of carbon peaking and carbon neutrality. Legal Science (journal of Northwestern University of Political Science and Law), 40(2), 123–137.

Horrigan, J. O. (1966). The determination of long-term credit standing with financial ratios. Journal of Accounting Research, 44–62.

Howell, S. T. (2017). Financing innovation: Evidence from R&D grants. American Economic Review, 107(4), 1136–1164.

Jensen, M. C., & Mecking, W. H. (1976). Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics, 3(4), 305–360.

Jin, J. Y., & Han, L. Y. (2016). Development trend and risk characteristics of international green bonds. International Finance Research, 11, 36–44.

Jones, R., Baker, T., Huet, K., Murphy, L., & Lewis, N. (2020). Treating ecological deficit with debt: The practical and political concerns with green bonds. Geoforum, 114, 49–58.

Lambert, R., Leuz, C., & Verrecchia, R. E. (2007). Accounting information, disclosure, and the cost of capital. Journal of Accounting Research, 45(2), 385–420.

Lev, B., & Thiagarajan, S. R. (1993). Fundamental information analysis. Journal of Accounting Research, 31(2), 190–215.

Li, D. D. (2022). Research on the impact of government R&D subsidies on firms’ innovation performance based on the perspective of firm scale and property rights heterogeneity. Journal of Economics, 9(1), 141–161.

Liu, T. B., Wang, T., & Xu, S. T. (2017). Research on the pricing mechanism of local government bonds in China-A perspective of factors influencing issuance interest rates. Research on Finance and Economics, 12, 76–82.

Liu, X. J., Li, P., & Wen, F. F. (2013). Research on financial evaluation of enterprises based on hierarchical analysis and fuzzy comprehensive evaluation method. Finance and Accounting Newsletter, 11, 34–36.

Roychowdhury, S., Shroff, N., & Verdi, R. S. (2019). The effects of financial reporting and disclosure on corporate investment: A review. Journal of Accounting and Economics, 68(2–3), 101246.

Saaty, T. L. (1990). How to make a decision: The analytic hierarchy process. European Journal of Operational Research, 48(1), 9–26.

Sangiorgi, I., & Schopohl, L. (2021). Why do institutional investors buy green bonds: Evidence from a survey of European asset managers. International Review of Financial Analysis, 75, 101738.

Shishlov, I., Morel, R., & Cochran, I. (2016). Beyond transparency: Unlocking the full potential of green bonds. Institute for Climate Economics, 2016, 1–28.

Shleifer, A., & Vishny, R. W. (1994). Politicians and firms. The Quarterly Journal of Economics, 109(4), 995–1025.

Tzelepis, D., & Skuras, D. (2004). The effects of regional capital subsidies on firm performance: An empirical study. Journal of Small Business and Enterprise Development, 11(1), 121–129.

Wang, Y., & Cao, C. (2016). Status and prospects of third-party certification of green bonds in China. Environmental Protection, 44(19), 22–26.

Wen, H. T., & Ren, C. P. (2011). The improvement of a dimensionless method for enterprise performance evaluation index. Economic Issues, 6, 61–65.

Wu, Y., Gaunt, C., & Gray, S. (2010). A comparison of alternative bankruptcy prediction models. Journal of Contemporary Accounting & Economics, 6(1), 34–45.

Yang, X. Y., & Shi, B. F. (2020). Factors influencing the pricing of green bond issuance. Financial Forum, 25(1), 72–80.

Yu, F. (2005). Accounting transparency and the term structure of credit spread. Journal of Financial Economics, 75(1), 53–84.

Zhang, W., & Chen, Z. F. (2022). China’s green bond market protection system: Current situation, problems and policy suggestions. Southern Finance, 5, 70–78.

Acknowledgements

This work is supported by the Social Sciences Planning Projects of Zhejiang (21QNYC11ZD).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zeng, S., Hu, J., Gu, F. et al. Financial information, green certification, government subsidies and green bond credit spreads–evidence from China. Int Entrep Manag J 19, 321–341 (2023). https://doi.org/10.1007/s11365-022-00822-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11365-022-00822-5