Abstract

Although green Sukuk (GS) as a sustainability enabler has started to emerge globally, a limited amount of research has focused on understanding its perspectives and potential. Accordingly, this research aims to explore the economic, social, and financial perspectives of GS by conceptualizing the effects of the issuance of green Sukuk (IGS) on economic growth (EG), social development (SD), and financial performance (FP). The fundamentals of the resource-based view (RBV) theory and institutional theory are employed to develop the theoretical underpinnings of this research. The panel data for IGS, EG, SD, and FP indicators between 2018 and 2021 were collected from Indonesia and were analyzed using the generalized method of movements regression technique. The results indicate that IGS positively interacts with all three indicators (EG, SD, and FP). Further analysis reveals that IGS has a moderate positive effect on EG, a weak positive effect on SD, and a significant positive effect on FP. Our research findings contribute to developing an integrated business landscape covering major domains of environmental sustainability, socioeconomic development, and financial performance under the GS theme.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The massive impacts of climate change and global warming are threatening the socioeconomic conditions of people around the world (Andrews & Smirnov, 2020). Indonesia, the world’s largest archipelago country with over 17,000 islands is among one of the most susceptible regions to climate change and jeopardizing the sustainability of natural ecosystems and resources (Susanto et al., 2020). A recently published report by the Ministry of Finance of the Republic of Indonesia (MFRI) indicated that climate change in Indonesia has increased the risks of hydro-meteorological disasters resulting in 80% of disasters in the country, key hazards causing 17.4% of floods in Jakarta, more than 3.9 million people in 105 cities in Java, and Nusa Tenggara experiencing drought, 3–5% increment in vector-borne disease, and 9.82% people are confined to live below the poverty line (MFRI, 2021a). These climate changes are alarming as the country’s economy heavily relies on these natural resources. The increased vulnerability to climate change together with the depletion of natural resources is projected to escalate serious socioeconomic issues in the country (Braun, 2010; Tang, 2021). Further, the global Islamic finance industry (IFI) and some of its products such as green Sukuk (GS) have also remained in limelight due to their performance and effectiveness to resolve climate change and socioeconomic issues (UNDP, 2021).

This research proposes GS as an innovative solution to address climate change, socioeconomic, and performance issues of IFI in Indonesia. GS is Islamic green bonds based on shariah principles to raise funds from the Islamic capital market for funding environment-friendly projects (Keshminder et al., 2021). GS is an iconic Islamic financing tool designed following rigorous Islamic ethical and legal frameworks to protect the earth and its residents from the negative effects of climate change (Alam et al., 2016; Ejaz et al., 2022). Indonesia endorsed the Paris Climate Agreement in 2016 which required continuous commitment to reduce the effects of climate change by leveraging strategic financing instruments to reverse the drivers of climate change. Accordingly, Indonesia issued its first global GS in March 2018 to source investment for environment-friendly projects, improve socioeconomic conditions, and resolve the IFI’s stability issues (MFRI, 2019). The massive success of its first GS was followed by the yearly issuance of a series of global and domestic GS representing the country’s dedication and seriousness to combating earlier highlighted issues (MFRI, 2022a).

Although the size of Indonesian GS is the highest (see Fig. 1) compared to its regional counterparts, the reduction in greenhouse gases emission by 29% and the continuity of socioeconomic challenges may undermine the actual impact of GS (The World Bank, 2020). This leads us to argue that there is a need to measure the economic, social, and financial performance of GS to establish whether the targeted environmental projects and investments are adequate and have the capacity to achieve the wider goals of GS. The findings of recent studies concluded that GS has emerged as a powerful tool to address sustainability and socioeconomic issues of developing countries and is likely to improve performance indicators of Islamic financial institutions (Aassouli et al., 2018; IDB, 2020; Liu & Lai, 2021; Rahman et al., 2020; Yan, 2020). Nonetheless, the dearth of empirical studies estimating the actual impact of GS and Indonesia’s road to zero emission by 2030 requires an additional IDR3.461 trillion (MFRI, 2021b), and it is essential to investigate the impact of existing GS to fill the knowledge gap in developing literature on green finance and sketch a policy roadmap by engaging IFI to fully achieve zero emission (Liu & Lai, 2021).

The broad objectives of this study are to measure the impact of GS on social, economic, and financial indicators in Indonesia which is expected to contribute to various theoretical and practical domains. First, this study empirically estimates the actual impact of GS on social, economic, and financial indicators allowing regulators in Indonesia to further develop additional GS series to fulfill financing needs and improve the infrastructure of GS to better mitigate the impacts of climate change in the country. Second, the Ministry of Finance Indonesia as a policymaker may consider the insight of this study for probing recommendations to the regulators looking for innovative and long-term financial resources to finance green projects in the country. Third, the Islamic financial institutions (IFIs) may use the outcome of this study to improve their financial performance which will eventually contribute to improving their brand image and expansion in regional as well as global markets. Fourth, the findings of the current study are projected to offer theoretical and methodological underpinnings to investigate the social, economic, and financial perspectives of GS.

Besides its theoretical and practical contributions, this study is motivated by the existing knowledge gaps in the scant literature offering nascent evidence about the interaction of GS with sustainability, socioeconomic, and performance indicators globally and particularly in Indonesia. A few normative and conceptual studies have highlighted that GS is less risky and have the ability to attract green investors (Ejaz et al., 2022) and are employed to increase earnings per share (EPS) and capital adequacy ratios of Islamic banks (Salhani and Mouseli, 2022). A recent study investigated the challenges in the issuance of GS and found that failure to identify green projects, maturity time, exposure to higher risk profiles, and a lack of clear benefits may affect the continuity of GS (Keshminder et al., 2021). In the Indonesian context, some scholars claimed that despite the increasing interest of investors in GS (Fitrah & Soemitra, 2022), the lack of regional government’s commitment leads to inconsistency in their issuance (Mawardi et al., 2022). The seminal studies on the performance of Indonesian GS revealed that investors tend to subscribe to GS for gaining financial benefits instead of resolving climate change issues; therefore, GS has no impact on sustainability and financial performance (Siswantoro, 2018; Siswantoro & Surya, 2021). The findings of these studies are scattered and do not offer any convincing evidence to predict whether GS improves social, economic, and financial performance in Indonesia.

The rest of the paper covers the literature review in Sect. 2 followed by the methodological approaches in Sect. 3. The main findings of this study are reported in Sect. 4. Finally, Sect. 5 discusses the different perspectives of the empirical results and presents the conclusion, implications to theory and practice, limitations, and future research agenda.

2 Literature review

2.1 Conceptualizing GS

GS is a combination of two words ‘green’ and ‘Sukuk.’ ‘Green’ terminology refers to the philosophies associated with clean processes, services, and recycling to reduce the negative impacts of firms’ products/services on the environment (Shrivastave, 1995). The green methods positively contribute to managing and designing environment-based business strategies allowing firms to conform to regulatory requirements, offer environment-friendly products, and maximize economic and financial performance (Lartey et al., 2020; Long et al., 2023; Loorbach et al., 2010). While ‘Sukuk’ originated from the Arabic word ‘Sakk’ literally means a document or a certificate (IFFM Sukuk Report, 2021). The use of ‘Sukuk’ dates back to the Middle Ages when Muslim traders started performing trade and commercial activities using Sukuk as a financial obligation in international markets (Adam and Thomas, 2004). Later on, Western scholars described it as a ‘cheque’ currently used in the contemporary banking world (Beik, 2011). Thus, Sukuk is an Islamic shariah bond issued to the holders as long-term security guaranteeing certain benefits in the form of profit-sharing, margin, and fees till maturity (AAOIFI, 2015; Sairally & Abdullah, 2017). In short, GS is long-term investments in environment-friendly projects such as renewable clean energy and environmental assets raised by issuing investment certificates conforming to shariah principles (Moghul & Safar-Aly, 2014; Obaidullah, 2017).

GS falls under the category of Islamic financing instruments for impact investments which play a preeminent role to address environmental and societal issues (Laldin & Djafri, 2021). Besides economic and financial benefits, GS allows mobilizing resources to realize SDGs in developing countries (Prakash & Sethi, 2021). The developing literature on green financing indicates that Islamic finance and socially responsible investments (SRI) have experienced significant growth over the last two decades (Jouti, 2019). The growth of investments in Islamic social finance has surpassed the investments in conventional finance due to the evolution of different financing tools such as SRI Sukuk, Islamic Sukuk, GS, and Islamic debt instruments (Tan and Shafie, 2021). The recent traction in GS can be linked to the increasing interest in green projects among global societies requiring innovative financing solutions (Abdullah & Keshminder, 2022). Further, global entities namely The World Bank, United Nations, and International Environmental Agency (EIA) have highlighted the significance of alternative financing instruments for achieving a cleaner and sustainable world ecosystem (Lian et al., 2022). This offers dynamic business opportunities for industries and businesses to improve their economic, social, and financial performance by tapping the surging global demand for green projects (El Amri et al., 2021). Following the significance of GS in sustainability, several scholars embarked on this emerging research domain. Table 1 outlines the summary of a few novel studies in the GS research domain.

