Abstract

It has been widely observed that financial support is the key to entrepreneurial activities. The last decade has witnessed tremendous growth of startups and financial markets in China. Despite “mass entrepreneurship and innovation” becoming a national agenda item in China in recent years, few studies have investigated how financial development is related to entrepreneurial activities across cities in such an emerging economy. Drawing on a unique dataset of over 5000 startups in China, this study investigates the geographical characteristics of startup cities and the role of finance in promoting startups across Chinese cities. We find that there exists significant geographical concentration of startups. Beijing, Shanghai, and Shenzhen are the most important startup cities in the country. Regression results show that strong financial supports from both equity financing and credit financing are beneficial to the development of startups at the regional level. Venture capital availability is found to have very positive effects on the entrepreneurial activities in a city. The agglomeration of startups in financial centers and neighboring regions indicate that there exist strong positive externalities of metropolitan cities where the key financial, political, and technology resources are located.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Cities with more startups usually have better economic performance than those that do not (Glaeser 2007). However, the geography of startups is unevenly distributed across regions (Stam 2010). In the USA, San Francisco, Boston, and New York appear more attractive for entrepreneurial activities than other cities (Florida and Mellander 2014). Similarly in China, startup agglomeration is extremely in some metropolises, such as Beijing, Shanghai, and Shenzhen (Guo et al. 2016).

Many studies have demonstrated that demographic structure, institutional environment, and agglomeration economies are the major factors influencing the location choice of startups (Kerr 2010; Lu and Tao 2010; Delfmann and Koster 2012). However, as a crucial factor determining new firm creation, the effects of financial resources on the distribution of startups have mostly remained uncharted (Malo and Norus 2009). Low availability of financial support is regarded as the main constraint for cities seeking to attract startups in regions with undeveloped financial markets, in China and India (GEM 2016).

As one of the largest emerging economy, China’s entrepreneurial environment had lagged for the lack of an effective financial market for startups for a long while (Lin and Li 2001). The Small and Medium Size Enterprise Board (SMEB) and the Growth Enterprise Market (GEM) were established in 2004 and 2009 in Shenzhen Stock Exchange, respectively, and the financial environment has been improved for startups since then. Moreover, the venture capital industry has grown very significantly after the launch of the two new boards (Pan et al. 2016). However, due to the extremely high listing requirements (Pan and Xia 2014), the two new boards have been unable to provide high-quality financial services to most China’s startups.

As the growth of China’s economy has slowed down in recent years, startups are expected to play a more important role in creating jobs, boosting innovation, and sustaining economic growth. Compared to large state-owned firms, startups are more flexible to market turmoil and more likely to find new market niches. Thus, they are crucial for the dynamics of urban and regional economies. To sustain the economic development and generate more jobs, the central government has been advocating entrepreneurship activities (Milana and Wang 2013; GEM 2016). To improve China’s national entrepreneurial environment, the central government launched a new policy to promote entrepreneurship and innovation in 2014 called “mass entrepreneurship and innovation.” One key strategy to achieve the goal is to provide a better financial environment. In the end of 2013, the central government launched the National Equities Exchange and Quotations (NEEQ) to provide a platform for startups to list their shares. Compared to listing on the SMEB and GEM, the financial and other mandatory requirements for listing on the NEEQ are much lower. The number of startups listed on NEEQ has grown dramatically since 2013 and reached to over 5000 by the end of 2015. The firms listed on the NEEQ can represent startups in the country.

Despite the overall improvement in the entrepreneurial environment of the country, there exist significant regional disparities with regard to the number of startups listed on the NEEQ. Drawing on the firms listed on the NEEQ, this study seeks to explore how the financial resources have impacted the distribution of startups across Chinese cities. We found that credit financing and equity financing are both important for entrepreneurial activities, with the latter appearing to be more important. It is also found that venture capital is extremely crucial for the development of startups. In particular cities with more mature venture, capital industries usually have more startups. Finally, we found that startups are more likely to locate in financial center cities or close to them, which indicates that the financial centers have strong externalities for startups.

This study contributes to existing literature in three ways: (1) it provides rigid empirical evidence from an emerging economy that financial factors are important for entrepreneurial activities at regional level; (2) it finds equity financing is more important than credit financing in promoting entrepreneurial activities and venture capital is extremely crucial for cultivating startups in cities in China; (3) it reveals that startups in China are highly concentrated in and inclined to be close to financial center cities where key financial, political, and other important resources are located.

The rest of the paper is organized as follows. Section 2 consists of literature review and hypothesis development. Section 3 describes the Chinese startups’ spatial distribution. Section 4 analyzes how financial factors affect the geography of startups across Chinese cities. Section 5 concludes the paper.

2 Literature review and hypotheses

2.1 Financing and entrepreneurial activities

Financing is as an important factor for startups because it is hard for entrepreneurs to gain enough financial capital (Schwienbacher 2007). Efficient financing can significantly help the growth of startups, although there has been a growing debate on differentiating the effects of credit financing and equity financing on promoting entrepreneurial activities (Pastor and Veronesi 2009; Gartner et al. 2012; Hsu et al. 2014).

