Abstract

The Russia-Ukraine significantly influences the oil market. We employ a time-varying parameter vector autoregression (TVP-VAR) in combination with an extended joint connectedness approach to identify the sources of the oil market’s volatility by studying interlinkages between the crude oil and gold and stock market by characterizing the connectedness of four markets starting from January 1, 2018 to April 8, 2022. Our attention is mostly paid to the period marked by the event that Russia invaded Ukraine on 24 February, 2022. Our results demonstrate that the war shocks appear to influence the system-wide dynamic connectedness, which signifies the interlinkages among the considered markets. Net total directional connectedness suggests that the oil and gold markets appear to be the net transmitter of spillover shocks in the system. However, there are shifts in the roles of these two markets during the time of the Russia-Ukraine war shock. Pairwise connectedness highlights the significance of the oil market in transmitting the adverse influences of shocks to other markets, especially during the Russia-Ukraine war.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

There have been critical warnings about the growing situation of crises in recent years. These crises show the diversity of genres (including financial, economic, health, social and political crises), space (either at the global or regional level), and time (over the last one and a half-decade). Evidently, the global economic crisis of 2007–2009 caused a decline in many economies and alterations in the market and economic dynamics (Adekoya and Adebiyi 2019; Adekoya and Oliyide 2021). Federal Reserve (2013) claims that the economic crisis’s intensity and prolongation were adequate to view it as “the Great Recession.” It was reported that financial markets began to have the strongest integration in history soon after the crisis (Adekoya et al. 2021b; Oliyide et al. 2021). In the year 2019/2020, the COVID-19 pandemic struck, while the financial crisis of 2008/2009 was still under discussion more than 10 years after its emergence. It is worth noticing that this flu pandemic is still considered as the most crucial event that depressed the international financial markets (Baker et al. 2020). How it drove and modified the patterns of causality and connectedness among diverse financial and economic goods markets are also emphasized in many studies (Adekoya et al. 2021a, b; Adekoya and Adebiyi 2019; Fasanya et al. 2021; Zhang and Broadstock 2020). More recently, Ukraine was invaded by Russia, beginning on February 24, 2022, which is causing havoc worldwide, and many countries have still been recovering. The petroleum market is considered to be the market that has been strongly affected by this war.

Modern economies consider energy efficiency and pollution emission reduction as integral aspects of sustainable growth (Arslan et al. 2022; Khan et al. 2022a, b). Based on a database of thirty International Energy Agency (IEA) members, Khan and Hou (2021a, b) demonstrate the critical role that environmental sustainability plays in pollution reduction. Furthermore, environmental sustainability is one of the most important factors in the pursuit of sustainable development goals (Zakari et al. 2022a, b, c). Energy security and environmental sustainability play a critical role in alleviating poverty (Taghizadeh-Hesary et al. 2022) and sustainable economic growth (Arslan et al. 2022). In the literature, there is a vast number of empirical studies on determinants of environmental sustainability, such as the role of green innovation (Zakari et al. 2022a, b, c); abundant energy resources (Zakari et al. 2022a, b, c) and alternative and nuclear energy (Khan et al. 2022a, b); economic growth, international trade, clean energy investment (Lyu et al. 2021); industrial value-added, capital formation, urbanization, population growth, biocapacity (Yang and Khan 2021); and the energy consumption, tourism growth (Khan and Hou 2021a), or the partnership between countries (Tawiah et al. 2021). A recent study has highlighted the importance of sustainable consumption and production of oil in promoting environmental performance (Zakari et al. 2022a, b, c). While both determinants and influences of environmental sustainability have attracted much attention from scholars, many aspects of environmental sustainability still require further investigation.

Due to a variety of factors, it is critical to examine the Russian-Ukraine conflict through the lens of the financial market and energy market performance. Firstly, even though the war is usually bilateral, it has produced a great deal of consternation in the international community, prompting some advanced nations, such as the USA and the UK, to impose heavy sanctions on Russia. Secondly, despite its brief duration, the war impacted crude oil production, the most important commodity traded and consumed worldwide.Footnote 1 Consequently, it significantly impacts most European countries that rely on Russia’s oil and gas exports. The worldwide price of crude oil rose as a result of the supply shock, reaching its highest level in 8 years. Furthermore, the impact of the war on the crude oil market looks to be distinct from prior significant crises. While oil prices fell sharply during the global financial crisis and the COVID-19 outbreak, they have risen sharply during the continuing conflict, signaling that the war’s economic and financial effects may differ. In addition, because crude oil is so important economically and has become more financialized over time, it has an extremely strong connection with other financial markets and commodities. This connection, however, depends on the state of the global financial markets at the time, as well as how the price of oil is affected. For example, the Independent newspaper reported that after the day following the initial assault, a few security prices fell, and gold and government bonds became attractive to investors for temporary relief (Independent, 2022). On the other hand, traders of energy, such as oil and gas, tend to gain more profit when their prices rise. Despite the war happening between two countries, the war appears to impact financial markets and investor sentiment globally.

Many experts have recently investigated the relationship between geopolitical risk and energy returns. According to Antonakakis et al. (2017), oil-stock market associations correlate with geopolitical risks. The results proved that geopolitical risks have a negative impact on oil returns. The relationships between oil prices, financial liquidity, and geopolitical risks are investigated by Su et al. (2019). They found that at a high geopolitical risk level, there was an association between oil prices and financial liquidity. Bouoiyour et al. (2019) examined how geopolitical uncertainties affect the oil market. Geopolitical acts remarkedly influenced the oil market, whereas geopolitical threats had no effect. Plakandaras et al. (2019) identified a correlation between oil prices and war-related geopolitical risks and concluded that short-term oil returns could be predicted correctly by war-related geopolitical risks. According to Li et al. (2020), crude oil prices and geopolitical uncertainty are closely linked. The results indicated the two variables’ short-run co-movement at high frequencies and the long-run co-movement at low frequencies.

Some experts have focused on the impact of geopolitical uncertainty on the energy market’s volatility. According to Wang and Yang (2018), geopolitical risks contributed to oil price volatility, especially in the shale revolution. Based on the results, the volatility of oil prices was more sensitive to shale production shocks than to geopolitical risks. Liu et al. (2019) employ the generalized auto-regressive conditional heteroskedasticity-mixed data sampling (GARCH-MIDAS) model to investigate the nexus between geopolitical risks and the oil market’s volatility. The results proved that the oil market became more fluctuated if there were geopolitical uncertainty. Demirer et al. (2019) examined whether geopolitical risks could help to predict volatility in the oil market and highlight its importance. In an analysis of the impact of geopolitical risk uncertainty on the volatility of oil future prices, Mei et al. (2020) utilized the mixed data sampling (MIDAS) model to reveal that geopolitical risk uncertainty was positively correlated with oil realized volatility. According to Asai et al. (2020), it may prove advantageous to forecast crude oil future volatility based on geopolitical risk.