GS is investments to produce renewable energy and manage environmental assets for authenticating the social legitimacies of IFIs to protect the environment (MFRI, 2021b). GS is issued and guided by the green bond and GS framework and an independent reviewer (Center for International Climate Research, CICERO) audits its efficiency and awards green shade levels (Mertzanis & Tebourbi, 2023). The outcome of the budget tagging process is used for the repetition of new initiatives to combat climate change using green bonds and GS as the financing instruments. The earnings/profit of GS can be used for financing green initiatives taken by the local governments. The structure of GS (Fig. 2) explains the operation, distribution of proceeds/profit to the stakeholders, and the projects/assets targeted to generate proceeds. The investments generated through the issuance of Sukuk are primarily used for shariah financing of green projects and then, proceeds are distributed to the Sukuk holders after deducting expenses of the Special Purpose Vehicle (SPV) (Ibrahim, 2015). The Sukuk holders have the obligation to purchase the portfolio at maturity from the SPV (Nagano, 2017). However, the prices of portfolios are estimated by adding the aggregate nominal values of the trust certificates and accrued unpaid periodic distribution. The utilization of assets to be used for GS is based on the certified Climate Bond Standards which may include solar parks, biogas plants, windfarms, clean and renewable energy projects, infrastructure development, acquisition of electric vehicles, and light rail.

GS structure adopted from Alam et al., 2016

2.2 Heterogeneous perspectives of GS

To understand the heterogeneous perspectives of GS, we refer back to the fundamentals of the Islamic financial system used as a foreground for developing GS. The Islamic financial system propagates social justice and welfare mainly by prohibiting interest-based practices (Pollard & Samers, 2007; Rethel, 2011). Prior to the emergence of GS, the use of green bonds and SRI was common to resolve environmental and socioeconomic issues. However, environmental scientists and financial practitioners have criticized conventional green bonds for their limited contribution due to their financial facades and political benefits (Fetica and Panzica, 2021; Peeter, 2003; Russo et al., 2021). Islamic scholars argue that the Islamic financial system’s inherited compatibility with the general requirements of green finance may improve environmental performance by channeling investments for environment-friendly projects (Ahmed et al., 2015; Ali et al., 2022; RFI, 2018; UNPRI, 2017). More specifically, GS is based on the ‘Wasatiyyah’ (moderation), and ‘Fasad’ (elevating disorder) concepts which require maintaining the natural state (Mizan) of planet earth by investing in environment-friendly, infrastructure development, and social welfare projects (RFI, 2018). These Islamic underpinnings demand businesses to cater to societal needs in a way that the original state of the environment and economy is preserved (Liu & Lai, 2021). Contextually, during climate change and humanitarian crises, business entities (IFIs) need to ensure that the financial instruments (GS) operationalized to address environmental and societal issues do not alter the original environmental and economic ecosystems (Obaidullah, 2017).

The implications of GS are much wider due to their extensive structural and operational coverage. However, for the sake of this research, we contracted it to the environmental, social, economic, and financial domains to better understand the converging perspectives of GS. First, as an environmental enabler, GS offers distinct opportunities for funding climate-friendly projects particularly to generate renewable energy (Alam et al., 2016). The findings of earlier studies have confirmed that GS may resolve environmental issues by funding environment-friendly projects in the regions such as the Middle East and North Africa (MENA) vulnerable to climate change (Aassouli et al., 2018; Rahman et al., 2020). However, the environmental effects of GS are still debatable as the proponents of GS confirmed that the issuance of GS enhances environmental protection (Larcker & Watts, 2020) and the critics argue that GS does not play any role in greening the environment (Alessi et al., 2021). Second, the recent growth of GS under the SRI banner to tackle socioeconomic issues represents another perspective to foster achieving ambitious social and economic goals and mitigating humanitarian crises in developing countries (Hasan et al., 2022; Jouti, 2019; Ledhem & Mekidiche, 2022). Third, from corporate social responsibility (CSR) and financial stability perspective, GS offers innovative business opportunities to organizations and particularly IFIs to tap the lucrative green sector by enhancing their products and services range which will address their CSR issues and optimize financial portfolios (Azman et al., 2022; Lynch & O’Hagan-Luff, 2023; Marwan & Haneef, 2019).

2.3 Unlocking GS potential in Indonesia

Unarguably, GS has a huge potential to unlock economic, social, and financial opportunities (Aassouli et al., 2018). The global community started recognizing and taking interest in the potential of GS when the Islamic Development Bank (IsDB) issued its first GS in 2019 (IsDB, 2020). This issuance attracted global green investors from both shariah-compliant and conventional finance as IsDB was the first multi-lateral development and euro-dominated bank to issue attractive offerings under GS provisions suitable for the needs of various investors (The World Bank, 2020). Although global issuance of GS is largely affected by the COVID-19 pandemic (RAM, 2020), the market for sustainable, SRI Sukuk, and GS is likely to expand as they offer innovative investment opportunities to recover economic crises and address socioeconomic issues (Fitch, 2020). Following the massive potential of GS, green investors may venture into profitable environment-friendly projects for maximizing return on their investments (Liu & Lai, 2021). Further, the wide coverage of green projects, green assets, and the availability of green investors for GS has enhanced their potential to serve as a strategic organizational tool to support environmental sustainability.

Indonesia envisaged becoming the top five economies of the world through economic expansion and aimed to push its real GDP growth to USD5.16 trillion by 2030 (MFRI, 2022a). Thus, the emergence of GS in Indonesia is consistent with its SDGs, economic and social development, and expansion of the Islamic capital market (Suriani et al., 2021). The economic plan of the country follows a 20-year development plan which is further segmented into 5-year medium-term development plans known as RPJMN (Rencana Pembangunan Jangka Menengah Nasional) specifying established developmental priorities (The World Bank, 2021). The current medium-term development plan focuses on strengthening economic conditions by developing capital and competitiveness in global markets (Ledhem & Mekidiche, 2022). However, the projections of a Fiscal Policy Agency show that the country may lose IDR110.37 trillion due to climate change, and IDR4,328.38 trillion needs to be added to the social, economic, and financial ecosystem to repair the damages caused by climate change. Hence, relying on public financing is insufficient and the country needs to explore innovative and long-term financing sources. Also, MFRI through its budget tagging has projected that the 2016–2020 public expenditure only covers 34% of current financing needs (MFRI, 2021b). Therefore, exploring alternative financial resources are required on an immediate basis to bridge financing gaps and mitigate the social, economic, and financial challenges caused by climate change. This further validates the potential and compatibility of GS with RPJMN by financing the initiatives taken to achieve the goals of the medium-term development plan and ambitious targets of SDGs by 2030.

MFRI has coordinated with several Ministries to design an integrated GS framework (Fig. 3) for unlocking environmental, economic, social, and financial opportunities. This framework outlines the use and management of proceeds to finance and re-finance eligible green projects in different sectors in Indonesia. Accordingly, the targeted sectors are energy, transport, tourism, green building, and agriculture. These investments focused on the generation and transmission of renewable energy through efficient energy infrastructure, research, and development of products and technology, clean transportation system, efficient management of waste and natural resources, development of climate resilient tourism system, and the implementation of clean agriculture methods. The projects are selected and evaluated by the MFRI in coordination with other ministries, and the required investments are provided through a budget tagging process. The proceeds of GS are managed by the MFRI, kept within the government of Indonesia’s general account, and credited to the relevant ministries for financing the eligible projects. The outcome of financed projects is reported annually as a GS impact report to highlight the cumulative benefits of ongoing projects. Finally, the compliance of GS with the designed framework is assured by engaging an independent third-party reviewer.

Integrated framework to operationalize GS in Indonesia. Source: (MFRI, 2022b)

2.4 Theoretical model and hypotheses

This study projects that investments in environment-friendly initiatives through GS may improve the economic, social, and financial indicators of Indonesia. Given the lack of empirical evidence about the impact of GS on these indicators and the argument that GS is yet to fully develop and establish as an environmental tool (Alessi et al., 2021; Liu & Lai, 2021), it is worth investigating its impact to verify whether the investments and strategies of GS are effective and achieve the desired objectives. To measure the effect of GS on economic and social indicators, we employed Barney’s (1991) resource-based view (RBV) theory, while the effect on financial indicators is estimated by importing the logic of Scott’s (1995) institutional theory. Figure 4 outlines the theoretical model of this study.

