Abstract

This study examines the moderating effect of institutional quality on the finance–growth nexus in the West African region via dynamic panel generalized method of moments. The findings reveal that the linear financial development has a separate positive influence on growth, while the interaction between financial development and institutional quality has a negative effect on growth. It implies that institutional quality constitutes a drag that diminishes and leaks out the growth benefits of financial development in West Africa. The threshold level of institutional quality beyond which financial development accelerates economic growth in the region is found to be 4.77 on the ordinal scale of 10 points. It is, however, evident that most of the countries in West Africa operate below the threshold. Hence, it is concluded that the institutional framework weakens the impact of finance on growth in the subregion of sub-Saharan Africa.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The positive role of financial development in stimulating economic growth has become a stylized fact (Wu et al. 2020; Gazdar and Cherif 2015; Ang 2008; Pagano 1993) in financial economics literature. Financial sector bridges the gap between deficit and surplus units through mobilizations and channelization of savings to finance promising entrepreneurial activities and viable investments with high rate of returns. This subsequently stimulates and spurs economic growth (Rahman et al. 2020; Ehigiamusoe and Lean 2019; Ehigiamusoe et al. 2019; Pan and Yang 2018; Türsoy and Faisal 2018; Bist 2018; Pan and Mishra 2018; Adusei 2018; Pagano 1993, King and Levine 1993; Levine 1991). This onus of allocating financial resources efficiently to boost the productive activities of the real sector lies in a well-functioning financial system (Khan et al. 2019; Hondroyiannis et al. 2005; Levine 1997). The recent trends in theoretical and empirical studies have shown that fruitful financial intermediations, quality and performance of a financial system require sound institutional framework and environment (Haini 2019; Fernández and Tamayo 2017; Law et al. 2014; Law et al. 2013a, b; Huang 2010; Miletkov and Wintoki 2009; Herger et al. 2008; Ahlin and Pang 2008; Baltagi et al. 2007; Capasso 2004; Ghirmay 2004; La Porta et al. 1997; Levine 1997). This is premised on the argument that it is not just financial development that matters for growth but financial development that is well rooted within a sound institutional framework (Law et al. 2018a; Law et al. 2013a, b; Muye and Muye 2017; Gazdar and Cherif 2015; Yahyaoui and Rahmani 2009; Demetriades and Law 2006). On the positive side, strong and efficient institutions enhance allocation of resources to productive activities (Acemoglu et al. 2005), while, on the other side, weak institutions tend to accommodate lapses and loopholes in a financial system which culminate in opportunistic behavior and sharp practices that are capable of diverting credit and distorting the ability of financial intermediaries to channel resources to productive activities of the real sector (Demetriades and Law 2006). This implies that positive effect of financial development on economic growth is conditional on the quality of institution in the economy. It is also an indication that more finance without sound institutions may not succeed in delivering economic benefits which foster and trigger growth (Demetriades and Law 2006).

Studies have shown that financial development has a larger positive effect on economic growth when financial system is embedded within a sound institutional framework (Haini 2019; Law et al. 2018a; Naceur et al. 2017; Kutan et al. 2017; Gazdar and Cherif 2015; Demetriades and Law 2006; Law and Habibullah 2006). In view of this assertion, the popular principle of “more finance, more growth” (Levine 2003) has been questioned in favor of “better finance, more growth” (see Law et al. 2018a; Raheem 2017; Raheem et al. 2016; Law et al. 2013a, b). It is opined that an economy is better financed when there are good institutions to ensure proper channelization of resources to productive activities in order to deliver more growth. However, more finance without good institutions may not translate to more growth, as political inferences and corruption in the financial system tend to divert credits to unproductive or wasteful activities (Law et al. 2018a; Demetriades and Law 2006) which are growth inhibiting. Hence, weak institutions inhibit growth-spurring tendency of financial development. This suggests that growth-enhancing role of financial development is contingent on the institutional quality. It has also been argued that increase in financial development, captured by standard indicators of financial development, may not result in increased growth owing to corruption and political interferences in the financial system which may culminate in abetting the diversion of credits to unproductive uses or wasteful activities (Law et al. 2018a; Ibrahim and Alagidede 2017a; Gazdar and Cherif 2015; Law et al. 2013a, b; Demetriades and Law 2006). This clearly supports the assertion that institutions make a difference in the way financial development influences economic growth (Demetriades and Law 2006).

Premised on this assertion, issues surrounding how institutions affect the growth-enhancing role of financial development have continued to attract the interests of scholars across the globe and the results of their research outputs are far from being conclusive. While some studies established that institutions played a complementary role to financial development in stimulating economic growth (Law et al. 2018a; Kutan et al. 2017; Gazdar and Cherif 2015; Balach and Law 2015; Arcand et al. 2015; Law et al. 2013a, b; Anwar and Cooray 2012; Yahyaoui and Rahmani 2009; Law and Habibullah 2006; Demetriades and Law 2006), some other studies found institutions to be constituting drags to the growth benefits of financial development, which implies that institutions and financial development are substitutes to each other in the growth process (Compton and Giedeman 2011; Ahlin and Pang 2008). Also, a few studies have empirically confirmed insignificant role of institutional quality in spurring financial development to produce better effect on growth (Effiong 2015; Rachdi and Mensi 2012). Aside from the mixed findings of extant studies, various studies have shown that the financial system in sub-Saharan Africa is the least developed in the whole world (IMF 2016; Tyson 2016; Kuada 2016; Demetriades and Fielding 2012; Allen et al. 2011; Andrianaivo and Yartey 2010). This is equally supported by the empirical findings of Allen et al. (2014) which used two indicators of financial development (both liquid liabilities and private credit as ratios of GDP) to show that sub-Saharan Africa (SSA) persistently lags behind from 2005 to 2011 as a region with the least developed financial market (Table 1). It is obvious that SSA’s financial market is showing a sign of marginal improvement but backward and least developed when compared to other regions in the world.

Some scholars have attributed underperformance of SSA’s financial market to weak institutional environment in the region (Menegaki and Tugcu 2016; Kuada 2016; IMF 2016; Tyson 2016; Demetriades and Fielding 2012; Andrianaivo and Yartey 2010). This goes in line with the assertion that the performance and quality of financial system depend on the quality of institutional environment (Fernández and Tamayo 2017; Law et al. 2014; Law et al. 2013a, b; Huang 2010; Miletkov and Wintoki 2009; Ahlin and Pang 2008; Baltagi et al. 2007; Capasso 2004; Ghirmay 2004; La Porta et al. 1997; Levine 1997), most especially in developing countries (Le et al. 2016). Proper channelization of resources from financial sector to productive activities in SSA where corruption and political interferences thrive may be challenging. In spite of this precarious situation, empirical studies that focused on this important subject in SSA are sparse.

2 Rationale for the study

Despite the weak financial development and deteriorating institutional framework in sub-Saharan Africa, up till date, there are only three studies (Aluko and Ibrahim 2020a; Bandura and Dzingirai 2019; Effiong 2015) which examined the role of institutions in stimulating financial development to impact positively on economic growth in SSA. Effiong (2015) considered only 21 SSA’s countries, Bandura and Dzingirai (2019) considered 28 countries and Aluko and Ibrahim (2020a) also selected 28 SSA’s countries. These three studies randomly selected the countries without taking cognizance of peculiarities of each geographical structure and heterogeneities of SSA’s subregions. Neglect of these particularities and different paces of institutional and financial development tends to undermine the usefulness of research output for appropriate policy recommendation. Another more recent study by Sghaier (2018) focused mainly on panel study of four North African countries. This present study deviates from the extant studies by providing the first attempt to examine the role of institutional quality in the nexus between financial development and economic growth in West African countries.