This article’s primary research objective is to assess the war shock’s severe effects on the volatility of the oil, gold, and stock markets in order to provide important information to policymakers in order for them to accurately comprehend the contagion effects of the Russia-Ukraine war shock and design and implement policies to limit the volatility of the oil market as well as the gold and stock markets. As the economy’s lifeblood, oil contributes greatly to economic progress and the economy’s welfare (Le et al. 2022). In difficult times, strategies that mitigate the negative effects of the Russia-Ukraine conflict crisis on the oil market and stable the gold and stock markets assist nations in growing and surviving. By extending the TVP-VAR model, this paper shows a novel approach to explore the interlinkages between different markets. The findings of this approach permit us to indicate the source of the energy market’s volatility, especially when there has been uncertain event like the Ukraine-Russia conflict.

This article makes at least two additions to the body of knowledge. To the best of our knowledge, we are the first to examine the impact of the Russia-Ukraine conflict on the interconnectedness of volatility of crude oil (WTI), gold, and the stock market. The effects of the Russia-Ukraine conflict on the financial market have recently captured academics’ attention in published works. In this article, we are concerned about the impact of the Russia-Ukraine conflict on the volatility of the oil market and its ripple effects on other markets. Early in March 2020, geopolitical tensions between Saudi Arabia and Russia contributed to price shocks (Corbet et al. 2020), which might be reflected by the risk component of oil price shocks (Akram 2020). Our research focuses on the effect of the Ukraine-Russia conflict shocks on the oil industry in the context of the interrelated oil, commodities, and financial markets.

Second, we adopt a time-varying parameter vector autoregression (TVP-VAR) coupled with an extended joint connectedness technique, as suggested by Balcilar et al. (2021). We use this empirical method owing to its many benefits. In particular, this pragmatic approach does not diminish our observation. Since the Russia-Ukraine conflict began on February 24, 2022, just a few weeks have transpired. Therefore, it is achievable in the situation of brief data spanning. In addition, the existence of an outlier does not significantly alter our findings; however, our method gives a superior response to parameter changes. The most crucial aspect of our technique is calculating the net pairwise connectivity, which identifies transmission pathways between these commodities and financial markets. Using daily data to investigate the effects of the Russia-Ukraine conflict on the oil business, the conclusions of this study are anticipated to provide investors and authorities with vital, insightful information and a warning.

This document presents the daily volatility numbers for crude oil (WTI), gold, and the stock market from January 1, 2018 through April 8, 2022. This paper explores the origins of crude oil market volatility by focusing mostly on the time beginning on February 24, 2022, when Russia invaded Ukraine. Our research shows vital insights. Our findings indicate that war shocks seem to have an effect on the system-wide dynamic connectivity, which denotes the interdependencies between the investigated markets. Total net directionality shows that the oil and gold markets are the net transmitters of system-wide spillover shocks. During the period of the Russia-Ukraine conflict shock, however, the roles of these two markets are shifting. Pairwise connectivity emphasizes the relevance of the oil market in transferring the negative effects of shocks to other markets, particularly during the Russia-Ukraine conflict.

The remainder of this paper is organized as follows. While “Literature review” discusses the linked literature on the connections between geopolitical shocks and the energy industry, “Data and methodology” presents the methodology and data collection. The empirical findings are presented in “Results,” followed by a summary and policy implications in “Conclusions and policy implications”.

Literature review

According to Khan and Hou (2021a), economic growth is often exchanged for environmental sustainability. In order to achieve a higher level of economic development, the quality of the environment is impeded (Khan et al. 2021a, b, c, d). As shown in Khan et al. (2021c), there is a strong positive correlation between energy consumption and economic growth, both in the short and long run. An analysis of the impacts of natural resources, energy consumption, and certain economic and social factors on environmental quality is presented by Khan et al. (2021a, b, c, d). New evidence on the association between energy intensity, financial development, and ecological sustainability has been found recently in Asia Pacific Economic Cooperation countries by Khan et al. (2022a, b) and in OECD countries by Khan et al. (2021a, b, d, e). While previous studies have examined both causes and influences of environmental sustainability, they have not fully accounted for the attendants of ecological sustainability. As well, there are channels through which the effects of environmental sustainability or the impacts of other factors on the environment can either be signified or mitigated. Recent studies focused more on the interconnection between different markets to explain the source of volatility in a typical market (Adekoya et al. 2022; Antonakakis et al. 2022; Asai et al. 2020; Chatziantoniou et al. 2022; Ha et al. 2022; Le 2022). Gnangnon (2020), on the other hand, classifies some sources of the volatility of resource revenue from non-resource revenue.

Both COVID-19 and geopolitical uncertainty, such as the recent conflict between Ukraine and Russia, have been extensively studied in the literature, primarily due to the impact on financial markets and the energy sector. In accordance with Dutta (2018), implied volatility indexes on the U.S. energy market are linked to implied volatility indexes on the global oil market. A long-term relationship has been established between oil’s implied volatility indices and the stock market. Furthermore, Xu et al. (2020) investigated whether crude oil could be employed as a hedge against stock market volatility in the USA, Japan, China, and Hong Kong. Crude oil cannot be used for long-term hedging, but it may be employed in times of anxiety, such as a pandemic period, according to the applied wavelet coherence analysis. Using a heterogeneous autoregressive realized volatility model, Bouri et al. (2019) examined the predictive ability of an uncertainty index based on daily newspaper reports. Their model was able to improve forecast accuracy by a great deal by incorporating such data.

COVID-19, a worldwide health crisis, has severely impacted the energy industry and the global economy (Chakraborty and Maity 2020). As indicated by Ha et al. (2022) and Ha and Nham (2022), the energy sector became highly volatile during the COVID-19 health shocks due to the volatility of both energy demand and energy supply. The first quarter of 2020 saw a dramatic decline in energy production from nuclear power plants in Europe and the USA due to declining worldwide demand (Hoang et al. 2021). A 2% decline in natural gas demand was observed during the same period, with China, Europe, and the USA experiencing the greatest declines (Hoang et al. 2021). The production of renewable energy has steadily increased around the world, resulting in a greater share of renewable energy in the world’s energy mix in the European Union, the USA, China, Japan, Southeast Asia, and Africa.