RBV argues that achieving environmental goals require the allocation of resources by developing advanced-level capabilities and resources which may guide the implementation of environment-friendly initiatives (Alam et al., 2019). Further, these capabilities allow strategic alignment between environmental initiatives and economic, social, and financial goals in two different ways. First, these capabilities promote the allocation of resources to develop clean technologies catering to the needs of businesses to operate in emerging global markets to achieve eco-efficiency targets (Hart, 1995). Second, the adoption of relevant capabilities inspires the development of clean and efficient energy policies to reduce CO2 emissions, protect the environment, and implement a range of environmental strategies (Abbasi & Erdebilli, 2023; Basu et al., 2019; Rivera et al., 2017). Theoretical components of institutional theory advocate that patronizing environment-friendly projects may contribute to financial performance as the practices used for implementing environmental initiatives may reduce operational costs, optimize resources, and conserve energy (Nguyen et al., 2020; Zheng et al., 2010).

Following RBV’s assertation, it is submitted that Indonesia may achieve its environmental goals of zero emission by 2035 by developing financial capabilities to invest in environment-friendly initiatives through the issuance of GS. Infect, the issuance of GS in Indonesia is consistent with its economic development plans envisaged in the 20-year development plan (Suriani et al., 2021). Therefore, it is predicted that financing the green and renewable energy projects through GS will help in transitioning to sustainable economic growth by financing the economic development projects which may have a positive effect on economic growth. The findings of recent studies confirmed that Sukuk (Ledhem & Mekidiche, 2022; Smaoui & Nechi, 2017; Yıldırım et al., 2020), in general, and GS (Larcker & Watts, 2020; Wahab and Mohamed Naim, 2019), in particular, have a linear relationship with economic growth. Meanwhile, a few studies have concluded that GS has a limited scope which may poorly address climate change and environmental issues further escalating growth volatilities that may negatively affect economic growth (Alessi et al., 2021; Hasan et al., 2022; Liu and Lai, 2021). Given the disagreement among the scholars and the recognition of GS as a strategic economic expansion tool by the government of Indonesia, this study investigates whether the issuance of GS contributes to economic development by positing the first hypothesis (H1) as follows:

H1

The issuance of GS affects the economic growth in Indonesia.

The Islamic financial system strives to create a sustainable social ecosystem by developing innovative instruments in the form of institutions, products, and services (Jouti, 2019; Marwan and Hareef, 2019; Mohd Nor et al., 2016). The emergence of GS is a modest attempt to stand up to its reputation as a social enabler (Azman et al., 2022). However, the effectiveness of GS to create a sustainable social ecosystem is debated by scholars due to the use of different tools such as SRI Sukuk, Islamic Sukuk, and GS to enhance the social contribution of IFIs (S&P Global Ratings, 2022). Although investments in Islamic social finance have surpassed investments in conventional finance (Tan and Shafie, 2021) and the GS market is likely to grow (Fitch, 2020) yet, there is no empirical evidence to claim that GS contributes the social development. The fundamentals of RBV stipulate that the organizational quest to achieve a competitive advantage motivates them to take environment-friendly initiatives to fulfill the expectations of influential stakeholders and seek wider social acceptance (Hart, 1995). Considering GS as an environmental initiative, it is predicted that an increase in the issuance of GS enhances investments in green social development projects such as the generation of renewable energy, development of infrastructure, roads, railways, and green agriculture. The investment in these projects may eradicate poverty by creating new jobs and sustainable sources of income which alternatively will improve the human development index (HDI). A few studies have also labeled GS as the tool to create a sustainable social ecosystem (Aassouli et al., 2018; Musari, 2021, 2022). This argument leads to propose the second hypothesis (H2) as follows:

H2

The issuance of GS affects social development in Indonesia.

Currently, the Indonesian IFI holds a 6.1% share of its total banking assets (IFSB, 2022), and it implements a range of strategies by designing different policies, procedures, and practices. The primary goals of these strategies are to achieve socioeconomic legitimacy, optimize financial performance, capture more market share, and resolve the looming efficiency issues of IFIs in Indonesia (Puteh et al., 2018). Recently, IFIs in Indonesia have started issuing GS to address climate and socioeconomic issues as well as diversify the financial portfolios of IFIs (Musari, 2021). The institutional theory argues that organizational business activities may transform their social and cultural expectations due to pressure from external stakeholders (Feng & Wang, 2016). This drives organizations to allocate specialized resources to participate in environmental initiatives to seek wider social acceptance, mitigate climate change effects, and improve their financial performance (Wang et al., 2018). Contextually, IFIs looking to enhance their social acceptance, address climate change issues, and improve financial performance need to further develop the landscape of GS by allocating funds for green investment. The findings of earlier studies have confirmed that GS creates higher yields as compared to non-green Sukuk (Roslen et al., 2021). The competitiveness, legitimacy, and viability of green technology may help in achieving a competitive advantage and generating higher financial outputs (Abdullah & Keshminder, 2022). However, several studies have highlighted the limitations of GS in improving financial performance due to doubtful green status (Liu & Lai, 2021), fear of low return over investment (Noordin et al., 2018; Siswantoro, 2018), and superior bank liability (Morea & Poggi, 2017). These contradictory findings inspired us to investigate whether GS has an impact on financial performance by proposing the third hypothesis (H3) as follows:

H3

The issuance of GS affects the financial performance of IFIs in Indonesia.

3 Research methods

3.1 Sampling and data

This study covers the economic, social, and financial performance of Indonesian GS between 2018 and 2021. The selection of study duration was crucial to confirm whether the issuance of GS indicates notable changes in the performance of these indicators. Indonesia issued its first GS in 2018 to address climate change, socioeconomic, and financial performance issues; therefore, we expect a clear difference in the performance of these indicators between the years 2018 (before GS issuance) to 2021 (after GS issuance). Initially, we sampled different government departments (agriculture, energy, construction, mining, and housing), all the departments under the Ministry of Social Affairs Republic of Indonesia, and the licensed Islamic banks in Indonesia as the target population for data collection. However, the use of the budget tagging process by MFRI screens eligible green projects for financing and re-financing through GS investments, therefore, the provision of funds is limited to certain economic and social sectors. Further, the unavailability of data on having received funding for financing green projects through GS makes it difficult to identify changes in the performance of a specific sector. Instead of measuring changes in the performance of individual sectors, we decided to measure the economic, social, and financial performance of GS through proxies and dummy variables. The use of proxies and dummy variables to measure performance is common in finance and environmental studies (Alshubiri & Elheddad, 2020; Amin et al., 2020; Dang et al., 2018; Hasan et al., 2009).

3.2 Experimental variables

To test the hypotheses of this research, we operationalized four main variables. The issuance of GS represented by IGS is operationalized as an explanatory variable and a predictor of economic growth, social development, and financial performance denoted by EG, SD, and FP acronyms. Following the empirical assumptions of this research, it is predicted that IGS may affect (positive/negative) EG, SD, and FP. IGS variable is estimated by the ratio of GS to total Sukuk assets and through a liquidity proxy representing liquid GS to total assets. The use of this technique to measure the IGS variable is consistent with Salhani and Mouselli's (2022) approach as GS is a relatively new research paradigm, and there is a lack of studies outlining the criteria to measure IGS. The replication of this approach will allow us to converge both global and domestic GS under one ratio and a liquidity proxy as the main goals of both GS are similar.

EG is a response variable, and it is measured by a proxy of GDP growth which is a log of real GDP per capita (Barro, 1991), and it reflects the real state of the economy (Asteriou & Spanos, 2019; Karim et al., 2022; kong et al., 2021; Sun & Tang, 2022;). This technique is consistent with the findings of previous studies (Smaoui & Nechi, 2017; Echchabi et al., 2016; Ledhem & Mekidiche, 2022; Malikov, 2017; Yıldırım et al., 2020) investigating the impact of Islamic securities and Sukuks on economic growth.

SD is also a response variable estimated by an index known as a social progress index (SPI) developed by computing scores of 6 sub-indicators following Chua et al. (2014) criteria. The sub-indicators used for computing SPI are considered more inclusive as they largely cover information on population, health, housing, education, work, and environmental indicators essential to determining social progress in society (Hickel, 2020). The use of SPI to determine social development is relevant for this research as it allows GS to record improvements in key social indicators of basic human needs (population, health, housing, education) and foundation and well-being (environment). This approach will also help researchers to bridge the knowledge gap in the literature on Islamic social finance and particularly in GS by operationalizing SPI to empirically measure social progress which further validates its usage as a proxy of social development.