Credit financing is often considered as the most important way to raise capital for startup although often difficult to acquire. The pecking order theory argues that when external financing is available, startups will prefer credit financing to equity financing (Myers and Majluf 1984). The advantage of credit financing is that entrepreneurs can keep better control of their firms. The financial behaviors of over-the-counter firms in the USA have been consistent with this theory (Hittle et al. 1992). Apparently, a well-developed credit market in a region could help establish a very supportive environment for startups.

However, in view of the high risk and uncertainties of providing loans to startups, credit financing is not efficient enough to promote entrepreneurial activities (Brown et al. 2013). There are two obvious shortcomings of credit financing for startups. First, credit markets lack efficient price signals, which makes it very difficult to pick up the potential borrowers (Rajan and Zingales 2001). Second, startups often have unstable and limited cash flows to pay debts (Brown et al. 2009).

Compared to credit financing, equity financing is more significant in promoting startups, since equity markets could provide a set of risk management tools to decrease the risk of investors’ portfolios. Moreover, equity market investors might share extraordinarily high returns if the invested startups are successful, while there are few rigid requirements from the regulators for equity financing (Brown et al. 2009). One empirical study based on the data of firms across 32 developed and emerging countries has found that countries with more developed equity markets have more entrepreneurial activities, although the credit markets have no significant effect on promoting startups (Hsu et al. 2014).

In China, credit financing has long been the major way for startups to raise money (Lin and Li 2001). Recently, the equity financing has grown quickly and played an increasingly important role in supporting entrepreneurial activities. In particular, the number of publicly listed firms in stock exchanges has grown significantly, although there exist strong regional disparities of such firms across cities (Pan and Xia 2014).

Collectively, these studies lead to our hypotheses 1a and 1b.

-

Hypothesis 1a: The more developed a city’s credit financing market is, the more startups the city has.

-

Hypothesis 1b: The more successful a city is in getting equity financing from capital market, the more startups the city has.

2.2 Venture capital and startups

Venture capital has been playing an increasingly important role in promoting startups globally. Venture capitalists are more specialized and active in helping startups than other traditional financial institutions (Hellmann and Puri 2000; Winton and Yerramilli 2008). Collaboration with venture capitalists can significantly improve startups’ abilities to obtain resources beyond capital for further growth (Stuart et al. 1999). Furthermore, the certification of a venture capitalist in the process of initial public offering (IPO hereafter) can better help the startups supported by it to complete their IPO (Megginson and Weiss 1991).

Venture capitalists scrutinize potential targets very carefully to gain sufficient information about startups, their competitors, and the market conditions. However, much information is “uncodified” and venture capitalists confront serious information asymmetry. To mitigate this problem, venture capitalists usually need to interact with entrepreneurs very frequently (Lerner and Josh 1999; Fritsch and Schilder 2012). After a venture capitalist has finally invested in a startup, it needs to monitor and provide service for the invested firm, which also needs a lot of interactions. Therefore, geographical distance has turned out to be a very important factor in the investing practice of venture capitalists (Zook 2002). Venture capitalists are more likely to finance startups located near their offices. In turn, startups are more likely to emerge and develop in close proximity to venture capitalists (Lissoni 2001; Ivkovi and Weisbenner 2005).

China’s venture capital industry has grown significantly and expanded over a wide geographical scope in the last decade (Zhang 2011; Pan et al. 2016). According to Zdatabase,Footnote 1 there were over 8500 venture capital firms with 20,000 accumulated investments in China by the end of 2013. While venture capital firms are not evenly distributed across the country, some cities have more dynamic venture capital industries than others. We capture this in hypothesis 2a.

-

Hypothesis 2a: Cities with more active venture capital firms will have more startups.

Given the higher risk but greater potential for returns in investing high-tech firms, venture capitalists are usually more interested in high-tech firms in Western economies (Florida and Kenney 1988). We may assume a similar situation to prevail in China. Hypothesis 2b is based on this observation.

-

Hypothesis 2b: Venture capital firms have a stronger positive relationship with entrepreneurial activities in high-tech sectors.

Among the main divestment ways of venture capital, IPO is the most favored one since it usually generates the highest investment returns (Gompers and Lerner 2001). Successful divestment through IPO of venture capitalists is very important for capital circulation. High returns make IPO become the strongest force driving further investments of venture capital (Jeng and Wells 2000). Therefore, an active capital market could help startups to gain more financial services by encouraging venture capitalists to invest more in startups (Storper 1997; Welch and Ritter 2002). In addition, successful IPO can also encourage more entrepreneurs to start their business. So, we have hypothesis 2c.

-

Hypothesis 2c: Cities with more venture-capital-backed IPO will have more active entrepreneurial activities.

2.3 Financial centers and entrepreneurial activities

Financial resources agglomerate in several financial centers and thus there exist strong regional disparities concerning financial development (Clark 2005). It is found that distance still matters in investment decisions by financial institutions. For instance, there exists proximity preference in venture capital investments (Chen et al. 2010). Financial centers might have strong advantages in providing financial services for startups. In addition, other types of advanced business service firms also get concentrated in financial center cities (Cook et al. 2007). As such, startups can benefit from being in or geographically close to financial centers to enjoy such agglomeration economies.