Globally, governments have implemented broad lockdowns in response to the pandemic over the past year. As a result, regional energy consumption may vary depending on the duration and scope of such efforts (Hoang et al. 2021). Conversely, less restrictive laws have reduced energy consumption by only around 10% in South Korea and Japan (Hoang et al. 2021). The country’s weekly energy consumption decreased due to the strict control of lockdowns in several of its hardest-hit districts. In Europe, regional weekly energy consumption decreased by an average of 17% during these periods of social separation. Additionally, the countrywide blackout resulted in a nearly 30% reduction in India’s energy use (Global Energy Review, 2020). Accordingly, the nation’s annual energy consumption is expected to decrease by up to 0.6% for each week of increased quarantine. The International Energy Agency (IEA) predicted a decline of up to 9% by 2020 in global oil production, reverting to 2012 levels. The output of primary coal-fired power plants has declined by up to 10%, and coal production decreased by up to 8%, while energy consumption has reduced by 5%.

Natural gas and coal use are driven mainly by power production, which is impacted by the frequency and duration of blackouts. Due to the varying levels of industrial activity, it has become more challenging to predict future energy use (e.g., coal, home gas, and electricity) (Jiang et al. 2021). Many fossil fuel companies’ mid-term plans and survival depend critically upon the government’s stimulus packages to help them overcome these difficulties in the near future. The US oil shale industry’s current crisis may give important insight into its future possibilities. The oil and gas industry faces the same difficulties as during the 2014–2015 downturn, with rig counts down and bankruptcy filings increasing. Landy et al. (2020) argue that the industry is expected to recover from this challenging period, but economists anticipate that production levels are not likely to reach pre-pandemic levels. Due to this setback, the USA’s aspirations to compete with other foreign energy providers and gain a substantial geopolitical advantage are now jeopardized. Economic development and energy use are two significant determinants of the future global energy market.

As a result of decreased manufacturing costs and an increase in system availability, renewable energy consumption has increased. According to Khan et al. (2020), participation in the international trade network contributes to the expansion of renewable energy installations. This investment in clean energy and resources allows countries to pursue environmental protection, and it simultaneously reinforces a country’s commitment to environmental sustainability and environmental responsibility in the eyes of foreign trading partners (Khan et al. 2021a, b, d, e). Despite the growing demand for renewable energy, financing and supply chain disruptions have negatively impacted project installation. As a result of Germany’s position as a significant source of renewable energy, coal production is gradually being phased out and deemphasized. Due to the decline in overall energy demand, renewable energy and carbon trading pricing schemes have been adversely affected. Additionally, Hoang et al. (2021) indicate that decreases in global energy demand result in substantial revenue losses for conventional and renewable energy producers due to lower energy pricing for systems with a higher proportion of renewable energy. As a result of the epidemic-related lockdown, there has been a significant impact on the deployment of renewable energy sources. A number of renewable energy projects have been halted due to delays in supply chains and the cessation of non-essential industrial operations.

During the pandemic and the recent Ukraine-Russia conflict, most of the funds allocated to support renewable energy projects were diverted to state-supported loans in order to assist struggling businesses. The developers and owners of high-priced properties have been the most vulnerable and exposed after the financial and geopolitical crisis. Projects that are considered part of the recovery plan for the economy may help alleviate the difficulties that renewable energy financing schemes may encounter as a result of global loss-absorption efforts by governments. As a result of hindsight, it may be that the global demand for fossil fuels peaked in 2019 rather than 2020 (Uhlmann et al. 2019). Therefore, the question of how to transition to a more sustainable energy future remains unresolved. The post-pandemic recovery program includes a novel commercial model for renewable energy. In spite of these possibilities, the COVID-19 pandemic and then the Ukraine-Russia conflict continue to significantly impact the clean energy sector because of their historical momentum (Edomah and Ndulue 2020). In the wake of the outbreak, there have been significant delays in the production and supply chains and delays in deploying renewable energy resources. Due to its inability to access financing programs and government incentives, the sector has been experiencing difficulties over the past year (Capelle-Blancard and Desroziers 2020). According to Siddique et al. (2021), a pandemic would likely reverse the previous decade’s gains in renewable energy. Policymakers can benefit the environment and the sustainability movement at the same time by encouraging investment in renewable energy resources and infrastructure as they expand the sector. Despite the fact that the clean energy transition faces several obstacles, individuals can be enthusiastic about a renewable energy renaissance.

Data and methodology

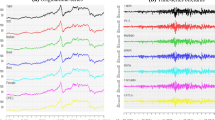

In this paper, we use the crude oil volatility index (VOL_OVX), which measures the estimated volatility of the future contract price of crude oil over the next 30 days. We also collect the daily data for the COMEX gold volatility index (VOL_GVX), which represents the expected 30-day ahead volatility of Comex Gold futures. We also employ the CBOE volatility index (VOL_VIX), which captures the volatility level of the US equity market. The data is sourced from January 1, 2018 to April 8, 2022. Our attention is mostly paid to the period marked by the event that Russia invaded Ukraine on 24 February, 2022. In this study, we use a time-varying parameter vector autoregression (TVP-VAR) in conjunction with an extended joint connectedness technique to quantify the percentage change in these four indices. Based on Elliott et al. (1996)’s unit-root test statistics for non-stationary processes, we produce the first log-differenced series read as a percentage change in the several variables under consideration. Figure 1 depicts the series’ pattern.

Table 1 shows that almost all series have a positive average level for the whole sample except for VOL_VIX. Among all the markets, VOL_VIX has the highest variance, followed closely by VOL_GVX, implying that these two markets are at greater risk. Among all series, including VOL_OVX, VOL_GVX, and VOL_VIX, the oil market (VOL_OVX) was reported to be significantly leptokurtic distributed, implying that the distributions have fatter tails compared to a normal distribution. As contended by Jarque and Bera (1980), the oil market is significantly non-normally distributed. For the gold (VOL_GVX) and stock (VOL_VIX) market, the distribution is platykurtic with a flatter peak, and less distribution is recorded at the tail while fewer values are distributed near the mean. According to the results attained from the ERS unit root test of Elliott et al. (1996), all returns are stationary, at least on the 1% significance level. Fisher and Gallagher (2012)’s weighted portmanteau test shows that the percentage changes in VOL OVX, VOL GVX, and VOL VIX and their squared returns are autocorrelated, supporting our decision to model the interconnectedness of the series using a TVP-VAR approach with a time-varying variance–covariance structure. Our ultimate objective is to explain why the oil, gold, and stock markets are so volatile and how the Russia-Ukraine conflict contributes to this volatility. As a result, we set out to track changes in the degree to which distinct market types were linked before and throughout the conflict.