FP as a response variable estimated by Tobin’s Q technique. This technique determines the firm’s ability to create value by using its assets and is measured by a ratio between (book value of total assets − book value of shareholder’s equity + market value of shareholder’s equity) and (book value of total assets) (Miroshnychenko et al., 2017). Further, Tobin’s Q is recognized as a reliable technique to estimate the actual effect of a firm’s long-term investments on environmental initiatives (Dowell et al., 2000; Surroca et al., 2010), and it is less sensitive to management’s manipulation as compared to other accounting methods (Hassan & Romilly, 2018). Past studies have vigorously employed this technique to analyze the impact of environmental initiatives on FP (King & Lenox, 2001; Manrique & Martí-Ballester, 2017; Shen et al., 2019; Surroca et al., 2010; de Castro Sobrosa Neto et al., 2020). From a business perspective, GS is long-term environmental investments to optimize the FP of IFIs; hence, the use of Tobin’s Q is valid to estimate the financial impact of these environmental investments. Also, this technique was frequently used by scholars to examine the impact of Sukuk on the FP of IFIs (Ledhem & Mekidiche, 2022; Salhani & Mouselli, 2022; Smoui et al., 2020) indicating its consistency to estimate the FP variable of this research.

Finally, we employ the trade openness index represented by external trade (TRADE), consumer price index (CPI) determined by the inflation rate, and gross fixed capital formation (GFCF) estimated by investments as control variables of EG. These variables are imported from extant literature to prevent the issues of bias and capture heterogeneity in EG over the years. Several past studies analyzing the impact of Sukuk on economic growth have confirmed that TRADE (Smaoui & Nechi, 2017; Tan & Shafi, 2021; Yıldırım et al., 2020), CPI (Ledhem & Mekidiche, 2022), and GFCF (Yıldırım et al., 2020) are also the indicators of EG; therefore, it is essential to control these variables while estimating EG through other indicators to ensure robustness. Similarly, financial leverage which is determined by the ratio of total debt to total assets, sales growth estimated by the log-difference of net sales log, and bank size determined by the natural logarithm of total assets are employed as control variables to measure the FP variable. These variables were also taken from past studies in Islamic finance literature concluding that leverage ratio (Hussein et al., 2019), sales growth (Daly & Frikha, 2017), and bank size (Al-Nasser Mohammed & Joriah Muhammed, 2017; Grira & Labidi, 2020) are also the predictors of FP; hence, we decided to operationalize them as control variables to optimize the robustness of FP. The experimental variables together with the procedures and sources used for data aggregation are reported in Table 2.

3.3 Econometric model

While measuring the linkage between IGS, EG, SD, and FP, it is essential to resolve endogeneity issues so that the findings are reliable and valid. According to Ullah et al., (2018, 2020), endogeneity issues during statistical analysis can be resolved by a generalized method of moments (GMM). This technique uses internal instruments by deriving lagged values of dependent variables (Blundell & Bond, 1998; Ullah et al., 2018). Additionally, the data loss during estimation can be recovered by a two-step GMM model (Ullah et al., 2018). Therefore, this study corroborated the dynamic two-step GMM model to resolve endogeneity and causality issues during model estimation which is consistent with the recent studies examining the economic and financial effect of Sukuks (Ejaz et al., 2022; Ledhem & Mekidiche, 2022; Salhani & Mouselli, 2022; Yıldırım et al., 2020).

To examine the effect of IGS on EG (H1), the GMM regression estimation model is as follows:

While EG represents economic growth estimated by the log of real GDP per capita and as alternative response variables, β is the coefficient of the degree of change; β1EGit − 1 represents first legged of the dependent variable; IGS is the explanatory variable which signifies issuance of green Sukuk; C indicates control variables; i represents each bank, t is the year, μ is the time effect (fixed), and git is the error term.

The effect of GIS on the SD of firms (H2) is analyzed through the following regression model:

While SD indicates the social development performance of GS, FPit − 1 represents the first lagged of outcome variable; IGS determines the issuance of green Sukuk; C represents control variables.

Similarly, the effect of IGS on FP (H3) is analyzed using the following regression model:

FP in Eq. (3) represents the financial performance of green Sukuk; FPit − 1 represents the first lagged of outcome variable; IGS determines the issuance of green Sukuk; C represents control variables.

3.4 Data analysis procedures

This research attempts to draw a correlation between Indonesia’s GS, EG, SD, and FP by hypothesizing the likely impact of GS. Indeed, GS investments contribute to improving environmental conditions by investing in green initiatives which alternatively may enhance economic, social, and financial performance which has motivated us to verify whether financing the green projects also helps to improve the performance of the above indicators. The panel data between 2018 and 2021 of economic, social, and financial indicators together with GS were drawn from ADB, Asset4, MFRI, World Bank, and Worldscope and were processed to Stata 16 software for further analysis to test our research hypotheses using two-step GMM regression analysis by controlling endogeneities of dynamic, simultaneous, and omitted variables (Ullah et al., 2018).

4 Empirical findings

4.1 Descriptive statistics

The descriptive statistics of the main variables, i.e., issuance of green Sukuk (IGS), economic growth (EG), social development (SD), and financial performance (FP) are reported in Table 3. It is notable that both predictor and outcome variables have a positive mean and standard deviation values and have a meaningful distribution peak confirming the high performance of GSI, EG, SD, and FP. The index value of 64.95 shows the high performance of GS, and a value of -2.1 represents the low performance of GS from the panel of selected economic, social, and financial indicators of Indonesia and are positively influenced by positive means and standard deviation values of IGS. Further, an increase in the number of IGS is likely to increase economic, social, and financial performance leading to infer that IGS may improve socioeconomic and financial conditions in Indonesia.

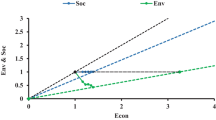

The correlation matrix (Table 4) indicates the correlation between the variables of this research. We observe that IGS is positively correlated with EG, SD, and FP. Moreover, the correlation between IGS and EG was weak, IGS and SD were moderate, and IGS and FP were significant. This also illustrates that IGS may weakly influence EG, moderately improve SD, and may significantly improve FP. Also, IGS was negatively correlated with TRADE establishing that the issuance of green Sukuk may not improve external trade in Indonesia. Another striking feature was the positive and significant correlation of IGS correlation with LEV, SALE, and SIZE delineating that IGS can be used as a tool to improve the FP of IFIs.

4.2 Hypotheses testing

Before testing the hypotheses, we addressed endogeneity issues in self-aggregated data. Usually, the problems of serial correlation, heteroskedasticity, and heterogeneity can be resolved by employing the GMM technique (Attari et al., 2016; Khan et al., 2018). Further, the assumptions of GMM allow us to detect the issues of serial autocorrelation (AR) using ρ values and establish that all explanatory variables are not endogenous. This is essential to reduce the over-fitting problem in our model as the sample size of this research is small which may result in a huge number of instruments leading to assume that explanatory variables are endogenous. The results of the Hansen test reported under GMM regression (Table 5) indicate that the ρ value for AR(1) is significant, whereas it is insignificant for AR(2) corroborating that our models do not contain serious autocorrelation. The results of GMM estimations indicate that IGS is positively associated with EG, SD, and FP which is consistent with the theoretical assumptions of this study. Altogether, we used 6 GMM regression models to examine the relationship between IGS, EG, SD, and FP. Specifically, the regression coefficients of EG are positive (moderate) and insignificant and are also positive (weak) and insignificant for SD, whereas the regression coefficients of FP obey a positive and significant trend.

4.3 Robustness checks

To confirm the robustness of the empirical results of this study, we performed an additional regression test by replacing the explanatory variable (IGS) with liquid green Sukuk (LGS) estimated by the liquidity ratio (liquid GS to total GS assets). The results of robustness checks estimate the impact of LGS on economic, social, and financial performance indicators. The GMM regression analysis reported in Table 6 indicates that our results are consistent with earlier findings (Table 5) as LGS represents an overall positive trend on EG, SD, and FP indicators. Contrary to our expectations, the regression coefficients of LGS indicated a significant positive impact on EG, and a moderate positive impact on SD. Perhaps, a logical explanation for this result is the provision of funding to invest in green projects for certain economic and social sectors which may have enhanced the contribution of energy, agriculture, transport, and real estate sectors by producing clean and renewable energy, efficient and low CO2 emitting transport system and the rise of green buildings in congested areas (Abbasi et al., 2021).