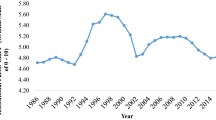

This study focuses on West Africa for some peculiar reasons. One, it is necessary because the institutional framework which governs and characterizes the financial system in West Africa appears to be weaker than what is obtainable in some other subregions in SSA. Following extant studies (Law et al. 2018a; Muye and Muye 2017; Law et al. 2013a, b), the ICRG (International Country Risk Guide) data on five institutional quality measures adopted are rescaled to 0–10 for comparability and uniform interpretations. The measures are subsequently averaged to compute an institutional quality index. The highest value the subregion attained was 4.73. This value was recorded in 1999. It means, on average, that the institutional quality index in West African countries is better in 1990s than in 2000s. From 1986 to 2015, the subregion persistently scored below 5 out of possible 10 points. The overall average value of the index in West Africa for the periods is 4.32 (47.3%). The trend of institutional development in West Africa does not follow a definite pattern (Fig. 1), and it oscillates ups and downs between 3.72 (recorded in 1987) and 4.73 (obtained in 1999). The oscillatory pace of institutional development may impair efficient allocation of resources from financial system to real sector and subsequently constitute a drag which leaks out the growth benefits of financial development in West African countries. The institutional development in the subregion appears weak, and it may accommodate loopholes and lapses which tend to inhibit the efficiency of financial system to properly finance productive activities of the real sector in West African countries. Two, the subregion is the largest in SSA in terms of population (Ehigiamusoe and Lean 2019). It means that whatever happens to West Africa tends to affect the entire SSA. Three, West African subregion is the fastest growing economy in Africa with a 7.2% growth rate in 2012 (Abekah-Koomson et al. 2019; African Economic outlook 2013). Four, most countries in West Africa are characterized by weak institutions (Aluko and Ibrahim 2020b) which threaten the growth-enhancing role of financial development in the subregion. Five, it tends to provide new insights on the effectiveness of various institutional reforms in financial sectors of West African countries. This is necessary as the knowledge of how institutional quality influences the finance–growth nexus is key to the policy formulations.

Furthermore, studies (Law et al. 2018a; Gazdar and Cherif 2015; Law et al. 2013a, b; Chinn and Ito 2006) have shown that there is a certain level of institutional quality threshold which has to be attained before financial development can be stimulated to accelerate economic growth. It has been suggested that below the institutional quality threshold, the effect of financial development is insignificant, while the growth effect of financial development becomes significant and positive above the threshold level (Ng et al. 2015; Law et al. 2013a, b). Studies that determine the threshold level of institutional quality beyond which financial development is strongly stimulated to enhance economic growth from sub-Saharan Africa, West African subregion in particular, are scarce. Thus, this study contributes to the extant studies by determining the level of institutional quality threshold in the finance–growth nexus in West Africa. Ascertaining the threshold tends to help and guide the policymakers and stakeholders on the minimum level of institutional quality that must be attained before countries in the subregion of SSA can benefit optimally from financial development in terms of economic growth.

In synopsis, apart from unveiling the linear effects of institution and financial development on economic growth, this paper adds steam to the existing studies by unearthing and providing new empirical evidence on the role institutional quality plays in mediating the influence of financial development on economic growth in West Africa. The knowledge of this is fundamental for policy formulations and implementations. Also, this study uncovers the threshold level of institutional quality beyond which financial development promotes and accelerates economic growth in the subregion of SSA. This is imperative as it would help countries in the subregion to ascertain the minimum level of institutional quality that is needed to facilitate and provide necessary stimulus for financial development to impact positively on growth.

The remainder of this study is organized as follows: Sect. 2 provides a brief overview of institutional quality and its implications on the efficiency of financial intermediation in West Africa; Sect. 3 discusses the theoretical underpinning and empirical evidence on the thematic subject of the study. Issues pertaining to methodology, data sources and description are examined in Sect. 4. Presentation and discussion of empirical findings are done in Sect. 5, while the last section focuses on the conclusion of the study.

3 Overview of institutional quality in West African countries

The appraisal of five institutional quality measures for 13 West African countries is examined, and their probable implications on the ability of financial system to allocate meagre resources of the subregion efficiently are equally discussed. The results of detailed analyses of institutional quality in the selected West African countries as measured by recognized and standard indicators such as corruption control (0–6), bureaucratic quality (0–4), law and order (0–6), government stability (0–12) and democratic accountability (0–6) are presented in Table 2. Following the existing studies (Law et al. 2018a; Muye and Muye 2017; Law et al. 2013a, b), the institutional quality measures are rescaled to 0–10 in order to allow comparability and uniform interpretations. The average index of institutional quality is computed to reflect the average faring of institutional quality in the selected countries of West Africa. Table 2 provides the pieces of information on the appraisal of institutional quality. Following the arguments in the literature that the success of financial sector reforms depends largely on the quality of institutions put in place. This is borne out of the fact that channelization of financial resources to productive activities which are the key ingredients to economic growth requires a sound institutional framework which blocks leakages and loopholes. Here, higher values of the institutional quality index imply strong institutional quality. The closer the value is to zero, the weaker the institution becomes. The rating of 10 indicates a very strong institutional environment or flawless institutions.

3.1 Corruption control

Corruption control is an index of institutional quality which measures the extent to which public powers and people are being checkmated to forestall or reduce inducements and sharp practices against the norms in public services and private affairs. The ICRG data reveal that corruption control in West African countries is below average in all of the years analyzed. Since this index failed to reach average value throughout the study period, it is an indication of weak institutions in West Africa which may abet corrupt practices and political interferences in financial system of the region. This may not be unconnected with the inabilities of regulatory agencies and parastatals to prevent corrupt practices in financial markets. The tendency for credit to be channeled to productive activities which give necessary impetus to economic growth without shady dealings in such an environment may be very low. The data reveal that control of corruption in the subregion does not follow a clear direction, as the trend oscillated ups and downs with no sign of focus. Ideally, corruption control supposed to be improving over time, but the reverse was the case in West African countries. The best of corruption control in the subregion was attained in the past, precisely in 1990s, while the index seemed to be worse off in 2000s. This may not facilitate efficient channelization of financial resources to productive sector.

3.2 Bureaucratic control

Bureaucratic quality measures government effectiveness. It captures the perceptions about the quality of public services, civil service and their degrees of independence from political pressures in policy formulation and implementation. Bureaucratic quality also gives a detailed account of government’s commitment and credibility to her policies. The best of this index in the selected West African countries was attained in 1990. This deteriorating performance may not be unconnected with countries such as Togo, Sierra Leone and Cote d’Ivoire hitting value of zero in the period. The mentioned countries recorded zero quality of bureaucracy in the period. Also, Mali and Liberia persistently scored zero out of 10 points in the entire study period (1986–2015). For the entire subregion, the index was 2.40 in 2009 and it has remained at that level till 2015. The bureaucratic quality supposed to be improving, but the reverse is the case for West African countries. This has great implication on the quality of financial system in the subregion. This might have impaired the success of various financial sector reforms, as the efficacy of parastatals and agencies in charge of policy implementation to boost the quality of financial services and contracts could not be guaranteed. This goes in tandem with the claims of Aluko and Ibrahim (2020a, b), Ibrahim and Alagidede (2017a), Kuada (2016), IMF (2016), Demetriades and Fielding (2012), Tyson (2016) and Mlachila et al. (2016) which attributed the weak financial development in sub-Saharan Africa to weak institutional quality.

3.3 Law and order

Law and order also known as “rule of law” has been tagged market-creating institutions. This measures the extent or degree to which people within a country are willing and ready to accept the established institutions to make and adjudicate disputes (Das and Quirk 2016). Sound rule of law ensures stakeholders have confidence and trust in the activities of financial system. This tends to foster financial development as legitimate activities in financial sector are encouraged, and corrupt practices and shady dealings are checkmated to barest minimum. It is observed that law and order index of institutional quality is below the average of 5 in all the years analyzed. Since law and order has been tagged market-creating institutional index, the data show that market-creating institutions for financial development in the subregion appear weak and below average. This gives impression that there is a very infinitesimal likelihood for people to yield positively to the institutional reforms in financial sector of West African countries. Also, weak law and order might impair the stakeholders’ confidence and trust in the activities of financial markets and it could also weaken the efficacies of financial intermediations in West African countries.