In mainland China, Beijing, Shanghai, and Shenzhen stand out as the lead financial centers. In fact, Beijing is a financial regulator center and the home to the NEEQ. Shanghai and Shenzhen, as the two lead financial centers of China, have SMEB and GEM. All the three cities are the venture capital centers in China (Pan et al. 2016). Obviously, startups in or near these cities’ housing key financial institutions including financial regulators, stock exchanges, and reputed venture capitalists would have better chance to get financial supports (Pan et al. 2016).

Moreover, China’s unique nature of institutional and cultural context has led to several significant differences in entrepreneurial financial systems as compared with those in the West (Bruton and Ahlstrom 2003; Zhang 2011). Owing to the special social networks nurtured by China’s Confucian society, Guanxi is a common way for startups to lower economic and legislative barriers to get financial support (Lee and Anderson 2007). However, frequent informal communication is the key to maintaining a strong Guanxi. Therefore, startups located in or near cities with key financial resources are likely to have more opportunities to build an effective Guanxi to get effective financial support. So, we formulate hypothesis 3:

-

Hypothesis 3: Startups prefer locations in or close to financial centers to get more financial support and enjoy agglomeration of economies for entrepreneurial activities.

2.4 Other factors

The growth of startups is not only influenced by the financial development of a city, but also by other regional factors. Therefore, the following control variables are also considered in the regression analysis.

Human capital

Startups need talents with different skills at an affordable cost. Thus, the availability of such talents can be a key to the development of startups in a city (Doeringer et al. 2004). In particular, the universities and scientific institutions are important for startups (Acs et al. 1994).

Overall economic development

Usually, cities with superior overall economic development have more startups (Moore et al. 1991; Keeble and Walker 2006). Economically advanced cities have more labor force and enjoy better spillover effects of localized knowledge, which can provide startups a better access to resources and realize better performance (Armington and Acs 2002).

Unemployment rate

The relationship between entrepreneurial activities and unemployment has been extensively researched. Studies in developed countries have found that higher unemployment rates can increase entrepreneurial activities (Masuda 2006). Conversely, increasing unemployment could weaken entrepreneurship activities in developing countries (Kum and Karacaoglu 2012). Considering that China is still an emerging economy, this paper presumes that cities with higher unemployment might discourage startups.

National high-tech zone

China’s high-tech zones with higher administrative level have more policy preferences (Walcott 2002). Therefore, startups located in China’s national high-tech zones are found to attract more favorable policies from the government (Ji et al. 2013). Thus, cities with national high-tech zones are likely to have better financial support for startups.

Administrative levels of cities

Despite the role of the market force in economic development has been strengthened since China’s reform and opening up, the government is still playing a key role in the finance market (White et al. 2005). The administrative levels of China’s cities have a great influence on the allocation of financial resources, so cities with higher administrative levels could obtain more financial resources (Pan and Xia 2014). It is found that the involvement of Chinese government can significantly strengthen the cooperation between startups and financial institutions (Zeng et al. 2010).

Infrastructure

It has been widely observed that cities with well-developed infrastructure can reduce the costs of entrepreneurial activities (North and Smallbone 2000; Mittelstaedt et al. 2006). There are many indicators to measure the quality of infrastructure of cities. In this study, we assume that access to internet is important for the operations of startups. Thus, we choose the number of telephone subscribers of a city to proxy the infrastructure quality.

3 Spatial distribution of startups

3.1 Introduction to the NEEQ

In December 2013, the NEEQ was launched as a national over-the-counter equity market in Beijing. It aimed at providing financial support for China’s startups. The number of firms listed on the NEEQ reached 5081 by the end of 2015, which was a huge achievement. Known as the “New Third Board,” the predecessor of the NEEQ was originally established as a regional stock exchange in Beijing to provide financing and trading services for startups, exclusively in Zhongguancun high-tech zone in January 2006. From August 2012, startups from Shanghai Zhangjiang, Tianjin Binhai, and Wuhan Donghu, the three national high-tech zones, were eligible to be listed on the New Third Board. In December 2013, the NEEQ was officially set up as a national over-the-counter equity market for startups from all over the country.

Most firms listed on the NEEQ presently are quite young and are in the early stage of their business. Table 1 shows over 83% of the firms listed on the NEEQ that were founded after 2000, which indicates that the sample firms listed on the NEEQ fit the definition of startups quite well. Previous studies demonstrated that most of the new ventures need 8 to 12 years to become a mature business (Biggadike 1979; Patricia and Robinson 1990; Davila and Foster 2005).

Therefore, as a national financial platform, the NEEQ provides us with authoritative and uniform data about China’s startups. Beyond examining the geography of startups across China’s cities, this paper explores the role of financial development in shaping the location of startups at city level under China’s unique institutional and cultural environment.

3.2 Overall spatial patterns of startups

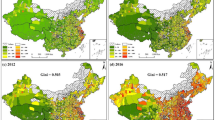

There were 5081 startups distributed across 221 citiesFootnote 2 by the end of 2015 in China (see Fig. 1b). Not surprisingly, the number of startups in different cities has varied significantly. Coastal cities have more startups than inland cities. Compared to the more widely distributed pattern of startups in eastern coastal cities, startups in inland China are extremely concentrated in some provincial capital cities such as Chengdu, Zhengzhou, and Xi’an. Because the predecessor of the NEEQ was established as a regional market, only four cities, namely Beijing, Shanghai, Tianjin, and Wuhan, had startups listed on the New Third Board before 2014 (see Fig. 1a).