A similar statistical description of these series in the subsample is outlined during the Russia-Ukraine war. The happening of the Russia-Ukraine war has had great consequences for the oil, gold, and stock market. Firstly, the war has left the markets with great changes in volatility. Specifically, there were significant increases in volatility in the oil market (VOL_OVX) and the stock market (VOL_VIX), while the gold market (VOL_GVX) experienced less risk during the war compared to figures obtained from the whole sample. Along with the occurrence of the war, all series have now witnessed a leptokurtic distribution: VOL_GVX and VOL_VIX turned into a leptokurtic distribution after the war indicating greater risks among the markets. The figures indicate great risk; however, the tension between the two nations is still not alleviated and predicted to increase in the near future. Therefore, the variances, average, and kurtosis of such markets have a high chance of continuing to rise, meaning with the ongoing tension, the situation in these markets will be more volatile, and riskier. Based on the ERS unit root and portmanteau tests on these variables, we are more inclined to use a TVP-VAR approach with a time-varying variance–covariance structure to model the interconnectedness of these series, as these results are more likely to be consistent with those obtained from tests on the entire sample.

Empirical methodology

Time-varying parameter vector autoregression

In this part, we present Antonakakis et al.'s (2020) TVP-VAR connectedness technique, which is combined with the approach of Diebold and Yilmaz (2012). The Bayesian information criterion (BIC) suggests that the TVP-VAR model be estimated with a lag length of order one in our article:

where

and \({\sum }_{t}\) are

and \({\sum }_{t}\) are

dimensional matrices, whereas \({y}_{t}, {y}_{t-1}\) and \({\uppsi }_{\mathrm{t}}\) are

dimensional matrices, whereas \({y}_{t}, {y}_{t-1}\) and \({\uppsi }_{\mathrm{t}}\) are

-dimensional vectors. \({R}_{t}\) is a

-dimensional vectors. \({R}_{t}\) is a

dimensional matrix, whereas

dimensional matrix, whereas

and \({u}_{t}\) are

and \({u}_{t}\) are

-dimensional vectors. This method includes all indices

-dimensional vectors. This method includes all indices

changing throughout time, as well as the connection between series. Moreover, the \({\sum }_{t}\) and \({R}_{t}\) variance–covariance matrices are considered to be time-varying. Almost all prior research has proven that variances and covariances change over time, particularly in the financial market; this shows the altering market and risk ratio.

changing throughout time, as well as the connection between series. Moreover, the \({\sum }_{t}\) and \({R}_{t}\) variance–covariance matrices are considered to be time-varying. Almost all prior research has proven that variances and covariances change over time, particularly in the financial market; this shows the altering market and risk ratio.

According to the Wold representation theorem, we turn TVP-VAR into a TVP-VMA model in the next step: \({y}_{t}= \sum_{h=0}^{\infty }{N}_{h,t}{\psi }_{t-1},\) where \({N}_{0}= {I}_{Z}\) and \({\psi }_{t}\) are a vector of white noise shocks (symmetric but not orthogonal) with

time-varying covariance matrix \(E\left({\psi }_{t}{\psi }_{t}\right)={\sum }_{t}\). As a result, the

time-varying covariance matrix \(E\left({\psi }_{t}{\psi }_{t}\right)={\sum }_{t}\). As a result, the

-step estimate error is expressed as:

-step estimate error is expressed as:

With a forecast error covariance matrix equal to

The suggested approach is based on Koop et al. (1996) and Pesaran and Shin's (1998)

-step forward generalized forecast error variance decomposition (GFEVD). The (scaled) GFEVD,

-step forward generalized forecast error variance decomposition (GFEVD). The (scaled) GFEVD,

, can be read as the impact of a shock in indicator j on indicator i and is written as:

, can be read as the impact of a shock in indicator j on indicator i and is written as:

where \({e}_{i}\) is a

zero selection vector with unity on its ith location and

zero selection vector with unity on its ith location and

is the decrease level of indicator i’s

is the decrease level of indicator i’s

-step prediction error variance owing to controlling the unexpected shocks of indicator j.

-step prediction error variance owing to controlling the unexpected shocks of indicator j.

Diebold and Yilmaz (2012) suggested standardizing the

to unity using the row sum, leading to the generalized spillover panel, \(g{ST}_{ij,t}\).

to unity using the row sum, leading to the generalized spillover panel, \(g{ST}_{ij,t}\).

The generalized spillover table is the foundation for numerous spillover summary estimates of the total directional connectedness from others to indicator i and the total directional connectedness from a shock in indicator i to others. This statistic may be expressed as follows:

The net total directional connectedness of indicator I shows whether indicator i impacts the system more than it is impacted by it, among the core metrics of the connectedness approach:

, indicator i is a net transmitter (receiver) of shocks, meaning that indicator i is driving (driven by) the system.

, indicator i is a net transmitter (receiver) of shocks, meaning that indicator i is driving (driven by) the system.

An important component of the connectedness center is the total connectedness index (TCI), which displays the interconnections within a system, in our case market risk. It is, therefore, an important signal for portfolio and risk administrators. The TCI is meant to be the average total directional connectedness from (to) others, and it is calculated as follows:

where a large value implies large market risk and thus a large degree of system spillovers, whereas a small value implies small market risk and thus that shocks in one indicator mainly affect its own volatility without influencing others, which is informative from the perspective of portfolio diverseness.

Lastly, the connectedness method gives evidence of the pairwise interrelationships of two indicators through the idea of net pairwise directional spillovers, which are described as:

, indicator i has a larger effect on indicator j than vice versa, meaning that indicator i dominates indicator j.

, indicator i has a larger effect on indicator j than vice versa, meaning that indicator i dominates indicator j.

Extended joint connectedness approach

The major purpose is to determine the

equivalence for the mutual connectedness method, called

equivalence for the mutual connectedness method, called

that meets these criteria:

that meets these criteria:

To do this, we must adopt the technique of Lastrapes and Wiesen (2021). As a result, the recommended computation of Eq. 12 must be correct. As the row total of the original and joint connectedness tables must equal 1, the joint connectedness table’s diagonal components must also remain the same. As a result, the scaling factor varies per row, yielding the given formula:

The sole difference between our \(\eta\) soaring and the one that arises from the joint connectedness technique is that our method allows greater flexibility because each row has its own soaring element. Then, the steps below must be arranged:

Furthermore, by varying the soaring parameter by row, the net total and pairwise directional connectedness metrics may be calculated based on

Our approach is expected to provide more precise findings than methods employed in previous studies because they solve the drawbacks of the row sum normalization technique, although the explanations are equal to those of the original connectivity approaches by Caloia et al. (2019). Overall, this strategy resolves a number of concerns with the previously suggested connectedness approach, including (i) no arbitrary rolling size must be chosen; (ii) outlier: outliers do not influence the predicted results and do not influence the predicted results due to the multivariate Kalman filter approach, which contains the Kalman gain; (iii) we enable the VAR coefficients to fluctuate over time; (iv) variances and covariances are also permitted to fluctuate over time to improve the observation of energy market volatility, which is important for portfolio and risk administrators; (v) the solution of Lastrapes and Wiesen (2021) to the row sum normalization problem has been implemented; and (iv) in a special manner, we have enlarged the joint connectedness method that is in line with the directional joint connectedness study but enables greater flexibility and the computation of the net total and pairwise directional connectedness measures. The latter is one of the core features of this strategy, and they are very important because they show the comparative bilateral power of the indicators.