3.4 Government stability

Still on the selected West African countries, another measure of institutional quality considered in this study is government stability. This measures the extent of political stability and the absence of violence/terrorism in an economy. Based on the data from ICRG, the selected West African countries appear to be improving and well above average. This dimension has, however, changed to an upward trend. Although, the index nose-dived in 2000s, but it stood well above average value of 5. Overall average of the index is 6.00. This indicates the evidence of strong government stability. The influence of this on financial development is a matter of empirical analysis, as this may not be revealed adequately via mere data analysis.

3.5 Democratic accountability

Democratic accountability refers to the extent to which a country’s citizens are able to participate in selecting their government and reward or sanction officials in charge of setting and enacting public policy (Jelmin 2012). West African countries performed above average. The index showed high level of inconsistent trends, but, on the average, it could be interpreted that democratic accountability is on the increasing trend. This is presumed because the least value was recorded in 1986 and the highest value happened to be in 2000s. There is a cause for concern, as the trend is expected to be consistently improving. On average, the democratic accountability in West African countries seems to be weak and this may hinders the transparency and accountability in the financial system of the countries.

3.6 Overall institutional index

The index of institutional quality does not follow a definite pattern. It oscillated ups and downs (Fig. 1). It is obvious that institutional quality is better in 1990s than in 2000s. Also, overall average value of the index in West Africa is 4.32. It indicates the state of weak institutional environment in West African countries. This hints that the level of institutional development in West Africa is not encouraging and the pattern does not portray a serious focus of a particular direction. The quality of institutions in the subregion is below average. The implication of this weak institutional quality on financial development is a subject of empirical analyses. The extant theoretical and empirical studies have emphasized the importance of a sound institutional framework as a sine qua non for financial development. Allocation of credit to productive activities has been described a mirage in the face of weak/porous institutional quality. This could also affect the influence of financial development on economic growth. It is needful to emphasize that the trend of institutional quality index (Fig. 1) does not show any serious efforts on the part of governments of selected countries to focus on the development of institutions to foster the institutional reforms which are capable of enhancing the efficiency of financial system.

4 Literature review

4.1 Theoretical issues

This study draws its theoretical foundation from endogenous growth theory. Within the context of endogenous growth theory, the institutions are regarded as the necessary ingredients to ensure efficiency in the allocation of resources to stimulate and provide positive impetus that reduces transaction cost and facilitates technological progress, innovative drives and economic activities which are stimulus that spur long-run growth (Ang 2008; Acemoglu et al. 2005; Levine 1991, 1997; Aghion et al. 1998). It is theorized that institution is an endogenous factor in economic growth which explains “why some countries are richer than others” (Romer 1989; Lucas 1988; Hall and Jones 1997; Acemoglu and Johnson 2005). Good institutions reduce bottlenecks and corrupt bureaucracy which act as taxes on the productive activities of the economy (Hall and Jones 1997). Similarly, in endogenous growth theory, it is conceptualized that financial development influences steady-state growth rate via the efficient allocation of capital to different investments alternatives (Blackburn and Hung 1998; Levine 1991; Pagano 1993). It is postulated within the context of endogenous growth theory that financial intermediation affects growth through saving rate (Pagano 1993). This occurs as financial intermediaries convert savings into productive investment which ginger economic growth. It is theorized that financial development reduces the loss of resources in the economy by bridging the gap between surplus and deficit units. However, the potential loss of resources is recognized in the process of mobilizing and channeling resources to investment, as certain percentage of resources are lost due to potential inefficiency in the financial system, which is termed the cost of financial intermediations (Pagano 1993). Premised on this theoretical foundation, this study postulates that efficient institutions are capable of increasing the efficiency of financial intermediaries, which may, in turn, culminate in reducing the potential loss of resources in the process of converting savings into productive investment. Thus, this study postulates that institutions provide impetus that enhances the positive role of financial development in the growth process. Financial development and institutions are endogenously developed to interplay in the growth process. Hence, following the position of endogenous growth theory, this study raises a hypothesis that institutions make a difference in the way financial development influences economic growth.

4.2 Empirical evidence

On both theoretical and empirical fronts, studies have provided evidence that financial development has the capacity to accelerate economic growth. Financial sector mobilizes and allocates resources efficiently to investment with high rate of returns, thereby enhancing economic growth (Ehigiamusoe et al. 2019; Hondroyiannis et al. 2005). However, it has continued to be one of the most intensely debated areas in financial economics. While the baseline studies such as Bagehot (1873), Schumpeter (1911), Patrick (1966), Levine (1991, 1999, 2005) and Pagano (1993) support the theoretical importance of financial development as an ingredient of growth, Lucas (1988), Robinson (1952) and Miller (1998) consider it as a badly over-stressed factor in growth that does not deserve serious discussion. Similarly, on the empirical sphere, the debates persist. Bulk of extant studies established positive impact of finance on growth (Pan and Yang 2018; Türsoy and Faisal 2018; Alexiou et al. 2018; Law et al. 2018a; Nyasha and Odhiambo 2018; Bist 2018; Pan and Mishra 2018; Puatwoe and Piabuo 2017; Ang 2008; Pagano 1993; King and Levine 1993), while some showed evidence of negative (Ehigiamusoe and Lean 2019; Iheanacho 2016; Gazdar and Cherif 2015; Adusei 2012; Loayza and Ranciere 2006). Still some other studies found evidence of insignificant impact of finance on growth (Narayan and Narayan 2013). Aside from these mixed and inconclusive findings, recent studies have highlighted the important role of institutional quality in facilitating financial development to impact economic growth (Law et al. 2018a; Ng et al. 2015; Law et al. 2013a, b; Demetriades and Law 2006).

It has been argued that finance–growth nexus is conditional on the level of institutional quality (Law et al. 2018a; Gazdar and Cherif 2015; Law et al. 2013a, b; Demetriades and Law 2006) an economy develops or fails to develop. Good institutions provide stimuli that enhance the efficiency of financial system to allocate resources to investment that spur growth, while weak institutions accommodate sharp practices and opportunistic behavior that culminate in corruption and political interferences that divert credit to unproductive and wasteful activities which leak out the growth benefits and productivity-enhancing tendency of financial development. Sequel to this assertion, scholars have empirically examined the role institutions played in the way financial development influences economic growth. The first empirical evidence was provided by Demetriades and Law (2006) in a panel analysis of 78 countries for the period 1978–2000 within the framework of mean group (MG) and pooled mean group (PMG) estimation techniques. The study established that institutional quality stimulated financial development to produce strong positive effect on economic growth. The similar results were obtained by Yahyaoui and Rahmani (2009) in panel study of 22 developing countries from 1990 to 2006. These studies indicated that financial development has larger positive effects on economic growth when financial system is embedded within a sound institutional framework.

Corroborating the evidence of extant studies, Law et al. (2013a, b) via Caner and Hansen (2004) instrumental variable threshold regression method found that finance–growth nexus is contingent on the institutional quality. It is ascertained that financial development promotes economic growth after institutions exceed a certain threshold level. The study emphasized the importance of better institutional environments for an economy to exploit the growth benefits financial development. It is inferred that low quality of institution tends to impair the ability of financial intermediaries to channel resources efficiently to finance productivity-enhancing activities. Likewise, similar results were obtained by Gazdar and Cherif (2015) within the framework of generalized method of moment (GMM) in a panel dataset of 18 MENA countries from 1984 to 2007. It is documented that institutional quality mitigated the negative effect of financial development on economic growth. The study further established that a threshold level of institutional quality must attain before financial development accelerates growth. The findings indicated that most of the MENA countries operated below the threshold, and it is obvious that there is a weak institutional infrastructure in the region which may weaken the positive impact of financial development on economic growth. The similar findings were documented by Arcand et al. (2015). The only study that examined the threshold of institutional quality in the finance–growth nexus in sub-Saharan Africa is Aluko and Ibrahim (2020a, b). The study adopted threshold regression analysis but failed to consider the peculiarity and weak institutions in West African subregion.