By the end of 2015, the total number of startups in China’s top 15 cites accounted for 55.54% of startups. Beijing (755), Shanghai (435), and Shenzhen (291) became the top three cities with the largest number of startups. Only 8 cities had more than 100 startups. It is worth noting that Shenzhen, Suzhou, and Hangzhou have more startups than Wuhan and Tianjin, whose startups got to be listed on the New Third Board before 2014 (see Table 2).

3.3 Spatial distribution of startups in different sectors

As shown in Table 3, startups from the top 10 sectors accounted for 95% of all the startups listed on the NEEQ. The manufacturing industry has the largest number of startups; it accounts for 53.29% of the total. The sector distribution of firms listed on the NEEQ is similar to those listed on the other boards in domestic stock exchanges (Pan and Xia 2014). The ICT (information and communication technology) industry ranks the second, accounting for 19.83% of the total.

The spatial pattern of startups in the manufacturing industry is similar to the pattern of the whole sample (see Fig. 2a). Beijing (194), Shanghai (170), Suzhou (169), and Shenzhen (146) are top 4 cities housing the most startups from the manufacturing industry. While startups from the ICT sector are more spatially concentrated than these from the manufacturing sector (see Fig. 2b), over 30% of startups in the ICT sector are located in Beijing (311), far beyond the figures for Shanghai (120) and Shenzhen (70), which rank the second and third, respectively. The three cities have more than 50% of all startups in the ICT sector, which indicates that the three cities have more favorable environment for the entrepreneurs in the high-tech sector (Zhang 2008).

On the contrary, startups from the agriculture-related sectors are much more evenly distributed. Many startups in the agriculture, forestry, animal husbandry, and fishery sector are located in the middle and western parts of China (see Fig. 2c).

4 Regression analysis

4.1 Model specification

Based on the assumptions proposed in the previous section, we used Poisson’s regression to test the research hypotheses in this study. The following regression equation was used:

The dependent variable (Num_Startup) is the number of startups of city i that were newly listed on the NEEQ in 2014 and 2015. All the independent variables measuring the financial development indices and other factors of city i are n-year lagged. The definitions of all variables are listed in Table 4.

Credit and Equity describe the development credit market and equity market, respectively. Credit is the ratio of credit balance of all financial institutions in the city to GDP of the city (Rajan and Zingales 1999), and Equity is measured by the number of all firmsFootnote 3 listed on Shanghai and Shenzhen stock exchanges.

Num.VCs and Num.VC-IPO stand for the development of venture capital in the city. Num.VCs is the number of venture capital institutions in the city and Num.VC-IPO is the number of VC-backed IPOFootnote 4 in the city. Data on these two variables were collected from Zdatabase.

Dis_FC is the Euclidean distance from each city to the closest domestic financial center (Beijing, Shanghai, or Shenzhen), which is calculated in Arcgis.

The controlling factors are defined as follows. HumCap describes the human capital condition of the city, which is measured by the number of universities in the city. Po.level stands for political level of the city. Following Pan and Xia (2014), the political levels of cities were divided into four categories. Municipalities directed under the central government were assigned 3; sub-provincial cities were assigned 2; non-sub-provincial capital cities were assigned 1; and all other prefectural-level cities were assigned 0. Econo stands for the economic development level of the city, which is measured as the GDP per capita (yuan). Hi-tech is a dummy variable, which represents whether city has the national high-tech zone. If the city has a national high-tech zone, we assign the value 1, otherwise 0. Infra stands for the development of city’s infrastructure, which is measured by the number of subscribers of local telephones. Unemploy refers to the rate of unemployment of the city.

We have found that most of control variables are not highly correlated (Table 5). However, some independent variables, such as Equity, Num.VCs, and Num.VC-IPO are highly correlated, so we will test their effects on the geography of China’s startups separately. Moreover, to eliminate the effect of index dimension and quantity of data, we use maximum difference normalization method to process the independent variables before conducting the respective regressions as follows:

4.2 Regression results

4.2.1 Basic results

We first apply 1 year lagged independent variables in all the models. Regression results show financing is key to the distribution of entrepreneurial activities across Chinese cities (see Table 6). First, both credit financing and equity financing are helpful in cultivating startups in Chinese cities. To further explore how financial development facilitates the development of startups, we introduce the independent variables in the models separately. Statistical results show that compared with credit financing, equity financing seems to be more important to promote startups, as the coefficient of Equity is higher than that of Credit. These results are consistent with the findings of Brown et al. (2013) and Hsu et al. (2014). Overall, the regression results support hypothesis 1a and hypothesis 1b.

Second, venture capital has a significantly positive effect in promoting startups. The regression results in Model 3 (see Table 6) show that the accumulated number of venture capital firms of the city in the previous year is significantly and positively correlated with the number of newly listed startups in the city. Moreover, the quality of the venture capital firms is also important (see Model 4 in Table 6). We measure the competitiveness of venture capital of a city by counting the accumulated number of venture-capital-backed IPO in the city. The results from Model 6 and Model 7 further demonstrate the importance of venture capital firms in boosting startups. Thus, hypothesis 2a and hypothesis 2c are supported.