5 Discussion and conclusion

According to the theoretical assumptions presented in H1, IGS affects EG in Indonesia. The results of GMM regression in Table 4 (models 1 and 4) represent that IGS together with all control variables have a moderate positive effect on EG (β = 0.036, p > 0.01; β = 0.028, p > 0.01) confirming the acceptance of H1. We employed GDP per capita as the proxy of GDP growth to estimate the real growth rate of the Indonesian economy. Although GS has moderately improved economic growth in Indonesia, it is inconsistent with the broad objectives of the IGS as developing countries tend to configure these financing instruments to resolve their economic and sustainability issues (Aassouli et al., 2018; Alam et al., 2016; Obaidullah, 2017). This result emphasizes the need for a sustainable transition by identifying the strategic drivers of sustainability initiatives to eventually promote social and economic developments in emerging societies (Abbasi et al., 2023; D’Adamo, 2022). Also, this finding validates the studies of Keshminder et al. (2021) and Liu and Lai (2021) corroborated that GS subscriptions may not yield immediate economic and financial benefits due to their maturity time, lack of clear benefits, and integration with International Green Bond Principles. The result of a moderate positive effect of IGS on EG supports the findings of Hasan et al. (2022), Jouti, (2019), and Ledhem and Mekidiche (2022) establishing that GS may partially serve as an economic recovery tool for developing countries during humanitarian crises.

The impact of IGS on SD is examined by hypothesizing H2. We estimated SD using the SPI index computed by the performance of six (health, housing, education, work, and environment) social indicators. The regression results in models 2 and 5 (Table 5) indicate that IGS along with the control variables of this research has a positive (weak) effect on SD (β = 0.008, p > 0.01; β = 0.005, p > 0.01) implying that H2 is supported. Although this result supports the theoretical assumptions of this study, it indicates that multistakeholder complexities such as their interests and influence are the barriers to achieving absolute sustainability (Salman et al., 2022). Thus, sustainability initiatives such as GS require strategic operationalization in a way that the interests of multiple stakeholders are covered under these initiatives. In this context, financial institutions may play their role by employing an integrated management system which will allow them to tap their sustainability and FP domains as well as engage different stakeholders of society (Peeters, 2003; Rahman et al., 2022). This finding authenticates the studies of Aassouli et al. (2018), Hasan et al. (2019), and Azman et al. (2022) establishing that compatibility between GS green finance contributes to environmental performance and infrastructure development by increasing investments in green and social welfare projects. However, the finding of a weak positive effect of IGS on SD is less supportive to propagate social development narratives which may further exacerbate low global recognition and acceptance of GS among international investors (Keshminder et al., 2021; Liu & Lai, 2021).

Similarly, the effect of IGS on the FP of IFIs is examined by referring to H3. FP was measured through a popular proxy of Tobin’s Q which is a ratio between (book value of total assets − book value of shareholder’s equity + market value of shareholder’s equity) and (book value of total assets) (Miroshnychenko et al., 2017). The regression coefficients of FP under models 3 and 6 (Table 5) elucidate that IGS has a significant positive effect on FP (β = 0.205, p < 0.01; β = 0.226, p < 0.01) implying that H3 is also accepted. This result is consistent with the findings of Ejaz et al. (2022) and Salhani and Mouseli (2022) confirming that GS is less risky and has the ability to attract green investors that may enhance FP. Based on this empirical finding, we endorse the recent projections of regional and global rating agencies about GS market expansion despite tightening economic conditions as more IFIs are expected to engage in green investments for capturing lucrative business and financial opportunities (Fitch, 2020; RAM, 2020). This finding contradicts the studies of Alessi et al. (2021), Fitrah and Soemitra (2022), Keshminder et al. (2021), Siswantoro (2018), and Siswantoro and Surya (2021) found that a low environmental and sustainability contribution, investor interest, and financial benefits hamper the growth of GS. Following the results of H3, we argue that GS offers a secure, ethical, and profitable business landscape for green investors to invest in environment-friendly projects in developing countries which will eventually improve sustainability and financial indicators.

This study conceptualized GS as an environmental tool may interact with economic, social, and financial indicators which are largely unexplored in extant literature. The current research documents empirical evidence by suggesting IGS as the predictors of EG, SD, and FP and employs RBV and institutional theory’s logic to develop the theoretical framework. The panel data between 2018 and 2021 were drawn from different sources to determine whether the IGS in Indonesia affects EG, SD, and FP. The statistical analysis suggests that IGS has a positive effect on EG, SD and FP establishing that GS may serve as the predictor of social, economic, and financial performance. Our findings further corroborate that IGS has a moderate positive effect on EG, a weak positive effect on SD, and a significant positive effect on FP.

5.1 Research contribution

This study has investigated the impact of GS on economic, social, and financial indicators which contributes to the developing literature on green finance. We operationalized GS as the strategic green financing tool to enhance EG, SD, as well as FP which may contribute to designing an integrated business model for organizations looking to resolve their sustainability, socioeconomic, and financial performance issues. The findings of this study contribute to the expounding literature on organizational change by implementing GS as the instrument of change to positively influence EG, SD, and FP. This research established the theoretical linkage between GS, EG, SD, and FP which contributes to laying the theoretical foundation for future researchers investigating GS linkage with environmental, economic, social, and financial domains. Following the increasing trend of IGS, our research highlights that economic, social, and financial outcomes legitimatize this trend implying that GS may become a promising research paradigm that contributes to creating disruptive green finance strategies. Finally, our statistically tested and validated model contributes to offering a generic insight into a relatively new research area of GS which can be used by financial (Islamic and conventional) institutions for understanding the preliminary ingredients essential to resolve socioeconomic and financial issues and play their role in achieving sustainable finance agenda.

5.2 Implications for theory and practice

The present study offers multiple implications for theory and practice. Theoretically, this research is grounded on RBV and institutional theory to investigate whether GS as a competitive advantage strategy interacts with economic, social, and financial indicators. Drawing broadly on RBV and institutional theory, this study extends the existing literature on strategic organizational change by operationalizing GS which contributes to the under-researched areas of sustainability, performance, and value creation strategies in IFIS. Based on the dearth of empirical studies investigating GS, this research is expected to offer a theoretical roadmap for future studies to propose robust green finance strategies for developing countries.

Our research findings have numerous practical implications for regulators, policymakers, practitioners, and financial consultants. First, the descriptive and empirical evidence presented in this study clearly highlights the contribution and potential of GS to sustainability and can be used by the regulators for developing market-enabling legislation to attract international investors and comply with Global Green Bond principles which will accelerate their progress to achieve zero carbon emission goals. Second, following the findings of this study, policymakers in developing countries may chart effective laws and policies to enhance GS portfolio, proceeds distribution, and asset identification which may attract more investments and overcome the issues of low benefits, risky investments, costs, and time constraints. Third, the practitioners in IFIs may use the results of this study to understand the contextual factors and drivers (economic, social, and financial) to focus on GS for achieving sustainability, economic, social, and financial goals. Additionally, this study is also expected to serve as a practitioner’s guide for Islamic and conventional institutions to undertake GS training through short professional programs which will help to better identify the green assets and enhance understanding of the benefits of investments through GS. Finally, the financial consultants may use the insight of this research to recommend value creation strategies and tactics to businesses and investors by configuring to secure and profitable GS business.

5.3 Limitations and future research

The main limitations of this study are associated with the theoretical model, data selection period, research instrument, data collection procedures, and data analysis techniques. The researchers have critically discussed and logically explained the theoretical components of our model; however, the construct of IGS operationalized in this research may not directly represent its actual state as MFRI uses the budget tagging process to screen and access the viability of green projects implying that beneficiary institution’ capabilities are likely to influence IGS; therefore, future studies are recommended to investigate the influence of the host organizations capabilities on IGS. The data collection timeline (2018–2021) may render the findings of this study controversial as the Covid-19 pandemic has ushered serious social, economic, and financial impacts therefore, future studies are recommended to expand the data selection timelines to truly represent the impact of GS on EG, SD, and FP indicators. This research has employed several proxies and dummy variables to estimate outcome variables, whereas certain proxies such as GDP growth, SPI, and Tobin’s Q have been criticized for their limited representation of EG, SD, and FP which may render the use of these proxies controversial. Since GS are long-term investments and an emerging research paradigm; therefore, the use of these proxies is justified, and future studies are encouraged to consider more proxies to measure these variables. The use of the GMM regression technique has largely addressed the endogeneity and heterogeneity issues in self-aggregated data; however, the endogeneity issues may still persist; thus, future studies are encouraged to consider additional measures and techniques such as difference-in-difference, generalized, two- and three-stage least squares regression to ensure the robustness of results.

Data availability

The datasets/materials used and/or analyzed for the present manuscript are available from the corresponding author upon reasonable request.