Furthermore, Kutan et al. (2017), in a more recent study of 21 MENA countries from 1980 to 2012, found institutional quality playing a complementary roles to financial development in stimulating economic growth. On the contrary, Rachdi and Mensi (2012) adopted the same estimation technique but found that institutional quality played no significant role in stimulating financial development to impact on growth in a sample of 13 MENA countries for the period 1990–2008. This contradicts the research output of Balach and Law (2015) which employed the same technique with Demetriades and Law (2006) to analyze the panel study of four South Asian Association for Regional Cooperation countries from 1984 to 2008. It is established that financial development has larger effects on economic performance when financial sector is embedded within a sound institutional framework. Also, Anwar and Cooray (2012) and Law and Habibullah (2006) confirmed the similar results in panel analyses of Asian countries. These studies found institutions and financial development to be complementing each other in the growth process (Table 3).

Negating the position of extant studies, Ahlin and Pang (2008) found the evidence that both financial development and corruption control were substitutes to each other in the course of promoting economic growth in a sample of 45 countries from 1960 to 2000. The marginal growth benefits of improving financial development are found to be greater when a country has higher corruption levels than at lower levels. It was reported that when corruption falls, the effect on growth seems to be higher in an economy with low levels of financial development than in a financially developed economy. The similar results were replicated by Compton and Giedeman (2011) in panel dataset of 90 countries. It was documented that institutions constituted drag that leaked out the positive effect of financial development on economic growth. The critical reviews above revealed that the outcomes of the existing are mixed and inconclusive. Meanwhile, the only studies which focused on sub-Saharan Africa are that of Aluko and Ibrahim (2020a, b) and Effiong (2015), while Berhane (2018) considered Africa with no emphasis on the heterogeneity of subregions in the continent. More so, Sghaier (2018) focused mainly on panel analysis of four North African countries (Tunisia, Morocco, Algeria and Egypt). Effiong (2015) established that institutional quality played an insignificant role in spurring financial development to impact positively on growth. The study covered randomly selected 21 countries without taking cognizance of heterogeneities of subregions of SSA. This may have undermined the research outcomes. This result is consistent with the findings of Bandura and Dzingirai (2019) considered 27 sub-Saharan African countries. Also, Berhane (2018), in a panel dataset of 40 African countries, found that institutional quality constituted a drag that leaked out the positive effect of financial development on economic growth. The study did not make an attempt to consider the heterogeneity and peculiarity of regions and subregions of the African continent. On the contrary, Sghaier (2018) revealed that institutions worked as a complement to financial development in the growth process. It is evident that the growth effect of financial development is more pronounced in the presence of the institutional quality. The study, however, relied on economic freedom index as a proxy for institutional quality, which may not be adequate. In a more recent study, Aluko and Ibrahim (2020a, b) in a panel study of 28 sub-Saharan African countries established that institutional quality complemented financial development to produce stronger positive effect on economic growth. The study also determined the threshold value of institutional quality beyond which institutions stimulate financial development to spur economic growth in sub-Saharan Africa. Meanwhile, the study did not give credence to the heterogeneity and peculiarity of each subregion in sub-Saharan Africa.

Also, Berhane (2018), Sghaier (2018) and Effiong (2015) did not make effort to determine the threshold level of institutional quality beyond which financial development is stimulated to spur growth in SSA. Also, none of extant studies focused on West African subregion. These obvious gaps are captured in this present study by examining the role institutional quality plays in the way financial development influences economic growth in West African countries. Also, deviating from extant studies in West Africa, this study determines the threshold of institutional quality beyond which financial development can accelerate economic growth in the subregion.

5 Methodology

5.1 Data source and description

This study makes use of annual dataset consisting of observations for 13 West African countries over the periods of 1986–2015. The sampled countries are Burkina Faso, Cote d’Ivoire, Gambia, Ghana, Guinea, Guinea-Bissau, Liberia, Mali, Niger, Nigeria, Sierra Leone, Senegal and Togo. Annual data on real gross domestic product (GDP) per capita, financial development indicators (private sector credit and domestic credit, these indicators are expressed as ratios of GDP), gross domestic product and gross fixed capital formation were obtained from World Development Indicator (World Development Indicator 2017). All these data are in US dollars based on 2010 constant prices. Also, following the extant studies (Law et al. 2018a, b, Gazdar and Cherif 2015), institutional quality is measured by five indicators such as (1) corruption control, (2) democratic accountability, (3) law and order, (4) bureaucratic quality and (5) government stability. Data on these institutional quality indicators were obtained from International Country Risk Guide (ICRG) assembled by Public Risk Services (PSR) group. The first three of these institutional quality measures are on the scale of 0–6, while the last two are on the scales of 0–4 and 0–12, respectively. In order to allow uniform interpretation and comparability, following the extant studies (Aluko and Ibrahim 2020a; Law et al. 2018a; Muye and Muye 2017; Law et al. 2013a, b) the institutional quality indicators are rescaled to 0–10. Higher value implies better institutional quality and vice versa (Gazdar and Cherif 2015; Demetriades and Law 2006). The institutional quality index is computed by averaging these five indicators which is referred to as the overall institutions index (see Law et al. 2018a; Law et al. 2013a, b).

5.2 Model specification

5.2.1 Theoretical model

Consistent with the work of Pagano (1993), this study is conceptualized within the framework of the simplest endogenous growth model called AK model. The potential effects of financial development on economic growth are captured. The process starts by making aggregate output \(\left( {Y_{t} } \right)\) a linear function of the aggregate capital stock \(\left( {K_{t} } \right)\). This is expressed as follows:

This production function recognizes capital as the only factor of production, and “\(A\)” measures the productivity of capital, and it depends on the efficiency of technological innovation (Thiel 2001). The capital stock changes over time to enhance the productivity with the depreciation of rate, \(\delta\), per period. It shows that investment is made in capital stock so as to increase aggregate output. This is explained as follows:

Assuming an economy without government activity, equilibrium is attained in the capital market when gross saving \(\left( {S_{t} } \right)\) is equal to gross investment \(\left( {I_{t} } \right)\). Under the condition of equilibrium, savings are mobilized from surplus unit through the activities of financial intermediaries, which are subsequently channeled to investments. It is assumed that a certain proportion, \(1 - \emptyset\), of savings’ flows are lost in the course of financial intermediation. This implies that the proportion, \(\emptyset\), is successfully channeled to investment. This means

\(\emptyset\) measures the efficiency of financial intermediation. It explains the proportion of available savings that are converted to investment. The remaining proportion, \(1 - \emptyset\), represents the savings that are not converted to investment, and it stands for the cost of financial intermediation. This goes to financial intermediaries such as banks, securities brokers and dealers as fees, commission and the likes

The two variables in Eq. (1), namely \(Y_{t}\) and \(K_{t}\), are expressed in terms of growth rate at time, \(t\) as follows: \(g = {\raise0.7ex\hbox{${\left( {Y_{t + 1} - Y_{t} } \right)}$} \!\mathord{\left/ {\vphantom {{\left( {Y_{t + 1} - Y_{t} } \right)} {Y_{t} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${Y_{t} }$}} = {\raise0.7ex\hbox{${\left( {K_{t + 1} - K_{t} } \right)}$} \!\mathord{\left/ {\vphantom {{\left( {K_{t + 1} - K_{t} } \right)} {K_{t} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${K_{t} }$}}\). These denote the respective steady-state growth rates of the output and capital stock. The term \(K_{t - 1}\) is sorted out in Eq. (2), and the expression in Eq. (3) is substituted into steady-state growth rate. Following these processes, the steady-state growth rate is expressed as thus:

where \(s_{t}\) is the gross savings rate, and it represents \({\raise0.7ex\hbox{${S_{t} }$} \!\mathord{\left/ {\vphantom {{S_{t} } {Y_{t} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${Y_{t} }$}} = {\raise0.7ex\hbox{${S_{t} }$} \!\mathord{\left/ {\vphantom {{S_{t} } {AK_{t} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${AK_{t} }$}}\). Equation (4) explains concisely how financial development influences growth, \(g\). The three possible transmission channels are well captured by \(A, \emptyset \; {\text{and}}\; s\).

An increase in \(\emptyset\) indicates an increase in the proportion of savings channeled to investment. It suggests an efficiency in the channelization of savings to investment and also signals a reduction in the loss of resources \(\left( {1 - \emptyset } \right)\) in the course of financial intermediation. Consistent with the proposition of Pagano (1993), the contribution of financial development to steady-state growth rate depends on the proportion \(\left( \emptyset \right)\) of savings that is converted to investment. It implies that the conversion process of savings to investment is one of the transmission mechanisms through which financial development influences economic growth (Hassan et al. 2011). The theoretical proposition of AK model suggests that financial development improves the efficiency of financial intermediation and subsequently reduces the loss of resources so as to bridge the gap between surplus and deficit units.