Third, we assume that being in or close to the top financial centers, including Beijing, Shanghai, or Shenzhen, can help startups to raise capital and thus overcome the inadequacies of the local financial institutions in supporting entrepreneurial activities. The regression results show that cities closer to the top financial centers have more startups. After controlling all other factors, the coefficient of Dis_FC is still significantly negative (see Model 5). Therefore, the findings provide empirical support for hypothesis 3. Firms closely located to a financial central city could enjoy lower financing costs and higher visibility of managerial financial information (Loughran et al. 2006). This indicates that the spillover effects of the financial center cities in providing financial and other types of business service for startups do exist in China. Similar findings have been reported by several studies from Western countries (Acconcia et al. 2011; El Ghoul et al. 2013). However, China’s unique institutional and cultural factors, such as Guanxi, might have also contributed to such patterns.

Finally, all the controlling factors applied in this study are found to be important in determining the levels of entrepreneurial activity. The coefficients of overall economic development level (Econo), human capital (HumCap), national high-tech zone (Hi-tech), and the development of infrastructure (Infra) are positive and statistically significant in all models, which are consistent with previous studies. While the political level of the city (Po.level) is not always positively related to the number of startups listed on the NEEQ, it indicates that support from the higher administrative governments is not necessarily important for startups in China, which is different from the situation of firms listed on the Shanghai Stock Exchange and Shenzhen Stock Exchange (Pan and Xia 2014). Besides, as discussed earlier, all coefficients related to unemployment (Unemploy) are significantly negative. These results indicate that an increase in unemployment has a negative effect on increase in the number of startups in the context of China, which is different from the situations in most developed countries (Reynolds et al. 1994).

4.2.2 Results on startups in the ICT sector

Owing to the uncertainties and high risk, venture capital and other types of financial arrangements have proved to be extremely important for startups in the high-tech sector (Zook 2002). Therefore, this study pays special attention to how financial development influences the distribution of high-tech startups, in particular those from the ICT sector in China. Thus, we apply the sub-sample of all startups from the ICT sector to conduct the respective regressions. As shown in Table 7, the number of startups in the ICT sector is used as the dependent variable. Comparing to the results presented in Table 6, it is found that financial development is even more important for entrepreneurial activities in the high-tech sector, especially with respect to the role of venture capital firms. Most of the coefficients of the variables measuring financial development are larger in Models 3, 4, and 5 in Table 7 than those in Table 6. In particular, the coefficients of Num.VCs in most models in Table 7 are larger than those in Table 6. The results provide strong evidence that venture capital is more important for the development of startups from the high-tech sector than other sectors, which supports hypothesis 2b.

Interestingly, we also find that the coefficients of Hi-tech in Table 8 are higher than those in Table 7. These results are consistent with the findings from many previous studies, which have found that cities with national high-tech zones are more attractive for high-tech startups (Cheng et al. 2014). High-tech startups tend to be located in cities with national high-tech zones because the national-level zone could provide more favorable policies for high-tech firms.

4.3 Robustness check

To address the endogeneity problem, we introduced all 5- and 10-year lagged independent variables (see Tables 8 and 9). Most of the variables involved in financial development are 5-year lagged because finance sectors are more dynamic and mobile than other traditional industries. All other variables are 10-year lagged. The results in Tables 8 and 9 with longer lagged variables are consistent with previous regression results presented in Tables 6 and 7, respectively.

We further test the robustness of our findings by using the data in 2014 and 2015 separately. The regression results presented in Tables 10 and 11 suggest that all coefficient estimates of financial development indices are consistent with those in Tables 6 and 7, respectively. Overall, the empirical findings in this paper are robust.

5 Conclusion and discussion

Financial support is regarded as one of the most important factors impacting the cultivation of entrepreneurial activities. This is particularly true in emerging economy where entrepreneurial capital is usually not sufficient. Drawing on a sample of startups across Chinese cities, this paper is one of the first to investigate the spatial distribution of China’s startups and the role of finance in influencing entrepreneurial activities at city level.

We find that China’s startups demonstrate a notably uneven geographical distribution. China’s startups are heavily concentrated in a few large cities, in particular several financial centers, which is consistent with previous studies on Western economies (Florida and Mellander 2014; Jacobs 1992). Moreover, the spatial distribution patterns of startups in different sectors vary significantly and startups from high-tech sectors are extremely concentrated in a limited number of large cities such as Beijing, Shanghai, and Shenzhen.

Our regression results show that both credit and equity financing are crucial to explaining the concentrated spatial distribution of entrepreneurial activities across Chinese cities, while equity financing is more important in promoting startup activities than credit financing in China. The rapid development of capital market and venture capital industry have provided more opportunities for startups to raise capital beyond borrowing from banks, which were found to have little motivation to provide sufficient financial support for startups in China (Lin and Li 2001).