References

AAOIFI, Accounting and Auditing Organization for Islamic Financial Institutions (2015). Shari’ah Standards No. 17 (5/1/4-5/1/5). Manama: Bahrain. Retrieved 22 June 2022 from http://www.nbfimodaraba.com.pk/Data/Sites/1/skins/nbfi/images/AAOIFI/ShariahStandard17.pdf

Aassouli, D., Asutay, M., Mohieldin, M., & Nwokike, T. C. (2018). Green Sukuk, energy poverty, and climate change: A Roadmap for Sub-Saharan Africa. Policy Research Working Paper No. 8680. World Bank, Washington, DC. © World Bank. https://openknowledge.worldbank.org/handle/10986/31082

AbbFasi, S., Daneshmand-Mehr, M., & Ghane Kanafi, A. (2023). Green closed-loop supply chain network design during the coronavirus (COVID-19) pandemic: A case study in the Iranian Automotive Industry. Environmental Modeling & Assessment, 28(1), 69–103. https://doi.org/10.1007/s10666-022-09863-0

Abbasi, S., Daneshmand-Mehr, M., & Kanafi, A. G. (2021). The sustainable supply chain of CO2 emissions during the coronavirus disease (COVID-19) pandemic. Journal of Industrial Engineering International, 17(4), 83–108. https://doi.org/10.30495/JIEI.2022.1942784.1169

Abbasi, S., & Erdebilli, B. (2023). Green closed-loop supply chain networks’ response to various carbon policies during COVID-19. Sustainability, 15(4), 3677. https://doi.org/10.3390/su15043677

Abdullah, M. S., & Keshminder, J. S. (2022). What drives green Sukuk? A leader’s perspective. Journal of Sustainable Finance & Investment, 12(3), 985–1005. https://doi.org/10.1080/20430795.2020.1821339

Adam, N.J., & Thomas, A. (2004). Islamic bonds: Your guide to issuing, structuring and investing in sukuk. Euromoney Institutional Investor.

Ahmed H., Mohieldin M, Verbeek J., & Aboulmagd, F.W. (2015). On the sustainable development goals and the role of Islamic finance. The World Bank Policy Research Working Paper 7266. Available at: https://openknowledge.worldbank.org/handle/10986/22000

Alam, N., Duygun, M., & Ariss, R. T. (2016). Green Sukuk: An innovation in Islamic capital markets. Energy and Finance. https://doi.org/10.1007/978-3-319-32268-1_10

Alam, M. S., Atif, M., Chien-Chi, C., & Soytas, U. (2019). Does corporate R&D investment affect firm environmental performance? Evidence from G-6 countries. Energy Economics, 78, 401–411. https://doi.org/10.1016/j.eneco.2018.11.031

Alessi, L., Ossola, E., & Panzica, R. (2021). What greenium matters in the stock market? The role of greenhouse gas emissions and environmental disclosures. Journal of Financial Stability, 54, 100869. https://doi.org/10.1016/j.jfs.2021.100869

Ali, Q., Parveen, S., Yaacob, H., Rani, A. N., & Zaini, Z. (2022). Environmental beliefs and the adoption of circular economy among bank managers: Do gender, age and knowledge act as the moderators? Journal of Cleaner Production, 361, 132276. https://doi.org/10.1016/j.jclepro.2022.132276

Al-Nasser Mohammed, S. A. S., & Joriah Muhammed, D. (2017). Financial crisis, legal origin, economic status and multi-bank performance indicators: Evidence from Islamic banks in developing countries. Journal of Applied Accounting Research, 18(2), 208–222. https://doi.org/10.1108/JAAR-07-2014-0065

Alshubiri, F., & Elheddad, M. (2020). Foreign finance, economic growth and CO2 emissions Nexus in OECD countries. International Journal of Climate Change Strategies and Management, 12(2), 161–181. https://doi.org/10.1108/IJCCSM-12-2018-0082

Amin, A., Dogan, E., & Khan, Z. (2020). The impacts of different proxies for financialization on carbon emissions in top-ten emitter countries. Science of the Total Environment, 740, 140127. https://doi.org/10.1016/j.scitotenv.2020.140127

Andrews, T. M., & Smirnov, O. (2020). Who feels the impacts of climate change? Global Environmental Change, 65, 102164. https://doi.org/10.1016/j.gloenvcha.2020.102164

Asteriou, D., & Spanos, K. (2019). The relationship between financial development and economic growth during the recent crisis: Evidence from the EU. Finance Research Letters, 28, 238–245. https://doi.org/10.1016/j.frl.2018.05.011

Azman, S. S. M. M., Ismail, S., Haneef, M. A., & Engku Ali, E. R. A. (2022). An empirical comparison of sustainable and responsible investment ṣukūk, social impact bonds and conventional bonds. ISRA International Journal of Islamic Finance. https://doi.org/10.1108/IJIF-04-2021-0074

Barney, J. B. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120.

Barro, R. (1991). Economic growth in a cross-section of countries. The Quarterly Journal of Economics, 106(2), 407–443. https://doi.org/10.2307/2937943

Basu, S., Roy, M., & Pal, P. (2019). Corporate greening in a large developing economy: Pollution prevention strategies. Environment, Development and Sustainability, 21, 1603–1633. https://doi.org/10.1007/s10668-018-0121-3

Beik, I. S. (2011). Optimalisasi SBSN dalam pembangunan ekonomi nasional. The article was presented at the Seminar Sukuk Negara Goes to Campus, Bogor, 29 April.

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

Braun, R. (2010). Social participation and climate change. Environment, Development and Sustainability, 12, 777–806. https://doi.org/10.1007/s10668-009-9224-1

Chua, H. W., Wong, A., & Shek, D. T. L. (2014). Social development index (SDI). In A. C. Michalos (Ed.), Encyclopedia of quality of life and well-being research. Springer.

D’Adamo, I. (2022). The analytic hierarchy process as an innovative way to enable stakeholder engagement for sustainability reporting in the food industry. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-022-02700-0

Daly, S., & Frikha, M. (2017). Determinants of bank Performance: Comparative study between conventional and Islamic banking in Bahrain. Journal of Knowledge Economy, 8, 471–488. https://doi.org/10.1007/s13132-015-0261-8

Dang, C., Li, Z. L., & Chen Yang, C. (2018). Measuring firm size in empirical corporate finance. Journal of Banking & Finance, 86, 159–176. https://doi.org/10.1016/j.jbankfin.2017.09.006

de Castro Sobrosa Neto, R., de Lima, C. R. M., Bazil, D. G., de Oliveira Veras, M., & de Andrade Guerra, J. B. S. O. (2020). Sustainable development and corporate financial performance: A study based on the Brazilian Corporate Sustainability Index (ISE). Sustainable Development, 28, 960–977. https://doi.org/10.1002/sd.2049

Dowell, G., Hart, S., & Yeung, B. (2000). Do corporate global environmental standards create or destroy market value? Management Science, 46(8), 1059–1074. https://doi.org/10.1287/mnsc.46.8.1059.12030

Echchabi, A., Aziz, H. A., & Idriss, U. (2016). Does Sukuk financing promote economic growth? An emphasis on the major issuing countries. Turkish Journal of Islamic Economics, 3(2), 63–73.

Ejaz, R., Ashraf, S., Hassan, A., & Gupta, A. (2022). An empirical investigation of market risk, dependence structure, and portfolio management between green bonds and international financial markets. Journal of Cleaner Production, 365, 132666. https://doi.org/10.1016/j.jclepro.2022.132666

El Amri, M. C., Mohammed, M. O., & Abdi, M. H. (2021). How green Sukuk structure contributes to SDGs? In M. M. Billah (Ed.), Islamic wealth and the SDGs. Palgrave Macmillan.

Fatica, S., & Panzica, R. (2021). Green bonds as a tool against climate change? Business Strategy and the Environment, 30(1), 2688–2701. https://doi.org/10.1002/bse.2771

Feng, T., & Wang, D. (2016). The influence of environmental management systems on financial performance: A moderated-mediation analysis. Journal of Business Ethics, 135(2), 265–278. https://doi.org/10.1007/s10551-014-2486-z

Fitch. (2020). Sukuk issuance picking up after coronavirus slowdown. Fitch Ratings. Retrieved 20 June 2022 from www.fitchratings.com/research/islamic-finance/sukuk-issuance-picking-up-aftercoronavirusslowdown-20-07-2020.