Results

The next section displays the average and dynamic findings for the connectivity measures in our research. The average value of the TCI is derived from the whole dataset. The TCI is shown first, followed by its dynamic progression through time. The latter method is essential for comprehending the TCI’s reaction to different economic factors. We also assess data for net total and pairwise connectivity in our suggested approach. This link allows us to comprehend the economic and environmental consequences of carbon emissions and the renewable and nonrenewable energy markets in more detail. Each indication may function as either a net shock emitter or receiver. The joint spillover index is computed in accordance with Lastrapes and Wiesen (2021). These data may be used to study the causes of shifts in the relationships between different network metrics.

Time-variant of average dynamic connectedness

Using the whole set of data and subsets of observations depending on the beginning of the Russia-Ukraine conflict, Table 2 presents the average findings about the interconnections of different markets within the network of varied markets. In this table, the diagonal element indicates that the volatility of a given market is accounted for by its own shocks, while the off-diagonal components describe the contribution of this market to others’ volatility and others to this market’s volatility (TO). In Table 2, the rows indicate the contribution of each individual market to the prediction error variance of a given market, and the columns show the influence that a single kind of market has on all other markets independently.

In terms of the total set of observations, the network of all markets can account for changes inside the network, given that the TCI average is 20.86%. Additionally, it noted that idiosyncratic effects are credited with accounting for around 79% of the system’s prediction error variation. The average findings in Table 2 also indicated that co-movement occurs between the aforesaid markets, implying that the oil and gold markets are transmitters of shock in the particular system. This is because, on a net average, oil (VOL_OVX) and gold (VOL_GVX) impact more than being affected by other markets. While according to the findings, the sole net recipient is the stock market (VOL_VIX). Additionally, oil (VOL_OVX) is the most significant net transmitter among the two transmitters of shock.

By delving into the subset of observations classified by the occurrence of the Russia-Ukraine war, this paper demonstrates how various markets may play distinct roles throughout subsequent pandemic periods. While the percentage has increased significantly, the network of all markets may still be held accountable for their growth in confrontation with the war (TCI = 41.49%). However, idiosyncratic impact perhaps accounts for around 59% of the cases. These data corroborate the notion that significant co-movements occurred, particularly during an uncertain period like during the Russia-Ukraine war. With the occurrence of the war, the role of each market has changed dramatically. While oil and gold turn into the two net recipients of shock, the stock market marked changes in becoming a transmitter of shock. Oil (VOL_GVX) is the most significant receiver among the three markets.

Time-variant of total connectedness

It is critical to remember that the average findings are mostly used to summarize the underlying interconnections. These findings cannot be used to examine a particular incident or large shock, such as the occurrence of the Russia-Ukraine war. Thus, it is critical to analyze the development of markets and the role changes of markets through time utilizing the dynamic or time-variant of total connectivity. The need to evaluate the switching roles of net transmitter and net receiver is one illustration of the model’s efficiency. Figure 2 depicts the TCI’s intertemporal progression. The TCI fluctuates significantly over the data period. With the exception of 2018, the TCI values for the next 4 years may be described as very consistent. From 2018 to the end of 2019, the figures fluctuate without showing a visible trend. The situation is prolonged until they peaked at about 45% in the first quarter of 2020 — the year the COVID-19 pandemic began and the year of increasing tension between the two countries. The growth of some commodity markets has been noted before in conjunction with various financial crises (2007–2009), as indicated by Balcilar et al. (2021) and Zhang and Broadstock (2020). Following that, the TCI showed a declining trend from the middle of 2020 until 2022, when the figure rose significantly and suddenly marked the occurrence of the Russia-Ukraine war. The higher the value of TCI, the bigger the spillovers across markets are. Though TCI began to decline after peaking in the middle of 2020, the figure suddenly rose to almost 30% in 2022 and remained at a significant level in comparison to previous periods. Based on our findings, we believe that the dynamic development of the TCI in response to increased uncertainty and in the face of war demonstrates a high degree of sensitivity.

Time-variant of total connectedness. We follow Balcilar et al. (2021) to set up the lead (20 leads) and lag length (1 lag) order of forecast error variance decomposition of in our TVP-VAR system. The robustness checks were also conducted by changing these values. We display both the joint interlinkages (the black shaded area) and original interlinkages (the red line)

Time-variant of net total and pairwise directional connectedness

In the following analysis, our study uses the connectedness results as an additional indication for distinguishing various market types as net transmitters or receivers. Additionally, the dynamic method gives insight into prospective alterations in the two positions in different markets. As a result, the function of the system’s net transmitter or receiver of shocks will vary according to the time interval and kind of market.

Our analysis begins with net total connectedness, which enables us to determine if the function of a market has changed over time in comparison to other markets. We next summarize our results on pairwise net connectedness in order to examine the growth or evolution of interlinkage over time and with respect to the two aforementioned roles via the lens of pair markets. Figure 3 depicts these results, with positive values indicating net sending and negative values indicating net receiving. From 2018 to the middle of 2021, the oil market (VOL_OVX) stayed mostly a net transmitter of shock with a few periods acting as a net receiver, while since the onset of the war at the end of 2021, the figure has remained constant as a net transmitter. For the gold market (VOL_GVX), half of 2018 was marked as the net receiver, yet for a long period of 1 and 1/2 years, from the last half of 2018 to the end of 2020, the gold market acted as a net transmitter. From 2020 till the end of 2022, the market remained mostly as a net receiver of shock, while the net transmitter period during this time is marked as not much on a significant side. With the start of 2022 and the onset of the war, the gold market (VOL_GVX) rises to act as net transmitter constantly. For most of the period between 2018 and 2021, the stock market (VOL_VIX) was highly affected by other markets, while with the occurrence of the war in 2022, the market has maintained as a net receiver of shock. These findings are consistent with earlier research indicating that the VIX is likewise a net recipient of shocks. As a result of the data, it can be concluded that VOL_VIX is the long-term net shock receiver, and VOL_OVC and VOL_GVX are the long-term shock transmitters.

Time-variant of net total directional connectedness. We follow Balcilar et al. (2021) to set up the lead (20 leads) and lag length (1 lag) order of forecast error variance decomposition in our TVP-VAR system. The robustness checks were also conducted by changing these values. We display both the joint interlinkages (the black shaded area) and original interlinkages (the red line)

The original method’s normalizing methodology is not based on any theory and hence represents an arbitrary mode of connectedness normalization. As a result, Lastrapes and Wiesen's (2021) theoretically generated metrics are proposed. Following that, our investigation will focus on the net pairwise connectivity findings shown in Figs. 4 and 5. We begin by examining the impact of other markets on the oil market and then continue to identify the impact of the oil market on other markets. The findings indicate that the other markets significantly influence the oil market, and the oil market may be held responsible for the market’s volatility.