Moreover, it is obvious from the AK model version of Pagano (1993) that the mechanism of converting savings to investment relies on financial development and its effect on growth depends on the quality of institutions. Strong institutions reduce corruption, red tape and bottlenecks in the financial system which subsequently stimulate growth (Claessens and Laeven 2003). This increases the efficiency \(\left( \emptyset \right)\) of financial intermediaries (Gapy et al. 2015) and reduces the probable loss of capital (\(\left( {1 - \emptyset } \right)\). It shows that institutions matter in the finance–growth nexus. Similarly, another way through which financial development influences steady-state growth rate is the component “\(A\)” (productivity of capital). Endogenous growth theorists assert that financial intermediaries increase the efficiency and productivity of physical and human capital through allocation of financial resources to finance the innovative activities of entrepreneurs (Rahman et al. 2020; King and Levine 1993; Schumpeter 1911).

The effectiveness of this process depends on the quality of institutions. Strong institutions ensure appropriate channelization of capital to productive activities. On the contrary, weak institutions give room for opportunistic behavior and rent-seeking activities which culminate in diverting credits to unproductive ventures (Demetriades and Law 2006; Law and Habibullah 2006; Nelson and Sampat 2001; North 1990). The third component in Eq. (4) through which financial development influences steady-state growth rate is saving rate \(\left( s \right)\). The interpretations of saving rate in Eq. (4) are not straightforward. The argument persists whether the prospects of better returns or lower risk on savings tend to induce an increase in the saving ratio, s, or not would in turn produce higher level of economic growth is uncertain (Thiel 2001). This is inferred because higher returns may actually decrease savings. This may be because the same future consumption can be accomplished with higher present consumption and thus lower present savings.

5.2.2 Empirical model

Consistent with the theoretical model, this study follows the modeling style of studies such as Law et al. (2018a), Gazdar and Cherif (2015), Law et al. (2013a, b), Demetriades and Law (2006) and Law and Habibullah (2006). The empirical specification is expressed as thus:

where \({\text{RGDPC}}\) is the real gross domestic product per capita; \({\text{FD}}\) is the financial development; \({\text{INS}}\) is the institutional quality, \(K\) is the capital stock which is proxy by gross fixed capital formation and the \(t\) is the time index. Also, \(\cap_{i}\) is the unobservable country-specific effect (which caters for heterogeneity among the cross-sectional units) and the subscripts \(i\) index countries. \(\gamma_{0} , \gamma_{1} , \gamma_{2} , \gamma_{3} \;{\text{and}}\; \gamma_{4}\) are parameters to be estimated. Aside from the variables in Eq. 1, studies have established that interaction between institutional quality and financial development has a separate impact on economic growth (Law et al. 2018a; Berhane 2018; Gazdar and Cherif 2015; Anwar and Cooray 2012; Demetriades and Law 2006). This is incorporated into Eq. (5), and it is re-specified as follows:

Equation (6) gives room to examine a separate effect of the interaction between financial development and institutional quality on economic growth in West African countries. Following the extant studies (Ehigiamusoe et al. 2020; Ehigiamusoe, Lean and Lee 2019; Olagbaju and Akinlo 2018; Gazdar and Cherif 2015; Hermes and Lensink 2003), the marginal effect of financial development on growth is determined through the partial derivatives of Eq. (6) with respect to financial development \(\left( {\text{FD}} \right)\). This results into Eq. (7) which is expressed as follows:

The role of institutional quality in influencing how financial development influences growth is conditioned on the two parameters: \(\gamma_{2} \;{\text{and}}\; \gamma_{4}\) in Eq. (7). These parameters produce four possibilities:

-

If \(\gamma_{2} > 0 \;{\text{and}}\; \gamma_{4} > 0\), it means that financial development impacts positively on growth, and institutional quality enhances and complements the positive effect.

-

If \(\gamma_{2} > 0 \;{\text{and}}\; \gamma_{4} < 0\), it implies that financial development contributes positively to growth, but institutional quality constitutes a drag which leaks out the positive effect.

-

If \(\gamma_{2} \left\langle {0 \;{\text{and}}\; \gamma_{4} } \right\rangle 0\), it connotes that financial development impacts negatively on growth, but institutional quality mitigates and lessens the negative effect

-

If \(\gamma_{2} < 0 \;{\text{and}}\; \gamma_{4} < 0\), it shows that financial development impacts economic growth negatively and institutions worsen or aggravate the negative effect.

Also, if \(\gamma_{2} \;{\text{and}}\; \gamma_{4}\) in Eq. (7) have different signs, it signals the existence of threshold of institutional quality beyond which financial development is stimulated to have strong effect on growth (Ehigiamusoe et al. 2019). Thus, following the extant studies (Ehigiamusoe et al. 2019; Olagbaju and Akinlo 2018; Gazdar and Cherif 2015; Hermes and Lensink 2003), the threshold of institutional quality is expressed as follows:

Moreover, studies (Buck et al. 2008; Hsiao 2003; Wintoki et al. 2012; Olaniyi et al. 2017a, b) have shown that the inclusion of country-specific effect \(\left( { \cap_{i} } \right)\) with a lagged dependent variable \(\left( {{\text{RGDPC}}_{it - 1} } \right)\) in a dynamic panel data model, as in Eq. (6), often produces biased estimates, using the traditional pooled OLS, fixed or random effect. This is due to the fact that there may be linear correlation between lagged dependent variable and country-specific effect \(\left[ {E\left( {{\text{RGDPC}}_{it - 1} , \cap_{i} } \right) \ne 0} \right]\). The suggested solution in the literature is to take the first difference of Eq. (6). This process facilitates the elimination of country-specific effect \(\left( { \cap_{i} } \right)\) which correlates with the explanatory variable (Arellano and bond 1991). This process of first-differencing transformation of Eq. (6) is given as follows:

where \(\Delta\) stands for first-difference operator. Also, the error terms, \(\Delta \mu_{it}\), of the transformed Eq. (9) meet the conditions of orthogonality. Meanwhile, the transformations that led to Eq. (9) have been able to resolve the problem of potential linear correlation between \({\text{RGDPC}}_{it - 1}\) and \(\mu_{it}\), but it causes another problem, which is the problem of endogeneity (Chang et al. 2011; Chen et al. 2014; Olaniyi 2019). This occurs as a result of potential linear correlation between lagged dependent variable and error term or \(E\left( {\Delta {\text{RGDPC}}_{it - 1} , \Delta \mu_{it} } \right) \ne 0\). Another likely source of potential endogeneity in Eq. (9) is the simultaneity bias (Olaniyi et al. 2017a, b; Ibrahim and Alagidede 2017b; Buck et al. 2008). This explains the possibility of a bidirectional causal relationship between financial development and economic growth (Khan et al. 2019; Nyasha and Odhiambo 2018; Shahbaz et al. 2017; Phiri 2015; Akinlo and Egbetunde 2010). Thus, testing the effect one on the other ignoring the possibility of feedback effect might result in a problem of dynamic endogeneity (Wintoki et al. 2012; Wooldridge 2002). Omitted variable bias is also a potential cause of endogeneity.

In an attempt to address the endogeneity in the model, this study follows the work of Beck et al. (2000) by adopting the newly revised dynamic generalized method of moments (GMM) technique. This approach makes use of instrumental variables to deal with endogeneity. Thus, the linear moment restrictions are applied as follows:

Following these conditions, this study takes after the method of Arellano and Bond (1991) to deliver consistent and reliable estimates. In order to remove the potential problem of outliers in the data distribution, natural logarithms of all the variables are taken (Meo et al. 2018; Shahbaz et al. 2017) with the exception of institutional quality which is already on the ordinal scale of 0–10.