Fitrah, R., & Soemitra, A. (2022). Green Sukuk for sustainable development goals in Indonesia: A literature study. Jurnal Ilmiah Ekonomi Islam, 8(01), 231–240. https://doi.org/10.29040/jiei.v8i1.4591

Grira, J., & Labidi, C. (2020). Banks, funds, and risks in Islamic finance: Literature & future research avenues. Finance Research Letters, 41, 101815. https://doi.org/10.1016/j.frl.2020.101815

Hart, S. L. (1995). A natural-resource-based view of the firm. Academy of Management Review, 20(4), 986–1014. https://doi.org/10.5465/amr.1995.9512280033

Hasan, I., Koetter, M., & Wedow, M. (2009). Regional growth and finance in Europe: Is there a quality effect of bank efficiency? Journal of Banking & Finance, 33(8), 1446–1453. https://doi.org/10.1016/j.jbankfin.2009.02.018

Hasan, R., Ahmad, A.U.F., & Parveen, T. (2019). Sukuk risks – a structured review of theoretical research. Journal of Islamic Accounting and Business Research, 10(1):35–49. https://doi.org/10.1108/JIABR-06-2015-0026

Hasan, R., Velayutham, S., & Khan, A. F. (2022). Socially responsible investment (SRI) Sukuk as a financing alternative for post COVID-19 development project. International Journal of Islamic and Middle Eastern Finance and Management, 15(2), 425–440. https://doi.org/10.1108/IMEFM-07-2020-0379

Hassan, O. A., & Romilly, P. (2018). Relations between corporate economic performance, environmental disclosure and greenhouse gas emissions: New insights. Business Strategy and the Environment, 27(7), 893–909. https://doi.org/10.1002/bse.2040

Hickel, J. (2020). The sustainable development index: Measuring the ecological efficiency of human development in the anthropocene. Ecological Economics, 167, 106331. https://doi.org/10.1016/j.ecolecon.2019.05.01

Hussien, M. E., Alam, M. M., Murad, M. W., & Wahid, A. N. M. (2019). The performance of Islamic banks during the 2008 global financial crisis: Evidence from the Gulf Cooperation Council countries. Journal of Islamic Accounting and Business Research, 10(3), 407–420. https://doi.org/10.1108/JIABR-01-2017-0011

Ibrahim, M. H. (2015). Issues in Islamic banking and finance: Islamic banks, Shari’ah-compliant investment and sukuk. Pacific Basin Finance Journal, 34, 185–191. https://doi.org/10.1016/j.pacfin.2015.06.002

IFSB, Islamic Financial Services Board (2022). Islamic financial services industry stability report - Resilience amid a resurging pandemic. Kuala Lumpur: Malaysia. Retrieved 15 Aug 2022 from https://www.ifsb.org/download.php?id=6571&lang=English&pg=/index.php

IIFM Sukuk Report. (2021). A comprehensive study of the global Sukuk market. Kingdom of Bahrain, Manama, 10th ed.

IsDB, Islamic Development Bank (2020). Annual impact report on IsDB debut green Sukuk. Retrieved 07 Feb 2022 from https://www.isdb.org/sites/default/files/media/documents/202101/Annual%20Impact%20Report%20on%20IsDB%20Debut%20Green%20Sukuk%20%28Dec%202020%29_0.pdf

Joof, F. (2020). Investigating the asymmetric effect of sukuk returns on economic growth-evidence from Indonesia, a NARDL Perspective. MPRA Paper. Retrieved 28 Mar 2023 from https://mpra.ub.uni-muenchen.de/id/eprint/102939

Jouti, A. T. (2019). An integrated approach for building sustainable Islamic social finance ecosystems. ISRA International Journal of Islamic Finance, 11(2), 246–266. https://doi.org/10.1108/IJIF-10-2018-0118

Karim, Z. A., Nizam, R., Law, S. H., & Hassan, M. K. (2022). Does financial inclusiveness affect economic growth? New evidence using a dynamic panel threshold regression. Finance Research Letters, 46(Part A), 102364. https://doi.org/10.1016/j.frl.2021.102364

Keshminder, J. S., Abdullah, M. S., & Mardi, M. (2021). Green sukuk – Malaysia surviving the bumpy road: Performance, challenges and reconciled issuance framework. Qualitative Research in Financial Markets, 14(1), 76–94. https://doi.org/10.1108/QRFM-04-2021-0049

Khan, S. A. R., Zhang, Y., Anees, M., Golpîra, H., Lahmar, A., & Qianli, D. (2018). Green supply chain management, economic growth and environment: A GMM based evidence. Journal of Cleaner Production, 185, 588–599. https://doi.org/10.1016/j.jclepro.2018.02.226

King, A. A., & Lenox, M. J. (2001). Does it really pay to be green? An empirical study of firm environmental and financial performance: An empirical study of firm environmental and financial performance. Journal of Industrial Ecology, 5(1), 105–116. https://doi.org/10.1162/108819801753358526

Kong, Q., Peng, D., Ni, Y., Jiang, X., & Wang, Z. (2021). Trade openness and economic growth quality of China: Empirical analysis using ARDL model. Finance Research Letters, 38, 101488. https://doi.org/10.1016/j.frl.2020.101488

Laldin, M. A., & Djafri, F. (2021). The role of Islamic finance in achieving sustainable development goals (SDGs). In M. K. Hassan, M. Saraç, & A. Khan (Eds.), Islamic finance and sustainable development. Palgrave Macmillan.

Larcker, D. F., & Watts, E. M. (2020). Where’s the greenium? Journal of Accounting and Economics, 69(2–3), 101312. https://doi.org/10.1016/j.jacceco.2020.101312

Lartey, T., Yirenkyi, D. O., Adomako, S., Danso, A., Amankwah-Amoah, J., & Alam, A. (2020). Going green, going clean: Lean-green sustainability strategy and firm growth. Business Strategy and the Environment, 29(1), 118–139. https://doi.org/10.1002/bse.2353

Ledhem, M. A., & Mekidiche, M. (2022). Islamic securities (ṣukūk) and economic growth: New empirical investigation from Southeast Asia using non-parametric analysis of MCMC panel quantile regression. Islamic Economic Studies, 29(2), 119–138. https://doi.org/10.1108/IES-06-2021-0020

Lian, Y., Gao, J., & Tao Ye, T. (2022). How does green credit affect the financial performance of commercial banks? - Evidence from China. Journal of Cleaner Production, 344, 131069. https://doi.org/10.1016/j.jclepro.2022.131069

Liu, F. H. M., & Lai, K. P. Y. (2021). Ecologies of green finance: Green sukuk and development of green Islamic finance in Malaysia. Environment and Planning A: Economy and Space. https://doi.org/10.1177/0308518X211038349

Long, H., Feng, G. F., Gong, Q., & Chang, C. P. (2023). ESG performance and green innovation: An investigation based on quantile regression. Business Strategy and the Environment. https://doi.org/10.1002/bse.3410

Loorbach, D., van Bakel, J. C., Whiteman, G., & Rotmans, J. (2010). Business strategies for transitions towards sustainable systems. Business Strategy and the Environment, 19(2), 133–146. https://doi.org/10.1002/bse.645

Lynch, B., & O’Hagan-Luff, M. (2023). Relative corporate social performance and cost of equity capital: International evidence. International Journal of Finance & Economics. https://doi.org/10.1002/ijfe.2808

Malikov, A. (2017). How do sovereign sukuk impact on the economic growth of developing countries? an analysis of the infrastructure sector. In: Efendić, V., Hadžić, F., Izhar, H. (eds) Critical Issues and Challenges in Islamic Economics and Finance Development. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-319-45029-2_1

Manrique, S., & Martí-Ballester, C. P. (2017). Analyzing the effect of corporate environmental performance on corporate financial performance in developed and developing countries. Sustainability, 9(11), 1957. https://doi.org/10.3390/su9111957

Marwan, S., & Haneef, M. A. (2019). Does doing good pay off? Social impact bonds and lessons for Islamic finance to serve the real economy. Islamic Economic Studies, 27(1), 23–37. https://doi.org/10.1108/IES-05-2019-0001

Mawardi, I., Widiastuti, T., & Al Mustofa, M. U. (2022). Constraints and strategies for municipal Sukuk issuance in Indonesia. Journal of Islamic Accounting and Business Research, 13(3), 464–485. https://doi.org/10.1108/JIABR-03-2021-0082

Mertzanis, C., & Tebourbi, I. (2023). National culture and green bond issuance around the world. European Financial Management. https://doi.org/10.1111/eufm.12419

MFRI, Ministry of Finance of the Republic of Indonesia (2019). Green Sukuk Issuance- Allocation and Impact Report. Retrieved 05 July 2022 from https://www.djppr.kemenkeu.go.id/page/loadViewer?idViewer=8536&action=download

MFRI, Ministry of Finance of the Republic of Indonesia. (2021a). Indonesia’s green bond & green Sukuk initiative. Retrieved from 02 Feb 2022 from https://climatepromise.undp.org/research-and-reports/indonesias-green-bond-sukuk-initiative

MFRI, Ministry of Finance of the Republic of Indonesia. (2021b). Green Sukuk allocation and impact report. Retrieved 05 Feb 2022 from https://djppr.kemenkeu.go.id/uploads/files/dmodata/in/6Publikasi/Offering20Circular/Green20Sukuk20Allocation20and20Impact20Report_2021b20FINAL.pdf

MFRI, Ministry of Finance of the Republic of Indonesia (2022a). Republic of Indonesia priced a US$ 3.25 billion Global Sukuk, the largest Global Sukuk transaction ever issued by the Republic. Press Release 24 May 2022.