Time-variant net pairwise directional connectedness: oil market to other markets. We follow Balcilar et al. (2021) to set up the lead (20 leads) and lag length (1 lag) order of forecast error variance decomposition in our TVP-VAR system. The robustness checks were also conducted by changing these values. We display both the joint interlinkages (the black shaded area) and original interlinkages (the red line)

Time-variant net pairwise directional connectedness: other markets to oil market. We follow Balcilar et al. (2021) to set up the lead (20 leads) and lag length (1 lag) order of forecast error variance decomposition in our TVP-VAR system. The robustness checks were also conducted by changing these values. We display both the joint interlinkages (the black shaded area) and original interlinkages (the red line)

Conclusions and policy implications

Three markets, crude oil, gold, and the stock market, are interrelated in a time-varying form utilizing an extended TVP-VAR technique to evaluate their interconnectivity. The novel econometric technique allows us to get the net pairwise connectivity measurements while also allowing us additional flexibility. For this study, we gathered daily volatility data for three asset classes: benchmark crude oil (WTI), gold, and the stock market. For the most part, this paper’s goal is to figure out what causes the oil market’s erratic behavior, particularly after the Russia-Ukraine conflict shock of February 24, 2022. Our paper is the first attempt to explore the source of the energy market’s volatility during uncertainty, like the serious conflicts between Ukraine and Russia, which are expected to continue to last in the future.

Results from a complete dataset demonstrate that the marketplaces analyzed are interrelated in both regular and war-like situations. Our findings highlight that the Ukraine-Russia conflict appears to have an influence on the interconnectedness between various markets. These markets, especially oil, became more volatile during the war. According to our sub-sample, the TCI value is roughly 41.49%, depending on the date of the battle. A time-varying net total and pairwise directional connectivity study show how each market’s involvement changes over time in our proposed system. However, in times of uncertainty, the oil market constantly conveys volatility shocks to other markets. According to the research, it is now clearer why oil prices have fluctuated lately. During the Russia-Ukraine conflict, the ups and downs of the oil price become increasingly evident and harder to anticipate. In light of these results, we may conclude that the market risk to which our developed network is subject is significant.

On the policy front, our research shows that uncertainty shocks like the war crises have a long-term impact on oil market volatility. Uncertainty shocks absorb the volatility of oil, gold, and the stock market, resulting in more severe implications for these markets. In order for policymakers and authorities to create strategies to counteract uncertainty shocks and alleviate the long-lasting implications of these shocks on the oil market, our results are critical. It would help investors and management see that uncertainty and risk are contagious as an early warning signal to rethink the investing plan. As a result of the lingering and long-term effect of shocks caused by uncertainty, the results of this article may also be relevant for policymakers looking to improve public welfare (Le et al. 2022). When establishing policies for a vulnerable population, it is essential to consider these factors in order to improve the welfare of society.

Data availability

Data available on request due to privacy/ethical restrictions.

Notes

In addition to being the world's third oil producer, Russia is the world's second natural gas producer, as well as one of the top five producers of nickel, steel, and aluminum. As a result of the invasion, world financial markets collapsed and the prices of oil, natural gas, metals, and food commodities surged. For the first time since 2014, brent oil prices have surpassed 100 dollars per barrel. Also, TTF gas prices in Europe have surged at a record level of 192 euros per thousand cubic feet.

References

Adekoya OB, Adebiyi AN (2019) Oil price-inflation pass-through in OECD countries: the role of asymmetries, impact of global financial crisis and forecast evaluation. Int J Energy Sect Manage 14(1):126–147. https://doi.org/10.1108/IJESM-02-2019-0013

Adekoya OB, Akinseye AB, Antonakakis N, Chatziantoniou I, Gabauer D, Oliyide J (2022) Crude oil and Islamic sectoral stocks: asymmetric TVP-VAR connectedness and investment strategies. Resour Policy 78:102877. https://doi.org/10.1016/j.resourpol.2022.102877

Adekoya OB, Oliyide JA (2021) How COVID-19 drives connectedness among commodity and financial markets: evidence from TVP-VAR and causality-in-quantiles techniques. Resour Policy 70:101898. https://doi.org/10.1016/j.resourpol.2020.101898

Adekoya OB, Oliyide JA, Asl MG, Jalalifar S (2021a) Financing the green projects: market efficiency and volatility persistence of green versus conventional bonds, and the comparative effects of health and financial crises. Int Rev Financ Anal 78:101954. https://doi.org/10.1016/j.irfa.2021.101954

Adekoya OB, Oliyide JA, Noman A (2021b) The volatility connectedness of the EU carbon market with commodity and financial markets in time- and frequency-domain: the role of the US economic policy uncertainty. Resour Policy 74:102252. https://doi.org/10.1016/j.resourpol.2021b.102252

Akram QF (2020) Oil price drivers, geopolitical uncertainty and oil exporters’ currencies. Energy Econ 89:104801. https://doi.org/10.1016/j.eneco.2020.104801

Antonakakis N, Chatziantoniou I, Gabauer D (2020) Refined measures of dynamic connectedness based on time-varying parameter vector autoregressions. J Risk Financ Manag 13(4):84. https://doi.org/10.3390/jrfm13040084

Antonakakis N, Cunado J, Filis G, Gabauer D, de Gracia FP (2022) Dynamic connectedness among the implied volatilities of oil prices and financial assets: New evidence of the COVID-19 pandemic. Int Rev Econ Financ. https://doi.org/10.1016/j.iref.2022.08.009

Antonakakis N, Gupta R, Kollias C, Papadamou S (2017) Geopolitical risks and the oil-stock nexus over 1899–2016. Financ Res Lett 23:165–173. https://doi.org/10.1016/j.frl.2017.07.017

Arslan HM, Khan I, Latif MI, Komal B, Chen S (2022) Understanding the dynamics of natural resources rents, environmental sustainability, and sustainable economic growth: New insights from China. Environ Sci Pollut Res 29(39):58746–58761. https://doi.org/10.1007/s11356-022-19952-y

Asai M, Gupta R, McAleer M (2020) Forecasting volatility and co-volatility of crude oil and gold futures: effects of leverage, jumps, spillovers, and geopolitical risks. Int J Forecast 36(3):933–948. https://doi.org/10.1016/j.ijforecast.2019.10.003

Baker SR, Bloom N, Davis SJ, Terry SJ (2020) COVID-induced economic uncertainty (Working Paper No. 26983; Working Paper Series). Natl Bureau Econ Res. https://doi.org/10.3386/w26983