In line with the conditions of adopting the generalized method of moments as the estimation technique, it requires the number of cross-sectional units (N) to be greater than the time-series observation (T). In order to ensure that this condition is fulfilled, following the trend in the literature (Law et al. 2018a; Gazdar and Cherif 2015; Beck et al. 2014; Zang and Kim 2007), three-year average of data is used with a maximum of ten observations per country. The ten observations span 1986–1988, 1989–1991, 1992–1994, 1995–1997, 1998–2000, 2001–2003, 2004–2006, 2007–2009, 2010–2012, 2013–2015. If the panel dataset is not averaged, using annual data tends to increase the number of instruments, and this has high probability of producing too many instruments problem (Law et al. 2018a; Roodman 2009). Besides, the use of three-year average of non-overlapping periods prevents the effects of business cycle phenomenon which tends to forestall biased estimates from GMM estimators (Law et al. 2018a; Effiong 2015; Zang and Kim 2007; Levine et al. 2000; King and Levine 1993).

6 Discussion on empirical findings

6.1 Descriptive statistics and correlation matrix

Before examining the roles and the threshold of institutional factors in the nexus between financial development and economic growth in West Africa, the characteristics of the variables are explored through descriptive statistics. Table 7 (see “Appendix”) provides the descriptive statistics for the variables. The average of real gross domestic product per capita (RGDPC) in West African countries over the study period is $706.14 which is higher than median value $529.25. This shows that the distribution of RGDPC is slightly skewed to the right, and it implies that majority of countries in West Africa have real per capita income that is lower than the average value. RGDPC is not normally distributed, and this is indicated by the value of Jarque–Bera statistic. The real per capita GDP lies between a minimum of $158.03 in Liberia and maximum of $2533.85 in Nigeria. This implies that Nigeria has the highest real per capita GDP in West Africa. Compared to the value of mean ($706.14), the standard deviation is relatively low at $440.05. It indicates that, on average, West African countries have real capita GDP close to the average value. Based on the Jarque–Bera statistic, all other variables except capital stock (K) are not normally distributed. This may be due to country-specific effect and unobservable heterogeneity in panel analysis, and it calls for testing serial correlation.

Furthermore, financial development indicator (FD) shows that the country with the best indicator is Cote d’Ivoire with 40.95 and the country with the least is Liberia with 0.18. Similarly, Gambia has the best (maximum) of institutional factor (INST) which is 6.58, while Liberia has the least (minimum) which is 0.90. These facts point out that Liberia has the weakest institutional quality, lowest real per capita GDP (RGDPC) and least developed financial market in West Africa. These economic situations of Liberia may not be unconnected with the civil war that ravaged the country in the past. On the values of standard deviation, which measures the degree of dispersion from the mean value, the statistic reveals that institutional factor (INST) is the most stable, followed by capital stock (K), financial development index (FD) and real per capita GDP (RGDPC) in serial order. Similarly, the descriptive statistic shows that real GDP per capita (RGDPC) and institutional factor (INST) are leptokurtic (peak) relative to normal distribution, as the series produce coefficient of kurtosis that is greater than 3. On the other hand, financial development indicator (FD) and capital stock (K) yield kurtosis coefficients that are approximately 3. Though the two stay marginally above 3, it could be interpreted that they are in between leptokurtic and mesokurtic in the shape of data distribution.

Besides, the threat of multicollinearity in the model is examined through the correlation matrix coefficients and the results are presented in the tail end of Table 7. The results indicate that the estimated model does not suggest the presence of multicollinearity. The pair with the highest coefficient is between financial development index (FD) and real GDP per capita (RGDPC) which produces 0.40 (40%). This is a moderate percentage which does not portend any serious danger of multicollinearity, as the link between RGDPC and FD is that of dependent–independent relationship.

6.2 Panel unit root tests

In order to examine the appropriateness of methodology, it is necessary to explore the stationarity properties of the variables, most especially in dynamic panel data model (Chen et al. 2014; Chang et al. 2011). This study adopts an array of panel unit root tests in order to deliver reliable and unbiased estimates. In line with the existing studies (Olaniyi 2019; Olaniyi et al. 2017a, b; Chen et al. 2014), the following panel unit root tests are adopted.

LLC (Levin et al. 2002), Breitung (2002) (Breitung’s t-statistic), the IPS (Im et al. 2003), the ADF (augmented Dickey–Fuller) and PP (Phillips–Perron)-Fisher Chi square (Maddala and Wu 1999). While LLC and Breitung assume common unit root processes among cross-sectional units, IPS, ADF-Fisher and PP-Fisher Chi square are based on the assumption of individual unit root processes across cross-sectional units. Also, in an attempt to select optimal lag length, Akaike information criterion (AIC) is selected.

The synopsis of the results of these tests is presented in Tables 4 and 5. Table 4 presents the results of panel unit root tests with individual effect only. The results of the four tests that are available indicate that institutional factor index (INST) and capital stock (K) attain stationarity at level (integrated of order zero, I[0]) at conventional levels of 1% and 5%. Only LLC supports the stationarity of financial development indicator (FD) at level, and other three tests indicate it is only stationary at first difference (I[1]). All the four tests show that real GDP per capita (RGDPC) is not stationary at level but only attains stationarity at first difference. Similarly, the results of unit root tests with individual intercept and trend (Table 5) reveal mixed orders of integration. Few tests support the stationarity at level, while majority indicate that the variables attain stationarity at first difference. Although the results from Tables 4 and 5 appear slightly contradictory and not all the series are integrated of order one [I(1)] processes, some variables are stationary at level. Since the orders of integration do not exceed one, it signifies that the common panel cointegration tests which are prevalent in the extant studies may not be applied (Chen et al. 2014). This position is tenable as the estimated model is already expressed in first differences. Hence, following the trends that orders of integration of RGDPC, FD, INST and K do not exceed one, then the first-differenced dynamic generalized method of moments (GMM) adopted in this study is appropriate.

6.3 The role of institutions in the finance–growth nexus

In order to obtain unbiased and consistent estimates, this study utilizes two-step GMM suggested by Arellano and Bond (1991). This produces reliable estimates that are more asymptotically efficient than one-step GMM estimates. Validity of instrumental variables is fundamental to the authenticity and reliability of GMM estimates; hence, the Sargan tests of over-identifying restrictions are used to verify this assertion. The Sargan tests confirm the acceptance of null hypothesis which states that instruments do not correlate with error term. This indicates that the instrumental variables adopted for the panel GMM estimates are valid. Similarly, the result of AR(2) shows that the model does not suffer from the problem of serial correlation in the differentiated residuals. Other diagnostic test such as F-statistic also confirms the reliability of the model; hence, the estimates are robust and reliable.

The results of GMM estimates in Table 6 reveal that previous real GDP per capita (RGDPC(-1)) exerts significant and positive influence on the current RGDPC at 1 percent level of significance. It indicates the importance of initial level of income per capita in the present status of income per capita in West African countries. This justifies the adoption of a dynamic panel data model and invalidates the appropriateness of static estimation techniques such as OLS, fixed and random effects. Hence, dynamic panel model adopted in the study fits the data of West Africa properly. Also, financial development (FD) yields a significant positive coefficient at 1 percent level of significance (Table 6). This indicates that financial development has strong positive influence on economic growth in West African countries. It suggests that development of financial sector serves as a necessary impetus to growth in the subregion, most especially by providing financial supports to entrepreneurial activities (Aluko and Ibrahim 2020a; Pan and Yang 2018). It could also mean that financial system of the subregion facilitates and enhances allocation of resources to crystalize investment and growth.