We also find that venture capital is the most important factor promoting city-level entrepreneurial activities of a city, especially in the case of high-tech entrepreneurial activities, as venture capitalists can provide startups with all sorts of resources and help them to use the resources more efficiently (Davila et al. 2003). The venture capital firms with more experience in successful IPO are found particularly important in promoting entrepreneurial activities in Chinese cities, since IPO is one of the best ways of divestment for venture capital firms.

The strong co-location of entrepreneurial activities and financial resources is significant in China, since the top financial centers, Beijing, Shanghai, and Shenzhen, are also the centers of entrepreneurial activities in China as well. Empirical results show that those financial center cities have strong spillover effects on providing financial and other types of business supports for startups from neighboring cities. In addition to the market factor, the co-location pattern of financial resources and startups might also be related to China’s unique institutional and cultural context, as building up and maintaining relationships might need more frequent interactions and being geographically close between startups and financial resources are crucial for both sides (Bruton and Ahlstrom 2003; Zhang 2011).

China has been eagerly promoting entrepreneurial activities; however, the financial system is still far from mature in providing high-quality financial services for startups. More research is needed to better understand the role of financial institutions in promoting entrepreneurial activities at individual and regional level in China. Moreover, there exist great regional disparities in entrepreneurial activities and financial environment in China and policies are needed to alleviate the big geographical unevenness.

Notes

A dataset belonging to the financial company Qingke Group (Zero2IPO) which is a leading financial service company providing detailed information of deals of IPO and venture capital investments. More detailed information on the company can be found at http://www.zero2ipo.com.cn/.

In this study, startups are aggregated at prefectural- and above-level cities.

Only A-share firms are calculated.

Only A-share firms are calculated.

References

Acconcia, A., Monte, A. D., & Pennacchio, L. (2011). Underpricing and firm’s distance from financial centre: evidence from three European Countries. Working papers.

Acs, Z. J., Audretsch, D. B., & Feldman, M. P. (1994). R&D spillovers and recipient firm size. Review Of Economics And Statistics, 76(2), 336–340. https://doi.org/10.2307/2109888.

Armington, C., & Acs, Z. J. (2002). The determinants of regional variation in new firm formation. Regional Studies, 36(1), 33–45. https://doi.org/10.1080/00343400120099843.

Biggadike, R. (1979). The risky business of diversification. Harvard Business Review, 57(3), 103–111.

Brown, J. R., Fazzari, S. M., & Petersen, B. C. (2009). Financing innovation and growth: Cash flow, external equity, and the 1990s R&D boom. Journal of Finance, 64(1), 151–185. https://doi.org/10.1111/j.1540-6261.2008.01431.x.

Brown, J. R., Martinsson, G., & Petersen, B. C. (2013). Law, stock markets, and innovation. Journal of Finance, 68(4), 1517–1549. https://doi.org/10.1111/jofi.12040.

Bruton, G. D., & Ahlstrom, D. (2003). An institutional view of China’s venture capital industry: explaining the differences between China and the West. Journal of Business Venturing, 18(2), 233–259. https://doi.org/10.1016/S0883-9026(02)00079-4.

Chen, H., Gompers, P., Kovner, A., & Lerner, J. (2010). Buy local? The geography of venture capital. Journal of Urban Economics, 67(1), 90–102. https://doi.org/10.1016/j.jue.2009.09.013.

Cheng, F. F., van Oort, F., Geertman, S., & Hooimeijer, P. (2014). Science parks and the co-location of high-tech small- and medium-sized firms in China’s Shenzhen. Urban Studies, 51(5), 1073–1089. https://doi.org/10.1177/0042098013493020.

Clark, G. L. (2005). Money flows like mercury: the geography of global finance. Geografiska Annaler Series B-Human Geography, 87B(2), 99–112. https://doi.org/10.1111/j.0435-3684.2005.00185.x.

Cook, G. A. S., Pandit, N. R., Beaverstock, J. V., Taylor, P. J., & Pain, K. (2007). The role of location in knowledge creation and diffusion: evidence of centripetal and centrifugal forces in the City of London financial services agglomeration. Environment and Planning A, 39(6), 1325–1345. https://doi.org/10.1068/a37380.

Davila, A., & Foster, G. (2005). Management accounting systems adoption decisions: evidence and performance implications from early-stage/startup companies. Accounting Review, 80(4), 1039–1068. https://doi.org/10.2308/accr.2005.80.4.1039.

Davila, A., Foster, G., & Gupta, M. (2003). Venture capital financing and the growth of startup firms. Journal of Business Venturing, 18(6), 689–708. https://doi.org/10.1016/s0883-9026(02)00127-1.

Delfmann, H., & Koster, S. (2012). Population change and new firm formation in urban and rural regions. Regional Studies, 48(6), 1034–1050. https://doi.org/10.1080/00343404.2013.867430.

Doeringer, P., Evans-Klock, C., & Terkla, D. (2004). What attracts high performance factories? Management culture and regional advantage. Regional Science & Urban Economics, 34(5), 591–618. https://doi.org/10.1016/j.regsciurbeco.2003.08.001.

El Ghoul, S., Guedhami, O., Ni, Y., Pittman, J., & Saadi, S. (2013). Does information asymmetry matter to equity pricing? Evidence from firms’ geographic location. Contemporary Accounting Research, 30(1), 140–181. https://doi.org/10.1111/j.1911-3846.2011.01147.x.