Balcilar M, Gabauer D, Umar Z (2021) Crude oil futures contracts and commodity markets: New evidence from a TVP-VAR extended joint connectedness approach. Resour Policy 73:102219. https://doi.org/10.1016/j.resourpol.2021.102219

Bouoiyour J, Selmi R, Hammoudeh S, Wohar ME (2019) What are the categories of geopolitical risks that could drive oil prices higher? Acts or threats? Energy Econ 84:104523. https://doi.org/10.1016/j.eneco.2019.104523

Bouri E, Gil-Alana LA, Gupta R, Roubaud D (2019) Modelling long memory volatility in the Bitcoin market: evidence of persistence and structural breaks. Int J Financ Econ 24(1):412–426. https://doi.org/10.1002/ijfe.1670

Caloia FG, Cipollini A, Muzzioli S (2019) How do normalization schemes affect net spillovers? A replication of the Diebold and Yilmaz (2012) study. Energy Econ 84:104536. https://doi.org/10.1016/j.eneco.2019.104536

Capelle-Blancard G, Desroziers A (2020) The stock market is not the economy? Insights from the Covid-19 crisis. Covid Econ 28:29–69

Chakraborty I, Maity P (2020) COVID-19 outbreak: migration, effects on society, global environment and prevention. Sci Total Environ 728:138882. https://doi.org/10.1016/j.scitotenv.2020.138882

Chatziantoniou I, Abakah EJA, Gabauer D, Tiwari AK (2022) Quantile time–frequency price connectedness between green bond, green equity, sustainable investments and clean energy markets. J Clean Prod 361:132088. https://doi.org/10.1016/j.jclepro.2022.132088

Corbet S, Larkin C, Lucey B (2020) The contagion effects of the COVID-19 pandemic: evidence from gold and cryptocurrencies. Financ Res Lett 35:101554. https://doi.org/10.1016/j.frl.2020.101554

Demirer R, Gupta R, Ji Q, Tiwari AK (2019) Geopolitical risks and the predictability of regional oil returns and volatility. OPEC Energy Rev 43(3):342–361. https://doi.org/10.1111/opec.12160

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28(1):57–66. https://doi.org/10.1016/j.ijforecast.2011.02.006

Dutta A (2018) Oil and energy sector stock markets: an analysis of implied volatility indexes. J Multinatl Financ Manag 44:61–68. https://doi.org/10.1016/j.mulfin.2017.12.002

Edomah N, Ndulue G (2020) Energy transition in a lockdown: an analysis of the impact of COVID-19 on changes in electricity demand in Lagos Nigeria. Global Transitions 2:127–137. https://doi.org/10.1016/j.glt.2020.07.002

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica 64(4):813–836. https://doi.org/10.2307/2171846

Fasanya IO, Oyewole O, Adekoya OB, Odei-Mensah J (2021) Dynamic spillovers and connectedness between COVID-19 pandemic and global foreign exchange markets. Econ Res-Ekonomska Istraživanja 34(1):2059–2084. https://doi.org/10.1080/1331677X.2020.1860796

Federal Rserve (2013) The Great Recession and Its Aftermath | Federal Reserve History. (n.d.) Retrieved April 23, 2022, from https://www.federalreservehistory.org/essays/great-recession-and-its-aftermath

Gnangnon SK (2020) Impact of the volatility of resource revenue on non-resource revenue volatility. J Econ Dev 23(2):102–115. https://doi.org/10.1108/JED-07-2020-0094

Ha LT, Nham NTH (2022) An application of a TVP-VAR extended joint connected approach to explore connectedness between WTI crude oil, gold, stock and cryptocurrencies during the COVID-19 health crisis. Technol Forecast Soc Chang 183:121909. https://doi.org/10.1016/j.techfore.2022.121909

Ha LT, Thanh TT, Linh VM (2022) An exploration of sources of volatility in the energy market: an application of a TVP-VAR extended joint connected approach. Sustain Energy Technol Assess 53:102448. https://doi.org/10.1016/j.seta.2022.102448

Hoang AT, Nižetić S, Olcer AI, Ong HC, Chen W-H, Chong CT, Thomas S, Bandh SA, Nguyen XP (2021) Impacts of COVID-19 pandemic on the global energy system and the shift progress to renewable energy: opportunities, challenges, and policy implications. Energy Policy 154:112322. https://doi.org/10.1016/j.enpol.2021.112322

Jarque CM, Bera AK (1980) Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Econ Lett 6(3):255–259. https://doi.org/10.1016/0165-1765(80)90024-5

Jiang P, Fan YV, Klemeš JJ (2021) Impacts of COVID-19 on energy demand and consumption: challenges, lessons and emerging opportunities. Appl Energy 285:116441. https://doi.org/10.1016/j.apenergy.2021.116441

Khan I, Hou F (2021a) The dynamic links among energy consumption, tourism growth, and the ecological footprint: the role of environmental quality in 38 IEA countries. Environ Sci Pollut Res 28(5):5049–5062. https://doi.org/10.1007/s11356-020-10861-6

Khan I, Hou F (2021b) The impact of socio-economic and environmental sustainability on CO2 emissions: a novel framework for thirty IEA countries. Soc Indic Res 155(3):1045–1076. https://doi.org/10.1007/s11205-021-02629-3

Khan I, Hou F, Le HP (2021a) The impact of natural resources, energy consumption, and population growth on environmental quality: fresh evidence from the United States of America. Sci Total Environ 754:142222. https://doi.org/10.1016/j.scitotenv.2020.142222

Khan I, Hou F, Le HP, Ali SA (2021b) Do natural resources, urbanization, and value-adding manufacturing affect environmental quality? Evidence from the top ten manufacturing countries. Resour Policy 72:102109. https://doi.org/10.1016/j.resourpol.2021.102109

Khan I, Hou F, Zakari A, Tawiah VK (2021c) The dynamic links among energy transitions, energy consumption, and sustainable economic growth: a novel framework for IEA countries. Energy 222:119935. https://doi.org/10.1016/j.energy.2021.119935

Khan I, Zakari A, Ahmad M, Irfan M, Hou F (2021d) Linking energy transitions, energy consumption, and environmental sustainability in OECD countries. Gondwana Res. https://doi.org/10.1016/j.gr.2021.10.026

Khan SAR, Yu Z, Golpira H, Sharif A, Mardani A (2021e) A state-of-the-art review and meta-analysis on sustainable supply chain management: future research directions. J Clean Prod 278:123357. https://doi.org/10.1016/j.jclepro.2020.123357

Khan I, Hou F, Zakari A, Irfan M, Ahmad M (2022a) Links among energy intensity, non-linear financial development, and environmental sustainability: new evidence from Asia Pacific Economic Cooperation countries. J Clean Prod 330:129747. https://doi.org/10.1016/j.jclepro.2021.129747