This supports the theoretical proposition of Schumpeter (1911), Levine (1991) and King and Levine (1993) which emphasizes the crucial roles of financial intermediaries to mobilize savings which are channeled to finance the promising productivity-enhancing activities of the real sector. It equally buttresses the positions of Levine (2003, 2005), Hondroyiannis et al. (2005), Pagano (1993) and Ang (2008) which stress the important role of financial development in endogenous growth model. Similarly, this finding stands in tandem with the research outcomes of extant studies (Aluko and Ibrahim 2020a; Law et al. 2018a; Pan and Mishra 2018; Berhane 2018; Durusu-Ciftci et al. 2017; Best et al. 2017) which point attention to the indispensable role of financial development in growth processes. In the same vein, the results from Table 4 indicate the strong positive effect of institutional factor (INST) on economic growth in West Africa. This is inferred as the coefficient (0.6064) is statistically significant at 1 percent level of significance, and it shows that institutions matter for growth and it is an essential ingredient of growth in West Africa. It supports the findings of Berhane (2018) and Effiong (2015) which establish that positive influence of institutional quality on growth in a panel analysis of Africa and sub-Saharan African countries, respectively. This is expected as institutional development serves as a stimulus to economic performance (Arminen and Menegaki 2019; Menegaki and Ozturk 2013; Bardhan 2001; North 1990). This is in conformity with theoretical exposition which emphasizes that the differences in the quality of institution are the major cause of difference in economic development across the countries (Alexiou et al. 2018; Acemoglu et al. 2005).

Having discussed the separate effects of financial development and institutional factor on growth in West Africa, the coefficient of interaction effect between financial development and institutional factor \(\left( {{\text{FD}}^{*} {\text{INST}}} \right)\) on growth is statistically significant but negative (− 0.1879) at 1 percent level of significance. This indicates that institutional factor does not enhance financial development to impact positively on growth in West Africa but rather constitutes itself a drag on the growth effect of financial development. These results negate the earlier findings which establish separate strong positive effects of the two factors in the growth prospects of the subregion. Meanwhile, the interactive term shows that the two factors are substitutes to the each other in the growth process. Institutional factors are supposed to be complementing financial development to impact positively on growth, but the reverse is the case in West African countries. This stands at variance with the conventional wisdom which suggests that institutional development is a precursor to the financial sector development (Mishkin 2009; Miletkov and Wintoki 2009). This research output is consistent with studies of Berhane (2018), Compton and Giedeman (2011) and Ahlin and Pang (2008) which establish the two factors of growth to be substitutes to each other in the growth process. It, however, contradicts the general findings that institutional quality provides the needed impetus to stimulate financial development to impact on growth (see Law et al. 2018a; Sghaier 2018; Gazdar and Cherif 2015; Arcand et al. 2015; Law et al. 2013a, b; Demetriades and Law 2006).

These scenarios might be due to several reasons. One, it may be that institutional developments in West African countries are not designed properly to strengthen the regulatory environments of financial system to enhance financial sector development to yield growth effects. Two, it suggests there are inherent loopholes and lapses in the institutional framework guiding the operations of financial system in West African countries. This abets sharp practices and corruptions which culminate in diverting credit from financial system to unproductive/wasteful activities. Three, the status of institutions in the subregion may be below the threshold level which requires before institutional factor can stimulate financial development to impact growth. This goes in line with position of extant studies that certain level of institutional quality must be attained before financial development can be stimulated to impact on growth (Law et al. 2018a; Hechmy 2016; Ng et al. 2015; Law et al. 2013a, b; Law and Azman-Saini 2012; Miletkov and Wintoki 2009; Chinn and Ito 2006). Four, it may suggest that the corruption and political interferences in the financial system are stronger than the quality of institutions put in place to checkmate the diversion of credit to unproductive activities in the subregion. The assertion goes in line with earlier finding that average of institutional factor index in West Africa is 4.32 out of maximum scale of 10 points (see Table 7 in “Appendix”). In summary, it is very clear that institutional factor and financial development are not complementary but rather substituting each other to hamper the growth process in West Africa. This shows that financial development impacts positively on economic growth and institutional quality lessens/diminishes the positive effect. The positive growth effect of financial development is weakened by the institutional conditions in West African countries. Institutional framework in these countries constitutes a drag to the growth benefits of financial development.

Also, the coefficient of capital stock (K) as proxy by the ratio of gross fixed capital formation to gross domestic product is significantly positive at 5 percent level of significance. This is in conformity with endogenous growth theory which emphasizes capital as an important factor input in growth. It equally supports the stand of baseline studies such as Romer (1986, 1990), Levine (1991), Mankiw et al. (1992) and Pagano (1993). These studies stress the crucial importance of capital in the growth process.

6.4 Threshold of institutional factor in finance–growth nexus

Following extant studies (Ehigiamusoe et al. 2020; Ehigiamusoe et al. 2019; Law et al. 2018a, Law et al. 2018b; Moradbeigi and Law 2017; Kratou and Gazdar 2016; Gazdar and Cherif 2015), the minimum level of institutional quality that must be attained by West African countries to benefit from financial development in terms of economic growth is calculated. The estimated equation (RGDPC) in Table 6 is differentiated with respect to FD (financial development indicator). The resultant outcome is set equal to zero to obtain the threshold value of institutional quality \(\left( {\frac{{\partial {\text{RGDPC}}}}{{\partial {\text{FD}}}} = 0.8957 - 0.1879{\text{INST}}} \right)\). Based on these premises, the threshold is therefore calculated as 4.77. This implies that for financial development to contribute meaningfully to economic growth, West African countries must attain and maintain persistently a level of institutional development that is greater than 4.77 out of 10 point scale. The indication from this result demonstrates that, on average, institutional factors may not be able to stimulate financial development to produce desirable growth when countries in the subregion operate below the threshold level of institutional development. It is obvious from the detailed analysis in the earlier section that institutional factors do not play a positive and stimulating role to financial development in order to enhance growth, and it rather stunts the development of financial sector by playing substituting role in the growth process. This substitutability may have occurred due to the fact that many West African countries’ institutional developments are below the threshold point. The average of institutional factor index in West Africa is 4.32 which is below the threshold value of 4.77.

Most of the countries in the subregion have their institutions below this threshold which has made it hard for institutional factors to stimulate financial development to enhance growth as it ought to. A few countries that attain this threshold are unable to sustain it over time. This is responsible for the inability of institutional factors to serve as an important and necessary stimulus and catalyst to financial development to positively enhance growth in West Africa. Few studies have established that when the level of institutional quality is below the threshold, the growth effect of financial development is either negative or insignificant (Gadzar and Chief 2015; Law et al. 2013a, b). Beyond the threshold, the financial development has a strong positive effect on growth (Law et al. 2018a; Law et al. 2013a, b; Arcand et al. 2015).

7 Conclusion

Following the recent studies which emphasize the moderating role of institutional quality in the finance–growth nexus, it has been argued that institutions make a difference in the way financial development influences economic growth. This shows that the institutions an economy develops or fails to develop are key in enhancing or leaking out the growth benefits of financial development. Meanwhile, the findings of the existing studies are mixed and inconclusive. Besides, extant studies on this subject matter from sub-Saharan African countries are scanty despite the weak institutions in the region. Up till date, there is no known study that has examined each subregion of SSA in spite of their heterogeneities and peculiarities. Thus, considering the unique institutional framework and the importance of West African countries in SSA, this study examines whether institutions matter or not in the finance–growth nexus in the subregion from 1986 to 2015. This is examined within the context of generalized method of moments (GMM) which captures the inherent endogeneity in the relationship. Similarly, it has been empirically argued and documented that there is a threshold level of institutional quality beyond which financial development is strongly stimulated to accelerate economic growth. This has not been empirically tested in SSA. Hence, this study also deviates from the extant studies in SSA by unearthing the threshold of institutional quality in the finance–growth nexus in West African subregion.

The empirical results of a two-step dynamic panel GMM adopted reveal that financial development has a separate and strong positive impact on economic growth in West African countries, but institutional quality constitutes a drag that diminishes and leaks out the positive influence on growth. It is an indication that financial development and institutional quality are substitutes rather than complements to each other in the growth process. This implies that the institutional framework in West African countries has inherent loopholes and lapses that allow sharp practices and opportunistic behavior which divert capital to unproductive or wasteful activities. This drains the growth benefits of financial development in the subregion. The research outcomes further hint that most of the countries in West Africa operate below the threshold of institutional quality. This may have been the reason institutional quality fails to spur and provide the needed stimulus to drive financial development to impact positively on economic growth in the subregion of SSA.