Florida, R., & Kenney, M. (1988). Venture capital and high technology entrepreneurship. Journal of Business Venturing, 3(3), 301–319. https://doi.org/10.1016/0883-9026(88)90011-0.

Florida, R., & Mellander, C. (2014). Rise of the startup city: the changing geography of the venture capital financed innovation. Working Paper.

Fritsch, M., & Schilder, D. (2012). The regional supply of venture capital: can syndication overcome bottlenecks? Economic Geography, 88(1), 59–76. https://doi.org/10.1111/j.1944-8287.2011.01139.x.

Gartner, W. B., Frid, C. J., & Alexander, J. C. (2012). Financing the emerging firm. Small Business Economics, 39(3), 745–761. https://doi.org/10.1007/s11187-011-9359-y.

GEM (2016). Global entrepreneurship monitor. http://www.gemconsortium.org/country-profile/51 Accessed 12 Aug 2017.

Glaeser, E. L. (2007). Entrepreneurship and the city. Ssrn Electronic Journal (32–33), 1626. https://doi.org/10.2139/ssrn.1001108

Gompers, P., & Lerner, J. (2001). The venture capital revolution. Journal of Economic Perspectives, 15(2), 145–168. https://doi.org/10.1257/jep.15.2.145.

Guo, Q., He, C. F., & Li, D. Y. (2016). Entrepreneurship in China: the role of localisation and urbanisation economies. Urban Studies, 53(12), 2584–2606. https://doi.org/10.1177/0042098015595598.

Hellmann, T., & Puri, M. (2000). Venture capital and the professionalization of start-up firms: empirical evidence. Journal of Finance, 57(1), 169–197. https://doi.org/10.1111/1540-6261.00419.

Hittle, L. C., Haddad, K., & Gitman, L. J. (1992). Over-the-counter firms, asymmetric information, and financing preferences. Review of Financial Economics, 2(1), 81.

Hsu, P. H., Tian, X., & Xu, Y. (2014). Financial development and innovation: cross-country evidence. Journal of Financial Economics, 112(1), 116–135. https://doi.org/10.1016/j.jfineco.2013.12.002.

Ivkovi, Z., & Weisbenner, S. (2005). Local does as local is: information content of the geography of individual investors’ common stock investments. The Journal of Finance, 60(1), 267–306. https://doi.org/10.1111/j.1540-6261.2005.00730.x.

Jacobs, J. (1992). The death and life of great American cities. New York: Vintage Books.

Jeng, L. A., & Wells, P. C. (2000). The determinants of venture capital funding: evidence across countries. Journal of Corporate Finance, 6(3), 241–289. https://doi.org/10.1016/S0929-1199(00)00003-1.

Ji, F., Chen, W., Yuan, F., & Sun, W. (2013). Development of sci-tech financial system and its spatial impacts on high-tech zone: the case study of Wuxi New District. Geographical Research, 32(10), 1899–1911.

Keeble, D., & Walker, S. (2006). New firms, small firms and dead firms: spatial patterns and determinants in the United Kingdom. Regional Studies, 28(4), 411–427. https://doi.org/10.1080/00343409412331348366.

Kerr, W. (2010) Clusters and startup location choice. In Lecture at the Harvard Business School Faculty Research Symposium.

Kum, H., & Karacaoglu, K. (2012). Relationship between entrepreneurship and unemployment in Turkey: a dynamic analysis. Actual Problems Of Economics (138), 399–405.

Lee, Y. C., & Anderson, A. R. (2007). The role of Guanxi in Chinese entrepreneurship. Las Vegas: Usa Info Inc..

Lerner, & Josh. (1999). The venture capital cycle. Cambridge: MIT Press.

Lin, J. Y., & Li, Y. (2001). Promoting the growth of medium and small-sized enterprises through the development of medium and small-sized financial institutions. Economic Research Journal, 1, 10–18.

Lissoni, F. (2001). Knowledge codification and the geography of innovation: the case of Brescia mechanical cluster. Research Policy, 30(9), 1479–1500. https://doi.org/10.1016/S0048-7333(01)00163-9.

Loughran, T., Schultz, P., Battalio, R., Bergstrand, J., Huang, R., & Ritter, J. (2006). Asymmetric information, firm location, and equity issuance.

Lu, J., & Tao, Z. (2010). Determinants of entrepreneurial activities in China. Journal of Business Venturing, 25(3), 261–273. https://doi.org/10.1016/j.jbusvent.2008.10.00.

Malo, S., & Norus, J. (2009). Growth dynamics of dedicated biotechnology firms in transition economies. Evidence from the Baltic countries and Poland. Entrepreneurship and Regional Development, 21(5–6), 481–502. https://doi.org/10.1080/08985620802332749.

Masuda, T. (2006). The determinants of latent entrepreneurship in Japan. Small Business Economics, 26(3), 227–240. https://doi.org/10.1007/s11187-005-0206-x.

Megginson, W. L., & Weiss, K. A. (1991). Venture capitalist certification in initial public offerings. Journal of Finance, 46(3), 879–903. https://doi.org/10.2307/2328547.