MFRI, Ministry of Finance of the Republic of Indonesia. (2022b). Green Sukuk allocation and impact report. Retrieved 15 july 2022 from https://www.djppr.kemenkeu.go.id/page/loadViewer?idViewer=11376&action=download

Miroshnychenko, I., Barontini, R., & Testa, F. (2017). Green practices and financial performance: A global outlook. Journal of Cleaner Production, 147, 340–351. https://doi.org/10.1016/j.jclepro.2017.01.058

Moghul, U. F., & Safar-Aly, S. (2014). Green Sukuk: The introduction of islam’s environmental ethics to contemporary islamic finance. Georgetown International Environmental Law Review, 27(1), 1–25.

Mohd Nor, S., Abdul Rahim, R., & Che Senik, Z. (2016). The potentials of internalising social banking among the Malaysian Islamic banks. Environment, Development and Sustainability, 18, 347–372. https://doi.org/10.1007/s10668-015-9651-0

Morea, D., & Poggi, L. A. (2017). An innovative model for the sustainability of investments in the wind energy sector: The use of green sukuk in an Italian case study. International Journal of Energy Economics and Policy, 7(2), 53–60.

Musari, K. (2021). Green Sukuk, Islamic green financing: A lesson learned From Indonesia. In O. Olarewaju & I. Ganiyu (Eds.), Handbook of research on climate change and the sustainable financial sector. IGI Global.

Musari, K. (2022). Integrating Green Sukuk and Cash Waqf Linked Sukuk, the Blended Islamic Finance of Fiscal Instrument in Indonesia: A proposed model for fighting climate change. International Journal of Islamic Khazanah, 12(2), 133–144.

Nagano, M. (2017). Sukuk issuance and information asymmetry: Why do firms issue sukuk? Pacific Basin Finance Journal, 42, 142–157. https://doi.org/10.1016/j.pacfin.2016.12.005

Nguyen, H., Ntim, C. G., & Malagila, J. (2020). Women on corporate boards and corporate outcomes: A systematic literature review and future research agenda. International Review of Financial Analysis, 71, 101554. https://doi.org/10.1016/j.irfa.2020.101554

Noordin, N. H., Haron, S. N., Hasan, A., & Hassan, R. (2018). Complying with the requirements for issuance of SRI sukuk: The case of Khazanah’s Sukuk Ihsan. Journal of Islamic Accounting and Business Research, 9(3), 415–433. https://doi.org/10.1108/JIABR-02-2016-0024

Obaidullah, M. (2017). Managing climate change: The role of Islamic Finance. IRTI Policy Paper No. PP/2017/01. Jeddah.

Peeters, H. (2003). Sustainable development and the role of the financial world. Environment, Development and Sustainability, 5, 197–230. https://doi.org/10.1023/A:1025357021859

Pollard, J., & Samers, M. (2007). Islamic banking and finance: Postcolonial political economy and the decentring of economic geography. Transactions of the Institute of British Geographers, 32(3), 313–330.

Prakash, N., & Sethi, M. (2021). A review of innovative bond instruments for sustainable development in Asia. International Journal of Innovation Science, Ahead-of-Print. https://doi.org/10.1108/IJIS-10-2020-0213

Puteh, A., Rasyidin, M., & Mawaddah, N. (2018). Islamic banks in Indonesia: Analysis of efficiency. Proceedings of MICoMS, 1, 331–336. https://doi.org/10.1108/978-1-78756-793-1-00062

Rahman, M., Isa, C. R., Tu, T. T., Sarker, M., & Masud, A. K. (2020). A bibliometric analysis of socially responsible investment sukuk literature. Asian Journal of Sustainability and Social Responsibility, 5, 7. https://doi.org/10.1186/s41180-020-00035-2

Rahman, H. U., Zahid, M., & Muhammad, A. (2022). Connecting integrated management system with corporate sustainability and firm performance: From the Malaysian real estate and construction industry perspective. Environment, Development and Sustainability, 24(2), 2387–2411. https://doi.org/10.1007/s10668-021-01538-2

RAM, Rating Agency Malaysia. (2020). Sovereign Sukuk Dominated Issuance in 1H 2020 despite Global Contraction.

Rethel, L. (2011). Whose legitimacy? Islamic finance and the global financial order. Review of International Political Economy, 18(1), 75–98. https://doi.org/10.1080/09692290902983999

RFI, Responsible Finance Institute (2018). Environmental impact in Islamic finance. Retrieved 05 July 2022 from http://report.rfi-foundation.org/download.html

Rivera, J. M., Muñoz, M. J., & Moneva, J. M. (2017). Revisiting the relationship between corporate stakeholder commitment and social and financial performance. Sustainable Development, 25, 482–494. https://doi.org/10.1002/sd.1664

Roslen, S. N. M., Sahlan, L. A. B., & Mary, P. (2021). Yield behavior of green SRI Sukuk. Global Business and Management Research: An International Journal, 13(4), 127–138.

Russo, A., Mariani, M., & Caragnano, A. (2021). Exploring the determinants of green bond issuance: Going beyond the long-lasting debate on performance consequences. Business Strategy and the Environment, 30(1), 38–59. https://doi.org/10.1002/bse.2608

Sairally, B. S. & Abdullah, M. (2017). Sukuk: Principles & Practices. ISRA.

Salhani, A., & Mouselli, S. (2022). The impact of Tier 1 sukuk (Islamic bonds) on the profitability of UAE Islamic banks. Journal of Financial Reporting and Accounting. https://doi.org/10.1108/JFRA-12-2021-0461

Salman, A., Jaafar, M., Mohamad, D., & Khoshkam, M. (2022). Understanding multi-stakeholder complexity & developing a causal recipe (FSQCA) for achieving sustainable ecotourism. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-022-02488-z

Scott, W. R. (1995). Institutions and organizations. Sage.

Shen, F., Ma, Y., Wang, R., Pan, N., & Meng, Z. (2019). Does environmental performance affect financial performance? Evidence from Chinese listed companies in heavily polluting industries. Quality & Quantity, 53, 1941–1958. https://doi.org/10.1007/s11135-019-00849-x

Shrivastava, P. (1995). Environmental technologies and competitive advantage. Strategic Management Journal, 16, 183–200. https://doi.org/10.1002/smj.4250160923

Siswantoro, D. (2018). Performance of Indonesian green sukuk (Islamic bond): a sovereign bond comparison analysis, climate change concerns? IOP Conference Series: Earth and Environmental Science, 200, 012056. https://doi.org/10.1088/1755-1315/200/1/012056

Siswantoro, D., & Surya, H. V. (2021). Indonesian Green Sukuk (Islamic Bond) of climate change: A revisited analysis. IOP Conference Series: Earth and Environmental Science, 716, 012044. https://doi.org/10.1088/1755-1315/716/1/012044

Smaoui, H., & Nechi, S. (2017). Does sukuk market development spur economic growth? Research in International Business and Finance, 41, 136–147. https://doi.org/10.1016/j.ribaf.2017.04.018

Smaoui, H., Mimouni, K., & Temimi, K. (2020). The impact of Sukuk on the insolvency risk of conventional and Islamic banks. Applied Economics, 52(8), 806–824. https://doi.org/10.1080/00036846.2019.1646406

Sun, Y., & Tang, X. (2022). The impact of digital inclusive finance on sustainable economic growth in China. Finance Research Letters, 50, 103234. https://doi.org/10.1016/j.frl.2022.103234

Suriani, S., Abd Majid, M. S., Masbar, R., Wahid, N. A., & Ismail, A. G. (2021). Sukuk and monetary policy transmission in Indonesia: the role of asset price and exchange rate channels. Journal of Islamic Accounting and Business Research, 12(7), 1015–1035. https://doi.org/10.1108/JIABR-09-2019-0177

Surroca, J., Tribó, J. A., & Waddock, S. (2010). Corporate responsibility and financial performance: The role of intangible resources. Strategic Management Journal, 31(5), 463–490. https://doi.org/10.1002/smj.820

Susanto, J., Zheng, X., Liu, Y., & Wang, C. (2020). The impacts of climate variables and climate-related extreme events on island country’s tourism: Evidence from Indonesia. Journal of Cleaner Production, 276, 124204. https://doi.org/10.1016/j.jclepro.2020.124204

S&P Global Ratings (2022). Islamic Finance Outlook-2022 edition. Dubai: United Arab Emirates. Retrieved 11 July 2022 from https://www.spglobal.com/ratings/en/research/pdf-articles/islamic-finance-outlook-2022-28102022v1.pdf.

Tan, Y.-L., & Shafi, R. M. (2021). Capital market and economic growth in Malaysia: The role of ṣukūk and other sub-components. ISRA International Journal of Islamic Finance, 13(1), 102–117. https://doi.org/10.1108/IJIF-04-2019-0066