These findings have some important policy implications. Countries in West Africa should review the existing institutional framework guiding the operation of financial sectors so as to detect loopholes and lapses that drain the productivity-enhancing power of financial development. Also, the institutional framework should be strengthened and further developed as the countries in the West Africa are operating below the minimum level required for institutions to accelerate financial development to impact positively on growth. Besides, it is necessary to emphasize that this study has contributed to the extant literature on the finance–growth nexus in West Africa by providing the new insights into the role of institutions on the link. Previous studies have considered the influences of other macroeconomic variables such as inflation and interest rate on the finance–growth nexus, but little has been done to investigate the influence of institutional quality. However, this study considers 13 West African countries due to non-availability of data on key variables on the remaining countries; hence, future researchers should include other countries. Moreover, other subregions of sub-Saharan Africa are not covered in this study; thus, this becomes a gap for other scholars to fill. Meanwhile, the limitations identified do not undermine or diminish the relevance of the present study, and they are raised to enrich and complement the research outcomes in the subsequent studies by other scholars.

References

Abekah-Koomson I, Loon PW, Premaratne G, Yean TS (2019) Total factor productivity growth: evidence from West African economies. Glob Bus Rev. https://doi.org/10.1177/0972150919856194

Acemoglu D, Johnson S (2005) Unbundling institutions. J Polit Econ 113(5):949–995

Acemoglu D, Johnson S, Robinson JA (2005) Institutions as a fundamental cause of long-run growth. Handb Econ Growth 1:385–472

Adusei M (2012) Financial development and economic growth: is Schumpeter right. Br J Econ Manag Trade 2(3):265–278

Adusei M (2018) The finance–growth nexus: does risk premium matter? Int J Finance Econ. https://doi.org/10.1002/ijfe.1681

African Economic Outlook (2013) Structural transformation and natural resources. African Development Bank, Abidjan

Aghion P, Howitt P, Howitt PW, Brant-Collett M, García-Peñalosa C (1998) Endogenous growth theory. MIT Press, Cambridge

Ahlin C, Pang J (2008) Are financial development and corruption control substitutes in promoting growth? J Dev Econ 86(2):414–433

Akinlo AE, Egbetunde T (2010) Financial development and economic growth: the experience of 10 sub-Saharan African countries revisited. Rev Finance Bank 2(1):17–28

Alexiou C, Vogiazas S, Nellis JG (2018) Reassessing the relationship between the financial sector and economic growth: Dynamic panel evidence. Int J Finance Econ 23(2):155–173

Allen F, Otchere I, Senbet LW (2011) African financial systems: a review. Rev Dev Finance 1(2):79–113

Allen F, Carletti E, Cull R, Qian JQ, Senbet L, Valenzuela P (2014) The African financial development and financial inclusion gaps. J Afr Econ 23(5):614–642

Aluko OA, Ibrahim M (2020a) Institutions and the financial development–economic growth nexus in sub-Saharan Africa. Econ Notes. https://doi.org/10.1111/ecno.12163

Aluko OA, Ibrahim M (2020b) Institutions and financial development in ECOWAS. J Sustain Finance Invest. https://doi.org/10.1080/20430795.2020.1717240

Andrianaivo M, Yartey CA (2010) Understanding the growth of African financial markets. Afr Dev Revew 22(3):394–418

Ang JB (2008) A survey of recent developments in the literature of finance and growth. J Econ Surv 22(3):536–576

Anwar S, Cooray A (2012) Financial development, political rights, civil liberties and economic growth: evidence from South Asia. Econ Model 29(3):974–981

Arcand JL, Berkes E, Panizza U (2015) Too much finance? J Econ Growth 20(2):105–148

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arminen H, Menegaki AN (2019) Corruption, climate and the energy-environment-growth nexus. Energy Econ 80:621–634

Bagehot W (1873) Lombard street: a description of the money market. Scribner, Armstrong & Company, New York

Balach R, Law SH (2015) Effects of financial development, institutional quality, and human capital on economic performance in SAARC countries. Emp Econ Lett 14(2):131–141

Baltagi B, Demetriades P, Law SH (2007) Financial development, openness and institutions. University of Leicester discussion paper in economics, p 5

Bandura WN, Dzingirai C (2019) Financial development and economic growth in Sub-Saharan Africa: the role of institutions. PSL Q Rev 72(291):315–334

Bardhan P (2001) Distributive conflicts, collective action, and institutional economics’. In: Meir G, Stiglitz J (eds) Frontiers of development economics. Oxford University Press, New York

Beck T, Levine R, Loayza N (2000) Finance and the Sources of Growth. J Financ Econ 58(1–2):261–300

Beck R, Georgiadis G, Straub R (2014) The finance and growth nexus revisited. Econ Lett 124(3):382–385

Berhane K (2018) The role of financial development and institutional quality in economic growth in Africa in the era of globalization. In: Heshmati A (ed) Determinants of Economic Growth in Africa. Palgrave Macmillan, Cham, pp 149–196. https://doi.org/10.1007/978-3-319-76493-1_6

Best A, Francis BM, Robinson CJ (2017) Financial deepening and economic growth in Jamaica. Glob Bus Rev 18(1):1–18

Bist JP (2018) Financial development and economic growth: evidence from a panel of 16 African and non-African low-income countries. Cogent Econ Finance 6(1):1449780

Blackburn K, Hung VT (1998) A theory of growth, financial development and trade. Economica 65(257):107–124

Breitung J (2002) Nonparametric tests for unit roots and cointegration. J Econom 108(2):343–363

Buck T, Liu X, Skovoroda R (2008) Top executive pay and firm performance in China. J Int Bus Stud 39(5):833–850

Caner M, Hansen BE (2004) Instrumental variable estimation of a threshold model. Econom Theory 20(5):813–843

Capasso S (2004) Financial markets, development and economic growth: tales of informational asymmetries. J Econ Surv 18(3):267–292

Chang HC, Huang BN, Yang CW (2011) Military expenditure and economic growth across different groups: a dynamic panel Granger-causality approach. Econ Model 28(6):2416–2423

Chen PF, Lee CC, Chiu YB (2014) The nexus between defense expenditure and economic growth: new global evidence. Econ Model 36:474–483

Chinn MD, Ito H (2006) What matters for financial development? Capital controls, institutions, and interactions. J Dev Econ 81(1):163–192

Claessens S, Laeven L (2003) Financial development, property rights, and growth. J Financ 58(6):2401–2436

Compton RA, Giedeman DC (2011) Panel evidence on finance, institutions and economic growth. Appl Econ 43(25):3523–3547

Das K, Quirk T (2016) Which institutions promote growth? Revisiting the evidence. Econ Pap J Appl Econ Policy 35(1):37–58

Demetriades P, Fielding D (2012) Information, institutions, and banking sector development in West Africa. Econ Inq 50(3):739–753

Demetriades P, Law HS (2006) Finance, institutions and economic development. Int J Finance Econ 11(3):245–260

Durusu-Ciftci D, Ispir MS, Yetkiner H (2017) Financial development and economic growth: some theory and more evidence. J Policy Model 39(2):290–306

Effiong E (2015) Financial development, institutions and economic growth: evidence from sub-Saharan Africa. MPRA paper no. 66085. http://mpra.ub.uni-muenchen.de/66085/

Ehigiamusoe KU, Lean HH (2019) Influence of real exchange rate on the finance-growth nexus in the West African Region. Economies 7(1):23

Ehigiamusoe KU, Lean HH, Lee CC (2019) Moderating effect of inflation on the finance–growth nexus: insights from West African countries. Empir Econ 57(2):399–422

Ehigiamusoe KU, Lean HH, Smyth R (2020) The moderating role of energy consumption in the carbon emissions-income nexus in middle-income countries. Appl Energy 261:114215. https://doi.org/10.1016/j.apenergy.2019.114215

Fernández A, Tamayo CE (2017) From institutions to financial development and growth: what are the links? J Econ Surv 31(1):17–57

Gapy NKG, Sobhanian SMH, Soretz S, Sahabi B (2015) Nonlinear effects of financial sector development on iran economic growth: with an emphasis on the role of interest rate. Development 5(2):75–96

Gazdar K, Cherif M (2015) Institutions and the finance–growth nexus: empirical evidence from MENA countries. Borsa Istanb Rev 15(3):137–160