Milana, C., & Wang, J. (2013). Fostering entrepreneurship in China: a survey of the economic literature. Strategic Change, 22(7–8), 387–415. https://doi.org/10.1002/jsc.1947.

Mittelstaedt, J. D., Ward, W. A., & Nowlin, E. (2006). Location, industrial concentration and the propensity of small US firms to export—entrepreneurship in the international marketplace. International Marketing Review, 23(5), 486–503. https://doi.org/10.1108/02651330610703418.

Moore, B., Tyler, P., & Elliott, D. (1991). The influence of regional development incentives and infrastructure on the location of small and medium sized companies in Europe. Urban Studies, 28(6), 1001–1026. https://doi.org/10.1080/00420989120081171.

Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187–221. https://doi.org/10.1016/0304-405X(84)90023-0.

North, D., & Smallbone, D. (2000). The innovativeness and growth of rural SMEs during the 1990s. Regional Studies, 34(2), 145–157. https://doi.org/10.1080/00343400050006069.

Pan, F., & Xia, Y. (2014). Location and agglomeration of headquarters of publicly listed firms within China’s urban system. Urban Geography, 35(5), 757–779. https://doi.org/10.1080/02723638.2014.909112.

Pan, F., Zhao, S. X. B., & Wójcik, D. (2016). The rise of venture capital centres in China: a spatial and network analysis. Geoforum, 75, 148–158. https://doi.org/10.1016/j.geoforum.2016.07.013.

Pastor, L., & Veronesi, P. (2009). Technological revolutions and stock prices. American Economic Review, 99(4), 1451–1483. https://doi.org/10.1257/aer.99.4.1451.

Patricia, M. D., & Robinson, R. B. (1990). New venture strategies: an empirical identification of eight ‘archetypes’ of competitive strategies for entry. Strategic Management Journal, 11(6), 447–467. https://doi.org/10.1002/smj.4250110604.

Rajan, R. G., & Zingales, L. (1999). Financial dependence and growth. Social Science Electronic Publishing, 88(3), 559–586.

Rajan, R. G., & Zingales, L. (2001). Financial systems, industrial structure, and growth. Oxford Review of Economic Policy, 17(4), 467–482.

Reynolds, P., Storey, D. J., & Westhead, P. (1994). Cross-national comparisons of the variation in new firm formation rates. Regional Studies, 28(4), 443–456. https://doi.org/10.1080/00343409412331348386.

Schwienbacher, A. (2007). A theoretical analysis of optimal financing strategies for different types of capital-constrained entrepreneurs. Journal of Business Venturing, 22(6), 753–781. https://doi.org/10.1016/j.jbusvent.2006.07.003.

Stam, E. (2010). Entrepreneurship, evolution and geography. In: Boschma R and Martin R. The handbook of evolutionary economic geography, 307–348.

Storper, M. (1997). The regional world: territorial development in a global economy. New York: Guilford Press.

Stuart, T. E., Hoang, H., & Hybels, R. C. (1999). Interorganizational endorsements and the performance of entrepreneurial ventures. Administrative Science Quarterly, 44(2), 315–349. https://doi.org/10.2307/2666998.

Walcott, S. M. (2002). Chinese industrial and science parks: bridging the gap. The Professional Geographer, 54(3), 349–364. https://doi.org/10.1111/0033-0124.00335.

Welch, I., & Ritter, J. R. A review of IPO activity, pricing, and allocations. In, 2002 (pp. 1795–1828). https://doi.org/10.1111/1540-6261.00478.

White, S., Gao, J., & Zhang, W. (2005). Financing new ventures in China: system antecedents and institutionalization. Research Policy, 34(6), 894–913. https://doi.org/10.1016/j.respol.2005.04.002.

Winton, A., & Yerramilli, V. (2008). Entrepreneurial finance: banks versus venture capital. Journal of Financial Economics, 88(1), 51–79. https://doi.org/10.1016/j.jfineco.2007.05.004.

Zeng, S. X., Xie, X. M., & Tam, C. M. (2010). Relationship between cooperation networks and innovation performance of SMEs. Technovation, 30(3), 181–194. https://doi.org/10.1016/j.technovation.2009.08.003.

Zhang, J. (2008). China’s dynamic industrial sector: the internet industry. Eurasian Geography And Economics, 49(5), 549–568. https://doi.org/10.2747/1539-7216.49.5.549.

Zhang, J. (2011). The spatial dynamics of globalizing venture capital in China. Environment and Planning A, 43(7), 1562–1580. https://doi.org/10.1068/a43562.

Zook, M. A. (2002). Grounded capital: venture financing and the geography of the Internet industry, 1994-2000. Journal of Economic Geography, 2(2), 151–177. https://doi.org/10.1093/jeg/2.2.151.

Funding

This research is supported by the National Natural Science Foundation of China (No. 41201107), the Fundamental Research Funds for the Central Universities (No. 2015KJJCB30), and the National Social Science Foundation of China (14ZDA035).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Pan, F., Yang, B. Financial development and the geographies of startup cities: evidence from China. Small Bus Econ 52, 743–758 (2019). https://doi.org/10.1007/s11187-017-9983-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-017-9983-2