Khan I, Tan D, Hassan ST, Bilal (2022b) Role of alternative and nuclear energy in stimulating environmental sustainability: impact of government expenditures. Environ Sci Pollut Res 29(25):37894–37905. https://doi.org/10.1007/s11356-021-18306-4

Khan SAR, Yu Z, Sharif A, Golpîra H (2020) Determinants of economic growth and environmental sustainability in South Asian Association for Regional Cooperation: evidence from panel ARDL. Environ Sci Pollut Res 27(36):45675–45687. https://doi.org/10.1007/s11356-020-10410-1

Koop G, Pesaran MH, Potter SM (1996) Impulse response analysis in nonlinear multivariate models. J Econom 74(1):119–147. https://doi.org/10.1016/0304-4076(95)01753-4

Landy JF, Jia ML, Ding IL, Viganola D, Tierney W, Dreber A, Johannesson M, Pfeiffer T, Ebersole CR, Gronau QF, Ly A, van den Bergh D, Marsman M, Derks K, Wagenmakers E-J, Proctor A, Bartels DM, Bauman CW, Brady WJ, …, Uhlmann EL (2020) Crowdsourcing hypothesis tests: making transparent how design choices shape research results. Psychol Bull 146(5):451–479.https://doi.org/10.1037/bul0000220

Lastrapes WD, Wiesen TFP (2021) The joint spillover index. Econ Model 94:681–691. https://doi.org/10.1016/j.econmod.2020.02.010

Le TH (2022) Connectedness between nonrenewable and renewable energy consumption, economic growth and CO2 emission in Vietnam: new evidence from a wavelet analysis. Renew Energy 195:442–454. https://doi.org/10.1016/j.renene.2022.05.083

Le HT, Hoang DP, Doan TN, Pham CH, To TT (2022) Global economic sanctions, global value chains and institutional quality: empirical evidence from cross-country data. J Int Trade Econ Dev 31(3):427–449. https://doi.org/10.1080/09638199.2021.1983634

Li B, Chang C-P, Chu Y, Sui B (2020) Oil prices and geopolitical risks: What implications are offered via multi-domain investigations? Energy Environ 31(3):492–516. https://doi.org/10.1177/0958305X19876092

Liu J, Ma F, Tang Y, Zhang Y (2019) Geopolitical risk and oil volatility: a new insight. Energy Econ 84:104548. https://doi.org/10.1016/j.eneco.2019.104548

Lyu L, Khan I, Zakari A, Bilal (2021) A study of energy investment and environmental sustainability nexus in China: a bootstrap replications analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16254-7

Mei D, Ma F, Liao Y, Wang L (2020) Geopolitical risk uncertainty and oil future volatility: Evidence from MIDAS models. Energy Economics 86:104624. https://doi.org/10.1016/j.eneco.2019.104624

Oliyide JA, Adekoya OB, Khan MA (2021) Economic policy uncertainty and the volatility connectedness between oil shocks and metal market: an extension. Int Econ 167:136–150. https://doi.org/10.1016/j.inteco.2021.06.007

Pesaran HH, Shin Y (1998) Generalized impulse response analysis in linear multivariate models. Econ Lett 58(1):17–29. https://doi.org/10.1016/S0165-1765(97)00214-0

Plakandaras V, Gupta R, Wong W-K (2019) Point and density forecasts of oil returns: The role of geopolitical risks. Resour Policy 62:580–587. https://doi.org/10.1016/j.resourpol.2018.11.006

Siddique A, Shahzad A, Lawler J, Mahmoud KA, Lee DS, Ali N, Bilal M, Rasool K (2021) Unprecedented environmental and energy impacts and challenges of COVID-19 pandemic. Environ Res 193:110443. https://doi.org/10.1016/j.envres.2020.110443

Su C-W, Khan K, Tao R, Nicoleta-Claudia M (2019) Does geopolitical risk strengthen or depress oil prices and financial liquidity? Evid Saudi Arabia Energy 187:116003. https://doi.org/10.1016/j.energy.2019.116003

Taghizadeh-Hesary F, Zakari A, Yoshino N, Khan I (2022) Leveraging on energy security to alleviate poverty in Asian economies. Singapore Econ Rev 1–28. https://doi.org/10.1142/S0217590822440015

Tawiah VK, Zakari A, Khan I (2021) The environmental footprint of China-Africa engagement: an analysis of the effect of China – Africa partnership on carbon emissions. Sci Total Environ 756:143603. https://doi.org/10.1016/j.scitotenv.2020.143603

Uhlmann EL, Ebersole CR, Chartier CR, Errington TM, Kidwell MC, Lai CK, McCarthy RJ, Riegelman A, Silberzahn R, Nosek BA (2019) Scientific Utopia III: Crowdsourcing Science. Perspect Psychol Sci 14(5):711–733. https://doi.org/10.1177/1745691619850561

Wang W, Yang F (2018) The Shale Revolution, geopolitical risk, and oil price volatility (SSRN Scholarly Paper No. 3241692). Soc Sci Res Network. https://doi.org/10.2139/ssrn.3241692

Xu S, Du Z, Zhang H (2020) Can crude oil serve as a hedging asset for underlying securities?—research on the heterogenous correlation between crude oil and stock index. Energies 13(12):3139. https://doi.org/10.3390/en13123139

Yang X, Khan I (2021) Dynamics among economic growth, urbanization, and environmental sustainability in IEA countries: the role of industry value-added. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16000-z

Zakari A, Khan I, Tan D, Alvarado R, Dagar V (2022a) Energy efficiency and sustainable development goals (SDGs). Energy 239:122365. https://doi.org/10.1016/j.energy.2021.122365

Zakari A, Khan I, Tawiah V, Alvarado R, Li G (2022b) The production and consumption of oil in Africa: the environmental implications. Resour Policy 78:102795. https://doi.org/10.1016/j.resourpol.2022.102795

Zakari A, Li G, Khan I, Jindal A, Tawiah V, Alvarado R (2022c) Are abundant energy resources and Chinese business a solution to environmental prosperity in Africa? Energy Policy 163:112829. https://doi.org/10.1016/j.enpol.2022.112829

Zhang D, Broadstock DC (2020) Global financial crisis and rising connectedness in the international commodity markets. Int Rev Financ Anal 68:101239. https://doi.org/10.1016/j.irfa.2018.08.003

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The author declares no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ha, L.T. Dynamic interlinkages between the crude oil and gold and stock during Russia-Ukraine War: evidence from an extended TVP-VAR analysis. Environ Sci Pollut Res 30, 23110–23123 (2023). https://doi.org/10.1007/s11356-022-23456-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-23456-0